#Private Finance

Text

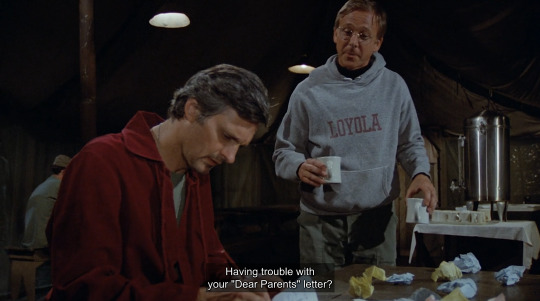

The frequency with which they seek to comfort each other gives me extremely large emotions btw

#they so often can feel when the other is aching and they literally go out of their way to provide care#i'm unwell about them#hawkeye pierce#father mulcahy#francis mulcahy#mashposting#mashblogging#m*a*s*h#s8e8#private finance#hawkahy

703 notes

·

View notes

Text

Private Finance (s8 e8): A dying soldier asks Hawkeye to return money made illicitly to his parents, and Klinger's motives for helping a young Korean girl are misunderstood.

The General's Practitioner (s5 e21): A general is determined to take Hawkeye on as his personal physician, while a GI about to be shipped home asks Radar to look after his Korean wife and their son.

9 notes

·

View notes

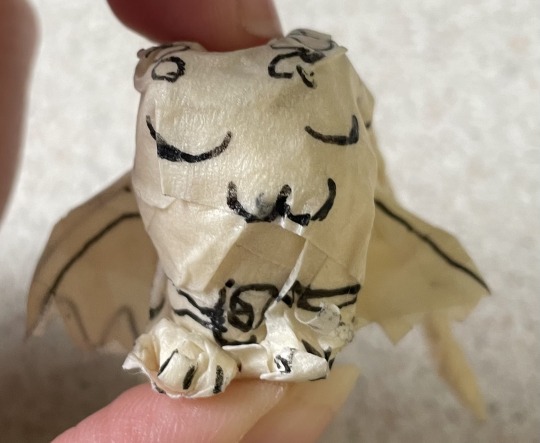

Photo

Private Finance Part 2

12 notes

·

View notes

Text

Multi-stakeholder round table 6: Domestic and international private business and finance.

6th Plenary meeting (continued) - Round table at the First Session of the Preparatory Committee for the 4th International Conference on Financing for Development, Addis Ababa, Ethiopia, 22-26 July 2024.

United Nations Economic and Social Council, United Nations Department of Economic and Social Affairs (DESA), UN Trade and Development.

Watch the Multi-stakeholder round table 6: Domestic and international private business and finance!

#roundtable#multistakeholders#private finance#Preparatory Committee#sustainable development#4th international conference on financing for development#united nations department of economic and social affairs (desa)#united nations economic and social council (ecosoc)#private business#domestic business#financing for sustainable development#ffd4

0 notes

Text

#personal loans#private loan in west bengal#private finance service providers in siliguri#private finance loan consultants in siliguri#private finance

0 notes

Text

Understanding the Difference Between Public Finance and Private Finance

Introduction to Public and Private Finance

Finance, a fundamental aspect of economic activity, can be broadly categorized into public finance and private finance. Understanding the difference between public finance and private finance is crucial for comprehending how financial systems operate at various levels.

Public finance primarily deals with the revenue, expenditures, and debt management…

View On WordPress

0 notes

Text

Private Finance in Chennai on cheque based

KFIS Private Finance Chennai

Private Loan Chennai

Cheque Based Private Finance Chennai

Private Finances Chennai can be classified as

Private finance against cheque ( Cheque based finance Chennai )

Short term private finances Chennai

Private finance property mortgage

Simple mortgage private Loan Chennai on property

Long term Private Finance Chennai

Service Availalble : TamilNadu , Chennai , Coimbatore , Madurai , Tirchy , Salem , Erode , Kanchipuram , Podicherry , Karur , Ramanathapuram

Contact Now | www.Kfis.in | +91 8939000056 | [email protected] >

Private Loan Chennai

The cheque based Private Finance Company Chennai can be borrowed for fulfilling private business loan needs , MSME Loan needs, working capital of business, Industrial Equipment loan for purchase. In this equipment purchase Private Loan supports the initial payment of equipment. Private Loan TamilNadu for commercial and residential Property purchase which supports initial payment for purchase.

KFIS Private Finance Chennai

KFIS is the most reliable and loyal to our business entrepreneurs on syndicating Private loans. It is also an instant business loan that helps to carry over the business to the next level. Private loan is a small wooden piece to safeguard your business from critical stages. Private finance Chennai supports more for business people to resolve the immediate requirements in running day to day expenses to meet out the important expenses shortly.

Service Availalble : TamilNadu , Chennai , Coimbatore , Madurai , Tirchy , Salem , Erode , Kanchipuram , Podicherry , Karur , Ramanathapuram

Contact Now | www.Kfis.in | +91 8939000056 | [email protected]

0 notes

Text

Develop sustainable finance initiatives.

The global wealth of US$430 trillion is not going where it is most needed under the current financial system. The current small, separate sustainable finance initiatives will not deliver the change at scale needed.

The answer: an architecture for sustainable finance based on the SDGs

The world needs an economic governance architecture deliberately designed to support governments, development agencies, civil society and the private sector to make decisions that prioritize investment in the SDGs.

UNDP’s strengths: UNDP is uniquely positioned to realize a sustainable finance architecture by working with multiple partners through:

Mobilizing financial expertise to sustainable development

Bringing sustainable development expertise to the private sector

Providing access to private financial investors

Designing instruments for the delivery of vertical funds and innovative instruments

Building a sustainable finance architecture at the country level

Facilitating South-South exchanges and horizontal knowledge-sharing on sustainable finance practices

UNDP ACCELERATES FINANCE FOR THE SDGS AND COVID-19 RECOVERY.

#Sustainable Finance Hub#UNDP#Public Finance#private finance#Sustainable Development Goals#Aganda 2030#FinancingSDG#sustainable finance initiatives

0 notes

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

421 notes

·

View notes

Note

Hey bitches! I know personal finance is personal, but if your s/o is being cagey about their finances even after you've been together for years and want to move in together/get married, is this a red flag? I don't expect them to disclose all their spending habits or whatever, because yeah, personal finance is personal. But I feel like it's reasonable to want to know what their income is and how much debt they have, especially if they know those things about you and you're planning on a life together. Those things affect the rent you can afford and all sorts of stuff. But they act like I'm unreasonable and invasive for wanting to know, which makes me wary.

When we say "personal finance is personal," we mean that your mileage may vary. It means that everyone's situation is different and therefore you can't rely on one-size-fits-all solutions.

It does NOT mean personal finance should be private. Especially when you're talking about joining your lives through cohabitation and shared bills!!!

We feel strongly that people should feel no shame about their personal finances and that the world would be a better place if we all talked openly about our money issues. After all, that's part of the foundation of BGR--talking about money stuff without shame so that we can all learn and grow together!

But more than that: if you are in a money-sharing relationship with someone, you deserve--nay!--you have the right to transparency within that relationship.

Maybe your partner is deeply in debt or has terrible credit and is afraid you'll leave them or won't want to move in with them if you find out. But shouldn't YOU be able to make that choice with all information on the table? It is not fair (and, I'd argue, super toxic) to hide financial information from a partner when that information could affect them. You deserve to know if getting on a lease together could negatively impact your credit! You deserve to know if their credit bills are so high that you'll be carrying the full burden of the household bills.

Or maybe they're a trust fund kid, sitting on a mountain of wealth, and they don't want that to affect how you see them. Which is super insulting of your character.

Either way, if they don't disclose the full picture, then I'd strongly reconsider moving in together. And do NOT get married until you know the full picture.

Season 4, Episode 2: “We’re Moving in Together but Don’t Plan To Get Married. How Can We Split Finances Fairly?”

How To Get Married: Bureaucracy, Finances, and Legal Paperwork To Do Before "I Do"

How Dafuq Do Couples Share Their Money?

If this helped you out, join our Patreon!

152 notes

·

View notes

Text

The two genders

#nonbinary margaret my queen#bigender margaret my queen#trans masc margaret my queen#literally anything is all true and valid for her my queen#margaret houlihan#hawkeye pierce#m*a*s*h#mashblogging#mashposting#s8e8#private finance#dear sigmund#s5e8

296 notes

·

View notes

Text

With Oasis reforming and Labour's Thatcherite revenants back in power, Britain is throwing itself gleefully into the vortex of shit 90s nostalgia.

18 notes

·

View notes

Photo

Private Finance Part 3

12 notes

·

View notes

Text

BOLD THE FACTS ft Valerie Powell

→ Tagged by the wonderful @corpocyborg--Thank you so much! ♡♡♡

→ Answers are based on her status during the in-game events

✧˖°. PERSONAL

$ Financial: wealthy / moderate / poor / in poverty

✚ Medical: fit / moderate / sickly / disabled / disadvantaged / non-applicable / would be in great shape if not for the brain worm

✪ Class or Caste: upper / middle / working / unsure / other

✔ Education: qualified/ unqualified / studying / other

✖ Criminal Record: yes, for major crimes / yes, for minor crimes / no / has committed crimes, but not caught yet / commits more crimes (bribes law enforcement) to avoid charges / yes, but charges were dismissed

✧˖°. FAMILY

◒ Children: had a child or children / has no children / wants children

◑ Relationship with Family: close with sibling(s) / not close with sibling(s) / has no siblings / sibling(s) is deceased

◔ Affiliation: orphaned / abandoned / adopted / disowned / raised by birth parent(s) / not applicable

✧˖°. TRAITS + TENDENCIES

♦ extroverted / introverted / in-between

♦ disorganized / organized / in-between

♦ close-minded / open-minded / in-between

♦ calm / anxious / in-between / highly contextual

♦ disagreeable / agreeable / in-between

♦ cautious / reckless / in-between / highly contextual

♦ patient / impatient / in-between

♦ outspoken / reserved / in-between / highly contextual

♦ leader / follower / in-between

♦ empathetic / vicious bastard / in-between

♦ optimistic / pessimistic / in-between

♦ traditional / modern / in-between

♦ hard-working / lazy / in-between

♦ cultured / uncultured / in-between / unknown

♦ loyal / disloyal / unknown

♦ faithful / unfaithful / unknown

✧˖°. BELIEFS

★ Faith: monotheist / polytheist / atheist / agnostic

☆ Belief in Ghosts or Spirits: yes / no / don’t know / don’t care / in a manner of speaking

✮ Belief in an Afterlife: yes / no / don’t know/ don’t care / in a manner of speaking

✯ Belief in Reincarnation: yes / no / don’t know / don’t care / in a manner of speaking

❃ Belief in Aliens: yes / no / don’t know / don’t care

✧ Religious: orthodox / liberal / in between / not religious

❀ Philosophical: yes / no / highly contextual

✧˖°. SEXUALITY & ROMANTIC INCLINATION

❤ Sexuality: heterosexual / homosexual / bisexual / asexual / pansexual

❥ Sex: sex-repulsed / sex neutral / sex favorable / naive and clueless

♥ Romance: romance repulsed / romance neutral / romance favorable / naive and clueless / romance suspicious

❣ Sexually: adventurous / experienced / naive / inexperienced / curious

⚧ Potential Sexual Partners: male / female / agender / other / none / all

⚧ Potential Romantic Partners: male / female / agender / other / none / all

✧˖°. ABILITIES

☠ Combat Skills: excellent / good / moderate / poor/ none

≡ Literacy Skills: excellent / good / moderate / poor / none

✍ Artistic Skills: excellent / good / moderate / poor / none

✂ Technical Skills: excellent / good / moderate / poor / none

✧˖°. HABITS

☕ Drinking Alcohol: never / special occasions / sometimes / frequently / alcoholic / former borderline alcoholic turned sober

☁ Smoking: tried it / trying to quit / quit / never / rarely / sometimes / frequently / chain-smoker

✿ Recreational Drugs: tried some / never / special occasions / sometimes / frequently / addict

✌ Medicinal Drugs: never / no longer needs medication / some medication needed / frequently / to excess

☻ Unhealthy Food: never / special occasions / sometimes / frequently / binge eater

$ Splurge Spending: never / sometimes / frequently / shopaholic

♣ Gambling: never / rarely / sometimes / frequently / compulsive gamble

Tagging: @medtech-mara, @vayneoc, @themermaidriot, @itzsassha, @elfjpeg, @morganlefaye79, and @vox-monstera ♡

dividers by @saradika | masterlist here (awesome resource--thank you so much! ♡)

#oc: valerie v powell#g: cyberpunk 2077#tumblr: dash games#gotta ramble some now:#i wasn't really sure how to characterize her finances during 2077#like she's not destitute but it's definitely not great#gig paycheck to paycheck sorta sitch#and she had a rich kid education#so lots of private tutors and travel experience#and she likes to read a lot#but she doesn't hold any fancy degrees or certificates#and both her parents have been deceased for 14+ years (if i remember my own timeline) by 2077#and she's introverted but she's an isfj so like the most social of the introverts#she's inclined towards caution but she can be swayed into reckless decisions if the right person (jenkins; jackie; arguably goro) asks#i feel like 'sex favorable' might undersell her libido a bit tbh lmao#combat and tech skills might get some tweaks post-2.0 depending on what build i end up rolling with#currently i see as her as VERY VERY good with firearms but less so with melee and blades#i think she's really sexy holding a katana tho and the ninja build or whatever they're calling it looks fun af#she was a work hard; play harder corpo party girl in her early 20s and did everything under the sun#but her mother died as a result of her addiction which *eventually* made valerie choose a totally sober life#and the medication is actually used for proper medical reasons not recreational#long post

41 notes

·

View notes

Text

2 weeks at uni and I’ve already reached peak procrastination. I found masking tape and somehow decided that the best use of my time was to make a tiny Belphemon-sleep.

#I actually can’t wait till student finance have processed my dsa#maybe next year or something I should look for an adhd diagnosis? if I’m having this much trouble focussing and a cup of coffee doesn’t work#anymore as a way for me to focus maybe I should see if meds would help?#(when I got my autism diagnosis i was also told its possible that I have adhd. I’d privately suspected adhd before I considered autism)#like. some days I can focus. it feels like I’m balancing on a knife-edge and it’s very stressful#and I can’t do it on command or anything#but sure#seeing one piece of fanart with Boy from tts#and my whole day goes down the drain because I can’t drag myself away from the series#and listening to video game soundtrack helps but then if I do that too much I start feeling lonely but I can’t listen to a podcast because#then I focus on that above the work I’m meant ti be doing#and even then I might look up other stuff about the video game I’m listening to#and the worst times are when I become self aware and that really breaks my focus but I know I’ve got to keep going#and then at the end of the day I feel awful because I’ve done about 1-2 hours actual work in 6 hours#time I could have spend doing other work or#heaven forbid#enjoying myself#that was more of a rant than I expected#I’m doing ok I think#I hope#i know I’m not meant to compare myself with others#but I’ve done more work than my flatmates#and that at least makes me feel a little better#I’m going to get myself a coffee now#hopefully that’ll help me today#my goal is at least 200 words#then I can stop#actually autistic#autism#personal rant

6 notes

·

View notes