#hans eiskonen

Explore tagged Tumblr posts

Text

--- harry collett

pour @batoub4tou, encore désolée pour ma lenteur, j'espère qu'ils te plairont <3

crédits : hans eiskonen, andrey azizov, shoom house, nick aesty, rawpixel (1,2)

13 notes

·

View notes

Photo

Art Print

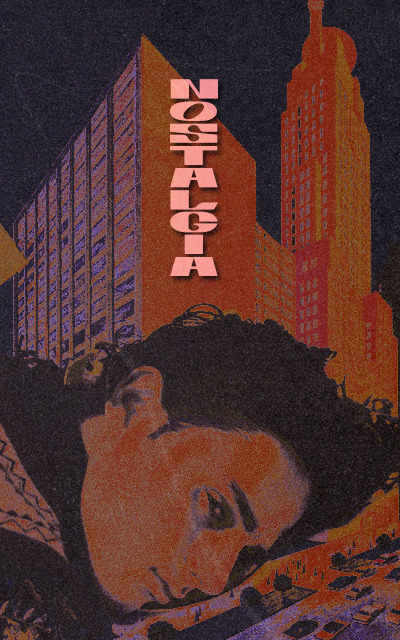

After Every Party I Die -Hans Eiskonen

4 notes

·

View notes

Photo

Art Prints by Hans Eiskonen

207 notes

·

View notes

Text

Penrose Background is edited stock by Hans Eiskonen on Unsplash

4 notes

·

View notes

Photo

What makes you happy? Is it a long list that never seems to be experienced? Most will put stipulations on their happiness only when they physically obtain that “thing” that they believe will make them happy. What if we can simplify your list to one thing. One thing that absolutely dictates your happiness. Would you use it? Would you work at it? Would you believe in it? Most people “choose” not to be happy because they “choose” not to believe in this one thing. (And yes, happiness is a choice.) That “one thing”, it is our thoughts. Sounds crazy but true. Whenever we think of someone we love, we feel love. Whenever we think of something that we believe makes us happy, we get happy. No matter where we are or what we are doing, we can change our energy and become happier just by thinking of those things we love. Don’t believe me, try it. Focus hard on that one thing you love. Focus on it being right there so you can touch, hold, smell, taste, or see it. Whatever it is. Focus on just that one thing and experience the feelings and emotions of love and happiness begin to develop. If you don’t feel these feelings it is because you are focused on the lacking or loss of this thing. The thoughts of not holding, feeling, tasting, smelling, and seeing of this thing. Use your imagination. The unconscious mind will still produce the emotions even when it is just a thought. Indeed, it is solely our thoughts that produce any emotions or feelings we experience. Love when we see those we love. Fear when we are spooked or scared. Excitement when we are not for sure. Mellow when we think of relaxation. All our emotions are created by our very thoughts. So how do you perceive any situation? That is the key. What do you thinking right now? Are you present with your thoughts? You can choose to be happy anywhere anytime!! Try it. Allow yourself to focus and be open to this idea and you will experience more of what you desire. EDIT your GOALS Every Day Internal Thoughts Guarantees Our Absolute Life Situations #inspire #inspiration #love #help #attitude #goals #life #coach #coaching #happiness #energy Background Picture by Hans Eiskonen https://www.instagram.com/p/CMHr1oQDNfv/?igshid=1lm38qqn7e1s9

2 notes

·

View notes

Text

By Hans Eiskonen

3 notes

·

View notes

Text

Put Reason Back to Sleep

Put Reason Back to Sleep (From Christopher Scott Thompson)

“The future will have a place for neither faith nor reason.”

From Christopher Scott Thompson

Photo by Hans Eiskonen on Unsplash Surrealist Prophecies #1

“It was in the black mirror of anarchism that surrealism first recognised itself.”

– Andre Breton

This poem is the first in a sequence of apocalyptic prophecies inspired by China Mieville’s novel Last Days of New Paris, which led me to…

View On WordPress

#Andre Breton#animism#apocalypse#automatic writing#Climate change#Poetry#prophecy#religion#surrealism

4 notes

·

View notes

Photo

Clipped They clipped my wings but I can still feel them flapping in my blood— when I want to fly, all I have to do is close my eyes and soar. —Words by Ricky Ray —Photo by Hans Eiskonen @eiskone http://ift.tt/2onwLcJ http://ift.tt/2FkueIp

1 note

·

View note

Text

Crypto Market Cycle: Data Shows Bitcoin On Pace For Post-Halving Bull Run

With Bitcoin’s halving arriving next month on May 11, 2020, the expectation across the world of crypto has long been that the valuation of the first-ever cryptocurrency would skyrocket, but last month’s catastrophic selloff has some questioning the theory. However, according to historical data, Bitcoin price is currently on pace with where the crypto asset was before the previous halving, and before the hype bubble began to inflate. Calculating the Crypto Cycle: Bitcoin on Pace With Previous Halving Price Action The crypto asset class has suffered through over two full years of brutal downtrend and bear market, eliminating 90% or more from the value of most cryptocurrencies. From peak to trough, Bitcoin price fell by 84% from its all-time high of $20,000 to the current bottom set at $3,200. Related Reading | Bitcoin To Explode By 80% Before Halving According to Past Cycle Comparison The catalyst for the massive bull run, when you look at Bitcoin price charts, appears to be the asset’s halving. Each halving the block reward miners receive for validating the blockchain network is reduced by 50%. The theory is that the reduced supply entering the market eventually lessens selling pressure from miners, causing an imbalance of supply and demand that causes valuations to skyrocket. Following the last two halvings, depicted in the above price chart as red dotted vertical lines, Bitcoin price absolutely exploded in value, not stopping until the next major peak is reached, and then cycle restarts anew. But the latest selloff in the face of the coming recession and the dramatic impact the pandemic has had on the economy, all liquid assets tumbled, including Bitcoin, gold, the stock market, and more. It caused even the strongest believers in the emerging tech and asset class to consider the possibility that the experiment is over, and fear that these assets could soon be priced at zero in the mad dash to cash out ahead of the coming storm. However, the latest collapse has actually taken Bitcoin back down to more realistic valuations, putting it perfectly on pace with the previous halving, signaling that the fabled post-halving crypto bull run isn’t out of the realm of possibility. When measuring the distance from the bottom of each cycle, to current levels comparatively with where Bitcoin price is now versus the last bear-transitioning-into-bull market cycle. From bottom to where Bitcoin price is currently trading, represents a more than 120% gain from the bottom set at $3,200. During the same timeframe in the last cycle – just one month away from the halving – Bitcoin price was also trading at 120% above where the bottom was set 18 months prior. What happened after put Bitcoin and crypto on the map as a financial asset. Bitcoin price grew from under $500 to over $5,000 before the public caught on. Later FOMO brought the asset to $20,000. Now, Bitcoin price is back at the peak point of financial opportunity. If it plays out exactly the same, Bitcoin price would momentarily trade above $300,000 at the next peak. Related Reading | Peak “Fear” Crypto Market Shows Big Bitcoin Recovery is Imminent: Analyst As exciting as that may sound, it would be unrealistic that Bitcoin price performs as well as it has in past cycles, as each new cycle has provided diminishing returns. Regardless, getting in now is still early enough to reap the benefits of the next crypto bubble, which has yet to even begin. Photo by Hans Eiskonen on Unsplash from CryptoCracken SMFeed https://ift.tt/2V21jC8 via IFTTT

0 notes

Photo

Art Prints by Hans Eiskonen

267 notes

·

View notes

Text

Crypto Market Cycle: Data Shows Bitcoin On Pace For Post-Halving Bull Run

With Bitcoin’s halving arriving next month on May 11, 2020, the expectation across the world of crypto has long been that the valuation of the first-ever cryptocurrency would skyrocket, but last month’s catastrophic selloff has some questioning the theory. However, according to historical data, Bitcoin price is currently on pace with where the crypto asset was before the previous halving, and before the hype bubble began to inflate. Calculating the Crypto Cycle: Bitcoin on Pace With Previous Halving Price Action The crypto asset class has suffered through over two full years of brutal downtrend and bear market, eliminating 90% or more from the value of most cryptocurrencies. From peak to trough, Bitcoin price fell by 84% from its all-time high of $20,000 to the current bottom set at $3,200. Related Reading | Bitcoin To Explode By 80% Before Halving According to Past Cycle Comparison The catalyst for the massive bull run, when you look at Bitcoin price charts, appears to be the asset’s halving. Each halving the block reward miners receive for validating the blockchain network is reduced by 50%. The theory is that the reduced supply entering the market eventually lessens selling pressure from miners, causing an imbalance of supply and demand that causes valuations to skyrocket. Following the last two halvings, depicted in the above price chart as red dotted vertical lines, Bitcoin price absolutely exploded in value, not stopping until the next major peak is reached, and then cycle restarts anew. But the latest selloff in the face of the coming recession and the dramatic impact the pandemic has had on the economy, all liquid assets tumbled, including Bitcoin, gold, the stock market, and more. It caused even the strongest believers in the emerging tech and asset class to consider the possibility that the experiment is over, and fear that these assets could soon be priced at zero in the mad dash to cash out ahead of the coming storm. However, the latest collapse has actually taken Bitcoin back down to more realistic valuations, putting it perfectly on pace with the previous halving, signaling that the fabled post-halving crypto bull run isn’t out of the realm of possibility. When measuring the distance from the bottom of each cycle, to current levels comparatively with where Bitcoin price is now versus the last bear-transitioning-into-bull market cycle. From bottom to where Bitcoin price is currently trading, represents a more than 120% gain from the bottom set at $3,200. During the same timeframe in the last cycle – just one month away from the halving – Bitcoin price was also trading at 120% above where the bottom was set 18 months prior. What happened after put Bitcoin and crypto on the map as a financial asset. Bitcoin price grew from under $500 to over $5,000 before the public caught on. Later FOMO brought the asset to $20,000. Now, Bitcoin price is back at the peak point of financial opportunity. If it plays out exactly the same, Bitcoin price would momentarily trade above $300,000 at the next peak. Related Reading | Peak “Fear” Crypto Market Shows Big Bitcoin Recovery is Imminent: Analyst As exciting as that may sound, it would be unrealistic that Bitcoin price performs as well as it has in past cycles, as each new cycle has provided diminishing returns. Regardless, getting in now is still early enough to reap the benefits of the next crypto bubble, which has yet to even begin. Photo by Hans Eiskonen on Unsplash from Cryptocracken WP https://ift.tt/2V21jC8 via IFTTT

0 notes

Photo

by Hans Eiskonen

102 notes

·

View notes

Photo

Guess who’s back...

Photo cred: Hans Eiskonen on Unsplash, Jason Blackeye on Unsplash, StooStock on Deviantart, and Josh Sorenson on pexels.

#winnernet#yg winner#our twenty for#ourtwentyfor#otf#seungyoon#seunghoon#mino#jinwoo#kpop#my obligatory photomanips!#myart

21 notes

·

View notes