#gst return filing procedure

Explore tagged Tumblr posts

Text

Looking GST Return filing servicec in delhi contact taxring professional , reach out CA office in delhi , Nirman Vihar , near metro station - Contact us

Registered Taxpayers: All businesses registered under GST must file returns, regardless of their turnover.

Composition Scheme Taxpayers: Businesses opting for the Composition Scheme are required to file GST returns quarterly and an annual return.

Non-Resident Taxable Persons: Non-resident entities making taxable supplies in India must file GST returns.

E-Commerce Operators: Platforms facilitating sales through e-commerce must file GST returns for the supplies made through them.

Input Service Distributors: Businesses distributing input tax credit to their branches must file returns.

Taxpayers under Zero-Rated Supplies: Exporters and businesses involved in zero-rated supplies need to file returns to claim refunds.

Suspended or Canceled Registrations: Even if a taxpayer's GST registration is suspended or canceled, they are required to file returns for the period they were active.

Annual Returns: All registered taxpayers must file an annual return, irrespective of the type of registration.

These requirements ensure compliance with GST regulations and accurate reporting of sales, purchases, and tax liability.

#who should file gst return#how to file gst return#gst return filing#gst return filing status#gst return filing date#gst return filing process#gst return filing online#gst return filing fees#gst return filing due date#gst return filing dates#gst return filing fees by ca#gst return filing course#gst return filing software#gst return filing charges#check gst return filing status#gst return filing images#gst return filing services#what is gst return filing#gst return filing procedure#gst return filing course free#gst return filing process step by step pdf#gst return filing status check

0 notes

Text

GST Registration Services Provider in Delhi – Ensuring Smooth Tax Compliance

For any business operating in the capital, having a dependable GST Registration Services Provider in Delhi is essential. With the complexities surrounding Goods and Services Tax, expert assistance ensures that registration and compliance are handled with accuracy and efficiency. Delhi, being a major commercial hotspot, offers numerous options, but choosing the right provider can make a significant difference to your business’s legal and financial health.

Understanding the Importance of GST Registration

GST registration is not just a legal formality—it is a gateway to availing tax credits, doing interstate trade, and establishing credibility in the market. Especially for businesses with turnover above the threshold limit, timely registration is mandatory under Indian tax law.

Here’s why professional GST service providers are helpful:

Professional Oversight: Experts keep up with frequent GST law changes and prevent errors.

Time Management: Delegating GST tasks frees up your time to focus on core business areas.

Documentation Handling: Professionals ensure accurate paperwork, which is critical for approval.

Avoiding Penalties: Timely filing avoids fines and legal consequences.

End-to-End Support: From application to advisory, they offer a complete package.

What Services Do GST Registration Providers in Delhi Offer?

Reliable service providers usually offer a wide array of GST-related solutions, including:

Initial GST Registration and GSTIN Allotment

Regular GST Return Filing

Rectification and Changes in Registration Details

Advisory on Tax Credits and Applicability

Support for GST Cancellation or Migration

These services are designed to simplify compliance and allow you to focus on growing your business.

Choosing a Trusted GST Services Provider in Delhi

When picking a GST registration expert in Delhi, look for:

Industry Experience: A firm with deep knowledge of local and national GST procedures.

Transparent Pricing: No surprise costs or hidden service charges.

Efficient Turnaround: Prompt submission of documents and filings.

Positive Reviews: Feedback from previous clients is a good indicator of service quality.

Continued Assistance: Providers that offer advisory and filing beyond registration.

Key Advantages of Timely GST Registration

Registering for GST on time provides multiple benefits:

Input Tax Credit Access: Helps reduce the effective tax burden.

Wider Market Reach: Required for selling across states and online platforms.

Improved Business Image: Being GST compliant builds trust with partners and clients.

Compliance Readiness: Preparedness for audits and inspections.

Conclusion

In the fast-paced business world of Delhi, working with a skilled GST Registration Services Provider in Delhi ensures that your operations remain smooth and compliant. These professionals handle the legalities so you can focus on your vision. From registration to regular filings and updates, they offer essential support for business sustainability.

2 notes

·

View notes

Text

Company Formations Procedure in India by Mercurius & Associates LLP

Starting a business in India requires careful planning and adherence to regulatory requirements. Whether you're a domestic entrepreneur or a foreign investor, understanding the Company formations Procedure in India is crucial. At Mercurius & Associates LLP, we simplify the process for you, ensuring compliance with all legal formalities.

Steps for Company formations Procedure in India

Choose the Business Structure

Before starting the registration process, decide on the business structure that best suits your needs. Common business entities in India include:

Private Limited Company (Ideal for startups and small businesses)

Public Limited Company (Suitable for large-scale operations)

Limited Liability Partnership (LLP) (Preferred for professional services and small businesses)

One Person Company (OPC) (For sole entrepreneurs)

Sole Proprietorship or Partnership Firm (Best for small and unregistered businesses)

Obtain Digital Signature Certificate (DSC)

Since company registration in India is done online, a Digital Signature Certificate (DSC) is required for all directors and authorized signatories.

Apply for Director Identification Number (DIN)

Every director must obtain a DIN from the Ministry of Corporate Affairs (MCA) through the SPICe+ form.

Name Reservation with RUN (Reserve Unique Name)

Select a unique name for your company and apply for approval through the MCA’s RUN service. The name should comply with the Companies Act, 2013 guidelines.

Drafting of Memorandum & Articles of Association (MOA & AOA)

Prepare and file MOA (defines business objectives) and AOA (rules for internal management) along with the incorporation application.

Filing of Incorporation Application (SPICe+ Form)

Submit the incorporation application through the SPICe+ form on the MCA portal, attaching all necessary documents, including:

MOA & AOA

Identity and address proof of directors

Registered office address proof

Declaration by directors

PAN & TAN Application

Along with the incorporation application, apply for the company’s Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

Certificate of Incorporation

Once the MCA verifies and approves the documents, a Certificate of Incorporation is issued, making the company a legal entity.

Post-Incorporation Compliance

After incorporation, businesses must adhere to several compliance requirements, such as:

Obtaining Goods and Services Tax (GST) registration

Opening a business bank account

Complying with tax and labor laws

Filing annual returns and financial statements with the MCA

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we provide end-to-end Company formations Procedure in India, including legal advisory, documentation, and compliance support. Our team of experts ensures a seamless and hassle-free incorporation process for entrepreneurs and businesses.

If you're looking to set up a business in India, contact us today and get started on your entrepreneurial journey with expert guidance!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#foreign companies registration in india#taxation#auditor#ap management services

4 notes

·

View notes

Text

GST Consultants in Delhi

Conquering the Labyrinth: Navigating GST with Legalntax, Your Expert GST Consultants in Delhi The Goods and Services Tax (GST) has revolutionized the Indian tax landscape, but its complexities can often leave businesses feeling lost in a labyrinth. Fear not, intrepid entrepreneurs! Legalntax, your trusted GST consultants in Delhi, are here to guide you through every twist and turn.

Why Choose Legalntax as Your GST Guide in Delhi? With a team of seasoned chartered accountants and tax specialists, Legalntax possesses the expertise and experience to handle all your GST needs. We're not just number crunchers; we're your strategic partners, providing comprehensive GST solutions tailored to your unique business.

Our Services:

GST Registration: We'll ensure smooth and hassle-free registration, helping you navigate the intricacies of online and offline procedures. GST Return Filing: Leave the complexities of return filing to us. We'll ensure accuracy and timely submission, minimizing the risk of penalties. GST Compliance: Stay compliant with ever-evolving GST regulations. Our proactive approach keeps you informed and updated, avoiding compliance pitfalls. GST Audits and Assessments: Face audits with confidence. We'll represent you with expertise and ensure smooth resolution of any discrepancies. GST Litigation: In case of disputes, our legal team will fight for your rights, protecting your business from unnecessary burdens. GST Advisory: We're your sounding board. Seek expert advice on optimizing your GST strategy, minimizing tax liabilities, and maximizing profitability. Beyond Technical Expertise:

Legalntax goes beyond just crunching numbers. We understand that GST compliance can be a significant burden on businesses. That's why we focus on simplifying the process, making it transparent and understandable for you. We provide regular updates and guidance on the latest GST developments, empowering you to make informed decisions. Our Commitment to Your Success: At Legalntax, your success is our priority. We're invested in your business, working alongside you to minimize tax liabilities, optimize compliance costs, and achieve long-term growth. We offer competitive rates and flexible packages to cater to your specific needs and budget. Ready to Conquer the GST Labyrinth with Confidence? Don't let GST compliance become a roadblock to your business success. Choose Legalntax, your trusted GST consultants in Delhi, and navigate the complexities with ease. Contact us today for a free consultation! Remember, with Legalntax as your guide, the GST labyrinth transforms into a path to success. We hope this blog post effectively positions Legalntax as the premier choice for GST consultancy in Delhi. By highlighting your comprehensive services, expert team, and commitment to client success, you can attract businesses seeking reliable and trustworthy guidance through the intricacies of GST. Here are some additional tips to enhance your blog post: Include compelling success stories or testimonials from satisfied clients. Share valuable insights and practical tips on managing GST compliance effectively. Offer downloadable resources like GST checklists or ebooks. Optimize your blog post for search engines by including relevant keywords and phrases. Promote your blog post on social media and other online platforms to reach a wider audience. By implementing these suggestions, you can create a blog that not only informs and educates potential clients but also positions Legalntax as the go-to GST consultants in Delhi.

2 notes

·

View notes

Text

Income Tax Compliance Course with Projects

Income Tax Course: एक Perfect Career Option for Finance Lovers

अगर आप finance field में career बनाना चाहते हैं, तो Income Tax Course आपके लिए एक अच्छा option हो सकता है। यह course ना सिर्फ आपके theoretical knowledge को बढ़ाता है, बल्कि आपको practical world के लिए भी तैयार करता है।

इस article में हम detail में जानेंगे income tax course के बारे में – इसका syllabus, duration, fee structure, benefits, और job opportunities। आइए शुरू करें।

✅ What is an Income Tax Course? – Income Tax कोर्स क्या है?

Income Tax Course ek professional training program होता है जो students को भारत के टैक्स laws और policies की जानकारी देता है।

यह course आपको सिखाता है कैसे आप income calculate करें, deductions apply करें, और returns file करें। इसमें TDS, GST और Advance Tax जैसे important topics भी cover होते हैं।

ये course उन लोगों के लिए useful है जो accounting, finance या taxation field में job करना चाहते हैं।

🎯 Why Should You Learn Income Tax Course? – Income Tax Course क्यों करें?

हर साल government अपने income tax laws में बदलाव करती है। इसलिए इस course की demand हर समय बनी रहती है।

अगर आप accountant बनना चाहते हैं या CA, CS या CMA की तैयारी कर रहे हैं, तो यह course आपके लिए फायदेमंद रहेगा।

��सके अलावा, अगर आप खुद का business चलाते हैं, तो यह course आपकी tax planning में help करेगा।

📘 Income Tax Course Syllabus – Course Syllabus क्या होता है?

Income Tax Course का syllabus काफी wide होता है, जिसमें basic से लेकर advanced concepts शामिल होते हैं।

Syllabus में शामिल topics:

Basics of Income Tax (आयकर की मूल बातें)

Types of Incomes and Heads (आय के प्रकार और हेड्स)

Tax Slabs & Rates (टैक्स स्लैब और दरें)

Deductions under Section 80C to 80U

TDS (Tax Deducted at Source)

Advance Tax and Self-Assessment

Filing of Income Tax Returns

E-filing procedures on Income Tax Portal

Penalties and Prosecution

Practical training भी दी जाती है जिसमें आप ITR forms भरना सीखते हैं।

🕒 Duration & Eligibility – कोर्स की अवधि और योग्यता

Duration: Income Tax Course की duration institute के अनुसार vary करती है। कई institutes 1 month से लेकर 6 months तक के courses offer करते हैं।

Eligibility Criteria: Minimum qualification 12th pass होती है। Commerce background वाले students के लिए यह course ज्यादा easy होता है। Graduates in B.Com, BBA या M.Com भी इस course को कर सकते हैं।

💰 Course Fee Structure – Income Tax Course की फीस क्या है?

Course fee depends करती है institute, course level और city पर।

Average Fees: ₹5,000 से ₹25,000 के बीच होती है। Online course में fee थोड़ी कम हो सकती है जबकि offline training institutes में थोड़ी ज्यादा होती है।

Tip: जब भी आप किसी institute को choose करें, उसका syllabus और faculty जरूर check करें।

📈 Benefits of Doing Income Tax Course – Income Tax Course करने के फायदे

Income Tax Course करने से आपको कई practical advantages मिलते हैं।

Main Benefits:

बेहतर job opportunities in finance and accounting field

खुद का Tax Consultancy business शुरू करने का मौका

Freelancing opportunities for return filing

हर साल changing tax laws के बारे में updated knowledge

Government job के लिए preparation में मदद

इसके अलावा आप friends और relatives की return filing भी कर सकते हैं और extra income earn कर सकते हैं।

💼 Career Opportunities After Income Tax Course – Job Scope and Career Options

Course complete करने के बाद आपके पास कई career options होते हैं।

Job Roles:

Income Tax Return Preparer

Tax Consultant

Accountant

Finance Executive

TDS Executive

Tax Analyst

आप private firms, CA offices, consultancies या corporates में काम कर सकते हैं।

Freelancing और work-from-home options भी available हैं।

🏫 Best Institutes for Income Tax Course – कहां से करें Income Tax Course?

India में कई reputed institutes हैं जो ये course offer करते हैं। कुछ popular institutes में शामिल हैं:

The Institute of Professional Accountants (TIPA), Delhi

ICAI certified taxation workshops

इन institutes में आपको live projects पर काम करने का मौका मिलता है और placement assistance भी दी जाती है।

📑 Certifications – क्या Income Tax Course के बाद Certification मिलता है?

Yes! Course complete करने के बाद आपको एक valid certificate मिलता है।

यह certification आपके resume में value add करता है। Job interviews में यह आपके practical skills को proof करता है।

कुछ institutes government recognized certifications भी offer करते हैं, जिससे आपके employment chances और भी बेहतर हो जाते हैं।

📚 Study Mode – Online vs Offline Course Mode

आप ये course online या offline किसी भी mode में कर सकते हैं।

Online Course के फायदे:

Flexibility to study anytime

Lower cost

Recorded lectures and online doubt support

Offline Course के फायदे:

Classroom interaction

Practical case study-based learning

Direct guidance from faculty

आप अपने time और budget के हिसाब से mode select कर सकते हैं।

🔍 Reference and Legal Framework – Income Tax Rules की जानकारी कहां से लें?

Income Tax Department की official website https://www.incometax.gov.in से आप सभी rules और updates प्राप्त कर सकते हैं।

यह site आपको ITR forms, deadlines और tax calculator जैसी सुविधाएं भी देती है।

इसके अलावा आप ICAI और government blogs भी follow कर सकते हैं।

🎓 Conclusion – Final Thoughts on Income Tax Course

आज के competitive world में सिर्फ graduation से काम नहीं चलता।

Income Tax Course एक ऐसा skill-based course है जो आपके career को fast-track कर सकता है।

चाहे आप student हों, job seeker हों या business owner – यह course सभी के लिए beneficial है।

Financial literacy आज की ज़रूरत है, और यह course उस दिशा में एक मजबूत कदम है।

🔖 FAQs: Income Tax Course

Q1. क्या ये course CA students के लिए useful है? हां, यह course CA students के लिए बहुत beneficial है क्योंकि इसमें practical exposure मिलता है।

Q2. क्या Commerce background जरूरी है? नहीं, लेकिन commerce background होने से concepts जल्दी समझ में आते हैं।

Q3. क्या part-time course options available हैं? हां, online ��र weekend batches दोनों ही options available हैं।

अगर आपको ये article helpful लगा तो इसे जरूर share करें। और अगर आप Income Tax Course करना चाहते हैं, तो सही institute चुनें और आज ही शुरुआत करें!

Accounting Course ,

Diploma in Taxation Course,

courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

SAP fico course ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Tally Course in Delhi ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

diploma in banking finance ,

Stock market Course,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

0 notes

Text

Who is the Chartered Accountant in Malappuram?

In today’s competitive and compliance-driven business environment, the role of a Chartered Accountant has become more important than ever. Whether you're a business owner, a salaried professional, or a startup founder, having a trustworthy financial expert by your side can make all the difference. When it comes to finding the right guidance in Kerala, many are asking: Who is the Chartered Accountant in Malappuram that can truly support business growth and financial clarity? Understanding the value a CA brings can help you make the right decision for your financial needs.

The Importance of a Chartered Accountant in Malappuram

Malappuram is a growing commercial region with businesses operating across multiple sectors such as trading, services, education, healthcare, and construction. As these businesses expand, so do their financial obligations and legal responsibilities. A Chartered Accountant in Malappuram plays a crucial role in helping these enterprises meet their tax, audit, and accounting requirements efficiently. They ensure that financial records are maintained correctly, taxes are filed on time, and government regulations are followed properly—thus allowing business owners to focus on their core operations without worry.

Financial and Tax Compliance Made Simple

For many individuals and businesses, dealing with taxation and financial reporting can be overwhelming. This is where a qualified Chartered Accountant in Malappuram becomes essential. From income tax returns to GST compliance, the accountant ensures that all procedures are carried out in accordance with the law. Their services help avoid penalties, reduce errors in documentation, and ensure timely submissions. More importantly, a Chartered Accountant also helps in effective tax planning, making sure clients save wherever legally possible.

Guidance for Startups and Small Enterprises

Many startups and small business owners in Malappuram are unfamiliar with the financial and legal complexities involved in setting up a business. A Chartered Accountant in Malappuram offers valuable guidance from the beginning—helping entrepreneurs choose the right business structure, register under applicable laws, and set up basic accounting systems. As the business grows, the CA provides insights on managing cash flow, setting budgets, and meeting financial targets, making them a key part of the startup ecosystem.

Business Growth Through Strategic Financial Planning

A good financial strategy is essential for the growth of any business. A Chartered Accountant in Malappuram provides deep financial insight that helps businesses make smarter decisions. They analyze current financial performance, forecast future trends, and suggest ways to increase profitability. Whether it’s deciding on a new investment, applying for a loan, or expanding operations, their expert advice ensures businesses move forward with confidence and clarity.

Audit and Assurance Services for Compliance and Trust

Auditing is not just about reviewing financial statements; it’s about ensuring transparency and building trust with stakeholders. A Chartered Accountant in Malappuram conducts internal and external audits to help businesses understand their financial health, identify risks, and maintain regulatory compliance. These services are especially important for companies that deal with investors, banks, or government tenders, as they need to demonstrate strong internal controls and financial accuracy.

Supporting Professionals and Individuals with Financial Needs

The services of a Chartered Accountant in Malappuram are not limited to businesses alone. Salaried individuals, professionals, and freelancers can also benefit greatly. Whether it’s filing income tax returns, applying for home loans, managing investments, or understanding new tax rules, a CA provides personalized advice that ensures your finances are in order. They also help with retirement planning, capital gains calculations, and handling notices from the tax department, giving individuals peace of mind.

Choosing the Right Chartered Accountant in Malappuram

When selecting a Chartered Accountant in Malappuram, it’s important to look for experience, qualifications, and a clear understanding of both local and national tax laws. A good CA listens to your needs, explains things in simple terms, and offers tailored solutions. The best professionals maintain transparency in their work and stay updated with the latest changes in tax regulations, digital filing systems, and financial trends. Building a long-term relationship with a CA can lead to consistent financial stability and legal safety.

Conclusion: Your Financial Partner for a Better Tomorrow

The financial world is becoming increasingly complex, but with the support of a qualified Chartered Accountant in Malappuram, managing your money and complying with regulations becomes far easier. Whether you’re a business aiming to grow, a professional seeking clarity, or an individual managing personal finances, a CA provides the trusted expertise you need. Choosing the right accountant is not just a transaction—it’s a long-term investment in financial success.

0 notes

Text

GST Return Filing Simplified for Small Businesses in India

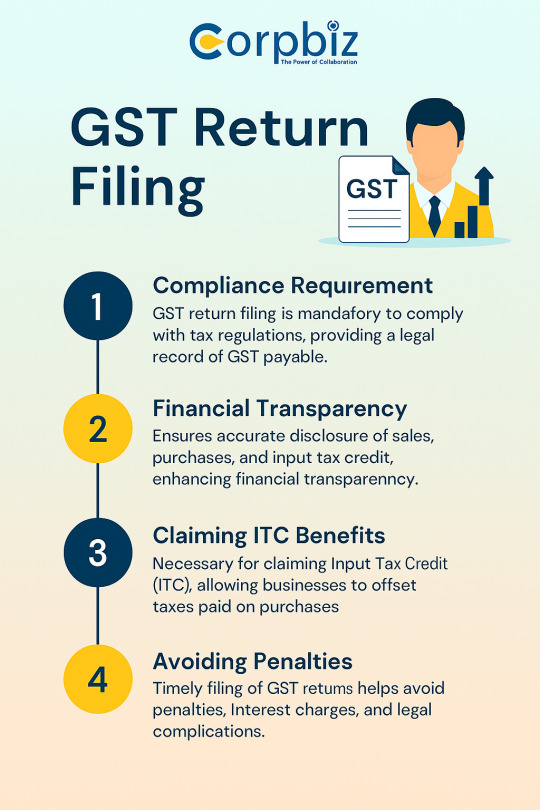

GST Return Filing is a process where businesses report their monthly, quarterly, or annual GST transactions to the government. For small businesses, timely gst return filing ensures legal compliance and helps avoid penalties. The gst return filing process includes collecting sales and purchase data, reconciling invoices, and filing via the GST portal. Understanding the gst return filing procedure can reduce stress and save costs. Whether you're a startup or MSME, choosing the right filing frequency and keeping accurate records is key to smooth GST compliance.

#GSTReturnFiling#SmallBusinessIndia#GSTFilingProcess#TaxCompliance#CorpbizIndia#GSTReturnProcedure#MSMETaxSupport#GSTMadeSimple

0 notes

Text

What are the best GST compliance audit tips for Virtual Office users?

GST compliance is of vital importance to all businesses, including startups, freelancers, agencies, and more that function through virtual office buildings. The virtual office space registration address applies fully to corporate GST registrations, provided the support documentation is compliant. With the right business address, virtual office users can run operations from anywhere, simultaneously meeting tax and official obligations. However, compliant stays exceed fair registration.

This includes accurate feedback, proper documentation and clear communication with GST authorities. In this blog, we look into key compliance audit tips for virtual office users. We will explain practical examples, frequent mistakes and best practices to help freelancers and businesses maintain clean GST recordings and avoid penalties.

Understand the meaning of virtual offices and GST

Virtual offices do business addresses without requiring physical occupation of office space. This model is especially useful for freelancers, startups and remote teams looking for virtual offices to address communication and meet legal procedures. Such addresses are accepted for business GST registrations if they are equipped with valid documents such as rental agreements, pension calculations, NOCs and more. After registration, virtual office users must follow the same GST rules as physical companies. This includes sending a return, appropriate ITC, and reply messages.

The GST department does not distinguish between an under-test virtual setup and a traditional setup. Therefore, users should ensure that the virtual office fully meets the GST standard to avoid legal or financial issues.

Key GST Compliance Challenges for Virtual Office Users

Virtual offices are efficient and cost-saving, but are equipped with specific challenges to GST conformance that users must deal with with caution.

1. Incomplete documentation:- Many users skip collecting all the documents they need, including rental agreements, electricity bills, NOCs and more. This often leads to rejection or delays in reviews during GST registration.

2. Incorrect communication with a service provider:- Your virtual office provider may not provide GST-compliant documentation. This can lead to adjustments to document shortages during audits and pose a compliance risk.

3. false gstin link:- Users often forget to update their GST profile when their virtual office address is deferred. This can lead to the fact that it deals with legal complications that are considered mischief.

4. I missed the deadline for submission:- Without physical memory, users can overlook the GSTR-1 or GSTR 3B registration date. These lack of deadlines attract late fees, penalties and GST messages.

5. ITC error (input tax credit):- Inappropriate persecution of ITC claims leads to false calculations. Companies can blame ITCs and cause audits or ITC rejections.

To address these challenges, choose a trusted provider for your virtual office, take a timely registration plan, and consult an expert about the accuracy of your ITC and GST registration.

GST Compliance Audit Tips for Virtual Office Users

The rest of the GST audit response is very important for virtual office users. Below are some proven tips for enhancing compliance:

1. own GST compliant documentation:- Always collect rental contracts, supply calculations and NOCs from your provider. Organize your software and hard copies as the examiner may request you at any time.

2. Files will be returned on time:- lines will be returned on time Late GST Return Registration can increase the red flag of the test and beget discipline. Set up calendar notifications or use our specialists to ensure timely GSTR-1, GSTR-3B, and annual return recipients.

3. Reconcile Input and Output Tax:- Please vote regularly for GSD-2B input data using actual purchase calculations. Also, to avoid incorrect adjustments, we will start a starting tax record with the GSTR-3B.

4. Use professional accounting tools:- Software such as Zoho, QuickBooks, and Tally automated tax calculations and applications. It also helps you pursue invoices and reduce the risk of manual GST errors.

5. Check the GSTIN details regularly:- Check the GSTIN details regularly Update the GST gate if the office address is changed or if the service provider is replaced. Incorrect details can lead to an exam and cancel your registration.

The right documentation, technical tools, and timely updates make a big difference.

Virtual office users need to manage GST compliance as thoroughly as physical office owners to maintain test tightness.

Practical Example: GST Compliance for a Virtual Office User

Scenario:

Ravi is a freelance digital marketer operating from Mumbai using a virtual office in Bangalore. He registered for GST using the virtual office address provided by a co-working space.

Steps Ravi Took to Stay Compliant:

1. Verified Documentation:- He ensured the co-working space gave him a rent agreement, electricity bill, and a valid NOC—all in his business name.

2. Accurate GST Filing:- Ravi filed GSTR-1 and GSTR-3B every month using accounting software, ensuring timely and error-free submissions.

3. Proper ITC Reconciliation:- He matched all purchase invoices with GSTR-2B before claiming input tax credit, avoiding mismatches.

4. Professional Help:- He consulted a GST expert quarterly for audit prep and updated advice.

5. Maintained Records:- Ravi stored all invoices, returns, and GST-related communication digitally and in hard copy.

Ravi passed a random GST audit without issues. His virtual setup didn’t affect compliance, thanks to timely filings and accurate documentation.

Common Mistakes Virtual Office Users Should Avoid

Operations through a virtual office are efficient, but certain frequent errors can lead to serious issues with GST compliance.

To continue to fit, users must avoid these errors and follow the correct steps diligently.

1. Use incomplete documentation:- Submitting GST registration to missing documents such as NO Input Certificate Certificate (NOC), rental agreements, or pension calculations can lead to applications for applications. Even if it is approved, you may get a red flag due to lack of appropriate documentation during the GST audit or review.

2. Do not update GST portal address:- If you have changed your virtual office provider but forget to update your address in the GST portal, this will cause disagreement. This non-meeting may lead to cancellation of GST messages and GSTINs if not improved within the time limit.

3. Overlooked by GSTR:- Freelancers or small teams often miss monthly or quarterly GST submissions such as GSTR-1 and GSD-3B. Lack of single returns can lead to interest, punishment and suspension of GST input-lone claims.

4. Bad invoice management:- There are no invoices, false tax rates, or inappropriate explanations are normal errors. Such invoices are often marked during audits, leading to input -deed (ITC) rejection.

5. Relying on Unverified Providers:- Choosing a cheap and impossible virtual office provider can be dangerous. If you do not provide GST-compliant documents, registration and compatibility will be reduced.

Keep GST compliant by checking providers, double checks of documents and accurate persecution of all submissions.

Proper Reconciliation of Input Tax Credit (ITC) (

For businesses using virtual offices, adjustment to ISTIP Tax Credit (ITC) is one of the most important GST compliance functions. With proper adjustments, we will ensure that your claims are valid and you are ready for review.

1. Complete purchase calculation using GSTR-2B:- Compare your supplier invoices with GST data automatically generated by the GST portal each month. Any inseparable from what the supplier reports and what it claims could lead to ITC is rejected.

2. Check seller compatibility:- Even if you purchase it, ITC will not be reflected unless the supplier files GSD-1. Follow your provider regularly to make sure you lose or risk your input credits.

3. Use the ITC Matching Tool:- Accounting software such as Tally, Quickbooks, and Zoho books can simplify your contract with GSTR-2B. These tools help reduce manual work, quickly identify incorrect adjustments, save time and reduce errors.

4. Assert only justified ITC:- Not all purchases can be excluded for personal expenses, fuel, or entertainment calculations. Understand the admission criteria before claiming ITC to avoid illegal claims.

5. Holds digital accounting protocols:- Save scanned copies or PDFs of all invoices with GST details securely, in a well-organized, digital format.

This ensures quick access and prompt proof of audits or department enquiries.

Adequate ITC voting will minimize audit risks, ensure smooth refund processing, and strengthen your GST compliance attitude.

FAQs

1. Can I register with GST using a virtual office address?

Yes, if you submit valid documents such as rental agreements, NOCs, and supply invoices, you can register with GST based on your virtual office space address.

2. Is the GST Audit Virtual Office accepted?

Yes, as long as your documents are GST compliant, your virtual office will be treated as well as a physical office during an audit.

3. Can Freelancers deal with the virtual official tax of Input-Deed (ITC)?

Yes, when Freelancers issue a GST invoice, they can invoice ITC and can be considered output according to the GST rules.

4. What happens if I change my virtual office address?

We will update the new address in the GST portal immediately to avoid disapproval and legal issues.

Conclusion

Virtual offices provide a smart, cost -effective way to run modern businesses without the burden of physical infrastructure. A virtual office space address can be legally used for commercial GST registration when supported by correct documentation.

However, GST compliance requires careful attention - accurate filing, eligible ITC claims, and timely updates are required. Businesses should select reliable providers, maintain appropriate records, and be cautious to change tax rules. By following the best practices, virtual office users can avoid audit, punishment and disruption.

With discipline and smart planning, a virtual office can help businesses be flexible and fully comply in today's competitive digital economy.

0 notes

Text

How to Register a Private Limited Company in India: A Step-by-Step Guide

Starting a business in India? One of the most reliable and sought-after business structures is a private limited company. With the increasing number of startups and entrepreneurs, private limited company registration in India has become a preferred choice because of the benefits like limited liability, separate legal identity, and ease of funding.

In this article, we’ll cover the key advantages and the registration process of a private limited company in India.

Why Opt for a Private Limited Company?

Choosing a private limited company offers multiple benefits:

Limited Liability Protection: Owners’ personal assets are protected from company liabilities.

Separate Legal Entity: The company can own assets, incur debts, and sue or be sued.

Credibility and Investor Confidence: Investors and banks are more willing to engage with registered companies.

Perpetual Succession: The company continues irrespective of changes in shareholders or directors.

Attractive for Funding: Easier to raise capital via equity or venture capital.

Stepwise Process for Private Limited Company Registration in India

The Ministry of Corporate Affairs (MCA) has simplified the incorporation procedure. Below are the main steps to complete your private limited company registration in India:

Digital Signature Certificate (DSC) Obtain DSCs for all directors for secure online filings.

Director Identification Number (DIN) Apply for DIN for all proposed directors using the MCA portal.

Name Approval Submit the desired company name(s) through the RUN service to ensure availability.

Filing SPICe+ Form This all-in-one form covers company incorporation, DIN allotment, PAN and TAN application, and optionally GST registration.

Prepare MOA and AOA These documents define your company’s objectives and governance.

Incorporation Certificate Issuance After verification, the Registrar of Companies (ROC) issues the certificate confirming your company’s registration.

Documents Needed for Registration

To successfully complete the process, prepare these essential documents:

Identity proof (PAN card, Aadhar card) of directors

Address proof (bank statement, electricity bill)

Passport-size photographs of directors

Registered office proof (rent agreement, NOC)

Passport copy for foreign nationals (if any)

Post-Incorporation Requirements

After registration, your company must comply with these legal requirements:

Open a dedicated bank account in the company’s name

Appoint statutory auditors

File commencement of business declaration (Form INC-20A)

Maintain all necessary statutory records and books

File annual returns and financial statements with ROC

Final Thoughts

Choosing private limited company registration in India provides a robust foundation for your business, offering flexibility, legal protection, and growth opportunities. With streamlined government processes, it’s easier than ever to register and start operations confidently.

#registration in India#charted accountant#private limited company registration in India#company registration in india

1 note

·

View note

Text

One Person Company (OPC) Registration: A Solo Entrepreneur's Gateway to Business Legitimacy

The days of needing a collective of people to form a company are over. There are no more partner or investor pitches. With the advent of the One-Person Company (OPC)Registration structure in India, legislated under the Companies Act, 2013, individual entrepreneurs can now call the shots without needing a cabinet to provide strategic oversight.

Whether you are a freelancer, solopreneur, or small business operator capable of employing your name, OPC could serve as a level of separation between your work and the officially established business entity.

Let's find out more about OPC registration and why this could be a solution, and a game-changer, for your activity.

What is a One Person Company?

As the name suggests, a one-person company (OPC) is a private limited company that can be created with just one person. Although a sole proprietor is not considered a separate legal identity from the person who owns it, an OPC is considered a separate legal entity. Thus, the entity known as the 'OPC' is seen as different from the individual who owns and runs it.

In simple terms, your assets are protected in the event your business fails.

This form works best for individual entrepreneurs who want the credibility, limited liability, and access to funding that come from being a private limited company, but who do not have any co-founders or partners.

Who is permitted to register an OPC?

Not everyone can register an OPC in India. The guidelines are clear:

• An OPC can be registered by only a natural person who is an Indian citizen and is resident in India.

• One person cannot be a member of more than one OPC at a time.

• An OPC can have only one director and only one shareholder, but it may be the same person.

• You must also have a nominee—whoever that person is, they will take over your company when you become incapacitated or when you die.

Step-by-Step OPC Registration Process

Let’s break it down so it doesn’t sound like a mountain of legal information. Here is the procedure for registering an OPC in India:

1. Obtain your DSC and DIN

To begin the registration process, you must obtain a Digital Signature Certificate (DSC) first. The DSC is your electronic fingerprint to sign documents electronically. Your next step will be the Director Identification Number (DIN), which registers your name and identifies you as the director of your company.

2. Grab your name

You will need to find a name for your company that is unique and does not infringe on any name or trademark. You will get to file a name reservation request through RUN (Reserve Unique Name) on the MCA portal. Pro Tip: Consider a couple of alternative names.

3. Prepare the MOA and AOA

These are your company's guidebooks:

The MOA (Memorandum of Association) states your objectives.

AOA (Articles of Association) tells you how the company will be operated.

Do not forget to make it clear in these documents that it is an OPC.

4. Submit SPICe+ Form

This is the incorporation form. This includes everything you need - PAN, TAN, GST, and much more, all in one form. You will need to upload your identity proof, address proof, nominee information, and the MOA/AOA here.

5. Get the Incorporation Certificate

When your application is approved, the Ministry of Corporate Affairs (MCA) issues the Certificate of Incorporation, and your OPC is created!

What About Compliance?

Yes, that's right, OPCs still have to comply with the rules. But don't panic, it's nowhere near as scary as it sounds.

Here are just some of the compliances that you are required to do:

Annual filing with the Registrar of Companies (RoC)

Maintaining proper books of accounts

Filing income tax returns

At least one board meeting every 6 months.

So while compliance is not as onerous as full private limited compliance, you should still seek a professional to ensure you're always in good standing.

Can You Later Convert an OPC?

Yes. Without a doubt. One of the best aspects of OPCs is the flexibility of the entity. As your business develops, you might want to bring on co-founders and/or investors. If you do, you can convert your OPC to a private limited company either voluntarily or when your turnover exceeds ₹2 crores or your paid-up capital exceeds ₹50 lakhs.

This conversion allows for:

Equity funding

Expansion of your board

Issuance of shares

Prevalent Misconceptions about OPCs -- Debunked!

Let's clear up some of the common misunderstandings people have about OPCs:

"You can't raise money with an OPC."

Not true. While you can't issue equity to multiple investors as an OPC, it's easy to convert to a private limited company in the future.

"It's too complicated for small businesses."

Not at all. It's structured specifically for single-person startups. With the right support, it can be registered in 7-10 days.

"OPC and Sole Proprietorship are more or less the same."

Wrong. One has legal identity and limited liability, the other does not.

Final thoughts: Is OPC the vehicle for you?

If you truly are serious about turning your solo venture into a registered business entity, then you should strongly consider One Person Company Registration as a good starting point. It is like giving your business a proper passport - it communicates to the world that you are serious in your endeavor (literally).

Whether you are a consultant, a designer, a software developer, or a baker baking from your kitchen, OPC gives you structure, respectability, and protection while avoiding the undertones to establish a complex management structure.

0 notes

Text

Special Economic Zones (SEZ) in India – Business Benefits, Setup & Compliance

Explore Special Economic Zones (SEZ) in India for tax benefits, export incentives, and hassle-free business operations. Get expert guidance on SEZ setup, approval, and regulatory compliance.

Special Economic Zones (SEZ) – Powering India’s Export-Led Growth

India’s Special Economic Zones (SEZs) play a pivotal role in driving foreign investment, enhancing exports, and generating employment. Designed to offer a globally competitive environment, SEZs are governed by a unique policy framework that offers multiple tax and regulatory benefits to businesses.

To fully leverage these advantages, companies often seek guidance from professionals offering SEZ consultancy services. These experts ensure smooth compliance with SEZ rules and facilitate operations from setup to ongoing management.

🔹 SEZ Formation and Approval Assistance

Setting up a unit in an SEZ requires approvals from the Development Commissioner, along with compliance under the SEZ Act, 2005. SEZ consultants assist businesses in selecting the right SEZ location, drafting applications, preparing project reports, and obtaining unit approval.

Whether you are in manufacturing, IT/ITES, biotech, or electronics, SEZ consultancy ensures you meet eligibility criteria and start operations without procedural delays.

🔹 Tax Benefits and Duty Exemptions under SEZ

One of the biggest attractions of SEZs is the range of fiscal incentives available to units:

100% Income Tax exemption on export income for the first 5 years

Duty-free import/domestic procurement of goods

Exemption from GST and other indirect taxes

External Commercial Borrowing (ECB) access without RBI approval

SEZ experts guide companies in structuring operations to maximize these benefits, ensuring all documentation, filings, and tax planning are fully optimized and compliant.

🔹 Operational Compliance and SEZ Returns

SEZ units must regularly file returns and maintain compliance under various provisions, including:

Form I and II for monthly and quarterly performance

Annual Performance Reports (APR)

SOFTEX filing for software exports

Real-time online tracking of exports and inventory

Professional SEZ consultancy services ensure your business adheres to every reporting requirement, preventing penalties and delays in approvals or incentives.

🔹 Exit, De-notification & Conversion from SEZ

Businesses sometimes need to exit the SEZ scheme or convert their unit to operate in the Domestic Tariff Area (DTA). SEZ consultants handle this transition seamlessly by managing de-bonding approvals, payment of applicable duties, and coordination with customs and SEZ authorities.

From documentation to obtaining the final exit letter, their expertise ensures that your business remains compliant and avoids procedural bottlenecks.

✅ Why Choose Professional SEZ Consultancy Services?

Specialized knowledge of SEZ laws, GST rules & FTP

Reduced turnaround times for licensing & approvals

Tailored advice based on industry-specific SEZ policies

End-to-end compliance support for seamless operations

#SpecialEconomicZones#SEZIndia#SEZSetup#MakeInIndia#IndianSEZ#SEZRegistration#DGFTCompliance#ExportSupport#SEZPolicyIndia#SEZApproval

0 notes

Text

Looking for the best GST return filing online course? You are in the right place. The Course covers How to prepare & Claim GST Refund from the Basic to Advanced level, covering all Taxation parts related to GST Refund, legal aspects, major compliances and Procedures. Join today! For more information, you can call us at 7530813450.

#gst registration service#income tax certification course#best income tax course#partnership firm registration services#gst filing training#basic gst course online#best income tax course online#best income tax preparation courses

0 notes

Text

Best company Incorporation Consultants in India

Starting a business in India is an exciting yet challenging journey. One of the critical steps in this process is company incorporation, which involves navigating legal, regulatory, and compliance requirements. To make this process seamless, businesses often seek the assistance of expert consultants. Among the best company incorporation consultants in India, SC Bhagat & Co. stands out for its unmatched expertise and client-centric approach.

Why Company Incorporation is Crucial Incorporating your company is the first official step in establishing a legal business entity. It provides several benefits, including:

Legal Recognition: Establishes your business as a separate legal entity. Limited Liability: Protects personal assets of the business owners. Enhanced Credibility: Builds trust with customers, suppliers, and investors. Tax Benefits: Opens doors to specific tax advantages for incorporated entities. Ease of Raising Capital: Simplifies securing investments from banks and venture capitalists. However, the incorporation process can be complex due to the various regulations, documentation requirements, and procedural formalities involved. This is where SC Bhagat & Co. comes in to simplify the process.

About SC Bhagat & Co. SC Bhagat & Co. is a leading consultancy firm in India, renowned for its expertise in company incorporation services. With decades of experience, they have assisted startups, SMEs, and large enterprises in setting up their businesses efficiently and compliantly.

Their team of highly skilled professionals ensures that the entire process is smooth and stress-free, allowing entrepreneurs to focus on their business goals.

Services Offered by SC Bhagat & Co.

Company Incorporation Services SC Bhagat & Co. specializes in incorporating all types of entities, including:

Private Limited Companies Limited Liability Partnerships (LLPs) One Person Companies (OPCs) Public Limited Companies Section 8 Companies (Non-Profits)

Document Preparation and Filing They handle all necessary documentation, such as drafting Memorandum of Association (MoA) and Articles of Association (AoA), obtaining Director Identification Numbers (DIN), and registering for GST and PAN.

Regulatory Compliance SC Bhagat & Co. ensures your business complies with all regulatory frameworks, including the Companies Act, 2013.

Post-Incorporation Support Their services don’t end with incorporation. They offer continued support with statutory filings, annual returns, and compliance audits.

Custom Business Advisory The team provides personalized guidance to ensure your business structure aligns with your objectives and market demands.

Why Choose SC Bhagat & Co. for Company Incorporation?

Expertise and Experience SC Bhagat & Co. has years of experience in handling company incorporations across various industries. Their expertise ensures a hassle-free process for clients.

Tailored Solutions Every business is unique, and SC Bhagat & Co. takes a personalized approach to meet your specific requirements.

Time and Cost Efficiency Their streamlined processes save you time and money, allowing you to focus on growing your business.

100% Compliance They ensure your business adheres to all legal and regulatory norms, minimizing risks of non-compliance.

Customer-Centric Approach SC Bhagat & Co. is known for its responsive and supportive team, providing end-to-end guidance throughout the incorporation process.

The Process of Company Incorporation with SC Bhagat & Co. Initial Consultation: Understanding your business needs and goals. Business Structure Selection: Advising on the most suitable entity type. Document Preparation: Drafting and compiling all required documents. Registration and Filing: Submitting applications with the Ministry of Corporate Affairs (MCA). Certificate of Incorporation: Assisting in obtaining the official Certificate of Incorporation. Post-Incorporation Setup: Helping with bank account setup, GST registration, and other requirements. Contact SC Bhagat & Co. If you’re looking for the best company incorporation consultants in India, SC Bhagat & Co. is your trusted partner.

Conclusion Choosing the right consultant for your company incorporation is critical to ensuring a smooth and compliant process. With their vast experience, tailored solutions, and dedication to excellence, SC Bhagat & Co. has earned its reputation as one of the best in the industry. Set your business up for success by partnering with SC Bhagat & Co. today!

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

3 notes

·

View notes

Text

Setting Up a Business in India: A Comprehensive Guide by Masllp

India has become a preferred destination for both local and international entrepreneurs, thanks to its growing economy, favorable government initiatives, and emerging consumer market. Whether you're a small startup or an established company looking to expand, setting up a business in India can offer remarkable opportunities. Masllp, a trusted consulting partner, specializes in helping businesses navigate the complex procedures of registration, compliance, and scaling in India.

Why Set Up a Business in India? India’s business landscape is evolving rapidly, making it an attractive destination for a wide range of industries. Here are a few key reasons to consider setting up a business in India:

Growing Consumer Market: With a large and young population, India offers a vast market for consumer goods, services, and technology. Ease of Doing Business: Government initiatives like Make in India and Startup India have simplified regulatory processes, reduced barriers, and encouraged foreign investment. Supportive Economic Policies: India's government has introduced tax incentives and simplified tax structures that foster a business-friendly environment. Skilled Workforce: India is home to a skilled and diverse workforce, making it easier to find qualified employees in virtually any industry. Steps to Setting Up a Business in India with Masllp Masllp offers end-to-end support in setting up a business in India, from choosing the right business structure to managing compliance. Here’s a step-by-step guide:

Choosing the Right Business Structure India offers several business structures, including Private Limited Company, Limited Liability Partnership (LLP), and Sole Proprietorship. Each has its advantages and requirements:

Private Limited Company: Ideal for businesses seeking to raise funds or expand quickly. LLP: Offers flexibility with limited liability and is easier to manage. Sole Proprietorship: Suitable for small businesses looking to test the market before expanding. Masllp assists clients in selecting a structure that aligns with their business objectives, ensuring compliance with local laws and regulations.

Registration and Legal Formalities Once the business structure is chosen, Masllp handles the complete registration process, including obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and Certificate of Incorporation. These are crucial for:

Establishing the company’s legal identity in India. Allowing the business to operate under its registered name. Providing a smooth setup process without regulatory hiccups.

Securing Necessary Licenses and Permits Depending on the nature of the business, specific licenses and permits might be required. Industries like food, pharmaceuticals, and manufacturing often need approvals from regulatory bodies. Masllp guides businesses through this process, ensuring that all permits are acquired for seamless operation.

Setting Up Bank Accounts and Financial Structuring Setting up a local bank account is essential for conducting business in India. Additionally, understanding India's taxation system is crucial for compliance. Masllp assists in setting up business bank accounts, as well as in understanding the Goods and Services Tax (GST), Income Tax, and other fiscal regulations, ensuring compliance and optimizing tax efficiency.

Hiring and Staffing Solutions India offers a large talent pool across diverse industries. Masllp provides HR solutions, including assistance with recruitment, payroll management, and employee benefits, to help businesses find the right team and establish efficient HR practices.

Ongoing Compliance and Reporting India has specific reporting and compliance requirements, such as annual returns, GST filings, and income tax submissions. Masllp offers ongoing compliance management, ensuring that businesses meet regulatory deadlines and avoid penalties.

Benefits of Partnering with Masllp When setting up a business in India, having an experienced partner like Masllp can streamline processes, reduce delays, and enhance operational efficiency. Masllp’s services include:

Expert Guidance: With in-depth knowledge of India’s business laws and market trends, Masllp offers strategic insights for a successful setup. Personalized Solutions: Each business is unique, and Masllp provides customized solutions to meet specific requirements. End-to-End Support: From registration to compliance, Masllp offers comprehensive support throughout the business setup journey. Common Challenges in Setting Up a Business in India While India’s business landscape is promising, challenges such as regulatory compliance, tax structures, and complex documentation can arise. Masllp has a deep understanding of these potential obstacles and employs a proactive approach to address them, ensuring smooth business initiation and growth.

Start Your Business Journey with Masllp Today! Setting up a business in India can be a transformative decision for entrepreneurs and companies alike. With Masllp by your side, you’ll have a trusted partner who understands the intricacies of the Indian market and regulatory environment. From initial planning to full-scale operations, Masllp ensures a smooth, compliant, and successful business setup experience in India.

#accounting & bookkeeping services in india#audit#businessregistration#foreign companies registration in india#chartered accountant#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Learn Taxation with Real-Life Examples | Join Online Today

Taxation Course Online – ऑनलाइन टैक्सेशन कोर्स से करियर बनाएं

💼 Why Choose a Taxation Course Online? – टैक्सेशन कोर्स ऑनलाइन क्यों करें?

आज के time में online taxation course बहुत demand में है। Students और working professionals दोनों ही इसे करना चाहते हैं।

क्योंकि यह course comfort के साथ flexibility भी देता है। इसके ज़रिए आप घर बैठे ही tax laws, GST, TDS जैसी चीजें सीख सकते हैं।

🎯 Scope of Taxation Course Online – टैक्सेशन ऑनलाइन कोर्स का स्कोप

India में tax professionals की ज़रूरत हर industry को है। चाहे वो private firm हो या government office, हर जगह tax experts की ज़रूरत होती है।

Online taxation course से आप finance, accounts, और auditing field में jobs पा सकते हैं। इससे freelancing opportunities भी खुल जाती हैं।

🏫 Top Institutions Offering Online Taxation Courses – प्रमुख संस्थान जो टैक्सेशन कोर्स ऑफर करते हैं

कुछ famous institutes जो ये course online mode में offer करते हैं:

The Institute of Professional Accountants (IPA) – Certified taxation programs in Hindi-English mix

NIIT – GST and Income Tax specialization

Coursera/EdX – International level content with certificates

इन platforms पर आपको recorded और live classes दोनों का access मिलता है। साथ ही downloadable study material और doubt-clearing sessions भी मिलते हैं।

📘 What You Learn in Taxation Course Online – टैक्सेशन कोर्स में क्या सिखाया जाता है?

Online course content काफी detailed होता है। यह syllabus को छोटे-छोटे modules में divide किया जाता है।

Main topics include:

Income Tax Act और उसका implementation

GST (Goods and Services Tax) की पूरी प्रक्रिया

TDS & TCS rules

Return filing through online portals

Assessment procedures और penalties

हर topic को real-life case studies के साथ समझाया जाता है। इससे समझने में आसानी होती है और practical knowledge भी बढ़ती है।

🧑🏫 Who Should Do This Course? – कौन-कौन कर सकता है टैक्सेशन कोर्स ऑनलाइन?

अगर आप commerce background से हैं, तो ये course आपके लिए perfect है। लेकिन इसका मतलब ये नहीं कि दूसरे stream वाले नहीं कर सकते।

Students, accountants, business owners, CA aspirants – सभी लोग ये course कर सकते हैं। Even housewives भी इसे part-time सीखकर freelancing start कर सकती हैं।

💻 Benefits of Online Taxation Course – ऑनलाइन टैक्सेशन कोर्स के फायदे

Flexibility – आप कभी भी, कहीं से भी सीख सकते हैं।

Affordability – Offline course के मुकाबले ये सस्ता होता है।

Updated Syllabus – नए amendments और rules पर आधारित content होता है।

Career Growth – Promotions और better salary opportunities भी बढ़ जाती हैं।

साथ ही कई platforms आपको placement assistance भी offer करते हैं। ये आपको job ढूंढ़ने में मदद करता है।

📅 Duration and Fees – कोर्स की अवधि और फीस

Course की duration average 3 से 6 months तक होती है। कुछ fast-track programs 1 month में भी complete हो जाते हैं।

Fees normally ₹5,000 से ₹25,000 के बीच होती है। Depends करता है course के level और institute पर।

💼 Job Roles After Taxation Course – टैक्सेशन कोर्स के बाद कौन-कौन सी Jobs मिल सकती हैं?

Taxation course online करने के बाद आप नीचे दिए गए roles में काम कर सकते हैं:

Tax Consultant – Individuals और companies को tax advice देना

GST Practitioner – GST registration, return filing व compliance में expert

Income Tax Return (ITR) Expert – Salaried और business ITRs prepare करना

Tax Analyst – Companies के लिए tax reports और projections बनाना

Accounts Executive – Accounting और tax management का combo role

इन roles की demand हर financial year में बढ़ती जाती है। इसलिए taxation skill हमेशा relevant रहेगी।

📚 Certifications You Get – कोर्स पूरा करने पर क्या सर्टिफिकेट मिलता है?

हर reputed institute completion पर आपको digital या hardcopy certificate देता है। कुछ institutes government-recognized certification भी offer करते हैं।

ये certificate आपके resume में value add करता है। और job interviews में आपके knowledge को validate करता है।

🌍 Language of Instruction – कोर्स की भाषा

Most online taxation courses bilingual होते हैं – English और Hindi में। इससे students को अपनी comfortable language में सीखने में मदद मिलती है।

IPA जैसे institutes pure Hindi-English mixed format offer करते हैं। इससे beginners को content grasp करने में दिक्कत नहीं होती।

📲 Tools and Software You Learn – कौन-कौन से software सीखते हैं?

Taxation course online में practical tools की knowledge भी दी जाती है:

Tally ERP 9 / Tally Prime for GST

Income Tax Portal for ITR filing

GSTN Portal for monthly filings

Excel में tax sheets बनाना भी सिखाया जाता है

इन skills की मदद से आप actual work में जल्दी expert बन सकते हैं।

🔗 Sources of Authentic Information – विश्वसनीय जानकारी के स्रोत

Taxation course में reference लिए जाते हैं इन authentic sources से:

Income Tax Department

GSTN Portal

CBIC circulars & notifications

ICAI और ICMAI जैसे bodies के publications

इनसे आपको सही और updated जानकारी मिलती है।

👨👩👧👦 Who Offers the Best Course in Delhi/NCR? – दिल्ली में सबसे अच्छा टैक्सेशन कोर्स कौन कराता है?

Delhi में "The Institute of Professional Accountants (TIPA)" top ranking institute माना जाता है। TIPA के courses practical और industry-oriented होते हैं।

Address: E-54, 3rd Floor, Metro Pillar No. 44, Laxmi Nagar, Delhi 110092 Phone: 9213855555 Website: www.tipa.in

यहां पर आपको placement support, bilingual classes, और GST training भी मिलेगी।

🎯 Conclusion – निष्कर्ष

अगर आप accounting या finance field में career बनाना चाहते हैं, तो Taxation Course Online आपके लिए एक smart choice है।

यह ना सिर्फ career options बढ़ाता है, बल्कि आपको self-employed बनने का मौका भी देता है।

अब जब दुनिया online हो रही है, तो learning भी online ही best तरीका बन चुका है।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

Leading the Way: Top Business Consulting Firms in Malappuram, Kerala for Complete Financial and Corporate Services

In today’s highly competitive market, businesses in Kerala—especially in Malappuram, Kuttippuram, and Tirur—are looking for more than just accounting support. They need strategic partners who can offer complete guidance in tax, finance, business setup, and growth strategy. That’s why the demand for the top business consulting firms in Malappuram, Kerala is steadily on the rise.

Whether you are launching a new business or looking to scale an existing one, expert consultancy can help you navigate financial regulations, streamline operations, and ensure long-term profitability. Firms that specialize in accounting, auditing, VAT, and corporate tax are becoming crucial for startups, SMEs, and enterprises seeking efficient compliance and cost-effective operations.

One such firm making a significant impact is AHMC Global Corporate Services, known for delivering reliable business setup and compliance services in the region. From guiding entrepreneurs through legal procedures to helping established companies stay on top of financial filings, AHMC has carved a niche as a go-to solution provider in Malappuram and beyond.

For those specifically operating in Kuttippuram, finding the best consulting firm in Kuttippuram can be a game-changer. The right partner doesn’t just prepare reports—they help businesses understand financial risks, discover tax-saving opportunities, and implement smarter strategies for sustainable growth. Whether it’s ITR filing in Kuttippuram or monthly GST returns, professional support saves both time and resources.

Meanwhile, businesses in Tirur are increasingly turning to management consulting in Tirur to optimize internal processes and boost efficiency. With the growing complexity in local and international compliance norms, business leaders need advisors who can provide clarity, control, and actionable insights across all functions—from HR to financial planning and operations.

A major area of demand for modern businesses is staying compliant with corporate tax, VAT, and statutory audits. Partnering with firms offering full-fledged accounting, auditing, VAT, and corporate tax support ensures your financial records are accurate and ready for inspection at any time. These services also help reduce the risk of penalties and reputational damage due to non-compliance.

One of the most important touchpoints in any business cycle is the timely filing of taxes. For entrepreneurs in and around Kuttippuram, ITR filing in Kuttippuram remains a crucial service. An experienced consultancy firm can ensure all personal and business returns are submitted error-free and on time, with expert advice on deductions and exemptions applicable under Indian tax law.

What sets the top business consulting firms in Malappuram, Kerala apart is their holistic approach. They don’t just file returns or handle audits—they understand your business vision, industry trends, and the local market environment. This enables them to provide not only compliance services but also valuable inputs on budgeting, financial forecasting, investment planning, and business restructuring.

In summary, if you're looking to grow your business, ensure tax compliance, and establish a strong financial base, turning to the best consulting firm in Kuttippuram or a reputed agency like AHMC Global Corporate Services is a smart move. Their comprehensive business setup and compliance services, paired with strong support in accounting, auditing, VAT, and corporate tax, make them ideal long-term partners for any serious business in Malappuram, Kuttippuram, or Tirur.

0 notes