#IRS Tax Code 2018

Explore tagged Tumblr posts

Text

Singer Beyoncé Squares Off with Uncle Sam over Alleged Tax Liability

A tax attorney in San Jose has learned that Beyoncé has squared off with the Internal Revenue Service regarding a tax liability of $2.7 million. The singer brought the challenge to the IRS in United States Tax Court.

According to Forbes, 41-year-old Beyoncé filed a Petition for Redetermination concerning tax bills for 2018 and 2019, which together totaled almost $2.7 million. The singer received a Notice of Deficiency for those years, which included penalties and interest.

IRS Claims Beyoncé Owes Millions in Tax Penalties

The agency assessed that Beyoncé owed $805,850 more than she paid for the taxable year 2018, and more than $161,000 in interest and tax penalties due to this alleged delinquency. For the taxable year 2019, it was also determined by the IRS that $1,442,747 in additional taxes were owed, and interest and penalties for that year were assessed at more than $288,500.

The total amount the “Lemonade” hit maker is disputing comes to almost $2.7 million. Beyoncé alleged in her petition that the IRS erroneously disallowed millions of dollars of legitimate deductions, such as those for expenses, professional and legal services, management fees, insurance, utilities, depreciation, and other expenses.

For example, the IRS alleges that a charitable contribution carryover, totaling more than $868,000, should not be allowed. This amount was reported in 2018, but the pop star disputes the agency’s claim.

Beyoncé also stated that the IRS was wrong when they determined that she failed to report $1,449 in 2018 as income from royalties. The singer has the option of seeking tax audit representation, but how the petition plays out remains to be seen.

Accuracy-Related Tax Penalties Also Assessed by IRS

The petition contested IRS-assessed penalties as well, which the Bureau categorized as accuracy-related fees. The agency calculates penalties of this kind at 20 percent of the total amount of the underpaid taxes according to Internal Revenue Service Code Section 6622.

The IRS website states that “disregard of rules and regulations,” “negligence,” and “significant understatement of income tax” are the most commonly awarded tax penalties in this category.

Beyoncé Asserts No Wrongdoing

Beyoncé asserted that her 2018 royalties and deductions were all properly reported and there should be no additional tax liability on her part. She went on to say that she “acted reasonably and in good faith,” and therefore should not be given accuracy-related penalties even if the IRS determines that additional taxes are indeed owed. A tax audit attorney is often consulted in such cases.

It Was a Very Good Year

Beyoncé enjoyed a profitable year in 2018, during which time she released an album with her husband, Jay-Z, entitled, “Everything Is Love,” and afterwards, the couple began their high profile “On the Run II” stadium tour. Beyoncé was also a headliner at the 2018 Coachella Valley Music Festival.

In addition to her 2018 accomplishments, Beyoncé made a profitable agreement with Netflix in 2019 regarding her concert film “Homecoming” and released a live album by the same name.

More than one tax attorney in San Jose will likely be following the developing story and providing updates. Regardless of celebrity status, those who find themselves at odds with the IRS should seek legal help from a back-tax attorney or other qualified legal professional.

0 notes

Text

Well I started looking around and found a piece about the org I did know was funding them. And oy.

It's called The People's Forum.

Apparently on October 8th, when WOL held a rally celebrating Hamas's attack, "a social media profile belonging to The People’s Forum on X, formerly Twitter, encouraged New Yorkers to go 'all out for Palestine!' It also urged supporters to 'stand with the people of Palestine, who have the right to resist apartheid, occupation & oppression.'"

On October fucking 8th.

That piece is from Fox News, so it ends with some sussy quotes from Republicans. But:

"Singham and The People’s Forum have also been accused of having links to Chinese propaganda outlets, including Dongsheng News, which The New York Times reported shares an address with The People’s Forum."

Oh lord. The Washington Examiner:

"That same charity hosts events with entities downplaying China‘s genocide against ethnic Uyghurs and has pocketed millions of dollars combined from groups tied to a reported “Chinese propaganda” influence operation, according to tax forms reviewed by the Washington Examiner."

Tax forms:

Oh no there's more.

"The People’s Forum was granted tax-exempt status in October 2017, an IRS determination letter shows. Since that time, the charity has been intent on 'bringing socialist ideas to the new generations of organizers and activists,' according to its website’s donation page."

That sounds good, right?

"This has meant the People’s Forum hailing China’s “new era led by Xi Jinping,” the Chinese Communist Party’s authoritarian general secretary,"

Oh no.

"as well as hosting events to support China’s “revolutionary struggle”"

Oh God no. The one with the genocide and the brutal authoritarian repression of Hong Kong?

"and push back against America’s “political persecution of overseas Chinese people, and economic and trade aggression against China.” It’s also meant hosting events with Code Pink,"

But I thought they were good

"a left-wing antiwar group that has sought to justify CCP genocide against Uyghurs in China’s Xinjiang region,"

Oh my God WHY

"and Qiao Collective, which “aims to challenge rising U.S. aggression towards the People’s Republic of China” and promotes CCP narratives on social media, according to the New York Times and New Lines Magazine."

I'm just gonna lie on the floor here and just pretend it's 2018 or something. That was an okay year, right? By... by comparison?

Source

37 notes

·

View notes

Text

Well, Trump's tax returns are public and, while the first wave of "oh my goodness, he paid no taxes!" stories have come out, we're now starting to get to the interesting stuff. SHORT RANT (TM) ahead.

By the way, if you're interested in reading through them yourself (they're about 5,000 pages in total), Politico has published them here.

NO TAXES

As with the last time we got a look at Trump's taxes, when The New York Times managed to get ahold of some and publish them a few years ago, we can see that there are years where he pays very little or even no taxes. This is a product of the fact that our tax code contains lots of incentives for property developers to build things and Trump's aggressive use of every trick in the book to get out of paying taxes.

What is surprising, though is that he paid significant taxes in three of the years covered. Not significant compared to the earnings he claimed, but taxes in the hundreds of thousands of dollars, even approaching $1 million in 2018. As for the reason why that's interesting, I'll get to that in a bit.

THE FAILURE OF THE IRS

One thing that was reported immediately, and is definitely something we should still be concerned about, is that the IRS failed to follow its own rules and audit the sitting president until Democrats took the House in 2019 and asked about it. Even then they didn't actually do the audit, they just rubber-stamped the papers that Trump had given them.

Every president since 1977 has been audited on a yearly basis, so why did the IRS fail to audit Trump? Did he or his people put pressure on the agency? Did the complexity of his tax returns overwhelm the IRS? There are very few answers I can think of that don't indicate some type of real problem and we should definitely track it down to get to the bottom of this so that we can fix it.

PRESIDENTIAL SALARY

Remember when Trump said he was so rich already that he'd donate his presidential salary of $400,000 per year to charity? I'm sure you're shocked to hear that didn't quite do that.

At least in 2020 he kept his entire salary, donating none of it to charity.

PAYING TAXES

I noted earlier that I was a bit surprised to see that Trump actually paid a reasonable amount of taxes in 2018 and 2019. The taxes he paid are from capital gains on $20 million and $9 million and, if you're familiar with capital gains taxes, you know that this means he sold that much in capital assets because you don't get taxed until you sell.

Now why would he sell? The standard tax strategy for rich people who own a lot of capital is just to borrow against their capital so they don't have to sell it and then pass it on to their descendants who don't have to pay the capital gains tax due to the stepped up basis. It's also a question of why he sold in those years and not others where losses could have offset the gains? He reported even greater losses in 2020 and didn't sell anything.

I've read two likely possibilities (see the CNN article linked below): either he was desperate for cash and unable to borrow or he got such a good deal on the sale that it was worth paying the taxes.

Either one of those possibilities raises HUGE red flags for possible conflicts of interest given that, you know, he was President of the United States at the time. If he got a sweetheart deal, who paid him that much money and why? If he was desperate for cash, who did he owe it to and did they demand anything else from him?

CONCLUSION

So yeah, these tax returns have only been public for about a day so far but already there's a ton of indications of problematic behavior that have been found. I'll be very interested to see how much more we can learn from them in the coming weeks and months.

SOURCES

#politics#us politics#short rant (tm)#trump#trump tax returns#donald trump#irs#politico#cnn#yahoo news

17 notes

·

View notes

Video

youtube

What if We Actually Taxed the Rich?

Income and wealth are now more concentrated at the top than at any time over the last 80 years, and our unjust tax system is a big reason why. The tax code is rigged for the rich, enabling a handful of wealthy individuals to exert undue influence over our economy and democracy.

Conservatives fret about budget deficits. Well, then, to pay for what the nation needs -- ending poverty, universal health care, infrastructure, reversing climate change, investing in communities, and so much more -- the super-wealthy have to pay their fair share.

Here are seven necessary ways to tax the rich.

First: Repeal the Trump tax cuts.

It’s no secret Trump’s giant tax cut was a giant giveaway to the rich. 65 percent of its benefits go to the richest fifth, 83 percent to the richest 1 percent over a decade. In 2018, for the first time on record, the 400 richest Americans paid a lower effective tax rate than the bottom half. Repealing the Trump tax cut’s benefits to the wealthy and big corporations, as Joe Biden has proposed, will raise an estimated $500 billion over a decade.

Second: Raise the tax rate on those at the top.

In the 1950s, the highest tax rate on the richest Americans was over 90 percent. Even after tax deductions and credits, they still paid over 40 percent. But since then, tax rates have dropped dramatically. Today, after Trump’s tax cut, the richest Americans pay less than 26 percent, including deductions and credits. And this rate applies only to dollars earned in excess of $523,601. Raising the marginal tax rate by just one percent on the richest Americans would bring in an estimated $123 billion over 10 years.

Third: A wealth tax on the super-wealthy.

Wealth is even more unequal than income. The richest 0.1% of Americans have almost as much wealth as the bottom 90 percent put together. Just during the pandemic, America’s billionaires added $1.3 trillion to their collective wealth. Elizabeth Warren’s proposed wealth tax would charge 2 percent on wealth over $50 million and 3 percent on wealth over $1 billion. It would only apply to about 75,000 U.S. households, fewer than 0.1% of taxpayers. Under it, Jeff Bezos would owe $5.7 billion out of his $185 billion fortune -- less than half what he made in one day last year. The wealth tax would raise $2.75 trillion over a decade, enough to pay for universal childcare and free public college with plenty left over.

Fourth: A transactions tax on trades of stock.

The richest 1 percent owns 50 percent of the stock market. A tiny 0.1 percent tax on financial transactions -- just $1 per $1,000 traded -- would raise $777 billion over a decade.That’s enough to provide housing vouchers to all homeless people in America more than 12 times over.

Fifth: End the "stepped-up cost basis" loophole.

The heirs of the super-rich pay zero capital gains taxes on huge increases in the value of what they inherit because of a loophole called the stepped-up basis. At the time of death, the value of assets is “stepped up” to their current market value -- so a stock that was originally valued at, say, one dollar when purchased but that’s worth $1,000 when heirs receive it, escapes $999 of capital gains taxes. This loophole enables huge and growing concentrations of wealth to be passed from generation to generation without ever being taxed. Eliminating this loophole would raise $105 billion over a decade.

Six: Close other loopholes for the super-rich.

For example, one way the managers of real estate, venture capital, private equity and hedge funds reduce their taxes is the carried interest loophole, which allows them to treat their income as capital gains rather than ordinary wage income. That means they get taxed at the lower capital gains rate rather than the higher tax rate on incomes. Closing this loophole is estimated to raise $14 billion over a decade.

Seven: Increase the IRS’s funding so it can audit rich taxpayers.

Because the IRS has been so underfunded, millionaires are far less likely to be audited than they used to be. As a result, the IRS fails to collect a huge amount of taxes from wealthy taxpayers. Collecting all unpaid federal income taxes from the richest 1 percent would generate at least $1.75 trillion over the decade. So fully fund the IRS.

Together, these 7 ways of taxing the rich would generate more than $6 trillion over 10 years -- enough to tackle the great needs of the nation. As inequality has exploded, our unjust tax system has allowed the richest Americans to cheat their way out of paying their fair share.

It’s not radical to rein in this irresponsibility. It’s radical to let it continue.

749 notes

·

View notes

Text

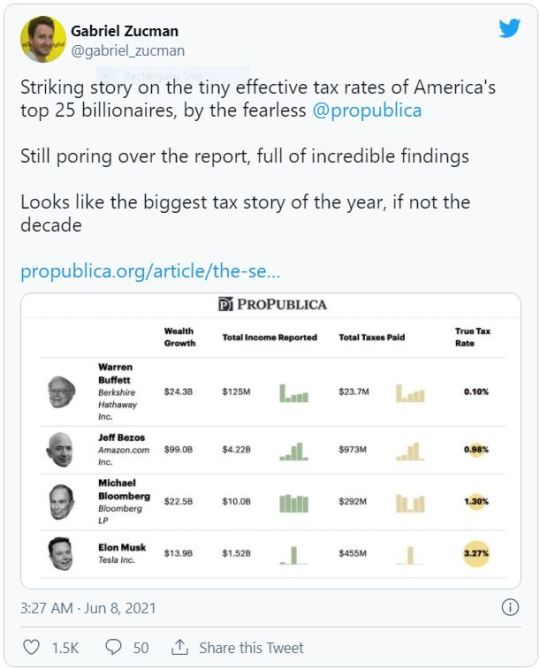

“A bombshell report by ProPublica reveals just how little the wealthiest Americans have been paying in taxes. ProPublica obtained more than 15 years of never-before-seen IRS information about the 25 richest Americans and found that sometimes they paid little or no federal income taxes. In 2018, for example, ProPublica found Elon Musk paid no federal income tax. Neither did Jeff Bezos in 2007 or 2011, the same year he claimed a $4,000 child tax credit. And renowned investor, Warren Buffett, avoided the most tax of any of the billionaires ProPublica looked at, according to the report. As shocking as it is, nothing that they did is illegal. Everything that they did is in keeping with our tax code. And the basic reason is, we tax income not wealth. Rich people often grow their fortunes through stocks, real estate or companies, so they don't have to pay taxes until they sell, and they can offset their income in other ways too. Meaning it's legal to be worth a lot and pay a little.”

Link: https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

Related: https://www.wsws.org/en/articles/2021/06/05/infr-j05.html

#taxes#propublica#tax the rich#politics#jeff bezos#inequality#elon musk#capitalism#warren buffett#federal income taxes#capital gains#capital gains tax#corporate taxes#corporate tax rates

85 notes

·

View notes

Link

A first-of-its-kind analysis of newly disclosed Internal Revenue Service data shows that the richest 25 billionaires in the United States paid a true federal tax rate of just 3.4% between 2014 and 2018—even as they added a staggering $401 billion to their collective wealth.

"Many will ask about the ethics of publishing such private data. We are doing so—quite selectively and carefully—because we believe it serves the public interest in fundamental ways, allowing readers to see patterns that were until now hidden." —Richard Tofel & Stephen Engelberg, ProPublica

Published Tuesday by the investigative nonprofit ProPublica—which obtained a sprawling cache of IRS data on thousands of the nation's wealthiest people dating back 15 years—the analysis takes aim at "the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most."

"Our analysis of tax data for the 25 richest Americans quantifies just how unfair the system has become. By the end of 2018, the 25 were worth $1.1 trillion," ProPublica notes. "For comparison, it would take 14.3 million ordinary American wage earners put together to equal that same amount of wealth. The personal federal tax bill for the top 25 in 2018: $1.9 billion. The bill for the wage earners: $143 billion."

"Many Americans live paycheck to paycheck, amassing little wealth and paying the federal government a percentage of their income that rises if they earn more," the outlet adds. "In recent years, the median American household earned about $70,000 annually and paid 14% in federal taxes."

The new analysis juxtaposes the recent wealth gains of U.S. billionaires—as estimated by Forbes—with the information in the newly obtained IRS data to derive the "true tax rate" paid by the mega-rich.

The results show that Amazon CEO Jeff Bezos—the world's richest man—and Berkshire Hathaway CEO Warren Buffett paid a true tax rate of 0.98% and 0.10%, respectively, between 2014 and 2018. In 2007, ProPublica notes, Bezos paid nothing in federal taxes even as his wealth grew by $3.8 billion.

Economist Gabriel Zucman, a professor at the University of California, Berkeley, said the ProPublica reporting is "full of incredible findings."

"Looks like the biggest tax story of the year, if not the decade," Zucman added.

ProPublica makes clear that, far from being the beneficiaries of a sprawling, illegal tax dodging scheme, "it turns out billionaires don't have to evade taxes exotically and illicitly—they can avoid them routinely and legally," a point that spotlights the systemic inequities of the U.S. tax system.

As the outlet explains:

Most Americans have to work to live. When they do, they get paid—and they get taxed. The federal government considers almost every dollar workers earn to be "income," and employers take taxes directly out of their paychecks.

The Bezoses of the world have no need to be paid a salary. Bezos' Amazon wages have long been set at the middle-class level of around $80,000 a year.

For years, there's been something of a competition among elite founder-CEOs to go even lower. Steve Jobs took $1 in salary when he returned to Apple in the 1990s. Facebook’s Zuckerberg, Oracle's Larry Ellison, and Google's Larry Page have all done the same.

Yet this is not the self-effacing gesture it appears to be: Wages are taxed at a high rate. The top 25 wealthiest Americans reported $158 million in wages in 2018, according to the IRS data. That's a mere 1.1% of what they listed on their tax forms as their total reported income. The rest mostly came from dividends and the sale of stock, bonds, or other investments, which are taxed at lower rates than wages.

To illustrate the consequences of a system that doesn't tax unrealized capital gains, ProPublica cites the example of Bezos' $127 billion explosion in wealth between 2006 and 2018. The Amazon CEO "reported a total of $6.5 billion in income" during that period and paid $1.4 billion in personal federal taxes—a 1.1% true tax rate.

"America's billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people," ProPublica notes. "Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell."

Richard Tofel, ProPublica's founding general manager and outgoing president, said Tuesday that he considers the tax analysis "the most important story we have ever published."

"In the coming months, we plan to use this material to explore how the nation's wealthiest people—roughly the .001%—exploit the structure of our tax code to avoid the tax burdens borne by ordinary citizens," Tofel and ProPublica editor-in-chief Stephen Engelberg wrote in a separate article Tuesday. "Many will ask about the ethics of publishing such private data. We are doing so—quite selectively and carefully—because we believe it serves the public interest in fundamental ways, allowing readers to see patterns that were until now hidden."

81 notes

·

View notes

Text

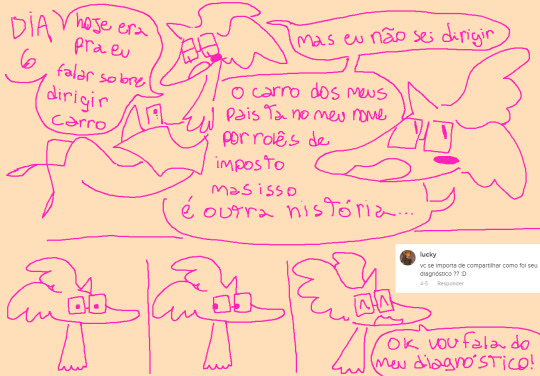

I wish I could have posted this sooner, but at least I got it done in time for my diagnosis birthday! Já passamos metadinha do mês e eu quero continuar fazendo quadrinhos de Aceitação Autista, se não conseguir fazer respondendo todas as perguntas to pensando em streamar e responder as perguntas e fazer arte autista se pá? Num sei! O que seis acham?

Ok ok enfim, transcrição + english translation on read more/continuar lendo

ENG

(first image) "DAY 6. today I was supposed to talk about driving" "but I can't drive. my parent's car is in my name for taxing reasons but that's another story..."

"do u mind sharing how was your diagnosis ?? :D" "ok i'll talk about my diagnosis!"

(second image)

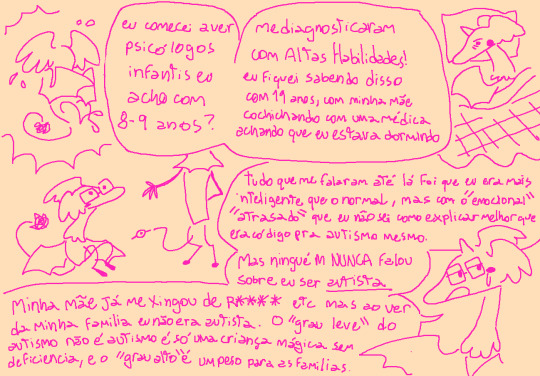

"I started seeing psychologists at ages 8-9 I think? I got diagnosed with a form of intellectual giftedness! I found out about this at 19 years old, when my mom was whispering with a doctor believing I was asleep"

"all I was told until then was that i was smarter than normal, but with a "delayed" "emotions" that I don't know how to explain better than it was code for autism really. But no one EVER talked about me being autistic. My mother already called me (R word) etc but in my family's eyes I wasn't autistic. The "high functioning" autism isn't autism it's just a magical child without disabilities, and the "low functioning" is a burden to families."

(third image)

" I wasn't surprised when I learned Dr Asperger is a gross "not-see""

" I lived being treated like a burden to the family, and like someone who should be superior always" "I had to discover myself autistic alone" "At 15 years old my mother reluctantly agreed to take me to a psychiatrist again"

"I saw so many doctors, it was luck one of them mentioned "asperger". Then I went to learn more about ASD, the first specialist told me to wear more bras and be less childish. then the hassle to find another, those were some bad years. but, late 2017 I managed to go to a clinic."

"the specialists and psychiatrists listened to me" "april 17th - 2018. i got my diagnosis! ASD and Depression"

(fourth picture)

"I remember I had school that day. i got there so happy with a bunch of papers. something so simple that made such a difference. finding out I'm autistic saved me. having doctors agree with me even more."

PT-BR

(primeira imagem)

"DIA 6. hoje era pra eu falar sobre dirigir carro" "mas eu não sei dirigir. o carro dos meus pais ta no meu nome por roles de imposto mas isso é outra história..."

"vc se importa de compartilhar como foi seu diagnóstico ?? :D" "ok vou fala do meu diagnóstico!"

(segunda imagem)

"eu comecei a ver psicólogos eu acho com 8-9 anos? me diagnosticaram com Altas Habilidades! Eu fiquei sabendo disso com 19 anos, com minha mãe cochichando com uma médica achando que eu estava dormindo"

"tudo que me falaram até lá foi que eu era mais inteligente que o normal, mas com "emocional" "atrasado" que eu não sei como explicar melhor que era código pra autismo mesmo. Mas ninguém NUNCA falou sobre eu ser autista. Minha mãe já me xingou de (palavra com R) etc mas ao ver da minha família eu não era autista. O "grau leve" do autismo não é autismo é só uma criança mágica sem deficiência, e o "grau alto" é um peso para as famílias."

(terceira imagem)

"eu não me surpreendi quando soube que o Dr. Asperger é um nojento "nasi""

"Eu vivi sendo tratade como um peso pra família, e como alguém que devia ser superior sempre" "Eu tive que descobrir que era autista sozinhe" "Aos 15 minha mãe relutantemente concordou em me levar em psiquiatra de novo"

"eu vi tanto médico, foi sorte que um mencionou "asperger". Aí eu pesquisei mais sobre TEA, a primeira especialista mandou eu usar sutiã e ser menos infantil. depois perrengue pra achar outra, foram uns anos ruins. mas, no finalzinho de 2017 eu consegui ir em uma clínica."

"as especialistas e psiquiatras me ouviram" "17 de abril - 2018. consegui meu diagnóstico! TEA e Depressão"

(quarta imagem)

"eu lembro que tinha aula no dia. cheguei mó feliz com um monte de papel. uma coisa tão simples que fez tanta diferença. descobrir que sou autista me salvou. e médicas concordarem comigo mais ainda."

#actuallyautistic#actually autistic#autism acceptence month#autism acceptance#autismacceptance#autismacceptancemonth#30 days of autistic art#30 days of autism acceptance#30daysofautismacceptance#comics#digital art#furry#redinstead#light it up gold

12 notes

·

View notes

Text

Some wealthy individuals will love no less than one sweetener in Democrats’ $3.5 trillion plan

A number of lawmakers from high-tax states like New York are pushing for adjustments to a key tax deduction in Democrats' $3.5 trillion spending bundle. Kent Nishimura/Los Angeles Instances by way of Getty Photographs

Whereas liberal lawmakers search for methods to boost taxes on the wealthy to finance their US$3.5 trillion spending bundle, some Home Democrats are aiming to decrease them.

Particularly, a number of Democrats from high-tax states resembling New York and New Jersey need to eradicate or no less than increase the $10,000 cap on the federal deduction of state and native taxes – often known as SALT – as a part of the invoice. The Democrats argue lifting the cap would assist middle-class taxpayers and assist homeownership.

“We’re dedicated to enacting a regulation that can embrace significant SALT aid that’s so important to our middle-class communities, and we’re working every day towards that aim,” a number of lawmakers mentioned in a Sept. 13, 2021, assertion.

However our analysis suggests wealthier People would see many of the financial savings.

A deduction primarily utilized by the wealthy

Earlier than 2017, taxpayers who itemized might deduct each penny of their state and native revenue or property taxes from their federal taxable revenue. This benefited householders as a result of they’re extra prone to itemize their taxes as a result of mortgage curiosity deduction.

Over 90% of households that earned $200,000 or extra took the deduction in 2017 in contrast with lower than 20% for these making beneath $100,000, in line with the IRS.

That modified after Congress handed a bundle of tax cuts in December 2017 that, amongst different issues, elevated the usual deduction for all taxpayers however added the cap on the state and native tax deduction for individuals who itemize.

In consequence, the share of households who itemized their taxes shrank from 31% in 2017 to 11% in 2018.

We examined the affect of the tax code change in a latest analysis paper, which used knowledge from the American Housing Survey and a Nationwide Bureau of Financial Analysis tax simulator. Primarily, we needed to estimate the federal revenue tax legal responsibility and tax advantages related to homeownership for a consultant set of taxpayers throughout the USA.

Our evaluation reveals that eliminating the cap would end in considerably decrease federal revenue taxes for high-income households, whereas making little distinction for individuals who earned much less.

For instance, a typical New Jersey family that earns $400,000 to $1.1 million would see federal revenue taxes lower by $14,401 if the cap have been eliminated, or 15.7% of all 2018 revenue taxes paid. Even in a comparatively low-cost state resembling Ohio, eliminating the cap would scale back federal revenue taxes for the same family by $5,466, or 5.2% of its 2018 tax invoice.

However, most significantly for individuals who favor a progressive tax code, our evaluation discovered that lifting the cap would barely have an effect on middle-income households.

For instance, a typical New York family incomes $100,000 to $150,000 would see its federal tax invoice go down $149 have been the cap lifted, whereas the median financial savings could be $16 in California and $407 in New Jersey. However for the overwhelming majority of states, eliminating the cap would don’t have any impact on most individuals on this revenue bracket, largely as a result of the 2017 tax regulation doubled the usual deduction. Throughout all states, the typical change in taxes for individuals incomes between $100,000 and $150,000 could be $49.

[Over 110,000 readers rely on The Conversation’s newsletter to understand the world. Sign up today.]

The affect of eradicating the cap would have a really small affect on most lower-income taxpayers since lower than 5% of them claimed the state and native tax deduction in 2018.

A middle-class false impression

The affiliation of the state and native tax deduction with middle-class homeownership is probably going the explanation for this false impression about who would profit from repealing the cap.

However in actual fact, one of many predominant methods middle-income householders profit from the tax code is thru the exclusion from capital positive factors taxes of as much as $250,000 in internet revenue from the sale of a house – $500,000 if submitting collectively.

The state and native tax deduction, nevertheless, primarily helps the wealthiest People.

The authors don’t work for, seek the advice of, personal shares in or obtain funding from any firm or organisation that will profit from this text, and have disclosed no related affiliations past their educational appointment.

1 note

·

View note

Text

Tax 101: Is Your Hobby Actually a Business?

After getting hit with an unexpected tax bill last year, a client recently decided she would start taking extra deductions by claiming expenses from her jewelry making hobby on next year’s tax return. While this may sound like a great idea, the Internal Revenue Service (IRS) has some pretty strict guidelines on the deductibility of hobby expenses – and whether or not her “hobby” may actually be a legitimate business!

From painting and pottery to car racing and horse breeding, many people enjoy hobbies that put a few extra bucks in their pocket. However, taxpayers who make money from a hobby must not only report that income on their tax return, they should also understand that none of the expenses connected with that hobby are deductible.

Beginning in 2018 and running through 2025, the law doesn't allow you to deduct hobby expenses from hobby income. You must claim all hobby income and are not permitted to reduce that income by any expenses.

Unfortunately, the 2017 tax reform law did away with itemized deductions (Code Section 67(g)), thereby doing away with hobby deductions in the process. So, the question becomes one of whether the jewelry making activity was a hobby or a business. Was our client doing it with the intent of making money?

To make that determination, we’d go through the following list of nine questions the IRS uses:

Does she carry on her jewelry making in a businesslike manner and maintain complete and accurate books and records?

Does the time and effort she puts into her jewelry making suggest she intends to make it profitable?

Does she depend on income from her jewelry making for her livelihood, or some portion thereof?

Are any losses due to circumstances beyond her control (or normal in the startup phase of her type of business)?

If she's been losing money, has she changed her methods of operation in an attempt to improve profitability?

Does she or her advisors have the knowledge needed to carry on her jewelry making as a successful business?

Was she successful in making a profit in similar activities in the past?

Did her jewelry making turn a profit in any 3 out of 5 consecutive years and if so, how much profit did it make?

Can she expect to make a future profit from the appreciation of the assets used in jewelry making?

The biggest tax limitation for a hobby is that you can’t deduct any expenses from its activities. Most hobbies come with some sort of expense – be it equipment, supplies or educational expenses. But the law says you can’t deduct those expenses if you are not engaging in that activity with the primary motive of making money. In other words, is it a business? Even if it's not and you have to report the income, at least the income is not subject to self-employment tax.

In the case of our jewelry maker, until her hobby becomes a business, she won’t be able to claim a loss on her taxes.

William D. Truax, E.A. and his friendly team of licensed tax preparers have been helping entrepreneurs and small business owners with their tax returns for nearly 50 years. He is licensed to represent taxpayers before the IRS and is also a member of the Bar of the United States Tax Court.

If you have tax questions about your hobby or would like to consider converting it into a real business, please contact us today for a FREE consultation. We’re here to help!

1 note

·

View note

Text

What Is The Best Tax Preparation Software For 2021

2020 was a year we are all happy to see in the rearview mirror. The global CoVID-19 epidemic shut down businesses last March and laid off millions of people. The economic impact on taxpayers was so significant that the IRS extended the 2019 filing deadline to July 15, 2020.

Matters are no less serious this year, but you will need to file your 2020 tax return (which you are filing in 2021)) usually by the April 15 deadline, with e-filing opening on February 12, If you want to wait as long as you can to submit your tax return, check out our tax tips for last-minute e-filers. But now tax filing services are open for business.

So you can get started and let's talk about "What Is The Best Tax Preparation Software"!

If you want to make your own Blog from scratch without any experience. You can follow our 12 easy steps guide to make your own blog and earn money online from it.

There Has Never Been A Better Time To E-file Your Taxes

Despite the many challenges this year, tax preparation services are in line with their reputation. In addition to many employees suddenly returning to work from home, these companies had to handle the growing business of taxpayers who were accustomed to moving to an office or retail location to complete their 1040s and file in person.

Some will file manually through a paper form they filled out themselves, but many people are turning to the online service to pay their taxes as reviewed here. If you've never tried an online DIY tax solution, for three reasons, this is a good year to start.

Previously, many changes to US tax laws did not make headlines because of the pressing headlines. Second, preparing and filing online can also get you a big refund, as these sites are trained to dig deeper into the deductions.

Finally, tax website developers continue to offer more ways to get in touch with tax professionals so they can help you complete and file your return. Or they can help you get the job done.

We have all learned how to do things differently in 2020. So, if you're still manually preparing your taxes, this would be a good year to move this operation online - especially if you had to turn to self-employment or job loss.

Working to deal with Tax Every website company has at least one version that allows you to complete and file a complex schedule. In fact, the 2020 edition supports all but the most obscure tax issues. So on your 1099s, you may face W-2s, your unemployment, your new work costs on virtually any tax situation you may face this year.

If you've been missing out on a web-based tax solution in the past, consider trying it again this year. Online personal tax preparation websites keep getting better

Significant Changes Have Been Made To The Tax Code

As we have said before, the change in the tax law has ended in a change this year. But you should know about them because they can affect you well. Tax website developers have incorporated all of these modifications into their online solutions.

For example, the amount of standard deductions for the 2020 tax year varies. They have, in fact, been slightly enhanced. If you are a married couple, the standard deduction is now 24,800. In addition, each spouse aged 65 or over receives a discount of 1,300.

If you are single, you can claim a standard deduction of 12,400. As a head of household, you get a deduction of ساتھ 18,650 with a reduction of یا 1,650 to those aged 65 and over.

The income tax line itself did not change in 2020, but inflation in the brackets is widespread.

Long-term capital gains remained the same in 2020, but their income thresholds increased. For example, you are now eligible for a 20% rate if you have earned more than 44 1,441,550 as a filer.

The income for the joint filing couple, the income limit is $ 496,600, and for household heads, 9 9,469,050. Most taxpayers will fall into the 0 or 15 range.

Some high-income taxpayers will face an additional 3.8% net investment income for short- and long-term benefits.

If you do not itemize Schedule A deductions, you can still deduct up to $ 300 in cash contributions from eligible organizations.

Some tax breaks were due to expire at the end of last year, including a reduction in mortgage insurance premiums (with some warnings) and energy-saving credits.

When we consider this to be true, it is quite certain that most Americans will be recipients of the second round of stimulus checks. But you still have to account for payments received earlier in 2020 under the Care Act. The developers of the tax website have created the required reporting.

You will be asked if you have received an Economic Impact Payment (EIP), which will be based on your 2018 or 2019 tax returns, and what the amount will be. If you received less than you qualified due to a change in your situation in 2020 (such as various filing status or increase or decrease in income), you will receive a recovery rebate credit on the tax return. If you get more, you are not expected to take revenge.

There are many other changes, including amendments to the rules for retirement plans. Personal tax preparation websites have incorporated these changes into the tax code into their online products. And to varying degrees, they also explain how you can expect to be affected.

Online Tax Filing Is Easier Than Ever

Considering the changes that have occurred, what will you get when you log in to the H&R Block, Tax Act, Turbo Tax, or any other website whose developer plans for several months at the end of January 2021? Making?

If you've used a personal tax preparation website or desktop software before and you return to the same product the same year, you won't see much difference.

Still, the site we've reviewed this year has improved, some more than others. But they are routine modifications. User interface adaptation and enhancement to help with changes in resources and prices and product lineup.

For the most part, this year's claimant crop looks and works the same as it did for the 2019 tax year. What's happening in the background is that your tax figures are being calculated and restructured to accommodate new rules and forms, although this is different. Today's leading tax site companies work hard in 2020 so that you don't have to in 2021.

How Online Tax Software Works

When you prepare income taxes using paper forms, you are far behind. You come to a line at 1040 that requires an auxiliary form or schedule, so you go there and complete it, and then move to 1040.

Sometimes you need to fill out a worksheet or pursue a document that you have received. Check the mail or your account twice because things don't look right. If there is a complication in your return, you will have to do this several times.

Tax websites work very differently. Once you've created an account and complied with the site's security requirements, you can stop worrying about which form you need and whether your calculations are correct. You also don't have to worry about how any change in the tax code will affect your return. That's all there is to it in the background.

When you use a digital tax preparation solution, you really fill out a huge questionnaire. These sites work like giant magicians: they ask questions on every page and you answer by answering. You enter information in blank fields, select the correct option from the list, or click the button.

When you have met all the requirements of a screen, you move on and complete it. You never have to look at the original IRS form or schedule (although in some cases, you can if you want to).

You will probably recognize the path you are taking. Sampled after ordering IRS Form 1040. You first provide contact information, including Social Security number (s) and date of birth (s), and then proceed to your income, deductions, credit, health insurance status, and taxes paid. After removing all headings that apply to you, these sites will review your return and highlight your mistakes or omissions.

When you clear them all, the software transfers your tax data back to any state you should file with (although not all of these are available in the preview that you received in late December and early January).

I'm watching). Once you have answered a variety of questions and checked your full refund, you have been asked to pay a service fee (if any). Finally, you can enter your return electronically and print it out.

What's It Like To Use Online Tax Services?

Along the way, personal tax preparation websites offer a lot of help. However, how helpful they will be if they only show copies of the original IRS forms and schedules on the screen and ask you to fill them out using the IRS instructions.

Instead, some of these solutions, such as H&R Blockchain and TurboTax, provide state-of-the-art user experiences. They are designed to make ugly work more beautiful. They use color, graphics, design, and layout to present screens that are lively and charming, rather than being as dull and lifeless as the original shapes.

The step-by-step path to data entry that they usually provide works unless you work your way through your entire return unless you have a lot of backing up or moving forward (where allowed). Jackson Hewitt, for example, asks if you would like to complete 1040 using your comprehensive interview. This option takes you through a long Q&A session. It asks you about any tax headings that may apply to you.

The second alternative, each online service offers, involves choosing the titles that apply to you. You choose from lists that provide income, deductions, credit, and taxes. When you select someone, the sites guide you through mini-interviews to get the information you need. After that, they will return you to the main list to choose another title, and so on, until you run out.

Most of the sites we've reviewed are hybrids of these two methods. The point is, what you have to read on the screen and follow its instructions. You spend most of your time answering questions and clicking on links to move on to the next screen or using the site's extensive navigation tools. These sites are good guides most of the time.

Tax Software Speaks Your Language, Not IRS-ESE

If you've ever filed a tax return, you know that understanding the IRS language in its formats and schedules can be a challenge.

Sometimes turning to written instructions doesn't help much. They are quite comprehensive - in fact, it is often difficult to find the exact answer to your question. When you find it, the language, again, can be difficult to understand.

From the earliest days, personal tax software developers have sought to translate IRS-ESE and make non-accounting more understandable.

They have rewritten their content so that the average taxpayer understands what is being requested. Services like Tax Act do more. For example, they provide hyperlinks to small help windows that further define a term or phrase. They expect questions you can ask and will post questions and answers, especially on complex topics. They try to make sure you understand the question being asked so that you provide the correct answer.

Everyone Needs More Help To Pay Their Taxes

Sometimes a friendly, understandable user experience and a description of the content displayed on the screens is not enough. Therefore, tax websites offer online help. Some, including the H&R block, offer context-sensitive explanations in panes attached to the main work area.

In some cases, this guide is not available until you click on the help link. And sometimes when you do, you have access to a large database of questions and answers. You may be guided by IRS instructions and publications on some sites, but in general, it is rewritten to make technical content understandable.

What will you do if your search for help on site fails? You may have a variety of questions: At first something like this happens, "Where do I enter the information that is in this paper form to me?" Or "The site won't let me go to the next page. What did I do wrong?" Or, simply, "I'm stuck. I can't find a way back to my screen where I enter information about mortgage interest."

All sites offer to contact the company's technical support representatives in at least one of three ways: by email, phone, or chat. Tax sellers, for example, offer all three. Some, such as the H&R block, offer online communities where you can see if someone else has already solved your problem.

However, these technical support representatives cannot advise you on points of technical law. So some offer to connect you to an accounting professional, often just by chat or phone. Although you will pay extra, if you use Turbo Tax directly you will get the latest and most comprehensive guide.

This service connects you directly to the CPA or EA (Registered Agent) via video chat, not only during the tax season but throughout the year. H&R Block has added similar services. Both companies have expanded these virtual resources for the 2020 tax year.

Are There Any Free Tax Filing Services Available?

Prices for tax websites range from 100 free this year. It turns out you can get a lot for free. According to our tax survey, in fact, 17% of you use free services. 20% of you use paid software. Every company we've reviewed offers a version that doesn't cost you anything to prepare and file your taxes. All support the 1040 form and assume you will make a standard deduction. In all of these, you can record or import your W-2 data in some cases.

Everyone goes even further in some ways. H&R Block is very generous in its free offerings in generally paid services. Block W-2 supports retirement plans and Social Security income. Child Care Expenses and Child Tax Credit Earned Income Credit (EIC); And interest to students.

The Tax Act also allows support for W-2, child tax credit, and college expenses, as well as retirement income, unemployment, and EIC. Turbo Tax lets you report W-2 income, EIC, and children's tax credit. Using the tax slider, you can enter your student loan interest and tuition fees in addition to W-2. And the free edition of Jackson Hewitt will produce and file EIC (no children), unemployment and W-2 income, and taxable income up to $ 100,000.

Two of the online tax services we reviewed are free (or nearly free): Credit Karma Tax and Free Tax USA. Both support all major IRS forms and schedules. Free Taxes does not charge anything unless you need to file a state return. Its price is 95 12.95.

You can also purchase enhanced support for support 6.99. Credit Karma Tax is the only personal tax preparation website that is completely free for both federal and state statements.

Lastly, note that if your income is below a certain threshold or if you are in the military, you may be eligible to use free paid software.

The IRS Free File program allows you to file federal (and possibly your state) tax-free, even if you're using an app like Turbo Tax. To find out if you are eligible, visit this page on the IRS website.

You Can Also Let the Tax Pros Take Over

The personal tax preparation services we review here are capable of preparing very complex tax returns. You'll have to pay more if you need to complete more forms and schedules (we reviewed the most popular versions, which in some cases weren't the strongest), but the tools are self-employed, Available for advanced topics such as depreciation, rental income. , And capital gains

If you are not comfortable with the ability to complete a complex tax return, but still want to give it a shot, you can go with a site like H&R Block. The company of course offers DI DIY preparation and filing. But if you go through some distance and feel that you are not sure about some tax issues, you can ask your H&R Block tax professional to review your return, complete it, and Can sign You can even just upload your documents and the pro will work on it. Turbo Tax offers similar services this year.

Stay Safe, Protect Your Privacy This Tax Season 2021

Whenever you send sensitive information to a network that you have no control over, you should be concerned. Since the tax is nothing more than sensitive data, you should worry about the coffee shop if you are filing from a coffee shop, bol, or airport.

It seems like half of you get it as if a tax survey we've put in the field for filing last year shows that 47 people who use online tax software of Concerned neo-hippies and their global warming, I'll tell ya.

Fortunately, protecting your traffic is as easy as using a VPN. A VPN can create a secure tunnel that encrypts your data, ensuring that anyone who manages to tamper with it only sees backbiting. In another survey on the security of using tax software, we found that only 37% of e-filers use VPN.

However, no amount of security software can protect you if you commit a tax scam by telephone, email, or in person. Scammers often rely on you to tell them what they want to know instead of getting it out of their computer with malware.

Instead, they make excuses, the IRS says, believing that there may be a reason to inquire about you and ask you to pay for your confidential information or imaginary fees. Are Know that the IRS will never call you in blue and ask for private information. The agency prefers to communicate via a text message sent via US mail. Here's how to avoid tax scams this filing season.

1 note

·

View note

Link

As the nearly $2 trillion congressional stimulus package comes into clearer focus, one of the most controversial components remains the corporate bailout package (which, as has been noted in the Prospect, is massive). In the days and weeks leading up to the bill’s final draft, a number of industries have been floated—by themselves or by the Trump administration—as worthy bailout recipients, due to the challenging economic conditions of coronavirus-induced shutdown. Among those listed: the airline industry, Boeing, the cruise lines, the fossil fuel companies, and more.

What do these industries have in common? They operate in far-flung corners of the economy, some consumer-facing, some not so much. Some are represented by veritable armies of lobbyists, others seem to just be near and dear to the Trump administration’s heart. But one thing that they all share is a pioneering commitment to federal income tax evasion. All of the industries listed are among the country’s most decorated exploiters of tax loopholes, offshoring, and public subsidies. In healthy economic times, they contribute almost nothing in tax revenue; now, in crisis, they’re poised to be some of the biggest recipients of public funding.

Let’s start with the airlines, which are poised to receive the lion’s share of a $75 billion fund earmarked for “businesses critical to national security.” How much have the airlines contributed to the public sector in recent years, during a time of record-shattering profits? In the two full years since enactment of the Tax Cuts and Jobs Act, the seven largest U.S. carriers reported $30 billion of pretax income. On that haul, they paid an average effective federal income tax rate of 2.3 percent. According to Matthew Gardner at the Institute on Taxation and Economic Policy, that rate is actually inflated by Southwest Airlines, which accounts for the overwhelming majority of the income taxes paid by this group. “The other six—Delta, American, United, Alaska Airlines, Spirit and Jetblue—paid effective rates in the single digits or negative during this two-year period,” he wrote in early March. Delta, JetBlue, and Alaska all paid an effective federal tax rate of zero or less in 2018.

That’s because of their widespread use of tax deferral, a generous provision in the Trump tax code. These companies have been using depreciation-related tax breaks to defer nearly all income taxes for the past two years. Every time they purchase a new plane to replace a sidelined one, the depreciation machine restarts. This minimizes tax contribution while juicing airline industry profits to help make the stock price look more appealing to investors. And if that wasn’t enough, to buy back their own stock, on which they’ve spent 96 percent of free cash flow during the past ten years.

Boeing, meanwhile, was paying single-digit federal tax rates even before the Trump tax cuts came along. Over the ten years prior to the Trump administration’s 2017 cut to the corporate tax rate, a time when corporations were levied at 35 percent, Boeing paid an effective federal tax rate of 8.4 percent on $54.7 billion of U.S. profits. Often, the company has paid negative income tax rates. To top things off, it took home an extra $1.1 billion after the Tax Cuts and Jobs Act passage.

That doesn’t even account for Boeing’s wealth of public contracts—$23.4 billion in government contracts in 2017, and multiple multibillion-dollar contracts in 2018 from the Department of Defense. Nor does it account for Boeing’s staggering use of state and local tax breaks, good for $14 billion, according to Good Jobs First. That group’s subsidy tracker also identified $70 billion in federal loans, loan guarantees, and bailout assistance: That’s before this most recent congressional bailout package. The stock price, accordingly, has surged during the past two days.

Cruise lines, meanwhile, have made effective use of offshoring to whittle their tax contributions down to nothing. Though they seem like American companies, are all traded on the New York Stock Exchange, and fully expect the American federal government to cut them a check, none of those companies are actually registered in the United States. Carnival Corporation is incorporated in Panama; Norwegian Cruise Line is incorporated in Bermuda; and Royal Caribbean is incorporated in Liberia, while their ships fly flags of various foreign countries. That right there accounts for 70 percent of the global cruise ship market.

These companies gleefully exploit an IRS provision that says that income earned via the international operation of a ship by a corporation set up in a foreign country is tax-exempt. That allows them, too, to pay negative income tax rates: In 2019, Carnival and Norwegian both reported that they received more in refunds or deductions than they paid or set aside for taxes. Royal Caribbean, meanwhile, told its shareholders its total income tax expense for 2019 was $32.6 million, on a total income of $1.9 billion. That’s 1.7 percent. And that’s to say nothing of their track record on labor (horrible) and environmental issues (also horrible).

Finally, the fossil fuel companies. Like Boeing, the fossil fuel industry has long enjoyed massive federal subsidies and tax breaks, made expert use of depreciation-driven tax deferrals, and paid next to nothing in federal income taxes. In 2018, Chevron paid an effective federal tax rate of zero; so too did EOG Resources (formerly known as Enron Oil and Gas). Ditto Halliburton, Kinder Morgan, Devon Energy, and more. Even before the Trump tax cut, from 2009 to 2013, the 20 largest oil and gas companies deferred payments on up to half of their federal income taxes, resulting in them paying a rate of just 11.7 percent on their pretax income. Meanwhile, ExxonMobil has enjoyed almost $4 billion in federal loans, loan guarantees, and bailout assistance.

The Trump tax cut kicked this long-standing trend into overdrive, resulting in 91 profitable Fortune 500 firms paying $0 in federal income taxes in 2018. Many of these same companies will travel hat in hand back to the government, who will move mountains to find money to deal with a near-term crisis.

So after years, or decades, of salting away record profits, or clamoring for lower and lower tax rates and funneling money to shareholders, the country’s largest corporations are threatening to shut down if the federal government doesn’t show them a bit of generosity. They were happy to reap federal contracts, enjoy federal subsidies, and rack up federal bailouts, taking out public money at every opportunity, all in the name of private profits. But they continue to have no interest in contributing money back into the public coffers, in good times or bad. Their belief in the value of the state, and the public purse, extends only to when they need it to balance out their books.

Of course, the bailouts could easily stipulate an end to these sorts of practices. In fact, they could mandate that recipients onshore their operations, or end any number of evasive practices. But there’s been little indication that that will be part of the package. And as programs like TARP, a signature component of the 2008 bailout package, taught us, without strict enforcement, loopholes will continue to be sought. For America’s largest and most profitable corporations, public money will continue to be viewed as a one-way street.

#SLUDGE#Alexander Sammon#us politics#covid-19#coronvirus#corporate bailout#bailout#economics#economy#taxes

7 notes

·

View notes

Text

How Much Will it Cost to Hire an Accountant to Do My Taxes?

The cost of recruiting a professional chartered accountant to do your taxes differs depending on your circumstance and what tax forms you are in need to file. The normal expense of recruiting a certified public accountant (CPA) to plan and present a Form 1040 and state get back with no ordered allowances is $176, while the normal charge for a separated Form 1040 and a state tax return is $273. If you are independently employed and need to recruit a CPA to set up an ordered Form 1040 with a Schedule C and a state tax return Form, the average charge increases to $457.1 It is important to remember that these are the normal expenses; the cost will contrast if parts of your tax filings are under extraordinary cases and take more time for the accountant to finish. In these conditions, accountants may charge you more in consultation fees and extra time work. Read More: IRS problem resolution West Palm Beach County

Preferences of Hiring a Tax Professional

When you pay a professional to do your taxes, you are getting the additional advantage of various different services, including accounting, tax consultation, record-keeping, and auditing. You can likewise employ an accountant who has a specific specialization, for instance, If you own a small company or live abroad. A few professionals are generalists, however, regardless, it is essential to recruit somebody with a level of experience.

Accountants can give help with working up a powerful accounting system to precisely and advantageously evaluate productivity, screen costs, and costs, control financial plans and conjecture future hypothesis patterns. Accountants can likewise talk with their customers on tax-related issues, for example, tax consistency and guidelines and strategies for a tax decrease.In addition, accountants can think of precise review reports, budget summaries, and other bookkeeping documentation required by government guideline and loaning organizations. At the day’s end, employing an accountant can be the beginning of a productive relationship with a financial consultant. They will find out about your business or family financial records and goals, and they can offer significant guidance and individual tax decrease proposals and answers to critical questions whenever the year. Read More: Federal Stimulus FAQ

Your decision about whether to enlist a professional or document your own taxes with the assistance of accounting software should be founded on how agreeable you are with numbers, your knowledge of basic tax rules, and how much time you are eager to spend. When the Tax Cuts and Jobs Act (TCJA) became effective on January 1, 2018, it rolled out some general improvements to the tax code. Specifically, there were many changes made to organized allowances. This has made recording taxes more convoluted, in any event, for those acquainted with the tax code.

Tax Filing Assistance Options

If you fall inside a specific level of pay or are a senior resident, you may fit the bill for tax recording help. Starting in 2020, the Volunteer Income Tax Assistance (VITA) gives free tax preparation services to individuals who acquire $56,000 or less every year. Likewise, If you are age 60 or more seasoned, you may fit the bill with the expectation of free tax preparation services through Tax Counseling for the Elderly (TCE) and the AARP Foundation’s Tax-Aide programs.

If you want to know more about the income taxes Preparing service you can contact KB CPA Group. KB CPA Group is the best Tax Advisors in West Palm Beach County, Broward County & Miami-Dade County. For more information call us at 9545109188 or visit our website.

#Income Tax Preparation West Palm Beach County#Tax Advisor West Palm Beach County#Financial Audit West Palm Beach County#Tax service Broward County#Agreed upon procedures Miami-Dade County

1 note

·

View note

Text

Tax — Equity Market Eagerly Waiting for Carbon Sequestration Guidance

Carbon sequestration is the process of capturing and storing atmospheric carbon dioxide. It’s one of the most promising methods invented in efforts to curb global warming. Well, this process occurs both naturally and because of anthropogenic activities. The United Nations Environment Programme and other environmental organizations, in response to worldwide concerns about climate change resulting from augmented carbon dioxide concentrations in the atmosphere, have drawn considerable interest to the probability of snowballing the rate of carbon sequestration through changes in land use and forestry and via reengineering techniques like carbon capture and storage.

With that in mind, fifteen members of the U.S. House of Representatives sent an official letter to the U.S. Department of the Treasury, urging it to issue the guidance for carbon capture projects under section 45Q of the tax code. The letter aims to throw light on the fact that there’s a significant amount of money sitting on the sidelines. This was the second such letter to be sent by members of Congress in the past couple of months.

The section 45Q of the Internal Revenue Code of 1986, as revised, offers a federal tax credit for the carbon oxides sequestration and other greenhouse gases netted*- from an industrial source that would under any other circumstances be discharged into the atmosphere as an industrial emission. It was initially enacted in 2008 to offer credit for the sequestration of carbon dioxide, but as most expected, it did not meet the required needs, which was the widespread use by carbon dioxide generating companies and their investors due to a yearly aggregate program-wide aggregate cap on the available credits.

Due to amendments in 2009 and more revisions under the Bipartisan Budget Act of 2018 (BBA), the program-wide cap was withdrawn, and the suitability of the credit has been extended to cover the sequestration of all “qualified carbon oxides.”

This carbon sequestration credit offers a dollar-for-dollar decrease in federal income tax liability for each metric ton of carbon oxide captured at an eligible plant and then

(i) Permanently buried,

(ii) Used as a tertiary injectant in an improved oil or natural gas recovery project or

(iii) Used in another profit-making process that would result in the long-lasting disposal of the carbon oxide. Just like the production tax credit, the carbon sequestration credit is available as a credit stream for 12 years, starting on the date the carbon capture device is first placed in service.

Latent tax-equity shareholders have expressed interest in carbon capture projects, but the market has yet to grow mainly because of a lack of guidance around the vital aspects of the statute and how tax-equity financing can work.

Open questions about this issue include:

Conditions to which the credit is subject to recapture.

Provision of the credit among partners in an established partnership.

And procedures for making an election allowed by the statute to sanction the entity that permanently buries or otherwise uses the carbon oxide to declare the credit in place of the proprietor of the carbon recapture tool.

The proper guidance for the carbon sequestration credit is on the Department of the Treasury and the IRS’s priority guidance plan for 2020. Practitioners all around the world expect that the guidance will be dispensed in multiple tranches. An IRS attorney, who is part of the team working on the guidance recently confirmed to several media outlets, at the American Bar Association Section of Taxation meeting, that the first two pieces of the guidance will be out in a couple of months.

For detailed information, you can buy Value Pack or you can get in touch with our team, by calling on official toll-free helpline no: +1-(844) 810–1151 or drop your queries to — [email protected].

3 notes

·

View notes

Text

Tax Code 179 Helps Your Business’ Bottom Line

Section 179 of the IRS Tax Code allows businesses to deduct the cost of new equipment that was purchased or financed during that tax year.

In previous tax years, businesses could reasonably expect to write off a percentage of the total cost of new equipment purchased. For example, if a company in 2017 purchased up to $2 million worth of new equipment, they were eligible to deduct a limit of $500,000. This sounds like a great deal (and it was a much better deal than 2009’s $250,000 deduction cap), but this deduction is still only covers 25% of the total cost of new equipment a business could purchase.

In 2018, this deduction was raised significantly.

As of this year, the passage and signing into law of Section 179 of the IRS tax code allows businesses to deduct up to $1 million dollars on equipment that is purchased or financed in 2018. This means you can deduct the FULL PURCHASE PRICE of all Equiinet equipment purchased for your business! There has never been a better time to update your company’s old phone systems and computer software with Equiinet. Plus, with Equiinet’s new Phone System Buy Back, there’s never been a better time to update your business equipment and save money in the process.

How does this work?

Essentially, between the dates January 1, 2018 and December 31, 2018, your business may lease or purchase any of the following items (and more!) and receive a full deduction of the total purchase prices. These items include:

Office equipment (including phone systems, printers, copiers, fax machines, etc.)

Office furniture

Computers

Computer software(that is purchased or financed from outside your company)

Tangible personal property used in business

Simply keep complete records of all the business equipment you leased or purchased during 2018 (including where you acquired the equipment from and the date it was acquired and put into service), and fill out IRS form 4562 when you file for your 2018 taxes. It couldn’t be easier!

Let Equiinet help your business have a stellar 2018!

Section 179 truly is fantastic for businesses. It is finally time to get those upgrades you desperately need! With Equiinet’s affordable services and products, plus our amazing new Phone System Buy Back Program, we are here to enable your business and help you have most amazing year yet! For more information on how Equiinet can protect your bottom line, give us a call. Click this link if you would like more information on Section 179 of the IRS tax code.

We can’t wait to help you grow!

0 notes

Text

Tax Code 179 Helps Your Business’ Bottom Line

Section 179 of the IRS Tax Code allows businesses to deduct the cost of new equipment that was purchased or financed during that tax year. In previous tax years, businesses could reasonably expect to write off a percentage of the total cost of new equipment purchased. For example, if a company in 2017 purchased up to $2 million worth of new equipment, they were eligible to deduct a limit of $500,000. This sounds like a great deal (and it was a much better deal than 2009’s $250,000 deduction cap), but this deduction is still only covers 25% of the total cost of new equipment a business could purchase.

In 2018, this deduction was raised significantly. As of this year, the passage and signing into law of Section 179 of the IRS tax code allows businesses to deduct up to $1 million dollars on equipment that is purchased or financed in 2018. This means you can deduct the FULL PURCHASE PRICE of all Equiinet equipment purchased for your business! There has never been a better time to update your company’s old phone systems and computer software with Equiinet. Plus, with Equiinet’s new Phone System Buy Back, there’s never been a better time to update your business equipment and save money in the process.

How does this work? Essentially, between the dates January 1, 2018 and December 31, 2018, your business maylease or purchase any of the following items (and more!) and receive a full deduction of the total purchase prices. These items include:

Office equipment (including phone systems, printers, copiers, fax machines, etc.)

Office furniture

Computers

Computer software(that is purchased or financed from outside your company)

Tangible personal property used in business

Simply keep complete records of all the business equipment you leased or purchased during 2018 (including where you acquired the equipment from and the date it was acquired and put into service), and fill out IRS form 4562 when you file for your 2018 taxes. It couldn’t be easier!

Let Equiinet help your business have a stellar 2018! Section 179 truly is fantastic for businesses. It is finally time to get those upgrades you desperately need! With Equiinet’s affordable services and products, plus our amazing new Phone System Buy Back Program, we are here to enable your business and help you have most amazing year yet! For more information on how Equiinet can protect your bottom line, give us a call. Click this link if you would like more information on Section 179 of the IRS tax code.

We can’t wait to help you grow!

0 notes

Text

Three Important Changes to the 2020 Tax Code

Todd Mardis, a financial professional with more than two decades of experience, is the president of Capital Preservation Services, a national financial firm based in Mississippi. Working predominantly with high-income earners, Todd Mardis’ company offers advanced tax planning services. Most years, the Internal Revenue Service (IRS) makes various changes to the tax codes. Such changes alter deductions or change the limit for charitable contributions. Here are a few of the more impactful changes to the 2020 tax code: - 401(k) contribution limits increased For the 2020 tax year, filers can contribute up to $19,500 to their 401(k) plans. Filers who are 50 years old or older can make catch-up contributions of $6,500, about $500 more than previous years. - A modest increase in income ranges for tax brackets As in 2019, the highest tax bracket for filers is 37 percent of reportable income. While the brackets themselves have remained the same, the income threshold has slightly increased from $510,300 in 2019 for individual taxpayers filing as single to $518,400 in 2020. From there, the brackets are 32 percent for incomes exceeding $163,300 for individuals, 24 percent for incomes above $85,525, and 22 percent for incomes of $40,125 or more. - Higher standard deductions Taxpayers have the option of either itemizing their deductions or taking the standard deduction set by the IRS. Most taxpayers will find that itemizing their deduction will not save them any money, particularly after the standard deduction almost doubled in 2018. This deduction rose again in 2020 to $12,400 for single filers and $24,800 for married filers.

1 note

·

View note