#Wi-Fi module for IoT

Explore tagged Tumblr posts

Text

#Zigbee#Wi-Fi Module#buy electronic components online india#electronic components distributor#electronic components online in india#electronics components distributor in india#buy electronic components online#Wi-Fi#Wi-Fi module for IoT

0 notes

Text

STMicroelectronics and Qualcomm Launch Mass Production of ST67W611M1 Wi-Fi 6/Bluetooth 5.4 Module for STM32 Ecosystem

June 9, 2025 /SemiMedia/ — STMicroelectronics has commenced mass production of the ST67W611M1 module, a compact solution integrating Wi-Fi 6 and Bluetooth Low Energy 5.4, developed in collaboration with Qualcomm Technologies. This module simplifies the implementation of wireless connectivity in systems utilizing STM32 microcontrollers, reflecting the successful realization of the partnership…

#Bluetooth 5.4 module#electronic components news#Electronic components supplier#Electronic parts supplier#IoT connectivity#PSA Certified Level 1#Qualcomm Technologies#STM32 microcontrollers#STMicroelectronics#Wi-Fi 6 module

0 notes

Text

#Buy Wireless Module Online#WiFi Module#Wi-Fi IoT Solutions#WiFi Module Receiver#WiFi Module price#Wi-Fi and Bluetooth modules#RF Module#IoT Module#Modules in telecom#rf modules in india#telecom modules#SIMCom modules#Modules distributors#Modules distributors in india#5G modules#LPWA modules

1 note

·

View note

Text

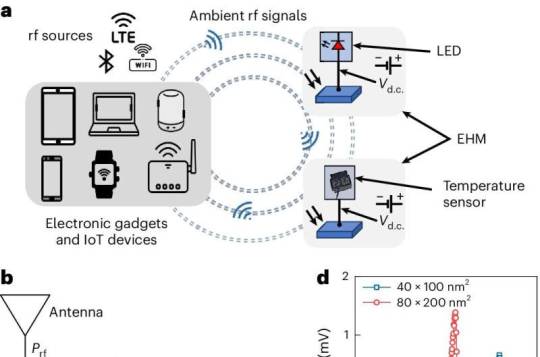

Battery-free technology can power electronic devices using ambient radiofrequency signals

Ubiquitous wireless technologies like Wi-Fi, Bluetooth, and 5G rely on radio frequency (RF) signals to send and receive data. A new prototype of an energy harvesting module—developed by a team led by scientists from the National University of Singapore (NUS)—can now convert ambient or "waste" RF signals into direct current (DC) voltage. This can be used to power small electronic devices without the use of batteries. RF energy harvesting technologies, such as this, are essential as they reduce battery dependency, extend device lifetimes, minimize environmental impact, and enhance the feasibility of wireless sensor networks and IoT devices in remote areas where frequent battery replacement is impractical. However, RF energy harvesting technologies face challenges due to low ambient RF signal power (typically less than -20 dBm), where current rectifier technology either fails to operate or exhibits a low RF-to-DC conversion efficiency. While improving antenna efficiency and impedance matching can enhance performance, this also increases on-chip size, presenting obstacles to integration and miniaturization.

Read more.

43 notes

·

View notes

Text

How-To IT

Topic: Core areas of IT

1. Hardware

• Computers (Desktops, Laptops, Workstations)

• Servers and Data Centers

• Networking Devices (Routers, Switches, Modems)

• Storage Devices (HDDs, SSDs, NAS)

• Peripheral Devices (Printers, Scanners, Monitors)

2. Software

• Operating Systems (Windows, Linux, macOS)

• Application Software (Office Suites, ERP, CRM)

• Development Software (IDEs, Code Libraries, APIs)

• Middleware (Integration Tools)

• Security Software (Antivirus, Firewalls, SIEM)

3. Networking and Telecommunications

• LAN/WAN Infrastructure

• Wireless Networking (Wi-Fi, 5G)

• VPNs (Virtual Private Networks)

• Communication Systems (VoIP, Email Servers)

• Internet Services

4. Data Management

• Databases (SQL, NoSQL)

• Data Warehousing

• Big Data Technologies (Hadoop, Spark)

• Backup and Recovery Systems

• Data Integration Tools

5. Cybersecurity

• Network Security

• Endpoint Protection

• Identity and Access Management (IAM)

• Threat Detection and Incident Response

• Encryption and Data Privacy

6. Software Development

• Front-End Development (UI/UX Design)

• Back-End Development

• DevOps and CI/CD Pipelines

• Mobile App Development

• Cloud-Native Development

7. Cloud Computing

• Infrastructure as a Service (IaaS)

• Platform as a Service (PaaS)

• Software as a Service (SaaS)

• Serverless Computing

• Cloud Storage and Management

8. IT Support and Services

• Help Desk Support

• IT Service Management (ITSM)

• System Administration

• Hardware and Software Troubleshooting

• End-User Training

9. Artificial Intelligence and Machine Learning

• AI Algorithms and Frameworks

• Natural Language Processing (NLP)

• Computer Vision

• Robotics

• Predictive Analytics

10. Business Intelligence and Analytics

• Reporting Tools (Tableau, Power BI)

• Data Visualization

• Business Analytics Platforms

• Predictive Modeling

11. Internet of Things (IoT)

• IoT Devices and Sensors

• IoT Platforms

• Edge Computing

• Smart Systems (Homes, Cities, Vehicles)

12. Enterprise Systems

• Enterprise Resource Planning (ERP)

• Customer Relationship Management (CRM)

• Human Resource Management Systems (HRMS)

• Supply Chain Management Systems

13. IT Governance and Compliance

• ITIL (Information Technology Infrastructure Library)

• COBIT (Control Objectives for Information Technologies)

• ISO/IEC Standards

• Regulatory Compliance (GDPR, HIPAA, SOX)

14. Emerging Technologies

• Blockchain

• Quantum Computing

• Augmented Reality (AR) and Virtual Reality (VR)

• 3D Printing

• Digital Twins

15. IT Project Management

• Agile, Scrum, and Kanban

• Waterfall Methodology

• Resource Allocation

• Risk Management

16. IT Infrastructure

• Data Centers

• Virtualization (VMware, Hyper-V)

• Disaster Recovery Planning

• Load Balancing

17. IT Education and Certifications

• Vendor Certifications (Microsoft, Cisco, AWS)

• Training and Development Programs

• Online Learning Platforms

18. IT Operations and Monitoring

• Performance Monitoring (APM, Network Monitoring)

• IT Asset Management

• Event and Incident Management

19. Software Testing

• Manual Testing: Human testers evaluate software by executing test cases without using automation tools.

• Automated Testing: Use of testing tools (e.g., Selenium, JUnit) to run automated scripts and check software behavior.

• Functional Testing: Validating that the software performs its intended functions.

• Non-Functional Testing: Assessing non-functional aspects such as performance, usability, and security.

• Unit Testing: Testing individual components or units of code for correctness.

• Integration Testing: Ensuring that different modules or systems work together as expected.

• System Testing: Verifying the complete software system’s behavior against requirements.

• Acceptance Testing: Conducting tests to confirm that the software meets business requirements (including UAT - User Acceptance Testing).

• Regression Testing: Ensuring that new changes or features do not negatively affect existing functionalities.

• Performance Testing: Testing software performance under various conditions (load, stress, scalability).

• Security Testing: Identifying vulnerabilities and assessing the software’s ability to protect data.

• Compatibility Testing: Ensuring the software works on different operating systems, browsers, or devices.

• Continuous Testing: Integrating testing into the development lifecycle to provide quick feedback and minimize bugs.

• Test Automation Frameworks: Tools and structures used to automate testing processes (e.g., TestNG, Appium).

19. VoIP (Voice over IP)

VoIP Protocols & Standards

• SIP (Session Initiation Protocol)

• H.323

• RTP (Real-Time Transport Protocol)

• MGCP (Media Gateway Control Protocol)

VoIP Hardware

• IP Phones (Desk Phones, Mobile Clients)

• VoIP Gateways

• Analog Telephone Adapters (ATAs)

• VoIP Servers

• Network Switches/ Routers for VoIP

VoIP Software

• Softphones (e.g., Zoiper, X-Lite)

• PBX (Private Branch Exchange) Systems

• VoIP Management Software

• Call Center Solutions (e.g., Asterisk, 3CX)

VoIP Network Infrastructure

• Quality of Service (QoS) Configuration

• VPNs (Virtual Private Networks) for VoIP

• VoIP Traffic Shaping & Bandwidth Management

• Firewall and Security Configurations for VoIP

• Network Monitoring & Optimization Tools

VoIP Security

• Encryption (SRTP, TLS)

• Authentication and Authorization

• Firewall & Intrusion Detection Systems

• VoIP Fraud DetectionVoIP Providers

• Hosted VoIP Services (e.g., RingCentral, Vonage)

• SIP Trunking Providers

• PBX Hosting & Managed Services

VoIP Quality and Testing

• Call Quality Monitoring

• Latency, Jitter, and Packet Loss Testing

• VoIP Performance Metrics and Reporting Tools

• User Acceptance Testing (UAT) for VoIP Systems

Integration with Other Systems

• CRM Integration (e.g., Salesforce with VoIP)

• Unified Communications (UC) Solutions

• Contact Center Integration

• Email, Chat, and Video Communication Integration

2 notes

·

View notes

Text

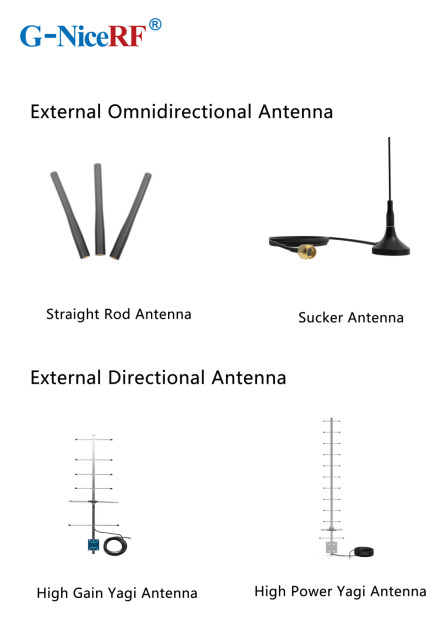

Best Partner for Wireless Modules: A Comprehensive Antenna Selection Guide

n the field of wireless communication, antenna selection is crucial. It not only affects the coverage range and transmission quality of signals but also directly relates to the overall performance of the system. Among various wireless modules, finding the right antenna can maximize their potential, ensuring stable and efficient data transmission.

When designing wireless transceiver devices for RF systems, antenna design and selection are essential components. A high-quality antenna system can ensure optimal communication distances. Typically, the size of antennas of the same type is proportional to the wavelength of the RF signal; as signal strength increases, the number of required antennas also grows.

Antennae can be categorized as internal or external based on their installation location. Internal antennas are installed within the device, while external antennas are mounted outside.

In situations where space is limited or there are multiple frequency bands, antenna design becomes more complex. External antennas are usually standard products, allowing users to simply select the required frequency band without needing additional tuning, making them convenient and easy to use.

What are the main types of antennas?

External Antennas: These antennas can be classified into omnidirectional antennas and directional antennas based on the radiation pattern.

Internal Antennas: These antennas refer to antennas that can be placed inside devices.

Omnidirectional Antennas: These antennas radiate signals uniformly in the horizontal plane, making them suitable for applications that require 360-degree coverage, such as home Wi-Fi routers and mobile devices.

Directional Antennas: These antennas have a high emission and reception strength in one or more specific directions, while the strength is minimal or zero in others. Directional antennas are primarily used to enhance signal strength and improve interference resistance.

PCB Antennas: These antennas are directly printed on the circuit board and are suitable for devices with limited space, commonly used in small wireless modules and IoT devices.

FPC Antennas: FPC antennas are flexible printed circuit antennas that are lightweight, efficient, and easy to integrate.

Concealed Antennas: Designed for aesthetic purposes, concealed antennas can be hidden within devices or disguised as other objects, making them suitable for applications where appearance is important without compromising signal quality.

Antenna Selection Guide

When selecting the appropriate antenna for a communication module, it's essential to first determine whether to use an internal or external antenna based on the module's structure.

External Antennas: These antennas offer high gain, are less affected by the environment, and can save development time, but they may take up space and impact the product's aesthetics.

Internal Antennas: These have relatively high gain and are installed within the device, maintaining a clean and appealing exterior.

Sucker Antennas: These provide high gain and are easy to install and secure.

Copper Rod Sucker Antennas: Made from large-diameter pure copper radiators, these are highly efficient with a wide bandwidth.

Rubber Rod Antennas: Offer moderate gain at a low cost.

Fiberglass Antennas: Suitable for harsh environments and ideal for long-distance signal

External Directional Antennas

Typically used in environments with long communication distances, small signal coverage areas, and high target density.

Panel Antennas have high efficiency, are compact, and easy to install, while considering the impact of gain and radiation area Yagi Antennas offer very high gain, are slightly larger, and have strong directionality, making them suitable for long-distance signal transmission; however, attention must be paid to the antenna's orientation during use

Internal Antenna Selection

Most internal antennas are affected by environmental factors and may require custom design or impedance matching

Spring Antennas are cost-effective but have low gain and narrow bandwidth, often requiring tuning for good matching when installed Ceramic Patch Antennas occupy minimal space and perform well, but have a narrow bandwidth

For details, please click:https://www.nicerf.com/products/ Or click:https://nicerf.en.alibaba.com/productlist.html?spm=a2700.shop_index.88.4.1fec2b006JKUsd For consultation, please contact NiceRF (Email: [email protected]).

2 notes

·

View notes

Text

Top 10 Projects for BE Electrical Engineering Students

Embarking on a Bachelor of Engineering (BE) in Electrical Engineering opens up a world of innovation and creativity. One of the best ways to apply theoretical knowledge is through practical projects that not only enhance your skills but also boost your resume. Here are the top 10 projects for BE Electrical Engineering students, designed to challenge you and showcase your talents.

1. Smart Home Automation System

Overview: Develop a system that allows users to control home appliances remotely using a smartphone app or voice commands.

Key Components:

Microcontroller (Arduino or Raspberry Pi)

Wi-Fi or Bluetooth module

Sensors (temperature, motion, light)

Learning Outcome: Understand IoT concepts and the integration of hardware and software.

2. Solar Power Generation System

Overview: Create a solar panel system that converts sunlight into electricity, suitable for powering small devices or homes.

Key Components:

Solar panels

Charge controller

Inverter

Battery storage

Learning Outcome: Gain insights into renewable energy sources and energy conversion.

3. Automated Irrigation System

Overview: Design a system that automates the watering of plants based on soil moisture levels.

Key Components:

Soil moisture sensor

Water pump

Microcontroller

Relay module

Learning Outcome: Learn about sensor integration and automation in agriculture.

4. Electric Vehicle Charging Station

Overview: Build a prototype for an electric vehicle (EV) charging station that monitors and controls charging processes.

Key Components:

Power electronics (rectifier, inverter)

Microcontroller

LCD display

Safety features (fuses, circuit breakers)

Learning Outcome: Explore the fundamentals of electric vehicles and charging technologies.

5. Gesture-Controlled Robot

Overview: Develop a robot that can be controlled using hand gestures via sensors or cameras.

Key Components:

Microcontroller (Arduino)

Motors and wheels

Ultrasonic or infrared sensors

Gesture recognition module

Learning Outcome: Understand robotics, programming, and sensor technologies.

6. Power Factor Correction System

Overview: Create a system that improves the power factor in electrical circuits to enhance efficiency.

Key Components:

Capacitors

Microcontroller

Current and voltage sensors

Relay for switching

Learning Outcome: Learn about power quality and its importance in electrical systems.

7. Wireless Power Transmission

Overview: Experiment with transmitting power wirelessly over short distances.

Key Components:

Resonant inductive coupling setup

Power source

Load (LED, small motor)

Learning Outcome: Explore concepts of electromagnetic fields and energy transfer.

8. Voice-Controlled Home Assistant

Overview: Build a home assistant that can respond to voice commands to control devices or provide information.

Key Components:

Microcontroller (Raspberry Pi preferred)

Voice recognition module

Wi-Fi module

Connected devices (lights, speakers)

Learning Outcome: Gain experience in natural language processing and AI integration.

9. Traffic Light Control System Using Microcontroller

Overview: Design a smart traffic light system that optimizes traffic flow based on real-time data.

Key Components:

Microcontroller (Arduino)

LED lights

Sensors (for vehicle detection)

Timer module

Learning Outcome: Understand traffic management systems and embedded programming.

10. Data Acquisition System

Overview: Develop a system that collects and analyzes data from various sensors (temperature, humidity, etc.).

Key Components:

Microcontroller (Arduino or Raspberry Pi)

Multiple sensors

Data logging software

Display (LCD or web interface)

Learning Outcome: Learn about data collection, processing, and analysis.

Conclusion

Engaging in these projects not only enhances your practical skills but also reinforces your theoretical knowledge. Whether you aim to develop sustainable technologies, innovate in robotics, or contribute to smart cities, these projects can serve as stepping stones in your journey as an electrical engineer. Choose a project that aligns with your interests, and don’t hesitate to seek guidance from your professors and peers. Happy engineering!

5 notes

·

View notes

Text

Essential Electronic Items for IoT and Electronics Enthusiasts

Are you diving into the world of Internet of Things (IoT) and electronics? Whether you are a seasoned engineer or simply beginning out, having a stable list of essential components is key to bringing your initiatives to existence. Here’s a curated list of electronic objects that each maker and tech enthusiast ought to have of their toolkit:

1. Microcontrollers

Arduino Uno: Great for novices and versatile for diverse projects.

Raspberry Pi: Ideal for more complex duties and going for walks complete operating structures.

ESP8266/ESP32: Perfect for wireless communication and IoT projects.

2. Sensors

DHT22: For temperature and humidity readings.

PIR Sensor: Useful for movement detection.

Ultrasonic Distance Sensor: Measures distances with high accuracy.

3. Actuators

Servo Motors: For unique manage in robotics and mechanical structures.

Stepper Motors: Ideal for applications requiring particular movement.

Solenoids: Good for growing mechanical actions and locks.

4. Displays

LCD Display: Useful for showing records and debugging.

OLED Display: Compact and clean for exact photographs and texts.

5. Connectivity Modules

Bluetooth Module (HC-05/HC-06): For short-range wi-fi communication.

Wi-Fi Module (ESP8266): Connects gadgets to the internet.

GSM Module: Enables verbal exchange over mobile networks.

6. Power Supplies

Battery Packs: Various types for transportable electricity.

Voltage Regulators: Ensure solid voltage ranges in your circuits.

Power Banks: Handy for charging and powering devices on the move.

7. Prototyping Tools

Breadboards: Essential for prototyping with out soldering.

Jumper Wires: For making connections on breadboards.

Soldering Kit: For everlasting connections and circuit meeting.

eight. Additional Components

Resistors, Capacitors, and Diodes: Fundamental for circuit design and stability.

Transistors: Key for switching and amplification tasks.

Connectors and Switches: For interfacing and controlling circuits.

By preserving these objects handy, you'll be nicely-prepared to address a huge range of IoT and electronics projects. Whether you're constructing smart domestic devices, wearable tech, or computerized structures, having the right additives can make all the difference.

#IoT#Electronics#Arduino#RaspberryPi#ESP32#Sensors#Actuators#Displays#ConnectivityModules#PowerSupplies#Prototyping#Tech#DIY#Makers#Engineering#ElectronicComponents#TechProjects

2 notes

·

View notes

Text

Genio 510: Redefining the Future of Smart Retail Experiences

Genio IoT Platform by MediaTek

Genio 510

Manufacturers of consumer, business, and industrial devices can benefit from MediaTek Genio IoT Platform’s innovation, quicker market access, and more than a decade of longevity. A range of IoT chipsets called MediaTek Genio IoT is designed to enable and lead the way for innovative gadgets. to cooperation and support from conception to design and production, MediaTek guarantees success. MediaTek can pivot, scale, and adjust to needs thanks to their global network of reliable distributors and business partners.

Genio 510 features

Excellent work

Broad range of third-party modules and power-efficient, high-performing IoT SoCs

AI-driven sophisticated multimedia AI accelerators and cores that improve peripheral intelligent autonomous capabilities

Interaction

Sub-6GHz 5G technologies and Wi-Fi protocols for consumer, business, and industrial use

Both powerful and energy-efficient

Adaptable, quick interfaces

Global 5G modem supported by carriers

Superior assistance

From idea to design to manufacture, MediaTek works with clients, sharing experience and offering thorough documentation, in-depth training, and reliable developer tools.

Safety

IoT SoC with high security and intelligent modules to create goods

Several applications on one common platform

Developing industry, commercial, and enterprise IoT applications on a single platform that works with all SoCs can save development costs and accelerate time to market.

MediaTek Genio 510

Smart retail, industrial, factory automation, and many more Internet of things applications are powered by MediaTek’s Genio 510. Leading manufacturer of fabless semiconductors worldwide, MediaTek will be present at Embedded World 2024, which takes place in Nuremberg this week, along with a number of other firms. Their most recent IoT innovations are on display at the event, and They’ll be talking about how these MediaTek-powered products help a variety of market sectors.

They will be showcasing the recently released MediaTek Genio 510 SoC in one of their demos. The Genio 510 will offer high-efficiency solutions in AI performance, CPU and graphics, 4K display, rich input/output, and 5G and Wi-Fi 6 connection for popular IoT applications. With the Genio 510 and Genio 700 chips being pin-compatible, product developers may now better segment and diversify their designs for different markets without having to pay for a redesign.

Numerous applications, such as digital menus and table service displays, kiosks, smart home displays, point of sale (PoS) devices, and various advertising and public domain HMI applications, are best suited for the MediaTek Genio 510. Industrial HMI covers ruggedized tablets for smart agriculture, healthcare, EV charging infrastructure, factory automation, transportation, warehousing, and logistics. It also includes ruggedized tablets for commercial and industrial vehicles.

The fully integrated, extensive feature set of Genio 510 makes such diversity possible:

Support for two displays, such as an FHD and 4K display

Modern visual quality support for two cameras built on MediaTek’s tried-and-true technologies

For a wide range of computer vision applications, such as facial recognition, object/people identification, collision warning, driver monitoring, gesture and posture detection, and image segmentation, a powerful multi-core AI processor with a dedicated visual processing engine

Rich input/output for peripherals, such as network connectivity, manufacturing equipment, scanners, card readers, and sensors

4K encoding engine (camera recording) and 4K video decoding (multimedia playback for advertising)

Exceptionally power-efficient 6nm SoC

Ready for MediaTek NeuroPilot AI SDK and multitasking OS (time to market accelerated by familiar development environment)

Support for fanless design and industrial grade temperature operation (-40 to 105C)

10-year supply guarantee (one-stop shop supported by a top semiconductor manufacturer in the world)

To what extent does it surpass the alternatives?

The Genio 510 uses more than 50% less power and provides over 250% more CPU performance than the direct alternative!

The MediaTek Genio 510 is an effective IoT platform designed for Edge AI, interactive retail, smart homes, industrial, and commercial uses. It offers multitasking OS, sophisticated multimedia, extremely rapid edge processing, and more. intended for goods that work well with off-grid power systems and fanless enclosure designs.

EVK MediaTek Genio 510

The highly competent Genio 510 (MT8370) edge-AI IoT platform for smart homes, interactive retail, industrial, and commercial applications comes with an evaluation kit called the MediaTek Genio 510 EVK. It offers many multitasking operating systems, a variety of networking choices, very responsive edge processing, and sophisticated multimedia capabilities.

SoC: MediaTek Genio 510

This Edge AI platform, which was created utilising an incredibly efficient 6nm technology, combines an integrated APU (AI processor), DSP, Arm Mali-G57 MC2 GPU, and six cores (2×2.2 GHz Arm Cortex-A78& 4×2.0 GHz Arm Cortex-A55) into a single chip. Video recorded with attached cameras can be converted at up to Full HD resolution while using the least amount of space possible thanks to a HEVC encoding acceleration engine.

FAQS

What is the MediaTek Genio 510?

A chipset intended for a broad spectrum of Internet of Things (IoT) applications is the Genio 510.

What kind of IoT applications is the Genio 510 suited for?

Because of its adaptability, the Genio 510 may be utilised in a wide range of applications, including smart homes, healthcare, transportation, and agriculture, as well as industrial automation (rugged tablets, manufacturing machinery, and point-of-sale systems).

What are the benefits of using the Genio 510?

Rich input/output choices, powerful CPU and graphics processing, compatibility for 4K screens, high-efficiency AI performance, and networking capabilities like 5G and Wi-Fi 6 are all included with the Genio 510.

Read more on Govindhtech.com

#genio#genio510#MediaTek#govindhtech#IoT#AIAccelerator#WIFI#5gtechnologies#CPU#processors#mediatekprocessor#news#technews#technology#technologytrends#technologynews

2 notes

·

View notes

Text

DESCRIPTION:

NodeMCU is an IoT Module based on the ESP8266 wifi Module. NodeMCU uses Lua Scripting language and is an open-source Internet of Things (IoT) platform. This module has CH340g USB to TTL IC.

2 notes

·

View notes

Text

How Do Power, Motor & Robotics Development Tools Drive Innovation in Automation?

Introduction to Modern Development Ecosystems

As the era of intelligent machines, automation, and smart manufacturing continues to advance, Power, Motor & Robotics Development Tools have emerged as essential components in transforming ideas into functioning prototypes and commercial solutions. These tools serve as the backbone for developing precise and reliable control systems used in a wide variety of sectors—from industrial robotics to electric mobility.

With the increasing integration of microcontrollers, sensors, thermal management components, and electronic controllers, development tools offer a modular and practical approach to building sophisticated electronic and electromechanical systems.

What Are Power, Motor & Robotics Development Tools?

Power, Motor & Robotics Development Tools consist of hardware kits, interface boards, and control modules designed to help developers and engineers test, prototype, and deploy automated systems with precision and speed. These tools make it possible to manage current, voltage, mechanical motion, and real-time decision-making in a structured and scalable manner.

By combining essential components such as capacitors, fuses, grips, cables, connectors, and switches, these kits simplify complex engineering challenges, allowing smooth integration with controllers, microprocessors, and sensors.

Exploring the Primary Toolsets in the Field

Power Management Development Tools

Efficient energy management is crucial for ensuring stability and performance in any robotic or motor-driven system.

Development boards supporting AC/DC and DC/DC conversion

Voltage regulators and surge protection circuits for safe energy flow

Thermal sensors and oils to maintain system temperature

Battery management ICs to control charge-discharge cycles

High-efficiency transformers and current monitors

Motor Control Development Tools

Motor control kits are built to manage torque, direction, and speed across a range of motor types.

H-bridge motor drivers for bidirectional motor control

Stepper motor controllers with high-precision movement

Brushless DC motor driver modules with thermal protection

Feedback systems using encoders and optical sensors

PWM-based modules for real-time torque adjustment

Robotics Development Tools

Robotics kits merge both mechanical and electronic domains to simulate and deploy automation.

Preassembled robotic arm platforms with programmable joints

Sensor integration boards for object detection, motion sensing, and environmental monitoring

Wireless modules for IoT connectivity using BLE, Wi-Fi, or RF

Microcontroller development platforms for logic execution

Mounting hardware and cable grips for secure installations

Benefits of Using Professional Development Tools

Advanced development kits offer more than just experimentation—they serve as stepping stones to commercial production. These tools minimize development time and maximize productivity.

Enhance system performance with modular plug-and-play designs

Enable easy integration with laptops, diagnostic tools, and controllers

Reduce design errors through pre-tested circuitry and embedded protection

Facilitate rapid software and firmware updates with compatible microcontrollers

Support debugging with LED indicators, thermal pads, and status feedback

Key Applications Across Industries

The adaptability of Power, Motor & Robotics Development Tools makes them suitable for countless industries and applications where intelligent movement and power efficiency are essential.

Industrial robotics and pick-and-place systems for manufacturing automation

Smart agriculture solutions including automated irrigation and drone control

Automotive design for electric vehicle propulsion and battery systems

Aerospace applications for lightweight, compact control mechanisms

Educational platforms promoting STEM learning with hands-on robotics kits

Essential Components that Enhance Development Kits

While the kits come equipped with core tools, several other components are often required to expand capabilities or tailor the kits to specific use cases.

Sensors: From temperature and light to current and magnetic field detection

Connectors and plugs: For flexible integration of external modules

Switches and contactors: For manual or automatic control

Thermal pads and heatsinks: For preventing overheating during operation

Fuses and circuit protection devices: For safeguarding sensitive electronics

LED displays and character LCD modules: For real-time data visualization

How to Choose the Right Tool for Your Project

With a vast array of kits and tools on the market, selecting the right one depends on your application and environment.

Identify whether your project focuses more on power management, motor control, or full robotic systems

Consider compatibility with popular development environments such as Arduino, STM32, or Raspberry Pi

Check the current and voltage ratings to match your load and motor specifications

Evaluate add-on support for wireless communication and real-time data processing

Ensure the tool includes comprehensive documentation and driver libraries for smooth integration

Why Development Tools Are Crucial for Innovation

At the heart of every advanced automation solution is a well-structured foundation built with accurate control and reliable hardware. Development tools help bridge the gap between conceptualization and realization, giving engineers and makers the freedom to innovate and iterate.

Encourage experimentation with minimal risk

Shorten product development cycles significantly

Simplify complex circuit designs through preconfigured modules

Offer scalability for both low-power and high-power applications

Future Scope and Emerging Trends

The future of development tools is headed toward more AI-integrated, real-time adaptive systems capable of learning and adjusting to their environment. Tools that support machine vision, edge computing, and predictive analytics are gaining traction.

AI-powered motion control for robotics

Integration with cloud platforms for remote diagnostics

Advanced motor drivers with feedback-based optimization

Miniaturized power modules for wearable and mobile robotics

Conclusion: Is It Time to Upgrade Your Engineering Toolkit?

If you're aiming to build smarter, faster, and more energy-efficient systems, Power, Motor & Robotics Development Tools are not optional—they’re essential. These kits support you from idea to implementation, offering the flexibility and performance needed in modern-day innovation.

Whether you're developing a prototype for a high-speed robotic arm or integrating power regulation into a smart grid solution, the right development tools empower you to transform challenges into achievements. Take the leap into next-gen automation and electronics by investing in the tools that make engineering smarter, safer, and more efficient.

#Power Motor & Robotics Development Tools#electronic components#technology#electricalparts#halltronics

0 notes

Text

CPE Chip Market Analysis: CAGR of 12.1% Predicted Between 2025–2032

MARKET INSIGHTS

The global CPE Chip Market size was valued at US$ 1.58 billion in 2024 and is projected to reach US$ 3.47 billion by 2032, at a CAGR of 12.1% during the forecast period 2025-2032. This growth trajectory aligns with the broader semiconductor industry expansion, which was valued at USD 579 billion in 2022 and is expected to reach USD 790 billion by 2029 at a 6% CAGR.

CPE (Customer Premises Equipment) chips are specialized semiconductor components that enable network connectivity in devices such as routers, modems, and gateways. These chips power critical functions including signal processing, data transmission, and protocol conversion for both 4G and 5G networks. The market comprises two primary segments – 4G chips maintaining legacy infrastructure support and 5G chips driving next-generation connectivity with higher bandwidth and lower latency.

Market expansion is being propelled by three key factors: the global rollout of 5G infrastructure, increasing demand for high-speed broadband solutions, and the proliferation of IoT devices requiring robust connectivity. However, supply chain constraints in the semiconductor industry and geopolitical factors affecting chip production present ongoing challenges. Major players like Qualcomm and MediaTek are investing heavily in R&D to develop advanced CPE chipsets, while emerging players such as UNISOC and ASR are gaining traction in cost-sensitive markets. The Asia-Pacific region dominates production and consumption, accounting for over 45% of global CPE chip demand in 2024.

MARKET DYNAMICS

MARKET DRIVERS

5G Network Expansion Accelerates Demand for Advanced CPE Chips

The global transition to 5G networks continues to drive exponential growth in the CPE chip market. As telecom operators roll out next-generation infrastructure, the demand for high-performance customer premise equipment has surged by over 40% in the past two years. Modern 5G CPE devices require specialized chipsets capable of supporting multi-gigabit speeds, ultra-low latency, and massive device connectivity. Leading chip manufacturers are responding with integrated solutions that combine baseband processing, RF front-end modules, and AI acceleration. For instance, Qualcomm’s latest 5G CPE platforms deliver 10Gbps throughput while reducing power consumption by 30% compared to previous generations.

IoT Adoption Creates New Growth Avenues for CPE Chip Vendors

The proliferation of Internet of Things (IoT) applications across smart cities, industrial automation, and connected homes is generating significant opportunities for CPE chip manufacturers. With over 15 billion IoT devices projected to connect to networks by 2025, telecom operators require CPE solutions that can efficiently manage diverse traffic patterns and quality-of-service requirements. This has led to the development of specialized chipsets featuring advanced traffic management, edge computing capabilities, and enhanced security protocols. Recent product launches demonstrate this trend, with companies like MediaTek introducing chips optimized for IoT gateways that support simultaneous connections to hundreds of endpoints while maintaining reliable performance.

Remote Work Infrastructure Investments Fuel Market Expansion

The permanent shift toward hybrid work models continues to stimulate demand for enterprise-grade CPE solutions. Businesses worldwide are upgrading their network infrastructure to support distributed workforces, driving a 25% year-over-year increase in CPE deployments. This trend has particularly benefited manufacturers of chips designed for business routers and SD-WAN appliances, which require robust performance for VPNs, unified communications, and cloud applications. Leading semiconductor firms have responded with system-on-chip solutions integrating Wi-Fi 6/6E, multi-core processors, and hardware-accelerated encryption to meet these evolving requirements.

MARKET RESTRAINTS

Supply Chain Disruptions Continue to Challenge Production Stability

Despite strong demand, the CPE chip market faces persistent supply chain constraints that limit growth potential. The semiconductor industry’s reliance on advanced fabrication nodes has created bottlenecks, with lead times for certain components extending beyond 12 months. These challenges are compounded by geopolitical tensions affecting rare earth material supplies and export controls on specialized manufacturing equipment. While the situation has improved from pandemic-era shortages, inventory levels remain below historical averages, forcing many CPE manufacturers to implement allocation strategies and redesign products with available components.

Rising Component Costs Squeeze Profit Margins

Escalating production expenses present another significant restraint for CPE chip suppliers. The transition to more advanced process nodes has increased wafer costs by approximately 20-30% across the industry. Additionally, testing and packaging expenses have risen due to higher energy prices and labor costs. These factors have compressed gross margins, particularly for mid-range CPE chips where pricing pressure is most intense. Manufacturers are responding by optimizing chip architectures, consolidating IP blocks, and investing in yield improvement initiatives, but these measures require significant R&D expenditures that may take years to yield returns.

Regulatory Complexity Slows Time-to-Market

The CPE chip industry faces growing regulatory scrutiny that delays product launches and increases compliance costs. New spectrum regulations, cybersecurity requirements, and equipment certification processes have extended development cycles by 3-6 months on average. In particular, the automotive and industrial sectors now demand comprehensive safety certifications that require extensive testing and documentation. These regulatory hurdles disproportionately affect smaller chip vendors who lack dedicated compliance teams, potentially limiting innovation and competition in certain market segments.

MARKET CHALLENGES

Technology Complexity Increases Design and Validation Costs

Modern CPE chips incorporate increasingly sophisticated architectures that pose significant engineering challenges. Designs now routinely integrate multiple processor cores, AI accelerators, and specialized radio interfaces, requiring advanced simulation tools and verification methodologies. The associated R&D costs have grown exponentially, with some 5G chip development projects now exceeding $100 million in budget. This creates a high barrier to entry for potential competitors and forces established players to carefully prioritize their product roadmaps. Furthermore, the complexity makes post-silicon validation more difficult, potentially leading to costly respins if critical issues emerge late in the development cycle.

Talent Shortage Constrains Innovation Capacity

The semiconductor industry’s rapid expansion has created intense competition for skilled engineers, particularly in critical areas like RF design, digital signal processing, and physical implementation. CPE chip manufacturers report vacancy rates exceeding 30% for certain technical positions, with hiring cycles stretching to 9-12 months for specialized roles. This talent crunch limits companies’ ability to execute aggressive product roadmaps and forces difficult tradeoffs between projects. While firms are investing in training programs and academic partnerships, the pipeline for experienced chip designers remains insufficient to meet current demand.

Standardization Gaps Create Integration Headaches

The evolving nature of 5G and edge computing technologies has led to fragmented standards across different markets and regions. CPE chip vendors must support multiple protocol variants, frequency bands, and security frameworks, complicating both hardware and software development. This fragmentation increases testing overhead and makes it difficult to achieve economies of scale across product lines. While industry groups continue working toward greater harmonization, interim solutions often require additional engineering resources to implement customized features for specific customers or geographies.

CPE CHIP MARKET TRENDS

5G Network Expansion Accelerates Demand for Advanced CPE Chips

The rapid global deployment of 5G networks is significantly driving the CPE (Customer Premises Equipment) chip market, with the segment projected to grow at over 30% CAGR through 2032. Telecom operators worldwide invested nearly $280 billion in 5G infrastructure in 2023 alone, creating substantial demand for compatible CPE devices. Chip manufacturers are responding with innovative solutions featuring multi-band support and improved power efficiency, with next-generation modem-RF combos now achieving throughputs exceeding 7Gbps. While 4G CPE chips still dominate current installations, representing about 65% of 2024 shipments, 5G solutions are rapidly gaining share due to superior performance in high-density urban environments.

Other Trends

Smart Home Integration

The proliferation of IoT devices in residential settings, expected to reach 29 billion connected units globally by 2027, is creating new requirements for CPE chips that can handle simultaneous broadband and IoT traffic management. Modern gateway solutions now incorporate AI-powered traffic prioritization and mesh networking capabilities to maintain quality of service across dozens of connected devices. Semiconductor vendors have responded with system-on-chip (SoC) designs integrating Wi-Fi 6/6E, Bluetooth, and Zigbee radios alongside traditional cellular modems. North America leads this adoption curve, with over 75% of new home internet subscriptions in 2023 opting for smart gateway solutions compared to just 32% in 2020.

Edge Computing and Network Virtualization Impact Chip Designs

Emerging virtualization technologies are reshaping CPE architectures, creating demand for chips with enhanced processing capabilities beyond traditional modem functions. Virtual CPE (vCPE) solutions now account for 18% of business installations, requiring chipsets that can efficiently run containerized network functions (CNFs) while maintaining low power envelopes. The enterprise segment has proven particularly receptive, with large-scale adoption in multi-tenant office buildings and smart city applications. Meanwhile, silicon designed for edge computing applications is increasingly incorporating hardware acceleration blocks for AI inference, allowing real-time processing of video analytics and other bandwidth-intensive applications at the network periphery. This evolution has prompted traditional chip vendors to expand their portfolios through strategic acquisitions in the FPGA and specialty processor spaces.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Partnerships Fuel Growth in the CPE Chip Market

The global CPE (Customer Premises Equipment) chip market remains highly competitive, characterized by technological innovation and aggressive expansion strategies. Qualcomm dominates the market with its extensive portfolio of 4G and 5G chipsets, capturing approximately 35% revenue share in 2024. The company’s leadership stems from its strong foothold in North America and strategic partnerships with telecom operators.

MediaTek and Intel follow closely, collectively accounting for 28% market share, owing to their cost-effective solutions for emerging markets and industrial applications. These players continue investing heavily in R&D, particularly for energy-efficient 5G chips catering to IoT deployments and smart city infrastructure.

Chinese manufacturers like Hisilicon and UNISOC are rapidly gaining traction through government-supported initiatives and localized supply chains. Their aggressive pricing strategies and custom solutions for Asian markets have enabled 18% year-over-year growth in 2024, challenging established western players.

Meanwhile, specialized firms such as Eigencomm and Sequans are carving niche positions through innovative chip architectures optimized for low-power wide-area networks (LPWAN) and private 5G deployments. Their collaborations with network equipment providers have become crucial differentiators in this evolving landscape.

List of Key CPE Chip Manufacturers Profiled

Qualcomm Technologies, Inc. (U.S.)

UNISOC (Shanghai) Technologies Co., Ltd. (China)

ASR Microelectronics Co., Ltd. (China)

HiSilicon (Huawei Technologies Co., Ltd.) (China)

XINYI Semiconductor (China)

MediaTek Inc. (Taiwan)

Intel Corporation (U.S.)

Eigencomm (China)

Sequans Communications S.A. (France)

Segment Analysis:

By Type

5G Chip Segment Dominates the Market Due to its High-Speed Connectivity and Low Latency

The CPE Chip market is segmented based on type into:

4G Chip

5G Chip

By Application

5G CPE Segment Leads Due to Escalated Demand for High-Performance Wireless Broadband

The market is segmented based on application into:

4G CPE

5G CPE

By End User

Telecom Operators Segment Dominates with Growing Infrastructure Investments

The market is segmented based on end user into:

Telecom Operators

Enterprises

Residential Users

Regional Analysis: CPE Chip Market

North America The mature telecommunications infrastructure and rapid 5G deployments in the U.S. and Canada are fueling demand for high-performance 5G CPE chips, particularly from vendors like Qualcomm and Intel. With major carriers investing over $275 billion in network upgrades, chip manufacturers are prioritizing low-latency, power-efficient designs. However, stringent regulatory scrutiny on semiconductor imports creates supply chain challenges. The region also leads in IoT adoption, driving demand for hybrid 4G/5G chips in smart city solutions and enterprise applications. Local chip designers benefit from strong R&D ecosystems but face growing competition from Asian suppliers.

Europe EU initiatives like the 2030 Digital Compass (targeting gigabit connectivity for all households) are accelerating CPE chip demand, though adoption varies across nations. Germany and the U.K. lead in 5G CPE deployments using chips from MediaTek and Sequans, while Eastern Europe still relies heavily on cost-effective 4G solutions. Strict data privacy laws and emphasis on open RAN architectures are reshaping chip design requirements. The region faces headwinds from component shortages but maintains steady growth through government-industry partnerships in semiconductor sovereignty programs.

Asia-Pacific Accounting for over 60% of global CPE chip consumption, the region is driven by China’s massive “5G+” infrastructure push and India’s expanding broadband networks. Local giants HiSilicon and UNISOC dominate low-to-mid range segments, while South Korean/Japanese firms focus on premium chips. Southeast Asian markets show explosive growth (20%+ CAGR) due to rural connectivity projects. However, geopolitical tensions and import restrictions create supply volatility. Price sensitivity remains high, favoring integrated 4G/5G combo chips over standalone 5G solutions in emerging economies.

South America Limited 5G spectrum availability keeps the market reliant on 4G LTE chips, though Brazil and Chile are early adopters of 5G CPEs using ASR and MediaTek solutions. Economic instability and currency fluctuations hinder large-scale infrastructure investments, causing operators to prioritize cost-effective Chinese chip suppliers. The lack of local semiconductor manufacturing creates import dependency, but recent trade agreements aim to improve component accessibility. Enterprise demand for industrial IoT routers presents niche opportunities for mid-tier chip vendors.

Middle East & Africa Gulf nations (UAE, Saudi Arabia) drive premium 5G CPE adoption through smart city projects, leveraging Qualcomm and Eigencomm chips. Sub-Saharan Africa depends on affordable 4G solutions from Chinese vendors, with mobile network operators deploying low-power chips for extended coverage. While underdeveloped fiber backhaul limits 5G potential, satellite-CPE hybrid chips are gaining traction in remote areas. Political instability in some markets disrupts supply chains, though rising digitalization funds (like Saudi’s $6.4bn ICT strategy) indicate long-term growth potential.

Report Scope

This market research report provides a comprehensive analysis of the global and regional CPE Chip markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global CPE Chip market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (4G Chip, 5G Chip), application (4G CPE, 5G CPE), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. Asia-Pacific currently dominates the market due to rapid 5G adoption.

Competitive Landscape: Profiles of leading market participants including Qualcomm, UNISOC, ASR, Hisilicon, and MediaTek, including their product offerings, R&D focus, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in semiconductor design, fabrication techniques, and evolving industry standards for CPE devices.

Market Drivers & Restraints: Evaluation of factors driving market growth such as 5G rollout and IoT expansion, along with challenges including supply chain constraints and regulatory issues.

Stakeholder Analysis: Insights for chip manufacturers, network equipment providers, telecom operators, investors, and policymakers regarding the evolving ecosystem.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

Take Smart Power to the Next Level with IEEE 802.3bt’s Autoclass Feature

Power over Ethernet (PoE) has revolutionized how we deploy networked devices — but with growing demands for power, efficiency is no longer optional. Enter Autoclass (AUC), a smart feature within the IEEE 802.3bt modules standard. Let’s dive into why Autoclass deserves a spot in your next PoE deployment.

Why PoE Is a Game-Changer

Lower installation costs: One Ethernet cable delivers both data and power, cutting down on labor and materials — no AC outlet required near every device.

Built for safety and ease: Safe under 60V DC, PoE avoids high-voltage complexities. It eliminates extra circuit protection and simplifies relocations.

Reliable power management: PoE systems include standardized protocols to negotiate and monitor power with built-in safety mechanisms.

What’s New with IEEE 802.3bt?

Formalized in September 2018, the IEEE 802.3bt standard aligns with the power needs of modern devices — CCTV cameras, Wi‑Fi 6/6E access points, thin/zero clients, 5G radios, and more.

Type 1 (802.3af): Up to 15.4W (PSE), 12.95W (PD) using two pairs.

Type 2 (802.3at): Up to 30W (PSE), 25.5W (PD) using two pairs.

Type 3/4 (802.3bt): Up to 90W (PSE), 71.3W (PD) using all four pairs.

This enables robust power delivery for high-demand scenarios — ideal for heavy-duty enterprise deployments.

⚙️ The Power Drawback in Traditional PoE

Earlier standards pre-assign power based on class — not actual need. So even if your device truly needs 65W, the system reserves the full 90W. That means wasted energy at the switch and fewer devices supported per port budget.

Autoclass to the Rescue

Autoclass transforms the game:

Smart handshake: During classification, a compliant PD signals Autoclass support to the PSE.

Power draw measurement: Once active, the PD draws its actual peak current.

Dynamic allocation: The PSE adjusts output to match real need — no more, no less.

Result: Up to 20W+ saved per port on a Class 8 setup — representing hundreds of watts saved across a switch.

Real-World Examples

Premium Cat5e cable: A 65W device pulls only ~68.8W instead of 90W — saving ~21W per port, or ~168W on an eight-port switch.

Copper-Aluminum cable: A 70W device uses ~73.8W, freeing ~16W per port — adding up to ~134W saved at scale.

PoweredEthernet™ PDs with Autoclass

Infomart’s PoweredEthernet™ IEEE 802.3bt PD modules — such as:

PEM9300BT (Class 8)

PEM6300BT (Class 6)

PEB9300BT (all-in-one PD board)

— support optional Autoclass. That empowers equipment designers to:

Accurately budget power based on real-world usage

Maximize port power capacity in high-density PoE networks

Minimize wastage and operating costs

Simplify device deployment with fewer external parts

These modules also include Maintain Power Signature (MPS) technology — supporting ultra-low standby power without losing PoE connection, plus built-in wall plug redundancy.

🎯 Why Autoclass Matters

Save energy — cut down on wasted watts, slash bills

Scale smarter — fit more devices under your switch’s power budget

Future-proof — ideal for next-gen devices and dense deployments

Boost ROI — lower infrastructure costs and maximize uptime

Ready to Power Smarter?

Autoclass in IEEE 802.3bt isn’t just a technical feat — it’s a strategic advantage. For any smart building, enterprise network, or IoT deployment, Autoclass is the difference between guesswork and precision. Want to explore specific use cases or product options? Let me know — I’d be happy to tailor the blog further!

0 notes

Text

#Buy Wireless Module Online#WiFi Module#Wi-Fi IoT Solutions#WiFi Module Receiver#WiFi Module price#Wi-Fi and Bluetooth modules#Wireless Modules#Wireless Modules for Embedded Design

0 notes

Text

Low Noise Amplifier Market Grows with the Rise of High-Speed Networks

The global Low Noise Amplifier (LNA) market, valued at US$ 4.9 Bn in 2022, is poised for significant expansion, projected to reach US$ 12.8 Bn by 2031, growing at a CAGR of 11.3% during the forecast period. The market is being propelled by rising demand for high-performance communication systems, especially with the rollout of 5G networks, the proliferation of smart devices, and increased adoption of LNAs in satellite and space-oriented applications.

LNAs are critical components in devices where signal integrity and amplification are paramount, including smartphones, Wi-Fi systems, satellites, and military equipment.

Market Drivers & Trends

A key driver of growth is the rapid development in the global telecommunications industry, marked by heavy investments in 5G infrastructure, VoLTE services, and the Internet of Things (IoT). LNAs are essential in boosting weak RF signals without adding significant noise, thereby enhancing connectivity and device performance.

The booming consumer electronics sector, characterized by increased smartphone penetration and demand for compact, high-efficiency components, is another major contributor. Moreover, modular LNA designs are allowing for greater customization, compatibility, and integration into IoT applications.

Latest Market Trends

Advanced Materials: There is a rising trend toward using Gallium Arsenide (GaAs) and Silicon Germanium (SiGe) in LNA design due to their superior frequency response and lower noise characteristics.

Software-Defined Vehicles (SDVs): LNAs are becoming integral in next-gen autonomous vehicles, with automotive OEMs increasingly requiring advanced signal processing components for radar and safety systems.

Miniaturization: The trend of smaller, more power-efficient devices is pushing manufacturers to innovate in compact LNA designs without compromising on gain and noise figure.

Key Players and Industry Leaders

Prominent players in the global LNA market include:

Analog Devices, Inc.

Skyworks Solutions, Inc.

NXP Semiconductors

Infineon Technologies

Texas Instruments

Panasonic Corporation

Qorvo, Inc.

Onsemi

Teledyne Microwave Solutions

Narda-MITEQ

Qotana Technologies Co., Ltd.

Microsemi Corporation

These companies are focused on innovation, product differentiation, and expansion through partnerships and acquisitions. Their strategies reflect a strong emphasis on high-growth applications such as autonomous driving, 5G networks, and satellite communications.

Recent Developments

In December 2023, Applied EV partnered with NXP Semiconductors to enhance autonomous vehicle safety using advanced control systems, likely incorporating high-performance RF front-end components including LNAs.

In August 2023, GlobalFoundries launched the 9SW RF SOI Technology, aimed at enhancing next-generation 5G mobile applications. The innovation supports low-power, low-cost, and flexible front-end modules where LNAs are central.

Market Opportunities

Space-Oriented Applications: The growing utilization of LNAs in navigation systems, disaster management, and weather forecasting satellites presents long-term growth opportunities.

Defense & Aerospace: With increased global defense spending, the demand for high-frequency LNAs in radar and communication systems is rising.

Healthcare: Medical imaging devices are increasingly incorporating RF components, opening new avenues for LNAs.

Future Outlook

With rapid technological shifts and increasing demand across multiple sectors, the global LNA market is expected to experience sustained growth through 2031. The evolution of 5G and 6G networks, coupled with increasing interest in software-defined platforms and advanced automotive electronics, will shape the next phase of the market.

Strategic collaborations, R&D in semiconductor materials, and regional manufacturing initiatives will remain pivotal for players seeking to stay competitive.

Access important conclusions and data points from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=22091

Market Segmentation

By Frequency

Less than 6GHz

6GHz to 60GHz

Greater than 60GHz

By Material

Silicon

Silicon Germanium

Gallium Arsenide

By Application

Satellite Communication Systems

Test & Measurement

Wi-Fi

Networking

Cellular Telephones

Others

By Industry Vertical

Consumer Electronics

Medical

Industrial

Defense

Automotive

Telecom

Others

Regional Insights

Asia Pacific led the global market in 2022 and is projected to retain dominance through 2031. This is attributed to:

High smartphone adoption

Growing consumer electronics production

Strong shift toward 5G network rollouts

Notably, India's emergence as a manufacturing hub is bolstering the regional landscape. For instance, Google’s 2023 decision to manufacture Pixel smartphones in India underlines the region’s importance in global tech supply chains.

North America and Europe also hold substantial market shares due to heavy investments in space exploration, defense modernization, and next-gen automotive systems.

Frequently Asked Questions (FAQs)

1. What is the expected value of the global LNA market by 2031? The market is projected to reach US$ 12.8 Bn by 2031.

2. What is the compound annual growth rate (CAGR) of the LNA market from 2023 to 2031? The market is expected to grow at a CAGR of 11.3%.

3. Which region dominates the LNA market? Asia Pacific held the leading share in 2022 and is expected to maintain dominance due to strong demand for consumer electronics and telecom growth.

4. Which applications are driving the LNA market? Key applications include satellite communication systems, Wi-Fi, cellular telephones, and networking equipment.

5. Who are the major players in the global LNA market? Top players include Analog Devices, Skyworks Solutions, Infineon Technologies, Texas Instruments, and NXP Semiconductors.

6. What are the key materials used in LNAs? LNAs are commonly made from Silicon, Silicon Germanium, and Gallium Arsenide for different performance needs.

7. What are the key opportunities in the LNA market? Emerging opportunities include autonomous vehicles, IoT applications, and space-based technologies.

Explore Latest Research Reports by Transparency Market Research: Surge Protection Devices Market: https://www.transparencymarketresearch.com/surge-protection-devices-market.html

Robotic Waste Sorting Market: https://www.transparencymarketresearch.com/robotic-waste-sorting-market.html

Photoionization Detection (PID) Gas Analyzer Market: https://www.transparencymarketresearch.com/photoionization-detection-gas-analyzer-market.html

Thin Film Power Inductor Market: https://www.transparencymarketresearch.com/thin-film-power-inductor-market.html

Silicon on Insulator (SOI) Market: https://www.transparencymarketresearch.com/silicon-insulator-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes