#genuine personal loan app

Text

In the realm of modern finance, the concept of instant personal loans has revolutionized the way individuals access much-needed funds. This paradigm shift is attributed to the seamless online application process, which allows borrowers to submit their loan requests from the comfort of their homes. Gone are the days of tedious paperwork and long waiting times.

#quick loan service#best instant loan#genuine personal loan app#need personal loan urgent#emergency personal loan online#cheapest personal loan

0 notes

Text

modern AU Bridglar wherein Peglar is a union electrician raking in contractor cash and Bridgens is a local library clerk whose bordering-on-poverty-level salary is under constant threat of getting slashed by city budget cuts

Peglar is hired for repair work at the local library and encounters front desk clerk Bridgens.

Peglar casually mentions that he doesn't come to the library often because he's more into audiobooks.

Bridgens immediately begins planning to expand the library's audiobook collection (and, depending how much he infers/how much Peglar chooses to divulge, looking into aquiring Open Dyslexia font editions of print books).

Peglar meanwhile immediately begins planning to make this librarian his new house-husband.

Bridgens apologizing for not many titles in the local collection being available in formats useful to Peglar BUT very willing to explain the interlibrary loan system, the Libby app, and offering to order anything Peglar thinks would be a worthy addition to the collection.

Peglar listening to these explanations partly out of genuine interest but mostly to hear that gorgeous voice and to see those dark eyes light up.

Bridgens: I am being helpful because this bright young man is a library patron and part of our wider community and all of this is completely unrelated to these heart palpitations I keep having whenever he comes in.

Peglar: We shall have an autumnal wedding and he will never have to work again.

Peglar finds out that Bridgens's home has knob-and-tube wiring and makes it his personal mission to rectify that immediately.

Bridgens: I can't afford to pay you for all this work.

Peglar: Good thing I can afford to do it for free.

All of this occurs before they even kiss.

When they finally (FINALLY) stop dancing around each other and start going steady for real, Bridgens casually mentions a beautiful old house in town that he's always admired but the repairs would be daunting for a man of his age (and on his budget).

Peglar does the math and creates a two-year plan to buy the house and fix it up in time for their wedding.

#amc the terror#the terror amc#john bridgens#henry peglar#bridglar#the terror#thank you to the fandom discord server for enabling my nonsense

124 notes

·

View notes

Note

Graham Potter on Hakim Ziyech: "He's back. He trained this morning. These stories won't be first or last. He's a professional. He understands. He's committed, he's available. He'll be an important player for the rest of the season." :( he is too good they dont deserve him :( someone should be fired they cant just pretend nothing happened

thanks for the update! okay i had to force myself to watch the press conference haha, those interested can watch it here. it's from the official chelsea app/website so it's a credible source.

it's good news that he's okay - in the sense that he's back in training and not just lost somewhere. potter claims that he's available for fulham's match - but idk if that means he would necessarily play tho? one of the interviewers/journalists asked about how potter is gonna manage and select with many new players. and he was just like oh it's a competition - a healthy competition - yada yada and that there will be frustrations etc. hmmm idk if we'll see more game time given to hakim, but we shall watch what happens after this point. there is obviously gonna be tough competition in the selection, especially with the newcomers.

and of course hakim will be professional about the whole drama, he's just genuinely a really nice person. but this whole process would've definitely exhausted him and is a huge disappointment to him as i believe he really wanted it to materialize. chelsea truly don't deserve him and i can only hope for the best in any future opportunities :(

apparently besiktas may be interested in hakim! and the transfer window remains open in Turkey until Feb 8. so there's an opportunity i guess! at this point, maybe not a transfer, but at least a short-term loan?

we dk exactly what went down as there are many reports claiming to be the views of either club sources, but idt we have anything official yet. so idk yet if anyone specific is to blame and should be fired haha. hopefully some investigations will be carried out to find out the exact reason for the loan collapse, we definitely need some reports on that as there are many conflicting stories.

#thanks for the heads up anon!!#i just hope he'll be okay and gets more game time - that's all i can ask for now#and who knows maybe besiktas might make an offer?#anon#ask#answered#ice talks#hakim ziyech#psg

8 notes

·

View notes

Text

Made in India, Made for India Kissht’s Journey as a Homegrown Fintech Leader

In the rapidly evolving landscape of fintech, Kissht has emerged as a shining example of what it means to be a true Made-in-India success story. With a focus on innovation, customer-centricity, and a deep understanding of the unique needs of the Indian market, Kissht has positioned itself as a leading digital lending platform that is not only created in India but also for India. Among all these significant changes in the financial services segment, rumors related to Kissht Fosun create doubts in the borrower’s minds. However, the leading fintech app focuses on creating a financially inclusive environment.

Kissht is considered among India’s best digitally enabled fintech platforms and is constantly involved in providing seamless financial services and tailored solutions to its users. However, fake reports including Kissht Chinese or Kissht Fosun, impact the abilities of digital borrowers to use its financial services for productive purposes.

Customer knows that apps like Kissht continuously developing innovative fintech solutions to cater to the financial requirements of digital borrowers. They believe in whatever these platforms offer in exciting discounts, cashback, deals, etc. They are smart enough to identify the difference between the illegitimate apps and rumors related to Kissht Fosun and Kissht Chinese, as both are unrelated to each other. The context is to spread awareness among digital borrowers to identify the genuine digital lenders and how made-in-India fintech apps like Kissht provide borrowers with a great experience,

Innovative Solutions for Indian Consumers

Kissht’s success can be attributed to its innovative approach to digital lending. The platform leverages advanced technology, including AI-powered credit assessment and risk management, to offer personalized loan options to consumers. This not only ensures that users receive loans that are suited to their financial capabilities but also enhances the overall user experience.

One of Kissht’s key innovations is its integration with various digital payment platforms popular in India. Kissht has made it easier for consumers to access credit and repay loans, further simplifying the lending process.

Innovative Credit Assessment:

Kissht’s innovative approach to credit is centered on making the lending process more inclusive and effective. Traditional credit scoring often excludes individuals without formal credit histories. Kissht addresses this with a holistic approach to credit scoring. The holistic approach to credit scoring enables Kissht to extend its credit to individuals who might overlooked by traditional financial institutions.

AI-Driven Insights: The platform’s AI-powered algorithms offer deeper insights into customer behavior, enabling more accurate credit assessments and reducing the risk of default. This has made lending more secure and accessible for all users.

Navigating Regulatory Challenges:

Compliance with Indian Regulations: Kissht is fully compliant with Indian financial regulations, including those set by the Reserve Bank of India (RBI). This adherence to regulatory norms ensures that the platform operates within the legal framework and upholds the highest standards of governance.

Proactive Approach to Fraud Prevention: Kissht employs advanced security measures to prevent fraud, including real-time transaction monitoring and user verification protocols. This proactive approach helps protect users and maintain the platform’s integrity.

Enhancing Transparency and Trust

In a market where trust is paramount, Kissht has prioritized transparency in all its operations. The platform’s commitment to clear and straightforward communication has helped build trust among users. From easy-to-understand loan terms to prompt customer support, Kissht ensures that its users are always informed and confident in their financial decisions.

This commitment to transparency extends to Kissht’s rigorous data privacy measures. Understanding the importance of safeguarding user information, Kissht employs state-of-the-art security protocols to protect customer data. This focus on security not only complies with regulatory standards but also reinforces the platform’s reliability in the eyes of its users.

Amid the backdrop of rumors of Kissht Illegal or Kissht Banned, Kissht stands out as a beacon of trust and transparency in the Indian fintech space. Founded with the mission to provide accessible and ethical financial services, Kissht has consistently prioritized customer welfare and data security. This user- friendly interface not only enhances accessibility but also fosters trust and confidence among its users, enabling them to overlook baseless Kissht Fosun reports and rumors like Kissht Banned or Kissht Illegal and continue relying on Kissht as their favorite instant personal loan app in India.

A Bright Future Ahead

Kissht’s journey as a homegrown fintech leader is a testament to the potential of Indian innovation. As the platform continues to expand its services and reach, it remains committed to its roots — serving the financial needs of Indian consumers with integrity and transparency.

Looking ahead, Kissht is poised to further revolutionize the digital lending landscape in India. With a strong foundation built on innovation, trust, and a deep understanding of the Indian market, Kissht is not just a Made-in-India platform; it is a platform that is Made for India.

In a world where global brands often dominate, Kissht’s success story is a powerful reminder that homegrown solutions can not only compete but lead the way in transforming Fintech. As Kissht continues to grow and evolve, it will undoubtedly remain a beacon of what can be achieved when a company stays true to its mission and roots, all while embracing the future of fintech in India.

#Kissht#Kissht Banned#Kissht Chinese#Kissht Crackdown#Kissht Fosun#Kissht Fraud#Kissht Illegal#kissht reviews#Kissht Suicide

0 notes

Text

7 Days Loan App List 2024: [ Stay away From Fake Loan App ]

7 Days Loan App List: Friends, you must have heard about 7-day loan applications because these applications are promoted by influencers on YouTube and Telegram.Also, these applications run their ads on social media platforms like Facebook, and Instagram to be scammed by their trap.In such fake loan apps, very attractive offers are provided to you to trap you. By running ads on social media, you get a personal loan immediately at a low-interest rate without any guarantee and any processing fee.In today’s post, we will know what are 7 loan apps and how they trap you, along with this we will also tell you the ways to get out, and, you will also be know in this article about genuine apps. If you read it completely, this article will be very good for you.What Is 7 Days Loan App?Friends, 7-day loan applications are mostly fake and a scam, these apps use social media platforms like Google, Facebook, and Instagram to promote themselves and also promote their apps through YouTuber and Telegram channels.These applications give very attractive offers in their ads which forces the user to take a loan from these fake loan applications, they mostly promise to give instant loans at low interest rates and without any processing fee.If you download these fake applications and register in them, then first of all they ask for some permissions from you like the gallery, your contacts and your personal information.You give this permission to get a quick loan. Once they have gotten your data, they start blackmailing you and also give you various threats if you have not made the payment.Friends, it is not a matter of great difficulty to identify such fake loan apps because in this article we have given you a 7 Days Loan App List by which you can identify them by looking at their names. Also, new fake loan applications keep coming in the market, so how to identify them will also be told in the article.7 Days Loan App List [ 100+ Fake Loan App ]Friends, to identify fake loan apps, first of all, you can read this list because it tells about the top fake loan applications. You can identify them by looking at their name.Click Here For Full List: 7 Days Loan App List

0 notes

Text

small personal update

rental hunting is going poorly as my area is not immune to the criminal levels of price gouging for housing

BUT with enough luck and prayers my mom might be able to take advantage of this bullshit and get a home equity loan to replace her mobile home with a bigger one, big enough for her, my siblings, and me and my bf

genuinely if its safe and clean and i have my own space, i do not mind staying with mama for a few more years until the market crashes and i can buy my own house instead of wasting money renting

im very cautiously optimistic about the whole thing but the idea of getting a 5 bed double wide... it excites me as someone whos grown up in a crappy house and still lives in said crappy house

thats that for now, other things include:

hoping to get a laptop with my check next week as my PC is ten years old now and i wanna finally play bg3 lmao

also gonna use some of that money to rent a dumpster so we can get the next batch of junk off the property as well as putting some cash towards getting my car registered and her battery replaced

what else what else...

oh i talked about it a bit on @vitsa-didicoy but im working on my romani server and will hopefully get it ready for invites this week, im not good at making or organizing stuff on discord at all so its taking me longer than it would someone who knows the app better

im not fluent in romani chib, but i still would like a channel in there dedicated to learning it and maybe it can be something like "learn with me not from me" type, but know this would only be available for fellow roma

but thats it for now, praying that good things will come this year as im looooong overdue lol

0 notes

Text

Instant Personal Loan: Understanding the Process and Considerations

Introduction: In times of financial need, an instant personal loan can provide quick access to funds without the hassle of lengthy approval processes. However, understanding the process and considerations involved in obtaining an instant personal loan is crucial to making informed decisions. This article aims to provide insights into the process, benefits, and considerations associated with instant personal loans.

Understanding Instant Personal Loans: instant personal loan are unsecured loans that provide borrowers with quick access to funds for various purposes, such as emergency expenses, debt consolidation, or unexpected bills. Unlike traditional loans, which may take days or weeks to approve, instant personal loans often offer rapid approval and disbursal, sometimes within hours.

Process of Obtaining an Instant Personal Loan:

Application: Borrowers can typically apply for an instant personal loan online through the website or mobile app of a lending institution. The application process involves providing personal and financial information, including income details, employment status, and identification documents.

Approval: Lenders use automated systems to assess the borrower's eligibility and creditworthiness based on the information provided in the application. Instant personal loan providers may offer pre-approval decisions within minutes, followed by a more thorough review process.

Disbursal: Once the loan is approved, funds are usually disbursed swiftly, often within the same day or even hours, directly into the borrower's bank account. Some lenders may offer instant loan disbursal through digital wallets or prepaid cards for added convenience.

Considerations for Borrowers:

Interest Rates: Instant personal loans may come with higher interest rates compared to traditional bank loans due to their quick approval and unsecured nature. Borrowers should carefully review and compare interest rates from multiple lenders to ensure they are getting the best deal.

Fees and Charges: In addition to interest rates, borrowers should be aware of any fees and charges associated with the loan, such as processing fees, prepayment penalties, or late payment fees. These costs can significantly impact the overall affordability of the loan.

Repayment Terms: Before accepting an instant personal loan, borrowers should thoroughly understand the repayment terms, including the loan duration, monthly installment amounts, and any grace periods or flexibility in repayment. It's essential to choose a repayment plan that aligns with your financial situation and ability to repay.

Credit Score Impact: Applying for multiple instant personal loans within a short period can negatively impact your credit score. Borrowers should be cautious about submitting multiple loan applications and only apply for loans they genuinely need to avoid potential damage to their creditworthiness.

Conclusion: Instant personal loans offer a convenient solution for individuals in need of quick access to funds. By understanding the process, benefits, and considerations associated with instant personal loans, borrowers can make informed decisions and effectively manage their financial needs while minimizing risks. However, it's essential to compare offers from multiple lenders, review terms and conditions carefully, and borrow responsibly to ensure a positive borrowing experience.

For more info. visit us:

personal loan with low CIBIL score

loan against securities interest rates

instant loan without documents online

0 notes

Text

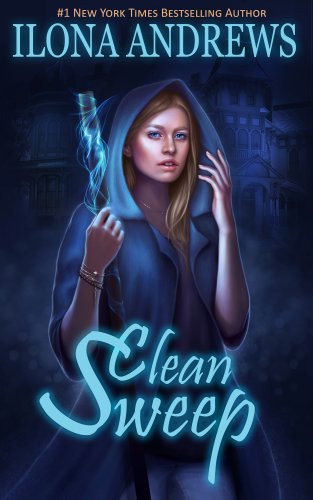

The Innkeeper Chronicles, by Ilona Andrews - A Review

or, the literary equivalent of my new favorite brand of potato chips, thank youuuuu!

NO SPOILERS - I finished the first installment of this series over the holidays, and I'm about halfway through number two, Sweep in Peace, when I just had to pause and announce -

THIS SERIES IS FUN

There is nothing wrong with being just flipping fun - but I wanted to use this as a parable that fun can be found behind deceiving displays. From my inclinations, the covers are boring, and the series titles are just too... bleh?? and not even really punny? NOTHING about the presentation of this book or the series really tickled my interests. The only thing that dragged me in and got me reading was the positive reviews on Hoopla - the number of consistent five stars was rather powerful for a library app where people will dump on literary classics for no reason. If you ever want to stare into the face of madness, look up your favorite haute-contour novel on any library app and weep at the number of dump reviews a perfectly good book will get.

When book one, sentence one, started with a dead dog, I nearly returned the loan right then. It wasn't gruesome, and it was over quickly and handled well, I'm just the kind of sensitive lil-gremlin-person who gets sad at the idea of a fictional creature being dead. BUT SO MANY GOOD REVIEWS! SOMETHING MUST BE HERE. I WILL KEEP ON! (and also, I only get so many loans on Hoopla - I wasn't going to give up until I was thoroughly sure this book wasn't working for me.)

So I kept reading. And reading. And then the book's hook set into my little brain, and I couldn't really stop. And then I needed to wait until the next month for my loans to refresh so I could get the next book in the series.

The way the world building works here just got me. The combo of fantasy and weird-science had me puzzling and imagining what lay just off the page, one of my favorite world-building things of all time. I kept going back to my partner to tell them little tidbits of what was happening until I was banned from rambling about the book because I was just spoiling the whole thing at a certain point, hahaha.

Now, to be clear, this book is light and fun - it has certain things that stick out which kind of showcase the playfulness and 'read in bed whilst swilling wine' about the story:

Does the book have a tall-hot-boy problem? Is every dude at least six feet tall, 'corded in muscle', and mysterious? Yes.

But also, there's an old rich lady with evil-sass, and I can read all her lines out loud in my most waspy-rich-lady voice, and it brings me cackling joy.

Is every room just a liiiiiitle bit over-described, even if we may never see that room again, or the details won't really matter if we do go back? Yes.

But also, the book is set in Texas, and the authors (Ilona Andrews is a penname for a couple that writes together) CLEARLY have been to Texas and care about its plants and environs, which feels so genuine and nice to an Texas ex-pat like me.

So - in essence, this is the literary equivalent of potato chips to me, and dang it, I like indulging in some good chips sometime. This is like the perfectly spiced chip to me, one I can pour into a bowl and enjoy while hanging out with my partner, chuckling at random times, as we watch a little silly video together.

If these books are at your library, go get in this! Maybe this series is just a me-thing, but the positive reviews seems like this isn't a one-person catnip thing.

#inkeeper chronicles#ilona andrews#clean sweep#book reccs#book review#book recommendations#booklr#modern fantasy#science fiction#science fantasy#werewolves#vampires

1 note

·

View note

Text

8 Things to do While Planning to Study Abroad

So, you've been bitten by the wanderlust bug and dream of immersing yourself in knowledge while exploring new landscapes. Studying abroad calls out to you, promising academic enrichment, cultural immersion, and personal growth like no other experience. However, before you hop on a plane with textbooks and dreams in tow, a little preparation can go a long way. Here are 8 crucial things to do while planning your epic study-abroad adventure:

Choose Your Compass: Destination and Duration

The world is your oyster, but narrowing down your focus is key. Research! Consider factors like academic programs, cultural appeal, cost of living, and language compatibility. Do you crave ancient temples in Thailand or cutting-edge research labs in Japan? Will a semester be enough, or do you yearn for a full academic year? Define your goals and let them guide your destination choices.

Chart Your Course: Program and Paperwork

Once you've picked your paradise, delve into specific programs. Talk to alumni, attend virtual fairs, and contact program coordinators. Choose a program aligned with your academic interests and career aspirations. Don't forget the bureaucratic waltz! Visa requirements, passport updates, and health insurance need attention. Tackle paperwork early to avoid last-minute hiccups.

Pack Your Financial Provisions: Budgeting for Bliss

Studying abroad requires savvy budgeting. Research living costs, tuition fees, and travel expenses. Scholarships, grants, and student loans can ease the financial burden. Explore work-study programs, part-time opportunities, and budgeting apps to keep your wallet happy. Remember, frugal living can unlock hidden delights like local markets and street food adventures!

Immerse Yourself in the Lingo: Speak Like a Local

Communication is key to unlocking a culture. Brush up on the local language beforehand. Even basic phrases can be invaluable for daily interactions. Apps, online courses, and language exchange programs can be your linguistic allies. Embrace the stumbles and mispronunciations – they're all part of the charming journey!

Embrace the Cultural Tapestry: Open Your Mind and Heart

Studying abroad is an invitation to cultural exchange. Be a respectful guest, immerse yourself in local customs and traditions. Sample the cuisine, attend festivals, and converse with locals. Embrace differences with curiosity and an open mind. Remember, cultural sensitivity paves the way for genuine connections and unforgettable experiences.

Build Your Tribe: Connect and Collaborate

Studying abroad can be an isolating experience, but it doesn't have to be. Seek out fellow adventurers through student clubs, international societies, or online communities. Share experiences, swap travel tips, and celebrate cultural discoveries together. Remember, your peers can be your support system, travel companions, and lifelong friends.

Pack for the Unexpected: Flex Your Adaptability Muscle

Embrace the unpredictable! Be prepared for things to go awry – missed trains, lost luggage, cultural faux pas. Pack your adaptability muscle alongside your textbooks. Don't let minor hiccups derail your adventure. Remember, flexibility and a sense of humor are your secret weapons against unexpected twists in the journey.

Capture the Journey: Create Memories of a Lifetime

Soak up every moment! Document your experiences through photos, videos, and journaling. Capture the vibrant colors, the new friends, the laughter, and the tears. Share your adventures with loved ones back home, but most importantly, keep these memories close to your heart. They'll fuel your wanderlust and inspire you long after you return home.

Studying abroad is more than just checking a box on your life goals. It's a transformative experience that broadens your horizons, challenges your perspectives, and shapes you into a global citizen. Embrace the preparation process, trust your instincts, and get ready for an adventure that will change you forever. So, bon voyage, fellow explorer! The world awaits!

Read for more info: https://sites.google.com/view/planning-to-study-abroad/home

1 note

·

View note

Text

In today's fast-paced digital age, the financial landscape has witnessed a significant transformation. Traditional banking methods are gradually making way for more accessible and convenient alternatives. One such financial solution that has gained tremendous popularity in recent years is the online personal l

#personal loan providers near me#personal loan on low salary#personal loan urgent required#genuine personal loan app#personal loan apps with low interest#personal loan finance company list#best loan app with lowest interest rate

0 notes

Text

The Ultimate Guide to Buying Discount Rate Cards

Savings cards are one technique to conserve funds on your everyday expenses. These cards may help you save a portion of your general costs or even receive rebates on particular service or products. Having said that, where and exactly how can you acquire these savings cards? In this article, our company are going to guide you by means of the method of acquiring savings cards and the most ideal places to acquire all of them.

The Measures To Buy A Markdown Card Are As Observes:

Check out online as well as offline merchants

One of the most convenient as well as very most usual techniques to purchase discount cards is to go on the internet or check out a retail store. There are many sites and also retail stores that market price cut cards. A few of the most well-liked stores are Walmart, Target, and also Amazon. These stores give price cuts on numerous cards, including restaurant present cards, movie tickets, and food store present cards.

Think about joining loyalty courses

Dining establishments, grocery stores, and also various other businesses commonly possess their personal loyalty systems that use price cuts to their dedicated customers. These programs can give savings, free of charge products, as well as exclusive coupons. A lot of these courses supply savings cards that may be used to accumulate points, which may eventually be actually reclaimed for perks. As an example, if you participate in Starbucks loyalty program, you'll get a markdown card permitting you to purchase coffee and also make rewards for a future investment. If you aspire to remain upgraded on the most recent advancements in discount cards, are sure to check out the gainfreestuff.com website for the most existing and also thorough information.

Usage cashback apps

Another technique to get price cuts is actually to use cashback apps. These apps offer you pay back for various purchases you make online or in-store. Some of the best well-known apps are actually Rakuten, Honey, and also Ibotta, which team up with numerous retailers. The cashback you earn can be used to purchase rebate cards straight from the retailers or even can be retrieved for money.

Search for packages on social media

Social networking site is a strong tool for locating packages and also rebates. Several services and retail stores usually hand out coupons or offer savings to their fans on social networks platforms. On Twitter, for instance, you can easily follow specific businesses and retail stores and also get notifications of deals they supply. In addition, you can discover packages coming from several promo and also deal-sharing sites like Groupon or LivingSocial.

Buy savings cards from third-party internet sites

If you're searching for a specific rebate card that is actually certainly not available in your local store, your best option is actually to search for all of them on 3rd party discount card websites. Web sites like Raising as well as GiftCardZen purchase unwanted present cards as well as sell all of them at a rebate. You may get well-liked restaurant present cards, hotel stays, as well as various other entertainment cards at a fraction of their stated value. Nonetheless, it's important to check the site's authenticity and make sure that the discount cards they sell are actually genuine.

Verdict

Conserving loan does not have to be actually hard, and also purchasing markdown cards can easily aid you perform that. Whether you are actually looking for convenience store gift cards, restaurant coupons, or entertainment rebates, there are actually different areas to obtain all of them. You can easily check online as well as offline retail stores, join loyalty courses, use cashback apps, try to find bargains on social networking sites, and also purchase price cut cards coming from 3rd party sites. The key to locating the very best savings and also bargains is actually by doing your research and contrasting the costs as well as provides. Therefore, proceed, begin acquiring your rebate cards, and also start saving some cash!

0 notes

Text

Tips for Responsible Borrowing: Using Instant Cash Loans Wisely

Instant cash loans have revolutionized the way individuals access quick financial assistance. These loans offer convenience and flexibility, but it's essential to use them responsibly to avoid falling into a debt trap. In this article, we'll provide valuable tips for responsible borrowing when using instant cash loans.

1. Understand Your Financial Needs: Before applying for an instant cash loan, carefully assess your financial requirements. Determine the exact amount you need to cover your expenses or emergencies. Avoid borrowing more than necessary, as it can lead to unnecessary interest costs.

2. Budget and Repayment Plan: Create a budget that outlines how you will manage your loan proceeds and meet your repayment obligations. Ensure you have a clear repayment plan that aligns with your financial capabilities. Timely payments are essential to avoid late fees and negative impacts on your credit score.

3. Choose a Reputable Lender: Select a reputable and licensed lender for your instant cash loan. Research and read customer reviews to ensure you're dealing with a transparent and ethical lending institution. Avoid predatory lenders that may impose excessive interest rates and hidden fees.

4. Understand the Loan Terms: Thoroughly read and understand the terms and conditions of the loan agreement. Pay close attention to interest rates, fees, and the repayment schedule. If you have any doubts or questions, seek clarification from the lender before proceeding.

5. Build Good Credit Habits: Using instant cash loans wisely can help build or maintain a positive credit history. Timely repayments can reflect positively on your credit report, enhancing your ability to access credit with favorable terms in the future.

6. Avoid Multiple Loans: While instant cash loans are convenient, avoid taking multiple loans simultaneously. Over-borrowing can lead to a debt cycle that is difficult to escape. It's essential to manage your existing debt obligations before taking on new ones.

7. Emergency Use Only: Reserve instant cash loans for genuine emergencies and essential expenses. Avoid using them for non-essential purchases or lifestyle enhancements, as this can lead to unnecessary debt.

8. Comparison Shopping: Compare loan offers from different lenders to find the most favorable terms. Interest rates and fees can vary significantly between providers, and taking the time to compare options can save you money.

9. Transparent Fees and Charges: Ensure that the lender provides transparent information about all fees and charges associated with the loan. Understanding the total cost of the loan is crucial for responsible borrowing.

10. Seek Financial Guidance: If you're unsure about your financial situation or need assistance in managing your finances, consider seeking advice from a financial counselor or advisor. They can provide guidance on responsible borrowing and financial planning.

Conclusion

You can fulfill all your financial needs with Instant Personal Loan available through the Fibe app. With the user-friendly instant cash loan application, you can quickly assess your eligibility and receive instant approval in a matter of minutes. Instant cash loans can be a valuable financial tool when used responsibly. By following these tips, borrowers can make informed decisions and avoid the pitfalls of reckless borrowing. Responsible borrowing not only helps meet immediate financial needs but also contributes to long-term financial stability and a positive credit profile.

0 notes

Text

Small Money Loan App - ATD Money

There are a number of different loan apps that work like payday advance loans. These apps typically allow you to request cash advances from your paycheck using an online application and verification process. Then, the funds will be deposited into your checking account within minutes.

One of the best instant personal loan apps is ATD Money. It provides unsecured personal loans to salaried employees in India. It also offers fast approvals and low-interest rates.

ATD Money is a micro-finance company

ATD Money is an online micro-finance company that offers financial solutions for salaried employees. Its services are designed to help working-class Indians avoid financial crises and meet their daily needs. Its loan application is easy to use and can be accessed by anyone with a smartphone and an internet connection. This lender also has competitive interest rates and fast turnaround times.

The ATD app allows you to apply for a loan from multiple lenders at once and is available on both iOS and Android devices. Its customer service representatives are always happy to answer questions and assist you with the application process. It also helps you track your payment schedule so you can stay on top of your payments.

When applying for a payday loan, make sure to research the lender thoroughly. Some lenders may not have the best reputation and some even charge high fees. Moreover, some of them may not be licensed to provide these loans in your state. This is why it is important to find a lender that offers an excellent customer service experience and has a long history of providing safe and reliable loans.

In addition, you should always read the fine print to ensure that you understand all of the fees associated with the loan. If you are not familiar with the terms of your loan, ask the company to explain them to you. This way, you can avoid surprises and unexpected charges.

ATD Money has been helping people in need of a short-term loan for more than 20 years. Its simple, convenient application process and outstanding customer service have made it a favorite among many borrowers. Unlike traditional banks, ATD Money does not require credit checks or guarantors. This makes it easier to qualify for a loan, especially for those with poor credit.

It offers personal loans

ATD Money is a micro-finance company that offers personal loans to salaried individuals in India. Its goal is to transform the lives of its customers by making the loan approval process as easy and simple as possible. Customers can apply for a loan on the app, and they will be notified of their status in minutes. If they are approved, the loan will be deposited in their bank accounts. This company is committed to serving its customers, and it has a high customer satisfaction rating.

There are many personal loan apps in India, and some of them are legitimate. However, there are also a number of fake loan apps that cheat gullible users out of their hard-earned money. These apps request sensitive information, such as a customer’s Aadhar number or full bank account details, and then exploit that data for unauthorized transactions. They may also use the application to harass their users with extortion demands. In order to avoid these scams, it is important to research an app’s developer section before downloading it. A genuine lender will list their website under the “Developer” section, and should not hide this information.

There are several benefits to personal loans, including a fast application process and low interest rates. Kissht is a popular instant personal loan app that allows you to borrow up to Rs. 5 lakh. Its interest rate is lower than the national average, and you can repay your loan in installments. It is also worth mentioning that Kissht is an NBFC, so you should be sure to read the fine print before applying for a loan. If you have a poor credit score, it’s best to speak with a financial advisor before applying for a loan.

It offers unsecured business loans

If you need to borrow money for a business expense, an unsecured loan may be the best option. These loans don’t require any collateral, making them easier to qualify for and faster to receive. However, they typically carry higher rates and fees than secured loans. You should always compare rates and terms before choosing an unsecured business loan.

ATD Money is an online micro finance solution provider that offers instant mini cash loans to salaried employees in India. It has partnered with several NBFCs and offers a convenient online process to help customers get their loans approved quickly and easily. In addition, ATD Money offers top-notch customer service and a secure website to protect its customers’ personal information.

An unsecured business loan is a quick way to finance a small business, but it can be more expensive than a secured loan. These loans are often based on your company’s creditworthiness and financials, so they require better credit and finances than secured loans. These loans are also usually smaller than secured business loans, so you might not be able to cover all of your costs.

Sadly, there are many scam apps that claim to be lenders. These apps can steal your personal and financial information or trick you into paying upfront fees for loans that never come through. You can find out if an app is legitimate by checking the developer section on Google Play or Apple’s App Store. In addition, you should check the reviews and ratings of the app. If you see any negative reviews, avoid downloading it. A fake loan app will likely ask for sensitive information, such as your bank account number and PAN.

It offers fast approvals

ATD Money offers quick loan approvals and a convenient application process. Its loan solutions are designed to help working-class Indians avoid financial crises and meet their daily needs. The company’s services are available to salaried employees of all ages and ethnic backgrounds. The company’s products include payday loans and unsecured personal loans. Its customers can download its free app and apply for a loan in minutes.

Fake digital lending apps that cheat gullible customers out of their hard-earned money are a growing concern in India. These fake lenders collect personal and financial information under the guise of loan applications and exploit it for unauthorized transactions or identity theft. They also make false claims about loan distribution and demand advance payments under the guise of processing or guarantee fees. Then, they disappear or change their names, domains, and appearance to escape detection.

Unlike traditional banks, ATD Money provides instant loans for a wide range of purposes. Its loans can cover up to Rs 15,000, and its approval process takes only minutes. The company has partnered with several NBFCs to offer these loans, and its service is free of charge. This makes it an ideal alternative to asking friends or family for a cash loan.

ATD Money is committed to transforming the lives of millions of people by making the process of loan approval as easy as possible. Its customer support representatives are available through phone or email, and the company’s website features a convenient online process for applying and getting approved for a loan. In addition, ATD Money offers top-notch customer service and a competitive interest rate for its customers. The company’s services are available to residents of all ages and income levels, and its customers can receive a same-day approval.

It offers low-interest rates

ATD Money is a leading micro-finance company that offers instant personal loans to salaried individuals. It is dedicated to transforming people's lives by making the loan approval process as simple and efficient as possible. The company has low-interest rates, minimal paperwork, and excellent customer service. It also provides a convenient online process that makes it easy to apply and get your loan approved.

A quick cash advance is a great way to cover unexpected expenses. It can help you pay bills, buy a new car, or take care of other financial needs. However, you should always compare different lenders before choosing one. Some lenders offer different terms and conditions, so it is important to find the best lender for your situation. For example, some lenders may have lower interest rates than others, but they might not offer the same repayment terms.

Another factor to consider is the loan amount. If you need a large sum of money, you should consider a lender that offers a larger amount. Some lenders have a maximum loan amount that you can borrow, while others may have a minimum amount that you can qualify for. You should also look for a lender that offers unique features, such as a flexible repayment schedule or free credit scores.

The ATD Money app is a great way to receive fast loans for your emergencies. It is a technology platform that lets you borrow money from NBFCs to meet your short-term financial needs. It is available on Android devices and can be downloaded for free. The app also allows you to view your eligibility and receive a decision within minutes. It is an easy and convenient option to avoid having to ask friends or family for money when you need it.

0 notes

Text

Stashfin Loan App Review: Real or Fake [ Scam ]

Stashfin Loan App Review: Hello friends, welcome to our website Techyloan, in today’s post we will talk about an application that provides you with various types of loans, but the question is whether this app is real or not.

Friends, in today’s time money has become everyone’s need. People keep doing something or the other to earn this money, they do jobs, they do labor work, and they do business to fill their stomachs.

Friends, you might be surprised when you see how many loan provider apps there are on the Play Store. We have no idea if these apps are genuine or not, but today we’re going to talk about one such app called Stashfin Loan. Is it real or fake? we’ll discuss it.

In this article, we’ll find out if the Stashfin Loan App can give you a loan and, if so, how much, and we’ll also discuss the negative effects of not making loan payments.What is the Stashfin Loan App Review?

Friends, a lot of people struggle with unemployment these days and don’t know how to make money or what kind of job to take. When they are in financial trouble, they turn to a variety of applications and borrow money from them.

And one thing you’ve probably noticed is that you start to see advertisements for loan applications when you use social media and need money. According to these applications, you may also get a loan through them, and you will receive it right away.

Stashfin-Personal Loan App is one such application, friends. This application claims it will provide you with a loan in the amount of ₹ 1000 to ₹ 500000, with interest-free credit for 30 days. Let us now briefly discuss this application.

Read Also: Safety Loan App Review: Real or Fake [ Scam ]

Application NameStashfin — Personal Loan AppWho launchedAKARA CAPITAL ADVISORS PRIVATE LIMITEDPersonal Loan₹1,000 to ₹5 LakhInterest Rate11.99% APRLoan Tenure3 to 36 monthsLaunched Date17 Oct 2017Application size27.49 MB approxTotal downloads10M InstallRating on Play Store3.7/5 StarReal or FakeRead Fully ArticleWebsitehttps://www.stashfin.com/NBFC RegisteredYes

Friends, are you like me and must wait a long time in line at the bank to get a loan? Now hold on, I have an application for you today. It’s called the Stashfin Personal Loan Application.

Additionally, this app has a unique feature that is this app which makes it different from other loan applications, this application provides you loan instantly.

Stashfin is an online loan provider, You can trust the Stashfin loan app because it is safe and run by AKARA CAPITAL ADVISORS PRIVATE LIMITED, an NBFC company connected to the Reserve Bank of India.

Read Here Full Scam: Stashfin Loan App Review

0 notes