#Micro Atm Machine

Explore tagged Tumblr posts

Text

Easy Cash Deposits & Withdrawals with AePS by Spice Money...

Now do cash deposits or withdrawals easily with AePS through Spice Money. No need for ATM or bank visit—just Aadhaar and fingerprint are enough. Safe, fast, and available in even remote villages. Local Adhikaris help people do banking near home. AePS is bringing smart banking to every doorstep.

visit now - https://spicemoney.com

#AEPS#aeps debit facility#AEPS Cash Withdrawal#Best AEPS Services Provider company#aeps registration#aeps portal#aadhaar pay#Domestic money transfer#money transfer business#bank transfer app#cash transfer app#money transfer applications#best money transfer app in india#instant money transfer service#online money transfer#payment transfer#mini atm#mini atm machine#mini atm machine with fingerprint#mini atm services#micro atm#micro atm machine#micro atm cash withdrawal#micro atm services#micro atm device

2 notes

·

View notes

Text

Finkeda Micro ATM: Easy Banking for All

Enable instant cash withdrawals and balance checks with Finkeda Micro ATM. A reliable solution for merchants, rural users & doorstep banking services. For more information visit : https://finkeda.com/micro-atm/

0 notes

Text

Micro ATM Machine- Everything You Need to Know

A micro ATM or Smaller-than-usual ATM is a convenient, handheld card swipe terminal used to administer cash, which bank ATMs can’t reach. A Smaller than usual ATM works as an exceptional “Bank-in-a-Crate”, permitting clients to pull out money and know their equilibrium.

This installment arrangement is aimed at taking branchless banking to the last mile. micro ATMs, similarly as the name recommends, are more modest compact renditions of ATMs and can assist you with supporting your pay with the insignificant venture as the micro ATM price is meager and profits are high.

0 notes

Text

How to Choose the Right Micro ATM Service Provider for Your Needs?

In today's world, financial transactions need to be fast, secure, and accessible to everyone. As Micro ATM Services grow in popularity, selecting the right Micro ATM Services Provider is essential for businesses and individuals looking to benefit from these compact and efficient banking solutions. This guide explores key factors to consider when choosing the right provider and highlights the impact of technology-driven solutions.

Understanding Micro ATM Services Providers

A Micro ATM Services Provider is a company or entity that supplies, operates, and maintains Micro ATM devices for business correspondents or other users. These providers play a pivotal role in extending banking services to remote areas by offering hardware, software, and operational support. Choosing a reliable provider ensures that transactions are secure, seamless, and efficient.

Key Factors to Consider When Choosing a Micro ATM Services Provider

1. Reliability and Reputation The reputation of a provider is critical. Research their track record and client testimonials. Providers with proven reliability can ensure consistent uptime and minimal technical issues. Established names in the industry often have better infrastructure and support systems.

2. Range of Services Offered Different providers offer varying levels of services. Ensure that the provider offers a comprehensive package, including cash withdrawals, deposits, balance inquiries, and fund transfers. Some providers also enable utility bill payments and government subsidies distribution. This versatility adds value to the service.

3. Technology and Security Advanced technology is at the core of any successful Micro ATM Services Provider. Look for providers that offer secure devices equipped with biometric authentication and encryption. Technology-driven providers, such as Xettle Technologies, leverage cutting-edge solutions to ensure reliable and safe transactions. Such features are essential to building trust among users.

4. Business Software Integration For businesses, seamless integration with existing systems is crucial. Check whether the provider offers compatible Business Software that simplifies transaction management and reporting. This integration can save time and reduce errors in operations.

5. Customer Support and Training A good provider should offer robust customer support and training programs for operators. This includes resolving technical issues, providing user manuals, and conducting workshops to train business correspondents. Proper training ensures smooth operations and better service delivery.

6. Cost and Pricing Models Evaluate the cost structure of the provider. While affordability is important, it is equally crucial to assess the value offered. Compare pricing models, maintenance charges, and transaction fees among multiple providers to find one that suits your budget and needs.

7. Scalability and Customization As your business grows, your needs might change. Choose a provider that offers scalable solutions and customizable features. This flexibility ensures that the services remain relevant and useful in the long term.

The Role of Technology in Selecting a Provider

Technology is the backbone of Micro ATM Services. Providers that invest in state-of-the-art technology deliver faster, more secure, and reliable services. For instance, companies like Xettle Technologies lead the industry with innovative solutions that enhance user experience. Their focus on secure software, user-friendly interfaces, and robust connectivity ensures seamless financial transactions, even in areas with limited infrastructure.

Benefits of Choosing the Right Micro ATM Services Provider

1. Improved Customer Satisfaction A reliable provider ensures efficient and error-free transactions, which improves customer trust and satisfaction. End-users are more likely to adopt formal banking channels when they experience secure and hassle-free services.

2. Enhanced Financial Inclusion By choosing a dependable Micro ATM Services Provider, businesses can extend banking services to unbanked and underbanked populations. This not only promotes financial inclusion but also fosters economic growth in remote areas.

3. Streamlined Business Operations For businesses, the integration of Micro ATM systems with business software simplifies financial management. Automated reporting, transaction tracking, and reduced manual errors contribute to operational efficiency.

4. Increased Profitability A good provider offers cost-effective solutions that enable businesses to maximize their returns. Affordable maintenance and transaction fees, coupled with reliable service, ensure sustainable profitability.

Challenges in Selecting a Provider

While the benefits are clear, selecting the right provider can be challenging. Connectivity issues in remote areas, varying service quality among providers, and hidden costs are common obstacles. Thorough research and due diligence can help mitigate these

2 notes

·

View notes

Text

Best Deals on Aadhaar Micro ATM Machines | Lowest Prices in India

Get the best micro ATM devices at unbeatable prices in India. Explore our range of mini ATM machines with Aadhaar integration, ensuring seamless transactions at the lowest cost.

#aadhaar micro atm price#Best micro atm device#Mini ATM Machine at Lowest Price#Mini ATM Machine in India

0 notes

Text

Catapult CPLT-BW-E 'EM4' (aka 'Creole')

This ‘Mech started off as an unremarkable CPLT-K2, but by the time of its first deployment, was a K2 in name only. Creole was developed in tandem with its pilot as part of the Blackwell Heavy Industries’ experimental Enhanced MechWarrior program, and was the sole such BattleMech developed and deployed, as the revelation of its pilot's existence set in motion events that would resonate beyond Helios, and ultimately help shape the early days of the new Star League... and also ensure the downfall of Blackwell itself.

Creole featured a mixed weapon loadout with answers for threats at any range, and an extensive EWAR suite to back up the well-rounded armament. What set it apart, however, was its unique cockpit configuration. Engineered specifically for use by its pilot EM4, she was as much part of the ‘Mech as the ‘Mech was part of her. A suite of proprietary Blackwell vDNI technology known as the Vehicular Advanced Neural Interface Layered Link Apparatus - or VANILLA - connected her to her pilot at such a deep level that it was hard to determine if the ‘Mech was an extension of the pilot, or the pilot an extension of the ‘Mech. In addition, Creole had cleanroom-grade cockpit filters and an airlock to accommodate its pilot's sensitivity to non-sterile environments.

Though the pair performed extremely well in all simulated environments, Operation TOUCHDOWN was the first time Creole would see an actual combat drop. After being given a clean bill of health by the SLDF MechTechs, the 'Mech would show what Blackwell’s finest - if also most unethical - minds were capable of.

(Creole was designed by yours truly, but belongs to @sapphic-design-is-my-passion / @the-emmapult. Art was done by the ever talented @cromwell300!)

TRO below the cut:

Catapult CPLT-BW-E 'EM4' (aka 'Creole')

Mass: 65 tons

Chassis: Composite Biped

Power Plant: 260 XL

Cruising Speed: 43.2 kph

Maximum Speed: 64.8 kph

Jump Jets: Standard

Jump Capacity: 60 meters

Armor: Ferro-Fibrous

Armament:

2 Micro Pulse Laser

1 Improved Heavy Large Laser

2 Heavy Machine Gun

1 Heavy Machine Gun Array

1 Snub-Nose PPC

2 Improved ATM 3

Manufacturer: Unknown

Primary Factory: Unknown

Communication System: Unknown

Targeting & Tracking System: Unknown

Introduction Year: 3153

Tech Rating/Availability: F/X-X-X-X

Cost: 17,721,688 C-bills

Type: Catapult

Technology Base: Mixed (Experimental)

Tonnage: 65

Battle Value: 1,919

Equipment Mass

Internal Structure Composite 3.5

Engine 260 XL 7

Walking MP: 4

Running MP: 6

Jumping MP: 2

Double Heat Sink 15 [30] 5

Compact Gyro 4.5

Small Cockpit 2

Armor Factor (Ferro) 211 11

Internal Armor

Structure Value

Head 3 9

Center Torso 21 32

Center Torso (rear) 10

R/L Torso 15 23

R/L Torso (rear) 7

R/L Arm 10 20

R/L Leg 15 30

Right Arm Actuators: Shoulder, Upper Arm

Left Arm Actuators: Shoulder, Upper Arm

Weapons

and Ammo Location Critical Heat Tonnage

2 Heavy Machine Gun CT 2 0 1.0

Heavy Machine Gun Array CT 1 0 0.25

Jump Jet RT 1 - 1.0

CASE RT 0 - 0.0

Extended-Range iATM/3 Ammo (20) RT 1 - 1.0

Standard iATM/3 Ammo (40) RT 2 - 2.0

High-Explosive iATM/3 Ammo (20) RT 1 - 1.0

Micro Pulse Laser RT 1 1 0.5

Improved ATM 3 LA 2 2 1.5

Snub-Nose PPC LA 2 10 6.0

2 Double Heat Sink LA 4 - 2.0

Targeting Computer LT 3 - 3.0

Jump Jet LT 1 - 1.0

Heavy Machine Gun Ammo (300) LT 3 - 3.0

CASE LT 0 - 0.0

Double Heat Sink LT 2 - 1.0

Micro Pulse Laser LT 1 1 0.5

Armored Cowl (Armored) HD 1 - 1.0

Nova Combined Electronic Warfare System HD 1 - 1.5

Direct Neural Interface Cockpit Modification None 0 - 0.0

Improved ATM 3 RA 2 2 1.5

CASE RA 0 - 0.0

2 Double Heat Sink RA 4 - 2.0

Improved Heavy Large Laser RA 3 18 4.0

Features the following design quirks: Battle Computer, Combat Computer, Cowl, Improved Communications, Improved Life Support, Improved Sensors, Multi-Trac, Variable Range Targeting, Cramped Cockpit, Difficult Ejection, Hard to Pilot, No/Minimal Arms, Non-Standard Parts, Prototype

18 notes

·

View notes

Text

CPLT-BW-E "EM4" (aka "Creole")

This ‘Mech started off as an unremarkable CPLT-K2, but by the time of its first deployment, was a K2 in name only. Creole was developed in tandem with its pilot as part of the Blackwell Heavy Industries’ experimental Enhanced MechWarrior program, and was the sole such BattleMech developed and deployed, as the revelation of its pilot's existence set in motion events that would resonate beyond Helios, and ultimately help shape the early days of the new Star League... and also ensure the downfall of Blackwell itself.

Creole featured a mixed weapon loadout with answers for threats at any range, and an extensive EWAR suite to back up the well-rounded armament. What set it apart, however, was its unique cockpit configuration. Engineered specifically for use by its pilot EM4, she was as much part of the ‘Mech as the ‘Mech was part of her. A suite of proprietary Blackwell vDNI technology known as the Vehicular Advanced Neural Interface Layered Link Apparatus - or VANILLA - connected her to her pilot at such a deep level that it was hard to determine if the ‘Mech was an extension of the pilot, or the pilot an extension of the ‘Mech. In addition, Creole had cleanroom-grade cockpit filters and an airlock to accommodate its pilot's sensitivity to non-sterile environments.

Though the pair performed extremely well in all simulated environments, Operation TOUCHDOWN was the first time Creole would see an actual combat drop. After being given a clean bill of health by the SLDF MechTechs, the 'Mech would show what Blackwell’s finest - if also most unethical - minds were capable of.

(Creole was designed by yours truly, but belongs to @sapphic-design-is-my-passion / @the-emmapult . Art was done by the ever talented @cromwell300 !)

TRO below the cut:

Catapult CPLT-BW-E 'EM4' (aka 'Creole')

Mass: 65 tons

Chassis: Composite Biped

Power Plant: 260 XL

Cruising Speed: 43.2 kph

Maximum Speed: 64.8 kph

Jump Jets: Standard

Jump Capacity: 60 meters

Armor: Ferro-Fibrous

Armament:

2 Micro Pulse Laser

1 Improved Heavy Large Laser

2 Heavy Machine Gun

1 Heavy Machine Gun Array

1 Snub-Nose PPC

2 Improved ATM 3

Manufacturer: Unknown

Primary Factory: Unknown

Communication System: Unknown

Targeting & Tracking System: Unknown

Introduction Year: 3153

Tech Rating/Availability: F/X-X-X-X

Cost: 17,721,688 C-bills

Type: Catapult

Technology Base: Mixed (Experimental)

Tonnage: 65

Battle Value: 1,919

Equipment Mass

Internal Structure Composite 3.5

Engine 260 XL 7

Walking MP: 4

Running MP: 6

Jumping MP: 2

Double Heat Sink 15 [30] 5

Compact Gyro 4.5

Small Cockpit 2

Armor Factor (Ferro) 211 11

Internal Armor

Structure Value

Head 3 9

Center Torso 21 32

Center Torso (rear) 10

R/L Torso 15 23

R/L Torso (rear) 7

R/L Arm 10 20

R/L Leg 15 30

Right Arm Actuators: Shoulder, Upper Arm

Left Arm Actuators: Shoulder, Upper Arm

Weapons

and Ammo Location Critical Heat Tonnage

2 Heavy Machine Gun CT 2 0 1.0

Heavy Machine Gun Array CT 1 0 0.25

Jump Jet RT 1 - 1.0

CASE RT 0 - 0.0

Extended-Range iATM/3 Ammo (20) RT 1 - 1.0

Standard iATM/3 Ammo (40) RT 2 - 2.0

High-Explosive iATM/3 Ammo (20) RT 1 - 1.0

Micro Pulse Laser RT 1 1 0.5

Improved ATM 3 LA 2 2 1.5

Snub-Nose PPC LA 2 10 6.0

2 Double Heat Sink LA 4 - 2.0

Targeting Computer LT 3 - 3.0

Jump Jet LT 1 - 1.0

Heavy Machine Gun Ammo (300) LT 3 - 3.0

CASE LT 0 - 0.0

Double Heat Sink LT 2 - 1.0

Micro Pulse Laser LT 1 1 0.5

Armored Cowl (Armored) HD 1 - 1.0

Nova Combined Electronic Warfare System HD 1 - 1.5

Direct Neural Interface Cockpit Modification None 0 - 0.0

Improved ATM 3 RA 2 2 1.5

CASE RA 0 - 0.0

2 Double Heat Sink RA 4 - 2.0

Improved Heavy Large Laser RA 3 18 4.0

Features the following design quirks: Battle Computer, Combat Computer, Cowl, Improved Communications, Improved Life Support, Improved Sensors, Multi-Trac, Variable Range Targeting, Cramped Cockpit, Difficult Ejection, Hard to Pilot, No/Minimal Arms, Non-Standard Parts, Prototype

12 notes

·

View notes

Text

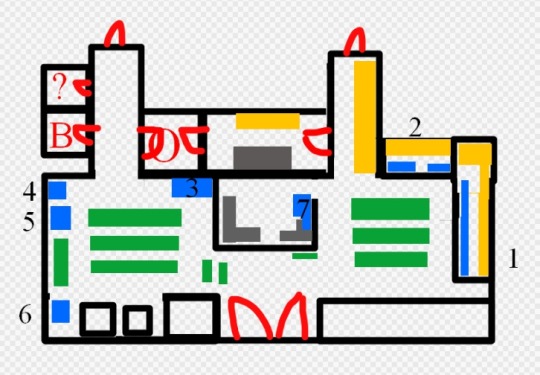

More long long work blather, because whatever, you get cuts.

So the storage situation, her over-ordering things, AND there being too many kinds of things is getting irritating. It's like trying to organize my basement.

So, here's the current layout, not at all to scale.

Green are shelves of stuff, both food and non-food though mostly food. I won't bore you with how it's all set up. The organization there by category is satisfying enough, but there's too much product, too varied product, and it's sloppy. There should be a little more green surrounding the bull pit and there are more short green ones in front of the bull pit, but it's already fussy.

Nothing more can be put in front of the bull pit because there are glass cases there with the pipes and things. I forgot to put it, but there's another locked case by freezer 3 with more pipes and things.

Blue are coolers. I missed the micro fridge that's near 7, and there's a small hand sink in there, too.

1 was non-alocholic drinks but she moved some of the alcoholic drinks into that cooler last week, which I think was a bad idea. A better solution to there being too much stuff in the beer cave would be to order less stuff.

2 is "the beer cave" which customers are allowed to go into, though they shouldn't be because everything is crammed in there really sloppy and there's a risk of customers knocking stuff over onto themselves and getting hurt. That's how big multipacks of beer are made available to customers, though now many of them are in the lower parts of the original beer cave doors.

3 is the freezer with the deli meat stuff in it. Since it opens from the top, the wall space there is not being used.

4 is the ice machine which customers should not touch, and 5 is the bags of ice customers can take.

6 is another top-loading freezer with ice cream in it.

7 is both a standing cooler with stuff like lunchables and pre-packed sandwiches in it, and then a long cooler that runs under the countertop which is where deli sandwiches are.

The big, unmarked rectangles and stuff across the front of the store are counter tops where the soda, coffee, slushies, and hot food are, the atm, and the lottery machine.

Yellow are storage. All of the sodas and deli stuff get put into the cooler (1), nothing is organized, and nothing is easy to get to. Returns and damaged product are also in there.

Beer cave is also cold storage, but only beer and things like hard lemonade go in there.

O is the office, and the grey rectangle near O is the big sink. There are lots of other machines in there like the water heater and soda fountain syrup set up, etc., and then one small shelf for supplies like trash bags, ice bags, etc.

B is the bathroom. ? is probably another bathroom but I don't actually know. Maybe it's already being used as storage but I've never been in there to get anything so it's probably just an unused bathroom.

-

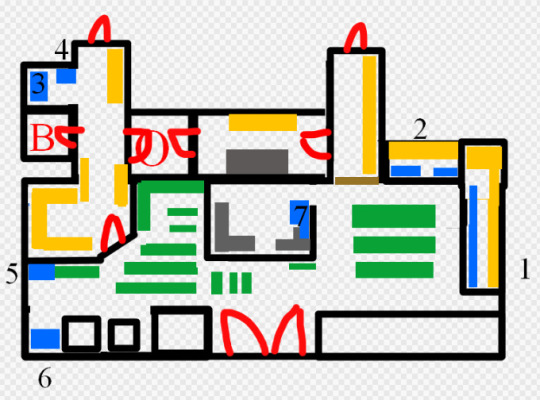

So, if I had the money and the go ahead to do whatever I wanted with the store.....

tl:dr I would have less shit on the sales floor and a lot more dry storage, a less is more set up.

First I would reduce the variety of things we have. That seems counterintuitive when you're considering customers might want all those things. They do, sometimes, but there's no room. Something has to give.

We would actually monitor which flavors of, say, bagged mini donuts actually sell and which really don't, and only order the big sellers, for example. That would disappoint a few customers, but they'd be ok.

I'd put all the alcoholic beverages back in one area (2) and order less.

I would gut the ?bathroom, remove the door and wall to improve air flow, and move the ice maker and deli freezer in there. If there's room, I'd also add a small counter space and a sink so that deli sandwiches were made THERE instead of on a tiny 6in by 1ft shelf on the mini fridge in the bull pit because that's annoying. The top of the mini fridge is angled because there's a lift-up door. It's hard to work, there, and customers constantly interrupt so whomever is making sandwiches should be left alone. Under the counter space I'd add a mini fridge or two to keep the cheese in, and wall shelves for the deli bread. Keep it all together and not cause condensation in the bread bags.

Having a dedicated sandwich making place would also make it easier to keep that space CLEAN because there wouldn't be people coming in and out all of the time and that area isn't exposed to customers at all.

Considering we're only actually using half the deli freezer as it is and the other half is full of ice build up and product that is unsellable, it could be replaced with a smaller one, maybe a proper deep-freeze with a lift-up door that seals better and can also be used as work space if needed.

_Those bathrooms may be larger or smaller than I think they are. I've never been in either room, and B and ? could be swapped, I don't really care which is the bathroom.

I'd rearrange the sales floor a lot and build another wall, turning a segment of the store space (which in reality wouldn't be that big.... this is not to scale like I said) into dry storage space and add an employees only sign to that door because people will come in and beeline for that hallway assuming that's where the public bathroom is.

The angled door makes sure we can still see into that corner, and that is where I would put big things that are difficult to steal anyway, like the firewood and bags of ice.

I'd also add a saloon door with an employees only sign to the other hallway because they do the same thing over there and I have to chase them down, and omit the yellow storage behind there completely since that's the path service people like plumbers would have to take if there were a problem with the sink or water heater, etc. and should be clear, or at least I'd instead put some shallow shelving that's meant for only small dry goods like the snack cakes, or store supplies. Right now it's head-high stacks of tallboy cans and it makes me nervous.

Lots of dry storage would let us have better looking, more organized shelves on the floor because it wouldn't need to be severely overstuffed just to get product out of boxes that also are left all around the sales floor.

I'd reduce the wine from 4 rows to 1. They're just... Not selling. I mean, a few are or else I wouldn't be constantly refilling those few, and with good inventory management and sales tracking, we'd only buy those.

I'd omit the big locked case that was by freezer 3 completely. I've only gotten into that case one time, and have only ever seen another employee need to get in there one time. Maybe it's more busy at other times, I don't know.

We have too many varieties of vapes, CBD, Kratom, etc. products. One locked case, the countertop displays that only open from the register side, and the "showcases" should be sufficient. Since those don't scan, there's no good inventory or sales tracking, and with good sales tracking, only what sells would be ordered.

Notice a trend?

Then I'd use the wall where the freezer was for light bags like candy up to eye level, small snacks, etc. with some shallow shelves lower down for various sweet food products like cookies, and put the toys in a bin on the ground level where kids can see them instead of up on the top.

I'd get rid of some of the hot food machines because they're barely used. There's a hot dog roller that I've only seen food in once, a popcorn machine that's never had popcorn in it, a pizza spinner thing that I have sold a couple slices from but we could just not, a giant pretzel spinner but you can't have those pretzels, you have to ask for them out of the cold food case where the deli sandwiches are and they're pre-packed, so we could just put a mini cold case out there with the pretzels in it, or put a big countertop one and put some of the deli stuff in it, OR use that space for room-temp pastries and local stuff so we could clear off a little of the counter around the bullpit which would give us more working space and a much better view of the store.

Manager tends to do computer work sitting on one chair with the laptop on another chair, hiding behind the tall cigarette case in the center of the bull pit and the tops of the showcases are also glass so we can't put anything heavy there, which means not being able to do a lot of work, there.

......

I would put a fridge case out back where expiring product could be placed for people to come take for free.

There's probably more stuff that I'm forgetting, but I'm getting hungry and do tend to lose focus when I'm hungry.

6 notes

·

View notes

Text

GRADE AA+ COUNTERFEIT MONEY

Take the chance now to multiply your money within the shortest time possible.

We are Professional IT technicians and we produce SUPER UNDETECTABLE COUNTERFEIT MONEY for all currencies. Our notes are industrially and professional produced.

We use quality , foil paper elements.20 of cellulose and 80 of cotton paper.Our bills have the Infrared Detecton which makes our bills to bypass the UV machines, Pen test and even eye detection by counterfeit experts.

Our notes are AAA+ grade Quality. We also sell and provide money cleaning services and solutions. We sell AAA+ SSD Black Money Solution

-Holograms and Holographic Strips

-Micro-Lettering

-Methalic Ink and Thread

-Watermarks

-IR Detecton

-Ultra-violet features

-See through Features

-Different serial numbers

These features make our bills to be 100 undetected,100 safe and secure to use in any of these areas: BANKS, CASINO, ATM, MONEY CHANGERS, STORES. They are 100 Undetectable

Build trust in yourself when contacting me , believe in yourself, contact me now and thank me latter.We can sehip to any part of the world within 2-4 days

Meanwhile Face to face deals are best if we agree.

contact me on my whatsapp for the fastest communication.

Contact us.

WhatsApp : +49 1521 0327184

Mr Abdalah

#Ssdchemicalsolutionssdchemicalcleandollarscleanblackmoneyblackmoneyactivationpowderantibreezeaaagradecounterfeitdetectedpen#artists on tumblr#stanford pines#agatha all along#911 abc#cats of tumblr

3 notes

·

View notes

Text

Boost Your Retail Business with Micro ATM Services

Retailers can now increase their income and footfall by providing banking services through Micro ATMs. These compact machines connect to banking networks and allow cash withdrawals using debit cards. With easy integration through APIs, real-time settlements, and RBI-compliant security, Micro ATMs are a smart addition for anyone looking to expand their business while contributing to financial empowerment across underserved regions.

0 notes

Text

Which AEPS Payment Methods Work Best? A Guide to Cash Withdrawal via Aadhaar

In the world of digital payments, the Aadhaar Enabled Payment System (AEPS) has revolutionized financial accessibility for millions of Indians. This system allows users to conduct basic banking transactions such as cash withdrawals, balance inquiries, and fund transfers by simply using their Aadhaar number and biometric authentication. If you're new to the concept of AEPS or curious about which AEPS payment methods work best for cash withdrawal, this guide is for you.

In this article, we’ll explore the various AEPS payment methods, focusing on how AEPS cash withdrawal works, and give you insights into the different services offered under Aadhaar pay. Whether you're in a rural or urban setting, AEPS has become a secure and convenient way to access banking services without needing a physical debit card or even a smartphone with an internet connection.

What is AEPS?

Before diving into the different AEPS payment methods, let’s start with what AEPS really is. The Aadhaar Enabled Payment System (AEPS) is a financial service launched by the National Payments Corporation of India (NPCI), designed to make banking accessible to everyone, especially those in remote areas. By using just an Aadhaar number and biometric authentication (like a fingerprint), AEPS empowers users to carry out financial transactions like cash withdrawals, balance checks, and transfers without visiting a bank branch.

AEPS is especially beneficial for people in rural areas, where access to physical banking infrastructure might be limited. For example, individuals can visit local banking correspondents or AEPS-enabled shops to withdraw cash, inquire about their balance, or even transfer money without needing to visit a distant bank branch.

How Does AEPS Cash Withdrawal Work?

The process of AEPS cash withdrawal is incredibly straightforward. A user can withdraw cash by simply visiting an AEPS-enabled point-of-sale or a banking correspondent with an Aadhaar-linked bank account. Here’s a step-by-step breakdown of the process:

Visit an AEPS-enabled service point – You can find these at local shops, small retailers, or service centers that offer AEPS.

Authenticate your identity – Provide your Aadhaar number and place your fingerprint for biometric verification.

Select the transaction type – Choose the option for cash withdrawal.

Enter the withdrawal amount – After the biometric authentication, input the amount you want to withdraw.

Complete the transaction – Once verified, the amount is disbursed instantly, and you’ll receive an AEPS cash withdrawal message confirming the transaction.

This simple yet effective method means that even people without access to ATMs or physical bank branches can withdraw cash anytime they need it. This service is particularly useful for those in rural areas where banking infrastructure might be lacking.

AEPS Payment Methods: What Works Best?

The beauty of AEPS lies in its flexibility. Let’s take a look at the different AEPS payment methods and discuss what works best, especially when it comes to cash withdrawals.

1. AEPS via Micro-ATMs

Micro-ATMs are small, portable machines used by banking agents or business correspondents (BCs). These devices are directly connected to the Aadhaar-enabled system and allow customers to withdraw cash using their Aadhaar number and biometric verification.

Why Micro-ATMs are effective:

Micro-ATMs can function in areas where traditional ATMs are unavailable, making them ideal for rural and semi-urban locations.

They provide immediate cash withdrawal services and are user-friendly, requiring no additional technology beyond a biometric reader and the AEPS system.

These devices allow banking correspondents to facilitate transactions at a lower cost than setting up an ATM.

While micro-ATMs are an excellent solution for individuals needing quick cash, they do depend on the availability of the banking correspondent. So, availability may vary based on the location.

2. Banking Correspondents (BCs) at Local Shops

Another popular AEPS payment method is the use of banking correspondents stationed at local shops or service points. These correspondents offer basic banking services on behalf of the bank, which includes cash withdrawals, deposits, and money transfers via AEPS.

Why BCs work well:

Banking correspondents are spread across the country, especially in rural areas, providing an extensive network of access points for financial services.

There’s no need for the user to own a smartphone or have internet access to make transactions. This makes it easier for users with limited digital literacy.

BCs offer a personal touch, where customers can ask for assistance, making banking more inclusive for all sections of society.

While the AEPS payment method through BCs is widely used and appreciated for its accessibility, the downside could be occasional delays in cash availability if the BC doesn’t have sufficient funds at the time of withdrawal.

3. Aadhaar Pay for Merchants

For merchants, AEPS comes with the added benefit of Aadhaar Pay. Aadhaar Pay allows customers to make payments directly from their bank accounts using their Aadhaar number and biometric verification. This service is particularly useful in rural and semi-urban areas where many customers might not have a smartphone or internet connection.

Aadhaar Pay Benefits for Merchants:

No need for cards or PINs – Customers only need their Aadhaar number and biometric authentication, making the payment process seamless.

Real-time transactions – Payments are instant and cashless, reducing the need for handling physical money.

Inclusive – Aadhaar Pay enables even those without debit/credit cards to make payments, expanding the merchant’s potential customer base.

Merchants across India are adopting Aadhaar Pay services to cater to customers who may not have traditional banking tools like debit or credit cards. If you’re a merchant or considering starting a small business, Aadhaar Pay could be an excellent payment method to boost your reach. You can explore more about this service here.

Why AEPS Payment Methods Are Secure

One of the main reasons AEPS payment methods have gained popularity is because of their security. Aadhaar-enabled payments are backed by biometric verification, which minimizes the risk of fraud or unauthorized transactions. Unlike traditional banking where a PIN or OTP can be compromised, AEPS uses the customer’s unique fingerprint or iris scan, making the authentication process highly secure.

Moreover, since AEPS doesn’t rely on cards or smartphones, the risk of phishing or cyber theft is reduced significantly. Every transaction is authenticated in real-time, and customers receive an AEPS cash withdrawal message immediately after each transaction, ensuring transparency.

The Future of AEPS and Aadhaar Pay

The future of AEPS looks promising, especially as the Indian government continues its push toward financial inclusion. The combination of AEPS cash withdrawal, balance inquiries, and fund transfers through local banking correspondents and micro-ATMs has already transformed how millions access banking services.

With Aadhaar Pay, the scope widens even further, allowing merchants and small businesses to cater to customers without worrying about the limitations of digital infrastructure. AEPS and Aadhaar Pay together promise a future where cashless transactions and digital banking become accessible to every Indian, no matter where they live.

If you're looking to explore more about AEPS or even offer Aadhaar Pay as a service at your business, you can learn more here.

Conclusion

The AEPS payment methods offer a blend of convenience, security, and accessibility, making it easier for people to access their bank accounts without the need for physical bank branches, ATMs, or even smartphones. From AEPS cash withdrawals through micro-ATMs to payments via Aadhaar Pay, this system is helping bridge the gap between urban and rural banking services.

Whether you're a customer looking for an easy way to withdraw cash or a business owner interested in offering Aadhaar Pay, AEPS has proven to be a reliable and inclusive solution in today’s digital age.

Ready to explore more? Dive into the world of Aadhaar-enabled payments and unlock the potential of financial inclusion with AEPS.

0 notes

Text

0 notes

Text

How does a Micro ATM ensure customer data privacy?

In an increasingly digital world, financial inclusion is essential — but so is data privacy. As more people in rural and semi-urban regions gain access to banking through innovative technologies like Micro ATM devices, there’s a growing need to ensure that customer information is secure. Micro ATMs are designed to perform essential banking functions without requiring customers to visit a traditional bank branch. However, these benefits must be balanced with strong privacy protocols and secure data handling practices.

This brings us to the question: How does a Micro ATM ensure customer data privacy? In this article, we’ll break down the key ways in which Micro ATM systems, along with their operators and micro atm service providers, safeguard sensitive financial and personal information.

What Is a Micro ATM?

A Micro ATM is a portable device that allows banking correspondents (also known as agents) to offer basic banking services like cash withdrawal, balance inquiry, mini statement, and fund transfer. The device typically uses biometric authentication, such as fingerprints, or card-based PIN validation to verify a user’s identity and facilitate secure transactions.

While these devices are highly convenient, especially in areas where full-sized ATMs or banks are not available, it’s critical that they maintain high standards of data privacy and security.

Key Methods for Ensuring Customer Data Privacy in Micro ATMs

1. Biometric Encryption

Micro ATMs often rely on Aadhaar-based biometric authentication, particularly in India, where this system is widely adopted. When a customer uses their fingerprint for verification, the biometric data is encrypted at the device level before it is transmitted. This means that even if data were intercepted during transmission, it would be unreadable without the proper decryption key, ensuring an additional layer of privacy and protection.

2. Secure Communication Channels

All communication between the Micro ATM and the bank’s servers is carried out over encrypted networks using protocols like HTTPS and SSL/TLS. These protocols are industry standards that protect sensitive information from being accessed or modified during transmission. This ensures that both the customer’s personal details and their transaction data remain private.

3. End-to-End Data Protection

Reputable micro atm service provider companies implement end-to-end security measures. This means data is encrypted from the moment it is captured at the Micro ATM until it reaches the bank's secure servers. During this process, no intermediate system or third-party has access to decrypted data, thereby minimizing the risk of leaks or misuse.

4. Tamper-Proof Hardware

Most modern Micro ATM devices are built with tamper-proof mechanisms. If someone attempts to open or alter the device physically, the system is designed to erase all sensitive data stored within. This kind of hardware-based security ensures that even in cases of theft or loss, the customer’s data remains protected.

5. Authentication Protocols

Customers must be authenticated using secure methods such as Aadhaar-based biometric verification or debit card PIN entry. This two-factor authentication not only helps in validating the customer’s identity but also prevents unauthorized access to their financial information.

6. Agent Training and Compliance

A major part of ensuring data privacy lies in training the banking correspondents who operate these Micro ATMs. Service providers educate agents about the importance of data security, handling sensitive information, and recognizing fraudulent activities. A reliable micro atm service provider also ensures compliance with regulatory standards such as those outlined by the Reserve Bank of India (RBI).

7. Regular Software Updates

Security vulnerabilities can be exploited if systems are not regularly updated. To combat this, Micro ATM devices receive periodic software updates from the service provider. These updates include patches for known vulnerabilities, new security protocols, and enhancements to ensure continued data protection.

8. Audit Trails and Monitoring

Micro ATM systems maintain audit trails of all transactions. These logs help detect and investigate any unusual activity or security breach attempts. Regular monitoring by the micro atm service provider ensures that anomalies can be quickly identified and addressed before they become serious threats.

Role of Technology in Ensuring Privacy

The importance of technology providers in securing Micro ATM systems cannot be overstated. For instance, Xettle Technologies, a company involved in empowering last-mile banking, uses advanced encryption, secure APIs, and real-time monitoring to uphold the integrity and confidentiality of user data. By integrating such robust technological frameworks, Micro ATM systems become more resilient against cyber threats and fraud.

Final Thoughts

As Micro ATMs become more widespread in delivering financial services to underserved communities, ensuring data privacy remains a top priority. Customers trust that their personal and financial details will remain secure during every transaction, and that trust must be preserved through diligent technical and operational safeguards.

From biometric encryption and secure communication to tamper-proof hardware and trained agents, every aspect of a Micro ATM ecosystem is designed with privacy in mind. A competent and trusted micro atm service provider plays a central role in implementing these protections and maintaining the highest standards of data security.

In conclusion, Micro ATMs not only enable banking at the grassroots level but do so with a strong commitment to protecting the privacy of every individual they serve.

0 notes

Text

Requirements For AePS Transactions

AePS (Aadhaar Enabled Payment System) does not require a smartphone, documents, or payment cards. To use AePS, customers only need to link their Aadhaar card to their bank account. The system captures the following information:

Aadhaar Number Biometric Fingerprint Identification Name or Bank Issuer Identification Number (IIN) If the full Aadhaar number is not remembered, the last four digits will suffice. A Business Correspondent with an AePS machine or Micro ATM in assisted mode can perform transactions for the customer.

#Aeps#aeps debit facility#AEPS Cash Withdrawal#Best AEPS Services Provider company#aeps service#aeps registration#aeps portal#aadhaar pay

0 notes

Text

BUY HIGH QUALITY UNDETECTABLE GRADE AA+ COUNTERFEIT BANKNOTES

Take the chance now to multiply your money within the shortest time possible.

We are Professional IT technicians and we produce SUPER UNDETECTABLE COUNTERFEIT MONEY for all currencies. Our notes are industrially and professional produced.

We use quality , foil paper elements.20 of cellulose and 80 of cotton paper.Our bills have the Infrared Detecton which makes our bills to bypass the UV machines, Pen test and even eye detection by counterfeit experts.

Our notes are AAA+ grade Quality. We also sell and provide money cleaning services and solutions. We sell AAA+ SSD Black Money Solution

-Holograms and Holographic Strips

-Micro-Lettering

-Methalic Ink and Thread

-Watermarks

-IR Detecton

-Ultra-violet features

-See through Features

-Different serial numbers

These features make our bills to be 100 undetected,100 safe and secure to use in any of these areas: BANKS, CASINO, ATM, MONEY CHANGERS, STORES. They are 100 Undetectable

Build trust in yourself when contacting me , believe in yourself, contact me now and thank me latter.We can sehip to any part of the world within 2-4 days

Meanwhile Face to face deals are best if we agree.

contact me on my whatsapp for the fastest communication.

Contact us.

WhatsApp : +49 1521 0327184

Mr Abdalah

#personal loans#make money online#moneyfinanancial#artists on tumblr#stanford pines#cats of tumblr#agatha all along#911 abc

2 notes

·

View notes

Text

Can AEPS Work Without Internet? Yes, Here’s How

Unlike traditional online banking, AEPS is designed to function in areas with limited or no internet access. Through biometric-enabled POS machines and micro ATMs, AEPS transactions can be processed using offline mechanisms, relying on Aadhaar and fingerprint verification. This makes AEPS uniquely suited for rural India, where connectivity can be a challenge.

Paysprint’s AEPS solution supports both online and offline-compatible environments, making it a top choice for service providers targeting low-connectivity zones.

0 notes