#Power-To-Gas Market Demand

Text

Global Power-To-Gas Market Is Estimated To Witness High Growth Owing To Increasing Demand For Renewable Energy Solutions

The global Power-To-Gas market is estimated to be valued at US$ 30.27 billion in 2022 and is expected to exhibit a CAGR of 12.2% over the forecast period of 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

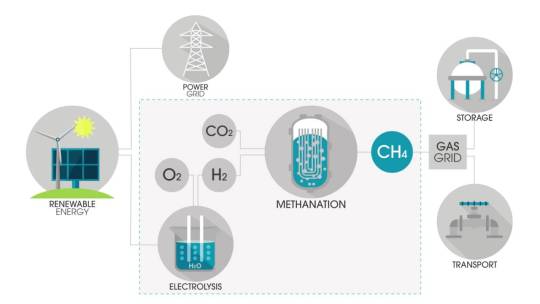

Power-To-Gas is a technology that converts electrical energy into chemical energy by using surplus renewable electricity to produce hydrogen or synthetic natural gas. This helps in storing excess renewable energy and enables its usage during periods of high demand. The process involves electrolysis, where water is split into hydrogen and oxygen, with the hydrogen further converted into methane. Power-To-Gas technology provides an efficient solution for energy storage and grid balancing, and reduces greenhouse gas emissions.

Market Key Trends:

One key trend in the Power-To-Gas market is the increasing demand for renewable energy solutions. As countries worldwide focus on reducing carbon emissions and transitioning towards cleaner energy sources, the demand for renewable energy solutions such as Power-To-Gas is expected to surge. This trend is driven by various factors, including government initiatives and policies promoting the use of renewable energy, growing concerns about climate change, and the need for energy security.

For example, countries like Germany and Denmark have been at the forefront of adopting Power-To-Gas technology to store excess renewable energy generated from wind and solar power. In Germany, Power-To-Gas systems are being used to convert surplus wind power into hydrogen, which can then be injected into the natural gas grid or used as fuel for transportation. Similarly, in Denmark, Power-To-Gas facilities are being utilized to produce synthetic natural gas from surplus wind power.

PEST Analysis:

- Political: Governments worldwide are implementing favorable policies and regulations to promote the adoption of renewable energy solutions. This includes providing subsidies, tax incentives, and feed-in tariffs for renewable energy projects.

- Economic: The decreasing cost of renewable energy technologies, such as solar panels and wind turbines, is making Power-To-Gas solutions more economically viable. Additionally, the potential for revenue generation from the sale of hydrogen or synthetic natural gas is attracting investments in Power-To-Gas projects.

- Social: Growing awareness about the need for sustainable energy solutions and the harmful effects of fossil fuels on the environment is driving the demand for renewable energy solutions like Power-To-Gas.

- Technological: Advancements in electrolysis technology and hydrogen fuel cells are improving the efficiency and cost-effectiveness of Power-To-Gas systems. The development of renewable energy storage technologies, such as hydrogen storage and underground caverns for synthetic natural gas, is further driving the adoption of Power-To-Gas.

Key Takeaways:

- The Global Power-To-Gas Market Size is expected to witness high growth, exhibiting a CAGR of 12.2% over the forecast period. This growth is driven by increasing demand for renewable energy solutions and the need for efficient energy storage and grid balancing.

- Regionally, Europe is expected to dominate the Power-To-Gas market, owing to supportive government policies, well-established renewable energy infrastructure, and high investments in Power-To-Gas projects. Asia Pacific is projected to be the fastest-growing region, driven by rapid industrialization, urbanization, and a shift towards renewable energy sources.

#Power-To-Gas Market#Power-To-Gas Market Demand#Power-To-Gas Market Growth#Power-To-Gas Market Analysis#Power-To-Gas Market Values#Coherent Market Insights#Power-To-Gas

0 notes

Text

Which by the way I'm getting so irritated this is off topic but does anyone remember in the movie Deep Impact (I think it was that one one of those disaster movies) Morgan Freeman played the president and when the time came to announce that the SHTF he not only told the ppl not to panic (though they inevitably will, there will always be the humans running out to hoard toilet paper); but he ALSO laid down some laws immediately he froze ALL prices saying NO PRICE GOUGING YOU HEATHENS (something to that effect) and I just freaking every day like I know it would take something like an E.O. or declaring emergency or war act or whatever in order to do this but PLEASE GOD CAN YOU JUST DO THAT bc seriously the inflation the gas prices rent everything- IT'S NOT ALL ACTUAL INFLATION IT'S BIG COMPANIES PRICE GOUGING AND MAKING RECORD PROFITS JUST BC THEY CAN then small local businesses and all consumers are just screwed and it is NOT okay it's being projected to keep going up whilst simultaneously complaining about homelessness like bitches hellO I just have to scream a minute

#ot#rant post#seriously I'm sick of hearing ppl correlate gas and product prices with who is in power#but also who is in power needs to do something before it's too late#but like derp we're coming out of a global pandemic that ducked up the supply chain etc etc#record drought making crop yields lower etc#there are legitimate things that are making prices skyrocket#but there is shit like shrinkflation and the shit chiptle is up to that is NOT#and gas and oil?#?!?! THERE IS PLENTY IT'S LITERALLY LIKE CHEVRON AND EXXON AND ALL THOSE FUCKERS RAISING PRICES#JUST. BC. THEY. CAN. and blame it on everything else#they have the supply now there's more demand they're manipulating the market#i can literally tell you for sure on the oil thing i know someone in the industry it's seriously just for profit#gas prices do not have to be this high#and that's what makes everything else even MORE expensive#ugh

3 notes

·

View notes

Text

The economic indicators speak of nothing less than an economic catastrophe. Over 46,000 businesses have gone bankrupt, tourism has stopped, Israel’s credit rating was lowered, Israeli bonds are sold at the prices of almost “junk bonds” levels, and the foreign investments that have already dropped by 60% in the first quarter of 2023 (as a result of the policies of Israel’s far-right government before October 7) show no prospects of recovery. The majority of the money invested in Israeli investment funds was diverted to investments abroad because Israelis do not want their own pension funds and insurance funds or their own savings to be tied to the fate of the State of Israel. This has caused a surprising stability in the Israeli stock market because funds invested in foreign stocks and bonds generated profit in foreign currency, which was multiplied by the rise in the exchange rate between foreign currencies and the Israeli Shekel. But then Intel scuttled a $25 billion investment plan in Israel, the biggest BDS victory ever.

These are all financial indicators. But the crisis strikes deeper at the means of production of the Israeli economy. Israel’s power grid, which has largely switched to natural gas, still depends on coal to supply demand. The biggest supplier of coal to Israel is Colombia, which announced that it would suspend coal shipments to Israel as long as the genocide was ongoing. After Colombia, the next two biggest suppliers are South Africa and Russia. Without reliable and continuous electricity, Israel will no longer be able to pretend to be a developed economy. Server farms do not work without 24-hour power, and no one knows how many blackouts the Israeli high-tech sector could potentially survive. International tech companies have already started closing their branches in Israel.

Israel’s reputation as a “startup nation” depends on its tech sector, which in turn depends on highly educated employees. Israeli academics report that joint research with universities abroad has declined sharply thanks to the efforts of student encampments. Israeli newspapers are full of articles about the exodus of educated Israelis. Prof. Dan Ben David, a famous economist, argued that the Israeli economy is held together by 300,000 people (the senior staff in universities, tech companies, and hospitals). Once a significant portion of these people leaves, he says, “We won’t become a third world country, we just won’t be anymore.”

19 July 2024

6K notes

·

View notes

Text

Europe Gas Generator Market Growth, Trends, Demand, Industry Share, Challenges, Future Opportunities and Competitive Analysis 2033: SPER Market Research

The Europe Gas Generator Market encompasses the production, distribution, and utilization of gas-powered generators across European countries. With increasing concerns about energy security, environmental sustainability, and power reliability, the demand for gas generators is rising. Key drivers include the transition to cleaner energy sources, infrastructure development, and backup power requirements. Additionally, advancements in gas generator technology, such as improved efficiency and reduced emissions, contribute to market growth. Key players focus on innovation, product differentiation, and service quality to meet the diverse needs of customers and capitalize on market opportunities in Europe.

#Europe Gas Generator Market#Europe Gas Generator Market Challenges#Europe Gas Generator Market Competition#Europe Gas Generator Market Demand#Europe Gas Generator Market Future Outlook#Europe Gas Generator Market Growth#Europe Gas Generator Market Report#Europe Gas Generator Market Revenue#Europe Gas Generator Market Segmentation#Europe Gas Generator Market Share#Europe Gas Generator Market Size#Europe Gas Generator Market Trends#Europe Hydrogen Gas Generator Market#Europe Industrial Gas Generator Market#Europe Laboratory Gas Generators Market#Europe Large Generator Market#Europe Natural Gas Generator Market#Europe Natural Gas Generator Market Forecast#Europe Natural Gas Generator Market Opportunities#Europe Power Generator Market#Europe Residential Gas Generator Market#Gas Generator Market

0 notes

Text

Power-to-Gas Market: Driving the Transition to a Hydrogen Economy

Power-to-Gas (P2G) is a rapidly emerging technology that aims to integrate renewable energy sources, such as wind and solar power, into existing gas infrastructure. P2G converts surplus electricity generated from renewables into hydrogen or synthetic natural gas (methane) through electrolysis. This process enables the storage and utilization of renewable energy in various sectors, including transportation, heating, and industrial applications.

Market Overview:

The global Power-to-Gas market has experienced significant growth in recent years and is expected to continue expanding at a substantial rate. The increasing focus on decarbonization, the integration of renewable energy sources, and the need for energy storage solutions are key factors driving the market's growth. Additionally, favorable government policies and incentives promoting clean energy technologies have further stimulated the adoption of Power-to-Gas systems.

Technologies:

Power-to-Gas systems primarily consist of three main components: electrolyzers, hydrogen storage, and methanation units.

Electrolyzers: Electrolysis is the core process in P2G systems. It involves the splitting of water molecules (H2O) into hydrogen (H2) and oxygen (O2) using electricity. Proton Exchange Membrane (PEM) electrolyzers and Alkaline Electrolyzers are the two main types used in P2G applications. PEM electrolyzers are known for their high efficiency, compact size, and fast response time, while alkaline electrolyzers offer lower costs and higher production capacities.

Hydrogen Storage: The produced hydrogen from electrolysis is stored for later use. Hydrogen can be stored in gaseous form in high-pressure tanks or as a liquid by cryogenic compression. Alternatively, it can be chemically combined with other elements to form more easily transportable compounds like ammonia or converted to synthetic natural gas.

Methanation Units: Methanation is the process of converting hydrogen with carbon dioxide (CO2) to produce synthetic natural gas (SNG). This step enhances the energy density and provides better storage options since the existing natural gas infrastructure can be utilized.

Applications:

The Power-to-Gas technology offers several applications across various sectors:

Energy Storage: P2G systems play a crucial role in storing surplus renewable energy and balancing supply-demand fluctuations in the electricity grid. Hydrogen or synthetic natural gas can be stored for extended periods and converted back to electricity or heat when needed.

Grid Balancing: P2G helps stabilize the electricity grid by providing grid operators with the flexibility to store excess energy during low demand and release it during peak demand periods. This improves the overall grid stability and reliability.

Sector Coupling: Power-to-Gas facilitates the integration of different sectors, such as transportation and heating, with the renewable energy sector. Hydrogen produced from P2G can be used as a fuel for fuel cell vehicles, while synthetic natural gas can be utilized for heating purposes in residential, commercial, and industrial settings.

Renewable Gas Injection: P2G enables the direct injection of renewable hydrogen or synthetic natural gas into existing natural gas pipelines, reducing the reliance on fossil fuels and decarbonizing the gas grid.

Market Outlook:

The Power-to-Gas market is expected to witness substantial growth in the coming years. The increasing deployment of renewable energy sources and the growing demand for energy storage solutions are the primary drivers for market expansion. The transportation sector, in particular, is anticipated to witness significant adoption of P2G technology, with the rise of fuel cell vehicles and the need for decarbonization. Furthermore, advancements in electrolyzer technologies, declining costs, and supportive government policies are likely to further accelerate market growth.

However, challenges such as the high cost of electrolyzers, limited infrastructure, and the need for effective carbon capture and utilization technologies remain key obstacles for wider market penetration. Continued research and development efforts, along with collaboration between industry stakeholders, are crucial to overcoming these challenges and unlocking the full potential of Power-to-Gas technology in the global energy transition.

0 notes

Text

When William Ruto was sworn in as Kenya’s fifth president in September 2022, he used his inauguration speech to demand an end to humanity’s “addiction to fossil fuels” and reaffirmed Kenya’s commitment to reach 100% clean energy by 2030. Kenya is not far off this target today.

In 2021, 81% of Kenya’s electricity generation came from the low carbon sources of geothermal, hydro, wind, and solar power. Over half of this low carbon electricity came from geothermal energy, which Kenya has in abundance. So much in fact, that excess geothermal energy is released during the night when electricity demand is low. Installed geothermal capacity in Kenya could be increased by at least eightfold, which could open opportunities for scaling up green manufacturing capacity or exporting excess electricity to neighbouring countries.

Renewable rollouts have substantially improved energy access. In 2013, around 28% of Kenyans had access to electricity. By 2020, this had risen to over 71%. This was achieved as the population grew by over seven million over the same period, while the rate of urbanisation continued to gather pace. According to the World Bank, barely one million Kenyans had electricity in 1990 [which, back then, was approximately just 5% of the population].

Ruto’s words, and Kenya’s actions, are timely due to the backdrop they are made against. Amid Russia’s invasion of Ukraine, and the vacuum created in global energy markets, European leaders and multinational fossil fuel firms have launched a ‘dash for gas’ across Africa, where a raft of new oil and gas projects, as well as old ones, are being given the green light. At COP27, Ruto kicked back against the dash for gas, stating that “we [Kenya] have taken a position that as a country we are going green and we are well on course.”

-via Rapid Transition Alliance, November 17, 2022

#kenya#green energy#sustainability#carbon emissions#air pollution#africa#world bank#developing nations#electrification#wind power#solar#solar power#geothermal#geothermalpower#fossil fuels#clean energy#good news#hope

224 notes

·

View notes

Text

Almost three years since the deadly Texas blackout of 2021, a panel of judges from the First Court of Appeals in Houston has ruled that big power companies cannot be held liable for failure to provide electricity during the crisis. The reason is Texas’ deregulated energy market.

The decision seems likely to protect the companies from lawsuits filed against them after the blackout. It leaves the families of those who died unsure where next to seek justice.

In February 2021, a massive cold front descended on Texas, bringing days of ice and snow. The weather increased energy demand and reduced supply by freezing up power generators and the state’s natural gas supply chain. This led to a blackout that left millions of Texans without energy for nearly a week.

The state has said almost 250 people died in the winter storm and blackout, but some analysts call that a serious undercount.

Within days of the storm, Texans affected by the failure of the energy system began filing lawsuits. Some of those suits were brought against power generators whose plants had stopped working in the storm or had run out of fuel to generate electricity.

After years of legal process, a three-judge panel convened to decide on the merits of those lawsuits.

This week, Chief Justice Terry Adams issued the unanimous opinion of that panel that “Texas does not currently recognize a legal duty owed by wholesale power generators to retail customers to provide continuous electricity to the electric grid, and ultimately to the retail customers.”

The opinion states that big power generators “are now statutorily precluded by the legislature from having any direct relationship with retail customers of electricity.”

🤡

53 notes

·

View notes

Text

💥 … good news!!! — July 20, 2024!!

By: LaillaB, founder of ‘Reclaim the Narrative’, from LinkedIn …

“As Israel's genocidal war against Gaza continues unabated, the Israeli economy is facing a catastrophe.

The economic indicators speak of nothing less than an economic catastrophe.

Over 46,000 businesses have gone bankrupt, tourism has stopped, Israel's credit rating was lowered, Israeli bonds are sold at the prices of almost "junk bonds" levels, and the foreign investments that have already dropped by 60% in the first quarter of 2023 (as a result of the policies of Israel's far-right government before October 7) show no prospects of recovery.

The majority of the money invested in Israeli investment funds was diverted to investments abroad because Israelis do not want their own pension funds and insurance funds or their own savings to be tied to the fate of the State of Israel.

This has caused a surprising stability in the Israeli stock market because funds invested in foreign stocks and bonds generated profit in foreign currency, which was multiplied by the rise in the exchange rate between foreign currencies and the Israeli Shekel.

But then Intel scuttled a $25 billion investment plan in Israel, the biggest BDS victory ever.

Three Israeli historians, two Zionists and one anti-Zionist, have declared that the Zionist project has come to an end.

Israel's power grid, which has largely switched to natural gas, still depends on coal to supply demand.

The biggest supplier of coal to Israel is Colombia, which announced that it would suspend coal shipments to Israel as long as the genocide was ongoing.

After Colombia, the next two biggest suppliers are South Africa and Russia.

Without reliable and continuous electricity, Israel will no longer be able to pretend to be a developed economy.

The physical destruction in Israel has been minimal, but one thing has been destroyed: its future.

When a critical mass of Israelis, regardless of their political opinions, become convinced that Israeli apartheid has become unsustainable, they will no longer agree to invest energy and money and risk their lives and their families for the sake of the Zionist project.

They will seek out a better future for themselves, as every sane person would, either by leaving Israel, or better yet, by working towards a new and democratic political system in Palestine 🇵🇸 إن شاء الله

Mondoweiss.

🃏 An economy built on the exploitation and suffering of others is a house of cards destined to collapse.

إن شاء الله

#reclaimthenarrative — 🍉🕊 — #FreePalestine … @hrexach

#dr rex equality news information education#graphic source#graphic#graphics#hortyrex ©#horty#quote#it is what it is#linkedin#israel#israhell#israel terrorist#economy#crashing#war#war crimes#war criminals#good news

11 notes

·

View notes

Text

What would you want to tell the next U.S. president? FP asked nine thinkers from around the world to write a letter with their advice for him or her.

Dear Madam or Mr. President,

Congratulations on your election as president of the United States. You take office at a moment of enormous consequence for a world directly impacted by the twin challenges of energy security and climate change.

Democrats and Republicans disagree on many aspects of energy and climate policy. Yet your administration has the chance to chart a policy path forward that unites both parties around core areas of agreement to advance the U.S. national interest.

First, all should agree that climate change is real and worsening. The escalating threat of climate change is increasingly evident to anyone walking the streets of Phoenix in the summer, buying flood insurance in southern Florida, farming rice in Vietnam, or laboring outdoors in Pakistan. This year will almost certainly surpass 2023 as the warmest year on record.

Second, just as the energy revolution that made the United States the world’s largest oil and gas producer strengthened it economically and geopolitically, so will ensuring U.S. leadership in clean energy technologies enhance the country’s geostrategic position. In a new era of great-power competition, China’s dominance in certain clean energy technologies—such as batteries and cobalt, lithium, graphite, and other critical minerals needed for clean energy products—threatens America’s economic competitiveness and the resilience of its energy supply chains. China’s overcapacity in manufacturing relative to current and future demand undermines investments in the United States and other countries and distorts demand signals that allow the most innovative and efficient firms to compete in the global market.

Third, using less oil in our domestic economy reduces our vulnerability to global oil supply disruptions, such as conflict in the Middle East or attacks on tankers in the Red Sea. Even with the surge in U.S. oil production, the price of oil is set in the global market, so drivers feel the pain of oil price shocks regardless of how much oil the United States imports. True energy security comes from using less, not just producing more.

Fourth, energy security risks extend beyond geopolitics and require investing adequately in domestic energy supply to meet changing circumstances. Today, grid operators and regulators are increasingly warning that the antiquated U.S. electricity system, already adjusting to handle rising levels of intermittent solar and wind energy, is not prepared for growing electricity demand from electric cars, data centers, and artificial intelligence. These reliability concerns were evident when an auction this summer set a price nine times higher than last year’s to be paid by the nation’s largest grid operator to power generators that ensure power will be available when needed. A reliable and affordable power system requires investments in grids as well as diverse energy resources, from cheap but intermittent renewables to storage to on-demand power plants.

Fifth, expanding clean energy sectors in the rest of the world is in the national interest because doing so creates economic opportunities for U.S. firms, diversifies global energy supply chains away from China, and enhances U.S. soft power in rapidly growing economies. (In much the same way, the Marshall Plan not only rebuilt a war-ravaged Europe but also advanced U.S. economic interests, countered Soviet influence, and helped U.S. businesses.) Doing so is especially important in rising so-called middle powers, such as Brazil, India, or Saudi Arabia, that are intent on keeping their diplomatic options open and aligning with the United States or China as it suits them transactionally.

To prevent China from becoming a superpower in rapidly growing clean energy sectors, and thereby curbing the benefits the United States derives from being such a large oil and gas producer, your administration should increase investments in research and development for breakthrough clean energy technologies and boost domestic manufacturing of clean energy. Toward these ends, your administration should quickly finalize outstanding regulatory guidance to allow companies to access federal incentives. Your administration should also work with the other side of the aisle to provide the market with certainty that long-term tax incentives for clean energy deployment—which have bipartisan support and have already encouraged historic levels of private investment—will remain in place. Finally, your administration should work with Congress to counteract the unfair competitive advantage that nations such as China receive by manufacturing industrial products with higher greenhouse gas emissions. Such a carbon import tariff, as proposed with bipartisan support, should be paired with a domestic carbon fee to harmonize the policy with that of other nations—particularly the European Union’s planned carbon border adjustment mechanism.

Your ability to build a strong domestic industrial base in clean energy will be aided by sparking more domestic clean energy use. This is already growing quickly as market forces respond to rapidly falling costs. Increasing America’s ability to produce energy is also necessary to maintain electricity grid reliability and meet the growing needs of data centers and AI. To do so, your administration should prioritize making it easier to build energy infrastructure at scale, which today is the greatest barrier to boosting U.S. domestic energy production. On average, it takes more than a decade to build a new high-voltage transmission line in the United States, and the current backlog of renewable energy projects waiting to be connected to the power grid is twice as large as the electricity system itself. It takes almost two decades to bring a new mine online for the metals and minerals needed for clean energy products, such as lithium and copper.

The permitting reform bill recently negotiated by Sens. Joe Manchin and John Barrasso is a good place to start, but much more needs to be done to reform the nation’s permitting system—while respecting the need for sound environmental reviews and the rights of tribal communities. In addition, reforming the way utilities operate in the United States can increase the incentives that power companies have not just to build new infrastructure but to use existing infrastructure more efficiently. Such measures include deploying batteries to store renewable energy and rewiring old transmission lines with advanced conductors that can double the amount of power they move.

Grid reliability will also require more electricity from sources that are available at all times, known as firm power. Your administration should prioritize making it easier to construct power plants with advanced nuclear technology—which reduce costs, waste, and safety concerns—and to produce nuclear power plant fuel in the United States. Doing so also benefits U.S. national security, as Russia is building more than one-third of new nuclear reactors around the world to bolster its geostrategic influence. While Russia has been the leading exporter of reactors, China has by far the most reactors under construction at home and is thus poised to play an even bigger role in the international market going forward. The United States also currently imports roughly one-fifth of its enriched uranium from Russia. To counter this by building a stronger domestic nuclear industry, your administration should improve the licensing and approval process of the Nuclear Regulatory Commission and reform the country’s nuclear waste management policies. In addition to nuclear power, your administration should also make it easier to permit geothermal power plants, which today can play a much larger role in meeting the nation’s energy needs thanks to recent innovations using technology advanced by the oil and gas sector for shale development.

Even with progress on all these challenges, it is unrealistic to expect that the United States can produce all the clean energy products it needs domestically. It will take many years to diminish China’s lead in critical mineral supply, battery manufacturing, and solar manufacturing. The rate of growth needed in clean energy is too overwhelming, and China’s head start is too great to diversify supply chains away from it if the United States relies solely on domestic manufacturing or that of a few friendly countries. As a result, diminishing China’s dominant position requires that your administration expand economic cooperation and trade partnerships with a vast number of other nations. Contrary to today’s protectionist trends, the best antidote to concerns about China’s clean technology dominance is more trade, not less.

Your administration should also strengthen existing tools that increase the supply of clean energy products in emerging and developing economies in order to diversify supply chains and counter China’s influence in these markets. For example, the U.S. International Development Finance Corp. (DFC) can be a powerful tool to support U.S. investment overseas, such as in African or Latin American projects to mine, refine, and process critical minerals. As DFC comes up for reauthorization next year, you should work with Congress to provide DFC with more resources and also change the way federal budgeting rules account for equity investments; this would allow DFC to make far more equity investments even with its existing funding. Your administration can also use DFC to encourage private investment in energy projects in emerging and developing economies by reducing the risk investors face from fluctuations in local currency that can significantly limit their returns or discourage their investment from the start. The U.S. Export-Import Bank is another tool to support the export of U.S. clean tech by providing financing for U.S. goods and services competing with foreign firms abroad.

Despite this country’s deep divisions and polarization, leaders of both parties should agree that bolstering clean energy production in the United States and in a broad range of partner countries around the world is in America’s economic and security interests.

I wish you much success in this work, which will also be the country’s success.

11 notes

·

View notes

Text

Excerpt from this story from Canary Media:

Texas has become an all-around clean energy juggernaut, thanks to its lax permitting regime, fast grid-interconnection process, competitive energy market, and ample amount of solar- and wind-friendly land.

Its plans for the next year and a half underscore that status. As of July, the state intended to build 35 gigawatts of clean energy over 18 months, more than the next nine states combined, according to a Cleanview analysis of U.S. Energy Information Agency data.

Texas has long been the biggest player in U.S. wind energy. But in recent years, energy developers have raced to build solar in Texas too. Five years ago, the state had connected just 2.4 gigawatts of utility-scale solar to its grid; as of this past June, it had installed almost 22 GW of solar, per an American Clean Power report released this week. That’s nearly 10 times as much as back in 2019, and enough to propel Texas past California for large-scale solar installations.

Now Texas is writing its next chapter on clean energy: The state has become the nation’s hottest market for grid batteries as energy developers chase after its cheap solar and wind energy.

Given its staggering construction plans, Texas is set to only further solidify its place at the top of the clean energy leaderboard. But the rapid rise of the state’s clean energy sector has not yet yielded an outright energy transition, as the writer Ketan Joshi points out.

Though Texas has built more large-scale clean energy than any other state in absolute terms, it lags behind California — and plenty others — in terms of how clean its grid actually is. The Golden State met over half its electricity needs with renewables in 2023, per Ember data, while clean sources generated just 28 percent of Texas’ power. Electricity produced in the Lone Star State remains slightly more carbon intensive compared with the U.S. average.

Part of the story here is that, largely thanks to data centers and bitcoin mines, Texas is seeing some of the fastest growth in electricity demand of any state. That means much of the new solar, wind, and battery storage it’s building is just meeting new demand and not necessarily booting dirty energy off the grid.

The other hurdle preventing Texas from cleaning up its grid faster is the entrenchment of the fossil fuel industry in its local politics. Last year, the state passed a law creating a taxpayer-funded program to give energy developers billions of dollars in low-interest loans to build several gigawatts’ worth of new fossil-gas power plants.

In other words, the Lone Star state’s fossil fuel buildout isn’t ending even as its clean energy sector takes off. For Texas to be considered a true leader on decarbonizing the power sector — and not just a state that builds lots of everything — that will need to change.

7 notes

·

View notes

Text

New Zealand has serious problems with its power supply. There are three underlying reasons: the weather, a flawed electricity market and a drive for ‘net zero’.

Sixty-five per cent of New Zealand’s electricity is provided by hydropower, and the remainder by geothermal, gas, coal, wind and some solar. Though hydropower is often seen as the one form of renewable energy which is not plagued by intermittency of supply, it sadly isn’t true. In a dry year, hydro’s ability to deliver falls away, and we lose about 10 per cent of our generation. In the past, we always tried to have the hydro reservoirs and coal stockpile full by the end of summer to guard against this possibility. When we switched to an electricity market, this was forgotten.

This year, we failed to refill the reservoirs, and levels are now unusually low. We are muddling along for the moment, but this is a difficult position from which to recover and there are likely to be blackouts at some point in the future.

The ability of our fossil fuel power stations to step into the gap has been severely restricted. We used to get 20 per cent of our electricity from gas-fired power stations, but six years ago, as part of their decarbonisation policy, the previous government banned further gas exploration, and we are now desperately short of gas. The new government is encouraging new exploration but we won’t see the results for several years.

We also have a single coal fired station with insufficient coal in its stockpile because our electricity market does not pay for the cost of maintaining an adequate stockpile.

The situation has been made worse by poor market design. New Zealand was one of the pioneers of electricity markets, and chose a risky model which has proved to be seriously flawed.

As a result, the problems this year have led to wholesale market prices rising to ridiculous levels of as much as £1/kWh. This has already caused some factories to shut down; others are under threat. The politicians are beginning to realise that the energy crisis could have serious effects on consumers, and there is speculation that they will be forced to intervene. This could mean instructing our gas and coal-fired power stations to run flat out day and night – which won’t make much difference because of the lack of fuel. Failing this, the only solution in the short term is rolling blackouts. and a public conservation campaign.

How did we get to this situation?

Firstly, the electricity market is simply not fit for purpose. The underlying propositions are that ‘electricity is a commodity like any other’ and that ‘when the price goes up, the demand goes down’. But electricity is not a commodity like any other, because it does not have an alternative or significant price elasticity. It isn’t a market that Adam Smith would recognise. As two departing CEOs said, the way to make money is to keep the system on the edge of a shortage. Which means that disaster is inevitable if a dry year occurs. And that is exactly what has happened.

The blind pursuit of ‘Net Zero’, has driven the closing down of gas exploration and the desire to shut down our coal fired station, even though it is doing a vital job in keeping the lights on.

The long-term problem

There has now been some rain on the hydro lakes and we are temporarily out of danger – assisted by the fact that the power companies have paid a stiff price to a major industrial gas user to shut down so that they can have its supplies.

But the long-term problem is still there: empty storage lakes that need to be refilled, not a lot of snow pack to melt in the springtime, declining supplies of gas, and the need to import 30 shiploads of coal and truck it to the power station. None can be achieved in the time available. The imminent shutdown of a 380 MW combined cycle power station, because it cannot find a secure gas supply for the next 20 years or so, adds to the problem.

Instead we are placing our faith in more wind and solar power. The price will skyrocket when it is in short supply, but that will not help the wind and solar farms’ accounts as that is when they have very little to sell. When wind and sun are abundant, prices will crash. This means that the wind and solar farms under construction and planned will not make enough money to pay for their construction and operation. New Zealand does not directly subsidise wind and solar power so we can’t even be sure that the generators will continue building them.

To be economic, wind and solar must be supported by low-cost long-term storage for days, weeks and months.There is no technology that can deliver this right now. New Zealand’s hydro reservoirs have huge capacity – approaching 10 per cent of a year’s electricity supply – but this storage capacity is already fully required to deal with the annual variations in hydro output. It cannot be used to back up solar and wind. Batteries simply can’t be used at national grid scales: they are too expensive by a factor of 50 or so.

Worse still the expectation is that electricity demand is going to increase rapidly, driven by domestic and industrial heat and road transport being electrified (although the extent to which this will actually happen in the face of rising power prices is debatable). Whether electric heating and transport arrive or not, we are already getting more and more data centres, which are a 24-hour per day load and need a reliable supply.

So the load will go up but we will be less able to keep the lights on when wind and solar are not delivering. Australia is 2000 km away, so there is no chance of importing from there, even if they did have power to spare, which they don’t.

We could build more geothermal stations, but that takes time, especially as the oil rigs they need to drill production wells have all departed overseas. There is probably 1000 MW so of identified geothermal potential, and there is the possibility that more could be found with exploration. But this is not a quick solution.

The only quick solution is to buy gas turbines and run them on diesel: not a nice prospect.

In the long-term we could consider more hydro generation, but that is blocked by many environmentalists, even though there is probably 2000 MW of potential left in the South Island. For those who do not believe in dangerous carbon-driven climate change – or who consider that atmospheric carbon levels will rise beyond desirable levels anyway due to China and India and that it is therefore pointless for Western nations to spend huge sums reducing their emissions – more coal and gas generation are an obvious solution but they are not quick.

For those who believe that man-made global warming is real and dangerous, and that it is worthwhile for the Western nations to cut emissions alone, we could be urgently considering nuclear power. This is the only practical and economic way of having reliable electric power with low carbon emissions. I suspect that in spite of a long-held opposition to nuclear armed and propelled ships, the New Zealand public are more sympathetic to nuclear power than they are believed to be.

Whatever happens, New Zealand faces a very uncertain situation in the next few years with an increasing risk of major shortages and a major increase in domestic electricity prices.

The implications for other countries

I suspect that this is the writing on the wall for all countries that have pursued net zero and ignored the importance of keeping the lights on at a reasonable price. The UK is already relying on interconnectors for about 10 per cent of its electricity and would be in serious trouble if Europe was unable to provide backup power when UK wind and solar are not delivering.

For as long as Europe and other countries have net zero as a prime objective, electricity blackouts and high prices are inevitable. As we are planning to make our entire society electrically powered, this is a bleak prospect.

7 notes

·

View notes

Text

Carbon Pipe Fittings : Astm A234 WPB Pipe Fittings Manufacturers

Introduction:

ASTM A234 WPB pipe fittings, also known as carbon steel pipe fittings, have largely become standard parts in many industries. The fitting elements will be used to adapt straight pipe or tubing sections, to maintain different size or shape, and to control the rate of flow of liquids.

Always resistant to strength and versatile, ASTM A234 WPB fittings play a critical role in industries dealing with oil, gas, petrochemicals, and power generation.

What are ASTM A234 WPB Pipe Fittings?

They are used to connect pipes in shapes such as elbows, tees, reducers, and caps. The prime factors that make the use of these fittings highly prevalent are their excellent mechanical properties, like high tensile strength and resistance to corrosion. They are very important in ensuring the integrity and efficiency of piping systems across industries.

Manilaxmi Industrial also supplies Carbon ASTM Pipe Fittings around the globe.

Real-Time Advancements in Industries

Ranging from new manufacturing technologies and materials science to improved performance and reliability, these fittings have carved out a niche in use. Applications of the ASTM A234 WPB carbon steel pipe fitting have greatly improved in the industrial sector.For example, refined heat treatment processes leave behind fittings that are easier to manipulate and work under higher pressure and temperature conditions.

Besides, numerous coating and lining innovations provide improved corrosion resistance and give extended life expectancy.

Manilaxmi Industrial the Indian manufacturers, suppliers, and exporters have been among the most active adopters of these developments to ensure that the country is retained as a main supplier of quality pipe fittings in the global market.

Technology and Need in Various Countries

Demands for ASTM A234 WPB carbon steel pipe fittings are ever-increasing in the global scenario. This demand has been hastened further by the requirement of strong, efficient piping systems in the developing countries and renovated or rejuvenated ones in the developed nations.

Such as setting up power plants and oil refineries. In contrast, developed nations always require update works and servicing of already existing facilities. Equipped with state-of-the-art technology in the manufacturing process, these fittings comply with strict standards that make them very important and cardinal for maintaining efficiency and safety during industrial operations.

Conclusion

In conclusion, ASTM A234 WPB pipe fittings are the most essential material in the industrial market, possessing qualities of high durability, adaptability, and tolerance toward extreme situations. With relentless development in the manufacturing technologies, further improvements are made in their performances, making them trustworthy for different applications.

#innovation#management#technology#metalfabrication#metalwork#supplychain#manufacturers#exporters#suppliers

9 notes

·

View notes

Text

Big tech has made some big claims about greenhouse gas emissions in recent years. But as the rise of artificial intelligence creates ever bigger energy demands, it’s getting hard for the industry to hide the true costs of the data centers powering the tech revolution.

According to a Guardian analysis, from 2020 to 2022 the real emissions from the “in-house” or company-owned data centers of Google, Microsoft, Meta and Apple are likely about 662% – or 7.62 times – higher than officially reported.

[...]

Even though big tech hides these emissions, they are due to keep rising. Data centers’ electricity demand is projected to double by 2030 due to the additional load that artificial intelligence poses, according to the Electric Power Research Institute.

Google and Microsoft both blamed AI for their recent upticks in market-based emissions.

[...]

Whether today’s power grids can withstand the growing energy demands of AI is uncertain. One industry leader – Marc Ganzi, the CEO of DigitalBridge, a private equity firm that owns two of the world’s largest third-party data center operators – has gone as far as to say that the data center sector may run out of power within the next two years.

15 September 2024

117 notes

·

View notes

Text

American Geopolitics: Corporations over Citizens

So 'Jim Crow Joe' Biden signed a $95.3B Foreign Aid Bill for Ukraine, Israel, & Taiwan. Most Americans think that Border Security is a higher priority, but as expected, Congressional Democrats were in lock step w/ Biden's Warmonger Agenda. Members of the CBC & Progressive Party played a major role, providing overwhelming support for this measure. $1B in Military Aid is slated to go to Ukraine WITHIN HOURS of signing this Bill, but a Military Package estimated at $300M was secretly shipped and was already being used last Week. The $61B 'Foreign Aid Package' for Ukraine includes:

$23.2B slated to replenish U.S. Defense stockpiles

$11.3B for current Ukrainian Defense operations

$13.8B for future Ukrainian Defense measures

This is on top of the $113B in American Aid already sent. The Package also includes $26B for Israeli Defense, w/ $1B set aside for 'Aid Relief' in Gaza, & $8B going to Taiwan. This sounds like a good thing for Defense Contractors, Lobbyists, & Commercial Banks (The Industrial Military Complex), but there is No Mention of funding for America's porous Southern Border.

Volodomyr Zelenskyy's Government has received over $300B in Global Aid for his War, but all he has to show for it are 500,000+ slain Ukrainian Soldiers, devasted Cities, & Tens of Millions of displaced Citizens. Accounts of WHERE these resources have gone are murky at best. Reports of American Weapons & Relief Materials appearing on the Ukrainian Black Market have persisted since shipments began. It's apparent that the situation is Critical. Ukraine has recently issued a Draft, calling ALL Ukrainian Men of fighting age to return Home to join the Theater of Battle; failure to do so, will lead to being labeled a 'Draft Dodger'. Meanwhile, rumors have circulated that 1,000- 2,000 French Infantrymen (possibly French Foreign Legionaries) have joined Ukrainian Soldiers on the Battlefield; discarding their French Uniforms & donning Ukrainian ones.

Taking ALL of these factors into account, why is The Biden Administration throwing more Money at Ukraine? Why isn't NATO trying to negotiate a Truce between Putin & Zelenskyy (i.e. Istanbul Summit Communique)? A recent Summit in Switzerland showed that Volodomyr Zelenskyy is sticking to his guns. He is demanding the Same Terms that he offered at the Beginning of the Conflict. Vladimir Putin obviously has momentum, so why is NATO & Ukraine refusing to hear his Terms? The effort by Western Powers & the WEF to humiliate Putin publicly & topple his government has been a dismal failure. The Sanctions placed on Russia have not worked; in fact, it has galvanized the Russian Public & made Vladimir Putin something of a Super Star in the Global South.

Despite U.S. imposed Sanctions, Russia continues to have robust trade w/ several Western European Nations. Germany & France alone have spent Billions on Russian Fertilizer & Timber. Billions more in Natural Resources like Coal, Cobalt, Copper, Tungsten, & Zinc are also being sold throughout Europe. China & North Korea are purchasing the Natural Gas & Oil that once flowed through the Nord Stream Pipeline, & Global South Nations are purchasing Russian Armaments. To be clear, Russia isn't starving. In fact, The Russian Ruble is stronger than it was Last Year. Julius Malema recently stated that Russia's & South Afrika's Gold & Platinum wealth will be the backbone of a BRICS Currency. Saudi Arabia has already began accepting Rubles over American Petrodollars. All of this may explain The Biden Administration's determination to press on in Ukraine.

Military Minds like Scott Ritter & Col. Douglas MacGregor have been talking about Russian dominance over NATO in Ukraine since The War began. They both point out how the diplomatic moves being made by Vladimir Putin are well thought out, & Geopolitical Minds like John Mearsheimer agree. Putin is playing a Long Game, & his actions have aroused 'Russian Patriots'. Since the 'Special Operation' in Ukraine began, the Russian Army has grown from 900,000 Soldiers to over 1.4 Million. Even Men over 40 are seeking Enlistment. Roughly 1,400 Men/Day are volunteering to join the Battle in Ukraine. Meanwhile, Ukrainian Soldiers are SERIOUSLY depleted, & American Armed Forces Enlistment numbers are down; THIS may explain the number of Young Male Illegal Immigrants being allowed into the Country. The Roman Empire also faced an Enlistment problem; They hired Visigoth Mercenaries to beef up their numbers. History shows how THAT worked out for the Romans.

The Role of Multinational Corporations in all of this has to be considered. Black Rock is buying up large tracts of land in Ukraine, while Defense Contractors rake in 10s of Billions from U.S. Military Aid Packages. The Pentagon says that We have to replenish the stocks that are being shipped to Ukraine & Israel, but neither Front has an 'End Game'. Volodomyr Zelenskyy is fighting a losing battle. He doesn't have enough Soldiers to confront a growing Russian Army; he doesn't even have enough Experienced Soldiers to operate the equipment that Biden intends to ship. As for Israel, Benjamin Netanyahu has been very successful in devastating the Gaza Strip, but he hasn't done any real damage to Hamas. Meanwhile, Hezbollah is forcing Israeli Settlers South, & the Houthis have hurt Israel economically... Now Iran has SERVED NOTICE on Israel that their vaunted Air/ Missle Defense Systems (& America's) cannot stop a [bonafide] Iranian assault.

Back in America, Detroit, Flint, & Jackson Ms. STILL need clean drinking water! The Gulf States STILL suffer from the effects of Hurricane Katrina, & Our Roads, Bridges, & Tunnels continue to deteriorate. $200B would go a long way to solving some of these Home Grown problems. Corporations can make their money HERE; improving Trade Routes & increasing the incomes of American Workers. Why isn't this a priority? 'Jim Crow Joe' likes to tout Job Growth numbers, but these are mostly 'Gig Economy' Jobs, or Jobs that offer 30hrs/ Week, w/ NO BENEFITS. Then there's the Border Crisis. Improving the Southern Border IS a National Security Issue, but it's been put on the back burner- Why is that? Why are MILLIONS of unvetted Young Men not just being allowed into America, but also being subsidized?

Why are struggling Black Communities being forced to compete w/ these Men for resources meant for Us? Why are Black Politicians ignoring their Constituents & lending their support to these people, along w/ 2 Wars that have NOTHING to do w/ Us? The 'Fix' is obviously In, but We WILL have the Last Laugh on Election Day.

-Best believe That!

8 notes

·

View notes

Text

Monopoly's event-horizon

When a superdense, concentrated mass forms a black hole, the laws of physics around it change, giving rise to an eldritch zone where the normal rules don’t apply. When corporations form a concentrated industry, the laws of economics likewise change.

Take copyright: when I was a baby writer, there were dozens of comparably sized New York publishers. The writers who mentored me could shop their rights around to lots of houses, which enabled them to subdivide those rights.

For example, they could separately sell paperback and hardcover rights, getting paid twice for the same book. Under those circumstances, giving authors broader copyrights and easier enforcement systems could directly translate into more groceries on those authors’ tables and more gas in their cars’ tanks.

But today, publishing has dwindled to five giant houses (possibly four soon, depending on whether Penguin Random House successfully appeals its blocked merger with Simon and Schuster). Under these conditions, giving exploited authors more copyright is like giving bullied schoolkids more lunch-money.

Whatever copyright authors get will be non-negotiably extracted from them via the near-identical, unviolable core contracting terms from the Big Five publisher. Today, the bullies don’t just take your paperback rights, they also acquire your audio and ebook rights.

Most of them now want your worldwide English rights, so you can’t resell the book in the Commonwealth, and some have started demanding graphic novel, film and TV rights.

In our new book, Rebecca Giblin and I call this “chokepoint capitalism”. In today’s highly concentrated creative labor markets, copyright’s normal role of giving creators bargaining leverage over their supply chain is transformed.

https://chokepointcapitalism.com

Instead of being a tool for creators, copyright is inevitably transferred to part of the supply chain — a publisher, label, streamer, ebook retailers, etc — where it becomes a tool to beat up on the rest of the supply chain, especially creators.

But copyright isn’t the only policy that breaks down at the event horizon of monopoly’s black hole. Policy itself breaks down, too. When power is pluralized among lots of firms an expert regulator can ask a technical question like “Does net neutrality lead to a decrease in private infrastructure investment?” and get lots of answers.

Some companies — cable operators hoping to override your choices about which data you want by slowing down traffic from sites unless they pay bribes — will insist that they can’t afford to build fiber without this incentive.

Others — ISPs who want to raid the cable operators’ customer base by giving you the data you request as fast as they can — will answer this charge. Both will provide supposedly empirical about their investment choices and capital and running costs, and both will vigorously probe the others’ submissions for factual weaknesses.

But when all the internet in your country has been monopolized so that nearly all Americans have little or no choice of ISP, the truth-seeking exercise of regulation becomes an auction, with the monopolists bidding together to bend reality (or regulation) to their will:

https://muninetworks.org/content/177-million-americans-harmed-net-neutrality

This is called “regulatory capture”: when there are four or five companies running an industry, nearly everyone qualified to understand it is an executive at one of those companies. Obama’s “good” FCC chair was a cable lobbyist, Trump’s “bad” chair was a Verizon lawyer.

Ironically, the term “regulatory capture” originated with right-wing, anti-regulation nihilists. They argued that capture was inevitable and the only way to preserve competition was to eliminate all regulation, including the regulation that blocked monopoly formation.

https://doctorow.medium.com/regulatory-capture-59b2013e2526

Eliminating anti-monopoly rules had the entirely predictable effect of producing lots of monopolies. Today, nearly every global industry — beer, shipping, banking, athletic shoes, concert tickets, eyeglasses, etc — is dominated by a handful of firms:

https://www.openmarketsinstitute.org/learn/monopoly-by-the-numbers

Today, the same people who advocated for removing anti-monopoly rules in every administration since Reagan’s insist that their deregulation has nothing to do with the growth of monopolies — that these monopolies arise out of some mysterious force of history: when it’s monopoly time, you get monopolies.

This is a wild thing to say aloud among reasonably intelligent adults, like claiming, “Well, when we put out rat poison, we didn’t have a rat problem. We stopped, and now we’re overrun by rats. But it would be hasty to assume that removing the rat poison led to the explosion of rats (by the way, does anyone have a cure for the plague?)”

But if you haven’t paid close attention to the history of antitrust law since the late 1970s, all of this might feel mysterious to you — or worse, you might mistake the cause for the effect: regulators keep making corrupt choices, so regulation itself is impossible.

This is like the artists’ rights advocate who says, “artists’ incomes keep falling, so we need more copyright” — in mistaking the effect for the cause, both blame the system, rather than the corporate power that has corrupted it.

The same is true in our online “censorship” “debate,” which poses the issue of speech online as one of “which speech rules should the Big Tech companies that have transformed the internet into five giant websites filled with screenshots of the other four adopt?”

https://doctorow.medium.com/yes-its-censorship-2026c9edc0fd

Good communities need good rules, sure — but by focusing on which rules we have, rather than what keeps people stuck in social media silos that have manifestly bad rules, we miss the point. Absenting yourself from the major social media platforms and online messaging tools extracts major costs on your personal, professional, educational and civil life, so many of us stay within those silos, even though every day we spend there is a torment.

The focus on penalizing firms with bad rules is another one of those mistaking-the-cause-for-the-effect-and-making-it-worse phenomena. A fine-grained, high-stakes duty to moderate makes it effectively impossible for small platforms — say, community-owned co-ops — to offer an alternative to Big Tech.

And once Big Tech platforms have a duty to police their users, they can argue, reasonably enough, that they can’t also be forced to interoperate with other platforms whose users they can’t spy on and thus can’t control.

The case that bad community managers give rise to toxic communities breaks down under conditions of monopoly, since attempts to improve platforms with billions of users are a) doomed (there is no three-ring binder big enough to encompass all the rules for three billion users) and b) inimical to standing up smaller, easier-to-administer communities.

Monopoly’s singularity also applies to free software and open source. In the mid-1980s, Richard Stallman coined the term “free software” to apply to software that respected your freedom, specifically, the freedom to inspect, improve and redistribute it.

These were considered the necessary preconditions for freedom in a digital world. Without a guaranteed right to inspect the code that you relied on and correct the defects you found in it, you were a prisoner to the errors or ill intentions of the software’s original author.

In 1998, another name was proposed for software licensed on “free” terms: “open source.” Nominally, this term was intended to resolve the ambiguity between “free as in beer” and “free as in speech” — that is, to make it clear that “free software” didn’t mean “noncommercial software.”

This was said to be necessary to resolve the fears of commercial firms that had been frightened away from free software due to a misunderstanding. As part of this shift, advocates for “open source” shifted their emphasis from free software’s ethical proposition (“software that gives you freedom”) to an instrumental narrative.

Open source software was claimed to be higher quality than proprietary software, because it hewed to the Enlightenment values of transparency, replicability and peer review (“with enough eyeballs, all bugs are shallow”).

Along with this claim, there was a second argument that open source software was cheaper to develop because a “community” would gather to help maintain it. Sometimes, this was couched as a “commons” where lots of actors, large and small, would work to produce a community good.

In 2018 Benjamin “Mako” Hill delivered a keynote to the Libreplanet conference that was a kind of postmortem to the 20-year experiment in instrumentalism (open source) over ethics (free software):

https://www.youtube.com/watch?v=vBknF2yUZZ8

Mako concluded that the experiment was a failure, producing a situation in which the tech giants enjoyed unlimited software freedom (because they ran the cloud servers we all depended on) while the rest of us merely had open source (the right to inspect the software powering the cloud, and to suggest ways to modify it).

In this account, the shift from ethics to instrumentalism paved the way for a series of compromises that turned the commons into a sharecropper’s precarious farmstead. When the open community was asked whether cloud software should be subjected to the same copyleft terms as software distributed for users, they weighed this as an instrumental proposition (“will this make the software better”), not an ethical one (“will this give users more freedom?”), and concluded that the answer was “this is fine.”

I think there’s a lot to this explanation — if nothing else, it explains how such a drastic shift took place without much hue and cry. But there’s another phenomenon at work that Mako’s account doesn’t grapple with: the rise of tech monopolies.

The reason that ethical propositions related to software freedom were sidelined so effectively in the decades after 1998 is the increasing power of tech monopolies: as tech giants gobbled up their competitors or put them out of business with predatory pricing, they gained power over regulators, universities, and individual technologists (increasingly employed by or dependent on a tech giant).

Copyleft — like copyright — breaks down at the event horizon of concentrated corporate power. With copyright, the breakdown manifests as the appropriation of copyright’s “power to exclude” by the firms it was supposed to be wielded against. With copyleft, it manifests as “software freedom” being hoarded by the same firms that copyleft licenses were supposed to keep in check.

This phenomenon isn’t limited to free software — it also plagues open-licensed “content” — material released under Creative Commons licenses, say. A year ago, Paul Keller and Alek Tarkowski published an important essay on “openness” entitled “The Paradox of Open”:

https://paradox.openfuture.eu/

In this essay, the authors — both significant contributors to the world of free software and open content — identify a phenomenon akin to the Mako’s observation of “freedom for big companies, openness for the rest of us.” From Openstreetmap to CC-licensed creative works, corporate monopolies have supercharged their power by plundering the commons.

This month, Open Future, who published “Paradox,” published a series of responses to the original paper:

https://paradox.openfuture.eu/responses/

They are uniformly excellent, but the one that I am most interested in comes from James Boyle, “Misunderestimating Openness”:

https://openfuture.eu/paradox-of-open-responses/misunderestimating-openness/

Here, Boyle sharply disagrees with Keller and Tarkowski’s argument, grouping it with similar claims about content moderation and censorship, arguing that openness was only ever a necessary — but insufficient — precondition for a better world. In the same way, online speech forums might be terrible places, but this is a failure of their moderators and their communities and their business-models, not an indictment of the idea of online discourse itself.

Both papers grapple with concentrated corporate power as a corrupting force, but neither puts it in the center of the breakdown of otherwise sound practices.

Reading all these people whom I respect and admire so much debating whether “openness” is good or bad makes me even more certain that fighting concentrated corporate power is the precondition for success in all other goals.

Fighting concentrated corporate power may seem like a tall order, and it is, but in that fight, we have comfort in a key idea from Boyle’s own work.

Boyle describes the history of the term “ecology.” Before this term was in widespread use, it wasn’t clear when two people were engaged in the same struggle. If you care about endangered owls and I care about the ozone layer, are we on the same team?

What do charismatic nocturnal avians have to do with the gaseous composition of the upper atmosphere?

The term “ecology” turns these issues (and a thousand more) into a movement.

Today, there are people of all walks of life living in all kinds of hurt who think their pain is caused by phenomena that are downstream of corporate power. Once we figure that out — once we figure out that to make our tools work again, we need to escape the event horizon of the capitalist singularity — then we can really begin the fight in earnest.

Image:

NASA’s Goddard Space Flight Center (modified)

CC BY 2.0 (asserted; more likely public domain)

https://creativecommons.org/licenses/by/2.0/

[Image ID: A NASA rendering entitled 'Neutron Stars Rip Each Other Apart to Form Black Hole,' pictured as a Fibonacci spiral of glowing red lines on black background. Superimposed over this is an image of Monopoly's 'Rich Uncle Pennybags,' clutching a Grim Reaper's scythe rather than a cane, his face a skull. The lower half of his body has been stretched and is disappearing into the black hole at the center of the NASA image. He is limned with red and orange and sports a red/orange comet-tail.]

123 notes

·

View notes

Text

“Markets can remain irrational longer than you can remain solvent” –John Maynard Keynes

Last year (September 2023) the Labour Party set out its plans to create Great British Energy:

“…a new publicly-owned clean energy company (which will) save £93 billion for UK households”

And more recently,

“Labour will work with the private sector to double onshore wind, triple solar power, and quadruple offshore wind by 2030.” (Labour: 'Make Britain a clean energy superpower’. 2024)

Bravo! Who doesn’t want, cheaper, cleaner energy production and a move away from reliance upon fossil fuels other than the big oil companies? But did you spot the possible contradiction between the two statements?

In the first statement Great British Energy was to be publicly owned and in the second Labour is going to work with “the private sector”.

How will Labour square the circle of private sector involvement coupled to public ownership? Your guess is as good as mine. Here is what the Financial Times had to say:

“Plans are light on detail. But the party has said it wants to co-invest alongside the private sector…The terms at which it will invest are unclear. (FT: 06/07/24)

What we are not going to get is an entirely state-owned energy company like EDF in France which generated 139.7bn euros in revenue for the French government in 2023.

So before we get too excited we should remember Britain’s railways are organised within a mishmash of private and public ownership, and have been described as “broken" and “no longer fit for purpose”. Is this going to be the case for Great British Energy?

Even if Great British Energy is 100% publicly owned, and the cost of renewable energy is brought down there is still the small problem of how the price of generated electricity is artificially pegged to the cost of gas. Nowhere have I seen Labour promising to fix this unfair practice.

The UK already produces over 41% of its electricity through renewable sources and private companies buy and trade energy at the market price. This market is different to the energy provider market where you and I buy our energy, which is controlled by OFGEM.

The energy generator market operates on the principle of marginal cost pricing which has nothing to do with competition or the cost of renewable generation. Marginal cost pricing is where ALL units of electricity are sold at the price of the most expensive unit needed to meet demand at a particular moment in time.

The most expensive units of electricity are gas turbine generated. In other words, cheap renewable energy is sold at the same price as that produced by the most expensive gas plants. Until this artificial pricing structure is replaced by something fairer, the price you and I pay for electricity, whether renewable or not, will remain artificially high.

4 notes

·

View notes