#upi transaction check

Text

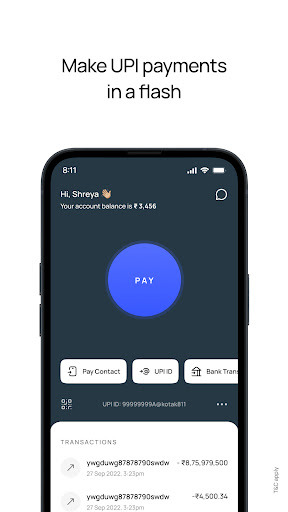

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check balance by debit card#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#track upi transaction#transaction status check#upi transaction check#upi transaction tracking#upi transaction id status check#check upi transaction status#check transaction status#upi transaction id status check online

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#internet banking app#net banking#e banking#premium mobile banking#digital banking#ebanking#internet banking#upi application#money transaction app#bank account check app#check bank account balance#upi mobile banking#upi bank account#mobile banking upi#mobilebanking app upi#app upi mobile banking#upi mobile banking app#upi net banking app#upi banking app#fd mobile app#instant bank account online transfer#transfer mobile banking app

0 notes

Text

ok so there's a bus app here called chalo and you can get a card that you recharge and pay from for tickets ok. so my dad recharged it with 100 rs day before yesterday. it didn't show up initially but it takes 24 hrs sometimes so i just left it. next day when i go to buy a ticket i.e when i do a transaction on the card i get a notification that 260 rs has been recharged to my chalo wallet. i checked my dad's upi and only 100 rs has been debited. i do not know where the extra 160 rs came from but thank you god?

4 notes

·

View notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#mobile banking account#upi mobile banking app#safe mobile banking#fast mobile banking#mobile banking account app#phone banking#net banking app upi#banking mobile upi#upi net banking#contactless banking#fd easy#mobilebanking app upi#upi account check#open fd#digital account#app upi mobile banking#upi enabled app#upi net banking app#fd account yearly#quick fd account

2 notes

·

View notes

Text

Oct. 11 (UPI) -- The Biden administration on Wednesday announced new measures in its ongoing effort to eliminate so-called "junk fees."

President Joe Biden was expected to join FTC Chair Lina Khan and Consumer Financial Protection Bureau Director Rohit Chopra at 11:45 a.m. EDT at the White House Wednesday to announce the latest initiative aimed at prohibiting surprise fees that continue to burden consumers.

The Federal Trade Commission proposed new rules Wednesday that would ban hidden fees on goods and services that continue to nickel and dime American consumers with unexpected costs.

If enacted, the new rules would prohibit junk fees and deceptive charges for airline tickets, hotel and resort bookings, live events, apartment rentals, and utility bill payments -- potentially saving taxpayers tens of billions of dollars each year.

The U.S. Consumer Financial Protection Bureau also issued fresh guidance Wednesday to the nation's big banks, saying they were still subject to the 2010 Consumer Financial Protection Act, which prohibits large financial institutions and credit unions from charging junk fees for basic customer service.

"While small relationship banks pride themselves on customer service, many large banks erect obstacle courses and impose junk fees to answer basic questions," Chopra said in the statement from the agency. "While the biggest banks have abandoned the relationship banking model, federal law still requires them to answer certain customer inquiries completely, accurately, and in a timely manner."

Since taking office in 2021, Biden has called for increased limits on bank fees for bounced checks and account overdrafts, which would save consumers more than $5 billion a year.

Under the FTC rule changes, businesses would have to disclose all mandatory fees up front, which would make it easier for consumers to comparison shop for the lowest price, the agency said.

Airlines would also be required to disclose all fees up front, and eliminate family seating fees, while hidden fees for concert and sports tickets would also be prohibited, the White House said previously.

The proposed rules seek to end bait-and-switch practices across the wider economy and prevent businesses from running up the tab with hidden fees, ensuring customers know exactly how much they are paying and what they are getting from the deal.

The changes would have the effect of sparking more competition in the market, leading to lower prices for consumers, the administration said.

The time savings alone equates to about $10 billion, or 50 million hours, that consumers currently spend each year searching for cheap tickets and hotel stays, according to government estimates.

The Biden administration requested public comments on bogus fees a year ago, with more than 12,000 consumers attesting to the ongoing impact of hidden charges.

"All too often, Americans are plagued with unexpected and unnecessary fees they can't escape," FTC Chair Khan wrote in a press release announcing the next phase of public commentary on the issue. "These junk fees now cost Americans tens of billions of dollars per year -- money that corporations are extracting from working families just because they can."

Khan said the hidden fees take advantage of consumer-protection loopholes while serving as a drag on the American economy.

During the first public comment phase, a majority of consumers said merchants often don't reveal the total cost of a product until the transaction is completed, and the receipt printed with the fees included.

Many also said that sellers often misrepresent the purpose of certain fees, leaving consumers wondering what they are paying for or if they are getting anything at all for the fee charged, the agency said.

"By hiding the total price, these junk fees make it harder for consumers to shop for the best product or service and punish businesses who are honest upfront," Khan wrote. "The FTC's proposed rule to ban junk fees will save people money and time, and make our markets more fair and competitive."

Should the provisions become law, the FTC vowed to enforce the rules by seeking federal damages against companies that do not comply and give those awards back to consumers.

The FTC voted 3-0 to approve the public notice of the proposed rules, which will now go into the Federal Register for 60 days for public comment.

14 notes

·

View notes

Text

UPI: The Force Behind Inclusion and Economic Growth

In this rapidly evolving world of digital finance, the Unified Payments Interface (UPI) has emerged as a powerful driver of economic growth and financial inclusion. UPI has revolutionized the way transactions are handled. It plays an important role in promoting a more inclusive and robust economic landscape.

Download App :

#net banking app upi#upi bank#fast mobile banking#bank account online#bank upi#contactless banking#mobile banking apps in india#safe mobile banking#quick fd account creation#app upi mobile banking#upi account number check#banking mobile upi#phone banking#upi mobile banking app#upi account check#new bank account#bank online account#mobilebanking app upi

2 notes

·

View notes

Text

Gold Buyer Near Me - Looking to sell your old gold and precious gems in Noida Sector 18? Your search ends here! Cashfor Gold & Silverkings offers the highest prices for your valuables. With multiple branches across Delhi NCR, visit us for a quick and lucrative deal. Enjoy various payment options like bank transactions, UPI, or hard cash. We even provide hassle-free home pick-up services. Your security is our priority, and our branches are ready to assist if needed. Call us at 9999821702 or check our website https://www.goldandsilverbuyer.co.in/best-gold-buyer-in-noida-sector-18.php for more information. Turn your old gold into instant cash with Cashfor Gold & Silverkings.

#cash for diamond#gold buyers#gold#silver#cash for silver#cash for gold#diamond#diamond buyers#silver buyers#diamond jewellery

2 notes

·

View notes

Text

Best Recharge Company

In today's fast-paced digital age, staying connected is not just a luxury; it's a necessity. Whether it's topping up your mobile phone, paying utility bills, or recharging your DTH (Direct-to-Home) connection, recharge companies have become an integral part of our lives. With numerous players in the market, each offering a unique set of features and benefits, finding the best recharge company can be a bit overwhelming. In this blog, we'll explore some of the top recharge companies and what makes them stand out.

Paytm - The All-in-One SolutionPaytm has become a household name in India, offering a versatile platform for mobile recharges, bill payments, flight bookings, and online shopping. What sets Paytm apart is its user-friendly interface and frequent cashback offers, making every recharge or payment a rewarding experience.

FreeCharge - Quick and SecureFreeCharge is known for its fast and secure payment options. With a focus on mobile recharges and bill payments, it's a go-to choice for those seeking hassle-free transactions. The platform often provides cashback deals and discounts, making it a cost-effective option.

PhonePe - UPI Integration at Its BestPhonePe's seamless integration with UPI payments has made it a popular choice in India. Besides recharges and bill payments, you can transfer money and shop online. Its user interface is lauded for its simplicity and convenience.

Google Pay - Trust and SecurityGoogle Pay is known for its robust security features, and its digital wallet allows users to make mobile recharges and bill payments with confidence. The option to link your bank account for transactions adds an extra layer of convenience.

Jio Recharge - For Jio CustomersIf you're a Jio customer, recharging your mobile number is a breeze through the official Jio website or app. With a range of prepaid plans offering data, voice, and SMS services, it caters specifically to Jio subscribers.

Airtel Thanks App - Airtel's All-in-One HubAirtel customers can manage their accounts, recharge their mobile numbers, and pay bills through the Airtel Thanks app. It offers a variety of prepaid and postpaid plans, as well as DTH recharges.

MyVodafone App (now Vi App) - Vi's User-Friendly InterfaceFor Vodafone Idea (Vi) customers, the MyVodafone app (now merged with Vi) provides an easy way to recharge mobile numbers, pay bills, and manage accounts. It simplifies the process for subscribers.

Amazon Pay - The Amazon TouchAmazon Pay, offered by the e-commerce giant Amazon, allows users to recharge mobiles, pay bills, and shop on Amazon. Frequent cashback offers and discounts make it an attractive choice.

Choosing the Right Recharge Company

When determining which recharge company is the best fit for your needs, consider the following factors:

Services Available: Ensure that the company offers the services you need, whether it's mobile recharges, bill payments, or other digital transactions.

User Interface: A user-friendly app or website can make the process smoother and more enjoyable.

Security: Look for companies that prioritize security, safeguarding your financial and personal information.

Offers and Discounts: Check for any promotions, cashback deals, or discounts that can help you save money on your transactions.

Reviews and Reputation: Reading user reviews and assessing the company's reputation can provide valuable insights.

Availability: Confirm that the services are available in your region.

In conclusion, the best recharge company for you will depend on your specific requirements and preferences. With the diverse options available, you're sure to find one that suits your needs and makes managing your digital transactions a breeze. Whether you prioritize cashback offers, user-friendly interfaces, or security, these top recharge companies offer a range of benefits to make your life easier.

2 notes

·

View notes

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Text

Kotak 811 – Mobile Banking Made Easy!

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#upi transaction id status check#upi transaction tracking#upi transaction check#track upi transaction#upi transaction check online#upi transaction id check online#check status of upi transaction#check upi transaction details

0 notes

Text

How to make a UPI Payment Without The Internet: A Simple Guide

UPI is a internet banking app that enables money transfer from one account to another. It requires an uninterrupted internet connection to complete transactions. But if you are in an emergency and need to make an immediate transaction, click *99# to complete a transaction.

#transfer mobile banking app#upi bank#secure net banking#phone banking#safe mobile banking#banking app#bank app#mobile banking account app#bank account app#mobile banking apps#phone banking app#mobile banking account#e banking app#best net banking app#mobile banking application#online banking#mobile banking apps in india#internet banking app#net banking#e banking#premium mobile banking#digital banking#ebanking#internet banking#upi application#money transaction app#bank account check app#check bank account balance#upi mobile banking#upi bank account

1 note

·

View note

Text

Digital Payments In Today’s World

Since the time of the stone age, we have witnessed several changes in all aspects of life forms. The oldest form of commerce, the barter system involved the exchange of goods and services between two or more parties without the use of money.

Later, the currency system emerged where the elites of Lydia and Ionia used stamped silver and gold coins to pay armies.

The Evolution of Money - Barter to Cryptocurrency

Throughout the years, like all life forms, economics and payments have seen a drastic change. From the barter system to the currency system, humankind has successfully adapted innovative technologies.

Today, we are witnessing the era of digital payments. The current payment methods are already a key indicator of our progress. They are powered by cutting-edge technology and boast our current technological advancements.

In fact, a number of countries like Sweden, Finland, the UK, China and Norway have already moved to a completely cashless society or are on their way to becoming one.

The concept of a cashless society is increasingly becoming popular. Payment methods like UPI, NEFT, Point-of-Sales terminals, and mobile wallets are preferred as they are single-click authentication.

Digital Payments in India

India has shown the world that they are a real-time digital payment by almost 40 per cent of all transactions. As a matter of fact, Prime Minister Narendra Modi praised UPI - Unified Payment Interface and the fintech sector on the occasion of Independence day.

According to the latest data, India’s digital payment market is expected to rise more than triple to $10 trillion by 2026. At the same time, digital payment methods including UPI transfers and credit card transactions will likely reach saturation point in India by FY27.

However, the cash flow will still be used. Such a transformation of the financial landscape will definitely observe intense involvement for business, society and government.

Having said that, let's have a look at the benefits and drawbacks of digital payments to understand why countries need to be even more adaptive to such payments soon.

Benefits

Digital payments provide better transparency in the transactions, which reduces the instances of money laundering & theft.

Extremely easy to track all the payments you make accurately and in real-time.

Digital payments can massively reduce the time and cost used to handle & store physical currency.

Faster transactions, making it easier and more convenient for both the retailer & the customer.

Tradition banking transactions charge some handling fee. However, Online Transactions are usually free, making transactions less costly.

Drawbacks

A potential risk of personal & financial data breach, in case the websites don’t have high-security measures in place.

Digital Payments rely upon internet connectivity heavily. So, when the internet connectivity is not there or the servers are down, it will be challenging for people to make transactions/payments.

Instances of impulsive buying may rise since you have to swipe or click to complete the transaction without needing to check your balance.

Taking all the benefits and drawbacks into consideration, digital payments come as a boon and have made our lives much easier than before.

At the same time, online retailers have a wide variety of security tools, For example - they encrypt data on the systems, Pay Pal’s security has a second authentication factor, SSL certificates, firewalls and regular system scans.

On the consumer end, there’s an option of creating strong passwords, sign up and anti-virus software up-to-date.

However, many still prefer to be more inclined toward traditional transaction methods. Ultimately, it all comes down to the personal preference of the person making the transaction, whether they want to go digital or stick to cash transactions only.

The Rise of Ecommerce

For all the reasons outlined above, online transactions are safe and secure. The shift in E-Commerce also played a pivotal role in promoting the use of digital payments, If data is to be estimated, there are around more than 289 million buyers buying things online. At the same time, it is expected to grow at a rate of 9.5% per year.

The more the use of E-commerce websites the more digital payments. Furthermore, it is also related to the strong accessibility to the internet.

Millennials are raised with internet usage and online shopping. This generation spends more money online than any other age group. Clearly, online payments are clearly the way of the future. But, the only concern that needs to be taken care of is security.

However, all cash is not the solution. So, where are we leading? Is a cashless society the future? Let’s move to the conclusion to know about the changed behaviours and alternate payment options.

Is a cashless society the future?

Today, technological innovation has made financial transactions seamlessly possible on computers and mobile devices. Now it is taken for granted, going forward.

Clearly, caution should still be exercised. Yet experts in a post-pandemic world say that it is likely that digital payments will become increasingly popular.

At the same time, with our transactions quicker, faster and better, caution should be taken regarding vulnerable people around us.

#ifmfincoach#ifm fincoach#digital currency#digitalcurrency#crypto#cryptocurrency#upi#neft#online currency

9 notes

·

View notes

Text

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code, commonly referred to as IFSC or Indian Financial System Code, is an eleven-character alphanumeric number that uniquely identifies bank branches and their associated NEFT or RTGS codes. This system was created by the Reserve Bank of India (RBI).

These IFSC codes are essential for Indian banking as they enable all online transactions such as the National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Service (IMPS). Not only do these IFSC codes prevent errors from occurring but they make transfers quicker and smoother too.

Identifying a Bank Branch

The Importance of IFSC Codes in Indian Banking

The Indian Financial System Code (IFSC) is an 11-character alphanumeric code used by banks to identify their branches across India. This unique system ensures funds are directed correctly to the right bank branch within each nation.

IFSC codes are essential for many reasons, such as speed and efficiency, enhanced security, and nationwide coverage. Furthermore, they make online money transfers simpler which benefits both parties involved in the transaction.

The IFSC (International Financial System Code) is an eleven-character alphanumeric code that uniquely identifies each bank branch. This code is utilized by NEFT, RTGS and IMPS systems to guarantee funds transfer to their intended destination. Furthermore, IFSC codes enable tracking transactions which helps reduce errors and fraudulence.

Identifying a Beneficiary Account

Bank IFSC codes are 11-character identification numbers which uniquely identify every bank branch in India participating in the NEFT, RTGS and IMPS payment systems. These help banks settle and validate transactions quickly between branches by expediting settlement processes.

IFSC codes simplify paperwork and enable individuals and organizations to transfer funds online without visiting a branch, saving banks valuable time, effort, and manpower.

If you need to look up an IFSC code, there are various resources such as the Reserve Bank of India website that can be utilized. Nevertheless, it's wise to double-check its accuracy with the relevant bank before transferring funds elsewhere.

Indian banking relies heavily on IFSC codes. They guarantee your money is transferred to its intended beneficiary promptly and efficiently, making IFSC codes essential when doing online transfers or using services like net banking.

Identifying a Bank Account

The IFSC code is a unique identification that's needed when transferring funds online through various methods such as National Electronic Fund Transfer (NEFT), Real Time Gross Settlements (RTGS), Immediate Payment System (IMPS) and Unified Payment Interfaces (UPI). Additionally, this helps identify a beneficiary account by providing their bank details.

It is essential to comprehend that an IFSC code consists of eleven alphanumeric characters, consisting of letters, numbers and symbols. The first four characters represent a bank name while the last six are either numbers or letters representing branch codes.

Indian banking relies heavily on IFSC codes, which are used to uniquely identify each bank branch. You may find IFSC codes on various documents like cheque books and account statements.

Online Fund Transfer

IFSC codes are an integral component of modern banking when transferring funds online. They identify the bank branch where your account is registered for NEFT, RTGS and IMPS transactions.

When sending money overseas or within India, the recipient's IFSC code is essential for smooth processing. To locate this number, check their cheque book or passbook.

An IFSC code is an 11-digit number issued by the Reserve Bank of India to all Indian banks and their branches. The initial four characters identify the bank, while the following six correspond to a particular branch.

5 notes

·

View notes

Text

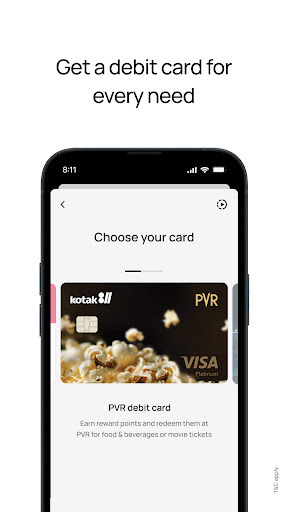

Kotak 811 – A one-stop destination for all your banking needs.

Make Money Transfers Smooth & Easy

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

Kotak811 mobile banking app is your one-stop solution for managing your bank account anytime, anywhere. Kotak811caters to your needs with its easy-to-use interface and wide range of features.

#banking upi mobile#upi mobile banking#upi registration#digital account app#fd account app#upi banking app#upi net banking app#upi bank account#mobile banking upi#upi account#fast mobile banking#mobile banking account#mobile banking account app#digital account#app upi mobile banking#fd account yearly#net banking app upi#phone banking#banking mobile upi#upi mobile banking app#safe mobile banking#fd account#upi enabled app#mobilebanking app upi#contactless banking#upi account check#fd account benefits#quick fd account#fd easy

0 notes

Text

Digital Account Opening: A Game Changer for Banking Success

In today's fast-paced world, traditional banking methods are quickly being overshadowed by innovative digital solutions. One such breakthrough is digital account opening, a transformative approach that is revolutionizing the way we manage our finances. At Digi Khata, we are at the forefront of this shift, providing a range of services designed to make banking more accessible and efficient for everyone. Here’s how digital account opening is changing the game for banking success.

The Convenience of Free Digital Account Opening

One of the most significant advantages of digital account opening is the ability to open a free digital account online. This process eliminates the need for in-person visits to the bank, allowing you to complete your account setup from the comfort of your home. With Digi Khata, you can enjoy free digital account opening with just a few clicks, making banking more convenient than ever before. This service is ideal for busy professionals, students, homemakers, and anyone looking to streamline their financial management.

Instant Account Opening for Immediate Access

Another major benefit is instant account opening, which provides immediate access to your banking services. Traditional account opening processes can be time-consuming, often requiring multiple visits and lengthy paperwork. However, with Digi Khata’s digital solutions, you can open a zero balance account quickly and start managing your finances right away. Whether you're looking to manage your personal finances or set up an account for a family member, our instant account opening service ensures you get access without unnecessary delays.

Tailored Solutions for Various Needs

Digi Khata understands that different individuals have unique banking needs. That's why we offer a variety of account options to cater to different requirements:

Zero Balance Account for Students: Ideal for students who need a simple, cost-effective banking solution without the burden of maintaining a minimum balance.

Free Digital Account for Professionals: Designed for working professionals who require a hassle-free, efficient way to manage their finances.

Open Digital Account for Housewives: Provides a convenient banking option for homemakers who want to keep track of their household finances.

Digital Account for Elders: Simplifies banking for senior citizens with easy-to-use features and minimal account maintenance.

Open a Zero Balance Account for Your Maid: Offers a practical solution for managing household finances for those who support their staff.

Enhanced Features with UPI Integration

Digi Khata goes beyond basic banking services by offering the ability to create a UPI ID online. Unified Payments Interface (UPI) is a cutting-edge payment system that allows for seamless, instant transactions. By integrating UPI with your digital account, you can easily make and receive payments, check balances, and manage your finances in real-time. This feature enhances the functionality of your digital account, making it a comprehensive tool for all your banking needs.

Flexible Minimum Balance Accounts

For those who prefer to maintain a minimum balance, Digi Khata also offers the option to open a minimum balance account. This type of account provides the flexibility to manage your finances while ensuring that you meet the minimum balance requirements set by the bank.

The Future of Banking with Digital Accounts

Digital account opening is not just a trend; it represents the future of banking. By embracing these advanced solutions, banks like Digi Khata are making financial services more accessible, efficient, and tailored to individual needs. Whether you're looking for a free digital account opening, instant access to banking services, or specialized accounts for different requirements, Digi Khata has the tools and expertise to support your financial journey.

Conclusion

In conclusion, digital account opening is a game changer for banking success. It offers unprecedented convenience, efficiency, and flexibility, making it an essential component of modern banking. With Digi Khata’s comprehensive suite of digital banking solutions, you can easily manage your finances, enhance your banking experience, and enjoy the many benefits of a digitally optimized financial system. Embrace the future of banking with Digi Khata and experience the transformative power of digital account opening today.

0 notes