#Property Redevelopment

Explore tagged Tumblr posts

Text

Sirpi Construction | Sirpi Property Care | Sriperumbudur | Ph. 9787813193

Sirpi Construction enhances community living through our park and landscaping services, creating appealing outdoor environments.

We focus on designing and building aesthetically pleasing, functional parks, ideal for both communities and corporate campuses.

#Sirpi#Sirpi Construction#Sirpi Construction in Sriperumbudur#Building Construction#Civil#Construction#Construction Company#Apartment Construction#Manufacturing Company#Flat Construction#Park Construction#Home Construction#House Construction#Office Construction#Villa Construction#Interior Design#Commercial Construction#Residential#Industrial Construction#Factory Construction#Amusement park#Warehouse#Farmhouse Construction#Property Redevelopment#Individual Plot Development#Consultation Design Maintenance#Remodeling Renovation#Floor Plan#General Construction#Work

2 notes

·

View notes

Text

H.B. No. 3143 - O'Connor Property Tax Reduction Experts

Get to know about H.B. No. 3143. the Property Redevelopment and Tax Abatement Act. For more updates on the Tax code, Visit https://www.poconnor.com/h-b-no-3143-2/

0 notes

Text

The Real Estate (Regulation and Development) Act, 2016, or RERA, is a crucial framework for property buyers in Pune, ensuring transparency, accountability, and protection. Developers must register their projects with RERA, providing clear details on project timelines, specifications, and approvals. Buyers are safeguarded against delays, with builders liable for penalties or compensation. Additionally, builders are responsible for fixing structural defects within five years of possession. For those looking to invest in Pune, understanding RERA is vital. SK Fortune Developers, known for their transparent and timely delivery, adheres to RERA guidelines, making them a trusted choice for homebuyers.

#fortune sk#sk fortune#SK Fortune Developers#best builders in pune#pune redevelopment projects#best redevelopment builders in pune#redevelopment projects in kothrud pune#top redevelopment builders in pune#redevelopment#pune builders and developers#pune real estate#SK Fortune Group#new residential projects in pune#best real estate developers in pune#redevelopment builders in prabhat road pune#3 BHK Flat for sale in Model Colony Pune#redevelopment builders in sb road pune#Residential projects in law college road#New Properties for Sale in Law College Road#Shriniwas Vishwambhar Sk fortune#Madhvachhaya SK Fortune#Ankur by SK Fortune Group#Fortune Developers#Prashanti SK Fortune#real estate developer#real estate projects in kharadi#redevelopment projects in shivaji nagar pune#real estate

2 notes

·

View notes

Text

Noida’s Real Estate Overhaul: What Homebuyers and Investors Must Know Before Stepping In

A city long caught between real estate ambition and execution gaps, Noida is finally rewriting its urban playbook. The Noida Authority, during its 218th board meeting, has approved sweeping reforms to revive stalled housing projects, promote high-end hospitality, and create new industrial corridors.

But what does this mean for the average homebuyer, the cautious investor, or the builder hoping to return to credibility? Let’s break it down—without the jargon, but with all the facts.

#Noida real estate 2025#Noida Authority board meeting#stalled projects Noida#FAR increase Noida#7-star hotels Noida#industrial plots Noida#real estate investment Noida#redevelopment in Noida#Noida homebuyers#Noida property news

0 notes

Text

Top Real Estate Property Management Companies in USA | Oceanfront Builders

Oceanfront Builders ranks among the leading real estate property management companies, offering expert real estate property management, real estate development, and redevelopment services. Trusted real estate property developers for tailored solutions. Learn more: https://oceanfrontbuilders.com/services/reip/

#real estate property management companies#real estate property management#real estate partnership#real estate development#real estate property development#real estate redevelopment#real estate property developer

1 note

·

View note

Text

Denver Skyscraper Meltdown (Office Towers Collapse into 98% Discount Foreclosure Freefall)

Key Takeaways Over 30% of Denver’s office-building mortgages are delinquent, making it one of the worst-hit metro areas for commercial loan defaults in the U.S. Iconic downtown skyscrapers are selling at up to 98% discounts, signaling historic opportunities—and risks—for investors. Office-to-residential conversions are accelerating, offering long-term buy-and-hold investment potential with tax advantages and strategic entry points. Denver’s skyline is disintegrating under the weight of debt, vacancy, and foreclosure. What happens when billion-dollar buildings can’t even fetch scrap value? Is Denver about to become a real estate investor’s biggest comeback story, or the next Detroit? Historic collapse of Denver’s commercial office market Shocking discounts and foreclosures sweeping the city Investor opportunities in conversions, cash deals, and bulk buys Let’s tear into the chaos and see where savvy investors can strike gold in the rubble. The Implosion No One Saw Coming (But Should Have) Downtown Denver is crumbling—tower by tower, loan by loan. What was once a gleaming symbol of the Rocky Mountain economic boom has turned into a battlefield of delinquent debt and desperate sales. Nearly 30% of office-tied commercial mortgages across the metro are now delinquent, making Denver the third-worst performing office market in the nation, trailing only behind San Francisco and Houston. But this isn’t just a temporary slump—it’s a full-scale unraveling. The dominoes are falling faster than ever. From the iconic Wells Fargo Center, immortalized in the Denver Nuggets skyline, to Republic Plaza, the city’s tallest building, lenders are no longer waiting for a rebound. They’re seizing properties, appointing receivers, and forcing distressed owners to abandon ship. It’s not just vacancy—it’s value vaporization. Towers that fetched hundreds of millions just a few years ago are now barely worth a few million dollars. Investor sentiment has shifted from patient optimism to cold surrender. “We have a lot of 1980s high-rise towers that are mostly vacant,” admitted Amy Aldridge of Tributary Real Estate. “People want to come back to the office, but they don’t want to come back to the 1980s office.” The death of Denver’s outdated office stock has begun. For real estate investors, this isn’t just another cycle—it’s a once-in-a-generation shockwave of wealth transfer. But with blood in the water, will they survive the chaos or capitalize on the carnage? Let’s go deeper. Discounted to Death: Skyscrapers for Pennies on the Dollar Downtown Denver’s towers aren’t just distressed—they’re being fire-sold for prices that would make 2008 blush. In a surreal twist that feels more like a liquidation auction than a metropolitan investment market, massive office complexes once valued in the hundreds of millions are selling for less than 2% of their former worth. These aren’t fringe properties on the city’s edge—these are skyscrapers in the heart of downtown. Case in point: Colorado Plaza Tower I and Tower II, with a combined footprint of 1.14 million square feet, were purchased for just $3.2 million. That’s a shocking 98% discount from their $200 million valuation in 2019. For perspective, that’s $3.30 per square foot in a market where office rents average $41.87 per square foot. Other bloodletting sales include: Hudson’s Bay Centre: Sold for $8.95 million, down from $41.5 million in 2014, an 80% haircut. Lincoln Crossing: Dumped for $10 million, a 90% drop from the 2018 price. Wells Fargo Center: In receivership after defaulting on a $327 million loan. And it’s not just the price tags that are plummeting, equity is being wiped out, leaving owners with nothing but the debt they can’t repay. Even buildings still technically in the black are under quiet distress, with modified loan terms, silent defaults, and lenders playing the “extend and pretend” game just to delay the inevitable. Here’s how the financial carnage looks:

Building Previous Value Sale Price % Discount Status Colorado Plaza Towers I & II $200M $3.2M 98% Sold (conversion planned) Hudson’s Bay Centre $41.5M $8.95M 78% Sold (distressed) Lincoln Crossing $100M+ $10M 90% Sold (distressed) Wells Fargo Center $327M debt N/A N/A In receivership For veteran investors, these prices are either a siren song or a death knell. Are these skyscrapers bargains, or ticking financial time bombs? One thing is clear: the scale of these discounts is more than historic, it’s a once-in-a-century signal that Denver’s commercial core has collapsed in plain sight. And this is just the beginning. The biggest deals are still hiding in the shadows. Zombie Buildings and the “Receivership Shuffle” Denver’s downtown is crawling with zombie towers—soulless shells too broke to function and too expensive to fix. These once-prized properties now sit in purgatory, neither dead nor alive, as lenders scramble to recover what little value remains. At least a third of Denver’s 105 largest office buildings (each over 100,000 square feet) are in some form of extreme financial distress, including: Loan defaults Court-ordered receiverships Outright foreclosures Voluntary ownership surrenders Distressed sales at catastrophic discounts This isn’t just a market correction, it’s a massive asset wipeout happening in slow motion. The infamous Wells Fargo Center, also known as the “Cash Register Building,” is under receivership after Brookfield defaulted on a $327 million loan. Republic Plaza, Denver’s tallest building, narrowly avoided foreclosure by renegotiating $134 million in debt. Meanwhile, lenders are installing third-party managers to stabilize properties and prepare them for auction, repurposing, or demolition. The cycle of distress looks like this: Owner defaults on commercial loan Lender appoints receiver to take control of operations Vacancy soars, and income disappears Asset value plummets Fire sale or foreclosure follows Denver’s downtown core, particularly Upper Downtown, is the epicenter of this collapse. The zone from Lawrence to Lincoln Street and 14th to 20th Street is now known as the “Foreclosure Belt of the Rockies." These aren’t obscure properties. The walking wounded include: Civic Center Plaza (1560 Broadway): Ownership returned to lender Denver Energy Center (1625 & 1675 Broadway): Seized by JPMorgan Chase Trinity Place (1801 Broadway): Claimed at auction by LoanCore Capital 1670 Broadway: Under third-party management after October default 1999 Broadway: Facing potential 70% vacancy if IRS pulls out To make matters worse, federal agencies—once considered ironclad tenants—are fleeing. The Department of Government Efficiency is slashing leases, and the IRS is eyeing a mass exit, gutting an already fragile leasing environment. And just when landlords thought things couldn’t get worse, Elevance Health (formerly Anthem) dealt a deathblow to 700 Broadway, vacating over 258,000 square feet and taking a stable 4.7% vacancy rate to a staggering 60% overnight. Denver’s skyline isn’t just distressed—it’s actively decaying. Investors who don’t understand the “receivership shuffle” may step into a deal that drains them dry before delivering any return. The stakes are sky-high, and the vultures are circling. Investor Warzone or Goldmine? The Redevelopment Gamble Denver’s broken towers may be bleeding capital, but they’re not dead yet. For the bold, they might be the greatest real estate arbitrage opportunity of the decade. Amid this brutal downtown collapse, a quiet renaissance is being whispered behind the scenes: office-to-residential conversions. Developers and deep-pocketed investors are pouncing on the chaos, buying skyscrapers for pennies, then sinking tens of millions into massive renovations, hoping to resurrect them as upscale apartments or mixed-use hubs. The Colorado Plaza Towers I & II are ground zero for this strategy. Acquired for a jaw-dropping $3.

2 million, Los Angeles developer Asher Luzzatto plans to spend $150 million to $200 million transforming the vacant giants into 700+ residential units. It’s the ultimate distressed play: buy the shell for nothing, inject capital, and rebirth the building as a luxury cash-flow machine. But there’s a catch. These buildings weren’t designed for housing. Many were built in the 1950s to 1980s, with deep floor plates, obsolete mechanical systems, and layouts that don’t naturally fit apartments. Add in asbestos remediation, ground leases, and elevator retrofits, and the costs can explode before a single rent check rolls in. Still, the math could work—especially with the steep discounts. Consider: Current residential vacancy in desirable downtown districts remains far lower than office. Rents for upscale urban apartments in Denver continue to outperform aging commercial leases. City officials are actively incentivizing conversions with fast-track approvals and zoning flexibility. With property tax assessments based on residential rates, annual liabilities plummet compared to office use. Here’s the punchline: A healthy office tower generates 4x the property taxes of a residential one. If you bought it at a 98% discount? That tax savings becomes part of your margin. However, success isn’t guaranteed. These conversion plays require: Massive upfront capital Navigating permitting minefields Winning zoning variances Long holding periods before profitability This isn’t a quick flip. It’s a war of attrition, and only the best-capitalized, most patient players will survive. Still, if pulled off, the return on investment could be staggering. Turning Denver’s dead towers into residential gold may become the city’s most dramatic real estate comeback story ever. But only if the visionaries can outlast the chaos. Strategic Entry Points for RE Investors Right Now While institutional giants retreat, private investors have a rare window to seize Denver’s fractured skyline if they know where to strike. This is no time for hesitation. As traditional lenders pull back and national firms offload properties in desperation, nimble investors can wedge themselves into deals once thought untouchable. The barriers are down. The doors are open. The distressed Denver office market has become a target-rich environment for those who move fast. Here’s where savvy real estate investors are making their plays: Joint Ventures with Debt Holders: Private lenders and distressed debt funds are hunting for partners to help stabilize or reposition troubled assets. JV structures allow smaller investors to gain equity access without full capital exposure. Seller Financing Fire Sales: Owners teetering on default may finance a sale just to walk away clean, allowing investors to step in with minimal upfront cash, especially attractive for value-add specialists. Ground Lease Leverage: Some towers, like Colorado Plaza, are on ground leases. While often seen as a complication, these leases can be negotiated or extended, letting investors buy buildings cheap and defer full land costs. Syndicated Capital Raises: With 80%–90% discounts becoming the norm, syndicators are assembling capital quickly to scoop up buildings in bulk. This group investment model is drawing accredited investors eager for outsized upside in a high-risk market. Opportunity Zones & Federal Incentives: Certain sectors of downtown Denver fall within designated Opportunity Zones, creating tax deferral and elimination potential for long-term investors pursuing redevelopment. Watch Zones: Not all of Denver is collapsing. The sharpest divide is forming between zones: Market Zone Status Upper Downtown Collapse underway Skyline Park Corridor High distress, high upside Union Station District Stable and in demand Central Platte Valley Modern, partially leased Cherry Creek & RiNo Top-tier tenant migration Pro tip: Investors should avoid outdated Class B/C towers unless they come with either deep discounts or strong conversion potential.

Focus instead on buildings with structure, location, and zoning flexibility, even if partially distressed. In short, Denver’s downtown disaster is now a developer’s dream and an investor’s litmus test. The deals are there, but only for those who know where to look, how to negotiate, and when to pounce. This isn’t just about timing the market, it’s about timing the implosion. Caution Ahead: Why Not All Distressed Assets Are Hidden Treasures In Denver’s downtown bloodbath, not every fire sale is a fortune. Some deals are dressed-up disasters waiting to detonate your capital. Yes, the headlines are blaring about 98% discounts. But behind those numbers lie ticking time bombs: toxic financing, terminally outdated layouts, and mechanical systems older than the internet. If you think every distressed tower is a hidden gem, think again—some of these buildings are unsalvageable money pits. Before you sink a dollar into Denver’s downtown, consider the real risks lurking beneath the surface: Outdated Infrastructure: Many of the worst-hit towers were built in the 1950s–1980s. Think lead pipes, low ceilings, inefficient HVAC systems, and asbestos in the walls. Retrofits cost millions—sometimes more than the building itself. Unfavorable Ground Leases: Several properties sit on land the buyer doesn’t own. Ground leases can be expensive, expiring, or non-renegotiable, strangling future ROI and complicating financing options. Zombie Tenancy and Leasing Black Holes: Buildings advertising “only 30% vacancy” may have ghost tenants—businesses that exist on paper but haven’t paid rent in months. Or leases that expire within a year with no renewals in sight. Lender-Controlled Death Spirals: Many distressed towers are under special servicing, receivership, or foreclosure, which means navigating multiple parties, legal red tape, and uncertain timelines. You could spend months bidding on a property only for the lender to yank it off the market at the last minute. Use Restrictions and Zoning Limits: Denver may be open to residential conversions, but not every building qualifies. Zoning overlays, height restrictions, historic designations, and structural limitations can kill a conversion plan before it starts. Skyrocketing Conversion Costs: What starts as a $10M steal could end up a $75M headache. Between permitting delays, structural retrofits, union labor costs, and inflation, many redevelopment projects are blown off course before lease-up. Investors chasing the siren song of downtown Denver must learn to differentiate between value and vacancy. There’s a difference between buying low and buying doomed. This market demands due diligence like never before. That means: Walking every property Inspecting every mechanical system Confirming lease status and zoning classifications Modeling worst-case scenarios, not just pro forma dreams Because in Denver’s crumbling core, the greatest fortunes and the greatest failures will be built on the same broken towers. The difference? Who knew what they were really buying? The City’s Future—and Your Window of Opportunity Denver isn’t dying—it’s transforming. But the path forward will be brutal, political, and wildly profitable for the right investors. Behind the boarded-up doors and half-empty high-rises, a new Denver is already beginning to take shape. The city's leadership knows its commercial tax base is collapsing—and with it, the revenue that funds everything from schools to sidewalks. This fiscal squeeze is forcing policymakers to embrace redevelopment and incentivize conversions like never before. According to Denver County Assessor Keith Erffmeyer, the last two-year assessment cycle saw a 25% drop in downtown commercial property values. That number is expected to plunge even further now that deeply distressed sales, some at 90%+ discounts, have begun flooding the books. Here’s the financial fallout: Office-to-residential conversions slash tax revenue. Thanks to Colorado’s

lower residential assessment rate, a converted tower will generate only one-quarter the property taxes of a stabilized office building. Sales and employment taxes vanish. Empty buildings mean no workers, no coffee shop sales, no lunch rush, no dry cleaners, no retail. This ripple effect devastates nearby businesses and erodes Denver’s long-term economic base. Yet… there’s hope. The city has no choice but to rebuild, rezone, and reinvest. Here’s what that means for real estate investors: Zoning Flexibility Is Expanding. Denver planners are under pressure to loosen restrictions to make conversion projects pencil out. New Resident Influx = Long-Term Stability. Every successful tower-to-apartment flip brings hundreds of new residents downtown, fueling demand for retail, amenities, and services. Public-Private Partnerships Are on the Rise. Expect tax incentives, grants, and development subsidies to flow toward those willing to bet big on downtown. This isn’t just a real estate cycle, it’s a civic identity crisis. And it’s one that creative, well-capitalized investors can help solve. You’re not just buying a broken building, you’re buying a stake in Denver’s comeback. The future of Denver’s downtown will be decided not by the city’s bureaucrats, but by the builders, buyers, and visionaries who step in during the chaos. The window is narrow. The stakes are sky-high. And your opportunity is now. Assessment Denver’s downtown skyline is no longer a symbol of growth—it’s a flashing red warning light for cities across America. What we’re witnessing isn’t just a collapse in property values. It’s a violent rebalancing of urban priorities, investor expectations, and commercial real estate fundamentals. For real estate investors, this is a moment of brutal clarity: The rules have changed. The math has changed. But the opportunity has never been greater. Yes, the risks are real: obsolete infrastructure, tenant flight, political uncertainty, and razor-thin margins on conversions. But in every great collapse lies the seed of reinvention. Investors who understand that timing, creativity, and grit now outweigh square footage and prestige will be the ones to reshape Denver and profit from its rebirth. Whether you’re scouting bulk office buys at 10 cents on the dollar, assembling capital for adaptive reuse, or locking in land deals before the next upcycle hits, the battlefield is set. The question is no longer if Denver will recover. It’s who will own it when it does.

#buy and hold#capital injection#capital restructuring#CMBS defaults#Colorado#commercial collapse#debt distress#Denver#distressed assets#downtown investments#foreclosure crisis#government leases#market crash#market implosion#office towers#Receivership#redevelopment#skyscraper deals#tax revenue decline#tenant exodus#tower conversion#tower sales#undervalued properties#Upper Downtown#urban conversions#urban planning#vacancy rates

1 note

·

View note

Text

Leading Redevelopment Builders in Mumbai

Harsh Group has emerged as one of the most trusted redevelopment builders in Mumbai, known for transforming aging properties into modern, well-planned living spaces. With decades of expertise and a deep understanding of the Mumbai real estate market, the company offers innovative redevelopment solutions that align with the evolving needs of homeowners and housing societies.

Their commitment to transparency, timely project delivery, and regulatory compliance sets them apart in the competitive redevelopment landscape. Harsh Group collaborates closely with residents, architects, and civic authorities to ensure that every project meets high standards of quality and sustainability. Whether it's a small housing society or a large-scale urban renewal project, the team brings the same level of professionalism and personalized attention to every redevelopment initiative.

By offering tailor-made redevelopment plans, Harsh Group helps societies unlock the true potential of their existing property while enhancing the value of their assets. Residents benefit from upgraded amenities, improved layouts, and increased safety—without any financial burden.

The company’s customer-first approach and proven track record make them a preferred choice among societies looking to redevelop their old buildings. Anyone seeking experienced and reliable redevelopment builders in Mumbai can trust Harsh Group to deliver excellence from start to finish.

#builder#developers#Developers in mumbai#real estate builders#real estate developers#Redevelopment Builders#construction#flats for sale#residential property#real estate#real estate investing

0 notes

Text

Here’s a step-by-step guide on How to Report an SRA (Slum Rehabilitation Authority) Development Law Violation:

Identify the Violation – Check for issues like project delays, illegal evictions, or non-compliance with SRA guidelines.

Gather Evidence – Collect documents, photos, agreements, or any proof of violations.

File a Complaint – Report the issue to the SRA office, municipal authorities, or RERA if applicable.

Seek Legal Help – Consult a property lawyer to understand your rights and legal options.

Follow Up – Track your complaint status and escalate it to higher authorities if needed.

#Real Estate & Construction Law Firm in Mumbai#SRA Lawyers in Mumbai#best Real Estate Lawyers in Mumbai#property dispute lawyers in mumbai#commercial property lawyer in mumbai#real estate litigation attorney in mumbai#redevelopment lawyers in mumbai#redevelopment lawyers in maharashtra#commercial property lawyers in maharashtra

0 notes

Video

youtube

Donald Trump’s Bold Gaza Plan – U.S. To Take Over & Resettle Palestinian...

#Gaza Strip#Middle East#MidEast Riviera#redevelopment#rebuilding Gaza#Trump administration#real estate#waterfront property

0 notes

Text

Sirpi Construction | Sirpi Property Care | Sriperumbudur | Ph. 9787813193

Build your aspirations with Sirpi Construction, located in Sriperumbudur. We provide comprehensive

construction services for both residential endeavors, such as apartments and villas, as well as

commercial projects. Our skilled team focuses on achieving exceptional results in civil and industrial

construction, ensuring your vision comes to life.

#Sirpi#Sirpi Construction#Sirpi Construction in Sriperumbudur#Building Construction#Civil Construction#Construction Company#Apartment Construction#Manufacturing Company Construction#Flat Construction#Park Construction#Home Construction#House Construction#Office Construction#Villa Construction#Interior Design#Commercial Construction#Residencial Construction#Industrial Construction#Factory Construction#Amusement park#Warehouse Construction#Farmhouse Construction#Property Redevelopment#Individual Plot Development#Consultation Design Maintenance#Remodeling Renovation#Floor Plan#General Construction Work#Roofing#partitioning

3 notes

·

View notes

Text

Swojas Enterprises - Your Premier Partner for Real Estate Construction Solutions in Pune

Discover innovative real estate construction services tailored to your needs at Swojas Enterprises. From residential developments to commercial projects, we bring expertise, quality, and dedication to every build. Explore our portfolio and collaborate with a trusted partner for your next construction venture.

#swojas enterprises#redevelopment builders in pune#top redevelopment builders in pune#Property Developers in Pune#Real Estate Property Developer in Pune

1 note

·

View note

Text

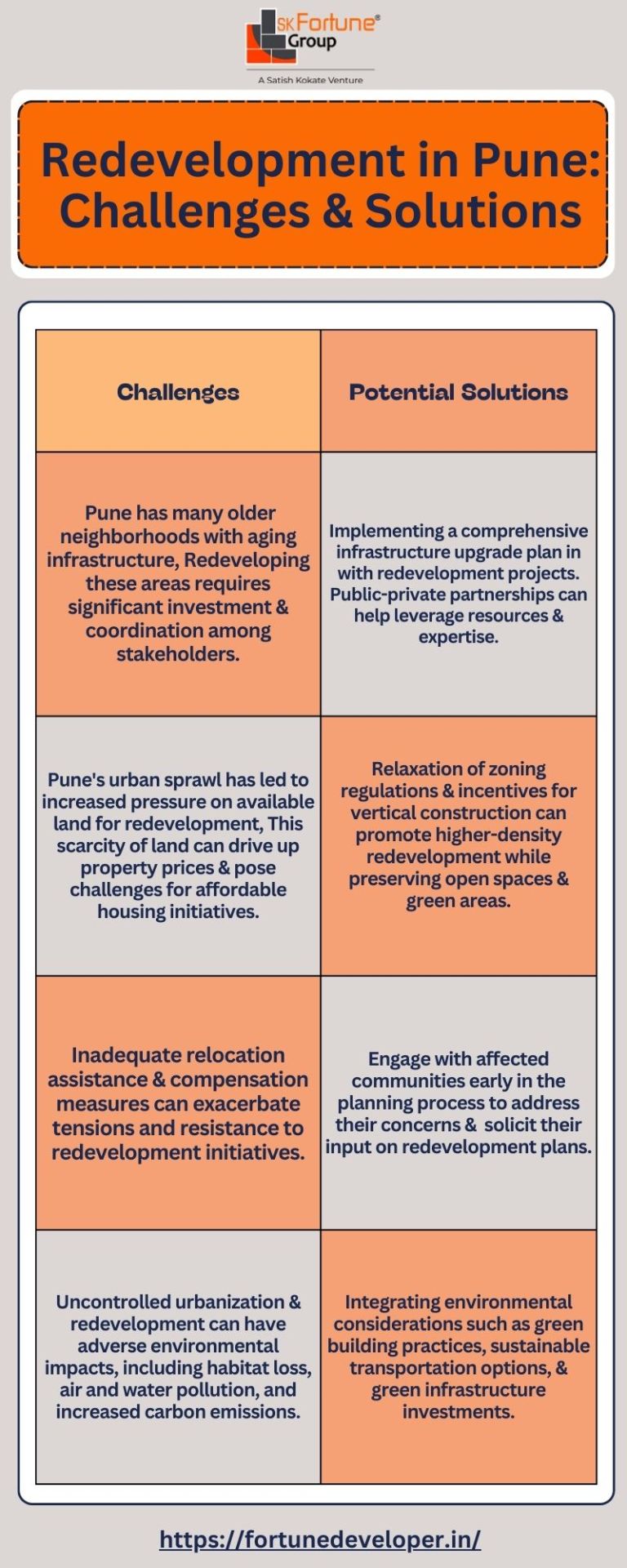

Redevelopment in Pune by SK Fortune Developers faces challenges like aging infrastructure, limited land, regulatory hurdles, tenant displacement, environmental impact, traffic congestion, and financial viability. Solutions include infrastructure upgrades via public-private partnerships, high-density mixed-use development, streamlined regulatory processes, fair tenant relocation, green building practices, transit-oriented development, and innovative financing mechanisms. SK Fortune Developers adopts a collaborative approach with government and communities to promote sustainable urban revitalization, aiming to create a more livable, resilient, and inclusive city.

#fortune sk#SK Fortune developers#redevelopment projects in shivaji nagar pune#best redevelopment builders in pune#pune redevelopment projects#top redevelopment builders in pune#redevelopment projects in kothrud pune#SK Fortune Group#Fortune Developers#Prashanti SK Fortune#Redevelopment builders in pune#redevelopment consultants in pune#redevelopment builder consultants in pune#Redevelopment in pune#best real estate developers in pune#top builders in pune#Budget homes in Kondhwa#redevelopment builders in prabhat road pune#3 BHK Flat for sale in Model Colony Pune#redevelopment builders in sb road pune#Residential projects in law college road#New Properties for Sale in Law College Road#Ankur by SK Fortune Group#Shriniwas Vishwambhar Sk fortune#Madhvachhaya SK Fortune

2 notes

·

View notes

Text

Premium Residential Properties in Mumbai for Every Lifestyle

Mumbai, a bustling metropolis, offers a unique blend of luxury, convenience, and culture. For those looking to elevate their living experience, Premium Residential Properties in Mumbai cater to diverse lifestyles, providing top-notch amenities and prime locations that suit various needs.

Luxury Living in Iconic Locations

Premium residential properties in Mumbai are located in some of the city's most prestigious areas, such as South Mumbai, Bandra, Juhu, and Worli. These neighborhoods are renowned for their proximity to business hubs, entertainment zones, and stunning coastal views. Living in these areas provides access to top schools, high-end shopping, and gourmet dining options.

Apartments, Penthouses, and Villas

Whether you're looking for a sleek apartment, a spacious penthouse, or an exclusive villa, Mumbai has it all. These premium properties often come with expansive living spaces, modern designs, and state-of-the-art features, ensuring a comfortable and luxurious lifestyle. Some even offer breathtaking views of the Arabian Sea or the city's skyline.

World-Class Amenities

What sets Premium Residential Properties in Mumbai apart are the world-class amenities that come with them. Gated communities and high-rise buildings often feature swimming pools, fitness centers, landscaped gardens, play areas for children, and 24/7 security. Some also offer private clubs, sky lounges, and wellness centers, making your home a sanctuary of relaxation and leisure.

Tailored to Different Lifestyles

Mumbai's premium properties cater to various lifestyles. Young professionals may prefer the vibrant energy of neighborhoods like Lower Parel or Powai, with their proximity to workspaces and social hubs. Families often gravitate towards areas like Malabar Hill or Pali Hill, known for their peaceful environment and excellent schools. For those seeking a blend of luxury and nature, Thane and Navi Mumbai offer high-end properties in serene, green surroundings.

A Sound Investment

In addition to offering a premium living experience, these properties also make excellent long-term investments. Mumbai’s real estate market has shown consistent growth, with high demand for well-located, premium homes. This makes them not only a great place to live but also a valuable asset for future gains.

Conclusion

Whether you're a young professional, a growing family, or a luxury seeker, Premium Residential Properties in Mumbai offer something for every lifestyle. With world-class amenities, prime locations, and a thriving real estate market, now is the perfect time to invest in your dream home in this dynamic city.

#residential properties in Mumbai#Under Construction Projects in Mumbai#redevelopment projects in Mumbai#ongoing projects in Mumbai

0 notes

Text

Had Westpac chosen in 1987 to redevelop rather than sell the former CBA head office at 335 Collins Street – a sale that netted a profit of $95 million – it would have owned a large development on each side of Collins Street.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#80s#1980s#20th century#choices#redevelopment#cba#commercial bank of australia#property development#collins street#melbourne

0 notes

Text

DOGE effort to sell off federal properties inadvertently exposes CIA black site in Northern Virginia — Bloomberg TV

#donald trump#second term#elon musk#doge#general services administration#government property#for sale

2K notes

·

View notes

Text

there was a fire in the building that houses my studio on new year's eve. i'll probably elaborate on that more at some point idk but tldr

it wasn't a big fire, nobody lost any stuff, nobody was hurt. the electrical mains gave up the ghost (likely due to an ongoing leak the landlord wouldn't fix)

but because the landlords have already wanted us out for ages so they can "redevelop" (read: tear down a slightly run-down building from around 1900) the place into Yet More Soulless Shiny Flats Nobody Around Here Can Afford they decided the damage is uneconomical to repair, refused our offer to contribute to repair costs, and are kicking us all out

because there was an "accident" causing "irreparable damage" they're exempt from the usual 3-month waiting period and everyone has to vacate by Feb 1

this is a community space occupied by artists and musicians so now there are a couple dozen broke-ass bitches who have to relocate short notice. the landlord, spectrum properties, is refusing to extend the time any further

so! there will shortly be some form of gofundme type situation to raise money for the costs of doing that (like storage units if we can't find another studio space), and also to tide over any artists who relied on that space for income since they've not had anywhere to work for a couple of weeks and probably won't for several more

i'll reblog this with the link when that's up and running but uh. yeah. that's a thing. which is happening.

#i'm likely going to have to pay for van rental to ship out bc my metal shelving units are a bit unweildy for a car i think#and possibly also a storage unit#i'm not losing any income from it that's just where i do my resin really#but i am going to japan on feb 1 which is like. fuck me could you not wait until i get back#we are going to try and challenge it legally because their assertion it's 'uneconomical to repair' is bullshit#but that also requires money - they are a multimillion £ property corportation with A Team. we have Vibes.#and unlike residential evictions challenging it doesn't hit the pause button on having to be out#so first thing's first we have to ship out in any case

1K notes

·

View notes