#mego

Explore tagged Tumblr posts

Text

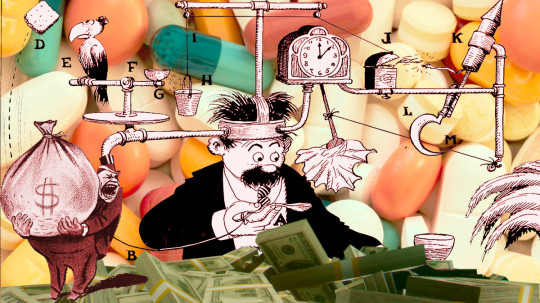

What the fuck is a PBM?

TOMORROW (Sept 24), I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Terminal-stage capitalism owes its long senescence to its many defensive mechanisms, and it's only by defeating these that we can put it out of its misery. "The Shield of Boringness" is one of the necrocapitalist's most effective defenses, so it behooves us to attack it head-on.

The Shield of Boringness is Dana Claire's extremely useful term for anything so dull that you simply can't hold any conception of it in your mind for any length of time. In the finance sector, they call this "MEGO," which stands for "My Eyes Glaze Over," a term of art for financial arrangements made so performatively complex that only the most exquisitely melted brain-geniuses can hope to unravel their spaghetti logic. The rest of us are meant to simply heft those thick, dense prospectuses in two hands, shrug, and assume, "a pile of shit this big must have a pony under it."

MEGO and its Shield of Boringness are key to all of terminal-stage capitalism's stupidest scams. Cloaking obvious swindles in a lot of complex language and Byzantine payment schemes can make them seem respectable just long enough for the scammers to relieve you of all your inconvenient cash and assets, though, eventually, you're bound to notice that something is missing.

If you spent the years leading up to the Great Financial Crisis baffled by "CDOs," "synthetic CDOs," "ARMs" and other swindler nonsense, you experienced the Shield of Boringness. If you bet your house and/or your retirement savings on these things, you experienced MEGO. If, after the bubble popped, you finally came to understand that these "exotic financial instruments" were just scams, you experienced Stein's Law ("anything that can't go forever eventually stops"). If today you no longer remember what a CDO is, you are once again experiencing the Shield of Boringness.

As bad as 2008 was, it wasn't even close to the end of terminal stage capitalism. The market has soldiered on, with complex swindles like carbon offset trading, metaverse, cryptocurrency, financialized solar installation, and (of course) AI. In addition to these new swindles, we're still playing the hits, finding new ways to make the worst scams of the 2000s even worse.

That brings me to the American health industry, and the absurdly complex, ridiculously corrupt Pharmacy Benefit Managers (PBMs), a pathology that has only metastasized since 2008.

On at least 20 separate occasions, I have taken it upon myself to figure out how the PBM swindle works, and nevertheless, every time they come up, I have to go back and figure it out again, because PBMs have the most powerful Shield of Boringness out of the whole Monster Manual of terminal-stage capitalism's trash mobs.

PBMs are back in the news because the FTC is now suing the largest of these for their role in ripping off diabetics with sky-high insulin prices. This has kicked off a fresh round of "what the fuck is a PBM, anyway?" explainers of extremely variable quality. Unsurprisingly, the best of these comes from Matt Stoller:

https://www.thebignewsletter.com/p/monopoly-round-up-lina-khan-pharma

Stoller starts by pointing out that Americans have a proud tradition of getting phucked by pharma companies. As far back as the 1950s, Tennessee Senator Estes Kefauver was holding hearings on the scams that pharma companies were using to ensure that Americans paid more for their pills than virtually anyone else in the world.

But since the 2010s, Americans have found themselves paying eye-popping, sky-high, ridiculous drug prices. Eli Lilly's Humolog insulin sold for $21 in 1999; by 2017, the price was $274 – a 1,200% increase! This isn't your grampa's price gouging!

Where do these absurd prices come from? The story starts in the 2000s, when the GW Bush administration encouraged health insurers to create "high deductible" plans, where patients were expected to pay out of pocket for receiving care, until they hit a multi-thousand-dollar threshold, and then their insurance would kick in. Along with "co-pays" and other junk fees, these deductibles were called "cost sharing," and they were sold as a way to prevent the "abuse" of the health care system.

The economists who crafted terminal-stage capitalism's intellectual rationalizations claimed the reason Americans paid so much more for health care than their socialized-medicine using cousins in the rest of the world had nothing to do with the fact that America treats health as a source of profits, while the rest of the world treats health as a human right.

No, the actual root of America's health industry's problems was the moral defects of Americans. Because insured Americans could just go see the doctor whenever they felt like it, they had no incentive to minimize their use of the system. Any time one of these unhinged hypochondriacs got a little sniffle, they could treat themselves to a doctor's visit, enjoying those waiting-room magazines and the pleasure of arranging a sick day with HR, without bearing any of the true costs:

https://pluralistic.net/2021/06/27/the-doctrine-of-moral-hazard/

"Cost sharing" was supposed to create "skin in the game" for every insured American, creating a little pain-point that stung you every time you thought about treating yourself to a luxurious doctor's visit. Now, these payments bit hardest on the poorest workers, because if you're making minimum wage, at $10 co-pay hurts a lot more than it does if you're making six figures. What's more, VPs and the C-suite were offered "gold-plated" plans with low/no deductibles or co-pays, because executives understand the value of a dollar in the way that mere working slobs can't ever hope to comprehend. They can be trusted to only use the doctor when it's truly warranted.

So now you have these high-deductible plans creeping into every workplace. Then along comes Obama and the Affordable Care Act, a compromise that maintains health care as a for-profit enterprise (still not a human right!) but seeks to create universal coverage by requiring every American to buy a plan, requiring insurers to offer plans to every American, and uses public money to subsidize the for-profit health industry to glue it together.

Predictably, the cheapest insurance offered on the Obamacare exchanges – and ultimately, by employers – had sky-high deductibles and co-pays. That way, insurers could pocket a fat public subsidy, offer an "insurance" plan that was cheap enough for even the most marginally employed people to afford, but still offer no coverage until their customers had spent thousands of dollars out-of-pocket in a given year.

That's the background: GWB created high-deductible plans, Obama supercharged them. Keep that in your mind as we go through the MEGO procedures of the PBM sector.

Your insurer has a list of drugs they'll cover, called the "formulary." The formulary also specifies how much the insurance company is willing to pay your pharmacist for these drugs. Creating the formulary and paying pharmacies for dispensing drugs is a lot of tedious work, and insurance outsources this to third parties, called – wait for it – Pharmacy Benefits Managers.

The prices in the formulary the PBM prepares for your insurance company are called the "list prices." These are meant to represent the "sticker price" of the drug, what a pharmacist would charge you if you wandered in off the street with no insurance, but somehow in possession of a valid prescription.

But, as Stoller writes, these "list prices" aren't actually ever charged to anyone. The list price is like the "full price" on the pricetags at a discount furniture place where everything is always "on sale" at 50% off – and whose semi-disposable sofas and balsa-wood dining room chairs are never actually sold at full price.

One theoretical advantage of a PBM is that it can get lower prices because it bargains for all the people in a given insurer's plan. If you're the pharma giant Sanofi and you want your Lantus insulin to be available to any of the people who must use OptumRX's formulary, you have to convince OptumRX to include you in that formulary.

OptumRX – like all PBMs – demands "rebates" from pharma companies if they want to be included in the formulary. On its face, this is similar to the practices of, say, NICE – the UK agency that bargains for medicine on behalf of the NHS, which also bargains with pharma companies for access to everyone in the UK and gets very good deals as a result.

But OptumRX doesn't bargain for a lower list price. They bargain for a bigger rebate. That means that the "price" is still very high, but OptumRX ends up paying a tiny fraction of it, thanks to that rebate. In the OptumRX formulary, Lantus insulin lists for $403. But Sanofi, who make Lantus, rebate $339 of that to OptumRX, leaving just $64 for Lantus.

Here's where the scam hits. Your insurer charges you a deductible based on the list price – $404 – not on the $64 that OptumRX actually pays for your insulin. If you're in a high-deductible plan and you haven't met your cap yet, you're going to pay $404 for your insulin, even though the actual price for it is $64.

Now, you'd think that your insurer would put a stop to this. They chose the PBM, the PBM is ripping off their customers, so it's their job to smack the PBM around and make it cut this shit out. So why would the insurers tolerate this nonsense?

Here's why: the PBMs are divisions of the big health insurance companies. Unitedhealth owns OptumRx; Aetna owns Caremark, and Cigna owns Expressscripts. So it's not the PBM that's ripping you off, it's your own insurance company. They're not just making you pay for drugs that you're supposedly covered for – they're pocketing the deductible you pay for those drugs.

Now, there's one more entity with power over the PBM that you'd hope would step in on your behalf: your boss. After all, your employer is the entity that actually chooses the insurer and negotiates with them on your behalf. Your boss is in the driver's seat; you're just along for the ride.

It would be pretty funny if the answer to this was that the health insurance company bought your employer, too, and so your boss, the PBM and the insurer were all the same guy, busily swapping hats, paying for a call center full of tormented drones who each have three phones on their desks: one labeled "insurer"; the second, "PBM" and the final one "HR."

But no, the insurers haven't bought out the company you work for (yet). Rather, they've bought off your boss – they're sharing kickbacks with your employer for all the deductibles and co-pays you're being suckered into paying. There's so much money (your money) sloshing around in the PBM scamoverse that anytime someone might get in the way of you being ripped off, they just get cut in for a share of the loot.

That is how the PBM scam works: they're fronts for health insurers who exploit the existence of high-deductible plans in order to get huge kickbacks from pharma makers, and massive fees from you. They split the loot with your boss, whose payout goes up when you get screwed harder.

But wait, there's more! After all, Big Pharma isn't some kind of easily pushed-around weakling. They're big. Why don't they push back against these massive rebates? Because they can afford to pay bribes and smaller companies making cheaper drugs can't. Whether it's a little biotech upstart with a cheaper molecule, or a generics maker who's producing drugs at a fraction of the list price, they just don't have the giant cash reserves it takes to buy their way into the PBMs' formularies. Doubtless, the Big Pharma companies would prefer to pay smaller kickbacks, but from Big Pharma's perspective, the optimum amount of bribes extracted by a PBM isn't zero – far from it. For Big Pharma, the optimal number is one cent higher than "the maximum amount of bribes that a smaller company can afford."

The purpose of a system is what it does. The PBM system makes sure that Americans only have access to the most expensive drugs, and that they pay the highest possible prices for them, and this enriches both insurance companies and employers, while protecting the Big Pharma cartel from upstarts.

Which is why the FTC is suing the PBMs for price-fixing. As Stoller points out, they're using their powers under Section 5 of the FTC Act here, which allows them to shut down "unfair methods of competition":

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The case will be adjudicated by an administrative law judge, in a process that's much faster than a federal court case. Once the FTC proves that the PBM scam is illegal when applied to insulin, they'll have a much easier time attacking the scam when it comes to every other drug (the insulin scam has just about run its course, with federally mandated $35 insulin coming online, just as a generation of post-insulin diabetes treatments hit the market).

Obviously the PBMs aren't taking this lying down. Cigna/Expressscripts has actually sued the FTC for libel over the market study it conducted, in which the agency described in pitiless, factual detail how Cigna was ripping us all off. The case is being fought by a low-level Reagan-era monster named Rick Rule, whom Stoller characterizes as a guy who "hangs around in bars and picks up lonely multi-national corporations" (!!).

The libel claim is a nonstarter, but it's still wild. It's like one of those movies where they want to show you how bad the cockroaches are, so there's a bit where the exterminator shows up and the roaches form a chorus line and do a kind of Busby Berkeley number:

https://www.46brooklyn.com/news/2024-09-20-the-carlton-report

So here we are: the FTC has set out to euthanize some rentiers, ridding the world of a layer of useless economic middlemen whose sole reason for existing is to make pharmaceuticals as expensive as possible, by colluding with the pharma cartel, the insurance cartel and your boss. This conspiracy exists in plain sight, hidden by the Shield of Boringness. If I've done my job, you now understand how this MEGO scam works – and if you forget all that ten minutes later (as is likely, given the nature of MEGO), that's OK: just remember that this thing is a giant fucking scam, and if you ever need to refresh yourself on the details, you can always re-read this post.

The paperback edition of The Lost Cause, my nationally bestselling, hopeful solarpunk novel is out this month!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/23/shield-of-boringness/#some-men-rob-you-with-a-fountain-pen

Image: Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#matthew stoller#pbms#pharmacy benefit managers#cigna#ftc#antitrust#intermediaries#bribery#corruption#pharma#monopolies#shield of boringness#Caremark#Express Scripts#OptumRx#insulin#gbw#george w bush#co-pays#obamacare#aca#rick rules#guillotine watch#euthanize rentiers#mego

446 notes

·

View notes

Text

Commander Zack Power and His PowerArm with Lightning Cycle (Mego)

273 notes

·

View notes

Note

Mego hugs Optimus against his chest, and poor Optimus is just like, "...I-I don't know what to do here..."

Like, he NOW realizes that Mego wasn't lying about not remembering anything but doesn't know how to feel.

-TFAmnesia Megatron Anon

Mego just keeps crying because now he's so overjoyed that Optimus came to check on him!! Sobbing while he's squeezing poor Op

92 notes

·

View notes

Text

"Mr. Spock, if we're all here, who's steering the ship?"

#Star Trek#Star Trek: The Original Series#Captain James T. Kirk#Dr. Leonard “Bones” McCoy#Lt. Commander Montgomery “Scotty” Scott#Mister Spock#Ensign Pavel Chekhov#Lieutenant Hikaru Sulu#Mego#action figures#toys#science fiction

38 notes

·

View notes

Text

57 notes

·

View notes

Text

A Superhero Is (Re)Born?

60 notes

·

View notes

Text

Reposting my smoocheroo art.

We got some

Camille x Gil Ed x Cleo Mego x Gina Hego x Electronique Bonnie x Junior Drakken x Shego Kim x Ron AND.... Monkey Fist x DNAmy

#camille leon#gil moss#motor ed#cleopatra#oc#mego#team go#gina#hego#electronique#drakken#shego#drakgo#kim posisble#ron stoppable#dnamy#monkey fist#bonnie rockwaller#junior

28 notes

·

View notes

Text

Star Trek Mr. Spock 6-Face Card (Type 1 Head / Unpainted Lips) (Mego, 1974)

#Star Trek#MEGO#Action Figures#Spock#Science Fiction#Toys#Vintage#Art#Action Figure#Star Trek TOS#Mr Spock#Illustration#Television#TV#Film#1974#1970s#70s

77 notes

·

View notes

Text

The Micronauts No. 19, dated July 1980. Cover by Michael Golden. Marvel.

47 notes

·

View notes

Text

Touch Hit Tit Tuesday: Jungle Edition.

#touch his tit tuesday#spirk#spock#kirk#I spent a bit too much time on this when I ought to be sleeping#Star Trek TOS#Star Trek#mego action figures#action figures#MEGO

31 notes

·

View notes

Text

Mego is my favourite Go brother ( •͈ᴗ•͈)💖💜

105 notes

·

View notes

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

431 notes

·

View notes

Text

Cheron - Star Trek (Mego)

150 notes

·

View notes

Note

Man, we're really making Mego a boyfailure.

Also, I really think the rest of Team Prime would constantly question if Megatron really has amnesia and at first would either verbally tell Mego to leave whenever he tries to visit or sometimes fight him on site.

-TFAmnesia Megatron Anon

He's so miserable and pathetic... He actually cries a couple times when he's chased off, because he'd had such a great idea! It was totally gonna work! (It would absolutely not have worked). Rip Mego

50 notes

·

View notes

Text

Next week on Star Trek the crew of the Enterprise encounter a strange alien that has beamed aboard!

#Star Trek#Star Trek: The Original Series#Martian Manhunter#Lieutenant Nyota Uhura#Ensign Pavel Chekhov#Dr. Leonard “Bones” McCoy#Captain James T. Kirk#Mister Spock#Lt. Commander Montgomery “Scotty” Scott#Lieutenant Hikaru Sulu#Mego#U.S.S. Enterprise Bridge Play Set#action figures#toys#Hasbro

37 notes

·

View notes

Text

Mego Planet of the Apes Treehouse playset, 1974.

182 notes

·

View notes