#check status of upi transaction

Text

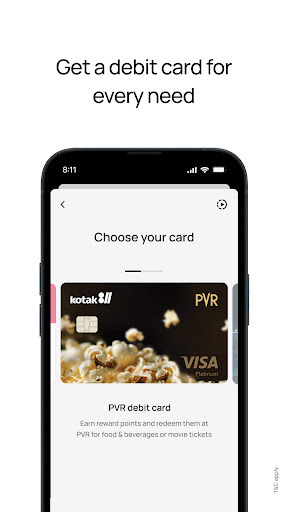

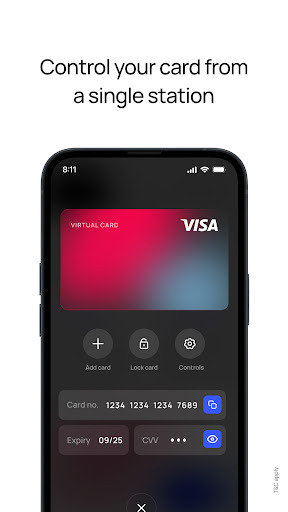

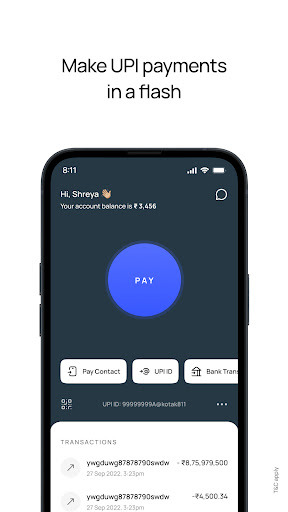

Kotak 811 – Mobile Banking Made Easy!

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#upi transaction id status check#upi transaction tracking#upi transaction check#track upi transaction#upi transaction check online#upi transaction id check online#check status of upi transaction#check upi transaction details

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc verification process#kyc procedure#account bank balance check#bank balance enquiry#upi transaction check online#check status of upi transaction

0 notes

Text

PhonePe API Integration by Infinity Webinfo Pvt Ltd: Revolutionizing Digital Payments in India

Introduction

In the rapidly evolving fintech landscape, digital payments are essential for businesses to offer seamless transaction experiences to customers. PhonePe, one of India’s leading payment platforms, has made it easier for enterprises to adopt its UPI-based payment solutions through API integrations. Infinity Webinfo Pvt Ltd, a prominent technology solutions provider, specializes in integrating the PhonePe API to enable businesses to harness the power of digital payments effectively.

PhonePe API Integration by Infinity Webinfo Pvt Ltd

What is PhonePe API Integration?

PhonePe API integration refers to the process of embedding PhonePe’s digital payment system directly into a business’s platform, such as a website or mobile app. This integration enables businesses to accept payments from customers through UPI (Unified Payments Interface), facilitating secure and instant transactions.

Infinity Webinfo Pvt Ltd takes this process a step further by ensuring that the integration is smooth, secure, and optimized for the best user experience. The PhonePe API integration provides businesses with a direct link to the UPI ecosystem, enabling faster and more efficient payments.

Why PhonePe API Integration Matters

Wide User Base: PhonePe has a large and growing user base across India. By integrating its API, businesses can tap into this vast customer base and offer a payment option that users are already familiar with and trust.

Instant Payments: UPI payments through PhonePe are instant, meaning there is no waiting period for fund transfers. This not only improves the customer experience but also ensures businesses receive their payments immediately, aiding cash flow management.

Improved Customer Convenience: By offering PhonePe as a payment option, businesses can reduce cart abandonment rates. Customers are more likely to complete their purchase if they can use a familiar and simple payment method.

Cost-Effective Solution: The PhonePe API operates with minimal transaction fees, making it a cost-effective solution for businesses that need to process a high volume of payments.

Support for Multiple Use Cases: The PhonePe API can be used for a variety of transactions, from one-time payments for goods and services to recurring transactions such as subscriptions. This versatility makes it suitable for businesses across industries, including e-commerce, retail, education, and entertainment.

Key Benefits of PhonePe API Integration by Infinity Webinfo Pvt Ltd

QR Code Payments: For businesses with physical storefronts, the PhonePe API allows for the generation of QR codes that customers can scan to make payments directly from their PhonePe app, simplifying the checkout process.

Auto payment Update: Auto payment in PhonePe allows users to set up recurring payments automatically for services like subscriptions, bill payments, or other scheduled payments. Instead of manually paying each time, PhonePe handles the payments at regular intervals, ensuring the service continues uninterrupted

Status check API: This API allows businesses to find out the current status of a payment by using the unique transaction ID (a code given to each payment). Business can see Updated Status instantly.Customers know right away if their payment was successful, reducing confusion or delays.

Seamless UPI Transactions: With PhonePe’s API, businesses can offer direct UPI payments, allowing customers to pay using their bank accounts with just a few clicks. This eliminates the need for intermediaries like wallets and ensures hassle-free transactions.

Faster Checkouts: One of the significant advantages of integrating PhonePe is the reduction in checkout time. Customers don’t have to enter card details or use multiple authentication steps, as UPI payments are processed instantly, ensuring a smooth purchasing experience.

Enhanced Security: PhonePe’s API comes with advanced security features such as multi-layer encryption, two-factor authentication, and compliance with RBI guidelines. Infinity Webinfo Pvt Ltd ensures that all integrations maintain the highest security standards, protecting both businesses and their customers from Pvt Ltd potential fraud.

Support for Multiple Platforms: Infinity Webinfo Pvt Ltd’s integration services support various platforms, including websites, e-commerce platforms, and mobile applications (both Android and iOS). This cross-platform support ensures that businesses can cater to a wide audience with minimal development effort.

Custom Solutions: Infinity Webinfo Pvt Ltd offers custom integration solutions, tailoring the PhonePe API to suit the specific needs of businesses. Whether it's an e-commerce platform, service provider, or retail outlet, the integration can be customized to ensure the best fit.

Merchant Dashboard: After the integration, businesses get access to a comprehensive merchant dashboard from PhonePe, where they can monitor transaction data, generate reports, and manage refunds. Infinity Webinfo Pvt Ltd provides support and training to ensure businesses can utilize this dashboard to its full potential.

Support for Recurring Payments: For businesses that rely on subscription models or recurring billing, Infinity Webinfo Pvt Ltd’s PhonePe API integration enables automated recurring payments through UPI. This is a great feature for SaaS platforms, OTT services, and other businesses with subscription-based revenue models.

Security and Compliance

Security is a top priority for PhonePe, and the API integration follows strict guidelines set by the Reserve Bank of India (RBI). The platform uses end-to-end encryption and secures tokenization methods to protect user data and ensure transaction integrity.

In addition to encryption, PhonePe requires multi-factor authentication for high-value transactions, further safeguarding the payment process. Businesses integrating PhonePe’s API must comply with data protection regulations and ensure that customer data is handled securely.

Advantages for Businesses

Increased Sales: By offering a trusted and widely used payment method like PhonePe, businesses can increase sales, especially among mobile users who prefer UPI transactions.

Enhanced Customer Trust: PhonePe’s strong brand and focus on security help build trust with customers, making them more likely to complete transactions.

Streamlined Operations: Automated reconciliation and real-time transaction tracking reduce the administrative burden on businesses, enabling them to focus on other aspects of their operations.

Scalable Payment Infrastructure: The API is designed to handle large transaction volumes, making it suitable for businesses of all sizes, from startups to large enterprises.

Steps in the PhonePe API Integration Process by Infinity Webinfo Pvt Ltd

Requirement Gathering and Analysis: Infinity Webinfo Pvt Ltd works closely with businesses to understand their specific requirements and ensure that the PhonePe API integration aligns with their business goals.

API Documentation Review: Infinity Webinfo Pvt Ltd’s team reviews PhonePe’s API documentation to ensure a clear understanding of the technical specifications required for seamless integration.

Development and Integration: The integration process involves embedding the PhonePe payment gateway into the website or app, ensuring compatibility with the existing platform.

Testing and Security Check: After development, Infinity Webinfo Pvt Ltd conducts rigorous testing to ensure the API is functioning correctly. This step includes security audits to ensure that all transactions are secure and compliant with regulatory standards.

Deployment and Support: Once the integration is successfully tested, Infinity Webinfo Pvt Ltd deploys the solution and provides ongoing support to address any issues or updates that may arise.

Impact of PhonePe API Integration on Businesses

Increased Conversion Rates: The simplicity and speed of UPI payments reduce cart abandonment and increase conversion rates, especially for e-commerce platforms.

Enhanced Customer Trust: PhonePe’s widespread adoption in India means customers trust the platform. By offering PhonePe as a payment option, businesses can increase trust among their customer base.

Improved Cash Flow: Instant UPI transactions improve cash flow, as businesses receive payments in real-time without delays, unlike traditional payment methods.

Conclusion

PhonePe API integration by Infinity Webinfo Pvt Ltd offers businesses an opportunity to streamline their payment processes, improve customer satisfaction, and enhance security. With its expertise in API integration, Infinity Webinfo Pvt Ltd ensures a hassle-free and secure payment experience that helps businesses stay competitive in the digital era. As UPI continues to dominate India’s digital payment space, partnering with experts like Infinity Webinfo Pvt Ltd ensures that businesses can fully leverage the advantages of PhonePe.

Contact Us On: - +91 9711090237

#PhonePe#PhonePe Payment Gateway#PhonePe Payment Gateway API Integration#Payment Gateway API Integration#api integration#infinity webinfo pvt ltd

0 notes

Text

📣 Dear Players 📣

We understand the frustration of delays in receiving your deposit, that's why we've created this detailed guide to help you provide quick feedback.

😊 Click the "BANK" Button ✔️

😊Click on "MY TRANSACTIONS" ✔️

😊Click "DEPOSIT" ✔️

😊Click the customer service icon next to deposit order ✔️

Enter the UTR number or UPI reference number of your successful payment.

😊Upload screenshot of successful payment transfer ✔️

😊Click "SUBMIT" ✔️

Please complete these steps to provide feedback on your order. Our service representatives will promptly assist you in checking its status upon receiving your feedback.

🆎🆎🆎 ➡️ MY777.COM (https://www.my777.com/) 👈

MY777 #PremiumCasino #QuickGuide #Feedback

0 notes

Text

Everything Foreigners Need to Know About UPI

The Unified Payments Interface (UPI) has become a cornerstone of India's digital payment ecosystem, offering a seamless and efficient way for users to send and receive money instantly. For foreigners living or visiting India, understanding UPI can greatly simplify financial transactions and enhance the overall experience. Here's everything you need to know about UPI:

What is UPI Payment?

The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It enables users to transfer money between bank accounts instantly using a mobile phone. UPI eliminates the need for traditional methods like NEFT or IMPS, making transactions quick, secure, and convenient.

How Does UPI Work?

The Unified Payments Interface (UPI) has revolutionised the way people in India make digital transactions, offering a seamless and efficient payment system. Let's take a closer look at how UPI works, focusing on the popular UPI app "CheqUPI":

Download and Registration:

First, users need to download the "CheqUPI" app from the App Store or Google Play Store.

Upon opening the app, users are prompted to register by providing their mobile number linked to their bank account.

An OTP (One-Time Password) is sent to verify the mobile number, after which users create a secure login PIN.

Creating a UPI ID:

Once registered, users can create a unique UPI ID, often in the format [name]@chequpi.

This UPI ID serves as the user's virtual payment address, allowing them to receive money directly into their bank account.

Linking Bank Account:

To start transacting, users need to link their bank account(s) to the CheqUPI app.

The app supports multiple bank accounts, providing flexibility to choose the account for transactions.

Adding Beneficiaries:

Users can add beneficiaries by entering their UPI ID, and account number, or scanning a QR code.

Once added, beneficiaries are securely stored in the app for future transactions.

Making Payments:

To send money, users select the "Send Money" option and enter the recipient's UPI ID or select from the list of added beneficiaries.

They enter the amount to be transferred and can add a note for reference.

A secure UPI PIN is required to authenticate the transaction.

Requesting Payments:

Users can also request money by selecting the "Request Money" option.

They enter the recipient's UPI ID or select from the list of added beneficiaries, along with the requested amount.

The recipient receives a notification to approve or decline the request.

Checking Transaction History:

CheqUPI provides a detailed transaction history, showing all incoming and outgoing transactions.

Users can view transaction details, including date, time, amount, and transaction status.

Additional Features:

CheqUPI offers a range of additional features to enhance the user experience.

This includes options for bill payments, mobile recharges, DTH recharges, and more, all accessible within the app.

Security Measures:

CheqUPI prioritizes security, implementing robust measures to safeguard user transactions.

Two-factor authentication is mandatory for all transactions, requiring a UPI PIN along with device lock PIN or biometric authentication.

The app employs encryption protocols to protect user data and transactions from unauthorized access.

Customer Support:

Users can reach out to CheqUPI's customer support for assistance with transactions, account-related queries, or technical issues.

The app provides options for in-app chat support, email support, and helpline numbers for quick resolution of queries.

Promotions and Offers:

CheqUPI often runs promotional campaigns and offers for users, providing cashback rewards, discounts, and other incentives for transactions.

Users can benefit from these offers while making everyday payments through the app.

Real-Time Notifications:

Users receive real-time notifications for every transaction, providing instant updates on the status of payments.

Notifications include details such as successful transactions, pending requests, and failed transactions for quick reference.

Future Advancements:

CheqUPI continues to evolve with new features and advancements in the UPI ecosystem.

Users can look forward to upcoming updates that enhance convenience, security, and usability of the app.

Convenience:

UPI eliminates the need for carrying cash or relying on physical cards for transactions. Foreigners can easily make payments using their mobile phones.

Instant Transfers:

Transactions through UPI are completed instantly, allowing foreigners to send money to friends, pay bills, or shop online without delays.

Wide Acceptance:

UPI is widely accepted across various merchants, online platforms, and utility bill payments, making it versatile for day-to-day transactions.

Multi-Language Support:

Many UPI apps offer support for multiple languages, catering to foreigners who may not be fluent in English or Hindi.

Transparency:

UPI provides real-time transaction updates and detailed transaction history, allowing users to track their spending easily.

How Foreigners Can Use UPI:

Bank Account:

Foreigners need an Indian bank account to use UPI. They can open a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account with an Indian bank.

KYC Verification:

Foreigners must complete the Know Your Customer (KYC) verification process as per Reserve Bank of India (RBI) guidelines to use UPI.

UPI App:

Download a UPI-enabled mobile app from the App Store or Google Play Store. Popular apps include Google Pay, PhonePe, Paytm, and BHIM.

Registration:

Register on the app using your Indian mobile number linked to the bank account. Create a UPI ID and set a UPI PIN.

Transactions:

Start sending and receiving money, paying bills, recharging mobile phones, and more using your UPI ID.

Tips for Using UPI:

Secure Your PIN:

Keep your UPI PIN confidential and do not share it with anyone. Avoid using simple or easily guessable PINs.

Verify Transactions:

Always verify the recipient's UPI ID and amount before confirming a transaction to avoid errors.

Check Limits:

Be aware of your daily transaction limits set by your bank and UPI app to avoid exceeding them.

Update Apps:

Regularly update your UPI app to ensure you have the latest security features and bug fixes.

Customer Support:

Familiarize yourself with the customer support options provided by your UPI app in case you encounter any issues or have questions.

Conclusion:

Understanding and using UPI can greatly simplify financial transactions for foreigners in India. With its convenience, speed, and security features, UPI has revolutionized the way payments are made in the country. Whether you're sending money to friends, paying bills, or shopping online, UPI offers a seamless and efficient payment experience for all.

Frequently Asked Questions (FAQs)

Can foreigners use UPI in India?

Yes, foreigners can use the Unified Payments Interface (UPI) in India, provided they have an Indian bank account. Foreigners need to open either a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account with an Indian bank. Once they have a valid Indian bank account, they can download a UPI-enabled mobile app from the App Store or Google Play Store to start using UPI for transactions.

What are the benefits of using UPI for foreigners?

Using UPI offers several benefits for foreigners in India. Firstly, it provides a convenient and hassle-free way to make payments. Foreigners no longer need to carry cash or rely on physical cards for transactions. UPI-enabled mobile apps allow users to send and receive money instantly using their smartphones, making it ideal for various transactions such as splitting bills with friends, paying for goods and services, or even transferring money back home.

Secondly, UPI transactions are completed instantly, offering quick and efficient payments. Whether it's sending money to friends, paying bills, or shopping online, foreigners can enjoy the speed and convenience of UPI. Transactions are processed in real-time, ensuring that the recipient receives the funds immediately.

Another advantage of UPI for foreigners is its wide acceptance across various merchants, online platforms, and utility bill payments. Whether it's making purchases at local stores, paying for groceries, or booking tickets online, UPI offers versatility and ease of use.

Additionally, UPI apps often provide multi-language support, catering to foreigners who may not be fluent in English or Hindi. This feature ensures that users can navigate the app and complete transactions comfortably in their preferred language.

Lastly, UPI offers transparency and security. Users receive real-time transaction updates and detailed transaction history, allowing them to track their spending easily. UPI transactions are secured with two-factor authentication, including a UPI PIN and often a device lock PIN or biometric authentication, ensuring the safety of transactions.

How can foreigners start using UPI in India?

To start using UPI in India, foreigners need to follow a few simple steps:

Open an Indian Bank Account: Foreigners must have an Indian bank account, such as a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account.

Download a UPI-Enabled Mobile App: Once the bank account is set up, foreigners can download a UPI-enabled mobile app from the App Store or Google Play Store. Popular UPI apps include Google Pay, PhonePe, Paytm, and BHIM.

Registration: Register on the UPI app using the Indian mobile number linked to the bank account. Create a unique UPI ID, which is usually in the format [name]@[bank], and set a secure UPI PIN.

Start Transacting: With the UPI app set up, foreigners can start sending and receiving money, paying bills, recharging mobile phones, and making various other transactions using their UPI ID.

What are some tips for foreigners using UPI in India?

Foreigners using UPI in India can benefit from the following tips to ensure a smooth and secure transaction experience:

Secure Your UPI PIN: Keep your UPI PIN confidential and do not share it with anyone. Avoid using easily guessable PINs such as birthdates or phone numbers.

Verify Transaction Details: Always double-check the recipient's UPI ID and the transaction amount before confirming a payment. This helps avoid errors and ensures that funds are sent to the intended recipient.

Know Your Limits: Be aware of the daily transaction limits set by your bank and the UPI app. This prevents exceeding the maximum transaction amount allowed per day.

Update Your UPI App: Regularly update your UPI app to the latest version available. Updates often include security patches and bug fixes, enhancing the overall security of the app.

Use Customer Support: Familiarize yourself with the customer support options provided by the UPI app. In case of any issues or queries, you can reach out to customer support for assistance and guidance.

Is UPI widely accepted in India?

Yes, UPI is widely accepted across India at various merchants, online platforms, utility bill payments, and more. The versatility of UPI makes it a preferred choice for digital payments, offering convenience and efficiency to users. Whether it's making everyday purchases, paying bills, or transferring money to friends and family, foreigners can rely on UPI for a seamless payment experience.

Can foreigners transfer money internationally using UPI?

No, UPI is designed for domestic transactions within India. Foreigners cannot use UPI to transfer money internationally. However, they can use other methods such as wire transfers, international bank transfers, or online remittance services to send money abroad from their Indian bank account.

Are there any fees associated with using UPI for foreigners?

Generally, UPI transactions for individuals are free of charge. Most UPI apps do not impose fees on users for sending or receiving money. However, it's essential to check with your bank or UPI app for any specific fees or charges that may apply, especially for certain types of transactions or services.

0 notes

Text

NPCI to Permit NRIs with International Numbers from 10 Countries to Use UPI Payments

NPCI (National Payments Corporation of India) will allow Non-resident Indians (NRIs) from 10 countries to transfer funds easily through UPI (Unified Payments Interface) from an international mobile number. The countries that fall into consideration are the United Kingdom, United States, Australia, Canada, UAE, Singapore, Qatar, Hong Kong, Saudi Arabia, and Oman. But to use this facility, people have to use Non-Resident Ordinary (NRO) or Non-Resident (External) Rupee (NRE) account. However, without an Indian mobile number, they can enjoy making digital payments.

An NRO account allows NRIs to manage the earned income in India while an NRE account permits the NRIs to transfer to India their foreign earnings. The Payments Corporation has announced 30 April as the deadline for the partner banks to comply with the instructions. The UPI move will not just assist local businesses abroad, but even the family, individuals, and international students.

Earlier the NRIs were unable to operate the UPI network because the same is dependable on SIM. The feature was to date accessible to only Indian SIM card phones. However, non-resident Indians can now utilize international SIM linked to their NRO or NRE accounts and make transactions online from their mobile UPI interface. Also, no charges will apply for such transactions. In December 2022 alone, UPI transactions saw a record high of Rs. 12.82 lakh crore. With the current step, the transactional amount will soar higher.

So, the NPCI will enable UPI transactions from mobile numbers bearing the country codes of the mentioned 10 nations along with the existing domestic country code. In the future, the facility can extend to other countries as well. UPI helps to instantly transfer money through mobile phones in easy steps. The partner banks have to make sure that the NRE and NRO accounts comply with the guidelines of the RBI (Reserve Bank of India) and FEMA (Foreign Exchange Management Act).

The beneficiary and remitter banks will keep in check all the transactions to combat money laundering and any act of terrorism so that the UPI system remains transparent and risk-free. NPCI has been receiving several requests from NRIs and customers to include a facility for some time now, and finally, international numbers from the 10 countries will be able to benefit from the instant and seamless payment on UPI.

Visit: - https://www.jsbmarketresearch.com/news/news-npci-nri-upi-payment

Follow our social handles:-

Instagram: - https://www.instagram.com/p/CnT9GV1o6gV/

Twitter: - https://twitter.com/JSBMarket/status/1613485999639924736?s=20&t=dnIEdrzbB7aUrWnhNzbrgA

LinkedIn: - https://www.linkedin.com/posts/jsbmarketresearch_nrisupi-upipayments-upiinternational-activity-7019251859638923264-y0CX?utm_source=share&utm_medium=member_desktop

YouTube: - https://youtube.com/shorts/K9dyiSHxeLQ?feature=share

Pint: https://pin.it/6hZ60IY

#NRI UPI Payments#Banking#Transaction#Global 10 Countries#NRI#Non-resident Indian#International Transactions#10 Countries#Financial Inclusion#Digital Payments#Cross-border Payments#swotanalysis#jsbmarketresearch#marketresearchreports

0 notes

Text

अगर UPI द्वारा लेन -देन करते समय कटे पैसे अगर वापिस नहीं आए तो बैंक देगा जुर्माना ,कहाँ करे शिकायत

अगर UPI द्वारा लेन -देन करते समय कटे पैसे अगर वापिस नहीं आए तो बैंक देगा जुर्माना ,कहाँ करे शिकायत

डिजिटल ट्रांजैक्शन फेल होने के बाद अगर अकाउंट से पैसे कट जाते हैं और पेमेंट नहीं होता तो बैंकों को यह पैसा एक तय समय में ग्राहक के अकाउंट में रिवर्स करना होता है. ऐसा नहीं करने पर बैंक को पेनाल्टी देनी पड़ती है.

कई बार जब आपको किसी को जरूरी पैसा भेजना होता है और आपका पेमेंट किसी भी डिजिटल प्लेटफॉर्म से नहीं जा पाता या फ़ाइल हो जाता है . और कई बार तो आपके अकाउंट से पेमेंट कटने के बाद भी आगे नहीं…

View On WordPress

#upi transaction#upi transaction charges#upi transaction charges sbi#upi transaction id#upi transaction id status check#upi transaction limit#upi transaction limit pnb#upi transaction status#upi transfer#upi transfer limit

0 notes

Text

How to save money on Online clothing stores?

Believe it or not but Corona has made us all so lazy especially when it comes to shopping.

We are obsessed with ordering everything from the comfort of our homes with a few clicks on our phones and laptops.

Surat dress online shopping is very convenient and time-saving. But, are you a smart buyer? Hopefully, you are not spending your hard-earned money on the wrong clothing website.

Here are some tips for you that will help you to select some of the best online clothing stores to save money.

Keep the Products on a Wishlist

Keeping the products on a wishlist is a great strategy to get discounts. This notifies the Surat online dress stores that you are willing to buy something but you are not making the purchase. You will able to buy wholesale sarees collection at the best market price

In a few hours, you get the notification of offers like buy one get one free or discounted price. To become a pro online shopper one needs to be patient.

2. Choose the right payment gateway

Never be in a hurry to pay the price and checkout. Read everything carefully if there is any discount or cashback offer running on a specific payment mode.

Sometimes there are offers on UPI's and sometimes on debit and credit cards.

Moreover, Most UPI apps offer cashback on transactions. So, if there is no offer running by the retailer you can choose to pay through UPI and avail a cashback.

3. Bulk shopping

Bulk shopping can save your delivery charges. Most Surat online clothing stores offer to waive delivery charges for a certain amount. That doesn’t mean you shop unstoppable.

To be a wise shopper you need to refrain from buying unnecessary items. Instead, you can ask your friends to buy stuff from the same online store and make a combined bill.

You may also get an extra discount on a big purchase if there is any offer running.

4. Wait for sale

Most Surat online clothing stores have seasonal and festive sales. So, if you are not in a hurry you must wait for the sale.

You can find the hidden gems in an end-of-season sale at an affordable price. Also, there are heavy sales running during festivals. A Wishlist can be helpful to get this benefit too.

5. Look for coupon codes

Check out the app carefully to find out if they are providing any coupon codes. Apply this code at the time of payment and get good discounts.

There are some other websites that provide coupon codes. Look for such websites and copy the codes. Sometimes they do not work but sometimes you can get lucky with the code.

6. Shop from a different account

Some Surat Indian clothing stores provide an extra discount to new customers. To avail special discount you can use a different mail ID and login newly to the app.

If you do not have a different Email ID then login through a family member’s account. It will also help you track the status of your shipment.

Overview

There is nothing wrong with online shopping. In fact, it saves time and money.

You just need to be a smart buyer and make good decisions at the right time. The above tips will definitely be helpful for your next Surat clothes online shopping.

1 note

·

View note

Text

Experience UPI Payments on WhatsApp in 4 easy steps

Whether shopping groceries from your local kirana stores, or sending and receiving payments from your friends and family, Unified Payments Interface (UPI) has made it extremely convenient to pay digitally. What is even more convenient is the option of combining the power of messaging and payments on the same platform. WhatsApp does exactly that; it offers the best of both worlds on its platform. On WhatsApp, transferring money is as easy as sending a message, allowing users to seamlessly make UPI-based payments in one convenient place - in their chats! All you need to do is tap the '₹' icon while chatting with a contact or scan a QR code across more than 20 million QR-code-enabled stores in India to initiate a UPI payment.

If you are yet to experience this perfect combination, here is how you can set up payments on WhatsApp in a few simple steps from the familiar chat interface window -

Step 1: Add your bank account: To add your bank account you will need an active account at an Indian bank that supports UPI. The primary phone number associated with this bank account must match the phone number of your WhatsApp account.

Open a chat with the person you want to send money to > tap the Payments icon. Alternatively, you can tap Attach > Payment.

Enter the rupee amount you'd like to send > tap Next > tap Get Started.

Tap Accept and Continue to accept our Payments Terms and Privacy Policy.

From the list of banks, tap the name of your bank.

Tap Verify via SMS > Allow. If WhatsApp already has permission to make and manage phone calls, you won't need to grant permission.

Tap the bank account you want to add to send and receive payments with WhatsApp.

To verify your debit card, tap Continue

Verify your debit card details > tap Verify Card.

Step 2: Send money: Once you've added your bank account to WhatsApp, you can send money to any contact.

Open a chat with the contact you want to send money to.

Tap the '₹' symbol (Payments icon)

Enter the rupee amount you'd like to send > tap Next > Send Payment.

Step 3: Verify the payment by entering your UPI PIN: You will be asked to confirm your UPI PIN before sending a payment. If you haven't set up a UPI PIN yet, you'll be asked to do so by verifying the last 6 digits of your debit card and the expiration date.

Step 4: Confirm the status of your payment: To know whether your payment was successful, all you need to do is check the status of your transfer in the chat or view past transactions in the payments settings.

WhatsApp also offers a host of stickers and backgrounds to personalise the payments experience on the platform. These stickers and backgrounds can be selected by tapping the 'Sticker' icon in the chat composer.

Read the full article

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check balance by debit card#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Park Plus for Playstore

The Park+ App is a one-stop solution and 360-degree eco-system for all your needs as a vehicle owner. Our most popular services include:

Parking - Find, book, and reserve parking spots everywhere you drive.

FASTag buy and recharge - Buy FASTag, recharge, and view transaction history in one place

Daily car wash - Premium Doorstep Car Wash service for daily car washing

Car Insurance - Get holistic details and overviews on the best car insurance policies and buy or renew your car insurance.

Car Health Checks - Get a thorough and true evaluation of the fitness of your car, and your car’s true condition.

Car selling - Sell your car for the best price with our Car Listing service.

Updated Traffic Rules and Regulations - View and use updated real-time information on RTO rules for fines etc. from State wise RTOs

EMI Calculator - Our EMI calculator helps you calculate the EMI requirement when you want to buy a new car and have the car of your dreams.

RTO e-challan Check - Get your vehicle challan details using the Park+ app. The pending echallan status can be checked against a vehicle’s RC or your DL number and cleared instantly.

Vahan Registration Details - Helps you find complete RTO vehicle information such as vehicle details, owner name, and address, make, model, pollution, insurance, and much more by just entering the vehicle registration number.

Manage cars and automobiles using services and information on our app, a comprehensive care zone for your vehicles that make us a Super App for Cars.

Buy and recharge FASTag

Register and recharge FASTag on the go with the Park+ easy-to-use comprehensive FASTag app.

Register for FASTag and fastag app download.

Update your FASTag details and KYC information.

Open or close a FASTag account all in one place.

Do FASTag balance check. Access FASTag Recharge app. Keep track of your FASTag balance on the Park+ fastag balance check app instead of complicated banking apps and signing in. You can check your FASTag expenditure and history with the fastag download.

Reload FASTag through banking / UPI on Park+.

Park+ answers all FASTag-related queries. 24/7 assistance for FASTag emergencies and help for all customers.

How to use our Park+ FASTag service: Open the Park+ App > Click on Services > Enter your vehicle / vahan number plate details > Click enter and access FASTag balance. Recharge through Net Banking, Debit /Credit cards, UPI, and online wallets.

Control your FASTag registered at multiple banks with a single clink. These include:

SBI FASTag

NCPI FASTag

Airtel FASTag

Axis FAStag

Kotak FASTag

IDFC FASTag

Bank of Baroda FASTag

PNB FASTag

HDFC FASTag

IndusInd FASTag

ICICI FASTag

Airtel FASTag

Know your Vehicle and RTO

With the easy-to-use, RTO vehicle information app and mParivahan app stay updated with car info vehicle registration details. Use traffic fine checker RTO fine app and RTO information app to ensure previous fines and challans are paid. Avoid late fees/penalty payments. With a few clicks, license information, or car number plate information, Park+ makes it possible to find details you require from the RTO and get the best e parivahan sewa.

1: RC Status. Use number plate details to check all vehicle information like insurance, ownership, car age and model, engine model, petrol/diesel, and accident history.

2: Fines and Challans. Feed-in Driver’s Licence or Car Plate numbers and find pending challans.

3: Complete Car model and vehicle info and ownership info like vehicle owner details and Vahan registration details.

4: Insurance details, financier details.

6: Licence details like expiration and renewal and address.

Find parking near you

With Park+, you no longer have to worry about finding car parking. Our app lets you book parking spots anywhere in the country.

To offer suggestions on improving the app or feedback for the Park+ team, reach out to us at [email protected]. Disclaimer: All information related to Vehicles is retrieved from the website of Parivahan which is publicly available. The information is original and we are displaying the information in Public Interest. We do not have any connection with the RTO authority.

0 notes

Text

iMobile banking by ICICI

iMobile Pay by ICICI Bank

iMobile is ICICI Bank’s official mobile banking application.

iMobile, the most comprehensive and secure Mobile Banking application, getting payments done through Unified Payment Interface (UPI), offers over 170 banking services on your mobile.

The features of the new iMobile are: https://bit.ly/3PzqZ3A

Pay and collect money from anyone instantly using Unified Payment Interface (UPI Payments). UPI ID is your virtual identity for UPI payments. Use your UPI PIN to do all UPI transactions.

View and transact from all your accounts including Loans, PPF, iWish, Insurance, Cards, Deposits and ICICI FASTag

Check your bank balance, view & email detailed statement and view passbook on your mobile.

https://bit.ly/3PzqZ3A

Manage ICICI Bank FASTag – Purchase FASTag, view FASTag balance, recharge FASTag, view FASTag statement, manage multiple FASTag accounts, link/de-link FASTag and much more

Transfer funds to an account or to contact no or email id

Send cash through ICICI Bank’s Cardless Cash facility

Transact superfast using Favourite feature. By tagging a transaction as favorite, you can quickly access and complete your transactions like mobile recharge or fund transfer

Connect directly to ICICI Bank Phone Banking Officer from your mobile phone application

Track your deliverables

Open FD – Open FDs, RDs or iWish deposits

Get personalized offers on your mobile

Access and manage Life Insurance policies

Service At Your Convenience: Avail banking services from the comfort of your home. You can locate an ATM, stop or check status of your cheque, order a cheque book, track your service requests and more.

Now you can also view the following details on your Smart watch by using iWear - ICICI Bank's Android Wear Banking application:

• Information about your Bank and Credit Card accounts

• Balance details and last 3 transactions

iWear is a companion app that works only when user has downloaded Android Wear to their mobile devices.

For more info...

0 notes

Text

How To Give Tips By UPI As a Foreigner In India?

Navigating India's financial landscape as a foreigner can be daunting, but with the Unified Payments Interface (UPI), the process becomes seamless. Understanding how to leverage UPI efficiently ensures a hassle-free experience during your stay. Let's delve into essential tips for utilizing UPI while in India.

Understanding UPI: A Quick Overview

To grasp its significance, let's first understand what UPI entails. The Unified Payments Interface is a revolutionary system facilitating instant fund transfers between bank accounts via mobile devices. It's a game-changer in India's digital payment ecosystem, offering a secure and convenient way to transact.

Demystifying CheqUPI: An Overview

CheqUPI stands as a pinnacle in India's digital payment landscape, enabling instant fund transfers between bank accounts via mobile devices. Its user-friendly interface and swift transactions make it an essential tool for any visitor in India seeking UPI tips for foreigners.

Setting Up CheqUPI for Foreigners

As a foreigner, setting up CheqUPI is straightforward:

1. Choose a Bank with CheqUPI: Opt for a bank supporting CheqUPI services. Most major banks in India provide this facility.

2. Download CheqUPI App: Install the bank's CheqUPI-enabled app from the App Store or Google Play Store.

3. Registration: Register with your mobile number linked to your Indian SIM card to receive OTPs.

4. Link Your Bank Account: Securely connect your Indian bank account details to the app.

5. Create CheqUPI PIN: Generate a unique CheqUPI PIN to authorize transactions securely.

Leveraging CheqUPI's Features for Seamless Transactions

1. Effortless Payments:

CheqUPI simplifies payments by enabling users to make transactions seamlessly. Whether it's at retail outlets, restaurants, or for online purchases, users can swiftly pay using CheqUPI-enabled QR codes or by entering mobile numbers.

2. Instant Fund Transfers: With CheqUPI, transferring funds becomes instant and hassle-free. Users can send or receive money swiftly without needing intricate bank account details, making transactions smoother than ever.

3. Utility Bill Payments: Paying utility bills—be it electricity, water, or gas—becomes convenient with CheqUPI. Users can settle bills promptly through the app, eliminating the need for physical visits or long queues.

4. Mobile Recharges: Recharging mobile phones is a breeze with CheqUPI. Users can recharge their mobile plans instantly using the app, ensuring continuous connectivity without any delays.

5. Secure Transactions:

CheqUPI ensures security with every transaction. Its encrypted platform and authentication processes prioritize the safety of user data and financial details, offering peace of mind with every use.

6. Multiple Bank Account Management: Users can manage multiple bank accounts within a single

CheqUPI-enabled app. This feature provides flexibility and convenience in handling finances across various accounts effortlessly.

7. User-Friendly Interface: CheqUPI offers a user-friendly interface, ensuring ease of navigation and operation. Its intuitive design simplifies the transaction process, making it accessible for users of all backgrounds.

8. 24/7 Availability: One of the significant advantages of CheqUPI is its round-the-clock availability. Users can initiate transactions or check their account status anytime, anywhere, ensuring accessibility at their convenience.

Leveraging these features, CheqUPI becomes a powerful tool for users, offering a seamless and efficient way to manage financial transactions with utmost ease and security.

Conclusion

Embracing UPI as a foreigner in India streamlines your financial transactions, offering a convenient and secure means of payment. By understanding its setup, functionalities, and security measures, you can confidently navigate India's digital payment landscape.

Frequently Asked Questions (FAQs)

1. What is CheqUPI?

CheqUPI is a digital payment system in India that facilitates instant fund transfers between bank accounts using mobile devices. It operates on a unified platform, allowing seamless transactions.

2. How does CheqUPI work?

CheqUPI works by linking a user's bank account to a CheqUPI-enabled app. Users can then make payments or transfer funds by using unique identifiers like mobile numbers or QR codes, bypassing the need for cumbersome bank details.

3. Which banks support CheqUPI?

Most major banks in India offer CheqUPI services. Users can choose from a wide range of banks supporting this convenient payment system.

4. Is it safe to use CheqUPI for transactions?

Yes, CheqUPI transactions are secured by multiple layers of encryption and authentication. However, it's crucial to safeguard your CheqUPI PIN and be vigilant against potential phishing attempts to ensure maximum security.

5. Can foreigners use CheqUPI?

Absolutely! Foreigners visiting India can also utilize CheqUPI by following the registration process and linking their Indian bank accounts to a CheqUPI-enabled app.

6. What types of transactions can be done using CheqUPI?

CheqUPI enables various transactions, including payments at retail stores, utility bill settlements, mobile recharges, peer-to-peer fund transfers, and much more.

0 notes

Text

RBI allows offline e-payments: All you need to know

News:

Recently the Reserve Bank of India (RBI) introduced a framework allowing offline e-payments to promote digital payments in rural and small urban areas.

In India, RBI plays the role of a regulator concerning all types of payments.

What is offline e-payment?

It is a type of digital payment which does not require internet or telecom connectivity. In offline mode, payments can be made face to face or by any means of proximity such as cards, wallets, and mobile devices.

The scheme was being worked on by RBI as a pilot project since August 2020; these transactions will not require the additional factor of authentication. Since the payment will be offline, customers will get 'alerts' after some time through SMS or e-mail.

This facility is mainly designed keeping in mind the small value digital payment. In this payment mode, the limit per transaction will be up to Rs 200 and its overall limit has been fixed at Rs 2000, although money can be re-added to the account through online mode only.

For this payment mode, first, the provisions of the circular issued by RBI in this regard will have to be agreed upon. Offline payments can be used only with the permission of the customers. With this move of RBI, small digital transactions will be able to take place even in inaccessible or internet-less areas.

Status of digital payment in India

In India, 60% of the total digital payment transactions take place through UPI.

According to the RBI report, digital payments have almost doubled in the last 5 years.

According to a report by capital markets company CLSA, digital payments in India will triple from $300 billion in 2021 to $1 trillion by 2026.

National Payment Corporation of India (NPCI) is an umbrella organization for digital payments in the country. It has been established by RBI and Indian Banks' Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

Check also: Online Harassment of Women and the GitHub Issue

Subscribe Million-$-Knowledge to get notifications about news and other educational articles.

#Million Dollar Knowledge#finance#Financial Help#economy#rbi news#india news#latest news#offline e-payments

1 note

·

View note

Text

NuWay – A NuWay to chat

If you have followed reviews here, you’ll know that we are fan of unique introduction of popular apps, specifically when they bring something distinctive to the benefit of global users. This familiar app of NuWay - NuWay chat app developed by Sark Mobile Solutions on the Play Store is wholly efficacious and satisfying all corners of users.

One could keep their number private in using this chat app. They can also chat by sharing just your NuWay ID, not your phone number. The users could share and converse with the whole world, safely. It could also have Recall Ping feature where one could type the right ping. Now users have a better chance to recall it. Long-press the ping, press the Recall icon. If Recall is successful, you would see a looped arrow next to the ping. For checking the status of recall from a group chat, just touch that message and you could see the recall status from each person.

With expediently using this NuWay – A NuWay to chat app users could get Routes - know when to start. They can also know the estimated travel time in traffic by selecting the start and destination. It would also enumerate you the 2 or 3 alternative routes, distance and estimated time in traffic. The major part is that you could change the time to know how travel time changes, easily find out when it is least.

How to use this app

· If you wish to use a route, touch it to open that route in Google Maps

· You could also save a route if you like to retrieve it with one touch again

One could also share their location with NuWay chat app. By duly performing this process of act it is possible to share your location with a friend or a group, who could then view your position and movement till you turn it off. This quality feature makes it simpler to assist your friends meet you if you are outside and not familiar with the area.

It could also mark a ping as important, which would then give out a distinct ringtone to the recipient and bring attention that a phone Contact has sent an important ping. They can also have a forward a message, enumerating that who did the original posting.

More importantly what you can do if a Forward for assistance you just received was a Spam from someone unknown or a genuine request? With this apt Forward feature, the NuWay ID of the user who did the original posting is actually retained. It is less likely for someone to start a Spam when they know their ID is actually displayed.

If you like to remind a friend or your group on something tomorrow then just send a reminder. It would also ring an alarm at the date and time you set. You don't have to worry if you would remember to remind on time and if the other person would have network.

By expediently using this app you can develop a poll within a group and take group's vote easily. There is no more back and forth a conversation that leaves everyone wondering what the group's choice was. It could also convert a 2-way call into a 3-way conference

They are also illustrated that anyone in a group can spontaneously start a conference. Everyone on the group, who is online, would get a call and on answering the call, also get added to the conference. For users it is so simple and convenient to do a conference, particularly at short notice.

It is much possible to recharge/pay any prepaid/postpaid mobile, DTH or Electricity service simple and fast with our app. For a prepaid number, the users could even recharge for multiple plans in a single transaction or repeat a past transaction with just a couple of clicks. It is conveyed that this key feature supports payment using UPI, Debit card, Credit card and net banking.

Apart from every other salient aspects if users like to send a ping or attachment to multiple people, they don’t have to copy and send to each separately. You could also just start a new ping, type the message or choose the attachment, press Send and select the recipients.

It is also noted that the users can keep their privacy settings and notifications different for your Phone contacts from others with who you might chat for any reason. So in case if users get that tone or see the LED flashing, you know it is someone who is a contact from your Phone book.

With this popular chat app you can highly express yourself and it is rendezvous. It is also popular for Group chat and Messaging app. They also have special group messaging and hidden chat. You can also come across Opinion Poll and share image features.

If users require having a one-time conversation with someone you just met, all you require to do is to share your NuWay ID; your acquaintance could simply find you using that ID and chat. In conclusion I highly suggest picking up NuWay chat app if you’re in the mood for unique features but seeking many advanced app features.

DOWNLOAD FROM PLAY STORE

DEVELOPERS SITE

youtube

#NuWay#NuWay – A NuWay to chat#Sark Mobile Solutions#rendezvous#Group chat#Messaging app#Opinion Poll#share image features#express yourself#chat app

2 notes

·

View notes