#but it’s a consistent enough pattern I can reliably predict it every day

Text

.

#so idk what’s going on here#but it’s a consistent enough pattern I can reliably predict it every day#I’m always hyper alert and v concentrated during the morning#but then around 11:30 am on#idk how to explain it#my brain gets jittery? like I can’t really focus or concentrate anymore#it’s almost like a sort of light headedness?#I just assume it means I need to eat#but when I eat it doesn’t really fix anything that much#I just stay light headed for the rest of the day#in the evening it calms down a bit like after 5#but idk man#it’s really annoying actually lol bc it means the last half of my day I’m just sorta useless#I just am not quite sure what’s going on but it happens literally every day#maybe I need a substantial lunch? I have a bowl of cereal or something thinking that’ll fix it but it never does

0 notes

Quote

If the Titan in question could strike fear in a demi-god, what hope did Earth have against him? It was not a pleasant thought and for the hundredth time since first hearing of Tony's vision, he was again tempted to make use of the Time Stone.

Wong joined him as he was arguing with the Cloak on the pros and cons of peering onto the future. He wasn't aware he'd been speaking aloud until Wong called his name with force in his tone.

"Stephen Vincent Strange!"

Stephen startled, almost dropping his tea cup which had been resting in his lap. "Wong? How long have you been here?"

"Long enough to hear you attempting to talk yourself into using the Time Stone to view the future." Wong growled. "Natural order Stephen. Despite Mordo's extreme views on the subject, it is still a real concern with serious consequences."

"I know that!" Stephen snapped. "But I just witnessed a demi-god react with fear and resignation when I told him of the Stones. What am I supposed to do with that? He didn't seem to think that anyone has any chance of stopping him. If he believes that, how will we, mere humans, keep him from the Time Stone?"

"Looking into the future is a pointless endeavour Stephen. I know you know that."

"Not if it would help put us on course to actually defeating him." Stephen retorted, sounding petulant.

"And how do you know which course to even look at?" Wong demanded. "Why do you think there has never been, in all the history of time, anyone who could accurately predict the future? Because precognition doesn't exist?"

"No. Of course it exists, but we're not talking about that, we're talking about the Time Stone."

"And what makes you think it doesn't work on the same principles? Just because it governs time doesn't make it any more reliable than a psychic. Both rely on possibilities and those possibilities rely on thousands of factors. You can't possibly know which course of action will lead to a desired outcome without also knowing all the factors which contribute to it."

"But some predictions come true Wong. It's not all left to chance." Stephen argued.

"Are you a child?" Wong snapped. "Predictions do come true, occasionally. But they are unreliable at best and usually not hard to predict through patterns. They are also much smaller in scale which are also accompanied by very little detail. How can you possibly predict a galaxy wide outcome if you're only seeing it from Earth AND from your limited perspective? Even meteorologists can't consistently and accurately predict the weather and you're proposing that the Time Stone will do just that."

"But the Ancient One looked at the future all the time." Stephen retorted.

"Only to guide us on how best to avoid conflict, never to predict outcomes Stephen. Do you ever wonder why no psychic has ever won the lottery?"

"Well, no but..."

"But nothing." Wong replied, cutting him off with an angry huff of impatience. "If she was predicting the future, don't you think she would've warned us all of Kaecilius' eventual betrayal? Or Dormammu's plans?"

"I... suppose." Stephen replied hesitantly.

"I know you're not naive Stephen and I know you're worried. But surely you're aware of chaos theory? How do you know for certain that your observation of a future event won't affect the outcome? Or that your emotional attachment to a specific outcome won't change the event itself? What if someone you care for were to die in a future you looked at? Would you not then be driven to find one where they lived?"

"I.. yes, I would. Of course I would." Stephen admitted. "But then why have the Time Stone in the first place? What's the point if it can't steer us away from something we're unprepared for?"

"To protect Time itself Stephen. Some things will happen regardless of whether or not we're ready, like what happened with Dormammu, which was a last resort event with no one deciding a course of action except you. Using it preemptively is a waste of time and resources because you cannot guarantee every factor outside your observation will come to pass. One person dying unexpectedly could alter everything you've seen and how will you know they matter? Unless you use the Time Stone every day, checking for its continued accuracy, you will never be able to ensure the desired outcome. Even if you tried that, you would go mad long before any of what you learned could be of use to you."

"So what you're saying is that essentially I'd have to start at the end and find the beginning of the thread or path that makes that ending possible."

"Which is entirely dependent on you seeing the outcome that has the highest probability of coming to pass than any other end you might look at. And how would you know it was the most probable one if you didn't then also look at parallel ends to compare them?" Wong countered.

"Alright, alright! You've made your point." Stephen groaned, massaging his temples. "Just stop now. You're giving me a headache."

"You did that to yourself." Wong asserted with a scowl.

Darkness, My Old Friend... and Silence IronStrange_Tales (RavenCall70)

9 notes

·

View notes

Text

entry #1

I have finally acquired Microsoft Word! I really didn’t want to pay a monthly subscription for it, but it is the best writing software out there. Every time I mention myself spending money, a small prayer goes out to all the tax-paying members of the nation, since all my money comes from Universal Credit, which is the United Kingdom’s cute name for a type of welfare money. I much prefer just calling it ‘welfare,’ or even better ‘NEETbux,’ which I discovered used in online forums as a word for the money people receive when they are not in education, employment, or training (N.E.E.T), which has been my status for about two years now. Then ‘bux’ is just ‘bucks,’ obviously. Bucks is just money, obviously. Many people receiving Universal Credit also work as well; they just receive less - enough to supplement their wages if they aren’t getting enough money from their jobs.

My last job was working in a busy restaurant for just about a year. Before that I was in university, but I dropped out after only completing the first year out of three. Before that, I worked as a carer for elderly people for just under a year. Before that, I was in college for two years, and I actually passed the course. I only passed it because the subject was forensic science, which included lots of writing about psychology, criminology and lab reports. I was never that good in the lab practically. I got flustered and bewildered in such a bright, sanitary environment that required precision and organisation to achieve the desired results. When it came to scrambling together a report to submit the next day though, I was pretty golden. I only dropped out of university because I had a mental break down as a result of poor mental health and just the fact that going outside and interacting with people was and still is incredibly exhausting for me. After a year of doing that consistently it seems, I get fatigued. In the end I got an average grade for the college course because some of the work was difficult, or boring, and that fatigue was hitting me by the second year. However, the grades I was getting on my university assignments for psychology and sociology were anywhere between top marks and good marks (Between 1st – 2:2 in UK student language). I never once read the feedback from the tutors who marked my work. All I needed to know was the mark was okay and moved on to the next assignment, firstly because I was arrogant and secondly, I couldn’t handle criticism. The mental break down itself involved me walking through the campus one day only to find myself slipping into a dissociative state. Nothing had happened immediately prior to trigger this, it just happened. It felt strange, like I wasn’t really real, and neither was anyone else. Everything felt distant and off, both externally and internally. It was frightening and strangely peaceful, as if at any moment someone could come in and blow the building up and I wouldn’t even react to it. That wasn’t normal. The only way to snap out of it was to lock myself in a toilet cubicle and lightly slice my arm with a tiny knife I had on my keys. It worked, but now I was in floods of tears and a state of distress, so I went to the student welfare services to see if they could help me or at least let me sit somewhere nicer than a toilet while I calmed down. It was an open office waiting area at the side of the bottom floor of a building that matched the layout of a prison ward with the stairs and the upper floors creating a square boarder of classrooms, that would have been cells for a prison. More for practical purposes than for aesthetic reasons, I’m sure. Still sobbing, and hiding my self-inflicted cuts, I asked the person behind the desk if I could ‘see someone,’ which is one polite British way of asking for help. After waiting a little while, a plump middle-aged lady appeared and brought me into her own little private office to ask me what had happened. She gave me her sympathy and asked me about my life and my history, and gave me some more sympathy, while relating her own experiences to mine. She was a good counsellor, basically. But having a good counsellor on site wasn’t enough to keep me on the course after that incident. Getting a degree just wasn’t worth it at the time. Being such a depressed and pessimistic person, I was only actually doing the course for ‘fun’ anyway, not for the hope that it will bring me a better future. Until recently, I never saw a future for myself. It wasn’t even a bleak future I imagined; it was just blank. I couldn’t even conceptualise it.

It’s not a mystery where all my misery came from. My childhood was a bit inconsistent to start, and from what I’ve observed, children need consistency more than anything to develop promisingly. I remember reading a study once that found children raised by parents who were consistently abusive to them were in fact more mentally stable than those raised by parents who could be lovely one day and nasty the next. It was not knowing what treatment they were going to get that did them in. It makes sense because if you’re always expecting to face a thrashing or a shouting at every day, you can at least prepare for it and train yourself to deal with it. We’re very adaptable creatures, but we need to be able to recognise patterns around us to do that. If there is no pattern, then how can we possibly make predictions? Without predictions, how can we possibly feel secure about our future? Having said all that, I was never abused in any way growing up, but I was sometimes neglected by my young mother, who was only 16 when she gave birth to me. Of course, it’s understandable now, but from a child’s perspective all you think is ‘why doesn’t my mum want me?’ When she sends you to your room for no reason and tells you not to come down for hours at a time. I asked ‘why’ a lot. Never got a good reason. I’m sure plenty of people who were raised by a drug-addicted parent can relate to this. She herself was a good mother, not amazing, but good. She told me she loved plenty of times, she gave me what she could, including a little sister when I was three years old. I think it was shortly after her birth that mum started taking heroin. It was only during drug education in year five of school (I would have been about 11) that I put the pieces together. She hid her addiction pretty well from us, but I sometimes found pieces of tin foil lying around the living room with lines of black residue on them, and once or twice witnessed her junkie friends ‘nodding off.’ There’s also a clear memory in my mind of being taken along by her and my nan to score some brown out of town and I can picture in my head the massive set of old-fashioned scales this drug dealer had sat on his coffee table right in front of me. I was too young to understand any of their lingo, though. Yes, I mentioned my nan, my mum’s mum. They got smacked up together, and they eventually got clean together. I’ll never know the details of how that came about because neither of them are alive anymore to ask. Mum died when I was 14 by taking an overdose of her methadone, then nan died when was 21 of a heart attack, likely due to the COPD she had developed from years of smoking.

My nan was so full of love for my mum, my sister and me. Some of my favourite childhood memories are being snuggled up in bed listening to her read me stories, which she did with flare and enthusiasm. She would affectionately call us her ‘wobblies,’ and give us more hugs kisses than we ever wanted. My mum definitely inherited her loving nature from her. But love on its own isn’t enough to keep kids clothed and fed and able to go out and do things. This is where the legend that is my grandad comes in. He is still going strong at 66 years old as of writing. God knows where I’d be without him. He’s been my father figure all my life since I never knew who or where my real dad was. He’s hard-working, reliable, responsible and strong. He supported us immensely despite not relating to him biologically. My biological grandfather was a free-spirited busker who liked to smoke and drink a lot, who I only met a hand full of times before he hanged himself when I was 19. His death did not affect me, but my mum’s and nan’s certainly did. I’ll probably have to see my grandad die as well eventually, and I don’t dread anything more.

Although I started off describing my family background by saying it’s obvious where my source of misery comes from, I must emphasise that my family is not the source of my misery. My childhood overall was pretty forgettable. I only have a few memories and they’re fond memories, despite the unfortunate situation I just described. Even getting my face ripped open by the neighbour’s dog when I was six didn’t faze me. It was only when puberty hit me that life started to feel horrible, and it just got worse.

I was an early bloomer, if blooming is what you call it. I call it mutating. I started getting hairy and growing tits when I was 10, and got my period about a year later. Now THAT is a traumatic memory. Waking up and going for a morning wee as usual, sitting down on the toilet and being overcome with horror at the sight of blood covering my pyjamas, realising there’s only one place that could have come from, then investigating the source only to confirm ‘Oh shit, I’m bleeding from between my legs!’ I was living with my nan and grandad at the time and I stayed there (or here, since I’m still living in the same house as of writing) under their guardianship while mum sorted herself out. After the shocking discovery of blood, I immediately ran into nan’s bedroom to wake her up. I vividly remember what and how she responded to me. With a sigh of what seemed like unsettling disappointment she said “Oh, darling, I’m sorry, I’m afraid you’ve got your period.’ I wonder now if she said it like that because she felt guilty for not warning me about this, as she should have. Someone should have. In all fairness I was young, but the other kids in my year at school were soon popping into adolescence alongside me, so I thought that soon enough everyone else would be going through what I was going through, but that wasn’t the case. I was bullied for having chronic acne. I was also a bit of a chubby boffin, but it was mostly the acne that people targeted me for. The girls shaved their legs once they started to get hairy, and I remember thinking ‘Damn, I suppose I’ve got to do that too,’ despite never wearing a skirt. They also seemed to relish in showing off and comparing their bras in the changing rooms, while I hid away as very best as I could. Make-up was a constant battle between students and teachers because they all wanted to look pretty, but it wasn’t allowed in middle school (Year 5-8), so luckily, I had an excuse for not wearing it. I’d regularly complain to my family about hating going to school, and how depressed I was, but it was all put down to teenage blues. ‘You’ll be alright once your hormones settle down,’ I was told more than once. I remember my nan telling me I would miss going to school when I was older and so far she’s been proven wrong.

2 notes

·

View notes

Photo

HOW SCIENTISTS AROUND THE WORLD TRACK THE SOLAR CYCLE Every morning, astronomer Steve Padilla takes a short walk from his home to the base of a tower that soars 150 feet above the ground. Tucked in the San Gabriel Mountains, about an hour’s drive north from Los Angeles, the Mount Wilson Observatory has long been a home for space science -- it’s Padilla’s home too, one of the perks to his work as Mount Wilson’s Sun observer. Mount Wilson has several solar system sentinels; the telescope perched at the top of this tower keeps constant watch on the Sun. Observers study the Sun closely, so we can better understand the life and activity of our star. Padilla boards the outdoor elevator. He clips himself to a safety harness, which is attached to the open-air cab, the same one used every day since the telescope went into operation in 1912 (the cables have since been replaced). “It can be a little scary on windy days,” Padilla said. At the top, Padilla adjusts a set of mirrors that projects an image of the Sun into an observing room far below. Back on the ground, he uses an array of pencils, varying in graphite weight, to sketch the dark spots mottling the face of the Sun. This daily chore is the foundation of the sunspot number, our longest record of solar activity. Humans have observed sunspots -- dark blotches that arise from strong magnetic activity -- for more than 1,000 years, and tracked them in detail since the invention of the telescope, for the past 400. Even with the modern-day host of spacecraft studying the Sun, taking the time to draw sunspots remains the chief way they’re counted. Surveying sunspots is the most basic of ways we study how solar activity rises and falls over time, and it’s the basis of how we track the solar cycle. Sunspots correspond with the Sun’s natural 11-year cycle, in which the Sun shifts from relatively calm to stormy. At its most active, called solar maximum, the Sun is freckled with sunspots and its magnetic poles reverse. (On Earth, that would be like if the North and South Poles flip-flopped every decade.) During solar minimum, sunspots are few and far between. Often, the Sun is as blank and featureless as an egg yolk. Understanding the Sun’s behavior is an important part of life in our solar system. The Sun’s powerful outbursts can disturb the satellites and communications signals traveling around Earth, or one day, Artemis astronauts exploring distant worlds. NASA scientists study the solar cycle so we can better predict solar activity. As of 2020, the Sun has begun to shake off the sleep of minimum, which occurred in December 2019. Solar Cycle 25 is underway, and scientists are eager for another chance to put their understanding of solar cycle signs to the test. “The most important thing to remember with predictions is, you’re going to be wrong,” said Dean Pesnell, a solar cycle expert at NASA’s Goddard Space Flight Center in Greenbelt, Maryland. “You’re never going to be perfect. It’s what you learn from that, that allows you to make progress in your predictions.” During drowsy solar minimum, Padilla observed more spotless days. “There are no spots to draw, so I just have a paper with nothing on it,” he said. Even the absence of sunspots is a useful observation: Tallying up spotless days is one indicator that the Sun’s mood is shifting toward minimum. (Instead of sunspots, dark coronal holes cloud the Sun’s poles at minimum.) On the other hand, in solar maximum, hundreds of spots can form at once. Some drawings can take several hours to complete. “The Sun has its own pace that we cannot speed up,” said Frédéric Clette, director of the World Data Center for the Sunspot Index and Long-term Solar Observations, or SILSO, at the Royal Observatory of Belgium in Brussels, which tracks sunspots and pinpoints the solar cycle’s highs and lows. “Sometimes, we have a hard time tempering the impatience of people who expect to know overnight if the Sun is truly waking up again.” Around the world, observers conduct daily sunspot censuses. They draw the Sun at the same time each day, using the same tools for consistency. Together, their observations make up the international sunspot number, a complex task run by SILSO. Some 80 stations around the world contribute their data. Exactly how many stations are included in each day’s count depends on a number of factors like weather (clouds and high winds obscure view of the Sun), or maybe a solar observer has a last-minute appointment. Despite the interference of daily life, these manual surveys are still the most reliable, long-term record of sunspots we have. “Satellites can do a lot of things better than a drawing by hand,” said Olivier Lemaître, a Royal Observatory of Belgium solar observer. “But consider a satellite with a 10- to 15-year lifespan -- that’s just one solar cycle. You can’t compare it to anything else outside that lifespan.” But long-term studies are the backbone of solar cycle science. With extensive historical records, scientists can trace the arc of decades-long patterns in the Sun’s behavior. When it comes to counting sunspots, it’s not so much about the accuracy or resolution of the observations as the consistency of the data itself. Even while their city was shut down due to the coronavirus pandemic, an observer from the Royal Observatory team made their way each day to the telescope tower, to keep the record intact. Lemaître approaches each sunspot drawing methodically, outlining a family of sunspots before shading in finer details. The delicate pencil work belies the powerful explosions sunspots can unleash. Sunspots arise from clusters of intense magnetic energy. Buoyed by their magnetic force, they rise through churning solar material like a grain of rice in a boiling pot. Sunspots appear darker because they’re cooler than their surroundings; the magnetic knot at their core keeps energy from radiating out past the Sun’s surface. When enough magnetic energy builds over the sunspot, a powerful eruption can burst free -- like an exploding soda bottle -- spewing light and solar matter. If they happen to be facing Earth, these solar storms can disrupt satellites, astronauts, and communications signals like radio or GPS. Earth’s upper atmosphere might expand in response, slowing satellites in orbit the way gravel roads slow down cars, eroding satellites’ lifetimes. Although changes on the Sun aren’t usually visible to us without the help of scientific instruments, they impact the space around Earth and other planets. Chasing Solar Minimum Deep inside the Sun, electrified gases flow in currents that generate the Sun’s magnetic field, which fuels its mighty outbursts. During solar minimum, the Sun’s magnetic field is relaxed. At the height of the solar cycle, it’s a tangled mess of magnetic field lines. Understanding this flow, called the dynamo, is key in the effort to predict what the Sun will do next. Since 1989, the Solar Cycle Prediction Panel -- an international panel of experts sponsored by NASA and NOAA, the National Oceanic and Atmospheric Administration -- has met each decade to make their prediction for the next solar cycle. The prediction includes the sunspot number at maximum and the cycle’s expected start and peak. The effort requires assessing many different models and navigating many personalities. “We each have our favorite predictions, or the ones we have the most confidence in,” said Lisa Upton, a solar physicist at Space Systems Research Corporation in Westminster, Colorado, and prediction panel co-chair. “Our duty is to come to a consensus. If we take all of our opinions and models, where is the most overlap, and where can we agree the solar cycle is going to land?” Scientists are always chasing solar minimum, but they can only recognize it in hindsight. Since minimum is defined by the lowest number of sunspots in a solar cycle, scientists have to see the numbers steadily rise before determining when they were at the bottom. To complicate things, solar cycles often overlap. As one cycle transitions to the next, both old and new sunspots emerge on the Sun at once. Sunspots often appear in groups, which are like magnets, each with a positive and negative end. As the Sun’s magnetic field slowly flips, so does the polarity of sunspot groups. Where one cycle’s sunspots drift across the Sun with their positive end in the lead, the next cycle’s spots walk negative foot first. On top of that, sunspots in the Sun’s two hemispheres also have opposite orientations. Each sunspot’s unique magnetic signature makes it possible to determine which cycle produced it -- the old one or the new. When the Sun stirs from solar minimum, besides counting the sunspots, scientists want to make sure all the spots rising to the surface are actually new. “I just caution people, because as excited as we are for the new cycle to come, we have to wait until we actually reach minimum,” Upton said. “It can be six to eight months past minimum before we can say minimum has actually occurred.” Indeed, not until September 2020 did scientists confirm the Sun reached solar minimum in December 2019. Invisible Indicators Besides sunspots, other indicators can signal when the Sun is reaching its low. If the Sun’s magnetic field were a jigsaw puzzle, one piece is still missing: the magnetic field at the poles. Although scientists can’t measure the polar magnetic field as accurately as other parts of the Sun, estimates provide clues. (Soon, ESA, the European Space Agency, and NASA’s Solar Orbiter will send new images of the Sun’s poles.) In previous cycles, scientists have noticed the strength of the polar magnetic field during solar minimum hints at the intensity of the next maximum. When the poles are weak, the next maximum is weak, and vice versa. The past few cycles, the strength of the magnetic field at the Sun’s poles has steadily declined; so too has the sunspot number. Now, the poles are roughly as strong as they were at the same point in the last cycle, Cycle 24. “This is the big test for our models -- whether Cycle 25 will play out about the same as Cycle 24,” Pesnell said. Another indicator of solar cycle progress comes from outside the solar system. Cosmic rays are high-energy particle fragments, the rubble from exploded stars in distant galaxies. During solar maximum, the Sun’s strong magnetic field envelops our solar system in a magnetic cocoon that is difficult for cosmic rays to infiltrate. In off-peak years, the number of cosmic rays in the solar system climbs as more and more make it past the quiet Sun. By tracking cosmic rays both in space and on the ground, scientists have yet another measure of the solar cycle. While minimum may lack the fireworks of solar maximum, it’s useful for scientists. They make their forecasts, and wait to see how their estimates play out. Some consider it a time to return to the basics. “In solar minimum, you can ask more difficult questions than at maximum,” Pesnell said. One area of solar study, called helioseismology, involves scientists collecting soundwaves from inside the Sun, as a way of probing the elusive dynamo. During solar minimum, they don’t have to worry about soundwaves bouncing off the sunspots and active regions characteristic of solar maximum. When sunspots disappear from view, scientists have a chance to finetune their models -- without all the solar drama. TOP IMAGE....Sunspot drawings from SILSO at the Royal Observatory of Belgium. Surveying sunspots with daily hand-drawn drawings is the most basic of ways we study how solar activity rises and falls over time, and it’s the basis of how we track the solar cycle. Credits: SILSO/Royal Observatory of Belgium LOWER IMAGE....Images from NASA's Solar Dynamics Observatory show the Sun near solar minimum in October 2019 and the last solar maximum in April 2014. Dark coronal holes cover the Sun during solar minimum, while bright active regions—indicating more solar activity—cover the Sun during solar maximum. Credits: NASA's Solar Dynamics Observatory/Joy Ng

2 notes

·

View notes

Text

FOUR ELEMENTS QUIZ

Stole from: @intergalacticstarlight

Tagging: anyone who wants to do it I guess. XD

Simm!Master: ICE

Ice is cool, calm, collected, logical, and abstract. It combines the calm, serenity, insight, adaptability, and wisdom of Water with the order, consistency, loyalty, and practicality of earth. They are creatures of cold, crystalline beauty – elegant and unapproachable. They are deep, mysterious, and inscrutable – yet they see the rest of the world with astounding clarity. They have a big-picture view of life and tend to be meticulous planners. Ice is also generally a very good judge of character, so long as Ice does not give in to pessimism or cynicism. That is one of Ice’s great internal struggles – the conflict between an intense inner idealism and pessimism about how corrupt the world is.

Ice is exceptionally perfectionistic. Ice is also known for its subtly determined nature. Instead of trying to break through barriers, Ice finds another way. When the barrier is weak or if Ice finds just the right angle, it breaks through with the force of a massive iceberg. Yet against stronger or more aggressive forces, Ice adapts, melts, flows around boulders, through piles of debris, over dams, and even through the smallest cracks. When it finds such small opening, it freezes – expanding and cracking the barrier apart.

Ice plans everything meticulously in advance and can be seen as opportunistic since it never lets any opportunity go to waste. Ice is very independent and often stubborn, but not aggressive or bossy. Rather than try to force the world to conform to itself, it bends and moves to suit the circumstances, subtly influences the world from the shadows, or else it simply leaves. Ice knows when to withdraw and leave a hopeless organization, pointless debate, or harmful relationship. Solitude is natural and comfortable for Ice, so it very capable of leaving toxic situations behind and not looking back. This tendency to choose an isolated lifestyle may be in reaction to past hurt or betrayal or it could just as easily stem from being highly introverted. It often views society as a whole as being cruel, stupid, chaotic, or threatening.

Ice is very structured, orderly, rational, and logical. They are punctual, organized, detail-oriented, planned, and are excellent at either creating or running vast, complicated systems – whether for business, politics and other practical concerns or for philosophy, religion, science, or other more abstract pursuits. They have both the creativity and wisdom to create as well as the practicality and diligence to administrate. They are strong and stable, honest and loyal, fair-minded and rational, orderly and reliable. Under stress and pressure that would break anyone else, Ice still stands like an ancient, unconquerable glacier. This ability to think well in both abstract and concrete ways makes Ice a natural planner.

Everything in Ice’s life goes to serve The Plan: an extremely complex life-long plan for success that incorporates every foreseeable variable and contingency. Often, Ice begins making The Plan while still a small child and continues to refine it and re-work it across his or her life. Their ability to predict the future is mysterious and can be either inspiring or terrifying depending on whether Ice is a friend or enemy. Ice generally uses its towering intellect to solve problems, express deep truths, create inventions, or unravel the mysteries of the universe rather than make money or get fame. Fame is of very little interest to Ice. Ice often has a strong creative and artistic streak, loving music, literature, philosophy, and the arts.

The Icy person often has a natural and effortless gift at creating pristine, elegant beauty – whether in artwork, abstract systems, or even in the clothes she or he wears. Yet all of these tremendous strengths do come with weaknesses. Ice is extremely introverted and cautious. If Ice is ever surprised and has no plan at all for the current situation, Ice often freezes up entirely – unable to act. Ice may be adaptable, but improvisation is very difficult. Ice does not like surprises and is often stubborn. Further, Ice is very emotionally withdrawn.

While Ice usually has a rich, complex internal world of emotions, Ice is very poor at expressing those emotions to others – and some Icy people may even have difficulty reading the emotions of others. Ice tends to be distant, remote, and very difficult to read - often having a constant poker face or unintentional icy death glare. Even when emotions are expressed, getting the right words out with the right vocal tone is frustrating. This often tends to push away the very people Ice wants most to get close to. This over-abundance of caution, difficulty improvising, and difficulty expressing emotions are Ice’s three great weaknesses. Yet for anyone who manages to get close enough to Ice to make a real emotional connection, they will find Ice to be very loving, devoted, and absolutely loyal. As a general rule, anyone who earns the love or friendship of Ice will enjoy lifelong, unbreakable commitment and they will get the rare treat of enjoying the warm and compassionate heart at Ice’s core.

Intellectually, Ice seeks understanding and efficiency. Water asks both “why” and “how.” It is holistic and sees everything in the universe as being connected with everything else. Ice is drawn to everything deep, abstract, and complex. It intuitively sees the connections between ideas and between cause and effect. It builds up complex networks of information with each bit connected in its mind with all the other bits that compare and contrast with it.

Yet it also has an intense drive to make sense of things. Ice creates order out of chaos, efficiency out of waste, and elegant systems out of aimless wandering. Budgets, long-term plans, engineering, and business management are second nature to Ice. It misses no detail no matter how small and excels at innovation and gradual improvement in general.

While everything fascinates Ice, it’s logical, orderly systems that are most interesting. Put together, this makes Ice well-suited for the humanities, sciences, and business – at least in theory. One of Ice’s intellectual weaknesses is its tendency to become lost in its own mind. This can be due to going down rabbit trails on related subjects, getting distracted, or simply getting so absorbed that it never even gets to make the decision in question.

The other is making the assumption that all people behave logically. Ice can easily misread a situation by failing to take into account the more emotional and chaotic elements of human nature, often missing subtleties and social cues. However, no element is more intelligent than any other. It is merely a different pattern of thinking.

Emotionally, Ice is the most introverted of all the elements or element combinations. Ice has strong feelings and ideals, but has great difficulty expressing them. Due to the fear of an embarrassing emotional outburst, Ice generally suppresses unwelcome emotions like anger, sadness, or fear. Ice may express positive emotions, but even then usually in a controlled way. This can cause negative emotions to build up and churn inside, magnifying them over time. Sadness, fear, and bitterness tend to be especially strong. If not deal with in a healthy way, this can lead either to sudden outbursts releasing days, weeks, or even years of frustration all at once. Ice’s wrath is rare, but terrible - especially if Ice believes the object of its anger deserves it. However, Ice may just internalize their emotions even further, withdrawing into themselves until they begin to view all the world as a hostile, threatening “other.” Sadness, fear, and bitterness are Ice’s negative emotions.

MBTI: INTP is the perfect example – though INTJ and INFJ can work as well. Occasionally, ISTPs may show up as Ice (though they are normally Earth/Air).

Functions: Introverted Thinking, Extroverted Intuition, Introverted Intuition, extroverted thinking

Enneagram Types: 1, 3, 4, 5, 6, and 9

Platonic Solid: Round (Icosahedron) and Cube (Hexahedron)

Aristotelian Environment: Cold (either Wet or Dry)

Temperament: Phlegmatic/Melancholic, Melancholic/Choleric, or Phlegmatic/Choleric

Cardinal Virtue: Wisdom/Caution (Prudentia) and Self-Control (Temperantia)

Yin-Yang: Yin

Opposite Element: Lightning – While Ice (Water/Earth) is wise, logical, calculating, self-controlled, dignified, calm, and innovative, Lightning (Fire/Air) is brave, willful, lively, free-spirited, dramatic, and visionary.

Core Strengths: Ice is calm, imaginative, wise, patient, adaptable, observant, artistic, idealistic, rational, practical, dependable, fair-minded, respectful, honest, loyal, and insightful

Possible Weaknesses: When immature, Ice might be depressed, pessimistic, passive, indecisive, self-loathing, overly cautious, unsocial, shy, stubborn, bitter, judgmental, callous, excessively serious, or withdrawn from reality.

#Oh lord it's totally 100% him#Cold and Logical is exactly how Simmy has always worked#Simm!Master#About Simm!Master#Headcanons

2 notes

·

View notes

Text

best options trading website Louisiana Break it down piece by piece and make it your own.

Post Outline

best options trading website Louisiana Before sitting down to write this post, I thought I would search the Internet to see what information existed on options trading systems.

day trading spx options Louisiana Pivot point trading is arguably the best way to trade options, because price action usually is explosive, and happens quickly in our direction when a trade works.

best desktop program for options trading Louisiana Human beings and there mental makeup are extremely complex so it is extremely important that stock option traders not only have a sound stock option trading methodology but the discipline to follow their trading methods.

books on options trading Louisiana Swing trade the Intra Day Bars!

options trading seminars Louisiana So focus your trading system on certain stocks that have price behavior that is predictable to the net results you wish to abstract from a stock.

trading options in an ira Louisiana With options, you can control hundreds or thousands of shares of stock at a fraction of the price of the stock itself.

credit spread options trading Louisiana When you add new trading criteria to your system, you should be able to see an improvement to your statistics.

best options trading advisory service reviews Louisiana By understanding time decay, factoring an option's time into your trading method, how volatility impacts a stock option's value, what defines a reliable stock option trading methodology, and your own trading psychology you now have a foundation to develop into a winning stock option trader.

best options trading website Louisiana Develop an options trading system that trades pivot points.

Objectivity - A good options trading system is based on measurable criteria that trigger buy and sell signals.

Important Theories:

what are options in stock trading Louisiana

alan ellman offers proven advice on stock and options trading strategies Louisiana

best options trading online course Louisiana

binary options trading course online Louisiana

options trading bots alerts Louisiana Keep it simple, buy calls for and upside trade or buy puts for a downside trade.

) You can go to cboe. com for more information on options trading. Directional options trading systems are the best. Keep it simple, buy calls for and upside trade or buy puts for a downside trade. But this means you need a directional stock trading system in order to trade directional options. Here are a couple of different approaches for directional systems:Develop an options trading systems that trades the swings in stock price movement. There are many good swing trading systems available today. We suggest you obtain one. Bottom line with swing trading is that you want to swing trade with the trend. Options brokers these days have advanced order technology that will allow you to enter swing trades based on the price movement of the stock so you don't have to watch this stock all day. That huge advancement to swing trading options.

financial advisor trading stock options Louisiana Knowing the ins and outs of various trade setups is useless if you don't have a trading methodology that guides you in every step of the trade process.

You can develop a trading system, a trading approach, and a trading methodology by identifying a price movement pattern (or lack of price movement pattern) or some event that occurs on some sort of regular basis.

how to make money trading options Louisiana Begin with a basic system and tweak it to define your trading criteria and hone your system.

There are five essential keys that any option trader must understand when developing a winning stock option system. First, you must understand the degree which time affects the premium of the option you are considering trading. There are two parts you must consider when factoring time into the stock option trading decisions. The first thing that you must take into account is the intrinsic time left on an option. Since options have a limited time period of anywhere from 30 days to several year depending on the particular option that you bought you must be sure that you purchase the correct option containing enough time on it to insure that time decay doesn't erode your investment away before your position has enough time to be profitable. The second skill of trading options profitably is factoring time into your trading system in relation to trading a particular stock option and knowing the statistics of your option trading methodology or option trading setup by knowing the average holding period of a trade signal. If your average holding time for an option trade is seven days then you don't want to buy an option with three months of time premium left on it because you would be paying more for the extra time with the option's purchase price. Nor would you buy an option with less that 30 days till expiration as time decay would erode the value of option so quickly that even if the option's underlying stock movement moved favorably to you the time decay would prevent you from realizing a gain in the option itself. The third thing to profitable option trading is understanding the relation of volatility between the market, the underlying stock that underlies the stock option, and the effect is has on the value of the option itself. When the general stock market as an index goes through periods of volatility or low trading ranges the stocks that make up the market tend to follow overall trend and also begin to experience periods of low overall volatility which in turn can cause derivative like stock options to become cheap or low premiums. But if the market's volatility rises it is likely that individual stocks will follow the trend causing stock option premiums to increase in value given that the market moves in the trader's favor. The next key in how to trade stock options successfully is having a stock option trading method that takes these key factors into consideration while giving clear entry signals, clear exit signals, a defined system of trade management, and a profit factor greater than your average loss over a series of trades. Knowing the ins and outs of various trade setups is useless if you don't have a trading methodology that guides you in every step of the trade process. A solid trading method holds you by the hand and defines each step while leading you to being a consistent winner in the markets and a profitable trader when all is said and done. Finally, the fifth and final key to successfully trading stock options is yourself, particularly your trading psychology. Human beings and there mental makeup are extremely complex so it is extremely important that stock option traders not only have a sound stock option trading methodology but the discipline to follow their trading methods. You can give two people the same exact winning trading system but it is very common for them to have different results. Invariably, the one that has the ability to remain as detached from his losing trades as well as his winning trades while maintaining the discipline to follow the system's rules no matter the trading result will emerge the greatest winner in the end. Using these five keys as a basis to develop your stock option trading methodology can help you avoid the mistakes and pitfalls of many beginning option traders. By understanding time decay, factoring an option's time into your trading method, how volatility impacts a stock option's value, what defines a reliable stock option trading methodology, and your own trading psychology you now have a foundation to develop into a winning stock option trader. Finding Or Creating Your Own Options Trading System That WorksStock Options are wonderful! This clever derivative of the equities market has to be one of the most ingenious inventions of modern times. For the trader who can learn how to win at trading options there are many luxuries in life that can be experienced. Success in options trading requires a consistent approach for long-term success. This statement is not meant to be grandiose, idealistic comment made by some 'trading theorist', rather, it is a statement born out of the hard knocks and success experiences of the author and many other long-term, successful trader contemporaries. This "consistent approach" to options trading can also be called a "trading system", or an "options trading system" in this case. The term "trading system" is not necessarily confined to a series of computerized "black box" trading signals.

best stocks for options trading 2021 Louisiana That huge advancement to swing trading options.

Since an Option is a "Derivative" of the stock you must derive your options trading system from a stock trading system. This means your trading system must be based around actual stock price movement. That said, your trading system doesn't need to work for all stocks it just has to work for certain types of stocks, certain volatility of stocks and certain price levels of stocks etc. So focus your trading system on certain stocks that have price behavior that is predictable to the net results you wish to abstract from a stock. You can develop a trading system, a trading approach, and a trading methodology by identifying a price movement pattern (or lack of price movement pattern) or some event that occurs on some sort of regular basis. This means you can trade price behavior patterns on price charts such as: traditional chart patterns, trends, swings, pivot points, boxes etc. or you can trade events that motivate stock price such as earnings runs, post earnings runs, stock splits, seasonal factors etc.

So focus your trading system on certain stocks that have price behavior that is predictable to the net results you wish to abstract from a stock. You can develop a trading system, a trading approach, and a trading methodology by identifying a price movement pattern (or lack of price movement pattern) or some event that occurs on some sort of regular basis. This means you can trade price behavior patterns on price charts such as: traditional chart patterns, trends, swings, pivot points, boxes etc. or you can trade events that motivate stock price such as earnings runs, post earnings runs, stock splits, seasonal factors etc. Bottom line to make the maximum profit in options trading you want your stock to move in your favor fast and you want it to move far. Just a relatively small movement in the price of a stock can double your money in options!There are so many different strategies and combinations that you can trade with options.

how to make a million dollars trading options pdf Louisiana Swing trade the day bars.

Directional options trading systems are the best.

how to find a mentor and trading program for options Louisiana When the general stock market as an index goes through periods of volatility or low trading ranges the stocks that make up the market tend to follow overall trend and also begin to experience periods of low overall volatility which in turn can cause derivative like stock options to become cheap or low premiums.

Most swing trading systems are based on daily bars on the stock price chart. Swing trade the Intra Day Bars! Their other fantastic systems based on intraday charts that pin point swing trading entries. Develop an options trading system that trades three to six month trends. This is where the big money is. Trading the large trends is where many are able to place larger sums of money to develop their net worth. Develop an options trading system that trades pivot points. Pivot point trading is arguably the best way to trade options, because price action usually is explosive, and happens quickly in our direction when a trade works. This is good because you can use shorter-term options and leverage yourself a little better. And it's also nice you can make great gains in five days to four weeks on average so time decay issues become less of a worry. There are many different directional trading methods you could use to trade options. You need to pick one, work it, and never use more than 10% options position size per trade on small accounts 1% to 5 % max position size on larger accounts. This methodical way of money management trading options is the fastest way to potentially rapid account growth, helping you avoid needless set backs. Options Trading System - 5 Steps To Better Options TradingWhat is an Options Trading System?Before sitting down to write this post, I thought I would search the Internet to see what information existed on options trading systems. I was shocked to find that there was barely anything posted on the subject. Seriously! There are hundreds of websites, brokerage firms, and trading services that want to sell you their system. The reality is that very few are able to describe what an options trading system actually is. At its core, an options trading system is a method of generating buy and sell signals through a tested method of stock analysis. The system can be based on any type of option strategy and includes both fundamental and technical analysis. Options trading systems might focus on changes in underlying stock price, volatility, time decay, unusual buy/sell activity, or a combination of these elements. Essentially, it is a checklist of criteria that must be met before trades are entered. When all conditions are met, a signal to buy or sell is generated. The criteria are different for each type of option trading strategy. Whether it is long calls, covered calls, bear spreads, or selling naked index options, each has its own trading system model. An option trading system that is worth its salt will help you weed out false signals and build your confidence in entries and exits. How Important is an Options Trading System?The options market is very complex. Trading options without a system is like building a house without a blueprint.

best online options trading service Louisiana Fine tune your criteria to eliminate making those same mistakes again.

This "consistent approach" to options trading can also be called a "trading system", or an "options trading system" in this case.

Key Approaches:

how i make consistent returns trading options Louisiana

review of options trading advice Louisiana

options trading terminology Louisiana

rich dad poor dad options trading Louisiana

0 notes

Text

So I took this interesting quiz and thought I’d share this results!

You are Ice! (Water/Earth or Water/Fire)

(More under the cut because the result was long and highly detailed.)

Ice is cool, calm, collected, logical, and abstract. It combines the calm, serenity, insight, adaptability, and wisdom of Water with the order, consistency, loyalty, and practicality of earth. They are creatures of cold, crystalline beauty – elegant and unapproachable. They are deep, mysterious, and inscrutable – yet they see the rest of the world with astounding clarity. They have a big-picture view of life and tend to be meticulous planners. Ice is also generally a very good judge of character, so long as Ice does not give in to pessimism or cynicism. That is one of Ice’s great internal struggles – the conflict between an intense inner idealism and pessimism about how corrupt the world is. Ice is exceptionally perfectionistic. Ice is also known for its subtly determined nature. Instead of trying to break through barriers, Ice finds another way. When the barrier is weak or if Ice finds just the right angle, it breaks through with the force of a massive iceberg. Yet against stronger or more aggressive forces, Ice adapts, melts, flows around boulders, through piles of debris, over dams, and even through the smallest cracks. When it finds such small opening, it freezes – expanding and cracking the barrier apart. Ice plans everything meticulously in advance and can be seen as opportunistic since it never lets any opportunity go to waste. Ice is very independent and often stubborn, but not aggressive or bossy. Rather than try to force the world to conform to itself, it bends and moves to suit the circumstances, subtly influences the world from the shadows, or else it simply leaves. Ice knows when to withdraw and leave a hopeless organization, pointless debate, or harmful relationship. Solitude is natural and comfortable for Ice, so it very capable of leaving toxic situations behind and not looking back. This tendency to choose an isolated lifestyle may be in reaction to past hurt or betrayal or it could just as easily stem from being highly introverted. It often views society as a whole as being cruel, stupid, chaotic, or threatening. Ice is very structured, orderly, rational, and logical. They are punctual, organized, detail-oriented, planned, and are excellent at either creating or running vast, complicated systems – whether for business, politics and other practical concerns or for philosophy, religion, science, or other more abstract pursuits. They have both the creativity and wisdom to create as well as the practicality and diligence to administrate. They are strong and stable, honest and loyal, fair-minded and rational, orderly and reliable. Under stress and pressure that would break anyone else, Ice still stands like an ancient, unconquerable glacier. This ability to think well in both abstract and concrete ways makes Ice a natural planner. Everything in Ice’s life goes to serve The Plan: an extremely complex life-long plan for success that incorporates every foreseeable variable and contingency. Often, Ice begins making The Plan while still a small child and continues to refine it and re-work it across his or her life. Their ability to predict the future is mysterious and can be either inspiring or terrifying depending on whether Ice is a friend or enemy. Ice generally uses its towering intellect to solve problems, express deep truths, create inventions, or unravel the mysteries of the universe rather than make money or get fame. Fame is of very little interest to Ice. Ice often has a strong creative and artistic streak, loving music, literature, philosophy, and the arts. The Icy person often has a natural and effortless gift at creating pristine, elegant beauty – whether in artwork, abstract systems, or even in the clothes she or he wears. Yet all of these tremendous strengths do come with weaknesses. Ice is extremely introverted and cautious. If Ice is ever surprised and has no plan at all for the current situation, Ice often freezes up entirely – unable to act. Ice may be adaptable, but improvisation is very difficult. Ice does not like surprises and is often stubborn. Further, Ice is very emotionally withdrawn. While Ice usually has a rich, complex internal world of emotions, Ice is very poor at expressing those emotions to others – and some Icy people may even have difficulty reading the emotions of others. Ice tends to be distant, remote, and very difficult to read - often having a constant poker face or unintentional icy death glare. Even when emotions are expressed, getting the right words out with the right vocal tone is frustrating. This often tends to push away the very people Ice wants most to get close to. This over-abundance of caution, difficulty improvising, and difficulty expressing emotions are Ice’s three great weaknesses. Yet for anyone who manages to get close enough to Ice to make a real emotional connection, they will find Ice to be very loving, devoted, and absolutely loyal. As a general rule, anyone who earns the love or friendship of Ice will enjoy lifelong, unbreakable commitment and they will get the rare treat of enjoying the warm and compassionate heart at Ice’s core.

Intellectually, Ice seeks understanding and efficiency. Water asks both “why” and “how.” It is holistic and sees everything in the universe as being connected with everything else. Ice is drawn to everything deep, abstract, and complex. It intuitively sees the connections between ideas and between cause and effect. It builds up complex networks of information with each bit connected in its mind with all the other bits that compare and contrast with it. Yet it also has an intense drive to make sense of things. Ice creates order out of chaos, efficiency out of waste, and elegant systems out of aimless wandering. Budgets, long-term plans, engineering, and business management are second nature to Ice. It misses no detail no matter how small and excels at innovation and gradual improvement in general. While everything fascinates Ice, it’s logical, orderly systems that are most interesting. Put together, this makes Ice well-suited for the humanities, sciences, and business – at least in theory. One of Ice’s intellectual weaknesses is its tendency to become lost in its own mind. This can be due to going down rabbit trails on related subjects, getting distracted, or simply getting so absorbed that it never even gets to make the decision in question. The other is making the assumption that all people behave logically. Ice can easily misread a situation by failing to take into account the more emotional and chaotic elements of human nature, often missing subtleties and social cues. However, no element is more intelligent than any other. It is merely a different pattern of thinking.

Emotionally, Ice is the most introverted of all the elements or element combinations. Ice has strong feelings and ideals, but has great difficulty expressing them. Due to the fear of an embarrassing emotional outburst, Ice generally suppresses unwelcome emotions like anger, sadness, or fear. Ice may express positive emotions, but even then usually in a controlled way. This can cause negative emotions to build up and churn inside, magnifying them over time. Sadness, fear, and bitterness tend to be especially strong. If not deal with in a healthy way, this can lead either to sudden outbursts releasing days, weeks, or even years of frustration all at once. Ice’s wrath is rare, but terrible - especially if Ice believes the object of its anger deserves it. However, Ice may just internalize their emotions even further, withdrawing into themselves until they begin to view all the world as a hostile, threatening “other.” Sadness, fear, and bitterness are Ice’s negative emotions.

MBTI: INTP is the perfect example – though INTJ and INFJ can work as well. Occasionally, ISTPs may show up as Ice (though they are normally Earth/Air).

Functions: Introverted Thinking, Extroverted Intuition, Introverted Intuition, extroverted thinking

Enneagram Types: 1, 3, 4, 5, 6, and 9

Platonic Solid: Round (Icosahedron) and Cube (Hexahedron)

Aristotelian Environment: Cold (either Wet or Dry)

Temperament: Phlegmatic/Melancholic, Melancholic/Choleric, or Phlegmatic/Choleric

Cardinal Virtue: Wisdom/Caution (Prudentia) and Self-Control (Temperantia)

Yin-Yang: Yin

Opposite Element: Lightning – While Ice (Water/Earth) is wise, logical, calculating, self-controlled, dignified, calm, and innovative, Lightning (Fire/Air) is brave, willful, lively, free-spirited, dramatic, and visionary.

Core Strengths: Ice is calm, imaginative, wise, patient, adaptable, observant, artistic, idealistic, rational, practical, dependable, fair-minded, respectful, honest, loyal, and insightful

Possible Weaknesses: When immature, Ice might be depressed, pessimistic, passive, indecisive, self-loathing, overly cautious, unsocial, shy, stubborn, bitter, judgmental, callous, excessively serious, or withdrawn from reality.

1 note

·

View note

Text

Start Making Money Fast Trading Options

Individuals need to begin making cash quick. The best system to use for that objective is exchanging alternatives. At the point when a great many people consider alternatives they accept that there dangerous. Which truth be told, they are for the individuals who don't exchange them effectively stock trading alerts

Investment opportunities are utilized to make use and control hazard. The systems I gained from my tutors are beneficial and straightforward once you get the hang of them.

There are two kinds of choices, calls and puts. There are additionally two things you can do with any alternative, either get it or sell it. The most fundamental technique for utilizing alternatives is known as a secured call. The procedure is made out of two unique positions.

In the event that you were long basic xyz which is exchanging at $15.00 you would sell a call alternative against it and gather cash in your record for selling that choice.

Purchase 100 portions of xyz at $15.00 and sell 1 agreement (which is equivalent to 100 portions of load) of the 15 hit calls with 30 days until lapse and gather $1 per share or $100 absolute.

At termination you profit if xyz is exchanging above $14.00. Truly, you can make cash in any event, when your stocks go down!

• If XYZ is above $15.00 you will sell your offers at $15.00 and keep the $100 you gathered to sell the alternative in the start of the exchange.

• If you purchase a call alternative you reserve the privilege to purchase a particular basic for a specific measure of time at a particular cost.

• If you sell a call alternative you are committed to sell a particular basic at a specific cost inside a specific measure of time.

• If you purchase a put alternative you reserve the option to sell a particular basic at a specific cost for a specific measure of time.

• If you sell a put choice you have the commitment to purchase a particular fundamental at a specific cost for a specific measure of time.

In the event that this is your first time finding out about choices I know it's befuddling. Be that as it may, trust me, exchanging choices will enable you to begin making cash quick.

By selling alternatives you can begin making cash quick by making a predictable month to month salary that you can copy again and again.

Making cash in exchanging is tied in with giving yourself an edge. Through different alternative selling systems you can do precisely that. 80% of alternatives terminate useless! So who's creation the vast majority of the cash? Believe it or not, choice merchants.

Choice Selling

There are such huge numbers of approaches to profit. Exchanging alternatives is the one that can truly transform you. There are such huge numbers of circumstances you can place yourself in through exchanging alternatives that give you a numerical edge.

The vast majority think exchanging choices is unsafe. The explanation is a great many people lose cash who exchange choices! 80% of choices terminate useless. Things being what they are, who's creation the entirety of the cash? The individuals who are purchasing those alternatives or the individuals who are selling them.

The explanation individuals state that alternatives are dangerous is on the grounds that they don't get them. In the event that they did they would have a very different supposition. Simply ask a fruitful market producer what the person thinks about alternatives. Market producers that I pursue know a ton of approaches to profit.

They are going to recount to a totally unique story. Alternatives lessen hazard and amplify benefits whenever exchanged accurately. In this page I will give you a portion of my preferred procedures that put me on the triumphant side. The side where I have the scientific favorable position.

Positive time rot implies that consistently that passes choice premiums rot or dissolve. As such if stock xyz is exchanging at $20 today and the $20 call is exchanging at $1.95 then daily later all different things being equivalent that alternative will exchange for under $1.95 on the grounds that there is less time for it to merit something.

There are a couple of significant parts to my general exchanging plan.

1. Cost and plan for entering

2. Picking the right methodology

3. Plan for leaving the exchange

4. Position Size

Each of the four of these pieces to the riddle are significant. The one I will concentrate on now is picking the right system.

Coming up next are my preferred characterized chance alternative spreads.

• Verticals

• Calendars

• Butterflies

• Iron Condors

• Diagonals

At the point when I was searching for approaches to profit I started exchanging. The issue I had as a learner with my exchanging was I adapted these techniques and began exchanging them yet I didn't have an arrangement for leaving and dealing with the positions. That part is similarly as significant as the real system.

For instance, one of the procedures I started exchanging to make additional cash is known as a bull put spread. The exchange is made on a stock you believe will go up. I would gather $2.00 on a $5.00 wide spread. At that point I would basically put it on and let it on and let it go with no leave plan. I needed to discover approaches to profit however I was losing $3.00 on my losing exchanges utilizing this procedure with no arrangement.

A portion of these would terminate useless and I would make the $2.00 however some would conflict with me and I would assume the maximum misfortune. Presently I figured out how to deal with those positions and make the $2.00 on my champs reliably and just lose $1.00 or less probably! Exchanges that go out on a limb contrasted with remuneration aren't getting down to business after some time.

Controlling danger is the most significant piece of exchanging. It's fundamental to make great predictable gains however it's progressively imperative to have little failures contrasted with your potential gains on your triumphant exchanges.

The best exhortation I can provide for starting dealers is the accompanying focuses.

1. Find the same number of fruitful merchants who have been around for a short time and adapt precisely how they exchange.

2. Learn as much as you can about every one of their exchanging styles since what one individual does probably won't work for you and the other way around.

3. Learn systems that bode well! In case you're going to purchase choices profit.

4. Have an arrangement to get out and limit hazard. As such, realize what the most dire outcome imaginable is before you even enter the exchange.

5. Ensure you can make enough on each exchange to legitimize being in the position. At the end of the day, if your think there is a half possibility you will win a specific exchange and you can make twice as much as you're gambling, than that bodes well!

6. Learn position estimating! Never at any point chance all the more then 3-5% of your portfolio on any one exchange. I never chance over 2% and that is exceptionally uncommon. I for the most part risk.5% of my record per exchange.

To summarize everything, there are numerous approaches to profit. I think exchanging is truly outstanding. It's uncommon to discover an open door that can have an arrangement behind it where are the situations both positive and negative are comprehended. On the off chance that the great versus awful situations bode well with that arrangement than that is an arrangement that will work after some time.

You can likewise begin making cash quick by purchasing choices. The most significant piece of alternative purchasing is you must have to know precisely which choices to purchase. You would prefer not to purchase an inappropriate choices since you'll lose the entirety of your cash!

Choice Buying

We as a whole need to make cash quick. Fortunately there are approaches to do it's basically realizing what they are and how to apply them. Numerous individuals state alternatives are hazardous, which they are in the event that you don't get them.

• If you comprehend alternatives you can utilize them to decrease chance and augment benefit.

• If you like to exchange directional or pattern exchange there is no preferred method to do that over alternatives.

• Lastly on the off chance that creation immense touchy gains in your exchanging account premiums you, at that point you have to figure out how to purchase choices accurately. It is the most ideal approach to make cash quick.

For instance, purchasing an alternative that has minimal possibility of regularly being worth cash doesn't bode well. The pitiful part is individuals do this the entirety of the time in light of the fact that those alternatives are generally modest.

There are two segments of an alternative. They are the inborn worth and extraneous worth. How about we start characterizing them both

• Stock xyz is exchanging at $60.00.

• The $50 call with 100 days until termination is exchanging for $11.00

The characteristic estimation of that choice is $10.00 in light of the fact that the contrast between the cost of xyz and the strike cost is $10.00.

The extraneous estimation of that alternative or time premium is $1.00 on the grounds that that is the additional premium paid for the choice that has no genuine worth.

This is a decent choice to purchase since it is route ITM (in the cash). You would prefer not to purchase alternatives with a great deal of outward worth. Those are the ones you need to sell.

In the event that you purchased this alternative you would start to profit as the stock ascents since it has a high delta (pace of progress of the choice). This choice would make cash quick since it would move rapidly in cost with the stock.

How about we take a gander at another guide to bring home the purpose of the sort of alternatives you need to purchase.

• Stock xyz is exchanging at $60.00

• The $60.00 call is with 45 days until termination is exchanging for $3.00

The inborn worth is $0.00. It has no genuine worth since it's OTM (out of the cash)

The extraneous worth is $3.00. This is the sort of choice you need to sell in light of the fact that consistently that sits back premium paid will diminish.

In the event that you purchased this $60.00 call you would require xyz to revitalize passed $63.00 at lapse to profit.

Thus, the system I prescribe is to purchase ITM (in the cash) choices with a delta of in any event (.7) or higher and at any rate 60 days until lapse. Obviously this must be went with a sound exchanging plan to limit chance by utilizing stop misfortunes and supporting methods.

On the off chance that you need to make cash quick, at that point this kind of system should some portion of your portfolio since it enables you to go out on a limb and make huge increases.

In any exchange you have to have characterized hazard. The most ideal approach to achieve this is by having a particular arrangement for your exchanges before you're even in them. Individuals who prevail with regards to exchanging don't enable their feelings to become possibly the most important factor.

In the event that you have cash in the business sectors whether you're overseeing it or giving somebody a chance to oversee pose yourself this significant inquiry. What is my general hazard and when do I intend to take my benefits? In the event that you don't have the foggiest idea about the response to t

0 notes

Text

A realization

Something that I have not been able to quite articulate, but has been bothering me about the “Flat-Earth” crowd. Almost without exception they claim the mantle of christianity. And a literal 6 day 6,000 year old creation. That in itself is not the problem. The problem comes in the fact that to make their entire cosmology work they have to force absurd explanations and near magical shells, and foundations set into something and so on. To me it recalls the creation myths of other cultures where you have god’s of whatever controlling the parameters of every bit of nature. However here you have a god who literally and supernaturally controls the weather, the movement of the sun and moon and how the light shines and creates night and if I read right holds everything together because gravity doesn’t actually exist. I feel like this limits God. Instead of the infinite creator who put together a finely tuned universe of near infinite size and complexity with rules governing everything from sub-atomic interactions to unimaginable forces binding the galaxies (which they deny exist) into universe spanning structures they posit a universe model that looks like it was built by a kid and they tack on stuff here and there to shore up whatever observation can’t be simply denied.

The idea that God is actively directing every drop of rain, every gust of breeze and and every shooting star seems bizarre. Not that he COULD do it, but that he does. I would think that if God were actively directing this in such a way there would be no patterns, no logical progressions and regularly made and reliable predictions. God is a God of Order.

Another point in this is the fact that universal constants apply across so many disciplines and point toward the observed nature of the universe.

Such things as the Inverse Square law. This applies (as observed) to gravity, light, magnetism and other wave propagation. The numerical and physical constants apply in places and ways that had not yet been thought of when the “conspiracy” of heliocentrism was made. If it indeed was made up then the underlying math would have been made up and it is almost impossible for it to not be riddled with areas where those same constants would not match up to the other scientific disciplines. The fact that such things remain consistent across astronomy, electronics, geology, audiology and so forth argue the underlying logical structure of the universe. And these are things that can be easily measured. If not quite with the precision of a large lab then well enough to see the correlations.

2 notes

·

View notes

Photo

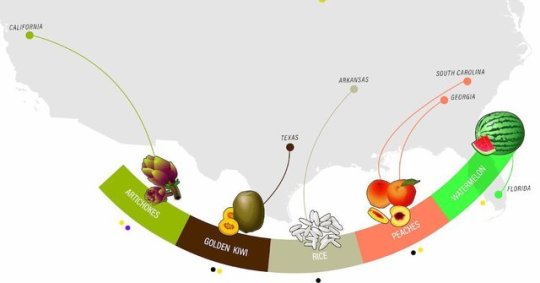

New Post has been published on https://toldnews.com/science/from-apples-to-popcorn-climate-change-is-altering-the-foods-america-grows/

From Apples to Popcorn, Climate Change Is Altering the Foods America Grows

The impact may not yet be obvious in grocery stores and greenmarkets, but behind the organic apples and bags of rice and cans of cherry pie filling are hundreds of thousands of farmers, plant breeders and others in agriculture who are scrambling to keep up with climate change.

Drop a pin anywhere on a map of the United States and you’ll find disruption in the fields. Warmer temperatures are extending growing seasons in some areas and sending a host of new pests into others. Some fields are parched with drought, others so flooded that they swallow tractors.

Decades-long patterns of frost, heat and rain — never entirely predictable but once reliable enough — have broken down. In regions where the term climate change still meets with skepticism, some simply call the weather extreme or erratic. But most agree that something unusual is happening.

“Farming is no different than gambling,” said Sarah Frey, whose collection of farms throughout the South and the Midwest grows much of the nation’s crop of watermelons and pumpkins. “You’re putting thousands if not millions of dollars into the earth and hoping nothing catastrophic happens, but it’s so much more of a gamble now. You have all of these consequences that farmers weren’t expecting.”

Because the system required to feed the country is complex and intertwined, a two- or three-week shift in a growing season can upset supply chains, labor schedules and even the hidden mechanics of agriculture, like the routes that honeybees travel to pollinate fields. Higher temperatures and altered growing seasons are making new crops possible in places where they weren’t before, but that same heat is also hurting traditional crops. Early rains, unexpected droughts and late freezes leave farmers uncertain over what comes next.

Here are 11 everyday foods, from all over the country, that are facing big changes:

Tart cherries

Michigan