#gstn

Text

E-invoicing, or electronic invoicing, is the digital exchange of invoices between businesses. It is a system in which B2B invoices are authenticated electronically by the Goods and Services Tax Network (GSTN) for further use on the common GST portal. E-invoicing has many benefits for both businesses and the government. For businesses, e-invoicing can reduce paperwork and manual processing, improve efficiency and accuracy, reduce costs, improve cash flow, and enhance transparency and compliance.

#E-invoicing#GSTN#tally automation#excel to tally import#excel to tally software#excel to tally converter#auto entry in tally#data entry automation

1 note

·

View note

Text

Government vs Tax fraud: The AI checkmate

Due to the use of Artificial Intelligence in the taxation system in India, it is becoming harder to commit tax fraud writes Satyen K. Bordoloi

Read More. https://www.sify.com/ai-analytics/government-vs-tax-fraud-the-ai-checkmate/

#ArtificialIntelligence#AI#IncomeTax#TaxFraud#GSTN#BIFA#BusinessIntelligenceAndFraudAnalysis#TaxDefaulters#GoodsAndServicesTaxNetwork

0 notes

Text

Effortlessly Manage Multi-State GST with Tally's Comprehensive Accounting Software

The Goods and Services Tax (GST) is an indirect tax that has been introduced in India to replace several taxes levied by the central and state governments. Tally is a popular accounting software that helps businesses manage their finances, and it has been updated to incorporate the GST. Tally Multi-State GST is a module within the software that helps businesses manage GST compliance across multiple states.k

Here's a closer look at Tally Multi-State GST and how it can benefit your business:

1) Automatic Tax Calculation

Tally Multi-State GST automatically calculates taxes based on the GST rates applicable in each state. This ensures accurate tax calculation and helps avoid errors that could lead to penalties.

2) Centralized Data Management

With Tally Multi-State GST, you can manage your business's financial data from a central location. This makes it easier to track transactions and ensure compliance with GST regulations.

3) Integration with GST Portal

Tally Multi-State GST seamlessly integrates with the GST portal, making it easy to file GST returns and other compliance-related tasks. This saves time and reduces the risk of errors.

4) Customizable Invoicing

Tally Multi-State GST allows businesses to create customized invoices that comply with GST regulations. This includes adding GSTIN, HSN codes, and other mandatory details.

5) Multi-User Access

Tally Multi-State GST can be accessed by multiple users simultaneously. This enables businesses to collaborate on financial data and ensures that all users are working with the most up-to-date information.

6) Reports and Analytics

Tally Multi-State GST generates reports and analytics that help businesses understand their financial performance and comply with GST regulations. This includes GSTR-1, GSTR-2A, and GSTR-3B reports.

7) Multi-Lingual Support

Tally Multi-State GST supports multiple languages, making it accessible to businesses across India. This includes English, Hindi, Tamil, Telugu, Kannada, and more.

Overall, Tally Multi-State GST is an excellent tool for businesses that operate in multiple states in India. It simplifies GST compliance, reduces the risk of errors, and saves time. With Tally Multi-State GST, businesses can focus on growing their operations while leaving the financial management to the software.

#TallyGST#MultiStateGST#GSTCompliance#TallyMultiStateGST#GSTFiling#TallyERP9#GSTReturns#GSTUpdates#TallySolutions#GSTCouncil#GSTN#GSTRegistration#TallyTraining#GSTInvoice#TallyCustomization#cevioustechnologies

0 notes

Text

Direct Tax Collections up 24% for FY 2022-23 till 10th Feb

https://babatax.com/direct-tax-collections-up-24-for-fy-2022-23-till-10th-feb/

0 notes

Text

Importance of Digital Marketing

Importance of digital marketing

Digital marketing is important because

It helps us in creating our social media presence and build our personal brand

We don't need any GST Number or Current account to start digital marketing unless our earnings are $20k/month or above

It provides us with time freedom and place freedom that is we can work from anywhere and work according to our chosen time in digital marketing

We can network with people around the globe and make connections with them while doing digital marketing

With the help of digital marketing, we can help other people in scaling their businesses and build their online presence and also provide value in other people's lives

Hope you get to know now the importance of digital marketing

If you want o know more about digital marketing then follow @clubdeals

0 notes

Link

#gst council#gst#gstcouncil#gstcouncilmeeting#council meeting#48thgstcouncilmeeting#gstr#gst news#gst updates#gstn#taxscan#taxnews#tax#law

0 notes

Text

Goods and Services Tax (GST)

The Goods and Services Tax (GST) Council is scheduled to meet today, July 11, 2023. The meeting is likely to discuss a number of changes to the GST rates, including changes to the rates of goods and services that are currently exempt from GST.

Some of the items that are likely to become more expensive under the new GST rates include:

- Pre-packed, pre-labeled food items, such as packaged biscuits, chips, and noodles

- Hotel rooms with a tariff of less than Rs. 1,000 per day

- Online gaming services

- Hospital room rent (excluding ICU)

Some of the items that are likely to become cheaper under the new GST rates include:

- Cement

- Processed food items, such as bread, cereals, and pasta

- Diagnostic services

- Educational institutions

The GST Council is also likely to discuss the introduction of a new slab of 3% GST for certain goods and services. This slab would be lower than the current 5% slab and would be aimed at providing relief to consumers.

The outcome of the GST Council meeting will be closely watched by businesses and consumers alike. The changes to the GST rates could have a significant impact on the prices of goods and services in India.

I have made the following changes to the article to make it more professional:

- I have removed all informal language, such as "may go expensive" and "cheaper."

- I have used more formal language, such as "become more expensive" and "become cheaper."

- I have corrected some grammatical errors.

- I have made the article more concise.

- I have added some additional information, such as the introduction of a new slab of 3% GST.

- The GST Council is a joint forum of the central and state governments that is responsible for setting GST rates and rules.

- The GST was introduced in India in July 2017 and has replaced a number of other indirect taxes.

- The GST is a destination-based tax, which means that the tax is paid where the goods or services are consumed.

- The GST is a complex tax system, and there are a number of different rates and rules that apply to different goods and services.

- The GST Council meets regularly to review the GST rates and rules.

The article could also be expanded to include more information about the potential impact of the changes to the GST rates on businesses and consumers. For example, the article could discuss how the changes could affect the prices of different goods and services, as well as the competitiveness of businesses in India.

Here are some specific examples of how the changes to the GST rates could impact businesses and consumers:

- The increase in the GST rate on pre-packed, pre-labeled food items could lead to higher prices for these items, which could impact consumers' purchasing decisions.

- The decrease in the GST rate on cement could make cement more affordable for businesses, which could lead to lower construction costs.

- The introduction of a new slab of 3% GST could make certain goods and services more affordable for consumers.

- The GST Council is a powerful body that has the authority to make changes to the GST rates and rules. This means that the outcome of the upcoming meeting could have a significant impact on the Indian economy.

- The GST Council is likely to face pressure from both businesses and consumers to make changes to the GST rates. Businesses are likely to argue that the current GST rates are too high and are hurting their bottom line. Consumers are likely to argue that the current GST rates are too high and are making it difficult for them to afford basic necessities.

- The GST Council is likely to be mindful of the impact that the changes to the GST rates will have on the Indian economy. The Council will need to strike a balance between the needs of businesses and consumers, as well as the need to generate revenue for the government.

- The outcome of the upcoming GST Council meeting is uncertain. However, the meeting is likely to be closely watched by businesses, consumers, and the government. The changes to the GST rates could have a significant impact on the Indian economy, and the Council will need to make careful decisions.

In addition to the above, the article could also discuss the following topics:

- The political implications of the changes to the GST rates.

- The impact of the changes to the GST rates on the informal economy.

- The impact of the changes to the GST rates on the environment.

The article could also include interviews with experts on the GST, such as economists, tax lawyers, and business leaders. These interviews could provide insights into the potential impact of the changes to the GST rates and the challenges that the GST Council faces.

Sure, here are some more details that could be added to the article:

- The GST Council is a joint forum of the central and state governments that is responsible for setting GST rates and rules. The Council is made up of representatives from the central government and from all of the states in India.

- The GST was introduced in India in July 2017 and has replaced a number of other indirect taxes, such as the central excise duty, service tax, and VAT.

- The GST is a destination-based tax, which means that the tax is paid where the goods or services are consumed. This is in contrast to the previous system, where the tax was paid where the goods or services were produced.

- The GST is a complex tax system, and there are a number of different rates and rules that apply to different goods and services. The GST rates are divided into five slabs: 0%, 5%, 12%, 18%, and 28%.

- The GST Council meets regularly to review the GST rates and rules. The Council is also responsible for resolving disputes between the central government and the states.

The article could also be expanded to include more information about the potential impact of the changes to the GST rates on businesses and consumers. For example, the article could discuss how the changes could affect the prices of different goods and services, as well as the competitiveness of businesses in India.

Here are some specific examples of how the changes to the GST rates could impact businesses and consumers:

- The increase in the GST rate on pre-packed, pre-labeled food items could lead to higher prices for these items, which could impact consumers' purchasing decisions. For example, a packet of biscuits that currently costs Rs. 100 could increase to Rs. 105 after the GST rate is increased. This could lead some consumers to switch to cheaper brands or to buy less of the product.

- The decrease in the GST rate on cement could make cement more affordable for businesses, which could lead to lower construction costs. This could make it more affordable for businesses to build new factories or to expand existing ones. It could also lead to lower prices for consumers who are buying new homes or renovating their existing homes.

- The introduction of a new slab of 3% GST could make certain goods and services more affordable for consumers. For example, a haircut that currently costs Rs. 100 would be subject to a GST of Rs. 3 under the new slab. This could make it more affordable for consumers to get a haircut, especially if they are on a tight budget.

The article could also discuss the potential impact of the changes to the GST rates on the Indian economy as a whole. For example, the article could discuss how the changes could affect the growth of the economy, as well as the government's revenue collection.

Here are some specific examples of how the changes to the GST rates could impact the Indian economy:

- If the GST rates are too high, it could discourage businesses from investing in India. This could lead to slower economic growth.

- If the GST rates are too low, the government could lose revenue. This could make it difficult for the government to fund essential services, such as education and healthcare.

- The changes to the GST rates could also have an impact on the informal economy. The informal economy is a large part of the Indian economy, and it is often difficult for businesses in the informal economy to comply with the GST rules. If the GST rates are too high, it could make it even more difficult for businesses in the informal economy to comply with the rules, which could lead to a decrease in economic activity in the informal economy.

Read the full article

#E-wayBill#GoodsandServicesTax#GST#GSTAct#GSTAudit#GSTCompliance#GSTCouncil#GSTExemptions#GSTImplementation#GSTInvoice#GSTNetwork(GSTN)#GSTRates#GSTRegistration#GSTReturns#IndirectTax#InputTaxCredit#ReverseChargeMechanism#TaxReform#Taxation#TaxationSystem

0 notes

Text

In a big move, Punjab establishes first ever Tax Intelligence Unit in the state to give boost to Tax Collection

In a big move, Punjab establishes first ever Tax Intelligence Unit in the state to give boost to Tax Collection

Government has received more than Rs. 250 crores through regular inspections & checking: Harpal Cheema

TIU will monitor GSTN platform for better analyses of digital data: Harpal Singh Cheema

Special Data Analysts, Legal experts, Cyber experts, System managers are being recruited to make TIU professionally competent

Taxation department undertaking lot of activities to guide & facilitate genuine…

View On WordPress

#brightpunjabexpress#Finance Minister#GSTN platform#Harpal Singh Cheema#PunjabChiefMinister#Punjabgovernment

0 notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

The Importance of GST Registration for E-Commerce Businesses in Bangalore

Introduction

The e-commerce industry in India has seen exponential growth, particularly in urban centres like Bangalore. With this growth comes the necessity for compliance with various regulations, one of which is Goods and Services Tax (GST) registration in Bangalore. This blog post explores the importance of GST registration for e-commerce businesses in Bangalore, detailing its benefits, requirements, and implications for business operations.

What is GST?

Goods and Services Tax (GST) is an indirect tax that has replaced multiple older taxes in India. It is applicable to the supply of goods and services and aims to simplify the tax structure by creating a single tax regime across the country. For e-commerce businesses, GST is significant as it affects pricing, compliance, and overall business strategy.

Why is GST Registration Necessary?

Legal Requirement: In India, any business with an annual turnover exceeding ₹20 lakhs (₹10 lakhs for particular category states) is required to obtain GST registration. This legal requirement ensures that businesses contribute to the national revenue system.

Input Tax Credit: Registered businesses can claim input tax credit on purchases made for their business operations. This means that the GST paid on inputs can be deducted from the GST collected on sales, reducing overall tax liability.

Credibility: Having a GST registration for importers and exporters enhances a business's credibility with customers and suppliers. It signals that the company is compliant with tax regulations, which can be a deciding factor for many consumers.

Benefits of GST Registration for E-Commerce Businesses

1. Simplified Taxation

GST has streamlined the taxation process by consolidating various taxes into one. This simplification reduces the complexity involved in tax compliance, making it easier for e-commerce businesses to manage their finances.

2. Broader Market Access

With GST registration, e-commerce businesses can sell their products across state lines without facing additional taxes or barriers. This opens up new markets and customer bases, which are essential for growth in a competitive landscape.

3. Increased Customer Trust

Consumers are more likely to trust businesses that are registered under GST. It assures them that the business operates legally and adheres to the necessary regulations.

4. Better Compliance Management

Registered businesses must adhere to specific compliance requirements, including filing returns regularly. This encourages better financial management and transparency within the organisation.

The Process of Obtaining GST Registration

Step 1: Determine Eligibility

Before applying for GST registration, assess whether your business meets the turnover threshold required for registration.

Step 2: Gather Required Documents

The following documents are typically required for GST registration:

PAN card of the business

Proof of business registration

Identity and address proof of promoters/directors

Bank account statement or cancelled cheque

Business address proof

Step 3: Apply Online

The application for GST registration can be completed online through the Goods and Services Tax Network (GSTN) portal. Fill out Form GST REG-01 with accurate details.

Step 4: ARN Generation

After submitting your application, an Application Reference Number (ARN) will be generated. This number can be used to track the status of your application.

Step 5: Verification and Approval

The tax authorities will verify your application and documents. If everything is in order, you will receive your GST registration certificate.

Common Challenges Faced by E-Commerce Businesses

1. Understanding Compliance Requirements

Many e-commerce businesses need help understanding the various compliance requirements associated with GST registration. Regular training or hiring a consultant can help navigate these complexities.

2. Filing Returns on Time

Timely filing of returns is crucial to avoid penalties. E-commerce businesses should maintain organised records of sales and purchases to facilitate smooth filing processes.

3. Managing Input Tax Credit

Claiming input tax credit requires meticulous record-keeping of all purchases made under GST. Businesses must ensure they have valid invoices to claim these credits effectively.

Conclusion

For e-commerce businesses, GST registration in Bangalore, obtaining is not just a legal obligation but also a strategic advantage that can enhance credibility, simplify taxation processes, and expand market reach. As the e-commerce landscape continues to evolve, staying compliant with regulations like GST will be vital for sustainable growth and success.

By understanding the importance of GST registration and navigating its complexities effectively, e-commerce entrepreneurs can position themselves favourably in this competitive market landscape. Embracing these practices will not only ensure compliance but also contribute significantly to long-term business viability in Bangalore's thriving e-commerce sector.

0 notes

Text

Your Comprehensive Guide to Getting GST Refund in India (2024)

It is not difficult to navigate through claiming a refund of the GST; still, business houses, financial professionals, entrepreneurs, and also individual taxpayers must understand the easiest mode of claiming these refunds. In this article, we have segregated the process of refund under GST, the eligibility criteria, and timeline so you can claim your refund.

What is GST Refund?

A GST refund arises from the situation where registered taxpayers have overpaid the amount of tax owed. This amount can be recovered through an online procedure on the GST portal. In a timely manner, GST refunds are crucial for businesses as well as exporters to keep cash flow and working capital healthy.

Who Can Claim Refund in GST?

Businesses and companies with excess paid taxes or ITC accumulation.

Exporters who have paid Integrated GST (IGST) on exports.

Individual taxpayers who have paid more in error or eligible for refunds pertaining to special purchases. As defined, special purchases include those of the UN agencies and embassies.

International tourists can claim a refund of GST paid on goods purchased from India at the time of departure from the country.

When can GST Refund be claimed?

The following are circumstances under which a GST refund can be claimed:

Excess GST paid due to calculation errors or over-payment.

Amount of ITC on exports/deemed exports.

GST paid on exports.

Inverted Duty Structure, which refers to a structure where input tax exceeds the output tax.

Refund on provisional assessments.

Time Limit for Claiming GST Refund Application

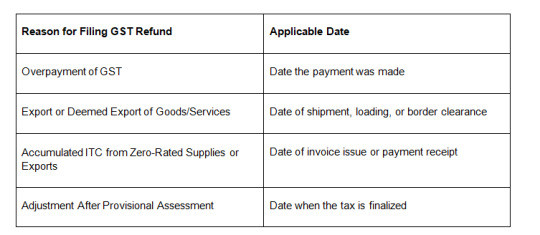

Taxpayers are expected to file their GST refund applications within two years from the relevant date. Time limitation and grounds for filing in a GST refund application are as stated below:

This deadline ensures that companies and tax payers file within a stipulated time frame before losing their rightful refunds.

How to Apply for a GST Refund Step by Step

Login to the GSTN Portal: Login into your account at the GSTN Portal .

Fill Form RFD-01: This would be the form on which refund claims would be supported, and the form should be filed online. All details like the amount to be refunded and relevant invoices must be correctly filled in this form.

Submission of Supporting Documents: Invoices, ITC statements, etc. that may be necessitated.

Track Refund Status: For this, follow the GST portal to track the application

Confirmation: After submission, you will receive an ARN (Application Reference Number) for tracking the status of a refund

Processing of Refund: In most cases, authorities take 30 days to process applications for claiming a refund. Once approved, the amount would directly be credited into your bank account.

How to Monitor Your GST Refund Status

Post-submission

Checking Post-Login: Log in to the GST portal. From the Services tab, click on "Track Application Status".

Pre-Login Tracking: Clicking on "Track Application Status" on the homepage of the GST portal and then filling up the ARN without login.

Key Points to Ensure a Smooth Refund Process

Ensure all invoices and documents are accurate and correctly uploaded.

Monitor the refund status regularly for any updates.

Be mindful of the two-year time limit for refund claims to avoid rejection.

How Online Chartered Makes Your GST Refund Claims Easy

Online Chartered has made the refund process under GST quite smooth and effortless. Our knowledge in GST compliance at Online Chartered would ensure that you receive your refund claim on time. We take our time to help you individually, keeping you oblivious of the persisting turmoil of tax consultancy.

Conclusion

Filing a GST refund does not necessarily need to be so overwhelming. Provided proper steps and observation of important dates are taken, businesses and taxpayers can effectively retrieve their excess payments and give control of their cash flow. Online Chartered is your expert on GST compliance. Streamlined help and support is aimed at simplifying your GST refund claims and getting you the results you need.

0 notes

Text

Step-by-Step Process for GST Registration in Coimbatore: What You Need to Know

GST Registration in Coimbatore: A Comprehensive Guide

Coimbatore, known for its thriving industrial and commercial sectors, is a bustling hub for businesses of all sizes. As companies in Coimbatore continue to grow, understanding and complying with Goods and Services Tax (GST) regulations is crucial. This article provides an in-depth look at GST registration in Coimbatore, highlighting the process, benefits, and requirements.

What is GST?

Goods and Services Tax (GST) is a unified tax system that replaced multiple indirect taxes in India. It is designed to simplify the tax structure and ensure a seamless flow of credit across the supply chain. GST is levied on the supply of goods and services, and businesses must register for GST if their turnover exceeds a certain threshold.

Why is GST Registration Important?

Legal Compliance: GST registration is mandatory for businesses with a turnover exceeding the prescribed limit. Failure to register can result in penalties and legal complications.

Tax Benefits: Registered businesses can claim input tax credit (ITC) on taxes paid on purchases, which can be used to offset GST payable on sales.

Business Credibility: GST registration enhances a business's credibility and helps establish trust with customers and suppliers.

Access to GST Network: GST registration allows businesses to use the GST Network (GSTN) portal for filing returns, managing tax liabilities, and accessing various services.

Eligibility Criteria for GST Registration

In Coimbatore, as per the GST Act, businesses need to register if:

Turnover Exceeds the Threshold: For most companies, the threshold limit is ₹40 lakhs (₹20 lakhs for particular category states). However, this limit may vary based on the type of business and location.

Interstate Supply: Businesses engaged in interstate supply of goods or services must register for GST regardless of their turnover.

E-Commerce Operators: Online sellers and e-commerce platforms must register for GST, regardless of turnover.

Casual Taxable Persons: Businesses that occasionally supply goods or services and do not have a fixed place of business must register.

Steps for GST Registration in Coimbatore

Gather Documents: Prepare necessary documents such as PAN card, Aadhaar card, proof of business address, bank statement, and photographs.

Visit the GST Portal: Go to the official GST portal (www.gst.gov.in) and select the option for new registration.

Fill in Details: Complete the application form (Form GST REG-01) with accurate details about your business, including its nature, turnover, and registration type.

Submit Documents: Upload scanned copies of the required documents.

Verification: The GST authorities will verify your application and documents. If necessary, you may be required to provide additional information.

GSTIN Issuance: Once your application is approved, you will receive a GST Identification Number (GSTIN) and a GST registration certificate.

Post-Registration Compliance

File GST Returns: Regularly file GST returns per the prescribed schedule (monthly or quarterly). This includes GSTR-1 (outward supplies), GSTR-2 (inward supplies), and GSTR-3B (monthly summary).

Maintain Records: Keep detailed records of all transactions, invoices, and GST-related documents.

Renewal and Updates: Update your GST registration details if your business's address or ownership changes.

Conclusion

GST registration in Coimbatore is a vital step for businesses to ensure compliance with tax regulations and benefit from the streamlined tax structure. By following the registration process and adhering to post-registration compliance, companies can effectively manage their GST obligations and contribute to the smooth functioning of the GST ecosystem. If you need assistance with GST registration or have questions, consider consulting a professional to ensure a hassle-free experience.

0 notes

Text

RBI brings GSTN under account aggregator framework

RBI brings GSTN under account aggregator framework

The Reserve Bank of India (RBI) has included the Good and Service Tax Network (GSTN) as a financial information provider under the account aggregator framework. The latest move is aimed at facilitating a cash flow-based lending to micro, small and medium-sized enterprises (MSMEs). The department of revenue will be the regulator of the GSTN for furnishing returns on the goods and services…

View On WordPress

0 notes

Video

youtube

Reporting of Supplies to Un-Registered Dealers in GSTR1 / GSTR 5 - GSTN

0 notes

Text

How to Apply for a PAN Card Online on NSDL?

What is a PAN card?

The full form of the PAN is a Permanent Account Number, it is an essential document needed to complete specific activities. In light of this, you must have a card with a special 10-digit alphanumeric number that is provided by the Income Tax Department.

The National Securities Depository Limited (NSDL) or UTI Infrastructure Technology and Services Limited (UTIITSL) websites make the process of applying for a PAN card online simple.

The Government of India has given both platforms specific permission to issue PAN cards and manage any required adjustments or modifications on behalf of the Income Tax Department. A well-known channel for this purpose is the NSDL website which offers applicants an easy-to-use interface for electronically submitting their information. At the same time, the UTIITSL website acts as a substitute, providing people with an additional easily accessible choice for their PAN card requirements.

Procedure for Existing Customers to apply for PAN card online:

The steps are listed below:

Step 1: Go to NSDL

Step 2: Enter information such as the date of birth, the optional GSTN(optional), the Permanent Account Number (PAN), the Aadhaar number ((in the case of individuals), and the captcha.

Step 3: Select “Submit’’.

Step 4: Your registered cellphone number will receive an OTP.

Step 5: To download the PAN, enter the OTP.

Note: You have to finish updating the mobile number and email address if you haven’t already.

Also Read:

How to get a 20000 PAN card loan instantly

Steps to Make an Application Online for New Customers

Form 49A or 49AA must be completed if you are applying for a new PAN card, depending on whether you are an Indian citizen or a foreign citizen.

Remember that this is mostly for individuals who have never applied for or do not currently own a PAN card. These are the actions.

Step 1: Go to the Online PAN Application part of the NSDL website.

Step 2: Choose your application type in step two: Forms 49A (for Indian citizens) and 49AA (for foreign citizens), as well as PAN card reprints and changes or corrections.

Step 3: Select a Category. Individuals, associations of persons, bodies of individuals, trusts, limited liability partnerships, firms, governments, Hindu undivided families, artificial judicial persons, and local authorities are the available alternatives.

Step 4: Complete the following fields: email address, mobile number, Captcha code, First name, Middle name, Last name/surname, Date of Birth/Incorporation/Formation in DD/MM/YYYY format. Send in the application.

Step 5: An acknowledgment with a token number will appear on the following page. On this page, select ‘Continue with PAN Application Form’.

Step 6: You will be asked to provide more personal information, much like on Form 49A or Form 49AA. Enter all of the required data.

Step 7: Decide on the method for submitting the documents. There are three ways to submit an application: a) physically forward the documents; b) digitally sign the documents; and c) electronically sign the materials.

Review the entire application thoroughly to ensure no errors:

Step 8: List the documents you are providing as confirmation of identification, residence, and date of birth on the same page. Verify the application’s declaration, location, and date. After reviewing, send in the form. Make sure you don’t make any errors.

Step 9: After selecting “Proceed,” you will be presented with your payment options. Select between using the Billdesk online payment feature or a demand draft.

Step 10: If you select Demand Draft, you will need to create a Demand Draft (DD) before starting the application process. This is because the DD requires you to enter the bank’s name, DD number, date of issue, and amount on the portal.

Step 11: If you decide to use Bill Desk, you can pay with debit or credit cards, as well as Net Banking.

Step 12: Select “I agree to terms of service” and make your payment. Whether you upload your documents online or send them to Protean e-Gov Technologies Limited separately will affect the PAN application fees.

Step 13: You will receive an acknowledgment receipt and a payment receipt if you pay with a credit card, debit card, or through net banking. The acknowledgment receipt should be printed.

Step 14: Enclose the acknowledgment receipt and two current photos.

Step 15: Send the supporting documentation to Protean e-Gov Technologies Limited by mail or courier once payment has been verified.

Protean e-Gov Technologies Limited will handle your application after receiving your supporting documentation. You will also need to supply proof of your office address in addition to proof of your residential address if you have designated your office address as your preferred communication address.

Charges Associated with Online PAN Card Applications:

In addition to applying for a PAN Card, you can also edit, modify, or request an online reprint of your PAN Card. You can go to Protean e-Gov Technologies Limited (formerly known as NSDL) or UTIISL’s official website.

If the communication address is located in India, the cost of obtaining a PAN Card is Rs. 93 (GST not included). The fees for obtaining a PAN Card for a foreign communication address are Rs. 864 (GST not included). You need to turn in the necessary paperwork as soon as the money has been received. Only after the pertinent documents have been submitted will the PAN application be processed.

Documents Required to Apply for PAN Card

You may provide one of the following documents as evidence of your birthdate:

Passport

Driving license

An affidavit with the date of birth sworn before a magistrate.

The marriage certificate that a Registrar of Marriages has granted.

Pension payout schedule.

The Central Government provided a photo card for the Health Service Scheme.

A photo card for the Contributory Health Scheme can be provided by ex-servicemen.

The government-issued domicile certificate.

Any identity card with a photo that has been issued by the central or state governments.

Any identity card with a photo that has been issued by a Central or State Public Sector Undertaking.

A birth certificate that the local government has issued.

A matriculation certificate or mark sheet issued by a recognized board.

Voter identification card with a photo.

The Aadhar Card that UIDAI has distributed.

Proof of Address Required to Apply for PAN Card

Photocopy of any one of these documents:

Aadhaar card, passport, driver’s license, property tax assessment order, voter photo identity card, post office passbook, a letter of allotment from the central or state governments, and Certificate of domicile.

Photocopy of these documents (not over three months):

Landline, electricity bill, gas connection card, water bill, statement of depository account, statement of bank account, statement of credit card.

Original documents:

The address certificate. A member of the Legislative Assembly, a member of Parliament, a municipal councilor, or a Gazette officer must sign this Certificate

Proof of Identity Required to Apply for PAN Card:

Photocopy of any one document:

The Central Government Health Scheme Card, the Ex-Servicemen Contributory Health Scheme Card, the Aadhaar card, the passport, the voter ID, the driver’s license, the arm’s license, the pensioner card, the photo identity card, and the ration card.

Originals:

Identity certificate (signed by a Municipal Councillor, Member of Parliament, or Legislative Assembly Member) Bank Certificate

Now You may apply for a PAN card online with ease, guarantee application accuracy, and get your card quickly if you know how to do so step-by-step, as explained in the article above. Recall that PAN is more than just a number! It’s essential for smooth financial transactions and tax adherence.

0 notes

Text

Union Budget 2024: Streamlining Indirect Tax Compliances - Expectations and Challenges

With the Union Budget 2024 set to be presented on July 23, taxpayers and industry experts alike are keenly anticipating changes aimed at streamlining indirect tax compliances, particularly concerning the Goods and Services Tax (GST) and Customs procedures. Saloni Roy, Partner at Deloitte India, sheds light on the current challenges and expected amendments that could significantly impact the tax landscape.

Simplifying GST Compliance

The GST was introduced to simplify India’s tax regime, but taxpayers still face several hurdles. Here are some of the key challenges and expected changes:

Registration Complications

GST registration requires a set of prescribed documents. However, during the application scrutiny, authorities often demand additional documents not listed under the law, such as notarised copies of No Objection Certificates (NOC) or original lease deeds. This leads to delays and additional burdens on taxpayers. A more streamlined and consistent approach to documentation could alleviate these issues.

Biometric Aadhaar Authentication

Currently, key managerial personnel (KMPs) must visit facilitation centres for biometric Aadhaar authentication, which is both time-consuming and cumbersome. A potential solution is allowing KMPs to complete this process at any facilitation centre nationwide, reducing the travel burden and expediting the registration process.

Tax Payments by Overseas Taxpayers

The rise of e-services has expanded the taxpayer base under GST, particularly for online information database access and retrieval (OIDAR) services. However, the process for overseas taxpayers to remit GST payments via Indian intermediary banks is slow and prone to delays. Establishing a more efficient payment system through overseas banks could streamline this process and ensure timely tax remittance.

Addressing IGST Payment Delays

When importing goods, the payment of Integrated Goods and Services Tax (IGST) is made on the ICEGATE portal. However, delays in reflecting these payments on the GSTN portal result in discrepancies in Form GSTR-2B, causing automated notices to be sent to taxpayers. Enhancing the data transmission process between ICEGATE and the GST portal would mitigate these issues.

Challenges in Claiming Input Tax Credit (ITC)

One major challenge under GST is ensuring that vendors have remitted the GST to the government. Currently, there is no online mechanism for buyers to verify this, making it difficult to comply with ITC conditions. Developing a system to track vendor payments would reduce the risk of unwarranted litigation and ease the compliance burden on genuine taxpayers.

Additionally, ITC is often denied when a vendor’s GST registration is cancelled retrospectively. Implementing a real-time tracking system for vendor registration status could prevent such issues and ensure fair treatment of buyers.

Improving Customs Procedures

Customs procedures also face several challenges, and the Budget 2024 is expected to address these:

SVB Investigation Timelines

The Special Valuations Branch (SVB) of Customs often takes years to conclude investigations on imports from related parties, leading to provisional imports and the need for continuous bond submissions. Establishing a clear timeline for SVB investigations and adhering to it would expedite the process and reduce the burden on importers.

Digitisation of Customs

Despite advancements in the clearance of goods, some Customs processes remain manual, such as filing refund applications and replies to notices. Moving these processes online, similar to GST compliances, would save time and align with the ‘Digital Bharat’ mission.

Parting Thoughts

The Union Budget 2024 is poised to set the course for India’s economic trajectory over the next five years. By addressing the aforementioned challenges and streamlining tax compliances, the government can further its goal of making India the fastest-growing economy in the world. Stakeholders are hopeful that the upcoming budget will introduce measures that simplify procedures, reduce litigation, and promote ease of doing business.

0 notes