#employment law

Text

What to do when something illegal happens at work

When your boss does something illegal at work, it's common to freeze up because you're not sure what to do. Here are a few tips for how to handle those situations during and after:

While it is happening:

Keep yourself safe. In the moment, your first priority is always to keep yourself and others from physical harm and out of danger as much as possible. If any other advice I give you conflicts with that, your safety takes priority.

Make sure you know where you are. If you think your safety might be at risk, getting your bearings can be critically important. Take note of potential exit routes, hazards, the flow of traffic (both vehicle and foot traffic), cameras, and any safe areas you know of. Later, knowledge of your exact location may be very important in reconstructing events.

Check the time. Knowing exactly when something happened, and how long it took, will be extremely valuable.

Look around for witnesses, and try to bring some over if possible. Witnesses will both reduce the likelihood of more outrageous behavior and help you to take action afterwards. Do your best to remember who was there.

Say "please let me finish" every time you're interrupted, and count the number of times it happened. Bullies love to interrupt people at the first sign of disagreement, and then later they'll claim that nobody disagreed with them when instead nobody could get in a word edgewise. Saying "please let me finish" calls out the fact that they were interrupting, and a count of the times you were interrupted will help you protect yourself from being misinterpreted later.

Avoid agreeing to anything or signing anything if possible. You have the right to review any document that you're asked to sign, which usually includes taking the document and having it examined by an attorney. If you're being threatened with serious consequences if you don't sign immediately, write "signed under duress". If they're asking for a verbal agreement, try to get them to accept a "let me think about it/check my to-do list/etc" rather than a hard "yes". Even if the thing you'd be agreeing to is something you're okay with, it's still important not to agree to things when you don't feel like you're allowed to say "no"; in stressful situations, our judgment can be seriously compromised, and allowing yourself to be bullied into saying "yes" will set a bad precedent for further interactions.

After it's over, as soon as you're in a safe place:

Complete the WTWFU checklist

Send a follow-up email summarizing your understanding of what was communicated. It can be as simple as "just to ensure we understood each other, what I got was that you were telling me/us that [we'll be disciplined if we discuss our wages/contacting a union is a fireable offense/our pay will be docked if anyone submits a complaint to OSHA/etc], is that correct?". If there is information that protects you, such as a health condition or pregnancy you need accommodation for or a prior agreement that is being violated, include it in your email even if the company already knows. CC HR and any coworkers who were present and BCC your personal email*. Forward any responses to your personal email as well*.

Rescind any agreements you made. Either in the same email as step #2 or in a separate email, depending on what you think is appropriate, say "I didn't feel like I could safely say 'no' in that situation, so I'd like to rescind my earlier agreement until I've had some time to reconsider." If it's something you think you'd have otherwise agreed to, try to offer a time frame for an actual decision. CC HR and BCC your personal email*.

Collect any evidence you can, and make note of any evidence that exists but isn't accessible to you. This includes emails about the issue, any photos that were already taken or that you can safely and legally take,

If something illegal was done or hinted at, contact the applicable regulatory agency as soon as possible with all of the information above.

Consider arranging a consult with an employment law attorney -- consults aren't the same as retainers, they're considerably cheaper (or sometimes free, depending on your income and the possibility of a lawsuit) and can either turn into ongoing representation or just be a one-time service.

* Don't include information that you have a legitimate duty to safeguard, such as customer data, protected health information, or non-public market-affecting information. This does not include any information pertaining to working conditions, your compensation, regulatory compliance, or workplace safety -- the company isn't allowed to demand that you keep those a secret. Either try to get the point across without including the specific information that's being safeguarded, or censor it by replacing it with two underscores per replacement with generic descreptors as necessary (i.e. 'I have safety concerns about the release of our secret robotics project on January 10' becomes 'I have safety concerns about the release of our __[project]__ on __[date]__').

35 notes

·

View notes

Text

https://vt.tiktok.com/ZSRvVv8c4/

#elon musk#twitter#chief twit#employment law#uk#uk employment law#uk law#law#redundancies#elon done fucked up

187 notes

·

View notes

Text

Work Expenses: Who Pays?

There are all sorts of work-related expenses out there that an employee might have to face, from the cost of their work uniform to the cost of cleaning their work uniform to bills for the cell phone they use for work calls to the cost of that laptop used for working from home.

The question is, under the law, when is the employer mandated to pay for such expenses, rather than leaving them to the individual employee to bear?

Summary: Under federal law, the only requirement is that expenses not bring employees' pay under minimum wage.

California and Illinois say the employer must cover "necessary expenditures and losses" including remote work equipment.

Montana, North Dakota, and South Dakota also say the employer must cover all the employee "expends or loses" due to work.

Washington D.C. says the employer must pay for required tools.

Iowa, New York, and New Hampshire require that the expenses be "authorized" by the employer or that employer and employee have an "agreement" beforehand for the employer to be liable for the costs. Iowa says such costs must be reimbursed within 30 days.

Minnesota requires that employee-paid work expenses be limited to $50 a month, and that the employer reimburse such costs at the end of the employee's employment.

Massachusetts requires that employers pay transportation expenses and the cost of uniforms specifically.

Federal law says only that if the employee's paying for expenses, that can't be used to effectively bring their wages below minimum wage level. So, if you're making minimum wage at a McDonald's, your employer can't then take the price of your work uniform out of your first paycheck, because then you'd effectively be making less than minimum wage.

This doesn't just apply to expenses directly paid to the employer, either; the statute specifically says that if the employee is required to buy their own tools required for a job, they have to be reimbursed if that would mean their pay going below minimum wage after deducting the cost of the tools from their pay.

But this only comes into play in connection to minimum wage. If your pay is high enough that your work expenses would still leave you above minimum wage, federal law doesn't say anything else making your employer liable for the cost.

But that's federal law. US law in general, and especially labor law, often has more specific restrictions within certain states, and this is no exception.

California law says that the employer has to pay for "all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties". In other words, if it's necessary for the job, under California law, the employer should be footing the bill. What counts as a "necessary expenditure or loss"? Excellent question. No definition is given for this in the statute, so it's all open for debate... though a recent court case suggests it includes remote working equipment, including for jobs that are normally in-person but went to remote work during the lockdown.

Illinois state law uses similar wording, with the employer paying for "all necessary expenditures or losses incurred by the employee within the employee's scope of employment and directly related to services performed for the employer." Illinois' statute does actually give a bit more definition to what counts as "necessary" here, however, and a 2023 amendment included specific factors to weigh when determining whether an expense is "necessary" and therefore should be paid by the employer. Like California, Illinois has specified that remote work equipment counts here.

Montana is similar as well, using the wording "all that he necessarily expends or loses in direct consequence of the discharge of his duties", as long as it's not "in consequence of the ordinary risks of the business in which he is employed." North Dakota's wording is nearly identical, with "all that the employee necessarily expends or loses in direct consequence of the discharge of the employee's duties as such" unless it's tools or equipment "also used by the employee outside the scope of employment". South Dakota also has similar wording, "all that the employee necessarily expends or loses in direct consequence of the discharge of the employee's duties".

Washington, D.C. law has the employer paying "the cost of purchasing and maintaining any tools required of the employee in the performance of the business of the employer."

Iowa's version is stricter, saying that the expense must be "authorized by the employer", but also sets a timetable, saying that such expenses must be reimbursed within thirty days' time. Similarly, New York says that the issue arises after there is an "agreement" between employer and employee about the expenses, and New Hampshire says that it must be "at the request of the employer".

Minnesota's got a different take on it--employers can make employees foot the bill, but once the employment ends, the employer has to pay the employee back for uniforms, equipment, supplies, and travel expenses that aren't just regular commuting. Also the initial out-of-pocket cost to the employee for such things can't be more than $50 a month. Although there's some weird exceptions and additional specifics for employees of motor vehicle dealers...

Massachusetts law specifically requires payment of "transportation expenses" and uniforms by the employer, with a definition given for what does and does not count as a uniform. The cost of uniform cleaning is covered if it requires "dry-cleaning, commercial laundering, or other special treatment".

Note that this is all assuming the employee would pay directly; laws vary somewhat if it is instead the employee charging (real, believed, and/or fraudulent) work expenses to a company card or account directly.

16 notes

·

View notes

Text

Oh shit.

The rule will be effective 120 days from today, on August 21, 2024.

The final rule (570 pages) can be found here:

I trudge through Medicare regulations all the damn time. I have never encountered a rule where the footnotes get over 1000, letters alone 1200. This was an intricately designed ruling and I’m amazed at how robustly it was constructed given how short the actual rule is. Here is the meat of it (starting on page 561):

There are a few more short subsections on existing agreements and notice to affected employees, of course. Here are some examples of the comments that led the FTC to approving this final rule:

Note: This final rule applies specifically to clauses (usually in employment agreements) that limit employees’ ability to work in the same field in a particular geographic area. It does not change the enforceability of non-disclosure agreements (keeping secrets), IP assignment agreements (from publishing to transfers to work-for-hire), or similar agreements.

This doesn’t affect some populations as much as others. In California, Minnesota, Oklahoma, and North Dakota, non-competes were already banned in general (with few exceptions).

Overall, this is an incredible development. It’s going to help a ton of people in a wide number of industries across every paygrade. I’m certain it will be challenged in court, but at first glance, there is some solid ground work already laid to defend it.

#news#current events#ftc#employment law#don’t trust me I’m a lawyer#I’m not your lawyer#none of you#not a single one#but this is pretty cool

3 notes

·

View notes

Text

The Role of Employment Law in Creating Thriving Work Environments

3 notes

·

View notes

Photo

Now processing: the papers of Professor Laura J. Cooper, who was heavily involved in the implementation of anti-discrimination procedures at the U of M in the wake of the Rajender Consent Decree.

These pamphlets from the National Lawyers Guild, Parents in the Workplace, and the Council on the Economic Status of Women have the best illustrations.

#university of minnesota#umn#umn law#minnesota law#rajender#laura cooper#employment law#maternity leave#pregnant employees#pamphlets#1980s#sex-based discrimination#riesenfeld center#archives#archival processing#employment discrimination#higher education#minnesota history#women's rights#national lawyers guild#legal advocacy#illustrations

43 notes

·

View notes

Text

Examples of Reasonable Accommodations in the Workplace

People who have disabilities may sometimes need accommodations. In the context of the workplace, reasonable accommodations are adaptations and changes to environment or procedures that assist disabled workers in performing their job. There are also accommodations that prospective employees may need throughout the hiring process as well. Needs and abilities vary from person to person and therefore so do the accommodations granted to each individual. Many different types of accommodations are relatively easy to provide and most come at no real cost to the employer.

Who is an Individual with a Disability?

When an individual has mental or physical limitations to their ability to perform major life activities, they are considered disabled by the Americans with Disabilities Act and are entitled to reasonable accommodations. When requesting accommodations at work, if the disability is not visibly obvious, the employer may ask for a doctor’s confirmation that the accommodation is necessary.

Types of Workplace Reasonable Accommodations

Reasonable accommodations come in three main categories:

No Tech – Accommodations that require minimum cost and effort. This can include allowing someone more time to complete tasks or letting them eat at their desk.

Low Tech – Accommodations that require a small amount of cost and effort. This can include providing lumbar support for chairs or wrist supports for mice and keyboards.

High Tech – Accommodations that require extra cost and effort. This can include installing automatic door and providing screen readers.

Common Examples of Reasonable Accommodations in the Workplace

There are many ways in which an employer can provide reasonable accommodations for their employees such as:

Alterations – Changing the way a job is performed, the time frame it is performed in, or the people responsible for individual aspects of the job itself.

Equipment – Altering equipment such as chair modifications or changing the display and audio settings on a computer and/or providing devices such as desk heaters or magnifiers.

Help – Allowing personal aids or caretakers to provide assistance.

Materials – Making alterations to the format of provided information.

Parking – Providing accessible parking for employees.

Reassignment – Moving an employee to an equal position that is better suited to their needs.

Scheduling – Allowing for flexibility within an employee’s schedule to allow for extra breaks or time off for doctor’s appointments.

Technology – Providing things such as screen readers, modified headsets, and assistive software.

Job Restructuring

An example of reasonable accommodation may be changing the way a job is performed. This can be done by reassigning workloads amongst different employees, changing the employee’s location, or even removing or replacing certain duties.

Rearranging the way tasks and duties are divided amongst coworkers is one way to reasonably accommodate employees with disabilities. If there are two receptionists and one of them is dyslexic, that employee might handle the majority of helping guests and transferring calls while the other handles the majority of the paperwork and typing.

Some disabilities may prevent people from being able to perform their job in the given work environment, perhaps due to mobility or sensory issues. If the job can be done from home or at a more accessible location, it may be reasonable to allow the employee to do so.

There are also some aspects of the way a job is performed that may be easily eliminated or changed completely. A deaf employee may be allowed to handle correspondences via text and email rather than making phone calls. An employee with mobility issues may be permitted to mail things out rather than making deliveries.

Modified Work Schedules and Flexible Leave Policies

Some disabilities may cause an employee to require a modified schedule. If accommodating that schedule does not cause the employer undue hardship, then it would be considered a reasonable accommodation. This may involve extra breaks, regular days off, or even a part time schedule.

A person with an ongoing illness may require regular days off to receive treatment.

A person with chronic pain may only be able to work every other day or require three day weekends in order to recuperate.

A person with diabetes may require extra breaks to eat and manage their insulin.

There are also some disabilities that may require employees to take a leave of absence for more than a day or two. The employer is not necessarily required to provide paid leave in these situations, but they are expected to allow for disability leave when applicable.

A person with a condition that involves flair ups may need extra time off.

Some treatments may have extended recovery time.

The workplace may be temporarily inhospitable due to a person’s disability.

A person with a prosthetic may need time off for repair or replacement.

A flexible work schedule accommodation may also involve an employee being permitted to work remotely a day or two a week or working weekends instead of weekdays.

Modification or Purchase of Equipment or Devices

There are many accessibility aids that can help someone with disabilities in the workplace. Employers are required to provide reasonable equipment when necessary. However, employers are only responsible for things specifically needed for the job. Accessibility aids required for daily functions such as glasses or hearing aids are the employee’s responsibility.

Employees who are visually impaired may require:

Screen reading software

Braille or raised print copies of documents

Magnifying devices

Additional lighting

Employees who are hard of hearing may require:

Teletypewriters

Text telephones

Transcript software

Employees with mobility issues may require:

Telephone headsets

Modified equipment controls

Modified desks for wheelchairs

Stabilizing devices

Employees with dyslexia or ADHD may require:

Guided reading software

Employees with chronic pain may require:

Modified seating

Training

Employers are required to provide employees with disabilities the same opportunities for advancement as their coworkers. This means ensuring that any training is accessible to everyone. Ways that employers may provide training accommodations include:

Making sure that training sites are accessible

Providing training materials in alternative formats

Including sign language interpreters in presentations

Adding captioning to video/audio guides

Modification of Policies

There are some companies that have policies that may prevent a disabled person from being able to do their job efficiently or safely. These policies would have to be amended or the employee given exemption. Examples of this may include:

A worksite that does not allow animals permitting an employee to bring their service dog

A company with a ‘no eating on the clock’ or ‘no food at your desk’ rule allowing an exception for a diabetic employee

An employee with sensory issues or ADHD being allowed to wear headphones

Modified emergency evacuation plans for employees with mobility issues

A company that only provides on site parking for management providing a space for a lower-level employee with mobility issues

Modification of Physical Site or Building

Sometimes, the way the worksite itself is designed poses a hindrance to disabled employees that their coworkers do not face.

Structural changes are sometimes necessary, such as:

Building ramps

Adding accessible bathrooms

Installing elevators/escalators

Non-structural changes may also provide solutions, such as:

Setting up water coolers

Syncing an alert light to the doorbell

Moving meetings and training to another area

Provision of Readers, Communication Access Providers, or Personal Assistants

Some employees may need accommodations by way of third party assistance. This assistance may be needed occasionally or frequently depending on situation at hand. If providing this assistance does not cause undue hardship to the employer, it is considered a reasonable accommodation.

Readers may be employed to assist employees with vision impairments as well as those with dyslexia or learning disabilities. The reader should be able to comprehend the materials being read so that they can clearly and accurately provide the information.

Sign language interpreters can be especially useful for employees who are hard of hearing and/or mute to easily and clearly convey and receive information with their boss, coworkers, and clients.

Captioners and transcribers may be needed for employees who are hard of hearing or have auditory processing disorder when dealing with video presentations.

Drivers may be provided for vision impaired employees who are required to travel as part of their job.

Personal assistants can help in a myriad of ways such as:

Carrying things for employees whose disability involves a weightlifting restriction.

Retrieving or filing things on high shelves for an employee in a wheelchair.

Performing fine motor functions for those with conditions such as Parkinson’s.

Reassignment to a Vacant Position and Light Duty

Sometimes, an employee may develop a disability during their employment that makes it difficult or impossible to perform the job they were already doing. Sometimes, accommodations can be made. If there are no viable reasonable accommodations that can be provided, the employer may need to reassign them to another position with job duties they would be able to perform.

The reassignment should not be a demotion and should pay the same or a comparable salary. The reassignment should also not conflict with another employee being entitled to the position due to a collective bargaining agreement or any seniority system in place.

Some employers have provisions in place to assign employees to light duty when needed. This is not a requirement under the ADA, but a prudent option for industries that involve heavy labor and/or high risk of injury such as construction, fire departments, and law enforcement. Light duty positions are considered a reasonable accommodation if:

The employee is unable to perform their current job due to disability

The employee is qualified and capable of performing the light duty work

Reassigning the employee to the light duty job would not cause undue hardship

Other Accommodations

Other accommodations and considerations may be needed for employees with disabilities depending on the specific situation.

Some jobs compensate their employees for gas milage when traveling is part of their duties. If an employee can not drive due to their disability, the employer may compensate them for public transportation costs instead.

Employees who have learning disabilities may be provided extra personal training to ensure that they are able to fully grasp the skills needed for their job.

Employees with ADHD may be permitted to use their own organizational system rather than company standard or given more flexibility in how they complete tasks.

Employees may be permitted to join meetings via phone or video chat if their disability prevents them from attending in person.

Workplace Reasonable Accommodation Considerations

The following are all considerations that employers must account for when providing reasonable accommodations.

Cost – Most accommodations require relatively low cost to the employer, and some can be provided at no cost at all. Reasonable accommodations are often far less expensive than anticipated.

Essential Job Functions – While employers are expected to provide reasonable accommodations, they are not required to alter their standards for quality and production.

Providing Accommodation – Employers are not usually expected to provide accommodations unless an employee with a disability requests it.

Selection – If there are multiple accommodations that may provide the same assistance to an employee, the employer is permitted to chose which one they will provide.

Undue Hardship – If providing an accommodation would impose an undue hardship on the employer, such as exorbitant cost or difficulty, then they are not required to provide it.

What Are Essential Functions?

The tasks and duties that make up the foundation of a job are referred to as essential functions. The ability to perform those functions to a satisfactory level is what makes someone qualified to hold the position. An essential function is defined by:

Being the reason the position exists

The skill and expertise necessary

How many employees are able to complete the same tasks

Reasonable Accommodation Process

The ADA and the EEOC maintain that accommodation requests be taken into consideration case by case. First, the employee must inform their employer that they have a disability. Employers are not responsible for accommodating disabilities that they are not aware of. The reasonable accommodation process depends on open communication and cooperation between the employer and the employee.

Requesting Reasonable Accommodations in the Workplace

Every employer has their own procedure for requesting accommodations, usually through a manager or human resources department. The request must state the presence of the disability as well as how the disability prevents the employee from properly doing their job. It is best to make the request in writing and retain a copy for your own records. While it is not necessarily required to use the phrase ‘reasonable accommodation’ or cite the ADA, it is good to be clear and direct.

Obtain Preliminary Documentation

Employers are not entitled to an employee’s entire medical history. However, if an employee is requesting accommodation for a disability that is not obviously evident, the employer may request specific documentation from a healthcare provider confirming the disability and the need for accommodation. It is best to only prove the information absolutely relevant to the accommodation request and not allow the employer unlimited access to medical records.

Employers Responsibility When Responding to Reasonable Accommodation Requests

When an employee submits a request for a reasonable accommodation, they then begin what is known as an interactive process with their employer. This is an open communication between the employee and the person handling the request so that they can come to an agreement as to the best accommodation necessary for the situation. The employee may have specific ideas in mind and the employer may have follow up questions. The employer can request a confirmation from a health care professional that the accommodation is necessary if the disability is not obviously evident. The employer may also wish to review ADA guidelines to be sure of the extent of their responsibility. If the accommodation the employee is requesting is deemed too costly, the employer may want to do research to see if an equal but less expensive alternative is available.

Using JAN as a Tool

In 1983, the Department of Labor’s Office of Disability Employment Policy founded a free service known as the Job Accommodation Network to provide employers with information and guidance regarding job accommodations. Before the ADA was created, this tool established the standard for employer guidance when it came to working with those with disabilities. JAN provides a helpful summary of common problems and possible solutions known as The Employers’ Practical Guide to Reasonable Accommodation under the Americans with Disabilities Act. The guide is frequently updated as new situations are brought to their attention.

Does An Employer Need to Provide the Accommodation Requested?

When an employee informs their employer that their disability is affecting their ability to do their job effectively, the employee may already have an accommodation solution in mind. The employer may choose to provide that particular accommodation, or they might find another equally effective accommodation that may be cheaper or easier to provide.

Furthermore, employers are not required to eliminate any essential functions of the employee’s position. If the employee is unable to perform that function due to their disability, the employer may find them reasonable accommodations or transfer them to another position of comparable pay.

Similarly, employers are not required to provide accommodations that would create an undue hardship on the employer. This is generally in reference to expense and difficulty, taking into consideration the cost in relation to the employer’s finances as well as the impact of providing the accommodation. The definition of what falls under this classification varies between situations as an accommodation that could be easily provided by a large company might impose an undue hardship on a small business.

Employers are also not required to provide employees with personal services and devices needed for everyday functions. Things like glasses and hearing aids may be covered by employer provided health insurance, but they are not considered workplace accommodations.

Implementing Reasonable Accommodations

While there are no exact required guidelines regarding the procedure for implementing an accommodation, it is best practice to move things along quickly and maintain respectful communication. Employers are encouraged to keep perspective on what the employee needs in order to perform their job and not on the disability itself. The employee is often the best person to ask when trying to come up with appropriate accommodations as they know best where the difficulty is and may already have ideas. It can also be beneficial to take the abilities and strengths of individual employees into consideration when assigning job duties.

Monitoring Accommodation Effectiveness

It is important that the employer and the employee work together when implementing an accommodation. The employee best understands their disability and what they need to perform their job. The employer best understands the business and what impacts certain accommodations might have. Ultimately, the employer has final say in how they will accommodate their employees, but the accommodation must sufficiently resolve the issue. It is advised that all parties keep a clearly documented record of the process.

What Happens if Workplace Reasonable Accommodations are Denied?

Sometimes, when an employer denies an accommodation, the matter can be easily resolved. They may require medical confirmation or a more thorough explanation of how the employee’s work is impacted. It might be the specific accommodation requested is not possible, but an agreement can be reached for a comparable solution.

If a manager or supervisor denies an accommodation request, the employee may be able to take the matter to human resources. If the company has no HR department, higher ups such as a district manager or business owner may be the next step.

If the employee is a member of a union, grievances can be filed through their union rep. There may be other procedures for filing internal complaints as well.

If all else fails, it may be necessary to file an external complaint. Employees can contact the Equal Employment Opportunity Commission to file a claim for disability discrimination. It may also be necessary to speak with an employment lawyer.

Contact Mesriani Law Group if Reasonable Accommodations are Denied?

People with disabilities have the right to reasonable accommodations in the workplace. Employers are required to provide those accommodations unless they would cause undue hardship. Unfortunately, not all employers comply with ADA regulations and try to deny their employees accommodations. When this happens, legal action may be necessary. Our employment attorneys have the experience and dedication to help our clients through this stressful and difficult process. If your employer has denied your right to reasonable accommodations, call Mesriani Law Group today.

Workplace Reasonable Accommodation FAQs

What are examples of accommodation in workplace?

Some reasonable accommodation examples are: An office worker who has a vision impairment may ask for an extra lamp for their desk, a magnifying glass to help read paperwork, and screen reading software for their computer. An employee battling cancer may require a flexible schedule to allow for treatments and rest days. They may also need extra breaks or extended leave. A cashier with chronic pain may request to be permitted to sit while they work.

How do you explain reasonable accommodation?

The Americans with Disabilities Act defines a reasonable accommodation as any change made to the job itself, the workplace environment, or the procedures of the hiring process that allow a person with a disability a fair chance to get and perform a job as well as someone who does not have a disability. A reasonable accommodation should not cause undue hardship for the employer.

What is reasonable accommodation in HR?

A company’s human resources department is generally responsible for processing and fulfilling requests for reasonable accommodations. They may ask follow-up questions, request medical confirmation, and ensure that effective accommodations will be possible and affordable for the company.

How do I write a reasonable accommodation request?

An accommodation request should explain that you have a disability and because of that disability, you are unable to perform the essential functions of your job and are requesting an accommodation. You do not have to go into detail regarding personal medical information but be clear about where the issue is and how it can be resolved.

#California Employment Law#Workplace Accommodations#Disability Discrimination#Workplace Discrimination#Employment Law#Employment Laywers#California Attorneys#Americans with Disabilities Act

3 notes

·

View notes

Text

Good News! Wage theft is now a criminal offense in NYS. If your employer is not paying you on time, writing bad checks, stealing your tips, making promises about future raises (in writing) and not delivering, or otherwise paying you incorrectly- contact an employment attorney! You might even get to see your boss go to jail!

#human resources#hr#hr is not your friend#your boss is not your friend#know your worth#know your rights#workers rights#new york#employment law#employment#capitalism#career advice#new york state#wage theft#minimum wage

2 notes

·

View notes

Text

Employment Lawyer Los Angeles | Theory Law APC

With the ever-changing laws and regulations in the world of employment, it is important to have a skilled employment lawyer in Los Angeles. Having an employment lawyer on your side can help protect your rights as an employee, ensure you are treated fairly, and provide you with the necessary legal advice. From employment contracts to wage disputes and wrongful termination, an employment lawyer in Los Angeles can help you navigate the complexities of the law and ensure your rights are protected.

If you feel you have been wrongfully terminated, discriminated against, or treated unfairly in the workplace, you should contact an employment lawyer in Los Angeles. An employment lawyer can provide you with the legal advice and representation you need to ensure your rights are protected. Additionally, if you are entering into a new employment contract, an employment lawyer can help you understand the terms and ensure you are receiving the best deal possible.

When looking for an employment lawyer in Los Angeles, it is important to find someone who is experienced and knowledgeable in the field. You should look for an attorney who has a good reputation, a proven track record of success, and who has extensive experience with employment law. Additionally, you should make sure the lawyer is licensed in the state of California and is familiar with the laws and regulations in your area.

Are you looking for a skilled employment lawyer in Los Angeles? Look no further than Theory Law APC. Our experienced attorneys provide comprehensive legal representation for a variety of employment-related matters. Whether you need help with a contract dispute, an unemployment claim, or a wrongful termination lawsuit, we have the expertise and dedication to help you achieve the best possible outcome.

At Theory Law APC, we understand the sensitive nature of employment law. We strive to provide individualized attention to each of our clients and to ensure that their rights are protected. Our attorneys are experienced in areas of California labor law and are knowledgeable about state and federal regulations. We will work hard to ensure that you receive the compensation that you are entitled to under the law.

We also provide guidance and advice on issues related to workplace safety and health, employee benefits, labor relations, and more. Our attorneys will work diligently to protect your rights and to ensure that you receive the justice you deserve.

Know More: Employment Lawyer Los Angeles | Theory Law APC

#Employment Lawyer Los Angeles#Employment Lawyer#Employment Law#Employee Rights#Labor Law#Los Angeles#Theory Law APC

2 notes

·

View notes

Link

8 notes

·

View notes

Photo

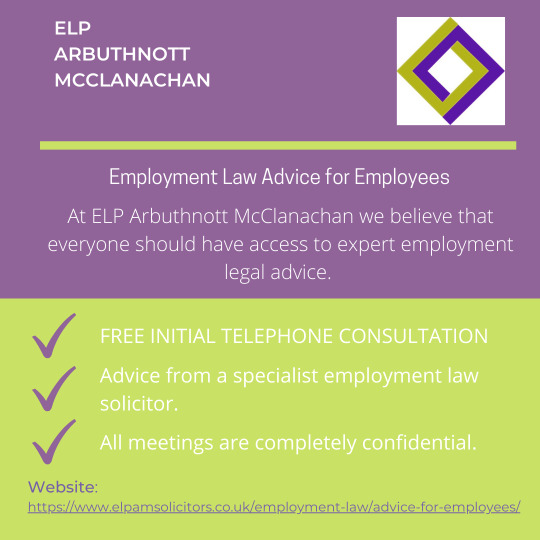

The specialist employment law solicitors at ELP Arbuthnott McClanachan can provide you with expert employment law advice. So whether you are facing dismissal or redundancy, are looking for advice on flexible working hours or maternity leave, or have been discriminated against, please get in touch.

https://www.elpamsolicitors.co.uk/employment-law/advice-for-employees/

2 notes

·

View notes

Text

Volunteer Work and Unpaid Internships: What's Legal?

What counts as "employment" might seem straightforward enough... until you're working for a non-profit, or as an intern.

What's the difference between volunteering for a non-profit and working there, besides the allowed pay rate? Can you work 40 hours during the week for your non-profit employer and then still volunteer for them over the weekends, too?

And what's the deal with unpaid internships? They're work, but they're not, and therefore they can be unpaid, despite minimum wage laws? How is that legal? When is that legal?

For that matter, what about those high school programs that involve working for an employer as part of a class? How does that work?

Most of the relevant law here is federal.

When it comes to "for-profit" employers, the Department of Labor has a handy dandy fact sheet explaining the law.

Unpaid internships and student work positions may potentially not qualify as "employees" under the Fair Labor Standards Act, which is the relevant law having to do with minimum wage, overtime, etc.

As per case law, the distinction comes from which party is the "primary beneficiary" of the arrangement. If the intern/student worker is benefiting more from the training and educational experience of their internship than the employer is benefiting from the work that they generate, then they are not considered an "employee" and do not need to be paid under the usual FLSA rules. On the other hand, if the employer is benefiting more from the work they're getting than the intern/student is from the experience, then they're an "employee" and need to be paid accordingly.

The court has made a list of seven factors to be considered when determining who's benefiting more from the arrangement, including things like "The extent to which the intern’s work complements, rather than displaces, the work of paid employees"--in other words, if the work the intern is doing would be done by regular employees if the intern wasn't there, that's a bad sign for the legitimacy of that internship's unpaid status. Other factors include the internship being tied to the school with coursework or credit, having educational training as part of the internship, etc. The intern is supposed to be learning from the internship--that's the whole point.

There are definitely industries where doing non-educational, entry-level work as part of an "unpaid internship" is commonplace, but under the FLSA, that's illegal, and some recent court cases involving big-name employers have involved substantial settlements for "unpaid internships" that didn't follow the FLSA rules.

Some states, like California and New York, have even more restrictive rules about unpaid internships, but the federal rules apply to unpaid internships throughout the United States.

As for non-profit volunteer work, well, the Department of Labor has a handy-dandy fact sheet for that one, too.

The non-profit charitable designation is not the only thing necessary to determine that someone can volunteer there; the volunteer work being done also has to be for a charitable rather than a commercial purpose. The fact sheet specifically mentions that volunteering in a gift shop likely isn't allowed even when the gift shop is for a non-profit organization, because the shop is itself a commercial enterprise and the work being done is commercial in nature.

As with interns/students, volunteer work becomes more suspect if it's displacing work that would otherwise be done by paid employees.

Also, if you work for a non-profit, you can volunteer for your employer outside of your regular work... but not by providing the same type of services you're employed to do. So, if you're employed as a marketer for an animal shelter, coming in on the weekends to clean cages and walk dogs would likely be perfectly fine volunteer work, but coming in on the weekends to draft the shelter's newsletter would likely be considered part of your regular employment, and thus subject to minimum wage and overtime rules.

That last restriction doesn't apply if the place you're volunteering for isn't your employer, though. So, if you're employed as a bus driver for the local school district, you can't volunteer to drive students around for field trips, but you can volunteer to be the driver for your local church's youth group trips, since the church isn't regularly employing you as a bus driver.

Another thing that can make volunteer work suspect is when benefits or bonuses are provided. Volunteer positions "working for tips" are usually breaking the law; things like providing free rounds of golf to volunteer caddies or free memberships/classes to volunteer gym trainers are also highly suspect.

There is some allowance for reimbursing volunteers for expenses incurred by their volunteer work, but this cannot be in the place of regular compensation and cannot include "reimbursements" for expenses that are not actually related to the volunteer work done.

#labor law#employment law#us law#american law#united states law#internships#unpaid intern#interns#internship#volunteer#volunteer work

11 notes

·

View notes

Text

You Won't Believe What HR Consultants Can Do for Your Business

As a business owner or manager, you may be familiar with the myriad of employment laws and ethical standards that govern your company’s operations. However, with the constantly evolving legal landscape and increased public scrutiny, it can be challenging to keep up and ensure your business is staying compliant and ethical. This is where HR consultants come in.

HR consultants are experts in…

View On WordPress

#business compliance#business ethics#compliance#compliance consulting#employment law#employment lawyers#employment regulations#ethical business practices#Ethical Standards#HR#HR Consultants#HR Management#HR Strategy#HR Support#human resources#labor laws#legal compliance#workplace compliance#workplace ethics#workplace rights#workplace rules

2 notes

·

View notes

Text

A number of multinational companies have recently announced mass layoffs, affecting thousands of employees. Some of the top companies like Twitter, Meta, Google, and Amazon are compensating their employees while terminating their services to save on rising operational expenses. The idea behind making this payment is to ensure that the employees have enough to survive on before they get employed at any other place. However, is the severance pay subject to taxation? if the answer is yes, then how is it taxed?

#severance pay#laid off#employment law#severance pay ontario#severance#severance package#severance pay calculator#severance agreement#what is severance pay#severance pay lawyer#how much is severance pay#how is severance pay calculated#severance deal#how to determine if your severance package is fair#severance provisions#termination severance#severance terms#severance release#should i accept severance#severance explained#finance#mint primer#mint

3 notes

·

View notes

Text

I know I'm mentally broken into my career when I get really excited seeing the FTC is trying to do away with Non-Competes all over the US

It's not in place right now, there is a 60 day comment period and God knows the lawsuits, but this is definitely going to speed up the rolling ball of the death of non-competes

#not jazz rants#law things#non competes#employment law#workers rights#if you have questions please ask!#or google

4 notes

·

View notes

Photo

Solicitors in Waterlooville, Portsmouth | Larcomes Legal Limited

Specialist Financial Settlement Legal Advice

If you are looking for financial settlement advice or have questions regarding points raised in this article, our specialist family law solicitors in Portsmouth and Waterlooville can help. We have the knowledge and experience to help you and your family regardless of the complexity of your situation. We will explain all the options available to you and ensure you are aware of the costs involved, guiding, and supporting you through every step of the process.

Remember, you can talk to us in complete confidence and gain reassurance from speaking to someone who understands your situation.

Please note that this article is not intended as legal or professional advice. This is a general news article only and updates to the law may have changed since it was published.

#Child Care Law#Civil Litigation#Contentious Probate#Employment Law#Family & Matrimonial Law#Financial Services#Industrial Diseases#Landlord & Tenant#Lasting Power of Attorney#Residential Conveyancing#Wills Trusts & Probate#Services For Business

3 notes

·

View notes