#Reduce Tax Payments

Text

Income Tax Consultant in Lucknow

As the financial year comes to a close, the daunting task of filing income tax returns looms large for many individuals and businesses in Lucknow. Navigating through the complex web of tax laws and regulations can be overwhelming, and that's where the expertise of an Income Tax Consultant comes into play.Income Tax Consultant in Lucknow.

The Complexity of Income Tax:

Income tax laws are ever-evolving, and the intricacies involved can make the process of filing returns a challenging endeavor. From deductions and exemptions to compliance with the latest tax codes, staying abreast of the nuances is crucial to ensuring a smooth and error-free tax filing. A skilled Income Tax Consultant not only possesses a deep understanding of these complexities but also stays updated on the latest changes in tax legislation.

The Local Advantage:

Lucknow, a city steeped in cultural heritage, also boasts a dynamic economic landscape. As a resident or business owner in Lucknow, having a local Income Tax Consultant brings about several advantages. They are not only well-versed in the national tax laws but also have a keen understanding of the local economic conditions, ensuring that your tax strategy aligns seamlessly with the unique aspects of Lucknow's financial environment.

Choosing the Right Consultant:

With several Income Tax Consultants in Lucknow vying for your attention, it's essential to choose one that aligns with your specific needs. Here are some key factors to consider:

Experience and Expertise:

Look for consultants with a proven track record and a comprehensive understanding of income tax laws. An experienced consultant will be better equipped to handle complex situations and provide valuable insights tailored to your financial situation.

Reputation:

Check online reviews, testimonials, and ask for referrals to gauge the reputation of the consultant. A positive track record and satisfied clients are indicative of a reliable and trustworthy professional.

Communication Skills:

Effective communication is paramount in tax consultancy. A consultant should be able to explain intricate tax matters in a way that you can comprehend. Regular updates and clear communication foster a collaborative and productive relationship.

Fee Structure:

Understand the consultant's fee structure upfront. Whether it's a flat fee, hourly rate, or a percentage of returns, clarity on costs ensures transparency and avoids any unpleasant surprises later.

Conclusion:

In conclusion, as the financial year draws to an end, enlisting the services of a proficient Income Tax Consultant in Lucknow is a strategic move to navigate the complexities of income tax filing. From ensuring compliance with the latest tax regulations to optimizing deductions, a skilled consultant can make the entire process seamless and stress-free. Take the time to research and choose a consultant who not only possesses the required expertise but also aligns with your specific financial goals. Your peace of mind and financial well-being are well worth the investment in a competent Income Tax Consultant in Lucknow.

1 note

·

View note

Text

What the FUCK do you mean the government changed the rules for voluntary higher education repayments earlier this year? They no longer count towards your compulsory repayment?? They're no longer factored into your tax statements????

I thought I was gonna get $2,000 back in tax return 😭

#ramblings of a bystander#instead i have to pay $600 because I got a significant pay rise earlier this year#which bumped my compulsory uni repayment up a few percentages#which retroactively means that the amount that was being taken out of my paycheck via PAYG for the first half of the financial year#wasn't enough to cover my actual required payment amount on my total income for the year#ok look fortunately i don't NEED those $2000 back and i have three months to pay the $600 tax owed#and I'm not that upset about owing 600 for my uni debt cause it'll need to get paid anyway#and earlier the better since it will reduce the indexation amount next year#HOWEVER i AM mad that the change to make voluntary uni payments tax deductible was NOT adequately communicated.

0 notes

Text

Giving a regular cash payment to the entire world population has the potential to increase global gross domestic product (GDP) by 130%, according to a new analysis published June 7 in the journal Cell Reports Sustainability. Researchers suggest that charging carbon emitters with an emission tax could help fund such basic income programs while reducing environmental degradation.

"We are proposing that if we can couple basic income with environmental protection, we can save two birds with one stone," says first author U. Rashid Sumaila of the University of British Columbia in Vancouver.

Continue Reading.

#Science#Environment#Economics#Political Science#Universal Basic Income#Poverty#Climate Change#Carbon Emissions

1K notes

·

View notes

Text

Hey, y'all, this is a reminder for anyone that has student loans that they are defaulted on or in collections for:

Apply for Fresh Start NOW if you haven't already done so. Like right now. Do it right this very second do not put it off any longer.

If you don't know, applying for Fresh Start will move your loan status from "Default" to "Current," you will no longer have to deal with collections calls! You won't have your wages garnished or your tax refunds taken by the Education Department! The default gets removed from your credit and you become eligible for federal mortgage programs! You become eligible for Income Driven Repayment (IDR) programs that can reduce your monthly payment in a huge way (from $400/month to $50/month for me!) and you get IDR credit for the three years you were in default during the pandemic freeze!

It only has upsides!

I mean it, it can make a huge difference! You can even submit both Fresh Start and an IDR application at the same time. It takes literal seconds. I had my name legally changed and I'm still eligible! I clicked like 3 buttons, checked a couple boxes, and boom. I sent off the application August 22nd and I got the letter yesterday (Sept 20th), but that letter was dated Sept 1st and was only to inform me that my loan was no longer in default would be transferred to a new loan servicer by the end of the month. It took a week and a half to process.

I also became eligible and received a refund check for money taken from me during the starting stages of the pandemic.

The best time to do it is now. Period.

Do. It. Right. Now.

5K notes

·

View notes

Text

Flint, Michigan, has one of the [United States]'s highest rates of child poverty — something that got a lot of attention during the city's lead water crisis a decade ago. And a pediatrician who helped expose that lead problem has now launched a first-of-its-kind move to tackle poverty: giving every new mother $7,500 in cash aid over a year.

A baby's first year is crucial for development. It's also a time of peak poverty.

Flint's new cash transfer program, Rx Kids, starts during pregnancy. The first payment is $1,500 to encourage prenatal care. After delivery, mothers will get $500 a month over the baby's first year.

"What happens in that first year of life can really portend your entire life course trajectory. Your brain literally doubles in size in the first 12 months," says Hanna-Attisha, who's also a public health professor at Michigan State University.

A baby's birth is also a peak time for poverty. Being pregnant can force women to cut back hours or even lose a job. Then comes the double whammy cost of child care.

Research has found that stress from childhood poverty can harm a person's physical and mental health, brain development and performance in school. Infants and toddlers are more likely than older children to be put into foster care, for reasons that advocates say conflate neglect with poverty.

In Flint, where the child poverty rate is more than 50%, Hanna-Attisha says new moms are in a bind. "We just had a baby miss their 4-day-old appointment because mom had to go back to work at four days," she says...

Benefits of Cash Aid

Studies have found such payments reduce financial hardship and food insecurity and improve mental and physical health for both mothers and children.

The U.S. got a short-lived taste of that in 2021. Congress temporarily expanded the child tax credit, boosting payments and also sending them to the poorest families who had been excluded because they didn't make enough to qualify for the credit. Research found that families mostly spent the money on basic needs. The bigger tax credit improved families' finances and briefly cut the country's child poverty rate nearly in half.

"We saw food hardship dropped to the lowest level ever," Shaefer says. "And we saw credit scores actually go to the highest that they'd ever been in at the end of 2021."

Critics worried that the expanded credit would lead people to work less, but there was little evidence of that. Some said they used the extra money for child care so they could go to work.

As cash assistance in Flint ramps up, Shaefer will be tracking not just its impact on financial well-being, but how it affects the roughly 1,200 babies born in the city each year.

"We're going to see if expectant moms route into prenatal care earlier," he says. "Are they able to go more? And then we'll be able to look at birth outcomes," including birth weight and neonatal intensive care unit (NICU) admissions.

Since the pandemic, dozens of cash aid pilots have popped up across the nation. But unlike them, Rx Kids is not limited to lower-income households. It's universal, which means every new mom will get the same amount of money. "You pit people against each other when you draw that line in the sand and say, 'You don't need this, and you do,' " Shaefer says. It can also stigmatize families who get the aid, he says, as happened with traditional welfare...

So far, there's more than $43 million to keep the program going for three years. Funders include foundations, health insurance companies and the state of Michigan, which allocated a small part of its federal cash aid, known as Temporary Assistance for Needy Families.

Money can buy more time for bonding with a baby

Alana Turner can't believe her luck with Flint's new cash benefits. "I was just shocked because of the timing of it all," she says.

Turner is due soon with her second child, a girl. She lives with her aunt and her 4-year-old son, Ace. After he was born, her car broke down and she was seriously cash-strapped, negotiating over bill payments. This time, she hopes she won't have to choose between basic needs.

"Like, I shouldn't have to think about choosing between are the lights going to be on or am I going to make sure the car brakes are good," she says...

But since she'll be getting an unexpected $7,500 over the next year, Turner has a new goal. With her first child, she was back on the job in less than six weeks. Now, she hopes she'll be able to slow down and spend more time with her daughter.

"I don't want to sacrifice the time with my newborn like I had to for my son, if I don't have to," she says."

-via NPR, March 12, 2024

#united states#flint michigan#michigan#cash aid#basic income#poverty#poverty relief#child poverty#mothers#pregnancy#prenatalcare#healthcare#healthcare access#public health#child development#good news#hope

349 notes

·

View notes

Text

Hi. I set up a GFM to help with urgent needs. If you enjoy my work, consider donating. If you can't donate, please share.

I really appreciate any support.

Details of the GFM are under the cut.

Hi there, my name is Morgan, otherwise known as Mx Morgan professionally. I am an artist, freelancing illustrator, retail and wholesale clerk living and working in the PNW. I'm here to ask for assistance with getting rent paid for me, my partner, and cat, and assistance to pay for my medication.

This year has been difficult, especially the summer. My partner was laid off her job because the business she worked at was not making much money. She was on unemployment from February to June and has been unable to work due to complications from mental illness and medication she was taking at the time. Since then, I've been helping her with day-to-day needs and picking up 100% of our expenses (previously we paid 50/50 on rent, bills, etc.). Currently, I am working three jobs - my retail job, my freelancing job, and a voluntary job at a game studio. My retail job has been having difficulty making expenses to stay open, and my hours are now 10 hrs/week. A lot of my freelancing work has been significantly reduced; I currently have a few open jobs, and the money made from those has gone directly to bills and rent. Therefore, I have been unable to set aside a percentage for quarterly taxes, which leads to penalties and fees (I already owe the IRS about $12k, and I am finding what options may be available to me). The voluntary game studio position is just that - it's a voluntary position that I give the least amount of my time to, and I continue to do so because it genuinely brings me some joy and things are moving forward despite personal setbacks.

I am currently looking for another job and part of a temp agency's hiring pool; however, I cannot move forward to hiring because my social security card went missing, and the card is required for work. I have a replacement on its way, but it will take about another week from this date.

Now, onto rent. My landlord was generous in allowing us to pay the outstanding amount of rent over the month of September. My rent for September was $1951.30, and mostly from freelancing, I have been able to bring that amount down. The amount left to owe is $1096.30. However, there's the issue of October's rent being due, and the way things are going, I will not be able to pay for that either, making the total amount due $2656.30. Our landlord utilizes Ratio Utility Billing System with little to no transparency of how the amount is divided among tenants, so my utilities can wildly fluctuate, often making my rent amount unpredictable. Some tenants have paid $60 for electricity while others have to pay $300, for example. Yes, I have brought up concerns. No, I have not received any solutions.

Breakdown of payments made for the month of September.

Amount paid so far.

Total amount remaining for September, along with rent that is due October 1st.

There is also the issue of health insurance - I have lost my health insurance due to not receiving letters (mail was stolen) asking for my income, so my coverage was terminated. I have reapplied and was approved, but my insurance is not available until October 1st. I have, after GoodRX coupons, about $82 worth of medication I need. Currently, I am out of amlodipine, which manages my high blood pressure. I am out of my anxiety medication and just winging it at this point.

Breakdown of medication, with prescriptions obscured for privacy.

All that said, the amount I am asking from GoFundMe is assistance for 1.) the past due rent 2.) medication and 3.) assistance with October's rent, if able. At minimum, I would like to get the past due rent paid off and be able to get 2 medications I am low on, if I cannot get the full amount for all my medication. At best, I would like to meet the goal and have everything caught up. I have a couple of jobs lined up, but I am likely not seeing any payment until mid-October, and by that time it may be too late to pay for any rent.

Any excess of donations will go toward other aid for friends and colleagues that have been impacted by this year. The sad fact is, I'm not the only career artist who has been affected by loss of work and life complicating things further.

Other than GoFundMe, if you would like to help me and get a little something out of it, I have a ko-fi shop with originals and downloadable licenses. I would be crowdfunding through there, but Stripe takes a percentage for processing and it's all counted for taxes. I'd like to keep business and gifts/donations separate for tax purposes. Typically, I would share my other shops, but due to the urgency of this situation, I will not be promoting them here. A free way of helping is simply sharing this GoFundMe.

My long term goal is to find a stable full time job, file for bankruptcy, and step away from freelancing. At this moment, I simply need help for now.

I think that's it for now. Thank you, take care.

Morgan

148 notes

·

View notes

Text

Things Biden and the Democrats did, this week #23

June 14-21 2024.

On the 12th anniversary of President Obama's DACA program President Biden announced a new pathway to legal status and eventual citizenship for Dreamers. DACA was an executive action by President Obama which deferred any deportation of persons brought to the US as children without legal status. While DACA allowed Dreamers to work legally in the US for the first time, it didn't give them permanent legal status. Now the Biden administration is streamlining the process for employers to apply for work Visas for Dreamers. With Visas Dreamers will for the first time have legal status, the ability to leave and reenter the US legally, and a pathway to a Green Card and eventual citizenship.

President Biden also announced protections for the undocumented spouses and children of US citizens. The new rule allows the spouse, or step-child of a US citizen to apply for lawful permanent residency without having to leaving the country. It's estimated this will help 500,000 undocumented people married to Americans, and 50,000 children under the age of 21 whose parent is married to an American citizen. Current law forces spouses to leave the United States if they're here illegally and wait and unclear period of probation before being allowed to return, but being allowed back is not assured.

The IRS announced that it'll close a tax loophole used by the ultra rich and corporations and believes it'll raise $50 billion in revenue. Known as a "pass-through" has allowed the rich to move money around to avoid taxes in a move the Treasury is calling a shell-game. Pass-throughs have grown by 70% between 2010 and 2019 and the IRS believes it helped the rich avoid paying $160 billion dollars in taxes during that time. The IRS estimates its crack down on these will raise $50 billion in tax revenue over the next 10 years.

The EPA and Department of Energy announced $850 million to monitor, measure, quantify and reduce methane emissions from the oil and gas sector. Methane is the second most common greenhouse gas, responsible for 1/3rd of the global warming. The funding will focus on helping small operators significantly reduce emissions, as well as help more quickly detect and cap methane leaks from low-producing wells. All this comes after the EPA finalized rules to reduce methane emissions by 80% from oil and gas.

The Biden Administration took steps to protect the nations Old Growth Forests. The move will greatly restrict any logging against the 41 million acres of protected land owned by the federal government. The Administration also touted the 20% of America's forests that are in urban settings as parks and the $1.4 billion invested in their protection through the President’s Investing in America agenda.

The Biden Administration released new rules tying government support for clean energy to good paying jobs. If companies want to qualify for massive tax credits they'll have to offer higher wages and better conditions. This move will push union level wages across the green energy sector.

The Department of Education announced large reductions in student loan payments, and even a pause for some, starting in July. For millions of Americans enrolled in the Biden Administration's SAVE plan, starting in July, monthly payments on loans borrowed for undergraduate will be reduced from 10% to 5% of discretionary income. As the department hasn't been able to fully calculate the change for all borrowers at this point it will pause payment for those it hasn't finalized the formula for and they won't have to make a payment till DoE figures it out. The SAVE plan allows many borrowers to make payments as low as $0 a month toward having their loans forgiven. So far the Biden Administration has forgiven $5.5 billion wiping out the debt of 414,000 people enrolled in SAVE.

The Biden Administration celebrated the 1 Millionth pension protected under the American Rescue Plan. Senator Bob Casey joined Biden Administration officials and Union official to announce that thanks to the Butch Lewis Act passed in 2021 the government would be stepping in to secure the pensions of 103,000 Bakery and Confectionery Union workers which were facing a devastating 45% cut. This brings to 1 million the number of workers and retirees whose pensions have been secured by the Biden Administration, which has supported 83 different pension funds protecting them from an average of 37% cut.

The Department of Energy announced $900 million for the next generation of nuclear power. This investment in Gen III+ Small Modular Reactor will help bring about smaller and more flexible nuclear reactors with smaller footprints. Congress also passed a bill meant to streamline nuclear power and help push on to the 4th generation of reactors

Vice President Harris announced a $1.5 billion dollar aid package to Ukraine. $500 million will go toward repairing Ukraine's devastated energy sector which has been disrupted by Russian bombing. $324 million will go toward emergency energy infrastructure repair. $379 million in humanitarian assistance from the State Department and the U.S. Agency for International Development to help refugees and other people impacted by the war.

America pledged $315 million in new aid for Sudan. Sudan's on-going civil war has lead to nearly apocalyptic conditions in the country. Director of USAID, Samantha Power, warned that Sudan could quickly become the largest famine the world has seen since Ethiopia in the early 1980s when a million people died over 2 years. The US aid includes food and water aid as well as malnutrition screening and treatment for young children.

Bonus: Maryland Governor Wes Moore pardoned more than 175,000 people for marijuana convictions. This mirrors President Biden's pardoning of people convicted of federal marijuana charges in 2022 and December 2023. President Biden is not able to pardon people for state level crimes so called on Governors to copy his action and pardon people in their own state. Wes Moore, a Democrat, was elected in 2022 replacing Republican Larry Hogan.

#Thanks Biden#Joe Biden#us politics#american politics#immigration#DACA#Dreamers#IRS#tax the rich#student loans#climate change#climate action#nuclear power#marijuana#criminal justice reform#ukraine#Sudan#Pensions

241 notes

·

View notes

Text

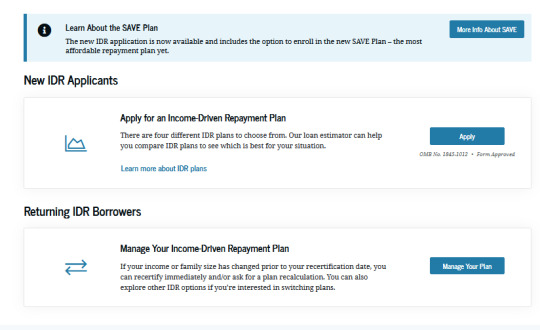

Hey, student loans payments are coming back in October, you should know about the SAVE plan.

this is america-centric but pls spread this around if you think any of ur mutuals could use the info.

If you're currently shitting yourself thinking how you're gonna start making student loan payments again, I suggest taking a deep breath, first off. Get comfy, put on some music and strap in.

If you got your student loans through the Federal Student Aid program FAFSA, then you can apply for an IDR (Income Driven Repayment plan) called SAVE.

what is SAVE?

This got my $115 monthly payment down to $40 a month, if you don't work or you can't afford much, this has the potential to reduce your payment even further.

Alls you need to do is go to https://studentaid.gov/idr/ and log into your federal student aid account, there's a section for both first time applicants and returning borrowers who previously may have had an IDR.

Even if you've done an IDR before! Look into the SAVE plan!! It forgave about 10k of debt for me!

Anyway, first time applicants can click the first option, "Apply for an Income-Driven Repayment Plan" and just go through and answer all their prompts, make sure you have all your financial information on hand (tax returns, most recent pay stub, etc) and go through the prompts until it gives you the option to apply for the SAVE plan. CLICK IT!

It should let you know at the end exactly how much you'll be paying per month and you should get an email confirmation as well. Any account specific questions should be directed to their call center

+1 (800) 433-3243

GOOD LUCK AND BE PATIENT, THE SITE IS SLOW AS SHIT.

DON'T GIVE UP! I BELIEVE IN YOU!!

if you have any questions feel free to DM me btw

#student loans#SAVE plan#FAFSA#student loan forgiveness#IDR#income driven repayment plan#THIS DOES NOT PAUSE INTEREST BTW#adulting#life tips#helpful#resources#websites#og post

436 notes

·

View notes

Text

Some of Joe Biden’s accomplishments:

**Domestic policy**

* **American Rescue Plan (2021)**: Provided $1.9 trillion in COVID-19 relief, including direct payments, enhanced unemployment benefits, and funding for vaccines and testing.

* **Infrastructure Investment and Jobs Act (2021)**: Allocated $1.2 trillion for infrastructure projects, including roads, bridges, broadband, and clean energy initiatives.

* **Bipartisan Safer Communities Act (2022)**: Expanded background checks for gun purchases and provided funding for mental health services.

* **Child Tax Credit Expansion (2021-2022)**: Temporarily expanded the Child Tax Credit to provide up to $3,600 per child in monthly payments.

* **Affordable Care Act Expansion (2021)**: Made health insurance more affordable for low- and middle-income Americans by reducing premiums and expanding subsidies.

**Foreign Policy**

* **Withdrawal from Afghanistan (2021)**: Ended the 20-year war in Afghanistan.

* **Re-joining the Paris Agreement (2021)**: Re-committed the United States to global efforts to address climate change.

* **Strengthening Alliances with NATO and the EU (2021-present)**: Repaired relationships with key European allies after strained relations during the Trump administration.

* **Supporting Ukraine in the Ukraine-Russia War (2022-present)**: Provided military, humanitarian, and diplomatic support to Ukraine in its defense against Russia's invasion.

* **Nuclear Deal with Iran (2023)**: Revived negotiations with Iran on a comprehensive nuclear deal, aimed at preventing Iran from developing nuclear weapons.

**Other Notable Accomplishments**

* **Appointing Ketanji Brown Jackson to the Supreme Court (2022)**: Made history by being the first Black woman appointed to the nation's highest court.

* **Signing the Respect for Marriage Act (2022)**: Ensured federal recognition of same-sex and interracial marriages.

* **Establishing the Office of the National Cyber Director (2021)**: Coordinated federal efforts to combat cybersecurity threats.

* **Creating the COVID-19 National Preparedness Plan (2021)**: Developed a comprehensive strategy to respond to future pandemics.

* **Launching the Cancer Moonshot (2022)**: Re-energized the government's efforts to find a cure for cancer.

180 notes

·

View notes

Text

Hi. My name is Terry and I went into debt during the pandemic lockdowns. Some of it was because I had to break a lease to escape a building the landlords were turning into a slum (elevator was broken for nearly a year, roaches overran the place, next door neighbour was throwing coke parties all night). For a while things were okay, but then the rising cost of living and rising interest rates made that debt unsustainable. Now I'm lurching from one crisis to the next and I need to get out from under this debtload before it crushes me. Everything donated to this fundraiser will go directly to paying down that debt, because it is the single biggest problem in my life and makes every other problem worse.

I actually owe over $10,000, but I have one Guaranteed Investment Certificate left over from years ago when I was able to save money. That matures in August and I've already made arrangements with my bank to have it applied directly to my debt. The GIC is for just over $7,000, which leaves me with $3,000+ to pay off somehow.

Currently I make just enough to cover bare minimums (rent, utilities, groceries) and if I can get extra shifts I can keep up on interest payments. But if I can't get those extra shifts or if I miss a shift I fall further behind. And sometimes I get enough to pay the interest, but I get it too late in the month to pay by the due date and still end up being charged a late fee. For a while I was making headway on the debt, then the cost of living went up and I was just breaking even. Then both the cost of living and interest rates went up and now I'm barely hanging on by my fingernails.

I have tried to make up the difference by cutting back. I've reduced my phone and internet services to the lowest levels available, and I try to keep my power usage to a minimum. Water is included in my rent but the area I live in is in drought conditions and water bills are going up. Property taxes are also going up in the region. My rent will probably go up at the end of my lease, whether I stay in this place or try to find a new one. Every apartment in this city is too expensive now, and my landlords have actually been comparatively reasonable in raising rent.

The cost of living has gone up too fast for me to keep up with, and I can't make my interest payments or reduce this debt on my own. Every small setback becomes a crisis, and I've made two posts here to cover things like vet bills and end of month bills. If I can reduce my interest payments immediately and reduce my debt over the next few months, I can get out of this spiral. If I can't, I'm going to keep tripping from one crisis to the next until I fall completely.

It's not all bad news. I have a couple of ongoing writing projects that might actually earn some money. My cats are healthy (thanks to everyone who donated to my previous fundraiser). And I have an apartment that is close enough to shopping and work that I don't need a car. I'd be doing alright if not for this debt. So: Everything donated to this fundraiser will go directly to paying down that debt, because it is the single biggest problem in my life and makes every other problem worse.

Thank you for reading this.

$100/$3100. Thank you!

102 notes

·

View notes

Text

Kamala Harris Will Pay You Not to Work

She has endorsed several measures that resemble Universal Basic Income.

By Matt Weidinger -- Wall Street Journal

A recent study confirms that universal basic income—no-strings-attached benefit checks offered to recipients regardless of need or contribution to the program—discourages work. That’s relevant to the presidential race. Kamala Harris has called more than once for paying UBI-like benefits.

Participants in the UBI program worked nearly 1½ hours less a week on average, and unemployment rose. Other adults in recipient households reduced their work effort, too. Overall, the study found for every dollar in benefits, “total household income excluding the transfers fell by at least 21 cents.”

As vice president, Ms. Harris cast the deciding vote to create a temporary UBI for parents through a significantly expanded child tax credit in 2021. Tens of millions of households collected these payments, which grew to as much as $3,600 a child, even as the program’s work requirement and work incentive features were suspended. A University of Chicago study calculated that if the change were made permanent, it would result in 1.5 million parents exiting the labor force. But the temporary policy lapsed when Sen. Joe Manchin refused to support its extension without a work requirement. The administration’s fiscal 2025 budget would revive the costly 2021 expansion, but they aren’t the only ones flirting with budget-busting proposals. On Sunday, Sen. J.D. Vance called for increasing the child tax credit to $5,000 and making it available to “all American families,” though he didn’t say whether he would make it conditional on work.

As a senator, Ms. Harris proposed two even larger UBI programs that would have displaced more work. In 2019 she introduced her “signature” bill proposing a UBI for lower-income adults, including childless adults. According to a Federal Reserve Bank of Atlanta report, high effective marginal tax rates on modest-income work (due to progressive tax rates coupled with phasing out current benefits) already “effectively lock low-income workers into poverty.” The phaseout of Ms. Harris’s new $3 trillion entitlement would only increase current disincentives to work and advance.

In 2020 she proposed a pandemic UBI program to issue most Americans $2,000-a-month “crisis payments.” That reckless proposal would have doled out a total of $84,000 to each adult and up to three children in households with adjusted gross income under $200,000 (or $150,000 for single-parent households). The total cost would have been $21 trillion.

Most voters, even Democrats, say benefit recipients should engage in work or training if they are able to do so. Ms. Harris obviously cares more about showering Americans with federal cash than the employment disincentives built into her ideas.

Mr. Weidinger is a senior fellow at the American Enterprise Institute.

#kamala harris#Tim Walz#Democrats#Obama#Biden#Schumer#Pelosi#AOC#malaise#lazy#losers#failure#corrupt#hunter biden#thief#trump#trump 2024#president trump#ivanka#repost#america first#americans first#america#donald trump#art#hunger#landscape#insta#instagram#instagood

27 notes

·

View notes

Text

[DW is German State Media]

The planned industrial action will start at 2 a.m. on Wednesday morning — and a few hours earlier for freight services — and continue until 6 p.m. the following Monday.

Although it's the latest in a series of GDL strikes, the threatened six-day action is set to last longer than those that have come before.

German rail operator Deutsche Bahn (DB) had tried to tempt the union back to the negotiating table with a new offer on pay and conditions on Friday, which the GDL said it was rejecting.

"With its third and supposedly improved offer, Deutsche Bahn has again shown that it is continuing its previous course of noncompliance and confrontation — there's no trace of a willingness to reconcile," the GDL said in its press release. [...]

The new strike would be the fourth in the current row over pay between DB and the GDL.

The GDL staged two large warning strikes late in 2023, and then another earlier in January that lasted three days and led to drastic reductions in available services.

DB even tried and failed to stop the strikes earlier this month via a court injunction. [...]

According to DB, its latest offer to the GDL foresaw a 4.8% pay increase on average for employees starting in August and a further 5% as of April 2025.

DB has said the terms would also include a compensatory payment to account for inflation that would be fixed for a period of 32 months.

Starting in 2026, it would also offer employees on shift rotations the option to move from an average of 38 hours a week to 37, or to receive extra pay if they do not wish to reduce their workload.

The GDL, meanwhile, is calling for an extra €550 (about $600) a month before tax for employees, and an inflation compensation payment fixed only for a period of 12 months.

It's also calling for an immediate reduction in shift workers' hours from 38 to 35, with no change in remuneration.

22 Jan 24

43 notes

·

View notes

Text

The Constable's Dues

During the 14th century successive kings believed it was their right to get tolls from vessels on the Thames. The Constable of the Tower of London was allowed to demand these tolls on the king's behalf.

Among the benefits, the Constable received fees from state prisoners at the Tower and was entitled to all flotsam and jetsam on the Thames. They could keep all livestock that fell from Tower Bridge into the river and owned any passing swans. For every foot of livestock that stumbled into the Tower moat, the Constable received a penny and any cart that fell in became his property. They received 1s a year from all ships carrying herring to London; 6s 8d a year from all boats fishing for sprat between the Tower and the sea; and 2d from each pilgrim who came to London by the river to worship at the shrine of St. James.

Perhaps the most significant perk was the toll collected from ships passing up the Thames into London. Historically, goods ships travelling upstream would have to moor at Tower Wharf and unload a portion of their cargo for the Constable as a form of toll. Such bounty might have included oysters, mussels, cockles or rushes (as much as could be held within their arms), as well as kegs of rum or wine. As river traffic increased and taxes became more regulated, these payments of goods progressively reduced until they were no longer enforced.

Still today, whenever a Royal Naval vessel moors on the Wharf, the Captain must present the Constable with a barrel of wine (the ‘Dues’). This is ceremoniously escorted into the Tower by the Yeoman Warders and presented to the Constable on Tower Green.

35 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

92 notes

·

View notes

Text

@traveling-spartan @priveetru

gonna be responding to this in a separate post because i've already left two comments on the post this was in reply to and i suspect that the OP already would consider that two too many.

at any rate:

Government regulation causes monopolies more often than it combats them.

[...]

It's why big corps like Disney lobby for said regulation in the first place, it crushes all their smaller competitors for them.

for what it's worth the data doesn't seem to be backing this up. if both these claims were true, you'd expect to see a multitude of pieces of regulation that disney supported, and few if any pieces of regulation that disney opposed, but this quick overview of some of disney world's political spending on florida trend [x] doesn't show that. now admittedly this is just the partial info for the disney world division in florida specifically, and not a general overview of all their political spending, so if anyone has more complete data i'd be interested to hear it. that said, i think it's a decent slice of data to start with.

in fairness, here we can find one notable example of disney lobbying for regulation- namely when they funded efforts to support Amendment 3, which would have prevented any more large casino chains from opening in florida, so that disney world could avoid competing with major casino chains like Genting and Las Vegas Sands. and, to be fair, as noted in the article this was a pretty major driver of campaign spending.

however, A: this was primarily aimed at combating rival megacorps, not combating small businesses, (and naturally the casino megacorps disney was fighting were spending their lobbying money to combat said regulation) and B: this was the only time in the article we see disney fighting for regulation rather than against. examples in the article of disney lobbying against regulation include:

By virtue of its size and economic importance, Disney has always been an influential voice in state politics. But the company had found itself on the losing end in a series of lobbying battles — among them, a fight with the National Rifle Association about whether employees could bring guns to work.

this is an important example of how regulation of private enterprise is sometimes necessary to preserve our fundamental rights- if disney can say employees can't bring guns to work even if they keep them in their parked car, what's to stop landlords from saying tenets can't bring guns in their apartment? if you value the right to bear arms, you should understand why sometimes the power of private enterprise over employees and customers must sometimes be curbed.

Disney also battled with personal-injury attorneys about whether parents could sign away the liability rights of their children and with counties and hotel chains about how online travel companies should be taxed.

[...]

Disney’s 2018 spending included $1 million on Amendment 2, which keeps a tax cap in place that limits increases in the taxable value of commercial and other non-homestead property from rising more than 10% per year. Records show Disney was by far the largest donor to a Florida Chamber of Commerce-backed political committee used to promote the amendment. The cap saved Disney more than $6 million last year alone through reduced property tax payments to Orange County and the South Florida Water Management District.

[...]

As prominent as Disney has made itself on the campaign trail, lawmakers who have worked with the company say it still tries hard to maintain a low profile while lobbying — to avoid having its brand linked with potentially controversial public policies.

Disney, for example, has exerted “significant influence” on the Legislature to not pass a law requiring employers to use the e-Verify system to ensure they aren’t employing undocumented workers, says former Senate President Don Gaetz, a Republican from Okaloosa County.

[...]

Cloaked or not, the company enjoyed a number of successes in the 2019 legislative session.

Late in the session, as lawmakers finalized a broad tax package, Disney — working through the Florida Retail Federation — persuaded lawmakers to add an extra sales-tax break that will help big retailers who order too much inventory and wind up not selling it all.

Retailers generally don’t have to pay sales tax when they order inventory because they are planning to resell it to consumers. The sale to consumers is the transaction that’s supposed to be taxed. But retailers must pay the tax on whatever they don’t sell, since they have become the end user of the product.

Disney has for years donated its leftover inventory to charities. So the company persuaded the Legislature to create a sales tax exemption for the leftover inventory that goes to charity. Economists expect the new tax break will save retailers about $5 million a year. Disney won’t say how much it expects to save itself.

Disney also worked quietly to reshape a bill, which it objected to in 2018, that would have exposed hotel operators to civil lawsuits if they failed to do enough to prevent human trafficking.

i'll leave it for the reader to consider why disney would want to combat regulation which might cause them to be held accountable for facilitating human trafficking.

Disney even won some changes in state rules for how tourist venues manage all the stuff — from hats to strollers to phones — that visitors lose or leave behind. Generally, businesses are supposed to alert law enforcement and must hold on to lost property for 90 days before they can dispose of it. But that has become cumbersome for Disney — and for Universal Orlando, Central Florida’s other big theme-park resort — which must devote lots of warehouse space simply to holding lost-and-found items.

Disney helped write a bill establishing new rules for theme parks, hotels and some other commercial venues that requires them to hold the property for just 30 days and then donate it directly to charity.

looking outside the article to other examples of disney's political lobbying, we find them lobbying against minimum wage laws [x]

Five years ago, on Nov. 6, 2018, the city’s voters approved Measure L, which mandated that “area resort workers” — Disneyland employees, basically — must be paid a living wage if the parent company receives city subsidies.

The Walt Disney Company, which at the time was paying some of its workers the state-mandated $11 an hour minimum, fought the measure bitterly, and the ordinance spent most of the next five years kicking around the state court system as a class-action lawsuit sought to force the company to comply. Only in late October, when the California Supreme Court declined to hear Disney’s final appeal, did Measure L become settled city law.

we can also find disney lobbying against heat safety regulations (and against raises to the minimum wage at the same time, a twofer) [x]

House Bill 433 prohibits local governments from passing legislation that protects workers from extreme heat and laws requiring companies to raise the minimum wage beyond the state’s current $12 an hour. But now, we’re learning more about how this bill was passed and the role that Disney World played in helping to remove basic protections from outdoor workers, including cast members.

According to Jason Garcia of Seeking Rents, the Florida Chamber of Commerce and Associated Industries of Florida donated more than $2 million to mostly Republican legislatures and another $1 million to the Florida Republican Party. The two lobbying groups expected House Bill 433 to become law for those donations.

[...]

Local government officials in South Florida were considering passing heat protections after the death of migrant farm workers of heat stroke. These laws would have prohibited work in extreme Florida heat and mandatory water breaks for workers.

The possibility of these laws stopping work became dangerous to businesses in Florida, which would have had to shut down in extreme heat. Thus, donations to politicians were made to get this bill passed.

[...]

The law was wildly unpopular, with hundreds of civic groups opposing it. That outrage nearly killed the bill. However, according to Garcia, with just one day left in the legislative session, lobbyists sent texts to lawmakers to ensure the bill’s passage.

so what can we see from all this? first, that there are more pieces of regulation that large businesses lobby against than regulations that they lobby for, so the claim that businesses are the primary force behind pushing regulation is patently false and B: when businesses do support regulation in order to pursue their financial interests, this is mainly in order to combat rival large corporations, not small businesses. because fundamentally large businesses don't have to worry that much about competition from small businesses, because fundamentally small businesses can't compete. a small business would have had to expand to the point of being a large corporation long before it would be something disney would have to worry about "competing" with instead of just buying out or ignoring entirely. you think that a megacorp like disney is worried about competition from a little mom and pop shop? get real.

Fines for breaking the rules, for example, always disproportionately affect small businesses where large corporations either have enough money to pay those fines and be unaffected by them, or have the legal teams to get around them.

a few responses to this. the first is, so what? laws against murder, rape, assault, etc are all easier for the rich to dodge, and yet we don't decide murder should be legal. the solution to that imbalance is to be more serious about holding rich people accountable for these crimes, or for fine-related punishment to scale the fine to income, not to get rid of the laws altogether. if a regulation outlaws genuinely abusive or harmful behavior from a company, the way that small companies can avoid that fine is by simply not engaging in abusive or harmful behavior.

secondly, plenty of regulations nonetheless have specific exemptions for small businesses anyway. for example

In general, if your business is under $50 million in annual sales and your fuel or additive has traditional chemistry, then you are exempt from the health effects testing requirements.

If you have non-traditional chemistry and are under $10 million in annual sales, you are exempt from some of the testing. EPA staff can discuss testing requirements.

[x]

or for another example:

The Federal Food, Drug, and Cosmetic Act requires packaged foods and dietary supplements to bear nutrition labeling unless they qualify for an exemption (A complete description of the requirements). One exemption, for low-volume products, applies if the person claiming the exemption employs fewer than an average of 100 full-time equivalent employees and fewer than 100,000 units of that product are sold in the United States in a 12-month period. To qualify for this exemption the person must file a notice annually with FDA. Note that low volume products that bear nutrition claims do not qualify for an exemption of this type.

Another type of exemption applies to retailers with annual gross sales of not more than $500,000, or with annual gross sales of foods or dietary supplements to consumers of not more than $50,000. For these exemptions, a notice does not need to be filed with the Food and Drug Administration (FDA).

On May 7, 2007, the Food and Drug Administration (FDA) launched a new web-based submission process for small businesses to file an annual notice of exemption from the nutrition labeling requirements. The new process will make it easier for businesses to update their information. In addition, firms eligible for the exemption will receive an electronic reminder when it is time to resubmit their nutrition labeling small business exemption notice.

[x]

or yet another:

Manufacturers of consumer products covered by the Department of Energy (DOE) standards with annual gross revenues not exceeding $8 million from all its operations, including the manufacture and sale of covered products, for the 12-month period preceding the date of application, may apply for a temporary exemption from all or part of an energy or water conservation standard. (42 U.S.C. 6295 (t))

[x]

so, no, regulations are not a sinister trick of large corporations to crush small business, because if they were they wouldn't specifically exempt small businesses.

does this mean that @priveetru was right? are regulations an important part of maintaining ideal market conditions and thus creating Real Capitalism, which is Good?

also no.

first, it's all "real capitalism". more regulated, less regulated, it's still Real Capitalism. and as demonstrated by the things going on around us, right now, real capitalism is Bad.

as @traveling-spartan pointed out, large corporations can simply afford to pay or dodge any fees for breaking regulation (though overall they would prefer not to have to, hence why they usually fight against regulation) and small businesses are often exempt from regulations in the first place. so who do regulations actually prevent from economic malfeasance?

nobody. not a soul. they're a completely ineffective bandaid on a bazooka wound which accomplishes nothing.

regulated or unregulated, all market economies tend towards consolidation. on a long enough timeline, all small businesses either are successful enough to become large businesses, are unsuccessful enough to go out of business, or are average enough to get bought out. it's an inevitable part of capitalism as it actually exists, and no matter what fantasy you chase after of a hypothetical, imaginary, impossible "real" capitalism, whether this fantasy is laissez-faire or tightly regulated, you will never escape that reality.

if you want to solve the problem, you can't keep chasing after an imaginary "real capitalism". instead you need to move past capitalism altogether. if you want to address the fact that bill gates and other billionaires are monopolizing farmland and therefore gaining control over our very subsistence, the solution to that isn't to sit around praying to the invisible hand of the free market to save us, and it's also not begging and pleading the existing bourgeoisie state to Le Heckin Tax The Billionaires. the real solution is for regular working class people like us to rise up and take back what is rightfully ours, and create a new state that actually serves the needs of the working people and not just the owning class.

14 notes

·

View notes

Text

Lincoln Project

* * * *

VP Harris challenges Trump on immigration

September 19, 2024

Robert B. Hubbell

On Wednesday, VP Kamala Harris spoke at the Congressional Hispanic Caucus Institute’s 47th Annual Leadership Conference in Washington, D.C. Harris took on Trump's nightmarish threat to deport millions of immigrants if he is elected.

Harris said,

While we fight to move our nation forward to a brighter future, Donald Trump and his extremist allies will keep trying to pull us backward. We all remember what they did to tear families apart, and now they have pledged to carry out the largest deportation, a mass deportation, in American history.

Imagine what that would look like and what that would be? How’s that going to happen? Massive raids? Massive detention camps? What are they talking about?

Harris’s speech is here: Harris delivers remarks at Congressional Hispanic Caucus Institute leadership event.

As VP Harris said, it is a dangerous fantasy to believe that Trump could deport ten million immigrants. An operation of that scale is beyond the resources of the federal and state governments combined. Although the effort would not succeed, it would lead to economic chaos as the labor pool is jolted by the sudden disappearance of workers who fill entry level service jobs, harvest America’s crops, provide home care for the elderly, and provide significant portions of the workforce in construction, hospitality, and manufacturing industries.

If you don’t have time to watch Harris’s entire speech, I recommend viewing the segment in which she frames reproductive rights as one of the freedoms guaranteed to Americans. She also notes that 40% of Latina women live in states with Trump abortion bans: Harris addresses impact of Trump abortion bans on Latina women.

VP Harris’s comments on abortion and reproductive freedom are powerful and moving. She continues to be an effective, focused campaigner who is sticking to the Democratic messaging of “freedom” and “an opportunity economy.”

As a reminder, Kamala Harris’s Opportunity Economy focuses on making the lives of middle-class Americans better. Her proposals include a $6,000 tax credit for families with newborns, expansion of the child tax credit, expansion of the earned income credit, a $50,000 deduction for new business owners, making rent affordable, incentivizing the construction of 3 million starter homes (as opposed to McMansions), subsidizing $25,000 of the down payment for first time homeowners, and reducing the cost of prescription drugs. See Issues - Kamala Harris for President: Official Campaign Website.

The Federal Reserve cuts interest rates by 0.5%

The Biden-Harris administration significantly reduced inflation levels while sustaining robust growth in the US GDP. As a result, the Federal Reserve announced today that it was cutting the prime interest rate by 0.5% and suggested that additional cuts would be forth coming. See Federal Reserve Board - Federal Reserve issues FOMC statement.

Even Trump admitted that “it was a big cut,” although he suggested the timing was political. In truth, the cut was overdue. The Fed waited too long to reduce rates. See Common Dreams, Fed 'Waited Too Long' But Finally Cut Interest Rates. As noted in the Common Dreams article,

Center for Economic and Policy Research senior economist Dean Baker also welcomed that the Fed is changing course, saying: "This is a belated recognition that the battle against inflation has been won. Contrary to the predictions of almost all economists, including those at the Fed, this victory was won without a major uptick in unemployment."

Kamala Harris and Joe Biden achieved the nearly impossible—avoiding a recession while taming inflation. They deserve great credit for doing so—and voters are starting to realize that fact. See Harris closes gap with Trump on the economy, new Pennsylvania poll shows | Pittsburgh Post-Gazette.

Per the Post-Gazette,

Pennsylvania voters no longer prefer former President Donald Trump over Vice President Kamala Harris on the economy in a poll that shows the Democratic presidential nominee all but erasing the deficit on which candidate can best handle the top issue for voters this fall.

In a Quinnipiac University poll of likely Pennsylvania voters released Wednesday, Trump’s advantage over Ms. Harris was just 50% to 48%, a two-point advantage well within the survey’s margin of error of plus or minus 2.7 percentage points.

Harris continues to do everything just right. While there is no guarantee of success, we should be gratified that we have a candidate who is running such a terrific campaign!

Trump's effort to cram voter suppression bill through Congress fails

Trump ordered Speaker Mike Johnson to make a futile attempt to pass a continuing resolution for the budget that included the GOP voter-suppression bill that would require proof of citizenship to register as a voter. (Note that our nation has survived for 235 years without requiring proof of citizenship to register to vote.) The bill was doomed to fail—and Mike Johnson knew it. But Trump ordered him to jump and Johnson’s only question was, “How high, sir?”

See Roll Call, Johnson's stopgap funding package goes down to defeat.

To be clear, Trump wants to force the US into a financial crisis for political advantage. He said on Truth Social,

If Republicans don’t get the SAVE Act, and every ounce of it, they should not agree to a Continuing Resolution in any way, shape, or form.

But extremists in the GOP caucus know that Mike Johnson will cave. Per Marjorie Taylor Greene, “Johnson is leading a fake fight that he has no intention of actually fighting.”

Americans deserve better than a House GOP caucus willing to hold the budget hostage for Donald Trump.

Trump's desperation is showing

Trump is promising tax cuts like a man who can smell defeat. On Wednesday, he promised New Yorkers that he would remove caps on federal deductions for state and local taxes (SALT). Trump's position is absurd because he proposed and obtained the SALT caps as a way of punishing taxpayers in New York, New Jersey, and California (among other states). Now that he senses that he might lose, he is telling voters in those states that he will remove the caps he instituted.

Members of Congress immediately trashed the idea. Although capping the SALT deduction was unfair to taxpayers in states that fund their operations and pay into the federal coffers, reversing the policy would add $1.2 trillion dollars to the deficit. See HuffPost, Donald Trump’s Latest Tax Pander Flops In Congress.

Trump's flip-flop is a sign of his willingness to promise anything to anyone to be re-elected. Trump's desperation is a more reliable sign of the state of the race than the polls!

Wall Street Journal debunks JD Vance immigrant / cat story

The Wall Street Journal published an article on Wednesday that reported (a) the city manager of Springfield told JD Vance that there was no evidence to support the cat-eating immigrant story before JD Vance doubled-down on the false claim on social media, and (b) the woman who filed a police report claiming her cat had been taken by Haitians later found her cat hiding in the basement of her house.

See Wall Street Journal, How the Trump Campaign Ran With Rumors About Pet-Eating Migrants—After Being Told They Weren’t True (This article is accessible to all.)

Per the WSJ,

[Vance] asked point-blank, ‘Are the rumors true of pets being taken and eaten?’” recalled [Springfield City Manager] Heck. “I told him no. There was no verifiable evidence or reports to show this was true. I told them these claims were baseless.”

By then, Vance had already posted about the rumors to his 1.9 million followers on X. Yet he kept the post up, and repeated an even more insistent version of the claim the next morning.

The WSJ article takes a deep dive into the situation in Springfield and is well worth your time to read the entire article. The WSJ reporters lay out in detail how Vance and Trump are exploiting an immigrant population that is helping Springfield to grow and prosper after decades of decline:

The local economy boomed. Business owners said they were grateful to have workers eager to work long shifts and do what it took to meet production goals. New subdivisions sprung up in the cornfields outside town. New restaurants opened. The Haitian flag flew at City Hall.

Growth came with growing pains. The number of non-native English speakers in the public schools quadrupled to more than 1,000 children. The local clinic and hospital were overwhelmed with people fleeing a country where healthcare had been scant. Traffic increased, as did frustration with drivers more accustomed with the chaotic streets of Port-au-Prince than the orderly grid of Springfield.

One thing is clear: Vance and Trump know the rumors have no basis in fact but continue to promote them—thereby hurting the people of Springfield. Trump claims he will visit Springfield—over the objections of the mayor and the Governor of Ohio (both Trump-supporting Republicans!). The fact that Republicans in Ohio understand the cynical dishonesty of Trump's propaganda is a good sign

[Robert B. Hubbell Newsletter]

#Robert B. Hubbell#Robert B. Hubbell Newsletter#Vance and Trump#JDV#Springfield Ohio#Trump lies#WSJ#Federal Reserve#Voter Suppression

9 notes

·

View notes