#crypto scam db

Text

Google Forms used by scammers for tech support crypto scams

🎣 Remember, the technical support of UniSwap, PancakeSwap Balancer, Metamask, TrustWallet, CoinBase, Kraken and so on will never give you a Google form link to fill out!

🛑 Never fill out anything in google forms, no matter what is the fake reason.

💸 Filling out data via google forms is a guaranteed way to get immediately robbed blind.

🏦 Never reveal nor enter your seed phrase (or wallet JSON) anywhere!

But some end users get desperate, are scared, insecure, inexperienced or plain old gullible and naïve, conveniently falling for the same scams that have been floating around since the ICO craze of 2017.

Meanwhile E Mask allowed anyone to buy a blue tick on twatter, so this type of scam is more successful than ever, gee thanks.

6 years later, literally the same scam from 2017 is still pocketing ill gotten gains to cybercriminals.

h/t Daniel Lopez

#scam#crypto scam#phishing#google forms#twitter#tech support scam#fraud#cryptoscam#cryptoscamdb#crypto scam db#spoof#cybercrime

211 notes

·

View notes

Text

Crypto influencer Ben Armstrong, formerly known as ‘BitBoy,’ reportedly spent the night in the slammer and has been hit with two charges following his conspicuous arrest. Armstrong, who was taken into custody on Sept. 25 while livestreaming outside a former associate’s house, spent a little over 8 hours in a cell according to the Gwinnett County, Georgia, Sheriff's Office.The crypto influencer has been released on bail but has been hit with charges of “loitering/prowling” and “simple assault by placing another in fear,” with a bond amount of $2,600 along with $40 of fees. Screenshot from Gwinnett County Sheriff's OfficeIn Georgia, loitering or prowling generally refers to when a person is “in a place at a time or in a manner not usual for law-abiding individuals under circumstances that warrant a justifiable and reasonable alarm or immediate concern for the safety of persons or property in the vicinity,” according to Georgia-based law firm Lawson & Berry. The consequences for a prowling and loitering misdemeanor include a fine of up to $1,000, or jail time of up to one year, or both, it added.Meanwhile, simple assault can involve: “(1) attempt to commit a violent injury to the person of another, or (2) commit an act which places another in reasonable apprehension of immediately receiving a violent injury.”Similar to loitering, a conviction for simple assault in Georgia is treated as a misdemeanor, though there can be certain situations where this is escalated, said the law firm.Following his release, Armstrong appeared to mock his punishment stating, “My name is Ben and I’m a loiterer. I did 8 whole hours in the slammer,”This is the hardest tweet I ever have had to make. I need to make a confession I never imagined I would admitI’m not even really sure if I have the courage to say it but I’m going to do my bestHere it goes: My name is Ben and I’m a loiterer. I did 8 whole hours in the slammer— Ben Armstrong (@BenArmstrongsX) September 26, 2023

A few hours later he posted: “I’m taking a week's break from social media,” before adding “No, not because of the memes,” on Sept. 27. Armstrong’s mug shot has been doing the rounds on crypto social media.pic.twitter.com/v9yL1OgFHk— db (@tier10k) September 26, 2023

On the evening of Sept. 25, Armstrong went to the house of his former associate Carlos Diaz who he alleged had possession of his Lamborghini.The livestream and general ranting went on for around 19 minutes before the local police turned up and arrested Armstrong. Crypto trader “EmperorBTC” told his 360,000 X followers that the arrest “should be a lesson for everyone.”Bitboy being arrested should be a lesson for everyone.1. If you scam, karma will get you. If not now, then someday, but for sure.2. Money gives you Power but Uncontrolled Power turns you insane. 3. Take care of your mental health, the world is waiting for you to breakdown.— Emperor (@EmperorBTC) September 26, 2023

The latest debacle is related to the ongoing dispute between Ben Armstrong and Hit Network which controls the “BitBoy Crypto" brand. The firm and its executives cut ties with Armstrong in August citing issues surrounding substance abuse and financial damage to employees.Get your money back: The weird world of crypto litigation

Source

0 notes

Text

2023-03-29

Singapore

Singapore-China project in Guangzhou to speed up expansion

72-year-old driver dies after crashing van into covered walkway near Redhill MRT

3-room HDB flat in Bidadari rented out for $4.1K - unit is just 2 years old & hasn’t reached MOP yet; owner allowed to rent out as overseas

Man arrested for suspected loan shark harassment in Pasir Ris

Geylang Serai Ramadan bazaar stallholders complain about steep rents & competition - They shouldn’t have taken up the stalls in the 1st place if they weren’t prepared to accept the rental price! Idiots!!!

At least $17.6m lost by over 1K victims to job scams since start of this year - maybe people here are just more stupid than elsewhere

Baby’s body found next to Hougang Ave 1 block - teenage girl aiding with investigations

DBS/POSB branches to stay open for 2 more hours as work to restore digital services continues - their lousy-a$$ $hit finally broke completely

5 arrested after incident at Bugis hotel - update to case here

Values tumble for high-end condos sold during 2013 property peak - analysts warn about buying high

Teenage boy recorded on video throwing bicycle into Punggol waterway

Health

WHO revises COVID-19 vaccine recommendations for new phase of pandemic - no one should have listened to this joke of an organisation in the 1st place

Scientists say high blood pressure may cause dementia

Art

A look at Yip Yew Chong’s latest works of Singapore through the decades

Finance

Singapore: Confidence in crypto slides, but 4 in 10 polled still have investments in it

Food

Malaysian woman dies after eating pufferfish - did she not know it’s extremely poisonous?!

Technology

Calculate your GST/VAT/other tax on products

Huge group calls for temporary pause on AI more advanced than GPT-4 - Elon Musk included

Geography

^ The Moldovan flag features an extinct species of cattle, the auroch

Transport

Singapore: ERP rates at 7 locations to increase by $1 from 3 April

Gossip

Liang Weidong says he still gets recognised - he was a very convincing villain, so maybe that’s why!

Jeffrey Xu says he still gets hate for being a China national in Singapore - How 'bout trying to assimilate instead of blaming others for not accepting you?! When in Rome...

0 notes

Video

youtube

Crypto Currency News In One Minute

CRYPTO SCAM AIMED AT ONLINE ACQUAINTANCES COSTS VICTIMS BILLIONS

LAWSUITS RELATED TO CRYPTOCURRENCY IN US ALMOST DOUBLE IN A YEAR

ANALYSIS | SANCTIONED CRYPTOCURRENCY TOOL APPEARS TO REEMERGE UNDER NEW NAME

NASDAQ-LISTED INTERACTIVE BROKERS TO OFFER CRYPTO TRADING IN HONG KONG BY COINTELEGRAPH

UK FCA TO TAKE ACTION AGAINST UNREGISTERED, ILLEGAL CRYPTOCURRENCY ATMS BY COINTELEGRAPH

BITTIMAATTI OPENS THE WORLD'S MOST NORTHERN CRYPTOCURRENCY ATM IN FINNISH LAPLAND

A MAJOR HOTEL IN THE BAHRAINI CAPITAL, MANAMA, ANNOUNCED SUNDAY THAT IT WILL START ACCEPTING PAYMENT IN CRYPTOCURRENCY

DBS BANK SET TO EXPAND CRYPTO SERVICES TO HONG KONG – CRYPTOPOLITAN

BRAZILIANS WILL BE ABLE TO PAY TAXES WITH CRYPTO – NEWS BITCOIN NEWS

SOUTH KOREAN REGULATORS KEEPING EYE ON RIPPLE VS SEC LAWSUIT BY COINEDITION

METISDAO TOKEN FACES REJECTION AT $37.51 AS SELLING PRESSURE PERSISTS BY COINEDITION

CEO OF ANALYTIC FIRM: CPI NEWS TODAY COULD PUSH BITCOIN SIDEWAYS BY COINEDITION

UK THINK TANK LAUNCHES A CRUSADE AGAINST 'SURVEILLANCE' CBDCS BY COINTELEGRAPH

MODERNOMY BY HASHEMIZADEGAN

0 notes

Text

Anndy Lian: “Crypto Regulation & Commercialisation 2021” at Digital Assets Investment Conference

youtube

Anndy Lian gave a speech on "Cryptocurrency Regulation & Commercialisation 2021" at the Digital Assets Investment Conference on 13 November 2020. In his speech, he gave an overview of regulations for cryptocurrency globally for 2021 & beyond, commercial adoption & implementation, and finally trends to look out for in 2021.

An Overview

He started by sharing some positive headlines:

– Investment banking giant JPMorgan is about to see the first commercial transactions with its own cryptocurrency, JPM Coin.

– PayPal allows Bitcoin and crypto spending. It has gone live today.

– Jack Dorsey’s Square buys $50 million in bitcoin

– Mode allocated up to 10% of cash reserves to purchase #Bitcoin and adopt it as a treasury reserve asset

– DBS Bank Is Planning to Launch a Digital Asset Exchange

– 22 Indian Bank Branches to Begin Offering Crypto Banking Services

– Alibaba Founder Jack Ma: "Digital Currencies" Are the Future

– World’s Second-Biggest Bank, China Construction Bank (CCB) has tapped Labuan-based digital asset exchange Fusang for the issuance of $3 billion worth of debt securities over a blockchain.

Then he also shared the not so positive headlines:

– BitMEX founder arrested for violation of US anti-money laundering laws

– China’s OKEx halts cryptocurrency withdrawals after founder arrested

– $150M Stolen by Hackers from KuCoin Crypto Exchange

Based on the above, Anndy felt that this is a positive sign in his opinion and stated that the blockchain and cryptocurrency space is taking its shape. Regulations are catching up. Investors are more aware of what they are investing in. And it is heading for mainstream.

Government attitude

The surveyed countries have categorized cryptocurrencies differently for tax purposes, as illustrated by the following examples:

Israel→taxed as asset

Bulgaria→taxed as financial asset

Switzerland→taxed as foreign currency

Denmark→subject to income tax and losses are deductible

United Kingdom→corporations pay corporate tax, unincorporated businesses pay income tax, individuals pay capital gains tax

In Singapore, the nation has started recognizing cryptocurrencies in 2017. The Payment Services Act (PSA) in Singapore, which came into effect on 28 January 2020, stated that cryptocurrency businesses must obtain a license from MAS to comply with AML/CFT regulations. This expands to companies that both transfer cryptocurrency within Singapore and outside of Singapore.

Similarly, more forward-looking countries have also started their public consultation for specific crypto-related bills to be passed.

To sum up, in this part, Lian emphasizes that we have to follow the rules and be upfront and open when dealing on unclear grounds. Having said so, the crypto space has been shifting and changing very fast. Experts should also find channels to update governments of the latest developments like Defi, AMM, and PMM and keep them informed of the latest scams and Ponzi schemes in the market. Proper education and awareness must be told to their people to avoid any form of fraud. Leading exchanges like Binance are always giving free lessons and updates on the industry. Information from credible sources and channels like them should be a useful reference. A formalized think tank in blockchain and cryptocurrencies accredited by the government must also be set up to be the voice.

Paths to commercialization

There must be clear incentives for the stakeholders and clients to drive proper ROI on the blockchain solutions. It should potentially have the ability to create revenue and cost-saving outcomes by using this new technology.

Blockchain technology implementation is no different from other technology. There must be clear strategic objectives, road maps, and specialized skill sets needed to drive commercialization and deliver business value.

It should also be an integrative approach, able to scale and provide a level of standardization so that existing data management and process standards can be applied to the blockchain solution.

Trends in 2021

Anndy highlighted that prop trading would be introduced, and social trading will gain more popularity in early 2021. On top of this, he also stated that STO would be more mature in 2021, more licenses will be approved, and will be operational in Q4.

Lian also mentioned briefly that DeFI would be more sustainable next year, stating that most of the higher risk companies would be flushed out from the ecosystem because of competition.

He mentioned that there would be more licensed LOTTO businesses getting into the crypto space.

Finally, he is optimistic that 2021 will hit a new milestone for the leading blockchain companies, and governments will be supportive. He also ended with an insightful quote.

"I do think that it is possible that Bitcoin goes to $100,000 but once it starts to affect governmental monetary policy and fiscal policy. You will see a whole different reaction." Anndy Lian

The post Anndy Lian: “Crypto Regulation & Commercialisation 2021” at Digital Assets Investment Conference appeared first on BLOCKPATHS.

source https://blockpaths.com/commentaries/anndy-lian-crypto-regulation-commercialisation-2021-at-digital-assets-investment-conference/

0 notes

Text

Bitcoin Hits $10.4K; Ether Balances on Exchanges Fall to 7-Month Low

Bitcoin was trending upward earlier than shedding momentum; ether holders are transferring their cryptocurrency off exchanges.

Bitcoin (BTC) buying and selling round $10,284 as of 20:00 UTC (Four p.m. ET). Slipping 0.12% over the earlier 24 hours.

Bitcoin’s 24-hour vary: $10,174-$10,488

BTC under its 10-day however above 50-day transferring averages, a sideway sign for market technicians.

Bitcoin continued its upward momentum from Wednesday, with the world’s oldest cryptocurrency rising as excessive as $10,488 on spot exchanges resembling Coinbase earlier than shedding some steam and now transferring in a sideways sample.

Constantin Kogan, associate at crypto fund of funds BitBull Capital, factors to bitcoin’s relative energy index, or RSI, as an indicator of the place the market is likely to be headed. RSI measures worth modifications to point market situations, resembling “overbought” when there was an excessive amount of shopping for or “oversold” when there’s an excessive amount of promoting.

Associated: Privacy Startup Nym Will Pay You in Bitcoin to Run Its Mixnet

Learn Extra: Structural Issues May Be Causing BitMEX’s Low Bitcoin ‘Cash and Carry’

“The relative energy index has shifted in favor of progress after the worth climbed to $10,355,” mentioned Kogan. “There’s a probability to return to the pivotal space of $10,756, however not every little thing is as rosy as we wish to see.”

Kogan mentioned bitcoin worth motion will depend upon the worldwide financial system’s efficiency for the stability of 2020.

“Many analysts predict that BTC will proceed to rise in worth in the long run,” Kogan added. “Nevertheless, this 12 months a breakthrough is unlikely. It’s anticipated subsequent 12 months if we gained’t see a worldwide recession escalation.”

Associated: Binance’s New Platform Will Connect CeFi and DeFi With $100M Fund

Learn Extra: Pandemic Will Speed Bitcoin Adoption, Says DBS Bank Economist

In bitcoin futures, open curiosity has been hanging across the $3.7 billion mark for the previous week.

“This represents a whole lot of indecision within the BTC market,” mentioned Daniel Koehler, liquidity supervisor for cryptocurrency change OKCoin, relating to the stasis in bitcoin futures. “I believe many bigger gamers hedged at these excessive worth ranges and are ready for momentum to obviously go in a single path.”

Learn Extra: YouTube Ignored Warnings About XRP ‘Giveaway’ Scams, Ripple Says

Henrik Kugelberg, a Swedish over-the-counter crypto dealer, factors to the longer-term outlook of bitcoin versus fiat’s efficiency. “The macro perspective is in fact that each one currencies will lose worth and the one hedge within the forex market the approaching months is bitcoin.”

Certainly, the U.S. Greenback Index, a measure of the American forex towards a basket of different fiat, continues to be within the doldrums, down 0.30% Thursday.

Italy-based over-the-counter crypto dealer Alessandro Andreotti mentioned he isn’t positive the bitcoin worth can preserve heading upward however he stays bullish. “Opinion appears break up on whether or not that is only a ‘bear entice’ or the start of a brand new bull market,” he instructed CoinDesk. “I’m shopping for both approach. Personally, I’m optimistic for the brief time period.”

Ether balances on exchanges dropping

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Thursday, buying and selling round $364 and climbing 2% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Learn Extra: Ether Traders May Be Hedging Against DeFi Slowdown: Analyst

The balances of ether on centralized exchanges is at a seven-month low. On Wednesday, 17,158,739 ETH sat on exchanges, the bottom it had been since Feb. 9, in line with information from aggregator Glassnode.

“My speedy thought is that many individuals have moved their ETH off exchanges to have the ability to take part in yield farming,” mentioned Andrew Tu, an govt at quant buying and selling agency Environment friendly Frontier. “A load of different merchants seemingly moved their ETH to have the ability to present liquidity to Uniswap swimming pools. SushiSwap is a major instance of this.”

Learn Extra: DeFi ‘Vampire’ SushiSwap Sucks $800M from Uniswap

Different markets

Digital property on the CoinDesk 20 are combined Thursday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Learn Extra: 1,000 New Token Pairs Added to Uniswap in One Week; Buyers Beware

Notable losers as of 20:00 UTC (4:00 p.m. ET):

Learn Extra: SushiSwap Migration Ushers in Era of ‘Protocol Politicians’

Equities:

Learn Extra: How to Watch INX’s IPO in Real Time on the Ethereum Blockchain

Commodities:

Oil is down 1.8%. Worth per barrel of West Texas Intermediate crude: $37.06.

Gold is flat Thursday, within the purple 0.10% and at $1,944 as of press time.

Learn Extra: Uniswap September Volume Tops August’s $6.7B Record in 10 Days

Treasurys:

U.S. Treasury bond yields all slipped Thursday. Yields, which transfer in the wrong way as worth, have been down most on the two-year, within the purple 5.3%.

Learn Extra: Why Crypto Investments Are Less Vulnerable to US-China Tensions

Associated Tales

Source link

from WordPress https://ift.tt/3mb3AXq

via IFTTT

0 notes

Text

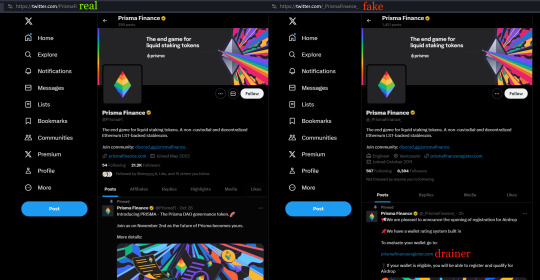

GOLD verified scam - no problem

The scam account is from 2011, the real one is from 2023. Only the follower count is higher on the real one, but scammers can buy followers as well.

Real page prismafinance.com

Real twitter twitter.com/PrismaFi

Scam twitter ( gold verified) twitter.com/PrismaFinance

So basically neither

the screen name

the verified badge

the square profile picture

the follower count

the account creation date

Can be trusted.

SCAMS DO NOT OPEN

layerzerofndlabs.net

layerzerofndllabs.net

layerzerofndzro.com

layerzerofndzro.net

layerzerofond.net

layerzerofondation.net

layerzerofondrais.net

layerzerofondrasing.net

layerzerofondzro.net

layerzerofoundation.network

layerzerofund.net

layerzerofundationzro.net

layerzerofundlabs.net

layerzerofundr.net

layerzerofundrasing.net

layerzerofundrzro.net

layerzerofundzro.net

layerzerofundzroo.net

layerzerolabsfnd.net

layerzerolabsfund.net

layerzerolabss.net

layerzerolabsszro.net

layerzerolabszro.net

layerzerollabsfnd.net

layerzerozro.com

layerzerozro.net

layerzerozro.network

layerzerozrofnd.net

layerzerozrofond.net

layerzerozrofund.net

layerzerozrofundr.net

layerzerozrolaabs.net

layerzerozrolabs.net

layerzerozroo.net

layerzerozroolabs.net

prismaafinance.com

prismaafinancee.com

prismafiinance.com

prismafinaance.com

prismafinancedrop.com

prismafinancedrop.com

prismafinancee.com

prismafinanceregister.com

prismmafinance.com

prismmafinancee.com

prissmafinancee.com

⛔ Do not visit X/Twitter if you use crypto

🐦 Do not click any links on X/Twitter, even from "verified" accounts.

🚫 Avoid X/Twitter when it comes to Web3/DeFi/Crypto

🛑 Anyone can buy a "verified" account and post scams with it, including GOLD verified as you can see.

#gold verified#twitter gold#twitter#scam#twitter scam#x gold#twitter verified is a scam#crypto scam#fake airdrop#fake#fraud#spoof#phishing#wallet drainer#crypto scam db#cryptoscamdb#prismafinance

0 notes

Text

Binance Creates ‘lunch for children’ Charity Using Zcoin Blockchain

The crypto exchange Binance has created a pilot charity to provide healthy food for students in Uganda. The program will further expand to Ethiopia and Kenya to provide corruption-free nutritious food for children.

The program is developed by the Binance Charity Foundation (BCF) which is the philanthropic wing of the Binance exchange. BCF announced earlier in January at the Singapore Blockchain Week that they planned on deploying the pilot program. For most of the year 2019, the program will provide 2 meals a day for over 200 school children.

#Binance Charity (@BinanceBCF) Launches Blockchain-Powered ‘Lunch for Children’ Program

The launch was held at Jolly Mercy Learning Centre in Kampala, Uganda, providing 2 meals a day for a full year (end of 2019) to more than 200 students & school staff

https://t.co/mPJtYfNEmt pic.twitter.com/V1Cjgut9hT

— Binance (@binance) February 21, 2019

BCF plans on merging the program with a pre-existing plan to help over a million people in the developing world. The primary aims of this project is to address hunger and access to primary education. The target nations will be Uganda, Kenya, and Ethiopia. The pilot lunch program, however, will start with Uganda.

The mechanics of the program will utilize a purpose-built blockchain using the Zcoin protocols. Food tokens will be sent out to parents and guardians of the school children so that food can be exchanged from designated retailers. The suppliers of food were carefully selected so that healthy food was a priority.

The Kenyan based non for profit organization Dream Building Service (DBS) partnered with Binance to promote the project. The official launch of the project attracted over 500 attendees.

Further support has come from Chinese volunteers aged 18-25 who monitor the blockchain to ensure the integrity of the transactions. Binance has noticed that many of these young volunteers have technical skills in blockchain that prove invaluable to the project.

Binance has noted that a blockchain is a great application for charity because the immutable nature of the technology prevents corruption. There has been a lot of controversy surrounding the charity sector with administration scams. The prospect of a corruption-free charity not only ensures the integrity of the transaction but also may draw in more donations due to such an increase in trust.

The Uganda Minister of State for Primary Education Rosemary Nansubuga Seninde resounds a similar sentiment by stressing that the technology provides protection from third-party corruption.

The use of Zcoin, however, may seem ironic because the blockchain usually specialises in creating anonymous transactions. However, the current project requires that transactions can be traced for reasons of integrity. The purpose-built blockchain by Zcoin allows for the transactions to be verified by the public.

The post Binance Creates ‘lunch for children’ Charity Using Zcoin Blockchain appeared first on ZyCrypto.

[Telegram Channel | Original Article ]

0 notes

Text

Colorado Takes Action Against Four More ICOs – 12 in Total

The Division of Securities of the U.S. state of Colorado has issued four new cease-and-desist orders to stop as many companies from promoting their tokens to residents of the state. So far, action has been taken against a total of 12 initial coin offerings by the state’s securities commissioner.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Four New Orders

Colorado Securities Commissioner Gerald Rome on Thursday signed four orders “directing the cessation of unregistered securities in the state of Colorado,” the state’s Division of Securities announced. So far, the division has taken action against a total of 12 initial coin offerings (ICOs), the announcement details.

The orders resulted from investigations by the division’s ICO task force which is part of the state’s Department of Regulatory Agencies (Dora). It was set up in May “to investigate potentially fraudulent activity targeting investors excited about the prospects of financial windfall through the cryptocurrency market.”

According to Thursday’s announcement:

The four orders signed today are for ICOs solicited by companies Bitcoin Investments, Ltd. (also doing business as Db Capital), Pinkdate, Prisma, and Clear Shop Vision Ltd.

While the four companies and their tokens are not registered in the state, the division explained that their websites are accessible to Colorado residents. The commissioner has directed all respondents to immediately cease and desist all alleged violations of the state’s Securities Act.

The division has previously taken ICO-related action against Bionic Coin, Sybrelabs Ltd., Global Pay Net, Estatex, Bitconnect Ltd., Magma Foundation, Linda Healthcare Corporation and Broad Investments. In addition, the division participates in Operation Cryptosweep, a coordinated effort by regulators in North America.

Companies Violating Securities Act

The first company named in the announcement, Bitcoin Investments Ltd., claims to have over $700 million in asset under management across multiple funds. The company promotes itself as a “leading blockchain investment firm and one of the largest institutional owners of cryptocurrencies.” In addition to allegedly claiming that “investors can expect over 1 percent daily returns with additional returns on internal exchanges” of its token, the company’s website states:

The average registered investment return over a two month period in 2017 was an amazing 95 percent.

Bitcoin Investments also lists a number of celebrity promoters for its ICO such as NBA basketball star Carmelo Anthony. However, “Most concerning to investigators was the alleged ‘spoofing’ of a U.S. Securities and Exchange Commission [SEC] webpage, www.howeycoins.com,” the Colorado securities division detailed. The Howeycoins website was set up by the SEC as an example of an ICO scam. The division asserted that Bitcoin Investment’s website “incorporates the same format, exact images, and an identical employee team as the SEC site.”

The second cease-and-desist order recipient, Pinkdate, provides “anonymously-operated, world-wide escorting service[s]” and purportedly seeks to raise over $5 million through an ICO. The order describes:

Pinkdate allegedly promotes a payout to investors of ‘50 percent of net profits through dividends,’ provides an investor portal, and offers to provide dividends in the form of bitcoin, ether, monero, or bitcoin cash.

The third company ordered to stop promoting its token to Colorado residents, Prisma, requires users to purchase its token in order to use its lending and arbitraging investment platform. Its whitepaper “does not disclose potential risks of the investment,” the division noted, adding that its website allegedly claims that investors “can profit up to 27 percent on their initial investment, and the ‘arbitrage bot’ can generate returns of up to 1.5 percent daily.”

The last of the four cease-and-desist order recipients, Clear Shop Vision Ltd., has launched three ICOs since June, according to the division. The order states that one of the tokens was represented as having “serious appreciation potential,” and investors are asked to send ether directly to the company’s wallet rather than an exchange. The company also allegedly offers to pay users in its token to promote the launch “on social media, translation services, and referrals.”

What do you think of the Colorado securities division taking action against all these ICOs? Let us know in the comments section below.

Images courtesy of Shutterstock, the SEC, and the Colorado government.

Need to calculate your bitcoin holdings? Check our tools section.

The post Colorado Takes Action Against Four More ICOs – 12 in Total appeared first on Bitcoin News.

READ MORE http://bit.ly/2QDZM0R

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

0 notes

Text

Thailand Updates ICO Licensing Progress, Warns Firm Issuing Token Without License

The Thai Securities and Exchange Commission has revealed the number of applications it has received from businesses wanting to operate initial coin offering portals in the country. However, at least one company is already issuing a token without obtaining approval. Meanwhile, the first Thai Stock Exchange-listed company to launch a token has a new plan to revitalize its coin.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

ICO Portal Applications

The Thai Securities and Exchange Commission (SEC), the country’s main cryptocurrency regulator, has revealed the number of companies that have applied to operate initial coin offering (ICO) portals in the country.

According to the Bangkok Insight, Mrs. Praopon Senanarong, the Assistant Secretary of the Thai SEC, said that the regulator is reviewing six applications for ICO portals, which are expected to be approved in the fourth quarter of this year. In addition, 12 more portals are interested but have not formally applied for a license.

Furthermore, the SEC will set up a committee of ICO experts and SEC representatives to oversee ICOs and ICO portals in September.

Firm Issuing Token Without License

The SEC issued a public warning last week about DB Hold Plc soliciting investments in shares and a token without approval after receiving inquiries from investors regarding the company.

After investigating, the SEC found that the company has been soliciting investors through social media for company shares and pre-ICO tokens in the amount of 500 million baht (~US$15,346,130).

Emphasizing that DB Hold Plc is not authorized to issue tokens, the SEC says that it has ordered the company to cease all activities relating to the issuance of the token. Furthermore, the regulator reiterates that no company has been granted approval to issue new tokens. Companies that launched their tokens prior to the adoption of the country’s crypto regulations, however, are exempt from having to apply for a license.

New Plan for First ICO by Thai Stock Exchange-listed Company

Jmart Plc is the first company listed on the Stock Exchange of Thailand to issue a token. The company issued Jfincoin through its subsidiary, Jventures Plc. Despite much effort, the coin’s value has fallen from 6.60 baht (~$0.20) per coin in February to about 1.70 baht (~$0.05) within 6 months of launch, Mgr Online reported.

Adding to the loss of investor confidence is the allegation that a former Jventures executive was involved in the high-profile bitcoin fraud case involving a well-known soap actor scamming a Finnish bitcoiner, the news outlet detailed.

The company has now come up with a new plan. Jmart is seeking permission from the Bank of Thailand and the SEC to use Jfincoin for payments in stores, starting with its own Jmart stores. If approved, this coin will be the first legal token that can be used for payments in the country, the publication conveyed.

What do you think of the way Thailand is handling ICOs? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Thailand Updates ICO Licensing Progress, Warns Firm Issuing Token Without License appeared first on Bitcoin News.

Thailand Updates ICO Licensing Progress, Warns Firm Issuing Token Without License published first on https://medium.com/@smartoptions

0 notes

Text

Bitcoin Daily: China Plans Crypto Crackdown

https://cryptobully.com/bitcoin-daily-china-plans-crypto-crackdown/

Bitcoin Daily: China Plans Crypto Crackdown

Share

Tweet

Share

Share

Share

Print

Email

Bitcoin fell below $7,000 on Thursday (March 29) – and analysts expect sales of bitcoin and other cryptos to increase as the April U.S. tax deadline approaches, CNBC reported. The price of bitcoin was $6,826.68 as of 11:13 p.m., according to CoinDesk.

And, in China, the country’s central bank is planning on cracking down on cryptocurrencies this year, Reuters reported. In addition, the bank plans to research and develop its own cryptocurrency.

In other news, Ripple’s XRP coin fell to its lowest point since December, Business Insider reported. Even so, Ripple has hired some big names in recent months and has been attracting new customers for its cross-border payment-related products. The price of Ripple was at about $0.4971 as of 11:15 p.m., according to CoinDesk.

And a new cryptocurrency called Chia has raised more than $3 million – without an initial coin offering (ICO), NewsBTC reported. The funding will be used for developing the startup’s coin and blockchain. And the person behind the startup? Bram Cohen, who invented BitTorrent.

In cybersecurity news, that supposed tech support rep from the cryptocurrency exchange may, in fact, be a scammer, CoinDesk reported. The Federal Bureau of Investigation (FBI)’s Internet Crime Complaint Center (IC3) said that it had received nearly 11,000 complaints on tech support scams. Customers, in all, said they lost more than $11 million in 2017 due to tech support fraud.

And, in South Korea, an insurance company will reportedly not pay a cryptocurrency exchange’s claim for losses it sustained in a December cyberattack, The Wall Street Journal reported. Youbit’s operating company, Yapian Corp., had filed the claim with DB Insurance Co. Its policy, which covered nearly $3 million for a yearly premium of $244,400, had only become effective weeks before.

In other news, MailChimp is cracking down on some crypto ads, such as those for initial coin offerings (ICOs), CoinDesk reported. But the company said in a tweet that not all information related to cryptocurrencies is banned: “It can be sent as long as the sender isn’t involved in the production, sale, exchange, storage or marketing of cryptocurrencies.”

…………………………

Cast Your Vote Today!

Ripple

0 notes

Link

Last week, mining manufacturer Bitmain launched its latest Antminer 17 series. Now Canaan Creative has published its own device specifications and pricing for the new Avalonminer 10 series that process between 31-33 trillion hashes per second (TH/s). In addition to Canaan’s latest miners, two more China-based companies are releasing next-generation miners this summer that mine at maximum hashrates between 46-70TH/s.

Also read: Statistics Show Bitcoin Cash Is a Strong Contender After Crypto Winter

Avalonminer 10 Series: 31-33 Trillion Hashes per Second

Bitcoin mining machines that process the SHA256 consensus algorithm are growing ever more efficient. Last year, a number of newly improved mining rigs were released by various manufacturers and this year there’s a bunch more on the horizon. News.Bitcoin.com recently reported on Bitmain and Canaan’s new miners but Canaan hadn’t published the latest Avalonminer 10 specifications or prices. The new Avalonminer 10 series documentation is now available on the company’s website and interested buyers can sign up for the waiting list.

There are two models available on Canaan’s store – the Avalonminer 1041 and the 1041F. Interestingly, even though one unit is a bit more effective than the other, they are both listed for the same price at $1,057 per mining rig. The 1041 unit processes the SHA256 algorithm at 31TH/s and power efficiency of 56 joules per terahash (J/TH). Another thing to note is that the 10 series models both use 16nm chipsets rather than the next-generation 10nm or 7nm chips used by competitors.

In addition to the chips used, the 1041 machine puts out 70 decibels (dB) of sound and weighs around 8kg. The more effective Avalonminer model, the 1041F, processes 33.5TH/s according to the 1041F specifications page. Canaan says the 1041F comes with top tier power efficiency by giving owners 63J/TH. The machine is a touch lighter at 6kg and also puts out 70db sound which Canaan calls a “traditional” output. Each machine has a 180-day warranty from when the mining rigs are received.

Strongu’s U8 Model: 46 Trillion Hashes per Second

In addition to the latest mining rigs being sold in 2019, the top three mining giants Ebang, Bitmain and Canaan have smaller competitors trying to make strides in the industry. Two models being sold this summer aim to give miners higher hashrate for their money. The first mining rig expected to go on sale this July is Strongu Mining’s STU-8 (also known as the U8) which claims to pack a maximum hashrate of 46TH/s. The model’s power consumption takes about 2100W off the wall according to specifications. A few vendors online expect the U8 model to sell between $1,520-1,883 per unit. The U8 is a bit louder too as the unit’s fan has a noise level of around 76dB. The U8 model will be sold in pre-sale batches as well (25 units per order) according to the Strongu website. However, the China-based firm does not disclose what type of chipset is used for the latest U8 model.

Microbt Whatsminer M20S: 70 Trillion Hashes per Second

Another mining rig expected this summer stems from another company headquartered in China. The manufacturer Microbt claims the new Whatsminer M20S will process a maximum hashrate of around 70TH/s. The machine has a power consumption of around 3360W and has a noise level of around 75dB. Microbt plans to sell the mining rig in August and the rig’s official distributor Pangolin is selling each unit for $2,349. The Pangolin website does disclose the type of chip used in the new M20S models, revealing it to be a 12nm TSMC made semiconductor.

Despite the crypto winter, bitcoin mining manufacturers have continued to develop faster models with next-generation chips. Both BTC and BCH hashrates have risen significantly in 2019 and global data shows the mining economy is still booming. It’s likely that next-generation machines will relentlessly push the envelope within this industry. With the Microbt Whatsminer M20S, Strongu’s U8, and the new Antminer 17s from Bitmain producing hashrates of over 50 trillion hashes per second, mining competitiveness is guaranteed to increase. Soon enough, mining participants and facilities will find that low hashrate-producing mining rigs will be far less efficient to the point of not being worthwhile to run, unless they’re combined in great numbers.

What do you think about 2019’s next-generation miners from Canaan, Microbt, and Strongu? Let us know what you think about this subject in the comments section below.

Disclaimer: Readers should do their own due diligence before taking any actions related to the mentioned companies, software or any of the affiliates or services. Bitcoin.com or the author is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. This editorial review is for informational purposes only.

Image credits: Shutterstock, Canaan Creative, Microbt, Asicminervalue.com, and Strongu.

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

Tags in this story

12nm, 16nm, Antminer, Antminer 17 Series, avalonminer, BCH, bitcoin cash, Bitcoin Core, Bitmain, BTC, Canaan, Ebang, Microbt, Miners, mining, mining rigs, N-Technology, next generation, Pangolin Miner, Strongu, Terahash, Trillion Hashes, Whatsminer

Jamie Redman

Jamie Redman is a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source code, and decentralized applications. Redman has written thousands of articles for news.Bitcoin.com about the disruptive protocols emerging today.

(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = 'https://connect.facebook.net/en_US/sdk.js#xfbml=1&version=v3.2'; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

0 notes

Text

Major UK Public Transport Provider Partners With Crypto Startup for Loyalty Program

Major United Kingdom public transport provider Go-Ahead Group Plc. is partnering with blockchain startup DOVU to introduce a tokenized rewards system for rail customers, TechCrunch reported Feb. 1.

Listed on the FTSE 250 — an index of the 101st to 350th largest companies listed on the London Stock Exchange — Go-Ahead provides over one billion rail and bus journeys in the U.K. every year. As well as being the largest bus service operator in London, the Group’s services reportedly account for around 30 percent of all U.K. train passenger journeys.

DOVU is now set to roll out its blockchain-based rewards platform — which uses a native ERC-20 token, DOV — on Go-Ahead’s widely-used Thameslink and Southern Rail services. The crypto-powered incentivization scheme will reward members for sharing their travel data, with a focus on the first and last leg of commuters’ journeys.

DOVU COO and co-founder Krasina Mileva has proposed the tokenzied system will provide Go-Ahead with “actionable data that can boost efficiencies and improve services.”

Alongside encouraging data sharing, the platform will reportedly be used to reward commuters with tokens for changes to their travel behavior — although the exact nature of such changes is not indicated in DOVU’s post.

The new partnership reportedly follows on from DOVU’s participation as a finalist in Go-Ahead’s accelerator scheme — The Billion Journey Project — which focuses on developing innovative proof-of-concepts and scale solutions for the transport industry.

To press time, Go-Ahead has not responded to Cointelegraph’s request for comment.

As reported, DOVU has previously partnered with major automobile manufacturer BMW on a tokenized rewards system that encourages drivers to track mileage on their leased vehicles.

Last month, Cointelegraph reported that major German railway operator Deutsche Bahn AG (DB) had partnered with blockchain integration platform Unibright to explore the possibility of tokenizing its ecosystem. The railway giant, which is considered to be the largest in Europe, has said it aims to ascertain whether decentralized solutions can cut operational costs and help DB interact with other members of the travel industry.

window.fbAsyncInit = function() { FB.init({ appId : '1922752334671725', xfbml : true, version : 'v2.9' }); FB.AppEvents.logPageView(); }; (function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_US/sdk.js"; js.async = true; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '1922752334671725'); fbq('track', 'PageView');

This news post is collected from Cointelegraph

Recommended Read

New & Hot

The Calloway Software – Secret Weapon To Make Money From Crypto Trading (Proofs Inside)

The modern world is inextricably linked to the internet. We spend a lot of time in virtual reality, and we're no longer ...

User rating:

9.6

Free Spots are Limited Get It Now Hurry!

Read full review

Editors' Picks 2

BinBot Pro – Its Like Printing Money On Autopilot (Proofs Inside)

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

User rating:

9.5

Demo & Pro Version Get It Now Hurry!

Read full review

The post Major UK Public Transport Provider Partners With Crypto Startup for Loyalty Program appeared first on Review: Legit or Scam?.

Read more from → https://legit-scam.review/major-uk-public-transport-provider-partners-with-crypto-startup-for-loyalty-program

0 notes

Text

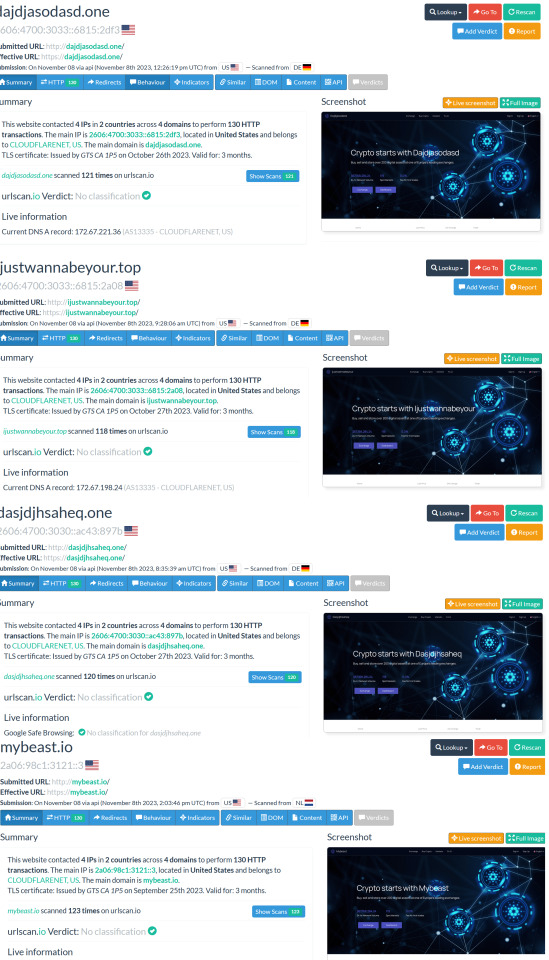

SCAM dasjdjhsaheq.one dajdjasodasd.one

Didn't you know that "Crypto starts with Dajdjasodasd" 🤡

SCAM crypt-validator.firebaseapp.com ⚠

SCAM crypt-validator.web.app ⚠

SCAM dajdjasodasd.one ⚠

SCAM dasjdjhsaheq.one ⚠

SCAM ijustwannabeyour.top ⚠

SCAM mybeast.io ⚠

Same scam, different name

#scam#phishing#spoof#fraud#fake#fake exchange#419#advance fee fraud#advance fee scam#pig butchering#pig butchering scam#cryptoscamdb#crypto scam db#cryptoscams#spamreports

0 notes

Text

Ponzi Scheme or Scare Tactic?

Ponzi Scheme or Scare Tactic?

We all knew that there would be Bitcoin critics throughout traditional financial sectors. In fact, there have always been critics. However, Bitcoin is gaining so much momentum and market value that the haters are coming out of the woodwork; and in the immortal words of Biggie Smalls, “More money, more problems.”

David Gledhill is the Head of Group Technology and Operations and the Group Chief of Information Officer for DBS, a major Asian bank.

According to Gledhill, “We see Bitcoin as a bit of a Ponzi scheme.”

The words Ponzi Scheme are incredibly harsh and scary to the traditional investor. Traditional investors have been notoriously scared to trade crypto-currencies because of their volatile nature. Plus, they’re still downright confusing to some people.

It’s easy to fear what you don’t understand. Then, when a major banking institution calls what you don’t understand, “a Ponzi scheme;” (a terrifying hoax that you do understand), what you don’t understand becomes incredibly easy to dismiss as a scam.

They’ll be Having None of That

According to Gledhill, Bitcoin is, “incredibly expensive,” to transact, with hidden fees throughout its, “crypto-mechanisms.”

During the Singapore Fintech Festival, he made it clear that DBS had no interest in being a part of the crypto-currency, “game right now,” because it wouldn’t, “create a competitive advantage,” for the organization. He feels that Bitcoin will become extremely cheap because of, “how it will scale.”

Gledhill doesn’t feel that working with Bitcoin will do anything to bring in new customers, new deposits or to enhance DBS’ current strategies for wealth management. Gledhill states that now is the time to simply, “watch and learn,” what Bitcoin will do.

Gledhill says DBS plans to focus on traditional electronic transactions of government-backed fiat.

Of course, Gledhill isn’t the first pundit to take a shot at Bitcoin. Despite the fact that DBS has always been a big supporter of emerging technologies, (introducing a cloud-based system for its employees, powered by artificial intelligence), Southeast Asia’s biggest lender stands behind Gledhill in his views, and has no immediate plans to look further into crypto-currency.

Don’t Drink the Hater-Ade

Crypto-currency recently took a nosedive, falling almost $2,400 per coin. However, its market value has begun another steady, strong climb.

Matthew Roszak, Chairman and Co-Founder of Bloq, (a blockchain software company) defended Bitcoin. “When I hear comments like that, I think a lot of folks are having their Kodak moment, where maybe they don’t really understand the magnitude of this technology.”

Images Courtesy of Flickr, Pixabay

http://ift.tt/2AOvKz6

0 notes

Text

Thailand Updates ICO Licensing Progress, Warns Firm Issuing Token Without License

The Thai Securities and Exchange Commission has revealed the number of applications it has received from businesses wanting to operate initial coin offering portals in the country. However, at least one company is already issuing a token without obtaining approval. Meanwhile, the first Thai Stock Exchange-listed company to launch a token has a new plan to revitalize its coin.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

ICO Portal Applications

The Thai Securities and Exchange Commission (SEC), the country’s main cryptocurrency regulator, has revealed the number of companies that have applied to operate initial coin offering (ICO) portals in the country.

According to the Bangkok Insight, Mrs. Praopon Senanarong, the Assistant Secretary of the Thai SEC, said that the regulator is reviewing six applications for ICO portals, which are expected to be approved in the fourth quarter of this year. In addition, 12 more portals are interested but have not formally applied for a license.

Furthermore, the SEC will set up a committee of ICO experts and SEC representatives to oversee ICOs and ICO portals in September.

Firm Issuing Token Without License

The SEC issued a public warning last week about DB Hold Plc soliciting investments in shares and a token without approval after receiving inquiries from investors regarding the company.

After investigating, the SEC found that the company has been soliciting investors through social media for company shares and pre-ICO tokens in the amount of 500 million baht (~US$15,346,130).

Emphasizing that DB Hold Plc is not authorized to issue tokens, the SEC says that it has ordered the company to cease all activities relating to the issuance of the token. Furthermore, the regulator reiterates that no company has been granted approval to issue new tokens. Companies that launched their tokens prior to the adoption of the country’s crypto regulations, however, are exempt from having to apply for a license.

New Plan for First ICO by Thai Stock Exchange-listed Company

Jmart Plc is the first company listed on the Stock Exchange of Thailand to issue a token. The company issued Jfincoin through its subsidiary, Jventures Plc. Despite much effort, the coin’s value has fallen from 6.60 baht (~$0.20) per coin in February to about 1.70 baht (~$0.05) within 6 months of launch, Mgr Online reported.

Adding to the loss of investor confidence is the allegation that a former Jventures executive was involved in the high-profile bitcoin fraud case involving a well-known soap actor scamming a Finnish bitcoiner, the news outlet detailed.

The company has now come up with a new plan. Jmart is seeking permission from the Bank of Thailand and the SEC to use Jfincoin for payments in stores, starting with its own Jmart stores. If approved, this coin will be the first legal token that can be used for payments in the country, the publication conveyed.

What do you think of the way Thailand is handling ICOs? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Thailand Updates ICO Licensing Progress, Warns Firm Issuing Token Without License appeared first on Bitcoin News.

READ MORE http://bit.ly/2wfHLh2

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

0 notes