#diode laser module

Explore tagged Tumblr posts

Text

Types and Characteristics of diode laser module

Diode laser module are devices that convert electrical energy into light energy. They are known for their small size, lightweight, high efficiency, and long lifespan. They are widely used in various fields such as industry, medicine, research, and military, including laser processing, optical communication, medical treatment, and laser ranging.

Types and Characteristics of diode laser module

Edge-emitting lasers (EELs): Mature technology, broad wavelength range, high electro-optical conversion efficiency, suitable for laser processing and optical communication.

Vertical-Cavity Surface-Emitting Lasers (VCSELs): Small size, suitable for the consumer electronics market, complementary to EELs in emerging applications.

High-power GaN-based lasers: Used for illumination, night vision, sensing, communication, etc., capable of long-distance detection and LiDAR imaging.

Fiber-coupled modules: Convenient for fiber transmission, suitable for solid-state laser pumping, material processing, medical treatment, etc.

Unpackaged bars and chips: Based on GaAs, InP, GaSb semiconductor structures, providing wavelengths from 750 nm to 2200 nm.

Application Examples

In the field of optical communication, EELs are typically used for long-distance and high-speed transmission, while VCSELs are used for short-distance and low-speed transmission.

In the consumer electronics market, VCSELs are widely used due to their small size and narrow wavelength, while EELs are suitable for long-range sensing and high-power processing.

In LiDAR applications, both EELs and VCSELs can be used for medium and short-range LiDAR, enabling features like blind spot detection and lane departure.

Technological Developments

With technological advancements, the performance of diode laser module in terms of power, reliability, and energy conversion efficiency has greatly improved.

High-power diode laser module are rapidly maturing in technology, with decreasing prices and expanding applications, such as laser welding and laser cutting.

Narrow linewidth diode laser module have broad applications in pump sources, Raman spectroscopy, laser-induced fluorescence, and other fields.

Market Prospects

It is expected that the edge-emitting laser market will grow to $7.4 billion by 2027, with a compound annual growth rate of 13%.

High-power semiconductor laser technology is rapidly maturing, with prices dropping and applications expanding.

In summary, diode laser module, due to their efficient, compact, and reliable characteristics, have a wide range of applications in various fields. With the continuous development of technology, their market prospects are broad.

0 notes

Text

What Are Laser Diodes in Electronics?

A Laser Diode stands as a semiconductor device, its operation grounded in the composite process of electrons and holes within semiconductor materials. By injecting current, the Laser Diode can generate a highly focused laser beam, boasting unique optical properties.

Knowing more: Laser Diode (characteristics, applications, and more)

#electronics#integrated circuits#semiconductor#components#electronic#module#electronic devices#manufacturing#chips#diodes#laser diode#laser diode market

0 notes

Text

CTF Photonics - CTF-3 Laser Aiming Module

So far it seems very well-constructed. The CNC billet 6065 aluminum body feels solid, the rail clamp is well thought-out, the and the battery caps don't impede button activation as much as I thought they would.

However, getting the bad out of the way first, the adjustment turrets, contrary to my original assumption, do not feature 'clicky' MOA increments - they seem like they've got an internal o-ring somewhere to tension the screws for zeroing adjustment and the marks on the vertical turret are just there as witness marks more than actual adjustments.

Additionally the screws are small and seem easy to strip for how much pressure's needed to turn them. But for they do seem like they'll hold zero no issue once adjusted, for what it's worth.

The unit is incredibly low-profile as you would expect - an IR-only laser diode sits center over bore with what amounts to two independent 300-style scout flashlight bodies sitting saddleback on either side of the top rail. One holds a white light and the other would hold some form of IR illuminator head (B.E. Meyers KIJI, Z-Bolt Blazer, 3EIR Vulcan).

It seems like a good solution for secondary or tertiary builds that you wanna tack NV capabilities onto. Incidentally, due to being so low-profile, it's the perfect MFAL for an AK or other rifles that you can't put excessively tall optic risers on due to the stock being lower than the top of the receiver.

I've ordered a Z-Bolt Blazer Head and will be donating this laser to @bureau-of-mines' AK in trade for a Holosun IRIS-3 or AMMJ Penumbra (depending on whether the former restocks before I make up the additional cash to afford the latter).

For the sake of comparison, here's the CTF-3 without any heads in between a Steiner DBAL D2 and an EG NGAL.

The CTF-3 seems like a large unit, but it's very flat and carries most of its weight in the integral flashlight bodies, which it spreads out nicely. Plus the fact it eliminates a separate white light setup also cuts down greatly on weight.

While I don't recommend this unit for AR15's (given the abundance of better options now), I'd say it still has a niche to fill. Basically, it's a DIR-V that traded the lighter weight and the crane port for superior build quality and sheer modularity. And also not costing $2000 fucking dollars.

#ir laser#laser aiming module#multi function aiming laser#ctf photonics#ctf-3 laser#ctf-3#ctf laser#nightfighting rifle#night vision

14 notes

·

View notes

Text

New high-power thermoelectric device may provide cooling in next-gen electronics

Next-generation electronics will feature smaller and more powerful components that require new solutions for cooling. A new thermoelectric cooler developed by Penn State scientists greatly improves the cooling power and efficiency compared to current commercial thermoelectric units and may help control heat in future high-power electronics, the researchers said. "Our new material can provide thermoelectric devices with very high cooling power density," said Bed Poudel, research professor in the Department of Materials Science and Engineering at Penn State. "We were able to demonstrate that this new device can not only be competitive in terms of technoeconomic measures but outperform the current leading thermoelectric cooling modules. The new generation of electronics will benefit from this development." Thermoelectric coolers transfer heat from one side of the device to the other when electricity is applied, creating a module with cold and hot sides. Placing the cold side on electronic components that generate heat, like laser diodes or microprocessors, can pump the excess heat away and help control the temperature. But as those components become more powerful, thermoelectric coolers will also need to pump more heat, the scientists said.

Read more.

14 notes

·

View notes

Photo

TINEE

Oh. my. Gosh. These things are SO SMALL. I got my new laser modules from overseas, and I've been tuning them up for use once I build a 3 tiered enclosure to hold 2 3d printers and 2 laser engravers(This thing is gonna reach the ceiling, have built in power, light, fire detection, cameras... and cost me like $800 once it's all said and done probably XD). These tiny little masterpieces were engraved using the Neje B30365 optical module. It has the smallest laser spot size I've ever seen on a diode laser. a mere .02mm square!!!! This thing is so small that my laser software issued me a literal "Sanity check" window, telling me that very few lasers in the WORLD can engrave at this level of detail. I didn't expect to have as much fun as I am with this module(The least powerful of the 3 new optical modules I got) but it has been the most fun so far with my new machines!! What you see on screen took a total of around 2 hours. Detail comes at a cost, and that cost is maaajor time. I could whip these out in half the time at twice the size on my other lasers, but the detail would not compare. apologies for the ramble, these new toys are sick and I must express!!! I did not have any of my own grayscle ready images on hand, so these were the ones that were chosen. I had Dall-E create the black hole scene. The Lackadaisy pic belongs to the talented artists over on the Lackadaisy channel of course! I couldn't resist putting that little guy on my hat.. Just look at that face!(If you guys want it taken down no problem, just let me know!)

Posted using PostyBirb

4 notes

·

View notes

Video

youtube

Atomstack M150 160W 6-diode Cores Laser Module 33W Output Laser

The Atomstack M150 laser module can be installed on most engraving machine model of Atomstack 10W series (S10 Pro/A10 Pro/X7 Pro), 20W series(S20 Pro/A20 Pro/X20 Pro)just use the corresponding adapter board, and it can be used without any additional settings.

2 notes

·

View notes

Text

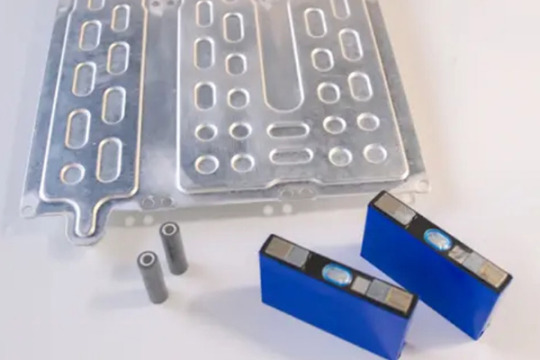

Diverse Application Scenarios of Water Cooling Plates

Water cooling plates, with their remarkable heat dissipation capabilities, have found their way into numerous application scenarios, playing an indispensable role in maintaining the optimal performance and longevity of various systems.

High-End Computing

In the realm of high-end computing, water cooling plates are a game-changer. In gaming computers and workstations equipped with powerful CPUs and GPUs, these components generate a substantial amount of heat during operation. Water cooling plates, when integrated into the cooling system, efficiently transfer the heat away from the processors. In overclocked gaming rigs, where the CPU and GPU are pushed beyond their standard operating frequencies to achieve higher performance, the heat output increases significantly. A water cooling plate ensures that these components remain at safe operating temperatures, preventing thermal throttling and enabling continuous high-performance computing. This not only enhances the gaming experience but also extends the lifespan of the expensive hardware.

Electric Vehicles (EVs)

The automotive industry, particularly the electric vehicle (EV) segment, heavily relies on water cooling plates. EV battery packs are sensitive to temperature fluctuations. If the battery temperature is too high, it can lead to a decrease in battery capacity, reduced lifespan, and even safety hazards. Water cooling plates are used to cool the battery modules by circulating coolant through channels integrated into the plates. This precise temperature control helps to maintain the battery within an ideal operating temperature range, ensuring consistent performance, maximizing the driving range, and enhancing the overall safety of the vehicle. Additionally, water cooling plates are also utilized to cool the power electronics in EVs, such as the inverters and chargers, which are crucial for the efficient operation of the vehicle's electrical system.

Data Centers

Data centers, which house thousands of servers, are another major application area for water cooling plates. As data centers handle massive amounts of data processing and storage, the servers generate a tremendous amount of heat. Traditional air-cooling methods often struggle to meet the cooling demands of high-density data centers. Water cooling plates, when applied to server racks, can significantly improve cooling efficiency. By directly cooling the server components, they reduce the overall temperature within the data center, lowering the energy consumption associated with air conditioning systems. This not only saves costs but also helps to achieve a more sustainable and environmentally friendly data center operation.

Medical Equipment

In the field of medical equipment, where precise temperature control is of utmost importance, water cooling plates are widely used. For instance, in MRI (Magnetic Resonance Imaging) machines, superconducting magnets need to be maintained at extremely low temperatures. Water cooling plates are part of the cooling system that helps to remove the heat generated by the electrical components within the MRI machine, ensuring the stability and accuracy of the magnetic field. In laser surgical equipment, water cooling plates are used to cool the laser diodes. Maintaining the proper temperature of these diodes is crucial for the consistent output power and beam quality of the laser, which directly impacts the effectiveness and safety of the surgical procedures.

Industrial Machinery

Industrial machinery also benefits from the application of water cooling plates. In manufacturing processes involving high-speed machining, welding, and forging, the tools and components can heat up rapidly. Water cooling plates attached to these tools or machine parts help to dissipate the heat, preventing thermal deformation and ensuring the precision of the manufacturing operations. This improves the quality of the products, reduces tool wear, and increases the productivity of the industrial processes.

Conclusion

In conclusion, water cooling plates have become an essential component in a wide variety of application scenarios. Their ability to provide efficient heat dissipation and precise temperature control makes them indispensable for modern technology, from computing and automotive to medical and industrial applications. As technology continues to progress, the demand for water cooling plates in these and emerging application areas is expected to keep growing.

0 notes

Text

diode laser module offering a flexible and efficient solution

A diode laser module is a type of laser that uses a semiconductor diode to emit coherent light. These modules are known for their compact size, high efficiency, and versatility, making them suitable for a wide range of applications, from industrial processing to medical treatments and scientific research .

Diode laser module are available in various configurations to meet different performance requirements. For instance, they can be designed to provide a homogenized beam for applications like semiconductor wafer defect detection and hair removal, with options for multiple wavelengths and high beam homogeneity . They can also be configured as single emitters for use in solid-state laser pumping, defense, and medical applications, offering a tuning range and multiple wavelength choices .

For applications requiring a high level of beam quality, fiber-coupled modules are available, which deliver the convenience of fiber delivery without sacrificing efficiency. These modules are used in solid-state laser pumping, materials processing, and medical therapeutics, offering a wide source selection and high brightness .

In terms of research and development, diode laser module have been crucial in areas such as spectroscopy, environmental monitoring, agriculture, atomic clocks, defense, medical science, and space research. They have been used in spectroscopic techniques across various fields of science, offering cost-effective and reliable solutions .

When it comes to practical applications, diode laser module are used in everything from laser engraving and wood sawmills to military applications and gun sights. They are available in a variety of wavelengths and power levels, with some modules offering focusable beams and others designed for specific tasks like line generation or cross-hair projection .

For those involved in scientific research or industrial applications, high-power diode laser module are available, offering high brightness, small size, and simplified thermal management. These modules are designed for reliability and can be scaled for various applications .

In summary, diode laser module offer a flexible and efficient solution for many laser-based applications, with a wide range of options available to suit different needs.

0 notes

Text

Unlocking Potential: Tailored Laser Diode Products for Advanced Applications

In the world of advanced applications, unlocking the full potential of laser diode technology is essential. That’s where tailored laser diode products come into play. These customized solutions are designed to meet the unique demands of advanced applications, offering precise performance and enhanced capabilities.

Tailored laser diode products are carefully crafted to address specific requirements and challenges. Whether it’s in the fields of research, medicine, industrial manufacturing, or beyond, these solutions are engineered to deliver optimal results. By understanding the intricacies of your application, a specialized manufacturer can develop a laser diode product that meets your exact needs.

One of the key advantages of tailored laser diode products is their ability to optimize performance. By customizing parameters such as wavelength, power output, and beam characteristics, the laser diode can be fine-tuned to match the specific requirements of your application. This ensures precise targeting, efficient energy delivery, and accurate results, enabling you to push the boundaries of what’s possible.

Furthermore, tailored laser diode products offer versatility and flexibility. They can be designed to integrate seamlessly into existing systems or workflows, making them a reliable and convenient solution for your application. Whether you require a compact form factor, specific mounting options, or compatibility with other components, the tailored design ensures a perfect fit.

Collaborating with a specialized manufacturer is crucial when seeking tailored laser diode products. These manufacturers have extensive expertise in laser diode technology and can provide valuable insights and recommendations throughout the customization process. Their in-depth knowledge allows them to optimize the product’s design, ensuring it meets your performance targets while maintaining reliability and durability.

Moreover, tailored laser diode products are built to withstand the demands of advanced applications. Robust construction, advanced thermal management, and reliable quality control measures are incorporated into the design to ensure long-lasting performance under challenging conditions. This reliability is essential for critical applications where precision and consistency are paramount.

By choosing tailored laser diode products, you unlock a world of possibilities for your advanced applications. These customized solutions provide the precision, performance, and capabilities needed to excel in your field. With the support of a specialized manufacturer, you can leverage their expertise to create a laser diode product that precisely matches your requirements and empowers you to achieve breakthrough results.

Tailored laser diode products offer a pathway to unlocking the full potential of laser diode technology in advanced applications. Through customization and collaboration with a specialized manufacturer, you can create a laser diode product that meets your specific needs. By optimizing performance, ensuring versatility, and delivering reliability, these tailored solutions open doors to new possibilities and advancements in your field.

0 notes

Text

Laser Diode Cover Glass Market : Valued at USD 156 Mn in 2025, Projected to Reach USD 234 Mn by 2025-2032

MARKET INSIGHTS

The global Laser Diode Cover Glass Market size was valued at US$ 156 million in 2024 and is projected to reach US$ 234 million by 2032, at a CAGR of 5.9% during the forecast period 2025-2032.

Laser diode cover glass is a high-precision optical component that protects laser diodes (LDs) and light emitting diodes (LEDs) while maintaining optical clarity. These components are manufactured from specialty glass materials like borosilicate or fused silica, with anti-reflective coatings to minimize light loss. They come in various geometries including square, hexagonal and custom shapes to fit different laser package configurations.

The market growth is driven by increasing adoption across industrial, medical and telecommunications applications. While industrial laser systems account for the largest application segment, medical lasers are showing the fastest growth due to rising minimally invasive surgical procedures. Furthermore, expanding 5G infrastructure deployments are creating new demand in the communication sector. Key manufacturers like Nippon Electric Glass and AGC Inc. are investing in advanced coating technologies to enhance product performance and durability.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Fiber Optic Communications Infrastructure to Boost Demand

The global fiber optics market is projected to grow at a compound annual growth rate of over 8% through 2030, directly driving demand for laser diode cover glasses which protect semiconductor lasers in optical transceivers. With hyperscale data centers requiring thousands of high-bandwidth optical modules annually, precision glass components have become critical for maintaining signal integrity. Over 70% of telecom infrastructure now utilizes laser diode-based systems, creating sustained demand for protective cover solutions.

Medical Laser Technology Advancements Creating New Applications

The medical laser market exceeded $5 billion in 2023 with applications ranging from surgical tools to diagnostic imaging. Laser diode cover glasses play an essential role in these systems by protecting sensitive emitters while maintaining optical clarity. Recent breakthroughs in minimally invasive procedures have increased adoption of laser-based medical devices, particularly in ophthalmic and dermatological applications. This expansion into healthcare segments represents significant growth potential for cover glass manufacturers.

Furthermore, technological advancements in industrial lasers for material processing are fueling demand. Fiber lasers now account for over 60% of the industrial laser market, each requiring multiple protective optical components. The shift toward higher-power laser systems necessitates more durable cover glass solutions capable of withstanding intense operational environments.

MARKET RESTRAINTS

Precision Manufacturing Requirements Limit Production Scalability

Laser diode cover glasses require micron-level precision in thickness and surface quality, with typical flatness tolerances below 0.1 microns. Maintaining these specifications across high-volume production runs presents significant technical challenges. Yield losses in precision glass machining can exceed 30% for complex geometries, directly impacting manufacturing costs. These production constraints make rapid capacity expansion difficult when facing sudden demand surges.

Additionally, the specialized polishing and coating processes require expensive capital equipment with long lead times. A single advanced polishing machine can cost over $2 million, creating substantial barriers to entry for new market participants. The industry-wide shortage of skilled optical technicians further compounds these production challenges.

MARKET CHALLENGES

Material Limitations Constrain Performance Enhancements

While conventional borosilicate glass dominates the market, its thermal and mechanical properties limit performance in next-generation laser applications. High-power laser systems generate substantial heat that can cause glass deformation, with thermal expansion coefficients typically exceeding 3.2 × 10-6/°C. Developing alternative materials with improved stability remains technically challenging, particularly for ultraviolet laser applications where transmission efficiency must exceed 99%.

Other Challenges

Supply Chain Vulnerabilities The industry relies heavily on specialized glass raw materials with limited global suppliers. Supply disruptions can cause production delays of several months, particularly for low-iron glass formulations required for high-transmission applications.

Miniaturization Demands The trend toward smaller optoelectronic packages requires cover glasses below 0.5mm thickness while maintaining mechanical strength, creating new engineering challenges for material scientists.

MARKET OPPORTUNITIES

Emerging Photonic Integrated Circuits Creating New Application Spaces

The photonic IC market is forecast to grow at 20% annually, representing a significant opportunity for laser diode cover glass suppliers. These advanced chips require specialized optical interfaces where miniature cover glasses serve critical protective functions. Over 60% of new optical communication modules now incorporate some form of photonic integration, driving demand for application-specific glass solutions.

Additionally, the automotive LiDAR market presents substantial growth potential. Each autonomous vehicle system requires multiple laser modules with protective optics, potentially creating demand for hundreds of millions of precision cover glasses annually as adoption accelerates. Leading manufacturers are already developing ruggedized glass formulations specifically for automotive environmental conditions.

LASER DIODE COVER GLASS MARKET TRENDS

Rising Demand for High-Precision Optical Components Drives Market Growth

Laser Diode Cover Glass Market size was valued at US$ 156 million in 2024 and is projected to reach US$ 234 million by 2032, at a CAGR of 5.9%. This surge is primarily driven by the increasing adoption of laser diodes in industrial, medical, and communication applications. Laser diode cover glasses play a crucial role in protecting sensitive components from environmental damage while maintaining optical clarity. The demand is particularly high in sectors requiring precision optics, such as semiconductor manufacturing and medical lasers, where even minor imperfections can significantly impact performance. Furthermore, advancements in glass manufacturing technologies have led to improved durability and optical transmission rates, further fueling market expansion.

Other Trends

Expansion in Industrial and Medical Applications

Industrial applications, including material processing and laser cutting, account for over 40% of the market share. The medical sector is also emerging as a key growth area, with laser diode cover glasses being extensively used in surgical lasers, dermatology treatments, and diagnostic equipment. The shift toward minimally invasive procedures has further propelled demand for high-quality optical components. Meanwhile, the communication sector is leveraging laser diode technology for high-speed data transmission, particularly in fiber-optic networks, contributing to the increasing deployment of cover glasses in telecom equipment.

Technological Innovations and Material Advancements

Recent advancements in glass fabrication techniques, such as ultra-thin coating processes and anti-reflective treatments, have significantly enhanced the performance of laser diode cover glasses. Manufacturers are increasingly focusing on producing cover glasses with superior thermal stability and resistance to mechanical stress. Additionally, the development of customizable shapes, including hexagon and square variants, has allowed for better integration into compact electronic devices. Leading companies like Nippon Electric Glass and AGC Inc. are investing in R&D to introduce next-generation cover glasses that cater to emerging applications in autonomous vehicles and LiDAR systems. Collaboration between optical component suppliers and end-user industries is expected to drive further innovation.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Precision Drive Competition in Laser Diode Cover Glass Market

The global laser diode cover glass market features a mix of established glass manufacturers and specialized optoelectronics companies competing for market share. Nippon Electric Glass currently leads the market with approximately 22% revenue share in 2024, owing to its advanced manufacturing capabilities and extensive distribution network across Asia and North America. The company’s continuous investment in R&D has enabled it to maintain technological leadership in precision glass components.

AGC Inc. and MSG Lithoglas GmbH together account for nearly 30% of the market, leveraging their expertise in glass engineering and strong relationships with industrial laser manufacturers. Their growth is driven by increasing demand from the automotive and medical sectors where high-purity cover glass is essential for laser reliability.

Emerging players like Jilin Henghua Optoelectric are gaining traction through competitive pricing and customized solutions, particularly in the Chinese market which is projected to grow at 7.5% CAGR through 2032. While these companies currently hold smaller shares, their focus on regional needs and faster innovation cycles position them for significant growth.

Meanwhile, IPG Photonics and Newport Corporation are strengthening their positions through vertical integration, combining cover glass production with laser diode assembly. This strategic approach not only ensures quality control but also creates new revenue streams in the value chain.

List of Key Laser Diode Cover Glass Manufacturers

Nippon Electric Glass (Japan)

AGC Inc. (Japan)

MSG Lithoglas GmbH (Germany)

IPG Photonics (U.S.)

Newport Corporation (U.S.)

Haas Laser Technologies (Germany)

Jilin Henghua Optoelectric (China)

Segment Analysis:

By Type

Square Segment Leads Market Share Owing to Widespread Use in Industrial Laser Applications

The laser diode cover glass market is segmented based on type into:

Square

Hexagon

Others

By Application

Industrial Applications Dominate Due to Growing Automation and Material Processing Needs

The market is segmented based on application into:

Industrial

Medical

Communication

Others

By Material Composition

ABC-G Glass Maintains Market Leadership for Superior Optical Properties

The market is segmented based on material composition into:

ABC-G (High-quality precision glass)

Fused silica

Borosilicate

Sapphire

By Coating Type

Anti-Reflective Coatings Gain Prominence for Enhanced Optical Performance

The market is segmented based on coating type into:

Anti-reflective coated

Uncoated

UV-enhanced coated

IR-optimized coated

Regional Analysis: Laser Diode Cover Glass Market

North America The North American market for laser diode cover glass is driven by strong demand from the medical and industrial sectors, coupled with significant investments in advanced manufacturing technologies. The U.S., which accounts for a substantial portion of the regional market, benefits from robust R&D activities in photonics and semiconductor industries. Major companies like IPG Photonics and Newport have established strong footholds here, contributing to innovations in high-performance cover glass solutions. While stringent environmental regulations affect production processes, they also push manufacturers to develop more sustainable materials without compromising optical performance. The adoption of laser diodes in automation and defense applications further fuels regional growth.

Europe Europe’s market is characterized by stringent quality standards and a focus on precision engineering, particularly in Germany and France. The region benefits from well-established automotive and medical device industries that extensively use laser diodes for cutting-edge applications. EU regulations on material safety and recycling influence product development, with manufacturers focusing on lead-free and chemically stable glass compositions. Collaborations between research institutions and industry players accelerate technological advancements, though higher production costs compared to Asian counterparts remain a challenge. The growing emphasis on fiber-optic communication networks also creates sustained demand for high-grade cover glass components.

Asia-Pacific As the largest and fastest-growing regional market, Asia-Pacific dominates laser diode cover glass production and consumption. China leads in both manufacturing capacity and technological adoption, supported by government initiatives in photonics and 5G infrastructure development. Japan’s expertise in precision glass manufacturing contributes significantly to the high-end segment, while emerging economies like India show increasing demand for cost-effective solutions. The region benefits from strong electronics supply chains, though price competition among local manufacturers sometimes affects quality standards. With expanding applications in consumer electronics and industrial automation, Asia-Pacific remains the growth engine of the global market.

South America The South American market is in a developmental phase, with Brazil showing the most promising growth in medical and industrial laser applications. While the region currently imports a significant portion of its high-performance cover glass, local manufacturing capabilities are gradually improving through technology transfers and joint ventures. Economic instability sometimes disrupts supply chains, limiting large-scale investments in advanced production facilities. However, the growing adoption of laser-based manufacturing processes in the automotive and mining sectors presents opportunities for market expansion. The lack of standardized quality controls remains a key challenge compared to more developed markets.

Middle East & Africa This region represents an emerging market with growing potential, particularly in telecommunications and oil/gas applications requiring durable laser components. While Israel has developed niche capabilities in defense-related photonics, the broader region still lacks comprehensive manufacturing infrastructure. The adoption of laser technologies in medical applications shows steady growth, supported by healthcare modernization programs. Investments in smart city projects across GCC countries are expected to drive future demand, though current market size remains limited compared to other regions. The absence of local specialty glass production means most cover glass is currently imported from Asia and Europe.

Report Scope

This market research report provides a comprehensive analysis of the Global and regional Laser Diode Cover Glass markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Laser Diode Cover Glass market was valued at USD 98.5 million in 2024 and is projected to reach USD 142.3 million by 2032.

Segmentation Analysis: Detailed breakdown by product type (Square, Hexagon, Others), application (Industrial, Medical, Communication, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The U.S. market size is estimated at USD 32.1 million in 2024, while China is projected to reach USD 28.7 million.

Competitive Landscape: Profiles of leading market participants including Nippon Electric Glass, MSG Lithoglas GmbH, AGC Inc, IPG Photonics, Newport, Haas Laser Technologies, and Jilin Henghua Optoelectric, covering their product offerings, R&D focus, and strategic developments.

Technology Trends & Innovation: Assessment of emerging fabrication techniques, material advancements, and evolving industry standards in precision glass manufacturing.

Market Drivers & Restraints: Evaluation of factors driving market growth including increasing demand for laser diodes in industrial applications, along with challenges such as raw material price volatility.

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities in optoelectronic components.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

Quantum LiDAR Improves Sensor Remote And Noise Rejection

Quantum LiDAR

Light identification and Ranging (LiDAR), a vital remote sensing technology, is poised for a major transformation thanks to cutting-edge quantum-enhanced and quantum-inspired research. Ground surveys, sea level monitoring, and autonomous vehicle navigation require LiDAR. It creates a 3D image by shining laser light on an object and measuring the reflected light.

Traditional LiDAR systems have many limitations, especially in tough settings. In poor light, weak signals, or considerable background noise from purposeful jamming or the environment, LiDAR has classic issues. Inability to distinguish signal and noise photons lowers SNR, making target identification impossible. Classic rangefinding methods sometimes require temporal alteration of the light source, which reduces covertness and makes the system vulnerable to jamming or spoofing by uncooperative targets.

Overcoming Noise and Jamming with Quantum-Enhanced LiDAR

Recent findings show how quantum principles can fix these weaknesses, particularly by exploiting photon pairs’ large temporal correlations. A quantum-enhanced LiDAR system was created by Strathclyde University academics M. P. Mrozowski, R. J. Murchie, J. Jeffers, and J. D. Pritchard. Even with high, time-varying classical noise, our system can identify and rangefind targets.

Their 2024 Optics Express study shows that they can detect targets with reflectivities as low as -52 dB and operate with a signal-to-background separation of more than five orders of magnitude.

A 405 nm pump laser on a ppKTP crystal generates heralded photon pairs by spontaneous parametric down-conversion (SPDC) in the Strathclyde system. Utilising these photon pairs’ high temporal correlations is a major advance. One photon (the “idler”) is detected locally, and its counterpart (the “signal”) explores the target.

Concurrent detection, in which a signal photon is reported only when its idler counterpart is detected, can reduce background counts and boost SNR. This technology makes it harder to spoof or intercept by allowing distance information to be extracted from the temporal delay at which a correlation is recognised without laser temporal modulation.

This quantum-enhanced approach improves performance. With 17 times faster target identification and a comparable error rate, it improved SNR by 30 dB over traditional lighting. Most notably, the system survived sluggish, high-frequency classical jamming. The system naturally resisted fast noise, but a new dynamic background tracking strategy that used a pre-calculated look-up table based on raw signal data protected it from moderate background oscillations.

Strathclyde exhibited moving target discrimination for rangefinding with a spatial resolution of 11 cm, but timing jitter from room-temperature single-photon avalanche diodes (SPADs) was the key restriction. Future integration with superconducting nanowire detectors may reduce timing uncertainty, despite SPAD resolution limitations. By making CW sources look as dim thermal sources, they limit spoofing and increase illumination covertness.

Millimetre-Level Precision Driven by Quantums

The University of Bristol Quantum Engineering Technology Labs have also developed “entanglement-inspired frequency-agile rangefinding” as a promising option. Weijie Nie, Peide Zhang, Alex McMillan, Alex S. Clark, and John G. Rarity created coupled photons using a classical laser to replicate quantum entanglement’s noise robustness. This technology overcomes genuine quantum computing’s brightness limits to attain a brightness more than six orders of magnitude higher than typical quantum sources.

Despite challenging daylight conditions, the Bristol system achieved 0.1 mm precision over 150 meters with 48 µW optical power and 100 millisecond integration time. This millimeter-level accuracy held through changing weather and solar backdrops. The new system architecture includes a frequency-agile pseudo-random generator to finely manipulate photon characteristics via fibre chromatic dispersion and pulse carving. Operating at modest transmission power improves its long-term usefulness and real-world deployment.

Statistical Advantage: Log-Likelihood Framework

Advanced statistical analysis benefits quantum-inspired and quantum-enhanced approaches. Strathclyde uses log-likelihood value (LLV) rangefinding and target recognition. This method determines if statistics support hypothesis 1 or 0. Higher target presence is observed at Λ>0, the LLV’s self-calibrating threshold (Λ=0). This method works well when the signal-to-noise ratio is low and standard methods fail.

The LLV framework may analyse data from several detector channels, including noncoincidence click information that present procedures miss, to improve state discrimination. This dependable statistical technique shows that quantum-enhanced systems outperform classical systems in high background-noise and low signal strength environments. Under the same conditions, the quantum-enhanced system had a peak distinguishability of 0.995, compared to 0.63 for the classical system.

Future View

These findings show that quantum correlations can enable lower light levels, faster detection, and more complex LiDAR applications that demand security and performance. Hybrid quantum-classical systems can increase performance and air turbulence resilience with these technologies.

LiDAR technology has advanced significantly and could improve situational awareness and enable more reliable autonomous systems in difficult real-world scenarios due to the inherent covertness of CW quantum-enhanced sources and the ability to confidently detect and rangefind in previously unmanageable noise conditions

#QuantumLiDAR#LiDAR#quantumcomputing#loglikelihoodvalue#LLVframework#News#Technews#Technology#TechnologyNews#Technologytrends#Govindhtech

0 notes

Text

Extend Component Life: How Laser Cladding is Revolutionizing Industries

Laser Cladding Market Growth & Trends

The global Laser Cladding Market size is projected to reach an impressive USD 1,042.1 million by 2030. This growth is anticipated at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030, as detailed in a new report by Grand View Research, Inc.

The increasing focus on lightweight materials and advanced engineering solutions across vital industries such as aerospace and automotive has significantly bolstered the demand for laser cladding. This technology is crucial for a range of applications, from repairing and refurbishing worn-out components to adding specialized functional coatings for purposes like creating thermal barriers or enhancing electrical conductivity.

Advancements in Laser Technology Fueling Expansion

Ongoing advancements in laser technology are a primary driver of market growth. These innovations include the development of higher power lasers, improved beam delivery systems, and enhanced process monitoring and control capabilities. Such technological progress has broadened the spectrum of materials that can be effectively processed and increased the complexity of geometries that can be coated. This, in turn, has expanded the potential applications of laser cladding, accelerating its adoption across a diverse array of industries.

Enhancing Infrastructure Lifespan and Operational Efficiency

Laser cladding plays a critical role in extending the lifespan of essential infrastructure and equipment in sectors such as energy, mining, and heavy machinery. By applying robust protective coatings to vulnerable areas prone to wear, corrosion, or erosion, laser cladding helps mitigate operational risks, minimize downtime, and significantly enhance asset reliability. This translates into substantial cost savings and improved operational efficiencies for asset-intensive industries.

Market Structure: Consolidation and Vertical Integration

The laser cladding market demonstrates a degree of consolidation and vertical integration, particularly among larger players with extensive capabilities and global reach. Equipment manufacturers in this sector often provide a comprehensive suite of solutions to their customers, which may include material supply, engineering services, and aftermarket support. This strategic integration helps streamline the supply chain, enhance customer service, and allows companies to capture a larger share of the overall value chain.

Curious about the Laser Cladding Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Laser Cladding Market Report Highlights

Based on type, the diode lasers segment led the market with the largest revenue share of 43% in 2023. The adoption of diode lasers is driven by their flexibility in beam shaping and modulation, enabling fine-tuning of process parameters to achieve desired coating properties

Based on type, the fiber lasers segment is expected to grow at a significant CAGR over the forecast period, due to their superior beam quality, high power density, and reliability. Fiber lasers utilize optical fibers as the gain medium, offering excellent beam stability and delivery characteristics

Based on material, the cobal based alloys segment led the market with the largest revenue share of 35% in 2023, due to their excellent wear resistance, corrosion resistance, and high-temperature strength. These alloys are widely used in applications such as aerospace, oil and gas, and power generation industries

Based on end-use, the aerospace and defense segment led the market with a revenue share of 31% in 2023. The aerospace and defense sector represents a significant end-user segment for global market. Laser cladding is used for repairing and enhancing critical components such as turbine blades, engine parts, and aircraft structures

Asia Pacific led the market in 2023, owing to expanding manufacturing sectors and increasing investments in infrastructure and technology driving the demand for laser cladding solutions

Laser Cladding Market Segmentation

Grand View Research has segmented the global laser cladding market report based on type, material, end-use, and region:

Laser Cladding Type Outlook (Revenue, USD Million, 2018 - 2030)

Diode Lasers

Fiber Lasers

CO2 Lasers

YAG Lasers

Laser Cladding Material Outlook (Revenue, USD Million, 2018 - 2030)

Cobalt Based Alloys

Nickel Based Alloys

Iron Based Alloys

Carbide & Carbide Blends

Others

Laser Cladding End-use Outlook (Revenue, USD Million, 2018 - 2030)

Aerospace & Defense

Oil & gas

Automotive

Power Generation

Medical

Others

Download your FREE sample PDF copy of the Laser Cladding Market today and explore key data and trends.

0 notes

Text

Understanding Optical Transceivers 🌐💡

Have you ever wondered how data travels at lightning speed across fiber-optic networks? The secret lies in the optical transceiver, a tiny yet powerful module that converts electrical signals into light pulses—and back again. Here’s what you need to know:

📌 What Is a Transceiver? A transceiver combines a transmitter and a receiver in one compact unit. In fiber-optic systems, it’s called an optical transceiver, and it handles both sending and receiving data over glass fibers.

📌 Key Components: • Laser Transmitter: Generates light pulses (via VCSEL, DFB, or EML laser diodes) • Photodiode Receiver: Detects incoming light and converts it back to electrical signals • Control Electronics & Housing: Encodes/decodes data and protects sensitive parts

📌 Where Are They Used? Optical transceivers power our modern networks—found in data-center switches, enterprise routers, telecom backbones, and even storage networks. Without them, long-distance, high-bandwidth communication simply wouldn’t be possible.

Next time you stream a video or upload photos, remember: an optical transceiver is working behind the scenes to keep your connection speedy and reliable! 🚀✨

1 note

·

View note

Text

0 notes

Text

Liquid Cooling Plates: Versatile Thermal Management Across Industries

Liquid cooling plates have become essential across numerous industries, thanks to their superior heat dissipation capabilities. They address the increasingly demanding thermal management requirements of modern technologies, ensuring both performance and reliability.

Electronics Industry: Enabling High-Performance Computing

In the electronics sector, liquid cooling plates are transforming thermal management—especially in high-performance computing. Data centers, filled with thousands of servers running CPUs, GPUs, and other critical components, generate vast amounts of heat. By being mounted directly on these heat-intensive components, liquid cooling plates efficiently draw heat away, preventing overheating-related slowdowns or system failures. This allows servers to maintain peak performance, essential for applications like cloud computing, big data analytics, and online gaming.

Enthusiasts and professionals using high-performance personal computers also rely on liquid cooling plates—especially when overclocking processors or utilizing high-end graphics cards. During tasks like 3D rendering or immersive gaming, these components can produce intense heat. Integrated with liquid cooling loops, the plates help maintain safe operating temperatures, enhancing both system performance and component longevity.

Automotive Industry: Supporting the EV Revolution

In the automotive world—particularly the rapidly growing electric vehicle (EV) market—liquid cooling plates play a critical role. EV battery packs generate significant heat during both charging and discharging. To ensure optimal performance, safety, and extended battery life, liquid cooling plates are embedded within the battery design, often wrapping around cells or modules. This is particularly crucial during fast-charging, where high current leads to rapid heat buildup. Liquid cooling plates mitigate this by maintaining a stable temperature, thereby improving charging efficiency and preventing thermal runaway—an uncontrolled and potentially dangerous overheating scenario.

Beyond batteries, EV drivetrain components like electric motors and power electronics also benefit from liquid cooling. These systems operate under high loads, and effective cooling helps sustain efficiency, reliability, and overall vehicle range.

Renewable Energy Systems: Enhancing System Efficiency

Liquid cooling plates are also integral to renewable energy technologies. In solar power systems, power conversion units like inverters convert direct current (DC) from solar panels into alternating current (AC) for grid use. These inverters generate substantial heat, and liquid cooling plates help manage it effectively, ensuring continuous and efficient operation. Stable inverter performance translates into more reliable energy output and improved system efficiency.

In wind turbines, control units and power electronics are exposed to harsh environmental conditions while generating heat during operation. Liquid cooling plates protect these sensitive components by maintaining safe operating temperatures, thus ensuring reliable turbine performance even in extreme climates.

Industrial Applications: Boosting Equipment Reliability

Industrial environments host a wide array of high-power equipment where precise thermal control is vital. High-power lasers used in applications such as cutting, welding, and engraving produce significant heat. Liquid cooling plates are used to cool laser diodes and essential optics, maintaining precision and consistent output—critical for quality-driven manufacturing.

Similarly, industrial power inverters, responsible for converting DC to AC in large-scale power systems, depend on liquid cooling to manage heat from high-power handling. Furthermore, in high-speed machining or heavy-duty manufacturing operations, liquid cooling plates are used in motors, spindles, and bearings to reduce friction, wear, and heat-induced degradation—ultimately improving productivity and equipment lifespan.

Conclusion: A Growing Role in Advanced Thermal Management

From electronics and automotive to renewable energy and industrial machinery, liquid cooling plates have established themselves as a foundational solution for advanced thermal management. As technologies become more powerful and compact, and the demand for efficient heat dissipation rises, the role of liquid cooling plates will continue to expand—driving innovation, performance, and safety across diverse sectors.

0 notes

Text

Solid State Cooling Market to Hit USD 1.7 Billion by 2034

The global solid state cooling market, valued at USD 780.0 million in 2023, is poised for substantial growth, projected to reach USD 1.7 billion by the end of 2034, expanding at a compound annual growth rate (CAGR) of 7.3% between 2024 and 2034. This expansion is driven by the increasing demand for energy-efficient semiconductor refrigeration solutions and the rising adoption of thermoelectric cooling technologies across diverse end-use industries, including electronics, automotive, aerospace, and healthcare. Solid state cooling, also known as thermoelectric cooling (TEC), leverages the Peltier effect in semiconductor materials to transfer heat without the need for moving parts or refrigerants, offering reliability, silent operation, and precise temperature control.

Market Drivers & Trends

Energy Efficiency Imperative Traditional cooling systems rely on mechanical compression and refrigerants, contributing to high energy consumption and environmental concerns. Thermoelectric modules, built from semiconductor materials, convert electrical energy directly into a cooling effect with no moving parts, reducing operational costs and carbon footprint.

Miniaturization of Electronics The proliferation of compact consumer electronics and high-performance computing devices has driven the need for cooling solutions that fit confined spaces while delivering high heat flux removal. Solid state cooling modules excel in cooling CPUs, GPUs, and laser diodes without the bulk of vapor-compression systems.

Noise-Sensitive Environments Solid state cooling systems offer virtually silent operation, making them ideal for medical laboratories, neonatal incubators, and scientific instruments where noise reduction is paramount.

Regulatory and Environmental Pressures Stricter regulations on greenhouse gas emissions and the phase-out of harmful refrigerants under global environmental agreements have accelerated the transition to solid state cooling technologies.

Latest Market Trends

Advanced Thermoelectric Cooler Designs Leading players are introducing multistage and micro-scale thermoelectric coolers that deliver higher temperature differentials and improved coefficient of performance (COP).

Integrated Thermal Management Services Thermal design simulation services are gaining traction, enabling manufacturers to predict system-level thermal behavior and optimize module placement within electronic assemblies.

Hybrid Cooling Solutions Research into hybrid systems that combine thermoelectric modules with conventional cooling techniques (e.g., liquid cooling) is underway to achieve unprecedented thermal performance for extreme applications.

Sustainable Material Development Efforts to develop novel thermoelectric materials—such as skutterudites, half-Heusler alloys, and organometallic compounds—are focused on boosting electrical conductivity while minimizing thermal conductivity.

Key Players and Industry Leaders The competitive landscape includes both established semiconductor and thermal management specialists as well as emerging innovators:

Ferrotec Holdings Corporation

Te Technology, Inc.

Align Sourcing LLC

Ams Technologies Ag

Coherent Corp.

Crystal Ltd.

Delta Electronics, Inc.

EVERREDtronics

Komatsu

Laird Thermal Systems, Inc.

MERIT TECHNOLOGY GROUP

Phononic

Solid State Cooling Systems

TEC Microsystems GmbH

Thermonamic Electronics (Jiangxi) Corp., Ltd.

These companies are investing in R&D to enhance the performance-to-size ratio of their modules and to broaden their product portfolios to address telecom, medical, aerospace, and automotive cooling needs. Their strategies include strategic partnerships, licensing of advanced materials, and geographic expansion to tap into high-growth markets.

Get a concise overview of key insights from our Report in this sample -

Recent Developments

June 2023: Laird Thermal Systems launched the OptoTEC MSX Series of micro multistage thermoelectric coolers, optimized for integration into optical packages (TO-39, TO-46, TO-8) to support precise temperature control in photonic devices.

April 2023: Laird Thermal Systems expanded its micro-TEC offerings with the OptoTEC MBX Series, featuring footprints as small as 1.6 × 1.6 mm and thicknesses down to 0.65 mm—ideal for space-constrained, high-temperature applications.

March 2024: Solid State Cooling Systems introduced the ThermoCube II line of recirculating chillers, delivering ±0.05 °C temperature precision in 200–500 W models. These units eschew compressors and harmful refrigerants, underscoring the market’s pivot toward sustainable cooling solutions.

Market Opportunities

Data Center Thermal Management As hyperscale data centers proliferate, the need for energy-efficient, modular cooling systems presents a lucrative opportunity for TEC-based solutions that can adapt to dynamic server loads.

Electric Vehicle (EV) Battery Cooling Battery thermal management is critical for EV performance and safety. Solid state cooling modules offer compact, localized cooling that can prolong battery life and mitigate thermal runaway risks.

Medical Transport and Storage Portable, silent, and reliable cooling is essential for transporting vaccines, biologics, and diagnostic reagents. TEC devices enable precise temperature control without bulky compressors.

Wearable and Implantable Devices Emerging applications in personal cooling and wearable health monitors will benefit from solid state cooling’s low-profile form factors and low power consumption.

Future Outlook Over the next decade, solid state cooling is expected to permeate new application domains, driven by:

R&D in High-zT Materials Significant investments in materials science will aim to increase the dimensionless figure of merit (zT), enabling modules with COPs that rival mechanical systems.

Cost Reductions through Scale As semiconductor manufacturing techniques evolve, the cost per watt of TEC modules is projected to decline, broadening adoption across price-sensitive consumer markets.

Integration with IoT and Control Systems Smart cooling solutions, featuring real-time temperature monitoring and adaptive control algorithms, will optimize energy usage and performance in complex systems.

Market Segmentation

By Type

Single-stage

Multi-stage

By Technology

Thermoelectric

Electrocaloric

Magnetocaloric

Others (Elastocaloric, Barocaloric, etc.)

By Application

Telecom Devices

Refrigerators

Battery Thermal Management

Heated & Cooled Vehicle Seats

Industrial Equipment

Air Conditioners

Chillers

Others (Laboratory & Scientific Equipment, Thermal Therapy Devices)

By End-use Industry

Automotive

Food & Beverages

Aerospace & Defense

Semiconductor & Electronics

IT & Telecommunications

Industrial

Others (Healthcare, Research & Academia)

Regional Insights

Asia Pacific emerged as the largest regional market in 2023, driven by rapid industrialization, growing data center investments, and heightened focus on green technologies. Strong demand in countries such as China, Japan, South Korea, and India is anchored by the electronics manufacturing boom and expanding healthcare infrastructure.

North America and Europe follow closely, with increasing adoption in automotive thermal management and medical device cooling. Government incentives to phase out hydrofluorocarbon (HFC) refrigerants are catalyzing market growth.

South America, Middle East & Africa present nascent but promising opportunities, particularly in telecommunications, defense, and mining equipment cooling.

Why Buy This Report? This comprehensive report offers:

In-depth Market Analysis: Detailed insights into growth drivers, restraints, and emerging trends across technologies and applications.

Quantitative Forecasts: Market size projections (2024–2034) segmented by region, technology, and end use, enabling strategic planning and investment decisions.

Competitive Landscape: Profiles of 15+ leading companies, covering product portfolios, business strategies, financial performance, and recent developments.

Customization Options: Electronic (PDF) and Excel formats facilitate data extraction and modeling for bespoke analysis.

Strategic Recommendations: Actionable guidance based on Porter’s Five Forces, value chain analysis, and gap assessments to help stakeholders capture growth opportunities.

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes