#Student loan debt elimination scam

Text

Intuit: “Our fraud fights racism”

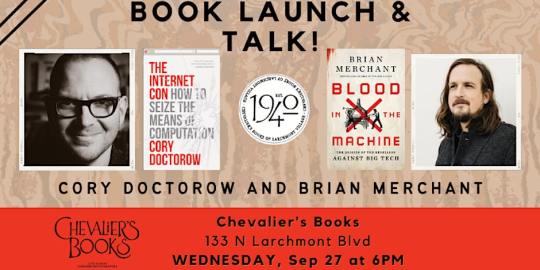

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

You have to understand.

At least at first, I didn’t mean to do it. I had just gotten out of College, a kid with a degree in History and an eye watering amount of debt. I made the mistake of telling the professor I did early 21st century historical reenactments for my summer job and he let me take on a titanic amount of debt for historical realism. I’m not sure who I owe the money to, since we live in a post scarcity society, but I sure worry about repaying it, so I have that going for me. Extra points for realism.

After I graduated - with an ulcer from stress worrying about the debt, another point for realism! - I was bumming around the orbital looking for a way to earn some quick cash and I realized how I could put my degree to use. Everyone has everything provided for them by the government because - after the Unpleasantness - we figured out that was easier and cheaper than giving everyone on the planet a gun.

But that means that everyone has mostly forgotten how to keep an eye out for scams. Who is going to scam you anyway when you all have the same access to cheap and easy housing, food, and Space Cocaine?

People who have mountains of debt due to historical accuracy, that’s who.

I set up shop right outside the exit from Customs on the station. Rubes-er People from all over the Galaxy would come, hellbent on seeing the sights of my planet and before they could hit up the Cøffee Haüs they would find me.

I started small; ran a couple of three card monte tables, but without a partner, convincing people they could win without them actually winning was tough. I hacked a janitorbot into being my assistant and soon enough I would have a crowd watching.

This, while effective was incredibly boring, so I changed to my plan B and just started making fake supplements. For maximum compatibility across all of the galactic species, mine were pure carbon (to absorb toxins you see). This increased who I could sell too without worrying (too much) about inadvertently poisoning anyone.

A few people were sad I moved away from scamming people with cards, but they became my first ‘partners’ in selling my supplement. I had to actually explain how a Ponzi scheme worked though, nobody remembered. I told them about how so long as they found more suckers underneath them, they wouldn’t be left holding the bag and it took off like an oxygen accelerated fire.

There was also an oxygen accelerated fire, but that can’t be traced back to me.

Three weeks later, I was the richest human in the Galaxy. Honesty, I didn’t even know where everyone even got the money, I thought we had eliminated it, but here I am, rich as hell. I feel a little bad about it, but if I admit the whole thing was a ploy to pay off my student loans, I worry that they’ll turn on me.

I still haven’t paid off my loans either. I don’t think I can swing the payments and the payments on my Super Dreadnought. Did you know they’ll build anyone one so long as you put the deposit down?

Anyway, do you want to get in on an incredible deal on the low effort world of supplement sales?

#writing#sci fi writing#jpitha#humans are deathworlders#humans are space oddities#humans are space orcs#humans are space capybaras#humans are space australians

235 notes

·

View notes

Text

latest Student Loan Forgiveness Scams to Avoid 2022 | #giftandtips.com

Student loan consolidation scam, Student loan debt elimination scam, Advance fees scam, Lawsuit scam, Student loan forgiveness scams, student loan and savings company reviews, student loan forgiveness program, student loan forgiveness organizations, student loan forgiveness 2022, national student loan center, student loan support phone call,

Understudy loan pardoning tricks have been an issue…

View On WordPress

#Advance fees scam#are there student loan scams going on#bbb student loan scams#department of education student loan scams#federal student loan scams#ftc student loan scams#great lakes student loan scams#how do student loan scams work#Lawsuit scam#national student loan center#navient student loan scams#nelnet student loan scams#report student loan scams#student loan and savings company reviews#Student loan consolidation scam#Student loan debt elimination scam#student loan forgiveness 2022#student loan forgiveness organizations#student loan forgiveness program#Student loan forgiveness scams#Student Loan Forgiveness Scams 2022#Student Loan Forgiveness Scams phone call#Student Loan Forgiveness Scams reddit#Student Loan Forgiveness Scams voice mail#student loan scams#student loan scams 2021#student loan scams 2022#student loan scams list#student loan scams phone calls#student loan scams us

0 notes

Text

Bits and Pieces - Scammers 7/4/21

Maybe it can’t be said and discussed enough now days. Scammers are out there, and they don’t care about you.

They aren’t contacting you (phone, email, US postal mail, flyers, etc.) because they are concerned about you and your credit or your situation. They aren’t worried about your credit card debt, your car payment, your home mortgage, etc.

You need to really get away from feeling that you are hurting their feelings if you hang up on them, throw away their paper, delete or put their stuff in junk/spam on your computer. You should not respond to messages or dial “0” or do anything except walk away and leave them.

However, if it becomes serious or consistent, what you should do is call the police and notify them. Then follow their directions.

In my emails recently I almost laughed out loud at one of the scams that made it through my Gmail filter.

The first give away that this was wrong was in the subject box. It was the long useless name I had created for Facebook.

There usually be a give away such as this one or misspellings or something out of place. Do not consider the mistake as unintentional. Consider it a warning to eliminate, ignore and destroy.

In the text of the message, the person gave me a name (not his own, I’m sure) and an agent number. There was also a “dedicated eligibility line” to call and a “personal validation code” to use. Most likely this was all created to give the illusion of being official. Do not be fooled.

The purpose of the email to notify me of my “eligibility” for my student loan “stimulus forgiveness.” Ha!!

I paid off my student loan over 50 years ago. It was also a State of Illinois student loan (the first year it was offered) and wouldn’t be part of this stimulus forgiveness program anyway.

After many blank spaces, at the end of the email was a website (most likely false) for removal “from future advertisements.”

Do not respond to a “take me off your list” or a “this doesn’t apply” to me or anything thing else that would give them the idea that you still exist.

You aren’t being rude or creating bad feelings. These people were rude to you in the first place when they falsely contacted you. They are doing this hacking and uninvited intrusion of your mail, time and humanity and do not deserve your sentimentality or consideration.

I created my own problems just opening this email. I have marked it as spam. Unfortunately, this hacker will strike again. I just need to be vigilant in putting these in spam with automatic disposal so that I appear as a non-contact.

Please consider doing the same. This is for your safety and peace of mind.

0 notes

Text

A textbook grift

Last week, I wrote up Marshall Steinbaum's case for forgiving student debt (we're already doing it, but only after it has destroyed debtors' lives).

https://pluralistic.net/2020/11/20/sovkitsch/#student-debt

By counterpoint, Michael Olenick argues that we shouldn't forgive student debt, we should make it easier to discharge it in bankruptcy - that way the predatory lenders get nothing and the bankrupt borrowers aren't stuck with a huge tax bill.

https://www.nakedcapitalism.com/2020/11/michael-olenick-how-biden-could-tackle-the-student-loan-crisis.html

Olenick offers some interesting technical and political notes on this, as well as some zingers (he calls bankruptcy "the Donald Trump special"), but I was struck by a quoted email exchange with Yves Smith about textbook pricing.

Textbooks are thoroughly monopolized, dominated by a handful of publishers who've reinvented themselves as "ed-tech" companies, but the "tech" is largely in service to price gouging.

Textbooks were always expensive, but for many courses (especially introductory ones) this was offset through the robust market in used texts (indeed, I remember an econ prof explaining that the price of textbooks reflected the expectation that many students would buy used).

In the years since I dropped out of university (four universities, two years, no degree, virtually no student debt), textbook publishers have figured out how to keep those high prices while eliminating the used market, extracting ever-larger sums from students.

The method is a combination of convincing profs to produce new editions of texts - even intro texts whose subjects barely change from year to year - and to assign "e-learning" components that require a login (bundled with new books) to read.

Why would profs assign new editions of texts when nothing has changed? Two reasons: first, they get bribed to do so; second, the e-learning resources are revised so they no longer work with old texts.

https://www.vice.com/en/article/pajze9/people-are-finally-fighting-back-against-the-college-textbook-industrys-scam

That's how textbooks have increased in price by 812% (inflation adjusted) since 1972.

In case that seems abstract, Olenick offers a solid example: Paul Krugman's "Economics," a standard introductory text, now in its sixth edition in 15 years.

Olenick: "because, you know, introductory economics for two-year degree students has radically changed since the first edition was published in 2005."

The 6th edition will set you back $395.50.

How about the fifth edition? $126.32 (or $28.95 in paperback). That's new, not used. Why is the fifth marked down by $169.18? Because to use it in a classroom, you have to separately purchase a $115.24 "access code."

This is literally a textbook example a distorted, monopolized market, maintained through grift. It isn't the only reason Americans have $1.7T in student debt, but it's a big part of it.

Image:

Inayaysad

https://commons.wikimedia.org/wiki/File:College_Textbooks.jpg

CC BY

https://creativecommons.org/licenses/by-sa/4.0/deed.en

46 notes

·

View notes

Text

You Should Never Pay an Upfront Fee for Student Loan Debt Relief

Americans owe $1.67 trillion in student loans, and rapacious private companies or outright scam artists are rampant, luring borrowers with offers of debt elimination or reduced payments. If you are asked to directly pay an upfront fee before you see student debt relief, stay clear. It’s a scam.

Read more...

from Finance https://twocents.lifehacker.com/you-should-never-pay-an-upfront-fee-for-student-loan-de-1845370953

via http://www.rssmix.com/

0 notes

Text

You Should Never Pay an Upfront Fee for Student Loan Debt Relief

Americans owe $1.67 trillion in student loans, and rapacious private companies or outright scam artists are rampant, luring borrowers with offers of debt elimination or reduced payments. If you are asked to directly pay an upfront fee before you see student debt relief, stay clear. It’s a scam.

Read more...

from Money https://twocents.lifehacker.com/you-should-never-pay-an-upfront-fee-for-student-loan-de-1845370953

via http://www.rssmix.com/

0 notes

Photo

Coronavirus Stimulus Checks: What To Expect https://ift.tt/33GoLYs

Congress is gearing up to send out stimulus checks to Americans across the country to combat the recession being created by the coronavirus pandemic. With stores, restaurants, and more being closed, and most other Americans forced to work from home, the country is gearing up for a recession or depression that is hasn't seen in almost a century.

With lessons learned from the Depression and Great Recession, one of the biggest ways to stimulate the economy and keep American's financially safe is to simply give them cash to spend - to pay rent, buy food, and take care of their families.

Let's look at the history of stimulus checks, and give you an idea of what to expect, how to prepare, and what you should seriously consider spending your stimulus check on given what we've learned from history.

Note: Currently, the stimulus checks are a proposal. We will update this page with all the information when it passes Congress (which should happen this week).

Quick Navigation

The 2020 Covid-19 Stimulus Checks

Other 2020 Stimulus Programs

Families First Coronavirus Response Act (FFCRA)

Student Loan Relief

History Of Stimulus Checks

How To Get A 2020 Stimulus Check

Best Ways To Use Your Check

Beware Of Scams

2020 Stimulus Check FAQs

The 2020 Covid-19 Stimulus Checks

Right now, the stimulus checks are just a proposal, but here's what they are proposing as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The baseline of the proposal is adults would get $1,200 each and children $500 each. The benefit would start to phase out at a rate of $5 for every additional $100 in income.

The benefit phaseout starts at:

$75,000 in adjusted gross income for singles

$112,500 for heads of household

$150,000 for married couples filing jointly

Completely phase out at $99,000 for singles and $198,000 for couples (with no children)

The current bill as written requires you to have filed a 2019 tax return, and it would send the benefit checks to the address listed on the tax return. See below for updating your information with the IRS.

Note: This may not be a one-time check. There are many proposals to make this a monthly check, but as of now, none of those have gained traction.

Other 2020 Stimulus Programs

Beyond the direct checks to individuals and families, there are a variety of other programs that are providing tax credits and loans to individuals and small businesses.

We will update this section as programs emerge.

Families First Coronavirus Response Act (FFCRA)

The biggest stimulus program right now is the Families First Coronavirus Response Act (FFCRA), which expanded paid leave and sick leave for millions of Americans. It also has tax breaks to help small businesses provide these expanded benefits.

The biggest component of the FFCRA is the emergency paid leave. You can qualify for leave if you meet any of the following six requirements:

You are subject to a federal, state, or local quarantine or isolation order related to COVID-19.

You are quarantined at the direction of a health authority or healthcare provider to prevent spread of COVID-19.

You are experiencing symptoms of COVID-19 and is seeking a diagnosis.

You are caring for another person who is subject to #1 or #2 above.

You are caring for a child or another person due to closure of a school or other facility due to COVID-19.

You are experiencing similar conditions that have been specified by the US Department of Health and Human Services (HHS).

Full-time employees can get up to 80 hours of paid leave, which would be covered by the US Government (so it's not a monetary burden to your employer).

The amount of the benefit is determined by which reasons you qualify for. If you qualify due to reasons #1, #2, or #3, you will receive the greater of: your rate of pay, Federal minimum wage, or your local minimum wage. The maximum benefit is $511 per day, or a total of $5,110.

If you qualify due to reasons #4, #5, or $6, the amount is 2/3's the rate above, with a maximum benefit of $200 per day, or a total of $2,000.

These are other benefits as well, check out this guide for more.

Student Loan Relief

The Department of Education has issued a lot of special options for families with student loan debt during this crisis.

Some of the key highlights include a student loan interest freeze, the ability to defer payments for at least 60 days with no penalty, and more.

We have a full guide to it here: Coronavirus student loan relief programs.

History Of Stimulus Checks

Stimulus checks aren't a new idea. In fact, in the last 20 years, the United States has given out stimulus checks three times. They've been used as a tool to combat major recessions in the United States.

Here are some past examples:

2001: Economic Growth and Tax Relief Reconciliation Act of 2001 provided $300 for single filer taxpayers and $600 for joint filers.

2008: Economic Stimulus Act of 2008 provided $300 to $600 per person, $1,200 for married couples, and $300 per child.

2009: Economic Recovery Payment of 2009 provided $250 for beneficiaries of select retirement programs, including Social Security, Veterans Affairs, and Railroad Retirement.

How To Get A 2020 Stimulus Check

The Department of Treasury will hopefully start sending out checks to qualified households as soon as possible. They typically use the IRS records to send out checks to families.

In past stimulus checks, you were have had to file a previous year's tax return. It appears that may be a part of the plan this year. Current proposals require a 2019 tax year return to have been filed. If you haven't filed your taxes yet, don't delay and get started now.

In 2008, it took two months to start distributing the stimulus checks after the law was signed. President Trump is pushing to have that start much sooner this year.

How Does The IRS or Treasury Know My Address?

Checks will start using information from tax returns. The IRS has an "Update My Information" tool that allows you to provide your updated address to make sure your check isn't delayed.

Here is the tool: IRS Update My Information Tool.

How Will The IRS Send My Money

Direct Deposit is the best way to get your stimulus check because it will be the fastest. The Treasury Department will use your tax return information to process a direct deposit (just like your tax return).

If you need a paper check, it typically adds 2-3 weeks to the process for the Treasury Department to print and mail your check.

Best Ways To Use Your Check

One of the biggest questions I get is how to use your stimulus check to do the most good. This is a tough question because it varies so much from person to person, and family to family.

However, here's an order of operations to consider for the best ways to use your stimulus check.

First - Get A Bank Account

If you don't have your own checking account, you need one now. Yes, you can receive a paper check and use a check-cashing service, but that's a waste of your own money.

Check out this list of the best free checking accounts and set yourself up for success right now. If you've been denied a bank account in the past, here's a list of second-chance checking accounts that will let you open an account.

Essentials

Obviously, if you're struggling, you have to take care of yourself first. Food, housing, medical supplies, children's essentials. Take care of yourself and your family. That's the biggest reason these checks are being issued - so Americans can take care of themselves in this time of crisis.

Eliminate Debt

Chances are this crisis is going to last a substantial amount of time. One of the biggest things that hurts most household budgets is debt. If you have debt, like credit cards or student loans, it could make sense to apply the payment to your debts.

If you have student loans, there are other coronavirus relief programs for student loans, and it might not make sense to put it towards your student loan debt.

Save For The Future

Most of us have upcoming expenses we may not be able to avoid. This could be a tax bill (property taxes or other - and remember the IRS moved the tax deadlines this year), or something else.

Plus, we're going into a big period of uncertainty, and job losses are spiking. You need to protect yourself and your family, and cash is king.

If You Don't Need The Money, Donate It

If you are financially prepared, consider donating your stimulus check to an organization that can use the money. Since fundraisers are basically non-existent right now, and charities everywhere are seeing increased demand, anything you can do will help.

Beware Of Scams

With everything, if money is involved, there is a scammer out there trying to take it from you. We see this every year with tax refunds - those robocalls pretending to be the IRS and getting you to pay them. We're undoubtedly going to see it with the stimulus checks as well.

If anyone calls you about the stimulus checks, it's 100% a scam. The government doesn't call people. They send letters and mail. That's how you'll be contacted.

Second, the government doesn't need your personal details! They have all your information already. If you need to update your information - use the IRS website we provided above.

Finally, you never have to pay anyone anything to receive a check. This is your money, you don't need to pay for it.

2020 Stimulus Check FAQs

Okay, that was a lot of information. Here are some basic FAQs about everything.

How much will my stimulus check be?

The baseline of the proposal is adults would get $1,200 each and children $500 each. The benefit would start to phase out at a rate of $5 for every additional $100 in income.

How quickly will I receive my stimulus check?

Based on history, likely about 2 months after the government passes the law. However, they are working to make it much faster this time.

How does the government know where to send the check?

The government will send it to the address on your tax return. You must have filed a 2019 tax return in order to get a stimulus check.

What if I need to update my information?

The IRS has an "Update My Information" tool where you can submit your updated address and information so that you don't miss anything from the IRS, or miss your stimulus check.

Is this a one-time check or an ongoing check?

Currently, it's set to be a one-time check. However, there are multiple proposals to make it ongoing.

How do I know if I qualify for a stimulus check?

You must file a 2019 tax return, and meet the income requirements of the program. Currently, the checks completely phase out at $99,000 for singles and $198,000 for couples (with no children).

Can I use my check for student loan debt?

Yes, you can, but it might not be the best way to use your check right now given that student loan interest is frozen. You might consider paying off other debts if your essentials are taken care of.

The post Coronavirus Stimulus Checks: What To Expect appeared first on The College Investor.

from The College Investor

Congress is gearing up to send out stimulus checks to Americans across the country to combat the recession being created by the coronavirus pandemic. With stores, restaurants, and more being closed, and most other Americans forced to work from home, the country is gearing up for a recession or depression that is hasn't seen in almost a century.

With lessons learned from the Depression and Great Recession, one of the biggest ways to stimulate the economy and keep American's financially safe is to simply give them cash to spend - to pay rent, buy food, and take care of their families.

Let's look at the history of stimulus checks, and give you an idea of what to expect, how to prepare, and what you should seriously consider spending your stimulus check on given what we've learned from history.

Note: Currently, the stimulus checks are a proposal. We will update this page with all the information when it passes Congress (which should happen this week).

Quick Navigation

The 2020 Covid-19 Stimulus Checks

Other 2020 Stimulus Programs

Families First Coronavirus Response Act (FFCRA)

Student Loan Relief

History Of Stimulus Checks

How To Get A 2020 Stimulus Check

Best Ways To Use Your Check

Beware Of Scams

2020 Stimulus Check FAQs

The 2020 Covid-19 Stimulus Checks

Right now, the stimulus checks are just a proposal, but here's what they are proposing as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The baseline of the proposal is adults would get $1,200 each and children $500 each. The benefit would start to phase out at a rate of $5 for every additional $100 in income.

The benefit phaseout starts at:

$75,000 in adjusted gross income for singles

$112,500 for heads of household

$150,000 for married couples filing jointly

Completely phase out at $99,000 for singles and $198,000 for couples (with no children)

The current bill as written requires you to have filed a 2019 tax return, and it would send the benefit checks to the address listed on the tax return. See below for updating your information with the IRS.

Note: This may not be a one-time check. There are many proposals to make this a monthly check, but as of now, none of those have gained traction.

Other 2020 Stimulus Programs

Beyond the direct checks to individuals and families, there are a variety of other programs that are providing tax credits and loans to individuals and small businesses.

We will update this section as programs emerge.

Families First Coronavirus Response Act (FFCRA)

The biggest stimulus program right now is the Families First Coronavirus Response Act (FFCRA), which expanded paid leave and sick leave for millions of Americans. It also has tax breaks to help small businesses provide these expanded benefits.

The biggest component of the FFCRA is the emergency paid leave. You can qualify for leave if you meet any of the following six requirements:

You are subject to a federal, state, or local quarantine or isolation order related to COVID-19.

You are quarantined at the direction of a health authority or healthcare provider to prevent spread of COVID-19.

You are experiencing symptoms of COVID-19 and is seeking a diagnosis.

You are caring for another person who is subject to #1 or #2 above.

You are caring for a child or another person due to closure of a school or other facility due to COVID-19.

You are experiencing similar conditions that have been specified by the US Department of Health and Human Services (HHS).

Full-time employees can get up to 80 hours of paid leave, which would be covered by the US Government (so it's not a monetary burden to your employer).

The amount of the benefit is determined by which reasons you qualify for. If you qualify due to reasons #1, #2, or #3, you will receive the greater of: your rate of pay, Federal minimum wage, or your local minimum wage. The maximum benefit is $511 per day, or a total of $5,110.

If you qualify due to reasons #4, #5, or $6, the amount is 2/3's the rate above, with a maximum benefit of $200 per day, or a total of $2,000.

These are other benefits as well, check out this guide for more.

Student Loan Relief

The Department of Education has issued a lot of special options for families with student loan debt during this crisis.

Some of the key highlights include a student loan interest freeze, the ability to defer payments for at least 60 days with no penalty, and more.

We have a full guide to it here: Coronavirus student loan relief programs.

History Of Stimulus Checks

Stimulus checks aren't a new idea. In fact, in the last 20 years, the United States has given out stimulus checks three times. They've been used as a tool to combat major recessions in the United States.

Here are some past examples:

2001: Economic Growth and Tax Relief Reconciliation Act of 2001 provided $300 for single filer taxpayers and $600 for joint filers.

2008: Economic Stimulus Act of 2008 provided $300 to $600 per person, $1,200 for married couples, and $300 per child.

2009: Economic Recovery Payment of 2009 provided $250 for beneficiaries of select retirement programs, including Social Security, Veterans Affairs, and Railroad Retirement.

How To Get A 2020 Stimulus Check

The Department of Treasury will hopefully start sending out checks to qualified households as soon as possible. They typically use the IRS records to send out checks to families.

In past stimulus checks, you were have had to file a previous year's tax return. It appears that may be a part of the plan this year. Current proposals require a 2019 tax year return to have been filed. If you haven't filed your taxes yet, don't delay and get started now.

In 2008, it took two months to start distributing the stimulus checks after the law was signed. President Trump is pushing to have that start much sooner this year.

How Does The IRS or Treasury Know My Address?

Checks will start using information from tax returns. The IRS has an "Update My Information" tool that allows you to provide your updated address to make sure your check isn't delayed.

Here is the tool: IRS Update My Information Tool.

How Will The IRS Send My Money

Direct Deposit is the best way to get your stimulus check because it will be the fastest. The Treasury Department will use your tax return information to process a direct deposit (just like your tax return).

If you need a paper check, it typically adds 2-3 weeks to the process for the Treasury Department to print and mail your check.

Best Ways To Use Your Check

One of the biggest questions I get is how to use your stimulus check to do the most good. This is a tough question because it varies so much from person to person, and family to family.

However, here's an order of operations to consider for the best ways to use your stimulus check.

First - Get A Bank Account

If you don't have your own checking account, you need one now. Yes, you can receive a paper check and use a check-cashing service, but that's a waste of your own money.

Check out this list of the best free checking accounts and set yourself up for success right now. If you've been denied a bank account in the past, here's a list of second-chance checking accounts that will let you open an account.

Essentials

Obviously, if you're struggling, you have to take care of yourself first. Food, housing, medical supplies, children's essentials. Take care of yourself and your family. That's the biggest reason these checks are being issued - so Americans can take care of themselves in this time of crisis.

Eliminate Debt

Chances are this crisis is going to last a substantial amount of time. One of the biggest things that hurts most household budgets is debt. If you have debt, like credit cards or student loans, it could make sense to apply the payment to your debts.

If you have student loans, there are other coronavirus relief programs for student loans, and it might not make sense to put it towards your student loan debt.

Save For The Future

Most of us have upcoming expenses we may not be able to avoid. This could be a tax bill (property taxes or other - and remember the IRS moved the tax deadlines this year), or something else.

Plus, we're going into a big period of uncertainty, and job losses are spiking. You need to protect yourself and your family, and cash is king.

If You Don't Need The Money, Donate It

If you are financially prepared, consider donating your stimulus check to an organization that can use the money. Since fundraisers are basically non-existent right now, and charities everywhere are seeing increased demand, anything you can do will help.

Beware Of Scams

With everything, if money is involved, there is a scammer out there trying to take it from you. We see this every year with tax refunds - those robocalls pretending to be the IRS and getting you to pay them. We're undoubtedly going to see it with the stimulus checks as well.

If anyone calls you about the stimulus checks, it's 100% a scam. The government doesn't call people. They send letters and mail. That's how you'll be contacted.

Second, the government doesn't need your personal details! They have all your information already. If you need to update your information - use the IRS website we provided above.

Finally, you never have to pay anyone anything to receive a check. This is your money, you don't need to pay for it.

2020 Stimulus Check FAQs

Okay, that was a lot of information. Here are some basic FAQs about everything.

How much will my stimulus check be?

The baseline of the proposal is adults would get $1,200 each and children $500 each. The benefit would start to phase out at a rate of $5 for every additional $100 in income.

How quickly will I receive my stimulus check?

Based on history, likely about 2 months after the government passes the law. However, they are working to make it much faster this time.

How does the government know where to send the check?

The government will send it to the address on your tax return. You must have filed a 2019 tax return in order to get a stimulus check.

What if I need to update my information?

The IRS has an "Update My Information" tool where you can submit your updated address and information so that you don't miss anything from the IRS, or miss your stimulus check.

Is this a one-time check or an ongoing check?

Currently, it's set to be a one-time check. However, there are multiple proposals to make it ongoing.

How do I know if I qualify for a stimulus check?

You must file a 2019 tax return, and meet the income requirements of the program. Currently, the checks completely phase out at $99,000 for singles and $198,000 for couples (with no children).

Can I use my check for student loan debt?

Yes, you can, but it might not be the best way to use your check right now given that student loan interest is frozen. You might consider paying off other debts if your essentials are taken care of.

The post Coronavirus Stimulus Checks: What To Expect appeared first on The College Investor.

https://ift.tt/2SHdpOY March 23, 2020 at 11:11PM https://ift.tt/33DseqS

0 notes

Text

The Chattel Report

New Post has been published on https://autotraffixpro.app/allenmendezsr/the-chattel-report/

The Chattel Report

Buy Now

The Chattel Report

12 WEEKS TO FREEDOMWhat this information represents is how one man was able to ditch his job, and live a life of pure freedom – and to not only live but thrive, by buying and selling personal property, also known as chattel.

Wouldn’t you like to do the same too? To find out how… READ ON!

COULD THIS BE THE PERFECT BUSINESS FOR YOU?

Small investment, start with only 100 bucks, which means:

NO loans from banks or investors.

NO borrowing from relatives.

NO hassles.

No overhead. Work at home.

No equipment to buy or lease.

No office or store to go to.

NO ROAD RAGE in rush hour traffic.

No LATCH KEY kids in your house.

REALISTIC AND DOABLE.

NO skills. No special talents. NO education required.

NO BOSS. Hey let’s repeat this one: NO BOSS!

NO customers, clients or pain in the neck EMPLOYEES.

Unlimited Potential.

PRIVATE– NO one even needs to know you do it.

And it is so SIMPLE, even my 11 year old does it.

DOES WHAT?

Buying and selling of CHATTEL. Personal property. It is a MULTI BILLION dollar industry

that is available to everyone. Many have learned how to do it and have made a great living – with no boss! You could do it part-time or full-time – whatever fits your lifestyle!

Any extra cash be used for anything a person wants to do. For example…

Pay off ALL the bills, and live totally debt free.

Start a DREAM BUSINESS…

Build a dream CASTLE. Become the KING or QUEEN of the world – Your world that is.

Take a VACATION anywhere in the world!

Here’s a FACT. Living your dreams is often dependent on how much MONEY you earn. And that is why you

may be looking into money making opportunities. That’s how you came to this site, right?

Maybe you are tired of not making enough money to fulfill all of your dreams.

Perhaps you have a JERK for a boss. Or you have a long drive on smog covered

expressways full of angry people ready to shoot you at the push of a break pedal.

Whatever the reason, there is a good chance that you are NOT making enough MONEY to do

what you really want to. But of course, you may not even know what you want to do.

Here is what I believe to be a truth. If you had ENOUGH MONEY, to take the daily

pressures off, then you could spend some TIME to find out what would really make you

happy.

But as my old friend Joe Karbo used to say:

“Most people are too

busy earning a living to make any money.”

And it was Joe that taught me about the “world’s most exciting business” the

DIRECT RESPONSE BUSINESS. Some call it Mail Order. Or Remote Direct Marketing. And I have

been involved in this business, it seems, forever.

But it was ALSO Joe who taught me about CHATTEL. And how buying and selling of chattel

could get me the START-UP capital for any type of business. At the time I was a student at

Golden West Community College in Huntington Beach, California. I think I was taking

Surfing 101 as I remember it. Mostly just hanging out. And Joe was at Sunset Beach when I

first ‘bumped’ into him, literally. Well, anyhow, that story is not important.

Here’s What’s Important…

Joe told me about how he made money BUYING & SELLING surplus boxes after he got

out of the Service. (We were kindered spirits, he was a Pharmacists Mate, I was a

Commissaryman).

And that is the money he used to buy a brand new car (with CASH), moved

into a handsome apartment, and put over $10,000 in the bank, all through BUYING &

SELLING.

Joe also BOUGHT a boat (which is CHATTEL) for a fraction of what the owner had paid.

And when Joe sold that boat, he made a very substantial PROFIT.

Joe Karbo is considered by many to be a marketing genius. And I agree with that. What

most people don’t know about Joe, he was “accessible” and helpful to people and

he gave this young college student more than the time of day. He gave me a way to make

money, anywhere, anytime I needed to.

Are you too busy earning a living that you don’t have the time to make any money?

Let me introduce you to what I affectionately call Joe’s OTHER direct

response business: the BUYING & SELLING of CHATTEL. And as I mentioned, it is so

simple my 11 year old does it.

You probably DO IT too. Or have. Have you EVER bought anything from some other person?

At a garage sale? Or yard sale? Or swap meet or flea market? Or from the classified

section in the newspaper?

Almost EVERYONE has bought and sold some of their PERSONAL PROPERTY at one time or

another.

But have you ever considered it as a way to MAKE MONEY?

A way to: RAISE INSTANT CASH?

Well I have. After one of the greatest marketing minds the world has ever known OPENED

MY EYES to buying and selling. And if was good enough for Joe Karbo, friends, it is good

enough for me.

Now I also, like Joe did, develop products and do Direct Response Marketing. That is

what I’m doing right now. I’m trying to sell you a product that I have created, just like

Joe taught me.

I want to sell my special report to YOU, directly. And I’m adding an element I learned

from one of my other mentors, Benjamin D. Suarez. I’m doing it REMOTELY.

Ben Suarez owns a debt free 100 Million dollar international direct response company.

He employs nearly 1000 people here in Northeast Ohio. And Ben personally recruited

me from a seminar audience to come and work for him. Based upon what I had learned from

Joe Karbo, and Melvin Powers and a few other “mentors”.

And although I did take a position with Ben’s company, (he made an offer I couldn’t

refuse), I CONTINUED to work my little operation of BUYING & SELLING of CHATTEL. And

made more in one fifth of the time than I did working for someone else.

It’s Time To Reveal My Secrets!

So I thought it was time to share my secrets with those of you that might be ready to

get out of the rat race, and into the CHIPS. ARE YOU READY?

BUT FIRST, let me get this off my chest. CHATTEL may NOT be the way for you to make

money on a PERMANENT basis. It takes time and effort. I personally don’t believe in FREE

lunches. I don’t like people that sit around their kitchen table in their underwear and

tell people how they can “get rich” doing practically nothing. And then have the

gall to sell you a 500.00 “course” in doing what they did. This really peeves

me.

But, WHATEVER! I mention this because I’m not going to sell you a course. I will

however sell you a brief report that I put together, with the help of my teenagers,

based on what I KNOW and DO. A report on CHATTEL. And how buying and selling chattel can

make you money. OH, I am going to be making some money from selling you this report. Do

you mind? I hope not, after all YOU are going to learn how to make money.

But don’t you judge information by volurme or weight. If you want lots of pages, I’ll

send you a phonebook? OK? This report is around 60 pages. It contains everything you need

to get started. REAL LIFE information like:

The BREAD & BUTTER of chattel.

MY personal areas I avoid. (You’ll be surprised).

How to build NETWORKS of cash laden buyers.

The PSYCHOLOGY behind this billion dollar industry.

You get the information you really NEED to get started. In fact, you will be doing

exercises within the first hour that teach you how to find UNDERVALUED chattel, and WHERE

you should sell it.

And even if you don’t do it on a REGULAR basis, it still can give you ALL THE CASH you

need to start a business you really want to do. Perhaps a REMOTE DIRECT RESPONSE BUSINESS.

(Hey maybe I can help you with that one also, AFTER you have raised some money, because in

“mail order” it takes money to make money, and I don’t care what anyone tells

you to the contrary).

So, PLEASE don’t BUY THIS report, if you are not seriously interested in doing

something about your current financial situation. This is NOT a magic wand that eliminates

your problems. But it CAN help you make money.

I have written this report with the average person in mind.

Because I consider myself to be VERY average and ordinary.

So this little money maker:

Does not take BRAINS. Hey I was 760 in my high school class. Out of only 900+ people.

I’m a long way from brainy. (Although I do have some pretty good common sense.)

Requires NO education. Did I mention I went to college mostly to meet the ladies?

Nothing wrong with that is there?

Can be started for 100 dollars. I think most AVERAGE people like myself can come up with

100 bucks to get started.

Builds step-by-step on the profits you make from the previous TRANSACTION.

See, I designed this report for those people that have been burned. Or scammed. Or had

their dreams stolen by the unscrupulous. Or had their hard earned money taken by some fast

talking swindler. And FRIENDS, there are plenty of them on the internet.

I (and my teenagers) put this report together so that anyone with the ability to read

can understand it.

I hold you by the hand, and teach you how to crawl. How to invest that 100 bucks, so

that you get a SUBSTANTIAL return on your investment.

I encourage YOU to go as slow OR AS FAST AS YOU DESIRE. I’m not about to limit anyone.

Want to go faster, skip ahead a few weeks. I set up the GROW-PLAN to have you do ONE

transaction a week for 12 weeks. But, feel free to do it at your own speed and comfort. Just keep going, and you’ll make it!

If you have never done anything like this before, then I teach you to CRAWL. Then

in week 3 to TODDLE. Then in week 8 to walk. And in week 12 you can RUN AT BREAKNECK

SPEED, if you so desire. Run all the way to the bank.

I call this THE G-PLAN. G stands for GROW. The grow as you go plan.

My teenager calls it the 12 STEP PLAN. 12 weekly, easy to follow steps, buying and

selling. And re-investing your profits each week, until you reach YOUR GOALS.

And I say your goals, because maybe $1.000.00 a week from some part time effort does

nothing for you. So set YOUR GOALS higher. Make as much as you want, or take the money you

make from THE PLAN and invest it in something else. Hey it is YOUR LIFE. DO AS YOU PLEASE.

Now to receive this special report on CHATTEL, simply click on the link below. It costs

just $47. It’s a digital download, so shipping is free!

Keep the report for 60 days. If you don’t make money, or it is not for you. Simply

let my friend Dien Rice know, and he’ll give you a full refund.

And for those of you that do not know me, if this is our first encounter, and you are

concerned about the fly-by-nighters, I don’t blame you, there are plenty of people to

worry about taking your money in this world. PLENTY. But I’m not one of them.

Lived in Cuyahoga Falls since 1960. Graduated ’68. (Yea 760th in my class). After the

service, and travelling and going to school in CA, I have chosen to live here today (hey

maybe I am a little crazy?). I’m not going anywhere except on a few vacations every year.

You can find me at the GOLF COURSE or the Natatorium or down at the new family aquatic

center floating in an inner tube around the lazy river, gleefully splashing my kids.

If that does not ease your mind a little, then please don’t order the report. And don’t

ask for details about my business or my private life. You won’t get them. So there. Hope

you’re not offended. Hey, I trust YOU enough to be honest with me about the report. OK?

Just Like Joe Karbo said to me many years ago; “TRY IT. AND JUDGE FOR

YOURSELF.”

If you have questions, e-mail me via my buddy Dien at [email protected]. We talk

often, he’ll let me know of any questions he can’t handle.

NO QUESTIONS? Then go ahead and click on the order link! You’re only a few short steps

away from a lifetime of FREEDOM.

Thanks for your time and attention.

Get THE CHATTEL REPORT – 12 WEEKS TO FREEDOM here…

Gordon (Mr. CHATTEL) Alexander

P.S. The price is 47 dollars U.S. You can download it immediately (it’s in PDF format), so there’s no shipping charge!

I reserve the right to remove this offer at any time. And if you DO know me, then you

know I will.

I guarantee you’ll make moolah – or else you can use the no conditions 60-day money back guarantee.

P.P.S. My buddy Dien Rice bought one of my original reports – and he’s been

successfully “chatteling” for years now. I’ve asked him to add a few pages at

the end of the report on how to do it – quickly and easily – using the internet. With this

“twist,” the profits are now easier to come by than ever before!

P.P.P.S. There’s also a special new section about how one of the world’s richest men –

an American multi-BILLIONAIRE – got started, just by doing this. You’ll find out who he is – and how he did it! What are you waiting for?

Get it Now

Contacting Dien Rice and the Chattel Report.

Email: [email protected].

Telephone: +61 4 1955 0447.

Address: P.O. Box 1323, Carlton, VIC 3053, Australia.

Copyright © Gordon Alexander and Dien Rice

0 notes

Text

Create a Budget for 2018 and Stick to It!

(Editor’s note: This article is published from The Council of Better Business Bureaus. Although it is written for consumers and individuals, it is also applicable to business. Better Business Bureau serving Central California and Inland Empire Counties contributed to this article.)

According to Principal Financial, 80 percent of Americans are making money-related resolutions that can end up changing their lives for the better.

Save more each month (40 percent), pay off credit card debt (32 percent), reduce spending (31 percent), save more for retirement (27 percent) and building an emergency fund (21 percent) round out the top five financial New Year’s resolutions for 2018.

When it comes to generations, 18 percent of millennial employees — higher than any other generation — are intending to pay off their student loan debt as a New Year’s resolution.

Of the top financial blunders of 2017, not saving enough (17 percent), accumulated credit card debt (11 percent) and taking on more debt (10 percent) rounded out the top three.

If you are looking to create a budget or get out of debt in the new year, BBB has tips and tools to help you get on the right track to a better financial future:

•Calculate your income. You can’t properly set a financial resolution unless you know what you’re working with. Calculate your monthly net income, which is after taxes, so you can set a clear budget with exactly what you are bringing home.

•Track your spending. Whether you prefer an app on your phone, computer software, or simply a notebook to jot down your expenses, keeping track is critical. It helps you see where you are actually spending your money, rather than where you think you are.

•Categorize your spending. Create categories based on necessities (housing, utilities, food, transportation) and luxuries (entertainment, dining out, travel). If you have credit card balances, student loans, car payments or other debt, make “debt reduction” one of your necessary categories.

•Set up a budget. Once you have an idea where you are spending money, you can set up a realistic budget. There are free online tools to help you, so there is no need to spend a lot of money. Be cautious of scams, however, and never share personal identifying information (PII) unless you are sure of the site’s legitimacy.

•Pay down debt. One method is to pay off the credit account or loan with the highest interest rate first (the “ladder method”). Another is to pay off the smallest balance first so you feel a greater sense of accomplishment (the “snowball method”). Use whichever methods works best for you. The important thing is that you are doing it. Also, call your credit card company and ask if they will lower your interest rate. Some lenders will agree just to keep you from transferring your debt to another lender with better terms. If you shave even a few percentage points off of your rate, it can save you thousands and help pay down your balances faster.

•Pay bills on time. Consider online bill-paying that eliminates writing checks, buying stamps, etc. Automatic payments can be scheduled ahead of time and can help you avoid late fees and penalties for missed payments.

•Save for the big things. Big purchases, such as vacation or holidays, can easily blow your budget. Avoid going into debt for these expenditures by saving up ahead of time and only spending what you are able to save. Many banks and credit unions offer savings clubs that might help.

•Save for emergencies. Emergencies – car or home repair, unexpected medical expenses, job loss – can blow your budget. Financial experts suggest an emergency fund of 3-6 months’ living expenses. If that is too ambitious, start smaller and build up.

•Contribute to your retirement. Make sure you are contributing enough to your 401k plan to get the full matching contribution from your employer. If you get a raise at your job, try and put that extra money aside into your retirement account. You were able to survive on that income for this long, so you won’t miss that extra cash and your retirement account will greatly benefit.

•Keep track of your credit score. Credit scores are used by lenders to make decisions about whether or not to offer you credit, and what those terms (interest or down payment) will be. Your credit score is a decision-making tool that lenders use to help them anticipate how likely you are to repay your loan on time.

from boston condos ford realtor http://bostonrealestatetimes.com/create-a-budget-for-2018-and-stick-to-it/

0 notes

Text

Tell Senate Democrats: Protect our consumer protection agency from Trump

https://act.credoaction.com/sign/trump_cfpb?t=1&akid=21886.10671767.XsyidM

Trump and Republicans in Congress have prepared a plan to gut Sen. Elizabeth Warren’s consumer protection agency – and corporate Democrats are already meeting with bankers to help them do it.

A number of Wall-Street-friendly Senate Democrats recently met with bank lobbyists about sabotaging the Consumer Finance Protection Bureau (CFPB), according to news reports.1 The meetings took place even as news broke of a detailed Republican plan to follow-up on Trump’s promises to erase rules on Wall Street and undermine the CFPB.2

Since it was created in 2011, the CFPB has returned roughly $11.8 billion to 29 million consumers. That’s an average of $407 for the equivalent of 9 percent of the U.S. population.3 Yet, corporate Democrats are now teaming up with Trump to tear it to shreds. We can’t let that happen.

Tell Senate Democrats: Protect our consumer protection agency from Trump.

Sen. Heidi Heitkamp’s office has admitted to meeting with bank lobbyists about the consumer protection agency. Sens. Jon Tester and Joe Manchin refused to comment. Manchin is a member of the Senate Democratic leadership, which makes his possible support for undermining one of the Democratic party’s greatest modern accomplishments absolutely unforgivable. One Democrat, Sen. Tom Carper, has gone as far as to publicly declare that he is interested in helping Republicans sabotage the CFPB by putting a commission in charge of it.4

Trump Republicans are trying to replace the CFPB’s strong director with a commission that they could fill with right-wing hacks or leave empty to hamstring the agency completely. The Trump administration has even pondered firing CFPB Director Richard Cordray, even though his term does not end for years. Firing Cordray without due cause might be grounds for a lawsuit – and, along with attacks on the CFPB, prove that Trump Republicans do not care about draining the swamp, only protecting their Wall Street pals.5

In just a few short years, the CFPB has reined in abuses by debt collectors, taken on for-profit colleges, protected home-buyers from unscrupulous lenders, investigated predatory private student loan companies, insisted on mortgage safeguards, recouped millions for military families who were overcharged or lost homes to foreclosure, unearthed the unethical practices of student debt collectors and shed light on dozens of predatory lending practices and consumer scams. And it only came into existence in 2011!6There should be no question about whether Senate Democrats will mount a fierce and unanimous resistance to protect the agency that protects all of us.

Tell Senate Democrats: Protect our consumer protection agency from Trump.

The Republican attack plan mirrors past attempts to sabotage the CFPB. They want to defund it, eliminate a fund that the CFPB uses to reimburse victims of fraud and let other regulators that are friendlier to lenders overrule the agency. They want to place limits on what kind of data CFPB can collect, because too many people were sharing such heartbreaking stories of abuse and fraud. They want to do all that before taking out the agency’s leadership.7

We know that Sen. Warren will fight fiercely for her brainchild. But many other Senate Democrats are far more cozy with big banks – and even eager to compromise with an authoritarian bigot who secured power without popular support. If Democrats stand united, they will protect millions of everyday Americans – and draw a sharp contrast that will show which party is willing to fight for the middle class. If Democrats refuse to fight, they will do untold damage to people and party.

Tell Senate Democrats: Protect our consumer protection agency from Trump.

Thank you for your activism.

Ryan Rainey, “Bankers Meet With Democrats to Push for Bipartisan CFPB Commission,” Morning Consult, Feb. 7, 2017.

Renae Merle, “GOP preparing plan to gut Consumer Finance Protection Bureau, roll back Wall Street regulations,” The Washington Post, Feb. 9, 2017.

Lucinda Shen, “Donald Trump Is Targeting an Agency That Has Recovered $11.8 Billion for Consumers,” Fortune, Jan. 27, 2017.

Rainey, “Bankers Meet With Democrats to Push for Bipartisan CFPB Commission.”

Lorraine Woellert and Josh Dawsey, “Trump's allies building case to oust consumer protection head,” Politico, Feb. 6, 2017.

Erika Eichelberger, “10 Things Elizabeth Warren's Consumer Protection Agency Has Done for You,” Mother Jones, Mar. 14, 2014.

Merle, “GOP preparing plan to gut Consumer Finance Protection Bureau, roll back Wall Street regulations.”

#USA Politics#Politics#US Politics#American politics#Boost#boosting#signal boost#signal boosting#Petition#Activism

0 notes

Text

What Is A Hardship Loan Modification?

Some types of modification are better than others, and your lender might not offer all of them, although it might have additional options.

• Principal reduction: Your lender can eliminate a portion of your debt, allowing you to repay less than you originally borrowed. It will recalculate your monthly payments based on this decreased balance, so they should be smaller. Lenders are typically reluctant to reduce the principal on loans, however. They’re more eager to change other features which can result in more of a profit for them—not a loss. If you’re fortunate enough to get approved for a principal reduction, discuss the implications with a tax advisor before moving forward because you might find that owe taxes on the forgiven debt. This type of modification is usually the most difficult to qualify for.

youtube

• Lower interest rate: Your lender can also reduce your interest rates, which will reduce your required monthly payments. Sometimes these rate reductions are temporary, however, so read through the details carefully and prepare yourself for the day when your payments might increase again.

• Extended term: You’ll have more years to repay your debt with a longer-term loan, and this, too, will result in lower monthly payments. This option is commonly referred to as “re-amortization.” But longer repayment periods usually result in higher interest costs overall because you’re paying interest across more months. You could end up paying more for your loan than you were originally going to pay.

• Convert to a fixed rate: You can prevent problems by switching to a fixed-rate loan if your adjustable-rate mortgage is threatening to become unaffordable.

• Postpone payments: You might be able to skip a few loan payments. This can be a good solution if you’re between jobs but you know you have a paycheck out there on the horizon somewhere, or if you have surprise medical expenses that will be paid off eventually. This type of modification is often referred to as a “forbearance agreement.” You’ll have to make up those missed payments at some point, however. Your lender will add them to the end of your loan so it will take a few extra months to pay off the debt.

youtube

Government Loan Modification Programs

Depending on the type of loan you have, it might be easier to qualify for a loan modification. Government programs like FHA loans, VA loans, and USDA loans offer relief, and some federal and state agencies can also help. Speak with your loan servicer or a HUD-approved counselor for details. The federal government offered the Home Affordable Modification Program (HAMP) beginning in 2009, but that expired on Dec. 31, 2016. The Home Affordable Refinance Program (HARP) expired two years later at the end of 2018. But HARP has been replaced by Freddie Mac’s Enhanced Relief Refinance Program and by Fannie Mae’s High Loan-to-Value Refinance Option, so these might be a good place to start for assistance.

Why Lenders Modify Loans

Modification is an alternative to foreclosure or a short sale. It’s easier for homeowners and it tends to be less expensive for lenders than other legal options. You get to stay in your home, and your credit suffers less from modification than it would after a foreclosure. Otherwise, your lender has several unattractive options when and if you stop making mortgage payments and it must foreclose or approve a short sale. It can:

• Attempt to collect the money you owe through wage garnishment, bank levies, or collection agencies

• Write the loan off as a loss

• Lose the ability to recover funds if you declare bankruptcy

youtube

How to Get a Loan Modification

Start with a phone call or online inquiry, and let your lender know about your financial situation. Just be honest and explain why it’s hard for you to make your mortgage payments right now. Lenders will require an application and details about your finances to evaluate your request, and some require that you also be delinquent with your mortgage payments, usually by 60 days. Be prepared to provide certain information:

• Income: How much you earn and where it comes from

• Expenses: How much you spend each month, and how much goes toward different categories like housing, food, and transportation

• Documents: Proof of your financial situation, including pay stubs, bank statements, tax returns, loan statements, and other important agreements

• A hardship letter: Explain what happened that affects you making your current mortgage payments, and how you hope to or have rectified the situation. Your other documentation should support this information.

• IRS Form 4506-T: Allows the lender to access your tax information from the Internal Revenue Service if you can’t or don’t supply it yourself.

The application process can take several hours. You’ll have to fill out forms, gather information, and submit everything in the format your lender requires. Your application might be pushed aside or worse, rejected if something your lender asked for is missing or outdated, such as a tax return that’s three years old. It might be several weeks before your lender gives you an answer, and it can take even longer to actually change your loan when and if you get approved. Keep in frequent contact with your lender during this time. It might have questions and just hasn’t gotten around to calling you yet. It’s usually best to do what your bank tells you to do during this time, if at all possible. For example, you might be instructed to continue making payments. Doing so could help you qualify for modification. In fact, this is a requirement for approval with some lenders. Lenders have different criteria for approving modification requests, so there’s no way to know if you’ll qualify. The only way to find out is to ask.

youtube

Mortgage Modification Scams

Unfortunately, homeowners in distress attract con artists. Beware of promises that sound too good to be true. It’s best to work directly with your lender to be on the safe side. Some organizations will promise to help you get approved for a loan modification, but these services come at a steep price and you can easily do everything yourself. They typically charge you, sometimes exorbitantly, to do nothing more than collect documents from you and submit them to your lender on your behalf. In some states, they’re not legally permitted to charge a fee in advance to negotiate with your lender, and in other states, they’re not allowed to negotiate for you regardless of when you pay them. Of course, don’t count on them telling you this.

Refinance the Loan Instead

Modification is typically an option for borrowers who are unable to refinance, but it might be possible to replace your existing loan with a brand new one. A new loan might have a lower interest rate and a longer repayment period, so the result would be the same you’d have lower payments going forward. You’ll probably have to pay closing costs on the new loan, however, and you’ll also need decent credit.

Consider Filing For Bankruptcy Protection