#TradingTips"

Explore tagged Tumblr posts

Text

Stay ahead in the share market with SMS Gateway Center!

📊 Connect investors instantly with Bulk SMS and WhatsApp Business API—perfect for stock updates, trading tips, and market alerts. Invest smarter today!

👉 https://www.smsgatewaycenter.com/bulk-sms-whatsapp-share-market/

#SMSGatewayCenter#BulkSMS#WhatsAppShareMarket#ShareMarket#InvestorUpdates#TradingTips#SMSMarketing#WhatsAppBusinessAPI#MarketSolutions#InvestmentTech

2 notes

·

View notes

Text

Penny Stock Primed For Massive Growth As Demand Skyrockets!

Penny Stock Primed For Massive Growth As Demand Skyrockets! https://www.youtube.com/watch?v=8leKGgVGKok This lithium stock is positioned to EXPLODE as EV demand surges. Atlas Lithium Corporation (ATLX) holds Brazil's largest lithium exploration portfolio. With a state-of-the-art processing plant arriving in Brazil and Warren Buffett's Berkshire Hathaway as top shareholder, ATLX is primed for massive growth. Wall Street analysts project up to 669% upside for this lithium mining stock with price targets from $19 all the way up to $45. ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/AvfGwbP 👉 Instagram: https://ift.tt/quWfMlY ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 Why 2024 Was My BEST YEAR EVER And How 2025 Will Be Even Better! https://youtu.be/JBpA0YX9tQM 👉 Will This Penny Stock SURGE After Huge Partnership News With AT&T? https://youtu.be/8N9lMRLC8f0 👉 This Stock Can Explode in 2025: Here's Why!! https://youtu.be/XZsI7a6vn1Y 👉 Haters LAUGHED When We Alerted This 10X Stock! https://youtu.be/hMpNn6eGPeY ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== Chapters: 0:00 Lithium Overview 1:59 ATLX 3:59 Reasons for Optimism 5:01 Price Targets and Analysis #swingtrading #stockstobuy #microcapstocks Disclaimer: Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. This is not financial advice. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. AvidTrader has been compensated one thousand five hundred dollars USD by ACH Bank Transfer by Sideways Frequency LLC for advertising Atlas Lithium Corp (ATLX). As of the date of this advertisement, the owners of AvidTrader do not hold a position in Atlas Lithium Corp (ATLX). This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Atlas Lithium Corp (ATLX), increased trading volume, and possibly an increased share price of Atlas Lithium Corp (ATLX), which may or may not be temporary and decrease once the marketing arrangement has ended. Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA April 22, 2025 at 06:00AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

3 notes

·

View notes

Text

📈Understand key trading terms and navigate the trading world like a pro!📊

✅Enjoy Zero Brokerage and 100X Leverage on your Trades ✅Instant Account Opening ✅5% Welcome Bonus on your first deposit ✅24/7 Customer Support

Trade now via link in bio.

#MintCFD#FundamentalAnalysis#LearnTrading#TradingChamp#LearnAndEarn#TradingTerms#TradingTips#CFDTrading#stockmarket#forextrader#TradingCommunity#TradeIdeas#InvestmentAdvice#TradingLifestyle#InvestWisely#TradingJourney

2 notes

·

View notes

Text

🌐 Join Us on Telegram for Daily Crypto News 🌐 Your Source for Timely, Accurate, and In-Depth Market Insights

CryptoTelegraphs is here to keep you updated with breaking news, expert analyses, and deep dives across crypto, technology, business, and global trends. 📊✨

🔹 Be the first to know about major shifts in the market 🔹 Get daily updates and exclusive insights delivered straight to you 🔹 Join our community of crypto enthusiasts and stay ahead!

💬 Join Our Telegram for Real-Time News

Stay connected and empowered with CryptoTelegraphs! 🚀

#CryptoTelegraphs#CryptoNews#TelegramUpdates#MarketInsights#CryptoCommunity#BlockchainNews#CryptoTrends#DailyCrypto#BitcoinNews#EthereumNews#AltcoinUpdates#TechAnalysis#GlobalMarkets#CryptoInvestors#FinancialNews#CryptoAlerts#StayInformed#CryptoWorld#TradingTips#BlockchainCommunity#Web3Updates#CryptoAnalysis

2 notes

·

View notes

Text

Achieve Trading Excellence with Spectra Global: Here Are the 5 Golden Rules for Successful Trading

2 notes

·

View notes

Text

Fundamental Analysis of Maruti Suzuki

Established in February 1981 as Maruti Udyog Limited, Maruti Suzuki India Limited (MSIL) is now the largest passenger car manufacturer in India. A joint venture between the Government of India and Suzuki Motor Corporation of Japan, the latter currently holds a 58.19% stake in the company. With a diverse portfolio of 16 car models and over 150 variants, Maruti Suzuki caters to various consumer segments, from entry-level small cars like the Alto to the luxury sedan Ciaz.

Sales and Industry Trends

Indian passenger vehicle industry saw record sales of 4.1 million units in 2023, becoming the third largest market globally

Share of utility vehicles in the industry increased to 53% in Q3, with SUVs contributing to about 63%

CNG vehicles saw a share increase to about 16.5% in the industry, with CNG sales reaching an all-time high of ~30%

Company crossed annual sales milestone of 2 million units in 2023 and had highest ever exports of about 270,000 units

Q3 FY23–24 saw total sales of 501,207 vehicles, with net profit rising over 33% year-on-year

Retail sales in Q3 were higher than wholesales, with discounts of INR 23,300 per vehicle

Maruti Suzuki Financials

Revenue and Net Profit: In FY23, Maruti Suzuki witnessed a YoY increase of 33.10% in revenue, reaching Rs. 1,17,571.30 crore, with a net profit of Rs. 8,211 crore, marking a 111.65% YoY increase.

Profit Margins: Operating Profit Margin (OPM) and Net Profit Margin (NPM) improved in FY23, standing at 9% and 6.83%, respectively.

Return Ratios: Return on Equity (RoE) and Return on Capital Employed (RoCE) showed improvements in FY23, reaching 13.28% and 16.02%, respectively.

Debt Analysis: The Debt to Equity ratio slightly increased to 0.02 in FY23, with a healthy Interest Coverage ratio of 70.37.

#StockMarket#Investing#TradingTips#FinancialFreedom#InvestmentStrategy#MarketAnalysis#StockPicks#PortfolioManagement#EconomicIndicators#StockResearch#RiskManagement#MarketTrends#DividendInvesting#TechnicalAnalysis#FundamentalAnalysis

3 notes

·

View notes

Text

#commoditymarket#commoditytrading#commodities#stock trading#investing stocks#gold trading#trading for beginners#tradingtools#trading books#trading course#trading stocks#tradingcommunity#tradingstrategy#tradingtips#forex education#forexmarket#forextrading#forex#forexlifestyle

3 notes

·

View notes

Text

🌐🚀 Embrace the Crypto Renaissance with GLITT COIN! 🚀🌟 Where Virtual 💻 and Real 🌟 Values Merge! 💰✨

🌟🔓 Shatter Limits, Unlock Glitt Coin Treasures! 💎💰

Join us today: https://glitt.io/

#cryptoadventure#financialsecurity#glittcoin#cryptogoals#easytrading#ethereum#btc#cryptoglitt#tradingtips#coinlaunch#bitcoin#crypto#blockchain#bitcoininvestment

2 notes

·

View notes

Text

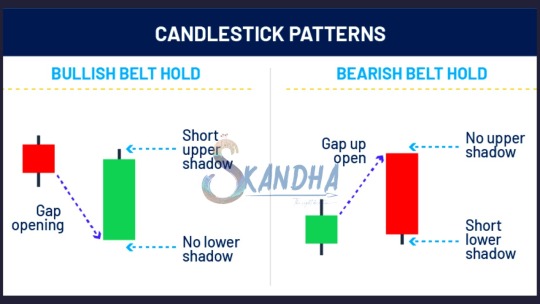

A belt hold pattern suggests that a trend may be reversing and indicates investor sentiment may have changed. When looking at them historically, there will often be a clear trend in one direction, followed by a clear trend in the other direction as the color of the candlestick changes.

There are two types of belt hold candlestick: one bullish and one bearish.

#skandhatrade #belthold #support #resistance #stock #chart #Trade #signal #patterns

#trend #Technicals #analysis #strategies #candlestick #priceaction #entry #supply #demand

To Learn More DM us

We Offer Paid Courses And Training Contact us Via

Email : [email protected]

https://forms.gle/8rWzz1gUuerxwVM49

Website: https://skandhatrade.com/

To Register for Learning:

2 notes

·

View notes

Text

🌟💰 Unleash Your Trading Potential with FunderPro.com: Exploring the World of Crypto! 💰🌟

Hey there, Tumblr fam! Today, I want to dive into the exciting realm of cryptocurrency trading and introduce you to an incredible prop firm that's making waves in the industry: FunderPro.com! 🚀

💼 What's FunderPro.com all about? 💼

FunderPro.com is a cutting-edge prop trading firm that specializes in the world of cryptocurrencies. Whether you're a seasoned trader or a newbie looking to explore the thrilling world of digital assets, FunderPro.com is your ultimate gateway to success. 💪

🌐 Unlocking New Opportunities 🌐

If you've been keeping an eye on the market, you'll know that cryptocurrencies have taken the financial world by storm. With FunderPro.com, you'll have the chance to capitalize on this digital revolution and potentially make some serious profits. 💸

🤝 Join the Elite Trading Community 🤝

What sets FunderPro.com apart from the rest is its strong focus on community and collaboration. When you sign up, you become part of an exclusive network of traders, mentors, and experts who are there to support and guide you every step of the way. It's a thriving ecosystem of knowledge sharing and growth that will help you sharpen your skills and maximize your potential. 📚✨

🔒 Cutting-Edge Trading Tools and Technology 🔒

FunderPro.com provides its traders with top-of-the-line tools and technology to ensure you stay ahead of the game. From advanced charting and analytics to real-time market data and lightning-fast execution, FunderPro.com equips you with everything you need to make informed trading decisions and seize lucrative opportunities. 📈📊

📈 The Future Is Crypto – Are You Ready? 🚀

Cryptocurrencies have proven time and again that they're here to stay, and the market is only getting more exciting. FunderPro.com gives you the chance to be at the forefront of this financial revolution, allowing you to trade a wide range of digital assets and explore new opportunities that traditional markets can't provide. It's an exhilarating journey where the potential for growth is limitless! 🌌

🔐 Take the First Step with FunderPro.com 🔐

Ready to embark on your crypto trading adventure? Head over to FunderPro.com and discover how this prop firm can help you turn your trading dreams into a reality. Join the vibrant community, harness cutting-edge tools, and embrace the world of digital assets like never before. The future is yours for the taking, so seize it with FunderPro.com today! 💫💪

Visit our website: https://funderpro.com/

#FunderPro#CryptoTrading#PropFirm#FinancialRevolution#DigitalAssets#Bitcoin#Ethereum#Altcoins#Blockchain#Cryptocurrency#Investment#TradingTips#CryptoCommunity#HODL#DeFi (Decentralized Finance)#CryptoNews#CryptoEducation#CryptocurrencyExchange#CryptoMarket#CryptoInvesting#CryptoTech#CryptoLifestyle#Cryptonews

4 notes

·

View notes

Text

Earnings Catalysts Could Make These Stocks Rocket

🚀 Earnings Catalysts Could Make These Stocks Rocket 🚀 https://www.youtube.com/watch?v=b1jLKdCDW2A Today I give you my top 3 stock setups going into earnings this week! Some I have bought personally, others looks primed to explode! Biotech's are super hot right now attracting a ton of hedge fund, smart money presence! Remember, when institutions see value and start buying, the street takes notes. Some tickers perform so well that they can be added to major index funds which will naturally cause more people to see value and buy the stock! Any questions please ask! TIMELINE: 0:00 Stock 1 2:01 Stock 2 3:37 Stock 3 ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/a3no9He 👉 Instagram: https://ift.tt/lBLGJWq ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader https://youtu.be/pZAKJLk9o0I 👉 How My Subscribers Doubled Their Money Today!!! https://youtu.be/s5M_OGv8AtM 👉 7 Great Value Stocks to Buy BEFORE They Explode! https://youtu.be/0I451lsCjAc 👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥 https://youtu.be/4B3EK7lb38k ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #stockstobuy #stockstobuynow #stockstowatch #stockstotradetomorrow #stockanalysis #stockmarketnews #stocknews #breakingnews #topstocks #topstockstobuynow #partnership #biotechstocks #millionaire #stockearnings #earningsreport #earningsweek #catalyst Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA May 07, 2024 at 05:55AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

2 notes

·

View notes

Text

Master the Thrusting Line Pattern

Want to sharpen your candlestick reading skills? Master the Thrusting Line Pattern — a subtle but powerful continuation signal that can guide your next trade. In our latest guide, learn:

What the Thrusting Line pattern looks like

When to use it

Real chart examples

Perfect for beginners and intermediate traders. Read now:

0 notes

Photo

Does it give up...Look at how close price is getting compressed....Looks like a classic bear flag. So how do you approach this play & when do you invalidate it ? $SPY

0 notes

Text

Algorithmic Trading

Trade automatically with speed and precision. Code your strategy, backtest it, and execute emotion-free trades in real time.

#tradingstrategies#AlgorithmicTrading#AlgoTrader#Backtesting#TradingBots#QuantTrading#AutomationInFinance#tradingtips#tradingstrategy#algotrading

0 notes

Text

Advantages of Stop Loss Order in 2025 and Why Should We Use It?

Stop Loss Order is one essential tool for risk management. In the fast-paced world of stock market trading, managing risk is crucial for both novice and experienced traders. Understanding the meaning of a stop loss order, its advantages, and how to effectively use it can significantly enhance your trading strategy and protect your investments.

This article explores the advantages of stop loss order, their meaning, and why incorporating them into your trading strategy is beneficial. Additionally, we will highlight how the ISMT Stock Market Institute helps traders understand and implement stop loss order effectively.

What is a Stop Loss Order?

Stop Loss Order Definition:

A stop loss order is a pre-set instruction to sell a security when it reaches a specified price, known as the stop price. This type of order helps traders limit their losses on a position by ensuring that the stock is sold before the price drops too far. In essence, this order is a risk management tool designed to prevent significant losses from adverse market movements.

Advantages of Stop Loss Order

1. Effective Risk Management:

The primary advantage of a stop loss order is its ability to manage risk. By setting a stop loss limit, traders can predetermine the maximum loss they are willing to accept on a trade. This helps protect capital and avoid catastrophic losses, especially in volatile markets.

2. Emotional Discipline:

Emotional trading is a significant challenge for many investors. Fear and greed can lead to poor decision-making and substantial losses. it enforces discipline by executing trades automatically when the stop price is reached, thereby removing emotional influences from the decision-making process.

3. Time Efficiency:

Constantly monitoring the markets can be time-consuming and stressful. It allows traders to set their exit strategy and focus on other activities without worrying about market fluctuations. This saves time and reduces the stress associated with active monitoring.

4. Protection Against Market Volatility:

The stock market is inherently volatile. Unexpected news, economic events, or geopolitical developments can cause sudden price swings. By using a stock market stop loss, traders can protect themselves from such volatility, ensuring they do not hold onto losing positions for too long.

5. Automatic Execution:

This order is executed automatically once the stop price is reached. This ensures that the trade is carried out promptly, without the need for manual intervention. Automatic execution is particularly beneficial during periods of rapid price movements, where quick decision-making is crucial.

6. Flexible Strategy Implementation:

This orders can be utilized in various trading strategies, including day trading, swing trading, and long-term investing. They can be adjusted based on the trader’s risk tolerance and market conditions, offering flexibility in their application.

7. Profit Protection:

Besides limiting losses, this order can also be used to protect profits. Trailing stop losses, for example, adjust the stop price as the stock price moves in a favorable direction. This allows traders to lock in profits while still giving the stock room to appreciate further.

8. Reduced Stress Levels:

Knowing that this order is in place provides peace of mind to traders. It allows them to pursue other activities or focus on other trades without the constant worry of monitoring every price movement, leading to a healthier and more balanced trading lifestyle.

9. Encourages Strategic Planning:

Using this order encourages traders to plan their trades more strategically. It forces them to think about their exit strategy before entering a trade, which can lead to more thoughtful and well-planned trading decisions.

10. Enhances Trading Consistency:

Consistent use of this orders promotes disciplined trading practices. It ensures that every trade has a predefined exit strategy, helping to maintain a consistent approach to risk management across all trades.

Why Should You Use Stop Loss Order?

1. Enhances Risk Management:

Incorporating stop loss into your trading strategy enhances overall risk management. By clearly defining the maximum loss you are willing to accept, you can trade with greater confidence and reduce the potential for significant financial setbacks.

2. Promotes Consistency:

Consistent use of stop loss promotes disciplined trading practices. It ensures that every trade has a predefined exit strategy, helping to maintain a consistent approach to risk management across all trades.

3. Improves Decision-Making:

With stop loss in place, traders can make more objective and informed decisions. Knowing that potential losses are capped allows traders to focus on analyzing market conditions and making strategic moves without the burden of worrying about excessive losses.

4. Facilitates Learning:

Using stop loss can be a valuable learning tool for traders. By analyzing trades where stop losses were triggered, traders can gain insights into their decision-making process and market conditions, helping to refine future strategies.

5. Supports Long-Term Success:

Successful trading is not just about making profits; it’s also about preserving capital. By consistently using stop loss, traders can avoid large, catastrophic losses, which is crucial for long-term success in the stock market.

6. Adapts to Market Changes:

Stop loss can be adjusted based on changing market conditions. This adaptability allows traders to refine their risk management strategies in response to new information, market trends, and personal experiences.

7. Provides Peace of Mind:

Knowing that a stop loss order is in place provides peace of mind to traders. It allows them to pursue other activities or focus on other trades without the constant worry of monitoring every price movement, leading to a healthier and more balanced trading lifestyle.

Types of Stop Loss Order

1. Fixed Stop Loss Order:

A fixed stop loss order involves setting a specific price at which the stock will be sold. This price remains constant unless manually adjusted by the trader. Fixed stop loss order are straightforward and provide a clear risk management strategy.

2. Trailing Stop Loss Order:

A trailing stop loss order moves with the stock price. If the stock price moves in a favorable direction, the stop price is adjusted accordingly, often by a fixed percentage or amount. This type of stop loss helps lock in profits while still providing protection against adverse price movements.

3. Stop Limit Order:

A stop limit order combines the features of a stop loss order and a limit order. When the stop price is reached, the order becomes a limit order to sell at a specified price or better. This order type provides more control over the sale price but carries the risk that the order may not be executed if the price moves too quickly.

4. Market Stop Loss Order:

A market stop loss order converts to a market order once the stop price is reached, ensuring immediate execution at the next available price. While this guarantees execution, it may result in a sale at a price significantly different from the stop price, especially in volatile markets.

How to Set an Effective Stop Loss Order

1. Determine Your Risk Tolerance:

Assess how much loss you are willing to tolerate on a trade. This depends on factors such as your trading strategy, financial goals, and risk appetite. Setting an appropriate stop loss limit based on your risk tolerance is crucial.

2. Analyze Market Conditions:

Consider current market conditions when setting a stop loss order. In highly volatile markets, you may need to set a wider stop loss limit to avoid being stopped out by normal price fluctuations.

3. Use Technical Analysis:

Utilize technical analysis tools to identify key support and resistance levels. Placing stop loss order near these levels can help avoid premature exits and provide a more strategic approach to risk management.

4. Review and Adjust Regularly:

Regularly review your stop loss order and adjust them based on market developments and your trading performance. This ensures that your stop loss strategy remains effective and aligned with your overall trading goals.

5. Combine with Other Risk Management Tools:

Stop loss order should be part of a broader risk management strategy that includes position sizing, diversification, and other risk mitigation techniques. Combining these tools can enhance your overall risk management approach.

Common Mistakes to Avoid with Stop Loss Order

1. Setting Stop Losses Too Tight:

Setting stop losses too close to the entry price can result in frequent stop-outs due to normal market fluctuations. This can lead to missed opportunities and unnecessary trading costs.

2. Ignoring Market Conditions:

Failing to consider market volatility and trends when setting stop loss order can lead to ineffective risk management. Always analyze the market environment to set appropriate stop loss limits.

3. Over-Reliance on Stop Loss Order:

While stop loss order are essential, relying solely on them without considering other risk management techniques can be risky. Ensure that stop loss order are part of a comprehensive risk management strategy.

4. Not Reviewing Stop Loss Order:

Market conditions and trading strategies evolve over time. Regularly reviewing and adjusting stop loss order ensures they remain relevant and effective.

5. Emotional Adjustments:

Avoid adjusting stop loss order based on emotions such as fear or greed. Stick to your predefined strategy and make adjustments based on logical analysis and market conditions.

ISMT Stock Market Institute: Mastering Stop Loss Order

The ISMT (Institute of Stock Market Training) Stock Market Institute is renowned for its comprehensive training programs that equip traders with the knowledge and skills necessary for successful trading. One of the key areas of focus at ISMT is the effective use of stop loss order. Here’s how ISMT helps traders master stop loss order:

1. In-Depth Understanding:

ISMT provides an in-depth understanding of the stop loss meaning and its importance in trading. The institute emphasizes the concept of risk management and how stop loss order can be a vital tool in mitigating losses.

2. Practical Training:

ISMT offers practical training sessions where traders can learn to set and adjust stop loss order in real-time market conditions. This hands-on experience is crucial for developing confidence and proficiency in using stop loss order.

3. Technical Analysis Integration:

The curriculum at ISMT integrates technical analysis with stop loss strategies. Traders learn to use technical indicators and chart patterns to determine optimal stop loss levels, enhancing their overall trading strategy.

4. Personalized Coaching:

Traders receive personalized coaching to understand their risk tolerance and trading goals. This tailored approach ensures that each trader can effectively implement stop loss order according to their individual needs.

5. Ongoing Support:

ISMT provides ongoing support and mentorship to traders, helping them continuously refine their stop loss strategies and adapt to changing market conditions. This long-term support is invaluable for sustained trading success.

CONCLUSION

Incorporating stop loss order into your trading strategy is a prudent decision that offers numerous advantages. From managing risk and promoting emotional discipline to saving time and protecting against market volatility, stop loss order are a critical tool for any trader. By understanding the stop loss meaning and effectively implementing it, you can enhance your trading strategy, protect your investments, and achieve long-term success in the stock market.

The ISMT Stock Market Institute stands out as a premier institution for mastering stop loss order and other essential trading skills. With comprehensive training, practical experience, and personalized coaching, ISMT equips traders with the knowledge and tools needed to succeed in the stock market. Whether you are a beginner or an experienced trader, leveraging the benefits of stop loss order through ISMT’s training can significantly enhance your trading performance and career.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#stoploss#tradingtips#stockmarket2025#howtoinvest#riskcontrol#learntotrade#investmentstrategies#moneymanagement#traderlife#daytrading#tradingpsychology#stockmarketeducation#stoplossexplained#financeblog#personalfinance#ismtinstitute#learnfromismt#ismt

0 notes