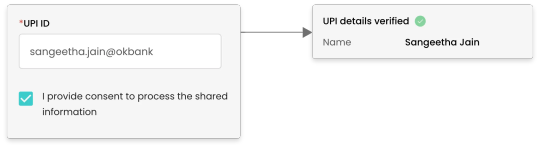

#UPI Verification api

Explore tagged Tumblr posts

Text

UPI Verification API: Revolutionizing Payment Systems with Ekytchub

In today’s fast-paced digital world, online payments are becoming more common and necessary across all industries. UPI (Unified Payments Interface) has emerged as one of the most powerful and widely adopted payment methods in India, allowing for seamless and instant money transfers between banks. However, with the growing volume of transactions, ensuring security, validating payment information, and reducing fraud are crucial.

To address these challenges, Ekytchub offers a cutting-edge UPI Verification API that helps businesses and developers verify UPI IDs, streamline transactions, and boost payment security.

#fintech#techinnovation#tech#technews#technology#UPI Verification api#ekychub#best api#best app development companies#aadhaar verification api

0 notes

Text

UPI Payment Gateway India

Empower Your Transactions with Quintus Tech: Leading Automated Payment Solution Provider in India. Discover seamless payment solutions in India with Quintus Tech – your trusted automated payment solution provider. Streamline transactions effortlessly Quintus Tech offers cutting-edge and seamless payment solutions in India, serving as your trusted automated payment solution provider. Our goal is to simplify and streamline transactions, making the payment process effortless for businesses and individuals alike. Automation, Security, User-Friendly Interface, Versatility, Integration, Customer Support, Innovation etc. Visit Our Website :- https://quintustech.in/

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions

0 notes

Text

UPI payment gateway in India

Quintus Tech provides a wide range of services including automated payment solutions in India and digital payment systems, mobile payment solutions, and UPI payment gateways. They enable businesses to easily and securely accept customer payments, settle transactions, and improve customer experience.

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business

0 notes

Text

What are Payout Solutions and How Do They Simplify Business Payments?

In today’s rapidly evolving financial landscape, businesses are constantly looking for efficient, reliable, and cost-effective ways to manage payments. Whether it’s paying employees, suppliers, or customers, seamless and error-free payment processes are critical for operational success. This is where payout solutions come into play. A payout solution is an advanced payment processing system that automates and simplifies bulk payments, ensuring businesses can send funds securely and quickly.

What are Payout Solutions?

Payout solutions refer to platforms or systems that enable businesses to distribute payments to multiple beneficiaries seamlessly and efficiently. These beneficiaries can include employees, vendors, freelancers, customers, or even stakeholders. By leveraging modern technology, payout solutions allow businesses to process bulk payments through a single interface, eliminating manual processes and reducing the chances of errors.

Payout solutions are particularly essential for businesses that deal with large volumes of transactions daily. Sectors such as e-commerce, fintech, gig economy platforms, and other industries rely heavily on streamlined payout systems to ensure their financial operations run smoothly.

For example, companies can use a payout solution to disburse salaries, refunds, commissions, incentives, or vendor payments at scale with minimal human intervention.

How Do Payout Solutions Work?

A payout solution works as a bridge between a business and its payment recipients. It integrates with the business’s financial system or software and streamlines the process of transferring funds. Here’s a step-by-step breakdown of how payout solutions operate:

Integration: The payout system integrates with the business’s existing financial software or banking platform to access required data, such as payment amounts and recipient details.

Bulk Upload: Businesses upload payment details, including beneficiary names, account information, and amounts, into the platform. This can often be done via a file upload or API integration.

Payment Processing: The payout solution processes the payments using multiple payment modes, such as bank transfers, UPI, NEFT, IMPS, wallets, or card-based systems.

Verification and Approval: Before releasing funds, the system verifies all recipient details to avoid errors or payment failures. Businesses can also set up approval workflows to ensure security and compliance.

Disbursement: Payments are disbursed instantly or as scheduled, depending on the system’s configuration and business requirements.

Notifications: Once payments are completed, recipients are notified via email, SMS, or other communication channels. Additionally, businesses receive confirmation reports to maintain records.

How Payout Solutions Simplify Business Payments

Payout solutions offer a variety of features that help businesses simplify their payment processes. Some of the key benefits include:

Automation of Payments One of the most significant advantages of payout solutions is automation. Businesses no longer need to process payments manually, which can be time-consuming and prone to errors. Automated solutions allow bulk payments to be processed quickly and accurately.

Multiple Payment Modes Modern payout systems provide businesses with flexibility by supporting various payment methods, including bank transfers, UPI, mobile wallets, and more. This ensures payments can be sent according to the preferences of recipients.

Real-Time Processing Traditional payment methods often involve delays, especially when dealing with bulk transactions. Payout solutions offer real-time or near-instant payment processing, ensuring recipients receive funds promptly.

Cost and Time Efficiency Manual payment processes require significant time and resources, leading to operational inefficiencies. By using a payout solution, businesses can reduce administrative costs and save valuable time that can be allocated to core operations.

Improved Accuracy and Security Errors in payment processing can cause delays, mistrust, and additional costs. Payout solutions use robust verification mechanisms to minimize errors and enhance security. Additionally, many systems comply with financial regulations, ensuring safe transactions.

Seamless Reconciliation Payout solutions simplify the reconciliation of payments by providing detailed transaction records and reports. Businesses can easily track completed, pending, or failed transactions, making financial management more transparent and organized.

Enhanced Customer and Vendor Experience Fast and error-free payments improve the overall experience for customers, vendors, and employees. For instance, e-commerce platforms can use payout systems to ensure quick refunds, leading to improved customer satisfaction and loyalty.

Payment Solution Providers and Their Role

Payment solution providers play a crucial role in the success of payout systems. These providers offer the technology and infrastructure needed for businesses to handle complex payment processes efficiently. By offering robust platforms, they enable organizations to send bulk payments with speed, accuracy, and security.

Companies like Xettle Technologies are leading players in the payout solutions ecosystem. They provide advanced payout platforms designed to cater to businesses of all sizes, ensuring streamlined payment operations and financial management. With such providers, businesses can focus on growth while leaving their payment challenges to trusted experts.

Key Industries Benefiting from Payout Solutions

Several industries rely heavily on payout solutions to manage their financial operations, including:

E-commerce: Automating refunds, vendor payments, and cashbacks.

Fintech: Handling instant disbursements for loans and digital wallets.

Gig Economy Platforms: Paying freelancers, contractors, and service providers seamlessly.

Insurance: Disbursing claim settlements quickly to enhance customer trust.

Corporate Sector: Managing salaries, incentives, and reimbursements.

Conclusion

Payout solutions have revolutionized the way businesses manage their financial transactions. By automating and simplifying payment processes, businesses can save time, reduce costs, and improve accuracy while ensuring recipients receive funds promptly. Whether it’s paying employees, vendors, or customers, payout solutions offer a scalable and secure way to handle bulk payments effortlessly.

As payment solution providers like Xettle Technologies continue to innovate, businesses can look forward to more efficient and seamless financial operations. For organizations aiming to streamline their payouts, adopting a reliable payout solution is a step toward achieving operational excellence and enhanced financial management.

2 notes

·

View notes

Text

Secure Payments Made Simple: How Gridline's Payment APIs Enhance Transaction Safety

Discover how Gridline's real-time payment verification APIs simplify transactions, reduce fraud risks, and ensure compliance. By validating bank accounts, UPI IDs, and assets, businesses can securely manage payments, minimize errors, and boost operational efficiency. With rapid and scalable solutions, Gridlines helps organizations maintain secure, seamless, and compliant digital payment processes.

#PaymentVerification#FraudPrevention#RealTimeAPI#UPIIDVerification#BankAccountVerification#DigitalPayments#Compliance#GridlinesAPI#SecureTransactions#PaymentSecurity#IdentityAPI#BusinessAPI#AssetVerification#EmploymentVerification

0 notes

Text

Enhancing Payment Security: How Gridlines' Real-Time Verification APIs Safeguard Transactions

In the digital-first business landscape, ensuring secure and seamless transactions is critical. From customer payouts to vendor settlements, each payment carries a risk—of fraud, errors, or non-compliance. Gridlines is helping businesses overcome these challenges with real-time payment verification APIs built for accuracy, speed, and scale.

Why Payment Verification Matters

Digital payments have exploded across sectors—e-commerce, fintech, lending, gig economy, and more. However, with this scale comes increased exposure to fraud, fake accounts, and compliance failures. One incorrect payment or a fraudulent bank account can lead to financial losses and erode customer trust.

That’s where Gridlines steps in—offering real-time verification tools to confirm account details, validate UPI IDs, and protect your transactions from the very start.

Gridlines APIs That Power Payment Security

Gridlines offers a comprehensive suite of APIs across four key categories:

Identity APIs: To verify the legitimacy of individuals via PAN, Aadhaar, Voter ID, and more.

Business APIs: To validate the authenticity of vendors, MSMEs, and other entities through Udyam, GSTIN, and MCA records.

Asset APIs: To verify ownership of financial assets such as bank accounts and UPI handles before initiating transfers.

Employment APIs: To validate income and employment details for risk profiling and decision-making.

Benefits of Using Gridlines for Payment Verification

✅ Reduced Fraud Risk: By verifying payees in real time, you eliminate fake accounts and reduce exposure. ✅ Faster Transactions: Instant validations cut down delays in disbursal and refunds. ✅ Regulatory Compliance: Stay aligned with KYC/AML norms and reduce the risk of non-compliance. ✅ Scalable Integration: Gridlines APIs are plug-and-play with modern platforms and support high transaction volumes.

Use Cases Across Industries

Fintech & Lending: Confirm bank accounts before disbursing loans.

Gig Economy Platforms: Ensure freelancers and drivers receive payments to verified accounts.

E-commerce Marketplaces: Reduce return fraud and process refunds securely.

Payroll & HRMS Systems: Safely credit salaries to verified employees.

Conclusion

In a world of instant digital payments, verification must happen just as fast—and just as accurately. Gridlines API infrastructure enables businesses to safeguard every transaction with confidence.

Whether you're scaling disbursements, reducing fraud, or streamlining operations, Gridlines empowers secure payments from the ground up—with the right data, right now.

0 notes

Text

Fantasy Cricket App Development in 2025: Features, Tech Stack & Cost Breakdown

The rise of fantasy sports is rewriting the playbook for digital engagement in India, and at the center of this revolution is fantasy cricket. As one of the most-loved sports in the country, cricket offers a perfect foundation for fantasy gaming platforms that attract millions of users, especially during major tournaments like IPL and ICC events. If you're considering building your own fantasy cricket app in India, 2025 is the ideal time to jump in.

This guide covers everything you need to know—from features and tech stack to development costs—to help you launch a successful fantasy cricket app.

Why Invest in Fantasy Cricket App Development?

India is home to over 160 million fantasy sports users, and that number is expected to grow with improved internet access and smartphone penetration. A well-designed fantasy cricket platform not only taps into this massive fan base but also opens doors to diverse monetization models—entry fees, in-app purchases, brand partnerships, and more.

This makes fantasy cricket app development a high-potential investment for startups, entrepreneurs, and even existing sports brands.

Must-Have Features for a Fantasy Cricket App in 2025

To stand out in a competitive space, your app needs more than just basic functionality. Here's a breakdown of essential features:

1. User Registration and Login

Social logins (Google, Facebook, Apple ID)

OTP-based mobile verification for security

2. Live Match Integration

Real-time match updates

Ball-by-ball commentary feed

Player stats and live scores synced with official data

3. Create & Join Contests

Public, private, and mega contests

Entry fee and prize pool customization

Leaderboards with real-time rankings

4. Fantasy Team Building

Player selection based on credits and match format

Captain/vice-captain selection with multiplier effects

Notifications for lineup announcements

5. Wallet and Payment Integration

Secure in-app wallet for deposits and withdrawals

Integration with Razorpay, Paytm, Stripe, or UPI

Transaction history and withdrawal status

6. Admin Dashboard

Manage matches, users, contests, and payments

Ban/suspend users or edit contest details

Real-time revenue analytics and reporting

7. Referral & Bonus Systems

Promote viral growth via referral codes

Signup bonuses and loyalty rewards to boost engagement

Recommended Tech Stack

Choosing the right technologies ensures performance, scalability, and security. Here’s a tech stack ideal for a fantasy cricket app in India:

Frontend (Mobile App): Flutter or React Native for cross-platform support

Backend: Node.js or Django for high-speed, scalable server architecture

Database: MongoDB or PostgreSQL

Real-Time Data Sync: Firebase or Socket.IO

Payment Gateway: Razorpay, Paytm, or Stripe

Push Notifications: Firebase Cloud Messaging (FCM)

Hosting: AWS, Google Cloud, or Azure

Many gaming app development companies specialize in these tools and offer custom development packages tailored to Indian audiences.

Development Cost Breakdown

The cost of building a fantasy cricket app depends on several factors, including features, platform support (Android/iOS), UI/UX complexity, and third-party API integrations.

Here’s an approximate cost range:

Development Stage

Estimated Cost (USD)

UI/UX Design

$2,000 – $5,000

App Development (MVP)

$8,000 – $15,000

Backend + API Integration

$5,000 – $10,000

Admin Panel

$3,000 – $6,000

Real-Time Data Feed APIs

$2,000 – $4,000/year

Total (Basic to Advanced App)

$20,000 – $40,000

Note: Costs may vary based on developer rates and region. Partnering with experienced gaming app development companies in India may offer better affordability without compromising on quality.

Final Thoughts

As cricket continues to dominate the Indian sports scene, the demand for intuitive, feature-rich fantasy platforms will only grow. Whether you're a startup entering the market or a sports brand looking to enhance fan engagement, investing in fantasy cricket app development offers excellent growth potential.

Choosing the right development partner, defining your feature set clearly, and focusing on user experience are key to standing out in this competitive landscape.

#real money game development services#fantasy cricket app development#appcurators#mobile apps#fantasy

0 notes

Text

Why Your Business Needs a Reliable Flight Booking API Provider in India

In India's rapidly expanding travel market, offering seamless flight booking services is no longer a luxury, but a necessity. Whether you're a travel agency, an online travel portal, or a business looking to integrate travel services into your platform, a reliable Flight Booking API Provider in India is essential. This article explores the compelling reasons why your business needs a robust fastag recharge api and how it can drive growth and enhance customer satisfaction.

The Indian aviation sector is experiencing unprecedented growth, with an increasing number of people opting for air travel. To capitalize on this trend, businesses need to provide convenient and efficient flight booking solutions. A reliable Flight Booking API Provider enables businesses to access real-time flight data, automate booking processes, and offer a seamless user experience.

Key Benefits of Integrating a Flight Booking API:

Real-Time Data Access: APIs provide access to up-to-date flight information, including availability, fares, and schedules, ensuring accuracy and reliability.

Automation and Efficiency: Automating the booking process reduces manual effort, minimizes errors, and streamlines operations.

Enhanced Customer Experience: Offering a seamless and user-friendly booking experience enhances customer satisfaction and loyalty.

Increased Revenue: Integrating a flight booking API can open new revenue streams by allowing businesses to offer a wider range of travel services.

Scalability: APIs allow businesses to scale their operations as demand grows, without the need for significant infrastructure investments.

Competitive Advantage: Offering convenient and efficient flight booking services can give businesses a competitive edge in the market.

Integration with Other Services: A good flight booking API can integrate with other essential services, like Bus Booking API Solution in India, allowing your business to offer a complete travel package.

Enhancing Security and Payment Options:

In today’s digital age, security and diverse payment options are critical. Integrating services like an Aadhar Verification API Solution in India can significantly enhance security by verifying customer identities. Offering diverse payment methods, including those facilitated by a UPI eCollection API Solution in India, ensures a smooth and convenient transaction process.

Why Cyrus Recharge Stands Out:

Cyrus Recharge is a leading software development and API provider in India, offering robust and reliable flight booking API solutions. Their expertise in API integration and commitment to customer satisfaction make them a valuable partner for businesses looking to enhance their travel services.

Frequently Asked Questions (FAQs):

What key features should I look for in a Flight Booking API Provider?

Key features include real-time data access, API reliability, ease of integration, scalability, robust security, and comprehensive customer support.

How can integrating an Aadhar Verification API Solution benefit my flight booking business?

Integrating an Aadhar Integration Service Provider in India enhances security by verifying customer identities, reducing the risk of fraud, and ensuring compliance with regulatory requirements.

Why is offering diverse payment options, like UPI, important for flight bookings?

Offering diverse payment options, including those facilitated by a UPI eCollection API Solution in India, provides customers with flexibility and convenience, enhancing their booking experience and increasing conversion rates.

fssai verification api

0 notes

Text

🔐 Prevent UPI Fraud with Ekychub’s Real-Time Verification API

The rapid growth of UPI (Unified Payments Interface) has revolutionized digital transactions in India. However, this surge in usage has also led to a sharp rise in UPI-related fraud. Fake UPI IDs, misrouted transactions, and impersonation scams are now major threats for businesses and customers alike.

To combat this, Ekychub offers the fastest and most secure UPI Fraud Prevention API, designed to help businesses verify UPI IDs in real time, safeguard their platforms, and build user trust.

🚨 Why Is UPI Fraud Prevention So Important?

Every second, thousands of UPI transactions are processed across platforms. Even a small lapse in verification can lead to:

Financial loss for the business or the customer

Damaged reputation due to failed or fraudulent transactions

Compliance issues in regulated industries

That’s where Ekychub steps in — providing a simple yet powerful solution to instantly verify UPI IDs before payment.

⚡ Ekychub’s UPI Fraud Prevention API – Key Features

✅ Real-Time UPI ID Verification

Our API instantly checks the validity of a UPI ID and confirms if it’s linked to a legitimate account.

👤 Fetch Account Holder Name

Match the UPI ID to the account holder’s name to detect impersonation or mismatches before processing payments.

🛡️ Fraud Detection & Prevention

Automatically flag suspicious UPI IDs or unknown patterns, minimizing the risk of fraud.

🔄 Seamless Integration

The API is lightweight, fast, and easily integrates into your existing payment system or app.

📈 Scalable & Secure

Whether you're handling hundreds or millions of transactions, our infrastructure is built to scale while keeping data encrypted and secure.

💼 Who Should Use This API?

Ekychub’s UPI Fraud Prevention API is ideal for:

Payment Gateways & Processors

Fintech Platforms & Digital Wallets

Lending & BNPL Apps

eCommerce & Marketplace Platforms

Subscription-Based Services

Basically, any business that accepts UPI payments should prioritize fraud prevention and user verification.

🧠 How It Works

Input the UPI ID into your platform (e.g., during checkout or onboarding).

Ekychub’s API validates the ID in real time.

Receive verified details including the account holder name and status.

Process the transaction securely with full confidence.

🚀 Benefits of Using Ekychub’s UPI Fraud Prevention API

Reduce failed transactions and chargebacks

Protect your customers and your brand

Speed up the verification process with automation

Build trust and ensure regulatory compliance

Lower operational costs related to fraud handling

🔗 Get Started Today

Don’t wait for fraud to affect your business. Integrate Ekychub’s UPI Verification API and take the first step toward secure, reliable UPI transactions.

#techinnovation#identityvalidation#tech#technology#technews#aadhaarintegration#fintech#ekychub#kycverificationapi#aadhaarverificationapi#UPIFraudPrevention#UPIVerification#SecurePayments#KYCAPI#DigitalKYC#Ekychub#FintechSolutions#InstantUPIValidation#PaymentSecurity#FraudDetectionAPI#🔐 “Stay ahead of scammers! Use Ekychub’s UPI Fraud Prevention API to validate users instantly and protect every transaction.”#UPIVerificationAPI#FraudDetection#RealTimeVerification#SecureUPI#aadharverificationapi#bankverificationapi#panverificationapi#ekycverificationapi

1 note

·

View note

Text

Payment Solution Providers in India

Empower Your Transactions with Quintus Tech: Leading Automated Payment Solution Provider in India. Discover seamless payment solutions in India with Quintus Tech – your trusted automated payment solution provider. Streamline transactions effortlessly Quintus Tech offers cutting-edge and seamless payment solutions in India, serving as your trusted automated payment solution provider. Our goal is to simplify and streamline transactions, making the payment process effortless for businesses and individuals alike. Automation, Security, User-Friendly Interface, Versatility, Integration, Customer Support, Innovation etc. Visit Our Website :- https://quintustech.in/

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions"

0 notes

Text

Automated Payment Solutions

Quintus Tech provides a wide range of services including automated payment solutions in India and digital payment systems, mobile payment solutions, and online payment gateways. They enable businesses to easily and securely accept customer payments, settle transactions, and improve customer experience.

#Payment Solution Providers in India#Automated Payment Solutions#Quintus Tech#UPI Payment Gateway#White Label Development#Bank Account Verification API#Digital Client Onboarding#Dynamic UPI QR Code Generator#Virtual Bank Account for Business#Recurring Online Transactions

0 notes

Text

Car Rental App Development Key Features in 2025

Car rental apps are changing the way people rent cars. Whether for travel, business, or daily use, these apps make it easy to book a vehicle in just a few taps. If you are thinking about building a car rental app, this guide will help you understand the key features needed for success.

Why Car Rental Apps Are Popular

Car rental apps save time and effort. Instead of visiting a rental office, users can book cars online, compare prices, and get their vehicle delivered or picked up. The demand for car rental services is growing fast, making it a great business opportunity.

Types of Car Rental Apps

Self-Drive Rentals – Users rent cars and drive themselves.

Chauffeur Services – Users book a car with a driver.

Peer-to-Peer (P2P) Rentals – Car owners rent out their vehicles.

Corporate Car Rentals – Businesses provide rental cars to employees.

Luxury Car Rentals – High-end cars for special occasions.

Must Have Features of a Car Rental App

For Users:

Easy Sign-Up & Login – Use email, phone number, or social media.

Car Search & Filters – Find cars based on price, type, fuel, and more.

Booking & Scheduling – Choose dates and reserve a car instantly.

Real-Time GPS Tracking – Track the rented car’s location.

Multiple Payment Options – Pay via credit card, wallet, or UPI.

User Reviews & Ratings – Check feedback before renting.

Customer Support – Get help through chat or call.

For Admins:

Dashboard & Reports – Track bookings and earnings.

Car Management – Add or remove vehicles.

User & Driver Management – Manage accounts and documents.

Pricing & Discounts – Set rental prices and offers.

Notifications & Alerts – Send updates to users and drivers.

For Drivers :

Profile & Verification – Register and submit documents.

Booking Requests – Accept or decline rides.

Navigation & Route Guide – Get optimized routes.

Earnings Dashboard – Track income and ride history.

Technology Used in Car Rental Apps

Frontend: React Native, Flutter, Swift, Kotlin

Backend: Node.js, Python, Java

Database: Firebase, PostgreSQL, MongoDB

Hosting: AWS, Google Cloud, Microsoft Azure

Payment Integration: Stripe, PayPal, Razorpay

Navigation: Google Maps API, Mapbox

How Car Rental Apps Make Money

Rental Fees – Users pay based on the rental period.

Subscription Plans – Offer memberships with discounts.

Surge Pricing – Increase prices during peak demand.

Ads & Promotions – Earn from third-party advertisements.

Corporate Partnerships – Tie up with businesses for bulk rentals.

Late Return Fees – Charge extra for late car returns.

Challenges in Car Rental App Development

Challenges in car rental app development include managing bookings, securing user data, setting up payments, creating simple interfaces, handling car fleets, ensuring accurate GPS, adjusting to demand, and following legal rules.

Legal Compliance – Following rules and getting licenses.

Car Maintenance – Managing and servicing rental vehicles.

User Trust & Security – Ensuring safe rentals with verified users.

Standing Out in the Market – Competing with established apps.

Conclusion

A car rental app is a good investment today. With the right features, strong support, and an easy design, you can create an app that attracts customers. Understanding costs and market trends will help you make the best decisions.

0 notes

Text

Learn what a UPI Verification API is, how it works, and why it’s essential for businesses. Discover how verifying UPI IDs boosts payment security, reduces fraud, and streamlines onboarding. Ideal for fintech, e-commerce, and any business handling UPI payments in India.

0 notes

Text

Looking for a seamless hotel booking solution? Our advanced Hotel Booking Software ensures smooth reservations, real-time updates, and secure payments. Enhance guest experience, boost efficiency & maximize revenue with our cutting-edge technology! 🚀

📞Call: 9119101723 📨[email protected] . . . Fintech, Banking, Mobile Recharge API, PAN Verification API, UPI Collection API, Payout API

#HotelBooking#TravelSmart#BestDeals#LuxuryStay#BudgetTravel#Staycation#sevenunique#EasyBooking#VacationMode#HotelLife#SmartTravel#jaipur#BookNow#ComfortStay#BusinessTravel#india#LastMinuteDeals#TravelTips

0 notes

Text

How to Build a Ride-Hailing App Like Uber & Careem? Cost & Features

The Evolution of Ride-Hailing Services

The ride-hailing industry has completely transformed urban transportation. Traditional taxis are being replaced by on-demand ride services like Uber and Careem, which offer seamless booking, real-time tracking, and multiple payment options.

With the global ride-hailing market projected to reach $300 billion by 2028, launching a taxi booking app can be a profitable business opportunity. However, creating a competitive app requires strategic planning, the right technology stack, and a clear understanding of costs.

In this guide, we’ll break down the core features, cost, and technology stack required to develop a successful ride-hailing app like Uber and Careem.

Uber vs. Careem: Key Differences & Market Comparison

Although Uber and Careem operate under similar business models, they cater to different markets with some key differences:

Market Presence: Uber dominates the global market, while Careem is more focused on the Middle East, North Africa, and South Asia.

Payment Options: Careem offers cash payment, which is preferred in regions where credit card penetration is low, whereas Uber primarily relies on digital payments.

Services: Careem provides additional services like food delivery, bike taxis, and courier services, whereas Uber is primarily focused on ride-hailing and Uber Eats.

Cultural Adaptation: Careem adapts better to regional preferences, offering services like "Careem Kids" for family-friendly rides and "Careem Bike" for low-cost transportation in Dubai.

Understanding these differences can help you position your app effectively in your target market.

Core Features of a Ride-Hailing App

A ride-hailing app consists of three main components:

Rider Features

User Registration & Login – Sign up using email, phone, or social media.

Ride Booking – Enter pickup and drop-off locations, select ride type, and confirm booking.

Fare Estimation – Display estimated fare before confirming the ride.

Real-Time Tracking – Track driver’s location and estimated time of arrival (ETA).

Multiple Payment Options – Integrate cash, credit/debit cards, digital wallets, and UPI.

Ride Scheduling – Allow users to book a ride in advance.

In-App Chat & Call – Secure communication between rider and driver.

Ride History & Receipts – View past rides and download digital invoices.

Reviews & Ratings – Enable users to rate drivers for quality control.

Driver Features

Driver Registration & Document Verification – Upload license, vehicle documents, and bank details.

Ride Requests – Accept or decline ride bookings based on availability.

Navigation & Route Optimization – Integrated maps for efficient routing.

Earnings & Payout Tracking – Dashboard to monitor earnings and receive payments.

Ride Cancellation – Allow drivers to cancel rides with valid reasons.

Surge Pricing Alerts – Notify drivers about peak pricing times for higher earnings.

SOS Button for Safety – Emergency feature for drivers in case of any incidents.

Admin Panel Features

User & Driver Management – Monitor ride activity and handle disputes.

Fare & Surge Pricing Control – Adjust pricing based on demand.

Real-Time Analytics & Reports – Track revenue, trip data, and driver performance.

Promotions & Discounts – Manage coupons and referral programs.

Complaint Resolution – Handle user complaints and disputes efficiently.

These features form the backbone of a successful ride-hailing platform.

Technology Stack for Ride-Hailing App Development

The right technology stack ensures smooth performance and scalability:

Frontend (User Interface): React Native, Flutter, Swift (iOS), Kotlin (Android)

Backend (Server-Side Logic): Node.js, Django, Ruby on Rails

Database Management: MongoDB, PostgreSQL, Firebase

Real-Time Tracking & Navigation: Google Maps API, Mapbox, OpenStreetMaps

Payment Gateways: Stripe, PayPal, Razorpay, Payfort (for UAE)

Push Notifications: Firebase Cloud Messaging (FCM), Apple Push Notification Service (APNS)

Cloud Hosting & Storage: AWS, Google Cloud, Microsoft Azure

Selecting the right technology stack ensures your app remains scalable, secure, and high-performing.

How Much Does It Cost to Build a Ride-Hailing App?

Developing a ride-hailing app requires investment in app development, backend infrastructure, and third-party integrations.

Cost Breakdown by Development Phase

UI/UX Design – $10,000 to $20,000

Frontend & Backend Development – $40,000 to $80,000

Real-Time GPS & Navigation Integration – $10,000 to $30,000

Payment Gateway Integration – $5,000 to $15,000

Testing & Debugging – $10,000 to $20,000

Deployment & Maintenance – $5,000 to $10,000

Factors Influencing the Development Cost

App Complexity – A basic MVP version costs less, while an advanced AI-based app increases costs.

Location of Development Team – Hiring developers in USA or UK costs $150-$200/hour, while in India or UAE, it’s $30-$80/hour.

Third-Party Integrations – Google Maps API, payment gateways, and SMS notifications add additional costs.

Region-Based Cost Comparison

USA/Canada – $150,000 to $300,000

UAE/Middle East – $100,000 to $250,000

India/Southeast Asia – $40,000 to $120,000

A strategic cost plan helps in budgeting your ride-hailing app effectively.

Challenges in Developing a Taxi Booking App & How to Overcome Them

Driver Retention – Offer better incentives, bonuses, and flexible commission rates.

User Trust & Safety – Implement background verification, live ride tracking, and SOS buttons.

Payment Security – Use PCI-DSS compliant payment gateways.

Regulatory Compliance – Ensure local transport licenses and permits.

Scalability Issues – Choose cloud-based infrastructure to handle growing demand.

Overcoming these challenges ensures long-term success in the ride-hailing business.

How to Market & Launch Your Ride-Hailing App?

Pre-Launch Marketing – Social media teasers, influencer promotions, and press releases.

Referral & Promo Codes – Encourage new users with first-ride discounts.

App Store Optimization (ASO) – Optimize app listings with high-ranking keywords.

Google & Facebook Ads – Target local customers with location-based ads.

Corporate Partnerships – Collaborate with hotels, malls, and event organizers.

A strong marketing strategy boosts initial downloads and engagement.

Final Thoughts & Recommendations

Building a ride-hailing app like Uber or Careem requires market research, feature-rich development, and an effective launch strategy.

By understanding cost factors, business models, and technical requirements, you can create a scalable and profitable ride-hailing platform.

Ready to launch your own taxi booking app? Connect with an expert development team today!

This article is SEO-optimized to attract organic traffic for ride-hailing app development. Let me know if you need feature images for it!

0 notes