#VWAP indicator

Explore tagged Tumblr posts

Text

Volume Weighted Average Price (VWAP) in Trading

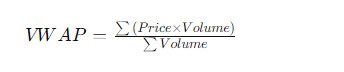

The VWAP indicator stands for Volume Weighted Average Price and is used by traders across the globe to analyse the average price of the security over a period of time taking into account both its price and volume.

Read Full Article: What is VWAP (volume-weighted average price) in trading?

0 notes

Text

In the fast-paced world of algorithmic trading, where decisions are made very quickly, having the right tools and indicators is crucial for success. One such indispensable tool is the VWAP indicator (Volume weighted average price indicator). In this blog, we will delve into why the VWAP calculator is essential for algorithmic trading and how it can enhance trading strategies.

#VWAP indicator#algorithmic trading#algorithmic trading platform#uTrade Algos#VWAP calculator online

0 notes

Text

VWAP

Unlocking Trading Strategies with VWAP Indicator: A Comprehensive Guide Are you an aspiring trader looking to navigate the complex world of financial markets with precision and confidence? Or perhaps you’re a seasoned investor seeking to enhance your trading strategies with advanced tools? Whatever your level of expertise, understanding the VWAP (Volume Weighted Average Price) indicator can be…

View On WordPress

#day trading#Financial Markets#learn technical analysis#Market Sentiment#stock markets#Support and Resistance#swing trading#technical analysis#Trading Strategies#trading tools#Trend Identification#Volume Weighted Average Price#VWAP#VWAP bands#VWAP crossovers#VWAP indicator

0 notes

Text

Here Is A List Of The Most Common Trading Indicators

In trading, an indicator is a statistical measure of market conditions used to forecast price changes. These are some of the most commonly used trading indicators, which are typically available on trading platforms like KuCoin: Simple Moving Average (SMA): An average of the price over a certain number of periods (like days or hours). The formula for SMA is (A1+A2+A3…+An)/n, where A is the asset…

View On WordPress

#ATR#Average True Range#Bollinger Bands#crypto trading#EMA#Exponential Moving Average#Fibonacci Retracement#MACD#Moving Average Convergence Divergence#Relative Strength Index#RSI#Simple Moving Average#SMA#Stochastic Oscillator#trading indicators#Volume Weighted Average Price#VWAP

1 note

·

View note

Text

Creating a Pre-Market Morning Routine: Start Your Trading Day Like a Pro

The market opens at 9:15 AM — but successful traders start much earlier.

What separates amateurs from professionals isn’t just strategy or screen time — it’s how they prepare. A strong pre-market routine helps you enter the day with clarity, a game plan, and the emotional discipline to execute under pressure.

Whether you’re a swing trader or intraday scalper, your morning routine is your mental warm-up. Here's how to build one that sharpens your edge — and how Univest makes the process smoother, smarter, and faster.

Why a Pre-Market Routine Matters

Reduces Emotional Trading Starting the day calm, focused, and pre-planned means you’re less likely to act on impulse once the market opens.

Improves Trade Selection You enter the market with a shortlist of high-quality setups, not scrambling to find trades in real-time.

Boosts Execution Confidence When your plan is clear and pre-analyzed, you can pull the trigger without hesitation.

Identifies Key Market Catalysts Knowing what events, earnings, or economic news are likely to move markets gives you an early edge.

What to Include in Your Pre-Market Routine

✅ 1. Wake Up Early (7:00–7:30 AM)

Give yourself enough time to prepare, reflect, and review. You’re not just waking up — you’re activating your trader mindset.

✅ 2. Check Global & Domestic Cues (7:30–8:00 AM)

SGX Nifty / Dow Futures / Global indices

Asian/US market closes

Crude oil, gold, and currency movements

Key news: inflation data, Fed comments, RBI updates, etc.

Understand the macro backdrop before you even look at a chart.

✅ 3. Review Your Watchlist (8:00–8:20 AM)

Stick to a list of 5–7 high-conviction stocks you want to monitor. Use Univest to:

Get SEBI-registered, expert-backed trade ideas

See predefined entry, stop-loss, and targets

Focus only on trades that match your setup

Don’t watch everything — focus beats FOMO.

✅ 4. Mark Key Levels on Charts (8:20–8:45 AM)

Identify support/resistance, gap zones, previous day’s high/low

Mark VWAP, trendlines, or indicator signals as per your strategy

Decide on your trade trigger: What will make you enter?

This part turns your plan from idea to execution-ready setup.

✅ 5. Write Down Your Trade Plan (8:45–9:00 AM)

For each shortlisted stock:

Entry trigger ✅

Stop-loss level 🔻

Target 🎯

Risk/reward ratio 📈

Max number of trades for the day 🧠

Writing this down keeps your head calm and committed.

✅ 6. Mindset Check (9:00–9:10 AM)

Are you feeling rushed, distracted, overconfident, or anxious?

If yes, take 5 deep breaths or a short walk.

Remind yourself: Today is about execution, not prediction.

Sample Pre-Market Checklist (Use Daily)

✅ SGX Nifty → Positive/Negative ✅ Key news/events ✅ 3–5 stocks shortlisted ✅ Entry/SL/Target levels noted ✅ Risk/reward checked ✅ Trading limit set (capital & number of trades) ✅ Mindset: Calm | Focused | Patient

How Univest Supercharges Your Morning Routine

Instead of spending hours analyzing charts and news, Univest gives you:

✅ Daily expert trade ideas curated from SEBI-registered analysts

✅ Clear entry, stop-loss, and target for every trade

✅ Real-time alerts so you don’t miss your trigger

✅ A focused, pre-vetted watchlist that saves you hours of research

✅ A trade log to review and reflect post-market

It’s like having a research desk in your pocket — ready before the bell rings.

Final Word: Start Strong, Trade Stronger

Most traders lose money in the first 15 minutes of the day because they show up late, unprepared, or reactive. But the pros walk in with a plan, a purpose, and a calm mindset.

📲 Download Univest and level up your pre-market routine with ready-to-execute trade ideas, expert support, and zero confusion.

0 notes

Text

The Importance of Volume in Technical Analysis: Read the Crowd Before the Candle

Let’s say it straight — if you’re ignoring volume in your technical analysis, you’re missing the heartbeat of the market. Price tells you where the market is going, but volume tells you why it’s going there, and if it’ll stay. It’s the difference between following the chart and understanding what’s actually happening behind it. Volume analysis is crucial in deciphering market sentiment and gauging the intensity of price movements; thus, understanding price and high volume data is essential to combine volume analysis effectively. , making it a vital component of any trading strategy.

A lot of traders get caught up in candlestick patterns, indicators, and trendlines — all valid trading tools. But none of them mean much if trading volume doesn’t back the move, underscoring the importance of trading volume analysis. Because in this game, price without volume is just noise. And once you understand volume in technical analysis, you start reading the market like a seasoned insider, not a hopeful guesser. Volume data provides insights into the buying pressure and selling pressure, helping traders to identify potential trend reversals and confirm the strength of market movements.

Understanding the intricacies of volume indicators such as On-Balance Volume (OBV), Chaikin Money Flow (CMF), and the Volume Weighted Average Price (VWAP) can enhance your ability to make informed trading decisions. These indicators help in assessing whether the market is experiencing strong buying pressure or if selling volume is dominating. By combining volume profile along with volume analysis and other indicators, traders can develop robust trading strategies that align with market trends and support and resistance levels.

Incorporating volume trading strategy into your approach means looking beyond the surface of price action to the underlying market activity. High trading volume suggests strong market participation, while low trading volume may indicate a lack of interest or liquidity; thus, high volume suggests that traders should be cautious. Recognizing volume patterns and volume spikes can be the key to unlocking significant price moves and understanding market direction. This deeper comprehension of volume and price dynamics allows traders to interpret volume effectively and react to market trends with precision.

In conclusion, volume and price data are intertwined, and mastering their relationship is essential for successful trading. By prioritizing current trading volume in your technical analysis, you gain a clearer picture of market strength, especially during periods of high volume and potential price breakouts, ultimately leading to more informed and profitable trading decisions.

What Is Volume in Trading?

Let’s start with the basics to learn volume trading. Volume is simply the number of shares, contracts, or units traded during a specific time frame. On most charts, it’s shown as vertical bars at the bottom — bigger bars mean more trades happened, smaller bars mean the market was quieter.

In volume analysis in trading, we don’t just care about the number — we care about how volume interacts with price. Are buyers stepping in on a breakout? Are sellers dumping into strength or showing volume divergence? Is the move real — or just a low-volume fakeout?

Learning how to read volume gives you insight into market conviction. When you see an increasing volume surge during a breakout or collapse, that’s participation. That’s real interest. When volume stays flat while price is grinding higher, that’s caution — and it could mean a reversal is coming.

Volume is more than just a metric; it's a window into the market's psyche. It helps traders distinguish between genuine price movements and those that lack conviction. For instance, a high trading volume during a price breakout suggests strong market sentiment and increased participation from market participants. This indicates a potential continuation of the price trend, providing traders with confidence in their trading decisions.

Conversely, a low trading volume during price rises or falls may signal a lack of low volume interest or liquidity, particularly during falling prices, raising red flags about the sustainability of the move. Traders can use volume data to identify support and resistance levels, as significant volume at these points often confirms their validity. Moreover, understanding volume trends over a specific period can alert traders to potential trend reversals or the emergence of new market trends, which also relates to market liquidity.

By integrating key volume indicators such as On-Balance Volume (OBV), Chaikin Money Flow (CMF), accumulation distribution, or the Money Flow Index (MFI) into their analysis, traders can gain a deeper understanding of market sentiment and the balance between buying and selling pressure. This comprehensive approach to volume analysis, including moving average convergence divergence, allows traders to make more informed trading decisions, aligning their strategies with the underlying market dynamics and enhancing their ability to react to significant price moves.

Ultimately, mastering volume analysis is essential for any trader looking to navigate the complexities of the market effectively. By prioritizing total trading volume in their technical analysis, traders can gain a clearer picture of market strength, potential price breakouts, and trend reversals, ultimately leading to more informed and profitable trading decisions.

Why Volume Matters in Technical Analysis?

Here’s the truth — volume is confirmation. It tells you whether the price move you're watching is legit or flimsy. You might see a clean breakout from a trendline — great. But if volume doesn’t increase on the breakout? That’s a red flag. No conviction, no strength, no follow-through. A high volume breakout, on the other hand, is what you want, as understanding how volume trading works shows the move has weight behind it. That’s when I pay attention.

Volume and price action go hand in hand. When volume increases during an uptrend, it suggests rising prices and that buyers are still aggressive. When it dries up, momentum is likely slowing. During pullbacks, rising volume on the downside can signal that sellers are taking control or that weak hands are getting shaken out.

In simple terms, volume confirms direction, strength, and sustainability, especially when it indicates falling prices.

Volume-Based Trading Strategy in Action

Building a volume-based trading strategy starts with the fundamental idea that price moves backed by significant volume trading are far more reliable than those without. This principle of volume trading can be a game-changer in your trading journey, offering a deeper understanding of market sentiment and price movements.

Here are several effective ways to learn volume trading and incorporate volume into your trading strategy:

Breakout confirmation: When the price breaks through a key resistance level, it's crucial to observe a surge in trading volume. A breakout with low volume is suspicious and may lack the strength to sustain the move. Conversely, a high volume breakout signifies strong market sentiment and increased participation from market participants, making it a more trustworthy signal for potential trend continuation.

Volume divergence: This occurs when the price hits new highs, but trading volume decreases, signaling a potential slowdown or trend reversal. This divergence between price and volume is a red flag, indicating that the upward momentum may be losing steam and that traders should exercise caution.

Volume spikes: These are invaluable indicators. A sudden spike in volume, especially after a prolonged period of low trading volume, can indicate institutional interest or a significant market move on the horizon. Recognizing these volume spikes can alert traders to potential opportunities or impending price action changes.

Support and resistance validation: When price approaches or bounces off a support or resistance level with strong volume, it confirms the significance of that level. High trading volume at these levels suggests strong buying or selling pressure, making them more reliable indicators for future price movements. In contrast, low volume may indicate a weaker level, susceptible to breakouts.

Utilizing volume indicator signals like On-Balance Volume (OBV), Accumulation/Distribution Line, or Volume Weighted Average Price (VWAP) can further enhance your analysis. However, even raw volume bars, when interpreted correctly alongside relative volume, provide invaluable insights into market dynamics. By mastering these concepts, traders can develop robust trading strategies that align with market trends, support and resistance levels, and overall market sentiment, ultimately leading to more informed and profitable trading decisions.

Volume Across Different Markets

Whether you’re trading stocks, forex trading, crypto, or indices, volume still matters — but how you access it depends on the market.

In stocks, volume data is direct and incredibly telling. Institutional buying shows up fast. You’ll often see volume patterns in stocks before you see the price move fully play out. Stocks with high trading volume are often more liquid, allowing for easier entry and exit points, particularly when rising prices are observed. trading software, which is crucial for effective trading strategies. Furthermore, understanding the relationship between volume and price movements can help traders identify potential trend reversals and validate price breakouts.

In forex, true volume is tricky since it’s a decentralized market, but you can use tick volume (number of price changes in a candle) as a proxy. It’s not perfect, but it’s reliable enough for volume analysis in forex, especially when paired with price structure. Forex traders often rely on volume indicators like the Chaikin Money Flow (CMF) or the Money Flow Index (MFI) to gauge market sentiment and identify potential buying or selling pressure. By combining these indicators with other technical analysis tools, traders can develop comprehensive trading strategies that align with current market trends.

In crypto, volume can be wild — and incredibly revealing. Since this market is still retail-heavy and often manipulated, understanding volume spikes can help you avoid traps and spot legit moves early. High trading volume in cryptocurrencies can indicate strong market participation and potential price breakouts, while low trading volume might suggest a lack of interest or liquidity. By analyzing volume data within a defined trading range , crypto traders can better interpret market movements and make more informed trading decisions.

Across all these markets, volume plays a critical role in understanding market activity and making informed trading decisions. Whether you're analyzing stocks, forex, or crypto, recognizing volume trends and patterns, alongside the relative strength index, can provide valuable insights into market sentiment, price action, and potential opportunities for profit. By incorporating volume analysis within a defined trading range into your trading strategy, you can gain a deeper understanding of market dynamics and improve your overall trading performance.

Price and Volume: The Relationship That Never Lies

The most important takeaway? Price and volume are best friends — and when they disagree, something’s off.

If price is pumping but volume is dying? Get ready. That rally could be running on fumes. If price is dropping but volume is climbing fast? There’s real pressure there — and probably more to come.

Learning the price-volume relationship lets you gauge sentiment, spot exhaustion, and identify strength. It gives you an X-ray vision into the market’s internals. And in a world where fakeouts are everywhere, that kind of insight is invaluable.

Let Volume Speak

Look, there are a hundred tools out there. But few are as raw, real, and revealing as volume. Using volume in technical analysis isn’t about being flashy — it’s about being precise. It’s about trading with eyes wide open, not chasing empty moves.

So next time you open your charts, don’t just stare at the candles. Look below. Let volume speak. Because when you can spot volume confirmation signals, read volume patterns, and react to volume spikes with clarity, you’re not just watching the market.

You’re reading it. Like a pro.

1 note

·

View note

Link

#High-FrequencyTrading#Liquidity#MarketMovements#marketvolatility#OrderExecution#priceaction#ProfitTaking#RapidTrading#riskmanagement#Scalping#Short-TermTrading#StockMarket#technicalanalysis#TradingStrategy#Ultra-FastTrading

0 notes

Text

Carbonxt Restructures Black Birch Lease, Secures Premium Placement to Drive Growth

Carbonxt Group Ltd (ASX: CG1) has successfully restructured its lease agreement for the Black Birch Powdered Activated Carbon (PAC) facility in Georgia, USA. The revised lease significantly reduces fixed costs while allowing Carbonxt to maintain full operational control. In a strategic move, the lessor has agreed to accept shares as lease payments through September 2025, demonstrating confidence in the Company’s growth trajectory. Carbonxt will issue 7.86 million shares at $0.08 each, representing a 37% premium to the 15-day VWAP.

Major Lease Restructuring to Reduce Costs

The Black Birch PAC facility, operating under a 50-year lease since 2017, had previously required minimum fixed rent payments. Under the renegotiated agreement:

The lease is secured through September 2025.

Monthly lease payments are reduced by over 50%, easing financial pressure.

Carbonxt will issue shares instead of making cash payments.

This restructuring provides Carbonxt with greater financial flexibility while ensuring continued production at Black Birch.

Investor Confidence Reflected in 37% Premium Placement

Alongside the lease restructuring, Carbonxt successfully completed a premium placement, reinforcing strong investor support. The 37% premium to the 15-day VWAP indicates confidence in the Company’s long-term prospects. The shift in capital structure helps preserve cash reserves, allowing Carbonxt to reinvest in core operations and growth initiatives.

Managing Director Warren Murphy emphasized the significance of this move, stating:

“We greatly appreciate our lease counterparty’s strong support and confidence in Carbonxt’s future. This restructuring ensures reduced costs, enhanced financial flexibility, and continued operational capabilities. The premium placement further highlights investor confidence in our growth strategy.”

Share Purchase Plan Extended for Investors

To allow shareholders more time to evaluate the impact of the lease restructuring, Carbonxt has extended the Share Purchase Plan (SPP) deadline to March 27, 2025. This extension ensures that investors can make informed decisions while considering the Company’s strengthened financial position.

Strategic Benefits and Growth Potential

The lease restructuring aligns with Carbonxt’s long-term strategy, delivering:

Cost Savings: A 50% reduction in lease payments improves the Company’s financial health.

Preserved Cash Reserves: Using shares for lease payments frees up capital for expansion.

Stronger Financial Flexibility: Reduced fixed costs allow for greater strategic agility.

Investor Confidence: The premium placement underscores strong market trust in Carbonxt’s future.

Positioned for Expansion in the Cleantech Sector

With a strengthened balance sheet and enhanced financial flexibility, Carbonxt is well-positioned to scale operations and explore new business opportunities in the cleantech industry. The Company’s PAC products play a crucial role in environmental solutions, supporting industries requiring advanced filtration technologies.

As investor confidence grows, Carbonxt is set to drive long-term value while expanding its footprint in sustainable industrial solutions.

0 notes

Text

Impact Minerals Launches $5.2M Rights Issue to Accelerate Key Projects

Impact Minerals Limited (ASX: IPT) has announced a 2-for-7 renounceable rights issue at $0.006 per share to raise up to approximately $5.2 million before costs. This offer presents a 33% discount to the last closing price of $0.009 and a 43.4% discount to the 90-day volume-weighted average price (VWAP) of $0.0106. Eligible shareholders will receive one free attaching option for every two new shares subscribed. These options have an exercise price of $0.015 and a term of 2.5 years. Both the new shares and options will be quoted on the ASX.

The rights issue is open to shareholders with registered addresses in Australia, New Zealand, and Germany as of the record date on 5 March 2025. Rights trading will commence on 4 March 2025, allowing shareholders to trade their entitlements. The offer is partially underwritten to $1 million by Mahe Capital Pty Ltd, and the company's directors have indicated their intention to participate.

0 notes

Text

In the dynamic world of financial markets, traders constantly seek tools and indicators to enhance their decision-making process and improve their chances of profitability. One such tool that has gained significant popularity among traders is the VWAP indicator (Volume weighted average price indicator). In this blog, we’ll find out what VWAP is, how it works, and how traders can effectively utilise it in their trading strategies.

0 notes

Text

🔥 Impact Minerals Announces $5.2M Renounceable Rights Issue! 🔥

Impact Minerals (ASX: IPT) is undertaking a 2 for 7 renounceable rights issue at $0.006 per share to raise to $5.2 million. Shareholders will receive 1 free attaching option (exercisable at $0.015, valid for 2.5 years).

🔹 Key Highlights:

✅ Highly Attractive Pricing: The last closing price ($0.009) is 33% discounted, and the 90-day VWAP ($0.0106) is 43.4% discounted. ✅ Current Stock Price: $0.0070 ✅ Tradeable Rights – Shareholders can trade their rights or apply for additional shares and options. ✅ Directors Back the Offer – Directors have indicated an intention to participate. ✅ ASX Quotation—The Company will apply for a quotation of the new shares and options on the ASX. ✅ Partially Underwritten – Mahe Capital Pty Ltd partially underwrites the Rights Issue to $1 million. ✅ Strategic Fund Allocation – Funds will support: The development of the Lake Hope High Purity Alumina (HPA) Project, with the Pre-Feasibility Study (PFS), is nearing completion. Exploration at the Arkun & Broken Hill Projects. General working capital and Offer expenses.

📅 Key Dates:

📌 Rights Trading Starts: 4 March 2025 📌 Record Date: 5 March 2025 (Buy before 4 March to participate) 📌 Rights Trading Ends: 14 March 2025 📌 Offer Closes: 21 March 2025

📢 Investor Opportunity – The Growing HPA Market

High-purity alumina (HPA) is a critical material used in lithium-ion battery separators, LED lighting, and semiconductor manufacturing. Due to the booming EV and clean energy sectors, global demand for HPA is forecast to surge beyond 100,000 tonnes per year by 2030, driven by the shift towards sustainable, high-tech applications. Chairman Peter Unsworth emphasised that this is the first equity raising extended to all shareholders since acquiring the Lake Hope HPA Project. With strong fundamentals and increasing global demand for HPA, Impact Minerals is poised for significant growth as it advances toward commercial production.

🔗 More Details: https://colitco.com/impact-minerals-5-2m-rights-issue-project-fund/

Disclaimer: This is not investment advice. Please conduct your research before making any investment decisions.

#ImpactMinerals#ASXIPT#RightsIssue#MiningInvestment#HighPurityAlumina#BatteryMetals#EVRevolution#ResourceExploration#MiningFinance#GrowthPotential#InvestmentOpportunity#StockMarket#ASX#HPA#RenewableEnergy#FutureMetals#TechMaterials#CriticalMinerals#MiningNews#BatterySupplyChain#Alumina#Electrification#StockMarketNews#WealthCreation#AustralianMining

0 notes

Text

Understanding Crypto Trading Volume: A Key to Smarter Trades

Crypto trading volume is one of the most important indicators in the market. Whether you're a day trader or a long-term investor, understanding volume can help you make better decisions and avoid potential pitfalls. But what exactly does trading volume tell us? Let’s break it down.

🔹 What Is Crypto Trading Volume?

Trading volume refers to the total amount of a cryptocurrency bought and sold within a given period—daily, weekly, or monthly. It’s measured in two ways:

By the number of coins or tokens traded

By the total monetary value of those trades

High trading volume means more activity and stronger market interest, while low volume signals reduced participation and lower liquidity. It’s a crucial factor that can reveal trends, confirm price movements, and indicate market strength.

🔹 Why Does Trading Volume Matter?

📈 Market Liquidity

A cryptocurrency with high trading volume has better liquidity, meaning buy and sell orders execute faster and with minimal price slippage. More liquidity also means fairer pricing and less volatility.

📉 Trend Confirmation

Price movements with strong volume are generally more reliable. If a coin is surging but volume remains low, it might be a weak rally with limited support. Conversely, a price drop with high volume can indicate serious sell pressure.

🚨 Early Warning Signals

Sudden spikes or drops in trading volume can signal: ✔️ Large buy-ins or sell-offs by major investors ✔️ Market reactions to news and events ✔️ Potential trend reversals

Staying aware of these changes helps traders react before prices shift dramatically.

🔹 How to Analyse Crypto Trading Volume Like a Pro

🔸 Compare current volume to historical averages – If volume is significantly higher than usual, it may indicate a new trend forming. 🔸 Watch for divergences – If price rises but volume stays low, the trend may not last. 🔸 Use indicators like volume-weighted average price (VWAP) and volume profile – These tools help identify strong buying/selling zones. 🔸 Combine volume with price action – Rising volume during price increases is bullish, while increasing volume during price drops is bearish.

🔹 Practical Tips for Using Trading Volume

✔ Don’t rely on volume alone – Pair it with trend indicators, moving averages, and fundamental analysis. ✔ Beware of fake volume – Some exchanges inflate numbers, so always cross-check data. ✔ Look for volume-supported breakouts – If price breaks a key resistance with high volume, the move is likely strong.

By understanding trading volume, you can improve your crypto strategy and make informed decisions in the ever-changing market. Keep learning, stay updated, and trade wisely! 🚀📊

#Crypto#CryptoTrading#Bitcoin#Ethereum#TradingVolume#CryptoAnalysis#Blockchain#CryptoMarket#Altcoins

0 notes

Text

5 Key Indicators Every Trader Should Know: Essential Tools for Today's Market

The Trading Compass: Navigating India's Current Market

Hey there, fellow traders! 📈 Have you been feeling the market's unpredictability lately? You're not alone! I've been trading through this volatility too, and wanted to share some hard-earned wisdom about the technical indicators that have truly made a difference in my decision-making process.

India's market has been particularly turbulent recently, with everything from global economic shifts to domestic policy changes throwing curveballs our way. That's why having reliable tools to guide your trading decisions isn't just helpful—it's essential for survival in today's market environment.

Let me walk you through the five indicators I personally rely on every single day:

1. RSI: Your Market Mood Reader

Think of the Relative Strength Index as your market psychiatrist—it tells you when the market is getting too emotional in either direction. On a scale of 0-100, it measures whether an asset is potentially overvalued or undervalued.

I've found RSI incredibly reliable lately, especially when:

It pushes above 70, suggesting a stock might be running too hot (happening frequently in our tech sector right now)

It dips below 30, hinting at oversold conditions (I've found some great bargains in manufacturing this way)

2. MACD: Your Trend's Best Friend

Don't let the complicated name fool you! The Moving Average Convergence Divergence indicator simply helps you understand the momentum and direction of trends.

Here's how I personally use MACD in today's market:

When the MACD line crosses above the signal line, I pay attention—this bullish signal has been remarkably accurate in renewable energy stocks lately (helped me catch a 12% move just last week!)

I watch the histogram to see momentum building or fading—crucial for timing entries and exits

Zero-line crossings give me confidence about the overall trend direction—essential for my medium-term positions

3. Bollinger Bands: Your Volatility Visualizer

In times like these, understanding volatility is everything—and Bollinger Bands make it visual. They expand during chaotic periods and contract during calmer ones.

Three ways I apply Bollinger Bands in my daily trading:

Band width immediately shows me if volatility is increasing/decreasing—absolutely crucial as our markets navigate current transitions (saved me from several false breakouts recently)

I love finding mean reversion opportunities when prices touch band extremes—this strategy has been particularly profitable in FMCG stocks

After consolidation periods, decisive band breakouts often precede strong trends—I've seen this pattern repeatedly in banking stocks this year

4. VWAP: Your Institutional Edge

As algorithms dominate more trading, understanding where big money is active becomes critical. VWAP (Volume-Weighted Average Price) helps me see the true average price incorporating volume—essentially showing where institutions are likely active.

Here's how VWAP gives me an edge:

Major institutions use it for execution benchmarks, creating natural support/resistance levels

Trading above/below VWAP helps confirm my intraday bias—essential in today's quick-moving markets

I use it as an exit benchmark to improve my average performance

5. Fibonacci Retracement: Your Timeless Market Map

It amazes me that a mathematical sequence discovered centuries ago works so well in our digital markets today, but Fibonacci retracement levels consistently help identify potential turning points.

My three favorite Fibonacci applications:

The 38.2%, 50%, and 61.8% retracement levels provide amazing entry points in trends—I've used these successfully throughout this year's commodity cycles

Fibonacci extensions help me project realistic profit targets beyond previous highs/lows

When Fibonacci levels align with other indicators like RSI or MACD, the high-probability setups that emerge have dramatically improved my win rate

Bringing It All Together: The Integrated Approach

Here's what I've learned after years of trading: while each indicator offers valuable insights, the real magic happens when you combine them strategically. I don't make major trading decisions without confirmation from multiple indicators—it's like having several expert advisors all agreeing on the same trade. You can learn this strategies and how to effectively apply them by enrolling in the Stock Market Courses in Mumbai

I'd love to hear which indicators you find most helpful in your trading! Drop a comment below and let's learn from each other. Happy trading! 📊

1 note

·

View note

Text

On the Hourly I've noticed when the 9 EMA crosses below VWAP in PM, it indicates a move to the upside.

0 notes

Text

Mastering Multiple Time Frame Analysis: A Day Trader's Guide to Futures Market Context

Ever stared at your charts feeling like you're trying to solve a Rubik's cube blindfolded? You're not alone. Technical analysis across multiple time frames can feel overwhelming, but I promise you – it's not rocket science. Let's break down this essential trading approach that'll help you stop trading like a caffeinated squirrel and start trading with real context.

Why Multiple Time Frame Analysis Matters

Remember that time you went all-in on a "perfect" 5-minute setup, only to get steamrolled by a daily trend? Yeah, we've all been there. Multiple time frame analysis in technical analysis helps you:

Avoid trading against major trends

Identify higher-probability setups

Understand market structure better

Manage risk more effectively

The Three-Timeframe Approach

Think of time frames like nesting dolls – each one fits inside the other. Here's how to structure your analysis:

Higher Timeframe (Trend)

Daily or 4-hour charts for context

Identifies primary trend direction

Shows major support/resistance levels

Intermediate Timeframe (Trigger)

1-hour or 30-minute charts

Confirms trend alignment

Spots potential entry zones

Lower Timeframe (Entry)

5-minute or 1-minute charts

Precise entry timing

Stop loss placement

Real-World Application: ES Futures Example

Let's put this technical analysis approach into practice using the E-mini S&P 500 futures (ES):

Higher Timeframe (Daily):

Identifying bullish trend above 20-day EMA

Major resistance at previous swing highs

Volume profile showing value areas

Intermediate Timeframe (1-hour):

Bull flag formation developing

RSI showing positive divergence

Volume increasing on pullbacks

Lower Timeframe (5-minute):

Looking for hammer candlesticks at support

VWAP bounces for entries

Clear stop loss below recent swing low

Common Pitfalls to Avoid

Analysis Paralysis Don't get stuck jumping between 20 different time frames like a kid in a candy store. Stick to your three chosen frames.

Timeframe Conflict When timeframes show conflicting signals, always defer to the higher timeframe. It's like arguing with your boss – technically you can, but should you?

Over-Trading Just because you see a setup on the 1-minute chart doesn't mean you need to take it. Wait for alignment across your chosen timeframes.

Pro Tips for Success

Start Wide, Go Narrow Always begin with the highest timeframe and work your way down. It's like using Google Maps – you start with the country view before zooming into street level.

Use Time-Appropriate Indicators

Higher timeframes: Slower indicators (200 MA, weekly pivots)

Lower timeframes: Faster indicators (9 EMA, RSI)

Practice Time Frame Alignment Create a checklist:

Higher timeframe trend direction ?

Intermediate timeframe confirmation ?

Lower timeframe entry trigger ?

Putting It All Together

The beauty of multiple time frame technical analysis is that it forces you to slow down and see the bigger picture. Think of it like planning a road trip:

Higher timeframe is your map view

Intermediate timeframe is your GPS

Lower timeframe is your actual driving

Remember, successful trading isn't about catching every move – it's about catching the right moves with proper context.

Conclusion

Multiple time frame analysis isn't just another fancy trading term to throw around at dinner parties (though it does sound impressive). It's a practical approach to understanding market context and making better trading decisions. Start with three timeframes, stick to your system, and watch how your trading perspective transforms.

Pro Tip: Don't forget to backtest your multiple time frame strategy on historical data. It's like practicing your dance moves before hitting the club – much better than learning the hard way!

Ready to level up your technical analysis game? Start by choosing your three timeframes and practice identifying alignment. Your future self (and trading account) will thank you.

Remember: The market will always be there tomorrow. Take your time to master this approach, and trade with confidence knowing you've done your homework across all relevant time frames.

#trading psychology#market analysis#trading strategy#futurestrading#market trends#marketindicators#tradingstrategy#trading education

1 note

·

View note

Text

Liquidity Llama: Thriving in High-Volume Markets on MintCFD

In online trading, some traders focus on markets with significant trading volume, where buy and sell orders are executed quickly and opportunities arise momentarily. These traders are often called Liquidity Llamas. They have the skills to easily navigate dynamic, liquid markets, using high-volume trading to boost their profits. For participants on MintCFD, adopting the Liquidity Llama mentality can be a profitable strategy, especially with access to a wide range of high-liquidity assets available on the platform.

What exactly is a Liquidity Llama?

A Liquidity Llama is a trader who performs well in one of the two categories of market structure: high-liquid markets where the large number of buyers and sellers influences the narrow bid-ask spread and minimum value of slippage. This environment fosters cost-efficient transactions and it is easy for a trader to enter and exit from the market. To the users of the MintCFD Trading App, assets such as major currency pairs, popular stocks, and actively traded commodities are most appropriate for high turnover trading since Liquidity Llamas thrive in this market.

The importance of markets with high liquidity

Where prices are rather stable, and orders can be filled quickly, the probability of large price fluctuations is reduced and the movement of large quantities is possible without adverse consequences on the price situation in the market. Liquidity Llamas capitalize on this by executing as many trades as possible, grid by instinct hard-driven by the dynamics of the market, charts, various patterns, and volumes. Here’s why these markets are attractive:

Lower Trading Expenses: A larger amount of liquidity results in a general narrowing of bid-ask margins and this implies that traders bear less cost whenever they enter or exit positions.

Minimized Slippage: The absolute cost is achieved near the expected one, even when buying and selling occur intensely, which is crucial for accurate pin-based approaches.

Swift Trade Execution: In a position where there are lots of buyers and sellers in the market, it becomes very clearly evident that transactional flow can be done promptly, which is much more suitable for the trader as it is effective and time-bound.

Becoming a Liquidity Llama on the MintCFD Platform

Focus on Liquid Assets: MintCFD offers very liquid instruments and the popular financial markets are Forex, Stocks, and top Cryptocurrencies. Liquidity Llamas usually prefer these assets to employ high turnover and relatively low variance in prices.

Leverage Volume Indicators: To Liquidity Llamas, volume is a key parameter in giving their clients the finest experience on the planet. The main feature of MintCFD’s charting is its volume, which allows the traders to measure the attitude towards the asset and the direction of the price movement. Using tools based on the volume, equivalent to On-Balance-Volume (OBV) and Volume-Weighted Average Price (VWAP) one can gain an understanding of the prices and useful information on entry/exit points.

Use Real-Time Chart Patterns: Dealing with high turnover requires analyzing different kinds of chart patterns that might suggest changes in prices. In order to benefit from short-term changes, Liquidity Llamas use patterns such as flags, pennants, and wedges.

Set Tight Stop-Loss and Take-Profit Levels: Price changes even if they could be marginal are more often in very liquid markets Note that liquid and highly liquid markets have been used interchangeably. This way, Liquidity Llamas shall have arranged well-placed stop-loss as well as take-profit levels that are tightly placed; this will help them to minimize risk and at the same time obtain auxiliary small profits. The MintCFD trading app, allows the traders to set these levels according to his or her desire to control the trades properly.

Stay Updated with Market News and Alerts: Liquidity Llamas need information as soon as possible because changes in the market require an immediate response and MintCFD offers news and alerts. When markets are highly liquid, issues of the economy’s condition affect them, and it is essential to monitor the news.

Benefits and Challenges of Being a Liquidity Llama

Benefits:

Enhanced Trading Opportunities: Markets with significant liquidity provide continuous trading possibilities, perfect for active traders skilled in quick decision-making.

Minimized Market Impact: This makes it easy for Liquidity Llamas to execute large transactions without significantly disrupting the market and making it easy for trading to occur.

Steady, Incremental Gains:��However, focusing on small frequent gains, Liquidity Llamas can gradually increase its profit, and this is their major advantage.

Challenges:

High Volume of Trades: Actively trading within liquid markets involves high speed/ turnover and thus may fall into the trading exhaustion category.

Need for Prompt Decisions: Many trades happen in other high turnover environments where decisions must be made quickly and it can be quite overwhelming for any trader.

Final Thoughts:

Liquidity Llama strategy is a rewarding approach for the traders at MintCFD Since the platform offers a rich set of liquid assets and capable trading instruments. Liquidity Llamas can become robust in the high turn environment by balancing speed, precision, and strategy while gaining value leverages of higher liquidity. While trading within these environments is rather rigorously disciplined the chances of steady, incremental gains make this possibility plausible to the insightful trader.

#cryptomarket#forextrading#cryptotrading#stockmarket#yolo247#onlinetrading#investmentstrategy#mintcfd#commoditiesinvestment#bitcoin

1 note

·

View note