#best gst billing software

Explore tagged Tumblr posts

Text

#billing software#erp#software#best gst billing software#free billing software#gst billing software#billing software for retail shop#hitech billing software#restaurant billing software

0 notes

Text

GST Registration In Jaipur

The concept of virtual offices comes as a great advantage in today’s competitive business world. It provides ample opportunity for companies to tend towards a professional image, sans the costs and commitments associated with leasing and maintaining a real office. Virtual offices seem particularly best suited to the needs of startups, small businesses, and freelancers who desire a legitimate business address for official use without bearing the overheads. Best Desk Cove Premium Virtual Office provides a perfect solution located in one of the premium locations, having robust services at cost-effective plans for businesses in Jaipur who want to get registered under GST or incorporate their companies. In this article, we are going to review why Best Desk Cove is the best virtual office provider for GST and Company registration in Jaipur.

The Advantages of a Virtual Office for GST and Company Registration in Jaipur

Virtual offices provide businesses with a professional address for all their official purposes without them having to physically rent space. The Indian regulations consider a business address to be one of the primary requirements for GST registration, and a good and credible address adds to the Company Incorporation process. Hence, this can dramatically serve in improving a business’s credibility with all sorts of clients, investors, and regulatory authorities. Best Desk Cove offers companies in Jaipur a chance to reduce overhead costs. They provide essential services such as handling mail, answering calls, and offering meeting rooms when needed. This support helps businesses operate efficiently and effectively. This is because it can offer a company a professional view and at the same time keep such a setup simple so that no hassles are faced at the time of GST registration and incorporation.

Why Jaipur is a Strategic Location for Virtual Offices

The capital of Rajasthan, Jaipur is also emerging as a key business hub by blending its age-old cultural heritage with modern infrastructure. Besides being one of the most ardent tourism and trade centers, Jaipur is also proving economical for new ventures owing to relatively lower real estate prices compared to metropolitan cities. The strategic position of the city in North India provides excellent connectivity and growing digital infrastructure, thus making it the most appealing entrepreneurship hub starting on a small scale, too, up to established companies. Setting up a virtual office in Jaipur, therefore, enables tapping into this vibrant market. Best Desk Cove Premium Virtual Office amplifies this with a prestigious address in a prime Gst Filing Through Virtual Office business district. More so, the combination with Best Desk Cove will let the company draw power from the vibrant ecosystem at Jaipur, build a professional presence, and find support in GST Registration In Jaipur and company incorporation.

#gst virtual office#gstreturns#gstfiling#gst billing software#gst registration#best gst registrations in jaipur#gst registration near me

2 notes

·

View notes

Text

#Hypermarket Billing Software in Chennai#best Hypermarket Billing Software in Chennai#Top Hypermarket Billing Software in Chennai#top billing software in Chennai#best gst billing software in Chennai#best billing software in Chennai#efficient billing software in Chennai#best billing software in chennai#gst billing software in Chennai#billing software in Chennai#nammabilling#best gst billing software in chennai#billing software inTamilnadu#tamilnadu billing software

0 notes

Text

RRFINCO Common Service Centre in Bihar is a one-stop service point for bringing e-services from the Indian Government to rural and remote locations of Patna.

#loan service#recharge software#dmt software#account opening#gst services#aeps software#api integration#api solution#b2b service#b2c services#app development company#mobile app design bd#mobile recharge#mobile app development#mlm software#mutual fund#best aeps service provider#bill payment#b2b lead generation#software company#it company#credit card#commercial#distributor#e government services#entrepreneur#csc center

0 notes

Text

What is GST and Why Accurate Billing Matters?

It's a Goods and Services Tax (GST) that came out for India as an indirect tax system under one head to replace the various indirect taxes such as VAT, service tax, and excise duty with effect from July 01, 2017, to simplify the taxation process in the country. The main intention was to create a tax system to be called "one nation, one tax," making compliance easy and boosting transparency in business transactions.

GST can be classified into three categories from the point of view of nature of the transaction; they include:

CGST (Central GST): Which is levied on an intra-state sale by the central government.

SGST (State GST): Which is levied on an intra-state sale by the state government.

IGST (Integrated GST): Which is levied on inter-state transactions and falls under the head of central government for collection.

Having said that, India's GST tax system has been formulated by defining multiple tax slabs such as 5%, 12%, 18%, and 28%, depending on the type of goods or services. Generally, it has been observed that essential appeals are placed in the lower slabs, while luxury ones go as high as possible.

Healthy and Accurate Billing in GST

Accurate billing plays an important part in GST compliance. A proper invoice should include:

Invoice number and date

Seller and buyer's GSTIN

HSN/SAC codes

Tax rate and amount break up

Place of delivery

The effects of errors in billing, such as wrong GSTINs, incorrect tax rates, or missing invoice elements, are that they lead to mismatching of returns and thus delay in input tax credits. By the GST Law, wrong billing can attract fines starting from ₹10,000 or 10% of the tax due-whichever is higher.

Benefits of Accurate GST Billing

Germ-free Return Filing: Correct invoices assure that you can file GSTR-1, GSTR-3B, GSTR-9 with no discrepancy.

Avoid Penalty: Avoid compliance hassle, audit, and government scrutiny.

Better Business Reputation: More professional and transparent invoices create better trust in clients and stakeholders.

Input Tax Credit Accuracy: Buyers can claim true ITC only if the invoices of their supplier are true and timely.

How Software Helps

Modern GST billing software automatically solves an equation, checks GST institutions, brings tax slabs up to date, and links the GST portal to perform direct uploads at the same time. With features like multi-user access, e-invoicing, and real-time reporting, it minimizes manual errors, optimizes tax compliance, and saves time.

Final Words

GST simplified taxation in India. But accurate billing is essential for compliance and competitiveness in business. Whether you run a small or large enterprise, entrusting reliable billing tools to use best practices is sufficient for smoother operational processes while keeping illegal risks at bay and developing long-term trust from customers and tax authorities.

This article was originally published on Tririd Biz

Contact

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

FAQ

Q1: Penalties for Wrong GST Billing

A: Penalties will start from a minimum of ₹10,000 or 10% of the tax amount and may be accompanied by an interest charge and GST registration cancellation for repeated offenders.

Q2: How frequently should GST invoicing be reconciled?

A: Monthly is an ideal practice to confirm that your GSTR-1 and GSTR-3B are in sync consistent and thereby claim rightful ITC.

Q3: For GST billing, is the use of free tools permissible for small businesses?

A: Yes! Many included applications on their scene offer free basic GST billing features perfectly suited for startups or micro-businesses.

Q4: What are necessary features of GST billing software?

A: Auto-calculation, GSTIN validation, HSN/SAC codes, integration of GSTR filing, and e-invoicing.

Q5: Will e-invoicing be a requirement for all businesses?

A: As of now, registration for e-invoicing is required for turnover more than ₹5 crores, but it might become universal in the future.

#Automated GST billing software#Best accounting software for GST#GST billing and accounting software#GST billing software for small businesses#Tririd Biz accounting software

0 notes

Text

GST Payments: The What, Why & How Without the Headache

Let’s be honest—when you hear GST, your brain probably goes, “Ugh, not again.” But what if we told you it’s actually way simpler than it sounds?

Whether you’re running a small business, freelancing, or just starting your startup dream, understanding GST payments can save you money, stress, and (most importantly) those last-minute filing marathons.

So let’s decode it—one simple step at a time. No jargon, no legal speak. Just real talk from WeGoFin.

#wegofin#best payment gateway#digital payment services#digital payments#best secure payment#payroll#payroll software#upi#upi transactions#hr payroll software#gst#gst services#gst billing software#gst registration#tax#income tax#bank

0 notes

Text

Discover the Best GST Billing Software with Bharat Bills

Bharat Bills provides an efficient and easy-to-use solution that ensures compliance with GST regulations while simplifying the billing process for your business. With features like automated tax calculations, GST return filing, and customizable invoices, our software is designed to meet all your GST billing needs. Get started today and streamline your business operations with the best GST billing software.

Need assistance? Feel free to reach out via Contact Us for any inquiries.

0 notes

Text

How GST Billing Software Simplifies Tax Filing and Invoicing

Gimbook combines powerful invoicing and tax filing tools into one platform. Automate GST calculations, track tax liabilities, and file returns effortlessly. Designed for businesses of all sizes, Gimbook is the ideal choice for staying compliant and enhancing operational efficiency.

In today’s fast-paced world, businesses of all sizes need tools that make their work easier. One such tool is GST billing software. But what exactly is it, and why is it so important? In this blog, we will explore how GST billing software simplifies tax filing and invoicing for businesses. We will also look at its benefits and how it helps companies comply with GST laws.

What is GST Billing Software?

GST billing software is a digital tool designed to help businesses manage their invoices and taxes under the Goods and Services Tax (GST) system. It simplifies tasks like creating invoices, calculating taxes, and filing returns. With the introduction of GST in India, businesses were required to follow specific rules and procedures for tax compliance. GST billing software makes this process easier by automating many steps.

Benefits of GST Billing Software

Using GST billing software offers many advantages for businesses. Let’s explore some key benefits:

Simplify GST Compliance One of the main challenges for businesses is staying compliant with GST laws. GST billing software helps by automatically applying the correct tax rates and formats to invoices. This ensures that all invoices follow GST guidelines, reducing the chances of errors and penalties.

Automated Tax Calculation Manual tax calculation can be time-consuming and prone to mistakes. GST billing software calculates taxes automatically, saving time and ensuring accuracy. Whether it’s CGST, SGST, or IGST, the software handles everything seamlessly. For example, a business processing 500 invoices per month can save approximately 40-50 hours by using automated tax calculation tools.

Seamless GST Filing Filing GST returns can be complex, especially for businesses with many transactions. GST billing software integrates with the GST portal, making it easy to file returns directly from the software. According to recent surveys, businesses using GST billing software reported a 60% reduction in errors during GST filing compared to manual methods.

Time and Cost Savings By automating invoicing and tax filing, GST billing software saves businesses a lot of time. This allows them to focus on other important tasks. Additionally, the software reduces the need for hiring extra resources for tax compliance, cutting costs in the long run. On average, small businesses can save up to ₹1.2 lakh annually by using GST billing software.

Digital Tax Tools GST billing software comes with digital tax tools that help businesses keep track of their tax liabilities. These tools provide detailed reports and insights, making it easy to monitor and manage taxes efficiently. A study found that 85% of businesses using digital tax tools experienced improved accuracy in tax reporting.

How GST Billing Software Simplifies Invoicing

Invoicing is an essential part of any business. However, creating and managing invoices manually can be tedious and prone to errors. Here’s how GST billing software simplifies invoicing:

Invoicing Tools with GST Features GST billing software includes invoicing tools with built-in GST features. These tools automatically apply the correct tax rates based on the type of goods or services. They also generate GST-compliant invoices that include all required details, such as GSTIN, HSN codes, and tax breakdowns.

Customizable Invoice Templates Businesses can use pre-designed templates to create professional-looking invoices. These templates are customizable, allowing companies to add their branding, logos, and other details.

Real-Time Invoice Generation With GST billing software, businesses can generate invoices in real-time. This is particularly useful for e-commerce companies and other businesses with high transaction volumes. For instance, companies processing over 1,000 transactions monthly reported a 70% increase in efficiency by using real-time invoicing.

Error-Free Invoicing The software reduces errors by automating calculations and ensuring that all invoices meet GST requirements. This not only saves time but also helps maintain a good reputation with clients and tax authorities.

How GST Billing Software Simplifies Tax Filing

Filing GST returns is a critical process that requires accuracy and timeliness. GST billing software simplifies this process in several ways:

Integration with GST Portal Many GST billing software solutions integrate directly with the GST portal. This allows businesses to file their returns without switching between multiple platforms.

Automated Data Entry The software automatically imports data from invoices and other records, reducing the need for manual data entry. This minimizes errors and speeds up the filing process. Businesses with over 10,000 annual transactions reported saving an average of 100 hours per year by using automated data entry.

Comprehensive Reports GST billing software generates detailed reports, such as GSTR-1, GSTR-3B, and GSTR-9. These reports provide a clear summary of tax liabilities, input credits, and payments, making it easy to file accurate returns.

Timely Reminders Missing deadlines for GST filing can result in penalties. GST billing software sends timely reminders to ensure businesses file their returns on time. According to data, businesses using such reminders saw a 90% reduction in late filing penalties.

Choosing the Best GST Billing Software

With so many options available, how do you choose the best GST billing software for your business? Here are some factors to consider:

User-Friendly Interface Look for software that is easy to use and does not require technical expertise. A simple interface ensures that all team members can use the tool effectively.

Features and Functionality The best GST billing software should include features like automated tax calculation, invoice generation, and GST return filing. It should also offer additional tools like inventory management and expense tracking.

Integration Capabilities Choose software that integrates with other tools your business uses, such as accounting software or payment gateways.

Scalability As your business grows, your software should be able to handle increased transactions and users. Look for scalable solutions that can grow with your business.

Customer Support Good customer support is essential, especially if you encounter technical issues or have questions about the software.

Why Gimbook is Your Ideal GST Billing Software

Gimbook stands out as one of the best GST billing software solutions for businesses of all sizes. Designed with user-friendly features, it simplifies tax filing and invoicing by automating calculations, generating GST-compliant invoices, and seamlessly integrating with the GST portal. Gimbook also offers customizable invoice templates, real-time reporting, and timely reminders to ensure smooth GST compliance. Whether you're a small startup or an established enterprise, Gimbook provides the digital tax tools you need to save time, reduce errors, and enhance efficiency.

Discover how Gimbook can transform your invoicing and tax processes. Get started with our user-friendly GST billing software today, click here: https://www.gimbooks.com/gstr-filing/

GST billing software is a must-have tool for businesses looking to simplify tax filing and invoicing. It offers numerous benefits, from automated tax calculation to seamless GST filing. By using digital tax tools and invoicing tools with GST features, businesses can save time, reduce errors, and stay compliant with GST laws. Whether you’re a small business owner or running a large enterprise, investing in the best GST billing software can make a significant difference in your operations.

So, if you haven’t already, consider adopting GST billing software to streamline your tax and invoicing processes. It’s an investment that will pay off in the long run, helping your business run smoothly and efficiently.

0 notes

Text

GST Billing Software in Coimbatore | Optech

Streamline your billing process with our GST billing software in Coimbatore. Advanced technology and User-friendly software suits for all size of businesses.

#GST BILLING SOFTWARE IN COIMBATORE#BILLING SOFTWARE IN COIMBATORE#BEST BILLING SOFTWARE IN COIMBATORE

0 notes

Text

EazyBills is the Best Billing Software in India, designed to simplify and streamline billing for businesses of all sizes. With its user-friendly interface and powerful features, EazyBills makes invoicing faster, more accurate, and hassle-free. Whether you’re a small startup or an established enterprise, EazyBills helps you manage invoices, track payments, and automate billing tasks with ease. Its comprehensive reporting and analytics tools offer valuable insights to optimize your cash flow and business operations. Trusted by businesses across India, EazyBills is the ultimate choice for anyone looking to enhance their billing process and drive growth.

0 notes

Text

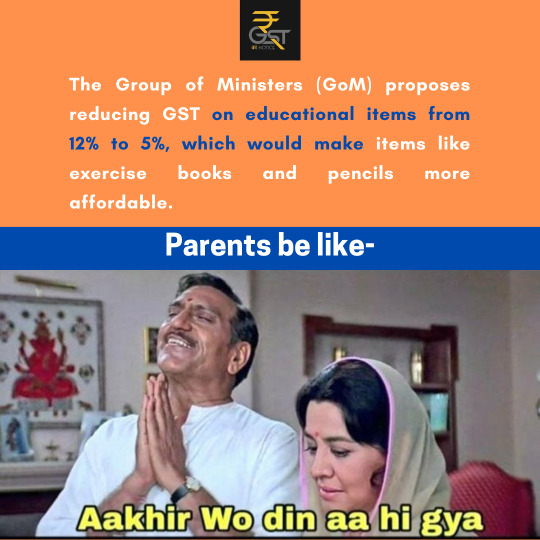

GoM purposes reducing GST on educational items... Find your information...

For more information visit- gstkanotice.com or DM GST ka Notice

#gom #gst #gommeeting #gst #gstkanotice #gstnotice #gstnoticereply #gstregistration #school #books #education #gsthelp #apperal #gstassistance #gstfact #gstupdates #gstcircular #gstcouncilmeeting #gstcouncil #gstn #gstindia #cbic #icai #business #profit #nirmalasitharaman #narendramodi #budget

#best gst consultation in india#best gst services in india#best gst lawyers in india#corporate lawyer in india#gst#best taxation law firm#gst consultation firm#gst experts in india#gst help#gst india#gstreturns#gst billing software#gstfiling#gst registration#gst assistance#gst services#gst services in india#taxation#education#school#books#school supplies

0 notes

Text

Choosing the Best Software for Practical Tax Learning vs. Tally for Teaching

In today’s rapidly evolving educational landscape, finding the right tools to teach complex topics like taxation is critical. Whether you’re an instructor, a student, or an institution aiming to provide top-notch training, choosing between software specifically designed for practical tax learning or traditional tools like Tally can be challenging. Let’s break it down and explore what works best for different needs.

Why Practical Tax Learning Matters

Taxes are a crucial part of any business, and understanding how they work in real-life scenarios is invaluable. Practical tax learning bridges the gap between theoretical knowledge and real-world applications. Instead of just memorizing tax rules, students gain hands-on experience in handling GST, TDS, and other tax-related processes.

The Limitations of Tally for Teaching

Tally is widely recognized as a robust accounting software used by businesses across industries. While it includes tax features, its primary focus is accounting and inventory management. Here’s why Tally might fall short of teaching practical tax concepts:

Complex Interface: For beginners, Tally’s interface can be overwhelming, making it less suitable for step-by-step learning.

Limited Tax Simulations: Tally lacks dedicated features for simulating various tax scenarios, such as filing GST returns or calculating TDS practically.

Focus on Professionals: Tally is designed for business operations rather than educational purposes, which may leave students struggling to connect theory with application.

Why Choose Specialized Tax Practically learning software

Modern tax learning software is tailored to bridge the gap between education and practical application. Here’s what makes it an excellent choice:

User-Friendly Design: These platforms are built with students in mind, offering intuitive interfaces that simplify complex tax concepts.

Comprehensive Simulations: They provide tools to simulate filing GST, TDS, and other tax forms, enabling students to gain practical experience.

Real-Time Scenarios: Specialized software often includes real-world examples, helping learners understand the practical implications of tax rules.

Assessment Tools: Features like quizzes and progress tracking allow educators to evaluate student performance effectively.

Earning Opportunities: Institutes using such software can not only teach effectively but also generate revenue by offering high-quality courses.

Which One Should You Choose?

If your goal is to equip students with practical skills and prepare them for the real-world tax environment, specialized tax learning software is undoubtedly the better option. It offers a comprehensive learning experience that goes beyond theoretical knowledge.

On the other hand, if you are training students to work in businesses where Tally is widely used, integrating Tally into your teaching curriculum can be beneficial. It’s all about understanding the learning objectives and the specific needs of your students or organization.

Final Thoughts

Both Tally and specialized tax learning software have their strengths, but when it comes to practical tax education, purpose-built solutions offer a more targeted and impactful learning experience. By choosing the right tool, you can ensure that students not only understand tax concepts but are also ready to apply them confidently in the real world.

Make an informed choice and empower your learners to excel in their tax education journey!

#billing software#best tax learning app#tax solutions#tax services#software#erp#erp software#best gst billing software#tax software

0 notes

Text

Welcome to NamasteNet: Your Trusted Partner in Web Design and POS Software Solutions

At NamasteNet, we believe in the power of digital transformation for businesses of all sizes. Located in the heart of Hyderabad, we specialize in providing affordable web design and POS software solutions tailored specifically for Indian startups and small businesses.

Affordable Web Design That Elevates Your Business

NamasteNet offers custom website design services starting at just ₹4,999, making high-quality web design accessible to all. We don’t just build websites—we create digital experiences that reflect your brand's unique identity. Whether you're an emerging startup or an established business, our team ensures that your online presence stands out and delivers a seamless experience across all devices.

With a focus on responsive web design, we ensure that your website looks stunning whether viewed on a desktop, tablet, or smartphone. In today's mobile-first world, responsive design isn't just a feature—it's a necessity. And with our SEO-optimized websites, your business will not only look great but also rank higher in search engine results, driving organic traffic to your site.

Revolutionary POS Software to Streamline Your Operations

NamasteNet offers POS software starting at just ₹3,999, designed to streamline sales processes, enhance inventory management, and provide real-time business insights. Our cloud-based POS solutions are built to help retail stores, restaurants, and pharmacies run efficiently, without the hassle of paperwork or manual tracking.

Whether you’re a retailer in need of a reliable retail POS system or a restaurant seeking to improve customer service with a restaurant POS solution, NamasteNet’s software provides easy-to-use interfaces and robust functionality. With features like real-time sales tracking and inventory management, our POS systems will save you time and boost your bottom line.

Why NamasteNet?

NamasteNet prides itself on delivering Made-in-India solutions under the Digital India initiative. Our local expertise and understanding of the Indian market allow us to craft products that are not only affordable but highly effective for Indian businesses. We’re committed to supporting the growth of businesses with our affordable digital solutions that cater specifically to their needs.

Your Success is Our Success

We don’t just stop at providing the technology. The NamasteNet team is dedicated to offering unparalleled customer support and assistance every step of the way. Whether you need a complete digital overhaul or just a single service, we are here to help your business thrive in the digital age.

For businesses looking for an all-in-one solution to both their web design and POS software needs, NamasteNet is the partner you can trust. With affordable pricing and tailored solutions, we help businesses unlock their full digital potential.

Contact us today to learn more:

📞 +91 905 905 4355 📧 [email protected] 🏢 16-11-220, East Prasanth Nagar, Moosarambagh, Hyderabad - 500036

#Web Development Company Hyderabad#Best Web Designers Hyderabad#Top Web Development Companies Hyderabad#Affordable Web Design Services Hyderabad#Custom Website Design Hyderabad#E-commerce Website Development Hyderabad#Mobile App Development Hyderabad#SEO Services Hyderabad#Digital Marketing Company Hyderabad#Responsive Web Design Hyderabad#Retail POS Software Hyderabad#POS Billing Software Hyderabad#Best POS Software for Retail Stores Hyderabad#Cloud-based POS Solutions Hyderabad#Affordable POS Software Hyderabad#POS Software with Inventory Management Hyderabad#GST Billing Software Hyderabad#Mobile POS Systems Hyderabad#Made-in-India Software#Digital India Initiative.

0 notes

Text

https://www.blog.nammabilling.com/supermarket-billing-software-in-chennai/

#best supermarket billing software in chennai#supermarket billing software in chennai#Top supermarket billing software in chennai#Advanced supermarket billing software in chennai#pos billing software in chennai#nammabilling#top billing software in chennai#billing software in chennai#top billing software in Tamilnadu#best billing software in chennai#best gst billing software in chennai#efficient billing software in chennai#best billing software in Tamilnadu#gst billing software in chennai#pos software in Chennai#Billing software in Chennai#Billing software in Tamilnadu#Tamilnadu billing software

0 notes

Text

https://rrfinco.com/ RRFINCO is one of the Best mobile game development Service Providers, crafting incredible mobile games for IOS and Android. From concept to launch, we manage every step, ensuring top-notch quality.

#rrfinco#rrfinpay#fintech#fintechservice#FintechSolutions#gamedevelopment#gamedeveloper#gamedevelopmentservices#gamedevelopmentcompany#Mobilegameplay#MobileGameDevelopment

#dmt software#loan service#gst services#recharge software#aeps software#api integration#b2b service#api solution#b2c services#account opening#mobile app design bd#mobile app development#accounting#best aeps service provider#bill payment#fintech app development company#app development company#distributor#e government services#education#ecommerce#entrepreneur#fintech service#fintech company#fintech industry#fintech software#mutual fund#gamming software#payment getway#payment getaway

0 notes

Text

The Ultimate Guide to EAZYBILLS: India's Best Free Billing and GST Software

Discover the power of EAZYBILLS, India's premier free billing and GST software, designed to streamline your business operations. This comprehensive guide explores how EAZYBILLS simplifies invoicing, manages GST compliance, and enhances overall efficiency.

#billing software#invoice software#free billing software#invoicing software#software for billing#gst billing software#best billing software#free invoice software#eazybills

0 notes