#Macre-May

Text

Day 1-2: Cord length and types

Before you can make a project you need to select a cord and cut it to the length needed. There's many types of cord to choose from, each with their own properties. :

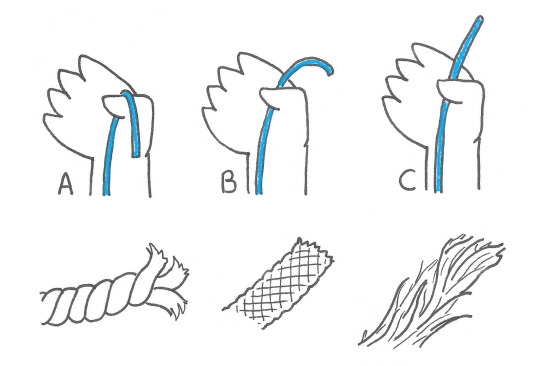

A. Limp cord, usually made out of twisted cotton, can be tough to use. It unravels and sometimes doesn't hold it's diameter- a tight knot can compress the cord. However, limp cord is the only type that doesn't hold it's past shape. It can be good for wall hangings where you don't want the hanging cords curly from being sold in a bundle. Since I'm not really into wall hangings I personally avoid this type.

B. Flexible cord like waxed braided cord is my favorite- the cord is strong and brightly colored, the ends don't unravel enough to be an issue, and the texture is smooth and nice on the hands. Sometimes sold in bundles, sometimes wrapped around a piece of cardboard.

C. Stiff cord is usually natural hemp fibers, which are sold in round bundles. This type is really good for trying out new designs without worrying about wasting fancy colored cord, plus the ends don't unravel. Be careful though- this cord is very hairy and can be lumpy and uneven. Natural fiber cord can also come in different colors and stiffness, but even limp natural fibers don't compress in a knot like cotton.

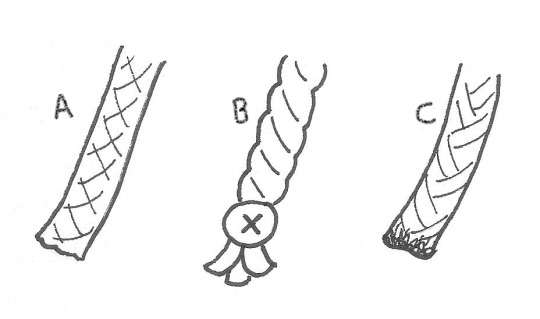

Try not to mix these cord types- limp cord is flattened in a knot with other types, making the knot uneven. Mixing natural fibers with braided cord is fine in certain projects but for the most part the mix of smooth versus hairy+lumpy is awkward.

Other types of cord include synthetic cord, which is limp and can unravel like cotton but can come in vivid colors and weird shapes like flat. I don't have much experience with these. Avoid elastic cords for macrame.

/\/\/\/\/\

^ Some cords don't unravel much and you can A) not worry about it. For cords that unravel you can B) tie the end in a knot, or for some synthetic cords C) singe/melt the endings with a lighter.

/\/\/\/\/\

One other thing to keep in mind is thickness- the width of the cord is usually given in millimeters (mm) but between you and me, tumblr, I don't think they know what a millimeter is. Who said that.

"1mm" is thin, good for smaller projects like jewelry. This is my default thickness. I've also seen 1mm be called "0.5mm." It doesn't matter much as long as it's thin macrame cord.

"2mm" is thick cord for smaller projects. I don't use thicker cord much because the thicker the cord the (slightly) easier it is for knots to unravel. 3mm and thicker starts getting unwieldy for my style of projects, but is common in stores because wall hangings got trendy.

/\/\/\/\/\

When it comes to the length of the cord many tutorials will just give you a length to cut. They give either the length for one specific project or there's a chart for bracelet/necklace/whatever. But people come in different sizes and having a 'one size fits all' measurement leads to wasted cord or a piece that's too small to wear. It can be a bit of a hassle. And I don't like having to dig out a ruler.

So I have my own method.

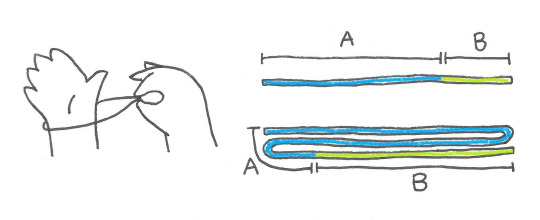

To measure by feel, use your chosen cord to figure out the length of the project (A). If it is a bracelet, wrap the cord around the wrist. You can make a necklace tight or loose. Whatever you like. Then, add like 3 or 4 inches, 15 to 20cm of bonus cord (B).

(The bonus cord is for you to hold onto when making the knots, and on longer strings it gives much needed wiggle room in case your knots eat up string.)

A and B together is the Project Length, or PL.

Next look at your project. Plan out what each string is doing- if it is used as a base string that goes the length of the project with no turns, it's length is 1 PL. Another string that is used in knots and has lots of turns can be 3 PL. The more PL, the more convoluted the path of the string.

For example, a series of square knots has two base strings and two strings that wrap around them. This project could be one cord, 2 PL, folded in half for the two base strings and a second, 6 PL, folded in half for the two wrapping strings.

So once you measure your project and decide on a PL, fold it back and forth until the cord is the desired length, and use that cord to measure the others in the project.

Another example with pics:

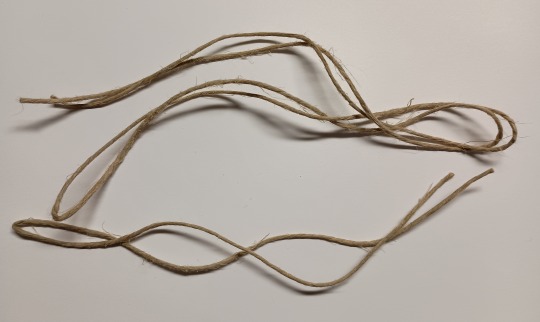

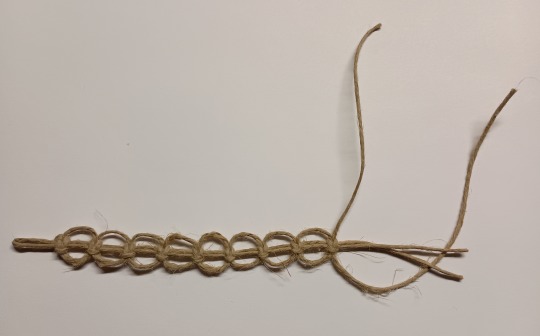

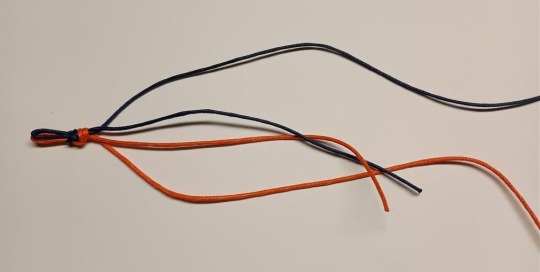

Two strings, natural hemp fiber, as straight as I could get them without taping them down lol. One is 2 PL and the other is 4PL, each folded in half. This makes two 1 PL strings and two 2 PL strings.

The long cords were used to make knots around the base cords, which are straight. (the wrapping cords ended up having more leftovers, but I chose a knot that's really light on the string. And I used string-saving techniques, oops)

(I didn't give myself that much room for the finishing knot, oops x2)

Final product with the strings trimmed! Don't worry about leftovers, the longer ones can be used in other projects or small samples for testing designs. It's better to overestimate the needed cord then to go through the circus of ending up short.

Anyway this way I can give you a design, say the Project Length of each string, and you can use that to build sweeping necklaces to child bracelets.

btw you can always look around at other tutorials of similar designs if you just want a solid number to work with.

(Macre-May Prompt list)

#Macre-May#Macre-May 2024#macrame#art challenge#not me throwing subtle shade at the wall hanging community#after wall hangings became a trend braided cord slowly stopped being sold in art stores#or at least there's less variety each year#it's all thick rope and cotton cord in varying shades of tan#boo#also#how did this become a mile long#I put two concepts in one post because this wasn't supposed to be wild#it got wild#also also#sorry for going back and forth with the words cord and string#there's a difference..... I can feel it but I can't explain it

3 notes

·

View notes

Text

A Miaoqian Câmera de vídeo digital profissional 4K Ultra HD é uma câmera de vídeo de mão de alta qualidade, projetada para atender às necessidades dos profissionais de vídeo. Com sua resolução 4K Ultra HD, ela captura imagens nítidas e detalhadas, proporcionando uma experiência visual imersiva.

Equipada com um sensor CMOS avançado, a câmera oferece uma excelente qualidade de imagem, mesmo em condições de pouca luz. Isso permite que você capture vídeos de alta definição, com cores vibrantes e detalhes precisos.

Além disso, a Miaoqian Câmera de vídeo digital profissional possui uma lente grande angular de 0,45X, que permite capturar uma área maior em cada quadro. Isso é especialmente útil para filmar paisagens, eventos esportivos ou qualquer situação em que você queira capturar mais elementos em uma única imagem.

A câmera também vem com um microfone estéreo embutido, que garante uma qualidade de áudio excepcional. Ele capta o som de forma clara e precisa, permitindo que você grave vídeos com um som imersivo e realista.

Além disso, a Miaoqian Câmera de vídeo digital profissional possui uma função macro, que permite capturar imagens em close-up com detalhes impressionantes. Isso é perfeito para fotografar objetos pequenos, como flores, insetos ou qualquer coisa que exija uma abordagem mais próxima.

Com sua construção robusta e ergonômica, a câmera é fácil de segurar e operar. Ela também possui uma tela LCD de alta resolução, que permite visualizar e reproduzir seus vídeos com facilidade.

Em resumo, a Miaoqian Câmera de vídeo digital profissional 4K Ultra HD é uma escolha ideal para videomakers profissionais que desejam capturar imagens de alta qualidade. Com sua resolução 4K, sensor CMOS avançado, lente grande angular, microfone estéreo e função macro, ela oferece recursos avançados para atender às suas necessidades de gravação de vídeo.

0 notes

Text

DOOMED...

As long as each side claims to be the good, the right, and the just. Always painting the other as wrong, bad, and evil. Things will only get worse for us all. But none of it really matters in a reality where this is all some sort of simulation or video game; where the plot is so fixed that any choice we make has no impact, imprint, or evidence on the outcome of the game. That no matter what you do in the game; you end up at the same boss fight at the end, with the same life, the same weapons, the same treasures and the same everything. It's these types of environments where the lack of realism is felt and where we eventually realize that something is not right with said reality. Some of it seems real, some seems normal and then you see a giant clown head with a spider tattoo on its forehead in the sky where the Sun should be. Eventually, the brain will tell us what is real and what is not real. It is when our realities are flipped upside down and inside out, like a tesseract, that feelings on reality become existential horror.

Real Terror…

There is an idea of freedom for all—some kind of abstraction—but there is no real freedom—only an empty thirsty void—something illusive, rich as fuck—and though we can hide our cold gaze—and we can shake our heads—and feel love—hate—and maybe—we can even sense our values may actually be comparable in some random and insignificant way: we simply—are not there. We are not—listening—We—simply—do not—care...

Apply all that to your common sense. How does reality feel right now? Something ABSOLUTELY does not feel right here… Yeah, we mean nothing. God cares not for you, me, your kids, your freedoms, their suffering, your suffering, and mine. With all that... All we have are those moments of love with those we love the most. Become obsessed with that!!! Not this Bull-Shit. It doesn't matter who we vote for. We all lose… By the time ‘right now’ impacts the future, I'll be dead. Some of you before me. Most of you shortly after me, again, it means nothing in the bigger picture. Why would I care about that in which I cannot alter, control or have input on? My vote makes zero impact. Why waste that by which I cannot ever get back? The energy and time? Once used they cannot be given back. The current landscape of politicians are not qualified to be politicians. As long as we look at Americans as us versus them or them versus us. We are all going to be trapped in this vicious cycle.

This is why I no longer give much time and energy in my headspace anymore. I will comment here/there, make fun of both sides but I am not interested in fighting for either side. It's not about community, politics or right or even wrong. It's a philosophical question. Most if not all politicians cannot do anything that has anything to do with bigger, deeper philosophical questions and concepts of any kind. It's why most of them talk in circles and never actually say anything when they talk. It’s just Charlie Brown’s parents lingo. How many times did we hear either one of the candidates actually answer the questions without going on with tangents and on with other subjects, complicated word salads that say nothing by both and/or makes claims about the other that have little to no actual meaning or substance? Post after post, after comment, after meme, it is all the same. Most Americans hate both these people. This is why ‘Crazy Ralph’ is correct; "we're all doomed."

I'm already dead… My brain and body just don't know it yet. Enjoy the moments, stop thinking about the future, because there isn’t one for you or me. Your kids, perhaps, but I chose before I was even old enough to have sex, that I never wanted kids of my own. I was then and am now even more severely against procreation for myself. There is no grand future, only now, and the foreseeable future which is how foreseeable exactly? Just enjoy the time we have left. Work towards things that make you happy. Stop trying to think you control these things in the macro-world or even impact them in any ‘meaningful’ way. Keyword, “meaningful.” You are not that important. What exactly can I do right now to help and/or make a real sharp change in the landscape? Nothing… I, personally, can do absolutely nothing. With all my issues by the time I have time to think about such things it's time for bed and do it all over again, so no. I cannot do anything about anything and stopped pretending I actually could after my near-death experience. I am much better off for it. I cannot say happier or good. I tend to say ‘less bad.’ Because good doesn’t really happen with me. I understand I am not that special, beautiful, or unique in any macroscopic way.

“You are not special. You're not a beautiful and unique snowflake. You're the same decaying organic matter as everything else. We're all part of the same compost heap. We're all singing, all dancing crap of the world.” ― Chuck Palahniuk, Fight Club

With that said, laugh at the memes… If you get triggered by this stuff this much it’s time to pull back and think about yourself, because “they” are going to do them first and do you last, if at all. That is what politics is in the 2020s. Love your country, but hate your leaders, because they do not lead, they dictate…

23 years ago the country stood still, and our hearts sank as the Twin Towers fell, smoke rose, and lives were forever altered. We remember where we stood, who we held, and the stunned silence that followed. It was a day that cracked the soul of a nation, and from those ashes rose a storm of uncertainty, fear, and division. Yet, in remembering that day, we honor the lost and the brave, a reminder to never let our differences overshadow our shared humanity. Let us never forget, not just the pain, but the unity we once sought. We need that desire for unity again…

Doomed…

by David-Angelo Mineo

9/11/2024

1,069 Words

#nihilism#politicalrant#twopartysystem#binarypolitics#nopartyaffiliation#politicalsatire#brokensystem#wakeupamerica#truthoverfiction#voteindependent#mainstreammedialies#politicaldisillusionment#criticalthinking#freespeech#censorship#hypocrisy#existentialism#identitypolitics#logicalfallacies#controlleddissidence#middleclass#breaktheillusion#createnotreact#unplugfrompolitics#politicaldebate#writer#blogger#blog#bloggerstyle#writing

0 notes

Text

Tax Tips For Small Business Owners For This Year’s Taxes

Filing taxes can be a complex and stressful process for small business owners. However, with careful planning and attention to detail, you can optimize your tax situation and potentially save money.

Here are some essential tax tips for small business owners:

Organize Your Records

Maintain organized records throughout the year. This includes income statements, expense receipts, bank statements, and any other financial documents. Use accounting software like QuickBooks or Xero to track your finances and generate accurate reports.

Understand Deductible Expenses

Identify all potential deductible expenses to reduce your taxable income. Common deductions include:

Home office deduction: If you use part of your home exclusively for business, you may be eligible for this deduction.

Business meals and entertainment: Deduct 50% of business-related meal and entertainment expenses.

Vehicle expenses: Deduct mileage or actual vehicle expenses if you use your car for business purposes.

Office supplies and equipment: Deduct costs for items like computers, printers, and office furniture.

Professional services: Deduct fees paid to lawyers, accountants, and consultants.

Take Advantage of Tax Credits

Explore available tax credits, which directly reduce your tax liability. Some key credits include:

Small Business Health Care Tax Credit: For businesses that provide health insurance to employees.

Work Opportunity Tax Credit (WOTC): For hiring employees from targeted groups.

Research and Development (R&D) Tax Credit: For businesses investing in innovation.

Consider Retirement Plans

Contributing to a retirement plan can provide tax benefits. Options for small business owners include:

Simplified Employee Pension (SEP) IRA: Allows significant contributions and is easy to set up.

Solo 401(k): Ideal for sole proprietors or business owners with no employees, allowing high contribution limits.

SIMPLE IRA: Suitable for businesses with fewer than 100 employees.

Estimate and Pay Quarterly Taxes

If you expect to owe $1,000 or more in taxes, you must pay estimated quarterly taxes. Failing to do so can result in penalties. Calculate your estimated taxes using Form 1040-ES and make timely payments to the IRS.

Keep Abreast of Tax Law Changes

Tax laws frequently change, and staying informed is crucial. Consult the IRS website or a tax professional offering small business tax planning in Fort Worth TX to ensure you’re aware of the latest tax regulations and how they impact your business.

Depreciate Assets

Depreciation allows you to deduct the cost of business assets over their useful life. Utilize the Modified Accelerated Cost Recovery System (MACRS) for depreciation. Consider Section 179 deduction and bonus depreciation for faster write-offs of eligible assets.

Track Carryovers

Certain deductions and credits may exceed your income for the year, resulting in carryovers. These can be applied to future tax years. Common carryovers include:

Net Operating Loss (NOL): Can be carried forward to offset future taxable income.

Capital Losses: Can offset future capital gains.

File on Time and Correctly

Filing your tax return on time is crucial to avoid penalties and interest. Use the appropriate forms, such as Schedule C (Form 1040) for sole proprietorships or Form 1120 for corporations. Consider e-filing for faster processing.

Consult a Tax Professional

Finally, working with a tax professional offering can provide invaluable guidance. They can help you navigate complex tax laws, identify potential deductions, and ensure accurate filing. This can ultimately save you time and money while minimizing the risk of errors.

By implementing these tax tips, small business owners can optimize their tax situation, reduce their liability, and ensure compliance with tax regulations. Consistent and careful planning throughout the year is essential for maximizing tax benefits and maintaining financial health.

0 notes

Text

Tax Planning for Small Business Owners: A Customized Approach for Different Industries

Tax planning might not be the most exciting topic for small business owners, but it’s crucial for maximizing your financial health and keeping more of your hard-earned money. Every industry has its unique set of challenges and opportunities when it comes to tax planning, so a one-size-fits-all approach often doesn’t cut it. In this blog post, I’ll share some personal insights into tax planning strategies tailored to various industries. Let’s dive in!

1. Retail and E-Commerce

Unique Challenges: Retail and e-commerce businesses face fluctuating inventory costs and sales tax complexities. Managing inventory accurately is critical, as it directly affects your cost of goods sold (COGS) and taxable income.

Personal Tip: Implement a robust inventory management system. It’ll help you keep track of inventory levels and valuation, which is essential for accurate tax reporting. Additionally, consider utilizing software that integrates with your accounting system to simplify sales tax calculations and ensure compliance with varying state regulations.

2. Service-Based Businesses

Unique Challenges: Service-based businesses often have fewer physical assets but may face complex issues related to labor costs and deductions for business expenses.

Personal Tip: Keep detailed records of all business expenses, including those that might not be immediately obvious, like home office expenses if you work remotely. Also, consider the tax implications of hiring independent contractors versus employees. Each choice has different tax responsibilities and potential deductions.

3. Construction and Real Estate

Unique Challenges: Businesses in construction and real estate deal with significant capital expenditures, project-specific expenses, and varying revenue recognition methods.

Personal Tip: Explore depreciation options for your equipment and property. The Modified Accelerated Cost Recovery System (MACRS) offers various methods that can help you manage depreciation expenses and maximize deductions. Also, be mindful of potential tax credits related to energy-efficient improvements or low-income housing projects.

4. Healthcare and Professional Services

Unique Challenges: Healthcare providers and professional services firms often have high compliance costs and complex billing structures.

Personal Tip: Utilize tax deductions related to continuing education, professional licenses, and malpractice insurance. Additionally, consider retirement plans like a SEP IRA or Solo 401(k) to benefit from substantial contribution limits and reduce taxable income.

5. Technology and Startups

Unique Challenges: Technology startups face unique challenges with R&D expenses, stock options, and potential future profitability.

Personal Tip: Take full advantage of R&D tax credits if you’re investing in innovative technology. Additionally, carefully manage stock options and their tax implications for yourself and your employees. Consulting with a tax advisor familiar with startup nuances can help you navigate these complexities.

6. Agriculture and Farming

Unique Challenges: Agriculture involves significant seasonal fluctuations and unique tax considerations for equipment and land.

Personal Tip: Consider using income averaging to manage the impact of variable income across different years. Also, look into deductions for soil and water conservation expenses, as well as other agricultural-specific credits and incentives.

General Tax Planning Tips

1. Stay Organized: Regardless of your industry, maintaining organized records is crucial. Use accounting software to track income, expenses, and deductions efficiently.

2. Consult a Tax Professional: Tax laws are constantly changing, and a tax professional can provide personalized advice tailored to your industry and business structure.

3. Plan Ahead: Don’t wait until tax season to think about your taxes. Regularly review your financials and tax strategy throughout the year to make informed decisions.

4. Utilize Tax Credits and Deductions: Be aware of industry-specific credits and deductions that can reduce your taxable income. Research these options or consult with a professional to ensure you’re not missing out.

0 notes

Text

Empowering Businesses with Commercial Solar Solutions: Design, Installation, and Maintenance

Commercial solar systems are a popular option for businesses that want to reduce their energy costs and boost their green image. They also have the potential to increase property values.

The process of going solar for a business involves a detailed evaluation of the facility’s structures and determining its energy usage. This information is used to create a formal design of the solar system.

Smart Energy Solutions

When it comes to installing solar power, picking the right team matters. You want folks who know what they’re doing, use great materials, and stick around if you need them later. This means checking their licenses, insurance, and experience, as well as learning about the types of equipment they offer and what kind of financing they have.

A top installer will also understand that no two roofs or pieces of land are the same. They’ll be able to craft solar power setups that fit your space like a suit tailored just for you.

Smart Energy Solutions is a Long Island, NY-based solar energy company with a proven track record of helping residential clients save on their utility bills. They’re also committed to using quality PV panels, inverters, and battery back-up systems that help their clients achieve their goals. They’re a certified solar provider with 40 years of experience and have earned a reputation for excellence in their industry.

Design

Commercial solar installation services provide a valuable service to businesses that want to reduce their dependence on energy from non-renewable sources. They can also help lower electrical costs and carbon footprints. These benefits have prompted more companies to embrace sustainable energy solutions.

The design of the system involves choosing specific panels, inverters, and mounting hardware, depending on owner goals. It also includes determining how much power the system can produce. Software can aid the process by estimating and optimizing energy yield based on a number of factors like row spacing, panel tilt, and solar irradiance.

The design stage must also be accompanied by permitting and other regulatory processes. The engineering firm will often manage this process on behalf of the client, ensuring that all necessary information is submitted to the “Authority Having Jurisdiction” (AHJ) for review. Getting the project designed and approved quickly can also help qualify for financial incentives sooner. Lastly, the installation stage includes the actual process of putting the solar panels in place on rooftops or ground-mounted arrays.

Installation

Commercial solar refers to the use of solar power for businesses, schools, government agencies, and other organizations. It is a different market from residential solar and requires specialized knowledge to ensure a successful deployment. It also offers unique incentives for organizations that choose to go green, including the federal investment tax credit and MACRS depreciation.

To compete in this market, it is important to gain credibility and demonstrate your experience with a high number of referrals from past clients. Attending trade shows and networking events can help build relationships with business owners who are considering switching to solar.

Unlike residential systems, commercial installations are usually larger and require a longer installation process. Once the system is in place, maintenance and monitoring services are key to ensuring optimal performance and efficiency. You should look for a company that has extensive maintenance and O&M resources, and is experienced with large commercial projects. This can include a comprehensive warranty, preventative maintenance, and periodic performance reviews.

Maintenance

When commercial solar panels are not properly maintained, they may begin to experience a drop in electricity production. This can be a sign that there is an issue with the system’s communication circuit, which could be caused by a variety of factors. If you notice a decline in your energy output, it’s important to contact a maintenance service for inspection and cleaning.

A preventative maintenance plan is key to the success of your commercial solar power system. It should include physical assessments, solar system performance monitoring and reporting, and warranty and support services. A well-crafted PV O&M strategy will optimize performance and accelerate the investment payback of your solar project.

A good O&M team will utilize a central platform for managing maintenance requests and dispatching field teams. This will ensure that maintenance requests are fulfilled as quickly and efficiently as possible. This will prevent performance issues, increase system reliability and reduce operational costs. Also, it will help maintain optimal production and extend the lifespan of your PV installation.

0 notes

Text

Commercial Solar Services

Commercial solar services are offered to a variety of businesses and organizations. These include companies, schools, churches, hospitals, local government agencies and nonprofits. Energy costs are a major expense for most of these entities, and they are eager to cut costs. Solar power is a good solution for these organizations and offers many benefits like reducing electric bills, tax credits and MACRS depreciation. Additionally, the installation process is quick and affordable.

The cost of solar systems has continued to decrease and is now very competitive with utility rates. This has spurred an increased interest in solar among businesses of all sizes. Fortunately, a number of financing options are available to help alleviate the upfront investment required for a commercial solar system. These include a solar PPA, a lease and a loan. The type of financing option you choose will depend on your ability to pay upfront and your desired cash flow over time.

Whether you opt for a roof-mounted or ground-mounted commercial solar system, the process begins with an audit and walk-through of your property by the commercial solar installation team. This allows them to gather information about the facility, including roof dimensions and structural elements. They will then design a system that meets the specific needs of your business.

When the final plan is complete, the project will move to permitting. This process is different from state to state, and can be complicated by the size of your system, local government requirements, and other factors. Depending on the complexity of your solar project, it may take anywhere from a few weeks to a few months for all permits to be issued.

After the permitting is completed, your commercial solar system will be connected to your electrical grid. Electricity will flow from the inverters, and your electric meter will track the amount of electricity your system produces and the amount used at your facility. If you produce more than your facility needs, your utility will compensate you for the surplus through net metering.

A commercial solar system can be made up of a large number of panels, each with multiple cells. Typical residential solar panels have 60 or 72 cells, while a commercial solar panel can contain up to 96 cells.

In addition to a wide range of installation options, commercial solar systems can also be installed on a variety of roof types. This includes flat and sloped metal, composition shingle, and even Spanish tile roofs. Solar technology has advanced to allow for this versatility, and commercial solar providers can work with any roof structure.

There are a number of incentives for businesses that go solar, and these can cover 45-80% of your total system cost. These incentives include federal, state and local rebates and incentives. These are combined with tax credits and MACRS depreciation, which can make going solar a smart financial decision for any business.

S.F.R. Electrical PTY LTD is a professional electrical company that has been in the industry for more than 30 years. The business was founded in 2006 and is a family run business. We specialise in the provision of professional electrical and solar services for both commercial and residential premises. We have great experience and incredible workmanship when it comes to the provision of electrical services.

#commercial solar services#commercial solar maintenance#industrial electrical maintenance services#6.6kw solar system

0 notes

Text

yamato 2199 all Garmilas dialogue in Dapna

ep 2

Dast rucsetegh ne skar Gerh egh üacser Balan.

Dast uïeath ubhosci. Na ath eg adre echi apkerlisas rucset ne üobrid.

Dast theisurhe cou!

Macrerh couer

ïunabamhin macr üacserreyden!

Rucseuch

Dast zinpera cien!!

ep 4

crumamhin dhes ne cuate

ep 5

ubhosci 4. uracec mai

nausuec laru tay 5

ubhosci 8. uracec mai

nausuec laru tay 4

_

odéc egrin ïara! arécda 40 naïicegh

Ep 8

Cobher omedherch min

Math sauréc, reinma eghi cobher mat ducerch ba lath ma omedhar cluen ne ceuen üacseren a deu Garmilas!

Cen math obéc lath, cobher motlach.

A cdeychurh lather edha.

Grudachma!

Pladhe Garmilas! Pladhe Dethlar

Ep 10

Dast souciec ather edha, macrafin!

Ather Garmileu rucsauabh!

Ep 11

Uderch! Dast cenhaghath ïintheci

Ucta crath! 7 net, cenhamhin! Macr

Uctargi!!

Ep 14

Acliamhin! 5 4 3 2 1

Acle

Ep 18

Cisvaras dou! Na ather cghulie?

Cenhoda bach, otes netseicmha!

Plouta rucséc! Dast cenhoudéc sauraci cbheu cighel!

Creusach, ïoucr tare.

0 notes

Text

How Commercial Solar Can Lower Your Electricity Costs

Commercial solar can help your business save thousands of dollars on electricity costs. Federal and local incentives-tax credits, accelerated depreciation, grants and rebates-can offset installation costs.

Larger commercial systems typically require planning permission and may need a large roof area. These systems produce energy on a 24/7 basis and so can require battery storage solutions.

1. Lower Energy Costs

For example, many companies are now offering their employees the opportunity to buy and install commercial solar installation sydney on their homes at reduced rates via a platform like Geostellar. This arrangement is a natural extension of their existing sustainability efforts and helps to attract and retain employees who care about the environment. It also shows that the company is invested in their team members and their community.

Business owners can take advantage of a federal investment tax credit that reduces the cost of a solar power system by 30%. State and utility company incentives like net metering can further reduce or eliminate the upfront cost of investing in solar.

In addition, a commercial solar system is 100 percent sustainable, which reduces emissions that degrade air, water, and soil quality. This is especially important for companies that depend on fossil fuels to produce their energy. Depending on the size of your system and your energy consumption, you can also make money by selling excess solar energy back to the utility grid under net metering programs.

2. Environmentally Friendly

Commercial solar is one of the most environmentally friendly ways to power your business. It lowers energy costs and decreases reliance on fossil fuels, which reduces carbon dioxide emissions. It also offers battery storage, which means your business can continue to operate during a power outage.

Fossil fuel-based electricity generates greenhouse gases that degrade the air, water, and soil quality. Solar energy eliminates this harm by limiting the amount of harmful GHG emissions.

Consumers are increasingly looking to support and work with sustainability-minded companies. This may boost your brand image and attract new customers. It can even help you win new supplier and vendor contracts. Additionally, the reduced operational costs from using a commercial solar system can reduce your OpEx. This can lead to increased profit, and in turn, more cash flow for your company.

3. Increased Productivity

The solar tax credit (ITC) is a valuable incentive that can significantly reduce your installation costs. Combined with the MACRS depreciation incentive, this allows commercial and nonprofit organizations to recover about 70% of their investment in a solar panel system in year one!

Agricultural operations, dairy farms, and other businesses using lots of electricity can reduce their power costs significantly with commercial solar. By generating energy on-site, businesses become immune to power company price increases.

Adding a storage component to your commercial solar project increases energy savings. By shaving peak demand, you can see substantial bill savings if your organization is on a demand charge utility rate.

Solar panels also bolster a brand’s image, demonstrating to consumers and stakeholders that your company is committed to sustainability and transitioning to renewable energy. This is increasingly important as consumer demands shift toward environmentally friendly products and services. Lastly, a professional energy audit will give your business an in-depth breakdown of how you use energy in your building, helping you identify the best ways to save.

4. Increased Employee Retention

Having a robust talent retention strategy is an important part of managing high quality solar industry teams. It is a key driver of employee satisfaction and productivity.

One great way to do this is by putting in place long-term employee incentive programs. Ambitious employees like to see their hard work and dedication rewarded, especially when that rewards comes with a direct financial upside.

5. Increased Productivity

With solar energy, businesses can significantly reduce their reliance on the grid. This not only helps reduce electricity prices but also eliminates the risk of power outages that could interrupt productivity.

Commercial projects can be more complex, with many different stakeholders involved. Getting everyone on board with a green initiative can be difficult, but the long term benefits of going solar are worth it.

Fortunately, federal and state tax incentives make it more affordable for businesses to go solar than ever before. With the ITC and MACRS (Modified Accelerated Cost Recovery System), companies can save up to 70% on their solar project costs. Additionally, with solar’s low energy rates, a company can be cash flow positive within a year. This includes savings from reduced utility costs and a predictable energy price for the entire system’s 30-year lifespan.

0 notes

Text

Passagem de Fortaleza para Porto Alegre: Um Guia Rápido para Viajantes Frequentes

Planeje sua viagem de Fortaleza para Porto Alegre com facilidade.

Você é um viajante frequente em busca de aventuras emocionantes pelo Brasil? Se sim, você veio ao lugar certo! Neste guia rápido, vamos explorar como conseguir passagens de Fortaleza para Porto Alegre, destacando as melhores opções e dicas para tornar sua viagem suave e agradável. Afinal, quem não ama um bom passeio pelo país? 🌴🌞

1. Encontrando as Melhores Ofertas de Passagem de Fortaleza para Porto Alegre

Você pode encontrar as melhores ofertas de passagem de Fortaleza para Porto Alegre de maneira rápida e fácil. Aqui estão algumas dicas para economizar dinheiro:

- Reserve com antecedência: Comprar suas passagens com antecedência pode resultar em tarifas mais baixas.

- Use comparadores de preços: Sites como Kayak e Skyscanner, ou o comparador da milhas travel são ótimos para comparar as tarifas de diferentes companhias aéreas.

- Aproveite programas de fidelidade: Se você é um viajante frequente, considere se inscrever em programas de fidelidade para acumular milhas e obter descontos.

2. Voos Diretos ou com Escala de Fortaleza para Porto Alegre?

Quando se trata de voos de Fortaleza para Porto Alegre, você tem duas opções: voos diretos ou voos com escala. A escolha depende do seu tempo e orçamento:

- Voos diretos: São mais rápidos, mas podem ser mais caros.

- Voos com escala: Podem ser mais econômicos, mas lembre-se de que você fará uma parada no caminho.

3. Escolhendo a Melhor Época para Viajar de Fortaleza para Porto Alegre

Agora que você sabe como encontrar boas ofertas, é importante escolher a melhor época para sua viagem. O clima em Porto Alegre é ameno durante todo o ano, mas se você prefere temperaturas mais quentes, considere viajar entre dezembro e março.

4. Acomodações em Porto Alegre

Depois de garantir suas passagens, é hora de pensar onde ficar em Porto Alegre. Aqui estão algumas opções populares:

- Hotéis no Centro: Ficar no centro da cidade coloca você perto de atrações como o Mercado Público e a Catedral Metropolitana.

- Bairros à Beira do Rio: Bairros como Moinhos de Vento oferecem vistas deslumbrantes do Rio Guaíba e ótimos restaurantes.

5. Atividades em Porto Alegre

Porto Alegre tem muito a oferecer, desde cultura até gastronomia. Não deixe de explorar:

- Museu de Arte Contemporânea (MACRS): Uma jóia arquitetônica com exposições impressionantes.

- Churrascarias Gaúchas: Experimente um autêntico churrasco gaúcho em um dos restaurantes locais.

6. Tabela de Comparações de Passagens entre Fortaleza para Porto Alegre

Aqui está uma tabela prática que compara as opções de voos de Fortaleza para Porto Alegre:

Companhia Aérea

Tipo de Voo

Preço Médio

Duração do Voo

Azul

Direto

R$ 600

3 horas

Latam

Com Escala

R$ 450

4-5 horas

Gol

Direto

R$ 620

3 horas

7. Pronto Para Decolar de Fortaleza para Porto Alegre?

Agora que você tem todas as informações necessárias, está pronto para planejar sua viagem de Fortaleza para Porto Alegre. Lembre-se de reservar com antecedência, explorar as melhores ofertas e aproveitar ao máximo sua estadia na encantadora Porto Alegre!

Mas antes de partir, não se esqueça de conferir mais dicas de viagem em Milhas Travel e garantir que sua jornada seja inesquecível!

FAQ sobre Passagens de Fortaleza para Porto Alegre

1. Qual é a melhor época para encontrar passagens baratas?

A melhor época para encontrar passagens baratas é geralmente com antecedência, especialmente se você planeja viajar durante a baixa temporada.

2. Há alguma companhia aérea que oferece voos diretos?

Sim, a Azul e a Gol oferecem voos diretos de Fortaleza para Porto Alegre.

3. Porto Alegre é um destino seguro para viajar?

Sim, Porto Alegre é geralmente considerada uma cidade segura para os turistas, mas é sempre bom tomar precauções normais durante a sua estadia.

Read the full article

0 notes

Text

With lower electricity costs and reduced carbon emissions, businesses that switch to commercial solar system Nerang experience both financial rewards and a boost to their public image. The right commercial solar system can also help organizations qualify for significant tax incentives.

These include a 30% federal Investment Tax Credit and Modified Accelerated Cost Recovery System (MACRS) depreciation for businesses that own their systems.

Installation

A commercial solar energy system provides access to a clean, renewable source of electricity that helps reduce operating expenses. It is connected to the local utility grid, and excess energy can be stored for later use. This can be especially helpful for businesses that are vulnerable to power outages and other natural disasters.

The process of installing a commercial solar system begins with a thorough evaluation of the property. This includes shade analysis and structural evaluations, as well as determining how many panels the property can accommodate and the construction details.

Because of the complexity, this phase can take a few months to over a year for large companies that need a larger system. The cost per watt of the solar panel system is lower for commercial sites than it is for homes, thanks to economies of scale. This means that you can expect to recoup your investment much faster than for residential systems. It is also possible to add an energy storage system, which allows you to store energy in the form of a battery and then release it as needed.

Commissioning

The commissioning process is often baked into the installation cost of a PV system. For that reason, it may be tempting to skip this step. But it’s a critical part of the project that ensures the system will be delivering energy as expected for decades to come.

Solar PV commissioning is a final inspection and testing phase before the PV system can be connected to the power grid. This is also where the system receives its ‘permission to operate’ from the utility company serving your site.

Local AHJ inspectors will inspect the system for things like electrical, fire, and seismic compliance. SunPeak will coordinate these inspections and manage any paperwork or certification required to bring the system online. Additionally, the team will conduct performance verification testing by allowing the system to run for 72 hours and compare its expected output to actual production. This will help identify any potential equipment issues such as ground faults (which cause stray current to flow to the ground, causing a fire risk) and wired inverter polarities.

Maintenance

Once a commercial solar system has been installed, commissioned and connected to the grid, business owners should establish preventative maintenance plans. Performing regular physical inspections, and documenting any observations can help business owners spot issues before they become major problems. The use of a monitoring platform can also provide insights into solar energy output over varying time periods.

While solar panels essentially capture sunlight, the inverters are necessary for turning this direct current into alternating current that can be used for powering businesses and household appliances. Having these components maintained is essential for the longevity of your commercial solar system. Additionally, it’s important to trim overgrown vegetation to ensure that sunlight is able to reach the panels. It’s also a good idea to have your panels cleaned regularly. Rain, hail, dust and debris can all impact the performance of a solar system. This is especially true if they’re exposed to the elements for long periods of time.

Financing

Adding solar to your business is an investment that starts to put money back into your bottom line immediately. Whether you choose to purchase your system outright with cash or take advantage of federal incentives through an SSA/PPA, the right financing model can align your financial goals with clean energy initiatives.

Solar loan programs are available to organizations with good credit that are looking to maximize the tax benefits of their project. These loans offer flexible terms, allowing the owner to deduct the interest from their taxes and build equity in their system over time.

Leases and PPAs are third-party owned arrangements that enable businesses to minimize upfront costs while enjoying the benefits of solar energy. These types of contracts typically have 20 year term and often include annual escalators. The agreements also allow you to benefit from net metering. A variety of lease programs are available to organizations with different tax statuses, including partnerships flips and sale leaseback arrangements.

0 notes

Text

Day 5-6: Square knot

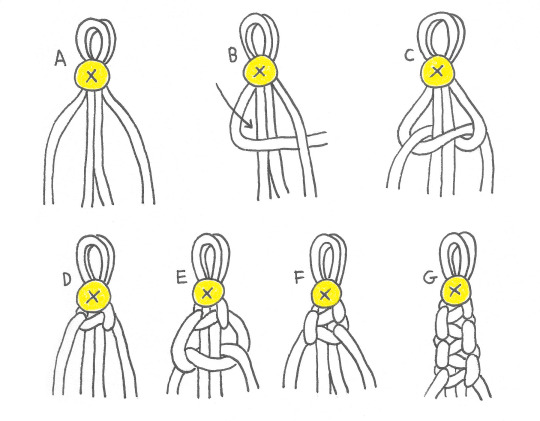

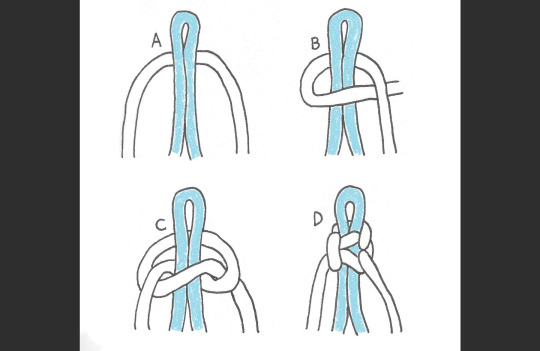

The square knot is one of the most basic knots in macrame, and one of my favorites! They're fast to build and are commonly used as a background knot in a bunch of more complicated patterns. It consists of base strings (usually two) and two strings that wrap around the outside.

A) Start with an overhand knot. The two strings in the center are the base cords, 1 PL each, and the two on the outside will form the knot. For a project of all square knots the outside cords are 3 PL each.

B) Take the left string and fold it over the base cords and then under the right string. This forms an armpit on the left side, arrowed.

C) Move the right string under the base cords and through the armpit.

D) Tighten

E) Follow steps B and C again except in the opposite direction. Start with the right cord folded over the base cords.

F) Tighten to complete one square knot.

G) Repeat steps B through F for multiple square knots.

BTW look for the last completed vertical loop nub on the side, it will be the same side as the next string that goes over the base cords.

A completed square knot (step F) has the nub on the left, so the left cord will start the next knot. At step D the nub is on the right.

A basic square knot project will look like this:

/\/\/\/\/\

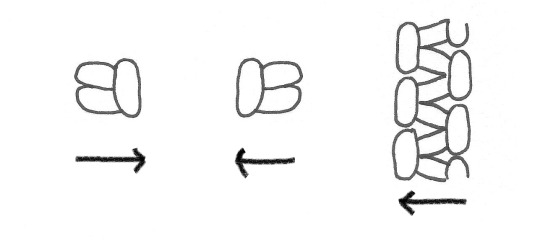

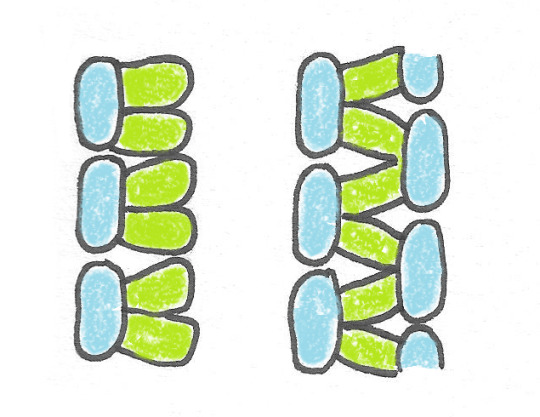

^ In my diagrams I draw a square knot in the same shape as a lark's head knot. The knots Do have a similar shape on their own.

You can tell them apart by their string interactions- a square knot is fours strings going in and four strings going out, to make an asterisk shape. A lark's head is two strings interacting in a T shape. In diagrams I will also color-code the lark's head knots orange.

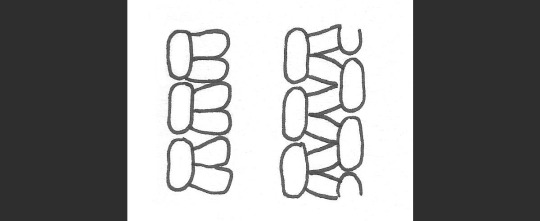

^ In a series of square knots I will only draw the vertical loop on one side, like the drawing on the left. Although the project will look more like the drawing on the right, the left drawing it's easier to count the number of individual knots.

/\/\/\/\/\

Square knot starter:

You can use a square knot to add the outside cord without securing it with an overhand knot. Great for having only one loop at the start of a project, starting extra square knots in weird places, or just making the start look a little smoother. Be aware that without the overhand knot the square knot can slide along the base cords.

A) Place the outside cords under the base cords. Be careful, the halfway points will be hard to maintain without the overhand knot but you can adjust the strings when the knot is closer to tightening.

B) Move the left cord over the base and under the right like you would for a regular square knot.

C) Fold the right cord under and through the armpit. This is where you would check the outside cords to make sure the left and right are the same length, before tightening.

D) Once the first square knot is completed this is where you would make sure the base cords are the same length.

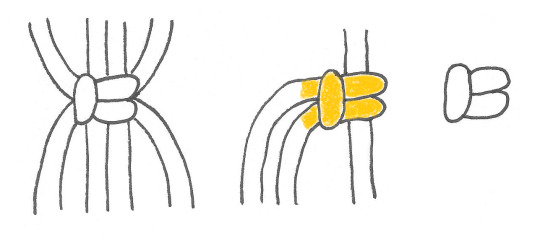

/\/\/\/\/\

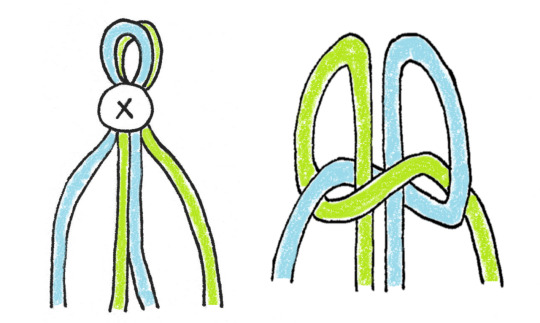

If you want the outside cords to be different colors you can fold the strings so that one cord is both a base and outside string. I highly recommend an overhand knot though because it gets really hard to tell where the bend point is located; a quarter of the way down.

It will look like this:

Note the color change of vertical and horizontal loops halfway though. You can change how the colors present by whether the first knot in a series starts with the left cord or the right.

(Macre-May Prompt list)

2 notes

·

View notes

Text

A Miaoqian Câmera de vídeo digital profissional 4K Ultra HD é uma câmera de vídeo de mão de alta qualidade, projetada para atender às necessidades dos profissionais de vídeo. Com sua resolução 4K Ultra HD, ela captura imagens nítidas e detalhadas, proporcionando uma experiência visual imersiva.

Equipada com um sensor CMOS avançado, a câmera oferece uma excelente qualidade de imagem, mesmo em condições de pouca luz. Isso permite que você capture vídeos de alta definição, com cores vibrantes e detalhes precisos.

Além disso, a Miaoqian Câmera de vídeo digital profissional possui uma lente grande angular de 0,45X, que permite capturar uma área maior em cada quadro. Isso é especialmente útil para filmar paisagens, eventos esportivos ou qualquer situação em que você queira capturar mais elementos em uma única imagem.

A câmera também vem com um microfone estéreo embutido, que garante uma qualidade de áudio excepcional. Ele capta o som de forma clara e precisa, permitindo que você grave vídeos com um som imersivo e realista.

Além disso, a Miaoqian Câmera de vídeo digital profissional possui uma função macro, que permite capturar imagens em close-up com detalhes impressionantes. Isso é perfeito para fotografar objetos pequenos, como flores, insetos ou qualquer coisa que exija uma abordagem mais próxima.

Com sua construção robusta e ergonômica, a câmera é fácil de segurar e operar. Ela também possui uma tela LCD de alta resolução, que permite visualizar e reproduzir seus vídeos com facilidade.

Em resumo, a Miaoqian Câmera de vídeo digital profissional 4K Ultra HD é uma escolha ideal para videomakers profissionais que desejam capturar imagens de alta qualidade. Com sua resolução 4K, sensor CMOS avançado, lente grande angular, microfone estéreo e função macro, ela oferece recursos avançados para atender às suas necessidades de gravação de vídeo.

0 notes

Text

Tax Planning Strategies for Real Estate Investors and Property Owners

Tax planning is a crucial aspect of real estate accounting investment and property ownership. Implementing effective tax strategies can help real estate investors and property owners minimize their tax liabilities, maximize returns, and optimize their overall financial position. In this article, we will discuss essential tax planning strategies that can benefit real estate investors and property owners.

Introduction

Real estate investors and property owners can significantly benefit from tax planning strategies that help minimize tax burdens and maximize profits. By understanding the intricacies of real estate taxation and implementing effective strategies, investors can optimize their financial position and enhance long-term investment success.

Understanding Real Estate Taxation

Before diving into tax planning property management accounting strategies, it is crucial to have a solid understanding of real estate taxation. Real estate investors and property owners may encounter various taxes, including income tax, property tax, capital gains tax, and potentially others at the federal, state, and local levels. Familiarize yourself with the specific tax obligations and regulations that apply to your real estate investments and properties.

Structuring Investments for Tax Efficiency

One effective tax planning strategy is to structure real estate investments in a way that maximizes tax efficiency. Consider factors such as the type of entity (e.g., limited liability company, partnership, or corporation) through which you hold the properties. Each structure has different tax implications, so consult with a tax professional to determine the most advantageous approach based on your specific circumstances.

Taking Advantage of Depreciation

Depreciation is a valuable tax benefit available to real estate investors. It allows you to deduct a portion of the property's value over its useful life, reducing taxable income. Understanding depreciation rules and methods, such as the Modified Accelerated Cost Recovery System (MACRS), can help you optimize tax deductions. Work with a qualified tax advisor to ensure accurate depreciation calculations.

Utilizing 1031 Exchanges

A 1031 exchange, also known as a like-kind exchange, provides an opportunity for real estate investors to defer capital gains taxes when selling one property and acquiring another similar property. By reinvesting the proceeds from the sale into a qualified replacement property, investors can defer tax liabilities and potentially increase their investment portfolio without a significant tax burden. Engage a qualified intermediary and follow the IRS guidelines for successful 1031 exchanges.

Leveraging Tax Deductions

Real estate investors and property owners can take advantage of various tax deductions to reduce their taxable income. Deductible expenses may include mortgage interest, property taxes, insurance premiums, repairs and maintenance costs, professional fees, and certain operating expenses. Keep detailed records and consult with a tax professional to ensure you claim all eligible deductions.

Hiring a Qualified Accountant or Tax Advisor

Navigating the complexities of real estate taxation requires expertise. Consider hiring a qualified accountant or tax advisor with experience in real estate to provide guidance on tax planning strategies, ensure compliance with tax laws, and help optimize your overall tax position. A professional can help you identify tax-saving opportunities specific to your real estate investments and properties.

Staying Updated with Tax Laws and Regulations

Tax laws and regulations are subject to change, and staying informed is crucial for effective tax planning. Keep abreast of tax law updates, new regulations, and potential tax incentives or credits relevant to real estate investments. Regularly consult tax resources, attend seminars, and engage with industry professionals to stay updated and make informed decisions.

Keeping Accurate and Organized Records

Maintaining accurate and organized records is essential for successful tax planning. Keep track of income and expenses related to your real estate investments and properties. Store receipts, invoices, lease agreements, and other relevant documents in an organized manner. Accurate records will facilitate the preparation of tax returns, substantiate deductions, and provide a clear audit trail if necessary.

Conclusion

Tax planning is a vital aspect of real estate investment and property ownership. By implementing effective tax planning strategies such as structuring investments for tax efficiency, utilizing depreciation, leveraging 1031 exchanges, maximizing tax deductions, hiring qualified professionals, staying updated with tax laws, and maintaining accurate records, real estate investors and property owners can optimize their tax position, minimize liabilities, and maximize returns.

FAQs

What is a 1031 exchange, and how does it benefit real estate investors?

A 1031 exchange, or like-kind exchange, allows real estate investors to defer capital gains taxes when selling a property and acquiring a similar replacement property. It provides an opportunity to reinvest proceeds without incurring immediate tax liabilities.

What are some common tax deductions available to real estate investors?

Real estate investors can often deduct expenses such as mortgage interest, property taxes, insurance premiums, repairs and maintenance costs, professional fees, and certain operating expenses. Consult with a tax professional to ensure eligibility and proper documentation.

Is it necessary to hire a tax advisor for real estate tax planning?

While not mandatory, hiring a qualified accountant or tax advisor with real estate expertise can provide valuable guidance, ensure compliance with tax laws, identify tax-saving opportunities, and optimize your overall tax position.

How can I stay updated with tax laws and regulations relevant to real estate?

Stay informed by regularly consulting tax resources, attending seminars or webinars on real estate taxation, and engaging with industry professionals. Additionally, subscribe to newsletters or publications that provide updates on tax law changes.

Why is accurate record-keeping important for real estate tax planning?

Accurate and organized records substantiate income, expenses, and deductions related to your real estate investments. They facilitate tax return preparation, provide evidence for deductions, and create a clear audit trail if needed.

0 notes

Text

Tax Savings Tips For Small Business Owners

Tax savings are crucial for small business owners looking to maximize profits and maintain financial health. Here are practical tax savings tips tailored for small businesses:

Take Advantage of Deductions: Maximize deductions by ensuring you claim all eligible business expenses. These include rent, utilities, office supplies, travel expenses, professional fees, and salaries. Keep detailed records and receipts to substantiate these deductions during tax filing.

Consider Section 179 Deduction: Utilize the Section 179 deduction to expense the cost of qualifying business property, such as equipment and machinery, in the year it was purchased rather than depreciating it over time. This can provide immediate tax savings by reducing taxable income.

Leverage Qualified Business Income Deduction (QBI): If eligible, claim the QBI deduction, which allows small business owners to deduct up to 20% of their qualified business income from partnerships, S-corporations, sole proprietorships, and certain trusts and estates. This deduction can significantly lower taxable income.

Employ Family Members: Hiring family members can be advantageous as their salaries are deductible business expenses. This strategy not only reduces taxable income but also supports family members financially.

Contribute to Retirement Plans: Maximize contributions to retirement plans like SEP IRAs, Solo 401(k)s, or SIMPLE IRAs. Contributions are tax-deductible, reducing current taxable income while enabling retirement savings growth. Ensure contributions are made before the tax filing deadline for the applicable year.

Take Advantage of Tax Credits: Explore available tax credits such as the Research and Development Tax Credit, Work Opportunity Tax Credit, and Small Employer Health Insurance Credit. These credits directly reduce tax liability, providing valuable savings for qualifying activities and expenditures.

Monitor Inventory: Implement inventory management practices to accurately track and value inventory. Using methods like FIFO (First-In-First-Out) or LIFO (Last-In-First-Out) can impact taxable income by adjusting the cost of goods sold, potentially lowering taxable profits.

Timing of Income and Expenses: Strategically time receipt of income and payment of expenses to optimize tax liability. Delaying invoicing or accelerating deductible expenses into the current tax year can effectively manage taxable income.

Consider Bonus Depreciation and Depreciation Methods: Take advantage of bonus depreciation and accelerated depreciation methods (like MACRS) to write off the cost of eligible property faster. This can lead to immediate tax savings by reducing taxable income in the year of purchase.

Stay Updated on Tax Law Changes: Regularly review changes in tax laws and regulations that may impact your business. Consult with a tax advisor to understand new deductions, credits, or compliance requirements that can be leveraged for tax savings.

Use Losses Strategically: If your business incurs a net operating loss (NOL), consider carrying it back or forward to offset taxable income in profitable years. This can result in tax refunds or reduced tax liabilities in future years, depending on your business's financial situation.

Invest in Tax Planning: Engage a qualified tax professional offering tax planning for companies in Fort Worth TX to develop a proactive tax planning strategy tailored to your business. Their expertise can help identify opportunities for tax savings, ensure compliance, and optimize financial outcomes.

By implementing these tax savings tips, small business owners can effectively manage their tax obligations, reduce tax liability, and retain more earnings to reinvest in business growth and sustainability. Regular monitoring and adjustment of tax strategies in response to business changes and tax law updates are essential for long-term financial success.

0 notes

Text

Schutzlösung für KRITIS vor Cyberangriffen

Die Lösung PREVENT/OT erkennt mögliche Angriffswege zur Beeinträchtigung des Betriebs kritischer Infrastrukturen - KRITIS. Ihr neuartiger Ansatz nutzt KI, um „wie Angreifer zu denken“ und Wege innerhalb der IT und OT zu visualisieren, die zu kritischen Infrastrukturen führen.

PREVENT/OT ist Teil der Darktrace/OT-Produktfamilie. Sie schützt komplexe Industrieumgebungen vor bekannten und unbekannten Angriffen. Dabei nutzt sie selbstlernende KI, um Anlagen zu identifizieren sowie subtile Abweichungen zu erkennen, die auf eine Cyber-Bedrohung hinweisen. Die Lösung setzen derzeit viele KRITIS-Unternehmen in Bereichen wie Strom, Wasser, Öl und Gas, Schifffahrt und Transport ein.

Intelligenz sucht nach Angriffspfaden

„Bei einem unserer ersten Anwender fand Darktrace AI einen vollständigen, praktikablen Angriffspfad von einem öffentlichen E-Mail-Konto zu einer stark geschützten und aktiven programmierbaren Steuerung in der Produktion“, so Jeffrey Macre, Industrial Security Solutions Architect bei Darktrace. „Das Unternehmen wusste nicht, dass dieser Pfad existierte, der sowohl IT- als auch OT-Systeme umfasste. Einige Schritte waren nicht einfach durchzuführen, aber grundsätzlich hätte ein engagierter Angreifer diesem Weg folgen und die Steuerungslogik manipulieren, Alarme auslösen oder, noch schlimmer, Prozesse starten und stoppen können, um den Betrieb der gesamten Anlage zu beeinträchtigen. Wir sind stolz darauf, dass wir heute so viele KRITIS-Betreiber unterstützen, und freuen uns, ihnen diese neue Lösung bereitzustellen. Sie können damit die schlimmsten Angriffe verhindern, bevor sie geschehen. Wir sehen ein großes Interesse der Kunden an ihren Funktionen.“

ITSiG 2.0 gilt ab Mai 2023

Darktrace schützt bereits Kunden in allen 8 KRITIS-Bereichen, die vom BSI in Deutschland benannt wurden. Die Abschlüsse unterstreichen den Paradigmenwechsel, der sich weltweit vollzieht. Denn Behörden führen immer neue Vorschriften ein, die einen robusteren Cyberschutz in kritischen Branchen wie dem Gesundheits- und Finanzwesen, der Energie- und Chemiebranche fordern. Dazu zählt in Deutschland das IT-Sicherheitsgesetz 2.0, das zum 1. Mai 2023 in Kraft tritt.

Passende Artikel zum Thema

Lesen Sie den ganzen Artikel

0 notes