#InfrastructureInvesting

Explore tagged Tumblr posts

Text

Crown LNG ($CGBS)'s Penny-Stock Label Won't Stick Much Longer

The stock market is a master at brand-labelling, and nothing triggers reflexive disdain faster than the phrase penny stock. We see a sub-dollar quote and instantly imagine empty office parks, one-well oil explorers, or biotech long shots with cash burn as their only distinguishing metric. Yet every so often, a company slips under that low-price ceiling not because its prospects are microscopic, but because the spreadsheet set never bothered to zoom the map out far enough. I’m convinced Crown LNG Holdings—ticker CGBS, last traded around eleven cents—fits that mislabelled mould, and the sooner investors recognise it, the less regret they’ll have to rationalise later.

Let’s deal with the obvious objection: Crown is pre-revenue, pre-FID, and yes, a de-SPAC. Those three facts alone put 90 percent of asset managers on “hard pass.” But Crown is also developing industrial hardware that dwarfs its equity value. Its flagship asset, the Kakinada terminal on India’s cyclone-battered east coast, carries a billion-dollar budget and—crucially—a licence for uninterrupted, 365-day operation. That licence matters. Most floating solutions flee or shut down during the June–September monsoon window; Kakinada’s gravity-based design does not. In the LNG world, three months of downtime can evaporate half a project’s EBITDA. Permanence is a moat. Meanwhile, management is importing the same blueprint to Scotland's Firth of Forth, where winter price spikes have made security-of-supply a front-page political issue, and exploring Vietnam, where rising data-centre loads all but guarantee a gas shortfall. Toss in a planned floating export hub in the US Gulf, and Crown has built a four-continent supply loop that looks suspiciously like something we’d credit to a blue-chip energy major—if only the quote weren’t stuck at pocket-change levels.

Sceptics argue that plenty of LNG hopefuls never cross the financing finish line. True. But context matters. ExxonMobil is doubling its LNG portfolio by 2030, Shell publicly pegs demand growth at roughly 60 percent by 2040, and Berkshire Hathaway forked over $3.3 billion for control of a single US terminal. These aren’t speculative capital pools; they’re the game’s steadiest allocators answering the same supply-gap signal Crown is trying to monetise. A rising tide will not guarantee Crown’s hull is seaworthy, but when heavy tonnage is racing into the harbour you ignore the draft at your peril.

Here’s the detail that should silence “pump-and-dump” arm-chair analysts: more than two years post-merger, not one senior executive has sold a single share. Zero Form 4 filings. If the people writing EPC cheques and haggling with sovereign lenders aren’t cashing out, either they are catastrophically bad portfolio managers or they know something the open market does not. In a sector notorious for sponsor quick-flips, that total lockdown is as bullish as insider behaviour gets.

There’s another catalyst lurking beneath the LNG story: the artificial-intelligence energy crunch. Every hyper scale data hall now entering site prep in India or Southeast Asia will require steadier electrons than regional grids can furnish with renewables alone. Gas-fired turbines remain the only practical buffer, and LNG is the flexible bridge fuel everyone grudgingly agrees on. The International Energy Agency projects data-centre electricity demand to double this decade; World Bank research suggests South and Southeast Asia will be the tightest markets. Crown’s sites sit right where investors will soon discover a queue of AI landlords begging for firm power contracts.

At eleven cents a share, Crown’s fully diluted equity clocks in at around $60 million. For perspective, that is less than the annual consulting budget Big Oil spends on policy white-papers—or, put differently, roughly six per-cent of the steel cost for one average-sized LNG jetty. Industry convention values a de-risked terminal at ten to fifteen per-cent of its build cost at Final Investment Decision. Apply that haircut to Kakinada’s billion-dollar tab and Crown’s equity should sit somewhere between $100 million and $150 million on that asset alone. Add Scotland, Vietnam, and the export hub, and the current quote looks almost comically detached from replacement-cost reality.

Markets often remedy mis-labelling abruptly. Sabine Pass transformed Cheniere from a swap-spread skeleton into a $30-plus-billion juggernaut almost overnight once first cargo sailed. The rerate didn’t wait for full trains; it happened when investors realised the engineering risk was gone and the cash-flow math was inevitable. Crown is effectively one FID announcement away from nudging investors toward the same epiphany: that a “penny stock” might in fact be the keystone feeding Asia’s hungry electrons.

Opinion pieces are, by nature, wagers written in prose. Mine is simple: the market is misplacing Crown LNG because the sticker says eleven cents, not because the fundamentals say zero. I’m willing to align with the insiders who refuse to sell, the majors piling billions into the same thesis, and the data-centre builders who will need every cubic metre Kakinada can regasify. If I’m wrong, my downside is a coffee-money stake. If I’m right, I’ll be loudly reminding anyone who will listen that price is not the same as value and that occasionally the penny-stock label hides the most scalable business in the room.

#CrownLNG#LNG#EnergyTransition#AI#DataCenters#NaturalGas#Exxon#Shell#Berkshire#IEA#SPAC#SmallCapStocks#EnergyStocks#GlobalEnergy#AIInfrastructure#IndiaEnergy#UKEnergy#VietnamGrowth#GulfEnergy#StockMarket#InvestSmart#EmergingMarkets#InfrastructureInvesting

0 notes

Link

0 notes

Text

Unveiling the V R Infraspace IPO: A Game-Changer in the Construction Sector

V R Infraspace IPO

Exploring V R Infraspace

V R Infraspace, a name synonymous with excellence in construction, stands at the forefront of innovation and reliability. With a track record of delivering premium infrastructure projects, V R Infraspace has garnered widespread acclaim for its commitment to quality and customer satisfaction. From residential complexes to commercial hubs, the company’s diverse portfolio reflects its versatility and expertise.

The Vision

At the heart of V R Infraspace lies a bold vision to redefine the standards of construction through innovation, sustainability, and efficiency. With a relentless focus on pushing boundaries and surpassing expectations, the company aims to pioneer transformative projects that not only enhance the urban landscape but also enrich lives and communities.

Market Potential

The timing of the V R Infraspace IPO couldn’t be more opportune, considering the burgeoning demand for infrastructure development worldwide. With rapid urbanization and infrastructural advancements driving the need for modern, sustainable solutions, V R Infraspace is well-positioned to capitalize on this growing market demand.

Strategic Differentiators

What sets V R Infraspace apart from its competitors is its unwavering commitment to excellence at every stage of the project lifecycle. From meticulous planning and design to flawless execution and timely delivery, the company’s holistic approach ensures optimal results and utmost client satisfaction. Moreover, V R Infraspace’s emphasis on sustainability and eco-friendly practices further reinforces its reputation as a responsible industry leader.

Investment Potential

For investors seeking lucrative opportunities in the construction sector, the V R Infraspace IPO presents an enticing proposition. With a proven track record of success, a robust pipeline of projects, and a visionary leadership team driving growth and innovation, V R Infraspace promises substantial returns and long-term value creation for its shareholders.

Conclusion

In conclusion, the V R Infraspace IPO represents a landmark moment in the construction industry, offering investors the chance to be part of a visionary venture poised for exponential growth and success. With its unwavering commitment to excellence, innovation, and sustainability, V R Infraspace is set to chart new heights of achievement and redefine the future of infrastructure development. Don’t miss out on this unparalleled opportunity to invest in the future with IPOBrains and V R Infraspace.

#VrInfraspaceIPO#IPOBrains#ConstructionRevolution#InfrastructureInvesting#InnovationInConstruction#SustainableDevelopment#UrbanTransformation#InvestingInFuture#BuildingTheFuture#InvestmentOpportunity#InfrastructureGrowth#VisionaryVenture#GameChangerIPO#ConstructionSector#EcoFriendlyConstruction

1 note

·

View note

Text

An open letter to the U.S. House of Representatives

Cosponsor H.R.4052, the National Infrastructure Bank (NIB) Act.

587 so far! Help us get to 1,000 signers!

I am writing to urge you to cosponsor H.R.4052, the National Infrastructure Bank (NIB) Act.

The National Infrastructure Bank would provide $5 trillion in low-cost loans for a broad range of public infrastructure projects – including massive water systems – without the need for increasing taxes or any deficit budget spending. This has been done previously in US history—this bill is modeled on the successful Reconstruction Finance Corporation (RFC) started by President Herbert Hoover and used by President Franklin D. Roosevelt to build Hoover Dam and bring water and electricity to the Southwest.

Infrastructure investment is crucial in the US. We have an immense backlog of infrastructure needs including: affordable housing, total broadband coverage, bridge and road repair or replacement, lead service line replacement, high-speed rail, mass transit, etc. The NIB would finance all these projects—it picks up where the Bipartisan Infrastructure Act left off.

There is wide-ranging support for this. Twenty-seven state legislatures have introduced resolutions of support, and eight passed at least one chamber. Dozens of city and county councils have endorsed including: Chicago, Philadelphia, Seattle, Los Angeles, San Francisco, Detroit, Cleveland, and many more.

Please add your name to cosponsor H.R.4052. And, many thanks again for all your work on behalf of the citizens of our state and the Nation.

▶ Created on March 18 by Jess Craven

📱 Text SIGN PIUROM to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PIUROM#resistbot#open letter#petition#NationalInfrastructureBank#Infrastructure#HR4052#USHouse#HouseOfRepresentatives#InfrastructureInvestment#InfrastructureProjects#PublicInfrastructure#LowCostLoans#ReconstructionFinanceCorporation#RFC#InfrastructureNeeds#BipartisanInfrastructureAct#AffordableHousing#Broadband#BridgeRepair#RoadRepair#HighSpeedRail#MassTransit#StateLegislatures#CityCouncils#CountyCouncils#SupportLocalInfrastructure#PublicWorks#GovernmentSpending

4 notes

·

View notes

Text

𝗟𝗼𝗼𝗸𝗶𝗻𝗴 𝗳𝗼𝗿 𝗮 𝗵𝗶𝗴𝗵-𝗺𝗮𝗿𝗴𝗶𝗻, 𝘂𝗻𝗱𝗲𝗿𝗽𝗲𝗻𝗲𝘁𝗿𝗮𝘁𝗲𝗱 𝗺𝗮𝗿𝗸𝗲𝘁 𝘄𝗶𝘁𝗵 𝗺𝗮𝘀𝘀𝗶𝘃𝗲 𝘂𝗿𝗯𝗮𝗻 𝗴𝗿𝗼𝘄𝘁𝗵 𝗽𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹?

𝗥𝘂𝘀𝘀𝗶𝗮 𝗘𝗹𝗲𝘃𝗮𝘁𝗼𝗿 𝗠𝗮𝗿𝗸𝗲𝘁 might just be the next high-return frontier you’re missing. 𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲

𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗻𝗮𝗽𝘀𝗵𝗼𝘁: With over 400,000 elevators in use—many of which are 25+ years old—Russia is sitting on a modernization goldmine. The mandatory replacement cycle, driven by aging infrastructure and updated safety regulations, is generating multi-billion dollar upgrade demand across residential and commercial segments.

𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀 : Liftprof, LLC, MeteorLift, KLEEMANN, Ningbo Hosting Elevator Co., Ltd., Shcherbinsky Elevator, Silach Lift, Fuji Elevator Co.,Ltd., SKESS Corporation and others.

𝗚𝗿𝗼𝘄𝘁𝗵 𝗗𝗿𝗶𝘃𝗲𝗿𝘀 :

Government-backed housing renovation programs

Rising urbanization across Moscow, St. Petersburg, and regional cities

Strong local manufacturing base with growing appetite for smart, energy-efficient elevators

Entry barriers that favor early strategic investors

𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆: The market is expected to grow at a 𝗖𝗔𝗚𝗥 𝗼𝗳 𝟮.𝟵% by 2030, but strategic capital deployed now can ride the wave of regulatory-driven replacement cycles and high-margin modernization projects. Think infrastructure + tech ROI, without waiting a decade for returns.

𝗦𝗺𝗮𝗿𝘁 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝗮𝗿𝗲 𝗮𝗹𝗿𝗲𝗮𝗱𝘆 𝗽𝗼𝘀𝗶𝘁𝗶𝗼𝗻𝗶𝗻𝗴 𝘁𝗵𝗲𝗺𝘀𝗲𝗹𝘃𝗲𝘀—𝘁𝗵𝗿𝗼𝘂𝗴𝗵 𝗝𝗩𝘀, 𝘁𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝘆 𝘁𝗿𝗮𝗻𝘀𝗳𝗲𝗿 𝗱𝗲𝗮𝗹𝘀, 𝗮𝗻𝗱 𝗳𝗶𝗿𝘀𝘁-𝗺𝗼𝘃𝗲𝗿 𝗺𝗮𝗻𝘂𝗳𝗮𝗰𝘁𝘂𝗿𝗶𝗻𝗴 𝗳𝗼𝗼𝘁𝗽𝗿𝗶𝗻𝘁𝘀. 𝗔𝗰𝗰𝗲���𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁

Question is: 𝗔𝗿𝗲 𝘆𝗼𝘂 𝗰𝗮𝗽𝗶𝘁𝗮𝗹𝗶𝘇𝗶𝗻𝗴 𝗼𝗻 𝘁𝗵𝗶𝘀 𝘃𝗲𝗿𝘁𝗶𝗰𝗮𝗹 𝗺𝗼𝗯𝗶𝗹𝗶𝘁𝘆 𝗿𝗲𝘃𝗼𝗹𝘂𝘁𝗶𝗼𝗻—𝗼𝗿 𝗷𝘂𝘀𝘁 𝘄𝗮𝘁𝗰𝗵𝗶𝗻𝗴 𝗶𝘁 𝗿𝗶𝘀𝗲 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝘆𝗼𝘂?

#ElevatorIndustry#RussiaMarket#InfrastructureInvestment#UrbanGrowth#SmartBuildings#PrivateEquity#EmergingMarkets#IndustrialInnovation

0 notes

Text

Infrastructure = Opportunity! 🏗️

The Federal Budget includes $17.1B in new infrastructure upgrades, setting the stage for growing suburbs, better transport, and rising property values across Australia.

🏙️ Key Projects:

$7.2B for Bruce Highway upgrades (QLD)

$2.3B for Western Sydney infrastructure

$2B for Sunshine Station (VIC), part of the Melbourne Airport Rail

$465M for road & rail upgrades in regional NSW

📍Buying near future infrastructure hubs could be your smartest property move.

💡Thinking of buying in a growth zone? Let me help you pinpoint the best locations.

#propertyinvesting#propertyinvestingaustralia#infrastructureboom#InfrastructureBoom#SmartBuying#smartbuying#HomebuyingTips#homebuyingtips#aussieproperty#investmentopportunities#FutureGrowth#futuregrowth#UrbanDevelopment#urbandevelopment#realestatetrends#InfrastructureInvestment#infrastructureinvestment#SuburbanLiving#suburbanliving#PropertyMarketInsights#propertymarketinsights#InfrastructureDevelopment#infrastructuredevelopment#EconomicGrowth#economicgrowth#housingmarket#BuildingTheFuture#buildingthefuture#CommunityGrowth#houselandrus

0 notes

Text

United Bridge Partners

United Bridge Partners invests in, builds, and operates privately funded transportation infrastructure, enhancing connectivity and economic growth across the U.S. Explore our innovative approach to bridge development.

0 notes

Text

Nepal’s economy is on the rise! 📈 Invest in thriving sectors like tourism, technology, agriculture, and hydropower for long-term growth. Discover more: https://yojinvest.com/services/.

#agricultureinvestment#technologyinvestment#infrastructureinvestment#tourisminvestment#hydropowerinvestment#InvestmentExpertNepal#FinancialStrategy#BoostYourReturns#InvestmentConsultant#InvestmentGuidance#PortfolioOptimization#SmartInvesting#InvestmentConsultantNepal#FinancialGrowthNepal#InvestmentOpportunitiesNepal#WealthManagement#InvestmentAdvisorNepal#InvestmentMarket#FinancialAdvice#InvestmentAdvice

0 notes

Text

High Demand for Project Managers in Australia

Australia is experiencing a surge in demand for project managers, even amid rising inflation and a talent shortage. Here are some key factors driving this trend:

1. Infrastructure Investment

The Australian government has significantly increased infrastructure funding, with an additional $17.9 billion allocated in 2022. This has resulted in a record $120 billion investment pipeline, creating a pressing need for skilled project managers across various sectors.

2. Competitive Salaries

Project managers in Australia enjoy impressive salaries, with a median of USD $103,789 (AUD $153,471). This competitive pay makes project management a lucrative career choice.

3. Diverse Career Paths

Many project managers come from technical backgrounds such as program development or data science. This opens up opportunities for those looking to transition into project management roles.

4. Essential Skills

To thrive, project managers need a blend of technical expertise and soft skills. Key skills include communication, problem-solving, and strategic thinking. Certifications like PMP can lead to salary increases of about 33%.

5. Adaptability to Change

As AI technology takes over repetitive tasks, the demand for skilled project managers who can combine technical skills with interpersonal abilities will continue to grow.

For more insights, check out the full article: High Demand for Project Managers in Australia Amid Inflation and Talent Shortage.

What are your thoughts on the project management landscape in Australia? Let’s discuss!

#ProjectManagement#Australia#CareerGrowth#JobMarket#InfrastructureInvestment#PMP#SalaryInsights#SkillsDevelopment#FutureOfWork#AI#TalentShortage#ProfessionalDevelopment#ProjectManagers#CareerPath#TechIndustry#ContinuousLearning

0 notes

Text

What to expect from union budget 2024?

Image by freepik The Union Budget 2024 in India is expected to focus on a variety of sectors with a strong emphasis on growth and inclusion. Here are some key expectations: Tax Reforms and Reliefs: There are calls for tax relief on interest earnings from deposits, home loans, and rationalizing the taxation of Employee Stock Ownership Plans (ESOPs). Simplifying tax compliance processes and…

#Budget2024#DigitalIndia#EconomicGrowth#ElectricVehicles#Fintech#GreenFinance#HealthcareBudget#IndiaBudget2024#InfrastructureInvestment#JobCreation#MakeInIndia#SkillIndia#Startups#TaxReforms#UnionBudget2024

0 notes

Text

How Crown LNG ($CGBS) Could Quietly Make Early Shareholders Very Loudly Rich

There is something deliciously deceptive about a stock that costs less than a subway swipe yet straddles the same mega-trends driving Exxon, Shell and Berkshire Hathaway to write multi-billion-dollar cheques. Crown LNG Holdings, ticker CGBS, finished the week at $0.11—a price that screams “penny stock” even while the company’s to-do list reads like a Fortune 500 growth plan. The mismatch is so stark that it feels less like a valuation gap and more like a time warp: Wall Street is still pricing yesterday’s risk while Crown is sprinting toward tomorrow’s cash flow.

The macro tailwind nobody can ignore Start with demand. Shell’s 2025 LNG Outlook forecasts about a 60 % surge in global liquefied-gas consumption by 2040, propelled largely by Asia’s industrial boom and the electricity hunger of digital infrastructure. ExxonMobil echoes the theme, saying it is “on track to nearly double its LNG portfolio by 2030,” with projects on four continents already under construction. Berkshire Hathaway, which rarely overpays for hype, bought a 75 % stake in the Cove Point terminal for roughly $3.3 billion—just one facility—because Warren Buffett sees decades of toll-booth cash flows in LNG. If the world’s most disciplined capital allocators are leaning hard into liquefied gas, a developer trading for sixty-odd million dollars begins to look like buried treasure.

The second tailwind is artificial intelligence. The International Energy Agency projects that global data-centre power demand will more than double to about 945 TWh by 2030—roughly Japan’s entire electricity use today—and calls out AI workloads as the prime culprit. Gas-fired turbines remain the only dispatchable source that can ramp fast enough to keep GPUs humming around the clock. A Reuters deep-dive last week made the connection explicit: energy majors are piling into Southeast-Asian gas precisely because data-centre developers have nowhere else to turn for reliable electrons. Crown’s planned terminals sit squarely in that power-hunger corridor.

A four-continent supply web hiding in plain sight. Crown’s blueprint begins with Kakinada, the first gravity-based LNG terminal ever licensed for 365-day operation on India’s cyclone-prone east coast. Its seven-million-tonne capacity would feed power plants and, increasingly, India’s hyper-scale server farms—just as New Delhi pushes gas to 15 % of the national energy mix. Cross half a world to Scotland’s Firth of Forth, where Crown is engineering an import hub aimed at taming Britain’s winter gas price spikes. Slide south-east to Vietnam, an economy whose data-centre footprint is exploding and whose planners forecast multi-million-tonne LNG deficits by 2030. Close the circuit in the U.S. Gulf of Mexico, where Crown’s proposed floating export platform would funnel cheap Permian and Haynesville molecules straight into its own receiving terminals. That is a vertically stitched, four-continent network—a micro-cap doing an impression of an integrated major.

Sceptics will note that Crown has no revenue yet, and they are right. But those same sceptics must grapple with an anomaly: not one core Crown executive has sold a single share in two years. In SPAC land, insiders usually sprint for the exits the day lock-ups expire. Here, they have welded their wallets to the rails. Either they are terrible traders—or they see value invisible to the wider market. For investors who prize alignment, that zero-sale streak is the loudest bullish klaxon in the small-cap universe.

Consider replacement cost. Building just one Kakinada-scale terminal runs to about $1 billion. Crown plans at least two such assets plus an export platform, yet its enterprise value sits around $60 million. Berkshire’s single Cove Point stake, again, cost fifty-plus times Crown’s entire market cap. Even a modest industry rule of thumb—valuing an LNG project at 10-15 % of cap-ex at Final Investment Decision—would catapult Crown’s equity into nine-figure territory the moment financing is nailed down. Eleven cents simply does not compute once steel hits seawater.

Management says it is targeting FID on the Scottish project as early as 2025 and Kakinada by 2026. Each milestone tends to unlock construction debt, long-term offtake contracts, and fresh equity interest. For context, Excelerate Energy’s valuation lifted immediately after its first FSRU charter passed bankable diligence—even before gas flowed—because the market finally trusted the revenue model. Crown is racing toward the same credibility inflection, but from a share price barely scraping double digits.

Wall Street’s crowded trades, mega cap tech, AI chips, large-cap energy, are priced for perfection. Crown LNG is priced as if the future never arrives. Yet Shell, Exxon and Berkshire believe that same future requires vastly more LNG than the world can currently deliver. If even one of Crown’s projects crosses the debt-financing finish line, the stock’s denominator changes faster than most portfolio screens can refresh.

Investors love to say they learn from missed chances. Apple at four, Amazon at eighty, Tesla at twenty. The common thread is that each looked too small, too risky, too early—right until reality rewrote the narrative. Crown LNG sits in that uncomfortable limbo now: tiny quote, giant ambitions, insiders all-in, macro winds at its back. When the first concrete caisson sinks into Indian waters or the first seabed pile is driven in Scotland, today’s eleven-cent tape will feel like ancient history.

History does not repeat, but it certainly rhymes. If you have ever sworn you would never again overlook the bargain hiding beneath an ugly price, Crown LNG is quietly offering you a redo. The only question is whether you will hear the keystone drop before the rest of the market wakes up.

#CrownLNG#LNG#EnergyTransition#AI#DataCenters#NaturalGas#Exxon#Shell#Berkshire#IEA#SPAC#SmallCapStocks#EnergyStocks#GlobalEnergy#AIInfrastructure#IndiaEnergy#UKEnergy#VietnamGrowth#GulfEnergy#StockMarket#InvestSmart#EmergingMarkets#InfrastructureInvesting

1 note

·

View note

Link

#hardware-softwaresynergy#infrastructureinvestment#QuantumComputing#quantumroadmaps#regionalinnovation#state-industrycollaboration#talentdevelopment#technologyadoption

0 notes

Text

Speakers Announced for SelectUSA Summit

The U.S. Department of Commerce has announced an impressive lineup of speakers for the 10th SelectUSA Investment Summit, taking place from June 23 to 26 at the Gaylord National Resort and Convention Center in National Harbor, Maryland. This year's summit will feature key U.S. Cabinet members and senior administration officials, highlighting the Biden-Harris Administration’s economic achievements.

Introduction

The SelectUSA Investment Summit is a pivotal event for fostering business investment into the United States. With a speaker lineup that includes U.S. Secretary of State Antony Blinken and U.S. Secretary of Transportation Pete Buttigieg, the summit promises to spotlight significant economic initiatives and investment opportunities. High-Profile Speakers This year’s speaker lineup includes: - U.S. Secretary of State Antony Blinken - U.S. Secretary of Transportation Pete Buttigieg - Acting U.S. Secretary of Labor Julie Su - U.S. Deputy Secretary of Defense Kathleen Hicks - U.S. Deputy Secretary of Energy David Turk - Deputy National Security Advisor for International Economics Daleep Singh Hosted by U.S. Secretary of Commerce Gina Raimondo, these speakers will discuss the Biden-Harris Administration’s economic agenda, focusing on investments in infrastructure and clean energy.

Focus Areas of the Summit

The 2024 SelectUSA Investment Summit will concentrate on several key areas: - Economic Achievements: Highlighting the Biden-Harris Administration’s successes in strengthening U.S. competitiveness through infrastructure investments. - Foreign Direct Investment: Attracting transformative investments that create well-paying jobs across the U.S. Summit Agenda and Announcements This year’s summit will be a platform for over 10 major announcements from businesses worldwide regarding their investment plans in the U.S. These announcements are expected to drive significant economic growth and development. Date Event Highlight June 23 Opening ceremony with keynote addresses June 24-25 Panel discussions on infrastructure and clean energy investments June 26 Closing remarks and major investment announcements Registration and Participation For those interested in attending, the registration process is straightforward. Accredited journalists must register online to cover the event. The summit offers an excellent opportunity for media to gain insights into the latest economic trends and policies. Registration Steps: - Complete the online application: Go to SelectUSA Summit Registration and click on the "Register Now" button. - Approval process: Applications will be reviewed by SelectUSA, and only approved applicants can register and attend the summit. - Booking accommodations: Once approved, attendees will receive instructions on booking a hotel room within the SelectUSA room block at the Gaylord National Resort and Convention Center.

About SelectUSA

SelectUSA, part of the International Trade Administration at the U.S. Department of Commerce, promotes and facilitates business investment into the United States. By coordinating with federal government agencies, SelectUSA serves as a single point of contact for investors and highlights the importance of economic development in the U.S. economy. SelectUSA assists U.S. economic development organizations in competing globally for investment by providing information, international marketing platforms, and high-level advocacy. Additionally, SelectUSA helps foreign companies navigate the federal regulatory system and connect with local resources. Summit’s Impact on Economic Development The SelectUSA Investment Summit has consistently proven to be a significant event for economic development in the United States. By attracting foreign direct investment, the summit helps create jobs, foster innovation, and promote sustainable growth. Key Benefits of the Summit: - Job Creation: Investments announced at the summit are expected to generate well-paying jobs across various sectors. - Innovation and Growth: The focus on infrastructure and clean energy investments will drive technological advancements and economic growth. - Global Competitiveness: By attracting international businesses, the U.S. strengthens its position in the global market. The Takeaway The 10th SelectUSA Investment Summit is set to be a landmark event, with high-profile speakers and major investment announcements that will shape the future of the U.S. economy. By highlighting the Biden-Harris Administration’s economic achievements and promoting foreign direct investment, the summit underscores the importance of economic development in fostering a prosperous future for the United States. For more information and to register for the summit, visit SelectUSA Summit. Sources: THX News & US Department of Homeland Security. Read the full article

#businessinvestment#cleanenergyfuture#economicachievements#EconomicDevelopment#foreigndirectinvestment#Infrastructureinvestments#internationalmarketing#U.S.Competitiveness#U.S.DepartmentofCommerce#U.S.economicgrowth

0 notes

Text

Building Resilient Cities: The Vital Role of Investment Banks in Combating Climate Change

Climate change poses one of the most urgent and complex challenges of our time, with increasingly evident and devastating impacts worldwide. Amidst this challenging scenario, cities emerge as critical points of vulnerability, facing the growing threat of extreme weather events that jeopardize infrastructure, economies, and the well-being of millions of urban dwellers.

In this context, investment banks play a crucial role in constructing more resilient cities prepared to face the challenges of climate change. Through their unique ability to mobilize financial resources, investment expertise, and market influence, these financial institutions play a vital role in promoting innovative and sustainable solutions to ensure a safer and more sustainable urban future.

The Challenge of Urban Climate Resilience

Cities are hubs of economic activity, innovation, and cultural diversity, but they are also vulnerable to the impacts of climate change. Extreme weather events such as floods, droughts, and heatwaves pose significant threats to urban infrastructure, citizen safety, and economic stability. Urban climate resilience, therefore, becomes an essential priority to ensure the sustainability and prosperity of urban areas in an ever-changing world.

The Transformative Role of Investment Banks

Investment banks play a transformative role in building resilient cities, acting as catalysts for strategic and innovative investments. Through financing resilient infrastructure, investment in renewable energy and energy efficiency, development of risk finance instruments, support for adaptive technology development, and promotion of awareness programs, these financial institutions are at the forefront of the fight against climate change.

Tangible Benefits and Positive Impacts

The benefits of investing in urban climate resilience are vast and tangible. Modernizing urban infrastructure, transitioning to clean energy sources, protecting against extreme weather events, and raising awareness among the population about climate challenges are just some of the ways investment banks can contribute to building more resilient and sustainable cities.

Collaboration and Collective Commitment

To achieve the goal of building resilient cities, close collaboration between investment banks, governments, businesses, and local communities is essential. Integrating environmental, social, and governance (ESG) criteria into investment decisions, promoting sustainable practices, and implementing innovative solutions are critical to ensuring the success of urban climate resilience initiatives.

Conclusion: Towards a Sustainable and Resilient Urban Future

In a world marked by increasingly urgent climate challenges, investment banks play a vital role in building resilient cities prepared to face the challenges of the 21st century. By investing in innovative solutions, promoting sustainability, and collaborating with various societal actors, these financial institutions are at the forefront of the fight against climate change, ensuring a safer, more sustainable, and resilient urban future for all.

This article highlights the importance of the role of investment banks in building climate-resilient cities and aims to inspire concrete actions in this direction.

#ResilientCities#ClimateChange#InvestmentBanks#UrbanResilience#SustainableFuture#ClimateAction#InfrastructureInvestment#RenewableEnergy#ClimateResilience#ESGCriteria#Collaboration#ClimateAdaptation#BuildingBetterCities#SustainabilityLeadership

0 notes

Text

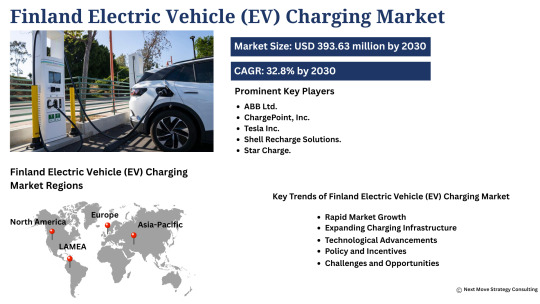

𝗙𝗶𝗻𝗹𝗮𝗻𝗱 𝗘𝗹𝗲𝗰𝘁𝗿𝗶𝗰 𝗩𝗲𝗵𝗶𝗰𝗹𝗲 (𝗘𝗩) 𝗖𝗵𝗮𝗿𝗴𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁: The Next Nordic Goldmine for Investors?

𝗗𝗶𝗱 𝘆𝗼𝘂 𝗸𝗻𝗼𝘄? Finland is quietly building one of the most advanced electric vehicle (EV) charging ecosystems in Europe — but only a few sharp investors are paying attention.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲

Backed by Finland's aggressive net-zero targets

Supported by EU Green Deal funds

Driven by skyrocketing EV adoption — Finland’s EV registrations grew over 50% YoY

Limited domestic competition — wide open for strategic capital & global partnerships

𝗧𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁 𝗶𝘀𝗻’𝘁 𝗷𝘂𝘀𝘁 𝗮𝗯𝗼𝘂𝘁 𝗰𝗵𝗮𝗿𝗴𝗲𝗿𝘀 — 𝗶𝘁’𝘀 𝗮𝗯𝗼𝘂𝘁 𝗱𝗮𝘁𝗮, 𝗲𝗻𝗲𝗿𝗴𝘆 𝗺𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁, 𝘀𝗺𝗮𝗿𝘁 𝗴𝗿𝗶𝗱𝘀, 𝗮𝗻𝗱 𝗰𝗿𝗼𝘀𝘀-𝗯𝗼𝗿𝗱𝗲𝗿 𝘀𝗰𝗮𝗹𝗮𝗯𝗶𝗹𝗶𝘁𝘆. 𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀 : ABB Ltd., ChargePoint, Inc, Tesla Inc, Shell Recharge Solutions, Star Charge, Siemens, Hyundai Motor Company and others.

As the Nordics emerge as a sustainable technology hub, Finland’s EV charging infrastructure offers:

Recurring revenue models

Public-private partnership opportunities

First-mover advantage in scalable tech infrastructure

𝗜𝗻𝘀𝘁𝗶𝘁𝘂𝘁𝗶𝗼𝗻𝗮𝗹 𝗰𝗮𝗽𝗶𝘁𝗮𝗹, 𝗽𝗿𝗶𝘃𝗮𝘁𝗲 𝗲𝗾𝘂𝗶𝘁𝘆, 𝘃𝗲𝗻𝘁𝘂𝗿𝗲 𝗳𝘂𝗻𝗱𝘀 — 𝘁𝗵𝗶𝘀 𝗶𝘀 𝗮 𝗺𝗼𝗺𝗲𝗻𝘁 𝗼𝗳 𝗮𝘀𝘆𝗺𝗺𝗲𝘁𝗿𝗶𝗰 𝘂𝗽𝘀𝗶𝗱𝗲. 𝗔𝗰𝗰𝗲𝘀𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁

If you're an investor looking for scalable green assets with strong policy tailwinds, Finland’s EV Charging Market is one of the most underpriced opportunities on the European map.

#EVcharging#Finland#InvestorAlert#Sustainability#PrivateEquity#InfrastructureInvestment#GreenEnergy#Fintech#GrowthOpportunities

0 notes

Text

Shaping the Future: India’s Premier Infrastructure Developers

India, a nation pulsating with energy and ambition, has embarked on a transformative journey towards becoming a global economic powerhouse. At the heart of this evolution lies the crucial role played by infrastructure development providers. These entities, ranging from government agencies to private enterprises, play a pivotal role in shaping the physical landscape of the country, laying the foundations for sustainable growth, and enhancing the quality of life for millions of citizens.

Infrastructure Development Provider in India encompasses a vast spectrum of sectors, including transportation, energy, telecommunications, water resources, and urban development. Each of these sectors presents unique challenges and opportunities, requiring innovative solutions and strategic investments to meet the evolving needs of a rapidly growing population and dynamic economy. As such, infrastructure development providers operate at the intersection of policy, technology, and finance, orchestrating complex projects that have far-reaching implications for the nation’s socio-economic development.

One of the key drivers of infrastructure development in India is the government’s ambitious initiatives aimed at modernizing and expanding the country’s physical infrastructure. Through flagship programs such as Bharatmala, Sagarmala, Smart Cities Mission, and Pradhan Mantri Awas Yojana, the government aims to revitalize transportation networks, upgrade ports and waterways, build smart cities, and provide affordable housing for all. These initiatives not only create employment opportunities and stimulate economic growth but also foster inclusive development, bridging the urban-rural divide and improving accessibility to essential services.

In addition to government-led initiatives, the private sector plays a significant role in driving infrastructure development in India. Private infrastructure development companies, both domestic and international, bring expertise, technology, and capital to the table, complementing government efforts and catalyzing progress across various sectors. From building world-class highways and airports to developing renewable energy projects and urban infrastructure, private players contribute to the expansion and modernization of India’s infrastructure backbone.

One of the most critical aspects of infrastructure development in India is the focus on sustainability and resilience. With mounting concerns over climate change, resource scarcity, and environmental degradation, infrastructure projects must be designed and implemented with careful consideration for their long-term impact on the environment and society. This entails adopting green building practices, integrating renewable energy sources, promoting water conservation, and enhancing resilience to natural disasters. By embracing sustainable development principles, infrastructure providers in India can create infrastructure that not only meets the needs of the present but also safeguards the interests of future generations.

Furthermore, technology and innovation are driving forces behind India’s infrastructure development efforts. The adoption of digital technologies such as artificial intelligence, Internet of Things (IoT), and blockchain is revolutionizing project planning, design, construction, and management. These technologies enable real-time monitoring, data-driven decision-making, and predictive analytics, leading to improved efficiency, cost-effectiveness, and quality outcomes. Moreover, innovation in materials, construction techniques, and project delivery models is unlocking new possibilities for faster, safer, and more resilient infrastructure development in India.

Despite the significant strides made in recent years, challenges persist in India’s infrastructure development landscape. Financing remains a perennial issue, with funding gaps hindering the implementation of large-scale projects. Addressing this challenge requires innovative financing mechanisms, including public-private partnerships (PPPs), infrastructure bonds, and foreign direct investment (FDI), to mobilize capital and mitigate investment risks. Additionally, regulatory bottlenecks, land acquisition issues, and bureaucratic hurdles often impede the timely execution of infrastructure projects, necessitating reforms to streamline processes and enhance transparency.

Looking ahead, the future of infrastructure development in India holds immense promise, fueled by demographic trends, urbanization, and economic aspirations. As the country continues on its path of rapid growth and urbanization, the demand for robust, resilient, and sustainable infrastructure will only intensify. Infrastructure providers in India must rise to the occasion, embracing innovation, collaboration, and inclusivity to deliver transformative projects that unlock economic opportunities, enhance quality of life, and foster sustainable development across the nation.

Infrastructure Development Provider in India play a vital role in shaping the future of India’s built environment, driving economic growth, fostering social inclusion, and enhancing environmental sustainability. Through strategic investments, innovative solutions, and collaborative partnerships, these entities are instrumental in building the infrastructure backbone that underpins India’s aspirations for progress and prosperity. As the nation marches towards its vision of becoming a $5 trillion economy, the importance of infrastructure development cannot be overstated, making it a cornerstone of India’s journey towards a brighter tomorrow.

0 notes