#Tds and Gst Return Software

Explore tagged Tumblr posts

Text

GST RETURN

0 notes

Text

Feeling overwhelmed by tax season? Are you a Chartered Accountant or Tax professional in India struggling with complex calculations, mountains of paperwork, and the ever-changing tax landscape? This podcast is your one-stop shop for conquering tax season! Join us as we explore Electrocom's revolutionary EasyOffice and EasyGST software solutions, designed specifically to streamline your workflow, boost productivity, and ensure compliance.

#tds filing software#income tax filing software#income tax calculation software#tds return software#gst reconciliation software#tds return filing software#gst return filing software

0 notes

Text

A comprehensive guide to Form 16A: A TDS Certificate

Form 16A is a TDS certificate that is issued by the deductor on a quarterly basis. It is a statement concerning the nature of payments, the amount of TDS, and the deposited TDS payments to the Income Tax department. It also consists of brokerage, interest, professional fees, contractual payments, rent, and other sources of income.

Unlike Form 16, which only consist salary structure, Form 16A of income tax charge TDS from:

Receipts from business or profession fees.

Rental receipts from a property or rent.

Sale proceeds from capital assets.

Additional source.

Important components of Form 16A

The important components of Form 16A are:

Details of the Employer: It contains the name, TAN, and PAN of the employer.

Details of Employee: It contains the name, TAN, and PAN of the employee.

Mode of Payment: Both offline and online modes of payment are available.

Receipt number of TDS: The receipt number of TDS helps in the tracking of back details.

The date and deposit tax amount with the income tax department help track information.

Significance of Form 16A

Form 16A plays a pivotal role while filing an income tax return, especially when someone has other sources of income apart from their salary. Here are the key benefits of Form 16A:

Filing of income tax returns: The details contained in Form 16A help employees file their income tax returns. It guides employees in reporting their total income, which includes salary and other sources.

Tracking of TDS: It helps every individual keep track of the tax deducted at source (TDS) on their income. It gives you a summary of TDS deducted at source.

Income Proof: Form 16A works as evidence of an individual's total earnings from other sources. Government agencies and financial institutions, like banks, easily accept this source as income proof.

Loan Applications: This form is important in verifying the loan applications. Financial institutions often need a record of the assets and liabilities of an individual to check the guarantee on loan repayment.

How to download Form 16A?

Below are the following steps to download Form 16A:

Visit the official website of the income tax department.

Complete the registration process on the website.

Click the "Download" tab, and then select Form 16A.

Fill in the PAN details, and then click “Go to continue.”.

Click submit and download Form 16A.

What is the difference between Form 16 and Form 16A?

Form 16 and Form 16A are both TDS certificates, but there are certain differences between them. The following are the differences between Form 16 and Form 16A:

Form 16 is a TDS certificate deducted from salary, whereas Form 16A is issued for income other than salary.

Form 16 is issued by the employer, whereas Form 16A is issued by financial institutions.

Form 16 is used for deducting tax from salary, whereas Form 16A is for removing taxes from another source of income apart from salary.

Final Thoughts

Paying taxes is the responsibility of the citizens of the nation. It is evident that the process of filing an income tax return and Form 16A is restless and troublesome. Some technical terms of income tax are not known to the new taxpayer. Worry not, because Eazybills will solve every tax-related problem and also offer TDS tracking.

So? What are you waiting for? Connect to us today through our website, where our professional team will guide you according to your requirements.

#form 16A#income tax return#tds certificate#file income tax return#easy billing software#gst billing software#free invoicing software#billing software#free billing software#best billing software#online billing software#online invoicing software#best invoice software

0 notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

Mastering e-Accounting: From Beginner to Expert

Introduction

In today’s fast-paced digital economy, traditional accounting practices are evolving into more streamlined, technology-driven processes. e-Accounting, or electronic accounting, has emerged as a vital skill for anyone involved in finance—whether you're a student, aspiring accountant, business owner, or working professional. The shift from manual to electronic bookkeeping has not only improved efficiency but also increased accuracy, especially in the fields of taxation and compliance. For those starting from scratch or looking to advance their knowledge, mastering e-Accounting from beginner to expert level is now more accessible than ever.

The Rise of e-Accounting

What makes e-Accounting different from traditional accounting is the integration of digital tools that handle everything from data entry to reporting. Software platforms are now capable of managing tasks like tax filing, income reporting, and ledger balancing in real-time. As government regulations become stricter and demand greater transparency, there is a growing need for skilled professionals who understand the core principles of digital finance.

People enrolling in an e accounting course in yamuna vihar are typically introduced to a range of topics including financial statements, GST compliance, and income tax procedures. These programs build foundational knowledge and gradually introduce learners to advanced tools used in real-world accounting tasks.

The Importance of Taxation Knowledge

Understanding taxation is an essential part of becoming proficient in e-Accounting. This is why many programs combine both accounting and tax education to provide a complete financial skill set. For instance, those taking tax accounting classes in yamuna vihar gain exposure to income calculation, tax deductions, and filing methods under Indian tax laws.

A specialized income tax course in yamuna vihar offers a focused approach to tax regulations, helping learners understand everything from basic slab rates to e-filing portals. Similarly, comprehensive tax classes in yamuna vihar are designed to teach both theoretical knowledge and practical skills through hands-on projects and case studies.

These sessions often overlap in content with a tax course in yamuna vihar, which emphasizes the importance of compliance, audit preparation, and digital documentation. Students also benefit from interactive workshops and mock filing sessions, ensuring they can apply their skills confidently in a professional environment.

From Classroom to Practice: The Training Experience

Hands-on training is a critical part of the learning process. While theory forms the base, practical application turns knowledge into skill. Enrolling in a tax training in yamuna vihar gives students access to real-time scenarios involving TDS, GST returns, and online portals. This bridges the gap between classroom learning and industry requirements.

A more structured approach can be found in a taxation course in yamuna vihar, where lessons are often aligned with current legal standards and updated tax rules. These courses typically include modules on balance sheets, profit & loss analysis, and tax reconciliation—skills that are essential for any professional accountant.

As digital filing becomes the norm, learners are also opting for a tax filing course in yamuna vihar, which teaches how to navigate the complexities of filing returns for individuals and businesses. This complements a broader tax training course in yamuna vihar that focuses not just on compliance but also on strategic tax planning and optimization techniques.

For those looking for a complete learning journey, tax learning courses in yamuna vihar offer a progressive curriculum that covers everything from basic definitions to advanced electronic submissions, making them ideal for beginners and intermediate learners alike.

Expanding Opportunities Across Other Regions

Learning opportunities are not limited to one area. Similar high-quality programs are also available for learners seeking an e accounting course in uttam nagar. These classes follow a similar structure and are equally comprehensive, covering both foundational concepts and modern software applications.

Those who want to delve deeper into tax-related topics can explore tax accounting classes in uttam nagar. These sessions emphasize the practical application of tax laws, ensuring students know how to deal with audits, notices, and legal compliance.

An income tax course in uttam nagar serves as a focused path for those wanting to work in tax preparation, consultation, or auditing. It typically includes training on ITR filing, tax-saving investments, and legal implications of incorrect reporting. For a broader approach, tax classes in uttam nagar cover multiple aspects of direct and indirect taxation.

Anyone pursuing a tax course in uttam nagar will also gain insight into tax planning strategies, case law analysis, and digital bookkeeping—key areas that enhance employability. These are often included in more detailed sessions like a tax training in uttam nagar, which combines academic learning with real-life business simulations.

A taxation course in uttam nagar may also feature industry expert-led sessions, offering insights into current trends and challenges. With the help of live filing exercises and practical modules, learners can effectively prepare for real-world roles.

For those keen on filing expertise, a tax filing course in uttam nagar offers practical tutorials on using government portals, verifying documents, and submitting returns accurately. To complement this, a tax training course in uttam nagar ensures that students are aware of regulatory frameworks and are trained in time-bound submissions and compliance protocols.

Lastly, beginners looking for a gradual and complete learning path may consider tax learning courses in uttam nagar, which introduce basic terms and gradually evolve into complex filing, reconciliation, and advisory skills, suitable for both freelance professionals and full-time accountants.

Conclusion

Mastering e-Accounting is more than just learning software; it’s about understanding the digital ecosystem of finance. From calculating income tax to filing returns, today’s accountant needs to be skilled not only in numbers but in using the tools that manage them efficiently. Whether you're starting with no prior knowledge or already working in finance, upgrading your skill set through a structured course can be a game-changer. From foundational courses to specialized tax training, e-Accounting offers a wide learning path that fits various career goals. With access to practical sessions, experienced trainers, and up-to-date content, learners can grow from beginners to experts capable of handling complex financial environments. Choose the right course, apply your learning, and build a future-ready career in the evolving world of digital accounting.

#Accounting#Accounting for Beginners#Learn Accounting#Financial Accounting#Accounting Course#Accounting Basics

0 notes

Text

#GSTCompliance#GSTReturnFiling#DSCIntegration#TallyReconciliation#DashboardAnalytics#BulkReturnProcessing#MultiUserAccess#ErrorValidation#ITCReconciliation#AutoGSTR3B

0 notes

Text

Unlock Career Opportunities by Joining the Best GST Course in Noida at GVT Academy

Looking to kickstart or upskill your career in taxation? At GVT Academy, our Best GST Course in Noida is designed with real industry challenges in mind, ensuring practical and job-ready training. This course is perfect for students, professionals, and business owners who want to gain hands-on knowledge of Goods and Services Tax and become job-ready.

Why Choose GVT Academy?

✅ Comprehensive Curriculum – Learn everything from GST Basics, ITC, Registration, Returns, and E-Way Bill to advanced concepts like Audit, Refunds, TDS, and E-commerce taxation. ✅ Real-time Practical Training – File real client data on GST Portal, Tally, and BUSY software with expert guidance. ✅ Includes Income Tax & TDS Modules – Understand personal taxation, ITR filing, TDS returns, exemptions, and much more. ✅ Exclusive Tally + BUSY Training – Learn to generate GSTR reports, TDS returns, and balance sheets directly in accounting software. ✅ Finalization & Banking Module – Gain advanced skills in balance sheet creation, CMA data, project reports, and tax planning.

Learn from experienced faculty and get certified training that enhances your resume and boosts your career growth!

Flexible Timings: 📌 Weekday and Weekend Batches Available 📌 Morning and Afternoon Slots

Join GVT Academy today and become a certified GST expert! Limited Seats – Book Your Spot Now!

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#gst course#e accounting#data analytics#advanced excel training#data science#python#sql course#advanced excel training institute in noida#best powerbi course#power bi#advanced excel

0 notes

Text

Start Your Career in Finance with BUSY Software Training

INTRODUCTION

In today’s competitive job market, having just a degree is often not enough. If you're a commerce student or aspiring finance professional, gaining practical software skills is the key to unlocking career opportunities. One of the most in-demand tools in accounting today is BUSY Accounting Software. It’s widely used by businesses for managing inventory, GST, invoicing, and financial reporting—making it a must-have skill for those looking to step confidently into the finance world.

Why BUSY Accounting Software?

BUSY is an integrated business accounting and management software used across multiple industries, especially in small and medium enterprises. Its simplicity and power make it a favorite for accountants and business owners. Whether it’s day-to-day accounting, GST returns, or inventory control—BUSY does it all. That’s why enrolling in BUSY Software Classes in Yamuna Vihar or BUSY Software Classes in Uttam Nagar is a smart investment in your future.

Learn by Doing: The Importance of Practical Training

Theory alone won’t prepare you for real-world accounting tasks. Practical exposure to tools like BUSY helps you understand how actual business transactions are recorded and managed. That’s where Advanced BUSY Software Training with Practical in Yamuna Vihar or Practical BUSY Software and Accounting Course in Uttam Nagar comes into play. These programs offer hands-on experience so you can confidently work with ledgers, GST reports, TDS entries, and more.

What You Will Learn in BUSY Software Courses

Enrolling in a Complete BUSY Accounting and GST Course in Yamuna Vihar or Uttam Nagar will help you build strong fundamentals and job-ready skills. Here's a glimpse of what you’ll learn:

Core Accounting Principles using BUSY

GST Setup and Invoicing

Voucher and Journal Entry Creation

Inventory Management

Financial Reporting and Analysis

TDS, TCS, and Taxation Handling

Payroll Processing

E-Way Bill and Return Filing

This is especially beneficial for students taking up the BUSY Accounting and Taxation Course in Uttam Nagar or BUSY Accounting Software with GST Training in Yamuna Vihar, where GST modules are integrated for complete job readiness.

Certified Training Means Better Job Prospects

A course from a Certified BUSY Accounting Software Institute in Uttam Nagar or Yamuna Vihar adds weight to your resume. It proves that you not only understand accounting principles but can also implement them using one of India’s most popular accounting platforms. Employers often give preference to candidates who have completed BUSY ERP Software Training Classes in Yamuna Vihar or similar certification-based training.

Career Opportunities After BUSY Software Training

Learning BUSY isn’t just for accountants. The skills you gain are useful in multiple roles across industries:

Junior Accountant

GST Executive

Billing Executive

Accounts Assistant

Data Entry Operator

Inventory Manager

Freelance Accountant for SMEs

Thanks to the rising demand for skilled professionals, students from Top Institutes for BUSY Software Training in Uttam Nagar are being placed in good companies, often with better starting salaries than peers who lack software experience.

Who Should Enroll?

B.Com, M.Com, BBA students

Job seekers in accounting or finance

Working professionals looking to upgrade skills

Entrepreneurs managing their own books

Freelancers offering accounting services

Final Thoughts

Starting your career in finance with BUSY Software Training is not just about learning software—it’s about becoming job-ready. The knowledge you gain from BUSY Accounting Software Training in Uttam Nagar can bridge the gap between classroom learning and workplace requirements. It gives you the confidence to apply for jobs, handle interviews, and perform efficiently in real-world accounting roles.

If you’re serious about building a future in accounting, now is the time to take that next step. Explore the BUSY ERP Software Training Classes near you and set your career in motion with skills that matter.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#busy accounting software course.#busy accounting#busy accounting training#busy accounting classes#busy accounting off#line course

0 notes

Text

Certified Accountant Course with Real Projects

Accountant Course: Become a Finance Expert with Practical Training

✅ Accountant Course क्या है?

An Accountant Course ek ऐसा professional training program hai jo students को accounting, finance aur taxation सिखाता है. Ye course beginners aur working professionals दोनों के लिए suitable hai jo अपने career को accounting में बनाना चाहते हैं.

इसमें theoretical knowledge के साथ-साथ practical training भी दी जाती है. Students को tally, GST, income tax filing और payroll जैसी important चीजें सिखाई जाती हैं.

🔍 Why Choose an Accountant Course?

Accountant Course ka selection karna एक smart career move है क्योंकि हर business को accountant की जरूरत होती है. Is course ko करने के बाद आप आसानी से job पा सकते हैं या खुद का accounting consultancy भी शुरू कर सकते हैं.

Course flexible timing, affordable fees aur high placement ratio के साथ आता है. इसलिए ये course students aur job seekers दोनों के लिए perfect है.

🎓 Types of Accountant Courses Available

🧾 Diploma in Accounting and Finance

Ye एक short-term course होता है jo basic से advance तक accounting concepts सिखाता है.

Key subjects में journal entries, ledger posting, trial balance, GST aur TDS शामिल होते हैं.

🧾 Certification Course in Tally with GST

Tally accounting software ka practical knowledge इस course में दिया जाता है. GST और invoice creation पर खास focus होता है.

🧾 Advanced Financial Accounting Course

Ye course unke लिए होता है jo already accounting सीख चुके हैं aur अब real-world financial applications को समझना चाहते हैं.

Accountant Course Syllabus – Kya Kya Padhenge?

हर institute का syllabus थोड़ा अलग हो सकता है, लेकिन नीचे दिए गए topics आम तौर पर हर accountant course में cover किए जाते हैं:

Basic Accounting Concepts – जैसे debit-credit rules, journal entries, balance sheet

Tally ERP 9/Prime – accounting software ka use kaise करें

GST (Goods and Services Tax) – GST registration, returns, और invoicing

Income Tax – ITR filing aur TDS का पूरा process

Bank Reconciliation Statement (BRS) – cash book aur bank statement ka match करना

Payroll Management – employee salary calculation, PF aur ESI

इन topics से students को strong foundation मिलती है aur job ready बनाया जाता है.

🕒 Accountant Course Duration and Eligibility

Course ki duration usually 3 months se lekar 12 months तक होती है. Ye depend karta hai ki aap कौन सा level choose करते हैं – basic, intermediate, या advanced.

Eligibility criteria simple है –

Minimum 12th pass hona चाहिए (preferably from Commerce stream)

Computer knowledge helpful रहता है लेकिन जरूरी नहीं

💰 Accountant Course Fees in India

Fees institute aur city के हिसाब से vary करती है.

Generally, accountant course की fees ₹10,000 se ₹50,000 tak hoti hai.

Affordable options भी available हैं jahan EMI aur scholarship facilities provide की जाती हैं. Delhi, Mumbai, और Bangalore जैसे cities में कई reputed accounting institutes हैं jo placement support भी offer करते हैं.

📈 Accountant Course Benefits – क्यों करें ये कोर्स?

✅ Job Opportunities

हर company को accounting professional की जरूरत होती है. Aap private firms, MNCs, ya CA firms में काम कर सकते हैं.

✅ High Demand

Digital India aur GST implementation के बाद accounting professionals की demand बढ़ गई है.

✅ Freelancing & Business

आप खुद का freelancing service शुरू कर सकते हैं ya small businesses को accounting services दे सकते हैं.

✅ Career Growth

Entry-level से लेकर senior accountant तक ka career path clear होता है.

✅ Skill Enhancement

Accounting ke साथ-साथ Excel, Tally, aur tax laws में भी expert बन जाते हैं.

👨🏫 Best Institutes for Accountant Course in India

कुछ popular institutes जो accountant course offer करते हैं:

The Institute of Professional Accountants (TIPA), Delhi

NIIT

ICA Edu Skills

Tally Academy

EduPristine

इन institutes में practical training aur placement support दिया जाता है.

TIPA जैसे institutes में students को hands-on experience मिलता है jo unko job-ready बनाता है.

Career Opportunities After Accountant Course

Accountant course complete करने के बाद आप इन roles में काम कर सकते हैं:

Junior Accountant

GST Practitioner

Tax Assistant

Tally Operator

Payroll Executive

Accounts Executive

Finance Analyst

Long term में आप Senior Accountant, Tax Consultant या Chartered Accountant भी बन सकते हैं.

🖥️ Accountant Course Online vs Offline

🏫 Offline Course

Face-to-face learning

Practical lab sessions

Better doubt clearing

🌐 Online Course

Flexible timing

Cost-effective

Learn from anywhere

Online options unke लिए best हैं jo working हैं या remote areas में रहते हैं.

🤝 Final Thoughts – Accountant Course is Your Smart Career Step

Aaj के समय में accountant course एक smart aur secure career option बन गया है.

Accounting skills हर field में काम आती हैं – चाहे आप job करें ya खुद का business.

इस course को करके आप ना केवल अपने लिए नौकरी पा सकते हैं, बल्कि दूसरो��� की भी मदद कर सकते हैं financially grow करने में.

Agar आप 12th ke baad career चुनने की सोच रहे हैं, तो accountant course एक best option है.

Practical skills, job placement aur low investment – sab कुछ आपको इस course में मिल जाएगा.

👉 Start your journey today – Accountant Course se banaye apna future bright!

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

GSTR 9: Annual GST Return

The annual return filing, known as GSTR 9, is required to be filed by every taxpayer before 31st December. This blog aims to provide a comprehensive guide to GSTR 9, helping businesses navigate through the complexities of this crucial annual return.

What is GSTR-9 annual return?

GSTR-9 is the annual return that every registered taxpayer under GST must file. It consolidates the details of all the monthly or quarterly returns filed during the financial year. The purpose of GSTR-9 is to provide a summary of the taxpayer's outward and inward supplies, tax liability, input tax credit (ITC) claimed, and other relevant details.

Who is liable to file GSTR-9, the annual return?

All taxpayers/taxable persons registered under GST must file their GSTR-9. Except:

Casual Taxpayers

Input Service Distributors

Non-resident Taxpayers

Taxpayers under composition scheme (They must file GSTR-9A)

E-commerce operators (They must file GSTR-9B)

TDS deduction or TCS collector under Section 51 or Section 52 of the CGST Act.

For FY 17-18 & 18-19, it is mandatory only if turnover exceeds Rs 2 crore.

What is the due date for filing GSTR-9?

GSTR 9 (GST Annual Return) is to be filed by 31 December of the year following the particular financial year. Accordingly, businesses should file GSTR-9 for FY 2022-23 by 31st December 2023.

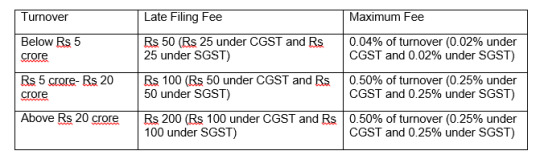

What is the late filing fee for GSTR 9?

The late filing fee for GSTR 9 has been categorized based on the turnover of the taxpayer w.e.f. FY 2022-23:

What details are required to be filled in GSTR-9?

The basic details which have to be provided in GSTR-9 are as follows:

Details of Sales with the breakup of those on which tax is payable and not payable.

Details of Purchases.

Tax payable.

Input Tax Credit available and reversed.

Details of transactions of sales and Input tax credit in the subsequent year but pertaining to the year for which return is being filed.

Besides that other details like HSN wise breakup of Sales & Purchases, Summary of Demands & Refunds, etc have to be provided.

For FY 17-18 & 18-19, some of the sections have been made optional.

Can a “NIL” GSTR-9 return be filed?

Yes, a Nil GSTR-9 can be filed if all the following conditions are satisfied:

No outward supply.

No receipt of goods/services.

No other liability to report.

Not claimed any credit.

No refund claimed.

No demand order received.

No late fees to be paid.

If the figure has to be reported in any of these, nil return cannot be filed.

How Web-GST simplifies your GST filing?

Web-GST is an across the board GST software that simplifies your GST return filing experience with useful tools & insightful reports.

No outward supply. Desktop-based Solution with 100% Data Security.

Easy & Prompt way to prepare & file GSTR 1, 3B, 9, & 9C etc.

Download GSTR-2A in one-click for the whole financial year or YTD.

Automatically identifies data mismatches for GST compliance.

Claim 100% accurate ITC with the Advanced Matching Tool.

Track GST Returns Filing Status on a single dashboard.

Experience Seamless Integration with ERPs and GSTN (Premium version).

1 note

·

View note

Text

The Importance of Hiring a Chartered Accountant in Delhi for Smart Financial Management

In today’s fast-paced business world, having a reliable Chartered Accountant in Delhi can make a significant difference in how your finances are managed. Whether you're a salaried individual, a small business owner, or managing a growing enterprise, a CA provides critical services like tax planning, accounting, and financial analysis that ensure compliance and optimize your financial outcomes.

Why Choose a Chartered Accountant in Delhi?

Delhi is not only India’s capital but also a booming commercial center, home to thousands of businesses and professionals. Engaging a qualified chartered accountant in this region can give you access to expert financial advice and services that are tailored to local laws and industry standards.

Major Benefits Include:

Accurate Financial Records: Avoid errors in accounting that can lead to penalties.

Regulatory Compliance: Ensure timely and accurate filings with government bodies.

Tax Optimization: Maximize deductions and minimize tax liabilities.

Audit Readiness: Be prepared for any audit with clear and transparent records.

Business Advice: Get valuable input on investments, budgeting, and financial planning.

Key Services Offered by Chartered Accountants in Delhi

A chartered accountant can take over a wide variety of financial responsibilities, freeing up your time and reducing stress.

● Taxation Services

Filing of income tax returns (ITR)

GST registration and filing

Tax consultancy and planning

TDS and advance tax computation

● Accounting & Bookkeeping

Preparation of ledgers, balance sheets, and profit & loss statements

Payroll processing and salary structuring

Data reconciliation and accounting software setup

● Auditing

Internal and statutory audits

Tax audits under the Income Tax Act

Compliance and process audits

Forensic accounting

● Company Incorporation & Compliance

Business registration (Pvt Ltd, LLP, OPC, etc.)

ROC compliance and documentation

Annual filings and secretarial services

What to Look for in a Chartered Accountant in Delhi

Selecting the right professional is essential to ensuring you receive top-quality services. Consider the following before hiring:

✅ Certification: Ensure the CA is a registered member of ICAI.

✅ Client Portfolio: A strong client base reflects reliability and competence.

✅ Communication Skills: The CA should be able to explain complex financial concepts in simple terms.

✅ Fee Structure: Compare pricing while keeping quality in mind.

✅ Use of Technology: Prefer accountants using modern accounting tools and cloud platforms.

The Strategic Advantage of Hiring a CA in Delhi

Partnering with a CA can give your business or personal finances a strategic edge:

Reduce the risk of financial mismanagement

Save money through optimized tax planning

Maintain up-to-date compliance with changing laws

Receive unbiased, expert advice

Gain peace of mind knowing your finances are in safe hands

Conclusion

Whether you’re running a startup, managing a large corporation, or handling personal wealth, hiring a Chartered Accountant in Delhi ensures that you stay compliant, efficient, and financially smart. Their expertise helps you navigate the complexities of finance while focusing on your core goals.

Don’t wait for financial errors to pile up—consult a chartered accountant in Delhi today and build a stronger financial foundation.

0 notes

Text

Professional Tax Consultants in Delhi India by SC Bhagat & Co.

Taxation is an integral part of every business and individual’s financial planning. With frequent changes in tax laws and growing compliance requirements, the need for professional tax consultants in Delhi, India has never been greater. This is where SC Bhagat & Co., a trusted name in tax consultancy, steps in to offer expert services tailored to meet your specific needs.

Why You Need a Professional Tax Consultant in Delhi Delhi is home to countless businesses, startups, professionals, and NRIs, all of whom need proper tax planning and compliance. Here’s why hiring a professional tax consultant is crucial:

Stay Compliant with Changing Tax Laws: The Indian taxation system is dynamic and requires up-to-date knowledge.

Avoid Penalties and Fines: Missing deadlines or filing incorrect returns can lead to hefty penalties.

Maximize Tax Savings: A skilled consultant helps you claim all eligible deductions and exemptions.

Strategic Tax Planning: Proper planning ensures long-term tax efficiency for individuals and businesses.

SC Bhagat & Co. – Your Trusted Tax Advisory Partner Established in Delhi, SC Bhagat & Co. is one of the leading tax consulting firms in India. With decades of experience and a client-first approach, the firm has built a reputation for delivering accurate, timely, and reliable tax solutions.

Our Core Tax Consultancy Services Income Tax Filing & Planning

For individuals, salaried professionals, and businesses

Timely return filing and tax-saving strategies

GST Consultation

GST registration, return filing, and advisory

GST audits and compliance support

Corporate Taxation

Tax structuring for companies and LLPs

Advance tax computation and planning

TDS & Withholding Tax Services

TDS return filing and reconciliation

Advisory on withholding tax obligations for domestic and international transactions

Representation Before Tax Authorities

Assistance in scrutiny cases, appeals, and assessments

End-to-end support during tax litigation

NRI Taxation

Double taxation avoidance advisory

Filing of income tax returns for NRIs and expatriates

Why Choose SC Bhagat & Co. as Your Tax Consultant in Delhi? ✅ Experienced Chartered Accountants & Tax Experts

✅ Client-Centric Approach with Personalized Solutions

✅ Transparent Pricing with No Hidden Costs

✅ Use of Advanced Tax Tools and Software

✅ Timely Communication & Updates

Who Can Benefit from Our Tax Services? Startups and SMEs

Corporates and LLPs

Salaried Professionals

Freelancers and Consultants

NRIs and Foreign Nationals

NGOs and Trusts

Whether you are a growing startup, an established business, or an individual looking for tax planning assistance, SC Bhagat & Co. has the expertise to support you.

Contact SC Bhagat & Co. – Professional Tax Consultants in Delhi Let tax compliance and planning no longer be a burden. Reach out to the expert team at SC Bhagat & Co. and ensure peace of mind with professional tax services.

#taxation#gst#taxationservices#accounting services#direct tax consultancy services in delhi#accounting firm in delhi#tax consultancy services in delhi#remittances#beauty#actors

1 note

·

View note

Text

Gain Practical Tally Skills from Trusted Delhi Training Centres

Accounting software users often have Tally near the top of their most trusted and commonly used tools. A strong Tally training institute can turn things around for both those who want to begin a career in accounting and seasoned professionals. Since Delhi is a centre for education and professional courses, you have many choices, and choosing the best Tally training institute in Delhi can help you excel.

Why Choose a Tally Course for Your Career

Tally does more than just accounting. Organisations of any size use Sage as a full business management tool. GST returns, payroll functions, bookkeeping, and inventory control are all made easy with Tally.

Boosts Career Opportunities: Knowing Tally gives you access to employment in accounting, finance and taxation. Businesses of all sizes are eager to find professionals capable of running Tally.

Essential for Accounting Professionals: Getting started in accounting now requires you to be familiar with Tally. Having a course in Tally gives your CV a stronger appeal to possible employers.

Keeps You Updated with Tax Laws: Most of the Tally training focuses on teaching participants about GST, TDS and various Indian taxes. It shows you the latest changes and methods of maintaining compliance.

Enhances Business Management Skills: Using Tally, business leaders might learn how to manage accounts, track their stock, manage payroll and manage invoices.

Makes You Industry-Ready: In a structured Tally course, you will learn theory as well as how to apply those ideas in real life. As a result, students can deal with real accounting issues in the working world.

What to Look for in a Tally Training Institute

To do well in training, make sure you learn from the best. You should keep these main points in mind when choosing the best institute for Tally course in Delhi.

Experienced Trainers: An excellent institute for training will have teachers who can teach you even the most complex things simply. Your training is improved when your instructors have real experience.

Comprehensive Course Structure: Key lessons should include Tally's main aspects, such as accounting, handling inventory, GST, TDS, payroll and detailed reporting. Check that the course topics match the industry guidelines.

Practical Learning Approach: Just having classroom theory is not enough. Performing practical assignments and real projects helps you gain both hands-on abilities and self-assurance.

Updated Software and Tools: Use up-to-date Tally software at the institute and generally add updates to the training curriculum. As a result, you get ahead when the financial world is always changing.

Certification and Placement Support: Completing a course at a good institute boosts your qualifications. Make sure you find institutes that are willing to help you secure a job or an internship once you have graduated.

How Tally Training Benefits Different Learners

Tally is created to help you handle different tasks and keep your life organised. Using these features, handling data, planning, and analysis becomes very easy.

Students Starting Their Careers: Students at Tally begin their careers with valuable skills that employers in the accounting and finance field use.

Working Professionals Seeking Promotions: Existing accountants can achieve promotion or move to better-paying positions by obtaining the Tally certification.

Entrepreneurs Managing Their Finances: When a business learns Tally, it can keep accurate financial accounts and rely less on other professionals.

Freelancers Offering Accounting Services: Adding Tally to their skills helps freelancers serve clients more completely, open up more work options and potentially make more money.

Job Seekers Looking to Upskill: Tally training helps people seeking to enter the job market or make a career switch by offering them the skills they’ll need for roles in finance or business.

Conclusion

Anyone considering a career in accounting or business management needs to learn Tally. Since there are so many training centres, picking one is an important decision. The top tally training centre in Delhi will help you gain useful knowledge, experience in real situations and the courage to deal with monetary matters in any company. Spending your effort on the best training can have lasting positive results.

0 notes

Text

Transform Manufacturing with Udyog Best ERP — India’s Smartest ERP Solution

In an era where digital transformation is reshaping industries, manufacturers need a technology partner that understands their unique challenges and delivers intelligent, scalable solutions. Udyog Software, a pioneer in business automation since 1993, offers exactly that with Udyog Best ERP — a smart, India-first Best erp in india manufacturing ERP Software india designed to revolutionize how manufacturing businesses operate.

Built for Indian Manufacturers, Backed by Global Standards

Udyog Best erp in india manufacturing ERP Software india is not just another ERP system. It is a product born out of decades of industry experience, specifically crafted for Indian enterprises. It goes beyond basic automation to deliver deep process integration, tax compliance, and real-time insights — all in a single platform

Key Features That Drive Transformation:

End-to-End Manufacturing Management

From the bill of materials to the final delivery of finished goods, Udyog Best erp in india manufacturing ERP Software india provides complete transparency and control across the entire production cycle. With powerful features like job work management, shop floor tracking, and process-wise costing, it empowers manufacturers to streamline operations, increase productivity, and minimize waste.

GST- Ready and Tax Compliant

Udyog Best ERP comes equipped with built-in support for GST, e-Invoicing, e-Way Bills, and TDS. This significantly reduces the compliance workload, ensures data accuracy, speeds up return filings, and keeps your business always prepared for audits.

Powerful Inventory & Asset Control

Real-time inventory tracking helps manufacturers stay updated on stock levels at all times. Reorder alerts ensure materials are always available when needed, reducing downtime. Expiry management adds another layer of control for perishable or time-sensitive items. In addition, Udyog Best erp in india manufacturing ERP Software india simplifies capital asset and CWIP project management. Automated depreciation, scheduled maintenance, and full asset lifecycle tracking keep operations smooth and compliant.

Modular & Scalable Design

Whether you’re a fast-growing startup or a large enterprise with multiple branches, Udyog Best erp in india manufacturing ERP Software india scales seamlessly with your business. Its modular design lets you start with what you need — like accounting, HR, production, or supply chain — and easily add more features as your operations grow.

In the fast-paced world of manufacturing, success is determined by how well a business adapts, automates, and innovates. With Udyog Best erp in india manufacturing ERP Software india Indian manufacturers now have a powerful tool to simplify operations, enhance productivity, and drive profitability. Visit www.udyogsoftware.com to book a free demo today.

0 notes

Text

Key Legal and Strategic Considerations After Company Registration in Mumbai (2025 Edition)

So, your company is officially registered in Mumbai — congratulations! But the journey doesn’t end there. Post-incorporation compliance and strategic planning are critical to ensuring your business operates smoothly, legally, and profitably.

Here’s a detailed breakdown of what to focus on after registration to build a strong legal and operational foundation.

1. 📂 Opening a Business Bank Account

Why it matters:

Keeps your personal and business finances separate.

Mandatory for statutory payments like GST, TDS, etc.

Helps maintain accounting accuracy and transparency.

Documents Required:

Certificate of Incorporation

PAN Card of the company

Memorandum & Articles of Association

KYC of directors

Board resolution authorizing account opening

Choose from leading banks company registration in Mumbai such as HDFC Bank, ICICI Bank, Axis Bank, or State Bank of India, depending on your preference for digital services or in-branch support.

2. 🧾 Apply for GST Registration

If your annual turnover exceeds:

₹40 lakh for goods

₹20 lakh for services

Then GST registration is mandatory. Even if your turnover is below the threshold, voluntary registration may be beneficial to claim Input Tax Credit (ITC) and build business credibility.

Documents Needed:

PAN, Aadhaar

Company incorporation documents

Bank account proof

Office address proof

DSC & Authorized Signatory authorization

Apply on the GST portal.

3. 🧑💼 Appoint a Chartered Accountant or Company Secretary

You’ll need professional help for:

Filing statutory returns (ROC filings)

Annual financial statements

Audits (if applicable)

Advisory on tax saving and compliance

Engaging a Mumbai-based professional ensures faster response times and better understanding of local jurisdiction.

4. 📊 Set Up Bookkeeping & Accounting Systems

Good accounting is the backbone of legal and financial health.

Options:

Use accounting software: Tally, Zoho Books, QuickBooks India

Hire in-house accountant

Outsource to a CA firm

Make sure to track:

Sales and purchase invoices

Employee payroll

Tax payments (GST, TDS)

Reimbursements and petty cash

5. 🧑💻 Employment & Labor Law Compliance

If hiring employees, you must:

Register for EPFO & ESIC (mandatory if you have more than 10 employees)

Issue employment letters

Maintain salary registers and employee records

Follow Shops & Establishments Act, Maharashtra

Also ensure:

Gratuity and Provident Fund contributions

Compliance with sexual harassment laws (PoSH Act)

6. 📆 Mandatory Annual ROC Filings

Every company registered under the Companies Act must file annual returns with the Registrar of Companies (ROC), Mumbai.

Key filings:

MGT-7 – Annual Return

AOC-4 – Financial Statements

DIR-3 KYC – Director KYC filing

Due Dates:

30 days from AGM for AOC-4

60 days from AGM for MGT-7

30th September or 31st December for DIR-3 KYC

7. 📢 Brand & Trademark Protection

Your brand is your identity — protect it.

Register your company’s name/logo as a trademark under the Trademarks Act, 1999.

Filing can be done online via the IP India website.

Prevents others from copying or misusing your brand.

8. 💼 Build Business Credit & Apply for MSME Benefits

Once operational:

Apply for Udyam Registration (MSME Certificate)

Helps access government tenders, subsidies, and collateral-free loans.

Additionally, register on:

GeM (Government eMarketplace)

Startup India (if eligible)

9. 🧮 Conduct Board Meetings & Maintain Registers

As a private limited company, you are required to:

Hold first board meeting within 30 days of incorporation

Maintain statutory registers like:

Register of Directors

Register of Shareholders

Register of Charges (if any loan is taken)

10. 🗂️ Other Registrations (If Applicable)

Import Export Code (IEC): If you're in export/import

FSSAI License: For food businesses

Shop and Establishment License: Mandatory for businesses operating in Mumbai

Professional Tax Registration: Required in Maharashtra for employees and professionals

🚀 Strategic Advice for New Business Owners in Mumbai

Network Constantly: Attend local startup meetups, chamber of commerce events.

Stay Tax-Aware: Keep up with tax reforms through platforms like Taxmann, CAClubIndia.

Focus on Digital Presence: Build a website, register on Google My Business, start social media branding.

Stay Organized: Set up reminders for statutory compliance deadlines.

🏁 Conclusion

Company registration in Mumbai is just the beginning. The real work starts post-registration — with regulatory, operational, and strategic actions that shape your business’s future.

By staying compliant and focusing on sound financial and operational practices, you lay the foundation for long-term success and scalability.

0 notes

Text

Tax Management Software: A Smart Move for Businesses That Want to Stay Ahead.

Ask any business owner or finance head what time of the year they dread most, and chances are, they’ll say tax season. From juggling endless paperwork to ensuring every figure lines up correctly, managing taxes manually is not only stressful — it’s risky.

That’s exactly why more and more businesses are switching to tax management software.

What Is Tax Management Software?

Simply put, it’s a tool that helps businesses handle everything related to tax management software — from calculating GST or TDS to generating returns, filing them on time, and maintaining proper records. It automates the complex, time-consuming parts of tax compliance and keeps your financials clean and audit-ready.

Why It’s a Lifesaver for Growing Companies

Fewer Errors, Fewer Headaches Let’s be honest — tax rules can get complicated. One small mistake in a manual entry can result in penalties or legal trouble. Tax software minimizes these risks by doing the math for you and flagging inconsistencies before they become real problems.

Saves Time During Filing Season Instead of scrambling through Excel sheets and invoices at the last minute, you get organized data, reports, and return-ready files in just a few clicks. What used to take days now takes minutes.

Keeps You Compliant Laws change, and keeping up with them is tough. Good tax software is regularly updated to reflect the latest rules, helping your business stay on the right side of the law without needing a full-time tax expert.

Easier Audit Trails If your books are ever under review, tax software gives you clear records of every filing, payment, and document. No last-minute panic, just ready-to-share files.

Conclusion

Whether you're a freelancer, a startup, or a mid-sized business owner, investing in a trustworthy tax management system isn't just about convenience; it's also about maintaining compliance, saving time, and avoiding expensive errors. It's one of those clever tools you'll wish you had used sooner in the hectic business world of today.

0 notes