#cash register sales and service

Text

‼️READING COMPREHENSION WARNING‼️

Read and comprehend the topic of this post above the "read more" link before attempting to respond. This is your only warning. Violators will be mocked and blocked.

A GUIDE TO TIPPING IN AMERICA FOR TOURISTS AND VISITORS

AND ASSHOLES WHO SOMEHOW LIVED HERE THIS LONG WITHOUT UNDERSTANDING THIS

This post is going to cover tipping people in restaurants/eateries and private transportation. Tipping can also apply to many, many other service industries including but not limited to: movers, handypeople, mechanics, etc. Since this is meant to be brief and focused on info relevant to visitors and tourists, I won't discuss that here.

You're tipping 20% minimum on your food and public/private taxi rides (including lyft, uber, etc). Include this in your budget calculations for engaging with these services.

I was going to jokingly just end the post here but let me explain. Minimum wage laws in the US allow employers to pay their employees UNDER FEDERAL MINIMUM WAGE if they're in an industry that receives tips on the regular. Taxi drivers are self-employed and have to pay for the costs of the lease on their vehicle, gas, and give a cut to their garage or ride service provider.

Therefore, capitalists have shifted the cost of paying a living wage to these people on to the consumer rather than the employer. No amount of arguments against tipping culture is going to magically fix this overnight. That's the long game and we're trying to abolish this shit. Therefore, you are tipping 20% minimum. Today.

Even if you did not like the food.

Even if the food was cold.

Even if the server didn't seem cheery and smiley.

Even if the taxi wasn't as fast as you wanted it.

Even if the taxi smelled a little funny or the driver didn't talk the amount you like.

If you did not suffer immediate physical harm or harassment or discrimination at the hands of the service person who provided you the service, full tip. Five stars if you have to rate them in an app. Perfect marks.

Does the above statement seem strange to you? It shouldn't, because remember: capitalists have forced you to cover the full cost of the service. THIS IS NOT THE FAULT OF THE SERVICE WORKER.

Cash is King

Tip in cash if you have it. Credit card companies can't take a chunk out of cash tips. And if someone who works a low-paying job can grab a bit of cash under the table, away from the eyes of the IRS, then they will do more economic good with that money than the tax cut that goes to pay for bombing other countries.

How do I figure out a 20% tip?

Easy. Look at the total (THE TOTAL, WITH TAX YOU FUCKING CHEAPSKATE). Double it, then divide by 10 (move the decimal place one over to the left). Round up the remainder to the nearest dollar. That's going to be at least 20%.

What about counter workers?

There is some confusion on how to tip people who work at a counter in cafes and fast food establishments. Because they are not considered tipped employees and they get minimum wage.

The rule is, if during your transaction the POS (point of sale) register asks you to add a tip, you add a 20% tip. If you see a tip jar, you tip. If neither of these things happen, you don't tip

What about food delivery?

20% minimum tip. You called/ordered via an app, and magically food showed up. In any weather. 20% tip.

Bonus Holiday section:

Let's say you're visiting America during the peak American holidays when it's either a common "dining out" holiday or a holiday where you usually spend time at home with family. This includes, in chronological order:

Valentines Day, Fourth of July Weekend (the whole weekend), Thanksgiving, Christmas, and New Years Eve and Day.

You tip even more on those days. 30% minimum. I've tipped 100% on meals and rides on Christmas and Thanksgiving. Because those people are taking the time out of spending the day with friends and family, what everyone else is doing, to make sure they have enough money to pay bills and survive in America. And no you fucking bigot, you don't get to eye up the server and figure out if they celebrate Christmas or not.

FAQ:

I can't afford a 20% tip. How do I pay for this?

You can't afford the full service or experience. You don't buy it. Next question.

Where I come from, we don't tip that much/not at all. Why do I have to do this?

You're in America now. You have to do this. Please, feel free to engage the worker in a spirited debate about tipping culture if you feel like you need more info. I'm sure you'll learn something new.

I have a tipping system. You see, first I start at 10% and for every...

Your system is bad and you're a cheapskate. 20% minimum.

Hey wait a minute, I'm an American and I have strict rules about who I tip and how much. And 20% is too high! What are you talking about?

Every decent human being quietly judges you for being an asshole. You are disliked by the people around you who tip like normal people. You are not going to become rich some day because you saved $5 on a tip. Own up and tip.

I ate at an expensive restaurant. Surely I don't have to tip 20% on a bill like this, do I?

Yes you do.

Holy shit. I'm going to follow this guide but wow. Do you Americans really live like this?

Oh buddy wait till you encounter states that don't list the tax on the price tag.

OH MY GOD TUMBLR KEEPS BREAKING THIS POST. ANYTHING BELOW THIS GIF GETS FUCKED PLEASE TRY TO BEAR WITH ME

340 notes

·

View notes

Text

It's just like, damn man communication and getting info cost so much around 2000.

You wanna look up some information on the phone so you can call someone that isn't in your phone book? That's like $4 in modern money.

You wanna call your aunt who lives a couple of states away and you're not paying the extra monthly landline cost for unlimited long distance? $15 in modern money for a 10 minute call in daytime hours, still like $3 nights and weekends, and these are both like "you got a pretty good deal" cases. Worse for most people.

OK so you just want to call your buddy who moved like 25 miles away? Maybe it's free cuz you lucked into still being in the same local call zone, but maybe you're still paying $3 in modern money for a 10 minute conversation because you managed to hit through two long distance zones. Especially if you're on opposite sides of a metro area or something. And if he had a cell phone you were calling, it might mean you paid even more because it registered as a further call.

But that's landline, let's say you were going cell. You might be paying the equivalent of $50 a month in modern money for 120 minutes of call time and no included texting. This service would likely charge you extra for "roaming", that is being out of your designated home calling area, as well as exceeding 120 minutes of talk time (and you would be billed a full minute minimum for any call that connected, mind), and texting once might be 75¢ in modern money on a cheaper provider, as much as $2 modern on others. Your excess call minutes might cost between 50¢ and $3 in modern money per minute and roaming calls would cost similar amounts even when you were within your plan. And on such a plan there was no cell data service so it would be an addon around $5 a month in modern money to have it at all - and prices of between 35¢ up to $5 in modern money per kilobyte transferred. Even if you were using strictly plain text that piled up quick.

You could of course move up to significantly more expensive plans per month in fixed costs to have much bigger pools of call minutes, freedom from roaming charges texts, and data. And to have significantly cheaper per-unit overage charges if you exceeded those. But that would quickly take your bill beyond $100, even $200 a month in modern money for a single line.

And of course if you wanted a couple songs from favorite singer? You ain't streaming it on a cheap monthly plan or likely even paying individually: your ass is paying nearly $38 in modern money for the whole album on CD, maybe $23 in modern money if you got a good sale price. And the artists still got a fraction of a penny off it cuz music royalties have been fucked forever. (of course you could pirate it probably... If you had internet service, if it was fast enough, if you could afford it for generally $36 a month in modern money for slow dialup, often much more if you had broadband available at all)

You wanna watch TV shows? Well like now you could watch the over the air stations for free. With tons of ads on the non-public stations ofc. But this is generally pre digital so there's much fewer stations on the air.

Or you could pay around $85 modern a month to get a pretty decent cable or satellite package and well you know, hope the time the shows you like line up with your schedule and of course it's full of ads too. Maybe you will setup a vcr or DVD recorder to catch what you couldn't be around for, and if you're not willing to wipe your old recording then you're going to need to drop serious cash to have fresh tapes and rewritable DVDs to keep that stuff around.

You want the higher end cable/satellite stuff? Well HBO alone back then was like $28 in modern money for a month on top of the rest of your bill - and most other similar no-ads premium channels were similar.

And let's not forget that this was still a time where getting official copies of shows on any kind of media often just Didn't Happen. Or they'd do it but they'd only put out random single episodes, maybe one full season on a multi season show. You might easily pay $26 in modern money for two half hour episodes or one full hour episode on a tape or DVD. Maybe you'd get lucky and instead be buying a whole season set for $75 in modern money, admittedly a much cheaper price per episode. Otherwise though, it's record it yourself in often pretty bad quality or trading and copying recordings from other people who liked that thing, if you got in touch with any.

And on-demand cable/satellite was just getting started and often required upgrading to a higher package, including paying more to rent a higher end TV box, with miniscule libraries. And the pay per view costs were often like $5 modern to watch a single movie squished to fit your TV, sometimes up to $35 modern for "new releases". Similarly, typical rental store costs were in the ball park of $7.50 to $30 in modern money per item, depending on overnight versus all week and sometimes old release vs new release. That shit added up quick! And Late fees could easily double up or triple up in just a few days.

And of course newspapers and magazines and books all cost money. We generally expect most of these to have some at least limited amount of free access on demand today, whether it's the free few articles a month before the paywall or getting free access digitally through your library. But of course back then, that's no such thing. A lot of online versions of publications were strict pay only, others only posted summaries for free, and that's if you were even online. It may not sound so bad to shell out 65¢ to $2 in modern money for a newspaper issue, or $4-$15 in modern money an issue for various magazines, but you'd be buying them pretty often if you wanted to keep up with things in more detail than they got into on TV. Even if you subscribe and get that discount for everything in a year, that's like maybe $90 a year in modern money for a major city paper, or $70 to $150 in modern money for a magazine depending on its frequency and size and content.

Shits just so fucking easy and cheap these days for real. You want to call someone you don't think about distance charges or roaming, you just fucking call. If you're calling overseas you probably use some app or program on a computer to call for free. A text message does not cost more than sending actual mail, it's nothing. Even all those stupid streaming services, which I don't use personally, you can have like 5 of those damn things, have way more to watch for less than cable back then, let alone modern cable prices, and have somewhat more reliability in what will be available next month!

Even when you're stuck on something like a strict budget, using prepaid cell service with blocks of minutes now, like some Tracfone "I only can afford $15 a month" stuff? It's like shlt at least that's 500 minutes/texts/megabytes of data. Like you're still getting screwed but it's much less so than what you got for that 10 or 20 or 25 years ago, and a lot more places have wifi you can use to stretch your data usage out.

27 notes

·

View notes

Text

Absolute goddamn chaos at work today.

So, very first thing I was told to set the gas prices to $3.09, but I set them to $0.309 and that lost the shop about $600 in gas sales. A customer came in and told me $60 in gas cost him only $7 and that's the only way I knew there was a problem.

That set the mood for the whole goddamn day.

Somehow I didn't get yelled at or fired.

My register had like no money in it. I had to scrounge around until someone paid in a $100 and I was able to swap it for some $20's from the cash stash.

A vendor came in to change out a display and the manager was like "Don't let people back here unless I'm here." Some other vendor walked up into the cooler and I was like "Hhyl.. You have to tel lsomeone before you go in there ok???" Manager was like "Did you price these??" and I was like nope. And she was like "Ok I won't yell at you for it, then...."

Some dude tried to convince me that I need to get drunk and I was very close to telling him off because people have been doing that forever and I'm sick of it.

The internet went down.

The connection between the pumps and the register went down.

The internet stayed down.

The card reader crashed.

Task customer task customer think about task customer customer all day like always.

Then all day there were vendors and workpeople in and out trying to fix the internet and deliver orders.

My feet fucking hurt.

And then

I'm not allowed to take phone calls while I'm at work but I think I'm going to have to talk to Manager about that, because

Around noon the school called to tell me my son bashed his head on the wall and needs stitches. I get off work at 1. They called me twice, then got a hold of That Guy, and the only reason THAT worked was because he happened to be here for a service call to fix the window.

Not that it would have mattered

BECAUSE I DON'T HAVE A GODDAMN CAR.

...

Manager has never had an employee with school aged kids before, and I bet she didn't even consider that when she made the no phone calls policy. I'll talk to her about it tomorrow, even though it still wouldn't have mattered since I can't get to the school regardless.

8 notes

·

View notes

Text

Black Lives Matter is headed for INSOLVENCY after plunging $8.5M into the red - but founder Patrisse Cullors' brother was still paid $1.6M for 'security services' in 2022, while sister of board member earned $1.1M for 'consulting'

By: Harriet Alexander

Published: May 24, 2024

Black Lives Matter Global Network Foundation, a non-profit that grew out of the protest movement, is haemorrhaging cash, financial records show

The group ran an $8.5 million deficit and saw the value of its investment accounts drop by nearly $10 million, with fundraising down 88% year-on-year

Despite the financial woes, the organization still paid relatives of the founder and of a board member hundreds of thousands of dollars for services

Black Lives Matter's national organization is at risk of going bankrupt after its finances plunged $8.5 million into the red last year - while simultaneously handing multiple staff seven-figure salaries.

Financial disclosures obtained by The Washington Free Beacon show the perilous state of BLM's Global Network Foundation, which officially emerged in November 2020, as a more formal way of structuring the civil rights movement.

Yet despite the financial controversy and scrutiny, BLM GNF continued to hire relatives of the founder, Patrisse Cullors, and several board members.

Cullors' brother, Paul Cullors, set up two companies which were paid $1.6 million providing 'professional security services' for Black Lives Matter in 2022.

[ BLM co-founder Patrisse Cullors' (left) employed her brother, Paul Cullors (right) for security at BLM's properties ]

[ Paul Cullors was employed as the head of the security team at the $6 million Los Angeles mansion (pictured) bought with charity donations ]

Paul Cullors was also one of BLM's only two paid employees during the year, collecting a $126,000 salary as 'head of security' on top of his consulting fees. He is best known as a graffiti artist, with no background in security.

Patrisse Cullors defended hiring him, saying registered security firms which hired former police officers could not be trusted, given the movement's opposition to police brutality.

For the previous year, 2021, tax filings revealed that BLM paid a company owned by Damon Turner, the father of Cullors' child, nearly $970,000 to help 'produce live events' and provide other 'creative services.'

Cullors resigned in May 2021.

'While Patrisse Cullors was forced to resign due to charges of using BLM's funds for her personal use, it looks like she's still keeping it all in the family,' said Paul Kamenar, an attorney for the National Legal and Policy Center watchdog group.

Shalomyah Bowers, who took over from Cullors when she resigned, also benefitted handsomely from the group: in 2022, his consultancy firm was paid $1.7 million for management and consulting services, the Free Beacon reported.

And the sister of former Black Lives Matter board member Raymond Howard was also employed in a lucrative role as a consultant.

Danielle Edwards's firm, New Impact Partners, was paid $1.1 million for consulting services in 2022, the Free Beacon said.

BLM GNF also agreed to pay an additional $600,000 to an unidentified former board member's consulting firm 'in connection with a contract dispute'.

The non-profit group ran an $8.5 million deficit, and its investment accounts fell in value by nearly $10 million in the most recent tax year, financial disclosures show.

The group logged a $961,000 loss on a securities sale of $172,000, suggesting the group sustained an 85 percent loss on the transaction. Further details of that security have not been shared.

And the cash flowing into BLM's coffers has dropped dramatically.

Donations plunged by 88 percent between 2021 and 2022, from $77 million to just $9.3 million for the most recent financial year.

Patrisse Cullors, who had been at the helm of the Black Lives Matter Global Network Foundation for nearly six years, stepped down in May 2021, amid anger at the group's financial decisions and perceived lack of transparency.

A year later, in May 2022, it was revealed Black Lives Matter spent more than $12 million on luxury properties in Los Angeles and in Toronto - including a $6.3 million 10,000-square-foot property in Canada that was purchased as part of a $8M 'out of country grant.'

The Toronto property was bought with grant money that was meant for 'activities to educate and support black communities, and to purchase and renovate property for charitable use.'

The group had said it was planning to use the property as main headquarters in Canada, and it has now been named the Wilseed Center for Arts and Activism.

It emerged that Cullors transferred millions from the organization to a charity run by her wife, Janaya Khan, to purchase the property.

Cullors admitted to AP that her group was ill-equipped to handle the finances of a charity which received $90 million the year after George Floyd was killed - but denied any wrongdoing.

Cullors issued a statement denying she used the $6 million LA property for personal purposes, but then had to backtrack and admit she had used the compound for purposes that were not strictly business.

The activist also amassed a $3 million property portfolio of her own, including homes in LA and Georgia, although there is no suggestion of any financial impropriety.

It is not known if the group paid out lucrative contracting fees to Cullors' friends and family past June 2022, when a new board of directors was brought in.

The board is now led by nonprofit adviser Cicley Gay, who has filed for Chapter 7 bankruptcy three times since 2005.

Gay was ordered by a court to attend financial management lessons, and at the time of her appointment in April 2022 had more than $120,000 in unpaid debt.

She was one of three people appointed to the board, the organization said in a tweet. She subsequently was described as being chair of the board.

She told The New York Times she had been appointed to straighten out the organization's finances, after BLMGFN faced intense scrutiny over its spending of donor cash.

'No one expected the foundation to grow at this pace and to this scale,' said Gay.

'Now, we are taking time to build efficient infrastructure to run the largest Black, abolitionist, philanthropic organization to ever exist in the United States.'

It later emerged that Gay has been declared bankrupt three times, according to federal reports obtained by The New York Post.

Gay, a mother of three, filed for bankruptcy in 2005, 2013 and 2016.

BLMGFN has faced intense questions about its handling of donations, which surged in particular during the George Floyd protests in the summer of 2020.

The organization in February 2021 said it had taken in more than $90 million in 2020 and still had $60 million on hand.

Last year, it was down to $42 million, while the Free Beacon reports BLM has now spent two thirds of the $90 million cash it had to hand.

Cullors, the co-founder of the organization, resigned in May 2021 as director of BLMGNF, amid scrutiny of her own property empire. She has written best-selling books, and has a contract with Warner Brothers to produce content.

Then in April 2022 it emerged that BLMGFN had bought a mansion in Los Angeles for $5.8 million, which they said was to be used as a 'safe space' for activists and for events.

The organization responded to the reports in a lengthy Twitter feed, with the group noting that more 'transparency' was required going forward.

[ Black Lives Matter has apologized following an expose that detailed how the organization had used donations to purchase a $6 million home in Los Angeles ]

[ In a lengthy Twitter thread on Monday morning, the group vowed to be more transparent in the future ]

'There have been a lot of questions surrounding recent reports about the purchase of Creator's House in California. Despite past efforts, BLMGNF recognizes that there is more work to do to increase transparency and ensure transitions in leadership are clear,' it stated.

BLM then proceeded to blame the media for the furore and the 'inflammatory and speculative' reports that saw journalists probing the group's financials saying that it 'caused harm'

The reports 'do not reflect the totality of the movement,' the organization claimed.

'We know narratives like this cause harm to organizers doing brilliant work across the country and these reports do not reflect the totality of the movement,' one of the tweets reads. 'We apologize for the distress this has caused to our supporters and those who work in service of Black liberation daily.'

'We are redoubling our efforts to provide clarity about BLMGNF's work,' noting an 'internal audit' was underway together with 'tightening compliance operations and creating a new board to help steer to the organization to its next evolution.'

[ The organization also criticized the original New Yorker article, pictured above, describing it as 'inflammatory and speculative' ]

[ BLM co-founder Patrisse Cullors (above) came under fire last year for a slew of high-profile property purchases. She resigned in May 2021 and has called reports investigation the $6 million mansion 'despicable' and claimed that criticisms against her are 'sexist and racist' ]

[ The home features six bedrooms and a pool in the back. BLM claimed the home was bought to provide a safe house for 'black creativity' but had allegedly tried to hide the home's existence ]

[ The mansion comes complete with a sound stage (pictured) and mini filming studio which the group had used in one of its video campaigns ]

BLM attempted to justify the purchase of the mansion by saying it was made to encourage 'Black creativity' with the property 'a space for Black folks to share their gifts with the world and hone their crafts as we see it.'

The organization also went on to defend how the funds the group raised were spent including the $3 million used for 'COVID relief' and a further $25 million dollars to black-led organizations.

'We are embracing this moment as an opportunity for accountability, healing, truth-telling, and transparency. We understand the necessity of working intentionally to rebuild trust so we can continue forging a new path that sustains Black people for generations,' the group wrote.

The barrage of tweets, which notably had their comments turned off, ended with the group announcing they were 'embracing this moment as an opportunity for accountability, healing, truth-telling, and transparency' and 'working intentionally to rebuild trust.'

[ Internal memos from BLM revealed the group wanted to keep the purchase secret, despite filming a video on the home's patio in May ]

[ The Studio City home - which sits on a three-quarter-acre lot - boasts more than half-dozen bedrooms and bathrooms, a 'butler's pantry' in the kitchen (pictured) ]

Concerns over the groups finances have swirled for years with BLM coming under intense scrutiny in the past.

In February 2022 the group stopped online fundraising following a demand by the California attorney general tho show where millions of dollars in donations received in 2020 went.

The group said the 'shutdown' was simply short term while any 'issues related to state fundraising compliance' were addressed.

--

Everybody figured out that it was a scam and always has been.

criticisms against her are 'sexist and racist'

"How dare you notice the things that I'm doing?" is the manipulative language of an abuser.

to rebuild trust

Grifters gotta grift. Defund BLM.

#Patrisse Cullors#BLM#Black Lives Matter#Buy Large Mansions#con artist#grifters gonna grift#grifters#scam artist#embezzlement#defund BLM#religion is a mental illness

10 notes

·

View notes

Text

We're two weeks in team! Have some simple blupjeans chatter

Day 14: celebrity au

Barry's just trying to buy a new tv for their bedroom, but Lup wants to talk about his celebrity status.

Read it on AO3

Barry considers the different tvs in front of him. “The 45 should be enough for where we're putting it. What do you think, babe?” He looks at Lup, but she's looking off in some other direction. “Lup?”

She turns to him. “Hm?”

“The tv?”

“Oh, yeah, whatever you want is fine.” She looks away again.

“Alright, uh,” he turns back to the sales associate helping them, “we'll go with the 45 inch one then.”

“Great! Just wait right here and I'll go grah the box from the back.”

They walk away, and Barry says to Lup, “what has you so distracted.”

She glances at him and grins. She links her arm through his and points to a tv nearby, “look.”

It's playing an episode of a cheesy mafia-themed soap opera. The same mafia-themed soap opera Barry was cast in 30 years ago to play the mob boss's fifteen year old son. The scene playing at the moment is from a recent season, showing Barry all done up in a suit, surveying some sort of shipment.

He rolls his eyes. “You're ridiculous.”

She laughs. “You're probably the only mainstream celebrity who comes to Best Buy for his tvs.”

“There's no way I'm mainstream. I'm like a T-list celebrity at best."

“Oh, come on. You're on Netflix!”

“Have you seen some of the shit on there? It's like finding an old can of beans from 1962 at the back of your grandma's cupboard sometimes. Plus,” he gestures vaguely at the tv, “the show's been running for over 30 years now, some streaming service was bound to pick it up eventually. It's not an indication of my celebrity status.”

Lup tuts. “You're selling yourself short, Bluejeans. You've gotta be at least E-list. The kids are getting into older shows nowadays.”

“I never get recognized in public.”

“Bullshit. There was that one time-”

“On the rare occasion that I do, they're almost always over the age of 60.” He gives Lup a look as he cuts her off, knowing she was going to mention that time they were on a road trip and a table of older women recognized him in a diner. She purses her lips, thinking. “You get recognized more than I do,” he says. “You're more of a celebrity than I am.”

“There's no way a YouTube channel makes me more famous than you, who's been a staple of daytime television since you were fifteen.”

“Oh yeah?” He tilts his head to indicate behind her, “six o'clock.”

“Excuse me?” Right on cue, a 20-something customer comes up to them. “I'm so sorry, but are you Lup Taaco?”

Barry takes a picture for them, and Lup talks to them for a few quick minutes until the sales associate comes back with their tv. The fan thanks her and scurries away. Barry takes the flat cart from the associate and starts driving it to the cash registers. “Told you,” he says.

“Shut up.” She crosses her arms. “I refuse to accept this slander to your popularity.”

“Lup, I'm a pudgy white guy in his 40s wearing jeans and a t-shirt. I'm practically set decoration when I'm in public. Now, if I walked around in a suit and waved a gun around going,” he makes a finger gun and does a silly impression of his tv self, “give me my fuckin’ money or I'll kill ya! Then I might get a little more attention.”

Lup considers this. “I don't think people would appreciate that.”

“No, I don't think they would. Unfortunately tv is pretend and I don't actually run the seedy underbelly of a major city.”

They get to the register, and Lup digs into her purse for her wallet. “Well at least we don't have to worry about the paps following us around.”

“And we can go to Best Buy for tvs.”

16 notes

·

View notes

Text

Closed for @dmpled

Finn wasn't sure what to make of the stranger in front of him. She wasn't the typical demographic of the store-the ones finn believed might have been daggered and lack tact, including himself. But there was something different. Finn was working behind the cash register, opting not speak to her anyway when the manager gestured him to talk. Finn groaned to himself before approaching the her.

"Those are buy 1, get one 50% off." He asked in the faux customer service voice, gesturing to the nendoroids. "We also have a sale on acryllic paint."

#dmpled#c;dilay#m;finn#(i need you all to know the reason why finn is employee of the month is because he actually does his job; the bar is in hell at this place)

7 notes

·

View notes

Text

Understanding GEM Registration: Meaning, Uses, and Benefits

GEM registration refers to the Government e-Marketplace, a digital platform established by the Government of India to facilitate efficient and transparent procurement of goods and services by government departments. The process allows businesses to register and sell directly to government entities, enhancing market access and visibility. Key benefits of GEM registration include creating a level playing field for all sellers, ensuring transparency, reducing costs and administrative time, and providing prompt payment mechanisms. It is particularly useful for businesses aiming to tap into government procurement opportunities, thus fostering growth and sustainability.

Understanding GEM Registration

We all live in a competitive marketplace where businesses and government entities constantly seek streamlined processes to connect and conduct transactions efficiently. One initiative that has gained significant prominence is GEM registration. This article will delve into the meaning of GEM registration, its full form, and its importance in the procurement ecosystem.

What is GEM Registration?

GEM, which stands for Government e-Marketplace, is an online platform established by the Government of India to facilitate the procurement of goods and services by various government departments and organizations. GEM registration allows businesses to sell their products and services directly to government entities, ensuring transparency, efficiency, and a hassle-free procurement process.

GEM Registration Meaning and Full Form

The full form of GEM is "Government e-Marketplace". It represents a digital marketplace where government buyers and sellers meet to conduct business transactions. The meaning of GEM registration is essentially the process through which sellers enlist themselves on this platform to offer their goods and services to government buyers.

GEM Registration Kya Hai?

In simpler terms, "GEM registration kya hai" translates to "what is GEM registration?" It is a crucial step for businesses aiming to expand their market reach to government sectors. Through GEM registration, vendors can access a wide range of procurement opportunities, making it a vital tool for growth and visibility in the public domain.

How GEM Registration is Used

GEM registration is primarily used to enroll sellers on the Government e-Marketplace, allowing them to list their products and services. Once registered, sellers can participate in bids and tenders posted by different government departments. The platform simplifies the procurement process by eliminating intermediaries, reducing paperwork, and ensuring prompt payment processes. Sellers benefit from a vast network of government buyers, leading to increased sales opportunities and potential business expansion.

Why GEM Registration is Useful

The utility of GEM registration lies in its ability to create a level playing field for all sellers, regardless of size. Here are some reasons why GEM registration is particularly useful:

Enhanced Market Access: It opens doors to a large and diverse market comprising various government departments, ministries, and public sector units.

Transparency and Efficiency: The platform ensures a transparent procurement process with clear guidelines and standardized practices, reducing the chances of corruption and favoritism.

Reduced Costs and Time: By digitizing the procurement process, GEM reduces administrative costs and time associated with traditional procurement methods.

Prompt Payments: The platform facilitates timely payments to sellers, improving cash flow and financial stability for businesses.

Growth Opportunities: With the government being a significant buyer, GEM offers substantial growth opportunities for businesses across various sectors.

Conclusion

GEM registration is a strategic move for businesses aiming to tap into the extensive network of government buyers. Understanding the meaning and benefits of GEM registration can empower businesses to leverage this platform effectively, ensuring growth and sustainability in the competitive market landscape. Whether you're a small enterprise or a large corporation, GEM registration offers a pathway to broaden your market reach and engage efficiently with government procurement processes.

2 notes

·

View notes

Text

Managing and Increasing Cash App Withdrawal Limits: Ultimate Guide 2024

Cash App has become a popular choice for users looking to manage their money digitally. With its convenient features, such as sending and receiving money, buying Bitcoin, and using a Cash Card for everyday transactions, Cash App has streamlined the way we handle our finances. However, like many financial services, Cash App imposes certain withdrawal limits that users must navigate. Understanding these limits and knowing how to increase them can significantly enhance your Cash App experience.

Understanding Cash App Withdrawal Limits

Before diving into how to manage and increase your Cash App withdrawal limits, it's crucial to understand what these limits are and how they work. Cash App places restrictions on the amount of money you can withdraw from your account, whether through an ATM, Bitcoin transaction, or transferring funds to a linked bank account. Here's a breakdown:

Cash App ATM Withdrawal Limit: The Cash App card ATM withdrawal limit is $310 per transaction, $1,000 per 24-hour period, and $1,000 per week. This limit applies to any ATM that accepts Visa, as the Cash Card is a Visa debit card.

Cash App Withdrawal Limit Per Day: In addition to ATM withdrawals, Cash App sets a general withdrawal limit of $2,500 per day for transfers to a linked bank account.

Cash App Bitcoin Withdrawal Limit: For those interested in cryptocurrencies, Cash App allows Bitcoin withdrawals, but it caps the limit at $2,000 worth of Bitcoin per 24-hour period and $5,000 per 7-day period.

Cash App Withdrawal Limit Per Week: Depending on the type of transaction, there are also weekly limits. For example, the ATM withdrawal limit for the Cash App card is set at $1,000 per week.

Cash App Card Withdrawal Limit: This is synonymous with the ATM withdrawal limit, meaning you can withdraw up to $1,000 per week using your Cash Card at any ATM.

How to Manage Your Cash App Withdrawal Limits?

Managing your Cash App withdrawal limits involves understanding when and how you use your Cash Card and the types of transactions you regularly perform. Here are a few strategies to help you manage within your limits:

Plan Your Withdrawals: If you know you have significant expenses coming up, plan your withdrawals accordingly. Since there is a daily and weekly cap, withdrawing small amounts regularly rather than one large amount might help manage cash flow better.

Use Cash Back at Point of Sale: Instead of solely relying on ATMs, you can use your Cash Card for purchases and opt for cash back at the register. This option often doesn't count against your ATM withdrawal limit.

Monitor Your Transactions: Keep an eye on your Cash App transactions to avoid reaching your withdrawal limit unintentionally. The app provides a history of all transactions, making it easy to track your spending.

How to Increase Your Cash App Withdrawal Limits?

While Cash App sets certain withdrawal limits, there are ways to request higher limits, especially for users who need more flexibility.

Verify Your Account: The first step to increase Cash App withdrawal limit is verifying your account. This involves providing personal information such as your full name, date of birth, and the last four digits of your Social Security number. Verified accounts typically have higher limits.

Request a Limit Increase: If you find the default limits restrictive even after account verification, you can request a higher limit through Cash App support. Be prepared to provide additional identification or documentation that proves your need for higher limits.

Increase Cash App Bitcoin Withdrawal Limits: For users interested in cryptocurrencies, increasing Bitcoin withdrawal limits also requires account verification. Make sure your account is fully verified and you have set up two-factor authentication for added security.

Upgrade Your Cash Card: Cash App offers different types of Cash Cards. Upgrading to a different tier can sometimes come with higher withdrawal limits. Explore the Cash App settings or contact support to learn about available upgrades.

Build a Good Transaction History: Regularly using Cash App responsibly can help build a positive transaction history. Over time, Cash App may increase your limits based on your consistent usage and account activity.

FAQs About Cash App Withdrawal Limits

Q1: What is the Cash App withdrawal limit per day?

A1: The Cash App withdrawal limit per day for ATM transactions is $1,000. However, for bank account transfers, the daily limit can be up to $2,500.

Q2: How can I increase my Cash App withdrawal limit?

A2: To increase your Cash App withdrawal limit, verify your account by providing personal information, request a limit increase through customer support, or consider upgrading your Cash Card.

Q3: What is the Cash App ATM withdrawal limit?

A3: The Cash App ATM withdrawal limit is $310 per transaction, $1,000 per 24-hour period, and $1,000 per week.

Q4: Can I increase my Bitcoin withdrawal limit on Cash App?

A4: Yes, you can increase your Bitcoin withdrawal limit by verifying your account and ensuring you have set up two-factor authentication.

Q5: Does Cash App have a weekly withdrawal limit?

A5: Yes, Cash App has a weekly withdrawal limit for ATM transactions of $1,000 and a Bitcoin withdrawal limit of $5,000.

Q6: What happens if I exceed my Cash App withdrawal limit?

A6: If you exceed your Cash App withdrawal limit, any additional withdrawal attempts will be declined until the limit resets after 24 hours or one week, depending on the limit.

By understanding your Cash App withdrawal limits and knowing how to manage and increase them, you can maximise your use of this versatile financial tool. Whether you need more flexibility with ATM withdrawals or Bitcoin transactions, following these steps will ensure you stay within your limits and make the most of your Cash App experience.

3 notes

·

View notes

Text

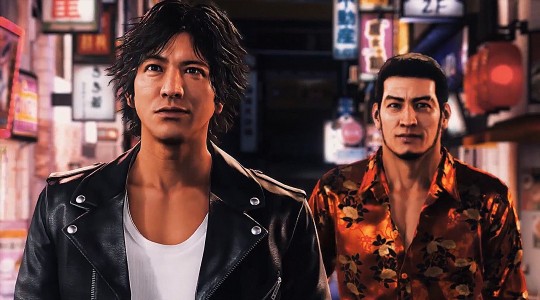

RGG/Yakuza/Judgement at the Grocery Store

UPPER MANAGEMENT = UP

WORKING CLASS = WC

CHAIRMAN AND HIS ENTOURAGE = CE

CLIENTS= C

Yakuza:

Kiryu (WC): Initially a Stock clerk was eventually Promoted to IT (responsible for price accuracy for the printed price shelf tags, maintaining the computers, point of sale software the cash registers use, and any electronic scales that weigh and print prices).

Akiyama (CE): Investor. Due to his generous “donations” to the company, he is part of the chairman’s entourage (due to his wallet’s size, his opinion matters). Thanks to him (and Tachibana), they were able to raise the salaries of the employees not part of upper management, so all of them love him and get along well when he is there. Akiyama can admit that he grew quite fond of many employees, especially Hana who will become his personal secretary. As expected, many members of upper management can’t stand him, wondering why he is even allowed to be around (they are jealous)

Haruka (WC): Cashier

Nishiki (WC): Online order clerk. Spends a lot of time chatting with Kiryu but likes his position since he is away from the upper management most of the day (he thinks they are scary and wants none of it)

Yumi (WC): Cashier

Daigo (CE): Chairman. A big picture of him is in the store saying he is the boss but you can rarely see him in the building. But for the few times, he visits the place, the upper management wake up out of their coma and pull up an act as if issues where not part of their daily lifes (they basically threaded MAjima to not blow the whistle about who is not doing their jobs.

Saejima (WC):. He prefers something more simple and since he listens to Majima’s endless rants about his position everytime. he would better be left alone away from customer service but ended up as a Loss prevention associate (helps a grocery store combat and apprehend shoplifters and unlawful employees. They often monitor security cameras for suspicious activity, and some dress as shoppers to monitor activity covertly. Loss prevention associates often contact local law enforcement to alert them of problems.). Lee, who is a security guard works along him.

Ryuji (C): Rude customer

Yuya (WC): shopping cart attendant. While he was proposed higher level position many times, he declined them

Nishida (UP): Previously a stock clerk who graduated from his position to become Majima’s right man. They separate Majima’s workload between them.

Majima (UP): Customer Service Representative. Held to higher regard because of more experience, knowledge, and skills. Since nobody in this company wants to do their job, he has to do a lot people’s tasks. Is the main person dealing with issues with customers (that’s the person we send when they say “I wanna talk to the manager”). Stressed.

Date: (highest working class) Pharmacist.

Rikiya (WC): Floor Clerk

Hana: (upper working class) HR Secretary. She will likely interview new employees.

Nishitani (UP): Supervisor. Regardless his personality, he actually does his job. He knows how to make the daily life spicy (Kashiwagi hates but since he knows how to manage rude clients to fuck off so gracefully and he can shut down arguments easily). Since he does his job so well, you can find do all type of random stuff in the store like taking hold of the AUX cord to blast Japanese 80s hits in the radion (play Namidawo Misenaide -Boys Don't Cry- by WINK) or buying items just to annoy Majima. His favorite activity is to announce employees birthdays on the store’s microphone before slapping a cake in their faces (Kiryu couldn’t escape it, Nishiki ran for his life). Nishitani succeeded to slap a cake in daigo’s face to everyone’s excitement (covertly or invertly expressed). He is just appointed himself to Mine’s burning anger, not now but one day. Always to take home what they are supposed get rid of (past date item and damaged food products)

Mine (CE): Chairman Assistant/Secretary.

Kashiwagi (UP): Inventory Control Specialist. Give this man a break. He is at the clock at 6AM everyday. Mr. Black Coffee. He spends most of his time making calls to suppliers (and often arguing with them) and check the inventory (IF PEOPLE WERE ENTERING THE DATA CORRECTLY SMH.)

Shinida (WC): Grocery clerk, who graduated from his position to become (kinda off) Majima assistant to help with everyday tasks. To take charge when Majima is too tired or angry. If not, they kinda work as duo for Majima’s work load.

Tachibana (CE): Financial Advisor. He is basically the one over the upper management of the store. If it was not for him being so good at problem-solving and calm regardless of the situation, Daigo will penalize him for how poorly the upper management are doing their job (that’s not on him lol). Always wanted to give Kiryu a promotion so he could join the upper management team and put things back in order.

Baba (WC): shopping cart attendant. Just wants to put his earphones on be left alone.

Hamura, Kuze & Sagawa (UP): Head supervisior, but nobody is sure what is role is since they can’t answer nobody’s questions about anything. More the corporate type, since they send another head supervisor (lower than them) to do all the work (a.k.a answering clients complaints). they spend all their day laughing, chatting and smoking and discussing everything but work-related things. But if there’s financial losses or their quota are not met, you will sure hear one of them raging anger ready to crack the whip on any subordinates.

Shimano (CE): Store Manager. He represents the Chairman when he is not there. So he kinda acts like he owns the place (in a way he does owns the building). He is the one watching over a lot of things in the store and especially keeping an eye over the employees. He picks Majima apart and sends Sagawa to scold him about what he is supposedly doing wrong. He is behind most (if not all) employees discharges. Keeps the business afloat.

Mirei (UP): HR

Yakuza 7/Like A Dragon

Ichiban (WC): Started as a custodian but (after Jo’s training) was upgraded to stock clerk for general merchandise and non-perishable food items. They are always calling him to go check prices and exchange articles since he is so fast and his store clerk colleagues are nowhere to be found.

Adachi (upper working class): Butcher

Nanba: (upper working class) Works in the pharmacy.

Han Joongi (WC): Food Preparation: Bread.

Zhao (WC): Food Preparation: Pastry/bakery. Decorates the cakes and makes pastries sold in the grocery store.

Saeko (WC): Beauty & Health Department Staff.

Masato Arakawa/Ryo Aoki & Kume (C): KAREN

Jo Sawashiro (UP): Hourly Supervisor & Training. Technically has the same job as Nishitani but he doesn’t even want to associate with this brown hair clown. But recently he has been upgraded to pay management and was more than willing to cut Ichiban’s pay off when he accidently spilled his coffee on him. (Chill, Jo! Is it even legal?!? Apparently, it is…)

Taka The Striker (WC): Auto Care Center Main Manager

Yumeno (C): Karen

Reina (WC): Cashier

Hamako (WC): Senior Cashier

Judgement/Lost Judgement/Judge Eyes

Yagami and Sugiura (C): they came only to buy a bag of chips and move on with their life but they are stuck waiting to checkout and it takes forever. For some reason, everyone that day filled their cart to feed the entire population of china.

Minami, Akutsu, Kaito (WC): Stock Clerk who is always late (or don’t even come) when someone call his department. Spends most his time chatting and smoking. Get to work when the boss or supervisor is near.

Tsukumo (WC): Data Entry Clerk

Higashi (WC): Electronic Department Staff

Mafuyu (WC): Beauty & Health Department Staff

Saori-San (WC): Cashier that covertly hate her job

Awabe (WC): Overnight Stock Clerk

Kengo (WC): shopping cart attendant

Sawa-Sensei (WC): Cashier

Kazuki Soma (CE): Investor. While nobody really knows where he stands or where his interested for the company comes. Rumors says he is an old supervisor but nobody ready really knows. Gets along well with Shimano and was able to conclude all types of deals with him like in exchange of generous “donations’” they could redirect some of the employees to work in his company. Some believe, him and Shimano use the grocery store for money laundering.

#modern au#yakuza like a dragon#yakuza 7#yakuza imagines#yakuza headcanons#yakuza#rgg imagines#rgg headcanons#rgg#judge eyes#lost judgment headcanons#lost judgment#kiryu kazuma#majima goro#goro majima#shinida#nishitani homare#ichiban kasuga#zhao tianyou#han joon gi#osamu kashiwagi#akira nishikiyama#takayuki yagami#sugiura fumiya#higashi toru#like a dragon#ryu ga gotoku imagines#ryu ga gotoku headcanons#ryu ga gotoku#ryo aoki

16 notes

·

View notes

Text

Streamline Your Business Operations with Alberta Cash Register's POS Software System

In today's fast-paced business landscape, efficiency and accuracy are paramount for any successful enterprise. For businesses in Alberta, Canada, seeking a reliable and comprehensive solution to streamline their operations, Alberta Cash Register offers cutting-edge POS software systems. Whether you run a retail store, restaurant, or any other business that requires effective point-of-sale management, Alberta Cash Register has got you covered. In this blog, we will explore the benefits and features of their top-notch cash register POS system and how it can enhance your business's performance.

The Power of POS Software System in Alberta: Alberta Cash Register's POS register system is an indispensable tool for businesses looking to optimize their sales processes. Designed specifically for businesses in Alberta, this system helps you manage transactions, track inventory, and maintain accurate sales records. With features tailored to various industries, their POS software caters to the specific needs of retail stores, restaurants, and other establishments.

Embrace Efficiency with Cash POS System: Gone are the days of traditional cash registers that only record transactions. Alberta Cash Register's modern POS software enables faster and more efficient transactions, reducing wait times for customers and ensuring a seamless checkout process. The user-friendly interface allows your staff to serve customers more effectively, leading to increased customer satisfaction.

The Perfect Cash Register POS System for Sale: If you're looking for a top-quality cash register POS system for sale in Alberta, look no further. Alberta Cash Register offers a range of reliable and robust systems that cater to businesses of all sizes. From small businesses to large enterprises, their POS solutions are scalable and customizable to meet your unique requirements.

Comprehensive Sales and Service: Beyond providing top-notch POS systems, Alberta Cash Register also offers exceptional sales and service support. Their team of experts ensures that your POS system is installed, integrated, and functioning optimally. Additionally, they offer ongoing technical support and maintenance, giving you peace of mind as you focus on your business.

Point of Sale Register System for Retail: For retail businesses, efficient point-of-sale management is crucial to success. Alberta Cash Register's POS system for retail empowers you to manage inventory, analyze sales data, and generate insightful reports. With these features at your fingertips, you can make informed decisions, optimize stock levels, and boost profitability.

Point of Sale Calgary: For businesses in Calgary, Alberta Cash Register offers a local solution to cater to your point-of-sale needs. Their presence in Calgary ensures that you receive prompt and personalized service whenever required. This local touch sets them apart from other generic POS system providers.

POS Software Calgary: The city of Calgary can benefit significantly from Alberta Cash Register's cutting-edge POS software. This state-of-the-art software streamlines your business operations, making it easier to manage sales, inventory, and customer data. Embracing POS software in Calgary is a game-changer for businesses seeking to stay competitive in the dynamic market.

Retail Cash Register: In the retail industry, precision and efficiency are vital to maintaining a smooth workflow. Alberta Cash Register's retail cash register systems provide a comprehensive solution to handle transactions, track sales, and simplify daily operations. Stay ahead of the competition and enhance your customers' shopping experience with their tailored POS solutions.

Conclusion: Alberta Cash Register's POS software system brings a plethora of benefits to businesses in Alberta, Canada. From efficient transaction processing to comprehensive sales and service support, their solutions are tailored to meet the unique demands of various industries. By embracing their cash register POS system, you can take your business to new heights of success. Say goodbye to manual processes and embrace the future of point-of-sale technology with Alberta Cash Register.

Visit albertacashregister.com today to discover how their POS software can transform your business!

#pos software system in alberta#cash pos system#cash register and pos system#cash register pos system for sale#cash register sales and service#point of sale register#point of sale system cash register#pos cash register for sale#pos cash register software#pos register system#retail cash register systems#point of sale calgary#pos software calgary#point of sale cash register#retail cash register#cash register systems#pos system cash register#touch screen cash register#pos system calgary#cash register for sale

0 notes

Text

Narendra Modi Story

Narendra Modi (born September 17, 1950, Vadnagar, India) Indian politician and government official who rose to become a senior leader of the Bharatiya Janata Party (BJP). In 2014 he led his party to victory in elections to the Lok Sabha (lower chamber of the Indian parliament), after which he was sworn in as prime minister of India. Prior to that he had served (2001–14) as chief minister (head of government) of Gujarat state in western India.

After a vigorous campaign—in which Modi portrayed himself as a pragmatic candidate who could turn around India’s underperforming economy—he and the party were victorious, with the BJP winning a clear majority of seats in the chamber. Modi was sworn in as prime minister on May 26, 2014. Soon after he took office, his government embarked on several reforms, including campaigns to improve India’s transportation infrastructure and to liberalize rules on direct foreign investment in the country. Modi scored two significant diplomatic achievements early in his term. In mid-September he hosted a visit by Chinese President Xi Jinping, the first time a Chinese leader had been to India in eight years. At the end of that month, having been granted a U.S. visa, Modi made a highly successful visit to New York City, which included a meeting with U.S. Pres. Barack Obama.

As prime minister, Modi oversaw a promotion of Hindu culture and the implementation of economic reforms. The government undertook measures that would broadly appeal to Hindus, such as its attempt to ban the sale of cows for slaughter. The economic reforms were sweeping, introducing structural changes—and temporary disruptions—that could be felt nationwide. Among the most far-reaching was the demonetization and replacement of 500- and 1,000-rupee banknotes with only a few hours’ notice. The purpose was to stop “black money”—cash used for illicit activities—by making it difficult to exchange large sums of cash. The following year the government centralized the consumption tax system by introducing the Goods and Services Tax (GST), which superseded a confusing system of local consumption taxes and eliminated the problem of cascading tax. GDP growth slowed from these changes, though growth had already been high (8.2 percent in 2015), and the reforms succeeded in expanding the government’s tax base. Still, rising costs of living and increasing unemployment disappointed many as grandiose promises of economic growth remained unfulfilled.

This disappointment registered with voters during the elections in five states in late 2018. The BJP lost in all five states, including the BJP strongholds of Madhya Pradesh, Rajasthan, and Chhattisgarh. The rival Indian National Congress (Congress Party) won more state assembly seats than the BJP in all five elections. Many observers believed that this portended bad news for Modi and the BJP in the national elections set for the spring of 2019, but others believed that Modi’s charisma would excite the voters. Moreover, a security crisis in Jammu and Kashmir in February 2019, which escalated tensions with Pakistan to the highest point in decades, boosted Modi’s image just months before the election. With the BJP dominating the airwaves during the campaign—in contrast to the lacklustre campaign of Rahul Gandhi and Congress—the BJP was returned to power, and Modi became India’s first prime minister outside of the Congress Party to be reelected after a full term.

In his second term Modi’s government revoked the special status of Jammu and Kashmir, stripping it of autonomy in October 2019 and bringing it under the direct control of the union government. The move came under intense criticism and faced challenges in court, not only for the questionable legality of depriving Jammu and Kashmir’s residents of self-determination but also because the government severely restricted communications and movement within the region.

In March 2020, meanwhile, Modi took decisive action to combat the outbreak of COVID-19 in India, swiftly implementing strict nationwide restrictions to mitigate the spread while the country’s biotechnology firms became key players in the race to develop and deliver vaccines worldwide. As part of the effort to counter the economic impact of the COVID-19 pandemic, Modi undertook executive action in June to liberalize the agricultural sector, a move that was codified into law in September. Many feared that the reforms would make farmers vulnerable to exploitation, however, and protesters took to the streets in opposition to the new laws. Beginning in November, massive protests were organized and became a regular disruption, particularly in Delhi.

Modi’s policies backfired in 2021. Protests escalated (culminating in the storming of the Red Fort in January), and extraordinary restrictions and crackdowns by the government failed to suppress them. Meanwhile, despite the remarkably low spread of COVID-19 in January and February, by late April a rapid surge of cases caused by the new Delta variant had overwhelmed the country’s health care system. Modi, who had held massive political rallies ahead of state elections in March and April, was criticized for neglecting the surge. The BJP ultimately lost the election in a key battleground state despite heavy campaigning. In November, as protests continued and another set of state elections approached, Modi announced that the government would repeal the agricultural reforms.

2 notes

·

View notes

Text

Tax code idea.

Abolish 100% of current code.

Replace it with:

20% transaction tax at point of sale for all goods and services.

A tax exemption will be created for transactions using a government issued benefits card to pay for goods or services. For example a purchase is tax exempt if made using a card containing government issued benefits such as food stamps, SSI, SSDI, Social Security, cash assistance for families with dependant children, and/or any other spendable government assistance or entitlement. This does not include government paychecks or salaries issued via a debit card.

Make a second tax category for luxury goods and services. Define luxury goods and services as any good or service that is priced at 3x the average price for the majority of similar goods and prices of the same type. For example if the average price for a wrist watch is $30 before tax a wrist watch costing $100 before tax would also be subjected to a 20% luxury item tax in addition to the original 20% transaction tax. It would cost $140 at the register/checkout.

A third tax category for super luxury items would also be created. A super luxury tax of 40% would be assessed to any good or service that cost 6x or more what the average price of a similar good or service of the same type. If wrist watches have an average price of $30 and you buy a wrist watch that costs $200 or more you'll pay an extra 40% tax in addition to the 20% transaction tax. So a $200 before tax wrist watch would cost $320 at the register/checkout.

These would be the only taxes a non business owning citizen will ever pay. No recurring taxes on items like land, homes, and cars can ever be implemented. Taxes on items themselves, like cigarettes, gasoline, and alcohol, can never be implemented. Citizens who do not own a busniess will never pay any tax except the transaction tax of 20% plus any luxury or super luxury tax applicable.

Business taxes.

Businesses must collect a 20% transaction tax for every transaction, that is not made with a benefits card, in which they are participating as the recipient of currency from a customer or client.

Transaction, luxury, and super luxury taxes must be remitted every quarter by the 15th day of the quarter following the quarter in which they are collected.

Micro businesses will be exempt from paying a business tax.

A micro business is any business that does not profit at least 5x the average annual income of a family of four.

Independent contractors and the self employed must obtain a business license and pay taxes according to their business classification based on the amount profit they generate.

A small business tax of 20% will be created for businesses that profit an amount equal to or greater than 5 times the average income of a family of four.

A large business tax of 30% will also be created for businesses that profit 100 times or more the average income for a family of four.

A commercial business tax of 40% will be created for businesses that profit 500x or more the average income of a family of four.

A super business tax of 60% will be created for businesses that profit 1000x or more the average income of a family of four.

A mega business tax of 75% will be created for businesses that profit 10000x the average income for a family of four.

Business taxes must be remitted at the same time as transaction taxes and must be based on the transactions for which those taxes are being submitted.

Profit is defined as all money generated through the sale of goods or services minus the cost of people employed by the hour and the typical costs of doing business such as utilities, rent for a brick and mortar location, raw materials necessary to manufacture, perform or create a good or service, or the cost of goods intended to be resold as is.

The earnings of investors, salaried employees, and executives do not count as cost of doing business and must be paid from a business's profit.

A tax refund will only be issued to businesses and only in the case of an overpayment of transaction, luxury, or super luxury taxes because of accidental faulty math or customer returns of purchased goods.

This is how to reset the economy and make it BOOM again. This is how you reduce poverty. This is how you reduce crime. This is how you increase wages. This is how you reduce prices. This is how you win.

#taxplan #taxreform #replacethetaxcode #economy #poverty #crime

2 notes

·

View notes

Text

Salon Management Software: The Key to Streamlining Your Salon Business

Salon management software has emerged as a game-changer, revolutionizing the way salons operate. This blog will delve into the essentials of salon management and explore the transformative role of salon POS software in streamlining business operations.

I. Understanding Salon Management:

Salon management involves overseeing the various aspects of a salon business, from appointment scheduling and inventory management to employee scheduling and customer relationship management. The goal is to create a seamless experience for both clients and salon staff.

II. The Importance of Salon Management Software:

Appointment Scheduling:

Efficiently manage appointments, reduce no-shows, and optimize staff schedules with the help of salon management software. Clients can book appointments online, and staff can access real-time schedules, enhancing overall workflow.

Inventory Management:

Keep track of products, manage stock levels, and streamline the ordering process. Salon management software helps avoid product shortages, reducing the risk of missed sales opportunities.

Customer Relationship Management (CRM):

Build lasting relationships with clients by utilizing CRM features. Personalized client profiles, appointment history, and automated reminders contribute to enhanced customer satisfaction and loyalty.

III. Salon POS Software: A Closer Look:

What is Salon POS Software?

Salon POS software, or Point of Sale software, is a specialized system designed to handle transactions and streamline the sales process in a salon. It combines the functionality of a cash register with advanced features tailored to the unique needs of the beauty industry.

Key Features of Salon POS Software:

Transaction Processing:

Facilitate quick and secure transactions, including cash, credit cards, and digital payments, providing convenience for both clients and staff.

Inventory Integration:

Seamlessly integrate with salon management software to ensure real-time updates on product availability and sales data.

Appointment Management:

Sync with the appointment scheduling system to unify the booking and payment processes, reducing wait times and enhancing the overall client experience.

Reporting and Analytics:

Generate comprehensive reports on sales, popular services, and inventory turnover, enabling informed decision-making for business growth.

IV. How Salon POS Software Streamlines Your Business:

Efficient Transactions:

Salon POS software speeds up the checkout process, minimizing waiting times and enhancing the overall customer experience.

Accurate Inventory Management:

Real-time updates on inventory levels and sales data help salon owners make informed decisions, preventing overstock or shortages.

Integrated Systems:

The seamless integration of salon POS software with management tools ensures a synchronized and efficient operation, reducing manual errors and increasing productivity.

Conclusion:

Salon management software, coupled with a robust POS system, is undeniably the key to streamlining your salon business. From optimizing appointments to managing inventory and enhancing customer relationships, these tools empower salon owners to focus on what they do best – providing exceptional beauty services while ensuring a smooth and efficient operation. Embrace the technological revolution in the beauty industry and watch your salon thrive.

#salon pos software#salon billing software#best salon software for small business#salon software in india#salon management software

2 notes

·

View notes

Text

Ok so this:

Physical Requirements:

Ability to use computers and other communication systems required to perform job functions

Perform repetitive hand and arm motions

Bend and lift products weighing up to 15 lbs. continuously, 25 lbs. frequently, and 50 lbs. on occasion

Pull or push up to 75 lbs. on occasion

Stand 100% of the time, frequently walking short distances

Be able to handle a variety of substances associated with cleaning and packaging materials, fresh fruits, vegetables, house plants/flowers and household cleaners

Use hands to frequently/continuously handle currency (paper and coin) as well as operate a variety of equipment such as cash register, lottery machine (where applicable), scanner, computer, and calculator

Frequent reaching and grasping at waist level: occasionally above shoulder or below waist level

Meet established volume activity standards for the position

Tolerate working in extreme hot/cold temperatures for up to 20 minutes at a time

Have sufficient visual ability to check ID cards, checks, invoices and other written documents

Is from a listing for a person that runs a meat grinder and manages perishables at the grocery store.

...

Duties and Responsibilities:

Maintain an atmosphere of enthusiastic customer awareness with primary emphasis on fast, friendly, and accurate customer service to create a positive shopping experience

Courteous and helpful to other associates

Understand and use company tools such as; average cost inventory system (ACIS) and ordering (CAO)

Receive deliveries, code where applicable, rotate and put in appropriate storage area

Ensure that ordering, receiving, preparation, conditioning and displaying of merchandise is done in accordance with policies and guidelines

Maintain proper product levels in all areas within the Perishable Department including meat, lunchmeat, frozen, dairy, ice cream

Process beef and grinds as directed from the planned production tool and as requested or needed

Wrap, label, weigh and stock meat case as requested or needed

Assemble, disassemble, and clean the grinder as requested or needed

Properly clean and sanitize the department

Maintains variety and layout standards

Ensure that all advertising and sales promotion materials applicable to the department are properly utilized

Maintain a complete understanding of and adherence to company guidelines, policies and standard practice

Understand and follow Food Safety and Workplace Safety guidelines and procedures

Observe and correct all unsafe conditions that could cause associate or customer accidents

Report all associate and customer accidents in accordance with established Food Lion procedures to the

It seems odd to me that the perishables person that's running the grinder would be pulled to a register. Ever. That's not their job.

Though it does have the big red flag of "other duties as assigned".

This is the first full time job listing to pop up at literally any of the grocery stores in my area but it's also not one I want to do. One of the things I hate the most about cooking is handling meat.

If there's an opening in their cheese dept. though....

Actually, I don't think they have a cheese department. The other grocery does, but got rid of most of the staff and started stocking only pre-packed cheeses mid-pandemic.

2 notes

·

View notes

Text

Art of affiliate marketing |vrankup|

Yo, welcome to the affiliate marketing rollercoaster! Buckle up, 'cause we digital marketing agency in dwarka, vrankup are about to dive deep into the rabbit hole of this digital dynamite. I'm gonna break it down for you in a way that's smoother than butter on hot pancakes.

Affiliate marketing, my friend, is like a tag team match between brands and regular folks – we call 'em affiliates. Imagine this: Brands got some killer products or services, but they need to spread the word like wildfire. That's where affiliates step in, armed with their blogs, YouTube channels, Insta grids, or even their own websites. These affiliates are like the hype squad, cheering for the brand from the digital sidelines.

Hold on tight, 'cause here comes the cool part. Affiliates get this magical link – it's like their golden ticket. When someone clicks on that link and buys the brand's stuff, ka-ching! The affiliate gets a slice of the pie – we're talking cold, hard cash. It's like a high-five moment for both sides. The brand gets exposure and sales, while the affiliate walks away with a grin and some extra cash to boot.

Now, let's flip the coin and see why brands are grinning like Cheshire cats over this affiliate magic. Imagine you're a brand with some next-level products. But here's the thing – those products won't sell themselves, right? That's where affiliates come to the rescue. These affiliates have their own fan clubs – blogs with dedicated readers, YouTube channels with subscribers hanging on their every word, and social media profiles with followers who trust them like a best friend's advice.

So, brands team up with these affiliates to get their products out there, to the masses. It's like a collaboration made in digital heaven. Brands are reaching audiences they might never have reached on their own.

Brands aren't just throwing money into a pit and hoping something sticks. Nah, they're smarter than that. With affiliate marketing, they're only shelling out cash when there's a real result – a sale, a lead, something that makes the cash register go cha-ching. It's like a marketing dream come true – you're investing where it counts and getting a bigger bang for your buck than a Fourth of July fireworks display.

Now, let's slide into the affiliate's shoes for a minute. Picture this: You're not a brand owner, but you're passionate about something. Let's say it's vintage video games. You've got a blog where you geek out about old-school consoles and pixelated adventures. Now, brands with killer retro game gear are peeping at you like, "Hey, wanna tell the world about our stuff?" And guess what? They're willing to pay you for it!

Affiliate marketing is like turning your passion into a paycheck. You're not inventing products, but you're like a tour guide showing people the hidden gems in your niche. You're recommending products you genuinely believe in, and for every sale that rolls in through your affiliate link, you're raking in some sweet commissions. It's like being the curator of an awesome museum, but you're making money while doing it.

This image has been removed for violating Quora's policy.

digital marketing agency in dwarka

Here's the kicker – you're not tied down to one brand. Nope, you're like a digital free bird, spreading your wings and partnering up with different brands. So, while you're geeking out about those vintage games, you could also be talking about other cool stuff like retro controllers, gaming chairs, or even gaming-themed socks. It's like having a bunch of mini-income streams, all flowing into your wallet. Who needs a nine-to-five when you've got this affiliate gig going on?

But hey, before you jump into the affiliate pool, let's talk strategy.

1. **Niche Power:** Pick a niche and own it like a boss. Whether it's vegan snacks, fashion hacks, or gardening gear, stick to your niche like glue. People trust experts, and you're gonna be their go-to guru in your corner of the internet.

2. **Content Wizardry:** Content is your magic wand. Don't just slap affiliate links all over the place like confetti. Create content that's engaging, informative, and oh-so-enticing. Think reviews, guides, "Top 10" lists – content that's like catnip for your audience.

3. **Authenticity Matters:** Listen up, honesty is your BFF. Your audience can spot a phony review from a mile away.

4. **Show Your Cards:** No hiding in the shadows, my friend. Transparency is key. Let your audience know when you're rocking an affiliate link. It's like letting them in on the secret handshake – they appreciate it, and it builds trust.

Now, before you put on your affiliate superhero cape, let's talk challenges. Like any epic quest, affiliate marketing's got its dragons to slay.

1. **Saturation Showdown:** In some niches, it's like a jam-packed party, and everybody's trying to outshine each other. To stand out, you've gotta bring the fireworks, the confetti, and maybe even a dancing unicorn.

2. **Ethical Everest:** Steer clear of the dark side, my friend. Dishonest promotions or misleading reviews? That's like wearing a neon sign that says "trust issues." Keep it clean, keep it real.

3. **Rulebook Rumble:** Different places, different rules. Some corners of the digital world need you to shout from the virtual rooftops that your content's got affiliate links. Know the rules; you're playing on their turf.