#forex fibonacci indicators

Explore tagged Tumblr posts

Text

AUDUSD Scalper mode trading M1 timeframe signal [AUDUSD,M1].

Official Website: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator metatrader4 LIFETIME LICENSE with NO LAG & NON REPAINT buy and sell Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside Brokers MT4 Plataform,indices, cryptos, metals etc. . ✅ NON REPAINT / NON LAGGING Signals ✅ New 2025 Version LIFETIME License 🔔 Signals Sound And Popup Notifications 🔥 2025 Profitable EA AUTO-Trade Option Available . ✅ * Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the MT4 platform of the customer who has access to his License*. ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at Exness brokerage. Signals may vary slightly from one broker to another ). . ✅ Cashpower Indicator Works in all charts inside Metatrader4 plataform for anybroker that have mt4. It will works inside anychart that your brokerage have examples: Forex charts, bonds charts, indicescharts, metals charts, energy, cryptocurrency charts and etc. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#cashpowerindicator#indicatorforex#forexindicator#forex#forextradesystem#forexprofits#forexsignals#forexindicators#forexvolumeindicators#forexchartindicators#forex fibonacci indicators#forex moving leverage#forex volume#forex bolinger bands#forex news#forex broker#forex factory#forex signal#forex expert advisor#forextrading#forex market#forex robot#forex expert advisors

0 notes

Text

Hot Bulenox Discount 91%

#Fibonacci#fibonacci retracements#Fibonacci extensions#stocks trading#futures trading#currencies trading#fx trading#forex trading#commodity trading#indices trading#ETF Trading#cfd trading#spx#ndx#ftse#nifty#Sensex#trading education#cci#rsi

1 note

·

View note

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

what are the best indicators for forex trading

Best Indicators for Forex Trading – Ultimate Guide (Overview)

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

1. Moving Averages (MA)

Moving Averages are among the most widely used indicators for identifying the direction of the trend.

Simple Moving Average (SMA): Smooths out price data over a period.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive.

Best use cases:

Spotting trend direction.

Entry/exit points when combined with crossover strategies (e.g., 50 EMA and 200 EMA golden/death cross).

2. Relative Strength Index (RSI)

RSI measures the speed and change of price movements on a scale of 0 to 100.

Overbought: Above 70

Oversold: Below 30

Best use cases:

Identify potential reversals.

Confirm trend strength in combination with price action.

3. Moving Average Convergence Divergence (MACD)

MACD is a momentum-following indicator showing the relationship between two EMAs.

Components: MACD line, Signal line, Histogram

Crossovers and divergences signal trade opportunities.

Best use cases:

Confirm trend direction.

Identify momentum changes.

4. Bollinger Bands

Created by John Bollinger, this indicator consists of a moving average with upper and lower bands set 2 standard deviations away.

Best use cases:

Measure volatility.

Identify potential breakout or reversal areas when price hits the outer bands.

5. Stochastic Oscillator

A momentum indicator comparing a particular closing price to a range of its prices over time.

Readings above 80 indicate overbought conditions.

Below 20 indicates oversold.

Best use cases:

Pinpoint entry points.

Effective in ranging markets.

6. Fibonacci Retracement

Used to identify potential support and resistance levels based on Fibonacci ratios (38.2%, 50%, 61.8%).

Best use cases:

Predict pullback levels.

Combine with trend indicators for optimal entries.

7. Ichimoku Cloud

A comprehensive indicator that shows support/resistance, trend direction, and momentum.

Key components: Kumo (cloud), Tenkan-sen, Kijun-sen, Chikou Span.

Complex but powerful once mastered.

Best use cases:

Full-market overview.

Effective in trending markets.

8. Average True Range (ATR)

Measures market volatility over a period.

Best use cases:

Set stop-loss and take-profit levels.

Identify volatile market conditions.

9. Volume Indicators (On-Balance Volume – OBV)

While Forex is decentralized, tick volume or broker volume helps gauge momentum.

Best use cases:

Confirm breakouts.

Validate trend strength.

10. Parabolic SAR

Used to determine the direction of an asset’s momentum and potential reversal points.

Best use cases:

Effective for trailing stop losses.

Best used in trending markets (not ranging).

Combining Indicators for Best Results

RSI + Moving Average: Confirm reversals in trend direction.

MACD + Bollinger Bands: Catch momentum in volatile periods.

Fibonacci + EMA: Plan entries on pullbacks during strong trends.

Tips for Indicator Use

Don’t rely on a single indicator.

Backtest your indicator strategy.

Use indicators with your trading style (scalping, day trading, swing trading).

Keep your chart clean – 2–3 indicators maximum.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex market#forex education#forex news#forex online trading#forex ea#forex factory#forex broker#crypto#forex indicators

0 notes

Text

Pin Bar Candlestick Pattern: A Trader’s Guide to Smart Entries and Exits

Have you ever noticed a candle on a chart that looks like a pin or a needle? That structure is known as a pin bar, and it can give traders powerful insights into future price movement. Whether you're entering or exiting a trade, the pin bar can help you make smarter, more strategic decisions.

If you've found it challenging to recognize or understand this pattern, you're not alone. In this Market Investopedia guide, we’ll walk you through everything you need to know about pin bars—how they work, their pros and cons, and how to trade them effectively.

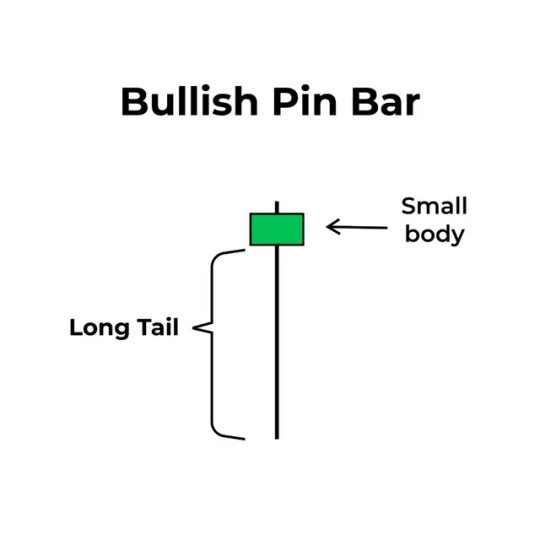

What Is a Pin Bar?

A pin bar is a candlestick formation that signals a potential price reversal or continuation. It’s made up of:

A small body (green or red),

A long wick on one end,

And a short wick on the opposite end.

This structure reveals price rejection—meaning the market attempted to move in one direction but was strongly pushed back, hinting at an upcoming shift.

Key Features of a Pin Bar

To identify a pin bar, look for the following elements on your chart:

Small Candle Body

The body should be short, showing little difference between the opening and closing prices. This indicates a balance—or struggle—between buyers and sellers.

Wicks (Shadows)

There are two wicks on a pin bar. One is very long, and the other is short. The long wick reveals where the price was rejected, and it's the most important part of the pin bar.

Closed Candle

Never trade a pin bar that hasn’t closed yet. Wait for the candle to close before making a decision based on its signal.

Types of Pin Bars

Bullish Pin Bar

Appears during a downtrend

Has a small green body

Features a long lower wick

Signals a potential upward reversal

The long lower wick suggests sellers pushed the price down, but buyers fought back, rejecting the lower levels. This often indicates a buying opportunity.

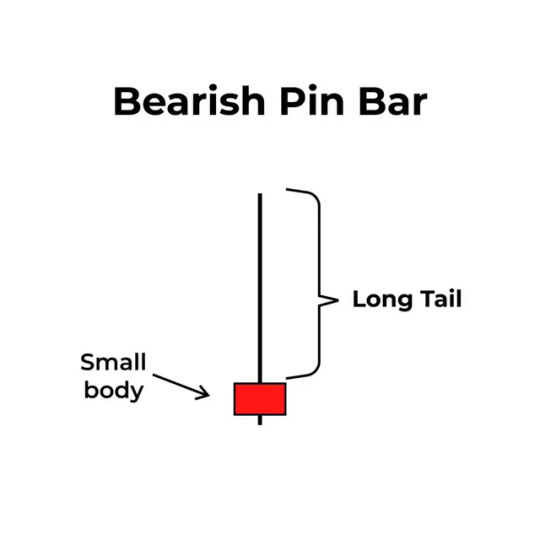

Bearish Pin Bar

Appears during an uptrend

Has a small red body

Features a long upper wick

Signals a potential downward reversal

Here, buyers tried to push the price higher, but sellers stepped in and rejected the highs. This often signals a selling opportunity.

How to Trade Using Pin Bars

1. Identify a Pin Bar

Scan your chart (preferably 4-hour, daily, or weekly) for a small-bodied candle with a long wick on one end and a short wick on the other.

2. Use Confirmation Tools

Combine pin bars with tools like:

RSI (Relative Strength Index)

Fibonacci Retracement

Bollinger Bands These indicators can help confirm whether the signal is strong enough to act on.

3. Trade Reversals

When a pin bar forms at a key support or resistance level, it often signals a reversal. Trade in the direction opposite the long wick.

4. Trade Trend Continuations

Not every pin bar signals a reversal. In some cases, especially during a trend pause, a pin bar can indicate that the current trend is about to continue. For example, a bullish pin bar during an uptrend suggests that buyers are still in control.

How to Spot High-Quality Pin Bars

Not all pin bars are equal. Here's what to look for in a strong setup:

Key Levels: Look for pin bars forming at significant support or resistance zones.

Longer Time Frames: Pin bars on 4H, daily, or weekly charts tend to be more reliable than those on 5-minute or 15-minute charts.

Wick Length: The longer the wick (at least two-thirds of the candle's length), the stronger the signal.

Smaller Body: A smaller body means less indecision and more rejection.

Volume Confirmation: Higher trading volume strengthens the validity of the pattern.

Pros of Trading Pin Bars

Easy to recognize, even for beginners

Work well with various assets—Forex, stocks, crypto, commodities Clearly define potential entry and exit levels

Combine well with trendlines, moving averages, and other tools Suitable for multiple timeframes

Cons of Trading Pin Bars

Less effective in choppy or sideways markets

Relies on probabilities—there’s no guarantee the signal will play out

Can produce false signals without proper confirmation

Final Thoughts

The pin bar candlestick is a powerful yet simple tool that traders can use to spot trend reversals or continuations. It's easy to learn, and when combined with other forms of analysis, it can provide high-probability trade setups.

However, like any trading method, pin bars are not foolproof. It's important to assess each one carefully, confirm the signal, and avoid trading them in low-quality setups or during erratic market conditions.

Ready to dive deeper into price action and trading strategies? Explore more articles on Market Investopedia or join our free webinar for hands-on learning with real chart examples.

0 notes

Video

youtube

Forex Weekly Recap May 17, 2025 4HR Supply & Demand Strategy in Action!

Welcome to my weekly Forex recap for the week of May 11th, 2025! In this video (recorded May 17th), I dive deep into my "Damn Near 100% Objective 4HR Supply & Demand Trade Plan," breaking down recent trades, potential setups, and how I use specific tools and indicators for high-probability entries.

In this video, you'll learn:

How I analyze the 4-hour chart for supply and demand zones.

My method for determining trend direction using 3 EMAs (50, 200, 800).

The step-by-step entry technique:

1-Hour Buy/Sell Shift (5/13 EMA Cross)

30-Minute Change of Character (CHoCH) using the Lux Algo indicator.

Using Fibonacci for precise entry points (71% or 78.6%).

Detailed analysis of trade setups on EURCAD, EURNZD, GBPAUD, and NZDJPY.

How to manage trades, set stop losses, and identify take profit targets.

Understanding invalidation zones and clean breaks of structure.

An update on the JIFU platform, its academies, scanners (like Golden Arrow & Impulse), and a limited-time $50 discount offer!

📊 Get My FREE "Damn Near 100% Objective 4HR Supply & Demand Trade Plan" PDF: https://sorianoblueprint.com/4HR-SUPPY-DEMAND-TRADE-PLAN.pdf

0 notes

Text

Top Swing Trading Strategies That Actually Work

Master the Market with Proven Techniques Backed by Real Experience

Understanding the Power of Swing Trading

In the fast-paced world of forex and financial markets, swing trading stands out as one of the most effective strategies for capturing short- to medium-term gains. Unlike day trading, which requires constant screen time, or long-term investing that demands immense patience, swing trading offers a balanced approach—allowing traders to capitalize on price movements that occur over several days or weeks.

But success in swing trading doesn’t come from guesswork. It requires discipline, a solid plan, and the right tools. In this guide, we break down top swing trading strategies that actually work, supported by expert insight and a real-life success story from a trader who turned knowledge into profit.

What Is Swing Trading?

Swing trading is a trading style that focuses on capturing price “swings” within a trend. Traders use a mix of technical and fundamental analysis to enter positions during corrective phases or breakouts and aim to hold them from a few days to a few weeks. This approach allows for flexibility and reduces exposure to overnight market risks compared to day trading.

This strategy is particularly well-suited for forex traders who want consistent returns without the high-pressure demands of intraday trading.

Top Swing Trading Strategies That Deliver Results

1. Trend Following Strategy

This strategy focuses on identifying and trading in the direction of a well-established trend. Swing traders using this technique look for retracements in an uptrend or downtrend and enter trades at key support or resistance levels.

Key Indicators:

Moving Averages (50-day and 200-day)

MACD (Moving Average Convergence Divergence)

Trendlines

Why It Works: Markets tend to move in trends, and riding the momentum increases the probability of success. By entering during pullbacks, traders gain a better risk-reward ratio.

2. Breakout Trading

Breakouts occur when the price moves beyond a well-established support or resistance level with increased volume. Swing traders seek to enter at the beginning of the breakout and ride the wave until the momentum slows.

Key Tools:

Volume Indicators

Bollinger Bands

Price Channels

Pro Tip: Always confirm breakouts with volume spikes to avoid false breakouts.

Click Now

3. Fibonacci Retracement Strategy

Fibonacci retracement levels are used to predict potential reversal zones during market pullbacks. Swing traders often combine Fibonacci levels with other indicators to time their entries and exits.

Common Levels: 38.2%, 50%, and 61.8% Best Used With: RSI (Relative Strength Index) or candlestick patterns

This strategy works especially well in trending markets, where traders aim to enter at the retracement and exit near the previous swing high or low.

4. Support and Resistance Trading

Trading based on horizontal support and resistance levels is a classic swing trading approach. When the price approaches a significant level, traders anticipate either a bounce or a breakout.

Tools for Identification:

Price action analysis

Historical chart data

Advantage: This method offers clear entry and exit points, reducing guesswork.

5. Moving Average Crossover Strategy

This strategy involves using two different moving averages—typically a short-term and a long-term one. When the short-term MA crosses above the long-term MA, it generates a buy signal, and vice versa for sell signals.

Common Pairings:

10-day and 50-day

20-day and 100-day

Benefit: This system is straightforward and effective for spotting trend changes early.

Real-Life Trader Success Story: How Sarah Mastered Swing Trading

Sarah Henderson, a 34-year-old marketing executive from the UK, ventured into forex trading as a side hustle. Initially overwhelmed by market volatility, she sought a method that suited her busy schedule. That’s when she discovered swing trading.

Sarah opened an account with FP Markets, drawn by their tight spreads and access to advanced charting tools. She focused on swing trading strategies—particularly trend-following and Fibonacci retracements. Using their MetaTrader 4 platform, she was able to backtest her strategies and identify profitable setups.

Within her first year, Sarah achieved a 27% return on her trading capital. Her most successful trade came during a GBP/USD rally, where she entered on a retracement at the 50% Fibonacci level and exited after a 250-pip move. “The key was not trading every day, but making every trade count,” Sarah shares.

Today, she continues to swing trade part-time while educating new traders through her blog, attributing her success to a disciplined strategy and the right broker.

Why Choosing the Right Broker Matters?

No matter how good your strategy is, a poor brokerage platform can derail your success. Swing traders require:

Fast trade execution

Low spreads and commissions

Reliable charting tools

Strong customer support

Trustworthy regulation

FP Markets ticks all these boxes. With access to MT4/MT5, ultra-low latency execution, and multi-regulated oversight, they are a top choice for serious forex swing traders.

FAQs – FP Markets & Forex Swing Trading

1. Is FP Markets good for swing trading? Yes, FP Markets offers competitive spreads, advanced charting platforms, and excellent execution speeds—making it ideal for swing trading.

2. What trading platforms does FP Markets offer? FP Markets supports MetaTrader 4, MetaTrader 5, and Iress. For swing traders, MT4 and MT5 provide a wide range of tools for technical analysis.

3. Does FP Markets allow holding positions overnight? Absolutely. FP Markets supports overnight positions, which is essential for swing trading. Just be mindful of swap/rollover fees depending on the instrument.

4. How can I manage risk while swing trading with FP Markets? Use proper stop-loss and take-profit orders, apply sound risk management (e.g., risking only 1-2% per trade), and backtest strategies on FP Markets’ demo accounts before going live.

5. Is FP Markets regulated and secure? Yes, FP Markets is regulated by ASIC (Australia), CySEC (Europe), and other financial authorities. This multi-jurisdictional regulation enhances trader security and transparency.

youtube

Final Thoughts: Swing Trading as a Path to Financial Freedom

Swing trading isn't just a strategy—it’s a mindset. With the right approach, tools, and broker, traders can systematically profit from the natural ebb and flow of market prices. Whether you're just starting or refining your edge, the strategies shared above are time-tested and battle-proven.

Platforms like FP Markets give you the foundation you need, but your discipline, patience, and education will ultimately determine your success. Take inspiration from traders like Sarah, and remember—mastering swing trading starts with understanding the market and respecting your plan.

Learn More

0 notes

Text

Top 10 Features That Make Axiom Trade a Game-Changer for Online Trading

AxiomTrade.net has emerged as one of the most competitive platforms in the world of online trading. Whether you’re a seasoned trader or a beginner stepping into the dynamic world of crypto and forex, Axiom Trade provides tools, security, and infrastructure that give it a decisive edge. Traders searching for an advanced and user-centric trading environment often ask about the axiom exchange invite code, as it opens the door to exclusive benefits on this cutting-edge platform.

1. Lightning-Fast Trade Execution

AxiomTrade.net offers blazing-fast order execution that minimizes slippage and improves precision in high-volatility markets. With trade processing speeds measured in milliseconds, traders can act on opportunities instantly without delays. This speed is particularly valuable in crypto trading, where prices shift rapidly.

2. Multi-Asset Trading Capabilities

AxiomTrade is more than just a crypto exchange. It supports forex, commodities, indices, and stocks, making it a robust multi-asset platform. This diversity empowers users to diversify their investment strategies within a single interface and manage all portfolios without switching platforms.

3. User-Friendly and Intuitive Interface

Designed with both novice and experienced traders in mind, the platform features a clean, modern UI that’s easy to navigate. Real-time data feeds, customizable charting tools, and a drag-and-drop layout make for a frictionless user experience that enhances productivity.

4. Advanced Charting and Technical Analysis Tools

Traders gain access to powerful charting features including over 100 technical indicators, drawing tools, and real-time price feeds. Whether you’re using Fibonacci retracements or MACD oscillators, AxiomTrade gives you everything needed for in-depth market analysis right at your fingertips.

5. Tight Spreads and Competitive Fees

AxiomTrade.net offers some of the lowest spreads in the industry, ensuring more of your profits stay in your pocket. Their fee structure is fully transparent with no hidden charges. This makes the platform ideal for scalpers and high-frequency traders looking for maximum efficiency.

6. Mobile Trading App with Full Functionality

The AxiomTrade mobile app is not a scaled-down version of the desktop platform—it's a full-featured trading tool that allows you to trade, analyze markets, and manage funds on the go. The mobile experience maintains the same lightning-fast execution and responsive design as the desktop version.

7. Comprehensive Risk Management Features

Risk control is built into every layer of the AxiomTrade system. With stop-loss, take-profit, and trailing stop options, traders can protect their investments even when away from the platform. Margin requirements and real-time margin monitoring are also clearly displayed.

8. High-Level Security Infrastructure

Security is a cornerstone of AxiomTrade.net. The platform uses military-grade encryption, cold wallet storage for digital assets, and multi-factor authentication (MFA) to ensure user funds and data are safe. It is also compliant with international KYC and AML regulations.

9. 24/7 Multilingual Customer Support

AxiomTrade provides 24/7 customer service in multiple languages via live chat, email, and phone. This means no matter where you're trading from or when an issue arises, help is always available. Their support team is trained to handle both technical and account-related queries quickly.

10. Learning Resources and Trader Education Center

New to trading? AxiomTrade offers a comprehensive educational hub packed with webinars, tutorials, market analysis, and trading strategies. These resources are free for registered users and are regularly updated to reflect market trends and platform updates.

Final Thoughts: Why AxiomTrade.net is Reshaping Online Trading

The fusion of speed, security, user-centric design, and multi-asset trading makes AxiomTrade.net a top choice for traders who want performance and reliability. With robust infrastructure, low fees, and an expansive feature set, it stands tall in a saturated market. Unlocking features via the axiom exchange invite code adds another layer of benefit for new users eager to maximize their trading journey from day one.

If you're serious about advancing your trading potential and leveraging a platform designed for growth, AxiomTrade.net offers the tools, environment, and support to help you excel.

0 notes

Text

Forex MT4 Plataform, #BUY SWING TRADE #US30Cash INDEX $4.100 Profits. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#US30Cash#forex index#usd30cash#us500cash#us30cash#best forex trade system#forex volume indicators#nt4 bollinger bands#mt4 fibonacci#metatrader4 fibonacci

3 notes

·

View notes

Text

How to Trade the Fibonacci Retracement Pattern: Complete Guide with Strategies

Fibonacci retracement is one of the most powerful tools in a technical trader’s toolbox. Derived from the famous Fibonacci sequence, this tool helps traders identify potential reversal levels in trending markets. Whether you’re trading stocks, forex, or cryptocurrencies, learning how to use Fibonacci retracements can significantly enhance your decision-making process. In this blog post, we’ll…

#Best Fibonacci retracement strategy for beginners#Candlestick confirmation#Combining Fibonacci retracement with RSI and moving averages#Entry and exit signals#Fibonacci levels explained#Fibonacci levels for intraday trading#Fibonacci levels in trading#Fibonacci Retracement#Fibonacci retracement confluence strategy#Fibonacci retracement forex#Fibonacci retracement in stock market#Fibonacci retracement indicator#Fibonacci retracement pattern#Fibonacci retracement trading strategies#Fibonacci sequence in trading#Fibonacci trading strategy#Golden ratio trading#How to draw Fibonacci retracement correctly#How to identify Fibonacci retracement levels#How to trade Fibonacci retracement#How to use Fibonacci retracement in day trading#learn technical analysis#Plotting Fibonacci retracement step by step#Risk management in trading#stock markets#stock trading#Stock trading using Fibonacci levels#successful trading#Support and resistance trading#Swing high and swing low

0 notes

Text

Technical Analysis Certification Course: Become a Pro Trader

Master market trends and trading strategies with our Technical Analysis Certification Course. Learn to analyze charts, use indicators, and predict price movements in stocks, forex, and crypto. This course covers candlestick patterns, moving averages, Fibonacci retracements, and risk management. Ideal for beginners and experienced traders, you'll gain hands-on expertise and a recognized certification. Enroll today and take your trading skills to the next level!

0 notes

Text

Reversal Trading: Forex Trading Strategy Explained

In the dynamic world of forex trading, strategies are essential for navigating the volatile market. One such effective strategy is reversal trading. This technique involves identifying points at which a trend is likely to reverse direction. Understanding and mastering this strategy can provide traders with significant advantages, enabling them to capitalize on market shifts. This article delves…

#Candlestick Patterns#Divergence#Downtrend#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Strategy#Forex Trading#Geopolitical Events#Market Conditions#Market Indicators#Market Sentiment#Moving Average#Overtrading#Price Movements#Profitability#Relative Strength#Reversal Signals#Reversal Trading#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Strategy#Trading Techniques#Trading Volume#Trend Following#Uptrend#Volume Analysis

1 note

·

View note

Text

Certificate in Technical Analysis | Master Stock Market Strategies

Gain a competitive edge in the financial markets with our Certificate in Technical Analysis. This specialized program is designed for aspiring traders, investors, and finance professionals who want to master the art and science of market analysis. Learn to interpret price charts, identify market trends, use technical indicators, and develop trading strategies that work. Our course covers everything from basic chart patterns to advanced techniques like Elliott Wave Theory, Fibonacci Retracements, and more. Led by seasoned market experts, the course combines theoretical knowledge with real-world applications, helping you make informed trading decisions. Whether you are planning to trade equities, commodities, or forex, this certification will empower you to navigate markets with confidence and precision. Enroll now and take the first step toward becoming a professional technical analyst!

0 notes

Text

mt4 non repaint system of forex

1. Introduction to MT4 and Non-Repaint Systems

https://secretindicator.com/product/powerful-true-mt4-scalping-indicator/

MetaTrader 4 (MT4) is a globally trusted trading platform used in the forex and CFD markets. Traders love MT4 for its speed, flexibility, and ability to use custom indicators and expert advisors (EAs).

Among the most desired tools in MT4 are non-repaint indicators and systems. These tools promise stable signals that don’t change after a candle closes. This reliability is critical for scalping, day trading, and even swing strategies.

2. What is a Repaint vs. Non-Repaint Indicator?

Repaint Indicator:

An indicator that changes its signal after the candle closes.

Example: A buy arrow appears, but after the next candle, the arrow disappears or shifts.

Repainting misleads traders into thinking past signals were more accurate than they were.

Non-Repaint Indicator:

Does not change its signal after a candle closes.

Once an arrow or signal appears, it stays fixed.

This ensures 100% visual reliability for historical testing and live trading.

3. Why Use a Non-Repaint System?

Benefits:

Accurate backtesting: What you see on historical charts reflects real-time data.

Confidence in signals: You can trust the entry points.

Consistent strategy building: Easy to create mechanical rules.

Use-Cases:

Scalping strategies

News trading

Breakout systems

Trend-following setups

4. How Non-Repaint Systems Work on MT4

A non-repaint system typically uses custom-coded indicators with logic that avoids modifying previous signals. These tools are designed using:

Price action

Mathematical algorithms

Time-based triggers

Support/resistance levels

Trend filters (moving averages, etc.)

Example:

A non-repaint arrow indicator waits for a candle to close above a resistance zone and confirms with an RSI filter. Only then does it place a fixed "Buy" arrow.

5. Best MT4 Non-Repaint Indicators

Here are some of the most trusted non-repaint tools in MT4:

1. Buy Sell Arrow Scalper

Provides clear BUY and SELL arrows

Ideal for M1, M5, M15 charts

Non-repainting and color-coded signals

2. Trend Magic Indicator

Uses a blend of CCI and Moving Averages

Plots a colored line that changes with trend direction

3. Super Arrow Indicator

Combines RSI, CCI, Momentum

Gives high-accuracy arrow signals

Best for scalping and intraday

4. Sniper Entry System

Combines support/resistance, Fibonacci, and arrow signals

Excellent for accurate entries

5. Non-Repaint MACD Histogram

Shows early divergence

Powerful trend reversal signals

Non-lagging & non-repainting

6. Complete Non-Repaint Trading Strategy

Here’s a simple and powerful strategy using non-repaint indicators:

Timeframe: M5 or M15

Currency Pairs: EUR/USD, GBP/USD, USD/JPY

Tools Needed:

Super Arrow Indicator (non-repaint)

Trend Filter (Moving Average or TMA)

RSI (14) or CCI (20)

Buy Entry Rules:

Super Arrow gives a BUY signal.

Price is above the 50 EMA or trend filter.

RSI is above 50.

Place SL below last swing low.

TP = 1:1.5 or use trailing stop.

Sell Entry Rules:

Super Arrow gives a SELL signal.

Price is below the 50 EMA.

RSI is below 50.

Place SL above last swing high.

TP = 1:1.5 or trail stop.

Example Setup (BUY):

EUR/USD, 15M chart

Buy arrow appears at 9:30 AM

EMA confirms uptrend

RSI = 58

Entry at 1.0735

SL at 1.0725, TP at 1.0755

7. Pros and Cons of Non-Repaint Systems

✅ Pros:

Trustworthy signals

Better decision-making

Great for auto-trading strategies

Easier backtesting

❌ Cons:

May be slower to signal than repaint indicators

Might miss early moves

Some non-repaint systems over-filter entries

8. Common Myths About Non-Repaint Indicators

❌ Myth 1: All repaint indicators are bad.

Truth: Some repainting tools like Zigzag are meant for structure only.

❌ Myth 2: Non-repaint means 100% accurate.

Truth: No indicator guarantees success — risk still exists.

❌ Myth 3: Non-repaint indicators lag more.

Truth: It depends on coding. Many are fast and responsive.

9. How to Install a Non-Repaint System on MT4

Step-by-Step Guide:

Download the .zip or .ex4 file

Open MT4 → File → Open Data Folder

Go to MQL4 → Indicators

Copy/paste the files

Restart MT4

Go to Navigator → Custom Indicators

Drag the indicator onto your chart

Pro Tip: Always test on demo before using real money.

10. Where to Find Free Downloads

✅ Trusted Sites:

ForexFactory.com (forum-based)

MQL5.com (official marketplace)

ForexWinners.net

ForexIndicators.net

GitHub (for open-source indicators)

⚠️ Warning:

Avoid downloading from unknown websites or Telegram groups that offer cracked indicators. They may contain malware or spyware.

11. Risk Management with Non-Repaint Systems

Even with a good system, risk management is key.

🔒 Golden Rules:

Never risk more than 1-2% per trade

Use Stop Loss always

Backtest at least 100 trades

Avoid trading during high-impact news

Use correlation filters if trading multiple pairs

Example:

If your capital is $1,000, and your SL is 20 pips, you should not risk more than $10–$20 per trade.

12. Final Thoughts

The MT4 non-repaint system is a powerful solution for traders seeking consistent, reliable, and visually accurate trading signals. While they don’t guarantee success, they remove a key psychological problem: changing signals after you act.

By combining non-repaint indicators with smart strategies, strong discipline, and good risk management, you can create a profitable forex trading approach.

https://secretindicator.com/product/powerful-true-mt4-scalping-indicator/

#forex factory#forex market#forex online trading#forex news#forex indicators#crypto#forex broker#forex#forex ea#forex education#forex signals#forextips#forextrading#forexsignals#forexstrategy#forexsuccess#forexlifestyle#forex robot#forexmastery

0 notes

Text

How Trade View Empowers Investors with Cutting-Edge Tools

In the fast-paced world of financial trading, having access to reliable tools and insights is crucial for success. Trade View, a leading platform in market analysis, has become an indispensable resource for traders and investors worldwide. This article explores the features, benefits, and impact of Trade View on the trading community.To get more news about Trade View, you can visit wikifx.com official website.

What is Trade View? Trade View is a sophisticated platform designed to provide traders with advanced charting tools, real-time data, and technical analysis capabilities. It caters to a wide range of financial instruments, including stocks, forex, cryptocurrencies, and commodities. With its user-friendly interface and powerful features, Trade View has become a go-to solution for both novice and experienced traders.

Key Features of Trade View Advanced Charting Tools: Trade View offers state-of-the-art charting capabilities, allowing users to analyze market trends with precision. The platform supports various chart types, indicators, and drawing tools, enabling traders to customize their analysis.

Real-Time Data: Access to real-time market data is a cornerstone of Trade View's offerings. Traders can monitor price movements, volume, and other critical metrics to make informed decisions.

Technical Analysis: Trade View provides a comprehensive suite of technical analysis tools, including trend lines, Fibonacci retracements, and moving averages. These tools help traders identify potential entry and exit points.

Multi-Monitor Support: The platform's desktop application supports multi-monitor setups, enhancing the trading experience by allowing users to view multiple charts and data streams simultaneously.

Community Insights: Trade View fosters a collaborative environment where traders can share ideas, strategies, and market insights. This feature promotes learning and growth within the trading community.

Benefits for Traders Trade View's robust features translate into several advantages for traders:

Enhanced Decision-Making: By providing detailed market analysis tools, Trade View empowers traders to make well-informed decisions.

Improved Efficiency: The platform's intuitive design and advanced functionalities streamline the trading process, saving time and effort.

Global Accessibility: Trade View's support for multiple languages and markets makes it accessible to traders worldwide.

Impact on the Trading Industry Trade View has significantly influenced the trading landscape by setting new standards for market analysis platforms. Its emphasis on innovation and user experience has inspired other platforms to enhance their offerings. Additionally, Trade View's role in fostering a collaborative trading community has strengthened the industry's foundation.

Conclusion In an era where technology drives financial markets, Trade View stands out as a beacon of innovation and reliability. Its comprehensive tools and features have revolutionized the way traders approach market analysis. As the platform continues to evolve, it remains committed to empowering traders and shaping the future of the trading industry.

0 notes