#Refinitiv

Text

Singapore's Sea verfehlt vierteljährliche Umsatzschätzungen

Das südostasiatische Technologieunternehmen Sea Ltd hat im zweiten Quartal seine Umsatzprognosen verfehlt. Die Verbraucher haben ihre Ausgaben für Internet und diskretionäre Dienste zurückgehalten. Die Aktien von Sea sind um 14% gefallen.

Laut Refinitiv-Daten stieg der Umsatz des Unternehmens im Vergleich zum Vorjahr um mehr als 5% auf 3,10 Milliarden US-Dollar. Die Analysten hatten jedoch mit…

View On WordPress

0 notes

Link

Europe was the most prominent & biggest importer in the global liquified natural gas sector in the year 2022, with the region buying considerably higher volumes than its competitors as it attempts to replace the shrinking Russian pipeline gas supplies. As per the news, EU nations acquired 101mn tonnes last year, which is 58% more than in the entire of 2021, as per the data provided by Refinitiv.

In previous years, the EU fall down to Japan and China on LNG imports but Russia’s attempt at energy weaponisation since its invasion of Ukraine has compelled the bloc to adopt alternative fuel sources.

Due to Europe’s requirements to import higher volumes to cater to its storage facilities in 2023, the global LNG market is expected to stay tight, possibly pushing up costs for gas users across the world.

“When the prices increase in Europe, Asia undoubtedly is required to expand the amount it pays accordingly to survive the competition to attract LNG cargoes,” stated Olumide Ajayi, senior LNG analyst at Refinitiv. “Europe has turned into a top-notch market.”

Read more: https://www.emeriobanque.com/news/europe-gears-up-lng-imports-as-global-competition-for-fuel-grows

0 notes

Text

Aframax tanker built by Iran for Venezuela to carry fuel components in first trip

New Post has been published on https://www.timesofocean.com/aframax-tanker-built-by-iran-for-venezuela-to-carry-fuel-components-in-first-trip-sources/

Aframax tanker built by Iran for Venezuela to carry fuel components in first trip

Houston/Maracay, Venezuela, (The Times Groupe)- Iranian-made oil tanker Aframax is scheduled to depart from the Middle Eastern country next month carrying fuel components for gasoline-hungry Venezuela, three sources told Reuters.

It is the latest sign of the growing energy collaboration between the two nations under U.S. sanctions. The South American country desperately needs fuel and diluents since its refining network is in poor condition, so Iran swaps crude for them.

Nicolas Maduro, who is not recognized by the U.S. government as the country’s leader, has benefited from the deals by helping revive Venezuela’s economy after years of recession and hyperinflation.

Aframax tanker Yoraco is the second vessel built by SADRA shipyard for Venezuela, and two more are on order. Mahduro, who visited Tehran last week as part of a tour spanning the Middle East and Asia, attended Yoraco’s launch.

One of the sources said that after tests of the 60 million euro Yoraco’s seaworthiness have been completed, PDVSA’s maritime arm will send a crew to the Iranian port city of Bushehr to assume command.

Another source said PDVSA executives are preparing a chartering contract for a shipment of Iranian fuel components that will depart in about 35 days.

PDVSA and SADRA did not respond to requests for comment.

This week, data from Refinitiv Eikon monitoring showed the tanker floating near Bushehr, on the Persian Gulf, with its transponder activated.

In 2014, SADRA built another tanker for Venezuela called Sorocaima. After U.S. sanctions on Iran prevented it from obtaining insurance and classification, it took three years before it could navigate commercially.

According to Refinitiv data, the vessel, now called Colon, is in Venezuelan waters after the tanker was detained by authorities in 2019.

Iranian and Venezuelan officials announced last week that SADRA will build two more tankers for Venezuela through 2024 after announcing a 20-year cooperation plan in the fields of oil, refinery, petrochemicals, defense, agriculture, tourism and culture.

Venezuela ordered more than 40 tankers from China to Argentina under late President Hugo Chavez to replace PDVSA’s aging fleet. However, only a few were delivered, and some were lost due to unpaid bills.

#Hugo Chavez#iran oil tanker#iran-venezuela relations#Iran-Venezuela two-decade cooperation deal#Iran's SADRA shipyard#Iran's tanker building for Venezuela#Iranian-made oil tanker Aframax#Iranian-made oil tanker Yoraco#Nicolas Maduro#PDVSA's maritime arm#Refinitiv#Refinitiv Eikon#Sanctions-hit Iran and Venezuela#Tanker built by Iran for Venezuela#The Times Groupe#Times#Times Of Ocean#Unravel News#US Sanctions#venezuela#Economy

1 note

·

View note

Text

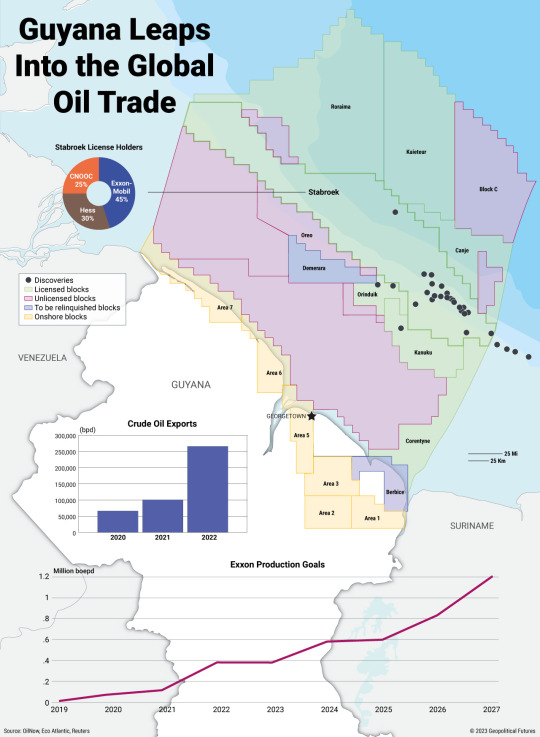

By 2035, the world’s fourth-largest offshore oil producer could be a South American country with fewer than 1 million people. According to Norway’s Rystad Energy, Guyana – with proven reserves of 11 billion barrels of oil equivalent – will surpass the U.S., Norway and Mexico in offshore production in the coming years. Only Saudi Arabia, Brazil and the United Arab Emirates will produce more oil. Already in 2022, Guyana more than doubled its crude exports to approximately 225,000 barrels per day from just over 100,000 bpd, according to Refinitiv data.

0 notes

Text

Bancos apostam em títulos de energia renovável para ganhar bilhões

Bancos apostam em títulos de energia renovável para ganhar bilhões

Títulos com certificação ESG garantem financiamento barato, lucros e incentivos fiscais

O investimento socialmente responsável, comercializado sob a sigla “ESG” (abreviação de meio ambiente, social e governança), é um negócio enorme e em crescimento. Em 2015, os ativos globais relacionados a ESG somaram US$ 2,2 trilhões, de acordo com a PwC, crescendo para US$ 9,4 trilhões em 2020 e quase…

View On WordPress

#Bancos#Bilhões#Dinheiro#Energia Renovável#Energia Solar#eólica#Forbes#grupo Refinitiv#hidrelétrica#Tecnologia

0 notes

Text

27 March 2023

Her Royal Highness The Princess Royal, Patron, Save the Children UK, accompanied by Vice Admiral Sir Tim Laurence, attended the International Financial Review Annual Awards Dinner at the Grosvenor House Hotel, Park Lane, London W1.

📸: Refinitiv, an LSEG business

#this is why i love dinner engagements#she looked so lovely#princess anne#princess royal#annegagements

55 notes

·

View notes

Text

Tổng hợp: Lúa mì quay đầu giảm mạnh trước áp lực nguồn cung từ Biển Đen

Tổng hợp: Lúa mì quay đầu giảm mạnh trước áp lực nguồn cung từ Biển Đen

Thị trường nông sản tiếp tục diễn biến trái chiều trong phiên hôm qua. Ngô nối dài đà phục hồi và trở thành mặt hàng nông sản tăng mạnh nhất cả nhóm. Trong khi đó, lúa mì đã quay đầu lao dốc hơn 1% trong phiên vừa rồi, sau hai phiên tăng giá liên tiếp trước đó. Đối với nhóm họ đậu, giá các mặt hàng duy trì xu hướng giằng co, và đều đóng cửa với mức biến động nhẹ, chưa tới 1%.

Lúa mì giảm mạnh nhất cả nhóm vào hôm qua. Bên cạnh áp lực bán kỹ thuật ở vùng giá 590, thị trường còn phải đối mặt với áp lực lớn đến từ triển vọng nguồn cung dồi dào hơn ở khu vực biển Đen. Cụ thể, Refinitiv mới đây đã nâng dự báo sản lượng lúa mì niên vụ 24/25 của Ukraine lên 21,9 triệu tấn, tăng 1% so với báo cáo trước, nhờ độ ẩm đất cao hơn ở các vùng Poltava và Mykolaiv. Sản lượng dự kiến lớn hơn ở Ukraine sẽ góp phần gia tăng thặng dự lúa mì toàn cầu, đồng thời gây sức ép đến giá CBOT.

Trong khi đó, những lo ngại về triển vọng sản xuất ở khu vực Nam Mỹ đã quay trở lại thị trường và tác động “bullish” đến giá ngô trong phiên vừa rồi. Theo tiến sĩ Cordonnier - chuyên gia tại công ty tư vấn Soybean&Corn - cho biết, phần diện tích ngô trồng muộn ở Argentina đã bị ảnh hưởng đáng kể và dự kiến sẽ có năng suất thấp hơn do thời tiết bất lợi. Ngoài ra, Inmet dự báo lượng mưa sẽ dưới mức trung bình trong tháng 3 ở phần lớn phía Bắc, Đông Bắc, Trung Tây và phía Nam Brazil. Điều này dự kiến sẽ cản trở sự phát triển của cây trồng, cũng như giảm tốc độ gieo trồng vụ ngô thứ 2 của các vùng sản xuất lớn trong khu vực.

Với triển vọng thời tiết không quá khả quan, lo ngại sản lượng đậu tương Brazil tiếp tục bị cắt giảm là yếu tố đã hỗ trợ giá tăng nhẹ trong phiên vừa rồi. Ở chiều ngược lại, Sở Giao dịch Ngũ cốc Buenos Aires (BAGE) cho biết mưa dự kiến trong những ngày tới sẽ mang lại lợi ích cho hầu hết các khu vực sản xuất nông nghiệp của Argentina, thúc đẩy sự phát triển của đậu tương đang ở giai đoạn tăng trưởng quan trọng. Dự báo thời tiết tích cực đang mang đến triển vọng nguồn cung tốt tại Argentina, tạo áp lực lên thị trường trong phiên sáng và kìm hãm đà hồi phục của giá vào hôm qua.

Giá khô đậu tương ghi nhận mức tăng nhẹ gần 1%, chủ yếu nhờ lực bắt đáy tại vùng hỗ trợ 325 và ảnh hưởng lan tỏa của giá đậu tương.

Đầu tư hàng hoá

Đầu tư hàng hoá

Đầu tư hàng hoá

3 notes

·

View notes

Text

UBS and Santander’s ‘green’ bonds linked to deforesters and rancher accused of slave labour in Brazil

The European banks UBS and Santander have raised hundreds of millions of pounds of “green” bonds that were partly intended for farmers and ranchers accused of environmental and human rights abuses in Brazil, an Unearthed and O Joio e O Trigo investigation has found.

Among those linked to the bonds are a farmer who allegedly held five labourers in “slave-like” conditions, a soy company identified as the biggest deforester in Brazil’s Cerrado savannah, a cattle rancher fined for preventing the regeneration of 17 sq km of Amazon rainforest, and an ethanol producer that poisoned a river relied on by an Indigenous community.

This influx of cash was made possible by financial tools called CRAs. As bonds specifically linked to Brazilian agribusiness, CRAs are little-known outside the country – neither Bloomberg nor Refinitiv, the London Stock Exchange’s financial data platform, track them in detail. CRAs comprise a relatively small proportion of Brazil’s total agribusiness funding, but are growing rapidly: the amount of capital they have raised has soared more than 500% over the past five years from R$7bn (£1.15bn) in 2018 to almost R$43bn (£7.1bn) in 2022, according to Uqbar, a Brazilian market intelligence company.

A CRA is a special type of asset backed security that may be issued by a company or individual who commits to invest the money in agribusiness. The role of the coordinating banks is to define the price of the bonds and sell them to investors. For this, the coordinating banks receive a fee, usually 3% to 5% of the total offer, which they divide among themselves.

“The CRA is gaining traction and becoming an important instrument [of agribusiness’ financing]”, said Juliano Assunção, executive-director of the Climate Policy Initiative, a public policy think tank.

The legal reforms that allowed CRAs to proliferate were initially touted as supporting small-scale, sustainable farmers, and were well received by groups including WWF and the Climate Bonds Initiative. In practice, however, this market has been led by Brazil’s livestock industry giants JBS, Marfrig and Minerva, which have been repeatedly linked to Amazon deforestation. Most recently, in August, Santander helped coordinate one of the year’s largest CRAs, a R$1.5bn (£240mn) bond for JBS.

As an Unearthed investigation can reveal for the first time, even CRAs distributed to investors by UBS and Santander and marketed as “green” have been destined for farmers and companies that are being investigated for their roles in socio-environmental disasters, large-scale deforestation, land grabbing, and slave labour.

“I think the term greenwashing is too weak… These are alleged human rights abuses,” Alex Wijeratna, senior director of Mighty Earth, told Unearthed.

Continue reading.

#brazil#brazilian politics#politics#environmental justice#workers' rights#environmentalism#mod nise da silveira#image description in alt

2 notes

·

View notes

Text

KYIV, Ukraine (AP) — An unprecedented wartime deal that allowed grain to flow from Ukraine to countries in Africa, the Middle East and Asia where hunger is a growing threat and high food prices are pushing more people into poverty was extended just before its expiration date, officials said Saturday.

The United Nations and Turkish President Recep Tayyip Erdogan announced the extension, but neither confirmed how long it would last. The U.N., Turkey and Ukraine had pushed for 120 days, while Russia said it was willing to agree to 60 days.

Ukrainian Deputy Prime Minister Oleksandr Kubrakov tweeted Saturday that the deal would remain in effect for the longer, four-month period. Russian Foreign Ministry spokeswoman Maria Zakharova told Russian news agency Tass that Moscow “agreed to extend the deal for 60 days.”

This is the second renewal of separate agreements that Ukraine and Russia signed with the United Nations and Turkey to allow food to leave the Black Sea region after Russia invaded its neighbor more than a year ago.

The warring nations are both major global suppliers of wheat, barley, sunflower oil and other affordable food products that developing nations depend on.

Russia has complained that shipments of its fertilizers — which its deal with Turkey and the U.N. was supposed to facilitate — are not getting to global markets, which has been an issue for Moscow since the agreement first took effect in August. It nonetheless was renewed in November for another four months.

Stéphane Dujarric, a spokesman for U.N. Secretary-General Antonio Guterres, said in a statement that 25 million metric tonnes (about 28 millions tons) of grain and foodstuffs had moved to 45 countries under the initiative, helping to bring down global food prices and stabilizing markets.

“We remain strongly committed to both agreements and we urge all sides to redouble their efforts to implement them fully,” Dujarric said.

The war in Ukraine sent food prices surging to record highs last year and helped contribute to a global food crisis also tied to lingering effects of the COVID-19 pandemic and climate factors like drought.

The disruption in shipments of grain needed for staples of diets in places like Egypt, Lebanon and Nigeria exacerbated economic challenges and helped push millions more people into poverty or food insecurity. People in developing countries spend more of their money on basics like food.

The crisis left an estimated 345 million people facing food insecurity, according to the U.N.’s World Food Program.

Food prices have fallen for 11 straight months, but food was already expensive before the war because of droughts from the Americas to the Middle East — most devastating in the Horn of Africa, with thousands dying in Somalia. Poorer nations that depend on imported food priced in dollars are spending more as their currencies weaken.

The agreements also faced setbacks since it was brokered by the U.N. and Turkey: Russia pulled out briefly in November before rejoining and extending the deal. In the past few months, inspections meant to ensure ships only carry grain and not weapons have slowed down.

That has helped lead to backlogs in vessels waiting in the waters of Turkey and a recent drop in the amount of grain getting out of Ukraine.

Ukrainian and some U.S. officials have blamed Russia for the slowdowns, which the country denies.

While fertilizers have been stuck, Russia has exported huge amounts of wheat after a record crop. Figures from financial data provider Refinitiv showed that Russian wheat exports more than doubled to 3.8 million tons in January from the same month a year ago, before the invasion.

Russian wheat shipments were at or near record highs in November, December and January, increasing 24% over the same three months a year earlier, according to Refinitiv. It estimated Russia would export 44 million tons of wheat in 2022-2023.

10 notes

·

View notes

Text

"Sóng ngầm" ở thị trường trái phiếu thế giới

BNEWS Cả Trung Quốc và Nhật Bản đều quan tâm đến việc hỗ trợ đồng tiền của họ. Đồng NDT liên tục giảm so với đồng USD, trong khi đồng yen ở mức thấp chưa từng có kể từ cuối năm 2022.

Nhật Bản và Trung Quốc nắm giữ 1.935 tỷ USD trái phiếu Chính phủ Mỹ tính đến tháng 6/2023. Theo dữ liệu của Refinitiv, con số này gần bằng 1/4 tổng giá trị trái phiếu Mỹ ở nước ngoài, nhưng chỉ chiếm dưới 8% tổng giá…

View On WordPress

3 notes

·

View notes

Text

As if there wasn't exhaustive enough evidence that "ESG" is nothing but a scam, the Financial Times was out this week with a piece detailing how many companies with good ESG scores pollute just as much as their lower-rated rivals.

Don't say we didn't warn you; we have been writing about the ESG con for years now, which along with other "sustainable" investments continues to see hundreds of billions of dollars in inflows from investors.

The FT added to our skepticism by revealing this week that Scientific Beta, an index provider and consultancy, found that companies rated highly on ESG metrics - and even just the 'Environmental' variable alone - often pollute just as much as other companies.

Researchers look at ESG scores from Moody’s, MSCI and Refinitiv when performing the analysis. They found that when the 'E' component was singled out, it led to a “substantial deterioration in green performance”.

Felix Goltz, research director at Scientific Beta told the Financial Times: “ESG ratings have little to no relation to carbon intensity, even when considering only the environmental pillar of these ratings. It doesn’t seem that people have actually looked at [the correlations]. They are surprisingly low.”

He added: "The carbon intensity reduction of green [ie low carbon intensity] portfolios can be effectively cancelled out by adding ESG objectives."

“On average, social and governance scores more than completely reversed the carbon reduction objective,” he continued. “It can very well be that a high-emitting firm is very good at governance or employee satisfaction. There is no strong relationship between employee satisfaction or any of these things and carbon intensity."

“Even the environmental pillar is pretty unrelated to carbon emissions,” he said.

Vice-president for ESG outreach and research at Moody’s, Keeran Beeharee, added: “[There is a] perception that ESG assessments do something that they do not. ESG assessments are an aggregate product, their nature is that they are looking at a range of material factors, so drawing a correlation to one factor is always going to be difficult.”

“In 2015-16, post the SDGs [UN sustainable development goals] and COP21 [Paris Agreement], when people began to really focus on the issue of climate, they quickly realised that an ESG assessment is not going to be much use there and that they need the right tool for the right task. There are now more targeted tools available that look at just carbon intensity, for example,” he added.

MSCI ESG Research told the Financial Times its ratings “are fundamentally designed to measure a company’s resilience to financially material environmental, societal and governance risks. They are not designed to measure a company’s impact on climate change.”

Refinitiv told FT that “while very small, the correlation found in this study isn’t surprising, especially in developed markets, where many large organisations — with focused sustainability strategies, underpinned by strong governance, higher awareness of their societal impact and robust disclosure — will perform well based on ESG scores, in spite of the fact that many will also overweight on carbon”.

Global director of sustainability research for Morningstar Hortense Bioy concluded: “Investors need to be aware of all the trade-offs. It is not simple. In this case, investors need to think carefully about which aspects of sustainability they would like to prioritize when building portfolios: carbon reduction or a high ESG rating.”

2 notes

·

View notes

Text

Malaysia LNG, majority owned by Petronas, has declared force majeure on liquefied natural gas supplies to its customers, including Japanese utilities, Mitsubishi Corp , which owns a stake in Malaysia LNG, said on Thursday.

The move came after Petronas declared force majeure on gas supplies to its LNG production and sales unit, Malaysia LNG, due to a pipeline leak, said a spokesperson at Mitsubishi.[...]

With a total LNG capacity of 25.7 million tons per annum, the Malaysia LNG project is one of the largest LNG facilities in a single location in the world, according to Mitsubishi.

The project's customers include Japan, South Korea, Taiwan and China.

Malaysia was the second biggest supplier of LNG to Japan in 2021, providing about 10 million tonnes, according to Japanese trade data. Malaysia delivered 50 cargoes to Japan from October through December last year, according to Refinitiv data.

6 Oct 22

3 notes

·

View notes

Text

The US economy added 372,000 jobs in June, an unexpected boost in hiring and a signal that the labor market remains robust despite recession fears, according to the monthly jobs report from the Bureau of Labor Statistics released Friday.

The unemployment rate held steady at 3.6%, still close to the 52-year low last reached in the months before the pandemic hit.

The June job total, slightly down from May's revised 384,000 jobs added, far surpassed expectations. Economists polled by Refinitiv projected 272,700 jobs would be added in June, amid a period of economic unease and growing fears that a recession is brewing.

3 notes

·

View notes

Text

Foreign Exchange

Now, the learning and strategizing part is only one part of the story. Some will even supply a panic button with which you may find a way to successfully close all of your open positions should you ever need to. So, you wish to make certain your chosen Forex dealer has the pair you are interested in. Here are a couple of factors to contemplate when selecting the most effective on-line Forex buying and selling platform that is best for you.

Think of it as practice before really getting began with actual cash. This can be a priceless asset for learning the basics of forex trading. There are Fibo Quantum Scalper of choices when considering a demo account, so select whichever suits your needs the best.

Before we proceed to discussing the preferred Forex trading strategies, it’s essential that we perceive the most effective methods of selecting a trading technique. There are three major components that should be taken into consideration in this course of. However, an individual trader needs to find the best Forex buying and selling strategy that suits their trading style, in addition to their danger tolerance.

Stay on high of forex market strikes ensuring you don’t miss any trading alternatives. Leverage next-generation capabilities with liquidity aggregation, value distribution, risk management, and more. For your single supply of access to most well-liked FX buying and selling venues with a seamless, end-to-end workflow for every trade, meet Refinitiv FX Trading. You additionally need to search out out what kind of account protections can be found in case of a market disaster, or if a dealer becomes bancrupt to minimize the risk. Furthermore, you could also hedge to mitigate your loss in other markets as well, such as, commodity market. There are numerous kinds of pairs out there from which you'll pick to course of your change, corresponding to Major pairs, Minor Pairs, Emerging Pairs and so forth.

The EUR/USD, USD/JPY, and GBP/USD are just a number of the most popular foreign exchange pairs. If you’re new to all this and wish to start trading forex easily and passively, we’d recommend opting for eToro. This copy trading platform has low fees, great customer support, and is fully regulated by ASIC. Forex rates are easily swayed by real-time economic and political events. This supplies short-term investors and day merchants with the proper taking part in field to capitalize on sudden price actions.

For instance, a multinational firm is buying and selling currencies to pay for expenses and wages in varied nations where they promote merchandise. Multiple Forex brokers supply low-to-zero deposit requirements, which can show to be a great alternative for merchants who have restricted funds. Additionally, most brokers also ask you to pay low spreads and transactional fees. Furthermore, the positioning has offices spread in thirteen different countries, together with France, Germany, Poland, and the United Kingdom. The platform’s low spreads and excessive range of belongings make it some of the popular options on the market.

#Forex#Forex Trading#How To Trade Forex#Forex Trader#Forex Strategy#Forex For Beginners#Live Forex Trading#Forex Signals#Learn Forex#Forex Trading Live#Forex Trading Strategy#Forex Course#Forex Trading Strategies#Forex Strategies#Live Forex#Simple Forex Strategy#Forex Trading For Beginners#Forex Lifestyle#Forex Education#Forex Market#Forex Tips#Live Forex Trade#Trading Forex#Forex Scalping#Forex Trading Course#Forex Day Trading

3 notes

·

View notes

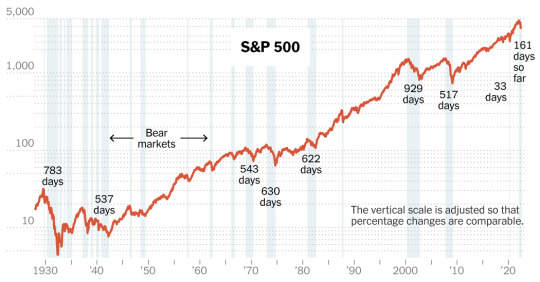

Photo

Plotted monthly through June 13, ’22. The vertical scale is adjusted so that percentage changes are comparable.Sources: Refinitiv; Yardeni Research; New York Times analysis of S&P 500 data; Federal Reserve Bank of St. Louis

by Karl Russell

The S&P 500 on Monday dropped into its second bear market of the pandemic, crossing a symbolic and worrisome threshold as stocks plunge following a meteoric rise over the last two years.

Bear markets — when stocks decline at least 20 percent from their recent peaks — are relatively rare, and they frequently precede a recession. This sell-off, dragging the S&P down from a peak on Jan. 3 (which reflects the new bear market’s starting point), comes as concerns mount over high inflation, the war in Ukraine, Covid and the Federal Reserve’s attempts to rein in the economy. | William P. Davis, Karl Russell and Stephen Gandel, When Stocks Become Bear Markets

Stock Market Today: Dow, S&P Live Updates for Jun. 14, 2022 | Rita Nazareth

“There will be an elevated level of volatility,” wrote Jim Caron, portfolio manager and chief fixed-income strategist at Morgan Stanley Investment Management. “While the Fed’s primary goal is to reduce wage inflation, this may instead deflate asset prices.”

“This is one of those environments where it is getting rougher,” said Jason Pride, chief investment officer of private wealth at Glenmede. “In our index, we’re seeing some nascent, but I would argue, not fully-throated signs of oversold conditions. So it’s flashing like this weird and somewhat inconvenient weak buy signal -- as opposed to like some sort of really strong oversold capitulation, high-conviction buy signal.”

“New money should be patient money as investment psychology has shifted to the negative side,” said George Ball, chairman of Sanders Morris Harris. “It’s better to miss the bottom of a market and buy on the way up than to guess where the exact bottom is.”

“Fed rate hikes and global central bank tightening will bring about slower growth,” wrote Dennis DeBusschere, the founder of 22V Research. “The question is how fast growth needs to slow to generate a policy-friendly inflation trend. Slower growth that doesn’t trigger a sharp recession, should lead to both lower 10-year yields and a lower equity risk premium. Under that backdrop, there is a good amount of upside to equities.”

3 notes

·

View notes

Text

Brazil’s Iron Ore Exports on the Rise in 2023

The Brazilian iron ore market has improved during 2023, with exports on the rise, much to the delight of the dry bulk market. In its latest weekly report, shipbroker Banchero Costa said that “2023 has been so far a positive year for global iron ore trade. In Jan-Aug 2023, global loadings of iron ore increased by +4.0% y-o-y to 1,028.8 mln tonnes, from 988.9 in the same period of 2022, based on Refinitiv vessel tracking data. It is also just above the 1,020.9 mln tonnes loaded in Jan-Aug 2021, which was the last all-time record. Exports from Australia increased by +2.5% y-o-y in Jan-Aug 2023 to 598.9 mln tonnes, easily a new alltime record high. From South Africa volumes have been down -4.3% y-o-y to 36.6 mln t in Jan-Aug 2023. From Canada, export volumes were up +4.3% y-o-y to 34.2 mln t in JanAug 2023. India also saw an increase of +67.7% y-o-y to 22.8 mln tonnes”.

Continue reading.

2 notes

·

View notes