#OptumRx

Explore tagged Tumblr posts

Text

What the fuck is a PBM?

TOMORROW (Sept 24), I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Terminal-stage capitalism owes its long senescence to its many defensive mechanisms, and it's only by defeating these that we can put it out of its misery. "The Shield of Boringness" is one of the necrocapitalist's most effective defenses, so it behooves us to attack it head-on.

The Shield of Boringness is Dana Claire's extremely useful term for anything so dull that you simply can't hold any conception of it in your mind for any length of time. In the finance sector, they call this "MEGO," which stands for "My Eyes Glaze Over," a term of art for financial arrangements made so performatively complex that only the most exquisitely melted brain-geniuses can hope to unravel their spaghetti logic. The rest of us are meant to simply heft those thick, dense prospectuses in two hands, shrug, and assume, "a pile of shit this big must have a pony under it."

MEGO and its Shield of Boringness are key to all of terminal-stage capitalism's stupidest scams. Cloaking obvious swindles in a lot of complex language and Byzantine payment schemes can make them seem respectable just long enough for the scammers to relieve you of all your inconvenient cash and assets, though, eventually, you're bound to notice that something is missing.

If you spent the years leading up to the Great Financial Crisis baffled by "CDOs," "synthetic CDOs," "ARMs" and other swindler nonsense, you experienced the Shield of Boringness. If you bet your house and/or your retirement savings on these things, you experienced MEGO. If, after the bubble popped, you finally came to understand that these "exotic financial instruments" were just scams, you experienced Stein's Law ("anything that can't go forever eventually stops"). If today you no longer remember what a CDO is, you are once again experiencing the Shield of Boringness.

As bad as 2008 was, it wasn't even close to the end of terminal stage capitalism. The market has soldiered on, with complex swindles like carbon offset trading, metaverse, cryptocurrency, financialized solar installation, and (of course) AI. In addition to these new swindles, we're still playing the hits, finding new ways to make the worst scams of the 2000s even worse.

That brings me to the American health industry, and the absurdly complex, ridiculously corrupt Pharmacy Benefit Managers (PBMs), a pathology that has only metastasized since 2008.

On at least 20 separate occasions, I have taken it upon myself to figure out how the PBM swindle works, and nevertheless, every time they come up, I have to go back and figure it out again, because PBMs have the most powerful Shield of Boringness out of the whole Monster Manual of terminal-stage capitalism's trash mobs.

PBMs are back in the news because the FTC is now suing the largest of these for their role in ripping off diabetics with sky-high insulin prices. This has kicked off a fresh round of "what the fuck is a PBM, anyway?" explainers of extremely variable quality. Unsurprisingly, the best of these comes from Matt Stoller:

https://www.thebignewsletter.com/p/monopoly-round-up-lina-khan-pharma

Stoller starts by pointing out that Americans have a proud tradition of getting phucked by pharma companies. As far back as the 1950s, Tennessee Senator Estes Kefauver was holding hearings on the scams that pharma companies were using to ensure that Americans paid more for their pills than virtually anyone else in the world.

But since the 2010s, Americans have found themselves paying eye-popping, sky-high, ridiculous drug prices. Eli Lilly's Humolog insulin sold for $21 in 1999; by 2017, the price was $274 – a 1,200% increase! This isn't your grampa's price gouging!

Where do these absurd prices come from? The story starts in the 2000s, when the GW Bush administration encouraged health insurers to create "high deductible" plans, where patients were expected to pay out of pocket for receiving care, until they hit a multi-thousand-dollar threshold, and then their insurance would kick in. Along with "co-pays" and other junk fees, these deductibles were called "cost sharing," and they were sold as a way to prevent the "abuse" of the health care system.

The economists who crafted terminal-stage capitalism's intellectual rationalizations claimed the reason Americans paid so much more for health care than their socialized-medicine using cousins in the rest of the world had nothing to do with the fact that America treats health as a source of profits, while the rest of the world treats health as a human right.

No, the actual root of America's health industry's problems was the moral defects of Americans. Because insured Americans could just go see the doctor whenever they felt like it, they had no incentive to minimize their use of the system. Any time one of these unhinged hypochondriacs got a little sniffle, they could treat themselves to a doctor's visit, enjoying those waiting-room magazines and the pleasure of arranging a sick day with HR, without bearing any of the true costs:

https://pluralistic.net/2021/06/27/the-doctrine-of-moral-hazard/

"Cost sharing" was supposed to create "skin in the game" for every insured American, creating a little pain-point that stung you every time you thought about treating yourself to a luxurious doctor's visit. Now, these payments bit hardest on the poorest workers, because if you're making minimum wage, at $10 co-pay hurts a lot more than it does if you're making six figures. What's more, VPs and the C-suite were offered "gold-plated" plans with low/no deductibles or co-pays, because executives understand the value of a dollar in the way that mere working slobs can't ever hope to comprehend. They can be trusted to only use the doctor when it's truly warranted.

So now you have these high-deductible plans creeping into every workplace. Then along comes Obama and the Affordable Care Act, a compromise that maintains health care as a for-profit enterprise (still not a human right!) but seeks to create universal coverage by requiring every American to buy a plan, requiring insurers to offer plans to every American, and uses public money to subsidize the for-profit health industry to glue it together.

Predictably, the cheapest insurance offered on the Obamacare exchanges – and ultimately, by employers – had sky-high deductibles and co-pays. That way, insurers could pocket a fat public subsidy, offer an "insurance" plan that was cheap enough for even the most marginally employed people to afford, but still offer no coverage until their customers had spent thousands of dollars out-of-pocket in a given year.

That's the background: GWB created high-deductible plans, Obama supercharged them. Keep that in your mind as we go through the MEGO procedures of the PBM sector.

Your insurer has a list of drugs they'll cover, called the "formulary." The formulary also specifies how much the insurance company is willing to pay your pharmacist for these drugs. Creating the formulary and paying pharmacies for dispensing drugs is a lot of tedious work, and insurance outsources this to third parties, called – wait for it – Pharmacy Benefits Managers.

The prices in the formulary the PBM prepares for your insurance company are called the "list prices." These are meant to represent the "sticker price" of the drug, what a pharmacist would charge you if you wandered in off the street with no insurance, but somehow in possession of a valid prescription.

But, as Stoller writes, these "list prices" aren't actually ever charged to anyone. The list price is like the "full price" on the pricetags at a discount furniture place where everything is always "on sale" at 50% off – and whose semi-disposable sofas and balsa-wood dining room chairs are never actually sold at full price.

One theoretical advantage of a PBM is that it can get lower prices because it bargains for all the people in a given insurer's plan. If you're the pharma giant Sanofi and you want your Lantus insulin to be available to any of the people who must use OptumRX's formulary, you have to convince OptumRX to include you in that formulary.

OptumRX – like all PBMs – demands "rebates" from pharma companies if they want to be included in the formulary. On its face, this is similar to the practices of, say, NICE – the UK agency that bargains for medicine on behalf of the NHS, which also bargains with pharma companies for access to everyone in the UK and gets very good deals as a result.

But OptumRX doesn't bargain for a lower list price. They bargain for a bigger rebate. That means that the "price" is still very high, but OptumRX ends up paying a tiny fraction of it, thanks to that rebate. In the OptumRX formulary, Lantus insulin lists for $403. But Sanofi, who make Lantus, rebate $339 of that to OptumRX, leaving just $64 for Lantus.

Here's where the scam hits. Your insurer charges you a deductible based on the list price – $404 – not on the $64 that OptumRX actually pays for your insulin. If you're in a high-deductible plan and you haven't met your cap yet, you're going to pay $404 for your insulin, even though the actual price for it is $64.

Now, you'd think that your insurer would put a stop to this. They chose the PBM, the PBM is ripping off their customers, so it's their job to smack the PBM around and make it cut this shit out. So why would the insurers tolerate this nonsense?

Here's why: the PBMs are divisions of the big health insurance companies. Unitedhealth owns OptumRx; Aetna owns Caremark, and Cigna owns Expressscripts. So it's not the PBM that's ripping you off, it's your own insurance company. They're not just making you pay for drugs that you're supposedly covered for – they're pocketing the deductible you pay for those drugs.

Now, there's one more entity with power over the PBM that you'd hope would step in on your behalf: your boss. After all, your employer is the entity that actually chooses the insurer and negotiates with them on your behalf. Your boss is in the driver's seat; you're just along for the ride.

It would be pretty funny if the answer to this was that the health insurance company bought your employer, too, and so your boss, the PBM and the insurer were all the same guy, busily swapping hats, paying for a call center full of tormented drones who each have three phones on their desks: one labeled "insurer"; the second, "PBM" and the final one "HR."

But no, the insurers haven't bought out the company you work for (yet). Rather, they've bought off your boss – they're sharing kickbacks with your employer for all the deductibles and co-pays you're being suckered into paying. There's so much money (your money) sloshing around in the PBM scamoverse that anytime someone might get in the way of you being ripped off, they just get cut in for a share of the loot.

That is how the PBM scam works: they're fronts for health insurers who exploit the existence of high-deductible plans in order to get huge kickbacks from pharma makers, and massive fees from you. They split the loot with your boss, whose payout goes up when you get screwed harder.

But wait, there's more! After all, Big Pharma isn't some kind of easily pushed-around weakling. They're big. Why don't they push back against these massive rebates? Because they can afford to pay bribes and smaller companies making cheaper drugs can't. Whether it's a little biotech upstart with a cheaper molecule, or a generics maker who's producing drugs at a fraction of the list price, they just don't have the giant cash reserves it takes to buy their way into the PBMs' formularies. Doubtless, the Big Pharma companies would prefer to pay smaller kickbacks, but from Big Pharma's perspective, the optimum amount of bribes extracted by a PBM isn't zero – far from it. For Big Pharma, the optimal number is one cent higher than "the maximum amount of bribes that a smaller company can afford."

The purpose of a system is what it does. The PBM system makes sure that Americans only have access to the most expensive drugs, and that they pay the highest possible prices for them, and this enriches both insurance companies and employers, while protecting the Big Pharma cartel from upstarts.

Which is why the FTC is suing the PBMs for price-fixing. As Stoller points out, they're using their powers under Section 5 of the FTC Act here, which allows them to shut down "unfair methods of competition":

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The case will be adjudicated by an administrative law judge, in a process that's much faster than a federal court case. Once the FTC proves that the PBM scam is illegal when applied to insulin, they'll have a much easier time attacking the scam when it comes to every other drug (the insulin scam has just about run its course, with federally mandated $35 insulin coming online, just as a generation of post-insulin diabetes treatments hit the market).

Obviously the PBMs aren't taking this lying down. Cigna/Expressscripts has actually sued the FTC for libel over the market study it conducted, in which the agency described in pitiless, factual detail how Cigna was ripping us all off. The case is being fought by a low-level Reagan-era monster named Rick Rule, whom Stoller characterizes as a guy who "hangs around in bars and picks up lonely multi-national corporations" (!!).

The libel claim is a nonstarter, but it's still wild. It's like one of those movies where they want to show you how bad the cockroaches are, so there's a bit where the exterminator shows up and the roaches form a chorus line and do a kind of Busby Berkeley number:

https://www.46brooklyn.com/news/2024-09-20-the-carlton-report

So here we are: the FTC has set out to euthanize some rentiers, ridding the world of a layer of useless economic middlemen whose sole reason for existing is to make pharmaceuticals as expensive as possible, by colluding with the pharma cartel, the insurance cartel and your boss. This conspiracy exists in plain sight, hidden by the Shield of Boringness. If I've done my job, you now understand how this MEGO scam works – and if you forget all that ten minutes later (as is likely, given the nature of MEGO), that's OK: just remember that this thing is a giant fucking scam, and if you ever need to refresh yourself on the details, you can always re-read this post.

The paperback edition of The Lost Cause, my nationally bestselling, hopeful solarpunk novel is out this month!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/23/shield-of-boringness/#some-men-rob-you-with-a-fountain-pen

Image: Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#matthew stoller#pbms#pharmacy benefit managers#cigna#ftc#antitrust#intermediaries#bribery#corruption#pharma#monopolies#shield of boringness#Caremark#Express Scripts#OptumRx#insulin#gbw#george w bush#co-pays#obamacare#aca#rick rules#guillotine watch#euthanize rentiers#mego

446 notes

·

View notes

Text

TRANS GUYS!!! DO NOT USE OPTUMRX HOME DELIVERY FOR YOUR TESTOSTERONE!!!!!!!!!!!

It may seem easier to just get it delivered, but the amount of on-fire hoops that you have to do backflips through are NOT WORTH IT‼️‼️‼️

I've been waiting for over three weeks for them to ship my prescription. I'm three days late to my last dose. My order is still on "order confirmed" as it has been for the past week.

Don't waste your time. It's tempting, but keep getting it at a physical pharmacy.

#its PRIDE MONTH where is my prescription.#I risk getting my period again because of this. I cannot go thru that ‼️‼️#testosterone#transman#trans man#transmasc#transgender#optumrx

7 notes

·

View notes

Text

tim noel | united healthcare

#tim noel#united health group#united healthcare#uhc#optumrx#amedisys#medicare#medicare advantage#lol it’s not my fault. that’s how image is on web

564 notes

·

View notes

Text

The parents of a 22-year-old Wisconsin man who died after an asthma attack have filed a lawsuit against Walgreens and UnitedHealth Group’s pharmacy benefit manager after they said the price for his medication suddenly rose from $66 to $539.

Cole Schmidtknecht, 22, had lived with asthma since he was a baby, but he was able to manage his symptoms by taking Advair Diskus, a preventative inhaler, every day, according to a lawsuit filed in federal court last week. Since 2023, Schmidtknecht had health insurance through his employer that covered his medication, which cost him no more than $66.86 each month.

However, when Schmidtknecht went to his local Walgreens pharmacy on Jan. 10, 2024, to fill his prescription, he was informed that his medication was no longer covered by his insurance, according to the lawsuit. Advair Diskus would now cost Schmidtknecht $539.19 out of pocket, and the pharmacy allegedly told him there were no cheaper alternatives or generic medications available to him. The lawsuit also says the pharmacist failed to contact Schmidtknecht’s physician or insurance company to seek an alternative.

A spokesperson for Walgreens told HuffPost they could not comment due to the pending litigation.

According to the lawsuit, OptumRx, a company that acts as a middleman between pharmacies, insurance plans and drug companies, updated its 2024 formulary stating that a patient using Advair Diskus or a generic alternative prescription could only have it filled if they obtained prior authorization from a doctor.

The Schmidtknechts’ lawsuit alleged their son was not notified by his insurance or Walgreens ahead of time that his inhaler would no longer be covered, despite state laws that required notification, according to the lawsuit. He left Walgreens that day without filling his prescription, and in the days that followed, he repeatedly struggled to breathe and relied solely on an old emergency inhaler, per the suit.

Five days after he left Walgreens, Schmidtknecht had a severe asthma attack and began to asphyxiate, according to the lawsuit. His roommate drove him to an emergency room in Appleton, but he became unresponsive and his heart stopped minutes before they arrived.

Emergency room staff noted in their records that Schmidtknecht appeared blue. Despite efforts to resuscitate him, he never regained consciousness. Schmidtknecht remained on a ventilator in the intensive care unit for six days until his parents ended life support. He was pronounced dead on Jan. 21, 2024.

The lawsuit claims that OptumRx would not have covered Advair Diskus’s generic equivalents, and instead only covered two newer brand-name drugs whose manufacturer had paid OptumRx a substantial rebate for a favorable placement on the company’s updated formulary. Attorneys representing the family referred to this practice as “non-medical switching,” and say it’s a way for pharmacy benefit managers to require patients to change medications in order to collect kickbacks from the drug manufacturer.

#walgreens#united health group#united healthcare#optumrx#healthcare#health insurance#asthma#advair#I’ve taken that before

0 notes

Text

Another preventable tragedy, here is a price comparison of Inhalers (aka puffers):

UK 32.99

AUS 39.50

CAN 39.50

NZ 39.09

USA 539.00

678 notes

·

View notes

Text

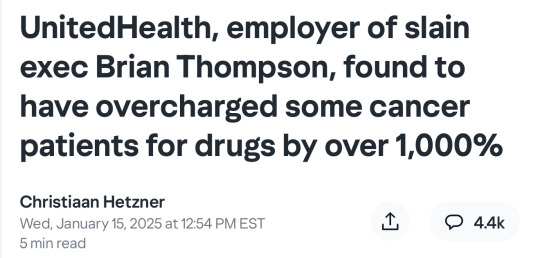

UnitedHealth Group is charging patients a markup for key life-saving drugs that could easily exceed their cost by a factor of ten or more, according to findings from the Federal Trade Commission.

The report, which levels the same allegations at CVS and Cigna, is the latest indictment of America’s broken healthcare system and comes on the heels of last month’s shocking murder of UnitedHealthcare CEO Brian Thompson.

The U.S. is notorious for incurring the highest costs per capita of any wealthy nation, yet failing to achieve an even remotely equivalent improvement in patient outcomes versus Europe’s social market-based economies.

Critics argue that is due largely to the highly opaque manner in which needless markups are hidden to conceal inefficiencies that serve various vested interests. These include, but are not limited to, the big three drug middlemen known as pharmacy benefit managers (PBMs).

According to the FTC report, UnitedHealth’s OptumRx, along with Cigna’s Express Scripts and CVS Caremark Rx, were able to collectively pocket $7.3 billion in added revenue above cost during the five year period of the study through 2022.

“The Big 3 PBMs marked up numerous specialty generic drugs dispensed at their affiliated pharmacies by thousands of percent, and many others by hundreds of percent,” it concluded.

A thousand percent increase in the price of a drug that costs $10 wholesale would result in a retail price of $110.

This markup rate applied to 22% of the specialty therapies examined, including Imatinib, a generic used to treat leukemia, or non-oncological Tadalafil for pulmonary hypertension. Others such as Lamivudine needed by HIV-positive patients were nearly quadruple the price of their acquisition cost.

Independent Vermont Sen. Bernie Sanders has been conducting Congressional hearings in an attempt to shed light on the problems posed by these drug middlemen as well as drugmakers themselves.

(continue reading)

#politics#healthcare#united healthcare#luigi mangione#brian thompson#insurance#price gouging#capitalism#ftc#lina khan#oncology#profitized healthcare#privatized healthcare#corporate greed#cvs#cigna#pharmacy benefits managers

522 notes

·

View notes

Text

the FTC finally going after pharmacy benefits managers is sooooooo delicious. I hope they roast optumRx on a giant spit

(pharmacy benefits managers are the middlemen who decide (1) which drugs your insurance company will cover and (2) how much they'll pay for them. part of the problem there is that the big PBMs are owned by the same insurance companies they service, which means they end up setting rates and policies designed to squeeze as much money out of both patients and pharmacies/providers as possible. drug manufacturers are still a big part of why prescription drug costs are so high thanks to patent fuckery and exclusivity agreements, but PBMs are arguably way worse since, unlike drug manufacturers who actually make useful drugs, they don't do anything except add layers of pointless bureaucracy and expense. this writeup I linked the other day is a great explainer about it all)

199 notes

·

View notes

Text

The three largest drug middlemen inflated the costs of numerous life-saving medications by billions of dollars over the past few years, the Federal Trade Commission said in a report Tuesday. The top pharmacy benefit managers (PBMs) — CVS Health’s Caremark Rx, Cigna’s Express Scripts and UnitedHealth Group’s OptumRx — generated roughly $7.3 billion through price hikes over about five years starting in 2017, the FTC said. The “excess” price hikes affected generic drugs used to treat heart disease, HIV and cancer, among other conditions, with some increases more than 1,000% of the national average costs of acquiring the medications, the commission said. The FTC also said these so-called Big Three health care companies — which it estimates administer 80% of all prescriptions in the U.S. — are inflating drug prices “at an alarming rate, which means there is an urgent need for policymakers to address it.”

83 notes

·

View notes

Text

A 22-year-old in Wisconsin died after a severe asthma attack because he couldn't afford the price of his inhaler, which was no longer covered by his insurance.

The pharmacy benefit manager (PBM) that rescheduled his medication is OptumRx, which is a subsidiary of UnitedHealth Group.

This young man was murdered by the for-profit healthcare system in the United States.

28 notes

·

View notes

Text

Pharmacy benefit managers started popping up in the late 1960s as providers of claims processing and administrative services for health insurers. Over time, they became essential middlemen between drugmakers and the many insurers, employers and government entities who purchase drugs on behalf of their members, constituents and beneficiaries. Mergers between PBMs have led to a market dominated by a small number of very large players. In 2023, the three biggest ones – OptumRx, Express Scripts and CVS Caremark – managed 79% of U.S. prescription claims and served roughly 270 million customers. The primary role of these companies is to negotiate price, affordability and access to prescription drugs. They do this by operating and designing formularies, which are lists of drugs that insurers cover. Formularies also assign drugs to different tiers that determine what patients must pay out of pocket to access the drug. Generic drugs are typically placed in the tier with the lowest out-of-pocket costs. Patented drugs that insurers prefer are placed in a tier with higher costs, and nonpreferred drugs are in a tier that requires patients to pay even more. Some drugs can even be excluded from the formulary altogether, meaning insurance won’t cover them. Tier placement determines how affordable a medication is to consumers and the effective drug price that insurers pay.

6 notes

·

View notes

Text

Many organizations in the healthcare industry, including PBM companies and health insurance companies, have consolidated in recent years to create larger healthcare enterprises with greater bargaining power, which has resulted in greater pricing pressures. For example, in July 2015, OptumRx, UnitedHealth Group’s pharmacy care services business, completed its combination with Catamaran Corporation, with the combined businesses expected to fulfill over one billion prescriptions in 2015 and be the third largest PBM company in the United States…. If this consolidation trend continues, it could give the resulting enterprises even greater bargaining power, which may lead to further pressure on the prices for our products and services.

Matt Stoller on the woes of Walgreens and why the pharmacy business is in a shambles due to market concentration

3 notes

·

View notes

Text

22-Year-Old With Chronic Asthma Died After Inhaler Price Went From $66 to $539: Lawsuit

Source: HuffPost

22-Year-Old With Chronic Asthma Died After Inhaler Price Went From $66 to $539: Lawsuit

Source: HuffPost

2 notes

·

View notes

Text

The parents of a 22-year-old Wisconsin man who died after an asthma attack have filed a lawsuit against Walgreens and UnitedHealth Group’s pharmacy benefit manager after they said the price for his medication suddenly rose from $66 to $539.

Cole Schmidtknecht, 22, had lived with asthma since he was a baby, but he was able to manage his symptoms by taking Advair Diskus, a preventative inhaler, every day, according to a lawsuit filed in federal court last week. Since 2023, Schmidtknecht had health insurance through his employer that covered his medication, which cost him no more than $66.86 each month.

97 notes

·

View notes

Text

It's Time to Break Up Big Medicine - BIG by Matt Stoller

So UHG has been under a lot of legal heat. But notice something about these lawsuits? None of them have to do with health insurance. UHG was sued over its manipulation of drug pricing, for buying a financial company, and for trying to acquire a bunch of medical caregivers. UHG, in other words, is not primarily a health insurer, but something new. It is the biggest employer of doctors in the nation, it has a significant software business, and it sits in the middle of the pharmaceutical pricing chain with its OptumRx pharmacy benefit manager and giant mail-order pharmacy. In 2020, when the U.S. government delivered tens of billions of dollars to hospitals, guess what financial conduit it used? Optum Bank, which is also owned by UHG. And it is now in the pharmaceutical production business, as is CVS. UnitedHealth Group isn’t, as Noah Smith believes, spending $241.9 billion paying for medical costs, it is trying to figure out how to use that money from UnitedHealth Care - its insurance arm - to buy from Optum - its arm of everything else. UHG even has a term for this spending, ‘intercompany eliminations,’ which have now reached 27% of its revenue.

2 notes

·

View notes

Text

ranting about insurance at the void under the cut

our insurance Requires prescriptions to be delivered through Shitty Mail Prescription System, no local pharmacies you can just fucking walk to and pick something up that day or the next unless maybe it’s your very first-est dose and you pwommy you won’t need any maintenance doses like someone who needs medical insurance or something

anyway, I’d been on testosterone gel because I transitioned during pandemic times and didn’t want to deal with all the extra stuff injections would require

but like a couple months ago gel was just Out Of Stock, when’s there gonna be more, who knows, it’ll be back in stock when it’s back in stock, and even trying to fill it at a real pharmacy didn’t help, and apparently this is a problem a lot of people have with the gel

so ok, I’ll just bid farewell to hand manitizer and learn to inject shit, some extra steps involved but at least my meds will like, exist. so down I go to planned parenthood, who are like ok we’ll try and subscribe you a couple months’ supply and your needles and syringes at CVS

after a week or so insurance said no, naturally, so ok heavy sigh send it through the damn mail

status on insurance website says it will arrive on Thursday. well, it says a two-week supply will arrive Thursday (note: this is one (1) vial), no mention of needles and syringes so we’ll see how that fucking goes

anyway if you hear about a guy caught crawling through OptumRX’s vents and his main identifying mark is weird-ass scars from administering his testosterone via the shards of the vial, maybe it was another dude who just happened to have the same problem who can say???

4 notes

·

View notes