#SecuredCreditCard

Explore tagged Tumblr posts

Link

#bestsecuredcreditcards2023#capitalonesecuredcreditcard#CreditCard#CreditCards#discoveritsecuredcreditcard#navyfederalsecuredcreditcard#securedcreditcard#securedcreditcards#securedcreditcardsthatgraduate#securedcreditcardstobuildcredit#whataresecuredcreditcards#whatisasecuredcreditcard

0 notes

Text

Secured Credit Cards: Your Secret Weapon to Building Credit! 🤫💳

Hey Tumblr fam, let's talk about something that can be a little confusing, but is actually super helpful: secured credit cards. If you are looking to build credit, or to fix bad credit, then secured credit cards are your secret weapon, and it’s time to find out why.

I know, building credit can seem like a mystery, especially if you are just starting out. And you might have heard all the myths, but not many people actually understand the basics of building credit. That’s why today we are focusing on secured credit cards, and how you can use them to your advantage.

A secured credit card is basically a credit card that requires you to put down a security deposit, and that security deposit becomes the base of your credit limit. It's not a prepaid card; it's an actual credit card that reports your activity to the credit bureaus, which is vital for building credit. So, it’s an actual tool to build credit.

A secured card is a great way to build credit if you have no prior credit history, or if you have a bad credit score. You can use them to build a positive payment history, and to show that you are responsible with your finances. And in the long run, this is all that matters to credit card companies, and other lenders.

It’s important to use them wisely, make small and regular purchases, and also pay off your balance on time every month. You need to be consistent and disciplined. And when you are using them correctly, they are the best way to improve your credit score. Understanding the power of secured credit cards is essential for your overall financial health.

So, what’s the bottom line? If you are just starting out on your credit building journey, or if you are looking for a way to repair your credit, then you should definitely look at the different types of secured credit cards. With responsible use, and consistency you will be able to get to your destination, and finally achieve financial success.

Ready to build your credit with a secured credit card? I've got all the details in our full guide! Click here to read the full article and start taking control of your credit journey today!

#SecuredCreditCards#BuildingCredit#GenZFinance#MoneyTips#CreditScore#PersonalFinance#FinancialLiteracy

0 notes

Text

Secured Credit Card Hack #securedcreditcard #creditboost #creditmatters

MARCEDRIC KIRBY FOUNDER CEO.

MARCEDRIC.KIRBY INC.

THE VALLEY OF THE VAMPIRES

0 notes

Text

Discover the best credit cards with no credit check, perfect for beginners or those with a negative history. Our blog lists fees, positives, and negatives of each card. Read till the end to know more. #NoCreditCheck #SecuredCreditCards

0 notes

Photo

Within The Forex Trading Brokers, There Are Many Account Types Offered To The Client While Deposits Or Withdrawals Should Be Seamless Processes That Are Performed With Speed And Efficiency.

Majority Of The Brokers Accept Credit Cards As Their Authorized Payment Method, Which Also Is Authorized By The Trading Markets Authorities. Best Credit Cards Brokers

#creditcard#capitalonecreditcard#securedcreditcard#citicreditcard#citicard#creditcardforex#creditcardbrokers#creditcardforexbrokers#bestcreditcards#forexfactory#forexexchange#forextradingstrategies#forexcurrency#forextradingevo

0 notes

Text

Within The Forex Trading Brokers, There Are Many Account Types Offered To The Client While Deposits Or Withdrawals Should Be Seamless Processes That Are Performed With Speed And Efficiency.

This Method Allows Transactions With Ease, At Any Time And Place, Delivering A Secure Environment And Performing Operation In A Very Short Time. Majority Of The Brokers Accept Credit Cards As Their Authorized Payment Method, Which Also Is Authorized By The Trading Markets Authorities.

#creditcard#capitalonecreditcard#securedcreditcard#citicreditcard#citicard#creditcardforex#creditcardbrokers#creditcardforexbrokers#bestcreditcards#forextrading#forexfactory#foreignexchangemarket#forexexchange#fxtrading#forexsignals#forextradingstrategies#forexcurrency#forexbrokers#freeforexsignals#malaysiaforexbrokers#malaysiabrokers#malaysia#forexop

0 notes

Video

youtube

If you don't have a good credit score, getting approved for a loan or unsecured credit card may be difficult for you. The best way to start improving your credit score it to use secured credit card.

Also check our reviews of secured credit cards on this page

0 notes

Text

What Is a Secured Credit Card?💳

A secured credit card is like a regular credit card but the main difference is that you’re required to make a deposit against the card’s credit limit. They are a great option for building a credit rating or re-establishing credit after poor credit history.

If you're looking to learn more, click our blog link below! Royal Debit is North America’s leading payment providers and can provide your business with credit card processing in Toronto. If you have any further questions on a secured credit card, you can trust our team for a reliable and trusted answer!😊

🌍 Read More: https://www.royaldebit.com/blog/secured-credit-card/ 📞 Phone: (416) 986-3342 📬 Email: [email protected] 📍 Location: 1595 16th Ave. suite 301, Richmond Hill, ON L4B 3N9

#SecuredCreditCard#PaymentSolutions#PaymentProcessing#RichmondHill#Markham#CreditCardPaymentProcessing#TorontoBusiness#CreditCardMachine#TorontoSmallBusiness#PaymentProcessingSolutions#Toronto#SmallBusinessAdvice#Payments#CreditCardProcessing#DebitMachine#DebitTerminal#Canada

0 notes

Photo

#buildCredit #creditscore #securedCreditCard #studentloandebt #taxdebt #taxes #thematrix #thedebtmatrix #fastcash #paychecktopaycheck #IRSdebt #financecar #bankruptcy #TEDtalk #PMI #mortgageDebt #mortgage #FHAmortgage #subprimemortgage #layoff #overdraftprotection #gapinsurance #paydayloan #creditcarddebt #studentloan #schooldebt #debt #highinterest #freefinancing https://www.instagram.com/whycryovermoney/p/BwFR30ihi9V/?utm_source=ig_tumblr_share&igshid=1qfnzlp5ym0ld

#buildcredit#creditscore#securedcreditcard#studentloandebt#taxdebt#taxes#thematrix#thedebtmatrix#fastcash#paychecktopaycheck#irsdebt#financecar#bankruptcy#tedtalk#pmi#mortgagedebt#mortgage#fhamortgage#subprimemortgage#layoff#overdraftprotection#gapinsurance#paydayloan#creditcarddebt#studentloan#schooldebt#debt#highinterest#freefinancing

0 notes

Photo

We love referrals! Have a friend or family member struggling with bad credit? We can help! Tell to DM/Txt "CREDIT"📲813.412.9464 #referrals #ilovereferrals #changinglives #helpingeveryone #credit #credits #creditos #creditcards #securedcreditcard #creditscore #creditrepairservices #creditrepair #ifixcredit (at Hillsborough County, Florida) https://www.instagram.com/p/Bso5gCOl1p_/?utm_source=ig_tumblr_share&igshid=1s8dgs4rsrvs

#referrals#ilovereferrals#changinglives#helpingeveryone#credit#credits#creditos#creditcards#securedcreditcard#creditscore#creditrepairservices#creditrepair#ifixcredit

0 notes

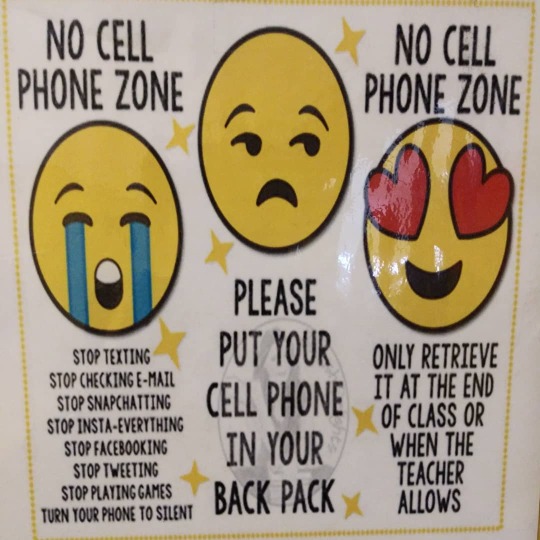

Photo

I'm Just Sayin 🤔 #students #schools #parents #teachers @usedgov If the #internet & #socialmedia were schools, we would have the best schools. If @Snapchat @instagram @Facebook @tiktok_us were subjects, students would be passing all classes. #forusbyus #schoolareforlearning #ucmtsu #wegotthis We The People Matter! Stay Blessed and Be Safe Community, Communities of Color, America, and Global Community 🙏🏿✌🏿 #werebetterthanthis quote by #elijahcummings #preparedpeople are ready for anything! How prepared are you? #tyroneglover #creditrecovery #creditscore #securedcreditcards #aimhigh #voterregistration #yo #yonkers #yonkersny #nineonefour #yesyonkersimtalkingtoyou #pushbackers Share your passion as #leveragecreditrecovery and #leveragecreditclub, kicks off our new season of #thepushback and our new series #thesquare. Subscribe to our #youtube channel. Share, like, follow! Be the game changer your personal economy needs! (at Yonkers, New York) https://www.instagram.com/p/B7rVfi3hMAz/?igshid=18l8b1drgyvub

#students#schools#parents#teachers#internet#socialmedia#forusbyus#schoolareforlearning#ucmtsu#wegotthis#werebetterthanthis#elijahcummings#preparedpeople#tyroneglover#creditrecovery#creditscore#securedcreditcards#aimhigh#voterregistration#yo#yonkers#yonkersny#nineonefour#yesyonkersimtalkingtoyou#pushbackers#leveragecreditrecovery#leveragecreditclub#thepushback#thesquare#youtube

1 note

·

View note

Video

tumblr

Within The Forex Trading Brokers, There Are Many Account Types Offered To The Client While Deposits Or Withdrawals Should Be Seamless Processes That Are Performed With Speed And Efficiency.

Majority Of The Brokers Accept Credit Cards As Their Authorized Payment Method, Which Also Is Authorized By The Trading Markets Authorities. Best Credit Cards Brokers

#creditcard#capitalonecreditcard#securedcreditcard#citicreditcard#citicard#creditcardforex#creditcardbrokers#creditcardforexbrokers#bestcreditcards#forextrading#forexfactory#foreignexchangemarket#forexexchange#fxtrading#forexsignals#forextradingstrategies#malaysiabrokers#malaysiaforexbrokers#malaysia#forextradingevo

0 notes

Text

Within The Forex Trading Brokers, There Are Many Account Types Offered To The Client While Deposits Or Withdrawals Should Be Seamless Processes That Are Performed With Speed And Efficiency.

This Method Allows Transactions With Ease, At Any Time And Place, Delivering A Secure Environment And Performing Operation In A Very Short Time. Majority Of The Brokers Accept Credit Cards As Their Authorized Payment Method, Which Also Is Authorized By The Trading Markets Authorities.

#creditcard#capitalonecreditcard#securedcreditcard#citicreditcard#citicard#creditcardforex#creditcardbrokers#creditcardforexbrokers#bestcreditcards#forextrading#forexfactory#foreignexchangemarket#forexexchange#fxtrading#forexsignals#forextradingstrategies#forexcurrency#forexbrokers#freeforexsignals#malaysiaforexbrokers#malaysiabrokers#malaysia#forexop

0 notes

Text

Excellent Tips for Handling Secured Credit Cards

Let’s discuss today several tips that can help you manage your secured credit card in the most effective way possible. Here are 5 pointers for secured credit cardholders.

Don’t spend more than your credit limit. Always remember that in secured credit card programs, the spending limit will depend entirely on how much security deposit you submit to your card issuer. So, keep that amount in mind. That way, you can determine the balance you can still use on your card. Moreover, it will be easy for you to assess whether or not you’ve reached your limit so that you’ll know when to stop charging transactions, like purchases or bills, on your card account. By doing so, you can avoid paying overdraft charges and other relevant penalties usually charged to consumers who have maxed out their credit cards.

Settle your bills in full and on-time. That way, you can prevent your interest charges from ballooning out and getting way out of hand. To have enough funds to cover your credit payments, we suggest that you set aside money for your credit card bills as soon as you receive your monthly salary. In so doing, you will have just the right amount of cash ready to make a complete and on-time payment. You can also benefit from signing up for automatic payment arrangements with your bank. In such arrangement, the personnel of your bank will withdraw funds directly from your savings or checking account that it will use to pay off your credit card transactions. By relying on such service, you won’t have to worry about missing out or skipping on your monthly dues.

Read more: Excellent Tips for Handling Secured Credit Cards

0 notes

Text

What Is A Secured Credit Card?

A secured credit card is very much like a regular credit card, but with one major difference - with secured cards, you're required to make a deposit against the credit card's limit. To learn more about the benefits of these cards, check out our blog post.

If you're looking for reliable Toronto credit card processing solutions for your business, give Royal Debit a call! We can't wait to speak with you.

🌍 Read More: https://www.royaldebit.com/blog/secured-credit-card/

📬 Email: [email protected]

📞 Phone: (416) 986-3342

📍 Location: 1595 16th Ave. Suite 301, Richmond Hill, ON L4B 3N9

#Toronto#Canada#PaymentProcessingSolutions#CreditCardInformation#CreditCardInfo#CreditCardProcessing#TorontoCreditCardProcessing#CreditCardTips#CreditCardAdvice#FinancialAdvice#PaymentProcessing#Finance#SecuredCreditCard#SecuredCreditCards#CreditCards#CreditCard

0 notes

Text

What are Secured Credit Cards All About?

Are you interested to know the answer to the question raised above? If you are then, this article will surely help you understand secured credit cards better.

How do Secured Cards Work?

As their names imply, secured cards come with a security or collateral requirement, in the form of an initial deposit. Such deposit serves two important functions. First, it serves as a guarantee for the repayment of your future credit card charges. In case you decide to default or skip on your monthly bills, your card issuer can immediately tap on the deposit you have provided to settle your unpaid financial obligations.

Second, the initial cash-out serves as the basis for the credit limit that will be imposed on your card account. Say you were asked to submit $750 as security deposit for your line of credit. This means that you can also use or charge as much as $750 on your secured credit card.

What are some of the common features of secured lines of credit? Apart from the initial deposit requirement, secured card accounts usually come with low interest rates, flexible payment terms, low credit limits and easy-to-prepare application requirements. No wonder, many consumers today are starting to ditch their old credit cards for these affordable and easy to take out card accounts.

Important Reminders for Prospective Cardholders

To score the best deals we suggest that you take the time to shop around and compare what each issuer is offering. Look closely at the rates of interest, security deposit requirements, credit limits, payment terms and options, and the eligibility requirements imposed on various card programs. Then try to compare them with your needs, spending habits and budget. By doing so, you will most likely end up with a line of credit that will definitely work to your advantage.

Stay away from secured credit cards with suspiciously good features. Be firm in turning down offers for secured cards with incredibly high credit limits, extremely low interest rates and no eligibility requirements. After all, these very attractive features are often used by scam artists and fraudsters to rip off card applicants. So to avoid becoming a victim of popular credit card scams you should resolve to steer clear from lines of credit with too-good-to-be-true features.

Take out secured credit cards only from reputable organizations. Look for firms that are not just willing to give you what you want but more importantly companies that have excellent track records in terms of dealing with consumers, in general, and those which are accredited by the federal or state government.

For online card applicants, make it a point to check out the security features of the site or webpage you’re currently viewing, before filling out and submitting online forms. Look for the code https or the padlock icon in the URL bar or the logo of organizations that offer accreditation for online security. By doing so, you can be sure that it is safe to disclose and transmit sensitive information through that sign up page or website.

Review the terms and conditions that will apply to your card program before signing your contract. And in case you have additional queries about the credit card you’re planning to take out then, don’t hesitate to contact the customer service representative or credit card agent of the firm and ask for more information.

0 notes