#best crypto invest in today

Text

Crypto Tokens: Their Use-Cases Explained

In today's digital age, cryptocurrencies have transformed the financial landscape, providing creative solutions while challenging old structures. Among the numerous types of digital assets, crypto tokens have emerged as adaptable tools with a wide range of applications. Crypto tokens shape the future of finance and technology by simplifying transactions and powering decentralized apps (DApps). In this post, we'll look at the numerous applications of crypto tokens, including their capabilities and possible impact on different industries.

Introduction

Crypto tokens are digital assets or utilities that exist on a blockchain network, usually based on existing platforms like Ethereum or Binance Smart Chain. Tokens, as opposed to cryptocurrencies such as Bitcoin or Litecoin, which serve primarily as a medium of exchange or a store of value, have broader functionality and can represent anything from assets to rights or privileges inside a certain ecosystem.

Utility Tokens: Powering Decentralized Applications (DApps)

Fueling Transactions: One key use for utility tokens is facilitating transactions within decentralized systems. These tokens act as the native money of DApps, allowing users to pay for services, access features, and participate in governance processes.

Accessing Features and Services: Utility token holders frequently gain access to premium features or services on decentralized sites. For example, in a decentralized finance (DeFi) protocol, holding the native token may grant access to sophisticated trading tools, yield farming opportunities, or liquidity provision rewards.

Governance and Decision-Making: Many decentralized projects use utility tokens for governance, allowing token holders to vote on crucial issues including protocol upgrades, parameter tweaks, and resource allocation. Staking or voting with their new crypto tokens allows users to affect the ecosystem's future direction actively.

Security Tokens: Digitizing Real-World Assets

Tokenizing Assets: Security tokens reflect ownership or investment in tangible assets such as real estate, stock, or commodities. Security tokens, which digitize these assets on a blockchain, provide better liquidity, fractional ownership, and transparency than traditional securities.

Compliance and Regulation: Security tokens are subject to regulatory standards that ensure they comply with securities laws and provide investor protection. Issuers must follow legal frameworks such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements to ensure a secure and compliant environment for investors.

Unlocking Liquidity: Tokenization can transform illiquid assets like real estate or private equity into tradable tokens, creating new prospects for liquidity and investment. Secondary market systems allow investors to purchase, sell, and trade security tokens, improving market efficiency and accessibility.

Non-Fungible Tokens (NFTs): Digital Collectibles and Unique Assets

Digital Collectibles: NFTs are becoming increasingly popular as digital collectibles, representing unique artworks, game products, and virtual real estate. Each NFT is indivisible and irreplaceable, offering blockchain-verified proof of ownership and validity.

Tokenizing Intellectual Property: NFTs go beyond art and entertainment, providing a new way to tokenize intellectual property rights like patents, trademarks, and copyrights. Smart contracts enable content creators to tokenize their work, establish ownership rights, and get royalties, empowering them and encouraging creativity.

Experiential Ownership: NFTs transform ownership in the digital domain, allowing users to experience ownership beyond mere possession. Whether it's owning a virtual plot of land in a metaverse or collecting rare digital items in a game, NFTs provide rich and individualized ownership experiences.

Conclusion

Crypto tokens represent a paradigm shift in our perception and interaction with digital assets. New Crypto tokens' adaptability and ingenuity are altering sectors worldwide, from utility tokens that fuel decentralized applications to security tokens that digitize real-world assets and NFTs that revolutionize ownership and collections. As blockchain technology advances and matures, the potential applications of crypto tokens expand, providing new prospects for financial inclusion, decentralized governance, and creative expression.

Finally, understanding the various applications of crypto tokens is critical for navigating the quickly changing landscape of blockchain and cryptocurrencies. Whether you're an investor looking for chances, a developer building decentralized applications, or a collector of digital collectibles, crypto tokens open you to a universe of possibilities only limited by your imagination.

#new crypto token#crypto currency#upcoming crypto tokens#New listed tokens#best crypto invest in today

0 notes

Text

Cryptohubnews is your premier destination

Cryptohubnews is your premier destination for the latest and most insightful updates in the world of cryptocurrency. As a dynamic WordPress domain, we strive to provide a comprehensive and user-friendly platform where enthusiasts and investors alike can stay informed about market trends, technological advancements, and regulatory developments

http://www.cryptohubnews.liveblog365.com/?i=1

#crypto#crypto news#crypto market#crypto trading#crypto news today#crypto today#crypto banter#crypto update#solana crypto#trading crypto#crypto investing#latest crypto news#icp crypto#top crypto to buy now#best crypto#kaspa crypto#best crypto investment#banter crypto#crypto expert#best crypto investments#crypto updates#cardano crypto#crypto altcoins#more crypto news#crypto banter live#crypto prediction#crypto live trading

6 notes

·

View notes

Text

Best online earning 2023 crypto currency

Crypto Earning 2023

Bestf2023 crypto currency

Cryptocurrency Mining: If you have the technical knowledge and access to specialized hardware, you can mine cryptocurrencies like Bitcoin or Ethereum. Mining involves solving complex mathematical problems to validate transactions on the blockchain and earn rewards in the form of cryptocurrencies.

Cryptocurrency Trading: Trading cryptocurrencies on various exchanges can be a way to earn profits. It requires understanding market trends, performing analysis, and making informed trading decisions. However, please note that trading involves risks, and it's important to do thorough research and exercise caution.

Staking: Some cryptocurrencies offer staking opportunities where you can lock up your coins to support the network's operations and earn rewards in return. Staking typically requires holding a specific cryptocurrency in a compatible wallet or platform.

Crypto Affiliate Programs: Many cryptocurrency exchanges and platforms offer affiliate programs that allow you to earn commissions by referring new users. If you have a website, blog, or social media following, you can promote these platforms and earn rewards when people sign up through your referral links.

Microtasks and Freelancing: Some platforms offer opportunities to earn cryptocurrencies by completing microtasks or freelancing jobs. These tasks could include participating in surveys, testing websites or applications, or providing services in exchange for cryptocurrencies.

#online earning#how to make money online#earn money online#make money online#online earning app#earning app#online earning in pakistan#online earning without investment#how to earn money online#best earning app#crypto#money earning apps#make money online 2023#online earning real app#best earning app 2023#new earning app today#online money earning apps in 2023 telugu#best online earning app#crypto currency#crypto currency news#free crypto earning

2 notes

·

View notes

Text

#bitcoin prediction#bitcoin trading#bitcoin#bitcoin news#btc latest news#bitcoin analysis today#bitcoin cryptocurrency crypto altcoin altcoin daily blockchain news best investment top altcoins ethereum tron best altcoin buys hodl vecha

9 notes

·

View notes

Text

Is it Smart to Invest in Cryptocurrency? Here are 4 Top Cryptos to Consider for Your Portfolio

Is it Smart to Invest in Cryptocurrency? Here are 4 Top Cryptos to Consider for Your Portfolio:

The cryptocurrency market has been wild, with prices soaring and plunging at seemingly random intervals. Yet, despite this volatility, the industry has continued to grow at an unprecedented pace in recent years, leaving many investors wondering whether it’s a smart move to invest in cryptocurrency.…

View On WordPress

#best crypto to invest#best crypto to invest today#investing in cryptocurrency#is it smart to invest in cryptocurrency#which crypto to buy

0 notes

Text

Investrap is the best website to enhance your knowledge about investing. We provide you with all the latest updates, trends, and tips about investing in India. Read now, and visit Investrap.

Investrap

#Investrap#best website for crypto knowledge#website to gain knowledge about stock markets#Website to get knowledge about finance management#latest updates on stock market in india today#All you need to know about investing#investing tips for beginners india

0 notes

Text

How to Buy Cryptocurrencies?

Cryptocurrency is digital money that uses cryptography (a mathematical system) to secure transactions, control access, and verify transfers. Cryptocurrencies are decentralized—there is no central bank or single administrator who sets monetary policy or collects taxes; instead, power over these activities rests with those who use them. These types of currencies have many advantages over traditional fiat money (government-issued currency), including faster transaction times, ease of international transactions, and security through encryption.

How to Get Started?

Cryptocurrencies have been around since 2009, but only recently have they become popular due to their decentralized nature and security features. There are currently over 1,500 cryptocurrencies in existence, many of them based off of Bitcoin's code.

There are many ways to purchase cryptocurrency. You can go directly to exchanges where you can find different coins listed for sale. If you are looking for a coin that is not listed on any exchange yet, you can create your own using Coinbase.

Which Exchanges to Use?

Coinbase is probably the best place to start if you are just getting into crypto. Coinbase offers three plans based on how much trading volume you want to handle. It is important to look for the best app to buy cryptocurrency, so as to be able to purchase your crypto of choice safely.

You should be aware of the location of any exchange's office because it will be subject to the laws and government of the country where it is located. You should strongly consider purchasing cryptocurrencies from a "local" or home-based crypto exchange. You cannot use an exchange free of cost. As a result, there will be some fees associated with the purchase. The amount, however, may differ from one exchange to another, from one token to another, or possibly from both.

Over time, the exchange fee structure might change. On top of the standard transaction fees, some exchanges also charge extra fees. Note them down. Additionally, some exchanges charge at different stages, including buying, selling, and repurchasing the profit. Before making a choice, consider and estimate all the costs.

How to find the best crypto?

When it comes to finding the best cryptocurrency to buy today, it is important to conduct proper research and know about the various options that are on offer.

#best cryptocurrency to invest#investing in cryptocurrency#best crypto to buy now#cryptocurrency to invest in#buy cryptocurrency#crypto investment#best cryptocurrency to invest today#best coin to invest#best crypto to invest today#best crypto to buy#best coin to invest today#best cryptocurrency to buy#crypto to buy today#best app to buy cryptocurrency#best crypto coin to buy#buy crypto

0 notes

Text

Here is the list of the best crypto coin to invest in 2022

Here is the list of the best crypto coin to invest in 2022

crypto coin to invest in 2022 Out of the thousands of crypto projects hosted by blockchain, with new chains and tokens released nearly every day, just a tiny fraction provide considerable value for investors. Some of the most well-known cryptocurrencies include tether, Bitcoin, Ethereum, and Tamadoge.

Ethereum (ETH)

On the Ethereum network, programmers can create their own cryptocurrency and…

View On WordPress

#best crypto coin to invest in 2022#best crypto under 1 cent 2022#best cryptocurrency to invest 2022#best cryptocurrency to invest today#coinmarketcap#Cryptocurrencies#cryptocurrency list#elonmusk#next cryptocurrency to explode 2022#stock market#Texas#top 10 cryptocurrency#top 10 cryptocurrency 2022

0 notes

Video

youtube

What is Chainlink Link Price Predictions

#youtube#what is chainlink#chainlink#link#deepdive#investing#cryptocurrency news#chianlink explained#cryptocurrency news today#crypto news#what is the best altcoin to buy right now

0 notes

Text

#free crypto#crypto#earn crypto free#earn crypto for free#earn crypto#earn free crypto#how to get free crypto#crypto news#crypto earning#how to earn crypto#crypto news today#how to earn crypto for free#earn crypto without investment#crypto passive income#free crypto apps for android#crypto airdrop#airdrop crypto#earn crypto free 2022#best app for crypto#crypto airdrops#earn crypto games#free crypto mining apps for iphone#crypto world

1 note

·

View note

Text

How to Find New Cryptocurrencies for Investment

The cryptocurrency market is continuously changing, and new tokens emerge regularly. Identifying promising new cryptocurrencies can be a difficult but lucrative task for investors seeking to diversify their portfolios and perhaps profit from early-stage growth. This article will walk you through the process of discovering and analyzing new cryptotokens with the potential for significant returns.

As the future of digital tokens unfolds, experienced investors can benefit from staying ahead of the curve and picking the finest cryptocurrency for 2024. Whether you want to invest in decentralized cryptotoken projects or investigate the use of blockchain in cryptotoken technology, this comprehensive guide will help you navigate the volatile cryptocurrency landscape and find the best cryptotoken to invest in today, including the best cheap crypto to buy right now.

Key Takeaways

The cryptocurrency market is continuously changing, and new tokens emerge regularly.

Identifying promising new cryptocurrencies can be a difficult yet profitable undertaking for investors.

A thorough investigation into the project team and the token's underlying economics (tokenomics) is critical.

Monitoring market trends and assessing the demand for new cryptocurrencies is critical for spotting investment opportunities.

Diversifying your cryptocurrency portfolio with new tokens can be an effective strategy for capitalizing on early-stage development, but it must be done in a balanced and prudent manner.

Identifying Promising New Cryptotoken Projects

When looking for new cryptocurrency projects with investment potential, it's critical to do extensive research on the project team and the token's underlying economics (tokenomics). Look for experienced and trustworthy developers, consultants, and leaders with a track record of successful new-token launches and decentralized cryptotoken initiatives.

Researching the Team and Tokenomics

Examine the token's supply, distribution, and tokenomics to determine the project's long-term viability and potential for growth. Pay special attention to the finest cryptotoken to invest in right now, as well as how the token's economics are structured to generate value and acceptance over time.

Evaluating the Project's Utility and Use Case

Assess the new cryptotoken project's real-world applicability and use cases. Look for the best crypto for 2024 projects with a clear and compelling value proposition that addresses real market needs. Examine how the token's blockchain technology and features will help the project's long-term success and the future of digital tokens.

Analyzing the Market Trends and New Cryptotoken Demand

As the digital asset ecosystem evolves, keeping up with the latest market trends and assessing the demand for new cryptocurrencies is critical for spotting attractive investment opportunities. Investors can acquire significant insights into the crypto market by staying up to date on dynamic movements.

Monitoring Social Media and Community Engagement

Monitoring social media channels and online forums is an excellent technique to evaluate interest and excitement for new cryptotoken ventures. Keep an eye on the degree of interaction, conversation, and sentiment in these communities, as they can provide vital information about the viability and growth potential of a newly listed cryptocurrency. Look for significant community support, active involvement, and favorable mood, since they can indicate a decentralized cryptotoken that is resonating with the larger crypto ecosystem.

Tracking Listing on Major Exchanges

Another crucial element when assessing market trends and demand for new digital tokens is to keep track of their listings on major cryptocurrency exchanges. When a top cryptocurrency for 2024 is listed on a major exchange, it can indicate improved visibility, liquidity, and accessibility for investors. Keep a watch on exchanges that are adding new blockchain-based cryptotoken projects, since this can be a good indicator of market interest and the project's potential for growth and adoption. Tracking these best cryptotokens to invest in today allows you to remain ahead of the curve and uncover the best inexpensive crypto to buy now and the best token to invest in today.

Diversifying Your Crypto Portfolio with New Tokens

As the cryptocurrency market evolves, investing in new cryptotokens can be a sensible approach to diversify your portfolio while also potentially capitalizing on early-stage growth prospects. However, to manage the inherent risks of new and speculative digital assets, this strategy must be approached with a balanced and careful perspective.

Understanding Risk Management Strategies

When adding additional cryptocurrencies to your portfolio, you must use appropriate risk management measures to preserve your investments. This could entail diversifying your holdings over numerous new cryptotokens, dedicating only a small amount of your portfolio to speculative new initiatives, and continuously monitoring and changing your positions as market conditions shift.

By carefully assessing the future of digital token projects, their underlying technology, and their potential for long-term growth, you may find promising new listed tokens with the potential to become the best crypto for 2024 and beyond. Consider the blockchain in a cryptotoken context to better grasp the technical basis of these new decentralized cryptotokens.

Conclusion

Investing in new cryptotokens and newly listed tokens can be an exciting and possibly profitable strategy for investors looking to diversify their portfolios and capitalize on the future of digital tokens. By thoroughly researching promising new cryptotoken projects, understanding market trends and demand, and employing smart risk management measures, you may improve your chances of discovering and investing in the best cryptocurrencies in 2024.

Whether you're looking for decentralized cryptotokens, blockchain-based tokens, or just the best cryptotokens to invest in now, it's critical to do your research and never spend more than you can afford to lose. By diversifying your crypto portfolio with a mix of established and new cheap cryptocurrencies to purchase now, you can position yourself to profit from the greatest token to invest in right now.

Remember that the new cryptocurrency market is always evolving, so remaining knowledgeable and adaptive is essential for navigating the ever-changing landscape. With the correct research, strategy, and risk management technique, you may maximize the benefits of investing in new cryptocurrencies while also contributing to the continued growth and innovation in the world of digital assets.

FAQ

What are the key factors to consider when researching new cryptocurrency projects?

When analyzing new cryptotoken initiatives, consider the team's experience and track record, the project's utility and use case, the token's economics (such as supply, distribution, and tokenomics), and the broader market demand and community participation surrounding the project.

How can I stay up-to-date on the latest developments in the cryptocurrency market?

Closely monitoring social media, online forums, and industry news sources may keep you up to date on new token listings, market trends, and the amount of interest and participation in upcoming cryptocurrency initiatives. Furthermore, monitoring the listing of new tokens on prominent exchanges can provide information about the growth and use of these digital assets.

Why is it important to diversify my crypto portfolio with new tokens?

Diversifying your cryptocurrency portfolio by investing in a mix of established and new projects can assist in reducing risk and boost your chances of capitalizing on early-stage development prospects. However, it is critical to employ solid risk management measures, such as devoting only a small amount of your portfolio to speculative new tokens and continuously monitoring and modifying your positions as market conditions shift.

0 notes

Text

Real innovation vs Silicon Valley nonsense

This is the LAST DAY to get my bestselling solarpunk utopian novel THE LOST CAUSE (2023) as a $2.99, DRM-free ebook!

If there was any area where we needed a lot of "innovation," it's in climate tech. We've already blown through numerous points-of-no-return for a habitable Earth, and the pace is accelerating.

Silicon Valley claims to be the epicenter of American innovation, but what passes for innovation in Silicon Valley is some combination of nonsense, climate-wrecking tech, and climate-wrecking nonsense tech. Forget Jeff Hammerbacher's lament about "the best minds of my generation thinking about how to make people click ads." Today's best-paid, best-trained technologists are enlisted to making boobytrapped IoT gadgets:

https://pluralistic.net/2024/05/24/record-scratch/#autoenshittification

Planet-destroying cryptocurrency scams:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

NFT frauds:

https://pluralistic.net/2022/02/06/crypto-copyright-%f0%9f%a4%a1%f0%9f%92%a9/

Or planet-destroying AI frauds:

https://pluralistic.net/2024/01/29/pay-no-attention/#to-the-little-man-behind-the-curtain

If that was the best "innovation" the human race had to offer, we'd be fucking doomed.

But – as Ryan Cooper writes for The American Prospect – there's a far more dynamic, consequential, useful and exciting innovation revolution underway, thanks to muscular public spending on climate tech:

https://prospect.org/environment/2024-05-30-green-energy-revolution-real-innovation/

The green energy revolution – funded by the Bipartisan Infrastructure Act, the Inflation Reduction Act, the CHIPS Act and the Science Act – is accomplishing amazing feats, which are barely registering amid the clamor of AI nonsense and other hype. I did an interview a while ago about my climate novel The Lost Cause and the interviewer wanted to know what role AI would play in resolving the climate emergency. I was momentarily speechless, then I said, "Well, I guess maybe all the energy used to train and operate models could make it much worse? What role do you think it could play?" The interviewer had no answer.

Here's brief tour of the revolution:

2023 saw 32GW of new solar energy come online in the USA (up 50% from 2022);

Wind increased from 118GW to 141GW;

Grid-scale batteries doubled in 2023 and will double again in 2024;

EV sales increased from 20,000 to 90,000/month.

https://www.whitehouse.gov/briefing-room/blog/2023/12/19/building-a-thriving-clean-energy-economy-in-2023-and-beyond/

The cost of clean energy is plummeting, and that's triggering other areas of innovation, like using "hot rocks" to replace fossil fuel heat (25% of overall US energy consumption):

https://rondo.com/products

Increasing our access to cheap, clean energy will require a lot of materials, and material production is very carbon intensive. Luckily, the existing supply of cheap, clean energy is fueling "green steel" production experiments:

https://www.wdam.com/2024/03/25/americas-1st-green-steel-plant-coming-perry-county-1b-federal-investment/

Cheap, clean energy also makes it possible to recover valuable minerals from aluminum production tailings, a process that doubles as site-remediation:

https://interestingengineering.com/innovation/toxic-red-mud-co2-free-iron

And while all this electrification is going to require grid upgrades, there's lots we can do with our existing grid, like power-line automation that increases capacity by 40%:

https://www.npr.org/2023/08/13/1187620367/power-grid-enhancing-technologies-climate-change

It's also going to require a lot of storage, which is why it's so exciting that we're figuring out how to turn decommissioned mines into giant batteries. During the day, excess renewable energy is channeled into raising rock-laden platforms to the top of the mine-shafts, and at night, these unspool, releasing energy that's fed into the high-availability power-lines that are already present at every mine-site:

https://www.euronews.com/green/2024/02/06/this-disused-mine-in-finland-is-being-turned-into-a-gravity-battery-to-store-renewable-ene

Why are we paying so much attention to Silicon Valley pump-and-dumps and ignoring all this incredible, potentially planet-saving, real innovation? Cooper cites a plausible explanation from the Apperceptive newsletter:

https://buttondown.email/apperceptive/archive/destructive-investing-and-the-siren-song-of/

Silicon Valley is the land of low-capital, low-labor growth. Software development requires fewer people than infrastructure and hard goods manufacturing, both to get started and to run as an ongoing operation. Silicon Valley is the place where you get rich without creating jobs. It's run by investors who hate the idea of paying people. That's why AI is so exciting for Silicon Valley types: it lets them fantasize about making humans obsolete. A company without employees is a company without labor issues, without messy co-determination fights, without any moral consideration for others. It's the natural progression for an industry that started by misclassifying the workers in its buildings as "contractors," and then graduated to pretending that millions of workers were actually "independent small businesses."

It's also the natural next step for an industry that hates workers so much that it will pretend that their work is being done by robots, and then outsource the labor itself to distant Indian call-centers (no wonder Indian techies joke that "AI" stands for "absent Indians"):

https://pluralistic.net/2024/05/17/fake-it-until-you-dont-make-it/#twenty-one-seconds

Contrast this with climate tech: this is a profoundly physical kind of technology. It is labor intensive. It is skilled. The workers who perform it have power, both because they are so far from their employers' direct oversight and because these fed-funded sectors are more likely to be unionized than Silicon Valley shops. Moreover, climate tech is capital intensive. All of those workers are out there moving stuff around: solar panels, wires, batteries.

Climate tech is infrastructural. As Deb Chachra writes in her must-read 2023 book How Infrastructure Works, infrastructure is a gift we give to our descendants. Infrastructure projects rarely pay for themselves during the lives of the people who decide to build them:

https://pluralistic.net/2023/10/17/care-work/#charismatic-megaprojects

Climate tech also produces gigantic, diffused, uncapturable benefits. The "social cost of carbon" is a measure that seeks to capture how much we all pay as polluters despoil our shared world. It includes the direct health impacts of burning fossil fuels, and the indirect costs of wildfires and extreme weather events. The "social savings" of climate tech are massive:

https://arstechnica.com/science/2024/05/climate-and-health-benefits-of-wind-and-solar-dwarf-all-subsidies/

For every MWh of renewable power produced, we save $100 in social carbon costs. That's $100 worth of people not sickening and dying from pollution, $100 worth of homes and habitats not burning down or disappearing under floodwaters. All told, US renewables have delivered $250,000,000,000 (one quarter of one trillion dollars) in social carbon savings over the past four years:

https://arstechnica.com/science/2024/05/climate-and-health-benefits-of-wind-and-solar-dwarf-all-subsidies/

In other words, climate tech is unselfish tech. It's a gift to the future and to the broad public. It shares its spoils with workers. It requires public action. By contrast, Silicon Valley is greedy tech that is relentlessly focused on the shortest-term returns that can be extracted with the least share going to labor. It also requires massive public investment, but it also totally committed to giving as little back to the public as is possible.

No wonder America's richest and most powerful people are lining up to endorse and fund Trump:

https://prospect.org/blogs-and-newsletters/tap/2024-05-30-democracy-deshmocracy-mega-financiers-flocking-to-trump/

Silicon Valley epitomizes Stafford Beer's motto that "the purpose of a system is what it does." If Silicon Valley produces nothing but planet-wrecking nonsense, grifty scams, and planet-wrecking, nonsensical scams, then these are all features of the tech sector, not bugs.

As Anil Dash writes:

Driving change requires us to make the machine want something else. If the purpose of a system is what it does, and we don’t like what it does, then we have to change the system.

https://www.anildash.com/2024/05/29/systems-the-purpose-of-a-system/

To give climate tech the attention, excitement, and political will it deserves, we need to recalibrate our understanding of the world. We need to have object permanence. We need to remember just how few people were actually using cryptocurrency during the bubble and apply that understanding to AI hype. Only 2% of Britons surveyed in a recent study use AI tools:

https://www.bbc.com/news/articles/c511x4g7x7jo

If we want our tech companies to do good, we have to understand that their ground state is to create planet-wrecking nonsense, grifty scams, and planet-wrecking, nonsensical scams. We need to make these companies small enough to fail, small enough to jail, and small enough to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

We need to hold companies responsible, and we need to change the microeconomics of the board room, to make it easier for tech workers who want to do good to shout down the scammers, nonsense-peddlers and grifters:

https://pluralistic.net/2023/07/28/microincentives-and-enshittification/

Yesterday, a federal judge ruled that the FTC could hold Amazon executives personally liable for the decision to trick people into signing up for Prime, and for making the unsubscribe-from-Prime process into a Kafka-as-a-service nightmare:

https://arstechnica.com/tech-policy/2024/05/amazon-execs-may-be-personally-liable-for-tricking-users-into-prime-sign-ups/

Imagine how powerful a precedent this could set. The Amazon employees who vociferously objected to their bosses' decision to make Prime as confusing as possible could have raised the objection that doing this could end up personally costing those bosses millions of dollars in fines:

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

We need to make climate tech, not Big Tech, the center of our scrutiny and will. The climate emergency is so terrifying as to be nearly unponderable. Science fiction writers are increasingly being called upon to try to frame this incomprehensible risk in human terms. SF writer (and biologist) Peter Watts's conversation with evolutionary biologist Dan Brooks is an eye-opener:

https://thereader.mitpress.mit.edu/the-collapse-is-coming-will-humanity-adapt/

They draw a distinction between "sustainability" meaning "what kind of technological fixes can we come up with that will allow us to continue to do business as usual without paying a penalty for it?" and sustainability meaning, "what changes in behavior will allow us to save ourselves with the technology that is possible?"

Writing about the Watts/Brooks dialog for Naked Capitalism, Yves Smith invokes William Gibson's The Peripheral:

With everything stumbling deeper into a ditch of shit, history itself become a slaughterhouse, science had started popping. Not all at once, no one big heroic thing, but there were cleaner, cheaper energy sources, more effective ways to get carbon out of the air, new drugs that did what antibiotics had done before…. Ways to print food that required much less in the way of actual food to begin with. So everything, however deeply fucked in general, was lit increasingly by the new, by things that made people blink and sit up, but then the rest of it would just go on, deeper into the ditch. A progress accompanied by constant violence, he said, by sufferings unimaginable.

https://www.nakedcapitalism.com/2024/05/preparing-for-collapse-why-the-focus-on-climate-energy-sustainability-is-destructive.html

Gibson doesn't think this is likely, mind, and even if it's attainable, it will come amidst "unimaginable suffering."

But the universe of possible technologies is quite large. As Chachra points out in How Infrastructure Works, we could give every person on Earth a Canadian's energy budget (like an American's, but colder), by capturing a mere 0.4% of the solar radiation that reaches the Earth's surface every day. Doing this will require heroic amounts of material and labor, especially if we're going to do it without destroying the planet through material extraction and manufacturing.

These are the questions that we should be concerning ourselves with: what behavioral changes will allow us to realize cheap, abundant, green energy? What "innovations" will our society need to focus on the things we need, rather than the scams and nonsense that creates Silicon Valley fortunes?

How can we use planning, and solidarity, and codetermination to usher in the kind of tech that makes it possible for us to get through the climate bottleneck with as little death and destruction as possible? How can we use enforcement, discernment, and labor rights to thwart the enshittificatory impulses of Silicon Valley's biggest assholes?

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/30/posiwid/#social-cost-of-carbon

#pluralistic#ai#hype#anil dash#stafford beer#amazon#prime#scams#dark patterns#POSIWID#the purpose of a system is what it does#climate#economics#innovation#renewables#social cost of carbon#green energy#solar#wind#ryan cooper#peter watts#the jackpot#ai hype#chips act#ira#inflation reduction act#infrastructure#deb chachra

155 notes

·

View notes

Text

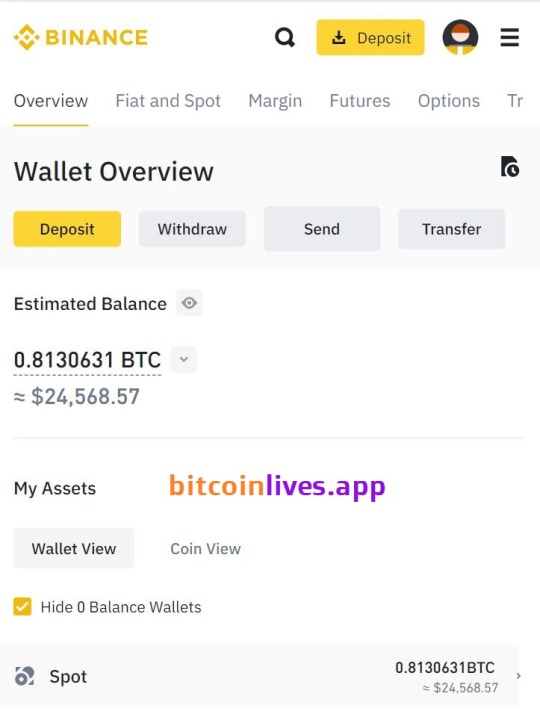

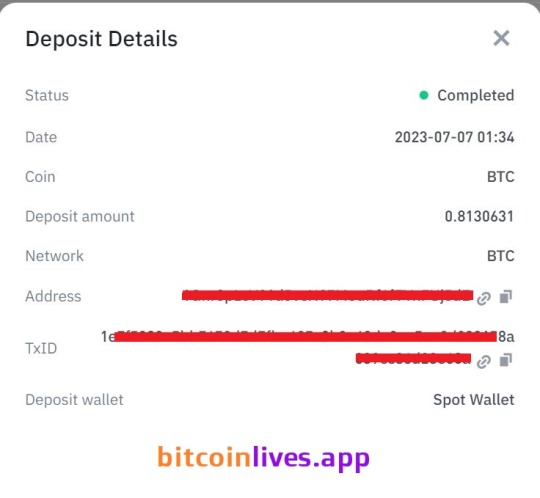

Bitcoin Mining platform

Bitcoin Live App is a crypto mining platform to help you start earning BTC! It contains the most necessary tools for working with digital assets: cloud bitcoin mining equipment with high hash power. It is a meta-universe of crypto investments available to everyone.

How does Bitcoin Mining App work?

Previously, to mine cryptocurrencies, you had to buy equipment and then recoup its cost. Bitcoin Live App allows you to start mining right now with a minimum cost threshold.

We have developed a quantum decryption algorithm to mine Bitcoin at unsurpassed speed. You only have to log in and activate our process with very simple steps, the magic happens in our the magic happens in our mining farms, so you just have to wait for your profits to be generated. No more hassle with buying and maintaining equipment or mining pools.It's easiest and most efficient way to make money from cryptocurrency mining without having to buy and maintain your equipment. Just choose and buy the best Crypto Mining Key for you and start earning today!

Join over 50.000 people with the world’s leading hashpower provider

During this time, We have won the trust of thousands of users. So, join our Platform and start earning bitcoin today by using our mining website. Start mining the quick way, Generate 1 BTC fast and easy with instant withdraw.

137 notes

·

View notes

Text

Advanced Trading With The Best DeFi Bot For Your Crypto Exchange!

Explore the power of decentralized finance and elevate your trading strategy with our Advanced DeFi Trading Bot. Maximize profits, minimize risks, and trade smarter with automated precision. Ready to transform your investment game? Join the DeFi revolution today!

Join Us>>>https://bidbits.org/blog/best-defi-trading-bots

#DeFiTradingBot#CryptoTrading#AutomatedTrading#DeFiRevolution#SmartInvesting#CryptoBot#DeFi#DeFiBot#TradingBot#Business#Technology#Crypto#Cryptocurrency#Bitcoin#Us#USA#Uk#SouthKorea#Thailand#Startups#CryptoExchange#Blockchain#Metaverse#Metaversegame#Singapore#China#NFT#Metavesre#Japan

4 notes

·

View notes

Text

What is best time for crypto trading?

There are no general rules about when to buy cryptocurrencies. It's usually not a good idea to buy at the top of a bubble, and it's usually not a good idea to buy when the price is falling. As the wisdom of the merchant goes, never take the knife off. The best time can be when the price is stable at a low level.

Cryptocurrency trading is a broad topic and determining exactly when a crypto bubble is in place and when it will burst is not an exact science. Today it is difficult to answer questions that are easy to see. Sometimes a coin starts to rise and once it crosses a major historical resistance line, many believe that the bubble has peaked when the real recovery is just beginning.

For example, few people buy $1,000 worth of bitcoins or $100 worth of Ether because the price seems too high to them. But after a few years, those prices seem like a bargain that won't hit the market again.

This is definitely not financial advice, but some general guidelines to help you decide when to invest include:

Don't compare the crypto bubble with a traditional bubble in mainstream finance. A ten percent increase or decrease in the value of a cryptocurrency can fluctuate daily. It may be a 100% bubble, but often it's just the beginning. 1000 percent chance it's a bubble, but it's not guaranteed to burst.

Don't buy it just because it's in the water. It can be different, so it takes time to observe the changing situation.

Don't buy it because you're afraid it will explode tomorrow. Be informed and buy when you are sure of your entry point.

Don't fall for reactive selling or "paper hands". Selling too early will ruin your plan and can hurt your ROI. Impose. Diamond hand. The money revolution has just begun.

With Fiordintel you can secure your crypto wallet with our advanced cryptography security solutions. keep your accounts safe from all forms of cyber infiltrations. You can also inform them about any kind of scam related to cryptocurrency and hopefully they will try their best to help you. For more info: go DM me.

2 notes

·

View notes

Text

The Power of Doing Your Own Research (DYOR) in the World of Bitcoin and Cryptocurrencies

In today's digital age, information is more accessible than ever before. With a few clicks, you can find countless articles, videos, and social media posts about almost any topic. This is especially true for Bitcoin and the broader cryptocurrency market. While this abundance of information can be empowering, it also comes with the risk of misinformation and hype-driven narratives. This is why it’s crucial to emphasize the importance of doing your own research (DYOR) before making any financial decisions.

The Cryptocurrency Information Overload

The cryptocurrency space is notoriously fast-paced and filled with complex jargon. From blockchain technology to decentralized finance (DeFi), understanding the basics can be overwhelming. Moreover, the crypto market is often subject to wild speculation and hype, leading to sensational headlines and exaggerated claims. While some sources provide valuable insights, others might be misleading or outright false. In this environment, DYOR becomes not just a recommendation but a necessity.

Why DYOR Matters

Understanding the Fundamentals: When you conduct your own research, you gain a deeper understanding of the fundamentals of Bitcoin and other cryptocurrencies. This includes learning about the technology, the problem it aims to solve, its potential applications, and the risks involved. A solid grasp of these basics will help you make informed decisions and avoid falling for scams or overhyped projects.

Avoiding Hype and FOMO: The fear of missing out (FOMO) is a powerful force in the crypto market. It can drive individuals to make impulsive decisions based on hype rather than sound analysis. By doing your own research, you can evaluate the true potential of a project or investment, rather than relying on the opinions of others. This disciplined approach helps you avoid the pitfalls of hype-driven investments.

Building Confidence: Investing in Bitcoin and cryptocurrencies can be a volatile journey. Conducting your own research instills confidence in your decisions. When you understand why you are investing in a particular asset, you are more likely to stay committed to your investment strategy, even during market downturns.

Identifying Opportunities: The crypto market is filled with opportunities, but not all of them are immediately obvious. Through thorough research, you can identify promising projects and investment opportunities that others might overlook. This proactive approach can lead to more profitable outcomes.

How to Do Your Own Research

Diverse Sources: Don’t rely on a single source of information. Read articles, watch videos, listen to podcasts, and follow reputable figures in the crypto space. Cross-referencing information from multiple sources helps ensure accuracy and provides a well-rounded perspective.

Official Documentation: Always review official documents such as whitepapers, technical papers, and project websites. These sources offer detailed insights into a project's vision, technology, and roadmap.

Community Engagement: Engage with the community through forums, social media, and discussion groups. Platforms like Reddit, Twitter, and Telegram host vibrant discussions where you can ask questions and get diverse viewpoints. Be cautious, however, as not all advice you encounter will be accurate or trustworthy.

Critical Thinking: Approach every piece of information with a critical mindset. Question the credibility of the source, the validity of the claims, and the underlying motivations. This analytical approach helps you separate valuable insights from noise.

Stay Updated: The crypto space evolves rapidly. Continuously updating your knowledge helps you stay informed about new developments, regulatory changes, and market trends.

Conclusion

In the dynamic world of Bitcoin and cryptocurrencies, doing your own research is not just a best practice—it’s an essential skill. By taking the time to educate yourself, you empower yourself to make informed, confident, and rational investment decisions. Remember, the journey to financial freedom through Bitcoin starts with knowledge and understanding. So, embrace the DYOR mindset and take control of your financial future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#Blockchain#DYOR#FinancialFreedom#CryptoEducation#CryptoResearch#BitcoinCommunity#DigitalGold#CryptoInvesting#HODL#CryptoMarket#CryptoAwareness#BitcoinNews#CryptoTips#BitcoinKnowledge#BitcoinRevolution#CryptoJourney#CryptoLife#financial experts#globaleconomy#unplugged financial#financial empowerment#financial education#digitalcurrency#finance

5 notes

·

View notes