#Regressive Tax laws

Text

“Changing the Narrative” based on Deuteronomy 15:1-4 and Matthew 26:1-16

I grew up in the country, and went to college in rural New Hampshire, so when I started interning as a pastor in urban Los Angeles, …. well, there was a big learning curve. I was scared of cities, because they were just new to me, and I found them overwhelming. Los Angeles is a major urban center, and like most of our urban centers it has dazzling wealth and heartbreaking poverty. Homelessness is an especially huge problem in Los Angeles because people spend their live savings to get there expecting to “make it big” by walking down the street and having a producer hire them for a major movie. Also, it isn't cold there, so there aren't networks of code blue shelters.

I worked at a wonderful church, the Hollywood United Methodist Church, and in ways similar to here, the congregation itself was a mixture of the housed and the unhoused, and no conversation about the church happened without awareness of their unhoused neighbors. One of the most distressing moments of my life was in getting to know the unhoused in the Hollywood Church and those who lived around it, and realizing that many of them were the same population as the people I cared for at Sky Lake Special Needs camps. That the most vulnerable among us were living the hardest lives is a lesson I've never gotten over. While I served there we would also go to Skid Row – the poorest part of Los Angeles - and serve meals, an experience that wiped any lingering blinders I had about the justice of unfettered competitive capitalism.

After my first year interning at Hollywood, I went on a mission trip to Cuba with Volunteers in Mission. We started in Havana, and eventually drove east to the site where we would work. After several days on the road I finally realized that I was tense all the time because it constantly felt like we were about to slip into a neighborhood like Skid Row, and I expected the punch to the stomach that I'd experienced in seeing Skid Row. But, in Cuba, everything felt like the neighborhood before you got to jaw-dropping poverty. But you never got to jaw-dropping poverty. This was 2004, and I've since learned that in the early years after the US embargo there really wasn't enough enough food, but by 2004 the island had figured out how to feed and house everyone sufficiently – even though cement crumbled and drug stores were largely bare.

There wasn't much panhandling in Cuba either. There was a little bit, in tourist spots, but our hosts pointed out that because everyone is housed and fed in Cuba, the panhandling was for extra money, not for for basics. I ended up going back to Cuba a few years later, and had very similar experiences. Like the metaphors of a fish being unable to understand water, it took leaving unfettered competitive capitalism for me to be able to see it.

This week I had the chance to attend a conversation led by the Labor and Religion Coalition on the New York State Budget. Many of us are familiar with the Federal Poverty Line, right? And we're also familiar with it's limitations, namely that it is abysmally low and a person or family living above that line will still be struggling to make ends meet. You may already know about the United Way measure “ALICE (Asset Limited, Income Constrained, Employed)”, but I didn't. (Can't tell you if I hadn't heard it or hadn't retained it though. Shrug.)

ALICE is a measure of who isn't making ends meet in society. Fabulously, United Way does an amazing amount of work with the data on Alice. For instance, in NYS 14% of people live under the poverty line. Another 30% of people are in ALICE, and 56% of people are “doing OK” and making ends meet. The numbers a bit worse in Schenectady – in our city 49.8 people live below the ALICE threshold, which is to say that HALF of the people in this city aren't making ends meet.

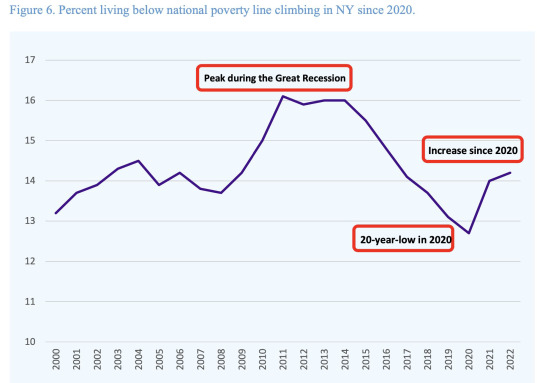

What was particularly interesting in the presentation this week was the visual on recent poverty rates.

Namely, that during 2020, when the government focused on responding to people's needs with stimulus checks, child tax credits, and expansion of SNAP benefits, people living under the national poverty line hit a 20 year LOW.

And since then, the rates have been creeping back up. The work of the Labor and Religion Coalition and their partners The Poor People's campaign includes asking NYS to readjust it's priorities. Stop having regressive tax laws that benefit corporations and the wealthy, and use the income gained to bring greater support for the most vulnerable.

Compared to how we have been operating as a society, this feels like a PIPE DREAM. There so many barriers, so many counter arguments, so much fear of the accusation of “raising taxes.” But then I read the Bible, and I read it with the guidance of Rev. Dr. Liz Theoharis and Rev. Dr. William Barber, and God is behind that pipe dream.

Which, for me at least, means it is possible.

Which means we can dream about what it would feel like to live in a society where everyone is housed, and housed adequately. Archaeology suggests that in the first 400 years of Ancient Israelite society – the years before kings – all the houses were about the same size. Which means that society was organized around mutual care for each other and sharing of resources. I've been shocked to learn from the book “The Dawn of Everything” by David Graeber and David Wengrow that MANY ancient societies were really egalitarian like that, including ones with major urban centers, including ones that were stable for many centuries. The ancient Hebrews weren't an outlier.

The Hebrew Bible, though, gets really clear on what is needed to create a society where people care for each other. Everyone needs access to resources – in their case land. Did you know that in Hawaii the native people divvied up the land like really narrow pieces of pie because they knew every group of people needed access to the resources of both the land and the sea? God has worked with peoples in so many times and places to take care of each other, and that means it is possible. Liz Theoharis sufficiently mentions the other rules, “forgiving debts, raising wages, outlawing slavery, and restructuring society around the needs of the poor.”1 That's what we hear in Deuteronomy today. That's what Jesus reflect on in the gospel.

I'm struck by her clear statement that “charity will not end poverty.” It reminds me of the Simone Weil quote, “It is only by the grace of God that the poor can forgive the rich the bread they feed them.” As long as we have a society that makes some people rich BY making other people poor we'll have lots and lots of opportunities for charity, but nothing will change.

Our work, I believe, is the work of “narrative takeover.” For us, it may take some time. There is a lot in this unfettered competitive capitalism that we've been trained not to see, or to think is necessary, or acceptable, and the work we're doing with “We Cry Justice” this year helps us reframe the narrative.

What IS the purpose of a society? If it is to fulfill “there will be no need among you,” then we know what direction to turn in, even it it will be a long journey to get there. It is funny, isn't it? That people know the quote “the poor you will always have with you” but they don't know that the implication of it is “as long as you fail to follow what God is asking of you.”

So I invite us to this dream. What would it be like to live in a society that houses people well, where everyone had enough nutritious food, where healthcare can accessed? Can you even dream it? What are the implications? I think life would be easier for teachers – because so many barriers to learning would be eliminated. If those who spend their lives fighting to make ends meet were able to focus there gifts elsewhere, what could they offer? We would be able to offer great care to those who are aging, those who are young, and those with special needs – none of which we're doing now. People fighting to survive might then have energy for art, music, gardening, and other wonderful things that would enrich their lives and the lives of those around them! I suspect mental health would increase, because the fundamental fear of falling through the safety net wouldn't keep people up at night, and because there would be less stress, and more time for people to connect with those they love. Lives would probably get longer, violence would decrease, ERs would be less crowded, I think there might even be less litter and faster scientific progress. OH, and just that quick reminder- studies say that housing everyone, and feeding everyone, and getting healthcare to everyone would COST US LESS AS A SOCIETY THAN HOW WE DO IT NOW.

Kinda makes you wonder who benefits from how we do it now, doesn't it?

OK, that's probably about as much fish trying to see the water as we can take for a day. But I'd love to hear from you what else WILL happen when we make God's dreams a reality.... let's keep on building that narrative for each other, until we can see the dream clearly and then see the ways we are most gifted at moving towards it. May there be no need among us. Amen

1Liz Theoharis “1: Is Ending Poverty Possible?” in We Cry Justice, ed. Liz Theoharis (Minneapolis: Broadleaf Books, 2021) used with permission.

Rev. Sara E. Baron

First United Methodist Church of Schenectady

603 State St. Schenectady, NY 12305

Pronouns: she/her/hers

http://fumcschenectady.org/

https://www.facebook.com/FUMCSchenectady

January 28, 2024

#thinking church#progressive christianity#fumc schenectady#first umc schenectady#schenectady#umc#sorry about the umc#rev sara e baron#Poor People's Campaign#Labor and Religion Coalition#Regressive Tax laws#No need among us

0 notes

Text

By Jake Johnson

Common Dreams

Jan. 9, 2024

"Almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that."

Nearly every state and local tax system in the U.S. is fueling the nation's inequality crisis by forcing lower- and middle-class families to contribute a larger share of their incomes than their rich counterparts, according to a new study published Tuesday.

Titled Who Pays?, the analysis by the Institute on Taxation and Economic Policy (ITEP) examines in detail the tax systems of all 50 U.S. states, including the rates paid by different income segments.

In 41 states, ITEP found, the richest 1% are taxed at a lower rate than any other income group. Forty-six states tax the top 1% at a lower rate than middle-income families.

"When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least," said ITEP research director Carl Davis. "And yet when we look around the country, the vast majority of states have tax systems that do just that."

"There's an alarming gap here between what the public wants and what state lawmakers have delivered," Davis added.

In recent years, dozens of states across the U.S. have launched what the Center on Budget and Policy Priorities recently called a "tax-cutting spree," permanently slashing tax rates for corporations and the wealthy during a pandemic that saw billionaire wealth skyrocket and company profits soar.

A report released last week, as Common Dreamsreported, showed ultra-rich Americans are currently sitting on $8.5 trillion in untaxed assets.

According to ITEP's new study, tax systems in just six states—California, Maine, Minnesota, New Jersey, New York, and Vermont—and the District of Columbia are progressive, helping to reduce the chasm between rich taxpayers and other residents.

Massachusetts, which has one of the more equitable tax systems in the nation, collected $1.5 billion in revenue last year thanks to its recently enacted millionaires tax, a measure that improved the state's ranking by 10 spots in ITEP's Tax Inequality Index. Minnesota has also ramped up its taxes on the rich over the past several years while expanding benefits for lower-income families, ITEP's study observes.

"The regressive state tax laws we see today are a policy choice, and it's clear there are better choices available to lawmakers."

But the full picture of U.S. state and local systems is grim. In 44 states, tax laws "worsen income inequality by making incomes more unequal after collecting state and local taxes," ITEP found.

Florida has the most regressive tax code in the U.S., with the richest 1% paying a mere 2.7% tax rate while the poorest 20% pay 13.2%.

Florida is among the U.S. states that don't have personal income taxes, which forces them to rely on consumption and property taxes that are "nearly always regressive," ITEP notes in the new analysis.

"Eight of the 10 most regressive tax systems—Florida, Washington, Tennessee, Nevada, South Dakota, Texas, Arkansas, and Louisiana—rely heavily on regressive sales and excise taxes," the study says. "As a group, these eight states derive 52% of their tax revenue from these taxes, compared to the national average of 34%."

Aidan Davis, ITEP's state policy director, said that "we've seen a lot of states shift their tax systems to become even more regressive in recent years by enacting deep tax cuts for the wealthiest."

The report points to Kentucky's adoption of a flat tax and repeated corporate tax cuts, which "delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides."

Davis said that "we know it doesn't have to be like this," arguing there is a "clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off."

"The regressive state tax laws we see today are a policy choice," said Davis, "and it's clear there are better choices available to lawmakers."

#regressive tax code#progressive tax code#tax the rich#wealth inequality#income inequality#tax law#politics#itep#public policy

9 notes

·

View notes

Text

Opinion | The GOP tax plan is to let the rich pay less and make you pay more

By Jennifer Rubin

President Biden, consistent with his idea of building an economy from “the bottom up and the middle out,” has tried to get the rich and big corporations to pay more taxes. The MAGA GOP, abandoning all pretense of populism, has a scheme to junk the progressive tax code and replace it with a national sales tax, with devastating results for the middle class.

That tells you a lot about the contrasting visions of the two parties. One still fights for the little guy in practical, concrete terms while the other proposes one harebrained scheme after another with no regard to the needs of average Americans.

Biden’s American Rescue Plan expanded the child tax credit for a year and permanently made it fully refundable, meaning that parents receive the money regardless of how much they owe in taxes. Keeping his promises not to raise taxes on anyone making less than $400,000 a year and to get businesses to pay more, Biden raised $300 billion in revenue in the Inflation Reduction Act by placing a new tax on stock buybacks and enacting a minimum tax on big corporations. To the chagrin of tax cheats (and their sympathetic Republican politicians), the law also boosted funding for the Internal Revenue Service to crack down on tax evaders.

None of these were radical changes in the code. More far-reaching plans to increase the individual top marginal tax rate, to boost the corporate tax rate, to equalize tax treatment of capital gains and ordinary income for those making more than $400,000, and to eliminate the step-up basis for the estate tax never passed.

The principle underlying all of these measures, which would be comparatively small adjustments that would not hit the vast majority of Americans, was simple: The rich have made out very well and should pay more taxes; working- and middle-class taxpayers shouldn’t.

“Over the past 40 years, the wealthy have gotten wealthier, and too many corporations have lost their sense of responsibility to their workers, their communities and the country,” Biden said in a speech in September 2021. “CEOs used to make about 20 times the average worker in the company that they ran. Today, they make more than 350 times what the average worker in their corporation makes.” He added, “Since the pandemic began, billionaires have seen their wealth go up by $1.8 trillion. That is, everyone who was a billionaire before the pandemic began, the total accumulated wealth beyond the billions they already had has gone up by $1.8 trillion.”

That grotesque widening of income inequality offends most Americans, who consistently tell pollsters the rich should pay more.

GOP politicians and their wealthy donors see things differently. The first tax measure proposed by the MAGA House was to try to take back funding for the IRS to chase down tax cheats.

“The debate should focus on one accurate and alarming number: the IRS has 2,284 fewer skilled auditors to handle the sophisticated returns of wealthy taxpayers than it did in 1954,” Chuck Marr of the Center on Budget and Policy Priorities wrote. “The decade-long, House Republican-driven budget cuts have created dysfunction at the IRS, where relatively few millionaires are now audited.”

But allowing tax cheats to avoid paying what they legally owe is not the sum total of the GOP thinking on taxes. “As part of his deal to become House Speaker,” Semafor reported, “Kevin McCarthy reportedly promised his party’s conservative hardliners a vote on legislation that would scrap the entire American tax code and replace it with a jumbo-sized national sales tax.”

A mammoth 30% sales tax would be grossly regressive, socking it to the same working- and middle-class families Republicans ostensibly worry are paying more at the pump and grocery store because of inflation.

You know the idea is rotten when Grover Norquist, the head of Americans for Tax Reform, blasted the move. He told Semafor: “This is a political gift to Biden and the Democrats.” Even Norquist knows that because the poor and middle class spend a much higher percentage of their income on necessities such as food and clothing, the impact would be devastating.

Unsurprisingly Democrats leaped at the chance to blast the scheme. Sen. Elizabeth Warren (D-Mass.) tweeted:

Biden also hammered Republicans: “National sales tax, that’s a great idea. It would raise taxes on the middle class by taxing thousands of everyday items from groceries to gas, while cutting taxes for the wealthiest Americans.”

The GOP plan boils down to this: Let rich tax cheats get away with not paying what they owe while redoing the entire tax system so the overwhelming burden will fall on those less able to pay. Genius! Well, if you are a Democrat running in 2024.

The plan is unlikely even to get a vote. But it is indicative of the utter lack of seriousness that pervades the GOP. They throw out one boneheaded idea after another, hoping to please some segment of their base or donors, with nary a care in the world for the needs of their constituents nor for the actual challenges we face.

#us politics#news#the washington post#op eds#Jennifer Rubin#president joe biden#biden administration#american rescue plan#inflation reduction act#taxes#us tax code#federal tax codes#internal revenue service#Chuck Marr#Center on Budget and Policy Priorities#Semafor#rep. kevin mccarthy#Grover Norquist#sen. elizabeth warren#tweet#twitter#the white house#2023#118th congress#us house of representatives#conservatives#republicans#gop policy#gop platform#gop

89 notes

·

View notes

Text

Many parts of former President Trump’s signature tax cuts will expire in 2025. This leaves limited time for policymakers to decide what to keep, what to let lapse, and how to deal with the other provisions of the Tax Cuts and Jobs Act of 2017 (TCJA). Whatever course of action they take will affect the federal deficit and how millions of households and businesses do their taxes.

To make those decisions, Congress needs to look past party lines and talking points to see the law’s actual impact. In a new paper, Jeff Hoopes (University of North Carolina), Kyle Pomerleau (American Enterprise Institute), and I did just that.

The TCJA introduced sweeping changes to individual and corporate taxation, cutting individual income tax rates, increasing the standard deduction and Child Tax Credit, slashing the corporate tax rate and the tax rate for certain unincorporated businesses, and other changes.

Here’s my take. Several effects of the law are clear. First, the good news. It simplified taxes for many households by reducing their dependence on itemized deductions and their use of the alternative minimum tax (AMT), although these gains were offset to some extent by more complicated taxes for businesses.

The bad news is that it was expensive: The TCJA will have raised federal deficits and debt by more than $2 trillion over its first 10 years according to the Congressional Budget Office. Forget the idea that the tax cut will pay for itself—that is nonsense.

More bad news: The TCJA exacerbated the already massive differences in the distribution of income. It made the rich richer and barely helped the poor. Urban-Brookings Tax Policy Center analysis shows that households in the lowest 20% of income distribution gained an average of about $60 per year. Annual tax cuts for the top 1% averaged over $50,000.

These are justifiable costs, say TCJA advocates, who believe the law spurred economic growth. But there does not appear to have been a growth effect. Patterns in aggregate economic data for 2018 and 2019 tell a fairly simple story: The basic underlying path of the economy—in terms of GDP, investment, and wages—was essentially unchanged after TCJA relative to before TCJA.

For example, a boom in investment never materialized. Investment was about the same share of GDP in 2019 as it was in 2015. Investment in intellectual property continued to grow at about the same rate that it had before the tax cut. Investment in equipment and structures, both of which received big tax cuts through the TCJA, essentially stagnated as a share of GDP.

U.S. investment performance compared to other countries was lackluster, too. Before TCJA, our investment-GDP ratio grew at the second fastest rate in the Group of Seven (G7). After TCJA? The fourth fastest. Lagging behind Europe is not the best look for the “biggest business tax cut in history.”

In particular, the historic cut in the corporate tax rate, down to 21% from 35%, was much less of an investment incentive than many TCJA advocates expected. The reduction mainly provides a windfall gain to investments made in the past—an inefficient way to stimulate new investment.

Hopefully in 2025, rather than continued partisan politicking, policymakers will seriously study the actual effects of TCJA policies when considering whether to extend them or let them lapse. Extending the expiring provisions would cost more than $4 trillion over the next decade according to CBO and would be extremely regressive. If the provisions expire, the economy is unlikely to fall into a tailspin. If TCJA provisions didn’t contribute to growth, their absence is unlikely to hurt growth, and it would help reduce the deficit and make the distribution of after-tax income more equal.

How to deal with TCJA is part of a larger discussion: How will the U.S. generate sufficient revenue to cover its expenses? Budgetary challenges are only getting worse, given slowly growing revenues and looming shortfalls in the Social Security and Medicare trust funds. If policymakers limit their debate in 2025 to the expiring TCJA provisions, they will miss a huge opportunity to reform the tax system and reduce fiscal deficits. Congress has many options, and many better ones, than simply extending TCJA.

5 notes

·

View notes

Text

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes | US income inequality | The Guardian

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes

New research found that poorest fifth pay a tax rate 60% higher, on average, than the top 1% of households

"A total of 44 of the 50 US states worsen inequality by making the wealthy pay a lesser share of their income in taxes than lower income people, a new analysis has found.

State and local tax regimes are “upside-down”, the new research finds, with weak or non-existent personal income taxes in many states allowing richer Americans to avoid tax. A reliance on sales and excise taxes, considered regressive because they disproportionately impact the poor, has helped fuel this inequality, according to the report.

CEOs of top 100 ‘low-wage’ US firms earn $601 for every $1 by worker, report finds

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least,” said Carl Davis, research director of the Institute on Taxation and Economic Policy (ITEP), which conducted the analysis.

“And yet when we look around the country, the vast majority of states have tax systems that do just that. There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”

Only six states, plus the District of Columbia, have tax systems that reduce inequality rather than worsen it, with the poorest fifth of people paying a tax rate 60% higher, on average, than the top 1% of households.

The super-wealthy are treated particularly lightly by the tax system, with the top 1% paying less than every other income group across 42 states. In most states, 36 in all, the poorest residents are taxed at a higher rate than any other group.

The most regressive states in terms of taxation are, in order, Florida, Washington, Tennessee, Pennsylvania and Nevada. The least regressive jurisdictions are DC, Minnesota, Vermont, New York and California.

Various state-level policies, such as cutting taxes on the wealthy to supposedly drive economic activity, has worsened this situation, the report found. Inequality in recent decades has been far starker in the US than in other comparable countries and while some pandemic-era interventions, such as a child tax credit, lessened the burden on the poorest in society, many of those measures have now lapsed.

“But we know it doesn’t have to be like this,” said Aidan Davis, ITEP’s state policy director.

“There is a clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off. The regressive state tax laws we see today are a policy choice, and it’s clear there are better choices available to lawmakers.”

• This article was amended on 11 January 2024. Owing to incorrect information supplied to us, an earlier version listed New Jersey as the fifth least regressive tax jurisdiction, according to the ITEP report, rather than California."

#I see why people are pissed but this isn't Biden's fault#It's about who people vote for#GOP#Wall Street#Tax Cheats#Trump Tax Scam#Wirst Stars For Taxes Are Florida Washington Tennessee Nevada#Vote Blue

4 notes

·

View notes

Note

Can I request regressor langue de chat cookie headcanons with caregiver cappuccino? :3

Regressor!Langue De Chat HC'S

As a general baseline, Langue de Chat Cookie is a very hardworking individual, much to his own detriment. Which makes it much harder to get into an age regression headspace than it already would be, given he's a lawyer and struggles to take breaks as is.

• Tends to have a preference towards age dreaming rather than full on regression when working, especially if he's working overtime. When he's on vacation, though, that changes.

• Usually regresses from ages 4-6, doesn't normally change much but sometimes he'll go younger if he's having a bad day.

• When in a regressed headspace, he tends to be very tired and quiet with low energy, mostly because of how taxing his job can be at time's. He's very sleepy, all the time. Perfect for Cappuccino Cookie's horrendous sleep schedule.

• Found out what age regression was through the internet, and grew to use it as a source of comfort and happiness overtime.

• Keeps his regression to himself almost at all times, not even his own parents know about it, (and they won't anytime soon).

• Very sweet kiddo, love's to help out Cappuccino Cookie around the house despite him not being able to do much. He's also clingy, and is practically Velcro when with Cappuccino Cookie. He won't be upset if he leaves, since he's either sleeping or distracted with something.

• Not a big fan on kid's show's, prefers to watch whatever Cappuccino is watching. (Which is normally Law And Order, Grey's Anatomy, or whatever 50 year old men watch).

• Would have one of those plush suitcases. Sorry I don't make the rules I just speak them. Also Cappuccino got it for him as a promotion present and he treasures it dearly.

Caregiver!Cappuccino Cookie HC'S

As a general baseline, Cappuccino Cookie is a rigid individual with a horrendous work schedule. He's a very calm, but strict caregiver at times. He is very caring, though, he just struggles to show it.

• Found out what age regression was through the internet as well, and didn't think much of it. I fact—he was kind of perplexed and grossed out by it. That was until he learned what it was, of course.

• Cappuccino Cookie, much like Langue de Chat, is also very tired due to his work. And most of there free time is spent sleeping together or watching TV shows on the couch.

• A surprisingly good cook despite a majority of his diet consisting of old takeout and frozen TV dinner's. Home cook's meal's for Langue de Chat, but not himself. He'll just eat the leftovers out of the pan.

• Enjoys rainy days, but also likes sunny one's too. Especially love's summer because that means he gets to take his kiddo to the beach, which they both love! (And to finally unleash his ridiculous collection of hawaiian t-shirts that have been gaining dust). Honorable mention, Langue de Chat also has a ridiculous collection of hawaiian t-shirts and is growing his collection everyday.

• Cappuccino knows how to play the guitar! Specifically the bass. When Langue De Chat's having a bad day, or is struggling to fall asleep, he'll play some 90's rock songs on there for him.

• On the topic of music, Cappuccino and Langue de Chat both really like the band Nirvana!

• He's not the biggest fan of bedtime stories and struggles with the whole enthusiasm part of it all, so he'll turn on some audiobooks for Langue de Chat and himself. There currently listening to a Shakespeare autobiography together :)

#cookie run#cookie run agere#cookie run headcanons#cookie run kingdom#cookie run ovenbreak#agere post#age dreaming#agere positivity#sfw agere#langue de chat cookie#cappuccino cookie#sfw caregiver#agere caregiver#Ofc you can! I'm so sorry I didn't respond earlier#I've been very busy (and tired). Anyways#enjoy!#Launge de chat icon from: @fallofthecelestial on tumblr

17 notes

·

View notes

Text

I see this attitude from a lot of people nowadays "Why should I have to pay money just to live? The basic necessities should be free!"

Let me tell you why. The answer is efficiency and sustainability. Basic necessities cost resources to produce, food, housing, clothing, it takes labor, material costs, energy, and other resources to produce these things, and it also takes resources to get these things to the people who need them. And it takes societal structures, businesses, organizations, infrastructures, to do it. And some methods of production and distribution are more efficient than others.

When people have limited money, and have to buy basic necessities, they shop around for the lowest price and for deals. And the act of doing this, helps to select for more efficient ways of producing and distributing goods. It also creates incentives to preserve things, like keeping clothing or equipment longer instead of just throwing it out. All of these things create incentives for protecting the environment too, because things that cost more to make often are using more energy or material resources that have negative environmental impact.

When people don't have enough money to buy basic necessities, instead of saying that the problem is that the necessities cost money, you could say that the problem is that they don't have money. Money is power to buy things, and the problem is that some people are so disempowered that they cannot even get their basic needs met.

Solutions like UBI or various social welfare programs address this by simply giving people money regularly.

I think this is often a better solution than simply giving people resources for free. If something is free, people will be more likely waste it, or to take more than they need. This makes the program more expensive than if people bought only what they needed. Someone is still paying for those free things, and if it's funded by a government grant, the whole supply chain of producing and distributing it probably isn't going to be as efficient. So even if no one took more free handouts than they needed, it still would be more expensive than simply giving people money and allowing people to shop around for deals.

Note also that the existence of ultra-rich people undermines the efficiency created by markets and the money system. If someone is rich past a certain point, they become insensitive to the cost of most goods, and they end up buying things for whatever prices they are available at. As a result they often end up buying things that took incredible amounts of resources to produce, and they thus end up having a disrpoportionate environmental impact too. This is why we see all this stuff about how the richest people are responsible for the most carbon emissions and pollution. It's also why you have problems like billionaires buying up tons of properties in London and driving up the cost of living, shaping the whole housing market so that developers build luxury housing instead of affordable housing.

The problem with our world isn't that money exists or that it rules the economy, the problem is simply that the money has been ridiculously concentrated in the hands of a tiny portion of people, and that the economic system and tax system and laws are designed such that it stays that way. Some people have too much money and others have too little and it creates problems on both ends. The solution isn't to eliminate money, it's to eliminate the regressive aspects of our tax code, laws, and economic system.

If there were only modest wealth disparities between people, all people had enough money to comfortably buy basic necessities, and no people had so much wealth as to be insensitive to cost, it wouldn't be a grave injustice that you need to pay for these things. It would just be part of the system that helps society to run more efficiently. And I think that would be a much better society to live in than one where we try to (centrally or decentrally) coordinate how to care for people without money.

#economics#markets#free market#efficiency#sustainability#ubi#injustice#capitalism#wealth disparity#wealth inequality#inequality#poverty#the rich

4 notes

·

View notes

Text

The Wealthy and Corporations Have Received Massive Tax Cuts in Recent DecadesCopy link

U.S. policymakers have substantially reduced taxes for wealthy households in recent decades. The 2001 and 2003 Bush tax cuts[2] reduced individual income tax rates, taxes on capital gains and dividends, and the tax on estates, all of which provided the largest benefits to the highest-income taxpayers. Though policymakers let many of the Bush tax cuts for high-income households expire in 2013, the 2017 Trump tax cuts again lowered individual income tax rates (including the top rate) and weakened the estate tax, so that it applied only to the wealthiest estates: those worth more than $11 million per person or $22 million per couple, indexed for inflation. The 2017 law also created a large new tax deduction on “pass-through” business income (business income from partnerships, S corporations, and sole proprietorships) and enacted large and permanent tax cuts for corporations.

Taken together, these tax cuts disproportionately flowed to households at the top and cost significant federal revenues, adding trillions to the national debt since their enactment.[3] By shrinking revenues, these tax cuts limit policymakers’ ability and willingness to make public investments that pay off in tangible and important ways for individuals, families, communities, and the country as a whole.

AND THEY WANT TO DO IT AGAIN!

0 notes

Text

Exploring Complex Taxation Issues: Master-Level Questions and Solutions

Taxation assignments can often be daunting, especially when dealing with complex theoretical concepts that require deep analytical skills. In this post, we explore a few master-level taxation theory questions, providing detailed solutions that clarify the intricate tax concepts. These questions, crafted by experts at DoMyAccountingAssignment.com, are designed to challenge your understanding of taxation and offer insightful guidance.

Question 1: The Principles of Tax Equity and Efficiency

Tax equity and efficiency are two fundamental principles in tax policy. Discuss the conflict between equity and efficiency in tax systems. Provide examples of how different types of taxes impact both principles.

Solution:

Tax equity and efficiency are often at odds in tax policy design. Tax equity refers to the fairness of the tax system, where taxpayers in similar situations should pay similar taxes (horizontal equity) and those with a greater ability to pay should contribute more (vertical equity). Efficiency, on the other hand, relates to the economic impact of the tax system, particularly how it distorts or affects economic behavior.

Conflict Between Equity and Efficiency:

Equity: A progressive tax system aims to ensure fairness by taxing higher incomes at higher rates, which aligns with the principle of vertical equity. However, this can lead to inefficiency as high tax rates might discourage work, investment, or savings, thus reducing economic output.

Efficiency: A flat tax rate or consumption-based tax may promote efficiency by minimizing economic distortions. However, such systems can be regressive, placing a heavier burden on lower-income individuals, thereby compromising equity.

Examples of Tax Types:

Income Taxes: Progressive income taxes promote equity by taxing higher earners more, but they can reduce efficiency by disincentivizing additional income generation or investment.

Sales Taxes: Sales taxes tend to be more efficient because they are simpler to administer and less intrusive on economic decisions. However, they can be regressive, disproportionately affecting lower-income individuals who spend a higher percentage of their income on taxable goods.

The conflict between these principles highlights the challenge in designing a tax system that balances both fairness and economic efficiency. Students often ask, "Can someone do my Taxation Assignment and help me understand these complex trade-offs?" This question arises because tax policy is rarely black and white, requiring a nuanced understanding of economic theory and societal goals.

Question 2: Taxation of Multinational Corporations

Multinational corporations (MNCs) often engage in tax planning strategies to minimize their global tax liabilities. Discuss the challenges tax authorities face in taxing MNCs and explain how transfer pricing rules are used to mitigate tax avoidance.

Solution:

Multinational corporations operate across multiple jurisdictions, which allows them to engage in complex tax planning strategies, such as profit shifting and base erosion, to minimize their tax burdens. These strategies create significant challenges for tax authorities, as they must balance attracting foreign investment with ensuring that MNCs pay their fair share of taxes.

Challenges in Taxing MNCs:

Jurisdictional Issues: MNCs often allocate profits to low-tax jurisdictions, making it difficult for tax authorities in high-tax countries to collect taxes on income that, in reality, was generated within their borders.

Complex Structures: MNCs may use complex corporate structures, such as subsidiaries and holding companies, to shift profits across borders, exploiting differences in national tax laws.

Transfer Pricing Rules: Transfer pricing refers to the pricing of goods, services, and intellectual property transferred within an MNC’s entities across different jurisdictions. Tax authorities use transfer pricing rules to ensure that these transactions are conducted at arm’s length, meaning they reflect the price that would be charged between unrelated parties. This prevents MNCs from artificially lowering their taxable income by setting non-arm’s length prices for intra-group transactions.

For example, if a subsidiary in a low-tax country sells goods to a parent company in a high-tax country at an artificially low price, the parent company may report lower profits and pay less tax. Transfer pricing rules aim to adjust these prices to ensure that taxable income is accurately reported in both countries.

These rules are a critical tool in mitigating tax avoidance by MNCs, though enforcement can be challenging due to the complexity of international transactions and the need for cooperation between tax authorities across different jurisdictions. It's no wonder students frequently search for expert help, thinking, "Can someone do my Taxation Assignment and explain transfer pricing intricacies?"

Question 3: The Role of Tax Treaties in International Taxation

Tax treaties are essential in the realm of international taxation, particularly in avoiding double taxation and preventing tax evasion. Discuss the role of tax treaties in international tax policy and provide an example of how they function in practice.

Solution:

Tax treaties are bilateral agreements between countries that establish rules for the taxation of income that crosses borders. These treaties are vital in reducing the risk of double taxation, where a taxpayer could be subject to taxes in both the source country (where income is generated) and the residence country (where the taxpayer resides).

Role of Tax Treaties:

Avoidance of Double Taxation: Tax treaties typically include provisions that allocate taxing rights between the two countries, ensuring that income is taxed only once. For instance, a treaty might allow the source country to tax certain types of income (e.g., dividends or royalties) at a reduced rate, while the residence country provides a tax credit to offset taxes paid abroad.

Prevention of Tax Evasion: Treaties often include exchange of information clauses, where the tax authorities of the treaty countries share information to combat tax evasion and ensure compliance with tax laws.

Example of Tax Treaty Application: Consider a scenario where a U.S. resident earns interest income from investments in Canada. Without a tax treaty, both the U.S. and Canada might tax the same interest income. However, under the U.S.-Canada tax treaty, the taxing rights are shared, and the U.S. provides a tax credit for taxes paid to Canada, thereby avoiding double taxation.

Tax treaties also help to promote international trade and investment by providing clarity and certainty for businesses operating across borders. Understanding these treaties is crucial for students pursuing taxation studies, as they play a significant role in shaping global tax policy. When the concepts become overwhelming, many students ask, "Can someone do my Taxation Assignment and help me navigate the complexities of international tax treaties?"

Question 4: Taxation of Digital Economy

With the rise of the digital economy, traditional tax systems face challenges in taxing digital transactions and services. Discuss how governments are adapting tax policies to address the digital economy and provide an example of a digital services tax (DST).

Solution:

The digital economy has created significant challenges for traditional tax systems, which were designed around physical goods and services. Digital businesses, such as social media platforms, online marketplaces, and streaming services, often operate across borders without a physical presence in the countries where they generate significant revenue. This raises questions about how and where these companies should be taxed.

Adapting Tax Policies: Governments are increasingly adopting digital services taxes (DSTs) as an interim solution to address the tax challenges posed by the digital economy. These taxes are levied on the revenues generated by digital companies from providing digital services within a country, regardless of whether the company has a physical presence there.In the longer term, international efforts, such as those led by the OECD, are focused on developing a global consensus on taxing the digital economy, including reallocating taxing rights to ensure that digital companies pay taxes in the countries where they generate significant economic value.

Example of a DST: France introduced a digital services tax in 2019, which imposes a 3% tax on the revenues of large digital companies that generate more than €750 million in global revenue and €25 million in revenue from digital services in France. This tax applies to revenue generated from services such as online advertising, data sales, and digital intermediation.

The DST is a temporary measure, as international tax negotiations continue to seek a more permanent solution to the challenges of taxing the digital economy. As the landscape evolves, students studying taxation must stay informed of these changes, which often prompts them to seek expert guidance. It’s common to hear questions like, "Can someone do my Taxation Assignment and explain the implications of digital services taxes?"

Conclusion

Taxation is an ever-evolving field, with new challenges arising as economies globalize and digitize. Mastering these complex topics is essential for students pursuing advanced taxation studies. At DoMyAccountingAssignment.com, our experts provide in-depth solutions to these challenging questions, ensuring students gain the knowledge they need to excel.

#education#college#domyaccountingassignment#pay to do assignment#accounting#domyaccountingassignmentforme#taxationaccounting#taxationassignmenthelp

0 notes

Text

US tax code is over 40,000 laws across 6,800 pages📚, most of them are regressive (for the bottom 90%). Which is why a lottery winner, winning a billion dollars. Will pay far more taxes, than a billionaire - borrowing a billion dollars.

0 notes

Text

The Adventures of David Dashiki-Stories/Lessons of/ for ALL African Americans-2024-Year of the Black Man

We believe in justice and human love. If our rights are to be respected, we too must respect the rights of all mankind: hence, we are ever ready and willing to yield to the white man the things that are his, and we feel that he too, when his conscience is touched, will yield to us the things that are ours. - Marcus Garvey

WHERE WAS i? AH, YES ! W E ARE BLACK PEOPLE. WE WERE BROUGHT TO THIS COUNTRY AGAINST OUR COLLECTIVE WILL NOW, CENTURIES LATER, AMERICA HAS YET TO PROVIDE RIGHTS PROMISED ALL CITIZENS OF THIS GREAT LAND. WHEN WE PROTESTED, THOSE FAILED, FAKE AND UNFILLED PROMISES, WHITE FOLKS BECAME ANGRY AND INSULTED BY THE ARROGANCE OF THOSE WHO PREVIOUSLYTENDERED THEIR CROPS, RAISED THEIR CHILDREN AND CLEANED THEIR RESIDENCES. THE RESPONSE OF WHITE FOLKS HAS BEEN TO DEVISE WAYS, MEANS AND LAWS TO FURTHER ENTRAP BLACK PEOPLE SO THAT THEY MIGHT REMAIN IN SERVITUDE. INDEED, AT NO TIME IN OUR LIFE IN AMERICA HAVE WE EVER TRULY BEEN WITHOUT CHAINS, MENTALLY OR PHYSICALLY.

FIGHT AS WE COULD AND WOULD, BLACK EOPLE HAVE NEVER BEEN ABLE TO SECURE FOR OURSELVES EQUALITY IN THIS LAND OF BROKEN DREAMS. OUR LACK OF PERSISTENT FERVOR FOR COMBAT(AS WE WERE NOT ARMED FOR THE PHYSICAL ATTACKS) OR THE CONSTANT TWISTING AND BENDING OF LAWS SUPOSSEDLY FOR OUR BENEFIT AND THE SYSTEMIC RACISM SANDWICHED WITHIN GLIMPSES OF HOPE PREPARED TO TEASE US THAT FREEDOM WOULD BE OURS SOON. IN SHORT, THERE IS THE SENTIMENT THAT BLACK FOLKS JUST SURRENDERED. AND SETTLED INTO A LIFE OF SLAVERY SINCE THE PRICE OF FREEDOM WAS TOO COSTLY. THAT BELIEF HAS BEEN DEBUNKED FOR IT IS FAR FROM THE TRUTH

AFTER, centuries of vicious combat. ( ONE-SIDED AS IT WAS)..we are still at the same rung on the ladder toward liberty. In fact, evidence would reveal that we have regressed. There are few if any novel initiatives, objectives or goals as to the time our desire for freedom will be met. The demands for schools with properly licensed and competent instructors are but the rush of cold air over smoldering ashes. We cannot name a current and even a significant movement under the leadership of a fervent, militant person who strikes fear into the hearts of any political party. As a people, we are often regarded as weak and non-threatening like a fly you swat with a newspaper There are countries which receive aid and resources from America, in the billions of dollars without the expectation of reimbursement. We cannot solicit from our government, better housing, health care, enriched school curricula in spite of the fact that we pay taxes. Our citizenship is treated as a sick patient infirmed, debilitated, impotent. We have activated it only partially. for our petitions are simply ignored in the states. We have become too comfortable. We do not any longer feel the pinch of the shoe. We have become somewhat apathetic. The defeats have become painful If we are not cautious, we will lead our children down the same hopeless and gloomy path. We need not call ourselves citizens. African-Americans shake the drink up. We have rights. We can't sit around as if things have changed. They have not and we need to indicate our dissatisfaction to our country.

First, there is no platform for us in the upcoming elections. No candidate feels it necessary to include us in its agenda to improve and enhance the lives of Black persons living here. Everyone is silent. We are supposed to be loyal. Yes, but no one is loyal to us. Here i a plan of action for the Black Man today...in this year 2024-year of the Black Man. We are not angry. We want to see some movement on our issues. Our plan: Grant to us without struggle, conflict, anger, pressure or forethought, all rights, privileges advantages, protections provided all citizens of this great land. Let America truly be America for all of its people.

0 notes

Text

By Jake Johnson

Common Dreams

Aug. 20, 2024

Gabriel Zucman, a leading authority on tax evasion by the rich, welcomed news that Kamala Harris' presidential campaign is embracing proposals to tax the ultra-wealthy and large corporations.

An economist at the forefront of the growing global push for a billionaire wealth tax is welcoming news that U.S. Democratic presidential nominee Kamala Harris is embracing calls for a minimum levy on the United States' richest individuals.

"Let's go!" Gabriel Zucman, an economics professor at the University of California, Berkeley, wrote Tuesday in response to Semaforreporting on the Harris team's endorsement of taxes on ultra-wealthy individuals and large corporations proposed in President Joe Biden's budget for Fiscal Year 2025.

Semafor highlighted a "little-noticed portion" of an analysis released late last week by the Committee for a Responsible Federal Budget, which wrote that Harris' campaign "specifically told us that they support all of the tax increases on the high earners and corporations that are in the Biden budget."

That budget blueprint includes a 25% minimum tax on billionaire wealth, much of which is unrealized capital gains that are not currently subject to taxation. A recent analysis by Americans for Tax Fairness estimated that U.S. billionaires and centi-millionaires collectively held at least $8.5 trillion in unrealized capital gains in 2022—a massive untapped source of federal revenue.

U.S. billionaires have seen their collective fortunes grow by more than $2 trillion since former President Donald Trump—the GOP's 2024 nominee—signed into law massive tax breaks for the rich and big corporations. Trump has campaigned on extending the deeply regressive and unpopular tax cuts and slashing rates for large companies even further.

Surging billionaire wealth at a time when roughly two-thirds of Americans are living paycheck-to-paycheck has amplified calls for a minimum tax on the richest Americans. Zucman noted in a May New York Times piece that in 2018, U.S. billionaires paid a lower effective tax rate than working-class Americans for the first time in the nation's history.

"The idea that billionaires should pay a minimum amount of income tax is not a radical idea," Zucman wrote in May. "What is radical is continuing to allow the wealthiest people in the world to pay a smaller percentage in income tax than nearly everybody else."

Polling has shown that a 25% tax on billionaire wealth is extremely popular with U.S. voters across the political spectrum. A survey in March of last year by Data for Progress found that 87% of Democrats, 68% of Independents and third-party voters, and 51% of Republicans back the idea.

A spokesperson for the Harris campaign confirmed to NBC News on Monday that in addition to backing the push for a minimum tax on billionaires, the vice president supports raising the corporate tax rate from 21% to 28% as a way to help finance parts of her broader economic agenda, which includes an expanded child tax credit and substantial assistance for first-time homebuyers.

The campaign spokesperson called the move—which would still leave the corporate tax rate lower than it was when Trump first took office in 2017—a "fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share."

0 notes

Text

A new budget by a large and influential group of House Republicans calls for raising the Social Security retirement age for future retirees and restructuring Medicare.

The proposals, which are unlikely to become law this year, reflect how many Republicans will seek to govern if they win the 2024 elections. And they play into a fight President Joe Biden is seeking to have with former President Donald Trump and the Republican Party as he runs for re-election.

The budget was released Wednesday by the Republican Study Committee, a group of more than 170 House GOP lawmakers, including many allies of Republican presidential nominee Donald Trump. Apart from fiscal policy, the budget endorses a series of bills “designed to advance the cause of life,” including the Life at Conception Act, which would aggressively restrict abortion and potentially threaten in vitro fertilization, or IVF, by establishing legal protections for human beings at “the moment of fertilization.” It has recently caused consternation within the GOP following backlash to an Alabama Supreme Court ruling that threatened IVF.

The RSC, which is chaired by Rep. Kevin Hern, R-Okla., counts among its members Speaker Mike Johnson, R-La., and his top three deputies in leadership. Johnson chaired the RSC from 2019 to 2021; his office did not immediately respond when asked about the new budget.

For Social Security, the budget endorses "modest adjustments to the retirement age for future retirees to account for increases in life expectancy." It calls for lowering benefits for the highest-earning beneficiaries. And it emphasizes that those ideas are not designed to take effect immediately: "The RSC Budget does not cut or delay retirement benefits for any senior in or near retirement."

The new budget also calls for converting Medicare to a "premium support model," echoing a proposal that Republican former Speaker Paul Ryan had rallied support for. Under the new RSC plan, traditional Medicare would compete with private plans and beneficiaries would be given subsidies to shop for the policies of their choice. The size of the subsidies could be pegged to the "average premium" or "second lowest price" in a particular market, the budget says.

The plan became a flashpoint in the 2012 election, when Ryan was GOP presidential nominee Mitt Romney's running mate, and President Barack Obama charged that it would "end Medicare as we know it." Ryan defended it as a way to put Medicare on better financial footing, and most of his party stood by him.

Medicare is projected to become insolvent in 2028, and Social Security will follow in 2033. After that, benefits will be forcibly cut unless more revenues are added.

Biden has blasted Republican proposals for the retirement programs, promising that he will not cut benefits and instead proposing in his recent White House budget to cover the future shortfall by raising taxes on upper earners.

The RSC budget also presents a conundrum for Trump, who has offered shifting rhetoric on Social Security and Medicare without proposing a clear vision for the future of the programs.

Notably, the RSC budget presents three possible options to address the projected insolvency of the retirement programs: raise taxes, transfer money from the general fund or reduce spending to cover the shortfall.

It rejects the first two options.

"Raising taxes on people will further punish them and burden the broader economy–something that the spend and print regime has proven to be disastrous and regressive," the budget says, adding that the committee also opposes "a multi-trillion-dollar general fund transfer that worsens our fiscal situation."

That leaves spending cuts.

The RSC budget launches blistering criticism at "Obamacare," or the Affordable Care Act, and calls for rolling back its subsidies and regulations that were aimed at extending insurance coverage.

#us politics#news#nbc news#republicans#conservatives#biden administration#2024#us house of representatives#republican study committee#Social Security#raising the retirement age#Medicare#Obamacare#affordable care act#Life at Conception Act#in vitro fertilization#ivf treatment#Rep. Kevin Hern#rep. mike johnson#Paul Ryan

4 notes

·

View notes

Text

K E Wee & Associates - Everything You Should Know About Company Taxation

Company taxation is a core component of a country's fiscal policy. Additionally, it significantly impacts the financial health of enterprises and the rate of economic expansion. Business owners, particularly, must comprehend the basic ideas and precepts underpinning corporation taxation to guarantee their business compliance.

Explore corporate taxation's fundamental ideas and concepts, illuminating its complexities and ramifications.

6 Key Concepts in Company Taxation

1. Scope of Company Taxation

Company taxation encompasses levying taxes on the profits earned by corporations or business entities. It is a primary source of revenue for governments worldwide, enabling them to finance public services and infrastructure. The scope of company taxation varies across jurisdictions but generally includes income generated from business activities, capital gains, and other related sources. The tax rates and regulations governing company taxation undergo revisions to align with economic objectives and fiscal policies.

2. Taxable Income and Deductions

The determination of taxable income forms the foundation of company taxation. Taxable income refers to the portion of a corporation's earnings subject to taxation after accounting for allowable deductions and exemptions. Common deductions include expenses incurred in business operations, depreciation of assets, interest payments on loans, and charitable contributions. Understanding the eligibility criteria and limitations associated with deductions is necessary for corporations to optimise their tax liabilities legally.

3. Tax Rates and Structures

Corporation tax rates vary significantly across jurisdictions, influenced by economic conditions, political considerations, and international competitiveness. Governments may adopt progressive, flat, or regressive tax structures to collect revenue from corporations. Progressive tax systems impose higher tax rates on larger profits, aiming for a fair distribution of tax burden. Conversely, flat tax systems apply a uniform tax rate to all corporate incomes, simplifying tax administration but potentially exacerbating income inequality. Regressive tax structures, although less common, impose higher tax rates on smaller profits, disproportionately affecting small businesses.

ALSO READ: Types of Business Entities in Singapore

4. Tax Credits and Incentives

Tax credits and incentives are necessary for company taxation, encouraging desirable behaviour and stimulating economic growth. Governments often offer tax credits for specific activities such as research and development, job creation, renewable energy investments, and export promotion. These incentives aim to spur innovation, boost employment, and enhance competitiveness in global markets. Understanding the eligibility criteria and compliance requirements for tax credits enables corporations to leverage available incentives effectively.

5. International Taxation and Transfer Pricing

International taxation presents unique challenges and opportunities for corporations operating across borders. Transfer pricing, the pricing of goods and services exchanged between related entities in different tax jurisdictions, is a prime consideration in international taxation. Governments implement transfer pricing regulations to prevent profit shifting and ensure that transactions between related parties are conducted at arm's length. Double taxation treaties and agreements govern the taxation of multinational corporations, aiming to minimise tax conflicts and promote cross-border trade and investment.

6. Compliance and Reporting Obligations

Compliance with company taxation laws and regulations is essential for corporations to avoid penalties, audits, and legal disputes. Corporations must maintain accurate financial records, file tax returns, and adhere to reporting obligations stipulated by tax authorities. Failure to comply with taxation requirements can result in fines, interest charges, and reputational damage. Adopting robust tax compliance processes and engaging qualified tax professionals can help corporations navigate the complexities of company taxation and mitigate compliance risks effectively.

Conclusion

Understanding the complexities of company taxation is necessary for businesses to effectively manage their tax obligations and navigate the regulatory landscape. Companies can enhance their tax planning strategies, minimise risks, and support long-term economic growth by mastering key concepts such as taxable income, deductions, tax rates, and international taxation.

Visit K E Wee & Associates, and don't let tax compliance issues weigh down your business growth.

0 notes

Text

The Comprehensive Guide to Taxation

Introduction to Taxation

Taxation is the compulsory financial Taxation charge or levy imposed by a governing authority, such as a national or local government, on income, property, sales, and other forms of economic activity. Taxes are a crucial source of revenue for governments, enabling them to fund public services, infrastructure development, social welfare programs, and other essential functions.

Understanding the Tax System

The tax system is a complex and multifaceted framework that varies across countries and jurisdictions. Nonetheless, most tax systems share some common elements, including:

Tax Rates and Brackets

Tax rates and brackets determine the percentage of an individual's or entity's income or other taxable activity that must be paid as taxes. These can be progressive, regressive, or flat, depending on the jurisdiction.

Tax Deductions and Credits

Tax deductions and credits allow taxpayers to reduce their taxable income or the amount of taxes owed, thereby lowering their overall tax liability.

Tax Filing and Compliance

Taxpayers are generally required to file tax returns, either annually or at other intervals, to report their income, deductions, and tax obligations to the relevant tax authority.

Types of Taxes

Governments levy a variety of taxes, each with its own purpose and impact on individuals and businesses. Some of the most common types of taxes include:

Income Tax

Income tax is a tax imposed on an individual's or entity's earnings, such as wages, salaries, and investment income.

Sales Tax

Sales tax is a tax levied on the purchase of goods and services, typically collected by the seller and remitted to the government.

Property Tax

Property tax is a tax imposed on the ownership of real estate, such as land and buildings, and is often used to fund local government services.

Payroll Tax

Payroll tax is a tax imposed on employers and employees to fund social insurance programs, such as Social Security and Medicare.

Capital Gains Tax

Capital gains tax is a tax imposed on the profits realized from the sale of assets, such as stocks, bonds, and real estate.

Tax Planning and Optimization

Individuals and businesses can employ various strategies to minimize their tax liabilities and maximize their financial outcomes. These strategies may include:

Tax-Efficient Investment Strategies

Investing in tax-advantaged accounts, such as 401(k)s and IRAs, can help defer or reduce the tax burden on investment income.

Business Tax Planning

Businesses can leverage tax deductions, credits, and other incentives to reduce their overall tax obligations and improve their profitability.

Tax-Efficient Estate Planning

Proper estate planning, including the use of trusts and other tools, can help minimize the tax burden on the transfer of wealth to heirs.

Compliance and Enforcement

Ensuring compliance with tax laws and regulations is essential to maintain the integrity of the tax system. Tax authorities employ various enforcement mechanisms, such as audits, penalties, and criminal prosecution, to ensure that taxpayers meet their obligations.

Evolving Tax Landscape

The tax landscape is constantly evolving, with governments adjusting tax policies and rates to address changing economic, social, and political priorities. Understanding these changes and adapting to them is crucial for individuals and businesses to stay compliant and optimize their tax strategies.

Seeking Professional Assistance

Given the complexity of tax laws and regulations, seeking the guidance of a qualified tax professional, such as a certified public accountant (CPA) or enrolled agent, can be highly beneficial in navigating the tax system, minimizing tax liabilities, and ensuring compliance.

Conclusion

Taxation is a critical component of modern society, providing governments with the resources to fund essential public services and programs. By understanding the tax system, leveraging available tax-saving strategies, and maintaining compliance, individuals and businesses can optimize their financial outcomes and contribute to the overall well-being of their communities.

0 notes

Text

“Mixed Multitude” Exodus 12:33-42 and Acts 2:5-11, 41-42

I love our “We Cry Justice” reading today (#25 by Daniel Jones) and the hot take on “mixed multitudes.” I loved the MLK quote it started with too, including, Pharaoh '”kept the slaves fighting among themselves.” This “trick” of having most of the resources in a society “float” to the top while leaving the multitudes fighting for the crumbs is well known, and unfortunately still well used. Take a look at governmental budgets and then the people advocating for various just causes – who accidentally end up fighting each other to prove the imperative nature of their own concern AT THE cost of the others. (Fixable, it turns out, by fixing the regressive tax code so it doesn't magnify inequality.)

Mr. Jones points out that Ancient Egypt was “an empire based on violence and injustice that sacrificed lives to the accumulation of wealth and its paranoia, viewed the murder of children as a fair price for keeping control.”1 I can't decide if I should respond “OUCH” or “PREACH” to that one. He goes on to say that the mixed multitude – the Israelites and those who suffered along with them in the empire – built a new society based on God's laws. “This higher law proclaims the accumulation of individual wealth to be immoral and demands freedom for enslaved people, forgiveness of debts, care for the environment, and the responsibility of everyone to their neighbors.” And THAT's why we call it the Promised Land.

The holiness of this mixed multitude, seeking shared goodness for each other instead of competing with each other and creating community out of shared need is found in Acts 2 as well. We normally only focus on Acts 2 on Pentecost, but it is another example that when God's Spirit is at work, people are bonded together across boundaries that might otherwise seem too impossible to cross.

God seems particularly committed to mixed multitudes.

Now this is funny thing to say right now I think. This week I've watched the incredible power of God's spirit move in the intractable-until-now United Methodist Church and all of a sudden there is hope abundant! And, truthfully, that hope abundant comes BECAUSE of disaffiliation, it comes because we split. It comes because we BROKE bonds.

Part of me - ok, a really large part of me – wants to simply say that those who left identified with the oppressor and oppressed God's beloveds and we are better off without them. But God has said to love our enemies, and I'm pretty sure being that petty isn't appropriate for a preacher... while preaching at least ;)

We who value the wide diversity of God's creation may find it easy to hear about the mixed multitudes and the amazing ways God's work to overturn oppression pulls people together. But I also know that we who value the wide diversity of God's creation sometimes find it really hard to deal with those who... don't.

Right?

It's OK, I know I'm right.

It turns out to be easier to be in a mixed multitude where people agree mixed multitudes are awesome than it is to be in a mixed multitude where there is a diversity of opinions about the value of diversity.

Or, maybe there is a bigger truth here. God's amazing work to overcome oppression and pull people together is REAL. But it is hard to live in community – there are ALWAYS differences. I think often of the story a little later in Acts when the incredibly diverse Body of Christ in its infancy already had issues with food distribution being fairly managed. Humans come into community with differences. There is no community without conflict. There is no community without bias. There is no community in prefect agreement – except maybe those who all defer to a strong-man leader.

The truth is that God binds us together. And, I think sometimes we get to the point when the best choice is to let some bonds go. Because not everything is now as it should be. We know this about marriage itself – there are times when two people have hurt each other enough that the best, most loving way forward, is apart. This week showed very clearly that all the dreams I've ever heard God dreaming for The United Methodist Church are possible – now that we're broken. And, to be fair, I hear from those in the Global Methodist Church that they think all the dreams they ever heard God dreaming are now possible there. The issue has ALWAYS been that we hear God differently.

So I've been thinking about what the moral, Christ-like response is to those with whom we have fundamental-values-level-differences. And I hear the echos of Jesus on the cross, “Father, forgive them for they know not what they do” and I think that's the actual start of it. I hear it in Martin Luther King teaching about the goal of his work being to bring everyone together, not to bring down the oppressor. Let's hear him:

Now there is a final reason I think that Jesus says, “Love your enemies.” It is this: that love has within it a redemptive power. And there is a power there that eventually transforms individuals. That’s why Jesus says, “Love your enemies.” Because if you hate your enemies, you have no way to redeem and to transform your enemies. But if you love your enemies, you will discover that at the very root of love is the power of redemption. You just keep loving people and keep loving them, even though they’re mistreating you. Here’s the person who is a neighbor, and this person is doing something wrong to you and all of that. Just keep being friendly to that person. Keep loving them. Don’t do anything to embarrass them. Just keep loving them, and they can’t stand it too long. Oh, they react in many ways in the beginning. They react with bitterness because they’re mad because you love them like that. They react with guilt feelings, and sometimes they’ll hate you a little more at that transition period, but just keep loving them. And by the power of your love they will break down under the load. That’s love, you see. It is redemptive, and this is why Jesus says love. There’s something about love that builds up and is creative. There is something about hate that tears down and is destructive. “love your enemies.”2

So, dear ones, I'm going to keep on loving the Global Methodist Church, because I deeply believe God asks me to. Further, I believe there are people in that church who need it, and others who will need it. And, apparently, we are supposed to love Christian Nationalists too – even when they misrepresent our tradition. (Pulling no punches today.)

I guess no one every said being a follower of Jesus was easy, huh? But, friends, it is the season of Easter and we are told over and over again that God is Love and Love wins and NOTHING, not even death, can stop God's power of love. So, dear mixed multitude, let's keep on loving on EVERYONE even when they don't seem to know how broad God's love is yet. Let's be accused of being naive with our love. Let's be radical, and a little too broad with it. Let's be like God. Amen

1We Cry Justice #25, page 110.

2https://kinginstitute.stanford.edu/king-papers/documents/loving-your-enemies-sermon-delivered-dexter-avenue-baptist-church

#thinking church#progressive christianity#fumc schenectady#first umc schenectady#umc#schenectady#rev sara e baron#hope#Love Your Enemy#I don't have to apologize for my denomination this week!

0 notes