#aadhar verification api

Explore tagged Tumblr posts

Text

Bank Account Verification API: Instant & Secure Payment Validation Solution

Ensure accurate and fraud-free transactions with a Bank Account Verification API. Businesses can instantly verify bank account details before processing payments, reducing errors and fraud risks. Enhance financial security, streamline KYC processes, and improve operational efficiency with this real-time validation solution.

Visit Site: https://cyrusrecharge.com/aadhaar-verification-api

0 notes

Text

0 notes

Text

Passiflora secrets: what do you know really?

Here we are with this new format. I promised you I would have proposed it. We will talk about in the next episode of Passiflora

I ask you to answer sincerely to the questions. It's not a problem if you don't know the answers.

This is a simple survey. Ready?

1. How familiar are you with Passiflora (Passion Flower)?

Very familiar

Somewhat familiar

Not familiar at all

2. Have you ever used Passiflora for any purpose? (e.g., medicinal, culinary, ornamental)

Yes

No

3. If yes, please specify how you have used Passiflora:

Medicinal purposes

Cooking or baking

Landscaping or gardening

Other (please specify)

4. What benefits do you associate with Passiflora?

Stress relief

Improved sleep

Enhanced digestion

Other (please specify)

5. Are you aware of any side effects or precautions related to Passiflora use?

Yes

No

6. Would you be interested in learning more about Passiflora and its applications?

Yes

No

7. Any additional comments or experiences you'd like to share about Passiflora?

Thank you for taking the time to complete this survey! Your feedback is invaluable.

The next article will be come soon!

Source: Passiflora secrets: what do you know really?

0 notes

Text

Karza Technologies Success Story: Aadhar Card, PAN Card Verification API | Video KYC, GST Verification API India | Karza

0 notes

Text

Sun Pharma Walk-in Drive for R&D - Analytical Development | 22nd September 2024 Sun Pharmaceutical Industries Ltd. (Sun Pharma), one of the world’s largest specialty generic pharmaceutical companies, is conducting a walk-in drive for R&D - Analytical Development roles. If you have an M.Pharm or MSc degree with 2-5 years of experience in Analytical Method Development, this is a fantastic opportunity to join a global leader in pharmaceuticals. The walk-in drive will take place on 22nd September 2024 at Sun Pharma's R&D Center in Vadodara, Gujarat. Open Positions: Designation: R&D - Analytical Development Qualification: M Pharmacy / MSc Experience: 2-5 Years in relevant R&D roles Location: R&D Center, Vadodara, Gujarat Key Responsibilities: Conduct routine analysis and Analytical Method Development for pharmaceutical products, including Orals, Injectables, Peptides, and APIs (Active Pharmaceutical Ingredients). Perform Analytical Method Validation, Method Verification, and Method Transfer while preparing detailed protocols and reports. Operate various analytical instruments such as HPLC, GC, Ion Chromatography, UV, Dissolution, and Particle Size Analyzers. Ensure compliance with global regulatory guidelines and maintain high-quality standards in all projects. [caption id="attachment_56281" align="aligncenter" width="930"] Sun Pharma Walk-in Drive for R&D - Analytical Development | Join Us in Vadodara[/caption] Walk-in Interview Details: Date: 22nd September 2024 (Sunday) Time: 10:00 AM to 03:00 PM Venue: Sun Pharmaceutical Industries Ltd. (R&D Center), Sun Pharma Road, Tandalja, Vadodara - 390012, Gujarat, India Required Documents: Candidates attending the walk-in interview should bring the following: Updated Resume PAN Card Aadhar Card Educational Certificates Passport Size Photographs

0 notes

Text

Aadhar Verification API with #Paytel

✅ Reliable, user-friendly instrument ✅ Quick & efficient Aadhar Card verification ✅ Verify any individual’s identity ✅ Verify through 12 digit aadhar number ✅ Validity of a user’s Aadhar Card ✅ Biometric and OTP Authentication ✅ Aadhaar Holder Privacy

For inquiries, reach out to us! 🌐 www.paytelgroup.com 📞 +91 9311472341

@arjun_vasshisht

paytelgroup #aadharcard #adharcardverificationapi #PaymentInnovation #FintechRevolution #DigitalIndia #UPIRevolution #TransactionMilestones #UPI #UPIpayments #UPIcollection #UPItransactions #UPIapi #API #DigitalPayments #NPCI #DigitalBanking #ModernBanking #UPIVerification #OpenAPI #VerificationAPI #APIstack #Fintech #FintechNews

0 notes

Text

Identity Verification - How to Check PAN Aadhaar Linking Status with API

In the rapidly evolving digital landscape, the significance of robust identity verification cannot be overstated, particularly in contexts like financial services and online transactions. Aadhaar, India's unique identification project, stands at the forefront of this revolution, offering a streamlined, secure method for verifying identities.

The Aadhaar Linking Status enhances digital platform security, compliance, and user experience. It is a robust security measure that leverages biometric data and demographic information, ensuring that individual identities are accurately verified. This process significantly reduces the risk of identity fraud and unauthorized access.

Additionally, it ensures compliance with various regulatory requirements, particularly in financial services, by establishing a reliable method of identity verification. Aadhaar linking simplifies access to multiple services for users, offering a seamless and integrated experience across different digital platforms. This system streamlines processes, making transactions both safer and more user-friendly.

This blog aims to delve into the intricacies of Aadhaar Linking Status, exploring its role in enhancing security measures, ensuring compliance, simplifying user experiences in digital platforms, and our API's role in streamlining this process. We will uncover how Aadhaar Linking Status integrates digital identity verification into everyday transactions and services.

Significance of Aadhar-Pan Linking

Integrating Aadhaar with PAN is a significant move towards fortifying the financial infrastructure in India. This linkage transcends being merely a regulatory mandate; it represents a strategic shift towards a transparent and efficient financial ecosystem. By enabling the government to monitor and track taxable transactions effectively, it plays a crucial role in curbing tax evasion and promoting a more equitable tax system.

For individuals, linking Aadhaar with PAN is essential for uninterrupted access to various financial services, including bank account operations, investment activities, and income tax filings. Non-compliance with this requirement risks rendering the PAN card inoperative, potentially disrupting these essential financial activities.

How can I check my Aadhaar PAN link status online?

There are two primary methods available to ascertain the linkage statute: primary methods are online. These methods provide a straightforward and efficient means to verify the connection between your Aadhaar and PAN, ensuring compliance with regulatory requirements and facilitating seamless financial transactions.

Each method offers a user-friendly approach, allowing individuals to check their linkage status through reliable online platforms quickly.

Aadhaar PAN card link status without logging into the Income Tax portal

Step 1: Check Income Tax e-filing portal.

Step 2: Head towards the ‘Quick Links’ heading, and click on the ‘Link Aadhaar Status’.

Step 3: Enter the ‘PAN number’ and ‘Aadhaar Number’ and click the ‘View Link Aadhaar Status’ button.

Upon successfully validating the Aadhaar-PAN linkage, users will receive a confirmation message. This message will indicate that the user's PAN is already linked to the provided Aadhaar number, confirming the successful completion of the linkage process. This notification serves as an assurance that the user's records are updated and in compliance with the necessary regulatory requirements.

When the Aadhaar-PAN linkage is being processed, users will receive a notification stating that their request for linking Aadhaar with PAN has been forwarded to the UIDAI for validation. This message prompts users to revisit the portal later and check their linkage status via the homepage's 'Link Aadhaar Status' option.

Conversely, suppose a user's Aadhaar is not linked with their PAN. In that case, an alert will appear indicating the absence of linkage and guiding the user to link their Aadhaar with their PAN through the 'Link Aadhaar' option.

Aadhaar PAN card link status by logging into the Income Tax portal

To check the Aadhaar-PAN linking status, follow these professional steps:

Access the Income Tax e-filing portal and log in.

Navigate to the 'Dashboard' on the homepage and select 'Link Aadhaar Status'.

Alternatively, visit 'My Profile' and choose 'Link Aadhaar Status'.

If your Aadhaar is already linked to your PAN, the system will display your Aadhaar number. In cases where Aadhaar is not merged with PAN, an option to connect will be presented. For requests pending validation by UIDAI, the status should be checked later.

Accessing Aadhaar-PAN Linking Status: Direct Online Portal

Here is the direct link to check the Aadhaar PAN card link status -

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

To ascertain the status of your Aadhaar-PAN linkage, input your PAN and Aadhaar numbers into the designated fields and select the 'View Link Aadhaar Status' option.

Upon doing so, the current status of your PAN-Aadhaar linkage will be displayed on your screen, providing you with the necessary information regarding the linkage process.

Verify the linkage status of your Aadhaar with PAN via SMS

Step 1 - Compose a message in the following format: UIDPAN [Your 12-digit Aadhaar Number] [Your 10-digit PAN Number].

Step 2 - Send this message to either 567678 or 56161.

Step 3 - Await a confirmation response from the government service.

If linked, a confirmation stating “Aadhaar is already associated with PAN [number] in ITD database” will be received. If not linked, you will receive a message indicating that “Aadhaar is not associated with PAN [number] in ITD database.” This service facilitates a convenient and efficient method for individuals to ensure their compliance with government regulations.

Link Aadhaar with a PAN card online

If your Aadhaar is not linked with your PAN card, initiating the linking process on the Income Tax website is imperative, which may involve a late penalty fee of Rs.1,000. You may refer to the detailed steps provided on the website for comprehensive guidance on paying the penalty and executing the Aadhaar-PAN linkage. Linking Aadhaar with PAN is streamlined for user convenience and can be summarized in a few key steps.

To link your Aadhaar with PAN card in a professional setting, follow these steps:

Access the Income Tax e-filing portal.

Select 'Link Aadhaar' under the 'Quick Links' section.

Input your PAN and Aadhaar numbers and click 'Validate'.

Proceed to 'e-Pay Tax' for payment.

Enter PAN and mobile number, then continue.

Under 'Income Tax', click 'Proceed'.

Complete the payment process.

Return to 'Link Aadhaar' under 'Quick Links'.

Re-enter PAN and Aadhaar details, then validate.

Add your Aadhaar number, mobile number, and OTP for final validation.

Your request will then be processed for validation by UIDAI. Alternatively, you can also visit a PAN card centre to submit a linking request form manually.

Fees for Aadhaar PAN card linking

The linkage of PAN with Aadhaar was complimentary until March 31, 2022. Post this date, up until June 30, 2022, a nominal penalty of Rs. 500 was applicable for linking. Subsequently, from July 1, 2022, the penalty amount for linking PAN with Aadhaar was revised to Rs. 1,000. It is imperative to pay this penalty for linking before June 30, 2023, to avoid the PAN card becoming inoperative starting July 1, 2023. This step ensures compliance with regulatory mandates and maintains the validity of the PAN card.

Who all should link Aadhaar with a PAN card?

Under Section 139AA of the Income Tax Act, all PAN cardholders must link their Aadhaar by June 30, 2023, with a stipulated penalty of Rs.1,000 for non-compliance, after which the PAN card will become inoperative. Exceptions to this requirement include non-resident Indians (NRIs), citizens above 80 years of age, and residents of Assam, Meghalaya, Jammu, and Kashmir. It is advised to verify your Aadhaar-PAN link status and ensure linkage by the specified deadline to maintain the operational level of your PAN card.

Now let’s understand Aadhaar-PAN linking status API

Aadhaar, a critical 12-digit identification number in India, necessitates using Aadhaar Verification API for reliable authentication. Given its importance in identification across various platforms, integrating Aadhaar API is crucial. At Instantpay, we offer specialised services to address the challenges of fraudulent Aadhaar use.

Our advanced methodology and robust algorithms are designed to validate Aadhaar details accurately, thereby supporting businesses and individuals in mitigating risks associated with counterfeit Aadhaar cardholders. Our verification process, which involves simply uploading Aadhaar data or a snapshot, ensures both efficiency and reliability in confirming Aadhaar credentials across India.

USP of Instantpay Aadhaar-PAN linking status API

The Aadhaar Verification API is meticulously developed using HTTP standard verbs and RESTful endpoints, ensuring high precision and intelligence in its architecture. This API is designed for optimal functionality and efficiency. Moreover, it incorporates comprehensive documentation, facilitating a seamless integration experience akin to a plug-and-play setup. This strategic approach ensures that the API performs effectively and integrates smoothly into various systems.

The API access is facilitated through HTTP requests directed to a specific version endpoint URL, utilising GET or POST methods for data retrieval. Each endpoint is secured with SSL-enabled HTTPS, ensuring data integrity and security. The API is structured with version control for methods, parameters, and other elements, requiring the inclusion of a version number in every call. Multiple versions with distinct endpoints are available.

Additionally, responses are systematically structured within a 'data' tag, typically including a status code, success flag, type, and address in each reaction, ensuring clarity and consistency in data delivery.

In the event of a failure, the API implements specific response codes for clarity and diagnostic purposes:

A 2xx series code indicates successful execution of the operation.

A 4xx series code signifies an error originating from the user's end.

These codes are crucial for identifying the nature of the issue and facilitating appropriate troubleshooting measures.

Industry Use Cases of Aadhaar Validation API

The Aadhaar Validation API is a powerful tool for verifying the authenticity of Aadhaar cards in India. Its applications go beyond simple identity verification, offering various benefits across various sectors. Here are some critical use cases for the Aadhaar Validation API in India:

[wptb id=2629]

Use Cases of Aadhaar Validation API

[wptb id=2641]

Digitalising Aadhaar verification through Instantpay's Aadhaar-linking status API unlocks significant benefits for institutions across diverse sectors. This innovative solution simplifies and expedites identity verification, offering immediate value in numerous scenarios.

Instantpay's API eliminates the complexities of implementing traditional UID verification methods. Removing tedious paperwork and manual processes offers a seamless and user-friendly experience for both institutions and individuals. The intuitive click-and-upload functionality significantly reduces friction and streamlines the verification process.

While immediate adoption of the API is highly encouraged, we recognise the importance of tailoring its integration to specific needs and workflows. Instantpay offers comprehensive support and guidance to ensure a smooth and efficient implementation, maximising the time and energy savings potential. By leveraging Instantpay's Aadhaar Verification API, institutions can unlock a new era of efficient, secure, and user-friendly identity validation, ultimately enhancing operational effectiveness and delivering excellent value to all stakeholders.

Frequently Asked Questions

Linking PAN with Aadhaar after the Deadline

Q: Can I link my PAN with my Aadhaar now?

A: Yes, you can link your PAN with your Aadhaar card even after the last date on the Income Tax e-filing portal after paying the penalty of Rs.1,000.

Reactivating an Inoperative PAN

Q: My PAN has become inoperative. What should I do?

A: When your PAN card has become inoperative due to its non-linking with your Aadhaar card, follow the below process to activate your PAN card:

Visit the Income Tax e-filing portal.

Pay the fine of Rs.1,000 through the 'e-Pay Tax' option. You can find the detailed process to pay the penalty here.

After paying the penalty, click the 'Link Aadhaar' option on the Income Tax e-filing portal.

Enter the 'PAN Number' and 'Aadhaar Number' and click the 'Validate' button.

Enter the Aadhaar number, mobile number, OTP and click 'Validate'.

The request to link PAN-Aadhaar will be sent to the UIDAI. However, the reactivation process will take around 30 days from the submission date of the request to link the Aadhaar-PAN and make the PAN card operational again.

Checking Aadhaar PAN Linking Status

Q: What is the status shown when I check Aadhaar PAN linking status?

A: The different status shown when you check your Aadhaar PAN linking status is as follows:

Aadhaar is linked with a PAN card.

Aadhaar is not linked with a PAN card.

The Aadhaar PAN linking request is pending for approval from the UIDAI.

Documents Required for Linking PAN with Aadhaar

Q: What are the documents required to link PAN with Aadhaar?

A: No documents are required to link your PAN with your Aadhaar card. You must know your Aadhaar number and PAN number before sending a request to link PAN with Aadhaar card. You must also have an Aadhaar-linked mobile number for which the OTP will be sent for verification to link your Aadhaar with PAN card. You must pay the penalty before sending the request for linking Aadhaar with your PAN card.

Rectifying Mismatches

Q: What should I do when there is a mismatch in the details of my PAN and Aadhaar card?

A: You must rectify the mismatches in the details of your PAN card and Aadhaar card. The information provided in your PAN card and Aadhaar card, such as name, address, etc., should be accurate and match each other. If there are any errors, update the information in your PAN card or Aadhaar card by visiting the NSDL portal/PAN centres or UIDAI portal/Aadhaar card centers, respectively.

Linking with Demographic Mismatch

Q: Can I link my Aadhaar with a PAN card when there is a mismatch in details?

A: No. The details in your PAN and Aadhaar must match to link your Aadhaar with the PAN card. However, where there is a demographic mismatch in Aadhaar and PAN cards, such as name, date of birth, and gender, you can choose the biometric-based authentication process to link your Aadhaar with PAN. The biometric-based authentication process is available at dedicated centers operated by PAN service providers, i.e., Protean and UTIITSL.

Penalty and Due Date

Q: What is the amount of fees payable for Aadhaar-PAN linking?

A: The fee to pay Aadhaar-PAN linking is Rs.1,000, which should be paid in a single challan.

Q: Should I pay the penalty before applying for Aadhaar-PAN card linking?

A: Yes. You can apply for PAN-Aadhaar linking only after paying the penalty of Rs.1,000.

Exempt Categories

Q: Is Aadhaar-PAN linking compulsory for all?

A: All taxpayers must link their Aadhaar-PAN before 30 June 2023, else their PAN will be inoperative. However, the following persons are not required to link their Aadhaar with PAN:

Persons residing in the States of Jammu and Kashmir, Assam, and Meghalaya.

A non-resident person as per the Income-tax Act, 1961.

Persons who are not citizens of India.

Persons of eighty years or more at any time during the previous year.

Valid Payments for Linking

Q: Which payments are considered valid for Aadhaar-PAN linking?

A: The payments done through e-Pay Tax functionality on the Income Tax Filing Portal for an amount of Rs.1,000 from 1st July 2022 in a single challan are considered as valid for Aadhaar-PAN linking.

Multiple Payments

Q: Can I make multiple payments under minor code 500 to pay the penalty?

A: No, there should not be an aggregation of challans with ‘Minor head 500’ to pay the amount of Rs.1,000.

Reactivation Time

Q: How many days does it take for my PAN card to be operative?

A: If your PAN card is inoperative due to non-linking it with an Aadhaar card, it will become operative again within 30 days after submitting the Aadhaar-PAN linking request.

Last Date for Linking

Q: What is the last date to link PAN with Aadhaar?

A: The last date to link PAN with Aadhaar is 30 June 2023. If your PAN is not linked with Aadhaar within 30 June, it will become inoperative from 1 July 2023. However, you can submit the Aadhaar-PAN linking request after 30 June 2023 by paying the penalty to make your PAN operative again.

0 notes

Text

What is Aadhar Verification API: Simplifying Identity Verification

Introduction

In today's digital age, identity verification has become an essential aspect of many online services. One such verification method widely used in India is the Aadhar Verification API. This article will delve into the concept of Aadhar Verification API, its benefits, use cases, and the importance it holds in streamlining the verification process.

What is the Aadhar Verification API?

Aadhar Verification API refers to the Application Programming Interface that enables businesses and organizations to verify the authenticity of an individual's Aadhar card details through an automated process. Aadhar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI) to residents of India. The API allows seamless integration of Aadhar verification into various applications, making the verification process quick, secure, and reliable.

For more information regarding Aadhar Verification API visit https://surepass.io/

Understanding the Working of Aadhar Verification API

The Aadhar Verification API functions by connecting to the UIDAI database and retrieving the necessary information for verification. When an individual's Aadhar details are entered into the system, the API sends a request to the UIDAI servers, which then validate the information provided. The UIDAI server responds to the API with the verification status, allowing businesses to make informed decisions based on the authenticity of the Aadhar details.

Benefits of Aadhar Verification API

1. Enhanced Efficiency and Speed

With the Aadhar Verification API, businesses can automate the verification process, eliminating the need for manual verification. This leads to increased efficiency and faster onboarding of customers or users. By reducing the time and effort required for verification, organizations can provide a seamless user experience.

2. Accuracy and Reliability

The Aadhar Verification API directly connects with the UIDAI database, ensuring accurate and reliable verification results. The API leverages the comprehensive information stored by UIDAI to validate the identity of individuals, reducing the chances of fraudulent activities.

3. Cost-Effectiveness

Implementing the Aadhar Verification API can significantly reduce costs associated with manual verification methods. By automating the process, organizations can streamline their operations, minimize errors, and save resources that would otherwise be spent on manual verification efforts.

4. Compliance with Regulations

In India, Aadhar verification is a mandatory requirement for several services, including financial transactions, government schemes, and e-KYC processes. Integrating the Aadhar Verification API ensures compliance with regulatory standards and strengthens the security and trust of the verification process.

Use Cases of Aadhar Verification API

The Aadhar Verification API finds application across various sectors and industries. Let's explore some of the prominent use cases:

1. Financial Institutions

Banks, insurance companies, and other financial institutions can leverage the Aadhar Verification API to authenticate the identity of customers during account opening, loan applications, and other financial transactions. This ensures that the institution complies with KYC (Know Your Customer) norms and mitigates the risk of identity theft and fraud.

2. Telecommunication Services

Telecom service providers can integrate the Aadhar Verification API to verify the identity of subscribers. This helps in preventing misuse of services and ensures that only legitimate users gain access to mobile connections.

3. Online Service Providers

E-commerce platforms, online marketplaces, and other digital service providers can incorporate the Aadhar Verification API to verify the identity of users. This helps in creating a secure environment, preventing fraudulent activities, and enhancing trust among users.

4. Government Agencies

Government agencies can utilize the Aadhar Verification API for various services, such as disbursing benefits under social welfare schemes, issuing government documents, and conducting identity verification for citizen services. The API streamlines the verification process, reducing paperwork and ensuring efficient service delivery.

Conclusion

The Aadhar Verification API simplifies the identity verification process by leveraging the power of technology and the UIDAI database. It offers numerous benefits such as efficiency, accuracy, cost-effectiveness, and compliance with regulations. By incorporating the Aadhar Verification API into their workflows, businesses and organizations can establish a secure and reliable verification process, enhancing trust and improving the overall user experience.

0 notes

Photo

On the auspicious occasion of 15 Aug, deal with API service and get best commission, start your business with 50% commission, contact startling world services.

Call Now: 9956251008

0 notes

Text

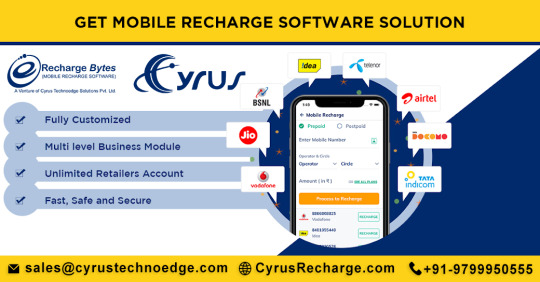

Best Company That Offers Advance All in One Recharge Software

Cyrus Recharge is India’s fastest-growing software company. We offer the best all-in-one Mobile Recharge Software along with all one RechargeAPI and BBPS. We are already working in this industry for a very long time. Our professional developers are experts in developing the software as per the client’s requirements. We have recently upgraded our software with specific features. This up-gradation enables our software to perform in a more flexible and reliable way. We provide fast and Online Mobile Recharge with high commission.

Cyrus Online Recharge Software is having a strong presence and portfolio in the Software industry. We provide you cost-effective services to start your profitable recharge business. Moreover, we have a complete Multi Recharge Software application ready with all advanced functionalities to run a multi-recharge business. On the other hand, BBPS is an add-on feature of all-in-one recharge software. Imagine the number of customers visiting your shop just to get their bill payment done.

The day-to-day bill payment is done frequently like every month or quarterly. It could be a long-term business plan for you. Furthermore, the demand for this service will never go down. Because people would no longer prefer to stand in a long queue to pay their bills, they can simply visit your shop rather than covering a long distance.

Conclusion

Start your own business and earn a good profit. We will provide a safe and secure portal that is user-friendly. Moreover, our all-in-one Mobile Recharge Software is advanced and updated with the latest features. You can create unlimited members under your admin account. Customers can use the support system to send their concerns to the owner. You can easily manage this Online Recharge Software. It is easy to use and there is no technical knowledge needed.

#recharge software#mobile recharge software#mobile recharge api#mobile recharge software for business#mpos machine#best mobile recharge api provider in india#recharge api integration#pan verification api#all in one recharge software#mobile recharge api integration in php#hotel booking api provider#paytm money transfer api#aadhar api php#multiple recharge#jio recharge api#pan cardnsdl#hotel api provider#all recharge company#india to nepal money transfer#upi payment api#aadhaar api integration in php#money transfer api free#free recharge software#multi recharge business#air ticket booking software#online money transfer software#money transfer portal#flight booking api india#mobile recharge portal#corporation mobile recharge

0 notes

Text

Enhancing Security: The Importance of an Aadhar Verification API Solution in India

Aadhar, India's unique identification system, plays a crucial role in various verification processes. An Aadhar Verification API Solution in India provides a secure and efficient way to verify the identity of individuals using their Aadhar numbers. This is particularly important for businesses in sectors such as finance, e-commerce, and telecommunications, where robust identity verification is essential for compliance and fraud prevention. When selecting an Aadhar Verification API provider, security and compliance with UIDAI guidelines are paramount. Other important factors include the accuracy and speed of verification, the ease of API integration, the availability of different verification methods (e.g., OTP-based, biometric), and the provider's data privacy policies. A reliable Aadhar Verification API solution can significantly strengthen your security posture and streamline your customer onboarding processes.

visit site: https://cyrusrecharge.com/aadhaar-verification-api

0 notes

Text

Tackling Frauds in Gaming with Seamless KYC Checks

It’s that time of the year again! Gaming season is upon us with the IPL in full swing. With rising smartphone and Internet penetration, India is clearly on its way to becoming an online gaming hub.

The pandemic has only accelerated the growth in online gaming in the country. Here are some numbers to understand the extent of this meteoric growth: In FY21, the Indian online gaming industry was valued at Rs 13,600 crore. This is expected to more than double to hit Rs 29,000 crore by FY25.[i]

However, as gaming platforms garner increasing popularity, there has also been a rising incidence of frauds. Gamers become easy targets for fraudsters given that many of these games involve in-game currency, in-game purchases, and real money.

Common frauds in the online gaming industry

An unregulated gaming industry can be vulnerable to many types of frauds:

Fake apps: Scammers may create fake apps to install malware on devices, which then steals personal information of the user. They may also get backdoor access to the user’s device, resulting in direct theft from the user’s bank accounts or credit card.

Spoof sites: Fraudsters send links or texts to gamers for verifying gamer information and in the process, steal their credit card or bank account data.

Money laundering: Many offshore gaming platforms are also used as fronts for money laundering and other illicit activities.

Further, there are also cases of widespread underage gaming and development of gambling habits. Given the revenue the gaming industry generates in India, there is certainty a need for proper regulations to protect the interests of gamers as well as gaming platforms or intermediaries.

Introduction of KYC norms for the gaming industry

In December 2022, the Ministry of Electronics and Information Technology (MeitY) was appointed as a nodal authority for online gaming. In Jan 2023, MeitY published draft amendments to the Information Technology Rules, 2021, proposing regulations for the gaming sector.[ii]

These draft amendments require all online gaming intermediaries to verify the identity of customers at the time of registering a new account for playing games.

However, the gaming industry has requested a relief in the KYC norms and suggested that MeitY follow the master directions for small prepaid payment instruments (PPIs) of the Reserve Bank of India (RBI). This would involve a simpler registration process for deposits lower than Rs 10,000.

Latest reports say that MeitY may not create stricter requirements than the RBI’s, with a graded approach to KYC norms for online gaming with real money.[iii]

The introduction of full KYC (know your customer) requirements would put the burden of heavy technical requirements on operators to verify customers. This also includes developing a video-based customer identification process to comply with KYC requirements.

Given the complexities gaming operators may face, Karza (A Perfios Company) Total KYC can be a ‘gamechanger’ for onboarding new users onto gaming platforms quickly. The solution encompasses complete KYC verification including PAN & Aadhar verification, KYC OCR checks, and more. Moreover, the Total KYC suite also includes Video KYC with award-winning cognitive features such as Face Liveness and Match, Address Match, and Name Match, all optimized for India-specific needs.

Gaming intermediaries need not invest in separate infrastructure for these checks as Total KYC works via APIs and is plug-n-play. While making digital onboarding frictionless, it can also be cost-effective for gaming platforms to use. In addition, the solution is designed to comply with RBI’s KYC guidelines and meets the strictest data-privacy requirements, ensuring the data security of gamers.

Well-devised regulations in the gaming industry are certainly a step in the right direct ion if one wants to elevate the quality of games, drive revenues, and build a positive perspective about the Indian gaming industry.

Know more about seamlessly onboarding new users onto your gaming platform using Karza (A Perfios Company) TotalKYC. Get in touch with us today at [email protected]

0 notes

Text

Aadhaar verification API is vital for any business, financial institutions or entity in determining the credibility of their customers. Aadhar card is the universal identification in India for any citizen. Signzy’s Online Aadhaar Verification Resource will help you verify your customers, swift and safe. Issued by the Government of India, Aadhaar cards contain information about your Full Name, Address, Mobile Number, and other data that could be used to verify an individual.

0 notes

Text

Aadhar Card Verify

When you are leading your business you need to focus on how you can make the most of the tools and technology you can find. This is critical because most businesses today rely on modern tools and machines. Hence, you need to focus on how you can integrate better technologies and programs that can allow your business to be more efficient and faster. Data has become the most valuable thing for businesses today and you can use it in many different ways for operations and marketing purposes. With the right data, you can secure your business as well. For this, you need to integrate the best customer verification programs that can help you manage your business.

Even before you decide what systems and programs you want to integrate you must have clarity on what you want. Different businesses have different requirements and preferences and therefore you must be sure about how you can make the most of the choices. Choosing local software companies would make sense and therefore you can focus on how they can help. If you want to integrate aadhar card verify API you can find the best software firms and developers. With this, you can ensure that you can make the most of the choices and options you can find.

Researching these software companies and developers would make sense. Hence, you must look for the ones that can provide you with the best deals. You can initiate your research with local recommendations and insights. This would allow you to get the best options that can make things work. To begin with, you can find many software companies and developers that can provide you with the best information you can find. If you are internet savvy you can browse the internet and look for data and insights that you can find. For this, you need to research and evaluate the choices that you can find in the market.

While you are looking for APIs that you want to integrate with your current business technology you need to focus on how you want to get things done. This is critical because you want to make the most of the choices and options you can find. For this, you need to look for reputed developers and firms that can provide you with the best services. Not all programs offer similar features and therefore you must be sure that you get the best developers that can help you get things done the right way. With better integration, you can manage your business efficiently and access data the right way.

Knowing how much you want to spend on these verification systems would be important. Hence, you must have relevant information that can help you do more. Different companies and developers would charge you different rates based on their reputation and experiences. You must also keep in mind that the software must work with your current set of technologies and programs so that you can integrate it well with your business options and choices.

0 notes

Text

How Does a Bulk SMS Service Help You Grow Your Business?

SMS Deals is Here to Answer Your Question, Explaining What We Do With Bulk SMS Services:

Using Bulk SMS India services, we provide your business with an outstanding reach to customers and clients. SMS deals brings you the best promotion services. From SMS services to Bulk Calling services, we have it all. Our team puts effort into making the experience seamless and smooth.

We make use of all our resources and the experience we have collected over the years. Our team has collected a database full of prospective clients. Which they have access to for all new clients. We also have a huge Bulk SMS Gateway. This gateway is used for finding target audiences. A good target audience helps a new business find its footing and establish a good flow. Giving up-and-coming businesses a head start is what we do.

Using the latest technology as well as software support. It has become incredibly easy to pair with APIs. Or Application Programming Interface-based software. This software makes it very easy for you to integrate your Bulk SMS Service. With popular social media apps like WhatsApp and Facebook messenger. It also can be tied into your website to provide direct updates and such. Another popular service these days is google verified SMSs. Google verifies a business and grants a verification tick. Along with the business logo on the message header. This reinforces customers’ trust in your services and products.

Our SMS Services:

SMS deals offers you the cheapest Bulk SMS Services in providing good services. To serve good we make sure that promotions do not cost you a fortune. With the best offers and deals on our services, we offer the most cost-efficient services to you.

We provide services Pan-India and are very popular in Lucknow, Ahmedabad as well as Delhi NCR. With the best Bulk SMS Gurgaon services, we make sure to provide you with the best. Working hard to maintain the titles we work hard and. Our team makes sure to update software as well as SMS techniques. With a unique technology that lets you customize SMS templates. As well as prepare them for an advance delivery date. We assure you of an amazing experience with our services.

Providing you with real-time analytics as well as link clicks and website traffic change. Our team works very hard to compile these and monitor them regularly. Our Bulk SMS Ahmedabad services include a lot of promotions for a variety of businesses. Thus providing us with unique insights. And an all-around experience in different types of businesses.

We also provide you with Short Code 56161 type SMSs, these are very efficient for recording feedback and reaching a bulk of customers. It is used by the government as well for linking PAN to Aadhar card services. These SMSs act as a two-way channel and can receive as well as send messages. Easy to set up, customizable with an unlimited number of sub-keywords. These Short code messages have revolutionized marketing and promotion services for businesses.

Our Bulk SMS Kolkata services too have yielded us great results. With 100% customizability and support for local languages, our SMS services are authentic. Making your customers feel comfortable. And providing them with the material in their local language works wonders. SMSs we provide are very efficient and very easy to set up and use. They can be well sent in Bulk remotely using your PC or any working machine.

Other Services:

Our services can also be used for more than just promotion, you can ask for feedback and send in amazing offers as well as discounts to customers. Some of these SMSs can be well customized to be reminders and can be well scheduled for a fixed time and date. Building an understanding with your clientele can help with long-term customer support.

Other than SMS we also provide Bulk Voice Calling facilities for your business promotions as well as reminders. Other than this we also have missed call services for feedback as well as complaints. Offering these services, we make sure that your customer base is interactive and well-versed with your system.

Deemed as the best Bulk SMS Provider in Lucknow we assure you of an amazing experience. Our team holds regular meetings as well as briefing sessions. To make sure our services live up to their name. Using these sessions to discuss any feedback as well as grievances that may arise. Updating our database as well as our software regularly leads to a smooth experience.

Helping you with bulk SMS campaigns as well as other large-scale operations too are some projects we deal with. A project like this is sure to skyrocket the customer base and make sure the best remains. An SMS campaign makes sure to provide you with an outstanding number of customers.

About Us:

SMS deals aims to provide only the best of what we can. We maintain our positions as well as our titles because of our team. They work very hard to provide the best results for our customers. Coming up with new and more efficient algorithms as well as solutions is what sets them apart.

Providing the best Bulk SMS Lucknow services. We are confident in our abilities for promotion. Using our Advanced API integrations as well as our algorithms. We have maximized the efficiency of our SMSs. With real-time tracking and analytics making long-term reports. As well as keeping a track of responses has become very simple.

Customer satisfaction is our number one priority and we take feedback very seriously. Making sure that all our customers receive the best of our services. We work hard to work on the grievances reported. Our team puts in the effort where it is well required and produces the best results they can.

So for more details on us as well as for quotations and exclusive offers visit SMS deals today. We provide festive offers as well as Bulk deals. Thus, checking our website can bring you some great discounts.

Source URL: - Click Here

#Bulk SMS Ahmedabad#Bulk SMS Lucknow#Bulk SMS Kolkata#Bulk Sms Deals#Bulk Sms India#Bulk Sms Gateway#bulk sms provider in lucknow#cheapest bulk sms

0 notes

Text

"Best HSM for Aadhaar card Authentication - Aadhar API Supported"

Unique Identity Authority of India (UIDAI) is created to provide unique identity to all residents of India. UIDA has enrolled the citizens to provide online authentication using demographic and biometric data. The UID (also known as Aadhar) number that uniquely identifies a resident, allows them to establish their identity to various agencies in India. Aadhar is a permanent non-revocable identity. Citizens can prove their identity using their Aadhar credentials. In order to bring transparency in the whole Aadhar Authentication system, an Hardware Security Module (HSM) plays a vital role.

What Is Adhar Authentication?

Aadhar authentication is a process of submitting the personal identity data to Central Identities Data Repository (CIDR) maintained by UIDAI. UIDAI confirms the proof of identity after matching the submitted identity data with the data at CIDR. UIDAI defined a framework called Aadhar Authentication Framework to provide the details of the authentication types offered. Currently, Aadhar Authentication supports Demographic Matching, Biometric Matching, and additional features such as One-Time-Password (OTP). In India, various institutions use Aadhar authentication to establish their customers’ identity, confirming beneficiary, even attendance tracking in offices. It can be used for demographic data verification too.

For providing efficient authentication mechanism, UIDAI defined a structure with the service providers viz., Authentication User Agency (AUA), e-KYC agency (KUA) Sub-AUA (SA), Authentication Service Agency (ASA). AUA/SA/ AUA, KUA & SA are known as authentication user agencies

AUA – It is an entity using Aadhar authentication to provide services to their customers.

SA – It is an entity having business relationship with AUA offering specific services in a domain.

ASA – It is an entity that directly connects UIDAI through private secure connection for transmitting authentication requests from various AUAs.

Terminal Devices – Biometric capture devices, attached with terminals are used by SAs/AUAs in the Aadhar authentication process. These authentication devices must comply with specifications provided by UIDAI to protect all the biometric and demographic information. Moreover, authentication devices initiate the authentication request, create PID block, and forward to user authentication agency server for creating auth XML. To ensure integrity and non-repudiation, the XML must be digitally signed by the AUA/KUA and/or ASA. In e-KYC service e-KYC response data is encrypted. UIDAI mandates the use of FIPS 140-2 Level 3 certified Hardware Security Module (HSM) for digital signing auth XML and decryption of e-KYC data.

Kryptoagile provides FIPS 140-2 Level 3 compliant Hardware Security Modules to fully comply UIDAI directives.

Here are some of the advantages of hardware security modules offered by Kryptoagile:

Best suited for general purpose data processing

Digital document signing

PDF signing

GST signing

E-invoice signing

Extremely popular in financial data processing

Payment processing,

NEFT transactions,

RTGS transactions

Electronic fund transfer management

Powered with world's most advanced data encryption mechanism

Compatible with cross industry applications

#aadharauthentication#Aadhaar card authentication#aadhaar authentication solutions#Itsecurity#it security services

0 notes