#Memorandum and Articles of Association

Explore tagged Tumblr posts

Text

Comprehensive Guide to the Memorandum and Articles of Association (MEMART)

#Articles of Association#Company#MEMART#Memorandum and Articles of Association#Memorandum of Association

0 notes

Text

Understanding MoUs, Legal Notices, Power of Attorney, and Non-Solicitation Agreements in Civil Law

In the context of civil law, written agreements together with legal documents serve to eliminate misunderstandings and safeguard rights. Starting a business or assigning representatives or managing employment relations requires proper legal documents as an essential practice. Four commonly used civil law tools are the Memorandum of Understanding (MoU), Legal Notice, Power of Attorney, and Non-Solicitation Agreement. This blog provides an explanation of their definitions along with their essential importance.

Memorandum of Understanding (MoU)

The Memorandum of Understanding (MoU) functions as written documentation that establishes mutual understanding between multiple parties before they enter into formal agreements. The purpose of this tool is to ensure that all parties reach an agreement on identical points before signing the final contract.

Why a Memorandum of Understanding (MoU) is Useful:

The document assists in preventing misunderstandings during the contract formation process.

The document provides an explanation of what the agreement entails.

The document defines the specific duties and responsibilities assigned by every involved entity.

The document aids in developing plans for what comes next.

An MoU functions as proof of mutual commitment between parties despite its potential lack of legal contract status.

Legal Notice

A Legal Notice serves as an official communication from one individual or company to another which starts a legal matter. This letter allows the recipient to resolve the issue before pursuing court action.

When to Use a Legal Notice:

When a person does not pay money that is owed.

When there is a property dispute.

When there is a problem at work.

When someone breaks a cntract.

Before starting a civil case, a Legal Notice functions as the initial action.

Power of Attorney

Through a Power of Attorney document which is legally binding, one individual can authorize another person to handle personal and financial as well as legal affairs. When someone grants power they become the principal while the recipient becomes the agent.

Types of Power of Attorney:

General Power of Attorney: Gives the agent wide powers.

Special Power of Attorney: Gives the agent powers for only specific tasks.

Durable Power of Attorney: Stays valid even if the principal becomes sick or unable to act.

The Power of Attorney becomes useful when somebody cannot attend to vital responsibilities.

Non-Solicitation Agreement

The Non-Solicitation Agreement prohibits people or organizations from attempting to acquire the staff members or customers from a business. Companies use this agreement when their employees move on or when they end their business relationship with other organizations.

Why a Non-Solicitation Agreement is Important:

It protects companies from losing their employees and clients.

It prevents businesses from competing unfairly.

It serves to protect business partnerships.

Both parties need to sign a Non-Solicitation Agreement which must use clear language to prevent potential problems.

Conclusion

The civil legal system provides essential mechanisms that defend rights and solve problems. Legal tools such as the Memorandum of Understanding (MoU), Legal Notice, Power of Attorney and Non-Solicitation Agreement function as basic yet effective instruments to control legal duties and minimize conflict possibilities. Knowledge about these tools allows both individual persons and organizations to operate their activities efficiently with assured confidence.

#Non-Disclosure Agreement (NDA)#Non solicitation Agreement#Employment Agreement#Partnership Deed#Memorandum of Association#Articles of Association#Memorandum of Understanding (MoU)Legal Notice#Power of Attorney#Master Service Agreements

0 notes

Text

New Company Registration Consultant in Lucknow | MY STARTUP SOLUTION

Would you like a new company registration consultant in Lucknow? Are you an aspiring entrepreneur? Congratulations for making this important move toward your dream fulfillment! But with so many rules and regulations to follow, managing the complex business registration procedure can be intimidating. Don't worry, though, as we at MY STARTUP SOLUTION are here to make this process easier for you.

Being a top Lucknow company registration expert, we are aware of the difficulties prospective business owners encounter. Our team of professionals is committed to offering you full help at every stage, from comprehending the legal framework to guaranteeing compliance with regulatory obligations.

Why Choose MY STARTUP SOLUTION?

Expert Guidance: With years of experience in the industry, our team consists of seasoned professionals who possess in-depth knowledge of new company registration consultant in Lucknow. We will guide you through the entire process, ensuring that all necessary documents are prepared and submitted accurately and efficiently.

Personalized Approach:

At MY STARTUP SOLUTION, we understand that every business is unique, and therefore, we tailor our services to meet your specific requirements. Whether you are a sole proprietorship, partnership, or a private limited company, we offer customized solutions that cater to your needs.

Timely Assistance:We value your time and strive to expedite the registration process without compromising on quality. Our proactive approach ensures that your company registration is completed within the stipulated time frame, allowing you to focus on other aspects of your business.

Transparent Communication: We believe in maintaining open and transparent communication with our clients throughout the registration process. Our dedicated consultants are always available to address any queries or concerns you may have, ensuring a smooth and hassle-free experience.

Cost-effective Solutions: Starting a new business involves various expenses, and we understand the importance of cost-effectiveness. Our competitive pricing ensures that you receive high-quality services at affordable rates, making us the preferred choice for entrepreneurs in Lucknow.

Our Services:

Company Name Reservation: Choosing the right name for your company is crucial, as it represents your brand identity. Our experts will assist you in selecting a unique and meaningful name that complies with the regulations set forth by the Registrar of Companies (ROC).

Preparation of Documents: From drafting the Memorandum of Association (MOA) and Articles of Association (AOA) to obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN), we take care of all documentation requirements on your behalf.

Filing of Application: Once all necessary documents are prepared, we will file the application for company registration with the ROC. Our meticulous attention to detail ensures that the application process is smooth and error-free, minimizing the risk of rejection or delays.

Follow-up and Compliance: Our support doesn't end with the registration process. We will continue to assist you in fulfilling post-registration formalities, such as obtaining the Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN), and ensuring compliance with statutory regulations.

Additional Services: In addition to company registration, we also offer a range of supplementary services, including GST registration, trademark registration, and business consulting, to help you establish and grow your business effectively.

Embark on Your Entrepreneurial Journey with Confidence:

Starting a new company is undoubtedly a significant milestone, but it doesn't have to be a daunting task. With the right guidance and support, you can navigate the complexities of company registration with ease. At MY STARTUP SOLUTION, we are committed to empowering entrepreneurs in Lucknow to realize their business goals and aspirations.

So why wait? Take the first step towards entrepreneurship today and partner with us to turn your vision into reality. Contact us now to learn more about our new company registration consultant in Lucknow and embark on your entrepreneurial journey with confidence.

Contact us for more details: +91 8795224400

Visit Now: www.mystartupsolution.in

#Digital Signature Certify#Memorandum Of Association#Articles Of Association#Permanent Account Number

0 notes

Text

NBFC (Non-Banking Financial Company) Registration — Fees, process, Documemnts Required

NBFCs or Non-Banking Financial Company are registered under the Companies Act 1956/Companies Act 2013. Though these do not possess a banking license, yet are involved in various financial services. Some of the services include:

Loan and credit facilities

Asset Financing

Acquisition of shares/stocks/bonds

Hire-purchase

Insurance business

Chit business

Currency exchange

Peer-to-peer lending

Hedge funds

*Classification of NBFC

Asset Finance Company (AFC)

Investment Company (IC)

Loan Companies (LC)

Infrastructure Finance Company (IFC)

Systematically Important Core Investment Company

Infrastructure Debt Fund (IDF-NBFC)

Mutual benefit financial company

Micro Finance Institution (NBFC-MFI)

Housing Finance Company

Core Investment Company

*Documents Required for NBFC Registration

Significant documents required for NBFC Registration in India are as follows:

Documents related to the administration and management of the company

Company Incorporation Certificate

The Memorandum of Association and the Articles of Association of the applicant-company or firm

Documents describing the location of the company

Detailed information about Directors or Partners of the Company

Accounts of the company well-audited for the last three consecutive years

Board Resolution in favor of NBFC formation

Should have a bank Account with a minimum paid-up equity share capital of INR-2 Crore

Income tax PAN, etc.

To know more (click here)

#nbfc#nbfc registration#memorandum of association#article of association#business#business growth#manage business#startup#india#partnership firm registration#nidhi company registration#private limited company registration in chennai#private limited company registration in bangalore

0 notes

Text

S. Baum at Erin In The Morning:

“There is a radical ideological agenda being pushed throughout every aspect of American life,” Attorney General Pamela Bondi wrote. The radical ideology of, according to Bondi, “gender.” On April 23, Bondi issued a memorandum seeking to turn President Donald Trump’s crackdown on trans-affirming health care providers via executive order into a reality. The document was obtained and released in full by legal reporter Chris Geidner but has not been independently verified by Erin in the Morning.

It is only “an internal memorandum from the attorney general — guidance implementing an earlier anti-transgender executive order from President Donald Trump that has itself already been partially enjoined in multiple courts,” Geidner wrote. In other words, it does not hold the weight of law, but it may empower anti-trans officials to further target trans-affirming health care by zeroing in on providers—or at least give them the appearance of being emboldened, which could lead more hospitals to veer into the trend of overcompliance out of fear of potential litigation. Titled “Preventing the Mutilation of American Children,” the memo starts by rattling off a series of false and misleading anti-trans talking points. It calls “transgenderism” a far-left “ideology” which has “infected an entire generation of children.” Here is what this means for trans Americans.

The memo bolsters disinformation about trans health care and its impacts.

Bondi’s memo says trans-affirming medical providers “profited” while their patients “struggle for the rest of their lives to overcome regret.” It cites articles from the New York Times, Fox News, and the New York Post; stories that in turn platformed anti-trans pseudoscience. One such piece, for example, cites dubious statistics assembled by Do No Harm, a Southern Poverty Law Center-designated hate group. The memo also makes false claims about the prevalence of “empirical data” when it comes to the efficacy and safety of gender-affirming care for trans people, which categorically shows that, like any other health intervention, access to quality care leads to quality results. Countless debunks exist showing that transition “regret” is a widely mischaracterized and often overstated phenomenon. A recent survey of 90,000 trans people, for example, shows the vast majority of people are “satisfied” with receiving gender-affirming care. Most if not all major medical associations in the United States and across the globe agree that gender-affirming care is life-affirming and life-saving medical care.

It seeks to mobilize the Attorney General’s office to implement Trump’s Executive Order 14187—a.k.a. “Protecting Children From Chemical and Surgical Mutilation”—using anti-FGM laws.

The memo threatens to target trans-affirming care providers under laws prohibiting female genital mutilation, or FGM, which Trump had vowed to do in his January executive order. “I am putting medical practitioners, hospitals, and clinics on notice: In the United States, it is a felony to perform, attempt to perform, or conspire to perform female genital mutilation (‘FGM’) on any person under the age of 18,” Bondi wrote. “That crime carries a maximum prison sentence of 10 years per count. I am directing all U.S. Attorneys to investigate all suspected cases of FGM—under the banner of so-called ‘gender-affirming care’ or otherwise and to prosecute all FGM offenses to the fullest extent possible.” It is not immediately clear what Bondi is referring to, as FGM is a particular kind of procedure performed for “non-medical reasons,” as per the United Nations. Gender-affirming “bottom surgery” performed on those assigned female at birth doesn’t meet the international criteria for FGM, and most hospitals can’t or won’t perform any kind of “bottom surgery” on a trans minor. (The irreversible, medically unnecessary surgeries performed on the genitalia of intersex children, however, continue to proliferate.) The Trump Administration also describes hormone therapies for trans people “chemical mutilation,” an echo of their rhetoric regarding FGM. It may reveal a glimpse into the GOP playbook for prosecuting HRT providers in the future.

[...]

It signals the government’s efforts to fortify anti-trans medical surveillance.

The memo says Bondi will “Establish [a] Federal and State Coalition Against Child Mutilation.” This is Bondi-speak meaning she wants the federal government and state collaborators to pool resources, creating a vast network capable of prosecuting health care providers. “Through this Coalition, I will partner with state attorneys general to identify leads, share intelligence, and build cases against hospitals and practitioners violating federal or state laws banning female genital mutilation and other, related practices,” Bondi wrote. It cites Alabama's Vulnerable Child Compassion and Protection Act, which makes it a felony for doctors to treat trans children with hormone therapy.

It says the AG’s office will support the creation and passage of new anti-trans laws.

Bondi says she has instructed the Office of Legislative Affairs to draft legislation “creating a private right of action for children and the parents of children whose healthy body parts have been damaged by medical professionals through chemical and surgical mutilation.” This empowers private citizens and anti-trans groups to file cases against trans-affirming health care providers. The proposed legislation “will establish a long statute of limitations and retroactive liability.” “Protecting America's children must be our top priority, whether from drug cartels, terrorists, or even our own medical community,” Bondi wrote. “Under my leadership, the Department of Justice will bring these practices to an end.”

Attorney General Pam Bondi’s memo on transgender care is full of anti-trans lies and distortions, such as falsely equating gender-affirming care to “mutilation.”

See Also:

The Advocate: Trump AG Pam Bondi falsely compares gender-affirming care for minors as the same as female genital mutilation

Law Dork: Read A.G. Bondi's memo purporting to implement Trump's anti-trans attacks

#Pam Bondi#Gender Affirming Healthcare#Transgender Health#Transgender#LGBTQ+#Do No Harm#Social Contagion Myth#Executive Order 14187#Female Genital Mutilation#Gender Confirmation Surgery

3 notes

·

View notes

Text

By Luke Rosiak

A Maryland school system knowingly used false information to discipline a Jewish teacher in response to her reporting to her principal that at a pro-Palestinian walkout — which the principal called “fantastic” — students praised Adolph Hitler and called for the death of Jews.

The Daily Wire reported in January that Paint Branch High School Principal Pam Krawczel gave excused absences to students to walk out of class in protest of Israel, and praised them even after the Muslim Student Association (MSA) faculty sponsor informed her that some made violent and genocidal remarks. In response, Krawczel falsely suggested that the MSA faculty sponsor, Brooke Meshel, was The Daily Wire’s source, doxxed a child, and took a photograph of students.

As a result, Montgomery County Public Schools (MCPS) has now prohibited Meshel from interacting with any member of the MSA, impeding her ability to teach her classes.

Krawczel knew the accusation was false because MCPS itself — not Meshel — was The Daily Wire’s source. Shortly after the highly-publicized walkout, the publication filed a public records request for Krawczel’s emails on the topic. The day the emails were received, this reporter emailed Krawczel asking her for comment, explaining that the story was based on the emails she had turned over.

Nonetheless, Krawczel summoned Meshel and drafted a “Summary of Concern” memo for her file, expressing “concern about the article posted in the Daily Wire in which Ms. Meshel was said to be the source.” Krawczel ordered Meshel to “reflect on the meeting” and stated that, “per this memorandum…. you are no longer to serve as the sponsor of MSA. Do not interact with any students in the MSA. Do not post any pictures of PBHS students.”

As evidence that Meshel was the source, Krawczel cited that an unnamed collection of students told her “Meshel had provided information to the writers” and told The Daily Wire “the whole event was anti-Semitic,” neither of which occured.

The letter also relied on another statement from a student that began, “to whom it may be concerned [sic], I have been asked to provide my statement on the article from the Daily Wire which has used my photograph without my permission,” claiming it “poses a threat to our lives.”

The student’s statement claimed, bizarrely, that a stranger appeared on campus distributing signs — from the Freedom Road Socialist Organization — and that the students decided to hold them and pose for photographs though the signs were “not representative of my personal or political views.” The photo was, in fact, proudly posted to Instagram by student walkout organizers, as the story made clear.

23 notes

·

View notes

Text

Representative Office in Thailand

A Representative Office (RO) serves as a non-revenue generating entity that allows foreign companies to establish a legal presence in Thailand without forming a full subsidiary. Governed by the Ministry of Commerce (MOC) and Foreign Business Act (FBA), ROs are ideal for:

Market research and business development

Coordination between headquarters and Thai partners

Quality control for regional suppliers

However, ROs face strict operational limitations—understanding these restrictions is critical before registration.

2. Legal Framework & Key Restrictions

Permissible Activities (Under MOC Notification No. 275)

An RO may only engage in:

Sourcing goods/services for its parent company

Inspecting/controlling quality of products ordered by HQ

Providing advisory support to HQ about Thai market

Disseminating information about new products/services

Reporting business trends to the parent company

Prohibited Activities (That Would Require a Full Company):

Direct sales, invoicing, or revenue generation

Signing contracts on behalf of the parent company

Providing services to third parties

Penalties: Violations can result in fines up to THB 1 million, imprisonment, or forced closure.

3. Registration Process: Step-by-Step Requirements

Phase 1: Pre-Registration Documentation

Parent Company Documents (notarized/apostilled):

Certificate of Incorporation

Memorandum & Articles of Association

Board Resolution authorizing RO establishment

Audited financial statements (last 3 years)

Thai Office Requirements:

Lease agreement (registered at Land Department)

List of intended expatriate staff

Phase 2: Ministry of Commerce Approval

Submit Application (Form Kor Tor 1) to MOC’s Business Development Department

Review Period: 30–60 days

Post-Approval: Register at DBD, Revenue Dept., and Social Security Office

Phase 3: Ongoing Compliance

Annual Audit Submission (even with no revenue)

Work Permits: Limited to 5 foreign employees

4. Tax & Financial Considerations

A. Tax Obligations

Corporate Income Tax: 0% (if compliant with RO restrictions)

Withholding Tax: 15% on remittances to HQ classified as "service fees"

VAT: Not applicable (no sales activity)

B. Capital Requirements

Minimum THB 5 million remitted to Thailand within first 3 years

Must maintain THB 2 million in a Thai bank account

C. Audit Requirements

Annual financial statements must be filed by a licensed Thai auditor

Transfer pricing documentation recommended for HQ transactions

5. Representative Office vs. Other Business Structures

CriteriaRepresentative OfficeRegional OfficeLimited CompanyAllowed RevenueNoYes (from affiliates)Yes (full operations)Tax LiabilityNone10% CIT (regional)20% CITCapital RequiredTHB 5MTHB 10MTHB 2M+Work PermitsMax 5No limitNo limit

Key Takeaway: An RO is not a substitute for a trading company—it’s a non-commercial liaison office.

6. Common Pitfalls & How to Avoid Them

A. Accidental Revenue Generation

Risk: Providing consultancy to local firms may be deemed as service income

Solution: Draft activity scope carefully in MOC application

B. Underestimating Compliance Costs

Hidden Fees: Auditor fees (~THB 50k/year), visa renewals, legal retainer

Budget: Minimum THB 1M/year for a compliant RO

C. Visa & Work Permit Issues

Expat Headcount: 5 is the absolute max—plan staffing accordingly

Local Hiring: Must have at least 1 Thai employee per foreign hire

7. When to Upgrade to a Regional/Branch Office

Consider transitioning if you need to: ✔ Generate revenue from affiliate companies ✔ Sign contracts locally ✔ Employ more than 5 foreigners

Upgrade Process: Requires new MOC approval and capital increase.

8. Expert Recommendations

For Market Entry:

Use an RO for 2–3 years to test the market before committing to a full subsidiary

Pair with a Thai distributor for actual sales

For Compliance:

Retain a Thai law firm to audit activities annually

Maintain separate bank accounts for HQ remittances

For Long-Term Strategy:

If scaling, convert to a BOI-promoted company for better incentives

Conclusion: Is a Representative Office Right for You?

A Thai RO offers low-risk market access but demands strict adherence to non-commercial activities. It’s ideal for:

Manufacturers vetting Thai suppliers

Tech firms exploring ASEAN expansion

Service companies needing a local liaison

Final Warning: Misuse can trigger FBA violations—always align activities with MOC approval. For complex cases, consult a Thai corporate lawyer before registration.

#thailand#corporate#thai#thailandcorporate#thaicorporate#representativeoffice#representativeofficeinthailand

2 notes

·

View notes

Text

Partner with the Best Company Incorporation Consultants in India for a Seamless Business Launch

Starting a new company in India is an exciting step, but incorporating your business correctly is crucial to long-term success. The legal and administrative requirements can be challenging without expert assistance. That’s why partnering with the best company incorporation consultants in India is a smart move for entrepreneurs and foreign investors looking to set up operations smoothly.

Why Expert Help Matters in Company Formation

India’s company registration process is governed by the Ministry of Corporate Affairs (MCA) and involves multiple legal formalities. Without professional help, it’s easy to overlook critical steps. A reliable consultant can guide you through:

Choosing the ideal business structure (Private Limited, LLP, OPC, etc.)

Securing Digital Signature Certificates (DSC) and Director Identification Numbers (DIN)

Getting company name approval

Drafting Memorandum and Articles of Association

Filing incorporation forms with the Registrar of Companies (ROC)

Applying for PAN, TAN, GST, and other registrations

These steps must be completed accurately and in a timely manner to avoid unnecessary delays.

Benefits of Hiring the Best Company Incorporation Consultants in India

The best company incorporation consultants in India provide tailored services that align with your business goals. Here are some key benefits:

✅ Strategic Legal Advice

They help determine the most appropriate legal structure for your business based on capital, risk, and ownership preferences.

✅ Full Regulatory Compliance

Professionals ensure all documentation and filings meet the latest MCA requirements.

✅ Hassle-Free Documentation

Consultants manage the entire paperwork process, reducing your burden.

✅ Faster Registration

With expert handling, your company can be registered in less time with fewer follow-ups.

✅ Specialized Support for Foreign Nationals

Consultants assist NRIs and foreign investors with FDI regulations, RBI guidelines, and FEMA compliance.

How to Choose the Right Consultant

To make sure you’re working with the best company incorporation consultants in India, look for:

Years of Experience: Established firms with a proven record offer greater reliability.

Wide Service Offerings: Top consultants provide incorporation plus legal, tax, and accounting support.

Responsive Communication: Choose a team that keeps you informed at every step.

Clear Pricing: Ensure all costs are disclosed upfront without hidden fees.

Core Services Offered

Most reputed incorporation consultants in India offer:

Entity type consultation

Name availability search and reservation

DSC and DIN processing

MOA and AOA drafting

MCA e-filing and registration

GST, MSME, PAN, and TAN registration

Annual ROC and tax compliance services

Conclusion

Your business deserves a strong foundation. With the support of the best company incorporation consultants in India, you can set up your company the right way—quickly, legally, and efficiently. Whether you're a local entrepreneur or a foreign investor, professional guidance will help you avoid pitfalls and focus on your growth.

Take the first step toward success—choose expert consultants for your company incorporation.

2 notes

·

View notes

Text

Company Registration India by Mercurius & Associates LLP

Introduction

Starting a business in India is an exciting journey, but navigating the legalities can be overwhelming. Company registration in India is a crucial step that provides legal recognition to your business. At Mercurius & Associates LLP, we offer expert guidance to simplify the company registration process, ensuring compliance with all regulatory requirements.

Types of Business Entities in India

Before registering a company, it is essential to understand the various types of business structures available:

Private Limited Company (Pvt Ltd) – The most preferred structure for startups and SMEs.

Public Limited Company – Suitable for large businesses looking to raise capital from the public.

Limited Liability Partnership (LLP) – Ideal for professionals and small enterprises.

One Person Company (OPC) – Best for single entrepreneurs seeking limited liability.

Sole Proprietorship – Simplest structure, but lacks legal distinction from the owner.

Partnership Firm – Suitable for small businesses with multiple owners.

Benefits of Registering a Company in India

Registering your business provides numerous advantages, such as:

Legal Recognition – Gives your business a distinct legal identity.

Limited Liability Protection – Safeguards personal assets from business risks.

Enhanced Credibility – Boosts trust among investors, customers, and partners.

Easy Fundraising – Enables access to bank loans, investors, and venture capital.

Tax Benefits – Offers various exemptions and deductions under Indian tax laws.

Step-by-Step Process of Company Registration India

Obtain Digital Signature Certificate (DSC)

The first step involves acquiring a DSC for all directors and shareholders. This is necessary for electronically signing registration documents.

Apply for Director Identification Number (DIN)

A DIN is a unique identification number required for individuals who wish to become company directors.

Name Reservation with RUN (Reserve Unique Name) Service

Choose a unique business name and get it approved through the MCA’s RUN service.

Draft and File Incorporation Documents

Prepare and submit the Memorandum of Association (MoA) and Articles of Association (AoA) along with Form SPICe+ on the MCA portal.

PAN & TAN Application

Upon successful verification, the company receives its Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

GST Registration & Compliance

If applicable, register for GST to ensure tax compliance and smooth business operations.

Open a Business Bank Account

After incorporation, open a corporate bank account to manage transactions under the company’s name.

Why Choose Mercurius & Associates LLP for Company Registration?

At Mercurius & Associates LLP, we provide end-to-end assistance in company registration with:

Expert Guidance – Our professionals simplify complex legal procedures.

Hassle-Free Processing – Quick and seamless company incorporation.

Affordable Pricing – Competitive pricing with no hidden charges.

Post-Registration Support – Ongoing compliance and legal advisory services.

Conclusion

Registering a company in India is a strategic move that offers multiple benefits. With Mercurius & Associates LLP, you can ensure a smooth and compliant company registration process tailored to your business needs. Contact us today to start your entrepreneurial journey!

2 notes

·

View notes

Text

Company Registration in Thailand

Thailand, a Southeast Asian gem, offers a lucrative business landscape for both domestic and international entrepreneurs. However, setting up a company in this vibrant nation requires careful consideration of legal and regulatory frameworks. This guide will walk you through the essential steps to successfully register your company in Thailand.

Types of Companies in Thailand

Limited Liability Company (LLC): The most common type for foreign investors, offering limited liability and flexibility.

Public Limited Company (PLC): Suitable for large-scale operations, requiring significant capital and public share offerings.

Key Steps to Company Registration

Reserve a Company Name:

Choose a unique name that complies with Thai regulations.

The Department of Business Development (DBD) will verify the availability.

Prepare Incorporation Documents:

Memorandum of Association (MoA): Outlines the company's objectives, capital structure, and shareholder details.

Articles of Association (AoA): Specifies the company's internal rules, procedures, and management structure.

Appoint Directors and Shareholders:

At least two directors and shareholders are required.

Consider appointing a local director to comply with specific regulations.

Obtain Necessary Approvals:

For certain industries, additional approvals from relevant government agencies may be necessary.

Register with the DBD:

Submit the required documents and pay registration fees.

The DBD will issue a Certificate of Incorporation upon successful registration.

Open a Corporate Bank Account:

Establish a bank account to facilitate financial transactions.

Register for Taxes:

Register with the Revenue Department for corporate income tax and value-added tax (VAT).

Essential Considerations

Foreign Business Act (FBA): If your business activities are restricted under the FBA, you may need additional licenses and permits.

Board of Investment (BOI): Consider applying for BOI privileges to enjoy tax incentives and other benefits.

Work Permits: Ensure compliance with work permit regulations for foreign employees.

Local Partner: In certain industries, a local partner may be required.

Seeking Professional Assistance

While it's possible to navigate the company registration process independently, engaging a legal and accounting firm specializing in Thai business law is highly recommended. They can provide expert guidance, streamline the process, and ensure compliance with all legal requirements.

By carefully following these steps and seeking professional advice, you can successfully establish your business in Thailand and capitalize on the country's thriving economy.

#company registration in thailand#thailand#corporate in thailand#business#business in thailand#businessthailand

2 notes

·

View notes

Text

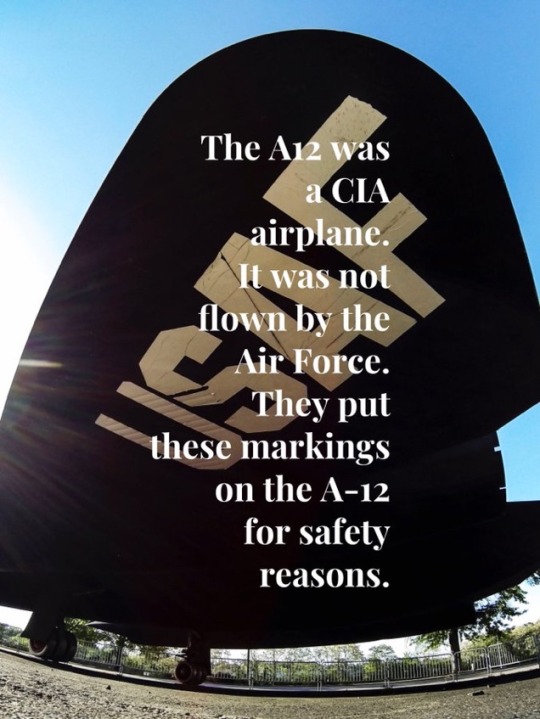

The CIA wanted to bring back the A-12 in 1972 to accelerate Sorties over the North Vietnam war coexisting with the SR 71. Existing weapons systems (EWS) A-12 would be required. Why did the CIA want to bring their oxcart A-12 out of mothballs? Perhaps it was because they wanted the end of the Vietnam War to come as soon as possible. Did this actually happen? I don’t think so . However, the CIA would never make it public. I found this article while researching declassified papers. The declassification was in 2007. I think it’s fascinating. I hope you do, too.~ Linda Sheffield

14 June 1972

Operational Considerations - Revival of OXCART

The following operational considerations are presented to assist you in preparing your memorandum to DDI on the subject of regeneration of the OXCART vehicle: a minimum of two aircraft and three pilots would be required with the potential for back to back or simultaneous missions. The aircraft is to be fully equipped with operational EWS. Existing weapon system

REQUIREMENT:

There is sufficient interest within CIA to warrant exploring the feasibility, cost and timing associated with regenerating an operational OXCART weapons system to be operated by a field unit under direction

of OSA. This regeneration to be accomplished so as to put an operational vehicle over a North Vietnam target in the shortest possible time.

BACKGROUND:

When the OXCART vehicles and program were put to bed in 1968

a complete "regeneration" package was placed in storage as well. This package contained operating procedures, mission directives, checklists, names of qualified personnel, etc. It did, in fact, contain all possible information which might be needed for program revival. It was

generally agreed that program regeneration in the first 6 months to a year could be fairly easy and rapid - after that time frame, recapture would become increasingly expensive, time consuming and difficult personnel wise. The OXCART aircraft and equipment went into storage in the June to September 1968 time frame on a 5/90 basis, i.e.,

ASSUMPTIONS:

A. Project would receive number one priority in personnel, funding and equipment.

B. Existing weapons system as put away could be brought out and would be useable, operationally capable. E . g . , no new EWS would be put in the aircraft.

C. Vulnerability assessment remains the same as when put

away.

D. That SR- 71 personal equipment and survival gear are compatible with OXCART airframe. This due to the OXCART seat being unsatisfactory and OXCART pressure suits no longer available.

That all types of qualified personnel are readily available, could be pitched and brought on board in minimum time with little or no security problems.

OPERATIONAL CONCEPT - TRAINING PHASE:

To provide a desirable level of operational capability, at least

two aircraft should be removed from storage and put into flying condition. Obviously, the more aircraft available, the higher the probability of achieving mission goals becomes.

Pilots could be drawn from the SR 71 program or former A-12 pilots could be recalled. In either case, the initial training phase would consist of extensive ground school on aircraft systems and

operating characteristics.

Four pilots should be selected initially for the two aircraft concept. The time required in this phase would be shorter if current SR-71 pilots were used because of the similarities

in basic aircraft systems and the fact that these pilots have the required personal equipment and high altitude physiological training.

The full article can be found here cia.gov/readingroom/do…

@Habubrats71 via X

16 notes

·

View notes

Text

Thai Limited Company Registration

Establishing a limited company in Thailand can be a strategic move for businesses seeking to operate within the country. This legal structure offers several advantages, including limited liability, tax benefits, and credibility. However, the registration process involves specific requirements and steps that must be followed meticulously.

Understanding the Thai Limited Company

A Thai limited company, often referred to as a "Company Limited" or "Co., Ltd.", is a legal entity separate from its shareholders. This separation provides shareholders with limited liability, meaning their personal assets are protected from the company's debts.

Key Steps to Registration

Company Name Reservation: The first step is to reserve a unique company name. The name must end with "Limited" or its Thai equivalent. Availability can be checked and reserved through the Department of Business Development (DBD).

Preparation of Documents: Several essential documents need to be prepared, including the Memorandum of Association, Articles of Association, and a list of shareholders and directors. These documents outline the company's objectives, structure, and management.

Statutory Meeting: A statutory meeting of shareholders must be held to approve the company's formation and appoint directors.

Registration: The completed documents, along with the necessary fees, are submitted to the DBD for registration. Upon approval, the company receives a registration certificate.

Tax Registration: The company must register for corporate income tax and value-added tax (VAT) with the Revenue Department.

Bank Account Opening: A corporate bank account is essential for conducting business transactions.

Required Documents and Information

Passport copies of shareholders and directors

Proof of address for shareholders and directors

Proposed company name

Registered office address

Share capital and share distribution

Business objectives

Considerations for Foreign Investors

Foreigners can own 100% of a Thai limited company in most industries. However, there are restrictions in specific sectors, such as media and agriculture. It's crucial to understand the foreign ownership limitations applicable to the intended business activity.

Benefits of a Thai Limited Company

Limited liability for shareholders

Clear legal structure

Tax advantages

Enhanced business credibility

Access to government incentives and support

Challenges and Considerations

Complex registration process

Ongoing compliance requirements, including financial reporting and tax filings

Potential for language and cultural barriers

While establishing a Thai limited company can be complex, understanding the process and seeking professional guidance can streamline the process and ensure compliance with legal requirements.

#lawyers in thailand#thailand#Thai Limited Company Registration#corporate in thailand#company registration in thailand#corporate lawyers in thailand

2 notes

·

View notes

Text

Comprehensive Guide to PRO Services in Dubai

Comprehensive Guide to PRO Services in Dubai

Dubai, a bustling metropolis and a global business hub, is renowned for its favorable business environment and strategic location. However, navigating the legal and bureaucratic landscape can be complex for entrepreneurs and expatriates. This is where PRO (Public Relations Officer) services come into play. This blog provides an in-depth look at PRO services in Dubai, their significance, and how they can facilitate your business operations.

What Are PRO Services?

PRO services in Dubai are specialized administrative services designed to assist individuals and businesses in handling governmental procedures and documentation. These services are crucial for ensuring compliance with local regulations, obtaining necessary permits, and managing paperwork efficiently.

Key Functions of PRO Services

Document Processing and Filing

Business Licenses: PRO services handle the application and renewal of various business licenses required to operate legally in Dubai.

Visas: They assist in securing work permits, residence visas, and other necessary visas for employees and dependents.

Trade Licenses: Assistance with obtaining and renewing trade licenses specific to your business activity.

Government Relations

Ministry Interactions: PROs act as intermediaries between your business and various governmental bodies, including the Ministry of Human Resources and Emiratization (MOHRE) and the Department of Economic Development (DED).

Regulatory Compliance: Ensuring your business complies with local regulations, such as labor laws and commercial regulations.

Company Formation

Company Registration: Facilitating the registration process of new businesses, including free zone and mainland company setups.

Documentation: Preparing and submitting required documents for company formation, such as Memorandums of Association and Articles of Incorporation.

Legal and Compliance Services

Labor Contracts: Drafting and managing labor contracts in compliance with UAE labor laws.

Trade Marks: Registering and renewing trademarks to protect intellectual property.

Visa Services

Employee Visas: Processing work visas for employees and ensuring they meet the criteria set by the UAE authorities.

Family Visas: Assisting expatriates with obtaining family visas for their dependents.

Renewals and Updates

License Renewals: Handling the renewal of business and trade licenses before they expire.

Document Updates: Updating records and documents with the relevant authorities as required.

Benefits of Using PRO Services

Expertise and Efficiency

PRO service providers have extensive knowledge of local regulations and procedures, ensuring that all paperwork is handled correctly and efficiently.

Time-Saving

Outsourcing administrative tasks to PRO services allows businesses to focus on core activities and strategic goals, saving valuable time.

Regulatory Compliance

Ensuring compliance with complex and frequently changing regulations can be challenging. PRO services help avoid legal issues and potential fines by staying up-to-date with current laws.

Local Knowledge

PROs have a deep understanding of the local business environment and can navigate the intricacies of governmental processes more effectively than outsiders.

Stress Reduction

Handling bureaucratic processes can be stressful. PRO services alleviate this burden, reducing administrative stress for business owners and expatriates.

2 notes

·

View notes

Text

Business Registration in India Made Easy with Mercurius & Associates LLP

India has rapidly emerged as a global business hub, attracting entrepreneurs, startups, and international corporations. With a booming economy, a vast consumer base, and pro-business reforms, registering a business in India is a smart move for anyone looking to establish or expand operations in the country. However, the legal and regulatory framework can be complex for new entrants. That’s where Mercurius & Associates LLP comes in — offering expert guidance and end-to-end support for seamless business registration in India.

Why Business Registration in India Matters

Registering a business in India is the first legal step to making your venture official. It offers several advantages:

Legal recognition under Indian law

Access to banking, credit, and investment opportunities

Eligibility to apply for government tenders and subsidies

Protection of the company name and brand

Enhanced credibility with customers and investors

Whether you're a solo entrepreneur or a multinational company, formal business registration builds trust and opens doors to growth.

Types of Business Entities You Can Register in India

Mercurius & Associates LLP helps you choose the right legal structure based on your goals, ownership, and tax preferences. Common types include:

✅ Private Limited Company

Ideal for startups and growing businesses. Offers limited liability and attracts investors easily.

✅ Limited Liability Partnership (LLP)

A hybrid structure combining flexibility and limited liability. Preferred for professional services and partnerships.

✅ One Person Company (OPC)

Perfect for solo entrepreneurs who want the benefits of a private company without needing partners.

✅ Sole Proprietorship

Simplest form of business; suited for small and unregistered businesses.

✅ Partnership Firm

Great for two or more individuals operating a business with shared responsibilities and profits.

✅ Branch Office/Wholly Owned Subsidiary (for foreign companies)

Allows international companies to establish a presence in India.

Why Choose Mercurius & Associates LLP?

When it comes to business registration in India, Mercurius & Associates LLP stands out for its personalized, professional, and legally compliant approach. Here’s why thousands of clients trust them:

✅ End-to-End Assistance

From choosing the right business structure to filing all necessary documentation and approvals, Mercurius & Associates LLP handles everything.

✅ Expert Legal & Tax Advisors

With a team of seasoned chartered accountants, company secretaries, and legal professionals, you get expert advice every step of the way.

✅ Quick & Hassle-Free Process

Time is money. Mercurius ensures a fast, smooth, and transparent registration process, minimizing delays and errors.

✅ PAN India Services

No matter where you are located, Mercurius offers business registration support across all major Indian cities.

✅ Post-Incorporation Support

Need help with GST registration, bank account setup, or accounting services? They’ve got you covered beyond registration.

Business Registration Process in India with Mercurius & Associates LLP

Consultation & Entity Selection Understand your needs and choose the best business structure.

Name Reservation & DSC Application Apply for the company name (via RUN or SPICe+) and Digital Signature Certificates (DSC).

Document Preparation & Filing Draft Memorandum and Articles of Association and file with the Ministry of Corporate Affairs (MCA).

Company Incorporation Certificate Get your Certificate of Incorporation (COI) and Company Identification Number (CIN).

Post-Registration Services Assistance with PAN, TAN, GST, and business bank account opening.

Documents Required for Business Registration in India

PAN Card and ID proof of directors/partners

Address proof of business premises

Passport-size photographs

Utility bills (for address verification)

MOA & AOA (for companies)

DSC (Digital Signature Certificate)

Ready to Register Your Business in India?

Don’t let the paperwork and legalities slow you down. Partner with Mercurius & Associates LLP for reliable, professional, and efficient business registration in India. With years of experience and a client-first approach, Mercurius ensures that your business journey begins on the right foot — legally sound and future-ready.

📞 Contact Mercurius & Associates LLP today and get your business registered without stress!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

2 notes

·

View notes

Text

"Attack on American Free Enterprise System"

That about adding Regan's inauguration got me to thinking. I wonder of there's a correlation between the recipients of The Powell Memo and financial contributors to Ronald Reagan's election campaign.

On August 23, 1971, less than two months before he was nominated to serve as an Associate Justice of the Supreme Court of the United States, Lewis F. Powell, Jr. mailed a confidential memorandum to his friend Eugene B. Sydnor, Jr., Chair of the Education Committee of the U.S. Chamber of Commerce. The memo was titled Attack On American Free Enterprise System and outlined ways in which business should defend and counter attack against a "broad attack" from "disquieting voices."

Initially the memo was viewed, and praised, by only a select few within the Chamber. That all changed on September 28 & 29, 1972, when the leaked document was the topic of negative treatment in syndicated newspaper columnist Jack Anderson's Washington Merry Go Round. With quotations from the document now public, the Chamber published it in full in Washington Report, the Chamber's newsletter. An off-print of the memo was made available to anyone requesting it from the Chamber.

Interest in the memorandum was revived in the early 1990s. The Alliance for Justice's 1993 report, Justice for Sale, mentions it prominently. The case for the memo being a seminal document in the neoconservative movement in the U.S. was made in 2000 with the publication of John B. Judis’s The Paradox of American Democracy. The Internet became a medium for access to the memo and for posting articles about it. Mediatransparency.org was one of the first World Wide Web sites to feature the memo, as was the official site of the U.S. Chamber of Commerce. Today the memo is both credited as having "changed America" and scorned as being "far out of touch with the concerns and structures of the current right."

Whatever it's influence, it has been and remains today the single most requested document in the Lewis F. Powell, Jr. Papers. On the fortieth anniversary of its creation, the Powell Archives has here assembled links to the memo and related documents from the Powell Papers. Lyman Johnson, Robert O. Bentley professor of law at Washington and Lee university School of Law, also wrote this piece in commemoration of this anniversary.

2 notes

·

View notes

Text

Bank Account Setup in Seychelles

Bank Account Setup in Seychelles: Everything You Need to Know (2025 Guide)

Opening a bank account in Seychelles is a strategic move for international entrepreneurs, offshore companies, and investors seeking financial privacy, asset protection, and ease of global transactions. This guide covers everything you need to know about the bank account setup in Seychelles, from types of accounts to documents required and benefits.

Why Set Up a Bank Account in Seychelles?

Seychelles, a thriving offshore financial center, offers secure and flexible banking options for individuals and businesses. Here’s why Seychelles stands out:

Political and economic stability

Strict banking confidentiality laws

Multi-currency accounts available

Remote account opening (in some cases)

Ideal for international business transactions

Who Can Open a Bank Account in Seychelles?

You can open a Seychelles bank account if you are:

An individual (resident or non-resident)

A Seychelles International Business Company (IBC)

A foreign company registered in Seychelles

A trust or foundation

Both personal and corporate accounts are available, but requirements vary.

Types of Bank Accounts in Seychelles

Account TypeDescriptionPersonal AccountFor individuals, with options for local or foreign currency accounts.Corporate AccountDesigned for businesses and offshore companies operating globally.Multi-Currency AccountAllows transactions in USD, EUR, GBP, etc., beneficial for international trade.Merchant AccountFor businesses that accept online payments and need payment gateway support.

Documents Required for Seychelles Bank Account Setup

For Personal Accounts:

Valid passport copy

Proof of address (utility bill or bank statement)

Bank reference letter or financial statement

Source of funds declaration

For Corporate Accounts:

Certificate of Incorporation

Memorandum & Articles of Association

Business plan or nature of business

Passport and address proof for directors/shareholders

Company structure and ownership documents

Source of funds and expected transaction volume

Note: Additional documents may be required depending on the bank’s due diligence process.

Step-by-Step Guide to Opening a Bank Account in Seychelles

Step 1: Choose the Right Bank

Seychelles has several local and international banks, including:

Absa Bank Seychelles

Nouvobanq

MCB Seychelles

Al Salam Bank

Bank of Baroda

Some banks specialize in offshore accounts, while others focus on local businesses.

Step 2: Submit Your Application

You can apply either in-person or through a licensed intermediary or agent, especially if you're opening a corporate offshore account.

Step 3: Compliance and Due Diligence

The bank will conduct a thorough KYC (Know Your Customer) and AML (Anti-Money Laundering) check. This can take 1 to 3 weeks depending on the complexity of the case.

Step 4: Approval and Account Activation

Once approved, you’ll receive your account number, internet banking credentials, and other related materials. Some banks also provide debit cards and multi-currency support.

How Long Does It Take to Set Up a Bank Account in Seychelles?

On average, the account opening process takes:

Personal Account: 5 to 10 business days

Corporate Account: 10 to 20 business days (subject to documentation)

Remote account opening is possible but may take slightly longer due to notarization and courier requirements.

Benefits of Seychelles Bank Account

✅ High Level of Privacy and Confidentiality

✅ Global Banking Access

✅ No Exchange Control

✅ Asset Protection Opportunities

✅ Tax-Efficient Environment for Offshore Companies

Challenges and Things to Consider

Stringent compliance: Offshore accounts require transparent documentation and a legitimate source of funds.

Some banks may have a minimum deposit requirement, usually between $5,000 to $10,000 USD.

Not all Seychelles banks offer remote account setup – it’s best to work through a registered agent.

Final Thoughts

Setting up a bank account in Seychelles is a smart financial move for global entrepreneurs and offshore companies. It provides access to international banking with strong privacy laws and efficient services. Whether you’re managing assets, operating an IBC, or expanding your international trade, Seychelles offers a solid and stable banking environment.

Pro Tip: To ensure a smooth setup process, consult a trusted offshore services provider or financial advisor familiar with Seychelles banking regulations.

0 notes