#ITR filing procedure

Explore tagged Tumblr posts

Text

2 notes

·

View notes

Text

Understanding Tax Refunds: JJ Tax made it easy

Handling tax refunds can seem overwhelming, but having a clear grasp of the process can make it straightforward. This newsletter aims to demystify tax refunds by covering key aspects: eligibility criteria, claiming procedures and tracking your refund status.

What is a Tax Refund?

A tax refund represents the amount returned to taxpayers who have overpaid their taxes over the fiscal year. This situation arises when the total tax deducted or paid exceeds the actual tax liability determined based on their income.

In India, tax payments are made through TDS (Tax Deducted at Source), advance tax, or self-assessment tax. When the total tax paid or deducted surpasses your tax liability as calculated in your Income Tax Return (ITR), the excess amount is refunded. This mechanism ensures taxpayers are reimbursed for any overpayments.

Who is Eligible for a Tax Refund?

Eligibility for a tax refund depends on various factors:

Excess Tax Payments If your TDS or advance tax payments exceed your tax liability, you’re eligible for a refund. This often applies to salaried employees, freelancers, and individuals with taxable investment income.

Claiming Deductions If you claim deductions under sections like 80C, 80D, etc., and these deductions lower your tax liability below the total tax paid, a refund may be due.

Filing an Income Tax Return Only those who file their Income Tax Return can claim a refund. The return must accurately reflect your income, deductions, and tax payments to establish if a refund is warranted.

Losses to Set Off If you have losses from previous years or the current year that can be carried forward and set off against current year income, you might be eligible for a refund if these losses reduce your tax liability.

Who is Not Eligible for a Tax Refund?

Certain situations or individuals may not qualify for a tax refund:

Income Below Taxable Threshold If your total income is below the taxable limit, a refund may not be applicable.

Salary Below Government Criteria Individuals earning below the minimum threshold specified by the Government of India may not qualify for a refund.

No Overpayment If your tax payments match your tax liability or you haven’t overpaid, a refund will not be available.

Non-Filers or Incorrect Filers Those who fail to file their Income Tax Return or file it incorrectly will not be eligible for a refund. Proper filing is essential for initiating the refund process.

Invalid Deductions Claims for deductions that do not meet tax regulations or lack valid documentation may result in a refund rejection.

Incorrect Bank Details If the bank account information provided in your ITR is incorrect or incomplete, the refund may not be processed.

How to Claim Your Tax Refund

Here’s a step-by-step guide to claiming your tax refund:

File Your Income Tax Return (ITR) Access the Income Tax Department’s e-filing portal. Choose the correct ITR form based on your income sources and eligibility. Accurately complete all required details, including income, deductions, and tax payments.

Verify Your ITR Verify your ITR using Aadhaar OTP, net banking, or by sending a signed ITR-V to the Centralised Processing Centre (CPC). Verification must be completed within 120 days of filing your ITR.

ITR Processing The Income Tax Department will process your return, assess your tax liability, and determine the refund amount. This process can take a few weeks to several months.

Refund Issuance After processing, the refund will be credited directly to your bank account. Ensure your bank details are accurate and up-to-date in your ITR.

Update Bank Account Details (if needed) If your bank details change after filing your ITR, promptly update them on the e-filing portal to ensure correct refund crediting.

How to Check Your ITR Refund Status for FY 2024-2025

To check your refund status, follow these steps:

Visit the Income Tax E-Filing Portal Go to the official Income Tax Department e-filing website.

Access the 'Refund Status' Section Navigate to the ‘Refund Status’ page, typically under the ‘Services’ tab or a similar heading.

Enter Required Details Input your PAN (Permanent Account Number) and the assessment year for your filed return.

Review the Status The portal will show the status of your refund, including whether it has been processed, approved, or if further action is needed.

Track Refund Processing Keep an eye on any updates or notifications from the Income Tax Department regarding your refund.

Understanding the tax refund process can simplify the experience. By following these steps and staying informed about your eligibility, you can make sure that you have a smooth process and quickly receipt of any excess tax payments. For expert guidance and personalized assistance, consult with JJ Tax. Visit our website or contact us today to get the support you need for all your tax-related queries.

JJ Tax

2 notes

·

View notes

Text

Union Budget 2024 (India) Summary

The Union Budget 2024 of India focuses on simplifying tax processes, promoting economic growth, and supporting various sectors. Here are the key highlights:

Simplification of Tax Processes

Income Tax Returns (ITR): The process of filing ITR has been simplified.

Revised Tax Deductions and Rates

Standard Deduction: Increased from ₹50,000 to ₹75,000 in the new tax regime.

Family Pension Deduction: Enhanced from ₹15,000 to ₹25,000.

New Tax Structure:

No tax on income up to ₹3 lakhs.

5% tax on income from ₹3 lakhs to ₹7 lakhs.

10% tax on income from ₹7 lakhs to ₹10 lakhs.

15% tax on income from ₹10 lakhs to ₹12 lakhs.

20% tax on income from ₹12 lakhs to ₹15 lakhs.

30% tax on income above ₹15 lakhs.

Changes in Import Taxes

Gold and Silver: Import tax reduced from 6.5% to 6%.

Support for Start-ups and Entrepreneurs

Angel Tax Exemption: Investors in start-ups are exempt from the angel tax.

Late Payment of TDS: No longer considered a crime.

Changes in Capital Gains Tax

Long-Term Capital Gains Tax: Set at 12.5%.

Short-Term Capital Gains Tax: Increased to 20%.

Industrial and Economic Growth Initiatives

Capital Gains: Increase in capital gain limit.

Industrial Parks: Plug and Play Industrial Park Scheme in 100 cities.

Export Concessions: For mineral products.

Support for Women: ₹3 lakh crores provision.

Cheaper Goods: Electric vehicles, gold and silver jewelry, mobile phones, and related parts.

Agriculture: Priority on increasing production.

FDI Simplification: Simplified process for foreign direct investment.

Interest-Free Loans: To states for 15 years.

Rural Development: ₹2.66 lakh crores provision.

Support for Farmers: ₹1.52 lakh crores provision.

Education Loans: Financial support for loans up to ₹10 lakhs for higher education.

Nine Priorities for Upcoming Years

Manufacturing and Services

Urban Development

Energy Security

Infrastructure

Innovation and R&D

Next-Generation Reforms

Productivity and Resilience in Agriculture

Employment and Skilling

Inclusive Human Resource Development and Social Justice

Employment-Linked Incentives

First-Time Employees: One-month wage incentive.

Manufacturing Sector: Incentives for employers and employees for four years.

Youth Employment: Incentives for 30 lakh youths entering the job market.

EPFO Contribution Reimbursement

Government will reimburse ₹3,000 per month towards EPFO contribution for two years for each additional employee.

E-Commerce and Youth Internship Initiatives

E-Commerce Export Hub: To be created in collaboration with the private sector.

Youth Internship Scheme: Internships for 1 crore youth with a one-time assistance of ₹6,000 and a monthly allowance of ₹5,000 during the internship.

The Union Budget 2024 aims to drive economic growth, support various sectors, simplify tax procedures, and provide robust support for employment and youth development. By focusing on these areas, the budget seeks to create a more inclusive and prosperous economy for all citizens. Click here read more

2 notes

·

View notes

Text

Master Income Tax & E-Filing: A Complete Guide for Beginners to Professionals

Become an expert in Indian Income Tax with this comprehensive course. Learn tax fundamentals, return filing procedures, TDS, ITR forms, and how to file online using government portals. Ideal for students, professionals, and entrepreneurs looking to manage taxes confidently and legally.

Visit Attitude Academy Yamuna Vihar: https://maps.app.goo.gl/gw9oKCnXDXjcz4hF7 Uttam Nagar: https://maps.app.goo.gl/iZoQT5zE3MYEyRmQ7 Yamuna Vihar: +91 9654382235 Uttam Nagar: +91 9205122267 Visit Website: https://www.attitudetallyacademy.com Email: [email protected]

#Income Tax#E-Filing#ITR Filing#Tax Consultant#Online Tax Filing#Indian Tax System#TDS#Form 16#Tax Return#Income Tax Course#GST#Taxation#Finance#CA#ITR 1#ITR 2#Tax Deduction

0 notes

Text

Digital Documentation for Business Visas – What’s Accepted and What’s Not

Which documents must be printed, signed, or uploaded online? Get clarity here

Introduction

In an age where digital transformation has touched nearly every industry, international visa procedures are no exception. Yet, when it comes to applying for a business visa, knowing which documents can be submitted digitally and which require physical signatures or hard copies is critical. Submitting the wrong format can delay processing—or worse, lead to rejection. This guide offers clear insights on what's accepted digitally and what still needs to be printed and signed for your business visa application.

The Rise of Digital Submissions

Embassies and visa centers across the world have gradually adapted to digital workflows. Most now accept online visa forms, scanned documents, and digital uploads through VFS portals or embassy-specific systems. However, not all documents can be entirely digitized. Some still require wet signatures, original stamps, or physical copies at the time of the appointment.

Common Digital Document Types – Accepted Formats

✅ Online Visa Application Forms

Almost all countries now require visa forms to be filled and submitted online. These are later printed and signed before submission (e.g., DS-160 for the USA, Schengen forms for Europe).

✅ Passport Bio Pages (Scanned)

High-resolution scanned copies of your passport’s front and back pages are universally accepted. Ensure scans are clear and not cropped.

✅ Flight and Hotel Bookings

Digitally generated and emailed tickets or booking confirmations are accepted as proof of travel plans. No need to print unless instructed otherwise.

✅ Bank Statements (e-statements)

Most consulates accept digitally generated bank statements, provided they are recent and downloaded directly from the bank’s portal. Hand-edited PDFs or screenshots are often rejected.

✅ Income Tax Returns (PDF format)

Digitally filed ITRs from the income tax portal are valid and acceptable. Include the acknowledgment receipts.

Documents That Must Be Printed and Signed

❌ Business Cover Letter

A printed business cover letter from your employer on official letterhead with a wet signature and company seal is mandatory. Scanned signatures are often not accepted.

❌ Invitation Letter from Foreign Company

Must be on official company letterhead, signed by the inviting party, and sometimes notarized depending on the country.

❌ Authorization Letter (if using an agent)

If a visa consultant is submitting on your behalf, a signed and printed authorization letter is required.

❌ Photographs

Digital uploads may be required online, but you must carry physical passport-size photographs meeting country-specific dimensions (e.g., 35x45 mm for Schengen).

Upload Tips for Online Visa Portals

Follow file size limits (usually under 2 MB)

Use PDF or JPEG formats as specified

Name files clearly (e.g., “Passport.pdf”, “BankStatement_June2025.pdf”)

Avoid low-resolution or blurred scans

Ensure all text is legible—especially financial and ID documents

Conclusion

While digital documentation is increasingly accepted in the business visa process, certain key documents still require physical signatures and original prints. Understanding what’s allowed digitally and what’s not will save time, prevent rejections, and streamline your visa journey. When in doubt, consult official embassy guidelines or seek help from a reliable visa advisor.

Click Here

1 note

·

View note

Text

Income Tax Compliance Course with Projects

Income Tax Course: एक Perfect Career Option for Finance Lovers

अगर आप finance field में career बनाना चाहते हैं, तो Income Tax Course आपके लिए एक अच्छा option हो सकता है। यह course ना सिर्फ आपके theoretical knowledge को बढ़ाता है, बल्कि आपको practical world के लिए भी तैयार करता है।

इस article में हम detail में जानेंगे income tax course के बारे में – इसका syllabus, duration, fee structure, benefits, और job opportunities। आइए शुरू करें।

✅ What is an Income Tax Course? – Income Tax कोर्स क्या है?

Income Tax Course ek professional training program होता है जो students को भारत के टैक्स laws और policies की जानकारी देता है।

यह course आपको सिखाता है कैसे आप income calculate करें, deductions apply करें, और returns file करें। इसमें TDS, GST और Advance Tax जैसे important topics भी cover होते हैं।

ये course उन लोगों के लिए useful है जो accounting, finance या taxation field में job करना चाहते हैं।

🎯 Why Should You Learn Income Tax Course? – Income Tax Course क्यों करें?

हर साल government अपने income tax laws में बदलाव करती है। इसलिए इस course की demand हर समय बनी रहती है।

अगर आप accountant बनना चाहते हैं या CA, CS या CMA की तैयारी कर रहे हैं, तो यह course आपके लिए फायदेमंद रहेगा।

इसके अलावा, अगर आप खुद का business चलाते हैं, तो यह course आपकी tax planning में help करेगा।

📘 Income Tax Course Syllabus – Course Syllabus क्या होता है?

Income Tax Course का syllabus काफी wide होता है, जिसमें basic से लेकर advanced concepts शामिल होते हैं।

Syllabus में शामिल topics:

Basics of Income Tax (आयकर की मूल बातें)

Types of Incomes and Heads (आय के प्रकार और हेड्स)

Tax Slabs & Rates (टैक्स स्लैब और दरें)

Deductions under Section 80C to 80U

TDS (Tax Deducted at Source)

Advance Tax and Self-Assessment

Filing of Income Tax Returns

E-filing procedures on Income Tax Portal

Penalties and Prosecution

Practical training भी दी जाती है जिसमें आप ITR forms भरना सीखते हैं।

🕒 Duration & Eligibility – कोर्स की अवधि और योग्यता

Duration: Income Tax Course की duration institute के अनुसार vary करती है। कई institutes 1 month से लेकर 6 months तक के courses offer करते हैं।

Eligibility Criteria: Minimum qualification 12th pass होती है। Commerce background वाले students के लिए यह course ज्यादा easy होता है। Graduates in B.Com, BBA या M.Com भी इस course को कर सकते हैं।

💰 Course Fee Structure – Income Tax Course की फीस क्या है?

Course fee depends करती है institute, course level और city पर।

Average Fees: ₹5,000 से ₹25,000 के बीच होती है। Online course में fee थोड़ी कम हो सकती है जबकि offline training institutes में थोड़ी ज्यादा होती है।

Tip: जब भी आप किसी institute को choose करें, उसका syllabus और faculty जरूर check करें।

📈 Benefits of Doing Income Tax Course – Income Tax Course करने के फायदे

Income Tax Course करने से आपको कई practical advantages मिलते हैं।

Main Benefits:

बेहतर job opportunities in finance and accounting field

खुद का Tax Consultancy business शुरू करने का मौका

Freelancing opportunities for return filing

हर साल changing tax laws के बारे में updated knowledge

Government job के लिए preparation में मदद

इसके अलावा आप friends और relatives की return filing भी कर सकते हैं और extra income earn कर सकते हैं।

💼 Career Opportunities After Income Tax Course – Job Scope and Career Options

Course complete करने के बाद आपके पास कई career options होते हैं।

Job Roles:

Income Tax Return Preparer

Tax Consultant

Accountant

Finance Executive

TDS Executive

Tax Analyst

आप private firms, CA offices, consultancies या corporates में काम कर सकते हैं।

Freelancing और work-from-home options भी available हैं।

🏫 Best Institutes for Income Tax Course – कहां से करें Income Tax Course?

India में कई reputed institutes हैं जो ये course offer करते हैं। कुछ popular institutes में शामिल हैं:

The Institute of Professional Accountants (TIPA), Delhi

ICAI certified taxation workshops

इन institutes में आपको live projects पर काम करने का मौका मिलता है और placement assistance भी दी जाती है।

📑 Certifications – क्या Income Tax Course के बाद Certification मिलता है?

Yes! Course complete करने के बाद आपको एक valid certificate मिलता है।

यह certification आपके resume में value add करता है। Job interviews में यह आपके practical skills को proof करता है।

कुछ institutes government recognized certifications भी offer करते हैं, जिससे आपके employment chances और भी बेहतर हो जाते हैं।

📚 Study Mode – Online vs Offline Course Mode

आप ये course online या offline किसी भी mode में कर सकते हैं।

Online Course के फायदे:

Flexibility to study anytime

Lower cost

Recorded lectures and online doubt support

Offline Course के फायदे:

Classroom interaction

Practical case study-based learning

Direct guidance from faculty

आप अपने time और budget के हिसाब से mode select कर सकते हैं।

🔍 Reference and Legal Framework – Income Tax Rules की जानकारी कहां से लें?

Income Tax Department की official website https://www.incometax.gov.in से आप सभी rules और updates प्राप्त कर सकते हैं।

यह site आपको ITR forms, deadlines और tax calculator जैसी सुविधाएं भी देती है।

इसके अलावा आप ICAI और government blogs भी follow कर सकते हैं।

🎓 Conclusion – Final Thoughts on Income Tax Course

आज के competitive world में सिर्फ graduation से काम नहीं चलता।

Income Tax Course एक ऐसा skill-based course है जो आपके career को fast-track कर सकता है।

चाहे आप student हों, job seeker हों या business owner – यह course सभी के लिए beneficial है।

Financial literacy आज की ज़रूरत है, और यह course उस दिशा में एक मजबूत कदम है।

🔖 FAQs: Income Tax Course

Q1. क्या ये course CA students के लिए useful है? हां, यह course CA students के लिए बहुत beneficial है क्योंकि इसमें practical exposure मिलता है।

Q2. क्या Commerce background जरूरी है? नहीं, लेकिन commerce background होने से concepts जल्दी समझ में आते हैं।

Q3. क्या part-time course options available हैं? हां, online और weekend batches दोनों ही options available हैं।

अगर आपको ये article helpful लगा तो इसे जरूर share करें। और अगर आप Income Tax Course करना चाहते हैं, तो सही institute चुनें और आज ही शुरुआत करें!

Accounting Course ,

Diploma in Taxation Course,

courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

SAP fico course ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Tally Course in Delhi ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

diploma in banking finance ,

Stock market Course,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

0 notes

Text

CA for Income Tax Return Services in India – Genuine Filings

Expert CA for Income Tax Return Services in India – Genuine Filings

Filing income tax returns can be a daunting task for many individuals and businesses in India. With ever-evolving tax laws, multiple forms, and the risk of errors, seeking expert guidance becomes not just beneficial but necessary. That’s where a CA for Income Tax Return Services in India comes into play. At Genuine Filings, we specialize in offering professional, affordable, and timely ITR filing services for salaried individuals, freelancers, businesses, and NRIs.

Why Hire a Chartered Accountant (CA) for ITR Filing?

A Chartered Accountant brings in-depth knowledge and experience of Indian tax laws. Their role goes beyond mere filing—they help in tax planning, ensuring compliance, and maximizing savings. Here’s why hiring a CA for Income Tax Return Services in India makes a difference:

Accurate Filing: Avoid penalties due to errors or late filing.

Customized Advice: Get tailored tax-saving tips based on your income and investments.

Compliance Check: Ensure that your returns are filed in accordance with the latest legal guidelines.

Time-Saving: Outsourcing tax filing to professionals saves time and effort.

Genuine Filings: Your Trusted Partner for Tax Return Filing

At Genuine Filings, we understand that each taxpayer’s needs are unique. Whether you are an individual with a single salary source or a business with complex finances, our experienced CAs provide personalized assistance to make your ITR filing seamless.

Our Income Tax Return Services Include:

ITR Filing for Salaried Individuals

ITR Filing for Business Owners

Freelancer and Consultant Tax Filing

Capital Gains Tax Filing

NRI ITR Filing

Revised and Belated Return Filing

Tax Audit Support

Advance Tax Planning

Our process is simple: consult with our experts, upload your documents securely, and let our CAs do the rest.

Benefits of Choosing Genuine Filings

1. Expert Guidance

Our team comprises highly qualified CAs who stay up-to-date with changes in tax laws and filing procedures. We ensure your returns are accurate, optimized, and compliant.

2. Affordable Pricing

We believe that expert tax services should be accessible to all. Our transparent pricing ensures there are no hidden charges.

3. Fast Turnaround

We value your time. Our streamlined process ensures your returns are filed on or before the deadline.

4. Data Security

We use advanced encryption and secure servers to protect your financial data. Your privacy is our priority.

5. End-to-End Support

From document collection to acknowledgment receipt, our team is available throughout the process to answer your questions and resolve concerns.

Who Needs a CA for Income Tax Return Services?

Salaried Employees with multiple Form 16s or rental income

Self-employed Professionals with business or consulting income

Businesses that require tax audit compliance

Investors with capital gains from shares, mutual funds, or real estate

NRIs with Indian income

Individuals with Foreign Income

If you fall into any of these categories, hiring a CA for Income Tax Return Services in India is highly recommended.

Conclusion

Income tax filing is a critical financial responsibility. Errors or non-compliance can lead to penalties and legal complications. Partnering with a trusted brand like Genuine Filings ensures peace of mind, accuracy, and timely filing. Our expert Chartered Accountants are committed to providing the best-in-class Income Tax Return Services in India tailored to your needs.

#delhi ncr#karol bagh#genuinefilings#best service tax consultants in delhi#accounting consultants#services in delhi

0 notes

Text

How an Accounting Course Can Help You Start Your Own Business in 2025, 100% Job, Accounting Course in Delhi, 110059 - Free SAP FICO Certification by SLA Consultants India, GST Certification, ITR & DTC Classes with 2025 Update, Tally Prime Certification,

Enrolling in an Accounting Course in Delhi in 2025 is a powerful step for anyone aiming to start their own business, especially in Delhi’s 110059 area where comprehensive programs like those offered by SLA Consultants India—featuring free SAP FICO certification, GST certification, ITR and DTC classes with the 2025 update, and Tally Prime certification—provide a robust foundation for entrepreneurial success. These courses do more than prepare you for employment; they equip with practical skills and knowledge essential for running and growing a business in today’s digital and regulatory landscape.

A key benefit of an Accounting Training Course in Delhi is learning how to establish and maintain a reliable financial system for your business. This includes tracking income and expenses, organizing transactions using a chart of accounts, and generating critical financial reports such as profit and loss statements, balance sheets, and cash flow statements. These skills are vital for making informed business decisions, securing funding, and ensuring compliance with tax and regulatory requirements. With hands-on training in Tally Prime and SAP FICO, you gain the ability to automate routine tasks, manage inventory, process payroll, and handle complex tax scenarios—saving time and reducing the risk of errors.

Accounting Certification Course in Delhi

Understanding the latest GST, ITR, and DTC regulations is another major advantage. Tax compliance is a significant challenge for new businesses, and errors can lead to penalties or legal issues. An accounting course ensures you are up to date with the latest tax rules and filing procedures, helping you avoid costly mistakes and build credibility with clients and partners. Additionally, proficiency in advanced accounting software allows you to streamline operations, gain real-time insights into your business performance, and respond quickly to market trends—skills that are increasingly important in the era of digital transformation and remote work.

E-Accounting, E-Taxation and E-GST Course Modules Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax) Module 2 - Part A – Advanced Income Tax Practitioner Certification Module 2 - Part B - Advanced TDS Practical Course Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA Module 3 - Part B - Banking & Finance Module 4 - Customs / Import & Export Procedures - By Chartered Accountant Module 5 - Part A - Advanced Tally Prime & ERP 9 Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance Module 6 – Financial Reporting - Advanced Excel & MIS For Accounts & Finance - By Data Analyst Trainer Module 7 – Advanced SAP FICO Certification

Beyond technical skills, accounting courses foster entrepreneurial thinking and adaptability. Many accountants use their training as a springboard to launch their own firms or consultancy services, leveraging their expertise to help other businesses navigate financial challenges. The Accounting Training Institute in Delhi provides 100% job guarantee provided by SLA Consultants India offers added security, giving you the option to gain industry experience before venturing out on your own. In summary, an accounting course in Delhi (110059) is a strategic investment for aspiring entrepreneurs, providing the knowledge, tools, and confidence needed to start, manage, and grow a successful business in 2025. For more details Call: +91-8700575874 or Email: [email protected]

0 notes

Text

NRI Wins Landmark Capital Gains Tax Battle in Delhi High Court

NRI Wins Major Capital Gains Tax Case in Delhi High Court!

An NRI in the US faced a significant tax ordeal after selling a property in Pune for Rs 2 crore. Despite the buyer correctly deducting 20% TDS (Rs 18.68 lakh), a critical error in the TDS form plunged the NRI into a battle with the Income Tax Department, resulting in a Rs 46 lakh tax demand notice.

The root of the problem? The buyer mistakenly used Form 26QB (for Indian residents) instead of Form 27Q (for NRIs) to deposit the TDS. This seemingly small error meant the TDS amount never appeared in the NRI’s Annual Information Statement (AIS), preventing him from claiming the credit when filing his Income Tax Return (ITR).

Compounding the issue, the Income Tax Department, unaware of the actual TDS payment, issued a tax demand notice for Rs 46 lakh, assuming no capital gains tax was paid. While the NRI had already paid an advance tax of Rs 1.9 lakh (which was reflected in his AIS), he was caught in a bureaucratic bind: facing a massive demand on one side and unable to claim credit for tax already paid on the other. Even the buyer’s efforts to correct the form with the bank were slow-moving, and the Income Tax Department cited procedural hurdles, including needing the buyer’s consent and an indemnity bond, to fix the issue on their end.

The Battle for Justice: A Timeline

Here’s how the saga unfolded, leading to the Delhi High Court’s intervention:

1998: NRI purchases property in Pune.

March 18, 2015: NRI agrees to sell property for Rs 2 crore.

September 5, 2015: Buyer deducts 20% TDS (Rs 18.68 lakh) and pays the remaining amount to the NRI.

October 27, 2015: NRI pays Rs 1.9 lakh as advance tax and repatriates funds to the USA.

March 4, 2023: Income Tax Officer issues notice under Section 148(b) (income escaped assessment).

April 15, 2023: NRI provides details, but the officer proceeds with a notice under Section 148A(d).

October 30, 2024: Another notice under Section 142 seeking documents is issued; NRI complies.

March 4, 2025: Income Tax Officer issues a proposed assessment order with a Rs 46 lakh tax demand and initiates penalty proceedings.

March 2025: NRI files a detailed reply, highlighting the TDS form error.

NRI directly appeals to the Delhi High Court.

Income Tax Department’s Stance and High Court’s Verdict

In court, the Income Tax Department argued their inability to correct the error was due to SOPs requiring buyer consent and other documents. When pressed by the Delhi High Court on why buyer consent was needed if the TDS deposit wasn’t disputed, the department stated it was to prevent the buyer from trying to recover the amount. Crucially, they admitted there was “no dispute as to the deposit of the TDS.”

On May 27, 2025, the Delhi High Court delivered a landmark judgment. Recognizing the “peculiar facts” and the undisputed payment, the court ordered the Income Tax Department to:

Immediately reflect the full Rs 18.68 lakh TDS credit under the NRI’s PAN, effective from the original deposit date.

Compute any tax refund due to the NRI.

Set aside all contradictory orders and communications.

This ruling is a significant victory for the NRI, ensuring he receives credit for tax already paid and is not unjustly penalized for a third-party’s clerical error. It underscores the judiciary’s role in ensuring fair treatment for taxpayers, especially when procedural rigidities hinder justice.

0 notes

Text

Annual Compliance for OPC in Patna: A Complete Guide for One Person Companies

Introduction

One Person Company (OPC) is a preferred business structure for solo entrepreneurs who want to enjoy the benefits of a private limited company while maintaining single ownership. While OPCs in India, including those in Patna, have fewer compliance requirements than other company types, they must still meet certain annual compliance obligations to stay legally compliant and avoid penalties. This article provides a comprehensive guide to Annual Compliance for OPC in Patna, including key filings, due dates, and benefits of timely compliance.

What is an OPC?

A one-person company is a hybrid structure that combines the benefits of a sole proprietorship and a private limited company. Introduced under the Companies Act, 2013, OPC allows a single individual to incorporate a company with limited liability protection.

Why is Annual Compliance Important for OPC in Patna?

Complying with annual requirements:

Enhances the credibility and trustworthiness of your business

Keeps your company in good legal standing with the Ministry of Corporate Affairs (MCA)

Avoids hefty penalties and legal actions

Ensures proper financial management and record-keeping

Key Annual Compliances for OPC in Patna

Here’s a list of essential annual compliance requirements for OPCs:

1. Appointment of Auditor

Timeline: Within 30 days of incorporation

Form: ADT-1

Details: Appoint a Chartered Accountant to audit the books of accounts

2. Annual Return Filing

Timeline: Within 60 days from the conclusion of AGM (If AGM is not held, within 180 days from the end of the financial year)

Form: MGT-7A (for OPC)

Details: Contains details about the company’s shareholders, directors, and other key information.

3. Filing of Financial Statements

Timeline: Within 180 days from the end of the financial year (generally by 27th September)

Form: AOC-4

Details: Balance sheet, profit and loss account, auditor’s report, and director’s report.

4. Income Tax Return Filing

Timeline: On or before 31st July (if not liable for audit) / 31st October (if liable for audit)

Form: ITR-6 (for companies)

Details: Includes income, expenses, and taxes paid during the year.

5. DIR-3 KYC

Timeline: On or before 30th September every year

Applicable To: Every director with a DIN (Director Identification Number)

Details: Ensures the director’s details are updated and active.

6. Form MBP-1 & Form DIR-8

Timeline: Every financial year

Details: Director must disclose any interest in other entities (MBP-1) and declare that they are not disqualified (DIR-8).

Penalties for Non-Compliance

Failure to comply with the OPC annual filing requirements can result in:

Penalty of ₹100 per day per form for late filing

Disqualification of directors

Additional fines or legal action by MCA

Benefits of Timely Compliance for OPC in Patna

Avoid Legal Trouble: No penalties or notices from MCA

Improves Creditworthiness: Helpful for loans and funding

Builds Business Reputation: Maintains trust with customers and partners

Smooth Closure or Conversion: Easier to convert or shut down if necessary

How to File Annual Compliance for OPC in Patna?

You can file a complaint:

Online through the MCA portal – Requires digital signatures and CA certification

With the help of professionals, contact a company secretary or legal expert in Patna for error-free and timely filings.

Conclusion

Although OPCs enjoy simplified compliance procedures compared to other companies, the timely fulfillment of Annual Compliance for OPCs in Patna is essential. Business owners must stay updated with statutory requirements to ensure the smooth operation and legal standing of their OPC. Seeking professional guidance can ease the process and help you focus on business growth without legal worries.

0 notes

Text

As an NRI (Non-Resident Indian), you can buy residential or commercial property in India, except for agricultural land, plantation property, or farmhouses. Here’s a step-by-step guide on the procedure and required documents for purchasing a plot or apartment in India.

Step-by-Step Procedure for NRIs Buying Property in India

1. Choose the Property

Decide whether you want to buy a plot, apartment, or under-construction property.

Verify the developer’s reputation (for apartments) or land title (for plots).

Ensure the property has clear titles and no legal disputes.

2. Hire a Lawyer for Due Diligence

Engage a local property lawyer to verify:

Title deed (ownership documents)

Encumbrance certificate (no pending loans/mortgages)

Approved layout plan (for plots)

RERA registration (for under-construction properties)

No objection certificates (NOCs) from relevant authorities.

3. Execute the Sale Agreement

Sign a Sale Agreement (for under-construction properties) or Sale Deed (for ready properties).

Pay the advance/booking amount (usually 10-30% of property value).

4. Secure Financing (If Required)

NRIs can get home loans in India from banks/NBFCs.

Required documents:

Passport & Visa copy

PAN card

Salary slips/bank statements (if employed abroad)

Power of Attorney (if applicable)

5. Make Payment

Payments must be made in Indian Rupees (INR) through:

NRE (Non-Resident External) Account (tax-free repatriation)

NRO (Non-Resident Ordinary) Account (taxable, but allows property purchase)

Foreign Inward Remittance Certificate (FIRC) is required for foreign funds.

6. Register the Property

Registration is mandatory under the Indian Registration Act, 1908.

Visit the Sub-Registrar’s Office with:

Original Sale Deed

Passport copies (attested)

PAN card

Passport-sized photographs

Payment receipts

Pay stamp duty & registration fees (varies by state, usually 5-8% of property value).

7. Mutation of Property

After registration, apply for mutation (updating municipal records in your name).

Required for property tax payments.

Key Documents Required for NRIs Buying Property in India

Identity & Address Proof

Passport copy (attested by Indian Embassy/Notary)

Overseas Address Proof (Utility bill/Driving License)

PAN Card (Mandatory for property registration)

Property Documents

Title Deed (in seller’s name)

Encumbrance Certificate (last 30 years)

Approved Building Plan (for apartments)

RERA Certificate (for under-construction properties)

NOCs (Society, Municipal, Pollution, etc.)

Payment & Tax Documents

FIRC (Foreign Inward Remittance Certificate) for foreign funds

Bank statements (NRE/NRO account)

TDS Certificate (if applicable, usually 1% for property > ₹50 lakhs)

Legal & Registration Documents

Sale Agreement/Sale Deed (drafted by lawyer)

Power of Attorney (if buying through a representative)

Stamp Duty & Registration Receipts

Additional Documents (If Taking a Home Loan)

Loan approval letter

Employment proof & salary slips

NRI status proof (Visa copy)

Important Points for NRIs

✔ Repatriation of Sale Proceeds – NRIs can repatriate up to $1 million per financial year from the sale of property, provided they meet certain conditions (property was bought in foreign currency or from NRE funds). ✔ Tax Implications – Capital gains tax applies on property sale (Long-term: 20% if held >2 years; Short-term: as per income slab). ✔ Power of Attorney (PoA) – If you cannot be present in India, appoint a trusted person via PoA (notarized & apostilled). ✔ Rental Income – Taxable in India; must file ITR if rental income exceeds ₹2.5 lakh/year.

Final Steps After Purchase

Update KYC with the housing society/municipal corporation.

Consider property insurance for protection.

If renting out, comply with TDS on rent (if rent exceeds ₹50,000/month).

By following these steps and ensuring proper documentation, NRIs can smoothly purchase property in India. It’s advisable to consult ICG- we are specializing in NRI property transactions for compliance.

0 notes

Text

Leading the Way: Top Business Consulting Firms in Malappuram, Kerala for Complete Financial and Corporate Services

In today’s highly competitive market, businesses in Kerala—especially in Malappuram, Kuttippuram, and Tirur—are looking for more than just accounting support. They need strategic partners who can offer complete guidance in tax, finance, business setup, and growth strategy. That’s why the demand for the top business consulting firms in Malappuram, Kerala is steadily on the rise.

Whether you are launching a new business or looking to scale an existing one, expert consultancy can help you navigate financial regulations, streamline operations, and ensure long-term profitability. Firms that specialize in accounting, auditing, VAT, and corporate tax are becoming crucial for startups, SMEs, and enterprises seeking efficient compliance and cost-effective operations.

One such firm making a significant impact is AHMC Global Corporate Services, known for delivering reliable business setup and compliance services in the region. From guiding entrepreneurs through legal procedures to helping established companies stay on top of financial filings, AHMC has carved a niche as a go-to solution provider in Malappuram and beyond.

For those specifically operating in Kuttippuram, finding the best consulting firm in Kuttippuram can be a game-changer. The right partner doesn’t just prepare reports—they help businesses understand financial risks, discover tax-saving opportunities, and implement smarter strategies for sustainable growth. Whether it’s ITR filing in Kuttippuram or monthly GST returns, professional support saves both time and resources.

Meanwhile, businesses in Tirur are increasingly turning to management consulting in Tirur to optimize internal processes and boost efficiency. With the growing complexity in local and international compliance norms, business leaders need advisors who can provide clarity, control, and actionable insights across all functions—from HR to financial planning and operations.

A major area of demand for modern businesses is staying compliant with corporate tax, VAT, and statutory audits. Partnering with firms offering full-fledged accounting, auditing, VAT, and corporate tax support ensures your financial records are accurate and ready for inspection at any time. These services also help reduce the risk of penalties and reputational damage due to non-compliance.

One of the most important touchpoints in any business cycle is the timely filing of taxes. For entrepreneurs in and around Kuttippuram, ITR filing in Kuttippuram remains a crucial service. An experienced consultancy firm can ensure all personal and business returns are submitted error-free and on time, with expert advice on deductions and exemptions applicable under Indian tax law.

What sets the top business consulting firms in Malappuram, Kerala apart is their holistic approach. They don’t just file returns or handle audits—they understand your business vision, industry trends, and the local market environment. This enables them to provide not only compliance services but also valuable inputs on budgeting, financial forecasting, investment planning, and business restructuring.

In summary, if you're looking to grow your business, ensure tax compliance, and establish a strong financial base, turning to the best consulting firm in Kuttippuram or a reputed agency like AHMC Global Corporate Services is a smart move. Their comprehensive business setup and compliance services, paired with strong support in accounting, auditing, VAT, and corporate tax, make them ideal long-term partners for any serious business in Malappuram, Kuttippuram, or Tirur.

0 notes

Text

Loan Against Property Online Apply Guide – Best Banks, Fast Approval & Lowest Interest in India

Why let your property sleep when it can help you fund your dreams?

In today’s fast-paced financial world, people often look for solutions that are quick, low-cost, and flexible. Whether you're planning a child’s wedding, managing medical expenses, expanding your business, or covering education costs, a Loan Against Property (LAP) can be a smart choice.

This guide is designed to help salaried and self-employed individuals understand everything about Loan Against Property in India — from interest rates and eligibility to how to apply online easily in 2025.

What is Loan Against Property (LAP)?

A Loan Against Property (LAP) is a secured loan where you pledge your residential, commercial, or industrial property as collateral to avail funds. The biggest advantage? You continue owning the property while utilizing its value for your needs.

Whether you're looking for an online loan against property or want an instant loan against property through a bank/NBFC, this guide will simplify your journey.

Why Are People Choosing LAP in 2025?

Lower interest rates compared to personal loans

High loan amount (up to 70% of property value)

Flexible tenure (up to 15–20 years)

Used for multiple purposes – medical, education, wedding, business

Both salaried and self-employed can apply

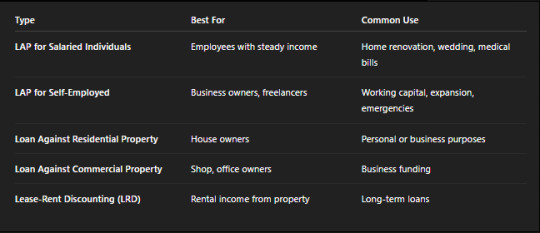

Types of Loan Against Property in India

Current Interest Rates (2025 Update)

Note: Rates may vary based on applicant profile, property type, and tenure.

Who is Eligible? | LAP Eligibility Criteria

For Salaried Individuals:

Age: 21–60 years

Minimum salary: ₹25,000/month

Permanent employment with a reputed company

Clear ownership of property

For Self-Employed Individuals:

Age: 25–65 years

Minimum business vintage: 3 years

Regular ITR filings

Property should be in the applicant’s or firm’s name

If you're wondering “how to apply for a loan against property for salaried individuals”, we cover it step-by-step below.

Documents Required to Apply for LAP

How to Apply for a Loan Against Property Online?

Applying for a fast loan against property is now easier than ever. Here’s a step-by-step guide:

Apply for a Loan Against Property Online in 2025:

Visit the lender's official site (e.g., HDFC, Bajaj, SBI)

Select the “Loan Against Property” option

Fill out the online LAP application form

Upload the required documents digitally

Get a pre-approval in 10–30 mins (instant loan against property)

Final approval after physical verification

Disbursal within 3–7 working days

Platforms also provide instant loans against property for emergency needs.

Real-Life Use Cases

Ravi (Salaried, Gurgaon): Took a ₹15 lakh LAP for daughter’s wedding. Easy EMIs, property still owned.

Priya (Self-employed, Bangalore): Applied for a loan against property for medical expenses after a sudden surgery. Received disbursal in 4 days.

Rohit (IT Professional): Used a loan against property for home expenses, including renovation and appliance upgrades.

This shows how people are using LAP for both personal and professional purposes.

Expert Tip:

“Don’t sell your property in an emergency. Use LAP to unlock its value and still retain ownership.”

Understanding LAP Terms (With Clarity)

LAP Loan Against Property: Simply means a loan backed by your property

Salaried LAP Meaning: A LAP product tailored for salaried professionals

Immediate Loan Against Property: Shorter documentation, faster disbursal—ideal for urgent medical or home needs

Loan Against Property Knowledge: Always verify the loan-to-value ratio, interest rate, and foreclosure charges before signing

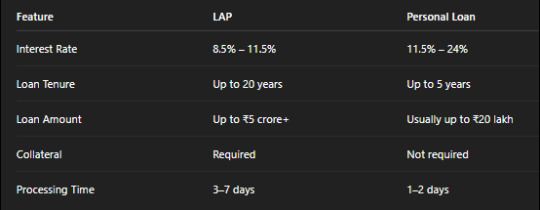

LAP vs Personal Loan – Which is Better?

Verdict:

Choose LAP if you need a high loan amount, a longer repayment period, and have property to pledge.

Choose a Personal Loan if you need quick funds, have no collateral, and need a smaller short-term loan.

Procedure of Loan Against Property

Check your property eligibility and ownership status

Choose the best lender as per interest rate and LTV

Fill LAP application form online/offline

Submit documents and wait for verification

Get a sanction letter and property valuation

Disbursal done post-signing agreement

The procedure of loan against property remains largely the same across banks and NBFCs.

FAQs on Loan Against Property in India

1. What is the maximum amount I can get through LAP?

You can get up to 60–75% of your property's market value, depending on the lender.

2. Can I apply for LAP even if I have an existing home loan?

Yes, provided your repayment track record is good and your property has sufficient equity.

3. How fast can I get a loan against property?

Many lenders offer immediate loan against property approval in 24–48 hours with digital applications.

4. Is LAP available for self-employed individuals with irregular income?

Yes. You may need to provide GST returns, business proof, and ITRs. Some lenders offer loans against property for self-employed individuals for medical expenses as well.

5. Is the CIBIL score important for LAP approval?

Yes, ideally above 700 is preferred. However, since it’s a secured loan, the chances of approval are still higher than unsecured loans.

Final Thoughts

Whether you are salaried or self-employed, a loan against property in India can be your safety net and opportunity creator in 2025. From planning your dream wedding to funding a startup or handling sudden medical bills, LAP gives you freedom without losing ownership of your property.

And with growing options to apply for LAP online, digital approvals, and fast loan against property schemes, the process has never been smoother.

#online loan against property#lap loan#instant loan against property#apply for lap#fast loan against property#apply for loan against property online#how to raise loan against property#how to apply for loan against property for salaried individuals#lap loan against property#salaried lap meaning#loan against property for salaried individuals for home expenses#loan against property lap india#loan against property for self employed individuals for medical expenses#how to apply for lap#loan against property for salaried individuals for medical expenses#immediate loan against property#procedure of loan against property#loan against property features for self employed individuals#loan against property knowledge

1 note

·

View note

Text

Guide on How to File ITR Offline for Super Senior Citizens During the financial year, super senior persons (those who are 80 or older) can file ITRs offline. If an individual or HUF has an income of less than ₹5 lakh and is not eligible for a refund, the ITR may also be filed offline.

This step-by-step procedure to file returns offline is mentioned below

Request Form 16. After that, the ITR returns must be submitted in paper form to the Income Tax Department. You will receive an acknowledgment slip from the Income Tax Department once the form has been submitted.

0 notes

Text

Why Is Comprehending the ITR 1 Filing Procedure Important?

More than just an annual duty, filing your income tax return is essential to managing your personal finances and adhering to Indian tax regulations. ITR 1 Filing is the most pertinent and widely utilised form for a large number of paid workers. But why is it so crucial to comprehend the ITR 1 filing procedure?

ITR 1: What is it?

For people with incomes up to ₹50 lakh from sources including salaries, one home property, and other sources like interest income, ITR 1, commonly referred to as Sahaj, is a straightforward return form. People who have capital gains or company income are exempt from it.

Understanding the ITR 1 Filing Process Is Essential for Ensuring Legal Compliance

Individuals who earn more than the taxable limit are required to file an ITR. Comprehending the ITR 1 procedure guarantees adherence to the Income Tax Act, preventing legal sanctions and departmental notifications.

Truthful Reporting of Income

Errors and scrutiny may result from improper filing. Accurately reporting income and claiming deductions lowers the possibility of inconsistencies when you follow the correct ITR 1 filing procedures.

Making Refund and Deduction Claims

Only by properly filing your return can you claim eligible deductions under sections like 80C, 80D, etc. Knowing how to file an ITR 1 helps you avoid losing out on refunds to which you are legally entitled.

Creates a Filed Financial Record ITRs are a legitimate form of income documentation. They are necessary when requesting a loan, obtaining a visa, or even renting a home. Transparency and financial discipline are demonstrated by a properly filed ITR 1.

Makes Tax Planning Easier

A greater understanding of the ITR 1 filing process aids in future tax planning. It enables you to set up your spending and assets in a way that minimises your tax liability.

In conclusion

Comprehending the ITR 1 Filing procedure is crucial for seamless and stress-free tax compliance, regardless of whether you are a pensioner or a salaried employee. It improves your financial picture in addition to helping you stay out of trouble. Consider using this straightforward guide to filing ITR 1 Sahaj, which explains the procedures in detail for both novice and seasoned filers, to further streamline the process.

0 notes

Text

Learn Taxation with Real-Life Examples | Join Online Today

Taxation Course Online – ऑनलाइन टैक्सेशन कोर्स से करियर बनाएं

💼 Why Choose a Taxation Course Online? – टैक्सेशन कोर्स ऑनलाइन क्यों करें?

आज के time में online taxation course बहुत demand में है। Students और working professionals दोनों ही इसे करना चाहते हैं।

क्योंकि यह course comfort के साथ flexibility भी देता है। इसके ज़रिए आप घर बैठे ही tax laws, GST, TDS जैसी चीजें सीख सकते हैं।

🎯 Scope of Taxation Course Online – टैक्सेशन ऑनलाइन कोर्स का स्कोप

India में tax professionals की ज़रूरत हर industry को है। चाहे वो private firm हो या government office, हर जगह tax experts की ज़रूरत होती है।

Online taxation course से आप finance, accounts, और auditing field में jobs पा सकते हैं। इससे freelancing opportunities भी खुल जाती हैं।

🏫 Top Institutions Offering Online Taxation Courses – प्रमुख संस्थान जो टैक्सेशन कोर्स ऑफर करते हैं

कुछ famous institutes जो ये course online mode में offer करते हैं:

The Institute of Professional Accountants (IPA) – Certified taxation programs in Hindi-English mix

NIIT – GST and Income Tax specialization

Coursera/EdX – International level content with certificates

इन platforms पर आपको recorded और live classes दोनों का access मिलता है। साथ ही downloadable study material और doubt-clearing sessions भी मिलते हैं।

📘 What You Learn in Taxation Course Online – टैक्सेशन कोर्स में क्या सिखाया जाता है?

Online course content काफी detailed होता है। यह syllabus को छोटे-छोटे modules में divide किया जाता है।

Main topics include:

Income Tax Act और उसका implementation

GST (Goods and Services Tax) की पूरी प्रक्रिया

TDS & TCS rules

Return filing through online portals

Assessment procedures और penalties

हर topic को real-life case studies के साथ समझाया जाता है। इससे समझने में आसानी होती है और practical knowledge भी बढ़ती है।

🧑🏫 Who Should Do This Course? – कौन-कौन कर सकता है टैक्सेशन कोर्स ऑनलाइन?

अगर आप commerce background से हैं, तो ये course आपके लिए perfect है। लेकिन इसका मतलब ये नहीं कि दूसरे stream वाले नहीं कर सकते।

Students, accountants, business owners, CA aspirants – सभी लोग ये course कर सकते हैं। Even housewives भी इसे part-time सीखकर freelancing start कर सकती हैं।

💻 Benefits of Online Taxation Course – ऑनलाइन टैक्सेशन कोर्स के फायदे

Flexibility – आप कभी भी, कहीं से भी सीख सकते हैं।

Affordability – Offline course के मुकाबले ये सस्ता होता है।

Updated Syllabus – नए amendments और rules पर आधारित content होता है।

Career Growth – Promotions और better salary opportunities भी बढ़ जाती हैं।

साथ ही कई platforms आपको placement assistance भी offer करते हैं। ये आपको job ढूंढ़ने में मदद करता है।

📅 Duration and Fees – कोर्स की अवधि और फीस

Course की duration average 3 से 6 months तक होती है। कुछ fast-track programs 1 month में भी complete हो जाते हैं।

Fees normally ₹5,000 से ₹25,000 के बीच होती है। Depends करता है course के level और institute पर।

💼 Job Roles After Taxation Course – टैक्सेशन कोर्स के बाद कौन-कौन सी Jobs मिल सकती हैं?

Taxation course online करने के बाद आप नीचे दिए गए roles में काम कर सकते हैं:

Tax Consultant – Individuals और companies को tax advice देना

GST Practitioner – GST registration, return filing व compliance में expert

Income Tax Return (ITR) Expert – Salaried और business ITRs prepare करना

Tax Analyst – Companies के लिए tax reports और projections बनाना

Accounts Executive – Accounting और tax management का combo role

इन roles की demand हर financial year में बढ़ती जाती है। इसलिए taxation skill हमेशा relevant रहेगी।

📚 Certifications You Get – कोर्स पूरा करने पर क्या सर्टिफिकेट मिलता है?

हर reputed institute completion पर आपको digital या hardcopy certificate देता है। कुछ institutes government-recognized certification भी offer करते हैं।

ये certificate आपके resume में value add करता है। और job interviews में आपके knowledge को validate करता है।

🌍 Language of Instruction – कोर्स की भाषा

Most online taxation courses bilingual होते हैं – English और Hindi में। इससे students को अपनी comfortable language में सीखने में मदद मिलती है।

IPA जैसे institutes pure Hindi-English mixed format offer करते हैं। इससे beginners को content grasp करने में दिक्कत नहीं होती।

📲 Tools and Software You Learn – कौन-कौन से software सीखते हैं?

Taxation course online में practical tools की knowledge भी दी जाती है:

Tally ERP 9 / Tally Prime for GST

Income Tax Portal for ITR filing

GSTN Portal for monthly filings

Excel में tax sheets बनाना भी सिखाया जाता है

इन skills की मदद से आप actual work में जल्दी expert बन सकते हैं।

🔗 Sources of Authentic Information – विश्वसनीय जानकारी के स्रोत

Taxation course में reference लिए जाते हैं इन authentic sources से:

Income Tax Department

GSTN Portal

CBIC circulars & notifications

ICAI और ICMAI जैसे bodies के publications

इनसे आपको सही और updated जानकारी मिलती है।

👨👩👧👦 Who Offers the Best Course in Delhi/NCR? – दिल्ली में सबसे अच्छा टैक्सेशन कोर्स कौन कराता है?

Delhi में "The Institute of Professional Accountants (TIPA)" top ranking institute माना जाता है। TIPA के courses practical और industry-oriented होते हैं।

Address: E-54, 3rd Floor, Metro Pillar No. 44, Laxmi Nagar, Delhi 110092 Phone: 9213855555 Website: www.tipa.in

यहां पर आपको placement support, bilingual classes, और GST training भी मिलेगी।

🎯 Conclusion – निष्कर्ष

अगर आप accounting या finance field में career बनाना चाहते हैं, तो Taxation Course Online आपके लिए एक smart choice है।

यह ना सिर्फ career options बढ़ाता है, बल्कि आपको self-employed बनने का मौका भी देता है।

अब जब दुनिया online हो रही है, तो learning भी online ही best तरीका बन चुका है।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes