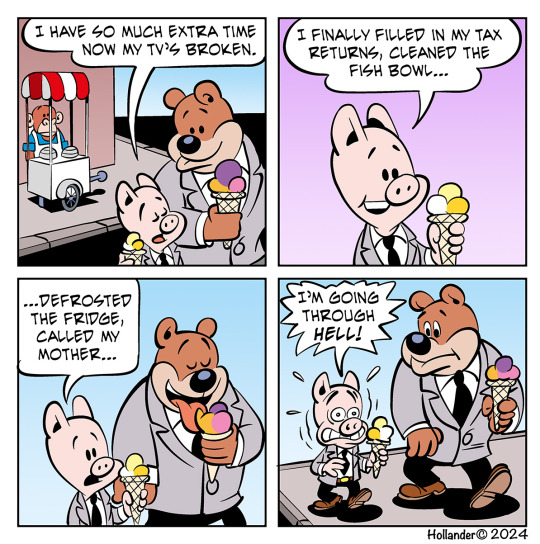

#TaxReturns

Text

Idling

#comic#comics#webcomic#webcomics#webcomicupdate#comicstrip#funnycomic#joke#funny#comicartwork#cartoonist#artwork#idle#taxreturns#taxes

2 notes

·

View notes

Photo

🤯 Feeling overwhelmed by accounting and tax jargon?

We're here to help you understand your business's accounting obligations without the confusion! Our expert team handles bookkeeping, financial statements, cash flow forecasting, budgets, and financial planning. 🌟

💼 Not only do we simplify finances, but we also liaise with external parties crucial for your business growth. Save time and gain clarity on your company’s financial health with our services.

For more details : https://eliteaccounting.co.nz/services/accounting-and-tax/

2 notes

·

View notes

Text

Pumpkin Tax Co.: Leading the Way in Bookkeeping Services Across Texas, USA

In Texas’s USA dynamic business climate, efficient bookkeeping is crucial for the success of businesses of all sizes. Pumpkin Tax Co. emerges as a trusted partner, providing comprehensive bookkeeping services tailored to meet the diverse needs of businesses across the Lone Star State.

Pumpkin Tax Co. offers a wide range of bookkeeping services designed to streamline financial processes and ensure compliance with tax regulations. From basic data entry and reconciliation to complex financial reporting and analysis, Pumpkin Tax Co. provides expert assistance to help businesses maintain accurate and up-to-date financial records.

What sets Pumpkin Tax Co. apart is its team of experienced bookkeeping professionals who possess in-depth knowledge of accounting principles and practices. With a commitment to accuracy and attention to detail, Pumpkin Tax Co. ensures that clients’ financial records are meticulously maintained, providing peace of mind and allowing businesses to focus on their core operations.

Moreover, Pumpkin Tax Co. leverages advanced bookkeeping software and technology to streamline processes and enhance efficiency. By automating routine tasks and leveraging cloud-based solutions, Pumpkin Tax Co. enables clients to access their financial data securely from anywhere, at any time.

In addition to traditional bookkeeping services, Pumpkin Tax Co. offers personalized guidance and support to help businesses optimize their financial processes and make informed decisions. Whether it’s budgeting, cash flow management, or tax planning, Pumpkin Tax Co. provides expert advice to help clients achieve their financial goals.

conclusion: Pumpkin Tax Co. stands as a beacon of excellence in bookkeeping services across Texas, USA. With its commitment to accuracy, efficiency, and personalized support, Pumpkin Tax Co.

#PumpkinTaxCo#TaxServices#TaxExperts#TaxPreparation#TaxSeason#TaxAdvice#TaxHelp#TaxSolutions#TaxReturns#PumpkinTaxServices#TaxPlanning#TaxConsultants#TaxFiling#TaxProblems#TaxAssistance#TaxAccounting#PumpkinTaxExperts#TaxRefunds#TaxResolution#TaxCompliance

0 notes

Text

ITR-6 Online Filing: Delhi's Tax Solution

Taxcellent has simplified the process of filing ITR-6, making it easy for you to do it from the comfort of your home or workplace. All you need to do is securely upload your documents on our website taxcellent.in. You can then monitor your progress as we handle the filing for you. Forget about waiting in long lines or dealing with excessive paperwork – with Taxcellent, completing your ITR-6 is fast and stress-free.

Website Url: https://taxcellent.in/income-tax-return-filing-india/itr-6-form/

0 notes

Text

Post: Watch: Minimizing tax liability | Life Hacks https://www.blaqsbi.com/5NKG

0 notes

Text

Congressman Ken Buck Defends First Amendment Rights in Colorado Ballot Trial

#Coloradoballots #CongressmanKenBuck #FirstAmendmentrights #Initiative93 #taxreturns

0 notes

Text

youtube

#MeruAccounting#bookkeepingservices#form2441#taxreturns#taxplanning#taxseason#accountingservices#bookkeeping#bookkeepingtips#bookkeepingcompany#india#bookkeepers#accounting#uk#Youtube

0 notes

Text

IRS destruction of paper returns had little impact

By Michael Cohn

The service's decision to destroy around 30 million unprocessed paper information returns to reduce its backlog during the pandemic probably had little effect on taxpayers, according to a new report.

0 notes

Text

🍁📑 Maple Tax Consultancy: Your guide to seamless tax management! With a focus on individual and business tax services, we're committed to tailored solutions, optimizing deductions, and strategic planning. Our expertise spans IRS representation, state-specific tax laws, and empowering educational resources. Let's unravel the complexities of taxes together!

#TaxSolutions#StrategicPlanning#FinancialEmpowerment#TaxConsulting#FinancialGuidance#TaxExperts#Taxation#IRS#FinanceTips#TaxAdvice#FinancialManagement#TaxStrategies#BusinessFinance#TaxReturns#TaxSeason#PersonalTaxes#TaxHelp#FinancialPlanning#EstateTaxes#TaxProfessionals#IRSRepresentation#TaxCompliance#InvestmentPlanning#FinancialServices#tumblr

1 note

·

View note

Text

Accounting Firm and Accounting Services: Your Guide to Financial Success

In the world of finance, finding the right Accounting Firm and Accounting Services is crucial for your success. Discover how these experts can help you manage your finances and make informed decisions.

Introduction

Welcome to the realm of financial wizardry, where Accounting Firms and Accounting Services play a pivotal role in the success of businesses and individuals alike. In this comprehensive guide, we will navigate through the intricate world of accounting, unraveling its significance, and explaining how these services can propel you towards financial excellence.

The Role of an Accounting Firm

Every business, irrespective of its size, relies on an Accounting Firm to manage its financial aspects efficiently. These experts offer a wide array of services that ensure the financial health of a company.

Financial Auditing

Financial auditing is a crucial aspect of any business. It helps in verifying financial records and ensuring compliance with legal regulations. An Accounting Firm conducts thorough audits to identify discrepancies and rectify them, offering peace of mind to business owners.

Tax Planning and Preparation

Taxes are an inevitable part of running a business. Accounting Firms are well-versed in tax laws and can help businesses minimize tax liabilities legally. They also prepare and file tax returns, ensuring businesses remain on the right side of the law.

Bookkeeping and Financial Reporting

Accounting Firms handle bookkeeping, maintaining accurate financial records. They also generate financial reports, giving business owners valuable insights into their financial performance.

Advisory Services

Beyond numbers, Accounting Firms offer strategic guidance. They help businesses make informed decisions by analyzing financial data and trends, ensuring long-term financial sustainability.

The Importance of Accounting Services

Accounting Services, an integral part of an Accounting Firm's repertoire, offer specialized assistance in various financial areas.

Payroll Management

Efficient payroll management ensures that employees are paid accurately and on time. Accounting Services streamline this process, helping businesses maintain a content and productive workforce.

Budgeting and Forecasting

Creating a budget and forecasting financial performance are critical for businesses. Accounting Services provide the tools and expertise to make realistic financial projections, allowing companies to plan for the future.

Risk Management

Unforeseen financial risks can destabilize a business. Accounting Services help in identifying potential threats and developing strategies to mitigate them, safeguarding your financial future.

Estate and Trust Planning

Personal finance is just as crucial as business finance. Accounting Services extend to estate and trust planning, aiding individuals in managing and preserving their assets for future generations.

FAQs

What is the difference between an Accounting Firm and Accounting Services?

An Accounting Firm is a company that offers a wide range of financial services, including auditing, tax planning, and advisory services. Accounting Services are specialized financial services offered by professionals within Accounting Firms, covering areas like payroll management, budgeting, and risk management.

How can an Accounting Firm benefit my business?

An Accounting Firm can benefit your business by ensuring financial accuracy, minimizing tax liabilities, and providing valuable strategic guidance. These experts help you make informed financial decisions, contributing to your business's growth and stability.

Do I need Accounting Services for my personal finances?

Yes, Accounting Services can be highly beneficial for personal finances. They offer services like estate and trust planning, ensuring that your assets are managed and preserved for future generations. This expertise can be invaluable for individuals seeking financial security.

Can Accounting Services help me with financial planning for the future?

Absolutely! Accounting Services excel in budgeting and forecasting, helping individuals and businesses plan for their financial future. With their assistance, you can make informed decisions and prepare for financial success.

What are the consequences of neglecting financial audits for my business?

Neglecting financial audits can lead to various consequences, including legal trouble, financial inaccuracies, and a lack of transparency. An Accounting Firm can conduct thorough audits to identify and rectify these issues, ensuring the financial health of your business.

How can Accounting Services assist with risk management?

Accounting Services are skilled in identifying potential financial risks. They can help you develop strategies to mitigate these risks, safeguarding your financial well-being and ensuring business continuity.

Conclusion

Accounting Firm and Accounting Services are the unsung heroes of the financial world. They offer a wide range of services that are crucial for both businesses and individuals. From financial auditing to payroll management and risk mitigation, these experts play a pivotal role in ensuring financial health and prosperity. So, whether you're a business owner or an individual seeking financial security, don't underestimate the power of Accounting Services. Embrace their expertise and take a step closer to financial success.

#AccountingServices#FinancialManagement#BusinessFinance#TaxPlanning#FinancialAuditing#Budgeting#SmallBusiness#FinancialSuccess#EstatePlanning#RiskManagement#FinancialConsulting#PersonalFinance#FinancialPlanning#AccountingExperts#TaxReturns#PayrollManagement#FinancialInsights#FinancialGuidance#FinancialSecurity#BusinessGrowth

0 notes

Text

youtube

The Art of Accounting: Managing Your Tax & Super Online with MyGov

#MyGov#TaxManagement#OnlineTax#Superannuation#TaxFiling#FinancialManagement#MyGovAccount#DigitalTax#TaxReturns#SuperOnline#FinancialPlanning#Youtube

0 notes

Text

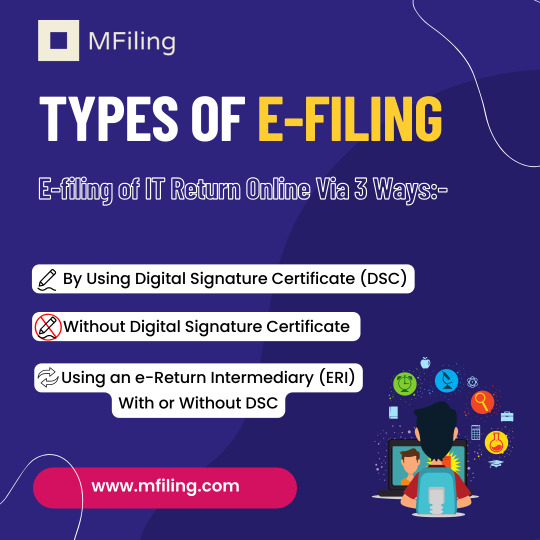

Streamline your tax season with www.mfiling.com 📂💻 Explore the three seamless ways to e-file your IT return: with Digital Signature, without DSC, or through an E-Return Intermediary! 🖋️💼

#EFileSimplified#TaxSeasonMadeEasy#MFiling#TaxFiling#IncomeTax#EFileNow#DigitalSignature#TaxReturns#OnlineFiling#FinancialFreedom#ERI#TaxSeason#EasyFiling#ThursdayThoughts#ThrowbackThursday#TBT#SeptemberVibes#InstaDaily#InstaGood#TechNews

1 note

·

View note

Text

Navigating Cultural Differences and Adapting to the London Work Environment

London's dynamic work environment offers a multitude of opportunities for professionals in the fields of accountancy servicing, tax consultancy, and financial management. Navigating cultural differences and adapting to the London work culture can be crucial for success in these domains. In this web 2.0 blog post, we will explore how accountants and tax consultants can effectively embrace cultural diversity while offering services such as bookkeeping, cashflow management, VAT returns, tax returns, small business tax advice, startup tax advice, and more in the bustling city of London.

1. Celebrating Cultural Diversity in London's Workforce: In a city renowned for its multiculturalism, accountancy servicing and tax consultancy professionals have the privilege of working with diverse clients from various cultural backgrounds. Embracing and celebrating this diversity can enrich your professional experience and broaden your understanding of different business practices and perspectives.

2. Effective Communication and Language Skills: London's cosmopolitan work environment necessitates effective communication skills, especially when providing services such as bookkeeping, cashflow management, VAT returns, and tax advice. Demonstrating proficiency in the English language, both written and verbal, is essential for clear and concise client communication.

3. Cultural Sensitivity and Respect: Understanding and respecting cultural norms and customs is paramount when serving clients from different backgrounds. Adapting your approach to meet their expectations and preferences can foster stronger client relationships and enhance client satisfaction.

4. Tailoring Services to Specific Client Needs: Each client, whether a small business or a startup, has unique requirements when it comes to tax advice, tax returns, and financial management. Being attentive to these individual needs and providing customized solutions will help you stand out in the competitive accountancy servicing and tax consultancy landscape of London.

5. Staying Updated on Local Tax Laws and Regulations: As an accountant or tax consultant in London, staying up-to-date with the ever-changing local tax laws and regulations is crucial. Engaging in continuous professional development and actively seeking tax knowledge will enable you to provide accurate and reliable advice to your clients.

6. Networking and Collaborating with Peers: Building a strong professional network within the accountancy servicing and tax consultancy community in London is vital for both personal growth and business expansion. Attending industry events, joining professional organizations, and collaborating with fellow accountants and tax consultants can lead to valuable partnerships and referral opportunities.

7. Embracing Technology and Digital Solutions: London's fast-paced work environment demands efficiency and productivity. Embracing technology-driven solutions for tasks like bookkeeping, cashflow management, and tax returns can enhance your service quality, streamline processes, and provide real-time financial insights to your clients.

Conclusion: Successfully navigating cultural differences and adapting to the London work environment is essential for accountants and tax consultants offering services such as bookkeeping, cashflow management, VAT returns, tax returns, small business tax advice, startup tax advice, and more. By embracing cultural diversity, enhancing communication skills, and staying updated on tax laws, you can provide exceptional accountancy servicing and tax consultancy services to clients from various backgrounds. Embracing technology, building strong professional networks, and demonstrating cultural sensitivity will empower you to thrive in London's competitive accountancy and tax consultancy landscape.

0 notes

Text

Best tax service company in Texas-Pumpkin tax co.

#PumpkinTaxCo#TaxServices#TaxExperts#TaxPreparation#TaxSeason#TaxAdvice#TaxHelp#TaxSolutions#TaxReturns#PumpkinTaxServices#TaxPlanning#TaxConsultants#TaxFiling#TaxProblems#TaxAssistance#TaxAccounting#PumpkinTaxExperts#TaxRefunds#TaxResolution#TaxCompliance

0 notes

Text

#IRStaxrelief#Indiana#tornadoes#severestorms#taxdeadlines#taxreturns#taxpayments#FEMA#disasterdeclaration#latepenalty#IRSrelief

0 notes

Text

Congressman Ken Buck Defends First Amendment Rights in Colorado Ballot Trial

#Coloradoballots #CongressmanKenBuck #FirstAmendmentrights #Initiative93 #taxreturns

0 notes