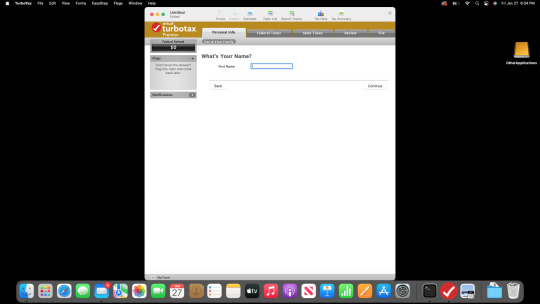

#tax software

Text

if you are an American,

🙂 are you good?

it’s officially tax season crunch-time folks!

You know what that means: sweaty searches for your W2 and paralyzing fear over whether you owe or not! 🙂

Will it be a return for you this year or will you be looking for a third job to cover that amount due? 🙃

I’m right there with you friends.

Let my humble contribution below, bring you some laughs as you languish to help combat the Sunday Scaries. 🐀❤️

youtube

#taxes#tax services#taxation#tax preparation#tax planning#tax professional#tax policy#tax payers#tax payment#tax filing#tax forms#tax free#tax liability#tax evasion#tax season#tax savings#tax strategies#tax software#mental health#mental illness#mental heath awareness#mental health matters#Youtube

226 notes

·

View notes

Text

Understanding the Benefits of Lacerte Tax Hosting for Tax Professionals

In tax practice, efficiency, accuracy, and protection are paramount. Tax specialists constantly search for methods to streamline their approaches, minimize errors, and safeguard sensitive client statistics. This is wherein Lacerte Tax Hosting steps in as a game-changer for tax experts.

Lacerte Tax Hosting is a cloud-based answer that allows tax specialists to access the powerful Lacerte tax software program from anywhere, anytime, using any internet-enabled tool. Rather than being tied to an unmarried laptop or office region, tax preparers can leverage the ability and convenience of cloud technology to beautify their workflow and patron carrier.

One of the primary advantages of Lacerte Tax Hosting is its accessibility. With the software program hosted inside the cloud, tax professionals can log in to their debts from simply anywhere with a web connection. Whether operating from the office, domestically, or on the go, they have on-the-spot access to all the equipment and sources they need to assemble and record taxes for their clients efficiently.

Moreover, Lacerte Tax Hosting gives scalability, permitting tax specialists to scale their operations up or down without difficulty based totally on their workload. During top tax season, firms can quickly upload additional customers or resources to deal with accelerated calls, ensuring that they can meet cut-off dates and provide well-timed providers to customers. Conversely, during slower durations, they can reduce without spending money on high-priced hardware or software licenses.

Another full-size advantage of Lacerte Tax Hosting is its collaboration capabilities. Tax professionals can effortlessly collaborate with group participants, customers, and other stakeholders in actual time, irrespective of their physical region. This fosters seamless communique, improves productivity, and enhances client enjoyment. Additionally, the software's multi-person abilities allow more than one group member to paint on the same purchaser documents, boosting efficiency concurrently.

Regarding security, Lacerte Tax Hosting offers robust measures to guard sensitive customer records. Leading web hosting providers appoint superior encryption strategies, firewalls, and different security protocols to shield records from unauthorized access, breaches, and cyber threats. Additionally, cloud-primarily based answers often go through regular safety audits and compliance exams to ensure particular adherence to industry standards and regulations.

Furthermore, Lacerte Tax Hosting removes the want for tax specialists to control and keep complicated IT infrastructure. With the software hosted inside the cloud, website hosting companies take care of software program updates, information backups, and system protection, releasing precious time and resources for tax specialists to pay attention to serving their clients.

In the end, Lacerte Tax Hosting offers tax specialists a comprehensive solution for streamlining their tax practice techniques, improving collaboration, and enhancing security. By leveraging the strength of cloud technology, tax experts can paint greater correctly, serve customers greater effectively, and stay ahead in a more and more competitive enterprise. Whether you are a solo practitioner or a part of a larger organization, Lacerte Tax Hosting offers the tools and aid you want to thrive in a modern-day, rapid-paced tax environment.

Verito is a central issuer of Lacerte tax hosting services, supplying tax experts the capacity to get the right of entry to the powerful Lacerte tax software securely and simply from anywhere with an internet connection. Verito's strong cloud infrastructure guarantees dependable performance, scalability, and advanced safety capabilities to shield sensitive consumer information. With Verito's Lacerte tax web hosting solution, tax experts can streamline their workflow, collaborate seamlessly with crew members and clients, and be conscious of delivering amazing careers without the hassle of coping with IT infrastructure.

0 notes

Text

The choice between tax software and a professional tax accountant ultimately depends on your individual needs, preferences, and financial circumstances. While tax software offers convenience and affordability, professional accountants provide expertise and personalized guidance, particularly for complex financial situations. By carefully evaluating your options and considering the factors outlined in this guide, you can make an informed decision that ensures compliance, maximizes savings and facilitates financial success. In this comprehensive guide, we’ll delve into the intricacies of each choice, helping you make an informed decision that aligns with your financial goals and circumstances.

Read Here:- https://mehracpa.com/tax-software-vs-accountant/

0 notes

Text

Tax Print : Your Partner for Affordable & Complete Tax & Accounting

Taxprint is a leading online payroll software company that provides comprehensive payroll solutions to businesses of all sizes in India. Our user-friendly software simplifies payroll management, ensuring timely and accurate processing of TDS, eTDS, ITR, and asset management tasks.

#asset management software#it asset management software#hr software#fixed asset#tax software#compliance management#asset management system#management software#fixed asset management#payroll management software#asset management tools#tds software#software payroll

0 notes

Text

Empowering Tax Professionals: Harnessing Technology For Efficient Workflows And Client Success

In the realm of tax preparation and resolution, technology is now a crucial partner. Workflow automation software is at the forefront, revolutionizing the operational landscape for tax professionals. With its ability to streamline tasks and enhance accuracy, this software has become an indispensable tool for modern tax firms.

For tax resolution professionals, having access to the best tax software is akin to processing a strategic advantage. This software equips them with the means to navigate intricate tax codes and regulations, while also automating complex calculations. It’s a game-changer in an industry that demands precision and efficiency.

A cornerstone of modern tax practice is the integration of Customer Relationship Management (CRM) for tax professionals. This tool not only organizes client information but also transforms interactions. CRM systems tailored for tax firms ensure that every client’s unique needs are met, ultimately bolstering client satisfaction.

In the dynamic field of tax resolution, resolution software stands as a beacon of innovation. This software empowers tax resolution professionals with the resources to effectively address complex tax issues and manage the resolution process efficiently. It’s an essential component for any tax firm aiming to provide top-tier services.

In the pursuit of excellence, tax professionals are turning to resolution tax software and CRM for tax professionals. These tools, combined with the best professionals’ tax software, form a trifecta of efficiency, accuracy, and customer-centric service. As the industry continues to evolve, these tools will likely remain fundamental to success.

#practice management#workflow software#tax software#tax resolution#crm for tax#professional tax software#accounting software

0 notes

Text

STUMPED

0 notes

Link

Australian first & best tax software.Visit your speed (ATO) tax portal system.this unique calculator will very help you workout your tax refunds or debt estimate. we'll provide you fast tax refunds software of hubex. use tax practitioner assistance to resolve matters you have been unable to resolve through other channels.convenient fast and simple to use software.become tax-smart in 2023. follow your tax refunds from starts to finish using our features,you can easily.

0 notes

Text

Tips For Hiring A Tax Consultant

Tips For Hiring A Tax Consultant

If you intend on hiring a tax consultant to assist with your returns this year, the IRS offers some advice to consider when selecting one. The right one can save you hundreds and already thousands of dollars. Unfortunately, choosing the wrong one or trying your hand with an unfamiliar online software program will not only waste your time and money, but consequence in the need to hire another…

View On WordPress

#tax brackets#tax calculator#tax deadline#tax deductions#tax forms#tax married filing jointly#tax refund schedule#tax return#tax software#tax standard deduction

0 notes

Text

Drake Tax Software: Streamlining Your Tax Preparation Process

Drake Tax Software is a powerful and flexible tax guidance software program designed to simplify and decorate the tax submitting system for individual and expert tax preparers. This complete software program solution is famend for its consumer-friendly interface, robust functions, and versatility, making it a famous preference for tax specialists, accountants, and people.

What is Drake Tax Software?

Drake Tax Software is a tax practice software advanced using Drake Software, a corporation with a long record of presenting tax-related software program answers. The software is designed to assist tax professionals in successfully and as it should be getting ready tax returns for his or her clients, and it can cope with a wide variety of tax scenarios, from simple man or woman returns to complicated business and property tax filings.

Key Features and Functions:

User-Friendly Interface: Drake Tax Software is understood for its intuitive and easy-to-navigate interface, which makes it reachable for tax professionals of all experience levels. Users can quickly input and overview records, reducing the risk of mistakes and streamlining the filing process.

Comprehensive Tax Forms: Drake Tax Software gives a massive library of federal and kingdom tax forms, ensuring that customers can put together returns for all 50 states and meet the desires of a diverse consumer base.

E-Filing Capabilities: The software offers digital submitting alternatives, permitting customers to submit tax returns securely to the IRS and country tax companies, which could result in faster processing and refunds for customers.

Extensive Reporting: Drake Tax Software gives robust reporting features, permitting customers to generate a comprehensive range of news for customers and their facts. These reviews may be custom-designed to provide a detailed breakdown of tax return facts.

Integration: The software can combine with other accounting and monetary software programs, enhancing the performance of information access and ensuring accuracy in calculations.

Updates and Support: Drake Software regularly updates its software to reflect changes in tax legal guidelines and rules, ensuring that users constantly comply with state-of-the-art requirements. They also provide superb customer support for any questions or problems customers may encounter.

What is the Use of Drake Tax Software?

The number one use of Drake Tax Software is to simplify and streamline the tax training manner. It is hired by tax professionals, which includes CPAs, enrolled marketers, and tax preparers, to effectively and accurately prepare tax returns for their clients. The software program can manage various tax situations, from individual income tax returns to complicated company and estate tax filings.

Some of the significant thing advantages of using Drake Tax Software include the following:

Efficiency: Drake Tax Software automates many elements of tax go-back instruction, reducing manual statistics entry and calculation mistakes. This efficiency saves time and allows tax specialists to serve a more significant number of customers.

Accuracy: The software's strong blunders-checking functions help catch mistakes before submitting, reducing the hazard of high-priced mistakes that could result in audits or penalties.

Compliance: Drake Tax Software stays up-to-date with ever-converting tax legal guidelines and guidelines, ensuring that users constantly comply with trendy tax requirements.

Client Management: The software offers features to manipulate consumer information, supporting tax experts to keep in tune with their clients' monetary details and tax histories.

E-Filing: Drake Tax Software lets in for electronic submitting, which could expedite the filing procedure and result in quicker customer refunds.

Verito, a relied-on company of tax software program solutions, gives access to Drake Tax Software. This complete and user-pleasant platform streamlines the tax preparation technique for experts and individuals. With its sturdy features, compliance updates, and efficient e-submitting competencies, Verito's imparting of Drake Tax Software enhances the tax instruction enjoyed, making it a splendid preference for tax specialists and people searching for a dependable and efficient answer for their tax filing desires.

0 notes

Text

Making life easier with the help of technology! 🖥 Spine Software is leading the way in mobile application and desktop software development. Create your own professional-looking apps and make everyday tasks simpler with our powerful, reliable, and easy to use tools. It's never been easier to build apps that are secure, intuitive and designed for your needs. Check us out today to get started.

Learn more:

0 notes

Note

Kitty I am losing my mind. My boss not only didn't get out 1099's done in Jan, but the ones we have now are incorrect for most of the team. I am just a project manager, and trying to fix this, and our accountant is saying they can't file corrected 1099's?? And... I am just... not sure what the problem is and if you have any idea what is going on? Looking online, it looks like you can file new 1099's with "corrected" and a new 1096 form (I know what none of this means/how it works) and I am just not sure how someone who does taxes for a small business couldn't... do that. I lack the knowledge to actually fix this problem for my designers who are getting fucked over and I am so upset.

uh

your accountant is either lying or dumbshit

you literally just send out the corrected form with the big box at the top that says CORRECTED checked to the IRS. unless the accounting software they're using is supremely shitty they should be able to do that no problem, and even then at worst you roll up your sleeves and you fill out forms manually because that shit's important. unless the 1099s are fucked because they've also been fucking up payroll this whole time.

if the 1099s are filed with disputes (which is what you have to do if the person who issued the 1099 is being a shit about their fuckup), that's going to draw the IRS's attention to the fuckup and the business is going to get charged penalties. like. it sounds like you have a paper trail right now that establishes intentional disregard for filing correct information and that's like $580 per incorrect form.

#original#i haven't done proper tax accounting in a while but. you correct it. you can always correct it. why would they not let you correct it.#the best case scenario i can think of is that your accountant is just stupid and doesn't understand how to fix it in their software#unless there's something complicated happening here that neither of us knows about

124 notes

·

View notes

Text

I have Done The Taxes, much later in the year than I usually do because hell world, but they're done and that's what matters.

#for the record#I do my own taxes#and my sisters' taxes#both of them#I've been doing it for like 12 years#I haven't paid for tax filing software since 2015#I also haven't had an issue with doing my own taxes ever#it's complicated as a general rule#because hell country#but if you've just got a W-2 and no HSA or investments#it's pretty easy#I always feel bad#when people are intimidated out of it#and pay $$$$ to have someone else do it#even when their returns are SUPER simple#if you've just got a W-2#and you don't have any investments#you can do your own taxes#very easily#trust me

12 notes

·

View notes

Text

#1 destination for finding software and services

We’re the #1 destination for finding software and services

Verified Reviews 2 million verified reviews from people like you to get the insights you need

Proprietary Insight 500+ softwarereviewforall Shortlist reports to narrow down your options and save you time

Expert Guidance Personalized software recommendations from human advisors in less than 15 minutes

Satisfied customer / FROM OUR USERS "softwarereviewforall helped us get insights from other people in our industry to make a better, more informed decision." JOSH D. Sales Engineer

Please note that "softwarereviewforall" is a placeholder, and you should replace it with the actual name or website you want to use in your text.

#software review#software reviews#antivirus software review#mint software review#you need a budget software review#jira software review#quicken software review#reaper software review#zoho software review#software testing review#xero software review#gimp software review#libre software review#topaz software review#software review sites#software review websites#software review site#nch software review#audacity software review#tax software review#video editing software review#4 vs 4s#best tax software 2023#avalanche software#what type of software controls the hardware of a computer?#hogwarts legacy review#procore#clipchamp review#shotcut review#stessa review

12 notes

·

View notes

Text

i don't know how i feel about AI being developed by people who are really paranoid about it destroying humanity. all i know is that chat gpt is much more helpful than stack overflow.

#i should just quit school and become that guy who works 20 remote software engineering jobs and makes 3 million a year#although my taxes would be way too complicated to figure out

21 notes

·

View notes