#Power-To-Gas Market Analysis

Text

Global Power-To-Gas Market Is Estimated To Witness High Growth Owing To Increasing Demand For Renewable Energy Solutions

The global Power-To-Gas market is estimated to be valued at US$ 30.27 billion in 2022 and is expected to exhibit a CAGR of 12.2% over the forecast period of 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

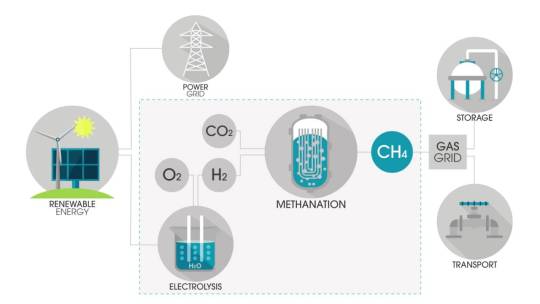

Power-To-Gas is a technology that converts electrical energy into chemical energy by using surplus renewable electricity to produce hydrogen or synthetic natural gas. This helps in storing excess renewable energy and enables its usage during periods of high demand. The process involves electrolysis, where water is split into hydrogen and oxygen, with the hydrogen further converted into methane. Power-To-Gas technology provides an efficient solution for energy storage and grid balancing, and reduces greenhouse gas emissions.

Market Key Trends:

One key trend in the Power-To-Gas market is the increasing demand for renewable energy solutions. As countries worldwide focus on reducing carbon emissions and transitioning towards cleaner energy sources, the demand for renewable energy solutions such as Power-To-Gas is expected to surge. This trend is driven by various factors, including government initiatives and policies promoting the use of renewable energy, growing concerns about climate change, and the need for energy security.

For example, countries like Germany and Denmark have been at the forefront of adopting Power-To-Gas technology to store excess renewable energy generated from wind and solar power. In Germany, Power-To-Gas systems are being used to convert surplus wind power into hydrogen, which can then be injected into the natural gas grid or used as fuel for transportation. Similarly, in Denmark, Power-To-Gas facilities are being utilized to produce synthetic natural gas from surplus wind power.

PEST Analysis:

- Political: Governments worldwide are implementing favorable policies and regulations to promote the adoption of renewable energy solutions. This includes providing subsidies, tax incentives, and feed-in tariffs for renewable energy projects.

- Economic: The decreasing cost of renewable energy technologies, such as solar panels and wind turbines, is making Power-To-Gas solutions more economically viable. Additionally, the potential for revenue generation from the sale of hydrogen or synthetic natural gas is attracting investments in Power-To-Gas projects.

- Social: Growing awareness about the need for sustainable energy solutions and the harmful effects of fossil fuels on the environment is driving the demand for renewable energy solutions like Power-To-Gas.

- Technological: Advancements in electrolysis technology and hydrogen fuel cells are improving the efficiency and cost-effectiveness of Power-To-Gas systems. The development of renewable energy storage technologies, such as hydrogen storage and underground caverns for synthetic natural gas, is further driving the adoption of Power-To-Gas.

Key Takeaways:

- The Global Power-To-Gas Market Size is expected to witness high growth, exhibiting a CAGR of 12.2% over the forecast period. This growth is driven by increasing demand for renewable energy solutions and the need for efficient energy storage and grid balancing.

- Regionally, Europe is expected to dominate the Power-To-Gas market, owing to supportive government policies, well-established renewable energy infrastructure, and high investments in Power-To-Gas projects. Asia Pacific is projected to be the fastest-growing region, driven by rapid industrialization, urbanization, and a shift towards renewable energy sources.

#Power-To-Gas Market#Power-To-Gas Market Demand#Power-To-Gas Market Growth#Power-To-Gas Market Analysis#Power-To-Gas Market Values#Coherent Market Insights#Power-To-Gas

0 notes

Text

#Global NiCd Batteries Market Size#Share#Trends#Growth#Industry Analysis By Type( Pocket Type#Sintered Type#Fibre Type)#By Application(Power#Transportation#Emergency Lighting#Oil and Gas#Telecommunications#Aviation#Others)#Key Players#Revenue#Future Development & Forecast 2023-2032

0 notes

Text

Power-to-Gas Market: Driving the Transition to a Hydrogen Economy

Power-to-Gas (P2G) is a rapidly emerging technology that aims to integrate renewable energy sources, such as wind and solar power, into existing gas infrastructure. P2G converts surplus electricity generated from renewables into hydrogen or synthetic natural gas (methane) through electrolysis. This process enables the storage and utilization of renewable energy in various sectors, including transportation, heating, and industrial applications.

Market Overview:

The global Power-to-Gas market has experienced significant growth in recent years and is expected to continue expanding at a substantial rate. The increasing focus on decarbonization, the integration of renewable energy sources, and the need for energy storage solutions are key factors driving the market's growth. Additionally, favorable government policies and incentives promoting clean energy technologies have further stimulated the adoption of Power-to-Gas systems.

Technologies:

Power-to-Gas systems primarily consist of three main components: electrolyzers, hydrogen storage, and methanation units.

Electrolyzers: Electrolysis is the core process in P2G systems. It involves the splitting of water molecules (H2O) into hydrogen (H2) and oxygen (O2) using electricity. Proton Exchange Membrane (PEM) electrolyzers and Alkaline Electrolyzers are the two main types used in P2G applications. PEM electrolyzers are known for their high efficiency, compact size, and fast response time, while alkaline electrolyzers offer lower costs and higher production capacities.

Hydrogen Storage: The produced hydrogen from electrolysis is stored for later use. Hydrogen can be stored in gaseous form in high-pressure tanks or as a liquid by cryogenic compression. Alternatively, it can be chemically combined with other elements to form more easily transportable compounds like ammonia or converted to synthetic natural gas.

Methanation Units: Methanation is the process of converting hydrogen with carbon dioxide (CO2) to produce synthetic natural gas (SNG). This step enhances the energy density and provides better storage options since the existing natural gas infrastructure can be utilized.

Applications:

The Power-to-Gas technology offers several applications across various sectors:

Energy Storage: P2G systems play a crucial role in storing surplus renewable energy and balancing supply-demand fluctuations in the electricity grid. Hydrogen or synthetic natural gas can be stored for extended periods and converted back to electricity or heat when needed.

Grid Balancing: P2G helps stabilize the electricity grid by providing grid operators with the flexibility to store excess energy during low demand and release it during peak demand periods. This improves the overall grid stability and reliability.

Sector Coupling: Power-to-Gas facilitates the integration of different sectors, such as transportation and heating, with the renewable energy sector. Hydrogen produced from P2G can be used as a fuel for fuel cell vehicles, while synthetic natural gas can be utilized for heating purposes in residential, commercial, and industrial settings.

Renewable Gas Injection: P2G enables the direct injection of renewable hydrogen or synthetic natural gas into existing natural gas pipelines, reducing the reliance on fossil fuels and decarbonizing the gas grid.

Market Outlook:

The Power-to-Gas market is expected to witness substantial growth in the coming years. The increasing deployment of renewable energy sources and the growing demand for energy storage solutions are the primary drivers for market expansion. The transportation sector, in particular, is anticipated to witness significant adoption of P2G technology, with the rise of fuel cell vehicles and the need for decarbonization. Furthermore, advancements in electrolyzer technologies, declining costs, and supportive government policies are likely to further accelerate market growth.

However, challenges such as the high cost of electrolyzers, limited infrastructure, and the need for effective carbon capture and utilization technologies remain key obstacles for wider market penetration. Continued research and development efforts, along with collaboration between industry stakeholders, are crucial to overcoming these challenges and unlocking the full potential of Power-to-Gas technology in the global energy transition.

0 notes

Link

#market research future#gas genset market analysis#gas genset market technologies#gas genset market companies#gas genset power

0 notes

Text

Power To Gas Market Future Growth Insight And Competitive Outlook 2030

The global Power To Gas market is estimated to attain a valuation of Bn by the end of 2030, states a study by Transparency Market Research (TMR). Besides, the report notes that the market is prognosticated to expand at a CAGR of % during the forecast period, 2020-2030.

The key objective of the TMR report is to offer a complete assessment of the global market including major leading stakeholders of the Power To Gas industry. The current and historical status of the market together with forecasted market size and trends are demonstrated in the assessment in simple manner. In addition, the report delivers data on the volume, share, revenue, production, and sales in the market.

Request for a Sample of this Research Report (Use Corporate Mail ID for Top Priority) - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=75683

The report by TMR is the end-product of a study performed using different methodologies including the PESTEL, PORTER, and SWOT analysis. The study with the help of these models shed light on the key financial considerations that players in the Power To Gas market need to focus on identifying competition and formulate their marketing strategies for both consumer and industrial markets. The report leverages a wide spectrum of research methods including surveys, interviews, and social media listening to analyze consumer behaviors in its entirety.

Power To Gas Market: Industry Trends and Value Chain

The study on the Power To Gas market presents a granular assessment of the macroeconomic and microeconomic factors that have shaped the industry dynamics. An in-depth focus on industry value chain help companies find out effective and pertinent trends that define customer value creation in the market. The analysis presents a data-driven and industry-validated frameworks for understanding the role of government regulations and financial and monetary policies. The analysts offer a deep-dive into the how these factors will shape the value delivery network for companies and firms operating in the market.

Power To Gas Market: Branding Strategies and Competitive Strategies

Some of the key questions scrutinized in the study are:

What are some of the recent brand building activities of key players undertaken to create customer value in the Power To Gas market?

Which companies are expanding litany of products with the aim to diversify product portfolio?

Which companies have drifted away from their core competencies and how have those impacted the strategic landscape of the Power To Gas market?

Which companies have expanded their horizons by engaging in long-term societal considerations?

Which firms have bucked the pandemic trend and what frameworks they adopted to stay resilient?

What are the marketing programs for some of the recent product launches?

The list of key players operating in the Power To Gas market includes following names:

ITM Power, McPhy Energy S.A., Siemens AG, Man Energy Solutions SE, Electrochaea GmbH, Hydrogenics, AEG Power Solutions, Solarplaza, ZSW, Alliander N.V., Energinet.dk, DNV GL, E.ON SEGet Customization on this Report for Specific Research Solutions - https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=75683

#Power To Gas Market#Power To Gas Market Size#Power To Gas Market Share#Power To Gas Market Growth#Power To Gas Market Analysis#Power To Gas

0 notes

Text

Big tech has made some big claims about greenhouse gas emissions in recent years. But as the rise of artificial intelligence creates ever bigger energy demands, it’s getting hard for the industry to hide the true costs of the data centers powering the tech revolution.

According to a Guardian analysis, from 2020 to 2022 the real emissions from the “in-house” or company-owned data centers of Google, Microsoft, Meta and Apple are likely about 662% – or 7.62 times – higher than officially reported.

[...]

Even though big tech hides these emissions, they are due to keep rising. Data centers’ electricity demand is projected to double by 2030 due to the additional load that artificial intelligence poses, according to the Electric Power Research Institute.

Google and Microsoft both blamed AI for their recent upticks in market-based emissions.

[...]

Whether today’s power grids can withstand the growing energy demands of AI is uncertain. One industry leader – Marc Ganzi, the CEO of DigitalBridge, a private equity firm that owns two of the world’s largest third-party data center operators – has gone as far as to say that the data center sector may run out of power within the next two years.

15 September 2024

117 notes

·

View notes

Text

Excerpt from this story from Canary Media:

Texas has become an all-around clean energy juggernaut, thanks to its lax permitting regime, fast grid-interconnection process, competitive energy market, and ample amount of solar- and wind-friendly land.

Its plans for the next year and a half underscore that status. As of July, the state intended to build 35 gigawatts of clean energy over 18 months, more than the next nine states combined, according to a Cleanview analysis of U.S. Energy Information Agency data.

Texas has long been the biggest player in U.S. wind energy. But in recent years, energy developers have raced to build solar in Texas too. Five years ago, the state had connected just 2.4 gigawatts of utility-scale solar to its grid; as of this past June, it had installed almost 22 GW of solar, per an American Clean Power report released this week. That’s nearly 10 times as much as back in 2019, and enough to propel Texas past California for large-scale solar installations.

Now Texas is writing its next chapter on clean energy: The state has become the nation’s hottest market for grid batteries as energy developers chase after its cheap solar and wind energy.

Given its staggering construction plans, Texas is set to only further solidify its place at the top of the clean energy leaderboard. But the rapid rise of the state’s clean energy sector has not yet yielded an outright energy transition, as the writer Ketan Joshi points out.

Though Texas has built more large-scale clean energy than any other state in absolute terms, it lags behind California — and plenty others — in terms of how clean its grid actually is. The Golden State met over half its electricity needs with renewables in 2023, per Ember data, while clean sources generated just 28 percent of Texas’ power. Electricity produced in the Lone Star State remains slightly more carbon intensive compared with the U.S. average.

Part of the story here is that, largely thanks to data centers and bitcoin mines, Texas is seeing some of the fastest growth in electricity demand of any state. That means much of the new solar, wind, and battery storage it’s building is just meeting new demand and not necessarily booting dirty energy off the grid.

The other hurdle preventing Texas from cleaning up its grid faster is the entrenchment of the fossil fuel industry in its local politics. Last year, the state passed a law creating a taxpayer-funded program to give energy developers billions of dollars in low-interest loans to build several gigawatts’ worth of new fossil-gas power plants.

In other words, the Lone Star state’s fossil fuel buildout isn’t ending even as its clean energy sector takes off. For Texas to be considered a true leader on decarbonizing the power sector — and not just a state that builds lots of everything — that will need to change.

7 notes

·

View notes

Text

Yves here. You are getting a Sunday extra on the conflict in Gaza and where it looks set to be headed, given Hamas’ apparent strategy, the dug in position of the US and Israel, and the so far on-track behavior of the Arab world.

John Helmer’s post clinically and persuasively draws conclusions that most commentators, including yours truly, have been loath to state clearly, perhaps because depicting the likelihood of bad outcomes somehow feels as if it increases the odds they come to pass (magical thinking cults and their lesser “intention” cousins illustrate this superstitious tendency).

Even though the earlier part of Helmer’s analysis is based on known facts (at least if you’ve been paying attention), he adds critical information about the implications of even a shortish war with Israel’s neighbors on Israel, and the apparently-not-heretofore-reported sighting that China has naval vessels in the Persian Gulf that have anti-sub and anti-missile capabilities.

It’s not hard to conclude from Helmer’s depiction that with the US and Israel unwilling to accept a loss and the lack of any adults on “our team” mean the odds of eventual nuclear war are way too high. And if you think Helmer is too pessimistic, listen to the section from Larry Johnson in the broadcast on Judge Napolitano with Ray McGovern. Starting at 11:40, Johnson describes how Pakistan has offered to send some of its nukes to Türkiye in case of a dustup with Israel.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

Preamble1. Since 1943 the US and its European allies, including Germany (Olaf Scholz’s government, not Adolf Hitler’s), have aimed to liquidate the secular nationalist Arab leadership capable of co-existence with the West and a state for the Jewish people.

2. In Palestine Hamas has studied seventy-five years of lessons on the impossibility of coordinating Arab state war in the defence of the Palestine part of the two-state solution.

3. For more than a year, therefore, Hamas has prepared in well-kept secret an offensive against Israel to achieve five objectives – the first to demonstrate how inferior the Israeli military is, how vulnerable, how incompetent their intelligence on the Arab world. This has been achieved by the initial attack of October 7.

4. The second Hamas objective has been to demonstrate the Israeli plan of ethnic cleansing of Gaza, genocide against the Arabs, and incorporation of all Israeli-occupied territories in a single theocratic Zionist state — Quod erat demonstrandum. The third objective is to hold out against the expected Israeli counterattack for long enough to activate the Hezbollah forces on the northern Lebanon front; Syrian and Iranian forces on the eastern Golan front; and the West Bank Palestinians, including the Jordanian Palestinians; the latter’s targets will be US air and armoured land force bases in Jordan. So far, so good.

5. The final Hamas objectives are to compel the vacillating sheikhdoms to resist US pressure; limit oil and gas supplies to the enemy markets; prevent regional land base and air transit rights being activated in support of Israel — so far, so good. And lastly, the fifth objective, to engage the friendly nuclear powers – Russia, China – to deter, and if necessary combat US forces in the region and Israel’s threat to fire its nuclear weapons.

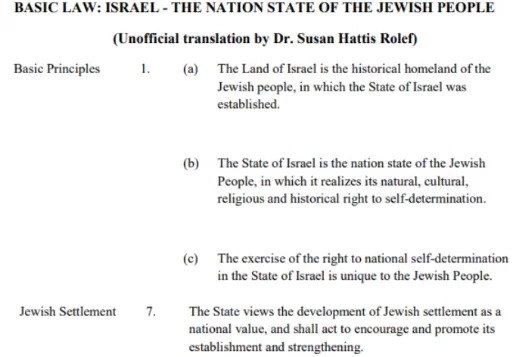

The rules of war

6. These aren’t in the code of secular international humanitarian law referred to in the western media and by UN officials in support of Israel. Those rules were eliminated by the destruction of two generations of Arab leaders willing to abide by them. The war doctrine of Hamas does not concede that international law may dictate to or supersede Islamic law. In parallel, the war doctrine of Israel is that Jewish and Israeli law supersedes every other.

This report is the most comprehensive record in English to date of the official Israel statements of genocide against the Gaza Palestinians in intention, policy and practice. Source: https://ccrjustice.org/

In 1948, the United Nations Convention on the Prevention and Punishment of the Crime of Genocide expressly included in Article II “the intent to destroy, in whole or in part, a national, ethnical, racial or religious group”. Forty years later, in 1988, the US Congress added two qualifiers to the provision in the US criminal code which defines genocide as a crime to be prosecuted if Americans commit it. This new US law declared genocide is “the specific intent to destroy, in whole or in substantial part, a national, ethnic, racial, or religious group”. “Substantial part,” the statute now said, meant “a part of a group of such numerical significance that the destruction or loss of that part would cause the destruction of the group as a viable entity within the nation of which such group is a part.” So long as the genocidal Arab killer isn’t “specific” in intention and the part of the people attacked isn’t “substantial”, the killer is off the hook in the US criminal code. This was a calculated US change to the crime of genocide. The US senator who drafted it and promoted it into law was Joseph Biden. For more, read The Jackals’ Wedding – page 14-18.

7. The Hamas offensive of October 7, OPERATION AL AQSA FLOOD ( عملية طوفان الأقصى, amaliyyat ṭūfān al-ʾAqṣā), is, as its code name indicates and in the interpretation of Islamic law, lawful self-defence, and the killing of Israelis, including civilians, lawful according to the retribution doctrine of Qisas. It’s clear there is a Koranic injunction against killing non-combatants, particularly children, the infirm, the old, and women. When women are combatants, as they are in the kibbutzim, they lose their exemption; also children, if they are armed and trained. So, the evidence question is — how many children under the age of arms-bearing were killed at the border settlements on October 7? And how did they die – by Hamas directly, or in crossfire between Hamas and IDF? The Israelis say one thing; Hamas says nothing.

8. It is clear the Israeli rules of war allow indiscriminate killing of children in offensive and defensive operations, in retribution and in collective punishment. No Palestinian Arab or Iranian is in any doubt that this has been Israeli policy from the beginning; that it has always been US policy to support it; and that the destruction of Gaza is the current episode of the long laid plan.

The two-state solution

9. Zionist ideology and Israel’s constitution have ruled out the two-state solution.

Source: https://perma.cc/9PZN-DJGY

10. The Arab state supporters of the two-state solution (including Fatah and the Palestine National Authority) cannot support it when Gaza is being liquidated by the Israel Defense Forces (IDF), supplied by the Pentagon.

11. President Joseph Biden’s (lead image) recent public remarks endorse Israel’s one-state solution, adding his personal religious benediction — “may God protect our troops”. Until he said that, Biden had limited himself to invoking God’s protection of “our troops” in speeches on the Afghanistan War in April 2021 and on the war against Russia in the Ukraine in February 2023. Before Biden, it was President George Bush Jr. who claimed God on the US side when he meant self-defence – “we will defend our freedom. We will bring freedom to others and we will prevail. May God bless our country and all who defend her.” With Biden the Christian, and Secretary of State Antony Blinken declaring himself Jewish in Israel, the war of Israel against Gaza is a theocratic one, a crusade. This is how it is understood now throughout the Muslim world.

12. According to God, therefore, there is only a one-state solution – it is either Palestine or Israel.

The current battlefield situation

13. On the Gaza front, Hamas has fought the IDF to a standstill outside the Gaza border wall. The Israel Air Force has dropped about 4,000 tonnes of bombs per week, 8,000 tonnes to October 21; that is more than the US Air Force dropped on Afghanistan in the peak year of 2019. More than 3,500 Palestinians have been killed so far, including at least 1,030 children and hundreds of family units; more than 12,500 people have been injured, one million Palestinians displaced, and thousands of homes destroyed. About 1,200 are missing believed to be trapped under the rubble. The Israeli and US government record, reported by the Institute for the Study of War (ISW) in Washington, documents the continuing firing from Gaza into Israeli territory in what the ISW calls its “Iran updates”. A prolonged IDF siege threatens to kill several hundred thousand Palestinians by starvation, dehydration, disease, and a combination of artillery and aerial bombardment, while leaving the Hamas forces relatively unscathed and waiting to inflict a higher rate of casualties on the IDF than it has ever experienced.

14. On the northern front across the Lebanon border, there have been exchanges of missile, drone, anti-tank rocket, artillery, and mortar fire between the IDF and Hezbollah. There have been casualties on both sides. Border settlements on the Israeli side have been evacuated to the south. For a summary of the ISW reports favouring Israel, read this; For maps and summaries of military action as of October 20 on the Gaza and northern fronts, as well as the Golan and West Bank, click to open.

Incident map on the northern front between October 12 and 17; source: https://www.washingtonpost.com/

15. US forces on the Jordan front. The Israeli press has been reporting some details of USAF reinforcements at the Muwaffaq Salti Air Base in the northeastern corner of Jordan and possible Marine deployments in Jordan. Whether the Marines will be moved to defend the Al-Tanf base on the Syrian side of the border, 230 kilometres northeast of Muwaffaq Salti, isn’t known.

Top, right – the US airbase at Muwaffaq Salti; source: https://twitter.com/

According to an Israeli report, “a squadron of U.S. F-15E Strike Eagle bombers based in Britain was deployed over the weekend at the Muwaffaq Salti Air Base east of the Jordanian capital of Amman. Another squadron of A-10 attack aircraft has also been deployed there.” Bottom, the location of Al-Tanf in Syria across the Jordanian and Iraqi borders.

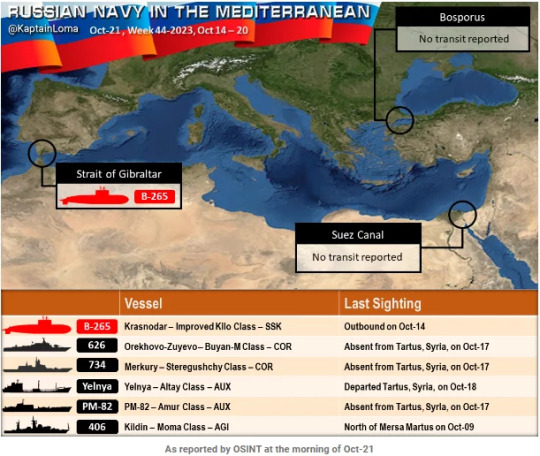

16. Russian and Chinese navy deployments. The Russian fleet based at Tartous, Syria, is at sea, as reported here. At the moment, there are as many, possibly more Chinese vessels of the 44th Naval Escort Task Force in the Persian Gulf. The anti-surface, anti-submarine, and anti-air missile capabilities of the Type-052D destroyer can be followed here, and of the Type-054A frigate here. For the time being, the significance of this Chinese screen to deter a US-Israeli missile and aircraft attack on Iran has been missed in the western press and by Russian military reporters.

Top: https://russianfleetanalysis.blogspot.com/

Bottom: the Chinese Defense Ministry announcement of the arrival of the destroyer Zibo and frigate Jingzhou at Kuwait on October 19.

Armageddon strategy

17. US Afghanistan War veteran: “Suppose Israel and the US understand they are facing an existential survival future in which they must combat swarm attacks on three or four fronts — Gaza/Hamas, North/Hezbollah, Golan/Syria/Iran, and West Bank/Jordan, and they calculate the Arabs have at least a 30 to 60–day arms supply in stock, do they calculate they can withstand a multi-front offensive for enough time, resupplied by air from the US? If they calculate that they can withstand a 30-day multi-directional swarm, they must understand that, at a minimum, Israel’s infrastructure and economy will be ruined. In a scenario like that, even if they ‘win’, they lose. In terms of airlifting and shipping supplies, we’ve already seen that the Arabs can hit Israeli military and civilian airfields, airports and seaports. Defending Israeli infrastructure with their air defence capability is the main mission of the strike groups the US is deploying in the eastern Mediterranean and in the Red Sea.

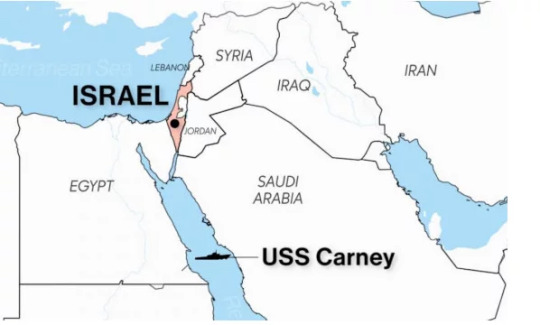

According to the Pentagon on October 19, the USS Carney, a part of the USS Gerald Ford group, had transited into the Red Sea through the Suez Canal the day before and was in the northern Red Sea when it intercepted three land attack cruise missiles and several drones.

Western societies like Israel cannot function without solid, reliable, electrical power and communications services. We can be certain that power generation, transmission and distribution will be targeted by the Arabs non-stop. The cell towers and central communications centres will be too.”

18. Moscow source. “When does the threat to Israel become so dire, they go nuclear, and when they do, against what targets will they fire – Hamas, Beirut, Damascus, Teheran?* The US won’t accept a Palestinian state so the only option left for the Palestinians, Arabs, Iranians, possibly Turks is to fight with this new kind of warfare whose objective is to cut into the flesh and bones of the Israeli adversary, and make life in that state unviable. Without a Palestinian homeland, all of Israel and the Arab territories become a battlefield. The IDF options then shrink to two – carpet bombing and mass killing of the civilian population centres on all fronts at once. If that isn’t sustainable or effective for the Israeli-American purpose, then option 2 is to attack Lebanon, Syria and Iran to stop the flow of reinforcements. But that’s regional war, and it can only be conducted by the Israelis with full US military participation. This becomes nuclear very quickly because President Putin has already placed the Kinzhal missiles in range of the US carrier fleet in the eastern Mediterranean, and the Chinese have installed their screen to protect Iran. It’s obvious that the race hatred policies of Biden and Netanyahu, and their belief that God has chosen them both as destroyers for their people, lead to the final, nuclear weapons solution. The Russians and Chinese can maximise their limited military projection by deterring, or if need be pre-empting a nuclear attack on the Arab cities or Teheran. For this to work, the Russians and the Chinese need to say more – loudly so there’s no mistaking what they mean.”

[*] In 1983, in conversation with his General Staff, Iraq’s President Saddam Hussein said: “the Iraqis would be able to withstand three years of fighting in a war. However, the Israelis cannot withstand one year of fighting in a war.” In April 1990 Hussein was hosting Yasser Arafat of the PLO in Baghdad. “[Israel] has 240 nuclear warheads, 12 out of them for each Arab capital,” Arafat said. Saddam replied: “I say this and I am very calm and wearing a civilian suit [everyone laughs]. But I say this so that we can get ready at this level.” Quoted in The Jackals’ Wedding, page 16.

41 notes

·

View notes

Text

In the summer of 1941, the United States sought to leverage its economic dominance over Japan by imposing a full oil embargo on its increasingly threatening rival. The idea was to use overwhelming economic might to avoid a shooting war; in the end, of course, U.S. economic sanctions backed Tokyo into a corner whose only apparent escape was the attack on Pearl Harbor. Boomerangs aren’t the only weapons that can rebound.

Stephanie Baker, a veteran Bloomberg reporter who has spent decades covering Russia, has written a masterful account of recent U.S. and Western efforts to leverage their financial and technological dominance to bend a revanchist Russia to their will. It has not gone entirely to plan. Two and a half years into Russian President Vladimir Putin’s war in Ukraine, Russia’s energy revenues are still humming along, feeding a war machine that finds access to high-tech war materiel, including from the United States. Efforts to pry Putin’s oligarchs away from him have driven them closer. Moscow has faced plenty of setbacks, most recently by losing control of a chunk of its own territory near Kursk, but devastating sanctions have not been one of them.

Punishing Putin: Inside the Global Economic War to Bring Down Russia is first and foremost a flat-out rollicking read, the kind of book you press on friends and family with proselytizing zeal. Baker draws on decades of experience and shoe-leather reporting to craft the best account of the Western sanctions campaign yet. Her book is chock-full of larger-than-life characters, sanctioned superyachts, dodgy Cypriot enablers, shadow fleets, and pre-dawn raids.

More than a good tale, it is a clinical analysis of the very tricky balancing acts that lie behind deploying what has become Washington’s go-to weapon. The risky decision just after the invasion to freeze over $300 billion in central bank holdings and cut off the Russian banking system hurt Moscow, sure. But even Deputy National Security Advisor Daleep Singh, one of the architects of the Biden administration’s response, told National Security Advisor Jake Sullivan that he feared the sanctions’ “catastrophic success” could blow up global financial markets. And that was before the West decided to take aim at Russia’s massive oil and gas exports, which it did with a series of half-hearted measures beginning later that year.

The bigger reason to cherish Punishing Putin is that it offers a glimpse into the world to come as great-power competition resurges with a vengeance. The U.S. rivalry with China plays out, for now, in fights over duties, semiconductors, and antimony. As Singh tells Baker, “We don’t want that conflict to play out through military channels, so it’s more likely to play out through the weaponization of economic tools—sanctions, export controls, tariffs, price caps, investment restrictions.”

The weaponization of economic tools, as Baker writes, may have started more than a millennium ago when another economic empire was faced with problematic upstarts. In 432 B.C., Athens, the Greek power and trading state supreme, levied a strict trade embargo on the city-state of Megara, an ally of Sparta—a move that, according to some scholars, sparked the Peloponnesian War. (Athens couldn’t break the habit: Not long after, it again bigfooted a neighbor, telling Melos that the “strong do what they can, and the weak suffer what they must.”) The irony of course is that Athens, the naval superpower, eventually lost the war to its main rival thanks to a maritime embargo.

It can be tempting to leverage economic tools, but it is difficult to turn them into a precision weapon, or even avoid them becoming counterproductive. The British empire’s 19th-century naval stranglehold and love of blockades helped bring down Napoleon but started a small war with the United States in the process.

Britain was never shy about using its naval and financial might to throw its weight around, but even the pound sterling never acquired the centrality that the U.S. dollar has today in a much bigger, much more integrated system of global trade and finance. That “exorbitant privilege,” in the words of French statesman Giscard D’Estaing, enabled the post-World War II United States to take both charitable (the Marshall Plan, for starters) and punitive economic statecraft to new heights.

The embargoes on Communist Cuba or revolutionary Iran were just opening acts, it turned out, for a turbocharged U.S. approach to leveraging its financial hegemony that finally flourished with the so-called war on terror and rogue states, a story well-told in books such as Juan Zarate’s Treasury Goes to War or Richard Nephew’s The Art of Sanctions.

Osama bin Laden is dead, Kabul is lost, Cuba’s still communist, and a Kim still runs North Korea, but the love of sanctions has never waned in Washington. If anything, given an aversion to casualties and a perennial quest for low-cost ways to impose its will, Washington has grown even fonder of using economic sticks with abandon. The use of sanctions rose under President Barack Obama, and again under Donald Trump; the Biden administration has not only orchestrated the unprecedented suite of sanctions on Putin’s Russia, but also taken Trump’s trade war with China even further.

Despite U.S. sanctions’ mixed record, the almighty dollar can certainly strike fear in countries that are forced to toe a punitive line they might otherwise try to skirt. Banks in third countries—say, a big French lender—could be forced to uphold Washington’s sanctions on Iran regardless of what French policy might dictate. Those so-called secondary sanctions raise hackles at times in places such as Paris and Berlin, prompting periodic calls for “financial sovereignty” from the tyranny of the greenback. But little has changed. Countries that want to continue having functioning banks have little choice but to act as the enforcers of Washington’s will.

What is genuinely surprising, as Baker chronicles, is that the growth of sanctions as the premier tool of U.S. foreign policy has not been matched by a commensurate growth in the corps of people charged with drafting and enforcing them. The Office of Foreign Assets Control, the Treasury Department’s main sanctions arm, is overworked and understaffed. A lesser-known but equally important branch, the Commerce Department’s Bureau of Industry and Security, struggles to vet a vast array of export controls and restrictions with a stagnant staff and stillborn budget. Post-Brexit Britain has faced even steeper challenges in leaping onto the Western sanctions bandwagon, having to recreate in the past few years a new body almost from scratch to enforce novel economic punishments.

Punishing Putin is not, despite the book’s subtitle, about an effort to “bring down” Russia. The sanctions—ranging from individual travel and financial bans on Kremlin oligarchs to asset forfeiture to sweeping measures intended to kneecap the ruble and drain Moscow’s coffers—are ultimately meant to weaken Putin’s ability to continue terrorizing his neighbor. In that sense, they are not working.

One of the strengths of Punishing Putin is Baker’s seeming ability to have spoken with nearly everybody important on those economic frontlines. She details the spadework that took place in Washington, London, and Brussels even before Russian tanks and missiles flew across Ukraine’s borders in February 2022, and especially in the fraught days and weeks afterward. It takes a special gift to make technocrats into action heroes.

The bulk of Baker’s wonderful book centers on the fight to sanction and undermine the oligarchs loyal to Putin who have helped prop up his kleptocracy. Perhaps, as Baker suggests, Western thinking was that whacking the oligarchs would lead to a palace coup against Putin. There was a coup, but not from the oligarchs—and it ended first with a whimper and then a mid-air bang.

There are a couple of problems with that approach, as Baker lays out in entertaining chronicles of hunts for superyachts and Jersey Island holding companies. First, it’s tricky to actually seize much of the ill-gotten billions in oligarch hands; the U.S. government is spending millions of dollars on upkeep for frozen superyachts, for example, but can’t yet turn them into money for Ukraine. And second, the offensive has not split the oligarchs from Putin: To the contrary, a Kremlin source tells Baker, “his power is much stronger because now they’re in his hands.”

At any rate, while the hunt for $60 billion or so in gaudy loot is fun to read about, the real sanctions fight is over Russia’s frozen central bank reserves—two-thirds of which are in the European Union—and the ongoing efforts to strangle its energy revenues without killing the global economy. Baker is outstanding on these big issues, whether that’s with a Present at the Creation-esque story of the fight over Russia’s reserves and the ensuing battle to seize them, or an explanation of the fiendishly complicated details of the “oil price cap” that hasn’t managed to cap Russian oil revenues much at all. More on those bigger fights would have made a remarkable book a downright stunner.

The Western sanctions on Russia, as sweeping and unprecedented as they are, have not ended Putin’s ability to prosecute the war. They have made life more difficult for ordinary Russians and brought down Russia’s energy export revenues, but they have not yet severed the sinews of war. “But, in fact, the West didn’t hit Russia with the kitchen sink,” Baker writes. Greater enforcement of sanctions, especially on energy, will be crucial to ratchet up the pressure and start to actually punish Putin, she argues. The one thing that is unlikely is that the sanctions battle will end anytime soon—not with Putin’s Russia, and not with other revisionist great powers such as China, whose one potential weakness is the asymmetric might of U.S. money.

“As long as Putin is sitting in the Kremlin,” Baker concludes, “the economic war will continue.”

5 notes

·

View notes

Text

Ilana Berger at MMFA:

In a new analysis of electric vehicle-related content on Facebook, Media Matters found that negative stories made up the vast majority of content, particularly on right-leaning and politically nonaligned U.S. news and political pages, a trend which does not align with the optimistic outlook of EV adoption and technological advancements.

Since 2021, the Biden administration has allocated billions of dollars toward meeting the ambitious goal of making half of all new cars sold electric or hybrid over the next few years. Provisions in the Inflation Reduction Act, the Infrastructure Investment and Jobs Act and the CHIPS Act have provided tax credits and other incentives to jump start electric vehicle sales and infrastructure such as charging stations, domestic battery manufacturing, critical mineral acquisition, in addition to preparing the automotive industry workforce for the transition.

In March, an Environmental Protection Agency rule setting strict limits on pollution from new gas-powered cars primed automakers for success in meeting these goals.

Biden’s EV push will continue to play an important role in the upcoming presidential election. Former president and current GOP candidate Donald Trump has insisted that Biden’s policies benefit China, which makes up the largest share of the global EV market. In March, while talking about the current state of the auto industry, Trump declared, “If I don’t get elected, it’s going to be a bloodbath for the whole — that’s going to be the least of it. It’s going to be a bloodbath for the country.” Economists disagree.

The comment tracks with years of outrage and opposition from Republican politicians, right-wing media, and fossil fuel industry surrogates, who have often disparaged the new technology and related policy and misleadingly framed the EV push as a threat to American jobs and national security.

Constant attacks on EVs from the right have helped fuel a politically divided market, where people who identify as Democrats are now much more likely to buy them or consider buying them, while nearly 70% of Republican respondents to a recent poll said they “would not buy” an EV. So far in 2024, headline after headline announced EV sales slumps and proclaimed that “EV euphoria is dead,'' despite reports of “robust” growth. In February, CNN changed a headline about EV sales on its website from a success story to a failure. Despite the positive long term outlook for EVs based on indicators like sales and government investments, the discourse around electric vehicles is often pessimistic.

[...]

Right-wing media have been driving anti-EV sentiment (with help from fossil fuel industry allies) since the start of Biden’s term. This trend was clearly reflected in Media Matters’ analysis. Out of the top 100 posts related to EVs on right-leaning pages, 95% were negative, earning over a million interactions in 2024 so far.

But on Facebook, politically nonaligned pages fed into this trend as well. Nearly three quarters (74%) of EV related top posts on nonaligned pages had a negative framing. These posts generated 83% of all interactions on EV-related top posts from nonaligned pages.

On non-aligned and right-wing Facebook pages, anti-electric vehicle content-- likely fueled by a mix of climate crisis denial and culture war resentments-- draws lots of reliable engagement, in contrast to the reality of increased EV adoption in recent years.

#Electric Vehicles#Culture Wars#Automobiles#Climate Change#Facebook#CHIPS Act#Inflation Reduction Act#Infrastructure Investment and Jobs Act#Biden Administration#Joe Biden#EV Charging Stations

9 notes

·

View notes

Text

Green Living: How Energy Audit Services Can Help You Go Eco-Friendly and Save Money

Green living is all about adopting habits and practices that contribute to the health of our planet. It's about making conscious choices to reduce waste, conserve resources, and minimize environmental impact. One powerful tool in this eco-friendly arsenal is the energy audit. But what exactly is an energy audit, and how can it help you go green while saving money? Let’s dive in.

Understanding Energy Audits

Definition of Energy Audits

An energy audit is a comprehensive evaluation of a building’s energy use. It identifies where and how energy is being consumed and pinpoints areas where energy is being wasted. The goal is to provide actionable recommendations to improve energy efficiency and reduce costs.

Types of Energy Audits

There are generally three types of energy audits:

Walk-Through Audit: A basic inspection to identify obvious energy waste.

Detailed Audit: An in-depth analysis including Energy Consumption data and specific recommendations.

Investment-Grade Audit: A thorough audit used to justify large-scale energy efficiency projects, often including financial analysis.

Components of an Energy Audit

An energy audit typically involves:

Inspection of HVAC Systems: Assessing heating, ventilation, and air conditioning for efficiency.

Lighting Analysis: Evaluating lighting systems for energy use and effectiveness.

Insulation Check: Inspecting insulation in walls, attics, and floors.

Appliance Assessment: Reviewing the efficiency of major appliances.

Benefits of Energy Audits

Financial Savings

By identifying inefficiencies and making the recommended changes, you can significantly lower your energy bills. For instance, sealing drafts and upgrading insulation can reduce heating and cooling costs by up to 30%.

Environmental Impact

Reducing energy consumption directly decreases greenhouse gas emissions. By using less energy, you help combat climate change and promote a healthier planet.

Improved Comfort and Health

Enhanced insulation, better HVAC systems, and sealed leaks contribute to a more consistent and comfortable indoor temperature, improving overall comfort and health.

Increased Property Value

Energy-efficient homes and buildings are more attractive to buyers and tenants. Energy audits can lead to improvements that enhance property value and marketability.

The Energy Audit Process

Initial Consultation

The process begins with a consultation where you discuss your concerns and goals with the auditor.

On-Site Inspection

Auditors visit your property to conduct a thorough inspection, using tools like infrared cameras and blower doors to detect issues.

Energy Consumption Analysis

By reviewing your utility bills and energy usage patterns, auditors can understand consumption trends and pinpoint high-energy-use areas.

Report and Recommendations

After the inspection and analysis, the auditor provides a detailed report with findings and specific recommendations for improvement.

Common Issues Identified in Energy Audits

Air Leaks

Air leaks around windows, doors, and other openings can cause significant energy loss.

Poor Insulation

Inadequate insulation in walls, attics, and floors leads to higher heating and cooling costs.

Inefficient Lighting

Old, inefficient lighting fixtures can be a major energy drain.

Outdated Appliances

Older appliances often consume more energy than newer, energy-efficient models.

How to Prepare for an Energy Audit

Choosing the Right Auditor

Look for reputable and certified energy auditors or companies with experience and positive reviews.

Gathering Utility Bills and Documentation

Collect past utility bills and any relevant documentation to help the auditor understand your energy usage patterns.

Preparing Your Home or Building

Ensure access to all areas of the building and list any specific concerns or areas you want the auditor to focus on.

Implementing Energy Audit Recommendations

Prioritizing Improvements

Start with the most impactful and cost-effective measures. This could include sealing leaks, upgrading insulation, or replacing outdated appliances.

DIY Solutions vs. Professional Services

Some recommendations might be simple enough to tackle on your own, while others may require professional services.

Utilizing Rebates and Incentives

Many governments and utility companies offer rebates, tax credits, and incentives for energy-efficient upgrades. An energy audit can help you identify and take advantage of these opportunities.

Future Trends in Energy Audits

Technological Advancements

Advancements in technology, such as smart home systems and more efficient diagnostic tools, are making energy audits more precise and effective.

Increasing Adoption of Renewable Energy

As renewable energy becomes more accessible and affordable, more energy audits are including recommendations for solar panels and other renewable energy sources.

Myths and Misconceptions About Energy Audits

Common Myths Debunked

Some believe energy audits are too expensive or unnecessary. However, the long-term savings and environmental benefits often outweigh the initial cost.

Facts to Consider

Energy audits can provide valuable insights and practical solutions, making them a smart investment for both homeowners and businesses.

Conclusion

Energy audits are a powerful tool for anyone looking to embrace green living and save money. By providing a clear picture of energy use and practical recommendations for improvement, Energy Audits help reduce waste, lower costs, and contribute to environmental sustainability. Investing in an energy audit is a step toward a more eco-friendly lifestyle and a more efficient, cost-effective property.

FAQs

What is an Energy Audit?

An energy audit is a thorough assessment of a building's energy use, identifying areas of waste and providing recommendations for improving efficiency.

How Much Does an Energy Audit Cost?

Costs vary depending on the size and type of building, but residential audits typically range from $200 to $600, while commercial audits can be more expensive.

How Long Does an Energy Audit Take?

The duration can vary, but most residential audits take a few hours, while more detailed commercial audits can take several days.

Are Energy Audits Worth It?

Yes, the potential savings on energy bills and the environmental benefits often make energy audits a worthwhile investment.

Can I Perform My Own Energy Audit?

While you can conduct a basic assessment, professional energy audits provide more accurate and comprehensive results.

2 notes

·

View notes

Text

In order for multinational corporations to protect their freedom to pollute the atmosphere, peasants, farmers, and Indigenous people are losing their freedom to live and sustain themselves in peace. When the Big Green groups refer to offsets as the “low-hanging fruit” of climate action, they are in fact making a crude cost-benefit analysis that concludes that it’s easier to cordon off a forest inhabited by politically weak people in a poor country than to stop politically powerful corporate emitters in rich countries—that it’s easier to pick the fruit, in other words, than dig up the roots.

The added irony is that many of the people being sacrificed for the carbon market are living some of the most sustainable, low-carbon lifestyles on the planet. They have strong reciprocal relationships with nature, drawing on local ecosystems on a small scale while caring for and regenerating the land so it continues to provide for them and their descendants. An environmental movement committed to real climate solutions would be looking for ways to support these ways of life—not severing deep traditions of stewardship and pushing more people to become rootless urban consumers. [...]

Geographer Bram Büscher coined the term “liquid nature” to refer to what these market mechanisms are doing to the natural world. As he describes it, the trees, meadows, and mountains lose their intrinsic, place-based meaning and become deracinated, virtual commodities in a global trading system. The carbon-sequestering potential of biotic life is virtually poured into polluting industries like gas into a car’s tank, allowing them to keep on emitting. Once absorbed into this system, a pristine forest may look as lush and alive as ever, but it has actually become an extension of a dirty power plant on the other side of the planet, attached by invisible financial transactions. Polluting smoke may not be billowing from the tops of its trees but it may as well be, since the trees that have been designated as carbon offsets are now allowing that pollution to take place elsewhere.

The mantra of the early ecologists was “everything is connected”—every tree a part of an intricate web of life. The mantra of the corporate-partnered conservationists, in sharp contrast, may as well be “everything is disconnected,” since they have successfully constructed a new economy in which the tree is not a tree but rather a carbon sink used by people thousands of miles away to appease our consciences and maintain our levels of economic growth.

—Naomi Klein, This Changes Everything (2014)

#climate change#environmental politics#anti capitalism#indigenous rights#god i just wish i could post the entire book#there is a whole chapter about extractivism and the first words are about the history of nauru#and the entire chapter ends up tying back into this former story so beautifully and horrifyingly in a way that is almost poetic#you just had to be there man

4 notes

·

View notes

Text

Customer Discovery

In quest to address issues, analysis and solutions to problems within the community. Join me as I explored and interviewed 5 people with the question: What is the problem that you often encounter in the community?

Answers, Hypotheses and Results:

Interviewee 1 & 2: No near Printing Stations

Customer’s Answer: Two students at Central Mindanao University expressed their frustration to the fact that there’s almost no near printing stations that are present around the campus.

Hypothesis: The lack of printing stations around the campus decreases the students’ productivity which means that it is really inconvenient for them. There may be a known place that provides printing services, which is the university’s market but pretty far from most of the colleges.

Method(s): Observing, Based on experience as I am also a student at CMU

Results: Upon observation, I realized that the absence of this service indeed gives difficulty for students. Many would travel and pay for a ride just to go to market or any other place, leading to delays in assignments and academic materials. Overall this negatively impacts the academic performance and overall experience of students at the university.

Interviewee 3: Improper Waste Segregation and Management

Customer’s Answer: Also, a student at CMU, highlighted the issue of improper waste segregation and management on the campus.

Hypothesis: The lack of waste segregation and management practices in the campus are causing environmental pollution and health hazards within the community.

Method(s): Audit, Assess the current waste management practices

Results: After assessment I later concluded that the university lacks proper waste segregation bins, systematic and structured waste management procedures. This led to the mixing of recyclable, biodegradable, and hazardous waste, that could lead to potential health risks for students and staff. Therefore, implementing effective waste segregation and management systems is crucial and is in need to address.

Interviewee 4: Expensive Gasoline, Increasing Various Product Costs

Customer’s Answer: A Filipino citizen expressed concerns about the rising costs of gasoline leading to the increased prices of other daily use products.

Hypothesis: The high cost of gasoline effects the prices of goods and services, resulting to community’s low buying power and unstable economy.

Method(s): Analyze historical data on gas prices and inflation rates to assess its correlation

Results: Upon further research the escalating prices of gasoline is indeed influences the adjustments of businesses to increase prices as transportation and operational expenses increases. So basically, this will affect consumer’s purchasing power and overall economic health within the country. Therefore, it is necessary to create strategies to mitigate the impact of rising fuel prices.

Interviewee 5: Weak Internet Connectivity

Customer’s Answer: Another student at CMU, sees weak internet connection as his problem within the community.

Hypothesis: Weak internet connectivity decreases the productivity of the students. Hindering academic research, fast communication, and access online resources.

Methods(s): Evaluate, Based on experience as I am also a student at CMU

Results: After testing, it confirmed that the problem is really an issue and needs urgent action. Most of the activities or assignment are commonly posted online via Google Classroom, which will make it difficult for students if the they need to turn in their responses. Majority of the teachers also post their learning materials for students online along with links like YouTube if a teacher wants his/her students to watch something, which is difficult if you have weak connection as it needs stable and strong internet connectivity.

TEAM’S OPTIONS

These options as solution to a problem are all based on the overall results from each team members.

1. Coin-operated Wi-Fi and Printing Station:

Suggested by a member. This solution could address the lack of printing stations and slow internet connection within the campus of CMU. The same concept applies to the peso Wi-Fi, but here if you connect to its Wi-Fi you’ll have 2 options, a pop-up will appear leading to a link asking if you want to print or just use the internet. Meaning you can use it for printing and internet at same time. If you choose to use only the internet, it will prompt you to insert a coin.

If you choose to print, you will be asked to provide the document or file you want to print (the user must have edited the file beforehand for direct printing), then the computer connected to the printer will automatically calculate the total price for what you want to print. Additionally, if printing is selected, payment can be made through GCASH.

If another user connects while someone else is using it, a pop-up will appear for the other user indicating that there is still someone connected. However, there is a limit of only 3 papers that can be used: A4, Long, Short (though there might be a printer that includes photo paper). This is not a typical printer it provides printing and internet service at the same time.

2. Transport App:

This option addresses the problem with the prohibition of the “habal-habal” drivers at CMU and to the fact that university is far from urban areas. This app is like Uber but more focused on motorcycles. It can deliver items to you, and you can also request them to buy something for you. For example, if you need medicine, you can book drivers through this app to inform them of your purchase, and then you can pay them for their services. The drivers for this app can be anyone as long as they are qualified, including students and teachers. It's not limited to motorcycle taxis. Before they are accepted as a driver, there is a process they have to go through. This idea was suggested by two of team.

3. Smart Waste Separator:

This solution was suggested by one of our members as solution to environmental pollution and health risks within the community. The idea is to create a machine that segregates garbage. It will have a hole where you can dispose of the trash, but inside, there are sensors that detect and segregate the waste. The collected waste will be segregated into decomposable material that can potentially be used as fertilizer or sold by the owner of the machine for their own use. The separated plastics can also be sold for recycling, allowing the owner to earn from it.

TEAM’S DECISION

After carefully considering all options, the preferred choice by all members is Option 1: Coin-operated Wi-Fi and Printing Station. This solution effectively addresses the lack of printing stations around the campus of CMU and provides a convenient way for students and faculty to access both printing and internet services in one place. It offers flexibility with its coin-operated system, allowing users to choose. Option 2 and 3 maybe useful but the team wanted something new and innovative.

LESSONS LEARNED BY THE TEAM

Through our customer discovery process and the exploration of potential solutions, our team gained valuable insights into the needs and challenges faced by our community. We learned that the lack of printing stations and slow internet connectivity within the campus significantly impacts students' productivity and academic performance. Furthermore, our team realized the importance of considering various perspectives and brainstorming creative solutions to effectively tackle complex issues. By actively engaging with members of our community, we were able to identify viable solutions that could make a positive impact.

Overall, this process has taught us the value of collaboration, innovation, and responsiveness to community needs in driving meaningful change and improving the quality of life for everyone involved.

2 notes

·

View notes

Link

#market research future#gas genset market analysis#gas genset market technologies#gas genset market companies#gas genset power

0 notes

Text

Global Drilling Dynamics: A Comprehensive Overview of Directional Drilling Services Worldwide

Directional drilling is technique where multiple holes are dug from same surface. This form of digging is used by oil companies for accessing the reservoir of oil which saves the operational cost and done with less damage to the environment. The directional drilling has been a part of oil industry for a longer period. The use of Directional Drilling has economic uses as well for the oil drilling companies because it has low maintenance and low equipment cost which is why it is preferred mainly. With the rising demand for sources of energy, companies are investing huge amount into advanced methods for drilling services. Use of advanced tools and technique for the discovery for finding new reservoirs with minimum expense and drilling them to bring out maximum output. The market will be driven by increasing demand for energy, rapid industrialization.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-toc-and-sample/14171

COVID-19 Impact analysis

The COVID-19 outbreak has highly impacted the oil & gases market. With rise in cases day by day, countries have been under complete lockdown. This resulted in low sales of automobiles and halt in industries such as airlines, transportation, and oil production.

The companies have to follow the lockdown protocol and shut down their production unit as per government rules and regulation. Also, because of shortage of labor and including their safety. Many ongoing projects have to be temporarily ceased with immediate effect. The oil & gas price and supply have been affected globally.

Top Impacting Factors

The population is growing rapidly and so is the demand for energy. The demand is more from developing countries owing to increasing infrastructure and changing lifestyle of people. To cope with the demand, it has become important to discover new oil and gas fields, to meet the energy demand. Thus, the market has been expanding due to increasing investment. The fluctuating crude oil price in the global market oil field operators are cutting down their expenses in field operations. Also, the government is now strict on the oil & gas mining. In several regions, government has applied some rules and regulation regarding the safety of workers and environment. The companies have to submit a rough plan to the government about their drilling plans and environment safety measures which they are taking. Apart from this, the list of equipment to be used and an evacuation plan in case of emergency if anything happens. Before drilling to get the permissions can take time and slower down the production and increase in production cost, which is expected to hamper the directional drilling services market. The increase in adoption of green energy sources will reduce dependency on oil & gas in the future is expected to affect the directional drilling services market.

Market Trends

The growing investment in off-shore sector to find more reservoirs and increase the oil & gas production. This makes it the fastest growing segment into the market. Countries like China, America, and Russia have already invested, because the cost of offshore drilling has declined over the past few years.

Currently the demand for coal, gases and fuels for transportation has been increasing due to globalization and urbanization, which needs the expansion of oil & gas industry and biggest market vendors such as China, Russia and the U.S. have increased their investment in search for oil fields.

The increased use of energy has expanded the global oil & gas industry. They are mainly used for the purpose of transportation, power generation, and industrial use with many other industries.

Technological advancement which helps drillers to go into more depth and advancement of drilling tools with better visibility under the water, America is dominating the market because of their better technology.

Countries which are largest consumer of oil & gas are China and the U.S.; they are investing more into renewable source of energy power generation to reduce carbon emission and their dependency on fossil fuels. They are setting hydro, solar and wind power energy substation at a larger extent, which will affect the oil, gas and drilling market at a larger level.

Enquiry Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/14171

Key Benefits of the Report

This study presents the analytical depiction of the directional drilling services industry along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the directional drilling services market share.

The current market is quantitatively analyzed to highlight the directional drilling services market growth scenario.

Porter’s five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed directio

Directional Drilling Services Market Report Highlights

Aspects & Details

By Drilling Technique

Conventional Methods

Rotary Steerable System

By Service Type

Rotary Steerable System (RSS) Logging-While-Drilling(LWD

Logging-While-Drilling(LWD

Measurement-While-Drilling (MWD)

Motors (MUD Motors)

Get a Customized Research Report @ : https://www.alliedmarketresearch.com/request-for-customization/14171

By Application

Onshore Applications

Offshore Applications

By Region

North America (U.S, Canada, Mexico)

Europe (Russia, France, Germany, Italy, Spain, UK, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific)

LAMEA (Brazil, Saudi Arabia, South Africa, Rest of LAMEA)

Key Market Players

Weatherford International Plc, Jindal Drilling & Industries Limited., Schlumberger Limited, Baker Hughes Incorporated, Nabors Industries Ltd, Halliburton Company, Cathedral Energy Services Ltd, General Electric Oil & Gas, National Oilwell Varco

3 notes

·

View notes

Text

The agricultural lobby is a sprawling, complex machine with vast financial resources, deep political connections and a sophisticated network of legal and public relations experts.

“The farm lobby has been one of the most successful lobbies in Europe in terms of relentlessly getting what they want over a very long time,” says Ariel Brunner, Europe director of non-governmental organisation BirdLife International.

Industry groups spend between €9.35mn and €11.54mn a year lobbying Brussels alone, according to a recent report by the Changing Markets Foundation, another NGO.

In the US, agricultural trade associations are “enormously powerful”, says Ben Lilliston, director of rural strategies and climate change at the Institute for Agriculture and Trade Policy. “Our farm policy is very much their policy.”

The sector’s spending on US lobbying rose from $145mn in 2019 to $177mn last year, more than the total big oil and gas spent, according to an analysis by the Union of Concerned Scientists (UCS).

In Brazil, where agribusiness accounts for a quarter of GDP, the Instituto Pensar Agropecuária is “the most influential lobbying group”, according to Caio Pompeia, an anthropologist and researcher at the University of São Paulo. “It combines economic strength with clearly defined aims, a well-executed strategy and political intelligence,” he adds.

As a result of this reach, big agribusinesses and farmers have successfully secured exemptions from stringent environmental regulations, won significant subsidies and maintained favourable tax breaks.

[...]

Research suggests that big farms and landowners reap far greater benefits from subsidy packages than small-scale growers, even though the latter are often the public face of lobbying efforts.

“It’ll almost always be a farmer testifying before Congress or talking to the press, rather than the CEO of JBS,” says Lilliston.

But between 1995 and 2023, some 27 per cent of subsidies to farmers in the US went to the richest 1 per cent of recipients, according to NGO the Environmental Working Group. In the EU, 80 per cent of the cash handed out under the CAP goes to just 20 per cent of farms.

22 August 2024

72 notes

·

View notes