#wagonslearning

Photo

Lending institutions are facing the heat with many accounts turning into Non-Performing Assets (NPA) post-pandemic. The difficulty in money recovery and uncertain cash flow is a huge deterrent to financing companies and banks in India, affecting balance sheets and bottom lines.

One of the major roadblocks in the process of debt recovery is the absence of deep collaboration between the borrower, & the collection & recovery teams

Enroll with Wagons Credit Collection and Recovery Skills Program, and learn about effective communication for result-oriented engagement and different ways to implement variation in relationship styles based on customer cohorts.

Program timings :-

06th Nov | 6 hours | 10am-1pm, 2pm-5pm

13th Nov | 6 hours | 10am-1pm, 2pm-5pm

20th Nov | 6 hours | 10am-1pm, 2pm-5pm

27th Nov | 6 hours | 10am-1pm, 2pm-5pm

Click on the link below to register 🔗

https://wagonseducation.com/home/course/credit-collection-and-recovery-skills-level-2/102

For more information visit:

https://www.wagonslearning.com/

#collectionagents#recoveryagents#creditreport#consumerdebtrecovery#creditrecovery#baddebts#debtcollection#risk#compliance#creditscore#learning#elearning#wagonslearning#wagonseducation#financialservices

2 notes

·

View notes

Video

undefined

tumblr

Practice and master strategies that will improve your professional relationships and assist you in succeeding within an organization. Our training program helps you demonstrate sound judgment by participating in critical thinking to arrive at choices and tackle issues independently.

Enroll in our professional skill courses and learn about a wide variety of topics and choose what you think will add to your or your team member's knowledge.

- As a FTM, know how to manage teams effectively

- Learn the process to be a business objective-focused champion storyteller

- Know how to make a tailor-made Resume that enhances the selection

Click on the link below to register - https://wagonseducation.com/home/course/art-of-story-telling-in-business-development/50

For more information visit: -

https://www.wagonslearning.com/

2 notes

·

View notes

Photo

Credit assessment helps in calculating the financial soundness of a business or organization. All in all, it is the assessment of the capacity of an organization to respect its monetary commitments. To avoid credit risks banks and financial institutions, work on the viability of the credit evaluation process and credit corresponding costs.

Our Credit Assessment Training Program gives you an in-depth understanding of the lending landscape, credit underwriting, credit administration, and regulatory requirements.

Batch Timings

05th Nov | 4 hours |10am -2 pm

13th Nov | 4 hours |10am -2 pm

19th Nov | 4 hours |10am -2 pm

27th Nov | 4 hours |10am -2 pm

Click on the link below to register

https://wagonseducation.com/home/course/credit-assessment-intermediate/109

For more information visit:

https://www.wagonslearning.com/

#creditanalysis#creditmodeling#creditmanagement#creditrisk#creditportfolio#creditderivatives#creditassessment#creditreport#debtfree#wagonslearning#wagonseducation#learning#training#blockchain#fintech

1 note

·

View note

Photo

A model is a framework, quantitative method, or approach that depends on assumptions and economic, statistical, mathematical, or financial hypotheses and techniques. The model processes information inputs into a quantitative-gauge kind of output. In finance, models are utilized broadly to identify expected future stock values, pinpoint trading opportunities, and assist company managers to make business decisions. Model risk is present whenever an inadequately accurate model is utilized to make decisions. Model risk can come from utilizing a model with programming, technical, or calibration errors. It can also be reduced with model management such as testing, governance policies, and independent review.

Financial institutions and investors use models to recognize the hypothetical worth of stock prices and to pinpoint trading opportunities. While models can be helpful tools in investment analysis, they can also be prone to various risks that can occur from the use of inaccurate data, and misinterpretation of the model's results.

Focused on models by investors, stakeholders, and regulators, investment managers are designing and executing model risk management (MRM) practices to relieve the vital, administrative, and functional dangers to their business.

For more information visit:

https://www.wagonslearning.com/

https://wagonseducation.com/

#investmentmanagement#investment#compliance#riskassessment#security#risk#riskmanagement#bfsi#wagonslearning#wagonseducation

1 note

·

View note

Photo

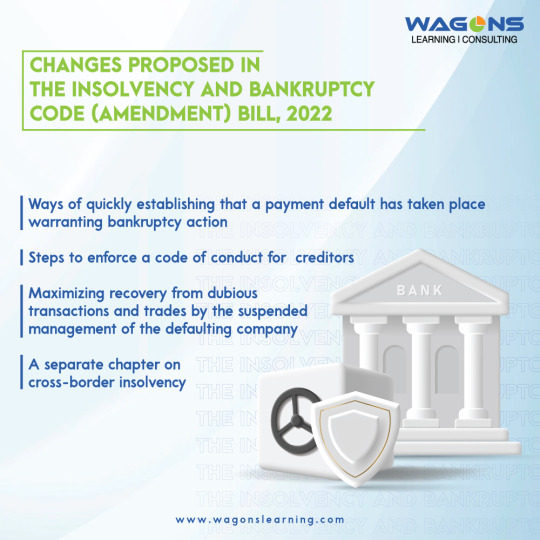

While the economy has recovered from the impact of the pandemic to a great extent, surging input costs pose new challenges. As part of its bankruptcy reform program, the ministry of corporate affairs has been holding consultations on how to improve the outcome of bankruptcy resolutions by recouping investment losses and facilitating fast decisions.

A number of changes will be made to the Insolvency and Bankruptcy Code (IBC) in order to enhance corporate resolution and facilitate cross-border insolvencies. Corporate debtors (CDs) in distress are the main objective of the Code. To enhance the effectiveness of the resolution process and facilitate cross-border insolvency resolution, necessary amendments will be made to the code.

Wagons Insolvency Bank Code (IBC) program aims to take learners through the path-breaking Insolvency and Bankruptcy Code reforms

Click on the link below to register :-

https://wagonseducation.com/

https://www.wagonslearning.com/

0 notes

Photo

The purpose of an induction program is to help employees settle into their position at a new company, business, or organization.

Here is a sneak preview of our client's induction training program. It was full of abundant learning, competing & knowledge gaining

Stay connected with us at #wagonslearning - creators of better learning experiences.

0 notes

Photo

Don't miss out on the next-generation career in financial technology.

Emerging financial technologies continue to impact how companies do business and how people handle digital transactions. Digital transformation, the rise of the internet, and smartphone usage have led to an explosion of technology in the financial services industry. Financial technologies aim to revolutionize traditional banking and financial services by automating processes with faster and more efficient solutions. This has led to the growth of multiple FinTech job opportunities, resulting in high demand for professionals with the right set of skills.

Enroll with Wagons Fintech and learn UI/UX and programming languages to develop a new age of FinTech functions and get hands-on with the FinTech market and shifting customer base.

Program Timings:

Batch 01 | 07th Oct | 4 hours | 3pm-7pm

Batch 02 | 14th Oct | 4 hours | 3pm-7pm

Batch 03 | 21st Oct | 4 hours | 3pm-7pm

Batch 04 | 28th Oct | 4 hours | 3pm-7pm

Click on the link below to register :-

https://wagonseducation.com/home/course/lunge-into-the-world-of-fintech-l1/96

For more information visit:

https://www.wagonslearning.com/

#finance#neobank#financialmanagement#wagonseducation#wagonslearning#digitalbanking#blockchain#insurance#fintech

0 notes

Photo

Don't miss out on the next-generation career in financial technology.

Emerging financial technologies continue to impact how companies do business and how people handle digital transactions. Digital transformation, the rise of the internet, and smartphone usage have led to an explosion of technology in the financial services industry. Financial technologies aim to revolutionize traditional banking and financial services by automating processes with faster and more efficient solutions. This has led to the growth of multiple FinTech job opportunities, resulting in high demand for professionals with the right set of skills.

Enroll with Wagons Fintech and learn UI/UX and programming languages to develop a new age of FinTech functions and get hands-on with the FinTech market and shifting customer base.

Program Timings:

Batch 01 | 07th Oct | 4 hours | 3pm-7pm

Batch 02 | 14th Oct | 4 hours | 3pm-7pm

Batch 03 | 21st Oct | 4 hours | 3pm-7pm

Batch 04 | 28th Oct | 4 hours | 3pm-7pm

Click on the link below to register :-

https://wagonseducation.com/home/course/lunge-into-the-world-of-fintech-l1/96

For more information visit:

https://www.wagonslearning.com/

#wagonslearning#wagonseducation#finance#banking#bfsi#insurance#fintech#learning#upskill#digitalbanking#digitalbank

0 notes

Photo

The goal of sales training is to improve the sales skills and tools of your sales team so that they can generate more and better sales opportunities and close more profitable deals. The success of a business is directly correlated with the effectiveness of sales training. The benefits of sales training also include higher opportunity win rates, increased pricing and volume claims, and the ability to fill pipelines and grow accounts.

Wagons Sales Bootcamp Training Program will enable participants to manage their client's expectations by using methods of probing, rapport building, and practicing need-based selling.

Program Timings:

Batch 01 | 07th Oct | 4 hours | 10am -2 pm

Batch 02 | 14th Oct | 4 hours | 10am -2 pm

Batch 03 | 21st Oct | 4 hours | 10am -2 pm

Batch 04 | 28th Oct | 4 hours | 10am -2 pm

Click on the link below to register:-

https://wagonseducation.com/home/course/sales-bootcamp-level-1/87

For more information visit:

https://www.wagonslearning.com/

0 notes

Photo

From an individual contributor, young managers and leaders are likely to move up to people manager roles. When individuals transition into first-time leadership roles, they face new and unexpected challenges as they perform against entirely different performance metrics than what they had before. The lack of focus and support in managing this transition can significantly affect team productivity and engagement.

With Wagons First Time Manager Program chisel the required skill set of a team leader, make learners reflect, develop, and plug gaps to be relevant. Instill confidence and foster a culture of transparent & sincere communication in people around

Program Timings

Batch 01 | 09th Oct | 4 hours | 11am-1pm, 2pm-4pm

Batch 02 | 16th Oct | 4 hours | 11am-1pm, 2pm-4pm

Batch 03 | 23rd Oct | 4 hours | 11am-1pm, 2pm-4pm

Batch 04 | 30th Oct | 4 hours | 11am-1pm, 2pm-4pm

Click on the link below to register :-

https://wagonseducation.com/home/course/first-time-program-manager/84

For more information visit:

https://www.wagonslearning.com/

0 notes

Link

Several factors contributed to the transformation of the payments industry, including the Covid-19 pandemic, industry consolidation, and customer demand for end-to-end service. With Payments 4.X, the industry enters a new era of embedded, invisible payments that enable frictionless customer experiences.

For more information visit :

https://www.wagonslearning.com/upcoming-trends-for-banking

0 notes

Photo

These days, our smartphone is glued to our hands. We use it for everything, communicating with friends and family, online shopping, ordering food, playing games, and so on. Then why not use smartphones for learning?

Mobile learning, also known as M-learning, is a new way to access learning content using mobile devices. It’s possible to learn whenever and wherever you want, as long as you have a modern mobile device connected to the Internet.

For more information visit:

https://www.wagonslearning.com/

https://wagonseducation.com/

#wagonslearning#wagonseducation#upskill#insurance#finance#banking#bfsi#digitallearning#corporatelearning#learningtech#lms

0 notes

Photo

Technological advances have revolutionized industries around the world, including the financial sector, over the last few years.

For example, in digital lending, lenders use digitized data to inform credit decisions and engage customers in an intelligent manner through digital channels for applying, disbursing, and managing loans.

Banks benefit substantially from digitizing their operations processes, including improved customer service, better decisions, and lower costs.

With the digitization of the processes having mixed results globally, much attention has been paid to hybrid models, in which technology and accessibility are combined to create a viable and scalable proposition.

Enroll with Wagons Fintech Program and understand the evolving technologies sweeping past the financial sector by acquiring knowledge of the Fintech landscape.

Click on the link below to register :- https://wagonseducation.com/home/course/explore-the-world-of-fintech-level-1/40

For more information visit:

https://www.wagonslearning.com/

#wagonslearning#bfsi#insurance#finance#banking#business#blockchain#technology#neobank#digitalbanking#neobanking

0 notes

Photo

Decentralized Finance (DeFi) democratizes finance by replacing legacy, centralized institutions with peer-to-peer relationships that can provide a full spectrum of financial services, from everyday banking, credits, and mortgages, to complicated contractual relationships and asset trading. It takes the key components of the work done by banks, exchanges, and insurers today like lending, borrowing, and trading, and shifts the baton to individuals who have the required expertise.

For more information visit:

https://wagonseducation.com/

https://www.wagonslearning.com/

0 notes

Video

undefined

tumblr

Functional skills transfer into a variety of work settings and are crucial for any professional to develop, especially when applying for a new role, or entering a new industry. Functional skills that are learned from one job can be used for another. It facilitates employees with essential knowledge, and understanding that will enable them to operate confidently, effectively, and independently, and also helps them to participate and progress in their training and development.

Wagons Functional Training Programs focus on employee skills development and help them to succeed in their job roles and responsibilities by developing their functional as well as technical skills.

Click on the link below to register https://wagonseducation.com/home/courses?category=sep-2022

For more information visit : https://www.wagonslearning.com/

0 notes

Photo

Do you find yourself saying “um” and “ah” too often in meetings and presentations?

While they may pass off in casual conversations, they can distract your audience when you're delivering a presentation or making a sales pitch.

Sometimes mind takes longer to organize thoughts, or out of habit you end up using filler words or sounds like "um," "so," and "like."

Using these words excessively can impact your credibility and take away the listener's attention!

We have some well-researched tips on how to overcome these filler words.

For more information you can visit:

https://www.wagonslearning.com/

https://wagonseducation.com/

0 notes