#creditrisk

Text

Stop guessing, start thriving. D&B's Business Information Report equips you with the intel you need to dominate your market.

Our in-depth analysis and reliable data give you a clear picture of your industry, competitors, and your own financial health. This empowers you to make smart choices across your entire business, from long-term strategy to everyday risk management.

Don't settle for flying blind. Make informed decisions with D&B. Your partner for building a stronger, more resilient business.

#duediligence#customeronboarding#creditmanagement#enterpriseriskmanagement#masterdatamanagement#riskmanagement#creditratings#creditrisk#creditreport

0 notes

Text

youtube

InvestTalk - 3-31-2023 – Why Credit Risk Suddenly Matters for Bond Fund Investors

Since the onset of the financial crisis in early March, the bond market landscape has shifted substantially, resulting in significant fluctuations in bond fund performance.

0 notes

Text

In the current financial environment, bank loans provide chances for both prospective profits and diversification. For investors, it is essential to comprehend these complications. Navigating various asset classes demands rigorous research and intelligent decision-making, even with the market's rise. In order to assist investors in achieving their financial objectives, this blog delves into the nuances and factors surrounding bank loan investing services.

#BankLoanInvesting#Opportunities#Considerations#Diversification#PotentialReturns#Borrowers#Financing#MarketGrowth#CreditRisk#InterestRateFluctuations#Analysis#StrategicDecisionMaking#FinancialGoals

0 notes

Text

Stay ahead of credit risk with strategic AR outsourcing! Discover expert insights on mitigating risk and optimizing cash flow. 💼💡

0 notes

Text

Transform lending with Retail Loan Origination Systems - streamline processes, manage risk, ensure compliance

#RLOS#loanorigination#automation#financialinstitutions#lending#creditrisk#compliance#efficiency#costreduction#decisionmaking#customerexperience#riskmanagement

0 notes

Text

Navigating the Financial Landscape: Unraveling the Dance Between Credit Risk and Profitability in Banking 💳🏦

Hey Tumblr fam! Let's dive into the intricate world of finance and explore the captivating dance between credit risk and profitability in the realm of banking. 🌐💰

📉 The Balancing Act: Credit Risk vs. Profitability

In the vast landscape of banking, every move is a delicate balance between risk and reward. Credit risk, the possibility of borrowers defaulting on loans, plays a pivotal role in shaping a bank's profitability. Here's the lowdown:

💼 Credit Risk Defined: At its core, credit risk is the potential loss a bank may face when borrowers fail to repay their debts. It's like stepping onto a financial tightrope, where one misstep can have a ripple effect.

💰 Profitability on the Line: Now, let's talk profits. Banks thrive on lending money and making savvy investments. However, with great financial power comes great responsibility – and risk. Striking the right balance ensures profitability without compromising the stability of the institution.

🔄 The Credit-Profitability Loop:

Loan Portfolio Quality: The types of loans a bank extends directly impact credit risk. Managing a diverse portfolio helps spread risk, akin to a well-curated investment strategy.

Risk Mitigation Strategies: Banks employ various risk mitigation strategies – from rigorous credit assessments to collateral requirements. It's all about minimizing the impact of potential defaults.

Interest Rates and Margins: The interest rates set by banks are influenced by credit risk. Balancing competitive rates with risk management is a juggling act that directly affects the bottom line.

Economic Climate Impact: The broader economic landscape plays a role. During economic downturns, credit risk may spike, affecting both profitability and the ability to lend.

🌈 Finding the Sweet Spot: Successful banks navigate this intricate dance by constantly reassessing their risk tolerance, refining lending strategies, and embracing technology to enhance risk management practices.

💡 Food for Thought: How do you think advancements in technology, like machine learning and data analytics, are shaping the future of credit risk management in banking?

Let's keep the conversation flowing! Share your thoughts, questions, or experiences in the wild world of finance. 🚀💬

0 notes

Text

RBI ने की चिंता व्यक्त | असुरक्षित खुदरा कर्ज़ में हुई 23% वृद्धि

खुदरा कर्ज़ खासकर पर्सनल लोन और अन्य असुरक्षित कर्ज़ में बेतहाशा वृद्धि पर आरबीआई ने चिंता जताई है। दास ने कहा कि बिना गारंटी वाले कर्ज़ वित्तीय स्थिरता के लिए ख़तरा हैं। ऐसे में हम उम्मीद करेंगे कि हालात पर नियंत्रण के लिए बैंक, गैर-बैंकिंग वित्तीय कंपनियां (एनबीएफसी) और फिनटेक आंतरिक निगरानी तंत्र मज़बूत करें। … Read more

#RBIConcern#RetailLoans#UnsecuredLoans#LoanGrowth#FinancialStability#RBIAlert#LoanRisks#EconomicTrends#CreditRisk#BankingSector

0 notes

Photo

We are looking for Credit Analyst

Join now

Contact Details : Call Now: +91 7226004473

Send cv on email : [email protected]

#CreditAnalystJobs#HiringCreditAnalysts#CreditAnalysis#FinanceJobs#CreditRisk#FinancialAnalysis#CreditUnderwriting#CreditRiskManagement#CreditPortfolioManagement#CreditDueDiligence#HumanResourceCompanyInSurat#BestHumanResourceCompaniesInSurat#TopHumanResourceCompaniesInSurat

0 notes

Video

youtube

Credit risk stress testing is both top down and bottom up. This video discusses credit risk stress testing models under CCAR & DFAST framework.

1 note

·

View note

Photo

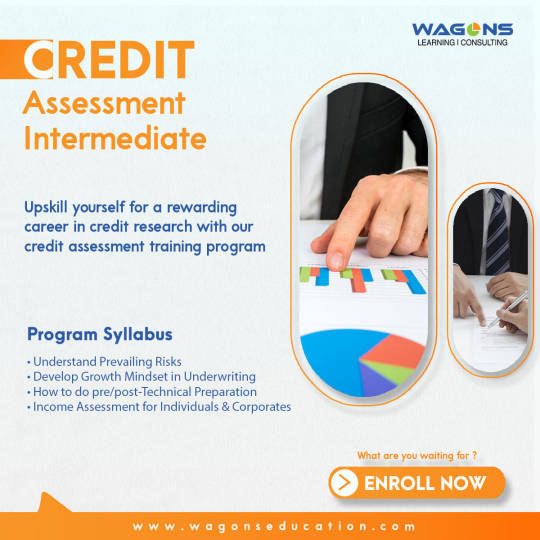

Credit assessment helps in calculating the financial soundness of a business or organization. All in all, it is the assessment of the capacity of an organization to respect its monetary commitments. To avoid credit risks banks and financial institutions, work on the viability of the credit evaluation process and credit corresponding costs.

Our Credit Assessment Training Program gives you an in-depth understanding of the lending landscape, credit underwriting, credit administration, and regulatory requirements.

Batch Timings

05th Nov | 4 hours |10am -2 pm

13th Nov | 4 hours |10am -2 pm

19th Nov | 4 hours |10am -2 pm

27th Nov | 4 hours |10am -2 pm

Click on the link below to register

https://wagonseducation.com/home/course/credit-assessment-intermediate/109

For more information visit:

https://www.wagonslearning.com/

#creditanalysis#creditmodeling#creditmanagement#creditrisk#creditportfolio#creditderivatives#creditassessment#creditreport#debtfree#wagonslearning#wagonseducation#learning#training#blockchain#fintech

1 note

·

View note

Text

Credit Risk Management Software

B2B credit risk management software eliminates manual tasks, accelerates credit processing, increases healthy revenues and minimizes the accounts receivable (AR) risk. Check out our blogs on how AI-powered credit automation empowers organizations with an end-to-end credit process.

1 note

·

View note

Text

Toyota Worth 1000 Bitcoins

Tosoni, seeking to diversify his investments, decided to use cryptocurrency as collateral for a loan to purchase real estate. But he ran into a problem - traditional banks did not show proper interest in the owners of the crypt, giving preference to clients with a constant income.

Michael Tosoni is the same poor fellow who bought a Toyota Prius for 1,000 bitcoins in 2013. Now he is trying to get a loan secured by crypto. And according to him, despite the difficulties, he found several creditors. Having analyzing the situation he realized that the interest on a loan secured by bitcoins would be lower. But there are several nuances here.

Compared to traditional mortgages which require only 10-20% down payment the crypto-secured loans are much more expensive. In most cases such loans are provided at 100% of the cost of borrowed funds.

“Using crypto as collateral will give me the opportunity to keep my bitcoins when buying a property. However, this approach comes with certain risks,” Michael said.

#securedloans#cryptocurrency#crypto#mortgage#finance#financialrisks#cryptocurrencycollaterals#investments#Bitcoin#creditrisks#personalfinance#diversification#financialsecurity

0 notes

Text

Spectral raises $23M to help create web3 credit scores

http://dlvr.it/SX947K

0 notes

Text

Unlocking Efficiency and Risk Management: The Power of Retail Loan Origination Systems

A Retail Loan Origination System (RLOS) serves as a pivotal software tool for financial institutions, revolutionizing their retail lending procedures from start to finish. Covering key stages such as pre-qualification, online application generation, credit decisioning, approval, underwriting, documentation, pricing, funds disbursement, and administration, this system acts as a comprehensive solution for lending operations.

By automating data collection, document management, and workflows, RLOS significantly simplifies loan administration tasks. Moreover, it plays a crucial role in managing credit risk associated with loan applications by meticulously evaluating applicants' credit scores, thereby providing valuable insights for informed decision-making on loan approvals.

The benefits of RLOS extend beyond mere automation. It empowers financial institutions to personalize customer onboarding experiences, ensuring a seamless and tailored journey for each client. Furthermore, by adhering to regulatory requirements throughout the loan origination process, RLOS helps institutions maintain compliance standards effectively.

One of the most significant advantages of Retail Loan Origination System is its capability to enhance operational efficiency while simultaneously reducing costs. By streamlining processes and eliminating manual intervention wherever possible, financial institutions can optimize their resources and allocate them more strategically.

Additionally, RLOS facilitates decision-making regarding loans within predefined profit margins. By providing insights into credit risk productivity, it enables institutions to make informed choices that align with their financial objectives while safeguarding against potential risks.

Another noteworthy feature of RLOS is its provision of a single system of record. By eliminating the need for redundant data entry, it minimizes errors and ensures data integrity across various stages of the lending process. This consolidation of information not only enhances operational efficiency but also simplifies auditing and reporting procedures.

In summary, a Retail Loan Origination System offers a comprehensive solution for financial institutions seeking to streamline their retail lending operations. By leveraging automation, risk assessment, compliance management, and data consolidation functionalities, RLOS enables institutions to enhance customer experiences, optimize operational efficiency, and make informed decisions that drive profitability.

#RLOS#loanorigination#automation#financialinstitutions#lending#creditrisk#compliance#efficiency#costreduction#decisionmaking#customerexperience#riskmanagement

0 notes

Photo

Jadwal Training Credit Risk Management. Pelatihan Credit Risk Management public training dan in house training. Training Manajemen Risiko online dan offline training. Info training lengkap: WA: 0851-0197-2488 Jadwal training lengkap: https://www.informasi-seminar.com | Training Credit Risk Management | Pelatihan Kredit Manajemen Risiko | Info Seminar Training Credit Risk Management | #credit #creditrisk #riskmanagement #manajemenrisiko #management #publictraining #inhousetraining #informasiseminar #informasitraining #seminaronline #trainingonline #trainingcenter #hrdforum #komunitashrd #banking (di Jakarta) https://www.instagram.com/p/CXc9ZUbp1oM/?utm_medium=tumblr

#credit#creditrisk#riskmanagement#manajemenrisiko#management#publictraining#inhousetraining#informasiseminar#informasitraining#seminaronline#trainingonline#trainingcenter#hrdforum#komunitashrd#banking

0 notes

Link

BCT Digital is driving digital transformation for banks & financial institutions through its risk management software product suite rt360.

rt360 is an award winning end-to-end risk management product suite to manage the entire risk portfolio of banks and financial institutions. The suite includes products to address enterprise risk management, credit risk, capital allocation, pricing risk, liquidity risk, model risk and operational risk.

1 note

·

View note