#Paymentsolution

Explore tagged Tumblr posts

Text

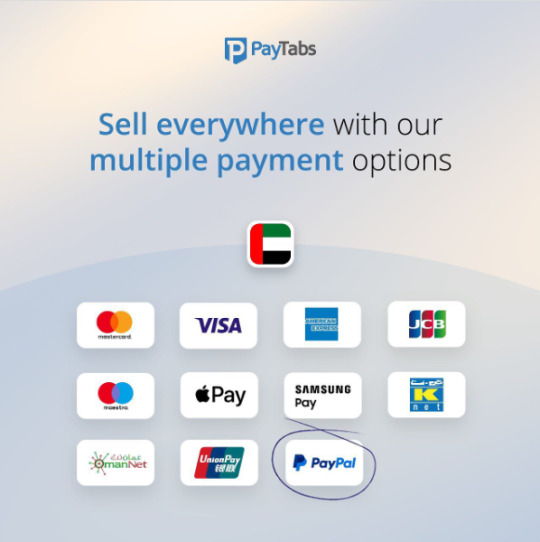

Industry Payment Solutions in the UAE: The Future of Digital Transactions

The UAE is a global leader in digital payments, fintech innovation, and seamless transaction experiences. Businesses need reliable payment solutions to stay competitive in this fast-evolving market. Whether you're looking for a payment gateway, payment orchestration, or a super app integration, the right payment solution company can transform your operations.

In this guide, we’ll explore key industry solutions shaping the UAE’s financial landscape and how top payment processors like PayTabs are driving innovation.

1. Payment Orchestration: Simplifying Multi-Gateway Transactions

Payment orchestration allows businesses to manage multiple payment gateways from a single platform. This ensures: ✔ Higher approval rates ✔ Lower transaction costs ✔ Better fraud prevention

For UAE businesses dealing with global customers, an orchestrated payment solution enhances efficiency. Explore PayTabs’ Payment Orchestration.

2. Super Apps: All-in-One Payment Ecosystems

The rise of super apps in the UAE combines payments, banking, shopping, and lifestyle services. Key benefits include: ✔ Seamless Tap n Go transactions ✔ Integrated loyalty programs ✔ Faster checkout experiences

Leading fintech companies are powering these platforms with secure payment processing solutions.

3. Tap n Go & Contactless Payments

With the UAE’s push for cashless economies, Tap n Go payments via NFC and mobile wallets are booming. Businesses must adopt: ✔ POS systems with Tap n Go ✔ Mobile wallet integrations (Apple Pay, Samsung Pay) ✔ QR code payments

A top payment provider ensures smooth, secure transactions.

4. Choosing the Right Payment Gateway

A robust payment gateway is crucial for online businesses. Look for: ✔ Multiple currency support (including USD, AED, EUR) ✔ High-security compliance (PCI DSS, 3D Secure) ✔ Fast checkout integrations (PayPal, Apple Pay, Samsung Pay)

Leading providers like PayTabs and PayPal offer seamless payment experiences tailored for UAE businesses. Whether you need a local payment gateway or global solutions like PayPal, selecting the right partner ensures smooth transactions. Learn More About PayTabs Gateway

Why Include PayPal?

Global Trust: PayPal is widely recognized for secure cross-border transactions.

Buyer/Seller Protection: Reduces fraud risks for UAE e-commerce businesses.

Multi-Currency Support: Essential for UAE’s international trade hub.

The UAE’s digital payment landscape thrives on diversity—from PayTabs’ orchestration to PayPal’s global reach. Whether you’re a startup or enterprise, leveraging the right payment provider fuels growth.

5. Why Partner with a Top Fintech Company?

The best payment solution companies in the UAE provide: ✔ Custom payment processing ✔ Fraud prevention tools ✔ Scalable APIs for growth

As a leading fintech company, PayTabs supports SMEs and enterprises with cutting-edge solutions.

The UAE’s digital payment landscape is evolving rapidly, with payment orchestration, super apps, and Tap n Go leading the change. Partnering with a trusted payment provider ensures your business stays ahead.

Ready to upgrade your payment solutions? Discover PayTabs’ Industry Solutions today!

0 notes

Text

Best Payment Solutions for Global E-Commerce Stores

Running a global e-commerce store brings enormous growth potential, but handling international payments can be challenging. Customers expect a seamless checkout experience, regardless of their location or preferred payment method. Offering secure, fast, and reliable payment options directly impacts customer satisfaction and conversion rates. The right payment solution helps you reduce abandoned carts, lower transaction costs, and protect your business from fraud.

Global e-commerce businesses face unique challenges such as cross-border fees, currency conversion, and varying regulations. Choosing the right payment solution requires balancing cost, convenience, and security while meeting the diverse needs of an international customer base. Here’s a detailed look at the best payment solutions for global e-commerce stores and how to select the one that fits your business.

Why Global Payment Solutions Matter

E-commerce is expected to reach $8 trillion in global sales by 2027. With growing competition, businesses need to offer more than just products they need to deliver a seamless shopping experience. Payment processing plays a major role in that experience.

Shoppers abandon carts when payment options are limited, transaction times are slow, or security concerns arise. A global payment solution ensures that customers can pay quickly and securely using their preferred currency and method. Businesses also benefit from faster settlement times, lower fees, and stronger fraud protection.

Key Features to Look for in a Global Payment Solution

1. Multi-Currency Support

Customers are more likely to complete a purchase if they see prices and complete transactions in their local currency. A strong payment solution automatically converts currencies and adjusts pricing based on real-time exchange rates. This removes friction and improves trust.

Payment processors like Stripe and PayPal handle multi-currency payments seamlessly. Businesses can set pricing in different currencies without manual adjustments, improving accuracy and transparency for international customers.

2. Localized Payment Methods

Credit and debit cards remain popular globally, but local payment preferences vary. In some regions, mobile wallets like WeChat Pay and Alipay are more common than credit cards. European customers often prefer SEPA Direct Debit and iDEAL, while Latin American shoppers lean toward cash-based payments.

A payment solution that supports a wide range of local payment options increases the chances of successful transactions. This includes support for debit and credit card payment processing, as well as alternative methods like buy now, pay later (BNPL) and digital wallets.

3. Seamless Integration and Compatibility

A payment processor should integrate easily with your e-commerce platform, whether you’re using Shopify, WooCommerce, Magento, or a custom-built site. Direct integration reduces technical issues and ensures consistent payment processing across web and mobile platforms.

Look for a solution that offers a simple API or plugin for quick setup. Compatibility with existing inventory and order management systems further improves operational efficiency.

4. Fraud Prevention and Security

Global e-commerce stores face higher fraud risks due to the complexity of cross-border transactions. A strong payment solution should offer built-in fraud detection tools that monitor transaction patterns and flag suspicious activity in real time.

Look for solutions that provide tokenization, encryption, and two-factor authentication (2FA) to protect sensitive customer data. PCI DSS compliance is essential for ensuring secure payment processing.

5. Fast Settlement Times and Lower Fees

Delays in fund settlements can disrupt business cash flow, especially for international sales. While traditional banks can take up to five business days to process international payments, modern payment solutions offer same-day or next-day settlements.

Competitive pricing models, including interchange-plus and flat-rate pricing, help reduce overall transaction costs. Watch for hidden fees tied to cross-border payments and currency conversion. Transparent pricing reduces unexpected costs and helps maintain profitability.

Best Payment Solutions for Global E-Commerce

✅ Fibonatix

Fibonatix offers global payment solutions tailored to high-risk industries, including adult e-commerce and dating businesses. Their services help businesses streamline payment processing, improve cash flow, and enhance customer experience. Fibonatix supports multiple currencies and payment methods, ensuring smooth and efficient transactions for international customers. Their strong fraud protection and secure platform make them a trusted partner for businesses operating in sensitive markets.

✅ Stripe

Stripe is known for its developer-friendly API and extensive global payment network. It supports over 135 currencies and a wide range of local payment methods. Stripe also provides automatic currency conversion and transparent pricing. Its built-in fraud detection and strong customer support make it ideal for businesses scaling globally.

✅ PayPal

PayPal’s reputation for secure transactions and customer trust makes it a preferred option for global e-commerce. It supports multi-currency payments and offers buyer protection, which increases customer confidence. PayPal’s merchant fees can be high, but its ease of use and strong security features make it a reliable choice for cross-border sales.

✅ Adyen

Adyen offers direct integration with major e-commerce platforms and supports over 250 payment methods worldwide. Its single-platform solution allows businesses to process online, mobile, and in-person payments through one account. Adyen’s dynamic currency conversion and advanced fraud protection give businesses more control over international payments.

✅ Square

Square is ideal for small to mid-sized businesses looking for a simple, transparent payment solution. While it primarily serves US-based merchants, Square’s international expansion now supports businesses in Canada, Japan, Australia, and the UK. Its competitive flat-rate pricing and fast settlement times make it an appealing option for growing businesses.

✅ Worldpay

Worldpay handles over 40 billion transactions annually and supports payments in over 120 currencies. Its strong presence in Europe and Asia makes it a preferred option for businesses looking to expand into new markets. Worldpay also offers advanced data analytics and real-time fraud monitoring.

✅ Soft POS Terminal

Soft POS terminal solutions allow businesses to accept contactless payments directly through a smartphone or tablet. This eliminates the need for traditional hardware and allows businesses to accept payments anywhere. For global e-commerce, this enables faster and more flexible payment processing, especially for mobile-first customers.

How to Choose the Right Payment Solution

Analyze Your Customer Base: Identify the most common payment methods and currencies used by your target customers.

Evaluate Transaction Costs: Compare fees for international payments, chargebacks, and currency conversion.

Prioritize Security: Choose a solution with strong encryption, tokenization, and fraud detection.

Test Integration: Ensure the solution works with your existing e-commerce platform and POS systems.

Check Support and Uptime: Look for 24/7 customer support and a track record of high system uptime.

Common Mistakes to Avoid

❌ Ignoring Local Payment Preferences

Customers are less likely to complete a purchase if their preferred payment method isn’t available. Ensure your solution supports local options.

❌ Overlooking Hidden Fees

Cross-border fees, chargeback penalties, and currency conversion rates can add up. Look for transparent pricing.

❌ Poor Mobile Experience

Most global shoppers buy through their phones. Ensure the payment flow works smoothly on mobile devices.

Conclusion

The best payment solution for your global e-commerce store depends on your business model, customer base, and sales volume. Processors like Fibonatix, Stripe, and Adyen offer strong global reach and competitive features, while Soft POS Terminal options provide added flexibility for mobile transactions. Focus on multi-currency support, fast settlement times, and strong security to improve customer experience and boost international sales.

#paymentsolution#payment processing#globalpaymentsolutions#paymentgatewaysforbusinesses#merchantaccountservices#internationalpaymentprocessing

0 notes

Text

🌟SmilePayz Payment Solution: We provide local payment methods in Indonesia 🇮🇩, Thailand 🇹🇭, Brazil 🇧🇷, and Mexico 🇲🇽, and also offering cryptocurrency payment solution as well.

Since we are based in these countries and connect directly to the source, we are able to provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

Whether you're in High Risk Gaming (I-Gaming), PSPs (Payment Solution Provider), Live Streaming, Forex, Stock & Crypto Broker, E-Sports & Other Online Gaming, SmilePayz is your best payment solution!

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#paymentsolution#paymentgateway#indonesiapayment#brokers#forex#Igaming#latam#southeast asia#API#integration#global payments#mexicopayment#brazilianpayment#thailandpayment#Qris#Dana

0 notes

Text

Collect Money Easily: The Latest Payment Solution Trends.

Learn about the latest payment solution trends, including surcharges, buy now pay later, and contactless payments.

0 notes

Text

Unlock the future of finance with ERP Cloud Intelligent Payments! 💳🚀 Streamline transactions, enhance security, and improve efficiency. Discover how Grey Space Computing can help your business thrive with cutting-edge payment solutions. 🔗Learn more: https://greyspacecomputing.com/oracle-erp-solution/ 📧 Contact us: https://greyspacecomputing.com/contact-us/ #ERPCloud #IntelligentPayments #Finance #GreySpaceComputing #OracleEBS #EBSsuite #Cloud #Oraclecloud #Oracle #ERP #Paymentsolution

#ERPCloud#IntelligentPayments#Finance#GreySpaceComputing#OracleEBS#EBSsuite#Cloud#Oraclecloud#Oracle#ERP#Paymentsolution

1 note

·

View note

Text

हमारी वेबसाइट और दुनिया भर के विभिन्न देशों के बीच वित्तीय संपर्क बढ़ाने के हमारे प्रयासों के तहत, हम भारतीय अंतर्राष्ट्रीय भुगतानों के लिए फोनपे एप्लीकेशन और पेटीएम की उपलब्धता की घोषणा करते हैं। क्यूआर कोड पर आधारित एकीकृत भुगतान इंटरफेस (यूपीआई) सेवा। यह जोड़ एक महत्वपूर्ण कदम है क्योंकि यह हमारे चैनलों के माध्यम से सीधे संचार के माध्यम से एकीकृत भुगतान इंटरफेस (यूपीआई) के माध्यम से भुगतान की स्वीकृति की सुविधा प्रदान करेगा, जो भारत के निवासियों के लिए बहुत फायदेमंद होगा जो हमारी वेबसाइट पर आते हैं और अंतरराष्ट्रीय कार्ड से भुगतान करने में समस्याओं का सामना करते हैं।

फोनपे भारत की सबसे बड़ी डिजिटल भुगतान कंपनी है, जिसके 515 मिलियन से अधिक पंजीकृत उपयोगकर्ता हैं। इस साझेदारी के माध्यम से, हमारी वेबसाइट पर भारत के नागरिकों के लिए भुगतान प्रक्रिया सरल हो जाएगी।

#upipayment#upi#upipayments#onlinepayment#paymentsolutions#digitalindia#phonepe#moneytransfer#payments#paymentgateway#googlepayindia#gigindia#bhim#qrcode#codavailable#danamojo#featurespotlight#zotzon

2 notes

·

View notes

Text

Wonderpay Your Trusted Payment Gateway With Instant Settlement And Free UPI Collection

Wonderpay offers Instant payment solutions across the country. This is very crucial for any business that aims to expand their reach for improving customer experiences. It also enhances the security of your payments with a minimum transaction cost. Our payment gateway supports a vast array of transactions, which makes it easier to manage financial transactions for all types of small e-commerce stores to large multinational corporations.

#payments#fintech#business#paymentsolutions#ecommerce#paymentprocessing#creditcardprocessing#money#merchantservices#finance#banking#bitcoin#payment#smallbusiness#pos#mobilepayments#pointofsale#paymentgateway#cryptocurrency#creditcards#crypto#blockchain#creditcard#technology#possystem#cash#onlinepayments#retail#digitalpayments#marketing

3 notes

·

View notes

Text

Join Wise and get £50. It’s simple, quick, and rewarding!

In an increasingly globalized world, managing money across borders has become a necessity for many. Whether you’re sending money to family members in another country, paying for services abroad, or simply managing multiple currencies, you need a reliable and cost-effective solution. This is where Wise.com comes into play. Known for its transparency, low fees, and user-friendly platform, Wise. com has quickly become a go-to service for those who value both their time and money.

#OnlineMoneyTransfer#paymentgateway#paymentsolutions#paymentprocessing#moneytransfer#moneymindset#moneymaker#moneymanagement#moneytransferservice#moneytransferapp#payments#payment gateway#payment solutions#payment processing#payment fraud protection#payment plan#partnership#credit#network#paypal#wise words#wise quotes#wise zzz#payment transfer easily#spilled ink#artists on tumblr#deadpool and wolverine#hermitcraft#photography#grunge

5 notes

·

View notes

Text

Real time payments are here! Say goodbye to waiting! Embrace the future of instant transactions with LightSpeedPay. Get in touch : https://forms.gle/syqTjuJrypPqQ4Ff8

#fintech#paymentsolutions#smallbusiness#instantpayments#businessgrowth#securepayments#entrepreneurlife#digitalpayments#techforgood#paymentgateway#startup#onlinesolutions#businesstips#easytransactions#saas#cashflow#businessowners#innovation#businesssuccess#securetransactions

2 notes

·

View notes

Text

💳 paydepotus.com is available!

An ideal domain for a payment service, fintech platform, or financial solutions provider in the US. Professional, clear, and business-ready.

🔗 Grab it now: www.godaddy.com/en-uk/domainsearch/find?domainToCheck=paydepotus.com

0 notes

Text

The Simpler Way to Collect Payments—SimpliCollect

Say goodbye to manual follow-ups and delays. With SimpliCollect by SprintNXT, businesses can streamline collections using intuitive, secure tools. Whether you're a startup or an enterprise, simplicity and speed are at your fingertips.

0 notes

Text

Tap, Pay, Done: The Future of Self-Service Payments

In today’s fast-moving digital world, customers expect speed, security, and simplicity—especially when it comes to payments. Self-service payment kiosks are redefining the checkout experience across industries, from retail to transport to utilities. With just a tap, transactions are completed in seconds—no lines, no delays. As businesses shift toward automation and contactless solutions, embracing smart kiosks isn't just a trend—it's the future. Are you ready to offer a faster, smarter, and more seamless way to pay?

#paymentsolutions#technology#kiosk#selfservicekiosk#kioskmachine#innovation#digitaltransformation#kiosks#ai#panashi#customerexperience#payments#paymenow

0 notes

Text

🌟SmilePayz Payment Solution: Covering All Industries, Seamless Integration! 🌟

We provide local payments in Indonesia 🇮🇩, Thailand 🇹🇭, Brazil 🇧🇷, and Mexico 🇲🇽, and also offering cryptocurrency payment solution as well.

Since we are a direct payment source for these countries, we can provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

Whether you're in Online Gaming, Forex, High-Risk Gaming (I-Gaming), Live Streaming, Forex, or financial services, SmilePayz is your best payment solution!

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#paymentsolution#paymentsolutions#API#Integration#payment gateway#indonesiapayment#brazilpayment#mexicopayment#thailandpayment#Qris#Dana#payment#Igaming#forex

0 notes

Text

Why Choosing a Flexible Payment Solution Matters: The Advantage of Red Maple’s Multi-Processor Integration - Red Maple

In today’s rapidly evolving commerce environment, businesses need payment solutions that are not only secure and reliable but also flexible. Red Maple’s payment solutions for Microsoft Dynamics 365 Finance & Operations stand out for their ability to integrate with a wide range of payment processors and gateways. This multi-processor compatibility isn’t just a technical perk—it’s a strategic advantage that empowers businesses to operate smarter, faster, and more efficiently.

#Payment Solution#Microsoft Dynamics 365 Finance & Operations#Red Maple#countersales#paymentsolutions#securepayments

0 notes

Text

Buy Now Pay Later (BNPL) Market: Key Drivers Behind the Surge in Popularity and Growth

The Buy Now Pay Later (BNPL) market has experienced significant growth in recent years, becoming an essential part of the global financial landscape. This payment solution, which allows consumers to purchase products and pay for them over a period, has transformed the way people approach spending and financial management. Several key drivers are fueling the expansion of the BNPL market, and understanding these factors is crucial to analyzing its future trajectory.

1. Shift in Consumer Behavior

One of the most prominent drivers of the BNPL market is the significant shift in consumer behavior. Modern consumers, particularly younger generations such as millennials and Gen Z, are more comfortable with digital transactions and online shopping. These consumers are increasingly seeking flexible payment options that align with their spending habits. Traditional credit cards, which often involve high-interest rates and complex repayment structures, are being replaced by more consumer-friendly BNPL services. These services typically offer interest-free payment plans for short-term purchases, which appeal to individuals looking for manageable ways to spread their spending without the burden of accruing debt.

2. E-Commerce Growth

The rise of e-commerce has been another major driver of BNPL services. As more consumers turn to online shopping, BNPL providers have partnered with e-commerce platforms to offer seamless payment solutions. The convenience of buying goods and services online, paired with the ability to pay in installments, has encouraged consumers to spend more. BNPL has become a natural fit for e-commerce businesses that want to enhance the shopping experience by providing an alternative to traditional payment methods. The proliferation of e-commerce across various sectors, including fashion, electronics, and home goods, has led to an uptick in BNPL usage as a preferred payment method.

3. Convenience and Accessibility

Another key driver for the growth of the BNPL market is the convenience and accessibility it offers consumers. BNPL platforms provide an easy-to-use interface, where users can quickly apply for and receive credit at checkout, often without the need for a credit check. This simplicity contrasts with traditional forms of credit, which may involve a lengthy application process and a review of the applicant's credit history. The ability to break down payments into smaller, manageable chunks makes it easier for consumers to afford higher-ticket items and manage their personal finances. As a result, BNPL is attracting a broader demographic, including individuals who might not have access to traditional credit due to poor or limited credit histories.

4. Retailer Adoption

Retailers have also played a pivotal role in the expansion of the BNPL market. By integrating BNPL options into their payment systems, retailers are able to cater to a wider audience and increase conversion rates. BNPL services are particularly attractive to merchants because they can potentially increase average order values and reduce cart abandonment rates. With BNPL, customers who might have otherwise hesitated to make a purchase due to upfront cost concerns are encouraged to complete their transactions. Moreover, BNPL platforms often take on the credit risk, meaning that retailers receive full payment upfront, while the BNPL provider assumes the responsibility of collecting payments from the consumer. This reduces the financial burden on merchants and makes BNPL an appealing payment option.

5. Marketing and Promotional Strategies

The aggressive marketing and promotional strategies employed by BNPL providers have significantly contributed to the market's growth. Many BNPL companies offer attractive incentives, such as zero-interest periods or deferred payment options, to entice consumers to use their services. Some providers even partner with retailers to offer exclusive deals for customers who choose BNPL as their payment method. These promotions, along with increased awareness of BNPL's benefits, have led to higher adoption rates and greater consumer engagement. As the market becomes more competitive, BNPL companies are likely to continue offering innovative incentives to attract new customers.

6. Regulatory Environment

While regulatory oversight has been a concern for the BNPL market in some regions, the evolving regulatory environment has also helped shape the market's growth. In some countries, governments have introduced regulations that ensure greater transparency and consumer protection in the BNPL sector. These regulations aim to safeguard consumers from falling into unmanageable debt while promoting responsible lending practices. In turn, this fosters trust in BNPL providers and encourages more consumers to use these services with confidence. Additionally, as more financial institutions and regulatory bodies recognize the potential of BNPL, the sector is becoming more standardized, which contributes to its overall growth.

7. Financial Inclusion

BNPL services are helping drive financial inclusion by providing an alternative credit source to individuals who may not have access to traditional banking services. In many cases, BNPL is accessible to individuals with limited or no credit history, as the platforms rely on different criteria to approve purchases, such as income verification or past purchase behavior. This inclusivity is expanding the reach of financial services to underserved populations, empowering individuals to manage their finances more effectively and access products they otherwise may not have been able to afford.

Conclusion

The BNPL market’s rapid growth can be attributed to a confluence of factors, including changes in consumer behavior, the rise of e-commerce, increased convenience and accessibility, retailer adoption, targeted marketing strategies, regulatory support, and financial inclusion. As these drivers continue to evolve, the BNPL industry is expected to play an increasingly integral role in shaping the future of consumer finance. However, the market must remain adaptable to the evolving regulatory landscape and ensure that its growth is sustainable for both consumers and service providers.

0 notes

Text

Looking for a better Lili bank account alternative? Zil.US offers fee-free business checking and powerful payment tools for SMBs and freelancers.

Learn more: https://zil.us/lili-bank/

Click here for interactive demo:

0 notes