#upi transaction id status check

Text

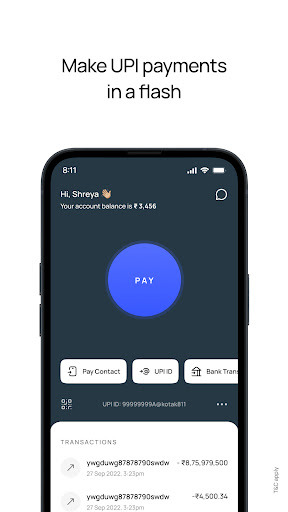

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check balance by debit card#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

PhonePe API Integration by Infinity Webinfo Pvt Ltd: Revolutionizing Digital Payments in India

Introduction

In the rapidly evolving fintech landscape, digital payments are essential for businesses to offer seamless transaction experiences to customers. PhonePe, one of India’s leading payment platforms, has made it easier for enterprises to adopt its UPI-based payment solutions through API integrations. Infinity Webinfo Pvt Ltd, a prominent technology solutions provider, specializes in integrating the PhonePe API to enable businesses to harness the power of digital payments effectively.

PhonePe API Integration by Infinity Webinfo Pvt Ltd

What is PhonePe API Integration?

PhonePe API integration refers to the process of embedding PhonePe’s digital payment system directly into a business’s platform, such as a website or mobile app. This integration enables businesses to accept payments from customers through UPI (Unified Payments Interface), facilitating secure and instant transactions.

Infinity Webinfo Pvt Ltd takes this process a step further by ensuring that the integration is smooth, secure, and optimized for the best user experience. The PhonePe API integration provides businesses with a direct link to the UPI ecosystem, enabling faster and more efficient payments.

Why PhonePe API Integration Matters

Wide User Base: PhonePe has a large and growing user base across India. By integrating its API, businesses can tap into this vast customer base and offer a payment option that users are already familiar with and trust.

Instant Payments: UPI payments through PhonePe are instant, meaning there is no waiting period for fund transfers. This not only improves the customer experience but also ensures businesses receive their payments immediately, aiding cash flow management.

Improved Customer Convenience: By offering PhonePe as a payment option, businesses can reduce cart abandonment rates. Customers are more likely to complete their purchase if they can use a familiar and simple payment method.

Cost-Effective Solution: The PhonePe API operates with minimal transaction fees, making it a cost-effective solution for businesses that need to process a high volume of payments.

Support for Multiple Use Cases: The PhonePe API can be used for a variety of transactions, from one-time payments for goods and services to recurring transactions such as subscriptions. This versatility makes it suitable for businesses across industries, including e-commerce, retail, education, and entertainment.

Key Benefits of PhonePe API Integration by Infinity Webinfo Pvt Ltd

QR Code Payments: For businesses with physical storefronts, the PhonePe API allows for the generation of QR codes that customers can scan to make payments directly from their PhonePe app, simplifying the checkout process.

Auto payment Update: Auto payment in PhonePe allows users to set up recurring payments automatically for services like subscriptions, bill payments, or other scheduled payments. Instead of manually paying each time, PhonePe handles the payments at regular intervals, ensuring the service continues uninterrupted

Status check API: This API allows businesses to find out the current status of a payment by using the unique transaction ID (a code given to each payment). Business can see Updated Status instantly.Customers know right away if their payment was successful, reducing confusion or delays.

Seamless UPI Transactions: With PhonePe’s API, businesses can offer direct UPI payments, allowing customers to pay using their bank accounts with just a few clicks. This eliminates the need for intermediaries like wallets and ensures hassle-free transactions.

Faster Checkouts: One of the significant advantages of integrating PhonePe is the reduction in checkout time. Customers don’t have to enter card details or use multiple authentication steps, as UPI payments are processed instantly, ensuring a smooth purchasing experience.

Enhanced Security: PhonePe’s API comes with advanced security features such as multi-layer encryption, two-factor authentication, and compliance with RBI guidelines. Infinity Webinfo Pvt Ltd ensures that all integrations maintain the highest security standards, protecting both businesses and their customers from Pvt Ltd potential fraud.

Support for Multiple Platforms: Infinity Webinfo Pvt Ltd’s integration services support various platforms, including websites, e-commerce platforms, and mobile applications (both Android and iOS). This cross-platform support ensures that businesses can cater to a wide audience with minimal development effort.

Custom Solutions: Infinity Webinfo Pvt Ltd offers custom integration solutions, tailoring the PhonePe API to suit the specific needs of businesses. Whether it's an e-commerce platform, service provider, or retail outlet, the integration can be customized to ensure the best fit.

Merchant Dashboard: After the integration, businesses get access to a comprehensive merchant dashboard from PhonePe, where they can monitor transaction data, generate reports, and manage refunds. Infinity Webinfo Pvt Ltd provides support and training to ensure businesses can utilize this dashboard to its full potential.

Support for Recurring Payments: For businesses that rely on subscription models or recurring billing, Infinity Webinfo Pvt Ltd’s PhonePe API integration enables automated recurring payments through UPI. This is a great feature for SaaS platforms, OTT services, and other businesses with subscription-based revenue models.

Security and Compliance

Security is a top priority for PhonePe, and the API integration follows strict guidelines set by the Reserve Bank of India (RBI). The platform uses end-to-end encryption and secures tokenization methods to protect user data and ensure transaction integrity.

In addition to encryption, PhonePe requires multi-factor authentication for high-value transactions, further safeguarding the payment process. Businesses integrating PhonePe’s API must comply with data protection regulations and ensure that customer data is handled securely.

Advantages for Businesses

Increased Sales: By offering a trusted and widely used payment method like PhonePe, businesses can increase sales, especially among mobile users who prefer UPI transactions.

Enhanced Customer Trust: PhonePe’s strong brand and focus on security help build trust with customers, making them more likely to complete transactions.

Streamlined Operations: Automated reconciliation and real-time transaction tracking reduce the administrative burden on businesses, enabling them to focus on other aspects of their operations.

Scalable Payment Infrastructure: The API is designed to handle large transaction volumes, making it suitable for businesses of all sizes, from startups to large enterprises.

Steps in the PhonePe API Integration Process by Infinity Webinfo Pvt Ltd

Requirement Gathering and Analysis: Infinity Webinfo Pvt Ltd works closely with businesses to understand their specific requirements and ensure that the PhonePe API integration aligns with their business goals.

API Documentation Review: Infinity Webinfo Pvt Ltd’s team reviews PhonePe’s API documentation to ensure a clear understanding of the technical specifications required for seamless integration.

Development and Integration: The integration process involves embedding the PhonePe payment gateway into the website or app, ensuring compatibility with the existing platform.

Testing and Security Check: After development, Infinity Webinfo Pvt Ltd conducts rigorous testing to ensure the API is functioning correctly. This step includes security audits to ensure that all transactions are secure and compliant with regulatory standards.

Deployment and Support: Once the integration is successfully tested, Infinity Webinfo Pvt Ltd deploys the solution and provides ongoing support to address any issues or updates that may arise.

Impact of PhonePe API Integration on Businesses

Increased Conversion Rates: The simplicity and speed of UPI payments reduce cart abandonment and increase conversion rates, especially for e-commerce platforms.

Enhanced Customer Trust: PhonePe’s widespread adoption in India means customers trust the platform. By offering PhonePe as a payment option, businesses can increase trust among their customer base.

Improved Cash Flow: Instant UPI transactions improve cash flow, as businesses receive payments in real-time without delays, unlike traditional payment methods.

Conclusion

PhonePe API integration by Infinity Webinfo Pvt Ltd offers businesses an opportunity to streamline their payment processes, improve customer satisfaction, and enhance security. With its expertise in API integration, Infinity Webinfo Pvt Ltd ensures a hassle-free and secure payment experience that helps businesses stay competitive in the digital era. As UPI continues to dominate India’s digital payment space, partnering with experts like Infinity Webinfo Pvt Ltd ensures that businesses can fully leverage the advantages of PhonePe.

Contact Us On: - +91 9711090237

#PhonePe#PhonePe Payment Gateway#PhonePe Payment Gateway API Integration#Payment Gateway API Integration#api integration#infinity webinfo pvt ltd

0 notes

Text

Everything Foreigners Need to Know About UPI

The Unified Payments Interface (UPI) has become a cornerstone of India's digital payment ecosystem, offering a seamless and efficient way for users to send and receive money instantly. For foreigners living or visiting India, understanding UPI can greatly simplify financial transactions and enhance the overall experience. Here's everything you need to know about UPI:

What is UPI Payment?

The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It enables users to transfer money between bank accounts instantly using a mobile phone. UPI eliminates the need for traditional methods like NEFT or IMPS, making transactions quick, secure, and convenient.

How Does UPI Work?

The Unified Payments Interface (UPI) has revolutionised the way people in India make digital transactions, offering a seamless and efficient payment system. Let's take a closer look at how UPI works, focusing on the popular UPI app "CheqUPI":

Download and Registration:

First, users need to download the "CheqUPI" app from the App Store or Google Play Store.

Upon opening the app, users are prompted to register by providing their mobile number linked to their bank account.

An OTP (One-Time Password) is sent to verify the mobile number, after which users create a secure login PIN.

Creating a UPI ID:

Once registered, users can create a unique UPI ID, often in the format [name]@chequpi.

This UPI ID serves as the user's virtual payment address, allowing them to receive money directly into their bank account.

Linking Bank Account:

To start transacting, users need to link their bank account(s) to the CheqUPI app.

The app supports multiple bank accounts, providing flexibility to choose the account for transactions.

Adding Beneficiaries:

Users can add beneficiaries by entering their UPI ID, and account number, or scanning a QR code.

Once added, beneficiaries are securely stored in the app for future transactions.

Making Payments:

To send money, users select the "Send Money" option and enter the recipient's UPI ID or select from the list of added beneficiaries.

They enter the amount to be transferred and can add a note for reference.

A secure UPI PIN is required to authenticate the transaction.

Requesting Payments:

Users can also request money by selecting the "Request Money" option.

They enter the recipient's UPI ID or select from the list of added beneficiaries, along with the requested amount.

The recipient receives a notification to approve or decline the request.

Checking Transaction History:

CheqUPI provides a detailed transaction history, showing all incoming and outgoing transactions.

Users can view transaction details, including date, time, amount, and transaction status.

Additional Features:

CheqUPI offers a range of additional features to enhance the user experience.

This includes options for bill payments, mobile recharges, DTH recharges, and more, all accessible within the app.

Security Measures:

CheqUPI prioritizes security, implementing robust measures to safeguard user transactions.

Two-factor authentication is mandatory for all transactions, requiring a UPI PIN along with device lock PIN or biometric authentication.

The app employs encryption protocols to protect user data and transactions from unauthorized access.

Customer Support:

Users can reach out to CheqUPI's customer support for assistance with transactions, account-related queries, or technical issues.

The app provides options for in-app chat support, email support, and helpline numbers for quick resolution of queries.

Promotions and Offers:

CheqUPI often runs promotional campaigns and offers for users, providing cashback rewards, discounts, and other incentives for transactions.

Users can benefit from these offers while making everyday payments through the app.

Real-Time Notifications:

Users receive real-time notifications for every transaction, providing instant updates on the status of payments.

Notifications include details such as successful transactions, pending requests, and failed transactions for quick reference.

Future Advancements:

CheqUPI continues to evolve with new features and advancements in the UPI ecosystem.

Users can look forward to upcoming updates that enhance convenience, security, and usability of the app.

Convenience:

UPI eliminates the need for carrying cash or relying on physical cards for transactions. Foreigners can easily make payments using their mobile phones.

Instant Transfers:

Transactions through UPI are completed instantly, allowing foreigners to send money to friends, pay bills, or shop online without delays.

Wide Acceptance:

UPI is widely accepted across various merchants, online platforms, and utility bill payments, making it versatile for day-to-day transactions.

Multi-Language Support:

Many UPI apps offer support for multiple languages, catering to foreigners who may not be fluent in English or Hindi.

Transparency:

UPI provides real-time transaction updates and detailed transaction history, allowing users to track their spending easily.

How Foreigners Can Use UPI:

Bank Account:

Foreigners need an Indian bank account to use UPI. They can open a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account with an Indian bank.

KYC Verification:

Foreigners must complete the Know Your Customer (KYC) verification process as per Reserve Bank of India (RBI) guidelines to use UPI.

UPI App:

Download a UPI-enabled mobile app from the App Store or Google Play Store. Popular apps include Google Pay, PhonePe, Paytm, and BHIM.

Registration:

Register on the app using your Indian mobile number linked to the bank account. Create a UPI ID and set a UPI PIN.

Transactions:

Start sending and receiving money, paying bills, recharging mobile phones, and more using your UPI ID.

Tips for Using UPI:

Secure Your PIN:

Keep your UPI PIN confidential and do not share it with anyone. Avoid using simple or easily guessable PINs.

Verify Transactions:

Always verify the recipient's UPI ID and amount before confirming a transaction to avoid errors.

Check Limits:

Be aware of your daily transaction limits set by your bank and UPI app to avoid exceeding them.

Update Apps:

Regularly update your UPI app to ensure you have the latest security features and bug fixes.

Customer Support:

Familiarize yourself with the customer support options provided by your UPI app in case you encounter any issues or have questions.

Conclusion:

Understanding and using UPI can greatly simplify financial transactions for foreigners in India. With its convenience, speed, and security features, UPI has revolutionized the way payments are made in the country. Whether you're sending money to friends, paying bills, or shopping online, UPI offers a seamless and efficient payment experience for all.

Frequently Asked Questions (FAQs)

Can foreigners use UPI in India?

Yes, foreigners can use the Unified Payments Interface (UPI) in India, provided they have an Indian bank account. Foreigners need to open either a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account with an Indian bank. Once they have a valid Indian bank account, they can download a UPI-enabled mobile app from the App Store or Google Play Store to start using UPI for transactions.

What are the benefits of using UPI for foreigners?

Using UPI offers several benefits for foreigners in India. Firstly, it provides a convenient and hassle-free way to make payments. Foreigners no longer need to carry cash or rely on physical cards for transactions. UPI-enabled mobile apps allow users to send and receive money instantly using their smartphones, making it ideal for various transactions such as splitting bills with friends, paying for goods and services, or even transferring money back home.

Secondly, UPI transactions are completed instantly, offering quick and efficient payments. Whether it's sending money to friends, paying bills, or shopping online, foreigners can enjoy the speed and convenience of UPI. Transactions are processed in real-time, ensuring that the recipient receives the funds immediately.

Another advantage of UPI for foreigners is its wide acceptance across various merchants, online platforms, and utility bill payments. Whether it's making purchases at local stores, paying for groceries, or booking tickets online, UPI offers versatility and ease of use.

Additionally, UPI apps often provide multi-language support, catering to foreigners who may not be fluent in English or Hindi. This feature ensures that users can navigate the app and complete transactions comfortably in their preferred language.

Lastly, UPI offers transparency and security. Users receive real-time transaction updates and detailed transaction history, allowing them to track their spending easily. UPI transactions are secured with two-factor authentication, including a UPI PIN and often a device lock PIN or biometric authentication, ensuring the safety of transactions.

How can foreigners start using UPI in India?

To start using UPI in India, foreigners need to follow a few simple steps:

Open an Indian Bank Account: Foreigners must have an Indian bank account, such as a Non-Resident Indian (NRI) account or a Foreign Currency Non-Resident (FCNR) account.

Download a UPI-Enabled Mobile App: Once the bank account is set up, foreigners can download a UPI-enabled mobile app from the App Store or Google Play Store. Popular UPI apps include Google Pay, PhonePe, Paytm, and BHIM.

Registration: Register on the UPI app using the Indian mobile number linked to the bank account. Create a unique UPI ID, which is usually in the format [name]@[bank], and set a secure UPI PIN.

Start Transacting: With the UPI app set up, foreigners can start sending and receiving money, paying bills, recharging mobile phones, and making various other transactions using their UPI ID.

What are some tips for foreigners using UPI in India?

Foreigners using UPI in India can benefit from the following tips to ensure a smooth and secure transaction experience:

Secure Your UPI PIN: Keep your UPI PIN confidential and do not share it with anyone. Avoid using easily guessable PINs such as birthdates or phone numbers.

Verify Transaction Details: Always double-check the recipient's UPI ID and the transaction amount before confirming a payment. This helps avoid errors and ensures that funds are sent to the intended recipient.

Know Your Limits: Be aware of the daily transaction limits set by your bank and the UPI app. This prevents exceeding the maximum transaction amount allowed per day.

Update Your UPI App: Regularly update your UPI app to the latest version available. Updates often include security patches and bug fixes, enhancing the overall security of the app.

Use Customer Support: Familiarize yourself with the customer support options provided by the UPI app. In case of any issues or queries, you can reach out to customer support for assistance and guidance.

Is UPI widely accepted in India?

Yes, UPI is widely accepted across India at various merchants, online platforms, utility bill payments, and more. The versatility of UPI makes it a preferred choice for digital payments, offering convenience and efficiency to users. Whether it's making everyday purchases, paying bills, or transferring money to friends and family, foreigners can rely on UPI for a seamless payment experience.

Can foreigners transfer money internationally using UPI?

No, UPI is designed for domestic transactions within India. Foreigners cannot use UPI to transfer money internationally. However, they can use other methods such as wire transfers, international bank transfers, or online remittance services to send money abroad from their Indian bank account.

Are there any fees associated with using UPI for foreigners?

Generally, UPI transactions for individuals are free of charge. Most UPI apps do not impose fees on users for sending or receiving money. However, it's essential to check with your bank or UPI app for any specific fees or charges that may apply, especially for certain types of transactions or services.

0 notes

Text

अगर UPI द्वारा लेन -देन करते समय कटे पैसे अगर वापिस नहीं आए तो बैंक देगा जुर्माना ,कहाँ करे शिकायत

अगर UPI द्वारा लेन -देन करते समय कटे पैसे अगर वापिस नहीं आए तो बैंक देगा जुर्माना ,कहाँ करे शिकायत

डिजिटल ट्रांजैक्शन फेल होने के बाद अगर अकाउंट से पैसे कट जाते हैं और पेमेंट नहीं होता तो बैंकों को यह पैसा एक तय समय ��ें ग्राहक के अकाउंट में रिवर्स करना होता है. ऐसा नहीं करने पर बैंक को पेनाल्टी देनी पड़ती है.

कई बार जब आपको किसी को जरूरी पैसा भेजना होता है और आपका पेमेंट किसी भी डिजिटल प्लेटफॉर्म से नहीं जा पाता या फ़ाइल हो जाता है . और कई बार तो आपके अकाउंट से पेमेंट कटने के बाद भी आगे नहीं…

View On WordPress

#upi transaction#upi transaction charges#upi transaction charges sbi#upi transaction id#upi transaction id status check#upi transaction limit#upi transaction limit pnb#upi transaction status#upi transfer#upi transfer limit

0 notes

Text

How to save money on Online clothing stores?

Believe it or not but Corona has made us all so lazy especially when it comes to shopping.

We are obsessed with ordering everything from the comfort of our homes with a few clicks on our phones and laptops.

Surat dress online shopping is very convenient and time-saving. But, are you a smart buyer? Hopefully, you are not spending your hard-earned money on the wrong clothing website.

Here are some tips for you that will help you to select some of the best online clothing stores to save money.

Keep the Products on a Wishlist

Keeping the products on a wishlist is a great strategy to get discounts. This notifies the Surat online dress stores that you are willing to buy something but you are not making the purchase. You will able to buy wholesale sarees collection at the best market price

In a few hours, you get the notification of offers like buy one get one free or discounted price. To become a pro online shopper one needs to be patient.

2. Choose the right payment gateway

Never be in a hurry to pay the price and checkout. Read everything carefully if there is any discount or cashback offer running on a specific payment mode.

Sometimes there are offers on UPI's and sometimes on debit and credit cards.

Moreover, Most UPI apps offer cashback on transactions. So, if there is no offer running by the retailer you can choose to pay through UPI and avail a cashback.

3. Bulk shopping

Bulk shopping can save your delivery charges. Most Surat online clothing stores offer to waive delivery charges for a certain amount. That doesn’t mean you shop unstoppable.

To be a wise shopper you need to refrain from buying unnecessary items. Instead, you can ask your friends to buy stuff from the same online store and make a combined bill.

You may also get an extra discount on a big purchase if there is any offer running.

4. Wait for sale

Most Surat online clothing stores have seasonal and festive sales. So, if you are not in a hurry you must wait for the sale.

You can find the hidden gems in an end-of-season sale at an affordable price. Also, there are heavy sales running during festivals. A Wishlist can be helpful to get this benefit too.

5. Look for coupon codes

Check out the app carefully to find out if they are providing any coupon codes. Apply this code at the time of payment and get good discounts.

There are some other websites that provide coupon codes. Look for such websites and copy the codes. Sometimes they do not work but sometimes you can get lucky with the code.

6. Shop from a different account

Some Surat Indian clothing stores provide an extra discount to new customers. To avail special discount you can use a different mail ID and login newly to the app.

If you do not have a different Email ID then login through a family member’s account. It will also help you track the status of your shipment.

Overview

There is nothing wrong with online shopping. In fact, it saves time and money.

You just need to be a smart buyer and make good decisions at the right time. The above tips will definitely be helpful for your next Surat clothes online shopping.

1 note

·

View note

Text

iMobile banking by ICICI

iMobile Pay by ICICI Bank

iMobile is ICICI Bank’s official mobile banking application.

iMobile, the most comprehensive and secure Mobile Banking application, getting payments done through Unified Payment Interface (UPI), offers over 170 banking services on your mobile.

The features of the new iMobile are: https://bit.ly/3PzqZ3A

Pay and collect money from anyone instantly using Unified Payment Interface (UPI Payments). UPI ID is your virtual identity for UPI payments. Use your UPI PIN to do all UPI transactions.

View and transact from all your accounts including Loans, PPF, iWish, Insurance, Cards, Deposits and ICICI FASTag

Check your bank balance, view & email detailed statement and view passbook on your mobile.

https://bit.ly/3PzqZ3A

Manage ICICI Bank FASTag – Purchase FASTag, view FASTag balance, recharge FASTag, view FASTag statement, manage multiple FASTag accounts, link/de-link FASTag and much more

Transfer funds to an account or to contact no or email id

Send cash through ICICI Bank’s Cardless Cash facility

Transact superfast using Favourite feature. By tagging a transaction as favorite, you can quickly access and complete your transactions like mobile recharge or fund transfer

Connect directly to ICICI Bank Phone Banking Officer from your mobile phone application

Track your deliverables

Open FD – Open FDs, RDs or iWish deposits

Get personalized offers on your mobile

Access and manage Life Insurance policies

Service At Your Convenience: Avail banking services from the comfort of your home. You can locate an ATM, stop or check status of your cheque, order a cheque book, track your service requests and more.

Now you can also view the following details on your Smart watch by using iWear - ICICI Bank's Android Wear Banking application:

• Information about your Bank and Credit Card accounts

• Balance details and last 3 transactions

iWear is a companion app that works only when user has downloaded Android Wear to their mobile devices.

For more info...

0 notes

Text

NuWay – A NuWay to chat

If you have followed reviews here, you’ll know that we are fan of unique introduction of popular apps, specifically when they bring something distinctive to the benefit of global users. This familiar app of NuWay - NuWay chat app developed by Sark Mobile Solutions on the Play Store is wholly efficacious and satisfying all corners of users.

One could keep their number private in using this chat app. They can also chat by sharing just your NuWay ID, not your phone number. The users could share and converse with the whole world, safely. It could also have Recall Ping feature where one could type the right ping. Now users have a better chance to recall it. Long-press the ping, press the Recall icon. If Recall is successful, you would see a looped arrow next to the ping. For checking the status of recall from a group chat, just touch that message and you could see the recall status from each person.

With expediently using this NuWay – A NuWay to chat app users could get Routes - know when to start. They can also know the estimated travel time in traffic by selecting the start and destination. It would also enumerate you the 2 or 3 alternative routes, distance and estimated time in traffic. The major part is that you could change the time to know how travel time changes, easily find out when it is least.

How to use this app

· If you wish to use a route, touch it to open that route in Google Maps

· You could also save a route if you like to retrieve it with one touch again

One could also share their location with NuWay chat app. By duly performing this process of act it is possible to share your location with a friend or a group, who could then view your position and movement till you turn it off. This quality feature makes it simpler to assist your friends meet you if you are outside and not familiar with the area.

It could also mark a ping as important, which would then give out a distinct ringtone to the recipient and bring attention that a phone Contact has sent an important ping. They can also have a forward a message, enumerating that who did the original posting.

More importantly what you can do if a Forward for assistance you just received was a Spam from someone unknown or a genuine request? With this apt Forward feature, the NuWay ID of the user who did the original posting is actually retained. It is less likely for someone to start a Spam when they know their ID is actually displayed.

If you like to remind a friend or your group on something tomorrow then just send a reminder. It would also ring an alarm at the date and time you set. You don't have to worry if you would remember to remind on time and if the other person would have network.

By expediently using this app you can develop a poll within a group and take group's vote easily. There is no more back and forth a conversation that leaves everyone wondering what the group's choice was. It could also convert a 2-way call into a 3-way conference

They are also illustrated that anyone in a group can spontaneously start a conference. Everyone on the group, who is online, would get a call and on answering the call, also get added to the conference. For users it is so simple and convenient to do a conference, particularly at short notice.

It is much possible to recharge/pay any prepaid/postpaid mobile, DTH or Electricity service simple and fast with our app. For a prepaid number, the users could even recharge for multiple plans in a single transaction or repeat a past transaction with just a couple of clicks. It is conveyed that this key feature supports payment using UPI, Debit card, Credit card and net banking.

Apart from every other salient aspects if users like to send a ping or attachment to multiple people, they don’t have to copy and send to each separately. You could also just start a new ping, type the message or choose the attachment, press Send and select the recipients.

It is also noted that the users can keep their privacy settings and notifications different for your Phone contacts from others with who you might chat for any reason. So in case if users get that tone or see the LED flashing, you know it is someone who is a contact from your Phone book.

With this popular chat app you can highly express yourself and it is rendezvous. It is also popular for Group chat and Messaging app. They also have special group messaging and hidden chat. You can also come across Opinion Poll and share image features.

If users require having a one-time conversation with someone you just met, all you require to do is to share your NuWay ID; your acquaintance could simply find you using that ID and chat. In conclusion I highly suggest picking up NuWay chat app if you’re in the mood for unique features but seeking many advanced app features.

DOWNLOAD FROM PLAY STORE

DEVELOPERS SITE

youtube

#NuWay#NuWay – A NuWay to chat#Sark Mobile Solutions#rendezvous#Group chat#Messaging app#Opinion Poll#share image features#express yourself#chat app

2 notes

·

View notes

Text

MyJio: For Everything Jio v6.0.37 MOD APK

MyJio Mod Apk is your one stop destination for recharges, UPI & payments, managing Jio devices, Movies, Music, News, Games, Quizzes, & a lot more

• MyJio Home:

Shortcuts to your favourite features across the app, hottest music & movies, games & more

• Account details:

i. Balance & usage: View real-time account balance or amount due for payments & usage patterns for calls, data & SMS

ii. Multiple accounts: Easily link & manage Jio accounts using your profile

iii. JioTunes: Set or manage your JioTunes. Let music express your mood!

• Settings:

i. Profile settings: Customise your personal profile & Jio account

ii. Manage devices: Manage your JioFiber devices with ease! Allow who connects to your JioFiber Wi-Fi, manage Wi-Fi names & passwords

iii. App language: Available in your language

• JioPay:

i. Payment instruments and wallets: Choose from a list of recharge plans and avail exciting offers. Link & pay with saved cards, JioMoney, Paytm & PhonePe wallets, & saved UPI IDs

ii. JioAutoPay: Set up AutoPay for hassle free payments

• JioCare:

i. FAQ’s and How-to videos: Find answers to your queries with comprehensive FAQs & How-to videos

ii. Helpful tips: Go through helpful tips or connect with our JioCare experts

iii. Live chat: Use live chat for real time assistance

• UPI: For all your payments:

i. All your transactions can be viewed in conversation style layout for easy access

ii. Transfer money, recharge, pay utility bills & more

iii. Scan and pay conveniently when you shop

• JioSaavn:

Explore a music library of more than 45 million songs. Enjoy music for every mood! Feeling happy, blue or in love, we've got you covered!

• JioCinema:

i. Get a sneak-peek of the latest trailers & enjoy an ultimate dose of entertainment

ii. Browse through popular movies & blockbusters, latest original web series, your favourite TV shows & more

• JioEngage:

We have boxes full of amazing prizes – just for you. Play exciting games, participate in quizzes & win them all!

• JioCloud:

i. Now backup your photos, videos, audio and documents & access them, anytime, anywhere

ii. Back up contacts, search, call, message, email, restore, merge & delete contacts

• JioNews:

i. Home: Get breaking news in 13+ languages from top news sources & free access to 250+ e-papers

ii. Magazine: 800+ magazines on various category including Politics, Sports, Entertainment, Business, Technology, Jobs, Health, Kids & more

iii. Videos: Trending videos from 10+ genres including Bollywood, Fashion, Health, Technology, Sports & more

iv. Live TV: Watch live news and videos from 190+ channels

• Stories:

From magazines to health tips, learning English to cooking fish, we have curated a list of videos & reads well over from 80+ popular papers & magazines

• JioGames:

A library of games at your fingertips with JioGames. Get exclusive benefits with every game!

• JioMart:

Enjoy the best deals, offers & a wide selection of products at unbelievable prices!

• EasyGov:

i. Discover Government welfare schemes, services and jobs for yourself, family members & others

ii. Check eligibility and get information about how to apply and documents required for various State & Central Government schemes

iii. Get real time updates & notifications on Government to Citizen (G2C) services

• Non-Jio users:

i. Jio apps: Explore Jio apps easily from one place

ii. Home delivery: Get your Jio SIM delivered at your doorstep

iii. Track order: Know the status of your Jio SIM delivery & activation

iv. Quick Recharge/Payment: Recharge or pay bills for any Jio number

• Your Digital Assistant:

i. JioInteract: Talk to celebrities on JioInteract, the world’s first AI based engagement platform

ii. HelloJio: The advanced voice assistant to solve all your problems! Ask for balance check or troubleshoot issues or find the latest movies. It’s that simple!

• Universal search:

Need to find something? Ask & we shall find it for you

• Universal QR:

Link accounts save contacts & much more with the Smart QR scanner

Read the full article

0 notes

Text

Govt HPCL R&D Officer Recruitment 2021 – Biotech & Microbiology Job

New Post has been published on https://biotechtimes.org/2021/03/04/govt-hpcl-rd-officer-recruitment-2021-biotech-microbiology-job/

Govt HPCL R&D Officer Recruitment 2021 – Biotech & Microbiology Job

Govt HPCL R&D Officer Recruitment 2021

Govt HPCL R&D Officer Recruitment 2021 – Salary 18 Lakhs Per Annum. Hindustan Petroleum Corporation Limited (HPCL) is a Maharatna Central Public Sector Enterprise (CPSE) is recruiting Bioscience candidate for Officer- Bioprocess role. Interested candidates can check out the Govt Bioscience job details below:

Biosciences R&D Officer Job

Position Name: Officer- Bioprocess

No. of Vacancies: 01

Min Exp. in Years: NIL

Pay Scale: 60000-180000

Cost to Company (CTC) Approx: 18.21 lakhs

Age Limit: 32 years

Important Dates

Commencement of online application: 3rd March 2021

Last date of online application: 15th April 2021

Selection Process

The selection process for Govt HPCL R&D Officer Recruitment may comprise of various shortlisting tools like Computer Based Tests, Group tasks, Personal interviews etc.

Candidates fulfilling all eligibility criteria basis scrutiny of the application, uploaded documents and category-wise and discipline-wise merit list, will be considered for the further selection process.

In the event of the number of applications being large, the Corporation will adopt shortlisting criteria to restrict the number of candidates to be called for the further selection process.

The shortlisting criteria will be based on any or all of the criteria i.e. higher relevant experience, higher qualification, number of patents (wherever applicable)/ publications in high-impact journals, etc.

Depending on number of candidates fulfilling all criteria, candidates will undergo single stage or multiple stage interviews.

Candidates are advised to upload their resume containing (a) Education details such as educational qualifications from 10th standard onwards, year of passing, aggregate marks, Institute, etc., (b) detailed work experience, (c) list of patents filed and granted separately, (d) list of publications in journals with impact factor, (e) list of books/ book chapters (f) list of papers presented in national/international conference (g) overall citations and ‘h’ index wherever applicable.

A category-wise merit list (Minimum-qualifying Marks (60 % for UR & EWS, 54% of OBCNC /SC/ ST/PwBD) will be drawn for all the candidates who qualify in all the selection parameters.

The detailed criteria of shortlisting of candidates will be uploaded on our website prior to the commencement of the selection process.

Application Process

a.Online Application will be accepted from 1200 hrs on 3 rd March 2021 till 2359 hrs on 15th April 2021.

b.Apply online only on https://www.hindustanpetroleum.com/hpcareers/current_openings after reading a detailed advertisement. No other mean / mode of the application shall be accepted.

c.Applications with incomplete / wrong particulars or not in the prescribed format will not be considered.

d.The email id/mobile number provided in online application should remain valid for at least one year. Candidates must use proper e-mail ids created in their names. Applications with pseudo/fake email ids will attract appropriate action under the law.

e.All the details given in the submitted online form will be treated as final and no changes will be entertained.

f.In the event of non-submission of completed application along with application fees (wherever applicable) from candidates for reasons whatsoever, his / her candidature will stand canceled and no further communication/consideration on the same will be entertained.

g. Candidates will be required to submit documentary evidence of eligibility during the course of the shortlisting/selection process. Any mismatch in name, qualification, other criteria of documents from the data given in the application form will lead to disqualification at any stage

Application Fee

a.The application fees are applicable to all positions.

b.SC, ST & PwBD candidates are exempted from payment of application fee.

c.UR, OBCNC and EWS candidates are required to pay a Non-Refundable Amount of ₹1180/- + payment gateway charges if any (Application fee of INR1000/- + GST@18% i.e INR180/- + payment gateway charges if applicable).

d.Payment Mode: Debit / Credit card/UPI/Net Banking: On paying the application fee online, the payment status will automatically change to “Your Transaction is successfully completed”, on successful receipt of fees.

e.All the candidates must ensure that the payment status is “Completed” as the transaction will be considered “incomplete” in case of any other payment status. Once the payment is done, candidates are required to take print of acknowledgment of payment and preserve the same for future reference.

f. No other mode of payment than those mentioned above will be accepted.

g. Application fee once paid will not be refunded under any circumstances.

General Instructions

a. Only Indian Nationals are eligible to apply.

b. The last date for reckoning age and all other eligibility criteria will be considered as of 3rd March 2021.

c. Queries can be emailed at [email protected] keeping the subject of the mail formatted as “Position Name – Application Number”.

d. Admit Card for Computer Based Test, Interview Call Letters etc. will not be sent to candidates in hard copy. Candidates will be required to download the same from HPCL website.

e. The total number of vacancies and the reserved vacancies is provisional and may increase/decrease at the discretion of the Corporation basis actual requirements for Govt HPCL R&D Officer Recruitment. HPCL reserves the right not to fill any or all of the above posts advertised at any stage of selection.

f. All the candidates are requested to remain updated at each step of the selection process by visiting our website www.hindustanpetroleum.com. Candidates may please note that personal calls and/or interaction with any of the HPCL’s officials during the recruitment drive is discouraged, except when absolutely necessary/critical. Candidates are requested to visit our website with respect to full details on the role, shortlisting, selection process and syllabus pertaining to this recruitment drive.

g. HPCL will not be responsible for any loss/ non-delivery of email/admit card sent/ any other communication sent, due to invalid/wrong email id or contact number.

h. All the qualifications should be full-time regular course/s from AICTE approved / UGC recognized University/Deemed University. The courses offered by Autonomous Institutions should be equivalent to the relevant courses approved / recognized by the Association of Indian Universities (AIU/UGC/AICTE)

i. Wherever CGPA/OGPA or letter grade in a qualifying degree is awarded, an equivalent percentage of marks should be indicated in the application form as per norms adopted by University/Institute. Please also obtain a certificate to this effect from University / Institute which shall be required at the time of interview shortlisting.

j. HPCL reserves the right to cancel or add any examination / Personal Interview centre depending on the response in that area/ centre.

k. The Corporation also reserves the right to cancel / restrict/ curtail/ enlarge the recruitment process and/or the selection process thereunder without any further notice and without assigning any reasons.

l. Candidates can apply for positions in different grades. However, applications for multiple positions within the same grade are not allowed. m. Candidates are advised to submit only one application. In case of multiple applications from a candidate for same position, the latest one shall be considered as final and the older applications shall be rejected without any notice.

n. Candidates presently employed in Government Departments / PSU’s / Autonomous Bodies owned by the Government should submit their application through a proper process. They must produce a No Objection Certificate at the time of Group Task and Personal Interview, failing which they will not be allowed to appear for the Group Task and Personal Interview process and their candidature will not be entertained.

o. Candidates must be in possession of all applicable Degree Certificates and mark sheets at the time of application.

p. All applicants must fulfil the essential requirements of the post and other conditions stipulated in the advertisement. They are advised to satisfy themselves before applying. No enquiry asking for advice as to eligibility will be entertained.

q. Reimbursement of 2nd class rail fare for Computer Based Test for SC, ST & PwBD candidates and 3rd AC for all candidates appearing in the Interview by the shortest route is admissible for outstation, provided the distance travelled is not less than 30 km. Candidates opting for examination Centre other than the Centre nearest from the mailing address will not be reimbursed travel fare. The candidates will be required to fill in the Travel Allowance (TA) Form as detailed on HPCL website and submit it along with Travel Proof for travel undertaken. Candidates also need to upload the tickets on our website with all the details. Travel allowance will be processed through online mode. This reimbursement is not applicable to candidates who are already in Central/State Government Services/PSUs.

Furnishing of wrong/false information will lead to disqualification and HPCL will not be responsible for any of the consequences of furnishing such wrong/false information. Since all the applications will be screened without documentary evidence, the candidates must satisfy themselves of the suitability for the position to which they are applying. If at any stage during the recruitment and selection process, it is found that the candidates have furnished false or wrong information or is found ineligible with respect to any of the eligibility parameters, his/her candidature will be rejected. If any of the above discrepancies w.r.t. to eligibility parameters, furnishing of wrong intimation and or suppressing of any material fact is detected / noticed even after appointment, his/her services will be liable for termination without any further notice. Canvassing in any form during any stage of the recruitment process will lead to the cancellation of candidature. The Court of jurisdiction for any dispute will be at Mumbai.

The general public is hereby informed that all applications are accepted through our online portal only and is not outsourced by HPCL to any agency/individual. Applicants are advised to beware such fraudulent agencies.

Any further corrigendum / addendum would be uploaded only on our website www.hindustanpetroleum.com

Min Educational Qualification

Ph.D. in Biosciences (Microbiology, Molecular biology or biotechnology or other relevant areas of chemical sciences).

For Govt HPCL R&D Officer Recruitment, Preference will be given to candidates having higher relevant experience, and having patents and publications in high-impact journals in relevant areas.

Job Description

– Undertake and direct research in the areas of application of Bioprocesses to the refinery processes/development of biocatalysts/biofuels.

– Guide in operating state-of-art laboratory-scale fermenter systems and translating the lab-scale fermentation process to pilot plant scale for the production of biofuels.

– Identify and undertake research projects in the area of ETP through membrane separation process in an industrial scale for improving ETP plants performance at HPCL refineries

– To interact and coordinate research activities with internal and external customers and other relevant agencies and undertake collaborative research programs.

Other Terms & Conditions

– For all the above positions, candidates must secure minimum 60% marks (50% for SC/ST/PwBD candidates) in Graduation as well as Post Graduation.

– Eligibility for Ph.D. holders would be Ph.D. after M.E/M.Tech, B.E/B.Tech or M.Sc. in relevant branch.

– Candidate with Integrated Ph.D. may also apply. However, such candidates must produce master’s degree qualification.

– For PhD in other relevant areas of chemical sciences, the relevancy of Ph.D. will be decided by subject matter experts.

– All work experience must be in a supervisory/executive capacity.

– Work experience post minimum educational qualification will only be considered as relevant work experience.

– For the positions where Ph.D. is mandatory, experience will be counted from the date of the successful defense of Ph.D. Dissertation/Thesis. It is mandatory for candidates possessing Ph.D. qualification to mention the date of the successful defense of Ph.D. in their application/resume.

– Research work carried out during course of acquiring Ph. D will not be considered as work experience.

– The courses offered by Autonomous Institutions / Foreign universities should be equivalent to the relevant courses approved / recognized by Association of Indian Universities (AIU/UGC/AICTE).

– Research Experience has to be in the relevant specialized area. Teaching experience will not be considered for calculating total work experience

Download Notification

Apply Online

0 notes

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Text

Kotak 811 – Mobile Banking Made Easy!

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#upi transaction id status check#upi transaction tracking#upi transaction check#track upi transaction#upi transaction check online#upi transaction id check online#check status of upi transaction#check upi transaction details

0 notes

Video

youtube

How to open IPPB account in mobile - IPPB account kaise khole - zero balance account how to open ippb account in dop finacle how to open ippb account in post office online how to open ippb account online in telugu how to open ippb bank account how to open ippb current account how to open ippb merchant account how to open ippb regular account how to open ippb account without pan card how to open ippb account in post office how to open a ippb account how to open account in ippb app how to open a bank account in ippb how to open ippb bank account online how to open digital account in ippb how to open account in ippb how to open account in ippb online how to open ippb account online how to open new account in ippb unable to open ippb account online how to open rd account in ippb online how to open ppf account in ippb how to open rd account in ippb how to open sb account in ippb is it good to open ippb account who can open ippb account How to open IPPB account in Mobile IPPB account login IPPB Regular saving account IPPB basic saving account IPPB account opening Menu IPPB App How to convert IPPB digital account to regular account IPPB account opening process in Finacle Page Navigation More results ippb mobile ippb app ippb ifsc code ippb micro atm ippb account open ippb toll free number ippb merchant ippb mobile banking apk ippb bank ippb online ippb account ippb apk ippb atm card ippb aeps ippb agent login ippb account check ippb a/c opening ippb a/c ippb a/c details is ippb a nationalised bank is ippb a public sector bank is ippb a jan dhan account is ippb a central govt job what is a ippb machine ippb balance enquiry ippb branch ippb bank app ippb bank full form ippb bank near me ippb branch name ippb bank app download ippb b ippb customer care ippb card ippb customer id ippb csp ippb current account ippb charges ippb check balance ippb card image ippb download ippb debit card ippb digital account ippb digital account open ippb details ippb download apk ippb dbt ippb details in hindi dop ippb ippb email ippb email id ippb exam ippb e kyc ippb established ippb error ippb exam syllabus ippb e banking pnb e statement ippb full form ippb full form in hindi ippb full kyc ippb full name ippb fd interest rate ippb facilities ippb form ippb franchise apply online ippb fmenu ippb gmail ippb gds ippb gds commission ippb gl code ippb guidelines ippb gpay ippb gov.in ippb guide ippb helpline number ippb hd logo ippb hindi ippb hq ippb how to login pnb home loan ippb holiday list 2020 ippb how to register ippbase.h ippb ifsc ippb ifsc code motihari ippb ifsc code siwan ippb ifsc code darbhanga ippb interest rate ippb ifsc code siwan bihar ippb imps charges ippb jobs ippb joint account ippb job profile ippb jan dhan account ippb jankari ippb jan dhan account opening ippb jobs 2020 ippb job recruitment ippb ka ifsc code ippb kyc ippb kya hai ippb ka ippb ka full form ippb kyc form ippb ka matlab ippb khata ippb login ippb logo ippb loan ippb location ippb latest news ippb logo png ippb limit ippb login customer id ippb mobile app ippb mobile banking ippb mini statement ippb mobile banking app download ippb m atm ippb m ippb near me ippb net banking ippb new account ippb neft charges ippb news ippb number ippb new user activation ippb news in hindi ippb online account ippb online service ippb opening ippb open account ippb online form ippb otp ippb officer salary ippb passbook ippb passbook print ippb post bank ippb photos ippb patna ifsc code ippb passbook image ippb pdf password ippb passbook format ippb qr card ippb quora ippb qr card login ippb qr card charges ippb qualification ippb question paper 2018 ippb quizlet ippb qas ippb q r card ippb registration ippb recruitment ippb rd ippb rates and charges ippb rd interest rate 2020 ippb rd interest rates ippb rd rates ippb rrb merger ippb scan ippb salary ippb saving account ippb sitamarhi ifsc code ippb sms banking pnb saharsa ifsc code ippb status ippb siwan ippb transaction charges ippb transfer limit ippb training ippb twitter ippb to paytm ippb therapy ippb training app ippb upi ippb upi id ippb user id ippb url ippb upi link ippb upsc ippb uses ippb upi pin ippb vacancy ippb virtual debit card ippb vpa id ippb video ippb vacancy online form ippb vacancy 2020 ippb vs sbi ippb vs posb ippb wikipedia ippb website ippb withdrawal ippb webmail ippb withdrawal limit per day ippb whatsapp group ippb whatsapp number ippb welcome kit ippb youtube ippb your account is locked ippb yojana ippb.your ippb sukanya yojana ippb previous year question paper ippb know your customer id ippb sukanya samriddhi yojana ippb zero account ippb zero balance account ippb zero balance account opening online ippb zimbra ippb bank zero balance account ippb 0 balance account SONUS KNOWLEDGE #sonusknowledge #ippb #ippbmobile #ippbbank #ippbmobilebanking #ippbaccountkaisekhole #zerobalanceacount by Sonus Knowledge

0 notes

Text

MBA Entrance Tests

For all you MBA admission seekers, here is a summary of the important MBA Entrance Tests.

Keep healthy, Keep Safe and Best Wishes for your MBA journey…!

MAT

Link: https://www.aima.in/testing-services/mat/mat.html

Management Aptitude Test (MAT) is a standardised test being administered since 1988 to facilitate Business Schools (B-Schools) to screen candidates for admission to MBA and allied programmes. Govt. of India, Ministry of HRD approved MAT as a national level test in 2003. Any B-School - national or international - can consider MAT Score as an admission input based on the Score Cards issued to the candidates. The largest test of its kind in the nation, MAT will continue to be your passport to over 600 B-Schools across India.

Eligibility

Graduates in any discipline. Final year students of Graduate Courses can also apply.

Mode of Test

(How to take the test)

Candidate can take MAT as

(i) Paper Based Test (PBT) or

(ii) Computer Based Test (CBT) or

(iii) Both PBT & CBT

How to apply

Register online at website link: https://mat.aima.in/may20/ with Credit Card/Debit Card (ATM Card), Net Banking, UPI or Paytm Wallet. The fees details are given below:

For Paper Based Test(PBT)

1650/-

For Computer Based Test (CBT)

1650/-

For Both PBT & CBT

2750/-

Essential Documents to be made ready for online registration:

· Valid Email Id

· Scanned image of photograph (10 to 50 kb)

· Scanned image of signature ( 5 to 20 kb)

· Credit Card/Debit Card (ATM Card) or Net Banking details

(Detailed procedure is given on the website link.)

SCHEDULE

Paper Based Test (PBT) :-

Test Date : 16 May 2020(Saturday)

Test Timing : 10.00 to 12.30 Hrs

Last Date for Online Registration : 10 May 2020 (Sunday)

Availability of Admit Cards : 12 May 2020 (1600 Hrs)

Computer Based Test (CBT) :-

Test Date : 03 May 2020 (Sunday)

Test Timing : In single/different time slots at specific test venues; subject to candidates registration

Last Date for Online Registration : 26 April 2020 (Sunday)

Availability of Admit Cards : 28 April 2020 (1600 Hrs)

MAT Result

Candidates have to download the MAT Score from AIMA website : https://www.aima.in

Test Cities

Test cities for Paper Based Test (PBT) and Computer Based Test (CBT) are different.

List of Participating Management Institutes

Select the institutes where you have applied or are applying for admission.

Important Notice: Candidates are advised to check the approval/recognition status of various programs directly from the concerned Authorities/ Institutes/ Universities.

AIMA has come across a couple of cases where the aspiring candidates' MAT score is not accepted by some participating institutes/universities for admission to MBA full time course despite their confirmation to AIMA MAT at the time of participation by incorporating their notifications in MAT e bulletin. Candidates are advised to recheck with the concerned institutes/universities before applying for MAT.

Admit Card

All provisionally registered candidates for PBT and/or CBT have to download their Admit Card from AIMA website : https://mat.aima.in/may20/ as per the schedule given above.

Admit Card contains Candidate's Name, Form No, Roll No, Test Date, Test Time and Test Venue Address.

Clarification

Candidates may clarify queries regarding MAT, if any, at e-mail: [email protected] and at 011-47673000/8130338839.

CMAT 2020

CMAT 2020 will be conducted by National Testing Agency (NTA) on the same pattern as per the Year 2019 i.e., Computer Based Test on January 28, 2020 from 09:30 am to 12:30 pm for admission to various management programs across the country.

The result of CMAT-2020 will be declared by February 7 th, 2020 as CMAT Score which will be accepted by over 1000 participating Institutes. The participating Institutes of CMAT-2020 are the Institutions which will be accepting the CMAT Score.

Candidates must apply separately to the desired CMAT-2020 participating institutes with the CMAT Score 2020. Then, each participating institute will release their respective cut – off CMAT Score which candidates should meet to get qualified for admission to that particular institute. Once qualified, the candidates will have to appear for selection procedure of that particular institute which may comprise of Group Discussion (GD) and Personal Interview (PI).

The final selection of the candidates will be on the basis of the candidates performance based on above. Candidates are advised to see the details of the admission process of each participating institute of CMAT-2020 on their respective website.

Helpline number: 0120-689-5200

Link: https://cmat.nta.nic.in/webinfo/public/home.aspx

Email: [email protected]

ELIGIBILITY The candidate must hold a Bachelor’s degree in any discipline. Candidates appearing for the final year of Bachelor’s degree (10+2+3) whose result will be declared before commencement of admission for academic year 2020-21 can also apply for CMAT-2020 computer based test (CBT). The candidate must be a citizen of India. There is no age restriction for appearing in CMAT-2020.

SCHEDULE FOR EVENTS WITH DATES:

On-line submission of Application Form 01.11.2019 to 30.11.2019 (Upto 11:50 p.m.)

Date for successful final transaction of fee 01.11.2019 to 01.12.2019 (through Credit/ Debit Card/ Net Banking/UPI/PayTM

Fee payable for CMAT - 2020

General Boys - Rs 1600/- Girls - Rs.1000/-

Gen-EWS/OBC (NCL) Boys – Rs 1000/- Girls - Rs.1000/-

SC/ ST/ PwD Boys - Rs 800/- Girls - Rs. 700/-

Transgender Rs - 700/-

Date for Choice of City 01.11.2019 To 02.12.2019 (11:50 p.m.)

Date of Examination 28th January, 2020 (Tuesday) Timing of Examination 09:30 a.m. to 12:30 p.m.

Printing of Admit Cards from NTA’s website From 24th December, 2019

Declaration of Result on NTA’s website By 07th February, 2020

TEST PATTERN The medium of Question Paper is English only.

Quantitative Techniques and Data Interpretation 25 100 Logical Reasoning 25

Language Comprehension 25

General Awareness 25

i) Each question carries 04 (four) marks.

ii) For each correct response candidate will get 04 (four) marks.

iii) For each incorrect response 01 (one) mark will be deducted from the total score.

CAT

Official information regarding CAT 2020 has not been published so far. However here is a look at CAT 2019.

Common Admission Test (CAT) is a computer based test for admission in a graduate management program.

CAT website: www.iimcat.ac.in

Help Desk Number: 18002090830

Important Dates

AUG 7, 2019, Wednesday: CAT 2019 Registration Starts at 10:00 AM

SEP 25, 2019, Wednesday: CAT 2019 Registration Ends at 5:00 PM

OCT 23, 2019, Wednesday: CAT 2019 Admit Card Download Begins at 5:00 PM

NOV 24, 2019, Sunday: CAT 2019 Test Day

ELIGIBILITY The candidate must hold a Bachelor’s Degree, with at least 50% marks or equivalent CGPA [45% in case of candidates belonging to the Scheduled Caste (SC), Scheduled Tribe (ST) and Persons with Disability (PWD) categories].

Candidates applying for CAT 2019 should fulfill any one of the following conditions: • Completed Bachelor’s degree with the required percentage of marks*. • Completed professional degree (CA/CS/ICWA) with required percentage*. • Should be in the final year of Bachelor’s degree with required percentage*. CAT Eligibility * SC/ST/PwD candidates should have minimum 45%. For General, EWS and NC-OBC candidates, the minimum is 50%.

REGISTRATION FEE ₹950 for SC, ST and PwD candidates. ₹1900 for all other candidates.

Please note that a candidate needs to pay the registration fee only once, irrespective of the number of institutes he/she is applying for.

Test Pattern:

Duration 3 hours

Score / grade range -100 to 300

The test has three sections:

Verbal Ability and Reading Comprehension (VARC)

Data Interpretation and Logical Reasoning (DILR) and Quantitative Ability (QA).

The total duration of the test is 180 minutes.

ATMA

ATMA is a comprehensive and single-window test for admissions to numerous Post-Graduate Management Programs like MBA, PGDM, MCA, MMS and other management post graduate course. ATMA is an online objective type Nationally accepted entrance test. This test is recognized by AICTE and Ministry of HRD, Government of India and is conducted across all the states in India.

ATMA does not require any specific prior knowledge of business or other subject areas. The Test is designed to assess the aptitude of the students for Higher Management Education and primarily consists of sections on verbal, quantitative and analytical reasoning skills.

There are around 399 Business Schools accepting ATMA scores for admitting students in management programs. Each college releases its own cutoff depending on factors such as number of students applied for admission against number of seats.

Link: https://www.atmaaims.com/index.html

Phone Number: 040-23417876, 48544057

Email: [email protected]

Fee: INR 1298

Held Multiple times a year ((February, May, June, July and December 2020)

Syllabus:

Analytical Reasoning Skills – I

Verbal Skills - I

Quantitative Skills – I

Analytical Reasoning Skills – II

Verbal Skills -II

Quantitative Skills – II

Pattern

180 questions

3 hours (30 minutes each section)

6 sections

MCQ questions

Aptitude test

There is negative marking

Eligibility

50% marks in a Bachelor’s degree

Previous University should be recognized by UGC

Candidates who have completed CA can apply.

Final year students can also apply.

IMPORTANT DATES

ATMA EXAM 24th May 2020

LAST DATE FOR FEE PAYMENT 17th May 2020 @ 5PM

LAST DATE OF REGISTRATION 18th May 2020 @ 2PM

LAST DATE OF PRINTING APPLICATION FORM 19th May 2020

ADMIT CARD DOWNLOAD 21st May 2020

RESULT 29th May 2020

SNAP

Link: https://www.snaptest.org/index.html

Call. : 18001231454 | +91-20-28116226/27

Whatsapp No. : +91-7709328908

Email : [email protected]

Candidates aspiring to join MBA / MSc programmes offered by Institutes of Symbiosis Internationa have to appear for the common, mandatory Symbiosis National Aptitude (SNAP) Online Test. A candidate needs to register for SNAP Test and also register for the Institute(s) offering her/his choice of programme(s) by paying separate registration fee for each programme. If shortlisted, s/he would then need to attend the further admission (GE-PIWAT) process conducted by each of these Institutes individually.

The registration process for SNAP & the Institutes is integrated. Candidates can complete the SNAP as well as programme registrations in the same portal (www.snaptest.org).

ELIGIBILITY

The candidate should be a graduate from any recognized / statutory University or Institution with a minimum of 50% marks or equivalent grade (45% marks or equivalent grade for Scheduled Castes / Scheduled Tribes).

Candidates appearing for final year examinations can also apply.

IMPORTANT DATES

Since official information has not been published for SNAP 2020, here is a list of previous years dates as guide.

Registration commences on 16 August 2019 (Friday)

Registration Closes on 26 November 2019 (Tuesday)

Payment Closes on 26 November 2019 (Tuesday)

Admit Card Live on (www.snaptest.org) 02 December 2019 (Monday)

SNAP Online Test 2019 15 December 2019 (Sunday) Time: 1400-1600 hours

Announcement of Result 10 January 2020 (Friday)

Please note that the SNAP 2019 test will be computer based test.

SNAP Test duration is of 120 minutes.

SNAP Test is an objective test. Each question has four responses (Only for Normal Questions). Candidate should choose an appropriate response.

Each wrong answer attracts 25% negative marks for Normal Questions and for Special Questions also.

GMAT

Graduate Management Admission Test (GMAT) is intended to assess certain analytical, writing, quantitative, verbal, and reading skills in written English for use in admission to a graduate management program, such as an MBA program. It requires knowledge of certain specific grammar and knowledge of certain specific algebra, geometry, and arithmetic.

Link: https://www.gmac.com/gmat-other-assessments/about-the-gmat-exam

Duration : 3 hours

Score / grade validity : 5 Years

Offered : Multiple times a year

Languages : English

Prerequisites / eligibility criteria : No official prerequisite. Fluency in English assumed.

Fee US$ 250

Sections:

Analytical Writing Assessment—measures your ability to think critically and to communicate your ideas

Integrated Reasoning—measures your ability to analyze data and evaluate information presented in multiple formats

Quantitative Reasoning—measures your ability to analyze data and draw conclusions using reasoning skills

Verbal Reasoning—measures your ability to read and understand written material, to evaluate arguments and to correct written material to conform to standard written English

In total the test takes just under 3 1/2 hours to complete, including two optional breaks.

#entrance exam for mba#mba entrance exam#best mba college in jaipur#mba entrance test#entrance test for mba college#mba college entance test#entrance exam for mba college abroad

0 notes

Text

How To Check The Transaction Status After Making Gas Bill Payment Through XPay.Life

The gas bill payment can be easily done through XPay Life without having to stand in the long queues, or wait for agencies to deliver the gas at the right time. The booking is usually taken through the mobile phone that redirects to a recorded call. But the agencies often miss the booked cylinder. Hence use XPay Life kiosks, Mobile App or the online website to book your gas cylinders. Timely payment assures you of the immediate settlement of payment and immediate booking. Hence you can enjoy steaming hot food at your home and restaurants.

But there are times when you want to check the transaction details if you are new to the XPay Life. The mobile application can be used to Pay Online Water Bill along with any multi-utility bills online. The mobile app and web is highly secure as it is built on the safest blockchain technology. This is the underlying technology that is used in the bitcoin cryptocurrencies hence deemed to be the most secure payment channel. Let me take you through the payment procedure:

1. After downloading the mobile app, it creates a mobile number-specific account taking the mobile number and the password you created for registrations. And hence all the payment transactions is available in the application.

2. Choose the related category to pay the gas bills, fill in the customer Id provided by the gas agency.

3. Click the fetch button and fetch the bill, verify the details regarding the bill number, amount to be paid and book the gas.

4. Before making the online booking for gas, you ave an option to either apply any coupon code to avail offers or an option to redeem the points.

5. Each transaction through the XPay Life application provides you with the points that can be redeemed while making any multi-utility bill payment like Broadband bill online payment.

6. Then proceed to pay with the payment of your choice by selecting the payment through debit/credit card, UPI payments, internet banking, and mobile banking.

Soon after any bill payment transaction including Reliance big tv recharge online, broadband payment, gas bill payment,etc. The notification of the successful payment is obtained through the registered mail, through the SMS to the registered mobile number and as a notification on the XPay Life App. Also, you can check the status by clicking on history and click on the recent payment. It redirects to a page that consists of the transaction status, whether is was paid or failed.