#money transfer api free

Text

instagram

#api service#money transfer api service#pan card api#Pan Card Api Services & Free Recharge#Instagram

0 notes

Text

What if I just become an annoying ADHD money blogger sometimes

#adhd adult money liveblogging

If you have problems saving money (especially emergency savings money) because you always spend it on too many impulse purchases, or take money out of your savings to cover your fun money:

you need to open a savings account with a new bank. The more impulsive you are, the more I recommend a small credit union or online only bank, or a really local bank. Someone whose online fund transfers to other banks takes three whole business days, so you literally can't just instant transfer money from savings to your checking account to spur of the moment buy things. If you're afraid this defeats the point of an emergency savings fund in the case of, well, an emergency, set up a small checking account with a minimal amount at this bank too, and just set aside the debit card somewhere you won't frequently use because it won't have much money until you pull it from emergency savings and put it in the checking account.

Look for one with a high APY relative to having basically no deposit minimum (mine is like 3%) and no minimum deposit or monthly fees. The APY is basically when bank sometimes pays you money for not spending money. It will be like, cents at first. Change in the sofa cushions. But over time, it will be more. Don't worry about it. It's just surprise money for later. Not a lot, mind you. But you're a competitive winner and every cent they give you FREE is a success to zap your brain with dopamine. (Eventually if you have enough money you can do this by like, investing in shit or buying CDs and they just give you MORE MONEY. BUT!!! BABY STEPS.)

This is crucial: if you have some kind of direct deposit paycheck set up, see if you can SPLIT the direct deposit between multiple accounts. The company my job uses to pay people allows us to choose between depositing a fixed dollar amount to certain accounts (with "remainder of paycheck balance" being automatic for one account), OR depositing a percentage of my paycheck to certain accounts. (Percents of a paycheck tend to be higher to start). If you don't get paid this way, figure out a good date to set a recurring transfer from your checking to your savings for an amount so it won't sit in your spendy account long. The goal is to pretend like you just actually never had the savings money in that paycheck. Poof. Gone. Disappeared. It got saved before you became aware of the money.

Feel free to start with a small amount. It can be $5 or whatever. Once you start doing this for a few paychecks look at your money. If you're not genuinely struggling to stay afloat after 2-3 months and are still comfortable, try increasing the number a little. Repeat as needed.

Now you've saved money. 🎉

This is genuinely how I managed to save money more consistently than anything else I've ever tried. Savings money goes in the secret money account. 🤷🏽♀️ Incredibly silly but it works.

29 notes

·

View notes

Text

Ok putting serious limits on my spending!! And this time I mean it! I’m so thankful for what my insurance spared me the expenses (and mad it didn’t cover more!) it did, but I am still left with a substantial amount of debt. I’m an expert tactician tho and used carecredit to finance my portion. Carecredit gave me six months interest free time to pay. With an absolutely predatory interest rate retroactively applied if not paid off within 6 months. I moved the majority of the amount to a credit card with a promotional 12 months interest free balance transfers. I paid a 3% fee for this. I can now comfortably pay the remaining amount on carecredit by the end of the promotional period.

Even though these balances give me anxiety, I won’t pay it off until we get to the end of the promotional period. Same with the balance transfer. I’m interested in or knowledgeable enough to go for a short term investment, so instead I have opened up a high yield savings account and put the payoff amount there. The APY is the highest I could find without needing to pay fees or meet other gross requirements.

I really need to focus and not spend money on my treats so I can be assured I will pay it all off in a year. This is the plan. With other balance transfer promotions as my safety. I do actually want to have actual savings. Even though the money isn’t actually free and clear. I’ve had so many expenses so far in my adult life. My future planning is limited to my 401k through work, and my open credit lines. No matter what worst case scenarios happen in my life (i can’t shake off the fear of houselessness and job loss etc. Because of anxiety yes. But also still a much more real threat for someone like myself) I can always fall back on maxing my credit as a last resort.

#Laura math#as a self-soothing method#need at least a few contingency plans at the ready#*chooses not to acknowledge Pokémon scarlet preorder*

1 note

·

View note

Text

Integrate Our UPI Collection API

Are you looking to integrate UPI payments into your business? Look no further! Rainet Technology Private Limited is here to provide you with the best UPI Collection API solution. Whether you run an e-commerce store, a subscription-based service, or any other type of online business, our API will enable seamless and secure UPI payment integration. In this blog post, we will explore what makes Rainet Technology the first choice for integrating UPI payments and how our features can benefit your business. So let's dive in and discover how Rainet can help simplify your payment processes!

What is the UPI Collection API?

What is the UPI Collection API?

UPI stands for Unified Payments Interface, a revolutionary payment system in India that allows users to transfer money instantly between different bank accounts through their mobile phones. UPI has gained immense popularity due to its convenience and ease of use.

Now, imagine integrating this powerful payment method into your own business operations. This is where the UPI Collection API comes into play. The UPI Collection API enables businesses to accept payments from customers directly into their bank accounts using the UPI platform.

With Rainet Technology's UPI Collection API, you can seamlessly integrate this payment solution into your website or application. By leveraging our robust and secure API, you can provide your customers with a hassle-free way to make payments using their preferred mode - UPI.

Our API ensures smooth transaction processing, real-time notifications for successful payments, and easy reconciliation of transactions. It also supports various features like QR code-based payments, recurring billing options, and customizable payment flows tailored to suit your business requirements.

By implementing the Rainet Technology's UPI Collection API, you can enhance the customer experience on your platform while streamlining your payment processes. So why wait? Let's explore how Rainet Technology Private Limited can be the perfect partner for integrating UPI payments into your business!

Why is Rainet Technology Private Limited the first choice for you?

Rainet Technology Private Limited is the first choice for businesses looking to integrate UPI Collection API. With our extensive experience in the field of payment gateways and APIs, we have established ourselves as a trusted provider.

One of the key reasons why Rainet should be your go-to option is our seamless integration process. We understand that time is of the essence for businesses, and our team ensures a smooth and hassle-free integration of UPI Collection API into your existing systems.

Another feature that sets us apart is our commitment to security. We prioritize data protection and employ robust encryption techniques to safeguard sensitive information during transactions. You can rest assured knowing that your customers' data will be safe with us.

In addition, Rainet offers flexible customization options for businesses. We understand that every organization has unique requirements, and our team works closely with you to tailor solutions that align with your specific needs.

Furthermore, Rainet provides comprehensive customer support throughout the integration process and beyond. Our dedicated team is available round-the-clock to address any queries or concerns you may have.

Choose Rainet Technology Private Limited as your partner for UPI API integration and unlock new possibilities for seamless payments within your business ecosystem!

What features do we provide?

At Rainet Technology Private Limited, we provide a range of powerful features with our UPI Collection API to help streamline and enhance your business operations. With our API integration, you can easily accept UPI payments from your customers and enjoy seamless transactions.

One of the key features we offer is real-time payment notifications. You will receive instant alerts whenever a payment is made through UPI, allowing you to keep track of all transactions in real-time. This ensures that you never miss out on any payments and allows for efficient reconciliation.

Our API also supports multiple payment modes, giving your customers the flexibility to choose their preferred method of making payments. Whether it's through QR codes or deep linking, our integration offers a user-friendly experience for both you and your customers.

Security is always a top priority for us. That's why our UPI Collection API utilizes advanced encryption protocols to safeguard sensitive customer data during every transaction. Rest assured that your customers' information will be protected at all times.

Furthermore, we understand the importance of customization in meeting the unique needs of different businesses. Our API provides extensive customization options so that you can tailor the user interface according to your branding requirements and create a seamless experience for your customers.

With these features and more, Rainet Technology Private Limited stands as an ideal choice when it comes to integrating UPI collection APIs into your business operations. Experience hassle-free transactions and enhanced customer satisfaction with our reliable services!

Why Choose us?

1. Expertise and Experience: At Rainet Technology Private Limited, we have a team of highly skilled professionals who have extensive experience in UPI integration API development. We stay up-to-date with the latest trends and technologies to provide you with the most reliable and efficient solutions.

2. Seamless Integration: Our UPI collection API is designed to seamlessly integrate into your existing systems, making it easy for you to start accepting UPI payments quickly. We offer comprehensive documentation and support throughout the integration process, ensuring a smooth transition for your business.

3. Security: We understand the importance of securing sensitive customer data during payment transactions. That's why our UPI integration API follows strict security protocols to ensure that all transactions are encrypted and protected against unauthorized access.

4. Customization Options: Every business has unique requirements when it comes to payment processing. With our UPI collection API, you can customize the solution according to your specific needs, whether it's adding additional features or integrating with other payment gateways.

5. Competitive Pricing: We believe in providing affordable solutions without compromising on quality or functionality. Our pricing plans are flexible and tailored to suit businesses of all sizes, allowing you to get the best value for your investment.

When it comes to UPI integration API services, Rainet Technology Private Limited stands out as a trusted partner that offers expertise, seamless integration, top-notch security measures, customization options, and competitive pricing options - everything you need for successful implementation of UPI payments in your business operations.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#app development#app developer#mobile app developer#android app developer#ios app developer#software development company#bbps login#bbps#bbps api provider#esc norway#education portal development company

0 notes

Text

The Ultimate Guide to Managing Freelance Income

Escape the corporate grind. Freelancing lets you run the show, set flexible hours, and work where you want! Ditching the commute saves time and money. Income scales infinitely higher without soul-crushing cubicle ceilings.

Think about all those mad skills and industry knowledge you've built up over the years at your job. As a freelancer, you can start monetising that expertise directly by offering your services to clients. Writers, developers, designers, consultants - the possibilities are endless.

Need to make extra cash this month? That is no problem; just hustle up and stack more clients.

Getting Loans

Making that jump to full-time freelancing? It's scary if you don't have savings built up. How do you pay bills without a steady paycheck while building the business?

Enter Personal Loans

This is where short-term unsecured personal loans can help. These loans give you cash to cover living costs. They create a financial runway as you get freelancing off the ground.

Build Your Safety Net

Use a personal loan for 6-12 months of living expenses. This buys you time to find great clients, so you won't rush into bad gigs out of desperation.

Less Stress

Having this safety net makes the career shift way less stressful. No panic about draining savings too fast. You can be picky about finding ideal work.

A short-term personal loan provides temporary cash flow, unlocking the flexibility to pursue freelancing with lower risk. Once freelance income is steady, plan out loan repayment.

Budgeting for Freelancers

As a freelancer with varying monthly income, budgeting calls for flexibility rather than fixed amounts. With unpredictable cash flow tied to fluctuating assignments, adapt your spending strategy month-to-month accordingly.

Apps and auto-transfers can make this uneven budgeting way easier. Set recurring transfers to automatically funnel portions of each payment into separate expense, tax, and savings buckets.

Freelancing offers incredible income potential and lifestyle freedom. But it requires adopting smart financial habits around budgeting, taxes, and security funds. With some diligence, you can make your money work smarter while pursuing your passion projects.

Planning for Taxes

Unlike regular employees, freelancers don't have taxes automatically withheld from payments. So, quarterly tax planning is a must to avoid penalties and surprises. A good rule is setting aside 25-30% of each payment to cover federal and state income taxes.

To simplify:

Create a dedicated "taxes" savings account for stockpiling those funds as you earn.

Better yet, pay your estimated quarterly taxes as income arrives so you're never behind.

Be diligent about recording all payments received and eligible expenses, too.

CPA Assist

If handling freelance taxes stresses you out, consider hiring an accountant. A skilled CPA can ensure you maximise deductions and make accurate quarterly payments to stay compliant.

Building an Emergency Fund

The unpredictable nature of freelancing brings sporadic work and pay. Savings to cover 3-6 months of bills allow breathing room when assignments dwindle. Emergency funds prevent stress when managing inconsistent contracts and variable monthly earnings. Smart planning conquers freelance income feasts and famines.

Security Net

This cash buffer buys flexibility and peace of mind. If you hit a dry spell with low billables for one month, you can pay essential bills from your emergency fund instead of going into debt. It prevents having to accept low-paying gigs out of desperation, too.

The Right Savings Tool

While building this vital fund, make sure you're storing that accessible cash but still earning you something. High-yield online savings accounts are an excellent option for parking emergency reserves and earning a risk-free APY.

Managing Invoices and Payments

As a freelancer, getting paid properly and on time is the name of the game. You live and die by that cash flow, so having a tight, professional invoicing system is crucial.

The Invoice 101

Your invoices need to clearly state the total amount owed, the due date, accepted payment methods, and any late fees. Having an organised numbering system to track invoices also helps.

Tech Helpers

Creating invoices manually is a hassle. Using invoicing software like FreshBooks or Wave makes it way more efficient. You can generate polished invoices, automatically track payments, and send late payment reminders.

Short-Term Loans

Need some temporary cash flow? Short-term unsecured personal loans can provide it. These loans don't require collateral, just a credit check. You get a lump sum to cover expenses. Then, you repay with interest over a set timeframe, usually under a year. Perfect for bridging income gaps or funding emergencies in a pinch. Just be mindful of higher interest rates and budgeting for those monthly payments.

Conclusion

Just know that managing your variable income streams requires a major mindset shift. Without a regular paycheck, budgeting and saving have to be on point since your monthly income can fluctuate heavily.

One solid technique is paying yourself an "employee" salary first from the monthly money you're billing clients. You'd set aside a modest but consistent amount upfront to cover personal expenses. Any extra on top goes straight into savings and investments. It creates a reliable baseline.

The hustle is real when you first build up that client base from scratch. But once you hit your stride as a freelancer? That freedom and income upside is life on another level. Just stay disciplined and be smart about managing your finances!

Meta Description

Learn effective strategies to manage your freelance income. Master budgeting, taxes, and financial planning to thrive as a freelancer and become successful.

For more information about no guarantor loans, loans without guarantor, loans no guarantor visit our website - https://www.getloansnow.co.uk/

Our Contact Address:

150 Bath Street, Glasgow, United Kingdom

150 Bath St, Glasgow G2 3ER, UK

Mobile: +44-1613940083

Email: [email protected]

0 notes

Text

Revolutionizing Connectivity: Unveiling the Power of Our Mobile Recharge API Services

In the rapidly evolving landscape of digital transactions, our Mobile Recharge API services are poised to redefine the way we connect and transact. As a pioneering Mobile Recharge API provider, we bring forth a comprehensive suite of solutions encompassing mobile recharge, bill payments, bulk payouts, and more. Join us on a journey as we explore the dynamic offerings that make us a leader in the realm of digital transactions.

Mobile Recharge API Services: Bridging Convenience and Connectivity

Our Mobile Recharge API services stand at the forefront of seamless connectivity. Whether it's recharging mobiles, paying bills, or facilitating bulk payouts, our services are designed to make transactions swift, secure, and user-friendly. The integration of cutting-edge technology ensures a hassle-free experience for users and businesses alike.

Bulk Payouts API: Empowering Financial Transactions

As a Bulk Payout API services provider, we understand the importance of streamlined financial transactions. Our Bulk Payout API services enable businesses to disburse funds efficiently, enhancing financial workflows and providing a robust solution for payroll, rewards, and incentives.

Flight Booking API: Soaring to New Heights

In addition to our mobile-focused services, we extend our capabilities to the travel sector. Our Flight Booking API opens up a world of possibilities for travel portals, enabling seamless airline ticket bookings. With real-time information and user-friendly interfaces, our Flight Booking API is set to elevate the travel experience.

Money Transfer API: Facilitating Seamless Transactions

Transferring money is a critical aspect of modern financial ecosystems. Our Money Transfer API provides a secure and efficient solution for transferring funds, catering to the diverse needs of individuals and businesses. Experience the ease of money transfer with our reliable API services.

Bill Payment API: Simplifying Financial Transactions

Our Bill Payment API services are designed to simplify the complex landscape of financial transactions. Whether it's utility bills, insurance premiums, or other payments, our API ensures a smooth and secure process, allowing users to manage their financial commitments with ease.

BBPS API Provider: Embracing Bharat Bill Pay

As a Bharat Bill Pay API provider, we contribute to the nation's digital payment ecosystem. Our BBPS API services empower businesses to offer a wide range of bill payment services, contributing to financial inclusion and the vision of a digitally empowered India.

Empowering Businesses, Connecting Users: The Essence of Our APIs

At the core of our offerings lies the commitment to empower businesses and connect users in a digitally transformed landscape. Our APIs are not just tools; they are enablers of progress, facilitating efficient transactions, powering travel experiences, and contributing to the growth of a connected economy.

In a world where connectivity is paramount, our Mobile Recharge API services emerge as the catalyst for a seamless and empowered future. Join us as we continue to innovate, connect, and redefine the possibilities in the realm of digital transactions.

0 notes

Text

NOW,TRADE WITHOUT ANY INVESTMENT

Robinhood: Robinhood offers commission-free trading for stocks, options, cryptocurrencies, and exchange-traded funds (ETFs). You can start trading with as little as $1.

Webull: Webull is another commission-free trading platform that offers stocks, options, and cryptocurrencies. They often provide promotions with free stocks when you sign up.

M1 Finance: M1 Finance allows you to invest in a portfolio of stocks and ETFs for free. You can choose your investments, and the platform will automatically rebalance your portfolio.

eToro: eToro is a social trading platform that allows you to trade stocks, cryptocurrencies, forex, and more. While there are real-money trading options, eToro also offers a virtual portfolio mode for practice trading.

TD Ameritrade (PaperMoney): TD Ameritrade provides a paper trading platform called PaperMoney. It allows you to practice trading with virtual money without risking real capital.

Fidelity (WealthLab): Fidelity offers a virtual trading platform called WealthLab, which lets you practice trading stocks, options, and mutual funds with virtual money.

TradingView: TradingView is a popular charting and analysis platform that also offers a simulated trading mode. You can practice trading stocks, forex, and cryptocurrencies with virtual funds.

hinkorswim by TD Ameritrade: Thinkorswim, a trading platform by TD Ameritrade, includes a paper trading feature where you can practice trading various financial instruments.

Alpaca: Alpaca is a commission-free API-first brokerage platform. They provide paper trading and live trading options for developers and traders.

NinjaTrader: NinjaTrader offers a free trading simulator where you can practice trading futures and forex. Please note that while these apps and platforms allow you to trade without using real money, it's essential to understand that trading always carries a risk. It's a good idea to use these tools to practice and learn before trading with real money. Additionally, be aware of any fees associated with transferring money, margin trading, or other trading-related activities, as these may still apply even when you're not investing your own funds.

1 note

·

View note

Text

UPI Collection API Integration Service

Are you looking for a seamless and efficient way to collect UPI payments for your business? Look no further! Rainet Technology Private Limited is here to provide you with the perfect solution - our UPI Collection API integration service. With our state-of-the-art technology and robust features, we can help streamline your payment collection process and boost your business's growth. In this blog post, we will explore what UPI Collection API is, how it can benefit your business, and how Rainet can assist you in harnessing the power of UPI payments. So let's dive right in!

What is the UPI Collection API?

What is the UPI Collection API?

UPI, which stands for Unified Payments Interface, has revolutionized the way we make payments in India. It enables users to link multiple bank accounts to a single mobile application and facilitates instant money transfers with just a few taps on the screen. The UPI system has gained immense popularity due to its convenience, security, and real-time transaction capabilities.

Now, imagine harnessing the power of UPI payments for your business. That's where UPI Collection API comes into play. An API (Application Programming Interface) acts as an intermediary between different software applications, allowing them to communicate with each other seamlessly.

In simple terms, UPI Collection API integration allows businesses to incorporate UPI payment functionality into their own platforms or mobile apps. This means that you can provide your customers with a hassle-free and secure way to make payments using their preferred UPI-enabled banking apps.

By integrating this powerful technology into your business processes, you can streamline your payment collection process and offer a seamless experience to your customers. Whether you run an e-commerce store, subscription-based platform, or any other type of online business - embracing UPI Collection API can open up endless possibilities for growth and success.

At Rainet Technology Private Limited, we specialize in providing top-notch UPI Collection API integration services that are tailored according to our clients' specific requirements. Our team of experts will work closely with you to understand your business needs and ensure a smooth integration process from start to finish.

So why wait? Embrace the future of digital payments by incorporating UPI Collection API into your business today!

Upi For Your Business by Rainet Technology Private Limited

Upi For Your Business by Rainet Technology Private Limited

Are you a business owner looking for a seamless way to collect payments from your customers? Look no further than UPI (Unified Payments Interface) - the revolutionary payment system that is transforming the way transactions are done in India.

Rainet Technology Private Limited, a leading technology company, offers an advanced UPI Collection API integration service that allows businesses to easily collect UPI payments. With our expertise and cutting-edge solutions, we provide a hassle-free experience for both businesses and their customers.

Our UPI Collection API Features

Our collection upi api integration service comes with a range of features designed to enhance your business operations. We offer secure and encrypted payment processing, ensuring the safety of your customer's data. Our API also supports multiple languages and currencies, making it convenient for businesses operating on a global scale.

How Can UPI Payments Help Your Business

Accepting UPI payments can bring numerous benefits to your business. First and foremost, it provides convenience for your customers as they can make instant payments using their smartphones without the need for cash or cards. This leads to faster transactions and reduces any delays or errors associated with traditional payment methods.

Furthermore, accepting UPI payments can help improve customer satisfaction and loyalty. By offering this modern payment option, you cater to the preferences of tech-savvy consumers who seek convenience in their purchasing experiences. This can give you an edge over competitors who have yet to adopt this innovative solution.

UPI Payments For Your Business - How Can Rainet Help

At Rainet Technology Private Limited, we understand that each business has its unique requirements when it comes to collecting payments. That's why our team of experts works closely with you to tailor our collection upi api integration service according to your specific needs.

We take care of all aspects of the integration process – from initial setup and customization through ongoing support – so that you can focus on what matters most: growing your business. With our reliable and efficient UPI Collection API, you

Our UPI Collection API Features

Our UPI Collection API comes with a range of powerful features that make collecting payments through UPI seamless and efficient. With our API, you can easily integrate UPI payment options into your website or mobile app, allowing your customers to make quick and secure transactions.

One of the key features of our UPI Collection API is its versatility. It supports all major UPI apps including Google Pay, PhonePe, Paytm, and more. This means that no matter which UPI app your customer prefers to use, they will be able to make payments without any hassle.

Another great feature of our API is real-time transaction status updates. You will receive instant notifications about successful payments as well as failed transactions. This enables you to provide prompt customer support and ensures transparency in your payment processes.

Our UPI Collection API also offers comprehensive reporting capabilities. You can access detailed reports on transaction history, success rates, refund requests, and much more. These insights help you analyze the performance of your payment system and identify areas for improvement.

Security is always a top priority when it comes to online payments, and our API takes this seriously. We have implemented robust security measures such as encryption protocols and fraud detection mechanisms to safeguard sensitive customer data.

In addition to these features, our UPI Collection API also provides easy integration options with popular e-commerce platforms like WooCommerce and Magento. This allows you to seamlessly incorporate UPI payments into your existing online store without any technical complexities.

With our reliable infrastructure and user-friendly interface, integrating the Rainet Technology Private Limited's UPI Collection API into your business operations has never been easier!

How Can UPI Payments Help Your Business

How Can UPI Payments Help Your Business

With the rapid growth of digital transactions, businesses are constantly exploring new and efficient ways to collect payments. UPI (Unified Payment Interface) has emerged as a game-changer in the Indian payment landscape, offering a seamless and secure way for businesses to accept payments.

One of the key advantages of UPI payments is its convenience. Customers can make instant payments directly from their bank accounts using simple mobile apps. This eliminates the need for cash or cards, making it easier for customers to complete transactions quickly and efficiently.

Another benefit of UPI payments is cost-effectiveness. Traditional payment methods often involve hefty transaction fees or setup costs, which can eat into a business's profits. With UPI, however, businesses can enjoy lower transaction charges and faster settlement times.

Moreover, UPI offers real-time payment tracking and reconciliation features that enable businesses to keep track of their transactions effortlessly. This ensures transparency and helps in streamlining financial operations effectively.

Furthermore, by integrating UPI collection API into your business processes, you open doors to a wider customer base as it allows you to accept payments from anyone with a bank account linked to their mobile number. This means that even customers who do not have credit or debit cards can easily make purchases from your business.

Embracing UPI payments can help your business enhance customer satisfaction by offering them a convenient and secure mode of payment while also reducing operational costs associated with traditional payment methods

UPI Payments For Your Business - How Can Rainet Help

UPI Payments For Your Business - How Can Rainet Help

Now that you understand the benefits of UPI payments and how they can transform your business, it's time to explore how Rainet Technology Private Limited can help you integrate UPI Collection API seamlessly into your operations.

As a leading provider of UPI collection API integration services, Rainet is committed to delivering top-notch solutions tailored to meet your specific business needs. Our team of experts will work closely with you to understand your requirements and guide you through the entire integration process.

Here are some ways in which Rainet can assist:

1. Expertise: With years of experience in the industry, our skilled professionals have extensive knowledge and expertise in integrating UPI payment systems. We stay updated with the latest trends and technologies to ensure that you receive cutting-edge solutions for seamless transactions.

2. Customization: At Rainet, we understand that every business is unique. That's why we offer customized UPI collection API integration services that align perfectly with your organization's goals and objectives. Whether you're a small startup or an established enterprise, we have flexible options to suit businesses of all sizes.

3. Seamless Integration: Our team ensures a smooth integration process without any disruptions to your existing systems or workflows. We take care of all technical aspects, making sure that the transition is hassle-free for both you and your customers.

4. Security: The security of financial transactions is paramount when it comes to online payments. With Rainet as your trusted partner, rest assured that we prioritize data protection and implement robust security measures throughout the integration process.

5. Customer Support: We believe in providing exceptional customer support at every step of the way. Our dedicated support team is always available to address any queries or concerns promptly, ensuring a hassle-free experience for both you and your customers.

In conclusion,

Integrating UPI payment systems into your business opens up new opportunities for growth by offering fast, secure, and convenient payment options to your customers. With Rainet Technology Private Limited

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#bbps#bbps api development company#bbps api provider#api provider#bbps login#bbps receipt#bbps website#bbps service#education portal development company#bharat bill pay receipt

0 notes

Text

Unlocking Efficiency and Productivity: 5 Key Benefits of Robotic Process Automation (RPA)

Robotic Process Automation (RPA) has emerged as a game-changer in the business world, offering organizations the power to automate mundane and repetitive tasks, thereby freeing up valuable human resources for more strategic endeavors. This article explores the five pivotal benefits that organizations can reap by embracing RPA technology, from enhancing efficiency and accuracy to cost savings, legacy modernization, and scalability.

RPA Promotes Increased Efficiency and Productivity

Knowledge workers, including programmers, engineers, HR personnel, and accountants, often find themselves bogged down by routine, click-heavy tasks that fail to leverage their specialized skills. RPA steps in to handle these repetitive chores, unlocking remarkable gains in employee efficiency and productivity. By automating the click-based aspects of knowledge workers' tasks, RPA digital transformation enables them to redirect their focus toward value-driven work.

RPA Ensures High Accuracy

Human error is an inevitable part of manual tasks, even for the most diligent workers. Data entry and critical processes are particularly susceptible to errors, which can be costly for businesses. RPA addresses this challenge by executing tasks with unparalleled accuracy. Once a script is correctly generated, robotic process automation tools perform their duties consistently and flawlessly, complying with industry and organizational policies. This level of precision minimizes the risks associated with data errors and ensures that processes run smoothly.

RPA Saves Time and Money

The symbiotic relationship between RPA and employee productivity leads to substantial cost savings. With repetitive tasks automated, employees can accomplish more within the same time frame. This increased efficiency allows them to allocate additional time to customer support, problem-solving, and value-driven activities.

RPA Paves the Path to Legacy Modernization

Many organizations grapple with legacy technology or custom-built database solutions that lack interoperability with modern systems. This disconnect often results in swivel-chair processes, where employees manually enter data into multiple systems. RPA bridges this gap by interfacing with legacy systems and facilitating data input and extraction. By mimicking human interactions with these systems, RPA streamlines data transfer between various applications, eliminating the need for manual intervention.

RPA Leads to Scalability

In the age of digital transformation, businesses face increasing demands for data input, processing, and integration. To remain competitive and align with customer expectations, organizations must prioritize scalability. RPA tools offer scalability akin to Application Programming Interfaces (APIs). The same set of bots can be repurposed for multiple projects. For instance, if one group of bots is designed to extract data from one application and transfer it to another, the same script can be used for a different application. Additionally, RPA empowers organizations to accomplish tasks without the necessity of hiring and training a larger workforce, optimizing resource utilization.

Conclusion

Robotic Process Automation is not just a buzzword; it's a transformative technology that empowers organizations to work smarter, not harder. By implementing RPA, businesses can elevate efficiency, bolster accuracy, reduce costs, modernize legacy systems, and scale operations—all of which are critical factors in staying competitive in today's rapidly evolving business landscape. As the RPA market continues to grow and evolve, organizations that embrace this technology will find themselves better positioned to meet the challenges and seize the opportunities of the future.

1 note

·

View note

Text

UPI Collection API Integration Service

Are you looking for a seamless and efficient way to collect UPI payments for your business? Look no further! Rainet Technology Private Limited is here to provide you with the perfect solution - our UPI Collection API integration service. With our state-of-the-art technology and robust features, we can help streamline your payment collection process and boost your business's growth. In this blog post, we will explore what UPI Collection API is, how it can benefit your business, and how Rainet can assist you in harnessing the power of UPI payments. So let's dive right in!

What is the UPI Collection API?

What is the UPI Collection API?

UPI, which stands for Unified Payments Interface, has revolutionized the way we make payments in India. It enables users to link multiple bank accounts to a single mobile application and facilitates instant money transfers with just a few taps on the screen. The UPI system has gained immense popularity due to its convenience, security, and real-time transaction capabilities.

Now, imagine harnessing the power of UPI payments for your business. That's where UPI Collection API comes into play. An API (Application Programming Interface) acts as an intermediary between different software applications, allowing them to communicate with each other seamlessly.

In simple terms, UPI Collection API integration allows businesses to incorporate UPI payment functionality into their own platforms or mobile apps. This means that you can provide your customers with a hassle-free and secure way to make payments using their preferred UPI-enabled banking apps.

By integrating this powerful technology into your business processes, you can streamline your payment collection process and offer a seamless experience to your customers. Whether you run an e-commerce store, subscription-based platform, or any other type of online business - embracing UPI Collection API can open up endless possibilities for growth and success.

At Rainet Technology Private Limited, we specialize in providing top-notch UPI Collection API integration services that are tailored according to our clients' specific requirements. Our team of experts will work closely with you to understand your business needs and ensure a smooth integration process from start to finish.

So why wait? Embrace the future of digital payments by incorporating UPI Collection API into your business today!

Upi For Your Business by Rainet Technology Private Limited

Upi For Your Business by Rainet Technology Private Limited

Are you a business owner looking for a seamless way to collect payments from your customers? Look no further than UPI (Unified Payments Interface) - the revolutionary payment system that is transforming the way transactions are done in India.

Rainet Technology Private Limited, a leading technology company, offers an advanced UPI Collection API integration service that allows businesses to easily collect UPI payments. With our expertise and cutting-edge solutions, we provide a hassle-free experience for both businesses and their customers.

Our UPI Collection API Features

Our collection upi api integration service comes with a range of features designed to enhance your business operations. We offer secure and encrypted payment processing, ensuring the safety of your customer's data. Our API also supports multiple languages and currencies, making it convenient for businesses operating on a global scale.

How Can UPI Payments Help Your Business

Accepting UPI payments can bring numerous benefits to your business. First and foremost, it provides convenience for your customers as they can make instant payments using their smartphones without the need for cash or cards. This leads to faster transactions and reduces any delays or errors associated with traditional payment methods.

Furthermore, accepting UPI payments can help improve customer satisfaction and loyalty. By offering this modern payment option, you cater to the preferences of tech-savvy consumers who seek convenience in their purchasing experiences. This can give you an edge over competitors who have yet to adopt this innovative solution.

UPI Payments For Your Business - How Can Rainet Help

At Rainet Technology Private Limited, we understand that each business has its unique requirements when it comes to collecting payments. That's why our team of experts works closely with you to tailor our collection upi api integration service according to your specific needs.

We take care of all aspects of the integration process – from initial setup and customization through ongoing support – so that you can focus on what matters most: growing your business. With our reliable and efficient UPI Collection API, you

Our UPI Collection API Features

Our UPI Collection API comes with a range of powerful features that make collecting payments through UPI seamless and efficient. With our API, you can easily integrate UPI payment options into your website or mobile app, allowing your customers to make quick and secure transactions.

One of the key features of our UPI Collection API is its versatility. It supports all major UPI apps including Google Pay, PhonePe, Paytm, and more. This means that no matter which UPI app your customer prefers to use, they will be able to make payments without any hassle.

Another great feature of our API is real-time transaction status updates. You will receive instant notifications about successful payments as well as failed transactions. This enables you to provide prompt customer support and ensures transparency in your payment processes.

Our UPI Collection API also offers comprehensive reporting capabilities. You can access detailed reports on transaction history, success rates, refund requests, and much more. These insights help you analyze the performance of your payment system and identify areas for improvement.

Security is always a top priority when it comes to online payments, and our API takes this seriously. We have implemented robust security measures such as encryption protocols and fraud detection mechanisms to safeguard sensitive customer data.

In addition to these features, our UPI Collection API also provides easy integration options with popular e-commerce platforms like WooCommerce and Magento. This allows you to seamlessly incorporate UPI payments into your existing online store without any technical complexities.

With our reliable infrastructure and user-friendly interface, integrating the Rainet Technology Private Limited's UPI Collection API into your business operations has never been easier!

How Can UPI Payments Help Your Business

How Can UPI Payments Help Your Business

With the rapid growth of digital transactions, businesses are constantly exploring new and efficient ways to collect payments. UPI (Unified Payment Interface) has emerged as a game-changer in the Indian payment landscape, offering a seamless and secure way for businesses to accept payments.

One of the key advantages of UPI payments is its convenience. Customers can make instant payments directly from their bank accounts using simple mobile apps. This eliminates the need for cash or cards, making it easier for customers to complete transactions quickly and efficiently.

Another benefit of UPI payments is cost-effectiveness. Traditional payment methods often involve hefty transaction fees or setup costs, which can eat into a business's profits. With UPI, however, businesses can enjoy lower transaction charges and faster settlement times.

Moreover, UPI offers real-time payment tracking and reconciliation features that enable businesses to keep track of their transactions effortlessly. This ensures transparency and helps in streamlining financial operations effectively.

Furthermore, by integrating UPI collection API into your business processes, you open doors to a wider customer base as it allows you to accept payments from anyone with a bank account linked to their mobile number. This means that even customers who do not have credit or debit cards can easily make purchases from your business.

Embracing UPI payments can help your business enhance customer satisfaction by offering them a convenient and secure mode of payment while also reducing operational costs associated with traditional payment methods

UPI Payments For Your Business - How Can Rainet Help

UPI Payments For Your Business - How Can Rainet Help

Now that you understand the benefits of UPI payments and how they can transform your business, it's time to explore how Rainet Technology Private Limited can help you integrate UPI Collection API seamlessly into your operations.

As a leading provider of UPI collection API integration services, Rainet is committed to delivering top-notch solutions tailored to meet your specific business needs. Our team of experts will work closely with you to understand your requirements and guide you through the entire integration process.

Here are some ways in which Rainet can assist:

1. Expertise: With years of experience in the industry, our skilled professionals have extensive knowledge and expertise in integrating UPI payment systems. We stay updated with the latest trends and technologies to ensure that you receive cutting-edge solutions for seamless transactions.

2. Customization: At Rainet, we understand that every business is unique. That's why we offer customized UPI collection API integration services that align perfectly with your organization's goals and objectives. Whether you're a small startup or an established enterprise, we have flexible options to suit businesses of all sizes.

3. Seamless Integration: Our team ensures a smooth integration process without any disruptions to your existing systems or workflows. We take care of all technical aspects, making sure that the transition is hassle-free for both you and your customers.

4. Security: The security of financial transactions is paramount when it comes to online payments. With Rainet as your trusted partner, rest assured that we prioritize data protection and implement robust security measures throughout the integration process.

5. Customer Support: We believe in providing exceptional customer support at every step of the way. Our dedicated support team is always available to address any queries or concerns promptly, ensuring a hassle-free experience for both you and your customers.

In conclusion,

Integrating UPI payment systems into your business opens up new opportunities for growth by offering fast, secure, and convenient payment options to your customers. With Rainet Technology Private Limited

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#ios app development#mobile app development company#android app developer company#api provider#api service#bbps service#education portal development company#rainet technology private limited

0 notes

Text

Mastering Business Payouts: Navigating Modern Finances with Instantpay

Table of Content | Understanding Business Payouts with Instantpay

What are Payouts and who actually needs them?

Different Payouts for Businesses

How Various Industries Rely on Payouts: Key Use Cases

Challenges Associated with Payouts

Payouts Your Business Needs - Instantpay Payouts

Diving into the Payout APIs with Instantpay

In the vast realm of financial transactions, payouts have emerged as a crucial component, especially for businesses. At its core, a payout is the disbursement of funds from one entity to another. Whether it's a company compensating its suppliers, an e-commerce platform refunding its customers, or a tech startup rewarding its affiliates, the underlying principle remains the same – the timely and accurate transfer of money.

With the digital revolution, the nature of payouts has undergone a significant transformation. Gone are the days of tedious paperwork and long waiting periods. Today's payout systems, bolstered by fintech innovations, promise speed, efficiency, and flexibility. Businesses can now execute bulk payouts, ensuring multiple recipients receive their dues simultaneously, saving time and reducing errors.

Moreover, the integration of analytics in modern payout platforms offers businesses insights into their transactions, aiding in financial planning and decision-making. The transparency and security these platforms provide further instill trust among stakeholders.

In this age, as businesses aim for global reach, having an efficient payout system isn't just an advantage—it's a necessity. It's an embodiment of a company's commitment to its partners, suppliers, and customers, ensuring relationships built on trust and reliability.

Understanding Business Payouts with Instantpay

Every business, whether a large enterprise or an SME, has to process payments. These payments, known as payouts, have become the lifeblood of modern commerce. But what exactly is a payout in the world of payments?

What are Payouts and who actually needs them?

At its essence, a payout is the process of disbursing funds from a business to another entity. This entity could be an individual, such as an employee receiving their salary, a vendor getting paid for their services, or even a customer receiving a refund.

Every business, from small startups to large multinational corporations, requires a system to process these disbursements. E-commerce platforms, for example, need to refund customers. Affiliate marketers require a system to pay their partners. Manufacturers have to compensate their suppliers. In essence, if a business has any monetary obligations outside of its operational costs, it will need a reliable payout system.

Introducing the Payout Product

In the evolving landscape of digital payments, businesses need more than just a method to send money. They require an entire system—a payout product. This system is designed to manage, schedule, and process multiple payouts seamlessly. The aim is to make transactions as smooth and hassle-free as possible, especially when dealing with bulk transactions like bulk payouts.

Why is a Good Payout Solution Essential?

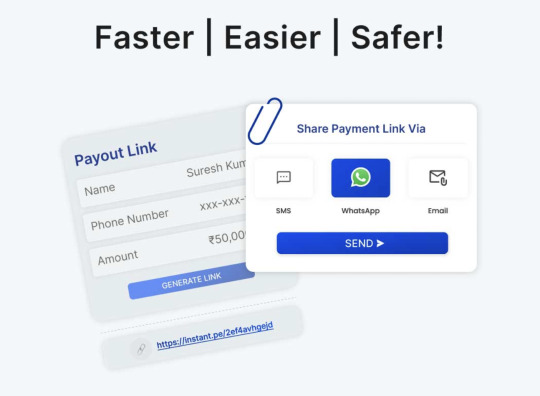

A robust payout solution like Instantpay's Payout Link ensures businesses can meet their financial commitments promptly.

In a digital age, delays can harm reputation, affect trust, and even lead to financial penalties in some sectors. An efficient payout solution:

Reduces Errors: Automated and streamlined processes decrease the chances of transactional errors.

Improves Cash Flow: Faster transactions ensure that funds are available when needed, aiding in better financial planning.

Enhances Trust: Consistent and timely payments foster trust among stakeholders.

How do businesses use a payout solution?

The traditional method of writing checks or making manual bank transfers is cumbersome and fraught with potential errors. Enter modern payout solutions, designed to simplify, streamline, and secure the process. Here's how businesses leverage these systems:

Bulk Payments: When disbursing payments to multiple recipients, businesses can use Bulk Payouts, ensuring each entity is compensated simultaneously, without the hassle of individual transactions.

Refunds: E-commerce platforms and online service providers can efficiently process customer refunds, enhancing customer satisfaction and trust.

Affiliate Compensation: Online platforms can automatically calculate and disburse commissions to partners, ensuring timely payments and maintaining healthy partnerships.

Supplier Compensation: Businesses can ensure their suppliers are paid on time, fostering long-term relationships and smooth operations.

Miscellaneous Payments: From compensating freelancers to disbursing cashbacks, modern payout solutions offer flexibility for a variety of payment needs.

Why is a good payout solution important for business?

Having an efficient payout solution isn't just a convenience—it's a business necessity.

Here's why:

Enhanced Efficiency: Automated processes reduce manual interventions, minimizing errors and speeding up transactions.

Improved Cash Flow: Efficient systems ensure that funds are available when needed, aiding in better financial planning.

Strengthened Trust: Timely payouts foster trust among stakeholders, be they employees, suppliers, or customers.

Scalability: As businesses grow, so do their payout requirements. Modern solutions can handle increasing transaction volumes without hiccups.

What to Expect from a Payout Solution?

When considering a payout solution, businesses should ensure the platform offers:

Speed & Reliability: Solutions like Instantpay's Payout Link ensure payments are processed swiftly, without delays.

Flexibility: Can it handle both individual and bulk payouts efficiently?

Security: Ensuring each transaction's safety is paramount. Top-tier encryption and secure protocols are essential.

Transparency: Businesses should have clear visibility into each transaction, with robust reporting and analytics features.

Integration: The solution should easily integrate with existing business systems, ensuring a unified workflow.

Different Payouts for Businesses

Every business, regardless of its size or sector, engages in some form of payout. These can vary significantly based on the nature and operations of the enterprise. Here’s a breakdown:

Vendor Payments: This includes payments made to suppliers, manufacturers, and other vendors who facilitate the operational needs of a company.

Salary Disbursements: One of the most common payout forms, businesses must ensure timely and accurate salary payments to their employees.

Affiliate and Commission Payouts: For businesses that operate with partners, affiliates, or on a commission basis, regular payouts are a necessity to maintain good relationships.

Customer Refunds: E-commerce and service-based businesses need a streamlined system to manage and process customer refunds efficiently.

Loyalty and Rewards: Many businesses run loyalty programs where they reward customers with cashbacks, points, or other incentives.

Bulk Payouts: Large organizations often need to send out a vast number of payments simultaneously. Platforms like Instantpay's Bulk Payouts make this task seamless.

How Various Industries Rely on Payouts: Key Use Cases

Financial transactions are the lifeblood of modern business, and payouts play an essential role across varied sectors.

Let's explore industries and their unique payout use cases:

E-commerce: E-commerce platforms, with their sprawling network of vendors and vast customer base, have to manage an array of financial transactions daily. From vendor payments and affiliate commissions to customer refunds, the sheer volume and frequency require an effective payout solution like Instantpay's Payouts. This ensures smooth business operations and maintains trust among stakeholders.

Logistics: In the fast-paced world of logistics, timeliness is paramount. Companies need to swiftly disburse payments to drivers, warehouse workers, and third-party vendors. They also handle refunds or compensations for lost or damaged shipments. Leveraging solutions like Instantpay's Bulk Payouts can streamline these processes, ensuring that payments are made promptly and accurately.

Healthcare: Healthcare institutions often juggle various payouts, from insurance reimbursements to patient refunds and vendor payments for medical supplies. With the increasing digitization in healthcare administration, it's essential to have a reliable payout solution that can seamlessly integrate with other systems, making tools like Instantpay's Payout Link indispensable.

SAAS (Software as a Service): SaaS companies often operate on global scales, dealing with international customers, partners, and affiliates. Regular subscription renewals, customer refunds, and affiliate commissions necessitate a robust payout mechanism. Integrating solutions like Instantpay Payouts ensures that transactions occur without hitches, solidifying the company's reputation.

Peer-to-Peer Lending Solutions: These platforms revolutionize the lending landscape by connecting individual lenders and borrowers directly, bypassing traditional banks. As intermediaries, they manage both loan disbursals to borrowers and repayments to lenders. Given the financial stakes and the need for transparent operations, an efficient payout system, such as Instantpay's suite of solutions, becomes pivotal.

Pharma: The pharmaceutical industry, characterized by its vast research initiatives, collaborations, and distribution networks, requires a robust payout system. From compensating clinical trial participants to settling payments with suppliers and distributors, a streamlined solution like Instantpay's Payouts ensures timely and accurate transactions.

Institutes: Educational institutes, ranging from schools to universities, deal with numerous transactions, including faculty salaries, vendor payments, and scholarship disbursements. They can benefit immensely from Instantpay's Bulk Payouts, which allows for mass payments, ensuring that stakeholders are compensated promptly.

Insurtech: As technology disrupts the insurance sector, insurtech companies are at the forefront of innovation. Payouts here include claim settlements, affiliate commissions, and vendor compensations. An efficient solution like Instantpay's Payout Link provides a hassle-free experience for policyholders and partners alike, solidifying the company's trustworthiness.

Digital Share Broker: The world of digital share trading is fast-paced. Brokers need to ensure that dividends, profits, and withdrawals reach their clients swiftly. Additionally, they handle payouts to partners, affiliates, and service providers. Implementing a reliable system like Instantpay's Payouts ensures that traders and partners receive their dues on time, fostering confidence in the platform.

Regtech (Regulatory Technology): Regtech companies, which offer solutions to help businesses comply with regulations efficiently, often work with a plethora of clients, partners, and service providers. Their payout needs span client refunds, affiliate commissions, and vendor payments. Integrating a solution like Instantpay's Bulk Payouts ensures that these transactions are handled efficiently, upholding the company's commitment to excellence.

Challenges Associated with Payouts

While the digital age has eased many aspects of business operations, it has also brought its own set of challenges, especially in the domain of payouts:

Delay in Transactions: One of the most common issues, a delay can occur due to various reasons – from technical glitches to errors in the entered details. Such delays can disrupt the cash flow and strain business relationships.

Security Concerns: With cyber-attacks on the rise, ensuring that the payment platform is secure is paramount. Businesses face the constant challenge of protecting sensitive financial information from potential threats.

Inflexibility: Traditional banking systems might not be equipped to handle diverse payout needs, especially when it comes to bulk transactions or international payments.

Regulatory Hurdles: Different regions have varied regulations concerning financial transactions. Navigating these can be complex and often requires a deep understanding of local laws.

Operational Overhead: Managing payouts manually can be a time-consuming process, especially for businesses with a large volume of transactions. It also increases the chance of human error.

Integration Issues: Businesses often struggle with integrating their payout systems with their existing operational tools, leading to disjointed processes.

Payouts Your Business Needs - Instantpay Payouts

Every business has its unique financial ecosystem, comprising vendors, customers, employees, and partners. Each of these stakeholders requires timely and accurate payments. The traditional methods of bank transfers, with their delays and often complex procedures, simply don't cut it anymore.

With Instantpay's Bulk Payouts, businesses can harness the power of bulk transactions without the hassle.

This system is tailor-made for scenarios where multiple transactions are the order of the day. Whether you're an e-commerce platform settling with numerous vendors or an NGO dispersing funds to beneficiaries, Instantpay's Bulk Payouts ensures it happens smoothly.

How is Payouts different from using banks for bulk payouts?

While banks have been the cornerstone of financial transactions for centuries, there are certain limitations when it comes to bulk payouts:

Time: Traditional bank transfers can take several days, especially for large volumes. With Instantpay's Bulk Payouts, transactions are almost instantaneous, ensuring businesses can operate without monetary delays.

Flexibility: Banks often have fixed operating hours. With Instantpay, you have the flexibility to send and receive payouts 24/7/365, catering to businesses that operate outside conventional hours.

Ease of Use: Setting up bulk payouts with banks can be a cumbersome process with a lot of paperwork. Instantpay provides a streamlined online interface, making the setup process a breeze.

Real-time Tracking: Instantpay offers real-time tracking of transactions, something that many traditional banks lack, giving businesses better control and visibility over their funds.

Send money to multiple recipients with Payouts

Handling payouts for a large number of recipients can be a logistical nightmare. Be it vendor payments, affiliate commissions, or salary disbursements; businesses often grapple with the challenge of ensuring timely and accurate payouts.

With Instantpay's system, sending money to multiple recipients is simplified:

User-friendly Dashboard: Easily add beneficiary details and track the status of each payout.

Multiple Transfer Modes: Whether it's bank transfers, UPI, or wallets, businesses can choose how they want to send money, ensuring recipients receive funds in their preferred manner.

Automated Payouts: Set up automated rules and schedules, so you don’t have to initiate payouts manually every time.

How can I get started? What documents are needed for Instantpay Payouts?

Diving into the realm of modern payout systems with Instantpay is straightforward. To get started, you would typically require:

Identity Verification: This usually involves standard KYC (Know Your Customer) documents such as PAN card, Aadhaar card, or other government-approved IDs.

Bank Account Details: Ensure you have the details of the bank account where you want the funds to be transferred.

Business Registration Proof: This could be your incorporation certificate or any relevant legal documentation that authenticates your business's existence.

Instantpay's platform provides a user-friendly interface, guiding you through every step of the submission process.

Does Instantpay support payouts to all banks and bank accounts?

Yes, with Instantpay, flexibility is at the core of their offering. Businesses can transact with almost all major banks and numerous types of bank accounts, be it savings, or current accounts. This universality ensures that no matter your bank or account type, Instantpay's bulk payouts have you covered.

Can you transfer funds on Sundays and bank holidays?

In today's fast-paced business environment, financial operations don't stick to the traditional 9-5. Recognizing this, Instantpay enables businesses to transfer funds 24*7*365. So whether it's a Sunday, a bank holiday, or late at night, you can rest assured that your transactions will go through without a hitch.

Does the payout transfer happen instantly?

In most scenarios, yes. Instantpay is designed to facilitate swift transfers. Payouts for IMPS, NEFT, UPI, and Wallets are processed instantly. However, in the case of RTGS, which is mostly used for high-value transactions, it can take 1-2 hours to ensure secure processing.

What if my transaction is pending or under process under payouts?

Kindly allow a brief period for the transfer's conclusive status to be determined. Upon completion of the processing, either the bank or NPCI will notify you about the payout status through an email. This notification will confirm whether the transaction was successful or if a refund has been initiated.

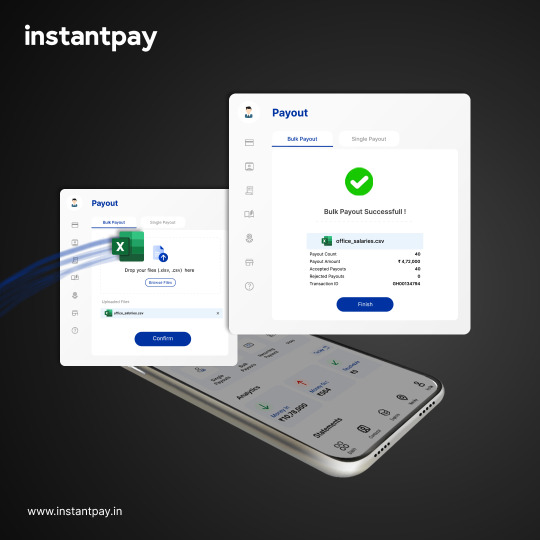

Is it simpler to send bulk payouts via file uploads or APIs?

Both file uploads and APIs have their unique advantages when it comes to sending bulk payouts. File uploads, for instance, are straightforward for businesses that already have payment details documented in spreadsheets. Just a simple upload and the process is initiated.

On the other hand, using APIs offers more flexibility and automation. With APIs, businesses can integrate their systems directly with the payout service for seamless transfers. For businesses aiming for scalability and automation, API-based bulk payouts might be the way forward.

How does Instantpay bulk payouts work?

The efficacy of Instantpay Bulk Payouts lies in its simplicity and efficiency. Businesses can choose between the file upload method or the API integration, depending on their preference. After choosing the method:

Prepare your bulk payout details in a specified file format.

Upload or send this data to Instantpay.

The Instantpay system processes these transactions securely and swiftly, ensuring that each recipient gets their due amount without hitches.

What is the maximum number of payouts that can be processed using Instantpay Bulk Payouts?

One of the distinguishing features of Instantpay Bulk Payouts is its capability to handle a large volume of transactions. Depending on your business subscription and package, the platform can process thousands of transactions in a single batch. This means, even if you're a large enterprise with numerous payouts, Instantpay ensures timely and accurate disbursements. Using the Bulk Payouts feature, you can process up to 10,000 payouts at once.

How can I check the transaction status for Instantpay Bulk Payouts?

Once you've finalized your Bulk Payouts, navigate to the Bulk Payout page for a comprehensive summary of your latest transactions. This overview displays the quantity of files uploaded, the cumulative number of payouts, those that have been processed, and the overarching transaction status. This page serves as a handy dashboard to seamlessly monitor the trajectory and current standing of your bulk payouts.

What is Instantpay’s Scheduled Payouts for Payments?

At the heart of Instantpay’s innovative offerings is their Scheduled Payouts system. Think of it as a set-it-and-forget-it system where businesses can program their transactions in advance. Whether it's disbursing employee salaries, vendor payments, or handling customer refunds, Scheduled Payouts lets businesses automate their recurring payments, ensuring punctuality and eliminating the hassle of manual interventions.

Is it Possible to Schedule Payouts in Advance?

Absolutely! One of the standout features of Instantpay's Bulk Payouts is the capability to pre-set transactions. This foresight ensures businesses are always a step ahead, providing reliability not just for the company itself but for those on the receiving end of these transactions. By simply inputting the necessary details and setting the desired transaction date, businesses can rest easy knowing their financial obligations will be met.

Can I Check the Status of Instantpay’s Scheduled Transactions?

Transparency is crucial when dealing with finances. With Instantpay, you're never in the dark. Once your payouts are scheduled, you can easily track and monitor the status of each transaction. Every scheduled payout comes with a detailed status report, giving businesses the confidence and assurance that their funds are being processed correctly and timely.

Diving into the Payout APIs with Instantpay

An innovative payout platform tailored to modern business needs. But beyond its core features, how does its API stand out?

Let's dive in!

Payouts Overview - API

The Instantpay API serves as the backbone for developers and businesses aiming to integrate seamless payouts into their platforms. Whether you're a burgeoning startup or a well-established conglomerate, understanding this API can revolutionize how you handle transactions.

Why an API for Payouts?

Traditional methods of processing payments can be cumbersome, particularly for businesses that handle a high volume of transactions. Manual interventions, the risk of errors, and time-consuming procedures are just some challenges. An API-driven approach, like that of Instantpay, streamlines these processes, enabling businesses to automate payouts, reduce errors, and improve efficiency.

Key Features of the Instantpay Payout APIs

Automation: With the API, businesses can set up automated workflows for payments. Whether it's paying suppliers at the end of every month or disbursing salaries, the API ensures timely, error-free transactions.

Real-time Tracking: The Instantpay Developer API allows businesses to track the status of their payments in real-time. No more waiting or guessing – get instant updates on your dashboard.

Bulk Payments: Handling mass payouts? No problem. With the API, businesses can manage bulk payments efficiently, ensuring all beneficiaries receive their dues promptly.

Enhanced Security: The API is built with robust security protocols, ensuring that all transactions are encrypted and secure.

Integration and Flexibility: Another advantage of the Instantpay API is its ease of integration. Developers can quickly embed it into their platforms, thanks to well-documented resources and support from the Instantpay team. Moreover, its flexibility means it can be tailored to various industries, be it e-commerce, healthcare, or finance.

Conclusion

In a competitive market, businesses need every edge they can get. Streamlined financial processes are more than just a convenience; they're an essential part of modern business operations. Instantpay's innovative payout solutions, be it their Bulk Payouts, Scheduled Payouts, or the Payout APIs, offer businesses that crucial edge.

Leveraging these tools ensures not just operational efficiency but also fosters trust among clients, employees, and vendors, reinforcing a brand's credibility and reliability.

0 notes

Text

Open source research isn’t only about analysing social media or satellite imagery. Another important area involves investigating company structures and relationships.

However, official company registries can be unwieldy or difficult to navigate.

This is where OpenCorporates – a free repository of company registries aggregated from primary public sources, published in order to promote corporate transparency – can be helpful. OpenCorporates is clear about the provenance of their data, so you know where they collected each record, and when. This is critical for companies and finance research and investigations.

While there are other databases like it, OpenCorporates is the only one that covers so many jurisdictions (145 as at 16 June 2023). To see other sites that offer access to corporate registries, go to the companies and finance tab of the Bellingcat Online Investigation Toolkit.

Still, even user-friendly websites like OpenCorporates can be a daunting prospect – conducting searches one by one takes a great deal of time, and it can involve a lot of copying and pasting of search results. But the Open Corporates API can save a lot of time.

What is an API and Why Use One?

An API is an Application Programming Interface. Broadly speaking, it allows users to obtain data from a database without having to know about the structure or languages used to manage that database. Users can build new and interesting tools with API access or create different ways to look at the data they contain, as many previously did with the Twitter API, for example.

Put simply, if you’re researching data at scale, access to the API of an organisation that stores a lot of data can be a powerful resource. It can allow researchers to explore and compare data in ways that might not otherwise be possible.

Imagine, for example, that you’re looking at a company and all the individuals and other companies related to it within OpenCorporates. If you did individual searches for each company and director, it would take a lot of note-taking and organising. Access to an API can allow you to pull all the data at once and create new methods of searching to more easily identify relationships.

Luckily, OpenCorporates provides free API access if you’re undertaking a public benefit project. We’ll detail how to apply for access later on in this guide.

Some investigative journalists say this method has helped them find leads earlier. David Szakonyi, co-founder of the Anti-Corruption Data Collective, reflects that “by accessing OpenCorporates’ API, we achieved in less than a day what would have taken two people between four and six months to do”. OpenCorporates helped the ICIJ to connect companies and directors for over 240,000 companies as part of the Panama Papers investigation, before releasing it all as open data.

What follows is a guide on how to get the best from Open Corporates. If you have coding or tool-building experience, you will be able to do more. But even those who don’t can learn how to use it and gather all manner of potentially valuable and revealing information. Whatsmore, once you understand how to explore the OpenCorporates API, you can begin to transfer that knowledge to other large datasets that provide API access such as the OpenSanctions database.

Much of what is contained within this guide can also be explored in the below video by Rebecca Lee of OpenCorporates. But this guide aims to build upon this very useful resource.

1 note

·

View note

Text

Steps to Buy Crypto in India

Crypto — An Introduction

This article describes crypto, its history, how it works, its key features, the top 5 cryptos, and how to buy crypto in India. Crypto is a digital or virtual currency that can be transferred instantly via the Internet at a lower fee, without requiring any intermediaries such as banks or regulatory authorities. The cryptographic technique is used for securing crypto transactions.

Cryptos use a decentralized system to record transactions and emerge as the most popular investment in recent years. They are managed by Peer-to-Peer (P2P) networks of computers running on open-source software.

Key Features