#track upi transaction

Text

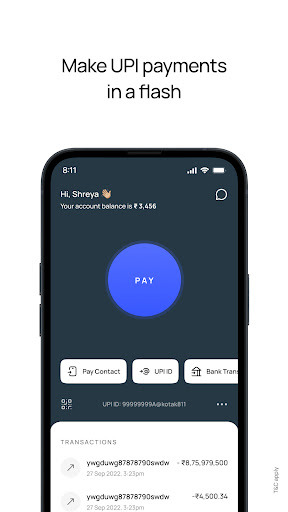

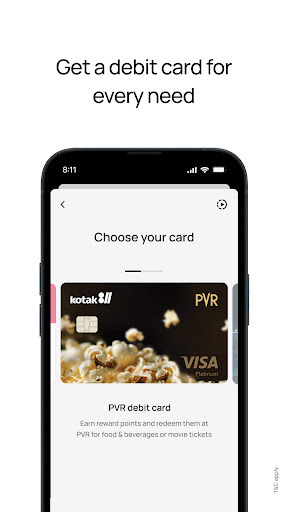

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check balance by debit card#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Kotak 811 – A One-Stop Destination for All Your Banking Needs

Make Money Transfers Smooth & Easy

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management. With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with high-interest Fixed Deposits!

The Kotak811 mobile banking app is your one-stop solution for managing your bank account anytime, anywhere. It caters to your needs with its easy-to-use interface and a wide range of features.

Move Money Effortlessly

Instant UPI Transactions: Send and receive money instantly using the Unified Payments Interface (UPI). Whether splitting a bill with friends at a restaurant, paying rent to your landlord, or repaying a colleague, Kotak811 makes it quick and convenient.

Scan & Pay in a Flash: Ditch the hassle of manually entering account details or carrying your cards everywhere. Simply scan QR codes displayed at stores, on bills, or shared by individuals to make secure and instant payments.

Fast & Secure Every Time: Rest assured, your money transfers are protected with advanced security measures like two-factor authentication and block/unblock features. Enjoy peace of mind knowing your finances are secure with Kotak811.

Stay on Top of Your Finances

Balance at Your Fingertips: Check your bank balance anytime, anywhere with just a few taps. Need a quick peek without revealing the entire amount? Utilize the convenient ‘hide balance’ feature for discreet viewing.

Track Your Transactions: Gain a complete view of your spending habits. Easily access your UPI transaction history, allowing you to categorize expenses and monitor your financial well-being.

Grow Your Savings

Open FDs with a Few Taps: Create new Fixed Deposit (FD) accounts directly within the Kotak811 App. The simple process makes investing and growing your savings for future goals easier than ever.

Manage FDs Conveniently: Monitor your existing FD investments, track their progress, and manage them effortlessly from the comfort of your phone.

Credit Card Management

Easily manage all your credit cards through the Kotak811 App. Make payments, check statements, set transaction limits, and more, all from one convenient place.

Why Choose Kotak811?

Seamless UPI Money Transfers: Send and receive money instantly using the widely accepted UPI network.

Effortless Scan & Pay: Skip manual entry and pay securely with just a quick scan.

24/7 Account Access: Manage your finances at your convenience, anytime, anywhere.

Discreet Balance Check & Transaction History: Stay informed about your finances with the ‘hide balance’ feature and easily access transaction history.

Grow Your Savings with FDs: Open and manage Fixed Deposits to achieve your financial goals.

Advanced Security Measures: Enjoy bank-grade security for all your money transfers.

User-Friendly Interface: Experience a smooth and intuitive design for a hassle-free banking experience.

Download the Kotak811 App today and redefine your banking experience.

#upi enabled app#upi account#internet banking#fd account app#upi money transfer app#banking mobile upi#fixed deposit account#phone banking#bank upi app#online fd

2 notes

·

View notes

Text

Digital Payments In Today’s World

Since the time of the stone age, we have witnessed several changes in all aspects of life forms. The oldest form of commerce, the barter system involved the exchange of goods and services between two or more parties without the use of money.

Later, the currency system emerged where the elites of Lydia and Ionia used stamped silver and gold coins to pay armies.

The Evolution of Money - Barter to Cryptocurrency

Throughout the years, like all life forms, economics and payments have seen a drastic change. From the barter system to the currency system, humankind has successfully adapted innovative technologies.

Today, we are witnessing the era of digital payments. The current payment methods are already a key indicator of our progress. They are powered by cutting-edge technology and boast our current technological advancements.

In fact, a number of countries like Sweden, Finland, the UK, China and Norway have already moved to a completely cashless society or are on their way to becoming one.

The concept of a cashless society is increasingly becoming popular. Payment methods like UPI, NEFT, Point-of-Sales terminals, and mobile wallets are preferred as they are single-click authentication.

Digital Payments in India

India has shown the world that they are a real-time digital payment by almost 40 per cent of all transactions. As a matter of fact, Prime Minister Narendra Modi praised UPI - Unified Payment Interface and the fintech sector on the occasion of Independence day.

According to the latest data, India’s digital payment market is expected to rise more than triple to $10 trillion by 2026. At the same time, digital payment methods including UPI transfers and credit card transactions will likely reach saturation point in India by FY27.

However, the cash flow will still be used. Such a transformation of the financial landscape will definitely observe intense involvement for business, society and government.

Having said that, let's have a look at the benefits and drawbacks of digital payments to understand why countries need to be even more adaptive to such payments soon.

Benefits

Digital payments provide better transparency in the transactions, which reduces the instances of money laundering & theft.

Extremely easy to track all the payments you make accurately and in real-time.

Digital payments can massively reduce the time and cost used to handle & store physical currency.

Faster transactions, making it easier and more convenient for both the retailer & the customer.

Tradition banking transactions charge some handling fee. However, Online Transactions are usually free, making transactions less costly.

Drawbacks

A potential risk of personal & financial data breach, in case the websites don’t have high-security measures in place.

Digital Payments rely upon internet connectivity heavily. So, when the internet connectivity is not there or the servers are down, it will be challenging for people to make transactions/payments.

Instances of impulsive buying may rise since you have to swipe or click to complete the transaction without needing to check your balance.

Taking all the benefits and drawbacks into consideration, digital payments come as a boon and have made our lives much easier than before.

At the same time, online retailers have a wide variety of security tools, For example - they encrypt data on the systems, Pay Pal’s security has a second authentication factor, SSL certificates, firewalls and regular system scans.

On the consumer end, there’s an option of creating strong passwords, sign up and anti-virus software up-to-date.

However, many still prefer to be more inclined toward traditional transaction methods. Ultimately, it all comes down to the personal preference of the person making the transaction, whether they want to go digital or stick to cash transactions only.

The Rise of Ecommerce

For all the reasons outlined above, online transactions are safe and secure. The shift in E-Commerce also played a pivotal role in promoting the use of digital payments, If data is to be estimated, there are around more than 289 million buyers buying things online. At the same time, it is expected to grow at a rate of 9.5% per year.

The more the use of E-commerce websites the more digital payments. Furthermore, it is also related to the strong accessibility to the internet.

Millennials are raised with internet usage and online shopping. This generation spends more money online than any other age group. Clearly, online payments are clearly the way of the future. But, the only concern that needs to be taken care of is security.

However, all cash is not the solution. So, where are we leading? Is a cashless society the future? Let’s move to the conclusion to know about the changed behaviours and alternate payment options.

Is a cashless society the future?

Today, technological innovation has made financial transactions seamlessly possible on computers and mobile devices. Now it is taken for granted, going forward.

Clearly, caution should still be exercised. Yet experts in a post-pandemic world say that it is likely that digital payments will become increasingly popular.

At the same time, with our transactions quicker, faster and better, caution should be taken regarding vulnerable people around us.

#ifmfincoach#ifm fincoach#digital currency#digitalcurrency#crypto#cryptocurrency#upi#neft#online currency

9 notes

·

View notes

Text

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code, commonly referred to as IFSC or Indian Financial System Code, is an eleven-character alphanumeric number that uniquely identifies bank branches and their associated NEFT or RTGS codes. This system was created by the Reserve Bank of India (RBI).

These IFSC codes are essential for Indian banking as they enable all online transactions such as the National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Service (IMPS). Not only do these IFSC codes prevent errors from occurring but they make transfers quicker and smoother too.

Identifying a Bank Branch

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code (IFSC) is an 11-character alphanumeric code used by banks to identify their branches across India. This unique system ensures funds are directed correctly to the right bank branch within each nation.

IFSC codes are essential for many reasons, such as speed and efficiency, enhanced security, and nationwide coverage. Furthermore, they make online money transfers simpler which benefits both parties involved in the transaction.

The IFSC (International Financial System Code) is an eleven-character alphanumeric code that uniquely identifies each bank branch. This code is utilized by NEFT, RTGS and IMPS systems to guarantee funds transfer to their intended destination. Furthermore, IFSC codes enable tracking transactions which helps reduce errors and fraudulence.

Identifying a Beneficiary Account

Bank IFSC codes are 11-character identification numbers which uniquely identify every bank branch in India participating in the NEFT, RTGS and IMPS payment systems. These help banks settle and validate transactions quickly between branches by expediting settlement processes.

IFSC codes simplify paperwork and enable individuals and organizations to transfer funds online without visiting a branch, saving banks valuable time, effort, and manpower.

If you need to look up an IFSC code, there are various resources such as the Reserve Bank of India website that can be utilized. Nevertheless, it's wise to double-check its accuracy with the relevant bank before transferring funds elsewhere.

Indian banking relies heavily on IFSC codes. They guarantee your money is transferred to its intended beneficiary promptly and efficiently, making IFSC codes essential when doing online transfers or using services like net banking.

Identifying a Bank Account

The IFSC code is a unique identification that's needed when transferring funds online through various methods such as National Electronic Fund Transfer (NEFT), Real Time Gross Settlements (RTGS), Immediate Payment System (IMPS) and Unified Payment Interfaces (UPI). Additionally, this helps identify a beneficiary account by providing their bank details.

It is essential to comprehend that an IFSC code consists of eleven alphanumeric characters, consisting of letters, numbers and symbols. The first four characters represent a bank name while the last six are either numbers or letters representing branch codes.

Indian banking relies heavily on IFSC codes, which are used to uniquely identify each bank branch. You may find IFSC codes on various documents like cheque books and account statements.

Online Fund Transfer

IFSC codes are an integral component of modern banking when transferring funds online. They identify the bank branch where your account is registered for NEFT, RTGS and IMPS transactions.

When sending money overseas or within India, the recipient's IFSC code is essential for smooth processing. To locate this number, check their cheque book or passbook.

An IFSC code is an 11-digit number issued by the Reserve Bank of India to all Indian banks and their branches. The initial four characters identify the bank, while the following six correspond to a particular branch.

5 notes

·

View notes

Text

BBPS Bill Payment API Integration by INFINITY WEBINFO PVT LTD

Introduction to BBPS

BBPS (Bharat Bill Payment System) is a centralized platform launched by the National Payments Corporation of India (NPCI) to facilitate seamless and efficient bill payments for consumers across the country. It aims to provide a standardized, secure, and user-friendly way to pay various utility bills.

BBPS Bill Payment API Integration by Infinity Webinfo Pvt Ltd

BBPS stands for Bharat Bill Payment System, an integrated bill payment system in India that enables consumers to pay their bills easily and securely. It was launched by the National Payments Corporation of India (NPCI) to facilitate seamless bill payments across various service providers.

BBPS Here are the key details regarding BBPS bill payments:

1. Services Covered

BBPS allows users to pay bills for a variety of services, including:

Electricity

Water

Gas

Telecom (Mobile and Landline)

DTH (Direct-to-Home)

Internet Services

Municipal Taxes

2. Payment Channels

Users can make payments through multiple channels, including:

Mobile Apps: Many banking and payment apps integrate BBPS.

Web Portals: Various websites provide BBPS services for bill payments.

Retail Outlets: Physical locations that are part of the BBPS network.

ATMs: Selected ATMs offer bill payment options.

3. Payment Methods

BBPS supports various payment methods to enhance user convenience:

Credit/Debit Cards

Net Banking

UPI (Unified Payments Interface)

Mobile Wallets

4. Features

Instant Confirmation: Users receive immediate payment confirmation via SMS or email.

User-Friendly Interface: Simple navigation for easy bill payment.

Dispute Resolution: Mechanisms in place for addressing transaction disputes.

Tracking and History: Users can view their transaction history for better management.

5. Security

BBPS employs advanced security measures, including:

Encryption: Protects sensitive user data.

Secure Transactions: Compliance with regulatory standards ensures a safe payment environment.

6. Benefits of Using BBPS

Convenience: Pay multiple utility bills in one place.

Time-Saving: Quick and easy payment process without the need to visit multiple service providers.

Wide Reach: Available across various service providers, ensuring accessibility.

7. How to Use BBPS

Choose a Payment Channel: Select a mobile app, website, or retail outlet.

Select the Service: Choose the type of bill to pay.

Enter Details: Provide necessary information such as account number and bill amount.

Make Payment: Select your preferred payment method and complete the transaction.

Receive Confirmation: Get instant confirmation of your payment.

8. Customer Support

In case of issues, customers can reach out to their respective service providers or the BBPS customer support for assistance.

What is BBPS Bill Payment API?

The BBPS (Bharat Bill Payment System) Bill Payment API provides businesses and service providers with the necessary tools to integrate BBPS functionalities into their platforms. This API allows for real-time bill payment processing, enabling users to pay their bills easily while ensuring a secure and efficient transaction experience.

INFINITY WEBINFO PVT LTD and BBPS Integration

INFINITY WEBINFO PVT LTD has recognized the potential of BBPS (Bharat Bill Payment System) and has successfully integrated the BBPS (Bharat Bill Payment System) Bill Payment API into its offerings. This integration enhances the service portfolio of the company, allowing its clients to offer a comprehensive bill payment solution to their customers.

Key Features of INFINITY WEBINFO PVT LTD’s BBPS Bill Payment Integration:

User-Friendly Interface: The integration comes with an intuitive interface, making it easy for users to navigate and pay their bills seamlessly.

Multiple Payment Options: Customers can pay their bills using various payment methods, including credit/debit cards, net banking, UPI, and wallets.

Real-Time Processing: The API ensures that all transactions are processed in real time, providing instant confirmation and reducing wait times for users.

Comprehensive Dashboard: INFINITY WEBINFO PVT LTD offers a robust dashboard for businesses to manage their transactions, track payment history, and generate reports.

Security Features: With advanced encryption and security protocols, the integration ensures that all transactions are safe and secure, protecting user data and financial information.

Multi-Service Capability: The API supports a wide range of utility services, allowing businesses to cater to diverse customer needs.

Scalability: INFINITY WEBINFO PVT LTD’s BBPS integration is designed to scale, accommodating increasing transaction volumes as businesses grow.

Benefits of BBPS Bill Payment API Integration

Enhanced Customer Experience: By providing a smooth and efficient bill payment process, businesses can improve customer satisfaction and retention.

Increased Revenue Streams: Businesses can leverage the BBPS platform to attract new customers and offer additional services, leading to increased revenue.

Simplified Operations: The integration automates the billing process, reducing manual effort and errors, thereby streamlining operations.

Regulatory Compliance: The BBPS framework ensures compliance with regulatory standards, giving businesses peace of mind regarding their payment processes.

Conclusion

The integration of the BBPS Bill Payment API by INFINITY WEBINFO PVT LTD represents a significant step forward in enhancing the utility payment experience in India. By leveraging this technology, businesses can provide a seamless, secure, and efficient bill payment solution, ultimately leading to greater customer satisfaction and operational efficiency. As the digital payment landscape continues to evolve, INFINITY WEBINFO PVT LTD is poised to be a key player in the industry, driving innovation and convenience for consumers across the nation.

For more information about BBPS API integration and how it can benefit your business, visit INFINITY WEBINFO PVT LTD’s official website or contact us.

For more details contact us now: - +91 9711090237

#Bharat Bill Payment System#BBPS API Integration#payment gateway api integration#payment gateway integration#BBPS#payment gateway#api integration#infinity webinfo pvt ltd

0 notes

Text

Digital Account Opening: A Game Changer for Banking Success

In today's fast-paced world, traditional banking methods are quickly being overshadowed by innovative digital solutions. One such breakthrough is digital account opening, a transformative approach that is revolutionizing the way we manage our finances. At Digi Khata, we are at the forefront of this shift, providing a range of services designed to make banking more accessible and efficient for everyone. Here’s how digital account opening is changing the game for banking success.

The Convenience of Free Digital Account Opening

One of the most significant advantages of digital account opening is the ability to open a free digital account online. This process eliminates the need for in-person visits to the bank, allowing you to complete your account setup from the comfort of your home. With Digi Khata, you can enjoy free digital account opening with just a few clicks, making banking more convenient than ever before. This service is ideal for busy professionals, students, homemakers, and anyone looking to streamline their financial management.

Instant Account Opening for Immediate Access

Another major benefit is instant account opening, which provides immediate access to your banking services. Traditional account opening processes can be time-consuming, often requiring multiple visits and lengthy paperwork. However, with Digi Khata’s digital solutions, you can open a zero balance account quickly and start managing your finances right away. Whether you're looking to manage your personal finances or set up an account for a family member, our instant account opening service ensures you get access without unnecessary delays.

Tailored Solutions for Various Needs

Digi Khata understands that different individuals have unique banking needs. That's why we offer a variety of account options to cater to different requirements:

Zero Balance Account for Students: Ideal for students who need a simple, cost-effective banking solution without the burden of maintaining a minimum balance.

Free Digital Account for Professionals: Designed for working professionals who require a hassle-free, efficient way to manage their finances.

Open Digital Account for Housewives: Provides a convenient banking option for homemakers who want to keep track of their household finances.

Digital Account for Elders: Simplifies banking for senior citizens with easy-to-use features and minimal account maintenance.

Open a Zero Balance Account for Your Maid: Offers a practical solution for managing household finances for those who support their staff.

Enhanced Features with UPI Integration

Digi Khata goes beyond basic banking services by offering the ability to create a UPI ID online. Unified Payments Interface (UPI) is a cutting-edge payment system that allows for seamless, instant transactions. By integrating UPI with your digital account, you can easily make and receive payments, check balances, and manage your finances in real-time. This feature enhances the functionality of your digital account, making it a comprehensive tool for all your banking needs.

Flexible Minimum Balance Accounts

For those who prefer to maintain a minimum balance, Digi Khata also offers the option to open a minimum balance account. This type of account provides the flexibility to manage your finances while ensuring that you meet the minimum balance requirements set by the bank.

The Future of Banking with Digital Accounts

Digital account opening is not just a trend; it represents the future of banking. By embracing these advanced solutions, banks like Digi Khata are making financial services more accessible, efficient, and tailored to individual needs. Whether you're looking for a free digital account opening, instant access to banking services, or specialized accounts for different requirements, Digi Khata has the tools and expertise to support your financial journey.

Conclusion

In conclusion, digital account opening is a game changer for banking success. It offers unprecedented convenience, efficiency, and flexibility, making it an essential component of modern banking. With Digi Khata’s comprehensive suite of digital banking solutions, you can easily manage your finances, enhance your banking experience, and enjoy the many benefits of a digitally optimized financial system. Embrace the future of banking with Digi Khata and experience the transformative power of digital account opening today.

0 notes

Text

Digital Wallets, Real Threats: The Dark Side of Mobile Payments in India

Imagine paying for your chai with a simple tap of your phone. Convenient, right? Now imagine that same tap exposing your entire financial history. Welcome to the world of mobile payment privacy breaches – the hidden cost of digital convenience in India's booming fintech landscape.

Why I'm Losing Sleep Over This

As a digital innovation enthusiast, I'm both excited and concerned about India's mobile payment revolution. It's democratizing finance and driving financial inclusion, but it's also creating a treasure trove of sensitive data that's catching the eye of cybercriminals. It's like carrying your entire bank in your pocket – convenient, but oh so risky!

The Mobile Money Tsunami

India's love affair with mobile payments is reaching fever pitch:

Digital payments in India hit 8,840 crore transactions in FY 2021-22 (RBI, 2022).

UPI transactions alone crossed 9.36 billion in volume and ₹10.25 trillion in value in May 2023 (NPCI, 2023).

That's a lot of digital money changing hands – and a lot of data up for grabs!

The Sneaky Ways Your Transactions Betray You

How are these seemingly secure apps leaving you vulnerable? Let's follow the money trail:

Phishing on Steroids: Fake payment apps that look eerily real.

Man-in-the-Middle Attacks: Intercepting your data mid-transaction.

Malware Mayhem: Sneaky software that steals your credentials.

QR Code Quagmire: Scanning your way into a hacker's trap.

Who's Paying the Price?

When mobile payment privacy is compromised, the ripple effects are far-reaching:

Users: Your financial data and hard-earned money are at risk.

Businesses: Customer trust evaporates faster than you can say "digital India."

Banks and Fintech Companies: Reputational damage and regulatory nightmares await.

The Regulatory Tightrope

India's regulators are trying to keep up, but it's like chasing a bullet train on foot:

The RBI's guidelines on digital payments security are evolving, but implementation lags.

The proposed Personal Data Protection Bill aims to address fintech privacy, but it's still in the pipeline.

It's a bit like trying to build a railway track while the train is already moving!

Safeguarding Your Digital Rupees

Don't worry, you don't need to go back to carrying cash! Here's how to keep your digital money safe:

Stick to official apps – no matter how tempting that "special offer" looks.

Enable biometric authentication – your fingerprint is harder to fake than a password.

Use a separate bank account for digital transactions – limit your exposure.

Be wary of public Wi-Fi – that free internet could cost you dearly.

Keep your apps updated – those pesky updates often patch security holes.

The Bottom Line

As India races towards a cashless future, we need to make sure we're not leaving our financial privacy behind. Stay vigilant, stay informed, and remember – in the world of mobile payments, convenience should never come at the cost of security.

So, the next time you tap to pay, take a moment to appreciate the technology – and then double-check your privacy settings!

Stay safe, stay smart, and maybe think twice before linking your entire life to that shiny new payment app!

0 notes

Text

Payomatix is a leading payment gateway solution designed to simplify and enhance digital transactions for businesses of all sizes. It offers a seamless integration process, allowing businesses to quickly set up secure payment options on their websites or apps. With features like real-time analytics, advanced fraud detection, and multi-currency support, Payomatix enables businesses to manage their payments efficiently and securely.

The platform provides a user-friendly dashboard for easy tracking of transactions and supports various payment methods, including credit/debit cards, UPI, and net banking. Payomatix stands out for its competitive pricing and round-the-clock customer support, ensuring businesses have the assistance they need at any time. It caters to a wide range of industries, offering flexible solutions that adapt to diverse business models.

With its commitment to security, innovation, and customer satisfaction, Payomatix is an ideal choice for businesses looking to optimize their payment processing and deliver a superior experience to their customers. Whether you are a startup or an established enterprise, Payomatix empowers you to handle payments effortlessly, allowing you to focus on growth and expansion.

Website:

https://payomatix.com/

Address:

UG - 06 to UG-17, Swarn Plaza, Swarn Nagari, Greater Noida, Uttar Pradesh, 201310, India

Phone Number:

1800 309 0113

Business Hours:

Mon - Sun:10:00am - 06:00pm

Contact mail:

[email protected]

[email protected]

1 note

·

View note

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Text

Kotak 811 – Mobile Banking Made Easy!

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#upi transaction id status check#upi transaction tracking#upi transaction check#track upi transaction#upi transaction check online#upi transaction id check online#check status of upi transaction#check upi transaction details

0 notes

Text

Best Online Shopping Deals in India: Why Gshoppi Stands Out

In today’s digital age, finding the best online shopping deals in India is more crucial than ever. With countless platforms offering a variety of products, it's essential to choose one that offers not only the best prices but also a smooth and secure shopping experience. Gshoppi has emerged as a leading name in the e-commerce space, providing customers with access to unbeatable deals and a vast selection of products across categories.

Why Choose Gshoppi for the Best Online Shopping Deals in India?

Exclusive Discounts and Offers

Gshoppi is renowned for offering some of the best online shopping deals in India, whether you're shopping for electronics, fashion, home essentials, or beauty products. Their exclusive deals, flash sales, and seasonal offers ensure that customers always get the most value for their money. From branded goods to essential items, Gshoppi provides discounts that are hard to match, making it a favorite among savvy shoppers.

Wide Range of Products

One of the standout features of Gshoppi is its extensive product range. Customers can find everything from cutting-edge electronics, home appliances, and fashion items to groceries, health products, and more. With Gshoppi, there's no need to browse multiple websites to fulfill all your shopping needs. The platform caters to all age groups and interests, ensuring there’s something for everyone.

User-Friendly Interface

Navigating Gshoppi is a breeze, thanks to its well-organized and intuitive platform. The search filters and categories are designed to help customers find the best online shopping deals in India quickly and efficiently. The website is mobile-optimized, allowing for a seamless shopping experience, whether you're browsing on your phone or desktop.

Fast and Reliable Delivery

Gshoppi understands that customers value quick and reliable delivery. The platform works with a wide network of logistics partners across India to ensure timely delivery to both metropolitan and rural areas. Customers can track their orders and enjoy hassle-free returns, making the shopping experience even more trustworthy and convenient.

Safe and Secure Payment Options

Shopping online means prioritizing security, and Gshoppi takes this seriously. They offer a range of secure payment options, including credit/debit cards, UPI, net banking, and cash-on-delivery. Customers can shop with confidence, knowing that their transactions are protected by the latest security protocols.

Customer-Centric Approach

At Gshoppi, customer satisfaction is the top priority. The platform boasts a dedicated customer service team available to assist shoppers with inquiries, issues, or concerns. Gshoppi's commitment to offering the best online shopping deals in India is further reflected in their customer-first policies, such as flexible returns and a focus on resolving issues promptly.

How Gshoppi is Redefining Online Shopping in India

Gshoppi is more than just a platform for deals; it’s a space where convenience meets quality. The company’s dedication to offering the best online shopping deals in India is evident in their efforts to regularly update their product selection, introduce new categories, and provide a personalized shopping experience.

Moreover, Gshoppi is constantly improving its technology and processes to ensure that customers enjoy a hassle-free experience from start to finish. Whether you’re a first-time buyer or a loyal customer, Gshoppi’s shopping platform makes sure you get the best value every time.

Conclusion:

Gshoppi – The Best Online Shopping Platform in India

In a highly competitive e-commerce landscape, Gshoppi shines with its unbeatable combination of vast product selection, excellent discounts, and customer-centric services. Whether you're looking for everyday essentials or high-end electronics, Gshoppi offers the best online shopping deals in India that cater to your needs without compromising on quality.

Make Gshoppi your go-to destination for all your online shopping needs and enjoy a world of convenience, savings, and satisfaction.

#online shopping#home appliances#shopping#best online shopping in india#best washing machine in india

0 notes

Text

Top benefits of using a QR code scanner:

Nowadays, it's impossible to live in the modern world without QR codes and contactless payments. Because they are so simple and adaptable, these decades-old technologies have many uses in industry and transportation.

Only recently have contactless payments and QR codes begun to permeate the consumer sphere; COVID-19's concerns about social isolation helped their widespread adoption. In this post, you will learn a lot about QR code scanner:

It's simple to begin taking touch-free payments with QR codes:

It might not be worthwhile redesigning your payment process or investing in new equipment merely to take a few touch-free payments, as many touch-free payment methods call for a specific payment terminal.

On the other hand, all you need to use QR codes is a regular printer. Accepting remote payments only takes a few seconds once you print your QR code.

Payments with QR codes are safe:

How secure are QR code payments for your customers? A QR code connects your account to the customer's payment app, not sensitive payment data. Customers can pay you without disclosing sensitive information like account numbers because the app encrypts their payment data.

Appeal to the Crowd:

Furthermore, customers find QR codes a convenient alternative to searching for their wallet or handbag because they can easily scan them using their smartphone. This is particularly helpful for processing payments at outdoor events and festivals, where space is frequently restricted, and transactions may need to be completed promptly.

Boost Loyalty to Brands:

Additionally, you may strengthen your ties with customers and boost customer loyalty by creating customized promos only available to buyers who scan QR codes. For example, you may provide rewards points for consistently using QR code scanner payments or discounts exclusively available through these methods.

Hassle is eliminated from the consumer journey with QR codes:

The easier it is for customers to check out, the fewer processes involved. Here's where QR codes come in handy. Before they could finish checking out in the past, consumers had to locate their register, scrabble to find their card, scan it, and confirm their details.

You can allow clients to conveniently finish their transactions from their mobile devices with a few taps by utilizing QR codes for payments. It's quick and practical.

Scans of QR codes can be tracked:

Businesses can utilize QR codes to gather data insights about customer habits and transaction trends because they can be tracked.

For instance, is there a certain time or day of the week when more sales are being made? Do customers immediately make a purchase after scanning a QR code, or do they just browse your website after scanning a QR code? How often do they bounce back? Utilize QR codes to find the answers to these queries and improve your future tactics.

Extremely versatile:

Finally, you are open regarding personalization as QR codes are quite flexible and allow you to change the design to suit your requirements. Encrypted data transmissions are also possible with QR codes to offer even more protection when making payments.

Bottom Line:

The above points clearly explain the benefits of QR code scanners. If you are going to a shop without cash in your hand, using the Upi app, you can just scan the QR code scanner and pay whatever your bill is.

#mobilebanking app upi#safe mobile banking#upi enabled app#digital account#app upi mobile banking#fd account yearly#upi mobile banking app#internet banking app#phone banking#net banking app upi#banking mobile upi#best net banking app#internet banking#fd mobile app

1 note

·

View note

Text

Airpay API Integration by Infinity Webinfo Pvt Ltd

In today’s digital world, providing seamless and secure payment solutions is essential for any business. Infinity Webinfo Pvt Ltd recognizes this need and offers expertise in API Integration, focusing on robust solutions like Airpay to enhance the online transaction experience.

Airpay API Integration by infinity Webinfo Pvt Ltd

What is Airpay?

Airpay is an omnichannel payment gateway designed to simplify payment acceptance for businesses across sectors. Its API integration provides flexibility and security, allowing organizations to handle payments from a wide range of sources, including online, mobile, and in-store transactions.

Let’s delve deeper into the specifics of Airpay API Integration and how businesses can benefit from it.

Key Features of Airpay API Integration

Omnichannel Payment Support: Airpay’s API enables merchants to accept payments from multiple platforms—websites, mobile apps, and physical retail stores. This unified approach means that all payment data is consolidated in a single dashboard, making reconciliation and reporting easier for businesses.

Multiple Payment Modes: With Airpay’s API integration, businesses can accept payments via credit and debit cards, net banking, UPI (Unified Payments Interface), wallets (Paytm, Google Pay, etc.), EMI options, and more. This versatility ensures that customers have flexible payment options at checkout.

Seamless Checkout Experience: The API allows for a fully customized checkout experience, with options to integrate directly into a website or mobile application. This eliminates redirections and enhances customer satisfaction by offering a smooth, native payment process.

Real-Time Payment Updates: Airpay provides real-time updates on payment status through its API. This feature allows businesses to instantly know whether a payment was successful, pending, or failed, allowing for immediate action if needed.

Transaction Security and Compliance: Airpay API complies with stringent security standards, such as PCI-DSS (Payment Card Industry Data Security Standard), ensuring that sensitive payment information is encrypted and secure. This minimizes the risk of fraud and ensures safe transactions for customers and businesses alike.

Multi-Currency Support: Businesses can use Airpay to accept payments in different currencies, making it ideal for global businesses or those serving international customers.

Refunds and Reversals: Airpay’s API supports both partial and full refunds, with seamless integration into e-commerce or ERP systems, ensuring efficient and smooth transaction management for both the business and customers.

How Airpay API Works

The Airpay API is a robust RESTful API, which allows developers to interact with the payment gateway to process transactions securely. Here’s how the API typically works:

Initiating a Payment Request: The merchant sends a payment request through the API with details like the amount, currency, and customer’s payment method (e.g., card, UPI, net banking).

Customer Authentication: Airpay’s API handles the redirection to the customer’s bank for authentication (via OTP, UPI PIN, etc.), ensuring a secure transaction flow.

Payment Processing: Once the customer has successfully authenticated, the payment is processed in real time. Airpay then sends a response back to the merchant’s system indicating whether the transaction was successful or failed.

Notification and Webhooks: The API includes webhook support, allowing Airpay to notify merchants about payment statuses or other events like refunds and disputes in real time. This keeps the merchant’s system updated and synchronized with the payment gateway.

Benefits of Airpay API Integration

1. Streamlined Payment Operations: Airpay’s API enables businesses to consolidate all payment methods under one platform, making it easier to manage and track transactions. This centralization reduces the complexity of handling payments across different platforms or providers.

2. Enhanced User Experience: With fully customizable interfaces and a streamlined payment process, businesses can create a frictionless experience for users, reducing cart abandonment and improving conversion rates.

3. Improved Payment Success Rate: Airpay’s API is designed for high transaction success rates with minimal downtimes. This reliability is crucial, especially during peak sales periods or for businesses handling large volumes of transactions.

4. Scalability: Airpay’s API can handle varying transaction volumes, making it a perfect solution for businesses looking to scale. Whether you’re a small startup or a large enterprise, the platform can adapt to your needs.

5. Comprehensive Reporting and Analytics: The Airpay dashboard offers detailed insights into transaction data, enabling businesses to track payment trends, understand customer preferences, and optimize their payment processes.

6. Cost-Efficiency: Airpay’s pricing model is competitive, and its API integration reduces the overhead costs associated with managing multiple payment gateways or providers. The automation and efficiency brought in by Airpay help businesses save time and resources.

Steps to Integrate Airpay API with Infinity Webinfo Pvt Ltd

At Infinity Webinfo Pvt Ltd, we follow a structured and professional approach to integrating the Airpay API with our clients' systems.

Consultation and Requirement Analysis: Our team works with the client to understand their specific needs, including the types of payments they need to accept, the platforms they use (website, mobile app), and any special requirements for transaction processing.

Configuration and API Setup: Once we understand the requirements, we assist in setting up the Airpay account, acquiring API credentials, and configuring them in the business's system.

Customization and Integration: The Airpay API is integrated into the client’s website or mobile app. We customize the user interface to ensure that the payment process aligns with the brand’s design and customer experience.

Testing: We rigorously test the integration to ensure that payments are processed securely and efficiently. Any issues encountered during the testing phase are resolved before going live.

Deployment and Support: After successful testing, the payment gateway goes live. We also provide ongoing support to monitor performance, handle updates, and ensure the system runs smoothly.

Conclusion

For businesses aiming to provide seamless, secure, and fast payment solutions, Airpay API Integration is a game-changer. Partnering with Infinity Webinfo Pvt Ltd guarantees a smooth integration process, helping you leverage the full potential of Airpay for your payment processing needs.

With our expertise in API Integration, we ensure that your business stays ahead in the competitive digital marketplace, delivering an exceptional payment experience to your customers.

For more contact us now: - +91 9711090237

#Airpay API Integration#Airpay Payment gateway API Integration#payment gateway api integration#payment gateway integration#Airpay#payment gateway#api integration#infinity webinfo pvt ltd

0 notes

Text

Empower Your Pharmacy with Truetab’s Innovative Software and Delivery App

As the healthcare landscape evolves, pharmacies need cutting-edge solutions to stay competitive and provide the best service possible. Truetab is here to revolutionize your pharmacy operations with its advanced pharmacy software and seamless online pharmacy delivery app. Our solutions are built to optimize store management and offer convenience to your customers, helping you meet the demands of the modern healthcare environment.

Optimize Pharmacy Operations with Truetab

Managing a pharmacy involves complex tasks such as inventory control, billing, and prescription management. Truetab simplifies these processes with comprehensive software that automates routine tasks, freeing up valuable time for pharmacy staff to focus on customer care. Whether you run a small pharmacy or a large chain, our software adapts to your needs, ensuring smooth and efficient operations.

Key Benefits of Truetab’s Pharmacy Software

Real-Time Inventory Monitoring

With Truetab, managing your stock is hassle-free. Our software provides real-time inventory tracking, sends alerts for low-stock items, and automates the reordering process. This ensures your shelves are always stocked with essential medicines, avoiding the risk of running out or overstocking.

Accurate and Fast Billing

The billing process is made simple with Truetab. You can generate detailed invoices instantly and accept multiple payment methods, including UPI, credit cards, and digital wallets. Whether it's for in-store purchases or online orders, the software ensures error-free billing and smooth transactions.

Streamlined Prescription Management

Managing prescriptions is easier with Truetab. Pharmacists can scan and store digital prescriptions, set automatic reminders for refills, and track customer medication history. This ensures that prescriptions are handled with precision and customers receive timely service.

Comprehensive Business Reports

Data is key to running a successful pharmacy. Truetab’s software provides detailed analytics, allowing you to track sales, customer trends, and stock movements. These insights help you make informed decisions to boost profitability and enhance overall performance.

Boost Customer Convenience with the Online Pharmacy Delivery App

In the age of e-commerce, customer expectations have shifted towards convenience and quick access to services. With Truetab’s online pharmacy delivery app, you can offer your customers a simple, fast, and secure way to order medications online and have them delivered directly to their homes.

Features of the Online Pharmacy Delivery App:

Simple and Easy-to-Use

Our delivery app is designed to offer an intuitive shopping experience. Customers can browse products, upload prescriptions, and place orders with just a few taps, making it easy for them to get their medications without stepping into the store.

Track Orders in Real Time

Customers can monitor their orders through real-time tracking, from the moment the order is placed to the point of delivery. This transparency ensures customer satisfaction and builds trust in your service.

Multiple Secure Payment Options

The app supports a range of secure payment methods, including credit cards, UPI, and digital wallets. This flexibility ensures customers can pay for their medications with ease and confidence.

Prescription Upload and Review

Customers can upload prescriptions directly through the app, and pharmacists can review and approve them digitally. This feature ensures compliance with regulations and eliminates the need for paper prescriptions.

One-Click Reordering

Regular customers can reorder their medications with a single click, saving time and improving convenience. This feature encourages repeat business and enhances customer loyalty.

Why Your Pharmacy Needs Truetab’s Software and Delivery App

Truetab’s solutions are designed to keep your pharmacy competitive in today’s market. Our pharmacy software ensures smooth in-store operations, while the online pharmacy delivery app extends your reach to customers who prefer the convenience of online ordering. By integrating both solutions, you can enhance your services, improve customer satisfaction, and stay ahead of the competition.

Conclusion

In today’s fast-paced world, pharmacies must adapt to new challenges and customer expectations. Truetab’s pharmacy software and online pharmacy delivery app provide the perfect combination of tools to streamline your business and offer a superior customer experience. With our innovative solutions, you can optimize your pharmacy operations and grow your business in a competitive market. Choose Truetab and lead your pharmacy into the future of healthcare.

0 notes

Text

The Definitive Guide to FASTag for First-Time Users

A first-time user of FASTag? Naturally, you will have a list of questions about what it is, how it works, and how to get started. This definitive guide is designed to walk you through everything you want to know about FASTag and make your transition to cashless toll payments easier.

What is FASTag exactly?

FASTag is an electronic toll collection system in India that uses Radio Frequency Identification (RFID) technology to deduct toll charges as you pass through toll plazas automatically. This means you no longer have to stop and pay in cash.

Instead, the toll amount is directly debited from your linked prepaid or savings account.

Why should you use FASTag?

Benefits are aplenty when you use FASTag. Some of these include the following:

Convenience – FASTag eliminates the need to carry cash or wait in long queues at tollbooths, saving time and effort.

Travel Made Simple – With FASTag, you can drive through toll plazas without stopping. This eventually leads to faster and more efficient travel experiences.

Discounts and Cashback – Some toll plazas offer discounts for using FASTag. Moreover, various banks often provide cashback offers to users.

Eco Friendly – It may not seem like a long time but stopping your vehicle and starting it up again does come down to a lot of gas emissions in the long run. Plus, if you combine it with thousands of vehicles passing toll booths regularly, you have a serious environmental problem. By reducing the idling time, FASTag helps lower fuel consumption and emissions.

How to get your FASTag?

Getting your FASTag is a simple process:

1. Choose a Provider: FASTag can be purchased through banks like IDFC First Bank, HDFC Bank, and ICICI Bank, as well as online marketplaces.

2. Documentation Formalities: You’ll need your vehicle’s Registration Certificate (RC), proof of identity (Aadhaar Card, PAN Card, etc.), and a passport-sized photograph.

3. Registration: Once you've chosen your provider, you can either visit their website or nearest branch to complete the registration process. You’ll need to fill out a form and submit the necessary documents.

4. Activation: After registering, your FASTag will be activated. Some providers offer immediate activation, whereas others may take a few hours.

5. Linking to an Account: You can link your FASTag to a prepaid account, savings account, or your UPI ID. This allows for automatic deduction of toll charges.

Using your FASTag

Once your FASTag is active, simply affix it to your vehicle’s windshield. As you approach a toll plaza, the RFID reader will scan your FASTag and the toll amount will be deducted from your linked account. You’ll receive an SMS notification for every transaction which helps in keeping track of your toll expenses.

FASTag is a game-changer for toll payments in India, offering a seamless and eco-friendly solution. By following this guide, first-time users can easily get started with FASTag and make their journeys more efficient in the long run.

0 notes