#financial software comparison

Explore tagged Tumblr posts

Text

#personal finance#free personal finance software#money management#budgeting#financial planning#financial goals#financial freedom#money saving tips#free budgeting software#free money management tools#personal finance apps#financial software comparison#online budgeting tools#free financial software#financial planning tools#money management apps#best free finance apps#financial independence#free personal finance software for students#best free personal finance software for beginners#free budgeting software for small business#free financial software for tracking expenses#how to choose free personal finance software#free personal finance software comparison

0 notes

Text

Explore ServiceNow stock price forecasts for 2025–2029, with insights on its AI-driven growth, fin. performance, and investment strategies #ServiceNow #NOW #NOWstockprice #ServiceNowforecast #enterprisesoftwarestocks #AIstocks #stockpriceprediction #SaaSinvestment #digitaltransformationstocks #ServiceNowfinancials #stockmarketanalysis

#AI stocks#Best enterprise software stocks 2025#Best stocks to buy now#digital transformation stocks#enterprise software stocks#How to invest in ServiceNow NOW#Investment#Investment Insights#Is ServiceNow stock a good investment#NOW#NOW stock market correction strategy#NOW stock price#SaaS investment#ServiceNow#ServiceNow AI growth potential#ServiceNow financial performance 2025#ServiceNow financials#ServiceNow forecast#ServiceNow stock#ServiceNow stock price forecast 2025–2029#ServiceNow stock valuation analysis#ServiceNow vs Salesforce stock comparison#Stock Forecast#Stock Insights#Stock market analysis#Stock price prediction#When to buy ServiceNow stock

0 notes

Text

Key Factors to Consider When Choosing an Online Trading Platform

The rise of online trading has made it easier for individuals to access financial markets and start trading from virtually anywhere. Whether you’re a novice looking to explore the world of trading or an experienced trader seeking advanced tools, choosing the right online trading platform is crucial to achieving your goals. With so many options available, selecting the best one can seem overwhelming. This guide will outline the key factors you should consider when choosing an online trading platform that suits your trading style and needs.

1. Platform Usability and Accessibility

A critical factor to consider when choosing an online trading platform is how easy it is to use. If the platform is complex or hard to navigate, you may miss trading opportunities or make mistakes that could cost you money. A good trading platform should have an intuitive and user-friendly interface that allows you to access your account, place trades, and track market trends with ease.

It’s also important to check whether the platform is accessible on different devices. The best platforms are available on desktop, mobile, and web browsers, so you can manage your trades from anywhere. For example, platforms like MetaTrader 5 (MT5) allow traders to access their accounts through mobile apps on both Android and iOS, as well as through desktop applications for Windows and macOS. Having access to your account on multiple devices ensures flexibility, allowing you to trade on the go.

2. Range of Features and Trading Tools

Another important aspect of a trading platform is the features and tools it offers. Advanced tools are essential for analyzing the markets, identifying trends, and making informed trading decisions. The platform you choose should provide various tools for both technical and fundamental analysis, such as real-time charts, technical indicators, and economic calendars.

Platforms like MetaTrader 5 (MT5) are known for their comprehensive toolkits. MT5 provides over 80 built-in technical indicators, charting options, and drawing tools to help traders analyze market trends. The platform also supports automated trading with Expert Advisors (EAs), allowing you to execute trades based on predetermined conditions. Additionally, MT5 provides features like backtesting and strategy testing, which help traders optimize their strategies before trading live.

3. Asset Variety and Flexibility

The variety of assets available on a platform is another key consideration. A trading platform that supports a wide range of asset classes, such as stocks, forex, commodities, and cryptocurrencies, gives you the flexibility to diversify your portfolio and adapt to changing market conditions.

MetaTrader 5 stands out in this regard, as it supports multiple asset types including forex, equities, indices, commodities, and cryptocurrencies. This flexibility allows traders to explore various markets and tailor their strategies to different asset classes. Diversification is essential in managing risk and ensuring that your investment portfolio remains balanced and resilient against market volatility.

4. Security and Data Protection

Security is a top concern when trading online, as you will be sharing sensitive financial data. You need to ensure that the platform you choose has robust security protocols to protect your funds and personal information. Look for platforms that offer two-factor authentication (2FA), encryption for transactions, and secure login procedures.

Top platforms like MetaTrader 5 use advanced encryption methods to protect users’ data. They also comply with the highest security standards to safeguard against cyber threats and unauthorized access. This gives traders peace of mind knowing that their personal and financial information is safe.

5. Customer Support and Educational Resources

For traders, especially beginners, having access to reliable customer support and educational resources is crucial. A platform with excellent customer support can help you resolve issues quickly and get the answers you need when you run into challenges. Look for platforms that offer 24/7 support via live chat, email, or phone.

Educational resources are also important, as they can help you improve your trading skills and gain a better understanding of market trends. Many platforms provide educational content such as video tutorials, articles, webinars, and demo accounts. These resources are ideal for new traders looking to build their knowledge and experienced traders who want to refine their strategies.

Conclusion

When it comes to choosing an online trading platform, there are several factors to consider, including usability, available tools, asset variety, security, and support. The right platform should be easy to navigate, offer advanced trading features, provide access to various asset classes, and ensure the safety of your funds.

MetaTrader 5 is one such platform that combines all of these features in one place, making it an excellent choice for traders of all levels. Whether you’re trading forex, stocks, or commodities, MetaTrader 5 provides an intuitive, secure, and feature-rich environment to help you achieve your trading goals.

For traders looking for a trusted and regulated broker to execute their trades securely, FTD is an ideal choice. FTD offers access to reliable platforms like MetaTrader 5, combining robust security, customer support, and all the necessary tools to help you succeed in online trading.

#Online Trading Platforms#Trading Software#MetaTrader 5#Trading Tools#Forex Trading#Stock Trading#Cryptocurrency Trading#Investment Platforms#Trading Features#Asset Diversity#Trading Security#Trading Education#Platform Comparison#Financial Markets#Trading Tips

0 notes

Text

How to Choose the Best Accounting Software for Your Business

Introduction In the fast-moving environment related to the business world, keeping yourself on top of the finances will never be an easy task. In reality, a company can easily slip into disarray without proper supervision of its finances. No matter whether yours is a small startup or a big corporation, the right kind of accounting software will certainly work wonders in the smooth flow of financial operations. But with accounting software options galore, how do you choose a software that’s suitable for your business? The guide from TechtoIO will take you through everything you need to know to make an informed decision. Read to continue

#analysis#science updates#tech news#trends#adobe cloud#nvidia drive#science#business tech#technology#tech trends#CategoriesSoftware Solutions#Tagsaccounting software comparison#AI in accounting software#automated invoicing software#best accounting software for business#blockchain accounting solutions#choosing accounting software#cloud-based accounting software#expense tracking software#financial reporting tools#FreshBooks review#integrating accounting software#mobile accounting software#QuickBooks vs Xero#scalable accounting software#secure accounting software#small business accounting software#top accounting software 2024#user-friendly accounting software#Wave accounting software

0 notes

Text

I've been trying out Plottr and I really like it, the featureset jives really well with how I outline and what information I want around in that process and how I want to manipulate it.

You'd think that would be enough for me to recommend it, but for some reason it's followed suit with the enshittification of the internet and the primary way to access it is a subscription service. It's a fuckin' piece of software that you download to your computer and has files stored locally. It is feature complete and a full release so there is no real excuse for a subscription-oriented model except the company realising that a drip feed from your wallet is more profitable than selling you a piece of software that does not need any upgrades. The website attempts to justify this by saying 'lifetime updates' are included but it is currently fully functioning as is so I question the value proposition of paying in perpetuity to use a program on my computer to access and interact with files stored on my computer.

(There is an online version as well. I understand subscription models in this case as this is an area where continued development and maintenance are required, as well as server costs for your files etc.)

But, you say! There is a lifetime license! Problem solved!

It is two hundred fucking united states dollars.

I am in a good financial position these days. I can spend money on stupid shit I want. But I cannot get past the audacity of charging $200 for what should be the default fucking option for owning software.

There's nothing that quite does what Plottr does, at least that I've found. But for some comparison:

Scrivener is $59.99 once-off and is probably the best writing-oriented program out there

Aeon Timeline is $65 once-off including a year of free updates

Campfire Blaze honestly has a payment structure I am sideeyeing but at least you can get a lifetime license tailored to what you need out of the program and characters + timeline is still cheaper than Plottr

Wavemaker is donationware

Metos is a subscription model, but has Web-only considerations mentioned above, specific plans for features in development, and is $24 annually rather than $150

The entire Microsoft Office suite is $149.99. Between Word, Excel, and OneNote you could definitely figure something out from a writing perspective and also have all the functionality of a full suite of office software FOR LESS MONEY THAN PLOTTR.

There are of course a wide array of free softwares (Google docs/sheets, Libre Office, etc) but I specifically wanted to call out paid options here to demonstrate how ridiculous their pricing structure is

I dunno man. People are allowed to charge whatever they want for the things that they make, but this is just so blatantly out of step with the market that I can only assume the lifetime license price is specifically aimed at deterring lifetime purchases and extracting the maximum amount of money possible from their target market through subscriptions instead. I feel a particular kind of way about that target market being writers, a group notoriously not known for their financial stability.

Fuck subscription services with no ongoing value proposition taking over how we access software and fuck every company that makes the revenue-driven decision to engage in this tactic. Even if your motivations are honourable (we have people to pay! you want us to be able to pay our hard-working employees, right?) you are pursuing those goals through nothing less than the exploitation of your customers for maximum financial gain.

#writing#guerrilla writeblogging#I apologise for the strong opinions but I am actually genuinely mad. ceo of Fictional Devices apologise to me directly.#after everything I am the going to undercut my argument by probably buying the lifetime license#because I do like it enough to want to continue using it#so unfortunately the market will charge what the market can bear#but tbqh if pirated sources of this program existed I would mail them $50 and my conscience would be completely clear.

38 notes

·

View notes

Text

Manipal University Online MCA

Conquering the Digital Frontier: Unraveling the Manipal University Online MCA Program

In the whirlwind of the digital age, a Master of Computer Applications (MCA) degree has become the gold standard for aspiring IT professionals. If you crave the flexibility of online learning while seeking the prestige of a renowned university, Manipal University Online's MCA program might be your perfect launchpad. Let's delve into this innovative program, examining its curriculum, eligibility criteria, fees, and the key factors that make it stand out.

Unveiling the Course Structure:

Manipal University Online's MCA program spans across four semesters, meticulously crafted to equip you with cutting-edge knowledge and hands-on skills. Here's a glimpse into the core areas you'll conquer:

Foundational Semesters (Semesters 1 & 2): Laying the groundwork, you'll master programming languages like C++, Java, and Python. Data structures, algorithms, and operating systems will become your playground, while subjects like computer networks and web technologies open doors to the digital world's infrastructure.

Specialization Semesters (Semesters 3 & 4): This is where you carve your niche. Choose from specializations like Artificial Intelligence and Machine Learning, Cloud Computing, Software Development, or Cyber Security. Deepen your expertise in your chosen domain with advanced electives and capstone projects that put your skills to the test.

Eligibility Criteria: Unlocking the Gateway:

To embark on this journey, you must have:

A Bachelor's degree in any discipline with Mathematics or Statistics as a compulsory subject at the 10+2 level or at the graduation level.

Secured a valid score in national entrance exams like NIMCAT, MAT, or ATMA.

A passion for technology and a thirst for continuous learning.

Admission Criteria: Demystifying the Selection Process:

Once you meet the eligibility criteria, your merit score in the chosen entrance exam forms the basis for selection. Shortlisted candidates are then invited for an online interview where your communication skills, technical aptitude, and career aspirations are assessed.

Financial Considerations: Unmasking the Fees:

The program fee for the Manipal University Online MCA program is currently set at around INR 2.5 lakhs per semester. However, scholarships and financial aid options are available for deserving students, easing the financial burden and making the program accessible to a wider pool of talented individuals.

Beyond the Classroom: What Sets Manipal Online MCA Apart:

While a robust curriculum is crucial, Manipal University Online goes the extra mile to elevate your learning experience:

Renowned Faculty: Learn from industry experts and academic stalwarts who bring real-world experience and a passion for teaching to the virtual classroom.

Interactive Learning Platform: Engage in live online sessions, access comprehensive study materials, and collaborate with peers through a user-friendly learning management system.

Industry Connect: Gain an edge with industry internships and mentorship opportunities that bridge the gap between theory and practical application.

Placement Assistance: Leverage the university's strong industry network and dedicated placement cell to land your dream job in the booming IT sector.

Embarking on Your Digital Quest:

The Manipal University Online MCA program is not just a degree; it's a passport to a rewarding career in the ever-evolving IT landscape. If you're driven by ambition, possess a curious mind, and yearn to make your mark in the digital world, this program can be your stepping stone to success.

Spotlight on Specializations: Dive deeper into each specialization, highlighting the specific courses, industry trends, and career prospects.

Alumni Success Stories: Feature interviews with successful alumni who have carved their niche in the IT world after graduating from the program.

Comparison with other Online MCA Programs: Briefly compare Manipal's program with other online MCA offerings, highlighting its unique strengths and value proposition.

Student Testimonies: Include quotes from current or past students about their experiences with the program, its challenges, and its rewards.

Career Outlook: Discuss the job market for MCA graduates, highlighting growth trends, in-demand skills, and potential salary ranges.

Q&A Section: Address frequently asked questions about the program, admission process, and career opportunities.

For further information and updates ,please visit on:-

Top MCA colleges in india with low fees ,visit on :-

11 notes

·

View notes

Text

Useful List of Accounting Services for Small Business in 2024

As small business owners, wearing many hats is inevitable. However, juggling essential tasks like accounting alongside day-to-day business operations can become overwhelming. The relevance of professional accounting services remains unchanged for businesses of all sizes, but for small businesses, efficient accounting is crucial for sustaining growth and compliance.

While outsourcing accounting might feel like a leap, it is a cost-effective solution for small businesses that lack the resources to hire full-time professionals. Unison Globus offers tailored solutions to simplify your accounting needs, helping you stay focused on your business goals. Below is a list of critical accounting services your small business can benefit from in 2024.

Detailed Descriptions of Each Service

Bookkeeping Services

Precise bookkeeping is the backbone of any business’s financial strength. It involves systematically recording financial transactions to ensure smooth accounting processes. Partnering with outsourced bookkeeping services ensures your records are kept up-to-date, helping you stay on track with cash flow and financial planning. By engaging with expert accountants and bookkeepers, you gain access to professionals who can manage your books using advanced software, ensuring efficiency and accuracy.

Monthly Accounting Activities

Monthly accounting reviews provide valuable insights into your financial standing. These reviews help detect early issues and enable informed decision-making for the future. Small business owners can benefit from accounting outsourcing services USA, ensuring that timely reports are generated and monthly financial statements prepared by experienced professionals.

Tax Preparation and Filing

Staying compliant with tax regulations is non-negotiable for small businesses. An understanding of common tax deductions and proper filing ensures you avoid penalties and save money. Engaging outsourced CPA services offers the expertise needed to manage tax-related obligations efficiently. Whether it’s navigating tax season or preparing returns, outsourced accounting services USA can help streamline the process.

Payroll Processing

Payroll management is often more complex than it appears. Ensuring on-time payments, compliance with tax regulations, and accurate payroll reporting are vital. Outsourced bookkeeping & accounting services help manage payroll smoothly, allowing you to focus on core business activities while ensuring compliance and proper tax filing.

Financial Planning and Analysis

Strategic financial planning plays a pivotal role in guiding business growth. With financial planning and analysis, businesses can make data-driven decisions based on in-depth financial insights. For example, using remote accounting services can provide regular financial forecasts and analyses that align with your business goals, aiding in long-term sustainability.

Outsourced CPA Services

Hiring a full-time CPA may not be feasible for small businesses due to cost. However, outsourcing to a bookkeeping outsourcing firm or CPA allows you to access expert advice at a fraction of the cost. These services provide advisory support, periodic reviews, and assistance in making strategic financial decisions.

Forensic Accounting Needs

Protecting your business from fraud is essential. Forensic accounting helps detect discrepancies and misstatements, identifying potential fraud early. By engaging with outsourced accounting services, small businesses can implement necessary safeguards and maintain financial integrity.

Benefits of Using Professional Accounting Services

The benefits of professional accounting services go beyond accuracy. They help small businesses stay compliant, avoid penalties, and make informed financial decisions. By outsourcing, you reduce the burden of in-house accounting while gaining access to expertise and technology solutions that enhance your financial processes.

Comparison of In-House vs. Outsourced Accounting

While in-house accounting provides control, it can be resource-intensive and costly for small businesses. Outsourced bookkeeping solutions offer flexibility, cost savings, and access to expert accountants without the overheads of full-time staff. Additionally, outsourcing allows small businesses to scale operations as needed without compromising quality.

Read also: https://unisonglobus.com/accounting-vs-bookkeeping-infographic/

Tips for Choosing the Right Accounting Service

Selecting the right accounting partner is essential. Look for bookkeeping firms that specialize in small business needs, offer competitive pricing, and have a strong track record. A good partner will provide personalized services, from outsourced bookkeeping for CPAs to payroll management, ensuring all aspects of your accounting are covered.

Pro Tips for Choosing the Right Accounting Service

Specialization in Your Industry Choose a firm that understands the unique challenges and requirements of your industry. Specialized accounting services ensure they are well-versed in the specific tax laws, compliance regulations, and financial reporting standards that apply to your business.

Scalable Solutions As your business expands, your accounting needs will advance. Look for firms that offer scalable accounting solutions—from basic bookkeeping to advanced financial analysis—so you can easily adjust the level of service based on your business's growth without switching providers.

Technology-Driven Services Opt for firms that integrate cloud-based accounting software and use the latest technology for secure, real-time access to your financial data. This will help you stay updated with your accounting reports, access your data on the go, and ensure your business uses cutting-edge solutions for better financial management.

Transparent Pricing Structure Ensure the accounting service provides a transparent pricing model with no hidden fees. Whether they offer hourly rates, fixed fees, or package deals, it’s crucial to understand what’s included in the service and how additional costs may arise as your needs grow.

Proven Track Record & Reputation Verify the firm’s experience by looking into their track record with businesses similar to yours. Client testimonials, reviews, and case studies can provide insights into how well they handle small business accounting needs and their success in delivering results.

Certifications & Qualifications Ensure that the accountants you work with have the proper certifications (e.g., CPAs, CAs, or EAs). Certified professionals provide assurance that they are held to high standards of competency and ethics, which is crucial for accurate reporting and regulatory compliance.

Comprehensive Service Offerings Choose a firm that offers a full suite of accounting services, including payroll management, tax preparation, bookkeeping, and financial advisory services. This ensures all aspects of your accounting are covered, reducing the need for multiple service providers and streamlining your operations.

Communication & Responsiveness Look for a partner who is responsive and communicative. Timely responses, regular check-ins, and easy access to financial reports are critical. A good accounting partner should feel like an extension of your team, keeping you updated and informed at all times.

Data Security Measures With increasing concerns around data breaches, ensure your accounting partner follows strict data security protocols to protect sensitive financial information. Opt for firms that use encrypted systems and have robust cybersecurity measures in place.

Proactive Financial Guidance A good accounting service doesn’t just handle your numbers; they act as strategic advisors for your business. Look for firms that offer proactive guidance, helping you identify cost-saving opportunities, improve profitability, and plan for future growth with data-driven insights.

Industry-Specific Accounting Services

Different industries have unique accounting requirements. Unison Globus offers specialized services across various sectors, from tech startups to e-commerce and manufacturing. Each industry benefits from tailored accounting services that address specific compliance and reporting needs.

For more details, visit our Market Page.

Technology Integration in Accounting

Modern accounting is driven by technology. Outsourced accounting services incorporate advanced software and tools to enhance data security, improve reporting accuracy, and streamline processes. Investing in technology-driven accounting and bookkeeping outsourcing services ensures your business stays ahead in an increasingly digital world.

Common Accounting Mistakes to Avoid

Small businesses often make common accounting errors such as improper record-keeping, missing tax deadlines, and poor cash flow management. Engaging with bookkeeping service providers ensures you avoid these pitfalls. Professional accountants help keep your financial records in order, ensuring timely reporting and filing.

Common Accounting Mistakes to Avoid:

Inaccurate Record-Keeping: Keep all financial records up to date and organized to prevent discrepancies. Tip: Use cloud-based accounting software for real-time updates.

Missing Tax Deadlines: Ensure timely filing to avoid penalties. Tip: Automate tax reminders and rely on professional accountants to handle tax compliance.

Poor Cash Flow Management: Monitor your cash flow regularly to avoid liquidity issues. Tip: Create monthly cash flow forecasts with the help of expert accountants.

Mixing Personal and Business Finances: Always keep personal and business accounts separate. Tip: Set up dedicated business accounts and track every transaction accurately.

Not Reconciling Accounts: Regularly reconcile your bank accounts to catch errors or fraud early. Tip: Schedule monthly reconciliations with professional bookkeepers.

Read more: https://unisonglobus.com/common-accounting-mistakes-and-how-to-avoid-them-expert-tips/

How to Maximize the Value of Accounting Services

To get the most from your accounting services, ensure regular communication with your accounting partner. Regular financial reviews, budget adjustments, and strategic planning sessions are essential. Outsource bookkeeping and accounting services that offer tailored advice and proactive solutions to enhance business growth.

On the whole

Accounting plays a crucial role in the success of any small business. With the right outsourced accounting services USA, you can streamline financial operations, stay compliant, and make better business decisions. Unison Globus is here to support your journey with customized, cost-effective accounting solutions. Our outsourced bookkeeping services and expert CPAs can help you maintain financial health, grow your business, and stay ahead in 2024. Contact us today to learn how we can assist your business in achieving its goals!

FAQs on Accounting Services for Small Businesses

What is the difference between bookkeeping and accounting? Answer: Bookkeeping involves recording daily financial transactions, such as sales and expenses. Accounting includes interpreting, classifying, analyzing, reporting, and summarizing financial data to provide deeper insights into your business.

Why should I separate my business and personal finances? Answer: Separating business and personal finances simplifies tax preparation, protects personal assets from business liabilities, and makes it easier to track business expenses and cash flow. It’s a fundamental step in maintaining financial clarity and compliance.

How often should I review my financial statements? Answer: Reviewing your financial statements monthly ensures accuracy and enables informed business decisions. Regular reviews allow you to identify trends, adjust strategies, and address any issues early on.

What are the benefits of outsourcing accounting services? Answer: Outsourcing saves time, reduces costs, and provides access to expert advice, ensuring tax compliance and accurate financial management. It allows business owners to focus on growth while experienced professionals handle the accounting workload.

How can cloud-based accounting services benefit my business? Answer: Cloud-based accounting services offer anytime, anywhere access to real-time financial data, improved collaboration, enhanced data security, and cost savings. These services integrate advanced technology, enabling better financial decision-making.

What should I look for when choosing an accounting service provider? Answer: Look for a provider with industry-specific expertise, a range of scalable services, advanced technology integration, and a strong reputation for communication. A good accounting partner will tailor services to your business needs and be responsive and transparent.

Can I prepare my company’s taxes myself? Answer: While possible, hiring a professional accountant ensures accuracy, maximizes deductions, and keeps you compliant with ever-changing tax laws. Accountants provide valuable strategic advice that can improve financial outcomes.

How much does it cost to hire an accountant? Answer: The cost varies on the services you expect, the complexity of your business, and the accountant’s experience. Always compare pricing and services to find an accounting partner that fits your budget and delivers value.

Read also: https://unisonglobus.com/how-much-does-it-cost-to-hire-a-cpa/

Connect with Unison Globus

At Unison Globus, we specialize in helping small businesses navigate their accounting needs with expert solutions, scalability, and advanced technology integration. Whether you need bookkeeping, tax services, or financial analysis, our team is here to support your growth with personalized services.

Contact us today to learn how Unison Globus can be your trusted accounting partner!

#Small business accounting services#Tax preparation services for small business#Outsourced accounting services#Bookkeeping Services#Monthly Accounting Activities#Tax Preparation and Filing#Outsourced CPA Services#Expert Accounting Solutions#Benefits of Using Professional Accounting Services#in-house vs. Outsourced Accounting

1 note

·

View note

Text

How to Play the Lottery Online

The customers can revel in playing everywhere they want to. According to a survey carried out via using The Gambling Commision of UK, ninety five% of the clients select to gambling at home and the age business enterprise who is much more likely to move for on-line lotteries is 25-34. For the modern-day generation, comfort comes first and gambling lottery online brings comfort.

24/7 availability

Online lottery structures make it feasible for lottery fanatics to play their favored lottery video games at any time of the day, as constant with their consolation. Whether it is on the equal time as journeying, within the direction of workplace breaks, or in their loose time, you could log in to their preferred platform and play the lottery video video games of their desire.

Secure and dependable

Customers need now not worry about the security in their valuable financial and private information with the net lottery operator. Online lottery software program application software carriers ensure that the systems they set up are designed to be regular from any risks of data theft and particular hardware mishaps.

Access to an entire lot of tickets

Online lottery systems provide a large fashion of lottery tickets alternatives to clients. With some international locations having a fantastic preference of lotteries in comparison to others, on-line lottery has facilitated clients to check out and select from the good sized alternatives available of their u . S . A . At the press of a button. Check out situs togel resmi toto.

Tickets right now from the server

Online lottery software program software program program guarantees that the tickets are proper and registered with a valuable database residing at the operator’s sturdy servers. This way, the customer may be confident of no possibility of tampering with the tickets in any manner.

0 notes

Text

Product Recommendation Quiz: Save Time and Money with Tailored Suggestions

Shopping online feels like a nightmare sometimes. There are thousands of products everywhere, and finding the right one takes forever.

People waste hours scrolling through pages of stuff they don’t need, reading reviews that contradict each other, and still end up buying the wrong thing.

A product recommendation quiz cuts through all that mess. These quizzes ask specific questions about what someone needs, then spit out a list of products that actually make sense for their situation. No more guessing games or buyer’s remorse.

How These Quizzes Actually Work

The setup is pretty straightforward. Users answer questions about their needs, budget, and preferences. The quiz software takes those answers and matches them with products in its database.

For skincare, the questions might cover skin type, main concerns, and what kind of routine someone wants. For laptops, it could be about work tasks, portability needs, and how much tech knowledge they have. Each category has its own set of relevant questions.

The tech behind it processes all those answers and ranks products based on how well they fit. Some systems get smarter over time as more people use them and provide feedback about whether the recommendations worked out.

Why This Saves Serious Time

The biggest win is cutting down research time. Instead of opening twenty browser tabs and making comparison charts, users get a short list of products that actually match what they’re looking for.

This focused approach stops the endless scrolling problem. When someone needs running shoes, they don’t want to see dress shoes, hiking boots, and casual sneakers all mixed together. The quiz filters out the irrelevant stuff right from the start.

People also avoid getting stuck in analysis paralysis. Too many choices make decisions harder, not easier. When a quiz narrows it down to three or four solid options, the choice becomes manageable.

Time spent browsing drops from hours to minutes

No need to learn technical jargon or specifications

Fewer tabs open means less confusion

Decision-making becomes faster and more confident

Money Benefits That Actually Add Up

The financial advantages go beyond just finding cheaper products. These quizzes help people avoid expensive mistakes by matching them with items that fit their actual needs rather than what they think they need.

Plenty of shoppers buy too much product for their situation. They get professional-grade equipment for weekend hobby use, or they go too cheap and end up needing upgrades quickly. Both scenarios waste money.

Quizzes also surface brands that might not show up in regular searches. While big names dominate advertising and search results, smaller companies often offer better value for specific uses. The recommendation system can find these hidden gems.

Returns cost money too — shipping fees, restocking charges, and the time spent dealing with customer service. When products match expectations from the start, returns happen less often.

Where This Technology Works Best

Beauty companies jumped on this trend early. With thousands of shades, formulas, and skin types to consider, a quiz makes more sense than browsing randomly through product pages.

Tech retailers use these tools for computers, phones, and gadgets. Most people don’t know the difference between processors or understand RAM requirements, but they can answer questions about what they plan to do with their device.

Home improvement stores have found success with paint selection, tool recommendations, and project planning. The quiz considers skill level, project size, and available time to suggest appropriate products and accessories.

What Makes a Quiz Worth Taking

Good quizzes ask the right number of questions — enough to get useful information but not so many that people give up halfway through. Most successful ones stick to eight to twelve questions.

The questions themselves need to focus on things that actually matter for product selection. Asking about favorite colors might be fun, but it doesn’t help choose a vacuum cleaner. The best quizzes stick to practical considerations.

Clear language matters more than people think. When quizzes use industry jargon or complicated terms, users guess at answers instead of providing accurate information. Simple questions get better responses.

Trust Builds Better Results

Users want to understand why certain products got recommended. When the system explains its reasoning, people feel more confident about the suggestions. This transparency also helps users learn what factors matter most for their needs.

The product selection behind the quiz needs variety. If recommendations always point toward expensive options or specific brands, users catch on quickly and stop trusting the results.

Real Limitations to Consider

These quizzes work well for common situations but struggle with unusual or highly specific needs. Someone with unique requirements might find the recommendations too generic or missing important considerations.

The recommendations can only be as good as the database and algorithms behind them. Poorly designed systems suggest inappropriate products or miss better alternatives that exist outside their selection.

Some quizzes have obvious bias problems. They might favor certain brands, push expensive items, or exclude budget options without good reason. Users need to stay aware of these potential issues.

Getting Better Results From Quiz Recommendations

Smart users treat quiz results as a starting point, not the final word. The suggestions help narrow down options and provide direction, but additional research on recommended products still makes sense.

Trying quizzes from different websites can reveal options that might otherwise get missed. Each platform has its own product database and matching system, so the results often vary.

Honest answers produce better recommendations. When people answer based on what they actually need instead of what they think sounds impressive, the suggestions work out better.

Compare results from multiple quiz platforms

Read product reviews from verified buyers

Check return policies before purchasing

Consider total cost including accessories and maintenance

The Future of Product Recommendations

This technology keeps getting more sophisticated. Some platforms now use photo recognition to provide more precise matches. Voice-activated quizzes are showing up as smart speakers become more common.

Integration with browsing history and purchase data is making recommendations more personalized. Some systems combine information from social media, previous purchases, and quiz responses to create detailed user profiles.

For shoppers willing to spend a few minutes answering questions, a product recommendation quiz offers real value. It cuts through the overwhelming number of choices in online retail and points toward products that actually match specific needs and budgets.

While not perfect, these tools make purchasing decisions easier and more successful in a marketplace that often feels designed to confuse rather than help.

#Online Shopping Tips#Personalized Shopping#Smart Shopping Tools#Product Match Quiz#Quiz Based Shopping

0 notes

Text

How Energy Procurement Companies Help Australian Businesses Make Smarter Decisions

Quick answer: Energy procurement companies give Australian businesses the tools, data, and insights to make smarter, faster, and more cost-effective energy decisions—far beyond just finding cheaper rates.

When most people think “energy procurement,” they think price shopping. But in 2025, it’s a completely different game. The smartest businesses aren’t just cutting costs—they’re making informed energy decisions based on real-time data, contract structuring, and forecasting insights. And they’re not doing it alone.

They’re relying on energy procurement companies to bring clarity to a chaotic energy landscape.

What does “smarter energy” actually mean for businesses?

It means making decisions based on information—not guesswork.

Whether you’re managing one venue or a dozen locations across states, every energy decision you make has downstream effects. Choose the wrong tariff, and your peak demand charges skyrocket. Delay switching contracts by two months, and you’re stuck with inflated rates for years.

Energy procurement firms bring a structured, analytical approach to prevent this.

They help you:

Forecast future usage and budget impacts

Model contract scenarios before you commit

Benchmark your current rates against market averages

Plan energy strategy aligned with your growth curve

It’s like having a financial controller—but for your power supply.

How do procurement experts turn data into business intelligence?

Here’s where it gets interesting. The best procurement providers don’t just quote prices—they deliver dashboards, trend reports, and strategic modelling that turns your usage into a business asset.

Key capabilities include:

Interval data monitoring: Tracking 15/30-minute consumption patterns

Historical analysis: Identifying seasonal spikes or operational inefficiencies

Retail vs spot price comparison: Helping you weigh risk vs cost trade-offs

Carbon impact tracking: Linking energy decisions to ESG targets

A Brisbane logistics company recently used procurement insights to shift 60% of its cold storage operations to off-peak hours—slashing their peak demand fees by over 40%. No hardware change, just smarter scheduling.

Why is procurement strategy a CFO conversation now?

Because it affects margin, risk, and growth.

In sectors like manufacturing, agriculture, hospitality, and retail—energy is now one of the top five operating expenses. But unlike wages or rent, it’s a lever you can optimise with the right insight.

CFOs are increasingly relying on procurement advisers for:

Multi-year budgeting confidence

Contract flexibility during expansion or restructuring

Transparency for investors and auditors

Alignment with sustainability goals and reporting

For multi-site businesses, procurement advisers often consolidate contracts, remove duplication, and even handle retailer disputes—all of which improves cash flow visibility.

Is this relevant for small and medium businesses too?

Yes—arguably more than for large corporations.

SMEs often don’t have in-house energy managers or time to dig into usage data. They rely on procurement firms to interpret their bills, identify billing errors, and proactively recommend improvements.

For example:

A boutique brewery in WA discovered it was on the wrong tariff band for 18 months, costing it ~$18,000. Their broker spotted the mismatch within two days.

A growing childcare group in Victoria used procurement data to stagger operating hours across locations, reducing demand spikes without affecting operations.

A family-run laundromat chain in NSW received a usage forecast aligned with solar battery integration—a plan they never would’ve built without expert guidance.

What role does software and automation play in modern procurement?

A big one.

Today’s energy procurement companies don’t operate on spreadsheets alone. Many use proprietary platforms or tap into APIs to access live pricing, automated alerts, and contract expiry tracking.

This gives businesses:

Early warning systems for contract rollovers

Real-time insights into usage patterns

Automated bill validation to detect anomalies

Monthly reports that blend usage, pricing, and savings opportunities

For busy operations teams, this means fewer surprises and faster decisions.

One national retailer described their procurement partner’s platform as “like Xero for energy”—a tool that finally made energy visible in the way finance already is.

FAQ: Strategic Procurement in Practice

Q: How often should we review our energy contracts and strategy? Ideally, every 6–12 months. Markets change quickly, and usage patterns evolve.

Q: Can procurement partners help with on-site generation? Yes. Many advise on solar, battery storage, or embedded networks based on ROI modelling.

Q: What if we don’t have a lot of usage data? They can start with what you’ve got—your bills—and build a plan from there.

Why is timing just as important as price?

Because buying at the wrong time can be more expensive than choosing the wrong provider.

Energy procurement companies track wholesale and retail markets daily. This means they can recommend contract renewals during market dips—sometimes saving businesses tens of thousands just by acting two months earlier.

For example, when prices softened in late 2024, businesses who renewed early avoided 20–30% hikes seen in early 2025. That insight came from watching the market—not reacting to it.

Final Reflection

Not every business can afford a full-time energy manager—but most can’t afford not to think strategically about energy anymore. With so many moving parts, energy procurement companies are becoming the trusted partner that helps Aussie businesses not just save, but decide.

In a world where operational agility matters more than ever, energy procurement companies aren’t just saving money—they’re empowering smarter business choices, one kilowatt at a time.

0 notes

Text

Top Reasons ComputerWorks Clients Prefer Adagio Accounting Software

For growing businesses, choosing the right accounting software isn’t just about features—it’s about finding a solution that fits seamlessly with operations, scales with growth, and offers the control that finance teams demand. That’s why so many clients of ComputerWorks choose Adagio Accounting Software to power their financial operations.

Known for its reliability, modular structure, and batch-oriented processing, Adagio Accounting Software has become the preferred choice for mid-sized businesses that have outgrown basic bookkeeping tools like QuickBooks but aren’t ready for the complexity (or cost) of full-scale ERP systems.

1. Designed for Financial Precision and Audit-Readiness

One of the top reasons ComputerWorks clients lean toward Adagio Accounting Software is its robust audit trail. Adagio uses batch-style processing, meaning users must explicitly post transactions, which adds a layer of control and accountability. This setup reduces errors and ensures financial integrity—an essential feature for companies subject to regulatory audits or financial scrutiny.

With Adagio, every entry is traceable, making it easier for accountants and auditors to verify transactions without digging through disconnected systems or spreadsheets.

2. Powerful Financial Reporting Capabilities

While many accounting platforms require third-party tools for customized reporting, Adagio Accounting Software includes its own advanced financial statement generator. Clients appreciate the flexibility it provides—whether they need department-level reports, consolidated statements, or multi-year comparisons.

ComputerWorks ensures that each client’s reporting needs are mapped during implementation, allowing stakeholders to view financial data in the format that best supports their decision-making.

3. Modular and Scalable for Growing Companies

Adagio isn’t a one-size-fits-all solution. Its modular architecture allows businesses to choose only the components they need—such as Ledger, Payables, Receivables, Inventory, and more—then add on as they grow.

This modularity is a key reason clients stick with Adagio Accounting Software over time. With support from ComputerWorks, businesses can expand their system capabilities without needing to replace their core infrastructure.

4. Seamless Integration with Existing Systems

Many mid-sized businesses use vertical market software or industry-specific tools. Adagio Accounting Software can be configured to integrate with a variety of third-party platforms, giving clients the flexibility to maintain their existing workflows.

ComputerWorks plays a critical role here, leveraging its in-house technical expertise to tailor integrations that align with client-specific requirements.

5. Exceptional Support and Training from ComputerWorks

Adopting new accounting software can be intimidating, but ComputerWorks ensures that the transition is smooth. Their team offers personalized onboarding, training, and ongoing technical support—helping clients fully utilize the power of Adagio Accounting Software.

Many clients cite ComputerWorks’ responsiveness, depth of product knowledge, and real-world accounting experience as deciding factors in both choosing Adagio and staying with it long term.

Conclusion

Choosing accounting software is a strategic decision—and for many mid-sized organizations, Adagio Accounting Software strikes the ideal balance between control, functionality, and affordability. Combined with the expert guidance and implementation support from ComputerWorks, it becomes a powerful tool for financial management, compliance, and growth.

If your business is ready to move beyond entry-level systems and gain deeper control over financial data, it’s time to explore how Adagio Accounting Software, supported by ComputerWorks, can deliver long-term value and confidence.

0 notes

Text

Why Every Business Needs a Hard Disk Shredding Service Today

Introduction

In the digital age, where data is both an asset and a liability, businesses are awakening to a critical reality — information must not only be secured during its lifespan but obliterated beyond recovery once it outlives its purpose. The traditional practices of wiping drives or storing them indefinitely are no longer adequate. Today, every organization, from burgeoning startups to legacy corporations, requires a comprehensive hard disk shredding service to ensure data sanctity and regulatory compliance. The urgency to adopt such a service is not merely technological — it’s existential.

The Evolution of Digital Vulnerability

Modern enterprises are built upon data — client records, financial logs, intellectual property, trade secrets, employee files, and more. The proliferation of digital tools has accelerated data accumulation exponentially. However, this explosion has inadvertently expanded the attack surface for cybercriminals, malicious insiders, and opportunistic thieves. No firewall can protect data sitting idly on decommissioned drives, waiting to be discarded or reused.

Erasing files or formatting hard drives does not erase the underlying data. Sophisticated recovery software can reconstruct deleted files, even after multiple overwrites. Only mechanical destruction — via a certified hard disk shredding service — renders this data irretrievable. This irreversible method ensures that sensitive information cannot be salvaged, analyzed, or exploited under any circumstance.

Regulatory Imperatives and Corporate Accountability

Governments and regulatory bodies worldwide have tightened data protection protocols. GDPR in Europe, HIPAA in the United States, and similar regulations across jurisdictions now enforce stringent standards for data disposal. Failure to comply can result in monumental fines, reputational erosion, and litigation.

When a business engages a hard drive destruction service in London, it gains not just peace of mind but legal armor. These providers typically offer certificates of destruction — an auditable proof that data was eliminated in accordance with prescribed standards. In courtrooms and audits, such documentation can mean the difference between vindication and liability.

The benefits are not abstract; they’re calculable. Data breaches cost companies millions annually, not just in immediate damages but in lost contracts, brand dilution, and customer attrition. The expense of shredding obsolete hardware pales in comparison to the devastation of compromised information.

Beyond Office PCs: The Rise of Electronic Waste and Its Hidden Dangers

Obsolete electronics do not vanish — they transform into liabilities. Old laptops, servers, and external drives, if not handled responsibly, end up in landfills or black markets. This poses both ecological and corporate threats. Improperly discarded devices may contain recoverable data, while contributing to the mounting crisis of global e-waste.

Engaging an accredited provider of electronic garbage disposal ensures environmental stewardship. These professionals not only obliterate data-bearing devices but responsibly recycle components, separating toxic elements from reusable materials. This dual approach safeguards both confidentiality and sustainability.

Incorporating electronic garbage disposal into company policy is more than a best practice — it’s an ethical imperative.

Data Centre Decommissioning: A High-Stakes Undertaking

As cloud computing ascends and edge technologies proliferate, businesses frequently migrate their infrastructure, leaving behind entire ecosystems of dormant hardware. Decommissioning a data centre is a complex choreography involving logistical planning, inventory audits, compliance reviews, and most crucially — secure data destruction.

Engaging a specialized data centre decommissioning service streamlines this transformation. These experts understand the intricacies of enterprise IT environments and can methodically dismantle, transport, and destroy obsolete drives with surgical precision. From asset tagging to final certification, their process is calibrated to prevent data leaks during transitions.

No organization can afford to overlook this step. Even a single mishandled server could contain terabytes of confidential information — an irresistible honeypot for adversaries.

Reputation, Trust, and the Invisible Cost of Negligence

Trust is the currency of commerce. A single data breach can obliterate years of goodwill and client loyalty. Consumers today are acutely aware of how their data is handled. Businesses that treat data disposal casually risk alienating their customer base.

Opting for a robust hard disk shredding service is a visible commitment to privacy. It tells clients, stakeholders, and partners: “We value your data even in its death.” Such demonstrations of integrity are subtle but powerful brand differentiators in a crowded marketplace.

Moreover, responsible shredding aligns with corporate social responsibility goals. By preventing data leakage and reducing e-waste, companies position themselves as conscientious stewards of both information and the environment.

The Anatomy of a Modern Shredding Protocol

Modern shredding isn’t a mere act of smashing disks with a hammer. It’s an orchestrated process involving chain-of-custody documentation, real-time video capture, barcode tracking, and post-destruction audits. Certified technicians handle the assets with precision, using industrial-grade shredders that mutilate platters into unrecognizable fragments.

Top-tier providers of hard drive destruction service in London even offer on-site shredding. This eliminates the risk of transport-related tampering. For highly sensitive institutions — law firms, banks, healthcare networks — this localized destruction ensures airtight security.

After shredding, the residue is sorted. Metal fragments are recycled, magnetic coatings are neutralized, and non-recyclables are disposed of per environmental regulations. The client receives a detailed report, including serial numbers of destroyed devices and time-stamped evidence of destruction. This is data death done right.

Future-Proofing the Enterprise

Emerging technologies such as blockchain, AI, and quantum computing are poised to revolutionize how data is stored and processed. Yet, these innovations will not eliminate the need for physical data disposal. In fact, they may exacerbate it.

The proliferation of decentralized storage and machine learning datasets will create new forms of hardware reliance. Training datasets, neural weights, and embedded systems will occupy localized storage that eventually becomes obsolete. These will demand the same level of secure disposal as conventional drives.

Forward-looking businesses must weave hard disk shredding service into their digital transformation blueprints. Not as an afterthought, but as a foundational pillar of security infrastructure.

Choosing the Right Partner

Not all shredding services are created equal. The right partner should offer a suite of services that include:

Certified hard disk shredding service

Regulatory-compliant electronic garbage disposal

Enterprise-grade hard drive destruction service in London

Turnkey data centre decommissioning

Transparency, traceability, and technology are the benchmarks of excellence in this domain. Look for providers who offer customizable service-level agreements, real-time tracking, and multi-format destruction capabilities (from SATA to SSD to NVMe).

Security is not a department — it is a culture. And that culture is only as strong as its weakest endpoint. Data disposal is that endpoint. Ignoring it is like locking your vault but leaving the key under the mat.

Conclusion: The Silent Sentinel of Cybersecurity

In an era where data breaches dominate headlines and privacy is a geopolitical concern, safeguarding information must extend beyond usage. It must continue after obsolescence, culminating in irreversible destruction.

Every organization — regardless of size or sector — needs to embrace the logic and logistics of a hard disk shredding service. From mitigating liability to enhancing brand reputation, from environmental stewardship to regulatory alignment, the rationale is irrefutable.

Data may be intangible, but its consequences are concrete. And when it comes time to dispose of that data, destruction is the only security that matters.

Source URL - https://medium.com/@fixedassetdisposal11/why-every-business-needs-a-hard-disk-shredding-service-today-cba2fa064fac

#hard disk shredding service#electronic garbage disposal#hard drive destruction service in london#data centre decommissioning

0 notes

Text

Best Free Tools for Algorithmic Trading Beginners in 2025

This visually appealing infographic lists the top algo trading software India 2025 orientated to beginners that are free such as the AlgoBulls trial package and the QuantMan free mode. In a conversational style, it incorporates icons and stats to highlight features such as drag-and-drop strategies, paper trading and mobile access. A timeline shows ease of setup, and a side-by-side comparison shows strengths for beginners. Ideal for sharing on social media, this infographic breaks down algorithmic trading, so beginners can see how free tools allow them to join India’s fast-paced financial trading without risk.

0 notes

Text

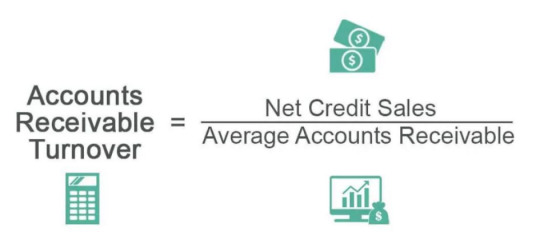

📘 Receivable Turnover Ratio: What It Means and Why It’s Crucial for Your Business

The receivable turnover ratio is more than just a number in your accounting software — it’s a direct window into how efficiently your business collects money. Whether you're an analyst reviewing stocks like Asian Paints, or a small business trying to manage cash flow, this ratio tells you how often receivables are converted into actual cash within a period.

🔍 Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

It’s classified under efficiency ratios, and it forms a part of broader financial statement analysis — crucial for understanding liquidity, cash flow health, and working capital efficiency.

🧮 How the Receivable Turnover Ratio is Calculated (With a Simple Example)

Let’s break it down with an example from the Indian market 📈

Imagine Hindustan Unilever Ltd. (HUL) made ₹10,000 crore in net credit sales last year and maintained an average accounts receivable of ₹1,000 crore.

🔢 That gives us:

Receivable Turnover Ratio = ₹10,000 crore / ₹1,000 crore = 10

This means HUL collects its receivables 10 times a year, or roughly once every 36 days.

High turnover indicates prompt collection — a positive sign for liquidity and credit control policies. A lower ratio might signal inefficient collections or weak credit screening of customers.

📊 What’s a “Good” Receivable Turnover Ratio? Here’s What the Numbers Say

There’s no universal “good” ratio — it depends on the industry. For instance:

🔹 FMCG companies like Dabur or Marico often have higher ratios because of fast-moving inventory and tight credit terms.

🔹 Automobile manufacturers like Tata Motors might show lower turnover due to B2B credit sales and longer cycles.

According to a 2023 Credit Research Foundation (CRF) report, the average receivable turnover ratio across Indian manufacturing firms stood at 7.4. In contrast, retail chains often score upwards of 12.

A good benchmark is to compare with your industry average, not cross-sector. This is where Strike Money becomes invaluable. The tool helps visualize receivable patterns, peer comparisons, and historic shifts — making data interpretation more actionable.

⚙️ How to Improve Your Receivable Turnover Ratio: 5 Key Strategies That Actually Work

A strong ratio reflects tight internal controls, disciplined credit policies, and timely collection systems. If your turnover is slipping, try these tactics 👇

💰 Tighten Credit Policies – Set clear terms and assess creditworthiness. Use third-party credit rating agencies in India like CRISIL and ICRA.

⏱️ Accelerate Invoicing – Issue invoices immediately upon delivery or service.

📞 Streamline Collections – Follow up diligently, automate reminders.

🔁 Offer Early Payment Discounts – Incentivize clients to pay faster.

📊 Monitor With Tools – Use platforms like Strike Money to track A/R trends and identify slow-paying clients.

A case study by Harvard Business Review in 2022 revealed that companies with receivable turnover ratios above industry medians showed 23% better free cash flows over five years.

🔁 Receivable Turnover vs Days Sales Outstanding (DSO): What’s the Difference?

These two metrics are siblings — closely related but slightly different in scope 🧩

⚖️ Receivable Turnover Ratio tells you how many times receivables are collected in a period.

📆 Days Sales Outstanding (DSO) tells you how many days it takes to collect.

🧠 Formula: DSO = 365 / Receivable Turnover Ratio

So if your turnover ratio is 10, your DSO is 36.5 days.

While turnover gives a rate-based view, DSO gives a time-based outlook. For a CFO at a company like Infosys, DSO offers a more relatable picture for cash flow planning.

💼 Real Examples From Indian Companies Using Receivable Turnover Effectively

Let’s explore how some Indian giants manage this ratio in the real world 🚀

📌 Asian Paints Ltd.: Known for its aggressive distribution network, the company maintains a receivable turnover ratio between 14–18 over the years. Their secret? Tight credit policies and tech-driven logistics.

📌 Pidilite Industries: Makers of Fevicol maintain a healthy ratio of 12–13, reflecting strong dealer relationships and efficient collections.

📌 Sun Pharma: As a pharma exporter, Sun Pharma often deals with international credit cycles. It balances a lower turnover of around 6–7 by ensuring credit is backed by robust documentation and export financing.

You can analyze these data points visually using Strike Money, which integrates quarterly reports and historical financials for side-by-side comparisons.

🚫 Common Mistakes When Interpreting the Receivable Turnover Ratio

Here are a few traps that even seasoned analysts fall into ❌

🔄 Including Cash Sales – The formula only considers net credit sales. Including all sales gives a distorted picture.

📅 Ignoring Seasonal Trends – A retail business may naturally have a skewed turnover post-holiday sales.

📉 Misreading a High Ratio – A very high ratio might look great but could signal overly strict credit policies that limit sales growth.

💡 Tip: Always cross-verify with DSO, inventory turnover, and current ratio for a fuller picture. Tools like Strike Money make this triangulation easier by plotting all efficiency ratios on interactive dashboards.

🔍 What Influences the Receivable Turnover Ratio?

Multiple operational, financial, and external factors influence your ratio. These include:

📈 Business Model – B2B companies often deal with longer credit cycles than B2C.

💳 Customer Profile – Institutional clients may delay payments compared to retail consumers.

🌍 Macroeconomic Conditions – In periods of inflation or recession, clients might delay payments, affecting turnover.

🧾 Regulatory Changes – In India, GST input credits and payment processing reforms impact payment behavior across sectors.

According to a RBI bulletin (2024), MSMEs in India faced an average payment delay of 45–50 days, leading to poor turnover ratios despite stable credit sales. This reinforces the need for internal control more than external dependence.

🧠 Why Receivable Turnover Is a Hidden Indicator of Business Health

Think of the receivable turnover ratio as a pulse check 🫀 on your liquidity. It directly reflects how fast your business converts sales into cash — critical for paying salaries, buying inventory, and funding growth.

🔍 Investors like Warren Buffett and Rakesh Jhunjhunwala (legacy) have repeatedly emphasized the importance of analyzing cash flow metrics over net profits. Receivable turnover is central to this.

A company showing consistent growth in sales but worsening receivable turnover is a red flag — it indicates money is stuck in receivables, not in the bank.

🧩 Combine this metric with other indicators like:

💡 Quick Ratio – For liquidity 📈 Operating Cash Flow – For real cash inflows 🔁 Inventory Turnover – For supply chain efficiency

With tools like Strike Money, you can track these over time, benchmark them against sector leaders, and visualize long-term trends that could otherwise be buried in raw data.

🧾 Final Word: Make Receivable Turnover Part of Your Regular Review

The receivable turnover ratio might not make headlines, but it quietly powers your business’s financial engine. It’s one of those “small hinges that swing big doors.”

🏁 Here’s what to remember:

🔹 Calculate it regularly 🔹 Compare it within your industry 🔹 Interpret it with context — don’t isolate it 🔹 Take corrective action if it drops 🔹 Use tools like Strike Money to visualize trends and opportunities

Whether you're a startup founder, retail investor, or finance manager — mastering this ratio equips you to handle cash crunches, negotiate better credit terms, and improve business efficiency.

Keep your receivables healthy — and your business will follow 🚀

0 notes

Text

Unlocking Financial Clarity: How Business Valuation & Tax Prep Drive Smart Growth

A thriving local business in Corpus Christi once faced a hard reality—despite increasing revenue, its owner couldn’t determine its actual value.

This uncertainty hindered expansion plans and complicated partnerships. Scenarios like this highlight the crucial need for proper financial analysis. Business valuation and tax preparation are not just administrative necessities; they are powerful tools for strategic decision-making. This article explores how specialized services, including Ez Tax By The Bay business valuation service Corpus Christi, can empower entrepreneurs and professionals to make informed financial choices in today’s competitive market.

UNDERSTANDING THE ROLE OF BUSINESS VALUATION SERVICES

A business valuation provides a clear picture of what a company is truly worth, which can affect everything from selling a business to securing investment or planning succession. The Ez Tax By The Bay business valuation service Corpus Christi plays a vital role in providing this clarity. It applies professional methods, considering tangible assets, revenue, and market comparisons. Understanding business value not only supports compliance with financial regulations but also fosters strategic growth. Without such accurate valuation, business owners often make misguided decisions that can stall progress or devalue years of hard work.

WHO NEEDS A BUSINESS VALUATION—AND WHY IT MATTERS

Whether preparing for a merger, resolving shareholder disputes, or seeking external funding, knowing a company’s worth is crucial. The Ez Tax By The Bay business valuation service Corpus Christi caters to diverse industries and offers a tailored approach based on unique business models. Valuation is essential even for small to mid-sized enterprises, especially those aiming to scale or refinance. Professionals often overlook how vital this step is until a critical financial event arises. Utilizing expert guidance not only mitigates financial risk but also strengthens operational credibility in the eyes of investors and partners.

IMPORTANCE OF TAX PREPARATION IN FINANCIAL SUCCESS

Tax preparation is more than filling out forms before deadlines—it’s a year-round process that affects budgeting, savings, and future planning. Choosing an expert like Ez Tax By The Bay tax preparer corpus christi ensures full compliance while optimizing deductions and avoiding penalties. Many individuals and small business owners in Corpus Christi find themselves facing IRS audits or surprise tax bills simply because of incorrect self-filing or generalized tax software. Professional preparation helps anticipate liabilities and gives clear financial direction, which is indispensable for long-term growth and stability.

HOW TAX EXPERTISE BENEFITS SMALL BUSINESS OWNERS

A trusted Ez Tax By The Bay tax preparer corpus christi offers more than just filing assistance—they provide insight into how taxes impact the entire business structure. By analyzing revenue flows, employee expenses, and investments, tax preparers guide owners toward smarter decisions. Their expertise reduces errors, minimizes audit risk, and ensures documentation is thorough and compliant. Accurate tax handling can also improve a company’s eligibility for credits and refunds, strengthening cash flow and boosting confidence during financial planning. This support becomes a cornerstone for businesses aiming for consistency and financial transparency.

BRIDGING THE GAP BETWEEN VALUATION AND TAX STRATEGY

When both valuation and tax strategy work in harmony, businesses gain a clearer path to growth. Professionals offering services like Ez Tax By The Bay tax preparer corpus christi and Ez Tax By The Bay business valuation service Corpus Christi contribute directly to long-term planning and risk management. From identifying cost-saving opportunities to aligning financial records with business goals, integrated financial consulting offers a distinct advantage. Many business owners in Corpus Christi now realize that regular valuation paired with proactive tax handling is the key to maintaining profitability and sustaining business resilience through fluctuating economic conditions.

CONCLUSION: THE VALUE OF LOCAL EXPERTISE

Financial success starts with understanding what the numbers truly mean—and acting on that insight with precision. That’s where EZ Tax by the Bay LLC makes a real difference. By offering reliable Ez Tax By The Bay business valuation service Corpus Christi and expert-level Ez Tax By The Bay tax preparer corpus christi, this firm supports both individuals and businesses in Corpus Christi to thrive in an increasingly complex financial environment. Visit to learn how financial clarity and compliance can become cornerstones of sustainable growth.

0 notes

Text

What Innovations Are Shaping the Future of Fintech Platforms?

The fintech industry is transforming at an unprecedented pace, fueled by advancements in technology and evolving customer expectations. From mobile wallets to blockchain-based lending, innovations in fintech software development are not only improving financial accessibility but also redefining how consumers and businesses interact with financial systems. As the demand for seamless, secure, and efficient fintech services grows, several key innovations are emerging as game-changers in the development of future-ready fintech platforms.

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the forefront of modern fintech innovation. These technologies are being integrated into fintech platforms to enhance personalization, detect fraud, automate financial advice, and improve decision-making. For instance, robo-advisors powered by AI analyze user behavior and risk appetite to offer tailored investment strategies. ML algorithms are also vital in credit scoring, where they assess a borrower’s creditworthiness beyond traditional credit scores by analyzing alternative data sources. In the realm of fintech software development, incorporating AI not only improves user engagement but also enhances operational efficiency.

2. Blockchain and Decentralized Finance (DeFi)

Blockchain technology has revolutionized the way data is stored, verified, and exchanged in financial transactions. By ensuring transparency, immutability, and decentralization, blockchain enables secure peer-to-peer transactions without intermediaries. Decentralized Finance (DeFi) platforms leverage smart contracts to provide services like lending, borrowing, and trading in a trustless environment. These innovations are reshaping traditional banking models and pushing fintech platforms towards more open and inclusive systems. For developers, blockchain introduces new paradigms in fintech software development, including tokenization, digital identity verification, and decentralized exchanges.

3. Open Banking and API Integrations

Open banking is redefining how banks and third-party providers collaborate. Through secure API integrations, fintech platforms can access user data (with consent) from multiple banks to offer consolidated services such as budgeting, credit comparisons, or personalized offers. This approach promotes competition and innovation in the financial sector. API-driven architecture is now a cornerstone of fintech services, allowing seamless interoperability between different financial institutions and service providers. It also supports faster onboarding, real-time transactions, and integration with external platforms like e-commerce or insurance.

4. Cloud Computing and SaaS Models

Cloud technology has become essential in fintech software development for its scalability, cost-efficiency, and flexibility. Fintech startups and enterprises alike are leveraging cloud-based platforms to deploy and manage applications in real time. The Software-as-a-Service (SaaS) model allows companies to deliver financial solutions on a subscription basis, enabling quicker time-to-market and lower infrastructure costs. Cloud-native fintech platforms benefit from better disaster recovery, real-time analytics, and easier maintenance. This trend is driving digital transformation across the fintech landscape.

5. Biometric Authentication and Enhanced Cybersecurity

With increasing digital transactions, security remains a top concern. Innovations in biometric authentication—such as fingerprint scanning, facial recognition, and voice identification—are improving the safety and user experience of fintech platforms. In parallel, cybersecurity technologies such as behavioral biometrics, end-to-end encryption, and secure coding practices are being embedded into fintech software development to prevent fraud and data breaches. Strong security frameworks help build user trust, which is essential for the growth of any fintech solution.

6. Embedded Finance