#ai and automation solution

Explore tagged Tumblr posts

Text

Sigma Solve designs AI and automation solutions for FinOps to identify inefficiencies, anomalies, and vulnerabilities to track waste and excessive human capital to improve productivity, cost-effectiveness, and data security. Set specific, measurable goals for what you aim to achieve with process automation solutions and AI. Integrate the chosen AI ML development services and automation tools into your workflows. Monitor their performance continuously and be prepared to iterate and refine your strategy

0 notes

Text

Optimize your hiring process effortlessly by tracking candidate metrics with ProAiPath. Our advanced platform enables detailed analysis of candidate performance, engagement, and suitability, helping recruiters make data-driven decisions for better talent acquisition results. Stay ahead with smart recruitment insights today.

#recruitment software demo#AI Recruitment Software For Hiring#recruitment software automation tool#cloud-based staffing solutions#mobile-friendly recruitment platforms#affordable recruitment software#secure staffing software#recruitment agency software#staffing software solutions

2 notes

·

View notes

Text

posts that make you want to die

#modern integrate efficiency transform automate orchestrate empowered streamlined solution efficiency AI collaboration revolutionise future#im so tired of this it’s been eight months

2 notes

·

View notes

Text

Top 5 DeepSeek AI Features Powering Industry Innovation

Table of Contents1. The Problem: Why Legacy Tools Can’t Keep Up2. What Makes DeepSeek AI Unique?3. 5 Game-Changing DeepSeek AI Features (with Real Stories)3.1 Adaptive Learning Engine3.2 Real-Time Anomaly Detection3.3 Natural Language Reports3.4 Multi-Cloud Sync3.5 Ethical AI Auditor4. How These Features Solve Everyday Challenges5. Step-by-Step: Getting Started with DeepSeek AI6. FAQs: Your…

#affordable AI solutions#AI automation#AI for educators#AI for entrepreneurs#AI for non-techies#AI for small business#AI in manufacturing#AI innovation 2024#AI time management#business growth tools#data-driven decisions#DeepSeek AI Features#ethical AI solutions#healthcare AI tools#no-code AI tools#Predictive Analytics#real-time analytics#remote work AI#retail AI features#startup AI tech

2 notes

·

View notes

Text

Smart Ecosystems, Smarter Apps: MeshTek’s IoT Innovation Engine

Experience the future of connected infrastructure with MeshTek’s cutting-edge IoT app development solutions. From smart cities to automated industries, our platform turns real-time data into actionable intelligence. Designed to scale, optimized for control, and built for performance—MeshTek ( IOT APP DEVELOPMENT COMPANY )empowers seamless connectivity across environments through robust, user-centric mobile applications.

#MeshTek#IoT App Development Company#Smart Infrastructure#IoT Solutions#Bluetooth Mesh#Smart City Technology#Industrial IoT#IoT App Development#Connected Devices#Mesh Networking#Smart Automation#Mobile IoT Apps#IoT Innovation#Scalable IoT#Edge Computing#Smart Lighting#MeshTek Technology#IoT Connectivity#AI Enabled IoT#Smart Industries

1 note

·

View note

Text

AI Chatbot Development Services for Seamless Customer Support

Our AI-based chatbot development services are designed to provide businesses with an efficient

and scalable solution to improve customer service and streamline workflows. With advanced features such as 24/7 availability, multilingual support, and seamless integration with CRM, ERP, and other business systems, our chatbot platform ensures a smooth customer experience.

We offer highly customizable chatbots tailored to your brand’s voice, enabling businesses to manage high volumes of interactions, enhance user engagement, and boost sales. Our chatbots also feature in-depth analytics that provides valuable insights into user behavior, helping you continuously optimize your customer service efforts. Whether you’re a small and medium enterprise (SME) or a large business enterprise, our chatbot services can be adapted to meet your specific needs. With support for both audio and video calls, and integration with multiple platforms like AWS, Google Cloud, and Azure, our chatbots are the smart choice for businesses looking to improve customer satisfaction and drive revenue growth.

Contact Information

Email: [email protected]

Phone Numbers: +1 408 454 6110

Location: 410 E Santa Clara Street, Unit #1023, San Jose, CA 95113

#<Ai Chatbot solutions>#<Ai chatbot development>#<chatbot services>#<Ai chatbot app development>#<Customer service Automation>#<Chatbot integration>

2 notes

·

View notes

Text

Secure, Smart, and Lethal: The Tech Behind Military Embedded Systems

Introduction:

The global military embedded systems market is undergoing significant transformation, driven by technological advancements and evolving defense strategies. As defense forces worldwide prioritize modernization, the integration of sophisticated embedded systems has become paramount to enhance operational efficiency, communication, and security. This article provides an in-depth analysis of the current market dynamics, segmental insights, regional trends, and competitive landscape shaping the future of military embedded systems.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40644-global-military-embedded-systems-market

Military Embedded Systems Market Dynamics:

Technological Advancements Fueling Growth

The relentless pace of technological innovation is a primary catalyst for the expansion of the military embedded systems market. The integration of artificial intelligence (AI), machine learning, and Internet of Things (IoT) technologies into embedded systems has revolutionized defense operations. These advancements enable real-time data processing, predictive maintenance, and enhanced decision-making capabilities, thereby improving mission effectiveness and operational readiness.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40644-global-military-embedded-systems-market

Rising Demand for Secure Communication Systems

In an era where information dominance is critical, the demand for secure and reliable communication systems has escalated. Military embedded systems facilitate encrypted communications, ensuring the integrity and confidentiality of sensitive data across various platforms, including land-based units, naval vessels, and airborne systems. This necessity is further amplified by the increasing complexity of modern warfare, which requires seamless interoperability among diverse defense assets.

Integration Challenges and Cybersecurity Concerns

Despite the promising growth trajectory, the military embedded systems market faces challenges related to the integration of new technologies into existing defense infrastructures. Legacy systems often lack the flexibility to accommodate modern embedded solutions, necessitating substantial investments in upgrades and compatibility assessments. Additionally, the heightened risk of cyber threats poses a significant concern. Ensuring the resilience of embedded systems against hacking and electronic warfare is imperative to maintain national security and operational superiority.

Military Embedded Systems Market Segmental Analysis:

By Component

Hardware: This segment holds a substantial share of the military embedded systems market, driven by the continuous demand for robust and reliable physical components capable of withstanding harsh military environments.

Software: Anticipated to experience significant growth, the software segment benefits from the increasing adoption of software-defined systems and the integration of AI algorithms to enhance functionality and adaptability.

By Product Type

Telecom Computing Architecture (TCA): Leading the market, TCA supports high-performance computing and communication needs essential for modern military operations.

Compact-PCI (CPCI) Boards: Projected to witness robust growth, driven by the adoption of modular and scalable systems that offer flexibility and ease of maintenance.

By Application

Intelligence, Surveillance & Reconnaissance (ISR): Dominating the application segment, ISR systems rely heavily on embedded technologies for real-time data collection and analysis, providing critical situational awareness.

Communication and Networking: This segment is poised for growth, reflecting the escalating need for secure and efficient communication channels in defense operations.

By Platform

Land-Based Systems: Accounting for the largest military embedded systems market share, land platforms utilize embedded systems for enhanced situational awareness, navigation, and control in ground operations.

Airborne Systems: Experiencing significant growth due to the integration of advanced avionics and communication systems in military aircraft and unmanned aerial vehicles (UAVs).

Military Embedded Systems Market Regional Insights:

North America

North America leads the military embedded systems market, driven by substantial defense budgets and ongoing modernization programs. The United States, in particular, emphasizes technological superiority, investing heavily in research and development of advanced embedded solutions.

Europe

European nations are actively enhancing their defense capabilities through collaborative projects and increased spending on advanced military technologies. The focus on interoperability among NATO members and the modernization of existing systems contribute to market growth in this region.

Asia-Pacific

The Asia-Pacific region is witnessing rapid growth, fueled by escalating defense expenditures in countries such as China, India, and Japan. The drive to modernize military infrastructure and develop indigenous defense technologies propels the demand for sophisticated embedded systems.

Middle East & Africa

Nations in the Middle East are investing in advanced defense technologies to bolster their military capabilities amidst regional tensions. The focus on upgrading naval and airborne platforms with state-of-the-art embedded systems is a notable trend in this region.

Competitive Landscape

The military embedded systems market is characterized by intense competition among key players striving to innovate and secure significant contracts.

Recent Developments

Curtiss-Wright Corporation: In January 2025, Curtiss-Wright secured a USD 27 million contract to supply Aircraft Ship Integrated Securing and Traversing (ASIST) systems to the U.S. Naval Air Warfare Center for use on Constellation Class Frigates.

Kontron AG: In December 2024, Kontron AG received an order valued at approximately EUR 165 million to supply high-performance VPX computing and communication units for surveillance applications, highlighting its expanding role in the defense sector.

These developments underscore the dynamic nature of the market, with companies focusing on technological innovation and strategic partnerships to enhance their market positions.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40644-global-military-embedded-systems-market

Conclusion

The global military embedded systems market is set for substantial growth, driven by technological advancements and the imperative for defense modernization. As military operations become increasingly complex, the reliance on sophisticated embedded systems will intensify, underscoring the need for continuous innovation and investment in this critical sector.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

#Military Embedded Systems Market#Defense Embedded Systems#Military Electronics#Embedded Computing Defense#Rugged Embedded Systems#Military IoT Solutions#Aerospace Embedded Systems#Military AI Technology#Tactical Embedded Systems#COTS Embedded Systems#Defense Avionics Market#Military Communication Systems#Secure Embedded Computing#Military Cybersecurity Solutions#Battlefield Management Systems#Embedded Processors Defense#Military Semiconductor Market#Real-Time Embedded Systems#Military Automation Solutions#Embedded Defense Electronics#4o

1 note

·

View note

Text

As technology continues to reshape the accounting industry, Artificial Intelligence (AI) and Robotic Process Automation (RPA) have emerged as two leading solutions for enhancing efficiency and accuracy. While both technologies offer significant advantages, understanding their distinct roles is crucial for US-based CPAs, EAs, and accounting firms seeking to optimize their processes.

This blog explores AI vs. RPA in accounting, their applications, benefits, and how to determine the best fit for your firm.

#AI in Accounting#unison globus#RPA for CPAs#Accounting Automation#CPA Technology Trends#AI Benefits for Accountants#RPA Implementation in Accounting#Future of Accounting Technology#AI and RPA Integration#RPA solutions for US accounting firms#Future trends in AI and RPA for accountants

1 note

·

View note

Text

Must-Have Programmatic SEO Tools for Superior Rankings

Understanding Programmatic SEO

What is programmatic SEO?

Programmatic SEO uses automated tools and scripts to scale SEO efforts. In contrast to traditional SEO, where huge manual efforts were taken, programmatic SEO extracts data and uses automation for content development, on-page SEO element optimization, and large-scale link building. This is especially effective on large websites with thousands of pages, like e-commerce platforms, travel sites, and news portals.

The Power of SEO Automation

The automation within SEO tends to consume less time, with large content levels needing optimization. Using programmatic tools, therefore, makes it easier to analyze vast volumes of data, identify opportunities, and even make changes within the least period of time available. This thus keeps you ahead in the competitive SEO game and helps drive more organic traffic to your site.

Top Programmatic SEO Tools

1. Screaming Frog SEO Spider

The Screaming Frog is a multipurpose tool that crawls websites to identify SEO issues. Amongst the things it does are everything, from broken links to duplication of content and missing metadata to other on-page SEO problems within your website. Screaming Frog shortens a procedure from thousands of hours of manual work to hours of automated work.

Example: It helped an e-commerce giant fix over 10,000 broken links and increase their organic traffic by as much as 20%.

2. Ahrefs

Ahrefs is an all-in-one SEO tool that helps you understand your website performance, backlinks, and keyword research. The site audit shows technical SEO issues, whereas its keyword research and content explorer tools help one locate new content opportunities.

Example: A travel blog that used Ahrefs for sniffing out high-potential keywords and updating its existing content for those keywords grew search visibility by 30%.

3. SEMrush

SEMrush is the next well-known, full-featured SEO tool with a lot of features related to keyword research, site audit, backlink analysis, and competitor analysis. Its position tracking and content optimization tools are very helpful in programmatic SEO.

Example: A news portal leveraged SEMrush to analyze competitor strategies, thus improving their content and hoisting themselves to the first page of rankings significantly.

4. Google Data Studio

Google Data Studio allows users to build interactive dashboards from a professional and visualized perspective regarding SEO data. It is possible to integrate data from different sources like Google Analytics, Google Search Console, and third-party tools while tracking SEO performance in real-time.

Example: Google Data Studio helped a retailer stay up-to-date on all of their SEO KPIs to drive data-driven decisions that led to a 25% organic traffic improvement.

5. Python

Python, in general, is a very powerful programming language with the ability to program almost all SEO work. You can write a script in Python to scrape data, analyze huge datasets, automate content optimization, and much more.

Example: A marketing agency used Python for thousands of product meta-description automations. This saved the manual time of resources and improved search rank.

The How for Programmatic SEO

Step 1: In-Depth Site Analysis

Before diving into programmatic SEO, one has to conduct a full site audit. Such technical SEO issues, together with on-page optimization gaps and opportunities to earn backlinks, can be found with tools like Screaming Frog, Ahrefs, and SEMrush.

Step 2: Identify High-Impact Opportunities

Use the data collected to figure out the biggest bang-for-buck opportunities. Look at those pages with the potential for quite a high volume of traffic, but which are underperforming regarding the keywords focused on and content gaps that can be filled with new or updated content.

Step 3: Content Automation

This is one of the most vital parts of programmatic SEO. Scripts and tools such as the ones programmed in Python for the generation of content come quite in handy for producing significant, plentiful, and high-quality content in a short amount of time. Ensure no duplication of content, relevance, and optimization for all your target keywords.

Example: An e-commerce website generated unique product descriptions for thousands of its products with a Python script, gaining 15% more organic traffic.

Step 4: Optimize on-page elements

Tools like Screaming Frog and Ahrefs can also be leveraged to find loopholes for optimizing the on-page SEO elements. This includes meta titles, meta descriptions, headings, or even adding alt text for images. Make these changes in as effective a manner as possible.

Step 5: Build High-Quality Backlinks

Link building is one of the most vital components of SEO. Tools to be used in this regard include Ahrefs and SEMrush, which help identify opportunities for backlinks and automate outreach campaigns. Begin to acquire high-quality links from authoritative websites.

Example: A SaaS company automated its link-building outreach using SEMrush, landed some wonderful backlinks from industry-leading blogs, and considerably improved its domain authority. ### Step 6: Monitor and Analyze Performance

Regularly track your SEO performance on Google Data Studio. Analyze your data concerning your programmatic efforts and make data-driven decisions on the refinement of your strategy.

See Programmatic SEO in Action

50% Win in Organic Traffic for an E-Commerce Site

Remarkably, an e-commerce electronics website was undergoing an exercise in setting up programmatic SEO for its product pages with Python scripting to enable unique meta descriptions while fixing technical issues with the help of Screaming Frog. Within just six months, the experience had already driven a 50% rise in organic traffic.

A Travel Blog Boosts Search Visibility by 40%

Ahrefs and SEMrush were used to recognize high-potential keywords and optimize the content on their travel blog. By automating updates in content and link-building activities, it was able to set itself up to achieve 40% increased search visibility and more organic visitors.

User Engagement Improvement on a News Portal

A news portal had the option to use Google Data Studio to make some real-time dashboards to monitor their performance in SEO. Backed by insights from real-time dashboards, this helped them optimize the content strategy, leading to increased user engagement and organic traffic.

Challenges and Solutions in Programmatic SEO

Ensuring Content Quality

Quality may take a hit in the automated process of creating content. Therefore, ensure that your automated scripts can produce unique, high-quality, and relevant content. Make sure to review and fine-tune the content generation process periodically.

Handling Huge Amounts of Data

Dealing with huge amounts of data can become overwhelming. Use data visualization tools such as Google Data Studio to create dashboards that are interactive, easy to make sense of, and result in effective decision-making.

Keeping Current With Algorithm Changes

Search engine algorithms are always in a state of flux. Keep current on all the recent updates and calibrate your programmatic SEO strategies accordingly. Get ahead of the learning curve by following industry blogs, attending webinars, and taking part in SEO forums.

Future of Programmatic SEO

The future of programmatic SEO seems promising, as developing sectors in artificial intelligence and machine learning are taking this space to new heights. Developing AI-driven tools would allow much more sophisticated automation of tasks, thus making things easier and faster for marketers to optimize sites as well.

There are already AI-driven content creation tools that can make the content to be written highly relevant and engaging at scale, multiplying the potential of programmatic SEO.

Conclusion

Programmatic SEO is the next step for any digital marketer willing to scale up efforts in the competitive online landscape. The right tools and techniques put you in a position to automate key SEO tasks, thus optimizing your website for more organic traffic. The same goals can be reached more effectively and efficiently if one applies programmatic SEO to an e-commerce site, a travel blog, or even a news portal.

#Programmatic SEO#Programmatic SEO tools#SEO Tools#SEO Automation Tools#AI-Powered SEO Tools#Programmatic Content Generation#SEO Tool Integrations#AI SEO Solutions#Scalable SEO Tools#Content Automation Tools#best programmatic seo tools#programmatic seo tool#what is programmatic seo#how to do programmatic seo#seo programmatic#programmatic seo wordpress#programmatic seo guide#programmatic seo examples#learn programmatic seo#how does programmatic seo work#practical programmatic seo#programmatic seo ai

4 notes

·

View notes

Text

artificial intelligence| ai development companies| ai in business| ai for business automation| ai development| artificial intelligence ai| ai technology| ai companies| ai developers| ai intelligence| generative ai| ai software development| top ai companies| ai ops| ai software companies| companies that work on ai| artificial intelligence service providers in india| artificial intelligence companies| customer service ai| ai model| leading ai companies| ai in customer support| ai solutions for small business| ai for business book| basic knowledge for artificial intelligence| matching in artificial intelligence|

#artificial intelligence#ai development companies#ai in business#ai for business automation#ai development#artificial intelligence ai#ai technology#ai companies#ai developers#ai intelligence#generative ai#ai software development#top ai companies#ai ops#ai software companies#companies that work on ai#artificial intelligence service providers in india#artificial intelligence companies#customer service ai#ai model#leading ai companies#ai in customer support#ai solutions for small business#ai for business book#basic knowledge for artificial intelligence#matching in artificial intelligence

2 notes

·

View notes

Text

Often, customers simply get distracted or decide to postpone their purchase. Regardless of the reason, each abandoned cart represents a missed opportunity for conversion. AI and automation solution can streamline these processes by implementing features such as single-click checkout, autofill of shipping and payment details, and guest checkout options. As technology continues to advance, embracing AI-driven solutions will be key to staying competitive in the ever-changing landscape of e-commerce.

#ecommerce solutions#process automation solutions#ecommerce website design#AI and A#ai and automation solution

0 notes

Text

How Can Gen AI Revolutionize Your Accounts Receivable Process?

The advent of Generative AI (Gen AI) heralds a paradigm shift in the landscape of Finance and Accounting (F&A). Much like the introduction of spreadsheets as a product innovation decades ago, finance professionals were quick to embrace and derive immense benefits from the use of spreadsheets.

Gen AI in Finance and Accounting emerges as a potential game-changer, poised to revolutionize traditional practices within the realm of F&A and invoice payments. However, for this potential to be realized, CFOs must demonstrate openness to experimentation, allowing themselves to explore the tangible impact of Gen AI in Finance and Accounting functions.

Embarking on this journey necessitates a focused exploration of Gen AI’s applicability, particularly within accounts receivable management and invoice payments. By delving into this domain, CFOs can gain firsthand insight into the transformative power of Gen AI in Accounts Receivable. As with any strategic business investment, it is prudent to assess the anticipated returns and the timeframe within which these benefits can be realized.

In essence, embracing Gen AI in accounts receivable and invoice payments represents not only a technological advancement but also a strategic imperative for forward-thinking finance leaders. By embracing innovation and fostering a culture of experimentation, organizations can unlock unprecedented efficiency, agility, and competitive advantage in the ever-evolving landscape of finance and accounting.

How Can Gen AI Revolutionize Your Accounts Receivable Process?

Irrespective of the organization, to ensure optimal efficiency within the accounts receivable function and to explore the potential of integrating Gen AI powered Accounts receivable, it is essential to adopt a strategic approach centered around four key building blocks. These pillars serve as the foundation for effective management and innovation in accounts receivable:

Receivable Antecedents :

This encompasses the meticulous orchestration of all preliminary tasks necessary to establish a receivable. From the initial engagement with clients to the negotiation of terms, to the careful documentation of agreements, each step in this process demands precision and foresight. Building strong receivables antecedents lays the foundation for smooth transactions, timely invoice payments and ensures a robust financial framework

They include:

Customer Onboarding: Accurate customer data collection, credit checks, and setting credit limits.

Sales Order Processing: Efficiently converting orders into invoices.

Contractual Agreements: Clear terms and conditions regarding payment terms, discounts, and penalties.

Order Fulfillment: Ensuring timely delivery of goods or services.

Timely Invoicing: Generate invoices promptly after goods/services are delivered.

Clear and Accurate Invoices: Ensure clarity, itemization, and correct pricing.

Invoice Presentment and Reminders:

In the dynamic landscape of revenue management, the presentation of invoices holds paramount importance. It transcends beyond mere documentation; it embodies the essence of your transactions, encapsulating the value exchanged with your clients. Your approach to invoice presentment and invoice payments is characterized by clarity, accuracy, and timeliness. Moreover, one need to recognize the strategic significance of reminders in facilitating prompt invoice payments. Through proactive communication and gentle nudges, you endeavor to uphold transparency, nurture client relationships, and optimize cash flow dynamics.

This step involves creating and delivering invoices to customers:

Multiple Channels: Offer electronic and paper-based invoice delivery to facilitate invoice payments.

Standard Payment Reminder Schedule:

o Set a consistent schedule for sending payment reminders. This helps maintain clarity and predictability for both you and your clients. o Send reminders before the due date to gently prompt clients to pay on time. o Issue reminders close to the actual due date to emphasize the urgency.

• Personalized Reminders:

o Customize your reminders to suit each client. Address them by name and include relevant details. o Personalization shows that you value the relationship and encourages prompt payment.

• Politeness and Professionalism:

o Maintain a polite and professional tone in your reminders. o Avoid threatening language or negativity that could harm the client relationship. o Clearly state the purpose of the reminder and the essential details, such as the invoice number, amount due, and due date.

Collaboration :

Collaboration lies at the heart of your approach, both externally with your valued customers and internally among your team members and departments. Externally, effective collaboration involves understanding your clients’ needs, communicating transparently, and working together to resolve any issues or discrepancies promptly. Internally, collaboration ensures alignment across functions, streamlines processes, and maximizes efficiency, ultimately leading to superior customer service and satisfaction.

Effective communication is crucial:

Customer Communication: Regular follow-ups, addressing queries, and resolving disputes.

Internal Coordination: Collaboration between sales, finance, and customer service teams.

Dispute Resolution: Swiftly address any discrepancies.

Payments and receipt management :

Efficient management of invoice payments and receipts is essential for maintaining cash flow and optimizing financial performance. This includes implementing secure and convenient payment channels, diligently tracking incoming payments, and promptly reconciling accounts. By prioritizing invoice payments and receipt management, you can minimize delays, mitigate risks, and ensure the stability and resilience of our financial ecosystem.

Efficient handling of incoming invoice payments:

Payment Channels: Accept various methods (credit cards, bank transfers, etc.).

Reconciliation: Match payments with outstanding invoices.

Cash Application: Apply payments accurately to the correct accounts.

What are the building blocks of Gen AI in Accounts Receivable?

Overall, Gen AI in accounts receivable encompasses a wide range of capabilities making it a versatile tool for various applications across different domains. A few of the core building blocks are –

Data Generation: Gen AI In accounts receivable, can generate synthetic data to augment existing datasets used for training predictive models. For example, it can create simulated customer invoice payments histories, including variations in payment amounts, frequencies, and timing. This synthetic data allows organizations to train their models more comprehensively, improving the accuracy of predictions regarding future payment behavior.

Data Conversion: Gen AI in accounts receivable can facilitate the conversion of data between different formats in the accounts receivable process. For instance, it can automatically convert paper-based invoices into digital formats by extracting relevant information such as invoice numbers, amounts, and due dates using optical character recognition (OCR) technology. This conversion streamlines the invoicing process, reducing manual effort and minimizing errors.

Data Categorization: Gen AI in accounts receivable, can categorize transactions based on various criteria such as invoice payment methods, customer segments, or invoice statuses. For example, it can automatically classify incoming invoice payments as cash, checks, or electronic transfers, allowing finance teams to track payment trends and reconcile accounts more efficiently. By categorizing transactions accurately, Gen AI powered accounts receivable enhances data organization and facilitates deeper insights into receivables management.

Advisor Functionality: Gen AI in accounts receivable serves as an intelligent advisor by providing actionable insights and recommendations based on analyzed data. For example, it can identify patterns of late invoice payments or discrepancies in invoicing that may indicate potential issues with specific customers or billing processes. By alerting finance teams to these anomalies, Gen AI powered accounts receivable enables proactive intervention to mitigate risks and optimize cash flow management.

Overall, Generative AI enhances the efficiency and effectiveness of accounts receivable operations by generating data, facilitating data conversion, categorizing transactions, and providing intelligent advisory support. By leveraging Gen AI capabilities, organizations can streamline receivables management processes, improve decision-making, and ultimately enhance financial performance.

#ar automation solution#AI in Accounts Receivable#ar collection#Payment Reminder#cashflow management#AI In Finance & Accounting

2 notes

·

View notes

Text

85% of Australian e-commerce content found to be plagiarised

Optidan Published a Report Recently

OptiDan, an Australia-based specialist in AI-driven SEO strategies & Solutions, has recently published a report offering fresh insights into the Australian e-commerce sector. It reveals a striking statistic about content across more than 780 online retailers: 85% of it is plagiarised. This raises severe questions about authenticity and quality in the e-commerce world, with possibly grave implications for both consumers and retailers.

Coming from the founders of OptiDan, this report illuminates an issue that has largely fallen under the radar: content duplication. The report indicates that suppliers often supply identical product descriptions to several retailers, resulting in a sea of online stores harbouring the same content. This lack of uniqueness unfortunately leads to many sites being pushed down in search engine rankings, due to algorithms detecting the duplication. This results in retailers having to spend more on visibility through paid advertising to compensate.

Key Findings in Analysis

Key findings from OptiDan's research include a worrying lack of originality, with 86% of product pages not even meeting basic word count standards. Moreover, even among those that do feature sufficient word counts, Plagiarism is distressingly widespread. Notably, OptiDan's study presented clear evidence of the detrimental impacts of poor product content on consumer trust and return rates.

Founder and former retailer JP Tucker notes, "Online retailers anticipate high product ranking by Google and expect sales without investing in necessary, quality content — an essential for both criteria." Research from 2016 by Shotfarm corroborates these findings, suggesting that 40% of customers return online purchases due to poor product content.

Tucker's industry report reveals that Google usually accepts up to 10% of plagiarism to allow for the use of common terms. Nonetheless, OptiDan's study discovered that over 85% of audited product pages were above this limit. Further, over half of the product pages evidenced plagiarism levels of over 75%.

"Whilst I knew the problem was there, the high levels produced in the Industry report surprised me," said Tucker, expressing the depth of the issue. He's also noted the manufactured absence of the product title in the product description, a crucial aspect of SEO, in 85% of their audited pages. "Just because it reads well, doesn't mean it indexes well."

OptiDan has committed itself to transforming content performance for the online retail sector, aiming to make each brand's content work for them, instead of against them. Tucker guarantees the effectiveness of OptiDan's revolutionary approach: "We specialise in transforming E-commerce SEO content within the first month, paving the way for ongoing optimisation and reindexing performance."

OptiDan has even put a money-back guarantee on its Full Content Optimisation Service for Shopify & Shopify Plus partners. This offer is expected to extend to non-Shopify customers soon. For now, all retailers can utilise a free website audit of their content through OptiDan.

Optidan – Top AI SEO Agency

Optidan is a Trusted AI SEO services Provider Company from Sydney, Australia. Our Services like - Bulk Content Creation SEO, Plagiarism Detection SEO, AI-based SEO, Machine Learning AI, Robotic SEO Automation, and Semantic SEO

We’re not just a service provider; we’re a partner, a collaborator, and a fellow traveller on this exciting digital journey. Together, let’s explore the limitless possibilities and redefine digital success.

Intrigued to learn more? Let’s connect! Schedule a demo call with us and discover how OptiDan can transform your digital performance.

Reference link – Here Click

#Shopify SEO consultant#E-commerce SEO solutions#Shopify integration services#AI technology for efficient SEO#SEO content creation services#High-volume content writing#Plagiarism removal services#AI-driven SEO strategies#Rapid SEO results services#Automated SEO solutions#Best Shopify SEO strategies for retailers

3 notes

·

View notes

Text

Supercharge Your Business with Microsoft Dynamics: Our Services Tailored for You! Harness the power of Microsoft Dynamics to streamline your operations and drive growth. Our expert consultants deliver comprehensive solutions, customization, and support. Get the full potential of this powerful platform and gain a competitive advantage in your industry.

2 notes

·

View notes

Text

Ultimate Guide to DeepSeek AI for Business Growth

Table of Contents of DeepSeek AI for Business Growth1. Introduction: Why AI is Essential for Modern Business Growth2. What Is DeepSeek AI?3. Top 5 DeepSeek AI Tools for Scaling Businesses3.1 Demand Forecasting Engine3.2 Customer Lifetime Value (CLV) Predictor3.3 Automated Supply Chain Optimizer3.4 Dynamic Pricing Module3.5 Sentiment Analysis Hub4. How DeepSeek AI Reduces Costs and Boosts…

#AI automation 2024#AI budgeting#AI business growth#AI for non-tech teams#AI for startups#AI implementation guide#AI in retail#AI supply chain#Business Intelligence#cost reduction strategies#data-driven decisions#DeepSeek AI#enterprise AI adoption#fintech AI solutions#generative AI for business#Predictive Analytics#ROI optimization#scaling with AI#SME AI tools#startup scaling

2 notes

·

View notes

Text

No-Code AI vs. Custom AI Solutions: Which is Right for You?

Artificial Intelligence has transitioned from niche innovation to business necessity. Whether you are a fast-growing startup, a data-savvy enterprise, or a solo entrepreneur, chances are you've considered using AI to unlock new efficiencies, insights, or services. Yet as AI becomes more accessible, the choices become more nuanced.

Should you choose a no-code platform that makes AI as simple as dragging and dropping elements into place, or should you build something from scratch that is perfectly tailored to your unique vision? The answer isn't always obvious; both options come with advantages and trade-offs that could significantly impact your strategy, resources, and results.

What is No-Code AI?

No-code AI refers to platforms that allow users to build, train, and deploy machine learning models without writing a single line of code. These platforms typically offer drag-and-drop interfaces, pre-built templates, and integrations that make data science more accessible to non-technical users.

Popular no-code AI tools include Google AutoML, DataRobot, and Microsoft Power Platform. These platforms excel in democratizing AI; they allow marketing analysts, business development teams, and operations managers to harness machine learning without needing a data science degree.

One powerful use case of no-code AI is in no-code AutoML for data analysis. These platforms can ingest structured data, suggest preprocessing steps, automatically choose the best models, and even visualize the results. The best part is that they significantly reduce the time it takes to go from data to insights.

What is Custom AI?

Custom AI involves building AI models from the ground up. This includes selecting algorithms, engineering features, writing code, tuning hyperparameters, and deploying models in a highly controlled environment. This approach often requires a team of data scientists, machine learning engineers, and software developers.

Custom AI solutions are best suited for organizations that have complex, unique problems that cannot be addressed by one-size-fits-all platforms. These solutions offer full flexibility and control; they are ideal for companies that need proprietary models, have strict compliance requirements, or operate in niche markets.

For instance, a large e-commerce company may use custom AI to power its personalized recommendation engine, taking into account real-time user behaviour, inventory status, and dynamic pricing. No-code tools might not be able to handle that level of complexity or integration.

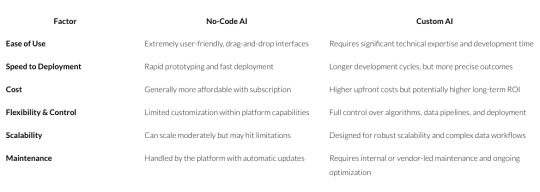

Comparing the Two Approaches

Let’s break down the key differences across several important factors in the table below:

Use Cases: When to Use Each Approach

When No-Code AI Makes Sense

You are exploring AI for the first time and want to test the waters.

Your team lacks technical expertise but has access to clean, structured data.

You need quick turnaround for tasks like churn prediction, sentiment analysis, or sales forecasting.

You are focused on no-code AutoML for data analysis and want to automate repetitive tasks.

When Custom AI is the Better Option

Your problem is highly specific or complex and cannot be solved with off-the-shelf models.

You require integration with multiple internal systems and APIs.

Compliance, data privacy, or regulatory considerations dictate full control over your AI pipeline.

You need to build one of the best AI tools for data pipeline automation tailored to your infrastructure.

“AI tools should be judged not by how advanced they are, but by how effectively they solve your problem.”

— Andrew Ng (Founder of DeepLearning.AI)

ROI Considerations

When choosing between no-code AI and custom AI, it's important to evaluate the return on investment (ROI) for both options. Understanding how quickly you can realize value from your AI investment is crucial. Here's a breakdown of key factors:

Time to Value: No-code AI solutions often provide quicker results. Since these platforms are designed to be user-friendly and efficient, they allow businesses to deploy AI models and start generating insights in a short period of time. In contrast, custom AI solutions have a longer development cycle, requiring more time to build, test, and optimize models.

Cost-Benefit Analysis: No-code AI typically offers a lower upfront cost, which can be an appealing factor for smaller businesses or those with limited budgets. However, for businesses that require highly specialized models, custom AI may deliver a higher long-term ROI. Custom solutions allow for more granular control, potentially leading to more accurate, tailored results and better scalability.

Long-Term Gains: While no-code solutions are fantastic for quickly addressing common problems, they might limit your ability to scale or handle complex tasks as your business grows. On the other hand, custom AI solutions are built for scalability and flexibility, allowing you to adapt to evolving needs over time.

The Future: A Hybrid Approach?

More and more organizations are discovering the benefits of combining both approaches. You might start with a no-code tool to validate a business case and then move to a custom solution for scalability and control. This hybrid strategy allows teams to be agile while laying the groundwork for long-term AI maturity.

For example, a retail company might use no-code AI to forecast short-term sales based on past trends; once they see value in the forecasts, they may invest in a custom AI pipeline that integrates with supply chain systems, POS data, and inventory management tools.

Common Mistakes to Avoid

Choosing between no-code AI and custom AI solutions can be tricky, especially for businesses that are new to AI or unsure of their needs. Here are some common mistakes to watch out for:

Assuming One Size Fits All: No-code AI tools are excellent for solving general business problems, but they may not be suitable for highly specific or complex use cases. Don’t assume that a no-code solution can address every AI challenge. Custom AI is better suited to businesses with specialized needs that require custom-built models.

Underestimating Data Complexity: One common mistake is underestimating the complexity of your data. If you’re dealing with unstructured data, noisy inputs, or intricate patterns, no-code tools might not be able to deliver optimal results. In such cases, custom AI allows for more data preprocessing and tuning to handle these complexities.

Overlooking Long-Term Scalability: While no-code tools can deliver fast results, they often have limitations when it comes to scalability. As your business grows, you may find yourself outgrowing the capabilities of these platforms. Custom AI solutions offer more control over scalability, allowing you to design solutions that evolve with your business needs.

Ignoring Integration Needs: Many no-code platforms may not integrate well with your existing systems. For example, if you need to integrate AI into a complex data pipeline or connect it with various APIs, no-code platforms might fall short. Custom AI solutions offer more flexibility for integration and customization to meet your specific needs.

Overcomplicating with Custom AI: On the flip side, some businesses dive straight into custom AI development without fully evaluating their needs. If you are solving a relatively simple problem, a no-code solution might suffice. Building a custom solution can be resource-intensive and unnecessary if a no-code tool can meet your requirements.

The debate between no-code AI and custom AI is not about which is better universally; it is about what is better for you. Consider your business needs, available resources, technical maturity, and strategic goals. No-code AI is a fantastic starting point for many companies, and it is especially powerful for teams looking to quickly adopt no-code AutoML for data analysis. On the other hand, if you are aiming to build the best AI tools for data pipeline automation with long-term customization and integration in mind, custom AI is the way to go.

Whichever direction you lean toward, what matters most is starting now. Begin with what you have, choose the approach that fits your current needs, and be ready to evolve as your business grows.

Learn more about DataPeak:

#datapeak#factr#saas#technology#agentic ai#artificial intelligence#machine learning#ai#ai-driven business solutions#machine learning for workflow#ai business tools#aiinnovation#ai solutions for data driven decision making#digitaltools#digital technology#digital trends#datadrivendecisions#dataanalytics#data driven decision making#data analytics#buisness#ai platform for business process automation#ai driven business solutions#ai for business efficiency#ai business solutions#no code platforms

0 notes