#check upi transaction details

Text

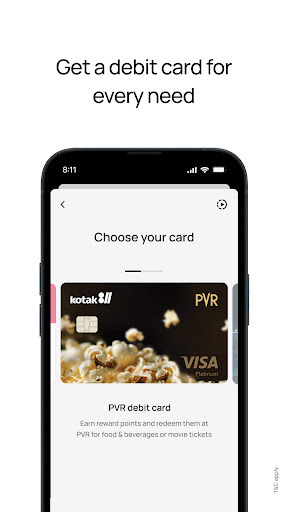

Kotak 811 – Mobile Banking Made Easy!

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#upi transaction id status check#upi transaction tracking#upi transaction check#track upi transaction#upi transaction check online#upi transaction id check online#check status of upi transaction#check upi transaction details

0 notes

Text

Kotak 811 – A One-Stop Destination for All Your Banking Needs

Make Money Transfers Smooth & Easy

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management. With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with high-interest Fixed Deposits!

The Kotak811 mobile banking app is your one-stop solution for managing your bank account anytime, anywhere. It caters to your needs with its easy-to-use interface and a wide range of features.

Move Money Effortlessly

Instant UPI Transactions: Send and receive money instantly using the Unified Payments Interface (UPI). Whether splitting a bill with friends at a restaurant, paying rent to your landlord, or repaying a colleague, Kotak811 makes it quick and convenient.

Scan & Pay in a Flash: Ditch the hassle of manually entering account details or carrying your cards everywhere. Simply scan QR codes displayed at stores, on bills, or shared by individuals to make secure and instant payments.

Fast & Secure Every Time: Rest assured, your money transfers are protected with advanced security measures like two-factor authentication and block/unblock features. Enjoy peace of mind knowing your finances are secure with Kotak811.

Stay on Top of Your Finances

Balance at Your Fingertips: Check your bank balance anytime, anywhere with just a few taps. Need a quick peek without revealing the entire amount? Utilize the convenient ‘hide balance’ feature for discreet viewing.

Track Your Transactions: Gain a complete view of your spending habits. Easily access your UPI transaction history, allowing you to categorize expenses and monitor your financial well-being.

Grow Your Savings

Open FDs with a Few Taps: Create new Fixed Deposit (FD) accounts directly within the Kotak811 App. The simple process makes investing and growing your savings for future goals easier than ever.

Manage FDs Conveniently: Monitor your existing FD investments, track their progress, and manage them effortlessly from the comfort of your phone.

Credit Card Management

Easily manage all your credit cards through the Kotak811 App. Make payments, check statements, set transaction limits, and more, all from one convenient place.

Why Choose Kotak811?

Seamless UPI Money Transfers: Send and receive money instantly using the widely accepted UPI network.

Effortless Scan & Pay: Skip manual entry and pay securely with just a quick scan.

24/7 Account Access: Manage your finances at your convenience, anytime, anywhere.

Discreet Balance Check & Transaction History: Stay informed about your finances with the ‘hide balance’ feature and easily access transaction history.

Grow Your Savings with FDs: Open and manage Fixed Deposits to achieve your financial goals.

Advanced Security Measures: Enjoy bank-grade security for all your money transfers.

User-Friendly Interface: Experience a smooth and intuitive design for a hassle-free banking experience.

Download the Kotak811 App today and redefine your banking experience.

#upi enabled app#upi account#internet banking#fd account app#upi money transfer app#banking mobile upi#fixed deposit account#phone banking#bank upi app#online fd

2 notes

·

View notes

Text

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code, commonly referred to as IFSC or Indian Financial System Code, is an eleven-character alphanumeric number that uniquely identifies bank branches and their associated NEFT or RTGS codes. This system was created by the Reserve Bank of India (RBI).

These IFSC codes are essential for Indian banking as they enable all online transactions such as the National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Service (IMPS). Not only do these IFSC codes prevent errors from occurring but they make transfers quicker and smoother too.

Identifying a Bank Branch

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code (IFSC) is an 11-character alphanumeric code used by banks to identify their branches across India. This unique system ensures funds are directed correctly to the right bank branch within each nation.

IFSC codes are essential for many reasons, such as speed and efficiency, enhanced security, and nationwide coverage. Furthermore, they make online money transfers simpler which benefits both parties involved in the transaction.

The IFSC (International Financial System Code) is an eleven-character alphanumeric code that uniquely identifies each bank branch. This code is utilized by NEFT, RTGS and IMPS systems to guarantee funds transfer to their intended destination. Furthermore, IFSC codes enable tracking transactions which helps reduce errors and fraudulence.

Identifying a Beneficiary Account

Bank IFSC codes are 11-character identification numbers which uniquely identify every bank branch in India participating in the NEFT, RTGS and IMPS payment systems. These help banks settle and validate transactions quickly between branches by expediting settlement processes.

IFSC codes simplify paperwork and enable individuals and organizations to transfer funds online without visiting a branch, saving banks valuable time, effort, and manpower.

If you need to look up an IFSC code, there are various resources such as the Reserve Bank of India website that can be utilized. Nevertheless, it's wise to double-check its accuracy with the relevant bank before transferring funds elsewhere.

Indian banking relies heavily on IFSC codes. They guarantee your money is transferred to its intended beneficiary promptly and efficiently, making IFSC codes essential when doing online transfers or using services like net banking.

Identifying a Bank Account

The IFSC code is a unique identification that's needed when transferring funds online through various methods such as National Electronic Fund Transfer (NEFT), Real Time Gross Settlements (RTGS), Immediate Payment System (IMPS) and Unified Payment Interfaces (UPI). Additionally, this helps identify a beneficiary account by providing their bank details.

It is essential to comprehend that an IFSC code consists of eleven alphanumeric characters, consisting of letters, numbers and symbols. The first four characters represent a bank name while the last six are either numbers or letters representing branch codes.

Indian banking relies heavily on IFSC codes, which are used to uniquely identify each bank branch. You may find IFSC codes on various documents like cheque books and account statements.

Online Fund Transfer

IFSC codes are an integral component of modern banking when transferring funds online. They identify the bank branch where your account is registered for NEFT, RTGS and IMPS transactions.

When sending money overseas or within India, the recipient's IFSC code is essential for smooth processing. To locate this number, check their cheque book or passbook.

An IFSC code is an 11-digit number issued by the Reserve Bank of India to all Indian banks and their branches. The initial four characters identify the bank, while the following six correspond to a particular branch.

5 notes

·

View notes

Text

Benefits of handling Digital Payments by using UPI

In ancient times, people used some types of coins for purchasing purposes. Then, they used the commodity exchange method. After that, we are using money in the form of paper and coins. We used to give cash in a physical form for every purchase, even if it was a single penny or a large amount. To give or receive money from someone, we have to appear physically. Then only we can get the amount if you want to send money to anyone through the bank, which also takes some time. But now we have an option for quick money transferthrough UPI transfer. Let’s look at the benefits of UPI transactions in the post.

UPI

UPI stands for Unified Payments Interface. The UPI method was introduced by the National Payments Corporation of India (NPCI) in 2016. UPI is a digital payment platform, even though you can use banks to send money to anyone by deposit into their account. However, it needs the account number, name, and IFSC, and you have to wait and spend your most valuable time in the bank. We must wait to take the Demand Draft, deposit the checks, and all. By using UPI money transfer,we made money transactions easy.

Digital Payment

Digital payments make our transactions more efficient through UPI money transfer.UPI is nothing but sending or receiving money using any mobile application. Now, it is more effective for everyone. To make a UPI payment, we don’t need to register the secondary person’s account details on our own. We just need the phone number linked to their bank account. One more way of digital payment is scanning the QR code to send money.

Benefits of UPI Payment

There is no need to carry cash, card, or wallet everywhere.

Caring for a mobile phone as a digital wallet is enough to make our payments.

You can instantly send money to anyone by using mobile phones.

It provides 24/7 support for money transactions.

It helps us to reduce the transaction fees from banks.

Can integrate more than one bank account under one UPI ID.

Can pay all bills by the use of UPI Payment.

You can shop for anything online by using it.

Many digital platforms provide cashback and offer reward points by using UPI Payment.

Everyone can use UPI Payment as it is a user-friendly platform.

It helps to save our time.

The Bottom line

After the UPI Payment's introduction, most payments are paid as digital payments. Everyone highly welcomes this payment method. Malls, Cinema Theaters, Department Stores, Showrooms, Educational Institutions, Hotels, Hospitals, and even very small merchandise shops also now have the digital payment method. Given the easy accessibility of the platform, the usage of UPI Payment is becoming more common nowadays. The UPI Paymenthas made a big change and created a revolution in Indian payment, making it more accessible to non-residential Indians. Now, this quick money transfermade us feel a stress-free life.

#banking upi mobile#upi mobile banking#upi registration#digital account app#upi banking app#upi net banking app#upi bank account#mobile banking upi#upi account#mobile banking account app#digital account#app upi mobile banking#net banking app upi#upi mobile banking app#safe mobile banking#upi enabled app#mobilebanking app upi

1 note

·

View note

Text

Get hassle free flights enquiry and booking with IRCTC Air

When you plan to travel by air, what you want is a website that enables ease of flights enquiry. A website where bookings can be done reliably and securely and where flight ticket enquiries are resolved in a faster time. It is here that IRCTC Air helps travellers with its offerings. IRCTC Air was launched to make economical air tickets accessible to flyers and also enable a smooth and hassle-free booking process.

How to book air tickets through IRCTC?

Visit the official IRCTC Air website www.air.irctc.co.in and get started with the booking process. As an alternative, you can get information regarding flight ticket booking IRCTC from the comfort of your phone at any time or location by downloading the IRCTC Air application from the Play Store or App Store.

Making your ticket type selection is the next step in the booking process. You can choose from different categories on IRCTC Air: one-way, or round-trip. There are certain discounts that you can apply to and get some deduction in the flight ticket price. These discounts are mainly for government employees, Indian Army personnel, students, and senior citizens.

Government officials and employees are entitled to one government-funded round-trip ticket, known as a “leave travel concession” (LTC). If they have the necessary documentation, they can simply claim this airfare concession on IRCTC Air, the sole official website. Likewise, Indian Army Personnel (serving or retired), students (with a valid student ID card), and senior citizens, can avail discounts from IRCTC Air.

After choosing a discount (if applicable), you must input the destination and arrival stops. When selecting the “from” tab, users can quickly select an option from the drop-down menu or enter name manually. We can proceed to the next stage after both destinations have been recorded and we can check flight availability to the destination.

Enter the departure and return dates in the next step and finalise the “departure date” tab. Then, simply choose the number of passengers, and the class (economy, business, or premium economy), to check flight availability and, if you have one, your favourite airline on the last tab. When you finally click search, a list of available airline tickets will appear.

Next, provide every detail about the traveller. Once you’ve reviewed the booking preview and are happy with all the details, proceed to the payment process. You have a variety of payment options when using IRCTC Air, such as UPI, wallets, credit cards, debit cards, net banking, etc. Simply select your preferred digital payment method to finish the transaction, and get confirmation in a matter of minutes. Check IRCTC AIR Flight Seat Availability Easily Online

Book your next flight tickets with IRCTC Air

IRCTC is the most reliable air ticket portal and comes in quite handy when you want to book your tickets in a hassle-free manner. With the help of the diligent customer support team, one can get all their queries answered in a single place. You can ask about flight schedules and changes in it, air tickets availability or get information about the confirmation of your tickets.

Conclusion

To facilitate user payments, all of the major credit cards, debit cards, UPI, net banking, etc. are available. Another fantastic feature is that IRCTC Air’s payment gateway is quite safe, so you don’t have to worry about online fraud. In addition to being easy to use, the IRCTC Air app saves your trip history for easy access whenever you’d like. So what are you waiting for? Get the IRCTC Air App and get the air ticket availability check without any hassle.

Source: – flight ticket booking irctc

#flightsenquiry#flightticketbookingirctc#checkflightavailability#airticketsavailability#airticketavailabilitycheck.

0 notes

Text

Top benefits of using a QR code scanner:

Nowadays, it's impossible to live in the modern world without QR codes and contactless payments. Because they are so simple and adaptable, these decades-old technologies have many uses in industry and transportation.

Only recently have contactless payments and QR codes begun to permeate the consumer sphere; COVID-19's concerns about social isolation helped their widespread adoption. In this post, you will learn a lot about QR code scanner:

It's simple to begin taking touch-free payments with QR codes:

It might not be worthwhile redesigning your payment process or investing in new equipment merely to take a few touch-free payments, as many touch-free payment methods call for a specific payment terminal.

On the other hand, all you need to use QR codes is a regular printer. Accepting remote payments only takes a few seconds once you print your QR code.

Payments with QR codes are safe:

How secure are QR code payments for your customers? A QR code connects your account to the customer's payment app, not sensitive payment data. Customers can pay you without disclosing sensitive information like account numbers because the app encrypts their payment data.

Appeal to the Crowd:

Furthermore, customers find QR codes a convenient alternative to searching for their wallet or handbag because they can easily scan them using their smartphone. This is particularly helpful for processing payments at outdoor events and festivals, where space is frequently restricted, and transactions may need to be completed promptly.

Boost Loyalty to Brands:

Additionally, you may strengthen your ties with customers and boost customer loyalty by creating customized promos only available to buyers who scan QR codes. For example, you may provide rewards points for consistently using QR code scanner payments or discounts exclusively available through these methods.

Hassle is eliminated from the consumer journey with QR codes:

The easier it is for customers to check out, the fewer processes involved. Here's where QR codes come in handy. Before they could finish checking out in the past, consumers had to locate their register, scrabble to find their card, scan it, and confirm their details.

You can allow clients to conveniently finish their transactions from their mobile devices with a few taps by utilizing QR codes for payments. It's quick and practical.

Scans of QR codes can be tracked:

Businesses can utilize QR codes to gather data insights about customer habits and transaction trends because they can be tracked.

For instance, is there a certain time or day of the week when more sales are being made? Do customers immediately make a purchase after scanning a QR code, or do they just browse your website after scanning a QR code? How often do they bounce back? Utilize QR codes to find the answers to these queries and improve your future tactics.

Extremely versatile:

Finally, you are open regarding personalization as QR codes are quite flexible and allow you to change the design to suit your requirements. Encrypted data transmissions are also possible with QR codes to offer even more protection when making payments.

Bottom Line:

The above points clearly explain the benefits of QR code scanners. If you are going to a shop without cash in your hand, using the Upi app, you can just scan the QR code scanner and pay whatever your bill is.

#mobilebanking app upi#safe mobile banking#upi enabled app#digital account#app upi mobile banking#fd account yearly#upi mobile banking app#internet banking app#phone banking#net banking app upi#banking mobile upi#best net banking app#internet banking#fd mobile app

1 note

·

View note

Text

PhonePe API Integration by Infinity Webinfo Pvt Ltd: Revolutionizing Digital Payments in India

Introduction

In the rapidly evolving fintech landscape, digital payments are essential for businesses to offer seamless transaction experiences to customers. PhonePe, one of India’s leading payment platforms, has made it easier for enterprises to adopt its UPI-based payment solutions through API integrations. Infinity Webinfo Pvt Ltd, a prominent technology solutions provider, specializes in integrating the PhonePe API to enable businesses to harness the power of digital payments effectively.

PhonePe API Integration by Infinity Webinfo Pvt Ltd

What is PhonePe API Integration?

PhonePe API integration refers to the process of embedding PhonePe’s digital payment system directly into a business’s platform, such as a website or mobile app. This integration enables businesses to accept payments from customers through UPI (Unified Payments Interface), facilitating secure and instant transactions.

Infinity Webinfo Pvt Ltd takes this process a step further by ensuring that the integration is smooth, secure, and optimized for the best user experience. The PhonePe API integration provides businesses with a direct link to the UPI ecosystem, enabling faster and more efficient payments.

Why PhonePe API Integration Matters

Wide User Base: PhonePe has a large and growing user base across India. By integrating its API, businesses can tap into this vast customer base and offer a payment option that users are already familiar with and trust.

Instant Payments: UPI payments through PhonePe are instant, meaning there is no waiting period for fund transfers. This not only improves the customer experience but also ensures businesses receive their payments immediately, aiding cash flow management.

Improved Customer Convenience: By offering PhonePe as a payment option, businesses can reduce cart abandonment rates. Customers are more likely to complete their purchase if they can use a familiar and simple payment method.

Cost-Effective Solution: The PhonePe API operates with minimal transaction fees, making it a cost-effective solution for businesses that need to process a high volume of payments.

Support for Multiple Use Cases: The PhonePe API can be used for a variety of transactions, from one-time payments for goods and services to recurring transactions such as subscriptions. This versatility makes it suitable for businesses across industries, including e-commerce, retail, education, and entertainment.

Key Benefits of PhonePe API Integration by Infinity Webinfo Pvt Ltd

QR Code Payments: For businesses with physical storefronts, the PhonePe API allows for the generation of QR codes that customers can scan to make payments directly from their PhonePe app, simplifying the checkout process.

Auto payment Update: Auto payment in PhonePe allows users to set up recurring payments automatically for services like subscriptions, bill payments, or other scheduled payments. Instead of manually paying each time, PhonePe handles the payments at regular intervals, ensuring the service continues uninterrupted

Status check API: This API allows businesses to find out the current status of a payment by using the unique transaction ID (a code given to each payment). Business can see Updated Status instantly.Customers know right away if their payment was successful, reducing confusion or delays.

Seamless UPI Transactions: With PhonePe’s API, businesses can offer direct UPI payments, allowing customers to pay using their bank accounts with just a few clicks. This eliminates the need for intermediaries like wallets and ensures hassle-free transactions.

Faster Checkouts: One of the significant advantages of integrating PhonePe is the reduction in checkout time. Customers don’t have to enter card details or use multiple authentication steps, as UPI payments are processed instantly, ensuring a smooth purchasing experience.

Enhanced Security: PhonePe’s API comes with advanced security features such as multi-layer encryption, two-factor authentication, and compliance with RBI guidelines. Infinity Webinfo Pvt Ltd ensures that all integrations maintain the highest security standards, protecting both businesses and their customers from Pvt Ltd potential fraud.

Support for Multiple Platforms: Infinity Webinfo Pvt Ltd’s integration services support various platforms, including websites, e-commerce platforms, and mobile applications (both Android and iOS). This cross-platform support ensures that businesses can cater to a wide audience with minimal development effort.

Custom Solutions: Infinity Webinfo Pvt Ltd offers custom integration solutions, tailoring the PhonePe API to suit the specific needs of businesses. Whether it's an e-commerce platform, service provider, or retail outlet, the integration can be customized to ensure the best fit.

Merchant Dashboard: After the integration, businesses get access to a comprehensive merchant dashboard from PhonePe, where they can monitor transaction data, generate reports, and manage refunds. Infinity Webinfo Pvt Ltd provides support and training to ensure businesses can utilize this dashboard to its full potential.

Support for Recurring Payments: For businesses that rely on subscription models or recurring billing, Infinity Webinfo Pvt Ltd’s PhonePe API integration enables automated recurring payments through UPI. This is a great feature for SaaS platforms, OTT services, and other businesses with subscription-based revenue models.

Security and Compliance

Security is a top priority for PhonePe, and the API integration follows strict guidelines set by the Reserve Bank of India (RBI). The platform uses end-to-end encryption and secures tokenization methods to protect user data and ensure transaction integrity.

In addition to encryption, PhonePe requires multi-factor authentication for high-value transactions, further safeguarding the payment process. Businesses integrating PhonePe’s API must comply with data protection regulations and ensure that customer data is handled securely.

Advantages for Businesses

Increased Sales: By offering a trusted and widely used payment method like PhonePe, businesses can increase sales, especially among mobile users who prefer UPI transactions.

Enhanced Customer Trust: PhonePe’s strong brand and focus on security help build trust with customers, making them more likely to complete transactions.

Streamlined Operations: Automated reconciliation and real-time transaction tracking reduce the administrative burden on businesses, enabling them to focus on other aspects of their operations.

Scalable Payment Infrastructure: The API is designed to handle large transaction volumes, making it suitable for businesses of all sizes, from startups to large enterprises.

Steps in the PhonePe API Integration Process by Infinity Webinfo Pvt Ltd

Requirement Gathering and Analysis: Infinity Webinfo Pvt Ltd works closely with businesses to understand their specific requirements and ensure that the PhonePe API integration aligns with their business goals.

API Documentation Review: Infinity Webinfo Pvt Ltd’s team reviews PhonePe’s API documentation to ensure a clear understanding of the technical specifications required for seamless integration.

Development and Integration: The integration process involves embedding the PhonePe payment gateway into the website or app, ensuring compatibility with the existing platform.

Testing and Security Check: After development, Infinity Webinfo Pvt Ltd conducts rigorous testing to ensure the API is functioning correctly. This step includes security audits to ensure that all transactions are secure and compliant with regulatory standards.

Deployment and Support: Once the integration is successfully tested, Infinity Webinfo Pvt Ltd deploys the solution and provides ongoing support to address any issues or updates that may arise.

Impact of PhonePe API Integration on Businesses

Increased Conversion Rates: The simplicity and speed of UPI payments reduce cart abandonment and increase conversion rates, especially for e-commerce platforms.

Enhanced Customer Trust: PhonePe’s widespread adoption in India means customers trust the platform. By offering PhonePe as a payment option, businesses can increase trust among their customer base.

Improved Cash Flow: Instant UPI transactions improve cash flow, as businesses receive payments in real-time without delays, unlike traditional payment methods.

Conclusion

PhonePe API integration by Infinity Webinfo Pvt Ltd offers businesses an opportunity to streamline their payment processes, improve customer satisfaction, and enhance security. With its expertise in API integration, Infinity Webinfo Pvt Ltd ensures a hassle-free and secure payment experience that helps businesses stay competitive in the digital era. As UPI continues to dominate India’s digital payment space, partnering with experts like Infinity Webinfo Pvt Ltd ensures that businesses can fully leverage the advantages of PhonePe.

Contact Us On: - +91 9711090237

#PhonePe#PhonePe Payment Gateway#PhonePe Payment Gateway API Integration#Payment Gateway API Integration#api integration#infinity webinfo pvt ltd

0 notes

Text

Gwg Game is best Lottery Game in 2024

In 2024, GWG Game has solidified its position as the premier choice for online lottery enthusiasts. Known for its engaging gameplay, high jackpots, and user-centric features, GWG Game offers an unparalleled lottery experience. Whether you’re a seasoned lottery player or new to the scene, GWG Game provides everything you need to enjoy the thrill of the lottery and chase those big wins.

Here’s why GWG Game is considered the best lottery game in 2024 and what makes it stand out from the competition.

1. Why GWG Game is the Best Lottery Game in 2024

GWG Game has earned its reputation as the top lottery platform through a combination of exciting features and player-focused benefits. Here’s what sets it apart:

Key Features of GWG Game:

Diverse Lottery Options: GWG Game offers a range of lottery games with different formats and prize structures, catering to various player preferences.

High Jackpots: The platform is known for its substantial jackpot prizes, providing players with the chance to win life-changing amounts of money.

User-Friendly Interface: With an intuitive and easy-to-navigate design, GWG Game ensures a seamless experience for buying tickets, checking results, and managing your account.

Mobile Compatibility: Accessible on both desktop and mobile devices, GWG Game allows you to participate in lottery games anytime, anywhere.

Secure Transactions: The platform uses advanced encryption and security measures to protect your personal and financial information.

2. How GWG Game Lottery Works

GWG Game provides a straightforward and enjoyable lottery experience. Here’s how you can get started:

Step 1: Select Your Lottery Game: Browse through the available lottery options on GWG Game. Each game features its own draw schedule and prize structure.

Step 2: Purchase Your Tickets: Choose your numbers or use the quick pick option to generate random numbers. Purchase your tickets directly through the platform.

Step 3: Await the Draw: Lottery draws occur at scheduled times. Keep track of the draw results on the platform to see if your numbers match.

Step 4: Claim Your Winnings: If your numbers are drawn, you can claim your prize directly through your GWG Game account. Winnings are processed efficiently and can be withdrawn as per your preference.

Example: If you choose the correct numbers and win the jackpot, your winnings will be credited to your account, allowing you to either use them for further play or withdraw them.

3. Why Players Love GWG Game

GWG Game has become a favorite among lottery players for several reasons:

Exciting Prize Pools: The platform offers large jackpots and enticing prize pools, making each draw exciting and rewarding.

Regular Draws: Frequent lottery draws ensure that players have numerous opportunities to win and stay engaged with the game.

Affordable Tickets: GWG Game offers tickets at various price points, making it accessible to players of all budgets.

Engaging Community: The platform fosters an active and supportive community of players who share tips, strategies, and celebrate wins together.

4. How to Get Started with GWG Game

Getting started with GWG Game is simple and quick. Follow these steps to begin your lottery journey:

Step 1: Register on GWG Game

Visit the official GWG Game website or download the mobile app.

Sign up by providing your basic details, such as name, email address, and phone number.

Step 2: Deposit Funds

Make your first deposit using one of the available payment methods, such as UPI, credit/debit cards, or e-wallets.

Step 3: Choose and Buy Lottery Tickets

Explore the different lottery games, select your preferred one, and purchase your tickets. You can choose your numbers manually or opt for a quick pick.

Step 4: Participate in the Draw

Wait for the scheduled draw to take place and check the results on the platform to see if you’ve won.

Step 5: Claim Your Winnings

If you win, your prize will be credited to your account. You can then withdraw it or use it for additional gameplay.

5. Promotions and Bonuses

GWG Game offers various promotions and bonuses to enhance your lottery experience:

Welcome Bonuses: New players may receive bonuses on their initial deposits, providing extra funds to use on lottery tickets.

Ongoing Promotions: Regular promotions such as free tickets, cashback offers, and special draws keep the excitement alive and give players additional chances to win.

6. Security and Fair Play

GWG Game is committed to maintaining a secure and fair gaming environment. The platform uses Random Number Generator (RNG) technology to ensure that all lottery draws are random and unbiased. Additionally, GWG Game implements robust security measures to protect your personal and financial information.

Customer Support:

GWG Game offers responsive customer support available through live chat, email, and phone to assist with any questions or issues.

Conclusion

In 2024, GWG Game stands out as the best lottery game platform, offering a range of exciting features and substantial jackpots. With its diverse lottery options, user-friendly interface, and commitment to security and fairness, GWG Game provides an exceptional lottery experience for players around the world.

Join GWG Game today, and immerse yourself in the best lottery game of 2024. Purchase your tickets, participate in thrilling draws, and chase those life-changing jackpots!

1 note

·

View note

Text

Andaman Scuba Packages for 2024: Book Your Trip Today!

Have you ever experienced a Scuba Diving adventure? If not then you must try Andaman diving packages. You will love this great experience or diving deep to discover the thrill of going against the fluttering waves. You must think about this as your next vacation plan.

There are many good places to experience the best Scuba Diving. If you visit Andaman you will get to learn more about this activity, you will have to experience it when you reach the Islands. You must consider scuba diving in Havelock so once you try the next time you will ask for more fun activities of the same kind.

Why Scuba Dive in the Islands?

Pristine Coral Reefs: The Andaman Islands boast some of the best coral reefs in India, teeming with colourful marine life.

Crystal-Clear Waters: Visibility in the waters around the islands can range from 10 to 30 meters, making it ideal for underwater photography and exploration.

Diverse Marine Life: Encounter a variety of marine species, including manta rays, sea turtles, reef sharks, and a myriad of tropical fish.

Unique Dive Sites: Explore various dive sites, including shipwrecks, underwater caves, and stunning coral gardens.

Best Time to Dive

Peak Season: November to April

Off-Season: May to October (Monsoon season, limited visibility and dive sites may be closed)

How to Book Andaman Scuba Packages Online?

You can easily book Andaman scuba packages online, check the detailed itinerary, and make your booking through net banking or UPI transactions. When the transaction is successful you will receive the booking confirmation mail.

Scuba diving in Andaman price in our package for shore scuba diving is INR 3,499 per person for a 60-minute duration and the boat scuba diving price is INR 4,249 per person for a 2-hour session. You can book the tickets online and once after successful booking you will receive a confirmation mail.

Highlights in Andaman Diving Packages that You Can Enjoy:

You can have so much fun if you try scuba diving. Here are some of the major highlights you can enjoy in your Andaman Diving packages.

1. Exploring Marine Life:

Coral Reefs: Discover vibrant coral gardens filled with diverse marine life, including anemones, sponges, and a wide array of colorful corals.

Fish Species: Encounter schools of tropical fish, such as angelfish, parrotfish, clownfish, and more. Each dive brings you face-to-face with the rich biodiversity of the ocean.

2. Weightlessness and Freedom:

Neutral Buoyancy: Experience the sensation of weightlessness as you float effortlessly underwater, giving you the freedom to move in any direction.

3. Adventure and Exploration:

Discovering New Places: Scuba diving takes you to remote and often inaccessible locations, such as uninhabited islands, hidden reefs, and marine reserves.

Conclusions:

You should try to book the scuba diving activity today without any second-guessing thoughts. You will love it for sure. The Scuba diving in Andaman age limit in our package is 10 years and above but different services will have different age limits specified in their official sites. Consider checking the age constraint before booking the tickets.

0 notes

Text

Effortlessly Collect Payments with the Best UPI and Online Payment Link Generator

Getting paid quickly and securely is key for any business. Whether you’re a small business owner, a freelancer, or running a bigger operation, having a smooth payment process is a big deal. That’s where UPI and online payment link generators come in, they make collecting payments super easy. Imagine your customers paying you instantly with just a click, no need for complicated steps. Sounds interesting? Let’s explore how these tools can make getting paid faster and easier, helping you focus more on growing your business.

The Rise of Digital Payments

Due to a combination of government initiatives, rising internet and smartphone usage, and the growth of e-commerce, the digital payments ecosystem in India has also expanded dramatically in recent years. The introduction of the Unified Payments Interface (UPI), which enables real-time interbank transactions, is one of the major initiatives. The use of digital payments has increased dramatically, particularly since the COVID-19 epidemic altered societal norms. More consumers are using digital payments due to the growing popularity of online shopping and the requirement for contactless transactions.

What is a Payment Link Generator?

Payment links are a super handy way to handle transactions because they’re so flexible. You can use a link for a single payment or make it for a specific product or service. It can be personalized for one customer or available for anyone. One of the most effective tools for achieving this is a payment link generator. You can also set the link to be used only once, for a limited time, or as a permanent link for recurring payments. This makes them great for things like subscriptions, invoices, and quotes.

How Does a Payment Link Generator Work?

Step 1 - The merchant’s server asks for a payment link.

Step 2 - The payment link generator creates the link.

Step 3 - The merchant gets the link and sends it to the customer.

Step 4 - The customer clicks on the link.

Step 5 - The link takes the customer to the payment page.

Step 6 - The customer enters their payment details and completes the checkout.

Step 7 - The payment link generator processes the payment and shows a “Payment Successful” message.

Step 8 - The merchant gets a notification confirming the payment.

Simplify your payments with Payomatix Payment Links. This easy-to-use feature lets businesses quickly request and receive payments, making the process smooth and convenient for both you and your customers.

What is UPI?

Unified Payments Interface, or UPI, is an innovative technology that enables real-time digital payments through a smartphone application. With just one click, you can send and receive money, pay bills instantly, and authorize transactions all within the same application.

Without carrying debit or credit cards, users can check account balances, manage numerous bank accounts, and conduct transactions using a variety of payment options, streamlining the entire payment process. Unlike traditional payment systems like RTGS or NEFT, UPI has simplified the payments ecosystem and eliminated time limits for businesses and individuals equally. By allowing companies to generate payment links that clients can utilize to make fast, secure payments, a UPI payment link generator can further improve this ease.

By integrating UPI payment link generator into your organization, you may completely transform the way that payments are made, leading to increased profits and decreased expenses. For a variety of platforms and transaction types, UPI is the best payment solution thanks to features like real-time transaction and quick payment notification. You can request payments with ease by using a UPI Link Generator, which is a tool that generates unique UPI payment links. A link for a one-time payment or recurring transactions can be generated. Send your clients this link over social media, text message, or email so they can easily and safely finish the payment.

Benefits of Using UPI and Online Payment Link Generators

Accessibility and Convenience

Online payment link generator and UPI offer an easy way of collecting payments. Instead of having to go through a drawn-out checkout process or visit a real business, customers can pay quickly. Small enterprises, freelancers, and service providers who need to get paid fast can especially benefit from this convenience.

Safe Transactions

Online payments place a high premium on security. Advanced encryption techniques are employed by UPI and online payment link generators to guarantee the safety and security of all transactions. Customers' trust is increased and the business is safeguarded as a result. As UPI is so popular in India, it's a great choice for companies trying to get into this huge market. You can serve a sizable portion of the populace who choose this payment option by providing UPI payment link.

Instant Payments

The speed at which transactions may be completed with UPI and payment link generators is one of its main benefits. Since payments are handled promptly, firms can get their money right away. This is especially helpful for companies with narrow margins of cash flow. Without requiring technical knowledge, you may rapidly generate payment linkages with a UPI link generator.

Affordable Transaction Costs

As UPI has a reputation for having cheap transaction costs, companies of all sizes may afford to use it. Additionally, a lot of payment link generators have affordable prices, so you won't have to pay payment processing costs that eat up a big chunk of your earnings.

Customizable Payment Links

You may add your branding to a lot of payment link generators to make the link a seamless representation of your company. Your logo, company name, and even a customized message can be added to give your clients a polished and standardized payment experience.

Track and Manage Payments

Many UPI payment link generator have integrated reporting and tracking tools. This enables companies to manage refunds when needed, trace all transactions, and keep an eye on payment statuses. Access to comprehensive payment data facilitates better financial management and decision-making for firms.

The major advantages are still the same whether you choose an online or UPI payment link generator: quick transactions, cost-effectiveness, simplicity of usage, and increased security.

Final Words

Using a payment link generator makes collecting payments quick and easy. Whether you choose a UPI payment link generator or an online payment link generator, you'll benefit from instant transactions, simplicity, and security. These tools help you get paid faster and reduce hassles, making them a great choice for any business. By using the right payment link generator, you can improve your payment process and provide a smoother experience for your customers.

0 notes

Text

Discover the Ultimate Fantasy Cricket Experience with MyMaster11 App - India's Leading Fantasy App! Download Now, Join Leagues, and Win Big The Best Fantasy Sports Thrill Awaits

In recent years, the popularity of fantasy sports has skyrocketed, with cricket leading the charge in India. Among the numerous platforms available, the MyMaster11 App stands out as a premier destination for fantasy cricket enthusiasts. This app has garnered a dedicated user base thanks to its innovative features, intuitive interface, and commitment to providing a top-notch gaming experience. Whether you're a seasoned pro or a newcomer to the world of fantasy cricket, the MyMaster11 App offers everything you need to enjoy the game to the fullest.

What Sets the MyMaster11 App Apart?

The fantasy cricket market is crowded with various platforms, but the MyMaster11 App distinguishes itself in several key ways:

1. Seamless User Experience

The MyMaster11 App is designed with user convenience in mind. From the moment you download the app, the registration process is quick and straightforward. The app's interface is clean and easy to navigate, ensuring that users can jump right into the action without any hassle. Whether you're creating a team, joining a contest, or checking live scores, every aspect of the app is optimized for a smooth experience.

2. Comprehensive Match Coverage

One of the standout features of the MyMaster11 App is its comprehensive match coverage. The app covers a wide range of cricket leagues and tournaments, from international matches to domestic leagues and T20 tournaments. This broad coverage ensures that users always have options, no matter which teams or players they follow.

3. Advanced Analytics and Player Stats

To succeed in fantasy cricket, having access to detailed player stats and match analytics is crucial. The MyMaster11 App offers in-depth data on player performances, including recent form, head-to-head records, and other critical metrics. This information helps users make informed decisions when selecting their fantasy teams, giving them a competitive edge.

4. Variety of Contest Formats

The MyMaster11 App caters to different playing styles by offering a variety of contest formats. Whether you prefer high-stakes public contests with large prize pools or private leagues with friends, the app has something for everyone. Users can participate in head-to-head matchups, small group contests, or massive tournaments, depending on their preferences and risk appetite.

5. Secure Transactions and Quick Withdrawals

Security is a top priority for the MyMaster11 App. The platform ensures that all financial transactions, from deposits to withdrawals, are secure and encrypted. Users can choose from multiple payment options, including credit/debit cards, UPI, and mobile wallets. Additionally, the app is known for its quick withdrawal process, allowing users to access their winnings without delay.

Getting Started with the MyMaster11 App

If you're new to fantasy cricket or the MyMaster11 App, getting started is simple:

Step 1: Download the App

The MyMaster11 App is available for both Android and iOS devices. Visit the app store, download the app, and install it on your device.

Step 2: Sign Up

Once the app is installed, you'll need to create an account. Provide your basic details, such as your name, email address, and mobile number, to register. You can also sign up using your social media accounts for quicker access.

Step 3: Explore the Features

Before diving into contests, take some time to explore the app's features. Check out the available matches, player stats, and upcoming contests. Familiarize yourself with the interface to make your gaming experience more enjoyable.

Step 4: Create Your Team

The core of the MyMaster11 App experience is team creation. Select your favorite players from the match lineup while staying within the allocated budget. Pay attention to player form, match conditions, and other factors that could influence performance.

Step 5: Join Contests

After assembling your team, choose from the wide array of contests available on the MyMaster11 App. Whether you're looking for high-reward public contests or more casual private leagues with friends, you'll find plenty of options to suit your preferences.

Step 6: Monitor Live Scores

Once the match starts, you can track your team's performance in real-time using the app's live score feature. The MyMaster11 App provides up-to-the-minute updates on player performances, allowing you to stay engaged throughout the game.

Winning Strategies for the MyMaster11 App

To maximize your success on the MyMaster11 App, consider these strategies:

1. Research is Key

Successful fantasy cricket is built on knowledge. Before selecting your team, research the players, pitch conditions, and recent match outcomes. The more information you have, the better your chances of picking the right combination of players.

2. Stay Updated with News

Player injuries, last-minute changes in the playing XI, and other news can have a significant impact on your team’s performance. Stay informed about the latest cricket news to make timely adjustments to your team.

3. Balance Your Team

While it’s tempting to pick star players, balancing your team with reliable performers and budget-friendly options is crucial. This ensures you have a well-rounded squad that can perform under different circumstances.

4. Enter Multiple Contests

Diversifying your entries by participating in multiple contests can increase your chances of winning. Consider creating different team combinations and entering them into various contests on the MyMaster11 App to spread your risk.

5. Practice with Free Contests

If you’re new to the MyMaster11 App or fantasy cricket in general, start by joining free contests. These contests allow you to practice your skills and develop your strategy without risking any money.

Benefits of Playing on the MyMaster11 App

The MyMaster11 App offers several benefits beyond the thrill of fantasy cricket:

1. Enhanced Cricket Knowledge

Playing fantasy cricket on the MyMaster11 App helps deepen your understanding of the game. By researching players, analyzing statistics, and following matches closely, you'll gain valuable insights into the nuances of cricket.

2. Social Interaction

Fantasy sports are a great way to connect with friends and other cricket fans. The MyMaster11 App allows users to create private leagues, challenge friends, and compete in friendly rivalries. This social aspect adds an extra layer of enjoyment to the game.

3. Real Money Rewards

The potential to earn real money is one of the most attractive aspects of the MyMaster11 App. By using your cricket knowledge and strategic thinking, you can win cash prizes and other rewards. Just remember to play responsibly and within your limits.

4. Continuous Learning and Improvement

Fantasy cricket is a skill-based game, and the MyMaster11 App provides opportunities for continuous learning. With each contest, you’ll refine your strategy, improve your decision-making, and become a more proficient player.

Conclusion: Why MyMaster11 App is a Must-Try

The MyMaster11 App is more than just a fantasy cricket platform—it's an immersive experience that enhances your love for the game. With its user-friendly interface, comprehensive features, and wide range of contests, the app caters to both casual fans and serious competitors. Whether you’re looking to test your cricket knowledge, compete with friends, or win real money, the MyMaster11 App offers it all.

If you’re passionate about cricket and haven’t yet explored the world of fantasy sports, the MyMaster11 App is the perfect place to start. Download the app today, create your team, and join the millions of cricket fans who are already enjoying this exciting platform.

0 notes

Text

How to Open Free Digital Account Online in Minutes: A Step-by-Step Guide

Managing finances has become incredibly straightforward in the digital era. With the advent of online banking and digital accounts, you can perform all your banking needs from the comfort of your home. Digi Khata offers a seamless way to open free digital account online quickly and effortlessly. This guide will walk you through the steps of free digital account opening, ensuring you can take advantage of instant account opening features and a range of convenient services.

Why Choose Digi Khata for Digital Account Opening?

Digi Khata is designed to cater to various banking needs, whether you’re a professional, student, housewife or elder. The platform offers a variety of account types, including zero balance accounts for students, minimum balance accounts, and even accounts tailored for housewives and homemakers. Here are the key benefits of choosing Digi Khata:

Instant Account Opening: Set up your digital account in minutes without the hassle of lengthy paperwork.

Versatile Account Options: From zero balance to minimum balance accounts, Digi Khata caters to all financial needs.

Seamless UPI Integration: Easily create UPI ID online and enjoy instant UPI account access.

Convenient Kiosk Banking: Utilize online kiosk banking service online for a comprehensive banking experience.

Self-Service Options: The digi kiosk self service and digital vyapar features offer unparalleled convenience.

Step-by-Step Guide to Open Free Digital Account Online

Step 1: Visit the Digi Khata Website

Start by visiting the Digi Khata website. Look for the free digital account opening option prominently displayed on the homepage. Click on it to begin the process.

Step 2: Fill in Personal Details

You will be prompted to enter your personal details, such as your name, date of birth, contact information, and address. Double-check all details for accuracy to prevent any verification problems.

Step 3: Choose Your Account Type

Digi Khata offers various account types tailored to different needs:

Zero Balance Account for Students: Ideal for students who need to manage their finances without maintaining a minimum balance.

Free Digital Account for Professionals: Suitable for working professionals requiring a versatile banking solution.

Open Digital Account for Housewives: Designed for housewives to manage household finances efficiently.

Digital Account for Elders: Specially designed for senior citizens with easy access and management features.

Select the account type that best suits your needs.

Step 4: Verify Your Identity

For instant account opening, you’ll need to verify your identity. Digi Khata uses a secure online verification process that may involve uploading a government-issued ID and a selfie. This step ensures that your account is secure and adheres to banking regulations.

Step 5: Create UPI ID Online

During the account setup, you’ll have the option to create UPI ID online. This will enable you to perform quick and seamless transactions through the Unified Payments Interface (UPI). Follow the on-screen instructions to set up your UPI ID.

Step 6: Finalize and Submit

Review all the information you’ve entered to ensure accuracy. Once you’re satisfied, submit your application. Digi Khata’s system will process your information, and you will receive confirmation of your free digital account opening within minutes.

Additional Features and Services

Online Kiosk Banking: Digi Khata’s online kiosk banking service online provide a comprehensive range of banking services accessible from digital kiosks. These kiosks are strategically located to ensure easy access for all users.

Digi Vyapaar and Instant UPI Accounts: Digi Khata’s digi vyapaar service caters to business owners, offering specialized banking solutions to manage business finances effectively. Additionally, the platform’s instant UPI account setup allows for quick and easy UPI transactions, making it ideal for both personal and business use.

Conclusion

Opening a digital account has never been easier with Digi Khata. The platform’s user-friendly interface and comprehensive services make free digital account opening a breeze. Whether you need to open free digital account online for personal use, manage business finances with digi vyapaar, or take advantage of the instant account opening feature, Digi Khata has got you covered. Embrace the future of banking today with Digi Khata’s innovative digital solutions.

#open free digital account online#instant account opening#digi vyapaar#instant UPI account#online kiosk banking#create UPI ID online

0 notes

Text

Life Insurance Corporation of India (LIC) Online Payment

Understanding LIC (Life Insurance Corporation) Online Payment

The Life Insurance Corporation of India, commonly known as LIC, is one of the oldest and most trusted insurance companies in the country. Established in 1956, LIC has been offering a wide range of insurance products, including life insurance, health insurance, and pension plans. With its strong presence and extensive network, LIC continues to be a reliable choice for millions of Indians.

The Importance of Insurance

In a world full of uncertainties, having insurance is like having a safety net. It protects you and your loved ones from unexpected financial burdens due to accidents, illnesses, or even death. Insurance policies provide peace of mind, ensuring that you’re covered when life throws curveballs your way.

Why Go Online?

So, why should you consider paying your LIC premiums online? It’s all about convenience, speed, and efficiency. No more standing in long queues or dealing with paperwork. With online payments, you can pay your premiums anytime, anywhere, from the comfort of your home. Plus, it’s environmentally friendly since it reduces the need for physical receipts and documents.

LIC of India Online Payment Overview

LIC’s online payment portal is a user-friendly platform that allows policyholders to pay their premiums, check policy details, and even download premium receipts. Whether you’re tech-savvy or not, the interface is intuitive and straightforward, making it accessible for everyone.

How to Register for LIC Online Services

To start using LIC’s online services, you’ll need to register on their official website. Here’s how:

Visit the LIC India website and click on ‘New User’.

Enter your policy number, date of birth, and other required details.

Create a username and password.

Verify your details through the OTP sent to your registered mobile number.

Log in and start using the online services.

Making Your First Online Payment

Making your first online payment is a breeze. Follow these steps:

Log in to your LIC account.

Go to the ‘Premium Payment’ section.

Select the policy for which you want to make a payment.

Choose your preferred payment method and complete the transaction.

Download the receipt for your records after successful payment.

Accepted Payment Methods

LIC offers a variety of payment options to cater to different preferences. You can pay via:

Credit/Debit Cards: Visa, MasterCard, American Express, etc.

Net Banking: Most major banks are supported.

UPI: Unified Payments Interface for quick payments.

E-wallets: Popular e-wallets like Paytm, Google Pay, etc.

Benefits of Using LIC Online Payment

Opting for online payments comes with numerous benefits, such as:

Convenience: Pay from anywhere at any time.

Instant Confirmation: Immediate payment confirmation and receipt generation.

No Extra Charges: LIC doesn’t charge any extra fees for online payments.

Record Keeping: Easy access to your payment history and receipts.

Safety and Security Measures

Worried about the safety of your online transactions? LIC employs robust security measures to protect your personal and financial information. This includes secure encryption, two-factor authentication, and regular monitoring of transactions to prevent fraud.

Troubleshooting Common Issues

Sometimes, things don’t go as planned. Here are some common issues and solutions:

Payment Failure: Check your internet connection or try a different payment method.

Login Issues: Reset your password by using the ‘Forgot Password’ option.

Receipt Not Generated: Check your email or the portal’s ‘Payment History’ section.

Conclusion

LIC of India’s online payment system is a convenient and efficient way to manage your insurance policies. With its easy registration process, multiple payment options, and robust security measures, it’s a hassle-free way to stay on top of your premiums. So, why wait?

Embrace the digital age and make your life easier with LIC’s online services.

By Paisainvests.com

#insurance payment online#LIC India#LIC online payment#LIC policy management#LIC registration#Life Insurance Corporation#manage LIC policies#online premium payment#pay LIC premiums online#secure payment options

0 notes

Text

Life Insurance Corporation of India (LIC) Online Payment

https://paisainvests.com/wp-content/uploads/2024/07/lic-life-insurance-corporation-of-india-1019x573-1.webp

Understanding LIC (Life Insurance Corporation) Online Payment

The Life Insurance Corporation of India, commonly known as LIC, is one of the oldest and most trusted insurance companies in the country. Established in 1956, LIC has been offering a wide range of insurance products, including life insurance, health insurance, and pension plans. With its strong presence and extensive network, LIC continues to be a reliable choice for millions of Indians.

The Importance of Insurance

In a world full of uncertainties, having insurance is like having a safety net. It protects you and your loved ones from unexpected financial burdens due to accidents, illnesses, or even death. Insurance policies provide peace of mind, ensuring that you’re covered when life throws curveballs your way.

Why Go Online?

So, why should you consider paying your LIC premiums online? It’s all about convenience, speed, and efficiency. No more standing in long queues or dealing with paperwork. With online payments, you can pay your premiums anytime, anywhere, from the comfort of your home. Plus, it’s environmentally friendly since it reduces the need for physical receipts and documents.

LIC of India Online Payment Overview

LIC’s online payment portal is a user-friendly platform that allows policyholders to pay their premiums, check policy details, and even download premium receipts. Whether you’re tech-savvy or not, the interface is intuitive and straightforward, making it accessible for everyone.

How to Register for LIC Online Services

To start using LIC’s online services, you’ll need to register on their official website. Here’s how:

Visit the LIC India website and click on ‘New User’.

Enter your policy number, date of birth, and other required details.

Create a username and password.

Verify your details through the OTP sent to your registered mobile number.

Log in and start using the online services.

Making Your First Online Payment

Making your first online payment is a breeze. Follow these steps:

Log in to your LIC account.

Go to the ‘Premium Payment’ section.

Select the policy for which you want to make a payment.

Choose your preferred payment method and complete the transaction.

Download the receipt for your records after successful payment.

Accepted Payment Methods

LIC offers a variety of payment options to cater to different preferences. You can pay via:

Credit/Debit Cards: Visa, MasterCard, American Express, etc.

Net Banking: Most major banks are supported.

UPI: Unified Payments Interface for quick payments.

E-wallets: Popular e-wallets like Paytm, Google Pay, etc.

Benefits of Using LIC Online Payment

Opting for online payments comes with numerous benefits, such as:

Convenience: Pay from anywhere at any time.

Instant Confirmation: Immediate payment confirmation and receipt generation.

No Extra Charges: LIC doesn’t charge any extra fees for online payments.

Record Keeping: Easy access to your payment history and receipts.

Safety and Security Measures

Worried about the safety of your online transactions? LIC employs robust security measures to protect your personal and financial information. This includes secure encryption, two-factor authentication, and regular monitoring of transactions to prevent fraud.

Troubleshooting Common Issues

Sometimes, things don’t go as planned. Here are some common issues and solutions:

Payment Failure: Check your internet connection or try a different payment method.

Login Issues: Reset your password by using the ‘Forgot Password’ option.

Receipt Not Generated: Check your email or the portal’s ‘Payment History’ section.

Conclusion

LIC of India’s online payment system is a convenient and efficient way to manage your insurance policies. With its easy registration process, multiple payment options, and robust security measures, it’s a hassle-free way to stay on top of your premiums. So, why wait?

Embrace the digital age and make your life easier with LIC’s online services.

By Paisainvests.com

#insurance payment online#LIC India#LIC online payment#LIC policy management#LIC registration#Life Insurance Corporation#manage LIC policies#online premium payment#pay LIC premiums online#secure payment options

0 notes

Text

📣 Dear Players 📣

We understand the frustration of delays in receiving your deposit, that's why we've created this detailed guide to help you provide quick feedback.

😊 Click the "BANK" Button ✔️

😊Click on "MY TRANSACTIONS" ✔️

😊Click "DEPOSIT" ✔️

😊Click the customer service icon next to deposit order ✔️

Enter the UTR number or UPI reference number of your successful payment.

😊Upload screenshot of successful payment transfer ✔️

😊Click "SUBMIT" ✔️

Please complete these steps to provide feedback on your order. Our service representatives will promptly assist you in checking its status upon receiving your feedback.

🆎🆎🆎 ➡️ MY777.COM (https://www.my777.com/) 👈

MY777 #PremiumCasino #QuickGuide #Feedback

0 notes

Text

5 Online Makeup Store Features Customers Must Check Before Shopping

There are an enormous number of cosmetic brands worldwide with an online store. As a customer, it's important to choose stores that are both safe and convenient. However, with an ocean of stores online, how can customers find their perfect shopping heaven? In this blog, we will talk about 5 features that you MUST check in a makeup store online before buying from them. By the end of this blog, we will also talk about one makeup store that ticks all the 5 boxes from convenience to security. Let’s get started.

1. Wide Range of Products

Look for a brand or makeup store that offers both makeup and skincare products. Even in the makeup section, look for stores that cover face, nails, eyes, lips, makeup bags, tools, and accessories. Also, having a wide range of products ensures that stores have products for all skin tones, skin types, and undertones.

2. Detailed Product Information

Unlike electronics or decor items, makeup and skincare products can actually affect your overall health; therefore, it is necessary to buy products with detailed information about ingredients, which skin type it suits, and how to use instructions. This is extremely helpful for people who have allergies or sensitive skin. A before-and-after image can help customers visualize their appearance after using the product.

3. Customer Review and Ratings

Check customer reviews and ratings for the product. This not only shows how good or awful the product is but also indicates that the store has nothing to hide. A mix of reviews, including some negative ones, can make positive reviews seem more credible and authentic. Additionally, reviews often provide specific details, such as whether the product is suitable for certain skin types or tones. For example, a makeup stick might not suit people with oily skin but will be perfect for people with dry skin. Reading reviews helps you make a more informed decision tailored to your needs.

4. Secure and Convenient Payment Options

Only shop at makeup stores that have reliable payment options. These are some of the reliable and convenient payment options available:

Credit and Debit cards

PayPal and Payoneer (for international transactions)

Apple Pay or Google Pay

Bank Transaction

Stay away from sites that use unknown payment options.

5. Flexible Return and Exchange Policies

Before making an online purchase, customers should review the return and exchange procedures to minimize any potential problems and guarantee a positive shopping experience. Customers can avoid unpleasant surprises about return requirements or costs by being aware of these policies and their rights regarding refunds, exchanges, and returns.

Colorbar Cosmetics: One of the Best Makeup Stores Online

Colorbar Cosmetics has one of the best makeup stores in India. First and foremost, their online store is beautiful, which makes customers enjoy browsing and shopping for their favorite products. Let’s look at the various features that make Colorbar’s makeup store online standout among other Indian brands.

Amazing range of skincare and makeup products. They have makeup products online for face, eyes, lips, makeup kit bags, and nails.

Detailed product description, which includes ingredients, application instructions, and standout product features.

All the reviews so that customers have a complete overview of the product.

Safe payment options like credit cards, debit cards, and UPI options.

Their return and exchange policy is expertly crafted. Here’s how it looks:

Refund based on the total amount originally paid for the product, including any reductions in price due to the use of discounts or credits.

Before 15 Days

Eligible for an equal-value product credit, same-value exchange, or full refund of the purchase price (less shipping and handling).

Within 15–30 Days

You are eligible for an equal-value product credit, product exchange, or 80% of the purchase price (less shipping and handling).

Within 31–50 Days

Eligible for an equal-value product credit or product exchange (less shipping and handling).

Conclusion

With hundreds of e-commerce websites selling makeup products, customers need to find one that is both convenient and safe. Colorbar Cosmetics ticks all the right boxes when it comes to makeup stores online. Their user-friendly interface and creative designs, paired with their high-quality, cruelty-free products, make them an ideal makeup store. Shop Now.

0 notes