#crypto tax

Text

Strategic Financial Guidance: Unleashing the Power of CFO Advisory

Discover the transformative potential of CFO advisory services. From optimizing financial strategies to enhancing operational efficiency, CFO Advisory offers invaluable guidance to businesses seeking to navigate complex financial landscapes. Unlock new opportunities for growth, streamline decision-making processes, and ensure long-term financial sustainability with expert insights from seasoned CFO advisors. Explore the strategic advantages of CFO advisory and empower your organization to thrive in today's dynamic business environment.

#cfo advisory#r&d tax consultants#ecommerce accountant#r&d tax incentive australia#crypto tax#bookkeeping services#crypto tax australia#startup accountant#crypto tax accountant#business bookkeeping

0 notes

Text

Spain Tightens Grip on Crypto: Treasury Targets Digital Assets in Tax Reforms

Key Points:

Spanish Treasury proposes reforms to General Tax Law, enabling seizure of crypto assets for unpaid taxes.

Royal Decree expands reporting obligations to include electronic money institutions and payment service providers.

Spain ramps up efforts to regulate crypto sector, aligning with international trends to enhance oversight and transparency.

In a bid to tighten its grip on the…

View On WordPress

0 notes

Text

The Japanese Tax Agency has launched investigations into firms suspected of crypto tax violations. Alleged non-compliance with tax regulations regarding cryptocurrencies has prompted official scrutiny. More insights can be found at the following link: Crypto Tax Violations Cases Opened by Japanese Tax Agency.

1 note

·

View note

Text

Expert Crypto Tax Services in Australia

Crypto investments have surged in popularity, but understanding and managing the associated tax implications can be complex. At [Your Company Name], we specialize in helping individuals and businesses make sense of crypto tax in Australia. Our team of experts is well-versed in the ever-evolving regulations surrounding cryptocurrencies, ensuring that you stay compliant while optimizing your tax position.

Whether you're a seasoned crypto investor or just starting your journey, our services are tailored to your needs. We offer comprehensive guidance on crypto tax reporting, capital gains calculations, and strategies to minimize your tax liability legally. Don't let crypto tax complexities overwhelm you; reach out to us today at 07 5301 9217 or drop us an email at [email protected], and let us make crypto tax compliance a seamless process for you.

1 note

·

View note

Text

Biden Proposes 30% Climate Change Tax on Crypto Mining

The White House is pleading with Congress to add a 30% tax on the power used in cryptocurrency mining in the 2019 federal budget in order to decrease the impact of the burgeoning industry on climate change. In his budget proposal for the fiscal year 2024, US President Joe Biden suggested a new tax on Bitcoin mining.

Businesses that participate in cryptocurrency mining—the process of producing new currencies by figuring out complicated cryptographic riddles and confirming transactions—will be subject to the Digital Asset Mining Energy (DAME) excise tax. The levy will amount to 30% of what it costs to mine bitcoins.

The enormous energy requirements of cryptocurrency mining have a detrimental effect on the environment, electrical grids, and the local communities where these companies are based. The DAME tax aims to force cryptocurrency miners to shoulder their fair share of societal costs, such as those incurred due to local environmental deterioration, rising energy costs, and increased greenhouse gas emissions.

1 note

·

View note

Text

What Are the Facts Related to The Popular Crypto Tax Accountant?

crypto tax accountant nzYou may be looking for a crypto accountant to assist you with crypto taxes now that tax season is in full swing; however, what should you look for when hiring a crypto tax accountant NZ?

youtube

In your country, a crypto accountant is a certified accountant who specializes in crypto. Finding an experienced accountant is hard because cryptocurrencies have many different aspects from traditional investments. The best advice for finding a crypto accountant is provided here.

Is cryptocurrency accounting necessary?

You may need an accountant for cryptocurrency if you need to keep track of many crypto trades and complex operations. These activities require better utilization of instruments like cryptographic charge programming and itemized reporting to ensure the data is right.

Hiring a professional tax accountant for cryptocurrency would be beneficial if you are a professional crypto investor or have tens of thousands of trades and a variety of income sources.

Instructions to pick a crypto accounting firm

There are some assessment standards you ought to have while picking a crypto tax accountant NZ firm to assist with your crypto charges, including:

Guarantee that the expense firms you are reaching have insight into crypto charges, given its intricacy and contrasts from different resources.

Become involved in different online networks and communities, where top crypto tax accountants assuredly offer some benefit.

Talk to the accountants you are interested in about the most recent changes to your country's crypto laws and how they affect crypto taxes.

Make preparations in advance. When you begin working with a crypto tax accountant, keeping track of your year-round crypto trades will simplify the crypto tax process.

Since crypto taxes are a new and highly specialized field that requires unique knowledge, be prepared to pay a premium. Set aside yearly money for this to get the best service possible.

Before picking a crypto tax accountant, figure out what regions they have some expertise in to check whether they are ideal for your necessities.

1 note

·

View note

Text

India Works Towards Crypto Legalisation with 30% Tax

0 notes

Text

Japanese Regulator Wants to Reform Crypto Tax Laws for Companies & Investors

The Financial Service Agency (FSA), the country’s chief financial regulator, has made it clear that it is willing to change the tax laws that control how businesses and their investors are taxed while engaging in transactions involving cryptocurrencies.

The measures are in reaction to Prime Minister Fumio Kishida’s pro-IT sector growth initiative, who has frequently asserted that Web3-related industries have the potential to catalyze an economic recovery. Kishida has also argued in favor of revisiting cryptocurrencies’ tax regulations this year. Many Japanese businesses are reportedly looking to relocate abroad, according to critics, some of whom are prominent lawmakers, who claim that this is because of Japan’s onerous tax rules, which want to tax cryptocurrency as income rather than as a capital gain for individuals. Crypto is frequently taxed for businesses under the laws governing corporate taxes. The law also mandates that businesses must pay tax on what are known as “paper gains,” or increases in the value of tokens relative to fiat.

This means that even while the same company does not sell its tickets for fiat, it would still be required to pay tax on the higher token value if, for example, a corporation issued a token whose value increased over the course of a year. In certain other countries, businesses would not be required to pay taxes until they “realize” the value of their coin holdings, that is when they sell them for fiat. The FSA has also stated that it wants to permit private investors in cryptocurrency companies to benefit from tax benefits, according to the media sites CoinPost and Bloomberg. The announcement that the FSA intends to provide retail investors access to the Nippon Individual Savings Account (NISA) tax break scheme, which might let them exempt up to $2,900 worth of assets from the capital gains tax, would also cheer them. From a crypto viewpoint, the silver lining has a cloud because it is unclear whether this will apply to crypto investments outside of the security token market. The regulator’s ideas must be approved by a legislative tax commission, which won’t meet for several months. The FSA’s requests are not legally binding. The recommendations will most likely be approved because the FSA is perhaps the Prime Minister’s closest rival when it comes to influencing crypto policy in the nation. Earlier this month, organizations from the private sector, including the self-regulatory Japan Virtual Currency Exchange Association (JVCEA), demanded immediate tax reform. The JVCEA and its allies also urged Tokyo to make it easier for cryptocurrency investors to file their tax returns.

#crypto tax#accept crypto#crypto tax bill#bitcoin news#cryptocurrency#silverline crypto news#silverlineswap

0 notes

Text

What is Cold Wallet | Important Terms you must know

What is Cold Wallet | Important Terms you must know

What is Cold wallet? A Few Centralized crypto platforms have recently come into the limelight 👀for not allowing users to withdraw their #crypto 🧐 If you plan to store your crypto off exchanges, here are a few basic terms you should know

Ledger nano:

Differences Between Crypto and Fiat

What is Public Key?

What is a Private Key?

What is Wallet?

Types of Crypto Wallets?

What is Cold…

View On WordPress

#cold wallet#crypto#crypto crash#crypto currency#crypto currency explained in hindi#crypto currency investing#crypto currency investing tamil#crypto mining#crypto news#crypto software#crypto tax#crypto trading#crypto trading bot#crypto tutorial#currency#currency exchanges#digital currency#future currency#hot wallet#invest in crypto#list of cryptocurrency#public key#tax on crypto#tax returns for crypto#vauld#what is crypto?

0 notes

Text

Cryptocurrency and Taxes: How Does Crypto Affect Taxes

Cryptocurrency and Taxes: How Does Crypto Affect Taxes

Cryptocurrency is the most interesting thing I have learned about to date. It was a concept that I couldn't have imagined I would spend this much time researching and learning about. Cryptocurrency has shown up in massive sources of media in 2022, but it has not yet reached mass adoption.

Many people that I have spoken with are preparing for a recession at the moment. While the US economy is experiencing a recession, cryptocurrency and the market generally would be expected to experience a downward trend or rather stagnant charts. Cryptocurrency can be unpredictable, and many people are experiencing what investors would call their first "bear market". A bear market is an event in which a market experiences prolonged downward trends on its charts or overall price declines, according to Investopedia.com.

During a bear market, market participants may experience an increased amount of FUD-or uncertainty and negative feelings toward the markets, which encourages the decline in value.

Cryptocurrency was introduced in 2009 with bitcoin, and other forms of crypto have gained massive amounts of popularity in the past several years. This article released by cpajournal.com in January 2019 lists Litecoin, Ethereum, and Ripple as popular forms of cryptocurrency. Today, July 20th, 2022, Litecoin $LTC is listed on CoinMarketCap at $58.87/coin. When this article was published in January 2019, Litecoin was listed at about $30/coin. If someone had invested $1,000,000 into Litecoin on January 18th, 2019 and withdrawn your money July 18th, 2022, you would have made an 82% total return and would have approx. $1,828,193.132 total today before taxes and before calculating CPI, according to https://dqydj.com/litecoin-return-calculator/ (a Litecoin return calculator). According to this Crypto Tax Calculator by Forbes, that is an Estimated Capital Gain of $828,193.13 and the Estimated Capital Gains Tax would be roughly $156,846.13, leaving the investor with around $671,347 in profit. By investing in Litecoin, an investor could have multiplied their starting investment by 1.489%.

Some resources to learn more about crypto/NFTs/Web 3.0 include: CoinTracker.com, CoinDesk.com, Forbes Crypto Tax Calculator

Tax Withholding is when an employer withholds income tax from their employee's paycheck and pays it to the IRS on their behalf. Wages paid, along with any amounts withheld, are reflected on

If you're an employee in The United States, you're probably used to having your taxes withheld from your paycheck by your employer. Every year, you get a refund during tax season. But what about people who own businesses or make income from other sources?

Cryptocurrency is a new form of income that is being taxed by the government. If you own or sell crypto, you will be taxed based on how much profit you earn and how long you hold the crypto/digital asset(s). This is different from how taxes are typically withheld from your paycheck, but it is essential to know how you will be taxed on this income. When it comes to taxes, even an honest mistake can be a critical one.

Regarding my previous post, I left a note that it was to-be-continued. I have done more research on my question:

What investment accounts (IRA, 401K, Etc.) can I open? Which ones should I open?

I created this blog because I wanted to learn more about financial literacy and the entire process of creating a healthy and successful business. I am researching and writing as I learn. After researching these topics, there are subjects that I want to learn more about that I think will benefit me as an entrepreneur.

How will the stock market and the crypto market behave during a recession?

How are specific niche sectors of crypto taxed, i.e., airdrops? NFTs in general?

What are the best ways to make financial gain during a recession?

How to handle cryptocurrency and stocks and taxes in the most efficient way possible?

How to open and make the most of investment accounts

How to calculate gain and loss on a stock: RESOURCE

CPI Consumer Price Index- What it really is, how it works.

Google Transparency as a tool and why it's necessary in today's world; begin learning about cybersecurity.

#crypto#cryptocurrency#cryptocurrencies#investing#investingforbeginners#income tax#taxplanning#taxpayers#crypto tax#cryptocurrency tax

0 notes

Photo

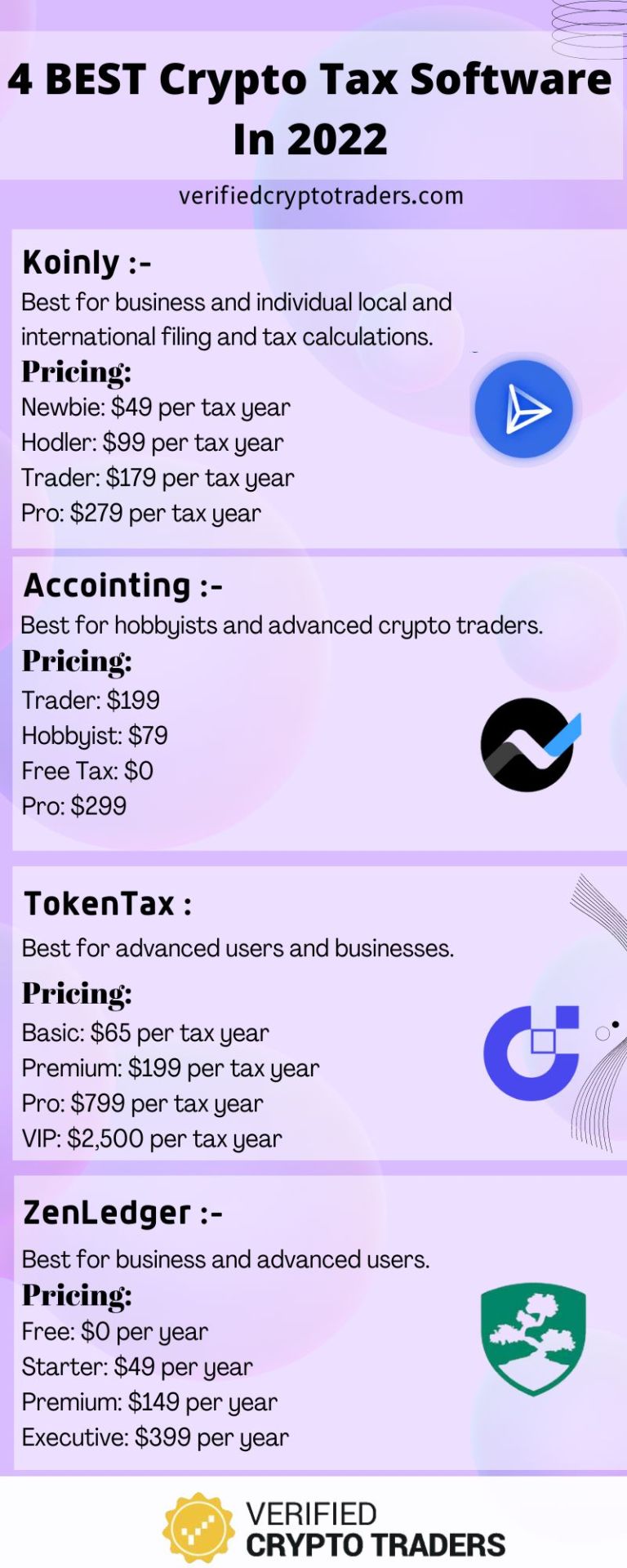

4 Best Crypto Tax Software In 2022 - Verified Crypto Traders

These best crypto tax software will take away your after-trading headaches by calculating your crypto tax liabilities with just a few minutes. .

https://www.verifiedcryptotraders.com/

0 notes

Text

Understanding Crypto Tax in Australia: A Comprehensive Guide for Investors

Dive into the essential aspects of crypto tax in Australia with our detailed guide. Learn about the Australian Taxation Office's (ATO) regulations, how to report your cryptocurrency transactions, and the implications for capital gains tax. Whether you're a new investor or an experienced trader, this resource will help you navigate the complexities of crypto taxation, ensuring compliance and optimizing your tax strategy in the evolving digital currency landscape.

#crypto tax australia#crypto tax#r&d tax consultants#cfo advisory#ecommerce accountant#r&d tax incentive australia#startup accountant#bookkeeping services#crypto tax accountant#business bookkeeping

0 notes

Text

Beyond Capital Gains: Understanding India's Crypto Tax Revolution

Key Points:

Unified Tax Rate: Unlike traditional assets, crypto transactions incur a flat 30% tax, irrespective of the holding period.

TDS Mandate: Section 194S introduces a 1% Tax Deducted at Source on crypto transfers exceeding ₹50,000, enhancing compliance.

Airdrops and Gifts: Unique taxation rules apply to crypto airdrops, while assets received as gifts are not exempt from taxation.

In the…

View On WordPress

0 notes

Text

How will the 1% TDS on crypto transactions rule work on CoinDCX App from July 1?

How will the 1% TDS on crypto transactions rule work on CoinDCX App from July 1?

One of the largest crypto exchanges in India, CoinDCX recently announced the implementation of the 1% TDS rule on crypto transactions through its app. As per the Government of India’s announcement, the 1% TDS will become applicable on crypto transfers from the 1st of July 2022 on the sale of crypto and other virtual digital assets.

In the Union Budget 2022, Finance Minister Nirmala Sitharama had…

View On WordPress

0 notes

Text

"We're doing a deep dive into the sham world for voluntourism, where people pay for the experience of charity without actually helping locals—and often even making their lives worse. Join us live on Twitch now:"

https://bird.makeup/users/vicenews/statuses/1688978145272111107

#vice news#vice#jerkmillionaires#jerktrillionaires#jerkbillionaires#voting is a scam#religion is a scam#scammers#scam#tourism#tourist#crypto fraud#billions of facebook users warned of ‘job fraud’ that could cost you – eight key signs to look out for#voter fraud#election fraud#tax fraud#fraud#voluntourism#poverty#working class#class warfare#class war#classism#classwar#ausgov#politas#auspol#tasgov#taspol#neoliberal capitalism

2 notes

·

View notes