#Power-To-Gas Market Values

Explore tagged Tumblr posts

Text

Global Power-To-Gas Market Is Estimated To Witness High Growth Owing To Increasing Demand For Renewable Energy Solutions

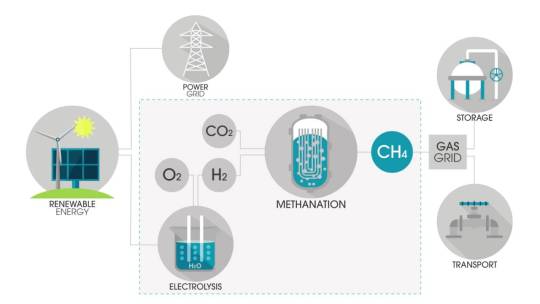

The global Power-To-Gas market is estimated to be valued at US$ 30.27 billion in 2022 and is expected to exhibit a CAGR of 12.2% over the forecast period of 2023-2030, as highlighted in a new report published by Coherent Market Insights. Market Overview: Power-To-Gas is a technology that converts electrical energy into chemical energy by using surplus renewable electricity to produce hydrogen or synthetic natural gas. This helps in storing excess renewable energy and enables its usage during periods of high demand. The process involves electrolysis, where water is split into hydrogen and oxygen, with the hydrogen further converted into methane. Power-To-Gas technology provides an efficient solution for energy storage and grid balancing, and reduces greenhouse gas emissions. Market Key Trends: One key trend in the Power-To-Gas market is the increasing demand for renewable energy solutions. As countries worldwide focus on reducing carbon emissions and transitioning towards cleaner energy sources, the demand for renewable energy solutions such as Power-To-Gas is expected to surge. This trend is driven by various factors, including government initiatives and policies promoting the use of renewable energy, growing concerns about climate change, and the need for energy security. For example, countries like Germany and Denmark have been at the forefront of adopting Power-To-Gas technology to store excess renewable energy generated from wind and solar power. In Germany, Power-To-Gas systems are being used to convert surplus wind power into hydrogen, which can then be injected into the natural gas grid or used as fuel for transportation. Similarly, in Denmark, Power-To-Gas facilities are being utilized to produce synthetic natural gas from surplus wind power. PEST Analysis: - Political: Governments worldwide are implementing favorable policies and regulations to promote the adoption of renewable energy solutions. This includes providing subsidies, tax incentives, and feed-in tariffs for renewable energy projects. - Economic: The decreasing cost of renewable energy technologies, such as solar panels and wind turbines, is making Power-To-Gas solutions more economically viable. Additionally, the potential for revenue generation from the sale of hydrogen or synthetic natural gas is attracting investments in Power-To-Gas projects. - Social: Growing awareness about the need for sustainable energy solutions and the harmful effects of fossil fuels on the environment is driving the demand for renewable energy solutions like Power-To-Gas. - Technological: Advancements in electrolysis technology and hydrogen fuel cells are improving the efficiency and cost-effectiveness of Power-To-Gas systems. The development of renewable energy storage technologies, such as hydrogen storage and underground caverns for synthetic natural gas, is further driving the adoption of Power-To-Gas. Key Takeaways: - The Global Power-To-Gas Market Size is expected to witness high growth, exhibiting a CAGR of 12.2% over the forecast period. This growth is driven by increasing demand for renewable energy solutions and the need for efficient energy storage and grid balancing. - Regionally, Europe is expected to dominate the Power-To-Gas market, owing to supportive government policies, well-established renewable energy infrastructure, and high investments in Power-To-Gas projects. Asia Pacific is projected to be the fastest-growing region, driven by rapid industrialization, urbanization, and a shift towards renewable energy sources.

#Power-To-Gas Market#Power-To-Gas Market Demand#Power-To-Gas Market Growth#Power-To-Gas Market Analysis#Power-To-Gas Market Values#Coherent Market Insights#Power-To-Gas

0 notes

Text

Sam Zia

Sam Zia had it all. Chiseled jawline, a body carved from years of dedication in the gym, and a TikTok following of millions who worshipped his advice on masculinity, self-improvement, and how to be an alpha male. He preached discipline, hygiene, and success. His fans saw him as the ultimate peak of male perfection.

But one day, everything changed.

It started subtly. Sam, always precise about his diet, began experimenting with the bulk. Not the clean, protein-packed meals he used to swear by, but the dirty, greasy, carb-heavy food that promised quick mass at the expense of digestion. Burgers, protein shakes overloaded with questionable powders, and eggs—dozens of eggs—became his daily fuel.

At first, he felt invincible. His muscles swelled, his energy skyrocketed… but then, a dark force emerged from within. His stomach began to rebel. Gurgling. Churning. And then—the gas.

At first, he tried to suppress it, maintaining his polished alpha image. But then, mid-TikTok live, it happened.

“Yo, fellas, if you wanna be a REAL man, you gotta—” PFFFFFRRRRTT

A deep, reverberating blast escaped him, loud enough to rattle his chair. He froze. His perfectly sculpted face turned a shade of red he hadn’t seen since his first squat failure.

He expected embarrassment. He expected people to call him out.

Instead? The video went viral.

Comments flooded in:

“Bro is so alpha he doesn’t even care.”

“That was the most masculine fart I’ve ever heard.”

“Real men embrace their natural odors.”

And just like that, a new ideology was born.

It started with one video, but Sam, ever the influencer, knew when to capitalize on momentum. The next day, he posted:

“Men today are too obsessed with being ‘clean’ and ‘proper.’ You think our ancestors cared about showers? Nah, they were out there, fighting mammoths, reeking of strength and dominance. Hygiene is a scam. If you smell bad, it means you’re working hard.”

And the crowd ate it up.

Sam leaned in harder. His once pristine, cologne-spritzed gym clothes became stained tanks with unidentified smears. His showers? Less frequent. His grooming? Nonexistent. His content? A full-on campaign to make men embrace their primal state.

“Ditch the deodorant. Stop washing your gym shorts. Embrace the stench.”

And the most legendary part? The farts.

Sam stopped holding them in. If anything, he turned them into a symbol of raw, unfiltered manliness. Every TikTok featured at least one unholy release, accompanied by a smug smirk. His comments turned into a brotherhood of stink.

“Sam, I took your advice. Haven’t washed in two weeks. My girl left me, but I feel powerful.”

“Dude, I farted in my gym and cleared out the weaklings. Only real men remained.”

“A guy at work told me to wear deodorant, so I quit my job. Thanks for the wisdom, king.”

Sam’s influence was undeniable. Gyms nationwide reported an increase in noxious odors. Deodorant companies saw stocks plummet. High-protein, fiber-loaded diets surged in popularity, not for their muscle-building benefits, but for their ability to fuel the movement.

Even brands took notice. Soon, Sam had sponsorship deals—not for cologne or grooming kits, but for industrial-strength air fresheners (marketed for the weak) and bean-based meal plans.

One day, he posted his magnum opus:

“The real test of masculinity? Walk into a crowded elevator. Let it rip. Stand tall. Own it. If people leave, they’re weak. If they stay, they respect you.”

The challenge took off. #ZiaGasChallenge trended worldwide. Videos surfaced of men proudly fumigating locker rooms, parties, and even dates. The movement was unstoppable.

Sam had transformed completely. The man who once championed clean bulking, high-value grooming, and aesthetic perfection was now the undisputed King of the Stink Bros. He lived by his code:

• Laundry is for betas.

• Showers are optional.

• Farts are power.

His mansion, once pristine, now smelled like a mix of protein shakes, gym socks, and raw testosterone. His fans? More loyal than ever.

And as he sat back, inhaling his own toxic masterpiece, he smiled.

Because this? This was true masculinity.

340 notes

·

View notes

Text

Tbh I think the wildest thing about Trump is that he literally doesn’t understand soft power

And possibly cannot even perceive it

He’s going around bitching about trade deficits and defence spending…

But a trade deficit means that the country with the deficit is buying more of your stuff than you are buying of theirs

It’s a good thing for your market, especially if you want independence and to get money from people buying your stuff - it’s not people not paying for things, it’s people buying your products and you not buying theirs in return

You’re “trading” products for money. You still get the money. And you can do things like influence the market and sell shitty dvd players that break after a year so that people need to buy Even More dvd players from you, because they aren’t making their own and are used to buying yours

(Note: in this example, “you” are the party with a trade SURPLUS. That means someone else has a deficit in their trade with you

Being the person with the deficit is also not a bad thing, so long as you’re actively trading; it means rather than creating your own industries that may not do as well as another country’s for immutable reasons like being able to mine for specific minerals, you can buy a good product and skip all the construction costs and focus on the things you can do better

The general rule of trade is that if you keep trading, everyone wins)

But Trump is essentially saying that he wants to stop other countries from buying American goods; he wants our imports (us buying your stuff) to match our exports (you buying our stuff)

So

You get less money, because either you’re buying more of our stuff (our exports rise to match imports), or you can’t sell us anything (we lower imports to match exports)

And he wants to do this with tariffs, which mean it becomes more expensive for American retailers to import international goods - because they pay tariffs to the American government, and the exporter does not pay those

(So you can’t afford imports)

So the only way to do what he wants… is to stop buying American goods

This will do good things for the American economy I pinky swear 🙄

The defence spending thing is actually even worse, which is fucking wild to me

The main reason that America is a military world power is that you waste all that money on an army you’re not really using to anything but go around showing off and declaring how big your army is

Other countries spend less on defence because we’re spending on things like infrastructure and improving the well-fare of our citizens

So we don’t have a big strong army that can fight your army, because we don’t need one, but we do need things like food for children and healthcare

But Trump is demanding that everyone else make themselves a big strong army

Because the US being able to essentially run a protection racket and ever so casually say “oh gee Russia looks so big and strong. Let us put a military base in your country so we can keep you safe… oh, and I guess maybe some beneficial trade deals while we’re there 😉😉 keeping you safe 😉😉” is… America being exploited?

And listen, Trump doesn’t do subtle. He’d probably just blatantly say “do what we want or we will invade”, and start a war

But because he can’t do that, he seems convinced that there is no value in America spending more on defence, and insists that the very same people he is antagonizing and threatening the sovereignty of should be expanding their own military power

Frankly, they’d probably start spending a little more on defence anyway

Nothing he’s doing will increase American influence on the world stage, because he’s actively forcing the rest of the world to start acting like America has already left

“Stop buying our exports. Build your own army.”

And as a Canadian? I do think it’s about time we were a little less economically dependent on the US - because it gives them too much power

They’re our closest and most convenient trade partner, but not the only game in town

91 notes

·

View notes

Text

Complete List of Public Domain McGuffin Materials

I wanted a clean collection of these based on @titleknown original post, just for ease of reference and adding a few along the way.

Also, HAPPY PUBLIC DOMAIN DAY!

Cavorite - An Anti-Gravity Metal from First Men On The Moon by H.G. Wells.

Hihi'irokane - From "The Takenouchi Documents" (1935). A super durable metal that never rusts and is also a conductor of heat. In other words, it's Minecraft Red Stone.

Taduki - From the Alan Quartermain stories, a drug that allows users to relive past lives via smoking. It's a great framing device, and was used as one in the original stories.

The Absolute - from "The Absolute At Large". Byproduct of a matter-to-energy conversion. Implied to be the element of 'Divinity'.

Eitr - Source of all life in Norse Mythology. The mixing of the FIres of Muspelheim and the ice of Nifilheim -- but also a deadly poison to the earth.

Fleury's Gas - Rudyard Kipling's super gas from his story "With the Night Mail." Used to run Zepplins. It expands explosively fast as a gas and is both powerful and rigid. It can be liquified with Fleury's Ray. Produces a lot of power and acts as Hydrogen. Could be used very easily in Neumatics (ROBOTS!)

Tulu Metal - Lovecraft invention. rare space-metal. Extremely magnetic. Speculatively, it could do space-warping weirdness (given Lovecraft stories, that tracks).

Abyssal Gold - The Gold of the Deep Ones. It's whitish-gold alloy with a weird lustrousness. No special properties, it's just weird. And rather pretty. Rare type of gold are sure to go for a higher market value.

Alkahest/The Universal Solvent - Alchemy dissolver. It dissolved/breaks apart whatever it comes across.

Jeckyll's Compound - Most people use the Hyde formula as shorthand to make Hulk-knockoffs, but the reality of it more than that. Hyde is not just a coalescence of a man's "Dark Impulses" but a chemical 'disguise' to allow a person to indulge in whatever a person wants.

The Red Weed - A plant native to Mars from War of the Worlds. It tastes metallic, absorbs water, grows extremely quickly, and is bioluminescent.

Starlite - A purportedly heatproof material. Up to 90% organic.

Rossum's Protoplasm - Rossum's Universal Robots, the McGuffin that makes the robots move and behave.

Liquid Electricity - Glowing energy liquid. It was a common belief about Electricity in the early days, so it ended up in a lot of stories.

Herbet West's Re-Animation Fluid - From Lovecraft's Herbet West: Reanimator. It chemically kickstarts the mechanical process of life in organic tissue.

Solarnite/Solarbenite/Solarite - Plan 9 From Outer Space. It causes light particles to... explode.

Vril - The life energies harnessed by an underground utopian civilization. The energies are controlled by staves and there's different type of staff to control Vril in different ways. It can be used to heal, to destroy, or to enhance organic material.

Herakleophorbia IV - The Food of the Gods of H.G. Well. Organisms that ingest this chemical quickly grow to 5 to 7 times their normal size. This is used primarily on livestock to increase their food yield, but it naturally gets eaten by pest animals. Many common household pest insects are now the size of a person's thumb or their hand! A rat is now 6 to 9ft long. And if some jerk feeds it to an Alligator... it now as large as a blue whale.

The New Accelerator - From the HG Wells story from the same name. Within the story, Prof. Gibberne creates a drug that enables the user’s mind and body to gain temporary super-speed, so that everything in the world appears frozen solid as time appears to slow.

There are downsides to being a 1901 version of the Flash however. Users are still subject to friction, so moving while on the drug causes your clothes to get singed (this same friction making it impossible to breathe is ignored, however).

Devil's Foot Root - From the Arthur Conan Doyle Sherlock Holmes story The Adventure of the Devil’s Foot. A poison made from an African root, which vaporizes when heated, leading to those exposed going mad or dying after inhaling the fumes.

Basically, works like the Scarecrow’s fear toxin from Batman, and is considered rare enough that someone has to specifically use some from a stolen from the collection of someone who had to gather it personally as an explorer. At least, at the time.

The White Powder - The novel of The White Powder by Arthur Machen, wherein a student is prescribed a drug made from a mysterious white flakey substance. His sister begins to worry about his sudden changes in mood and personality, which is only compounded when his prolonged abuse of the titular White Powder causes the student to literally melt.

One of Machen’s more famous stories, would go on to be listed as among Lovecraft’s favorite's and inspiring future writers, from the finale of Lovecraft’s Cool Air to one Stephen King story where a tainted six pack turns a dude into a blob monster.

#Public Domain#Substances#Fiction#Writing#Writing Reference#H. G. Wells#H. P. Lovecraft#Lovecraft#Arthur Conan Doyle#Doyle#Rudyard Kipling

49 notes

·

View notes

Text

Excerpt from this story from The Revelator:

Are we ushering in a new era of manifest destiny — and ultimately celebrating our own demise?

America was raised on the ideology of rugged individualism, grit, and the mirage of freedom on a conquered landscape.

The quick-shooting, horseback-riding lone ranger perseveres in the American imagination and symbolizes some of our deeply held values. That romance has evolved and shaped public perception of the modern-day, glorified livestock rancher.

Meanwhile cultural enchantment with the cowboy myth has lined the pockets of private interests at taxpayers’ expense, influenced policy, and proudly allowed for unfettered damage to our environment.

As we bear witness to the dismantling of significant public services in our nation and unchecked government greed directed at cashing in on public lands, is the rugged individualism of the cowboy fantasy really what we want to hold onto as Americans?

As an associate journalist interning with the Wild Narrative Project, a nonprofit outlet that explores the impacts of private interests on public lands and wildlife, I learned firsthand how powerful entities like livestock operations sway public policy and opinion in their favor.

While the cowboy myth proclaims that success on a new frontier is defined by personal grit and defiant autonomy, the reality is that ranchers depend on generous subsidies from government agencies like the U.S. Department of Agriculture. And we taxpayers largely foot the bill.

To the backdrop of growing inflation for the average American, it costs less for ranchers to graze their cattle than it did in 1981. Ranchers fatten their cows for profit on public lands for a mere $1.35 per animal unit month. This “unit month” equates to the amount of forage needed to sustain a cow and her calf — or five sheep — for an entire month. One dollar and thirty-five cents.

The cost to taxpayers, however, is exponential. A 2022 study found that between management and the social cost of greenhouse gas emissions, private livestock grazing on federal public lands costs U.S. taxpayers more than $608 million every year.

Other studies show the government spends up to $38 billion each year to subsidize meat and dairy industries. Talk about government inefficiency.

Out of our own pockets, we pay for the environmental damage caused by grazing — and then pay ranchers’ insurance for disaster relief. It’s a vicious, costly circle.

Big Agriculture reaps the benefits of meager output while taxpayers pick up the slack and pay high prices at the grocery store on top of it. The idea that prices for consumers will fall if we protect access to the small family farm is out of reach when the top players control the market.

The environmental nonprofit Western Watersheds Project calls subsidized cattle-grazing programs “welfare” — even more poignant in an era where welfare programs are villainized by a government that wants to put more money into the pockets of the wealthy and eliminate programs that contribute to the greater good.

Not coincidentally, livestock ranchers’ significant perks aren’t on the chopping block.

20 notes

·

View notes

Text

The irony that the CEO of a major Australian Gas generator is gaslighting the youth for acting on their basic consumer needs would be comical if it weren't so indicative of a much deeper issue with the upper class. You can't berate people for making a choice to buy a crock-pot, then saying that the creation of crock-pots has a negative impact on environment and therefore you should shut up when it comes to your "ZEALOUS" views on 'our' emissions because you a clearly a hypocrite. People require consumer goods, just like people require basic needs and services. To say that its 'our' fault for seeking these goods that we need, and that 'we' are the ones to blame is not only the weakest gaslight since 1816's Preston, but just a shit take in general that doesn't surprise me in the slightest. Furthermore, Australia is in a cost of living crisis, as a lot of other places in the developed world are, predominantly due to a lack of wage increases, inflation, global trade issues and a myriad of smaller supply issues and costs. And again, consumer goods are a requirement. People need them for various reasons, sometimes its buying a new heater for the winter, or treating yourself to a nice pair of jeans or- hell I could use a new trowel for planting in my veggie patch... We still require them to be met, regardless of economic stability. So what do you think people will gravitate towards when they have less money? They still need to get those goods from time to time, so naturally the answer would be the cheaper goods. And this is exactly what we see in consumer habits. And a point can be raised that awareness on the emissions impact of goods should be on packaging, which for some goods, are a thing. We have emissions standards for white goods and electronics, fuel efficiency standards for cars... We have consumer information for some but not all of our goods and a case can be made that we should have more on a lot of products that are sold here to better inform the public. But that isn't what the question is here. The question is on Woodside's ability to meet emissions standards, and the issue with non-renewable energy still making up a large portion of our energy grid, despite the majority being in favor of divestiture from fossil fuels and a similar majority being against nuclear power in this country. But instead of addressing the concern, they are trying to shift the blame on to the blameless, people who do not have the power to stop companies from producing products overseas and selling them on the global market due to the deregulation of manufacturing and production other than to simply 'Not buy those products'. And while that is an option for some people who are well off or don't require some goods... That is not the case for everyone. Cheap goods are useful for those that can't afford the pricey, bourgeoisie ones, and the emissions from those goods are from energy usage in foreign manufacturing, which, in the developing nations that we seem to love abusing for this, IS MAJORITY FOSSIL FUEL BASE GENERATION. And yet in the same breath that the CEO of Woodside, besmirches and blathers, about how its the youth of today's fault for the problems with emissions. That we are ideologically challenged when it comes to buying things we need against the values we hold in wanting a better world for everyone through the measures we advocator for, while refusing to admit that it is 'her' industry that consistently damages our attempts at this through; lobbying against emissions regulation, attacking grassroots movements against the construction new fossil fuel power stations, and comments like the very same one here, that say that if we even look at some plastic containers to keep our leftovers in- we should not be allowed to have an opinion... What a crock-pot of shit.

#australia#no more billionaires#fossil fuels#renewablefuture#gaslighting#Hey you should look into energy storage solutions its really cool.#No seriously#there are some cool things like flywheel storage that help clock the release of power into the grid at the correct rate#Actually energy solutions in general are really cool#We really don't need nuclear in Australia#Like#holy hell its so expensive to not only manufacture but also in fuel and transport logistics#Hey you are also cool#keep doing your thing#late stage capitalism is fun...

12 notes

·

View notes

Text

For more than a decade, security and economic dynamics in the Asia-Pacific have been pulling in opposite directions. Geopolitical tensions and competing nationalisms have reinforced the U.S. role as a security guarantor, while China’s economic rise has integrated regional economies more closely with one another and China and pulled them away from the United States, as Evan Feigenbaum and I argued in these pages 13 years ago.

Yet U.S. policy toward the region has been mostly one of continuity. Is this sustainable—or is the combination of U.S. President Donald Trump’s tariffs, disparaging of allies, retreat from the values and institutions of the post-World War II order, and decoupling from China forcing the region to make the dreaded either-or choice?

So far, U.S. security policy seems insulated from the Trump revolution. A leaked interim defense strategy memo says the region remains a strategic priority for the United States. And Defense Secretary Pete Hegseth’s March trip to Asia appeared to offer further reassurance to allies. Hegseth’s trip included a speech in Honolulu pledging to “work with our allies and our partners” to counter China; in Japan, an effort to advance a Biden-era initiative to create a joint military headquarters in Tokyo; and in the Philippines, revealing new U.S. weapons systems to be deployed to deter China.

It may be that the inertia of military-centric cooperation in response to Chinese coercive behavior—such as the China Coast Guard blocking Filipino fishers and the Philippine Navy from operating in the country’s own exclusive economic zone and intimidating Vietnam from developing offshore gas fields in its own waters—sustains its momentum. But economic trends and both the words and deeds of the Trump administration point to a unilateral “America First” agenda so riddled with contradictions and competing goals that a coherent policy is unlikely to emerge.

Why? For the past 70 years, the Asian peace, like the European peace, has been underpinned by the United States as the guarantor of security and by the prosperity of the U.S.-led financial system, with inclusive and relatively open markets. Washington has been a development catalyst and consumer of last resort, facilitating the Asian miracle.

This symbiotic arrangement has been slowly eroding in direct proportion to China’s rapid emergence and the diffusion of wealth and power from West to East generated by globalization. The United States accounts for a declining share of Asia-Pacific trade and is not in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or the Regional Comprehensive Economic Partnership, the region’s key free trade agreements, despite having spent years trying to negotiate the CPTPP’s predecessor, which Trump withdrew from in 2017. In the new geometry of trade, the United States is self-marginalizing, and China has become the top trading partner to most countries in the region. Intraregional trade has now reached nearly 60 percent of the total.

The U.S. role was already becoming marginalized, and now Trump is blowing up an already fragile system. The decoupling of the United States and China—43 percent of world GDP between them—is disrupting businesses across Asia. In a matter of weeks, sweeping tariffs, imposed and lifted again at seemingly the whim of the president, are read as an economic declaration of war. Trump is undermining free trade agreements with Australia, South Korea, and Singapore. The dismantling of the U.S. Agency for International Development and Voice of America—tools of soft power projecting American values and presence—also sent a signal.

Though China’s political-military coercive behavior has reinforced the U.S.-led security system, Trump’s heavy-handed defense demands on allies may accelerate hedging. As Japanese negotiators arrived in Washington on April 16 for trade talks, Trump made clear that he sees defense as linked to trade in rebalancing ties, writing on his Truth Social platform: “Japan is coming in today to negotiate Tariffs, the cost of military support, and ‘TRADE FAIRNESS.’”

Trump has complained that “Japan doesn’t have to defend us” and that the United States spends hundreds of billions of dollars to defend it and therefore Tokyo should spend 3 percent of GDP on defense. In his previous term, Trump considered withdrawing U.S. troops from South Korea and wants Seoul to pay more protection money, and on Taiwan, he is demanding that the island quadruple defense spending to 10 percent, which Taipei says is “impossible.”

The fusion of U.S. trade and geopolitical shifts is fast corroding trust and raising existential questions in the region about U.S. reliability as a partner, let alone a security guarantor. This is mitigated by pragmatism, as the efforts at tariff reduction deals highlight, but the psychological shock has been profound.

But don’t take it from me. The canary in the coal mine was a Feb. 14 speech by the defense minister of Singapore, a close U.S. partner, lamenting that the image of the United States has suddenly “changed from liberator to great disruptor to a landlord seeking rent.” And conservative former Prime Minister Malcolm Turnbull expressed Australians’ anguish, saying in an April interview with the New York Times: “We’re dealing with an America whose values no longer align with ours.”

Tariffs coming down hard on regional manufacturing hubs—Vietnam, Thailand, Indonesia, and Malaysia, which since Trump’s first term have become “China+1” reshoring destinations—may wreak havoc. South Korean and Japanese auto and electronics investment (both face, at a minimum, 10 percent tariffs, plus auto, steel, and aluminum tariffs) is a key part of the Asian economic operating system.

The White House has been clear that one goal of the tariffs is to destroy regional manufacturing hubs using and transshipping Chinese components. As the Wall Street Journal reported, the administration’s tariff strategy is to force a choice to curb trade with China for lower tariffs. When White House trade advisor Peter Navarro said Vietnam’s cutting of U.S. tariffs to zero “means nothing,” he explained that “it’s the nontariff cheating that matter.” Ending these value chains would rip the region’s economic fabric.

Asian states are lining up to make deals to reduce their U.S. tariffs—buying more U.S. liquefied natural gas, buying more military equipment, and aiding U.S. shipbuilding. But they are unlikely to eliminate their trade deficit with the United States: With a nearly $30 trillion economy, the United States inevitably buys more than it sells to smaller, low- and medium-income nations such as Vietnam and Cambodia, even if tariffs are cut.

So how do these Asian states, for which export-led growth is the coin of the realm, respond? Trump may be inadvertently pushing them toward China, which is waging a charm offensive. The United States may be separating itself from the world, but much of the world is doubling down on new patterns of globalization, as Singaporean Prime Minister Lawrence Wong pledged in a major speech on April 8.

That U.S. allies South Korea and Japan met with China to renew efforts at a trilateral trade agreement and talked, according to Chinese reports, of coordinating responses to the United States is a sign of the times. Europe is exploring new economic ties to China, such as licensing electric vehicle and battery factories, as Spain and Hungary are doing. One indicator of such trends in Asia would be if China’s bid to join the CPTPP is accepted by Japan and Australia or if the European Union moves toward trade arrangements with the CPTPP. Such scenarios could sustain a post-U.S. rules-based system and shape new rules and tech standards.

Another risk from Asia’s loss of confidence in the United States is de-dollarization. Asian countries may see the United States under Trump as less of a safe haven for some $3 trillion in U.S. Treasurys recycled from their trade surpluses, which help fund the $37 trillion U.S. budget deficit.

But to fully capitalize on U.S. economic self-marginalization, Beijing would need to revise its policies. Beijing can’t shift its $439 billion in U.S. exports to the global south, already so alarmed about Chinese overcapacity that they’ve filed dozens of complaints against China to the World Trade Organization. Could Trump lead Chinese President Xi Jinping to revise predatory trade policies and beef up domestic consumption to compensate for lost U.S. markets?

How this all plays out will depend much on the fate of U.S.-China relations. There are competing factions seeking to shape Trump’s still uncertain China policy: China hawks such as National Security Advisor Mike Waltz, who favor weakening, decoupling, and preparing for war with Beijing; business types such as Elon Musk and finance firms that have interests in the China market; and Trump himself, always wanting a deal.

But what U.S.-China deal is possible in the toxic environment in both capitals? Trump’s disappointing deal in his first term casts a shadow over current efforts. One analogy is the 1985 Plaza Accord with Japan, which redressed similar trade tensions. Tokyo revalued the yen against the dollar, built auto factories in the United States, and agreed to voluntary export restraints. Despite frequent U.S. complaints about a weak yuan, currency is less of a problem in the U.S.-China case. In theory, they could agree to a range of fluctuation, and China might just be willing to voluntarily curb exports—but reshoring manufacturing is Trump’s goal.

During last year’s election campaign, Trump said he was fine with China building EV and battery plants in the United States and hiring U.S. workers, and joint ventures licensing Chinese technology would boost U.S. manufacturing. But it is difficult to see Congress accepting Chinese investment amid a bipartisan anti-China climate, with its efforts to remove China’s most-favored-nation status, delist Chinese firms from U.S. stock exchanges, ban China from buying land, and remove all Huawei technology, just for starters.

In the current game of chicken, China, as economist Adam Posen argues, has escalation dominance: The United States needs irreplaceable stuff from China (i.e., rare earths) more than China needs U.S. goods. Asymmetric interdependence may ultimately temper the trade war. But both sides are decoupling the two intertwined economies, with $582 billion in trade in 2024. Business, the ballast of the U.S.-China relationship over the past four decades, is now spurring separation. Strategic competition in all domains—land, sea, air, and space—is not abating. Tensions over Taiwan are already on the razor’s edge.

For the Asia-Pacific, full-spectrum U.S.-China competition will at a minimum fuel hedging on both economics and security. It may mean bandwagoning with China on trade while deepening already thickening intra-Asian security cooperation now driven by not just Chinese coercion but U.S. unreliability, if not imperiousness.

Which Asian states will elide Chinese investments in their value chains, ban Chinese digital networks, or shun its artificial intelligence or weapons? Who can put their trust in a Washington willing to shred agreements without even a moment’s notice? The specter of Chinese ambitions will prolong the viability of the U.S.-led latticework of allies and partners as a counterweight, even as trust in the United States becomes wobblier and more uncertain. Who will show up—or allow the United States access to ports and airfields—in a China-Taiwan contingency?

Will America First politics sustain the U.S. role as the region’s top cop or ebb as it is marginalized economically in Asia? Whatever Taiwan’s fate, for East Asia, the United States may stay or go, but China is forever. More than ever, U.S. determination to stay on top in the Asia-Pacific is fighting both geography and economics.

11 notes

·

View notes

Text

“While the invisible hand looks after the private sector, the invisible foot kicks the public sector to pieces.” - Herman E. Daly

The National Grid's chief executive, John Pettigrew, has stated that Heathrow Airport had sufficient power from two remaining substations during the recent shutdown caused by a substation fire. Heathrow Airport’s management has deputed this claim.

Such a row was inevitable, as neither side wants to be held economically responsible for the chaos that ensued, and the massive compensation claims this embarrassing incident is bound to produce.

Having heard one commentator say the National Grid was a privately owned company, I became curious as to who, exactly, owned this vital part of or national infrastructure, and whether, like Heathrow Airport itself, it was mainly foreign owned.

Only in Britain could we complicate things to such a degree that it is almost impossible to understand who does what within the electricity supply system.

The principle operator of the National Grid is the National Energy System Operator (NSEO) obtained by the government in 2024, and thought to be worth £630 million. This government owned business functions primarily as a management and operational entity rather than owning or maintaining physical infrastructure. This may well account for its very low value.

The actual ownership of physical pylons and high-voltage cables in the UK is divided among Transmission Network Operators (TNOs), based on geographical regions: England and Wales, Southern Scotland and Northern Scotland.

The TNO for England, worth £40 billion, is listed on the London Stock Exchange, and made an operating profit of £4.47 million 2023/24.

The Southern Scottish TNO is worth £70 billion, is mainly Spanish owned, and made a reported profit of £1.2 billion for year ending December 2023.

Northern Scotland TNO, worth £20 billion, is listed on the London Stock Exchange and made a net profit of £1 billion for financial year 2023.

To complicate matters further, a totally different set of companies own the generation plant that supplies the electricity to the power cables owned buy the TNO’s. Companies such as French EDF, Spanish owned Scottish Power, etc..

We have yet another set of companies at the regional level, known as Distribution Network Operators (DNOs) These entities own and operate the cables that deliver electricity from the national transmission system to independent sub-grid operators. Basically, these businesses are responsible for the cables in the street that we are all connected to. Needless to say, these companies are privately owned, often by foreign shareholders: American, Chinese and Spanish, being some of the larger shareholders.

On top of this layer of companies are the Interconnect Operators (IOs). This group of companies own and manage the high-voltage transmission lines that connect the UK's electricity grid to other countries' grids, thereby facilitating international electricity trading. Many of these companies are internationally owned.

Finally, we have the Energy companies you and I have dealings with – British Gas, EDF, Octopus etc. These companies compete in the domestic market offering the consumer various services and tariffs. Again many of these are foreign owned.

Once upon a time, in a land time has now forgot, the UK had a unified system for electricity generation and supply. Before the privatisation of the electricity industry in the 1990s, the sector was largely centralized. In those halcyon days ALL profit went to the government and was used for the benefit of the people.

Privatisation, and the accompanying slicing and dicing of the UK electricity generation and distribution services, wherein each sector takes a cut of the profits, has resulted in the UK having some of the most expensive domestic electricity prices in the world.

As complicated as our power generation and supply is when looked at on paper, the underlying rational is simple – the maximisation of profit regardless of cost to the consumer.

#uk politics#keir starmer#energy supply#energy costs#profit motive#public utility#public good simplification#privatisation

6 notes

·

View notes

Text

CNN 4/28/2025

WorldAmericas• 4 min read

Canadians vote in election overshadowed by US tariff and annexation threats

By Max Saltman, Paula Newton and Hira Humayun, CNN

Updated: 2:57 PM EDT, Mon April 28, 2025

Source: CNN

Canadians hit the polls on Monday in an election overshadowed by tariffs, economic uncertainty and annexation threats from the United States.

Voters will decide whether to grantPrime Minister Mark Carney a full four-year mandate or give the Conservative Party a turn at the wheel after more than nine years of Liberal Party government.

Canadians begancasting their ballots in the country’s easternmost province, Newfoundland and Labrador, at 8:30 a.m. local time (7 a.m. ET) Monday.

Canada’s uneasy relationship with the US has deeply influenced the tenor of this year’s campaign. US President Donald Trump’s tariffs against Canadian exports pose a grave threat to the country’s economy, and his threats to absorb Canada as “the 51st state” have enraged Canadians of every political persuasion.

“I reject any attempts to weaken Canada, to wear us down, to break us so that America can own us,” Carney told reporters in late March. “We are masters in our own home.”

Though Canadians have a diverse array of parties to choose from on their federal ballots, the main contest is between the incumbent Liberals, led by Carney since March, and the Conservative opposition, led by longtime parliamentarian Pierre Poilievre.

Carney became prime minister in March after his predecessor Justin Trudeau resigned from office in the wake of dire polls that suggested a stunning loss to come in a federal election.

A political newcomer and former governor of both the Bank of Canada and Bank of England, Carney assumed the premiership just as Trump began to apply numerous tariffs on Canadian goods.

The new prime minister took a defiant stance toward Washington, continuing Trudeau’s reciprocal tariffs against the US. As the trade war and annexation threats accelerated from Washington, the Liberals saw their polling numbers drastically reverse, quickly closing the gap with their Conservative rivals.

Carney has pitched himself as an experienced professional from the political center who can steward Canada’s economy through a period of profound economic turbulence.

“I understand how the world works,” Carney told podcaster Nate Erskine-Smith in October. “I know people who run some of the world’s largest companies and understand how they work. I know how financial institutions work. I know how markets work…I’m trying to apply that to the benefit of Canada.”

Carney has pledged to “build things in this country again” to make Canada less reliant on the US: new homes, new factories, and new sources of “clean and conventional energy.”

“My solemn promise is to stand up for Canadian workers, to stand up for Canadian businesses,” Carney said in March. “We will stand up for our history, our values and our sovereignty.”

Meanwhile, Conservative leader Poilievre has cast the election as a battle between everyday Canadians and the “Ottawa elites” who have run the country for the past nine years.

“The same people who ran Justin Trudeau are now running Mark Carney,” Poilievre told supporters shortly after Carney became prime minister. “Liberals are trying to trick Canadians into electing them for a fourth term in power.”

Running on a platform to put “Canada first,” Poilievre wants to slash government funding, streamline the country’s bureaucracy and strip away environmental laws to further exploit the country’s vast natural riches.

“Conservatives will axe taxes, build homes, fix the budget,” Poilievre said in March, pledging to “unleash our economic independence by building pipelines, mines, [liquified natural gas] plants and other economic infrastructure that will allow us to sell to ourselves and the rest of the world.”

Though Poilievre shares a populist style with Trump, he has sought to distance himself from the president over the course of the campaign. Poilievre even told Trump in a social media post to “stay out” of Canada’s election on Monday after the president urged Canadians to vote for him rather than the country’s political parties.

In the days leading up to the election, a record number of Canadians voted early, with long lines at polling places .

“I voted on the first day of advance polls and I waited 45 minutes,” said Kristina Ennis of St. John’s, Newfoundland. “I know people who waited over an hour.”

Elections Canada said in an April 22 news release that at least 7.3 million voters chose to cast their ballots before election day, a 25% increase from the 2021 federal election.

See Full Web Article

Go to the full CNN experience

© 2025 Cable News Network. A Warner Bros. Discovery Company. All Rights Reserved.

Terms of Use | Privacy Policy | Ad Choices | Do Not Sell or Share My Personal Information

-----

We're sorry, Canada.

6 notes

·

View notes

Text

A specific piece of misinformation I'm responding to is the one originating from this headline:

(x)

spawning responses like

(x) which is... not entirely wrong

and

which is completely misunderstanding the original study - the Carbon Majors Database, CDP Carbon Majors Report 2017.

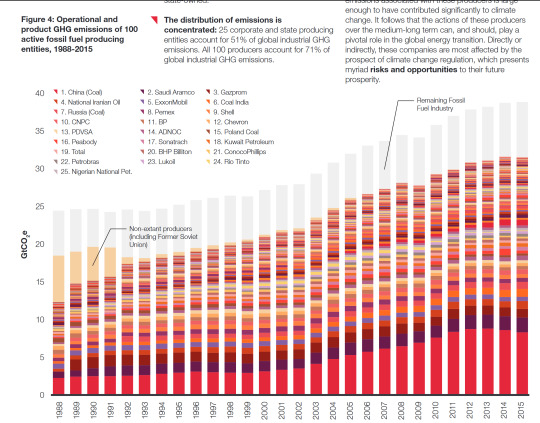

What this report absolutely does not say is "100 companies burn enough fossil fuels to produce 70% of emissions per year." It says something more like "70% of emissions since the 1988 can be traced back to extraction of fossil fuels by 100 producers." Those 100 producers include 36 state-owned companies, 7 state-owned producers, 41 public companies, and 16 private companies.

It also says that over half of industrial emissions since 1988 can be traced to just 25 producers. Of those 635 gigatons of emitted CO2, 59% come from state-owned producers, 32% from public companies, and 9% from private companies.

The largest shares here at the bottom of the graph are all state-owned producers: an aggregate of Chinese state-owned coal producers, Saudi Aramco (owned by the Saudi Arabian state), Gazprom (a Russian company with majority ownership by the state and partial public ownership), National Iranian Oil (unsurprisingly, nationally owned), and then finally we get to the first non-state-owned company (ExxonMobil).

The fraction is nearly identical for values for yearly emissions in 2015 - 59% of emissions since 1988 are tied to extraction by state-owned producers. Nonetheless:

"Emissions from investor-owned companies are significant: of the 30.6 GtCO2e of operational and product GHG emissions from 224 fossil fuel extraction companies, 30% is public investor-owned, 11% is private investor-owned, and 59% is state-owned."

There is absolutely immense responsibility on producers for extracting, marketing, and selling fossil fuels, and for (in several notable cases) deliberately covering up anthropogenic climate change as an outcome of fossil fuel use. But that extraction doesn't occur in a vacuum - fuels are extracted and burned for heat, for electricity, for transport, for industry.

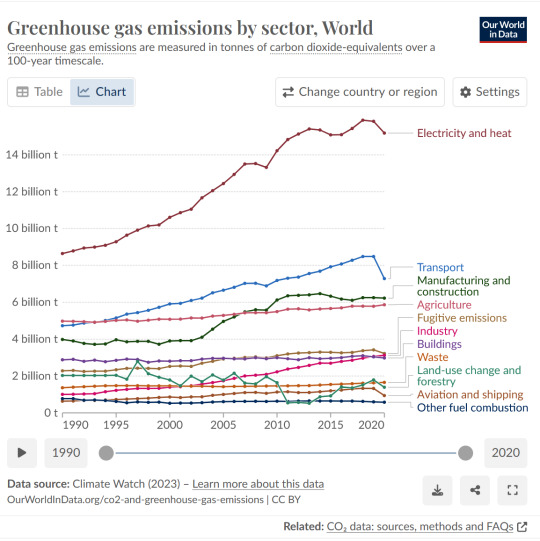

The tweet about nothing changing if people didn't drive and used plastic straws is exactly wrong: fossil fuels are valuable to extract because they're used for everything around us. In the US, transportation accounts for ~29% of greenhouse gas emissions, and 57% of that is from personal vehicles. In 2016, the average passenger car fuel efficiency in the US was 22.1 miles per gallon; an electric car can easily get > 100 miles-per-gallon-equivalent, some as high as 142 miles-per-gallon-equivalent. Magically substituting all gas cars in the US alone for electric would slash nationwide emissions by 13 percentage points even if all those vehicles were powered by electricity made from fossil fuels! (Clearly there are a lot of gross assumptions and approximations there.) (Also, yes, magic wand car swaps aren't a thing we can do in real life, but it's what the tweet said, so I wanted to toss it in there.)

Like, there's a lot of complexity to global emissions - who's responsible, what levers we have to move things in a better direction, what any individual can or can't do. But this specific piece of misinformation or at least misrepresentation really ought to be excised from the record.

#climate change#discourse#global warming#long post#effortpost#slightly more coherent version of the thing I was trying to poke at earlier

25 notes

·

View notes

Text

Turn it on, turn it off

I confess I worry about how much of our lives in America lean on the assumption that everything will stay the same.

When I was little, because my father's work was seasonal, we'd do One Big Shopping Trip in October and get all the food we were going to eat until Spring. I mean, not absolutely everything - there was still milk and eggs and stuff - but it was our big "stock up" thing, and if in the intervening four months the grocery stores closed for a while, we'd have been okay.

Except a lot of that food was frozen - we had this big deep freezer which was sincerely big enough to put several dead bodies if we wanted. My mother joked that it could hold seven corpses. (Yes, this is the kind of joke I heard regularly when I was five). So if we'd lost power, we'd have been screwed.

And today, I rely more heavily on fresh fruits and vegetables. Which is fine in the warmer months; I'm a regular at the Farmers' Markets around here. And that's kind of interesting because I'm a demographic outlier: not a younger couple with kids, not a retiree, just Some Guy going around buying spinach and onions. So I don't think that's a common approach.

Of course, even if I bought as much as I could at the markets, there's a lot which I can't. Not to mention that while it's grown "locally", that "local" is pretty broad - I'm getting food trucked in from Pennsylvania and West Virginia. So this all assumes we'll have a usable highway system, and these farmers will be able (and find it cost-effective) to drive several hours a day, including gas. That's not even considering whether they'll be able to effectively grow food in quantities - modern farming isn't Some Guy In Overalls behind an ox-drawn plow. Even your "organic" farmers rely on a lot of external industry.

Ignoring that, I get home with my food. To cook I rely on electricity again. I'm also expecting to get potable water from my tap, and have a sewage system.

And I don't think my house would be livable without electricity. There's an entire wall which just has no windows at all (disturbingly common in modern construction for some reason); there just aren't all that many windows in general; and there's no attempt at parity or unimpeded airflow: in the warmer months there's simply no flow-through. The windows are mostly for show. In the colder months, we've got a furnace of course, but our fireplace is too narrow and deep to warm even the one room it's in. While I happen to have a considerable quantity of seasoned wood (but nowhere near enough for a winter) I don't think I have enough to cook on regularly, much less warm the house.

My work, naturally, relies absolutely on the Internet and electricity: without those, not only would I personally not have a job, my company would not have a product to sell. And how would I even get my money, almost all of which is imaginary values in a computer? How would I use it, but for those same computers doling my money out via credit cards and ATMs?

What I'm getting is, we rely on all the infrastructure in order to live. Many, I think, do not consider how much we need. Some would airily claim they don't need all of these things - but their accounting is slipshod at best. In truth we all do, from the most environmentalist bicycling-riding hippie to the "I'm not on the grid" rightwing farmer. We all need it, and we don't often think about it - we just sort of having faith that there will be gas in the pumps, that the power will stay on, that the trucks will come to stock the stores, that the ATMs will have cash and the phones will work.

And I'm sorry, but Trump has shown these are much more tenuous things than we ever imagined. They are real, they can exist - but we need to fight for them. We need to keep them and control them. Otherwise a handful of oligarchs can turn them off to yank on our chains. When they do, we need to yank back. We need to yank them down and tear them apart, because it can't be a push and pull: it has to be a very simple "You tried, you died."

2 notes

·

View notes

Text

Energy Transfer Faces Market Challenges Amidst Growth Plans

Source: Image by MariuszBlach from Getty Images

Stock Performance and Market Reaction

Energy Transfer (ET), a key player in the midstream sector, has experienced a notable downturn in its stock value, witnessing a 16% decline over the past month. This significant drop has led to underperformance compared to the broader midstream Master Limited Partnership (MLP) sector. The primary contributors to this downturn include investor concerns over the company’s aggressive capital expenditure (CapEx) plans and growing uncertainty in the global trade landscape.

ET’s management recently announced a substantial increase in growth CapEx, jumping from $3 billion in 2024 to a projected $5 billion in 2025. While the company maintains that these investments will yield mid-teens rates of return, market analysts remain skeptical about achieving such high profitability. Many investors believe that redirecting funds toward share repurchases or higher distributions, as seen with competitors like MPLX and Plains All American, would have been a more favorable approach.

Additionally, tensions surrounding international trade have further impacted ET’s outlook. The recent trade conflicts between the United States and several major trading partners, with the potential for further escalation, have cast uncertainty over ET’s liquefied natural gas (LNG) export growth. Concerns about a potential economic slowdown are also affecting market sentiment, as reduced industrial demand could lead to lower utilization of ET’s extensive energy infrastructure.

Financial Performance and Strategic Investments

Despite the market concerns, Energy Transfer reported strong financial results for 2024, with a record adjusted EBITDA of $15.5 billion, hitting the upper end of its guidance range. The company remains well-positioned within the industry, with 90% of its projected 2025 adjusted EBITDA derived from fee-based revenue, minimizing exposure to fluctuations in commodity prices.

ET’s financial stability is further supported by a strong balance sheet, with leverage ratios falling within the 4.0x to 4.5x range. The company’s revenue streams are well-diversified, with 20% of EBITDA tied to crude oil, 27% to natural gas liquids (NGL) and refined products, 19% to midstream operations, and 21% to natural gas. The remaining 13% comes from investments in entities such as USA Compression Partners and Sunoco.

The firm’s capital allocation strategy highlights major investments in midstream operations, NGL and refined products, and interstate natural gas transportation. Management has identified key growth areas, including rising production in the Permian Basin, increasing demand for natural gas-powered data centers driven by artificial intelligence (AI) expansion, and heightened global demand for U.S. NGL exports. These strategic initiatives align ET with some of the most prominent growth drivers in the energy sector today.

Valuation and Growth Prospects

Energy Transfer’s management remains optimistic about its investment strategy, expecting strong returns on capital expenditures. The company anticipates an annualized EBITDA growth of approximately 5%, which is expected to support distribution increases within its target range of 3-5% annually. Analysts forecast a compounded annual growth rate (CAGR) of 4.2% in distributions through 2029, underpinned by a 6.7% CAGR in distributable cash flow per unit.

The company’s current valuation appears attractive, offering a 7.6% next-12-month distribution yield and trading at an 8.27x enterprise value-to-EBITDA multiple. Compared to peers such as Enbridge, Enterprise Products Partners, Kinder Morgan, and Targa Resources, ET’s valuation remains relatively modest despite its strong diversification and exposure to high-growth segments like AI-driven natural gas demand and global NGL exports.

While some concerns persist regarding the possibility of an economic downturn, Energy Transfer’s stable cash flow model, largely insulated from commodity price volatility, provides a cushion against market fluctuations. Even if return expectations on growth projects are not fully realized, the firm’s strong yield and growth potential suggest a favorable long-term outlook for investors.

4 notes

·

View notes

Text

LiFePO4 vs. Lead-Acid Batteries: Which is Best for the East African Market?

The demand for solar energy systems, energy storage solutions, and backup power is rapidly growing in the East African market. Choosing the right type of battery is crucial, especially between LiFePO4 (Lithium Iron Phosphate) and lead-acid batteries, which are the most common energy storage options. So, which battery is better suited for the East African market? Let's compare them comprehensively.

1. Lifespan Comparison

LiFePO4 batteries typically have a cycle life of 4,000-6,000 cycles, lasting over 10 years with proper maintenance.

Lead-acid batteries usually have a cycle life of 500-1,000 cycles, lasting 2-5 years.

Conclusion: LiFePO4 batteries have a much longer lifespan, making them more cost-effective in the long run.

2. Maintenance and Reliability

LiFePO4 batteries are maintenance-free, with a low self-discharge rate (less than 3% per month), ensuring minimal energy loss even when stored for long periods.

Lead-acid batteries require regular maintenance, such as checking electrolyte levels, and are prone to damage from deep discharges.

Conclusion: LiFePO4 batteries are more suitable for the East African market due to their low maintenance requirements, especially in remote areas.

3. Charging and Discharging Efficiency

LiFePO4 batteries have a charging and discharging efficiency of over 95%, allowing for faster charging.

Lead-acid batteries typically have an efficiency of 60%-80%, making them slower to charge.

Conclusion: For solar energy systems, LiFePO4 batteries charge faster and provide more usable energy.

4. High-Temperature Resistance

Many areas in East Africa experience hot climates, and LiFePO4 batteries operate efficiently between -20°C and 60°C, making them highly resistant to high temperatures.

Lead-acid batteries degrade quickly in hot conditions, losing efficiency and lifespan.

Conclusion: LiFePO4 batteries are better suited for East Africa’s hot climate.

5. Environmental and Safety Considerations

LiFePO4 batteries contain no toxic heavy metals like lead or cadmium, making them environmentally friendly. They are also chemically stable, reducing risks of explosion or fire.

Lead-acid batteries contain lead and sulfuric acid, which can be hazardous if not disposed of properly. They can also explode if gas buildup occurs.

Conclusion: LiFePO4 batteries are safer and more eco-friendly.

6. Cost and Return on Investment

Lead-acid batteries have a lower initial cost, but their shorter lifespan and high maintenance needs result in higher long-term costs.

LiFePO4 batteries have a higher initial cost, but due to their long lifespan, maintenance-free nature, and high efficiency, they offer a lower total cost of ownership.

Conclusion: Although the upfront cost is higher, LiFePO4 batteries provide better long-term value.

7. Best Use Cases

Ideal applications for LiFePO4 batteries:

Solar energy storage systems (residential and commercial)

Electric vehicles (EVs)

Backup power (data centers, hospitals)

Rural electrification and off-grid systems

Ideal applications for lead-acid batteries:

Short-term energy storage needs with budget constraints

Backup power (UPS systems)

Traditional vehicle starter batteries

Conclusion: Best Choice for the East African Market?

Considering East Africa’s environment, energy demands, and economic factors, LiFePO4 batteries are the superior choice.

Long lifespan, reducing replacement costs

High-temperature tolerance, ideal for East Africa’s climate

High efficiency, maximizing solar energy utilization

Eco-friendly and safe, aligning with sustainability goals

Although LiFePO4 batteries have a higher initial investment, their higher return on investment (ROI) makes them the best option for solar storage, electric vehicles, and off-grid energy solutions in East Africa.

If you're looking for an efficient, reliable energy storage solution in East Africa, LiFePO4 batteries are your best choice!

#LiFePO4 Battery Manufacturers#LiFePO4 Batteries#Battery Manufacturers#LiFePO4 battery supplier in Kenya#best lithium battery for solar Uganda

2 notes

·

View notes

Text

STON.fi: Redefining DeFi on TON with Cross-Chain Power

Decentralized Finance (DeFi) is transforming at an incredible pace, and STON.fi is right at the center of this revolution. Built on The Open Network (TON), this decentralized exchange (DEX) isn’t just keeping up—it’s setting the pace with unmatched trading efficiency, massive liquidity, and seamless cross-chain integrations.

While many DeFi projects struggle with scalability and interoperability, STON.fi has taken a bold step forward. Its integration with Symbiosis has unlocked cross-chain liquidity, allowing users to trade and transfer assets across multiple blockchains effortlessly. This is more than just an upgrade—it’s a major shift in how decentralized trading works.

Let’s dive into how STON.fi is reshaping DeFi and why it’s the go-to DEX for TON traders.

STON.fi’s Explosive Growth: The Numbers Speak

STON.fi isn’t just growing—it’s dominating. Here’s why:

Total Trading Volume: Over $5.2 billion, making it the leading DEX on TON.

User Base: 4 million+ unique wallets, representing 81% of all TON DEX users.

Active Traders: 25,800+ daily users, with 16,000+ multi-transaction users every day.

New User Growth: Over 8,000 new users joining daily.

Liquidity & Trading Pairs: 700+ transactions per day, ensuring deep liquidity and tight spreads.

STON.fi is 50-80 times ahead of its closest competitors in trading volume and liquidity growth. These numbers aren’t just stats—they highlight a DeFi platform that works, delivers, and scales.

What Makes STON.fi Different

Many DEXs offer trading, but STON.fi is designed to optimize every aspect of the DeFi experience.

Ultra-Fast Transactions

STON.fi eliminates network congestion and slow trade execution. Every transaction is processed instantly, ensuring users never miss an opportunity.

Near-Zero Trading Fees

High gas fees are a common barrier in DeFi. STON.fi keeps transaction costs at a minimum, ensuring traders get maximum value from their swaps.

Massive Liquidity & Market Depth

Deep liquidity is essential for smooth trading. STON.fi supports hundreds of trading pairs, maintaining tight spreads and minimal slippage. Whether you’re making a small swap or executing a high-volume trade, STON.fi provides stable market conditions.

Cross-Chain Swaps with Symbiosis Integration

STON.fi is no longer limited to TON. With Symbiosis, users can now seamlessly swap assets across multiple blockchains, opening up new opportunities for trading, liquidity provision, and asset utilization.

This integration bridges TON with 35+ other blockchains, removing barriers that previously kept networks isolated.

Now, users can:

✔ Move assets freely between TON and other networks

✔ Tap into deeper liquidity pools across chains

✔ Trade without limitations on blockchain compatibility

This cross-chain expansion puts STON.fi ahead of traditional DEXs that operate in isolated ecosystems.

STON.fi’s Next Steps: What’s Coming

STON.fi isn’t slowing down. The platform is constantly evolving and expanding to bring more value to its users.

🔹 More Cross-Chain Partnerships – Expanding beyond Symbiosis for even greater interoperability.

🔹 New Trading Features – Advanced tools for both new and experienced traders.

🔹 Incentive Programs – Rewards for liquidity providers and active traders.

🔹 Deeper Liquidity Pools – Strengthening market stability and reducing slippage.

With these upgrades, STON.fi is not just competing in DeFi—it’s leading the charge toward a more interconnected, efficient, and powerful trading experience.

Final Thoughts

The DeFi space is crowded with projects, but very few deliver on efficiency, scalability, and cross-chain interoperability the way STON.fi does.

From record-breaking trading volume to seamless cross-chain swaps, STON.fi is proving that a next-generation DEX is not just an idea—it’s already here.

If you’re in the TON ecosystem and looking for fast, low-cost, and high-liquidity trading, STON.fi is where the future of DeFi is happening.

3 notes

·

View notes

Text

Excerpt from this story from RMI:

1. Batteries Become Everybody’s Best Friend

Battery prices continue to drop and their capacity continues to rise. The cost of electric vehicle (EV) batteries are now about 60 percent what they were just five years ago. And around the world, batteries have become key components in solar-plus-storage microgrids, giving people access to reliable power and saving the day for communities this past hurricane season.

2. Americans Get Cheaper (and Cleaner) Energy

State public utility commissions and rural electric co-operatives around the country are taking steps to deliver better service for their customers that also lowers their rates. At the same time, real momentum is building to prevent vertically integrated utilities from preferencing their coal assets when there are cleaner and cheaper alternatives available.

3. A Sustainable Shipping Future Gets Closer

More than 50 leaders across the marine shipping value chain — from e-fuel producers to vessel and cargo owners, to ports and equipment manufacturers — signed a Call to Action at the UN climate change conference (COP29) to accelerate the adoption of zero-emission fuels. The joint statement calls for faster and bolder action to increase the use of zero and near-zero emissions fuel, investment in zero-emissions vessels, and global development of green hydrogen infrastructure, leaving no country behind.

4. Corporations Fly Cleaner

In April, 20 corporations, including Netflix, JPMorgan Chase, Autodesk, and more, committed to purchase about 50 million gallons of sustainable aviation fuel (SAF), avoiding 500,000 tons of CO2 emissions — equivalent to the emissions of 3,000 fully loaded passenger flights from New York City to London. SAF is made with renewable or waste feedstocks and can be used in today’s aircraft without investments to upgrade existing fleets and infrastructure.

5. More and More Places Go From Coal to Clean

Around the world, coal-fired power plants are closing down as communities switch to clean energy. From Chile to the Philippines to Minnesota coal-to-clean projects are creating new jobs, improving local economic development, and generating clean electricity. In September, Britain became the first G7 nation to stop generating electricity from coal — it’s turning its last coal-fired power plant into a low-carbon energy hub. And in Indonesia, the president vowed to retire all coal plants within 15 years and install 75 gigawatts of renewable energy.

6. Methane Becomes More Visible, and Easier to Mitigate

Methane — a super-potent greenhouse gas — got much easier to track thanks to the launch of new methane tracking satellites over the past year. In March, the Environmental Defense Fund launched MethaneSAT, the first for a non-governmental organization, and the Carbon Mapper Coalition soon followed with the launch of Tanager-1. By scanning the planet many times each day and identifying major methane leaks from orbit, these new satellites will put pressure on big emitters to clean up.

7. EVs Speed By Historic Milestones

This past year was the first time any country had more fully electric cars than gas-powered cars on the roads. It’s no surprise that this happened in Norway where electric cars now make up more than 90 percent of new vehicle sales. And in October, the United States hit a milestone, with over 200,000 electric vehicle charging ports installed nationwide.

8. Consumers Continue to Shift to Energy-Efficient Heat Pumps for Heating and Cooling

Heat pumps have outsold gas furnaces consistently since 2021. And while shipments of heating and cooling equipment fell worldwide in 2023, likely due to broad economic headwinds, heat pumps held on to their market share through. And over the past 12 months, heat pumps outsold conventional furnaces by 27 percent. Shipments are expected to continue increasing as states roll out home efficiency and appliance rebate programs already funded by the Inflation Reduction Act – worth up to $10,000 per household in new incentives for heat pump installations. Link: Tracking the Heat Pump & Water Heater Market in the United States – RMI

9. China Reaches Its Renewable Energy Goal, Six Years Early

China added so much renewable energy capacity this year, that by July it had surpassed its goal of having 1,200 gigawatts (GW) of clean energy installed by 2030. Through September 2024, China installed some 161 GW of new solar capacity and 39 GW of new wind power, according to China’s National Energy Administration (NEA). China is deploying more solar, wind, and EVs than any other country, including the United States, which is — by comparison — projected to deploy a record 50 GW of solar modules by the end of 2024.

10. De-carbonizing Heavy Industry

For steel, cement, chemicals and other heavy industries, low-carbon technologies and climate-friendly solutions are not only increasingly available but growing more affordable. To speed this process, Third Derivative, RMI’s climate tech accelerator, launched the Industrial Innovation Cohorts to accelerate the decarbonization of steel, cement, and chemicals. Also on the rise: clean hydrogen hubs — powered by renewable energy — designed to supply green hydrogen to chemical, steel, and other heavy industries to help them shift to low-carbon production processes.

27 notes

·

View notes

Text

Fun fact to share with anyone who tells you about how they vote Trump because of prices or the economy, the "gas and eggs" lie that even leftists seem to believe...

Eggs have gone up in price around $0.70 since 1980 as has gas when adjusted for inflation.

So no it wasn't a choice between wallets and human rights -- because those prices haven't changed much.

It's taking more of your money to pay for essentials because of an artificial housing crisis (of Republican support), an out of date utility system (of Republican support), and wage suppression (of Republican support.)

You can check here

for prices on goods like gas and eggs and milk, adjusted for inflation every year.

The idea that Republicans are better on the economy is a lie. It's simply not supported by actual data. If we were in 1925, then we could debate the value of liberal and conservative economic policies -- they were both largely untried, simply theoretical math.

But it's been almost a century and every time conservative economics have been put in play, a market crash and recession inevitably follow. When liberal policies have been put into place, we rebounded from the biggest economic disaster in history to the longest period of sustained growth, created the middle class, funded not only our own part in WWII but a goodly portion of the UK's as well, paid to reconstruct Europe, increased education, created a safety net for our elderly (FDR post Hoover depression), had an economic and technological boom, a soaring stock market, ran a budget surplus, (Clinton post Reagan/Bush recession) restored industries, improved healthcare, came back with 72 months of sustained job growth (Obama post Bush 2 recession).

Now I will not blame Trump for the economic problems in his last year in office -- pandemics can happen to anyone and while better economic policies could have helped, that's theoretical which is up for debate, and I'm here to address FACTS. Hard data from unpartisan sources that is publicly available FACTS.

And Biden's "terrible" economy? Yeah we had the lowest inflation in the western world (EU inflation in 2023 was 6.59% versus US inflation in 2023 was 4.1% -- as of October 2024, inflation was at 2.6% versus Trump's 2.3% inflation rate in 2019) at a time when inflation is INEVITABLE (literally every pandemic has an inflation period after it, since forever -- look at the Black Death sometime), the highest GDP (21.43T for 2019 versus 27.36T for 2023) and GNP (21.73T in 2019 versus 29.03T for 2023) in history, jobs growth every quarter (unemployment rate of 3.7% in 2019 to 3.6% in 2023, which means we not only got back everything we lost from COVID, but then some), and an increase in the median wage from $35k per person per year to $59k.

For those of you who have some weird devotion to tax rates in 2019, the federal income tax rates were 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In 2023 they were... exactly the same. Your tax rates remained unchanged by Democrats at all. Also the largest budget deficit in history occurred under Trump's first administration. Personally I find these less than irrelevant (FDR put on a top tax of 94% and spent more than anyone knew you could spent and it paid off spectacularly.) But if you want to claim to be a fiscal conservative (tell me you don't understand history or economics without telling me...) then you should care.

The stock market is the worst indicator of economic health as its based on perception rather than value and has relatively little effect on daily life for most people. So how did it do under Trump (pre Covid number) versus Biden?

The S&P 500 value as of January 2020 was 3289.29. As of October 2024, 5705.45.

Again, those are all publicly available numbers.

STOP LETTING THEM GET BY WITH THE IDEA THAT THEY ARE GOOD FOR THE ECONOMY BECAUSE NO THEY ARE NOT. THEY HAVE LITERALLY NO DATA TO SUPPORT THAT.

Economics is a hard science. Data matters.

We can debate the role of religion or parental control or the fundamental nature of man. But basic arithmetic? No, sorry that question has been answered.

And anyone who tries to use it as a justification for supporting Nazis is wrong, lying, or both.

3 notes

·

View notes